8b46204080bef42387752457961a591b.ppt

- Количество слайдов: 37

Module III: Techniques for Risk Management Week 7 – October 7 and 9, 2002 J. K. Dietrich - FBE 432 – Spring, 2002

Module III: Techniques for Risk Management Week 7 – October 7 and 9, 2002 J. K. Dietrich - FBE 432 – Spring, 2002

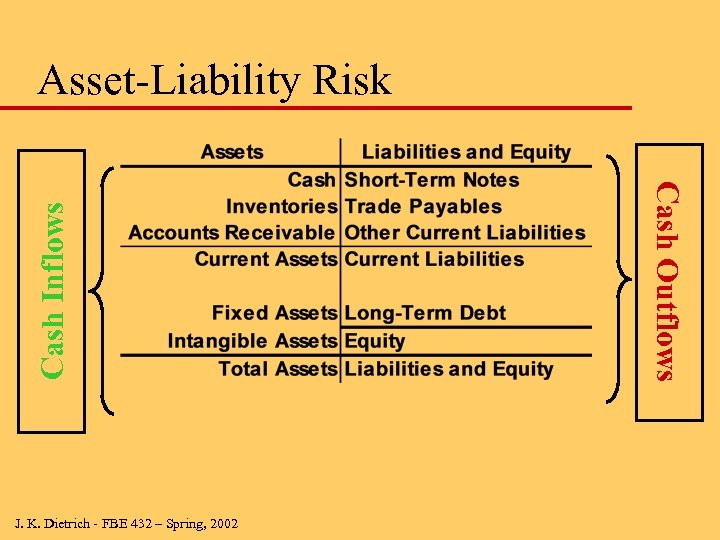

J. K. Dietrich - FBE 432 – Spring, 2002 Cash Outflows Cash Inflows Asset-Liability Risk

J. K. Dietrich - FBE 432 – Spring, 2002 Cash Outflows Cash Inflows Asset-Liability Risk

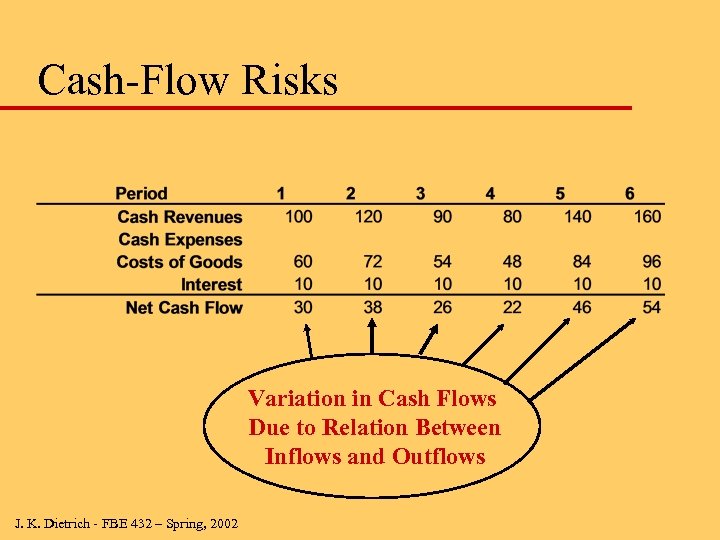

Cash-Flow Risks Variation in Cash Flows Due to Relation Between Inflows and Outflows J. K. Dietrich - FBE 432 – Spring, 2002

Cash-Flow Risks Variation in Cash Flows Due to Relation Between Inflows and Outflows J. K. Dietrich - FBE 432 – Spring, 2002

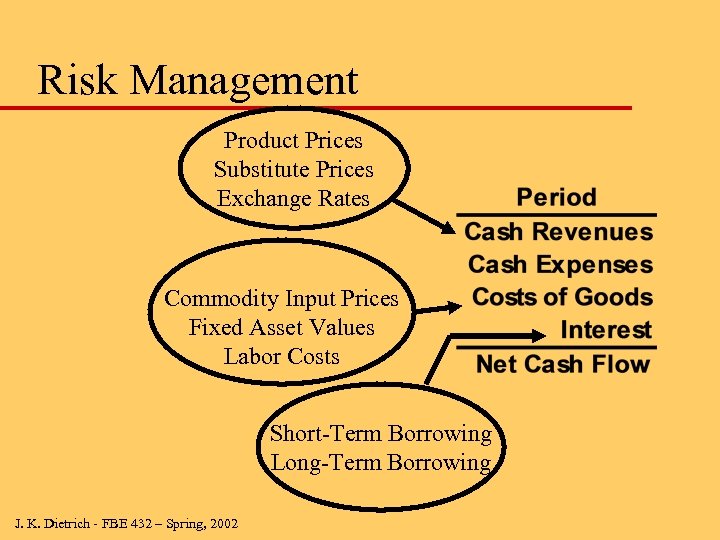

Risk Management Product Prices Substitute Prices Exchange Rates Commodity Input Prices Fixed Asset Values Labor Costs Short-Term Borrowing Long-Term Borrowing J. K. Dietrich - FBE 432 – Spring, 2002

Risk Management Product Prices Substitute Prices Exchange Rates Commodity Input Prices Fixed Asset Values Labor Costs Short-Term Borrowing Long-Term Borrowing J. K. Dietrich - FBE 432 – Spring, 2002

Asset-Liability Management u Focus on variability of cash flows – Main concern is to be able to make all contractual payment to avoid defaults – Secondary concern is to minimize risk (variability) – Third concern is to increase net cash flows by taking advantage of predictability in variations u Objective is to measure and manage variability in cash flows J. K. Dietrich - FBE 432 – Spring, 2002

