34d18d59634b72f30e2f373150cf82f5.ppt

- Количество слайдов: 33

“Monetary and Financial Policies in the Asian Network Economy Tuesday, 18 April 2006 Kuala Lumpur Convention Centre by Datuk Seri Panglima Andrew L. T. Sheng Tun Ismail Ali Professor of Monetary and Financial Economics Faculty of Economics and Administration University of Malaya

“Monetary and Financial Policies in the Asian Network Economy Tuesday, 18 April 2006 Kuala Lumpur Convention Centre by Datuk Seri Panglima Andrew L. T. Sheng Tun Ismail Ali Professor of Monetary and Financial Economics Faculty of Economics and Administration University of Malaya

Contents 1. 2. 3. 4. 5. 6. 7. Introduction Network Concept Asian Supply Chain Asian Financial Network Node Stability vs Network Stability Dollar as Standard Concluding Remarks

Contents 1. 2. 3. 4. 5. 6. 7. Introduction Network Concept Asian Supply Chain Asian Financial Network Node Stability vs Network Stability Dollar as Standard Concluding Remarks

The Changing Landscape • Since Berlin Wall in 1989, over three billion workers and consumers have joined the market economy. Brazil, Russia, India and China (BRIC) are expected to become larger than G 6 in less than 40 years. • Information and communication technology is growing at Internet speed. 1. 02 trillion Internet users (15. 7% of world population) pushing spread of knowledge and global market. • Liberalization of trade and finance, innovation and globalization have resulted in large trade and capital flows. Global trade in physical goods and services reached US$11 trillion in 2004, but trading in foreign exchange amounted to US$ 1. 9 trillion daily.

The Changing Landscape • Since Berlin Wall in 1989, over three billion workers and consumers have joined the market economy. Brazil, Russia, India and China (BRIC) are expected to become larger than G 6 in less than 40 years. • Information and communication technology is growing at Internet speed. 1. 02 trillion Internet users (15. 7% of world population) pushing spread of knowledge and global market. • Liberalization of trade and finance, innovation and globalization have resulted in large trade and capital flows. Global trade in physical goods and services reached US$11 trillion in 2004, but trading in foreign exchange amounted to US$ 1. 9 trillion daily.

Markets as Networks “A financial system, like all structures, is as strong as its weakest link” – Alan Greenspan, December 1997 • “The Asian crisis was a large-scale example of a cascading financial failure, a natural consequence of connectedness and interdependency…. . ” - Albert-Laszlo Barabasi, Linked: How Everything is Connected to Everything Else and What It Means for Business, Science, and Everyday Life, Plume Books, May 2003

Markets as Networks “A financial system, like all structures, is as strong as its weakest link” – Alan Greenspan, December 1997 • “The Asian crisis was a large-scale example of a cascading financial failure, a natural consequence of connectedness and interdependency…. . ” - Albert-Laszlo Barabasi, Linked: How Everything is Connected to Everything Else and What It Means for Business, Science, and Everyday Life, Plume Books, May 2003

Six degrees of Separation: Network Theory • • • A network is a set of interconnected nodes. Nodes do not connect with each other at random preferential attachment Hubs and clusters are efficient because of network externality. Preferential attachment and network externalities together explain “winner-take-all” situation common to networks. Networks are scale-free and not static, because of continual each competition or cooperation between hubs. Since markets are by their nature competitive, they adapt and evolve around their environment.

Six degrees of Separation: Network Theory • • • A network is a set of interconnected nodes. Nodes do not connect with each other at random preferential attachment Hubs and clusters are efficient because of network externality. Preferential attachment and network externalities together explain “winner-take-all” situation common to networks. Networks are scale-free and not static, because of continual each competition or cooperation between hubs. Since markets are by their nature competitive, they adapt and evolve around their environment.

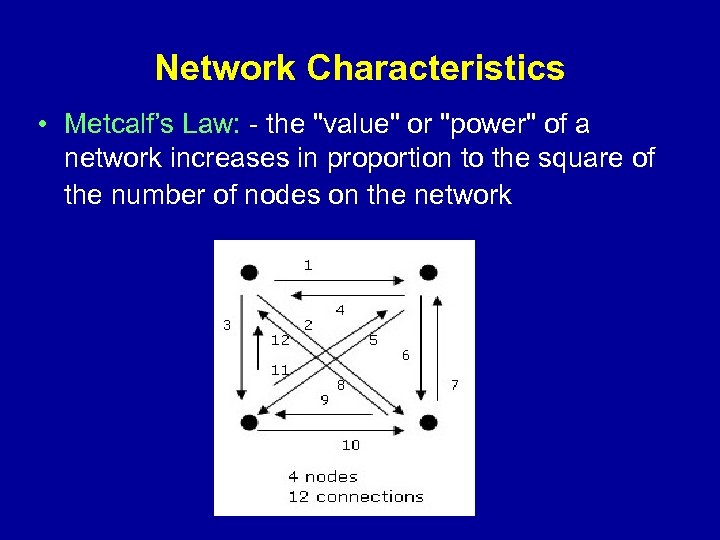

Network Characteristics • Metcalf’s Law: - the "value" or "power" of a network increases in proportion to the square of the number of nodes on the network

