Monetarism.pptx

- Количество слайдов: 40

MONETARISM Banks, money and money market 1

Those goods have something in common Dolphin teeth on Polinesia Islands Shells in some regions of Africa Cigarettes in war prisoner camps Nylon stockings in Germany after the WWII 2

The substance of money Money: an asset that is generally accepted as a medium of payments. It is anything that is regurarly used in exchange. „Money” should not be confused with „wealth”. Wealth consists of many sorts of assets. Money is only one of them, though special. 3

Functions of money It is medium of exchange / blue coloured dollar It is store of value / wafer icecream It is measure of value (unit of account) / see next slide 4

Homework Say that i. Phohe costs 4 pairs of Air. Nike and 100 litres of fuel. 1 pair of Air. Nike can be purchased by three Toshiba pendrives (5 MB) and newest CD of Justin Bieber. How many litres of fuel do you have to pay to get Bieber’s CD? 5

Benefits that result from having money Benefits of exchange clarity Benefits of specialization (double coincidence of wants - the problem in a system of barter that one person may not have what the other desires). 6

Types of money Commodity money: money that would have value even if it were not being used as money. Commodity-backed money: money that can be exchanged on demand for a specific commodity (e. g. gold). Fiat money: money that has no intrinsic value but has value as money because a government decreed that it has value for that purpose. Source: Economics About 7

Supremacy of gold Durability (gold vs. eggs) Scarcity (gold vs. stones) Divisibility (gold vs. elephants) Homogeneity (gold vs. apples) 8

Money aggregates M 0 (monetary base): cash reserves of commercial banks + coins and banknotes held by subjects other than banks. M 1: coins and banknotes held by subjects other than banks + the most liquid deposits in banks (e. g. checkable deposits). M 2, M 3, etc. The greater number, the smaller liquidity. 9

What do we mean by „money supply”? Supply of money: the amount of the asset that can be used to pay for goods or services in the economic circulation. M 0 doesn’t measure supply of money. Money aggregates measure supply of money, however the basic metric of money suppy is M 1 – the sum of most liquid assets that can be used as the medium of payments. 10

Supply of money in a nutshell SUPPLY OF MONEY = CASH + DEPOSITS The less liquid deposits are included, the broader definition of money suppy. 11

What do we mean by „demand for money”? Demand for money: the amount of the asset that can be used to pay for goods or services that is wanted by the economic subjects which make spending. 12

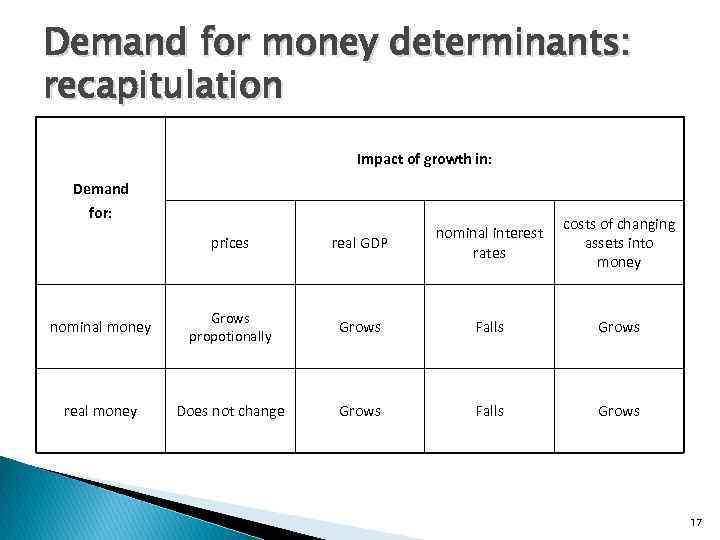

Demand for money determinants Short-term nominal interest rates Total value of transactions (≈real GDP) Costs of changing other assets into money Prices (but only in the case of demand for nominal money) 13