Asset-Liability Management u Focus on variability of cash flows – Main concern is to be able to make all contractual payment to avoid defaults – Secondary concern is to minimize risk (variability) – Third concern is to increase net cash flows by taking advantage of predictability in variations u Objective is to measure and manage variability in cash flows J. K. Dietrich - FBE 432 – Spring, 2002

Exposure to Risk u. A general term to describe a firm’s exposure to a particular risk (e. g. a commodity price) is to classify the exposure as long or short u Long exposure means that the firm will benefit from increases in prices or values u Short exposure means that the firm will benefit from decreases in prices or values J. K. Dietrich - FBE 432 – Spring, 2002

Exposure to Risk u. A general term to describe a firm’s exposure to a particular risk (e. g. a commodity price) is to classify the exposure as long or short u Long exposure means that the firm will benefit from increases in prices or values u Short exposure means that the firm will benefit from decreases in prices or values J. K. Dietrich - FBE 432 – Spring, 2002

Long Exposure u. A firm (or individual) is long if at the time of the risk assessment if it has or will have an asset or commodity. As examples – The firm owns assets, as in inventories of raw materials or finished goods – The firm produces a commodity or product, as in an agribusiness raising wheat or livestock – The firm will take possession in the future or a commodity or an asset – The firm has bought a commodity or asset J. K. Dietrich - FBE 432 – Spring, 2002

Long Exposure u. A firm (or individual) is long if at the time of the risk assessment if it has or will have an asset or commodity. As examples – The firm owns assets, as in inventories of raw materials or finished goods – The firm produces a commodity or product, as in an agribusiness raising wheat or livestock – The firm will take possession in the future or a commodity or an asset – The firm has bought a commodity or asset J. K. Dietrich - FBE 432 – Spring, 2002

Short Exposure u. A firm (or individual) is short if at the time of the risk assessment if it needs or will need an asset or commodity. As examples – The firm is planning or has promised to deliver raw materials or finished goods – The firm uses a commodity or product in production as inputs, like steel or lumber – The firm will have possession in the future or a commodity or an asset it does not need or needs to sell – The firm has sold a commodity or asset and must deliver J. K. Dietrich - FBE 432 – Spring, 2002

Short Exposure u. A firm (or individual) is short if at the time of the risk assessment if it needs or will need an asset or commodity. As examples – The firm is planning or has promised to deliver raw materials or finished goods – The firm uses a commodity or product in production as inputs, like steel or lumber – The firm will have possession in the future or a commodity or an asset it does not need or needs to sell – The firm has sold a commodity or asset and must deliver J. K. Dietrich - FBE 432 – Spring, 2002

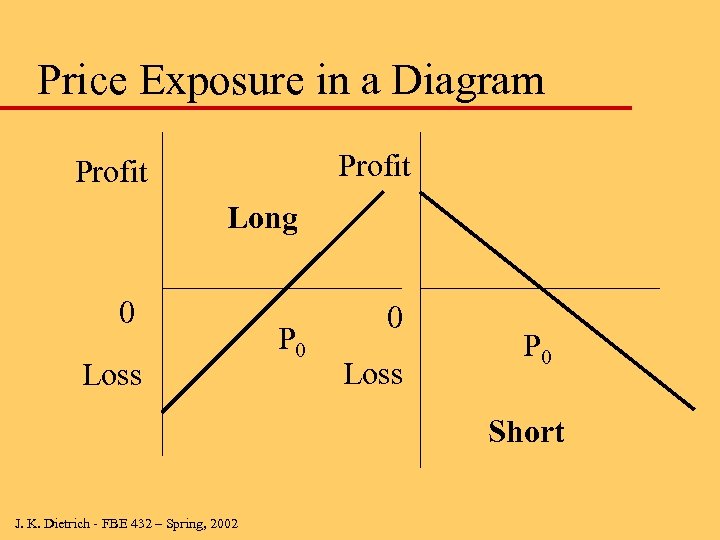

Price Exposure in a Diagram Profit Long 0 Loss P 0 Short J. K. Dietrich - FBE 432 – Spring, 2002

Price Exposure in a Diagram Profit Long 0 Loss P 0 Short J. K. Dietrich - FBE 432 – Spring, 2002