Network Characteristics • Metcalf’s Law: - the "value" or "power" of a network increases in proportion to the square of the number of nodes on the network

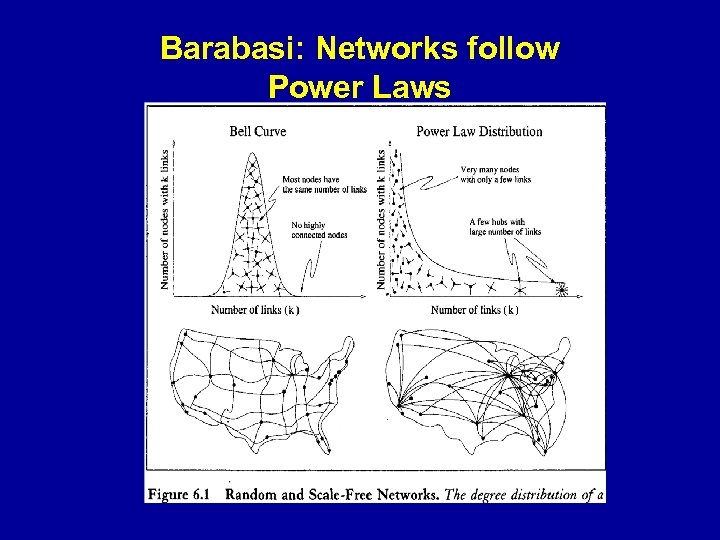

Barabasi: Networks follow Power Laws

Barabasi: Networks follow Power Laws

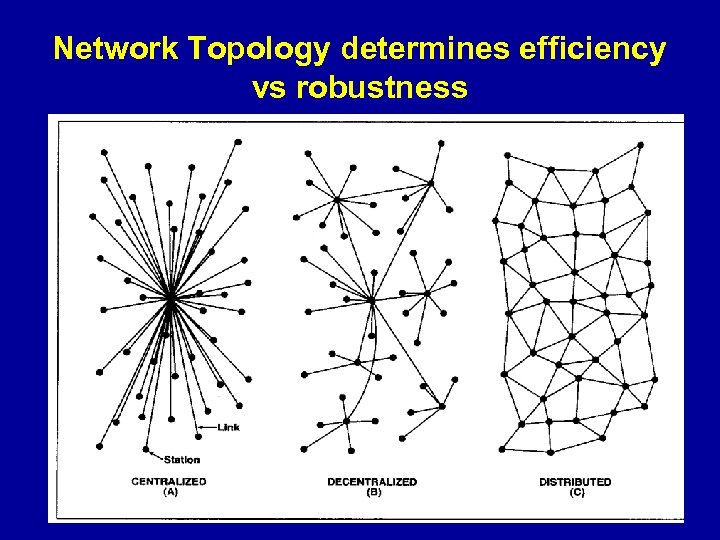

Network Topology determines efficiency vs robustness

Network Topology determines efficiency vs robustness

Network Altruistism Principle • Rich get richer characteristic of networks is inherently unstable. • Network Altruistic Principle where dominant hub helps the others maintains stability. • The more you share knowledge, the more you gain knowledge • The more you share wealth, the more you gain wealth • The more you share power, the more you gain power.

Network Altruistism Principle • Rich get richer characteristic of networks is inherently unstable. • Network Altruistic Principle where dominant hub helps the others maintains stability. • The more you share knowledge, the more you gain knowledge • The more you share wealth, the more you gain wealth • The more you share power, the more you gain power.

Asian Supply Chain Network • Information technology, automation, innovation and competition have converged to the degree that manufacturing has become more flexible, with higher quality standards and greater responsiveness to consumer needs. • IT has driven globalization through its networks, so that the global is increasingly operating as one global net where ideas, capital and products flow with less and less concerns for geographical borders. • Through the World Wide Web, manufacturers are able to source production, restructure operations and delivery system to serve global customers.

Asian Supply Chain Network • Information technology, automation, innovation and competition have converged to the degree that manufacturing has become more flexible, with higher quality standards and greater responsiveness to consumer needs. • IT has driven globalization through its networks, so that the global is increasingly operating as one global net where ideas, capital and products flow with less and less concerns for geographical borders. • Through the World Wide Web, manufacturers are able to source production, restructure operations and delivery system to serve global customers.