Nominal interest rate Why „nominal” (not „real”)? Why „rate” (not „rates”)? Why „short-term” (not „long-term”)? 14

Demand for money determinant: the case of Japan The amount of cash Japanese people hold is high in comparison with other nations. It can be explained by: ◦ low interest rates (below 1% since the mid of 90. XXth), ◦ intitutional environment, ◦ low criminality. 15

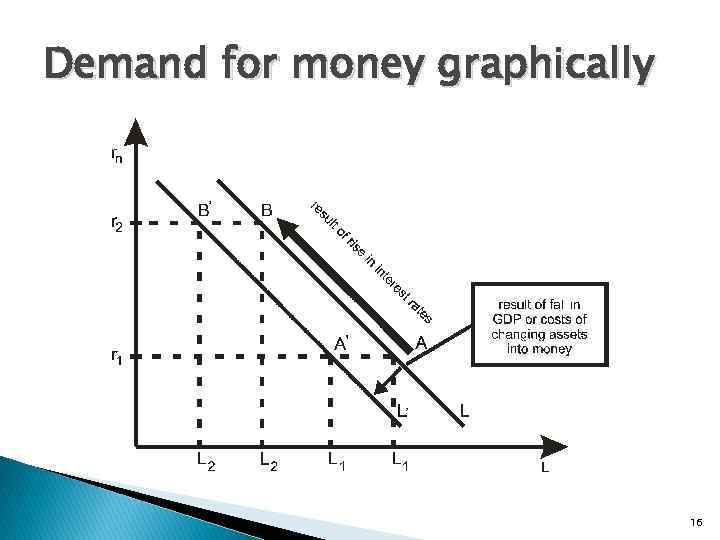

Demand for money graphically 16

Demand for money determinants: recapitulation Impact of growth in: Demand for: costs of changing assets into money prices real GDP nominal interest rates nominal money Grows propotionally Grows Falls Grows real money Does not change Grows Falls Grows 17

Banking system In Poland, as in many other countries, banking system is divided into two parts: ◦ central bank, ◦ commercial banks. 18

Roles of central bank Issuing bank Bank of banks Bank of country 19

Commercial banks Commercial banks: organizations that receive funds from savers and channel them to investors (financial intermediaries). They do that for profit. 20

Banking operations & other important items Banking operations: ◦ ◦ passive (deposits), active (loans), clearings, quasi-banking operations (leasing, investment banking, insurance etc. ). Loan interest rate > deposit interest rate Reserves 21

Financial panic & self-fulfilling prophecy Each loan corresponds a deposit. Yet, when all deposit holders require the immediate return of their money at the same time no bank can fulfill the requirement. Even healthy bank can collapse in such a situation. 22

Financial panic prevention Obligatory cash reserves Guarantee funds / deposit insurance Loan granted by the central bank Capital requirements 23

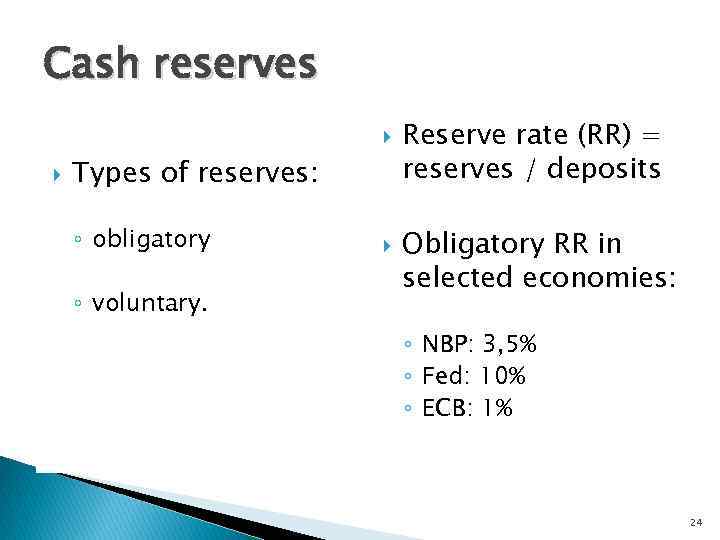

Cash reserves Types of reserves: ◦ obligatory ◦ voluntary. Reserve rate (RR) = reserves / deposits Obligatory RR in selected economies: ◦ NBP: 3, 5% ◦ Fed: 10% ◦ ECB: 1% 24