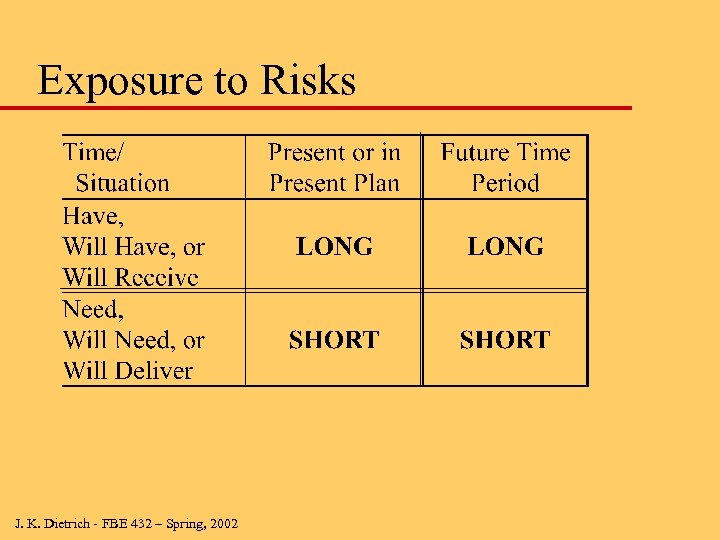

Exposure to Risks J. K. Dietrich - FBE 432 – Spring, 2002

Exposure to Risks J. K. Dietrich - FBE 432 – Spring, 2002

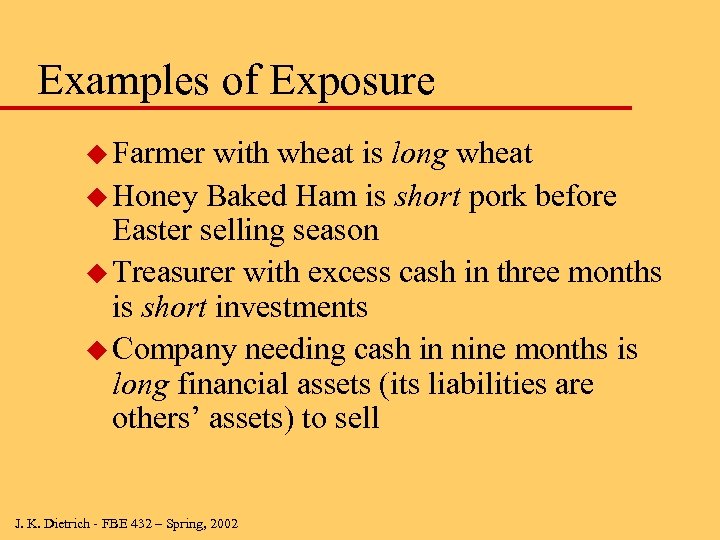

Examples of Exposure u Farmer with wheat is long wheat u Honey Baked Ham is short pork before Easter selling season u Treasurer with excess cash in three months is short investments u Company needing cash in nine months is long financial assets (its liabilities are others’ assets) to sell J. K. Dietrich - FBE 432 – Spring, 2002

Examples of Exposure u Farmer with wheat is long wheat u Honey Baked Ham is short pork before Easter selling season u Treasurer with excess cash in three months is short investments u Company needing cash in nine months is long financial assets (its liabilities are others’ assets) to sell J. K. Dietrich - FBE 432 – Spring, 2002

Types of Derivative Contracts u Three basic types of contracts – Futures or forwards – Options – Swaps (we discuss next week) u Many basic underlying assets – Commodities – Currencies – Fixed incomes or residual claims J. K. Dietrich - FBE 432 – Spring, 2002

Types of Derivative Contracts u Three basic types of contracts – Futures or forwards – Options – Swaps (we discuss next week) u Many basic underlying assets – Commodities – Currencies – Fixed incomes or residual claims J. K. Dietrich - FBE 432 – Spring, 2002

Futures Contracts u Wall Street Journal tables u Standardized contracts – Quantity and quality – Delivery date – Last trading date – Deliverables u Clearing house is counterparty u Margin requirements, mark to market J. K. Dietrich - FBE 432 – Spring, 2002

Futures Contracts u Wall Street Journal tables u Standardized contracts – Quantity and quality – Delivery date – Last trading date – Deliverables u Clearing house is counterparty u Margin requirements, mark to market J. K. Dietrich - FBE 432 – Spring, 2002

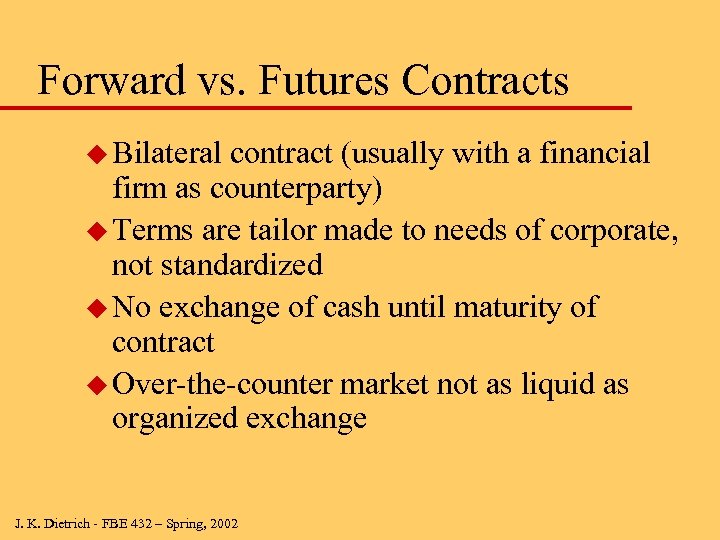

Forward vs. Futures Contracts u Bilateral contract (usually with a financial firm as counterparty) u Terms are tailor made to needs of corporate, not standardized u No exchange of cash until maturity of contract u Over-the-counter market not as liquid as organized exchange J. K. Dietrich - FBE 432 – Spring, 2002

Forward vs. Futures Contracts u Bilateral contract (usually with a financial firm as counterparty) u Terms are tailor made to needs of corporate, not standardized u No exchange of cash until maturity of contract u Over-the-counter market not as liquid as organized exchange J. K. Dietrich - FBE 432 – Spring, 2002

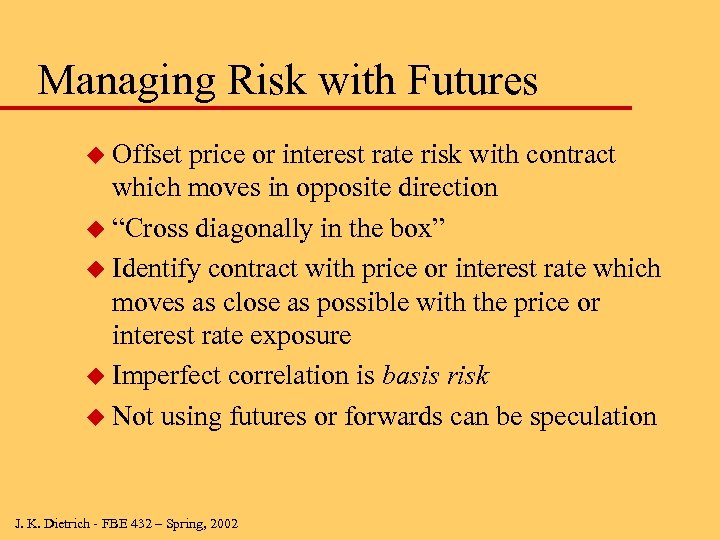

Managing Risk with Futures u Offset price or interest rate risk with contract which moves in opposite direction u “Cross diagonally in the box” u Identify contract with price or interest rate which moves as close as possible with the price or interest rate exposure u Imperfect correlation is basis risk u Not using futures or forwards can be speculation J. K. Dietrich - FBE 432 – Spring, 2002

