20fe371876147e74a532778483c6971b.ppt

- Количество слайдов: 84

Monday, 27 th AUGUST 2012 SRISAILAM Inheritance, Family Settlement & HUF TAX ISSUES Organized by CPE Committee of ICAI jointly with SIRC of ICAI CA. GOPAL KRISHNA RAJU FCA, AICWA, ACS, PGDOR, PGDFM, DISA Partner: M/s. K. Gopal Rao & Co. , Chartered Accountants, Chennai 3 Day CPE Residential Seminar - SRISAILAM Hosted by HYDERABAD BRANCH OF SIRC OF ICAI AUGUST 25 th – 27 th 2012

Monday, 27 th AUGUST 2012 SRISAILAM Inheritance, Family Settlement & HUF TAX ISSUES Organized by CPE Committee of ICAI jointly with SIRC of ICAI CA. GOPAL KRISHNA RAJU FCA, AICWA, ACS, PGDOR, PGDFM, DISA Partner: M/s. K. Gopal Rao & Co. , Chartered Accountants, Chennai 3 Day CPE Residential Seminar - SRISAILAM Hosted by HYDERABAD BRANCH OF SIRC OF ICAI AUGUST 25 th – 27 th 2012

Residential Seminar - SRISAILAM 2 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Residential Seminar - SRISAILAM 2 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Agenda 1. Introduction 2. Coparceners and Members 3. Creation of HUF 4. Business Income 5. Assessment to Income Tax 6. Wealth Tax 7. Gifts – to and by 8. Tax Planning Residential Seminar - SRISAILAM 3 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Agenda 1. Introduction 2. Coparceners and Members 3. Creation of HUF 4. Business Income 5. Assessment to Income Tax 6. Wealth Tax 7. Gifts – to and by 8. Tax Planning Residential Seminar - SRISAILAM 3 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Agenda 1: Introduction SRISAILAM 4 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Agenda 1: Introduction SRISAILAM 4 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Family • A family consisting of parents and their children living together as a unit has played a crucial role in the evolution of human society. • A family so understood has been the basic unit of society, primitive, feudal or tribal, ancient or modern. • There are two vital difference between the family in Hindu Society and the family as commonly understood elsewhere. SRISAILAM 5 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Family • A family consisting of parents and their children living together as a unit has played a crucial role in the evolution of human society. • A family so understood has been the basic unit of society, primitive, feudal or tribal, ancient or modern. • There are two vital difference between the family in Hindu Society and the family as commonly understood elsewhere. SRISAILAM 5 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Family in Hindu Society i. The concept of the family has been extended to include not only parents and their off-spring but also many other relatives connected by blood, more specifically those claiming descent from a common ancestor, and ii. The carrying on of economic activity – agricultural, commercial, industrial – and ownership of property by the family as a distinct and separate unit. SRISAILAM 6 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Family in Hindu Society i. The concept of the family has been extended to include not only parents and their off-spring but also many other relatives connected by blood, more specifically those claiming descent from a common ancestor, and ii. The carrying on of economic activity – agricultural, commercial, industrial – and ownership of property by the family as a distinct and separate unit. SRISAILAM 6 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

HUF – an institution by law • HUF is essentially a unit of society and not necessarily an economic or commercial unit. ♥ It needs, therefore, to be emphasized that there could be an HUF which does not own property or carry on business. • Our tax administrators and law makers have been viewing this institution (always) with suspicion. SRISAILAM 7 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

HUF – an institution by law • HUF is essentially a unit of society and not necessarily an economic or commercial unit. ♥ It needs, therefore, to be emphasized that there could be an HUF which does not own property or carry on business. • Our tax administrators and law makers have been viewing this institution (always) with suspicion. SRISAILAM 7 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Family Relationship - Sapindaship • A HUF consisting of male members descended lineally from a common male ancestor, their wives and unmarried daughters and bound together by the fundamental principle of sapindaship or family relationship is an institution unique to India. • This is a living institution which is not going to disappear or to be killed by legislation. Residential Seminar - SRISAILAM 8 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Family Relationship - Sapindaship • A HUF consisting of male members descended lineally from a common male ancestor, their wives and unmarried daughters and bound together by the fundamental principle of sapindaship or family relationship is an institution unique to India. • This is a living institution which is not going to disappear or to be killed by legislation. Residential Seminar - SRISAILAM 8 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

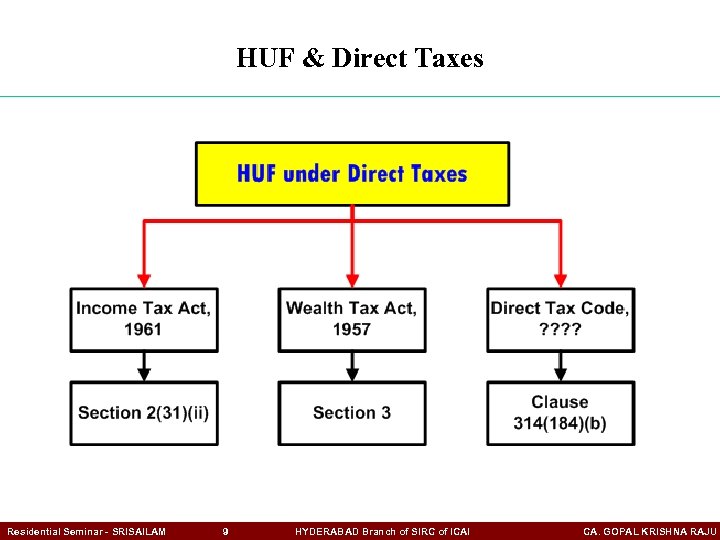

HUF & Direct Taxes Residential Seminar - SRISAILAM 9 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

HUF & Direct Taxes Residential Seminar - SRISAILAM 9 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

HUF & Direct Taxes • Under section 4 of the Income Tax Act, 1961, incometax is payable by ‘every person’ and the word ‘person’ as defined in section 2(31)(ii) of the Income Tax Act, includes a ‘Hindu Undivided Family’ • Similarly, under section 3 of the Wealth Tax Act, 1957, wealth is chargeable to tax in respect of the net wealth of every ‘Hindu Undivided Family’. Residential Seminar - SRISAILAM 10 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

HUF & Direct Taxes • Under section 4 of the Income Tax Act, 1961, incometax is payable by ‘every person’ and the word ‘person’ as defined in section 2(31)(ii) of the Income Tax Act, includes a ‘Hindu Undivided Family’ • Similarly, under section 3 of the Wealth Tax Act, 1957, wealth is chargeable to tax in respect of the net wealth of every ‘Hindu Undivided Family’. Residential Seminar - SRISAILAM 10 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

HUF – Legal Definition - ? !#%* • HUF – a legal entity under direct tax laws • No separate definition of the expression HUF has been attempted in any of the direct tax laws because the term has a definite connotation under the Hindu Law. • The courts have declared that the expression HUF must be construed in the sense in which it is understood under the Hindu Law. [Surjit Lal Chhabda vs. CIT 101 ITR 776 (SC); CIT vs. Gomedalli Lakhsmi Narayan 3 ITR 367 (Bom) ] Residential Seminar - SRISAILAM 11 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

HUF – Legal Definition - ? !#%* • HUF – a legal entity under direct tax laws • No separate definition of the expression HUF has been attempted in any of the direct tax laws because the term has a definite connotation under the Hindu Law. • The courts have declared that the expression HUF must be construed in the sense in which it is understood under the Hindu Law. [Surjit Lal Chhabda vs. CIT 101 ITR 776 (SC); CIT vs. Gomedalli Lakhsmi Narayan 3 ITR 367 (Bom) ] Residential Seminar - SRISAILAM 11 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