What (or who) determines money supply? If supply of money = cash + deposits (see slide 11) then in the economy without banks it would equal cash (and it would be the same as M 0). The amount of cash is determined by the cetral bank that is issuing bank. Yet, commercial banks exist and they can multiply – through deposits - the money issued by the central bank. 25

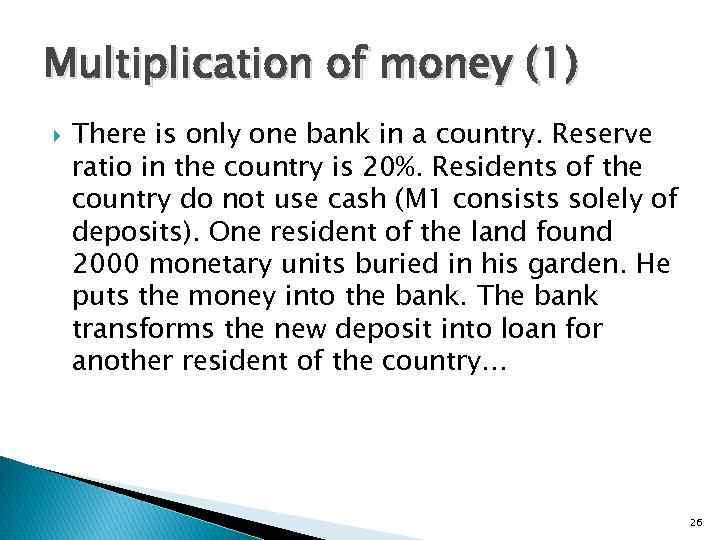

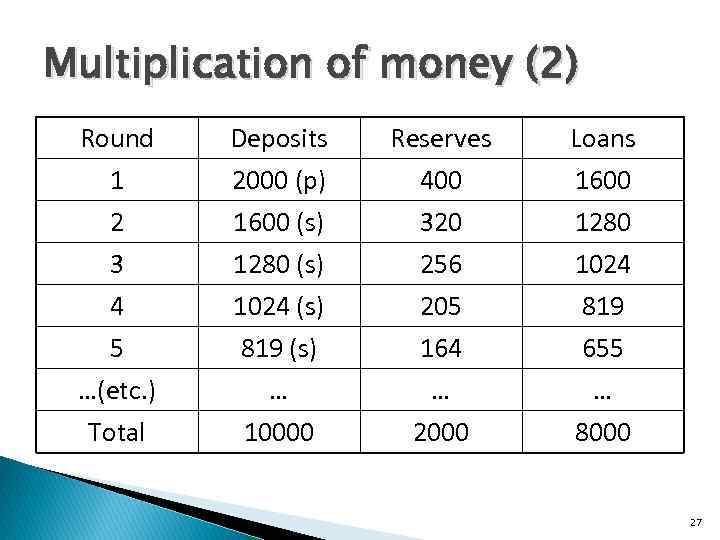

Multiplication of money (1) There is only one bank in a country. Reserve ratio in the country is 20%. Residents of the country do not use cash (M 1 consists solely of deposits). One resident of the land found 2000 monetary units buried in his garden. He puts the money into the bank. The bank transforms the new deposit into loan for another resident of the country… 26

Multiplication of money (2) Round 1 2 Deposits 2000 (p) 1600 (s) Reserves 400 320 Loans 1600 1280 3 4 5 …(etc. ) Total 1280 (s) 1024 (s) 819 (s) … 10000 256 205 164 … 2000 1024 819 655 … 8000 27