Managing Risk with Futures u Offset price or interest rate risk with contract which moves in opposite direction u “Cross diagonally in the box” u Identify contract with price or interest rate which moves as close as possible with the price or interest rate exposure u Imperfect correlation is basis risk u Not using futures or forwards can be speculation J. K. Dietrich - FBE 432 – Spring, 2002

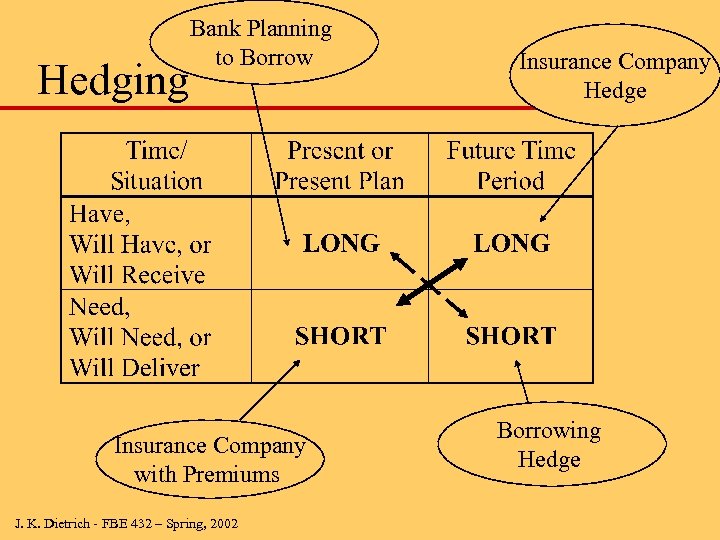

Hedging Bank Planning to Borrow Insurance Company with Premiums J. K. Dietrich - FBE 432 – Spring, 2002 Insurance Company Hedge Borrowing Hedge

Hedging Bank Planning to Borrow Insurance Company with Premiums J. K. Dietrich - FBE 432 – Spring, 2002 Insurance Company Hedge Borrowing Hedge

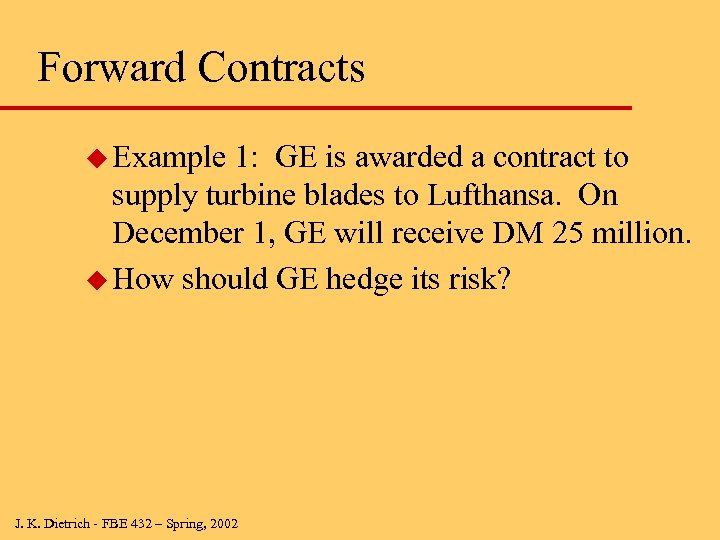

Forward Contracts u Example 1: GE is awarded a contract to supply turbine blades to Lufthansa. On December 1, GE will receive DM 25 million. u How should GE hedge its risk? J. K. Dietrich - FBE 432 – Spring, 2002

Forward Contracts u Example 1: GE is awarded a contract to supply turbine blades to Lufthansa. On December 1, GE will receive DM 25 million. u How should GE hedge its risk? J. K. Dietrich - FBE 432 – Spring, 2002

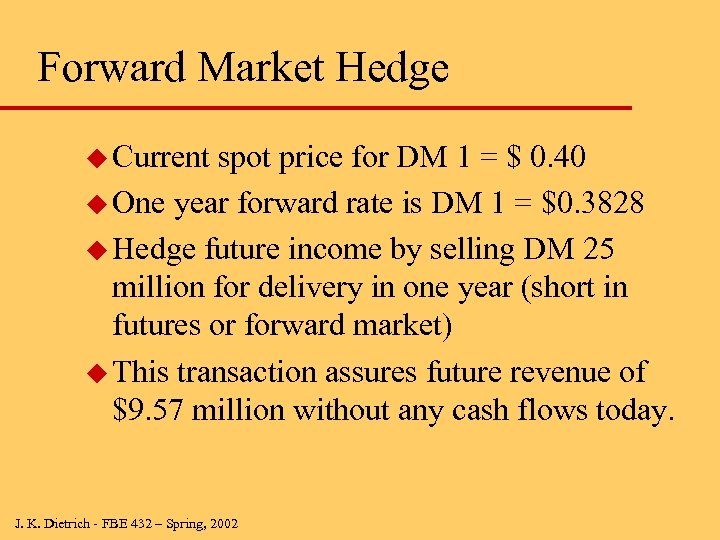

Forward Market Hedge u Current spot price for DM 1 = $ 0. 40 u One year forward rate is DM 1 = $0. 3828 u Hedge future income by selling DM 25 million for delivery in one year (short in futures or forward market) u This transaction assures future revenue of $9. 57 million without any cash flows today. J. K. Dietrich - FBE 432 – Spring, 2002