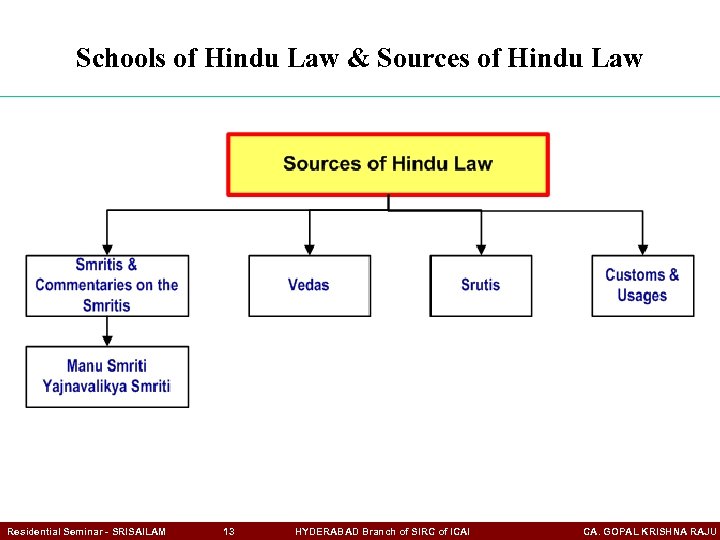

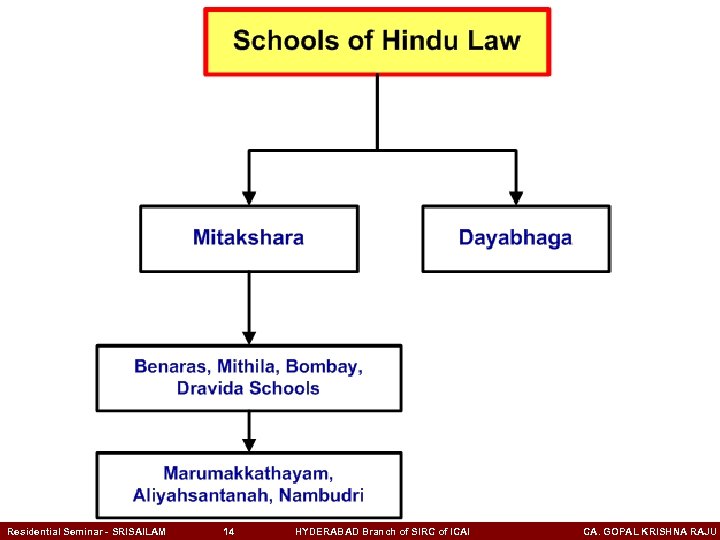

Schools of Hindu Law & Sources of Hindu Law • There are two major schools of Hindu Law, Mitakshara and Dayabhaga. • The sources of Hindu Law are the Vedas, the Srutis, the smritis, the commentaries on the smritis and above all custom and usage. Residential Seminar - SRISAILAM 12 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Schools of Hindu Law & Sources of Hindu Law • There are two major schools of Hindu Law, Mitakshara and Dayabhaga. • The sources of Hindu Law are the Vedas, the Srutis, the smritis, the commentaries on the smritis and above all custom and usage. Residential Seminar - SRISAILAM 12 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Schools of Hindu Law & Sources of Hindu Law Residential Seminar - SRISAILAM 13 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Schools of Hindu Law & Sources of Hindu Law Residential Seminar - SRISAILAM 13 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Residential Seminar - SRISAILAM 14 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Residential Seminar - SRISAILAM 14 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

The essence of schools of Hindu Law • In Dayabhaga there is unity of possession but no unity of ownership. • As Mulla has put it “The essence of coparcenary under Mitakshara is unity of ownership. The essence of coparcenary under Dayabhaga is unity of possession”. Residential Seminar - SRISAILAM 15 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

The essence of schools of Hindu Law • In Dayabhaga there is unity of possession but no unity of ownership. • As Mulla has put it “The essence of coparcenary under Mitakshara is unity of ownership. The essence of coparcenary under Dayabhaga is unity of possession”. Residential Seminar - SRISAILAM 15 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Mitakshara & Dayabhaga • Sometime in the 11 th century, Vijneshwara compiled a compendium of the law as it then existed, calling it Mitakshara. • Dayabhaga is a treatise written by Jimutavahana in 12 th century. It is critical of Mitakshara in many ways, but more particularly in repsect of law of inheritance and succession. • Where Dayabhaga is silent, Mitakshara automatically prevails. Dayabhaga Law is applicable to Bengal. Residential Seminar - SRISAILAM 16 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Mitakshara & Dayabhaga • Sometime in the 11 th century, Vijneshwara compiled a compendium of the law as it then existed, calling it Mitakshara. • Dayabhaga is a treatise written by Jimutavahana in 12 th century. It is critical of Mitakshara in many ways, but more particularly in repsect of law of inheritance and succession. • Where Dayabhaga is silent, Mitakshara automatically prevails. Dayabhaga Law is applicable to Bengal. Residential Seminar - SRISAILAM 16 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Primary difference between Dayabhaga & Mitakshara • In Mitakshara school a coparcener’s interest in the joint family does not remain fixed and keeps fluctuating in as much as his interest expands when the family expands and when his family loses property or part of the property his interest in the family property automatically reduces. • In Dayabhaga school, a Hindu on the death of his father succeeds to a definite share in the property left by his father. Residential Seminar - SRISAILAM 17 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Primary difference between Dayabhaga & Mitakshara • In Mitakshara school a coparcener’s interest in the joint family does not remain fixed and keeps fluctuating in as much as his interest expands when the family expands and when his family loses property or part of the property his interest in the family property automatically reduces. • In Dayabhaga school, a Hindu on the death of his father succeeds to a definite share in the property left by his father. Residential Seminar - SRISAILAM 17 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Dayabhaga (act of volition) & Mitakshara(operation of Law) • In Mitakshara school a person from the inception acquired a right in the family property, in the Dayabhaga school the property devolves on the death of a Hindu on his heirs and successors. • A Hindu under the Mitakshara school becomes a coparcener by operation of law and a Hindu governed by the Dayabhaga school becomes a coparcener by an act of volition. Residential Seminar - SRISAILAM 18 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Dayabhaga (act of volition) & Mitakshara(operation of Law) • In Mitakshara school a person from the inception acquired a right in the family property, in the Dayabhaga school the property devolves on the death of a Hindu on his heirs and successors. • A Hindu under the Mitakshara school becomes a coparcener by operation of law and a Hindu governed by the Dayabhaga school becomes a coparcener by an act of volition. Residential Seminar - SRISAILAM 18 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Residential Seminar - SRISAILAM 19 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Residential Seminar - SRISAILAM 19 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

The Hindu Succession (Amendment) Act, 2005 9 -9 -2005 SRISAILAM 20 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

The Hindu Succession (Amendment) Act, 2005 9 -9 -2005 SRISAILAM 20 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Can a Female be a Karta? • Membership of a coparcenary is a necessary qualification for managing a joint family. • A Hindu female was not a coparcener till the coming into force of the amendment of the Hindu Succession Act, 1956 in the year 2005 and thus did not have the right to become a manager of a joint Hindu family. • VMN Radha Ammal v. CIT 18 ITR 225 (Mad) • CIT v. Seth Govindram Sugar Mills (1965) 57 ITR 510 (SC) Residential Seminar - SRISAILAM 21 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Can a Female be a Karta? • Membership of a coparcenary is a necessary qualification for managing a joint family. • A Hindu female was not a coparcener till the coming into force of the amendment of the Hindu Succession Act, 1956 in the year 2005 and thus did not have the right to become a manager of a joint Hindu family. • VMN Radha Ammal v. CIT 18 ITR 225 (Mad) • CIT v. Seth Govindram Sugar Mills (1965) 57 ITR 510 (SC) Residential Seminar - SRISAILAM 21 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

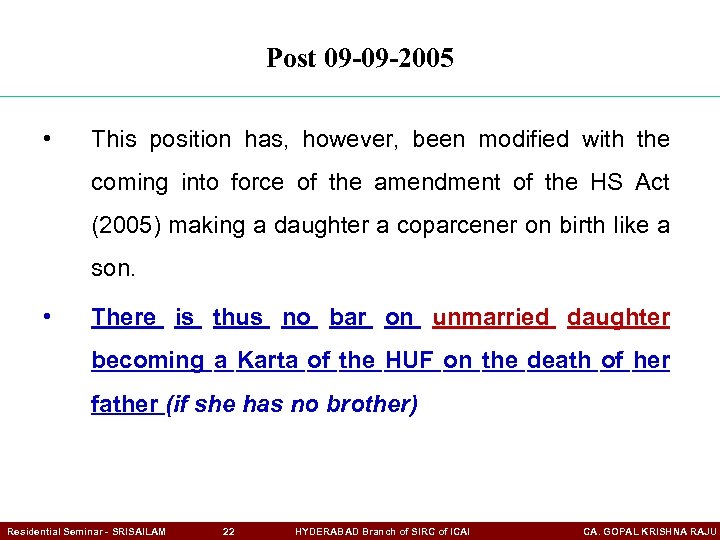

Post 09 -09 -2005 • This position has, however, been modified with the coming into force of the amendment of the HS Act (2005) making a daughter a coparcener on birth like a son. • There is thus no bar on unmarried daughter becoming a Karta of the HUF on the death of her father (if she has no brother) Residential Seminar - SRISAILAM 22 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Post 09 -09 -2005 • This position has, however, been modified with the coming into force of the amendment of the HS Act (2005) making a daughter a coparcener on birth like a son. • There is thus no bar on unmarried daughter becoming a Karta of the HUF on the death of her father (if she has no brother) Residential Seminar - SRISAILAM 22 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

