Monetarism Notes Econ 102 Mr. Smitka Winter 2003

Monetarism Notes Econ 102 Mr. Smitka Winter 2003

Prime Minister Kakuei Tanaka, 1972 田中角栄 • 列島改造計画 Plan to Rebuild the Japanese Archipelago – Slowdown ca. 1970 encouraged fiscal policy – Tanaka started in the construction industry, used that to raise campaign funds for faction / political party • 1971 ¥/$ appreciation: end of “Bretton Woods” – huge inflow of dollars, bought to lessen forex shift but boosted money supply / lowered interest rates • Sum: both stimulative MP and stimulative FP – Double-digit inflation by 1973

Prime Minister Kakuei Tanaka, 1972 田中角栄 • 列島改造計画 Plan to Rebuild the Japanese Archipelago – Slowdown ca. 1970 encouraged fiscal policy – Tanaka started in the construction industry, used that to raise campaign funds for faction / political party • 1971 ¥/$ appreciation: end of “Bretton Woods” – huge inflow of dollars, bought to lessen forex shift but boosted money supply / lowered interest rates • Sum: both stimulative MP and stimulative FP – Double-digit inflation by 1973

Oil Crisis • October 6, 1973 Yom Kippur War – OPEC already more active – Boom not just in Japan but also US, Europe • I worked overtime, 7 days / week, at UAW wages … • Demand made cartel discipline moot – Oil prices quadrupled • Japan imported 99+% of oil • Huge boost in inflation • Inflation jumped to 25% – Panic buying: shoppers trampled to death buying TP

Oil Crisis • October 6, 1973 Yom Kippur War – OPEC already more active – Boom not just in Japan but also US, Europe • I worked overtime, 7 days / week, at UAW wages … • Demand made cartel discipline moot – Oil prices quadrupled • Japan imported 99+% of oil • Huge boost in inflation • Inflation jumped to 25% – Panic buying: shoppers trampled to death buying TP

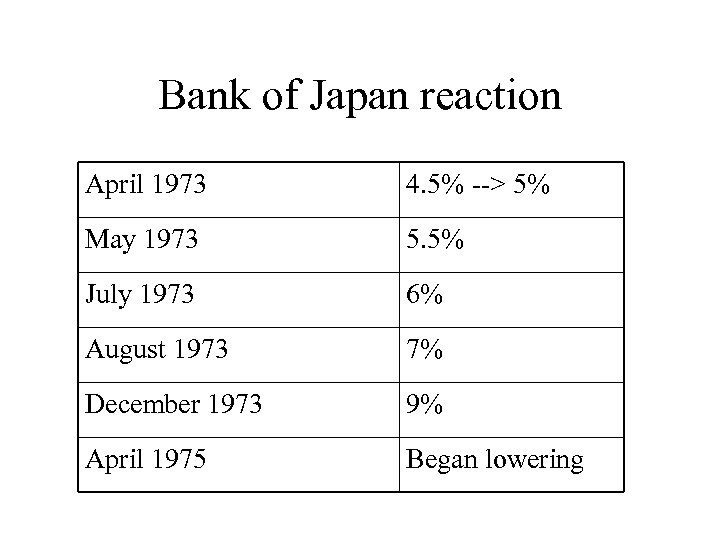

Bank of Japan reaction April 1973 4. 5% --> 5% May 1973 5. 5% July 1973 6% August 1973 7% December 1973 9% April 1975 Began lowering

Bank of Japan reaction April 1973 4. 5% --> 5% May 1973 5. 5% July 1973 6% August 1973 7% December 1973 9% April 1975 Began lowering

Analytic issues • Time lags – Recognition – Implementation – Impact • Time consistency – Short-run versus long-run • Structural issues – Institutional change renders historical relationships (model parameters) misleading

Analytic issues • Time lags – Recognition – Implementation – Impact • Time consistency – Short-run versus long-run • Structural issues – Institutional change renders historical relationships (model parameters) misleading

Monetarist models • MP = ? … what should be goals? • MV PY … an identity: true by definition – M is money stock – V is velocity, ability of a given amount of money to support economic activity – P is price level, Y real GDP • So PY is nominal GDP • Can this framework be used?