Asian Supply Network: Flying Geese • 1950 -60 s: Japan first to industrialize • 1960 -70 s: As costs rise, industries move to NIEs (Korea, Taiwan, Hong Kong, Singapore) • 1970 -80 s: ASEAN began to industrialize and also benefit from US IT investments • 1990 s: China begins to become global supply chain hub, after the Asian crisis, because of cheap labour and attraction of large domestic market. • India becomes IT service outsourcing hub

Asian Supply Network: Flying Geese • 1950 -60 s: Japan first to industrialize • 1960 -70 s: As costs rise, industries move to NIEs (Korea, Taiwan, Hong Kong, Singapore) • 1970 -80 s: ASEAN began to industrialize and also benefit from US IT investments • 1990 s: China begins to become global supply chain hub, after the Asian crisis, because of cheap labour and attraction of large domestic market. • India becomes IT service outsourcing hub

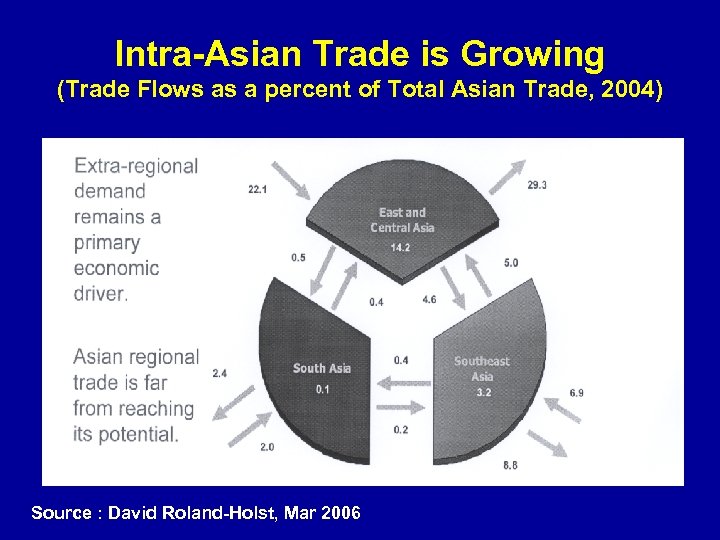

Intra-Asian Trade is Growing (Trade Flows as a percent of Total Asian Trade, 2004) Source : David Roland-Holst, Mar 2006

Intra-Asian Trade is Growing (Trade Flows as a percent of Total Asian Trade, 2004) Source : David Roland-Holst, Mar 2006

Asia’s Growth and Its Sources, 2005 -2025 (%) Note : TFP means total factor productivity Source : Asian Development Bank

Asia’s Growth and Its Sources, 2005 -2025 (%) Note : TFP means total factor productivity Source : Asian Development Bank

Great Gains in Real Income if Liberalization (% change from baseline in 2025) Source : Asian Development Bank

Great Gains in Real Income if Liberalization (% change from baseline in 2025) Source : Asian Development Bank

Great Gains in Real Exports (% change from baseline in 2025) Source : Asian Development Bank

Great Gains in Real Exports (% change from baseline in 2025) Source : Asian Development Bank

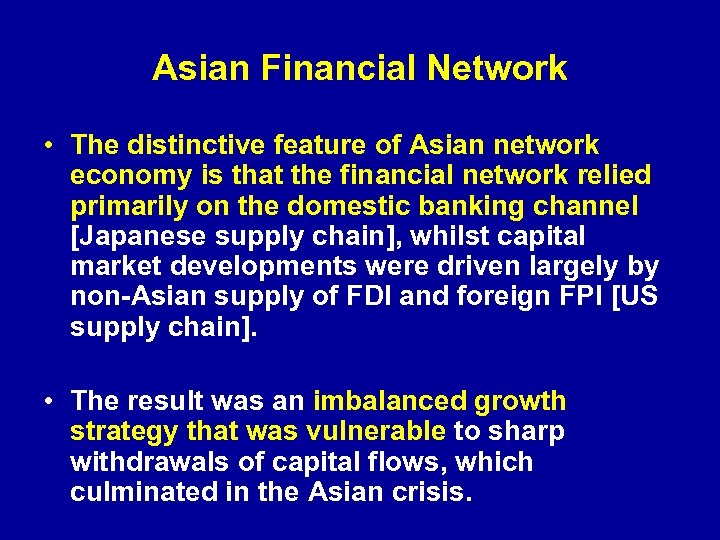

Asian Financial Network • The distinctive feature of Asian network economy is that the financial network relied primarily on the domestic banking channel [Japanese supply chain], whilst capital market developments were driven largely by non-Asian supply of FDI and foreign FPI [US supply chain]. • The result was an imbalanced growth strategy that was vulnerable to sharp withdrawals of capital flows, which culminated in the Asian crisis.

Asian Financial Network • The distinctive feature of Asian network economy is that the financial network relied primarily on the domestic banking channel [Japanese supply chain], whilst capital market developments were driven largely by non-Asian supply of FDI and foreign FPI [US supply chain]. • The result was an imbalanced growth strategy that was vulnerable to sharp withdrawals of capital flows, which culminated in the Asian crisis.