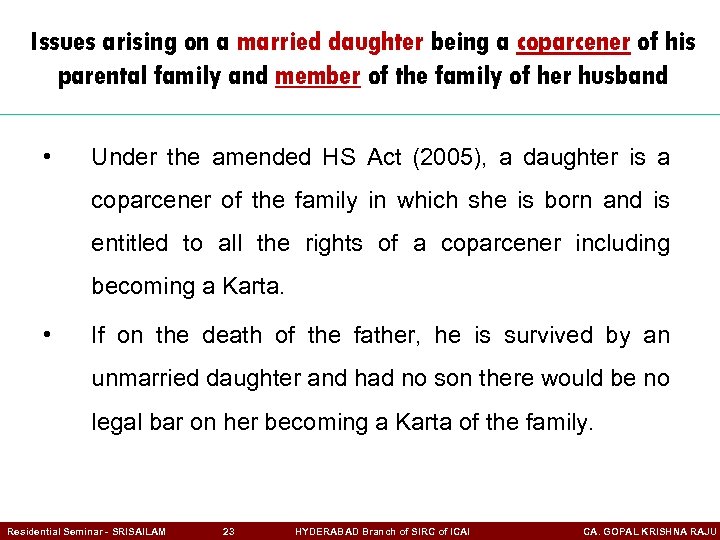

Issues arising on a married daughter being a coparcener of his parental family and member of the family of her husband • Under the amended HS Act (2005), a daughter is a coparcener of the family in which she is born and is entitled to all the rights of a coparcener including becoming a Karta. • If on the death of the father, he is survived by an unmarried daughter and had no son there would be no legal bar on her becoming a Karta of the family. Residential Seminar - SRISAILAM 23 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Issues arising on a married daughter being a coparcener of his parental family and member of the family of her husband • Under the amended HS Act (2005), a daughter is a coparcener of the family in which she is born and is entitled to all the rights of a coparcener including becoming a Karta. • If on the death of the father, he is survived by an unmarried daughter and had no son there would be no legal bar on her becoming a Karta of the family. Residential Seminar - SRISAILAM 23 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

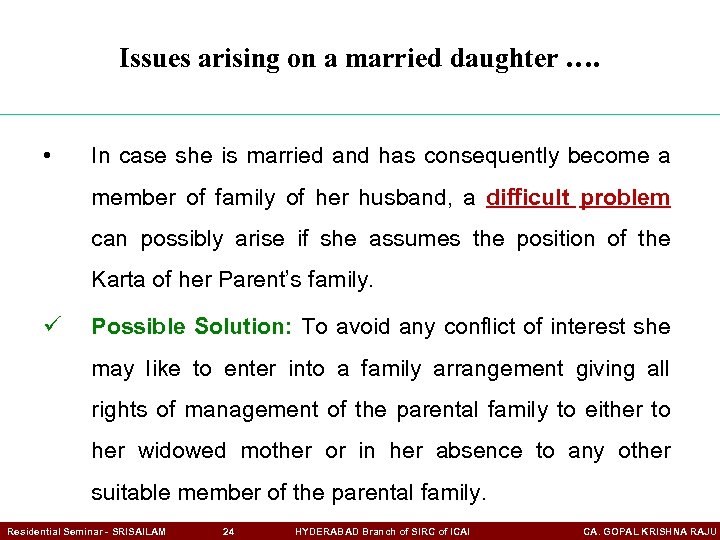

Issues arising on a married daughter …. • In case she is married and has consequently become a member of family of her husband, a difficult problem can possibly arise if she assumes the position of the Karta of her Parent’s family. ü Possible Solution: To avoid any conflict of interest she may like to enter into a family arrangement giving all rights of management of the parental family to either to her widowed mother or in her absence to any other suitable member of the parental family. Residential Seminar - SRISAILAM 24 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Issues arising on a married daughter …. • In case she is married and has consequently become a member of family of her husband, a difficult problem can possibly arise if she assumes the position of the Karta of her Parent’s family. ü Possible Solution: To avoid any conflict of interest she may like to enter into a family arrangement giving all rights of management of the parental family to either to her widowed mother or in her absence to any other suitable member of the parental family. Residential Seminar - SRISAILAM 24 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

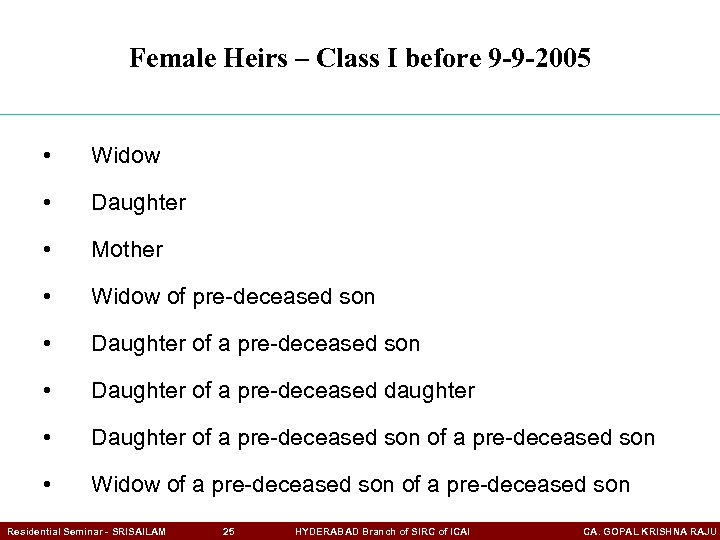

Female Heirs – Class I before 9 -9 -2005 • Widow • Daughter • Mother • Widow of pre-deceased son • Daughter of a pre-deceased daughter • Daughter of a pre-deceased son • Widow of a pre-deceased son Residential Seminar - SRISAILAM 25 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Female Heirs – Class I before 9 -9 -2005 • Widow • Daughter • Mother • Widow of pre-deceased son • Daughter of a pre-deceased daughter • Daughter of a pre-deceased son • Widow of a pre-deceased son Residential Seminar - SRISAILAM 25 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Addition made to Female Heirs : post 9 -9 -2005 • Daughter of a pre-deceased son of a pre-deceased daughter (w. e. f 09 -09 -2005) • Daughter of a pre-deceased daughter of a pre-deceased son (w. e. f 09 -09 -2005) • Daughter of a pre-deceased daughter (w. e. f 09 -09 -2005) Residential Seminar - SRISAILAM 26 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Addition made to Female Heirs : post 9 -9 -2005 • Daughter of a pre-deceased son of a pre-deceased daughter (w. e. f 09 -09 -2005) • Daughter of a pre-deceased daughter of a pre-deceased son (w. e. f 09 -09 -2005) • Daughter of a pre-deceased daughter (w. e. f 09 -09 -2005) Residential Seminar - SRISAILAM 26 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Addition made to Male Heirs : post 9 -9 -2005 • Son of a pre-deceased daughter (w. e. f 09 -09 -2005) Residential Seminar - SRISAILAM 27 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Addition made to Male Heirs : post 9 -9 -2005 • Son of a pre-deceased daughter (w. e. f 09 -09 -2005) Residential Seminar - SRISAILAM 27 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Agenda 2: Coparceners and Members of HUF “A HUF is a unit of society consisting of male members descended lineally from a common male ancestor, their wives and unmarried daughters” SRISAILAM 28 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Agenda 2: Coparceners and Members of HUF “A HUF is a unit of society consisting of male members descended lineally from a common male ancestor, their wives and unmarried daughters” SRISAILAM 28 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Coparcener • A HUF consists of members male and female, adult and minor. • Some of the members of an HUF are designated as coparceners. • Only a coparcener can seek partition of the family property and the other male members can have no direct claim over HUF property, but can claim such right through the coparceners. SRISAILAM 29 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Coparcener • A HUF consists of members male and female, adult and minor. • Some of the members of an HUF are designated as coparceners. • Only a coparcener can seek partition of the family property and the other male members can have no direct claim over HUF property, but can claim such right through the coparceners. SRISAILAM 29 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