Monetarist models • MP = ? … what should be goals? • MV PY … an identity: true by definition – M is money stock – V is velocity, ability of a given amount of money to support economic activity – P is price level, Y real GDP • So PY is nominal GDP • Can this framework be used?

MV PY • IF velocity “V” is stable • AND the link between nominal and real GDP is predictable • THEN can tie changes in money supply to changes in “P” – that is, inflation • But in fact – V is noisy and shifts with institutional change – PY is not easy to decompose

MV PY • IF velocity “V” is stable • AND the link between nominal and real GDP is predictable • THEN can tie changes in money supply to changes in “P” – that is, inflation • But in fact – V is noisy and shifts with institutional change – PY is not easy to decompose

Sample arithmetic • MV PY…to use, add growth rates – M plus 5% • V ± 2% since volatile / large error component – Then PY can range from +7% to +3% • Real Y avg +2% but can fall as much as -1% – [increase can be more short-run, coming out of recession] – So P can range from: • 7% - (-1%) = 8% • 3% - 2% = 1% • Monetarist framework offers little insight under “normal” growth rates of US and post-1973 Japan

Sample arithmetic • MV PY…to use, add growth rates – M plus 5% • V ± 2% since volatile / large error component – Then PY can range from +7% to +3% • Real Y avg +2% but can fall as much as -1% – [increase can be more short-run, coming out of recession] – So P can range from: • 7% - (-1%) = 8% • 3% - 2% = 1% • Monetarist framework offers little insight under “normal” growth rates of US and post-1973 Japan

Sample arithmentic #2 • M = +25% • V ± 2% as before – Then PY can range from 27% to 22% – Even with real Y = +5% inflation is high – But oil crisis ---> Y = -2% [or worse!] • So inflation 24% ≈ 29% • High “M” growth is indicative of problems

Sample arithmentic #2 • M = +25% • V ± 2% as before – Then PY can range from 27% to 22% – Even with real Y = +5% inflation is high – But oil crisis ---> Y = -2% [or worse!] • So inflation 24% ≈ 29% • High “M” growth is indicative of problems

Other aspects • FP side effects – Implications of lifetime consumption model • MP side effects – Do you really want low investment to persist? – Are big swings in forex rates desirable? • International side effects – How to respond to exogenous forex shifts?

Other aspects • FP side effects – Implications of lifetime consumption model • MP side effects – Do you really want low investment to persist? – Are big swings in forex rates desirable? • International side effects – How to respond to exogenous forex shifts?

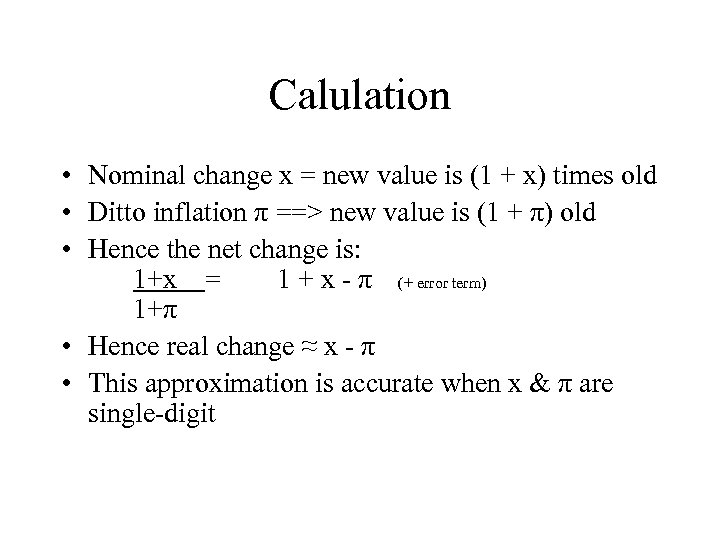

Calulation • Nominal change x = new value is (1 + x) times old • Ditto inflation π ==> new value is (1 + π) old • Hence the net change is: 1+x = 1 + x - π (+ error term) 1+π • Hence real change ≈ x - π • This approximation is accurate when x & π are single-digit

Calulation • Nominal change x = new value is (1 + x) times old • Ditto inflation π ==> new value is (1 + π) old • Hence the net change is: 1+x = 1 + x - π (+ error term) 1+π • Hence real change ≈ x - π • This approximation is accurate when x & π are single-digit