Forward Market Hedge u Current spot price for DM 1 = $ 0. 40 u One year forward rate is DM 1 = $0. 3828 u Hedge future income by selling DM 25 million for delivery in one year (short in futures or forward market) u This transaction assures future revenue of $9. 57 million without any cash flows today. J. K. Dietrich - FBE 432 – Spring, 2002

Possibilities u Say the spot price on December 1 is $0. 36 per DM. u GE sells its DM 25 million for 0. 3828 per DM, yielding $9. 57 million u If it had not hedged, its DM 25 million, at a rate of $0. 36, would yield $9 million. u The forward is worth $0. 57 million. J. K. Dietrich - FBE 432 – Spring, 2002

Possibilities u Say the spot price on December 1 is $0. 36 per DM. u GE sells its DM 25 million for 0. 3828 per DM, yielding $9. 57 million u If it had not hedged, its DM 25 million, at a rate of $0. 36, would yield $9 million. u The forward is worth $0. 57 million. J. K. Dietrich - FBE 432 – Spring, 2002

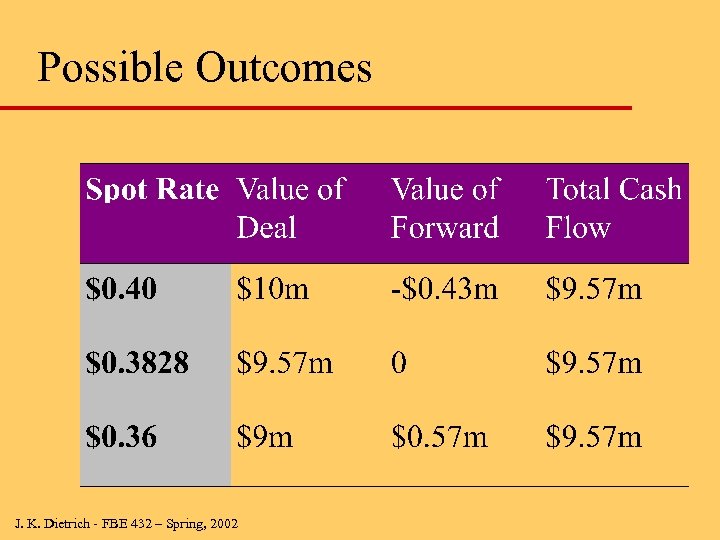

Possible Outcomes J. K. Dietrich - FBE 432 – Spring, 2002

Possible Outcomes J. K. Dietrich - FBE 432 – Spring, 2002

Key Points u Revenues are guaranteed irrespective of exchange rate movements – The cost of hedging varies depending on exchange rate movements u Futures hedging is effective when the magnitude and timing of future currency cash flows is known u Pricing in dollars simply shifts risk J. K. Dietrich - FBE 432 – Spring, 2002

Key Points u Revenues are guaranteed irrespective of exchange rate movements – The cost of hedging varies depending on exchange rate movements u Futures hedging is effective when the magnitude and timing of future currency cash flows is known u Pricing in dollars simply shifts risk J. K. Dietrich - FBE 432 – Spring, 2002

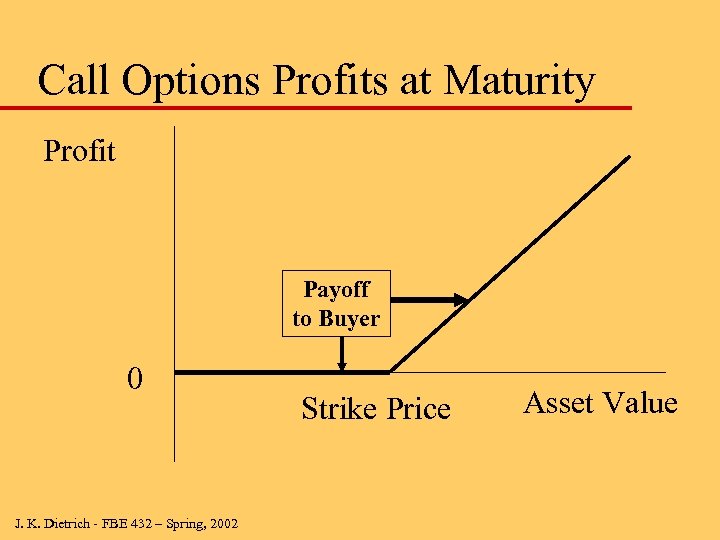

Options (Definition) u An option is the right (not the obligation) to buy or sell an asset at a fixed price before a given date – call is right to buy, put is right to sell – strike or exercise price is a fixed price which determines conversion value – expiration date u Options on stocks, commodities, real estate, and future contracts J. K. Dietrich - FBE 432 – Spring, 2002

Options (Definition) u An option is the right (not the obligation) to buy or sell an asset at a fixed price before a given date – call is right to buy, put is right to sell – strike or exercise price is a fixed price which determines conversion value – expiration date u Options on stocks, commodities, real estate, and future contracts J. K. Dietrich - FBE 432 – Spring, 2002

Call Options Profits at Maturity Profit Payoff to Buyer 0 J. K. Dietrich - FBE 432 – Spring, 2002 Strike Price Asset Value

Call Options Profits at Maturity Profit Payoff to Buyer 0 J. K. Dietrich - FBE 432 – Spring, 2002 Strike Price Asset Value