A Coparcener consists of: • A coparcenary consists of a male ancestor and his lineal descendants in the male line till 2005 within four degrees including himself. 1 st Degree: Holder of ancestral property for the first time 2 nd Degree: Sons and Daughters since 2005 3 rd Degree: Grandsons 4 th Degree: Great Grandsons SRISAILAM 30 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

A Coparcener consists of: • A coparcenary consists of a male ancestor and his lineal descendants in the male line till 2005 within four degrees including himself. 1 st Degree: Holder of ancestral property for the first time 2 nd Degree: Sons and Daughters since 2005 3 rd Degree: Grandsons 4 th Degree: Great Grandsons SRISAILAM 30 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Coparcenary • All the coparceners of family constitute what is called a coparcenary. • The coparcenary is a limited body, a part of the HUF, smaller than the membership of the HUF. • However, conceivably, there can be an HUF all of whose members are also coparceners but there cannot normally be an HUF without a coparcener or coparceners. SRISAILAM 31 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Coparcenary • All the coparceners of family constitute what is called a coparcenary. • The coparcenary is a limited body, a part of the HUF, smaller than the membership of the HUF. • However, conceivably, there can be an HUF all of whose members are also coparceners but there cannot normally be an HUF without a coparcener or coparceners. SRISAILAM 31 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Issue 1: Single male coparcener • A family has a single male member and no female members at all – the male member is either unmarried or a widower without children. Does he own the ancestral property as an Individual or as an HUF? • It was held that a single person, male or female, does not constitute a family and a family consisting of a single individual is a contradiction in terms. [C. Krishna Prasad vs. CIT 97 ITR 493 (SC)]…. . the assessee is an individual and not a family SRISAILAM 32 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Issue 1: Single male coparcener • A family has a single male member and no female members at all – the male member is either unmarried or a widower without children. Does he own the ancestral property as an Individual or as an HUF? • It was held that a single person, male or female, does not constitute a family and a family consisting of a single individual is a contradiction in terms. [C. Krishna Prasad vs. CIT 97 ITR 493 (SC)]…. . the assessee is an individual and not a family SRISAILAM 32 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Issue 2: Family consisting of females only • Whethere can be an HUF consisting only of females, there being no male member after the death of the sole coparcener. • “Under the Hindu law it is not predicated of a Hindu joint family that there must be a male member. So long as the property which was originally of the joint Hindu family remains in the hands of the widows or the members of the family and it is not divided among them, the joint family continues” [CIT vs. Rm. AR. Veerappa Chettiar 76 ITR 467 (SC)] SRISAILAM 33 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Issue 2: Family consisting of females only • Whethere can be an HUF consisting only of females, there being no male member after the death of the sole coparcener. • “Under the Hindu law it is not predicated of a Hindu joint family that there must be a male member. So long as the property which was originally of the joint Hindu family remains in the hands of the widows or the members of the family and it is not divided among them, the joint family continues” [CIT vs. Rm. AR. Veerappa Chettiar 76 ITR 467 (SC)] SRISAILAM 33 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Agenda 3: Creation of HUF “HUF is not created, only its kitty is filled” (Only Assets are provided to it by gift or otherwise) SRISAILAM 34 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Agenda 3: Creation of HUF “HUF is not created, only its kitty is filled” (Only Assets are provided to it by gift or otherwise) SRISAILAM 34 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Creation of Assets of HUF • A Hindu male with his sons and grandsons constitutes an HUF but this HUF need not own any property. {A situation where the family has not inherited any property} • In today’s India there are large number of men who are entirely self-made, in trade, in industry, in profession and in services. Yet, they constitute a joint family not only with their children, but very often with their brothers. SRISAILAM 35 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Creation of Assets of HUF • A Hindu male with his sons and grandsons constitutes an HUF but this HUF need not own any property. {A situation where the family has not inherited any property} • In today’s India there are large number of men who are entirely self-made, in trade, in industry, in profession and in services. Yet, they constitute a joint family not only with their children, but very often with their brothers. SRISAILAM 35 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Creation of Assets of HUF…pivotal question? • The assets acquired by different income earning members in practice and in law, belonged either to the bigger family of brothers or the smaller family constituted with their children. • But the income from these assets, was invariably clubbed with their individual income and subjected to tax. • A question, therefore, arises: How the families consisting of a father and his sons, or of brothers, and the like, can acquire assets? SRISAILAM 36 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Creation of Assets of HUF…pivotal question? • The assets acquired by different income earning members in practice and in law, belonged either to the bigger family of brothers or the smaller family constituted with their children. • But the income from these assets, was invariably clubbed with their individual income and subjected to tax. • A question, therefore, arises: How the families consisting of a father and his sons, or of brothers, and the like, can acquire assets? SRISAILAM 36 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

1. Properties of HUF can be acquired by joint labour • Joint Labour: HUF property (movable and immovable) can be acquired under Mitakshara by joint labour of the coparceners and this can be utilised as a source of creating HUF property or nucleus of a branch of HUF. • Joint Family funds: Even though some (or one) of the members had put in their labour and skill for earning the income, then the property will be joint family property. SRISAILAM 37 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

1. Properties of HUF can be acquired by joint labour • Joint Labour: HUF property (movable and immovable) can be acquired under Mitakshara by joint labour of the coparceners and this can be utilised as a source of creating HUF property or nucleus of a branch of HUF. • Joint Family funds: Even though some (or one) of the members had put in their labour and skill for earning the income, then the property will be joint family property. SRISAILAM 37 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

2. Vesting of self-acquired property in family hotchpot • HUF assets can be created by vesting of self-acquired property in the family hotchpot even where the family kitty is empty. • Thus assets of a main family or branch of the family are created by a Karta or another coparcener throwing his self-acquired property into the hotchpot of the family or branch of the family to which they belong. • There is nothing in Hindu Law which prevents a Hindu male from throwing his self-acquired property in the hotchpot of the smaller unit to which he belongs while the larger unit remains intact. SRISAILAM 38 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

2. Vesting of self-acquired property in family hotchpot • HUF assets can be created by vesting of self-acquired property in the family hotchpot even where the family kitty is empty. • Thus assets of a main family or branch of the family are created by a Karta or another coparcener throwing his self-acquired property into the hotchpot of the family or branch of the family to which they belong. • There is nothing in Hindu Law which prevents a Hindu male from throwing his self-acquired property in the hotchpot of the smaller unit to which he belongs while the larger unit remains intact. SRISAILAM 38 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

3. Section 64(2) does not bar creation of HUF…. . • Caution: There is an erroneous impression that this provision u/s 64(2) debars or obstructs the creation of HUF assets where none existed before. • What is does is to merely ensure that the income from the assets so transferred or gifted would be assessed in the hands of the donor individual and not in the hands of HUF to which the assets now belong. • But, this does not prevent the HUF from utilising the assets and income there from for carrying on business or trade, the income from which would not be caught within the mischief of section 64(2) SRISAILAM 39 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