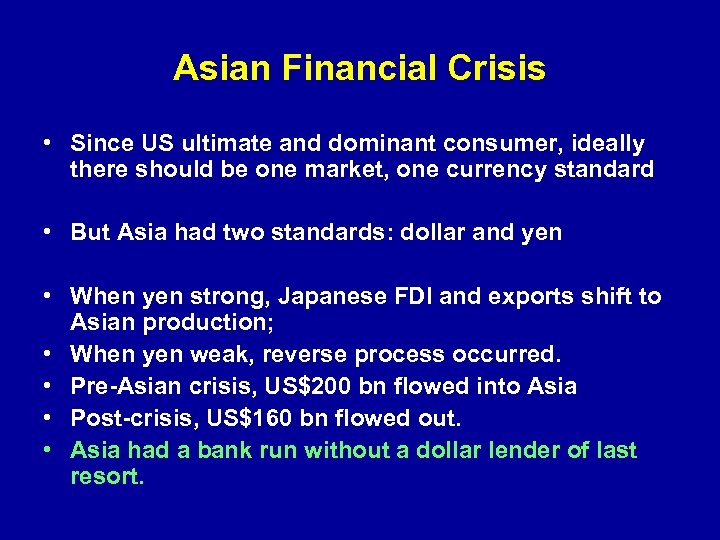

Asian Financial Crisis • Since US ultimate and dominant consumer, ideally there should be one market, one currency standard • But Asia had two standards: dollar and yen • When yen strong, Japanese FDI and exports shift to Asian production; • When yen weak, reverse process occurred. • Pre-Asian crisis, US$200 bn flowed into Asia • Post-crisis, US$160 bn flowed out. • Asia had a bank run without a dollar lender of last resort.

Asian Financial Crisis • Since US ultimate and dominant consumer, ideally there should be one market, one currency standard • But Asia had two standards: dollar and yen • When yen strong, Japanese FDI and exports shift to Asian production; • When yen weak, reverse process occurred. • Pre-Asian crisis, US$200 bn flowed into Asia • Post-crisis, US$160 bn flowed out. • Asia had a bank run without a dollar lender of last resort.

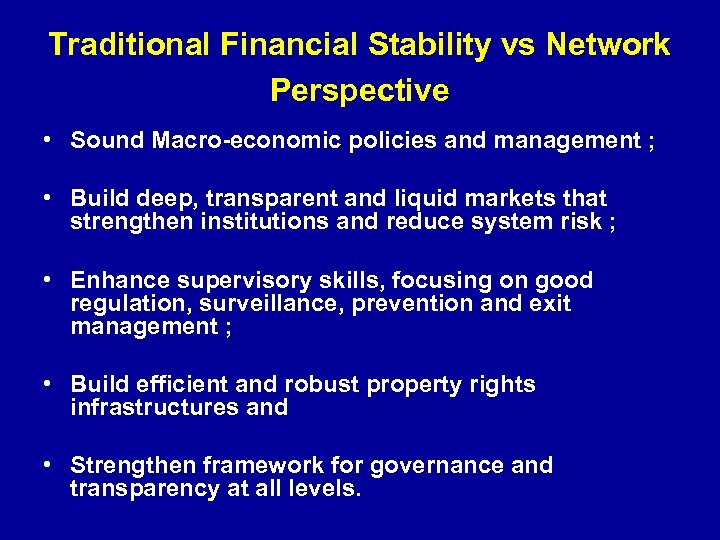

Traditional Financial Stability vs Network Perspective • Sound Macro-economic policies and management ; • Build deep, transparent and liquid markets that strengthen institutions and reduce system risk ; • Enhance supervisory skills, focusing on good regulation, surveillance, prevention and exit management ; • Build efficient and robust property rights infrastructures and • Strengthen framework for governance and transparency at all levels.

Traditional Financial Stability vs Network Perspective • Sound Macro-economic policies and management ; • Build deep, transparent and liquid markets that strengthen institutions and reduce system risk ; • Enhance supervisory skills, focusing on good regulation, surveillance, prevention and exit management ; • Build efficient and robust property rights infrastructures and • Strengthen framework for governance and transparency at all levels.