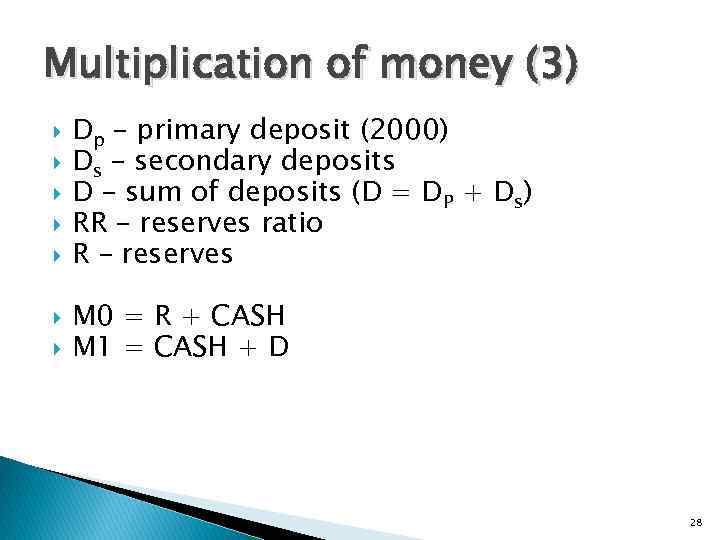

Multiplication of money (3) Dp – primary deposit (2000) Ds – secondary deposits D – sum of deposits (D = DP + Ds) RR – reserves ratio R – reserves M 0 = R + CASH M 1 = CASH + D 28

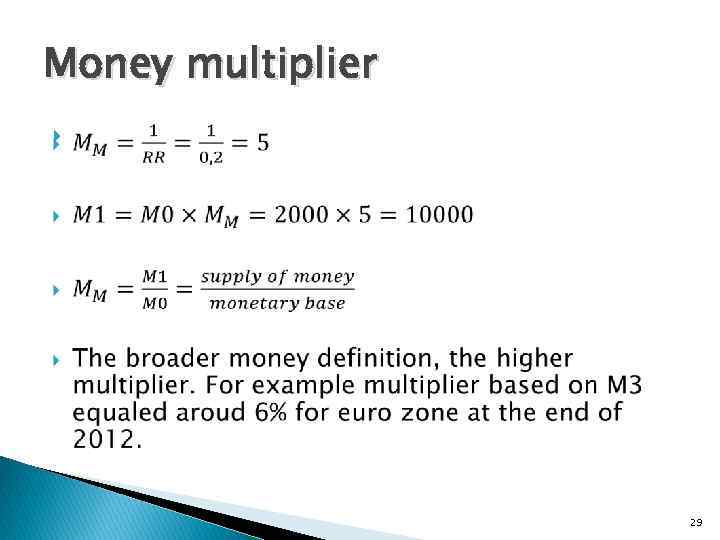

Money multiplier 29

Money multiplier in practice Multiplier based on M 1 is normally low because people use cash (in contradiction to the hypothetical case studied so far). The more cash in the structure of M 1, the more can be transformed into loans by commercial banks (ceteris paribus). 30

Reserve ratio and money supply RR formula (see slide 29) suggests that money supplied can be affected by reserve ratio. In Poland RR = 3, 5% since October 2003. In USA it was not modified since 1992. 31

Discount rate and money supplied Money supply can be also influenced by the discount rate of the central bank. The increase in the rate leads to more cautious behaiour of commercial banks (they borrow less which means decrease in money supply). 32

Open market operations and money supply (1) Open market operations: sale or purchase of short-term government securities in transactions with commercial banks. Sale: decrease in money supply Purchase: increase in money supply 33