3. Section 64(2) does not bar creation of HUF…. . • Caution: There is an erroneous impression that this provision u/s 64(2) debars or obstructs the creation of HUF assets where none existed before. • What is does is to merely ensure that the income from the assets so transferred or gifted would be assessed in the hands of the donor individual and not in the hands of HUF to which the assets now belong. • But, this does not prevent the HUF from utilising the assets and income there from for carrying on business or trade, the income from which would not be caught within the mischief of section 64(2) SRISAILAM 39 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Planning for Nucleus… • The Individual who transferred the asset to an HUF can be saddled with the liability to pay tax u/s. 64(2) on income of the assets but not on the income arising out of the investment of the accumulated income which belongs to the HUF and the same can be utilised or invested for expanding the coffers of the newly created HUF. • For creation of Nucleus HUF, it is advisable to get gifts from members of the bigger HUF or outsiders so as to be caught within the mischief of section 64(2) with respect to gifted amount from a member of the HUF. SRISAILAM 40 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Planning for Nucleus… • The Individual who transferred the asset to an HUF can be saddled with the liability to pay tax u/s. 64(2) on income of the assets but not on the income arising out of the investment of the accumulated income which belongs to the HUF and the same can be utilised or invested for expanding the coffers of the newly created HUF. • For creation of Nucleus HUF, it is advisable to get gifts from members of the bigger HUF or outsiders so as to be caught within the mischief of section 64(2) with respect to gifted amount from a member of the HUF. SRISAILAM 40 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Care & Caution… • A newly created HUF as a unit may receive gifts from outsiders or from father or brothers of the Karta who are not members of the donee HUF. • All such gifts will result in accretion to the family fund without attracting he provisions of section 64(2). • The only precaution to be taken is that none of the debtors should be coparceners or members of the donee HUF. SRISAILAM 41 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Care & Caution… • A newly created HUF as a unit may receive gifts from outsiders or from father or brothers of the Karta who are not members of the donee HUF. • All such gifts will result in accretion to the family fund without attracting he provisions of section 64(2). • The only precaution to be taken is that none of the debtors should be coparceners or members of the donee HUF. SRISAILAM 41 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Creation of new HUFs through partition of an existing HUF • Partition of an HUF by dividing its assets among its coparceners and members is a recognised method of creating a number of smaller HUFs and thereby distributing its income into a number of units which bear tax at a lower rate. • It is thus a useful tool in tax planning. • The partition strategy can therefore be usefully adopted to create smaller HUFs. SRISAILAM 42 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Creation of new HUFs through partition of an existing HUF • Partition of an HUF by dividing its assets among its coparceners and members is a recognised method of creating a number of smaller HUFs and thereby distributing its income into a number of units which bear tax at a lower rate. • It is thus a useful tool in tax planning. • The partition strategy can therefore be usefully adopted to create smaller HUFs. SRISAILAM 42 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Creation of HUF through reunion after total partition • If the circumstances of the family require partial partition while others remain joint and continue to carry on the business of the main HUF, the members can first have a total partition dividing all the family assets and liabilities amongst smaller HUFs and claim a total partition under section 171 before the ITO. • The ITO will enquire and pass an order u/s. 171(1). • Two or more smaller HUFs so formed can then reunite. SRISAILAM 43 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Creation of HUF through reunion after total partition • If the circumstances of the family require partial partition while others remain joint and continue to carry on the business of the main HUF, the members can first have a total partition dividing all the family assets and liabilities amongst smaller HUFs and claim a total partition under section 171 before the ITO. • The ITO will enquire and pass an order u/s. 171(1). • Two or more smaller HUFs so formed can then reunite. SRISAILAM 43 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Creation of HUF through reunion … • It is legally permissible for the coparceners who had originally separated, if they throw back into the joint pool all the assets which they had been allotted in the earlier partition. • This reunion will partially nullify the effect of total partition. • There is no rule in Hindu Law which can prevent the smaller HUF to reunite. SRISAILAM 44 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Creation of HUF through reunion … • It is legally permissible for the coparceners who had originally separated, if they throw back into the joint pool all the assets which they had been allotted in the earlier partition. • This reunion will partially nullify the effect of total partition. • There is no rule in Hindu Law which can prevent the smaller HUF to reunite. SRISAILAM 44 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Caution… • The intention to reunite was to be based on the evidence in the form of subsequent conduct, or subsequent memorandum of reunion, etc. , • The onus is on the reuniting coparceners to prove that they have reunited. • It is not necessary that all the coparceners reunite but any of the coparcener who reunites must bring back to the family what he had taken away or what is left out of the same with him. SRISAILAM 45 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Caution… • The intention to reunite was to be based on the evidence in the form of subsequent conduct, or subsequent memorandum of reunion, etc. , • The onus is on the reuniting coparceners to prove that they have reunited. • It is not necessary that all the coparceners reunite but any of the coparcener who reunites must bring back to the family what he had taken away or what is left out of the same with him. SRISAILAM 45 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

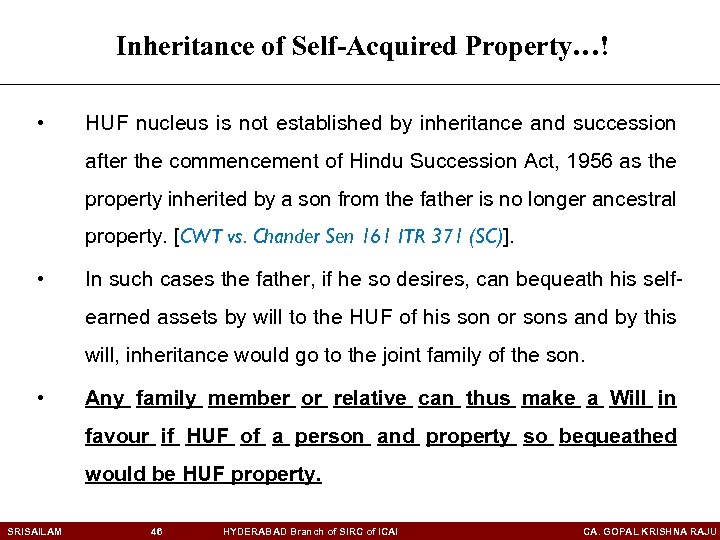

Inheritance of Self-Acquired Property…! • HUF nucleus is not established by inheritance and succession after the commencement of Hindu Succession Act, 1956 as the property inherited by a son from the father is no longer ancestral property. [CWT vs. Chander Sen 161 ITR 371 (SC)]. • In such cases the father, if he so desires, can bequeath his selfearned assets by will to the HUF of his son or sons and by this will, inheritance would go to the joint family of the son. • Any family member or relative can thus make a Will in favour if HUF of a person and property so bequeathed would be HUF property. SRISAILAM 46 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Inheritance of Self-Acquired Property…! • HUF nucleus is not established by inheritance and succession after the commencement of Hindu Succession Act, 1956 as the property inherited by a son from the father is no longer ancestral property. [CWT vs. Chander Sen 161 ITR 371 (SC)]. • In such cases the father, if he so desires, can bequeath his selfearned assets by will to the HUF of his son or sons and by this will, inheritance would go to the joint family of the son. • Any family member or relative can thus make a Will in favour if HUF of a person and property so bequeathed would be HUF property. SRISAILAM 46 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Agenda 4: Business and HUF “HUF can carryon business as proprietor” SRISAILAM 47 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Agenda 4: Business and HUF “HUF can carryon business as proprietor” SRISAILAM 47 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

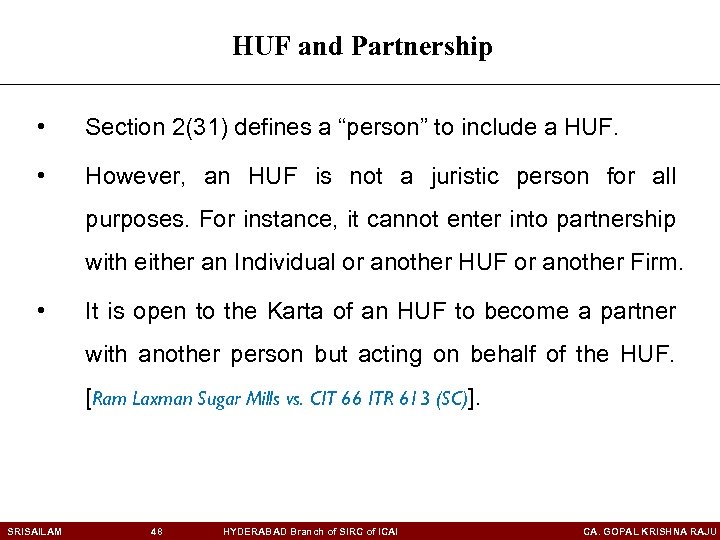

HUF and Partnership • Section 2(31) defines a “person” to include a HUF. • However, an HUF is not a juristic person for all purposes. For instance, it cannot enter into partnership with either an Individual or another HUF or another Firm. • It is open to the Karta of an HUF to become a partner with another person but acting on behalf of the HUF. [Ram Laxman Sugar Mills vs. CIT 66 ITR 613 (SC)]. SRISAILAM 48 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

HUF and Partnership • Section 2(31) defines a “person” to include a HUF. • However, an HUF is not a juristic person for all purposes. For instance, it cannot enter into partnership with either an Individual or another HUF or another Firm. • It is open to the Karta of an HUF to become a partner with another person but acting on behalf of the HUF. [Ram Laxman Sugar Mills vs. CIT 66 ITR 613 (SC)]. SRISAILAM 48 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