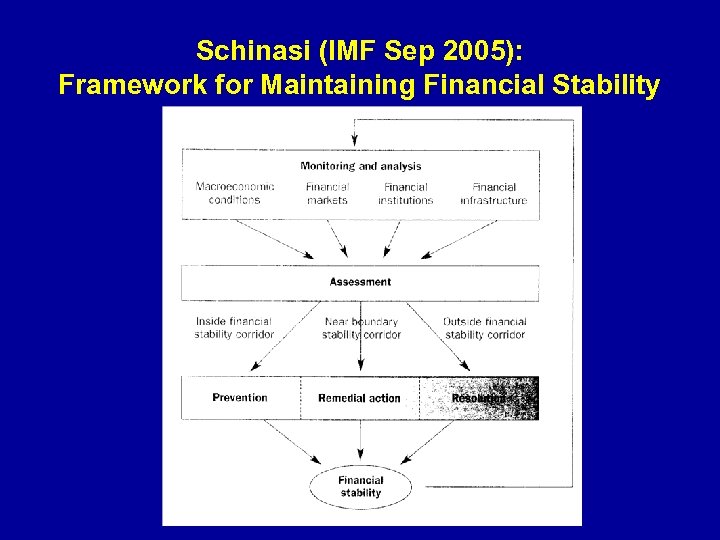

Schinasi (IMF Sep 2005): Framework for Maintaining Financial Stability

Schinasi (IMF Sep 2005): Framework for Maintaining Financial Stability

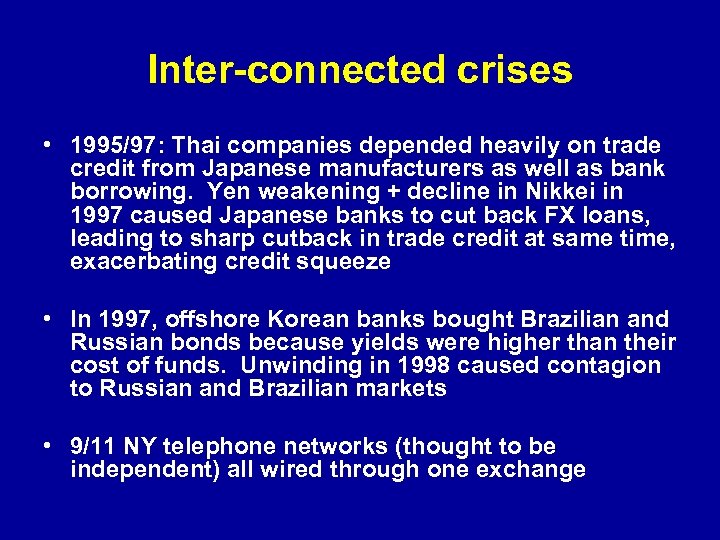

Inter-connected crises • 1995/97: Thai companies depended heavily on trade credit from Japanese manufacturers as well as bank borrowing. Yen weakening + decline in Nikkei in 1997 caused Japanese banks to cut back FX loans, leading to sharp cutback in trade credit at same time, exacerbating credit squeeze • In 1997, offshore Korean banks bought Brazilian and Russian bonds because yields were higher than their cost of funds. Unwinding in 1998 caused contagion to Russian and Brazilian markets • 9/11 NY telephone networks (thought to be independent) all wired through one exchange

Inter-connected crises • 1995/97: Thai companies depended heavily on trade credit from Japanese manufacturers as well as bank borrowing. Yen weakening + decline in Nikkei in 1997 caused Japanese banks to cut back FX loans, leading to sharp cutback in trade credit at same time, exacerbating credit squeeze • In 1997, offshore Korean banks bought Brazilian and Russian bonds because yields were higher than their cost of funds. Unwinding in 1998 caused contagion to Russian and Brazilian markets • 9/11 NY telephone networks (thought to be independent) all wired through one exchange

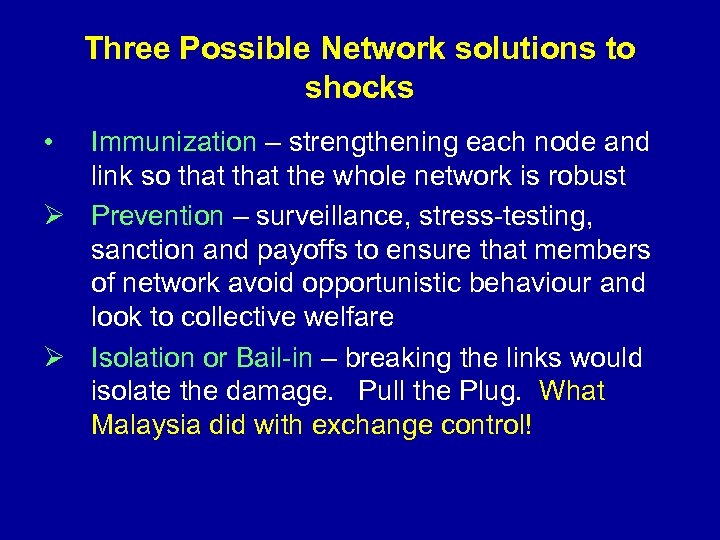

Three Possible Network solutions to shocks • Immunization – strengthening each node and link so that the whole network is robust Prevention – surveillance, stress-testing, sanction and payoffs to ensure that members of network avoid opportunistic behaviour and look to collective welfare Isolation or Bail-in – breaking the links would isolate the damage. Pull the Plug. What Malaysia did with exchange control!

Three Possible Network solutions to shocks • Immunization – strengthening each node and link so that the whole network is robust Prevention – surveillance, stress-testing, sanction and payoffs to ensure that members of network avoid opportunistic behaviour and look to collective welfare Isolation or Bail-in – breaking the links would isolate the damage. Pull the Plug. What Malaysia did with exchange control!