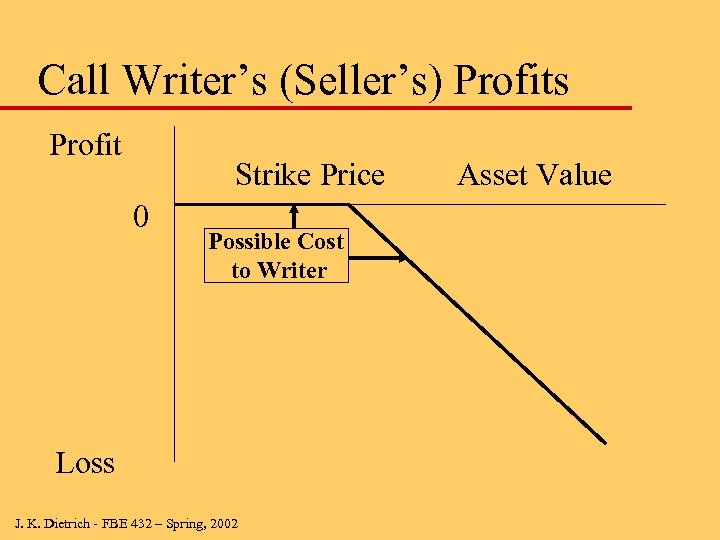

Call Writer’s (Seller’s) Profits Profit Strike Price 0 Possible Cost to Writer Loss J. K. Dietrich - FBE 432 – Spring, 2002 Asset Value

Call Writer’s (Seller’s) Profits Profit Strike Price 0 Possible Cost to Writer Loss J. K. Dietrich - FBE 432 – Spring, 2002 Asset Value

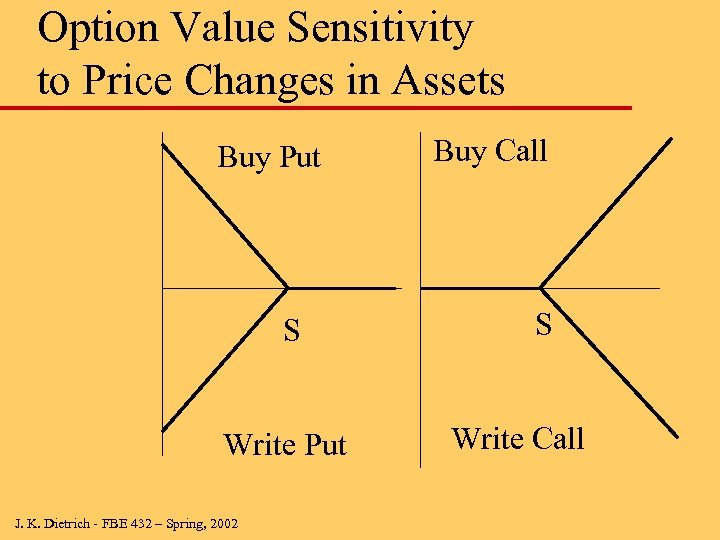

Option Value Sensitivity to Price Changes in Assets Buy Put S Write Put J. K. Dietrich - FBE 432 – Spring, 2002 Buy Call S Write Call

Option Value Sensitivity to Price Changes in Assets Buy Put S Write Put J. K. Dietrich - FBE 432 – Spring, 2002 Buy Call S Write Call

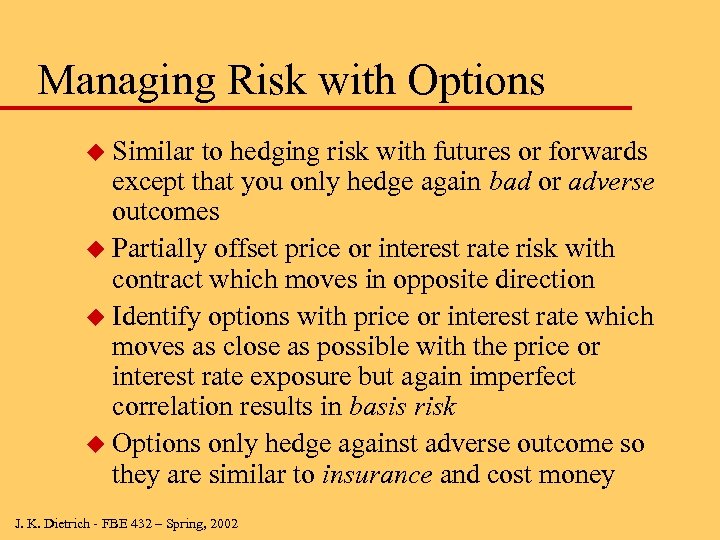

Managing Risk with Options u Similar to hedging risk with futures or forwards except that you only hedge again bad or adverse outcomes u Partially offset price or interest rate risk with contract which moves in opposite direction u Identify options with price or interest rate which moves as close as possible with the price or interest rate exposure but again imperfect correlation results in basis risk u Options only hedge against adverse outcome so they are similar to insurance and cost money J. K. Dietrich - FBE 432 – Spring, 2002

Managing Risk with Options u Similar to hedging risk with futures or forwards except that you only hedge again bad or adverse outcomes u Partially offset price or interest rate risk with contract which moves in opposite direction u Identify options with price or interest rate which moves as close as possible with the price or interest rate exposure but again imperfect correlation results in basis risk u Options only hedge against adverse outcome so they are similar to insurance and cost money J. K. Dietrich - FBE 432 – Spring, 2002