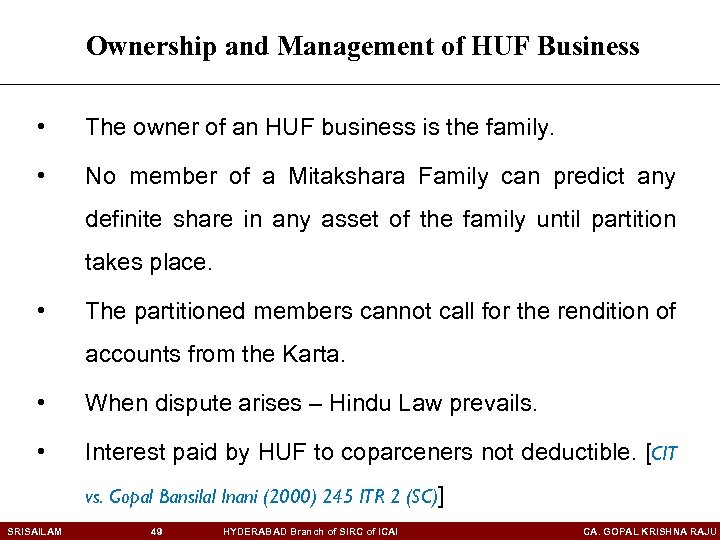

Ownership and Management of HUF Business • The owner of an HUF business is the family. • No member of a Mitakshara Family can predict any definite share in any asset of the family until partition takes place. • The partitioned members cannot call for the rendition of accounts from the Karta. • When dispute arises – Hindu Law prevails. • Interest paid by HUF to coparceners not deductible. [CIT vs. Gopal Bansilal Inani (2000) 245 ITR 2 (SC)] SRISAILAM 49 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Ownership and Management of HUF Business • The owner of an HUF business is the family. • No member of a Mitakshara Family can predict any definite share in any asset of the family until partition takes place. • The partitioned members cannot call for the rendition of accounts from the Karta. • When dispute arises – Hindu Law prevails. • Interest paid by HUF to coparceners not deductible. [CIT vs. Gopal Bansilal Inani (2000) 245 ITR 2 (SC)] SRISAILAM 49 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Issue 3: Criteria for determining whether income belongs to an HUF or an Individual Member or Coparcener • Whether the income received by the coparcener had any real connection with the investment of Joint Family funds. • Whether the income was directly related to any utilization of family funds or assets. • Whether the family had suffered any detriment in the process of realisation of income from the business. • Whether income was earned with the aid and assistance of family funds. • SRISAILAM [Raj Kumar Sing Hukam Chandji vs. CIT 78 ITR 33 (SC)] 50 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Issue 3: Criteria for determining whether income belongs to an HUF or an Individual Member or Coparcener • Whether the income received by the coparcener had any real connection with the investment of Joint Family funds. • Whether the income was directly related to any utilization of family funds or assets. • Whether the family had suffered any detriment in the process of realisation of income from the business. • Whether income was earned with the aid and assistance of family funds. • SRISAILAM [Raj Kumar Sing Hukam Chandji vs. CIT 78 ITR 33 (SC)] 50 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Remuneration to director for personal skill • In view of the finding of the fact that remuneration had been paid to Mr. G as director on account of his skill and acumen, it was not assessable in the hands of HUF. • The test is whether remuneration was compensation or whether it was in substance, though not in form, one of the modes of return made to the family because of investment of family funds in business. • SRISAILAM [CIT vs. Gopal Narain Singh 170 ITR 72 (Pat)] 51 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Remuneration to director for personal skill • In view of the finding of the fact that remuneration had been paid to Mr. G as director on account of his skill and acumen, it was not assessable in the hands of HUF. • The test is whether remuneration was compensation or whether it was in substance, though not in form, one of the modes of return made to the family because of investment of family funds in business. • SRISAILAM [CIT vs. Gopal Narain Singh 170 ITR 72 (Pat)] 51 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

HUF acting as partner in a firm – Legal position • HUF is a firm in fact but not in law. • HUF cannot be legally a partner in a firm. But it may, through its Karta enter into a valid partnership with a stranger or with the Karta of another HUF. However, other members of the HUF, do not become partners through Karta may be accountable to them. [CIT vs. Seth Govind Ram Sugar Mills (1965) 57 ITR 510 (SC) ] • A female member can represent an HUF in a firm…. [CIT vs. Banaik Industries 119 ITR 282 (Pat)] SRISAILAM 52 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

HUF acting as partner in a firm – Legal position • HUF is a firm in fact but not in law. • HUF cannot be legally a partner in a firm. But it may, through its Karta enter into a valid partnership with a stranger or with the Karta of another HUF. However, other members of the HUF, do not become partners through Karta may be accountable to them. [CIT vs. Seth Govind Ram Sugar Mills (1965) 57 ITR 510 (SC) ] • A female member can represent an HUF in a firm…. [CIT vs. Banaik Industries 119 ITR 282 (Pat)] SRISAILAM 52 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

HUF cannot directly become partner in a firm - SC • HUF does not act in a representative capacity in the partnership. He functions in his personal capacity like any other partner. • If there are two partner one of them is Karta of a HUF. Upon death of Karta, the partnership stands dissolved. In the absence of a contract to the contrary, another member of the HUF cannot step into the shoes of the Karta. • SRISAILAM [Rashik Lal & Co Vs. CIT 229 ITR 458 (SC)] 53 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

HUF cannot directly become partner in a firm - SC • HUF does not act in a representative capacity in the partnership. He functions in his personal capacity like any other partner. • If there are two partner one of them is Karta of a HUF. Upon death of Karta, the partnership stands dissolved. In the absence of a contract to the contrary, another member of the HUF cannot step into the shoes of the Karta. • SRISAILAM [Rashik Lal & Co Vs. CIT 229 ITR 458 (SC)] 53 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Issue 4: Unique Combinations • Partnership between an Individual Member of an HUF and the Karta representing the family - Is it Valid? • Can an HUF represented by a particular member in partnership enter into partnership with that member representing himself? • Coparcener as working partner in a firm where HUF is represented by the Karta – Is it Valid when coparcener contributes only labour and skill and no capital? SRISAILAM 54 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Issue 4: Unique Combinations • Partnership between an Individual Member of an HUF and the Karta representing the family - Is it Valid? • Can an HUF represented by a particular member in partnership enter into partnership with that member representing himself? • Coparcener as working partner in a firm where HUF is represented by the Karta – Is it Valid when coparcener contributes only labour and skill and no capital? SRISAILAM 54 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Agenda 5: Assessment of HUF “HUF is a separate and distinct Tax entity” SRISAILAM 55 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Agenda 5: Assessment of HUF “HUF is a separate and distinct Tax entity” SRISAILAM 55 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Issue • Once a notice under section 148 and other notices under sections 143(2) and 142(1) were issued treating the assessee as individual then the AO cannot frame the assessment treating the income in the hands of HUF • SRISAILAM [CIT vs. Rohtas (2009) 311 ITR 460 (P&H)] 56 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Issue • Once a notice under section 148 and other notices under sections 143(2) and 142(1) were issued treating the assessee as individual then the AO cannot frame the assessment treating the income in the hands of HUF • SRISAILAM [CIT vs. Rohtas (2009) 311 ITR 460 (P&H)] 56 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Payments for maintenance by husband or father-in-law • Any payments made by an HUF to a Hindu married woman, widow, children and aged parents under the provisions of Hindu Adoption and Maintenance Act, 1956 are exempt from tax in the hands of the recipient u/s. 10(2) SRISAILAM 57 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Payments for maintenance by husband or father-in-law • Any payments made by an HUF to a Hindu married woman, widow, children and aged parents under the provisions of Hindu Adoption and Maintenance Act, 1956 are exempt from tax in the hands of the recipient u/s. 10(2) SRISAILAM 57 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Relief admissible in respect of self occupation of HP • Relief for self occupation of house is admissible under section 23 to an HUF also. • There is nothing in the words used in section 23(2) which may show that they cannot apply to HUF which is nothing but a group of individuals related to each other. • SRISAILAM [ITO vs. Tarlok Singh & Sons 29 ITD 139 (Del)] 58 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Relief admissible in respect of self occupation of HP • Relief for self occupation of house is admissible under section 23 to an HUF also. • There is nothing in the words used in section 23(2) which may show that they cannot apply to HUF which is nothing but a group of individuals related to each other. • SRISAILAM [ITO vs. Tarlok Singh & Sons 29 ITD 139 (Del)] 58 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Gift & Vest • The only difference between gift and blending is that blending or vesting is a unilateral act and does not require any consent of other coparceners. • In case of gift, however, the donee HUF must accept the gift. • Further a gift deed in the case of immoveable property requires registration. In case of a gift of an immeavable property, the same will not be valid in law if there is no registration. However, vesting of an immovable property by a coparcener is not governed by section 17 of Registration Act. SRISAILAM 59 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Gift & Vest • The only difference between gift and blending is that blending or vesting is a unilateral act and does not require any consent of other coparceners. • In case of gift, however, the donee HUF must accept the gift. • Further a gift deed in the case of immoveable property requires registration. In case of a gift of an immeavable property, the same will not be valid in law if there is no registration. However, vesting of an immovable property by a coparcener is not governed by section 17 of Registration Act. SRISAILAM 59 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Conditions satisfying gift u/s. 64(2) • The donor is a member or coparcener of the family and continues to be the member of the family during the relevant assessment year. • If the donor is no longer a member of the family, then the income from the gifted asset will continue to be assessed in the hands of HUF and will not be clubbed with the income of the donor. Implications of section 64(2): • Gift by unmarried daughter of a Karta. • Gift by a lady to a HUF of which her betrothed is a coparcener. SRISAILAM 60 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Conditions satisfying gift u/s. 64(2) • The donor is a member or coparcener of the family and continues to be the member of the family during the relevant assessment year. • If the donor is no longer a member of the family, then the income from the gifted asset will continue to be assessed in the hands of HUF and will not be clubbed with the income of the donor. Implications of section 64(2): • Gift by unmarried daughter of a Karta. • Gift by a lady to a HUF of which her betrothed is a coparcener. SRISAILAM 60 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Loans to HUF by member – not covered by 64(2) • Section 64(2) covers cases of vesting of property and gifts of HUF but does not cover cases where a coparcener advances a returnable loan as in that case the HUF income remains that of HUF and the only liability of HUF is to pay the loan back to the member concerned with or without interest. • Consider the case of Income from HP with the help of funds obtained by the Karta as a Loan. • SRISAILAM [Justice G. Ramanujulu Naidu vs. ITO 6 ITD 465] 61 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Loans to HUF by member – not covered by 64(2) • Section 64(2) covers cases of vesting of property and gifts of HUF but does not cover cases where a coparcener advances a returnable loan as in that case the HUF income remains that of HUF and the only liability of HUF is to pay the loan back to the member concerned with or without interest. • Consider the case of Income from HP with the help of funds obtained by the Karta as a Loan. • SRISAILAM [Justice G. Ramanujulu Naidu vs. ITO 6 ITD 465] 61 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Agenda 6: HUF and Wealth Tax “HUF – A Taxable Entity for levy of Wealth Tax” SRISAILAM 62 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Agenda 6: HUF and Wealth Tax “HUF – A Taxable Entity for levy of Wealth Tax” SRISAILAM 62 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Mitakshara vs. Dayabhaga • A Mitakshara HUF is liable to wealth-tax on the net wealth owned by it but not a Dayabhaga family. SRISAILAM 63 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Mitakshara vs. Dayabhaga • A Mitakshara HUF is liable to wealth-tax on the net wealth owned by it but not a Dayabhaga family. SRISAILAM 63 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