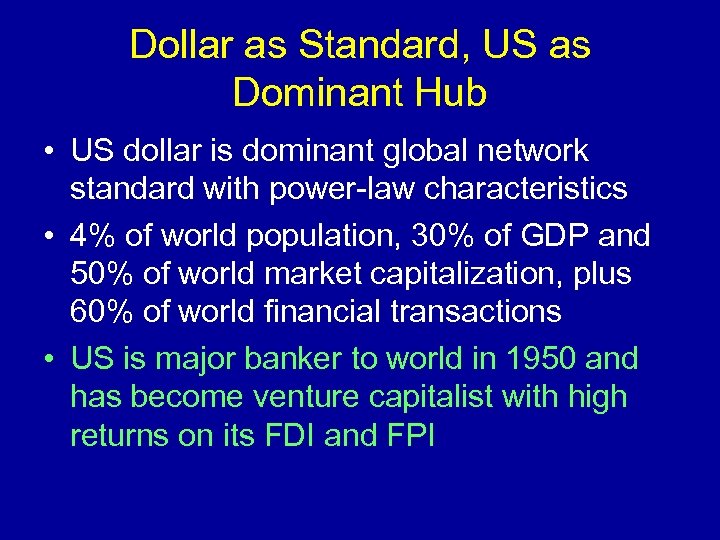

Dollar as Standard, US as Dominant Hub • US dollar is dominant global network standard with power-law characteristics • 4% of world population, 30% of GDP and 50% of world market capitalization, plus 60% of world financial transactions • US is major banker to world in 1950 and has become venture capitalist with high returns on its FDI and FPI

Dollar as Standard, US as Dominant Hub • US dollar is dominant global network standard with power-law characteristics • 4% of world population, 30% of GDP and 50% of world market capitalization, plus 60% of world financial transactions • US is major banker to world in 1950 and has become venture capitalist with high returns on its FDI and FPI

Global Imbalances Growing: AVERAGE CURRENT ACCOUNT BALANCES IN US$Bn Source : IMF

Global Imbalances Growing: AVERAGE CURRENT ACCOUNT BALANCES IN US$Bn Source : IMF

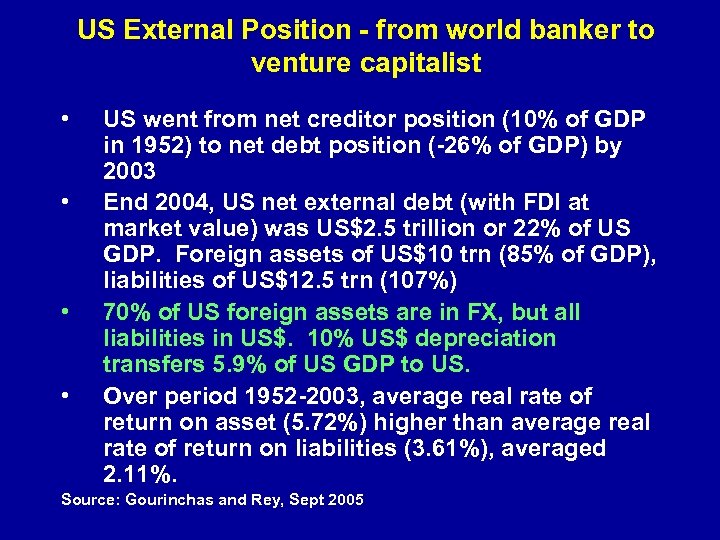

US External Position - from world banker to venture capitalist • • US went from net creditor position (10% of GDP in 1952) to net debt position (-26% of GDP) by 2003 End 2004, US net external debt (with FDI at market value) was US$2. 5 trillion or 22% of US GDP. Foreign assets of US$10 trn (85% of GDP), liabilities of US$12. 5 trn (107%) 70% of US foreign assets are in FX, but all liabilities in US$. 10% US$ depreciation transfers 5. 9% of US GDP to US. Over period 1952 -2003, average real rate of return on asset (5. 72%) higher than average real rate of return on liabilities (3. 61%), averaged 2. 11%. Source: Gourinchas and Rey, Sept 2005

US External Position - from world banker to venture capitalist • • US went from net creditor position (10% of GDP in 1952) to net debt position (-26% of GDP) by 2003 End 2004, US net external debt (with FDI at market value) was US$2. 5 trillion or 22% of US GDP. Foreign assets of US$10 trn (85% of GDP), liabilities of US$12. 5 trn (107%) 70% of US foreign assets are in FX, but all liabilities in US$. 10% US$ depreciation transfers 5. 9% of US GDP to US. Over period 1952 -2003, average real rate of return on asset (5. 72%) higher than average real rate of return on liabilities (3. 61%), averaged 2. 11%. Source: Gourinchas and Rey, Sept 2005

Global Assets Under Management (US$ trillion end 2003) International Banking Assets (BIS data) International debt securities 14. 6 Insurance companies 13. 5 Pension Funds 15. 0 Investment Companies 14. 0 Hedge Funds 0. 8 Other Institutional Investors 3. 4 Total: 84. 9 23. 6 Memo: OTC Derivative Contracts (notional) 270. 1 Source: BIS, IMF