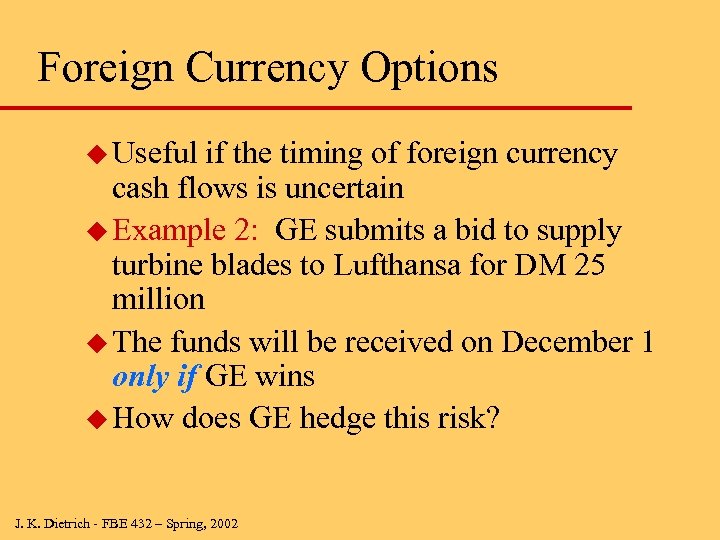

Foreign Currency Options u Useful if the timing of foreign currency cash flows is uncertain u Example 2: GE submits a bid to supply turbine blades to Lufthansa for DM 25 million u The funds will be received on December 1 only if GE wins u How does GE hedge this risk? J. K. Dietrich - FBE 432 – Spring, 2002

Foreign Currency Options u Useful if the timing of foreign currency cash flows is uncertain u Example 2: GE submits a bid to supply turbine blades to Lufthansa for DM 25 million u The funds will be received on December 1 only if GE wins u How does GE hedge this risk? J. K. Dietrich - FBE 432 – Spring, 2002

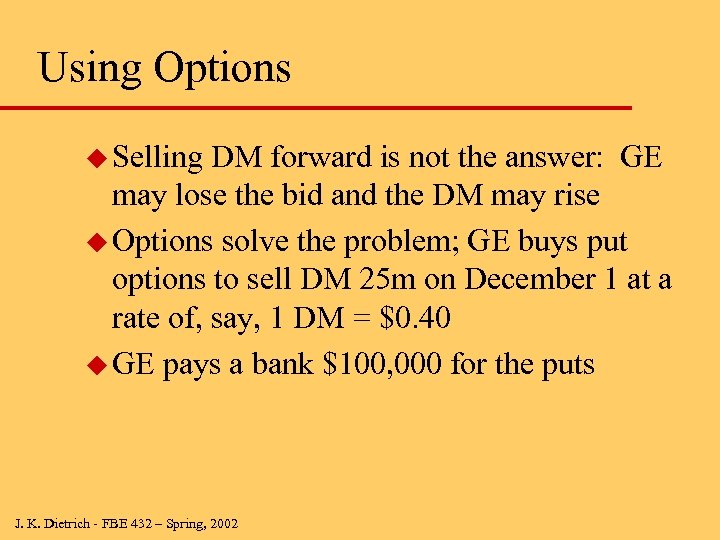

Using Options u Selling DM forward is not the answer: GE may lose the bid and the DM may rise u Options solve the problem; GE buys put options to sell DM 25 m on December 1 at a rate of, say, 1 DM = $0. 40 u GE pays a bank $100, 000 for the puts J. K. Dietrich - FBE 432 – Spring, 2002

Using Options u Selling DM forward is not the answer: GE may lose the bid and the DM may rise u Options solve the problem; GE buys put options to sell DM 25 m on December 1 at a rate of, say, 1 DM = $0. 40 u GE pays a bank $100, 000 for the puts J. K. Dietrich - FBE 432 – Spring, 2002

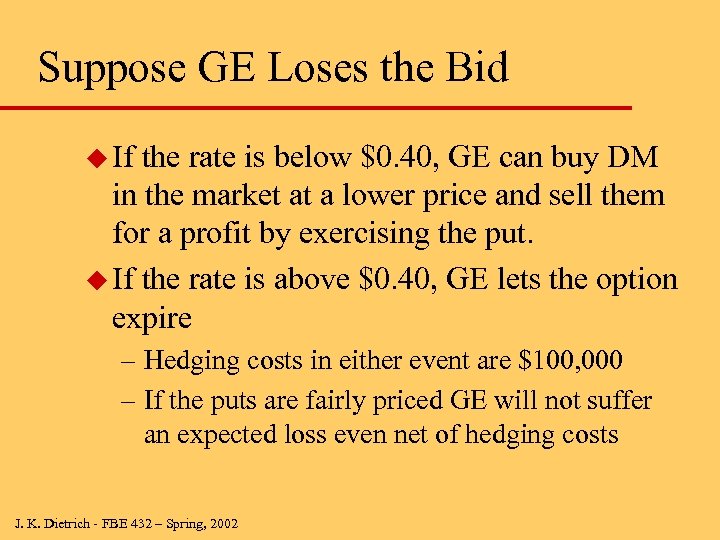

Suppose GE Loses the Bid u If the rate is below $0. 40, GE can buy DM in the market at a lower price and sell them for a profit by exercising the put. u If the rate is above $0. 40, GE lets the option expire – Hedging costs in either event are $100, 000 – If the puts are fairly priced GE will not suffer an expected loss even net of hedging costs J. K. Dietrich - FBE 432 – Spring, 2002

Suppose GE Loses the Bid u If the rate is below $0. 40, GE can buy DM in the market at a lower price and sell them for a profit by exercising the put. u If the rate is above $0. 40, GE lets the option expire – Hedging costs in either event are $100, 000 – If the puts are fairly priced GE will not suffer an expected loss even net of hedging costs J. K. Dietrich - FBE 432 – Spring, 2002