WT Assessment • For assessment of wealth-tax, HUF includes all those families which are covered by Hindu Law and includes Jains, Buddhists, Sikhs and also those born of mixed marriage who have been brought up as Hindus. SRISAILAM 64 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

WT Assessment • For assessment of wealth-tax, HUF includes all those families which are covered by Hindu Law and includes Jains, Buddhists, Sikhs and also those born of mixed marriage who have been brought up as Hindus. SRISAILAM 64 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Single coparcener • When the HUF is reduced by death or partition to a single coparcener with female members, the properties continue to belong to HUF and are assessable in the hands of the HUF. • It is not necessary that there should be at least two coparceners to form a taxable unit. SRISAILAM 65 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Single coparcener • When the HUF is reduced by death or partition to a single coparcener with female members, the properties continue to belong to HUF and are assessable in the hands of the HUF. • It is not necessary that there should be at least two coparceners to form a taxable unit. SRISAILAM 65 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Issue • When an HUF on the death of Karta is reduced to a Widow with unmarried daughter, they succeed to the property as HUF or as Individuals? SRISAILAM 66 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Issue • When an HUF on the death of Karta is reduced to a Widow with unmarried daughter, they succeed to the property as HUF or as Individuals? SRISAILAM 66 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Severance vs. Physical division • Mere severance of status in HUF would not amount to a partition and a physical division by metes and bounds is required. • SRISAILAM [Tatavarthy Rajah vs. CWT 225 ITR 561 (SC)] 67 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Severance vs. Physical division • Mere severance of status in HUF would not amount to a partition and a physical division by metes and bounds is required. • SRISAILAM [Tatavarthy Rajah vs. CWT 225 ITR 561 (SC)] 67 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Invalid Gifts • Caution! • The value of assets gifted by HUF to members of the family or strangers which are not treated as valid will continue to be included in the net wealth of HUF. SRISAILAM 68 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Invalid Gifts • Caution! • The value of assets gifted by HUF to members of the family or strangers which are not treated as valid will continue to be included in the net wealth of HUF. SRISAILAM 68 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Agenda 7: Gifts by HUF & Gifts to HUF “Gift consists of the relinquishment (without consideration) of one’s own right (in property) and the creation of the right of another, and the creation of another man’s right is completed on that other’s acceptance of the gift but not otherwise” - Mitakshara SRISAILAM 69 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Agenda 7: Gifts by HUF & Gifts to HUF “Gift consists of the relinquishment (without consideration) of one’s own right (in property) and the creation of the right of another, and the creation of another man’s right is completed on that other’s acceptance of the gift but not otherwise” - Mitakshara SRISAILAM 69 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Gift by HUF Power to Gift • A Hindu father has no power to gift away ancestral or joint property to either members of the family or strangers except small portions of such property to discharge moral or legal obligations or for pious purposes up to a reasonable amount. SRISAILAM 70 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Gift by HUF Power to Gift • A Hindu father has no power to gift away ancestral or joint property to either members of the family or strangers except small portions of such property to discharge moral or legal obligations or for pious purposes up to a reasonable amount. SRISAILAM 70 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Gift by HUF With Love to Daughter • Gift by a father to his daughter of ancestral property on the occasion of her marriage is gift in discharge of an indispensable duty and is valid in Hindu Law. • Thus gift of jewellery, other presents etc. , on the occasion of marriage of a daughter is in discharge of moral and legal obligation of the HUF. • Gift to minor daughters is valid. [CWT/CIT v. K. N. Shanmugha Sundaram (1998) 232 ITR 354 (SC)] SRISAILAM 71 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Gift by HUF With Love to Daughter • Gift by a father to his daughter of ancestral property on the occasion of her marriage is gift in discharge of an indispensable duty and is valid in Hindu Law. • Thus gift of jewellery, other presents etc. , on the occasion of marriage of a daughter is in discharge of moral and legal obligation of the HUF. • Gift to minor daughters is valid. [CWT/CIT v. K. N. Shanmugha Sundaram (1998) 232 ITR 354 (SC)] SRISAILAM 71 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Gift by HUF With Love to grandchildren of married Daughter • Gifts made to children of the married daughter of the Karta within reasonable limits could be indispensable acts of duty on Karta’s part and as such could not be considered void. • [H. P Nanda & Sons (HUF) v. ITO 30 ITD 193 (Del. )] • [S. R. Kahani (HUF) v. CIT 180 ITR 141 (MP)] SRISAILAM 72 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Gift by HUF With Love to grandchildren of married Daughter • Gifts made to children of the married daughter of the Karta within reasonable limits could be indispensable acts of duty on Karta’s part and as such could not be considered void. • [H. P Nanda & Sons (HUF) v. ITO 30 ITD 193 (Del. )] • [S. R. Kahani (HUF) v. CIT 180 ITR 141 (MP)] SRISAILAM 72 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Gift to HUF • A gift can be made not only to an individual but specifically to the HUF consisting of an Individual, his wife and children and gift can be and is utilized for creating a nucleus for a smaller HUF where no such HUF nucleus existed earlier. • A new tax entity can thus be created. • Gift can be made for creating nucleus of an HUF if the intention to gift to the Karta on behalf of his HUF is made clear in the gift deed. SRISAILAM 73 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Gift to HUF • A gift can be made not only to an individual but specifically to the HUF consisting of an Individual, his wife and children and gift can be and is utilized for creating a nucleus for a smaller HUF where no such HUF nucleus existed earlier. • A new tax entity can thus be created. • Gift can be made for creating nucleus of an HUF if the intention to gift to the Karta on behalf of his HUF is made clear in the gift deed. SRISAILAM 73 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Gift to HUF • Certain gifts received by HUF have been excluded under proviso to section 56(2)(v) • Under a will or by way of inheritance; or • In contemplation of the death of the payer • Thus any sum of money (maybe in lakhs/crores) can be received by HUF ☻ Caution: All gifts > Rs: 50, 000 received by an HUF will be assessed to tax under section 56(2)(v) as income from other sources. SRISAILAM 74 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Gift to HUF • Certain gifts received by HUF have been excluded under proviso to section 56(2)(v) • Under a will or by way of inheritance; or • In contemplation of the death of the payer • Thus any sum of money (maybe in lakhs/crores) can be received by HUF ☻ Caution: All gifts > Rs: 50, 000 received by an HUF will be assessed to tax under section 56(2)(v) as income from other sources. SRISAILAM 74 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Agenda 8: Tax Planning through HUF “Tax Planning is a Valid Exercise and is not Tax Evasion” SRISAILAM 75 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Agenda 8: Tax Planning through HUF “Tax Planning is a Valid Exercise and is not Tax Evasion” SRISAILAM 75 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Reunion and Tax Planning • Section 171(9) seeks to nullify the tax advantage that accrued by partial partition to the coparceners and members of HUF by providing for the clubbing of the income of the resultant HUFs with those of the bigger HUF. • In this situation what the HUF can do is to go in for a TOTAL partition of the family to seek recognition under section 171, a