Global Assets Under Management (US$ trillion end 2003) International Banking Assets (BIS data) International debt securities 14. 6 Insurance companies 13. 5 Pension Funds 15. 0 Investment Companies 14. 0 Hedge Funds 0. 8 Other Institutional Investors 3. 4 Total: 84. 9 23. 6 Memo: OTC Derivative Contracts (notional) 270. 1 Source: BIS, IMF

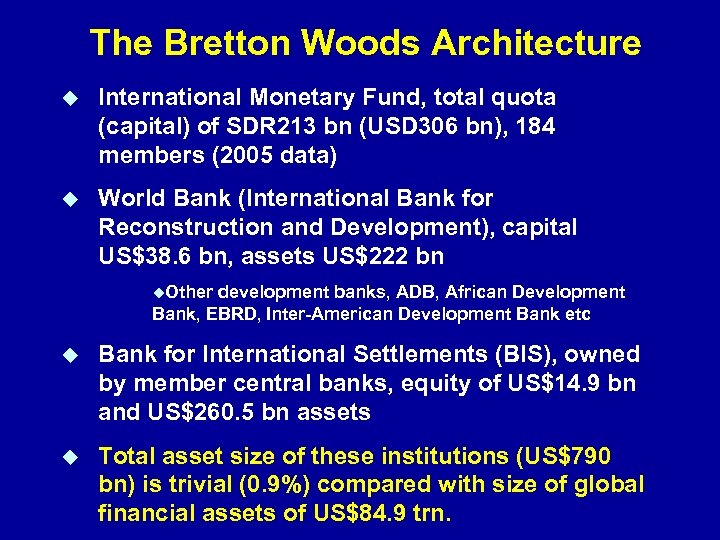

The Bretton Woods Architecture International Monetary Fund, total quota (capital) of SDR 213 bn (USD 306 bn), 184 members (2005 data) World Bank (International Bank for Reconstruction and Development), capital US$38. 6 bn, assets US$222 bn Other development banks, ADB, African Development Bank, EBRD, Inter-American Development Bank etc Bank for International Settlements (BIS), owned by member central banks, equity of US$14. 9 bn and US$260. 5 bn assets Total asset size of these institutions (US$790 bn) is trivial (0. 9%) compared with size of global financial assets of US$84. 9 trn.

The Bretton Woods Architecture International Monetary Fund, total quota (capital) of SDR 213 bn (USD 306 bn), 184 members (2005 data) World Bank (International Bank for Reconstruction and Development), capital US$38. 6 bn, assets US$222 bn Other development banks, ADB, African Development Bank, EBRD, Inter-American Development Bank etc Bank for International Settlements (BIS), owned by member central banks, equity of US$14. 9 bn and US$260. 5 bn assets Total asset size of these institutions (US$790 bn) is trivial (0. 9%) compared with size of global financial assets of US$84. 9 trn.

Reform of IMF - Mervyn King Feb 2006 IMF no longer can play role of lender of last resort (70% of IMF outstanding loans were to 3 countries) Since IMF resources too small, then its roles are to: Forum for discussion of global risks Independent “ruthless truth-telling” Monitor international balance sheets, look at ERR choices, and encourage countries to maintain global stability through higher transparency. Focus on balance sheets, not just flows.

Reform of IMF - Mervyn King Feb 2006 IMF no longer can play role of lender of last resort (70% of IMF outstanding loans were to 3 countries) Since IMF resources too small, then its roles are to: Forum for discussion of global risks Independent “ruthless truth-telling” Monitor international balance sheets, look at ERR choices, and encourage countries to maintain global stability through higher transparency. Focus on balance sheets, not just flows.

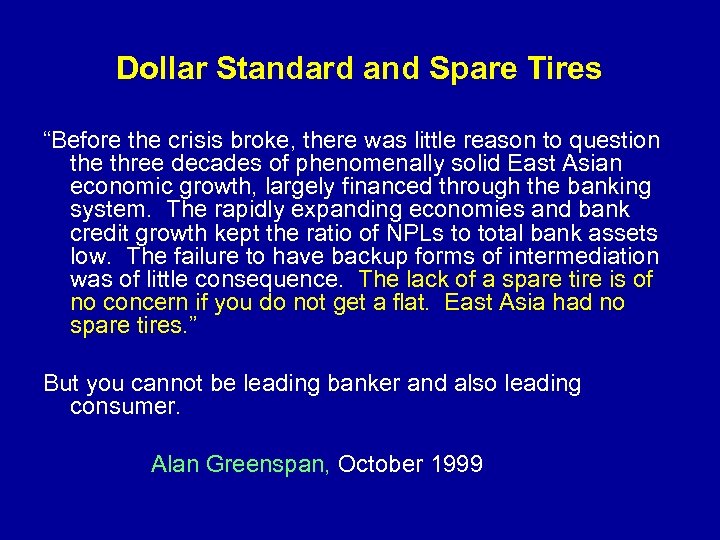

Dollar Standard and Spare Tires “Before the crisis broke, there was little reason to question the three decades of phenomenally solid East Asian economic growth, largely financed through the banking system. The rapidly expanding economies and bank credit growth kept the ratio of NPLs to total bank assets low. The failure to have backup forms of intermediation was of little consequence. The lack of a spare tire is of no concern if you do not get a flat. East Asia had no spare tires. ” But you cannot be leading banker and also leading consumer. Alan Greenspan, October 1999