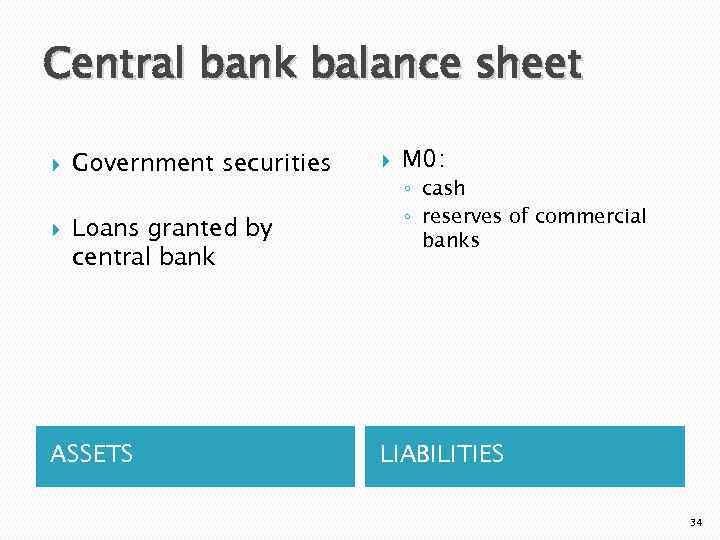

Central bank balance sheet Government securities Loans granted by central bank ASSETS M 0: ◦ cash ◦ reserves of commercial banks LIABILITIES 34

Open market operations and money supply (2) Open market operations change M 0 and – through money multiplier – money supply: ◦ purchase of securities increases M 0 (CB increases reserve accounts by the payment for securities), ◦ sale of securities decreases M 0 (CB decreases reserve accounts by the payment for securities). The increases / decreases in the reserve accounts are created / deleted in the electronic way – should be considered the electronic counterpart of printing money. 35

Monetary policy Monetary policy: policy of determining volume of money in the economy in order to keep inflation under control as well as to affect production and income. 36

Monetary policy tools: recap. RR (directly affects money multiplier) Discount rate of central bank (indirectly affects money multiplier) Open market operations (affects M 0) -------------------- Today only open market operations matter. Other tools of monetary policy are of marginal use. 37

Contractionary monetary policy: less money in the economy It is aimed at the decrease in money supply which can be achieved by: ◦ increase in RR, ◦ increase in the discount rate of central bank, ◦ sale of securities on the open market. 38

Expansionary monetary policy: more money in the economy It is aimed at the increase in money supply which can be achieved by: ◦ decrease in RR, ◦ decrease in the discount rate of central bank, ◦ purchase of securities on the open market. 39

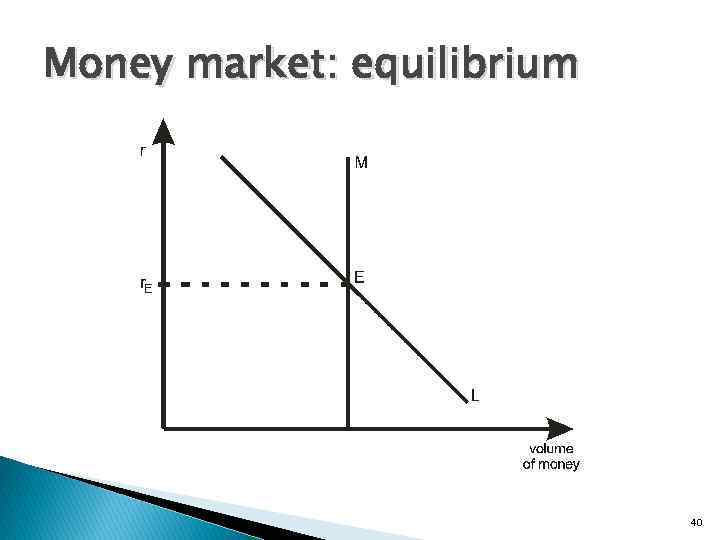

Money market: equilibrium 40

Monetarism.pptx