recognition which the authorities cannot deny. • Soon thereafter, the partitioned units of the family may reunite in the permutation or combination which gives them the desired tax benefit. SRISAILAM 76 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Reunion and Tax Planning • Section 171(9) seeks to nullify the tax advantage that accrued by partial partition to the coparceners and members of HUF by providing for the clubbing of the income of the resultant HUFs with those of the bigger HUF. • In this situation what the HUF can do is to go in for a TOTAL partition of the family to seek recognition under section 171, a recognition which the authorities cannot deny. • Soon thereafter, the partitioned units of the family may reunite in the permutation or combination which gives them the desired tax benefit. SRISAILAM 76 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Exchange of shares – Not Transfer • Exchange of shares in a family arrangement does not involve transfer and does not attract capital gains tax. • Thus shuffling of interest in firms and companies in consequence of a family arrangement between the members of the family, should not attract liability to capital gains tax as it is not a transfer. • SRISAILAM [CIT vs. Kay Arr Enterprises (2008) 299 ITR 348 (Mad) ] 77 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Exchange of shares – Not Transfer • Exchange of shares in a family arrangement does not involve transfer and does not attract capital gains tax. • Thus shuffling of interest in firms and companies in consequence of a family arrangement between the members of the family, should not attract liability to capital gains tax as it is not a transfer. • SRISAILAM [CIT vs. Kay Arr Enterprises (2008) 299 ITR 348 (Mad) ] 77 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Family Settlements and Tax Planning • Family arrangement does not involve a transfer and therefore section 64 of Income Tax Act is not applicable. • Thus planning through family arrangement, if done, within the limitations of law has immense possibilities. • [CIT vs. R. Ponnammal 164 ITR 706 (Mad)] • It is device to channelize and reduce the taxable wealth and income in the hands of certain members of the family. SRISAILAM 78 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Family Settlements and Tax Planning • Family arrangement does not involve a transfer and therefore section 64 of Income Tax Act is not applicable. • Thus planning through family arrangement, if done, within the limitations of law has immense possibilities. • [CIT vs. R. Ponnammal 164 ITR 706 (Mad)] • It is device to channelize and reduce the taxable wealth and income in the hands of certain members of the family. SRISAILAM 78 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Renunciation • Under Hindu Law a coparcener is entitled to relinquish his interest in the coparcenary but he cannot do so in favour of any particular member of the family. • Such a renunciation must be definite, clear and unequivocal (through a Deed of Renunciation – needs for an expert here), there should be no doubt left in the minds of any person about the fact of renunciation. • SRISAILAM [CIT v. D. B. D. Krishna Kishore 9 ITR 695 (SC)] 79 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Renunciation • Under Hindu Law a coparcener is entitled to relinquish his interest in the coparcenary but he cannot do so in favour of any particular member of the family. • Such a renunciation must be definite, clear and unequivocal (through a Deed of Renunciation – needs for an expert here), there should be no doubt left in the minds of any person about the fact of renunciation. • SRISAILAM [CIT v. D. B. D. Krishna Kishore 9 ITR 695 (SC)] 79 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Renunciation vs. Partial Partition • Renunciation does not mean to amount to a partition or partial partition and, therefore is not covered by provisions of section 171(9) • Thus a coparcener may renounce his interest in the family in lieu of a fixed maintenance allowance and this would not require a recognition u/s. 171 by the ITO ☻ Caution: If renunciation, however, is of a unit including his sons, it may amount in fact to a partial partition. SRISAILAM 80 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Renunciation vs. Partial Partition • Renunciation does not mean to amount to a partition or partial partition and, therefore is not covered by provisions of section 171(9) • Thus a coparcener may renounce his interest in the family in lieu of a fixed maintenance allowance and this would not require a recognition u/s. 171 by the ITO ☻ Caution: If renunciation, however, is of a unit including his sons, it may amount in fact to a partial partition. SRISAILAM 80 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Renunciation – Judicial views • Interest of a coparcener who renounces the same is extinguished therein; • By release there is no division of the HUF properties and he does not receive anything in respect of his share in the Joint Family properties, but in a partition he takes his share in the family property and goes out of the family; and • Even after such renunciation, the coparcenary continues as before, intact and unimpaired save for the exit of the renouncing coparcener. Whether other coparceners are also divided or continue will depend upon their future conduct. • SRISAILAM [Kantilal Trikamlal vs. CED 74 ITR 353 (Guj)] 81 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Renunciation – Judicial views • Interest of a coparcener who renounces the same is extinguished therein; • By release there is no division of the HUF properties and he does not receive anything in respect of his share in the Joint Family properties, but in a partition he takes his share in the family property and goes out of the family; and • Even after such renunciation, the coparcenary continues as before, intact and unimpaired save for the exit of the renouncing coparcener. Whether other coparceners are also divided or continue will depend upon their future conduct. • SRISAILAM [Kantilal Trikamlal vs. CED 74 ITR 353 (Guj)] 81 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Renunciation & Tax Planning • As section 64(2) applies to an individual who is a member of an HUF, the coparcener can renounce or extinguish his interest in the HUF after vesting an asset in the HUF and thus, cease to be a member of the HUF. • On such relinquishment his interest in the HUF property ceases and, therefore, at the time of receiving the income, the individual would no longer be a coparcener and so income arising out of converted property cannot be included in the hands of the vesting coparcener. • SRISAILAM Helpful in circumventing the rigours of section 64(2). 82 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Renunciation & Tax Planning • As section 64(2) applies to an individual who is a member of an HUF, the coparcener can renounce or extinguish his interest in the HUF after vesting an asset in the HUF and thus, cease to be a member of the HUF. • On such relinquishment his interest in the HUF property ceases and, therefore, at the time of receiving the income, the individual would no longer be a coparcener and so income arising out of converted property cannot be included in the hands of the vesting coparcener. • SRISAILAM Helpful in circumventing the rigours of section 64(2). 82 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Reflections ?

Reflections ?

Disclaimer • These are my personal views and cannot be construed to be the views of the SIRC or my firm M/s. K. GOPAL RAO & Co. , CAs • No representation or warranties are made by the SIRC or its branches with regard to this presentation • These views do not and shall not be considered as professional advice • This presentation should not be reproduced in part or in whole, in any manner or form, without my or SIRC’s written permission Residential Seminar - SRISAILAM 84 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU

Disclaimer • These are my personal views and cannot be construed to be the views of the SIRC or my firm M/s. K. GOPAL RAO & Co. , CAs • No representation or warranties are made by the SIRC or its branches with regard to this presentation • These views do not and shall not be considered as professional advice • This presentation should not be reproduced in part or in whole, in any manner or form, without my or SIRC’s written permission Residential Seminar - SRISAILAM 84 HYDERABAD Branch of SIRC of ICAI CA. GOPAL KRISHNA RAJU