Dollar Standard and Spare Tires “Before the crisis broke, there was little reason to question the three decades of phenomenally solid East Asian economic growth, largely financed through the banking system. The rapidly expanding economies and bank credit growth kept the ratio of NPLs to total bank assets low. The failure to have backup forms of intermediation was of little consequence. The lack of a spare tire is of no concern if you do not get a flat. East Asia had no spare tires. ” But you cannot be leading banker and also leading consumer. Alan Greenspan, October 1999

Why do Asians Hold More FX Reserves? Asians now have US$ 2+ trillion in FX reserves. Asian FX reserves are 10 times larger than combined reserves of G 7. In the absence of Lender of last Resort, Asia now has a spare tire. Asia may be fast becoming the dollar spare tire. ”

Why do Asians Hold More FX Reserves? Asians now have US$ 2+ trillion in FX reserves. Asian FX reserves are 10 times larger than combined reserves of G 7. In the absence of Lender of last Resort, Asia now has a spare tire. Asia may be fast becoming the dollar spare tire. ”

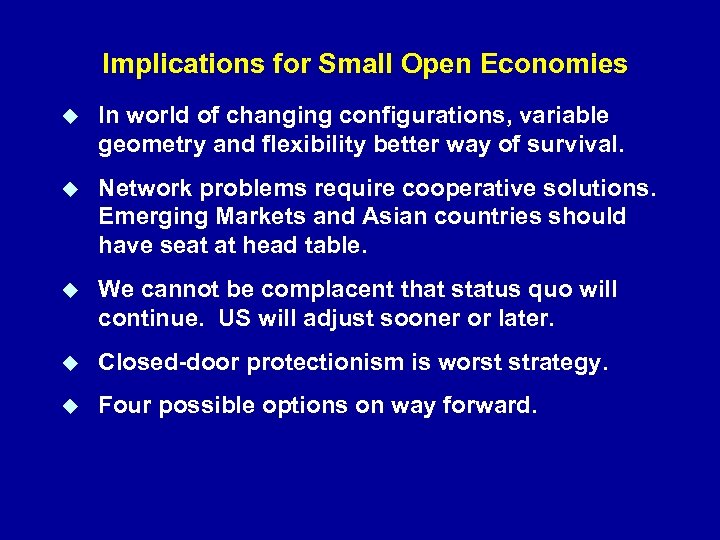

Implications for Small Open Economies In world of changing configurations, variable geometry and flexibility better way of survival. Network problems require cooperative solutions. Emerging Markets and Asian countries should have seat at head table. We cannot be complacent that status quo will continue. US will adjust sooner or later. Closed-door protectionism is worst strategy. Four possible options on way forward.

Implications for Small Open Economies In world of changing configurations, variable geometry and flexibility better way of survival. Network problems require cooperative solutions. Emerging Markets and Asian countries should have seat at head table. We cannot be complacent that status quo will continue. US will adjust sooner or later. Closed-door protectionism is worst strategy. Four possible options on way forward.

Four Possible Ways Forward u Continue with Dollar Standard - evidence of Asia moving away from dollar bloc u Increase use of Euro - requires Euro bloc agreement u Work on Asian currency bloc - current lack of leadership and statesmanship in this area u Free floating and pull the plug if shocks get too large. Muddling through.

Four Possible Ways Forward u Continue with Dollar Standard - evidence of Asia moving away from dollar bloc u Increase use of Euro - requires Euro bloc agreement u Work on Asian currency bloc - current lack of leadership and statesmanship in this area u Free floating and pull the plug if shocks get too large. Muddling through.

Concluding Thoughts u Move from Linear, Segmented thinking to Matrix, Inter-Connected approach to global markets. u In Interdependent world, greater mutual understanding and cooperation is necessary u Since markets have structure, understanding topology helps in market reforms u Tun Ismail legacy: We must have clear thinking in fast changing and confusing world.

Concluding Thoughts u Move from Linear, Segmented thinking to Matrix, Inter-Connected approach to global markets. u In Interdependent world, greater mutual understanding and cooperation is necessary u Since markets have structure, understanding topology helps in market reforms u Tun Ismail legacy: We must have clear thinking in fast changing and confusing world.

Thank you Questions to as@andrewsheng. net

Thank you Questions to as@andrewsheng. net