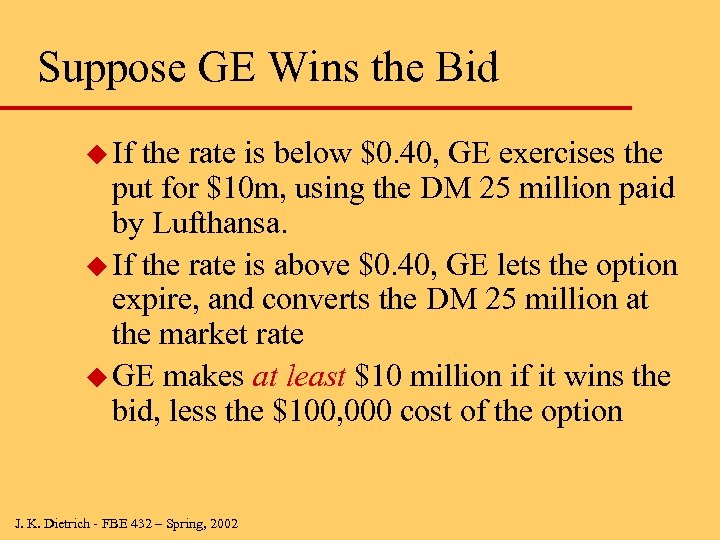

Suppose GE Wins the Bid u If the rate is below $0. 40, GE exercises the put for $10 m, using the DM 25 million paid by Lufthansa. u If the rate is above $0. 40, GE lets the option expire, and converts the DM 25 million at the market rate u GE makes at least $10 million if it wins the bid, less the $100, 000 cost of the option J. K. Dietrich - FBE 432 – Spring, 2002

Suppose GE Wins the Bid u If the rate is below $0. 40, GE exercises the put for $10 m, using the DM 25 million paid by Lufthansa. u If the rate is above $0. 40, GE lets the option expire, and converts the DM 25 million at the market rate u GE makes at least $10 million if it wins the bid, less the $100, 000 cost of the option J. K. Dietrich - FBE 432 – Spring, 2002

Other Uses of Options u Use call options to hedge the risk of foreign tender offers u Hedge risk when quantity of cash flows is uncertain u Currency options can be used to protect profit margins and prevent frequent revisions of product prices abroad J. K. Dietrich - FBE 432 – Spring, 2002

Other Uses of Options u Use call options to hedge the risk of foreign tender offers u Hedge risk when quantity of cash flows is uncertain u Currency options can be used to protect profit margins and prevent frequent revisions of product prices abroad J. K. Dietrich - FBE 432 – Spring, 2002

Interest-Rate Derivatives u Interest rates and asset values move in opposite directions u Long cash means short assets u Short cash means long (someone else’s) asset u Basis risk comes from spreads between exposure and hedge instrument, e. g. default risk premiums u Problem with production risk, e. g. interest rates up, needs for funds may be down with slowdown J. K. Dietrich - FBE 432 – Spring, 2002

Interest-Rate Derivatives u Interest rates and asset values move in opposite directions u Long cash means short assets u Short cash means long (someone else’s) asset u Basis risk comes from spreads between exposure and hedge instrument, e. g. default risk premiums u Problem with production risk, e. g. interest rates up, needs for funds may be down with slowdown J. K. Dietrich - FBE 432 – Spring, 2002

Caps, floors, and collars u If a borrower has a loan commitment with a cap (maximum rate), this is the same as a put option on a note u If at the same time, a borrower commits to pay a floor or minimum rate, this is the same as writing a call u A collar is a cap and a floor J. K. Dietrich - FBE 432 – Spring, 2002

Caps, floors, and collars u If a borrower has a loan commitment with a cap (maximum rate), this is the same as a put option on a note u If at the same time, a borrower commits to pay a floor or minimum rate, this is the same as writing a call u A collar is a cap and a floor J. K. Dietrich - FBE 432 – Spring, 2002

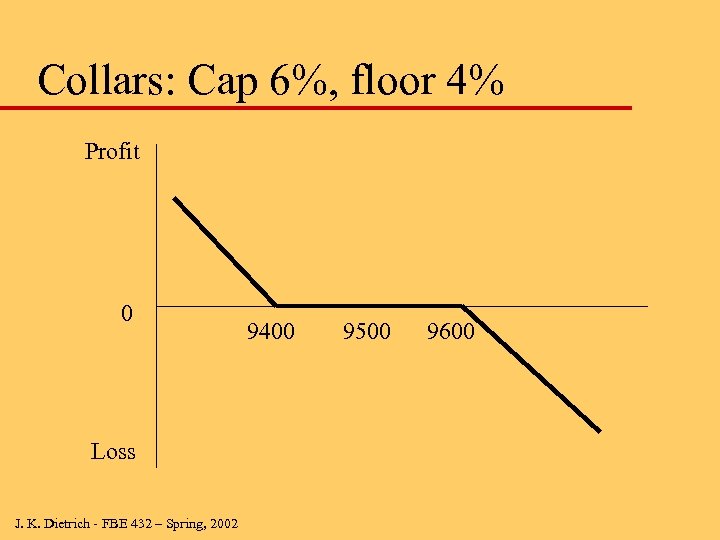

Collars: Cap 6%, floor 4% Profit 0 Loss J. K. Dietrich - FBE 432 – Spring, 2002 9400 9500 9600

Collars: Cap 6%, floor 4% Profit 0 Loss J. K. Dietrich - FBE 432 – Spring, 2002 9400 9500 9600

Other option developments u. Credit risk options u. Casualty risk options u. Requirements for developing an option – Interest – Calculable payoffs – Enforceable J. K. Dietrich - FBE 432 – Spring, 2002

Other option developments u. Credit risk options u. Casualty risk options u. Requirements for developing an option – Interest – Calculable payoffs – Enforceable J. K. Dietrich - FBE 432 – Spring, 2002

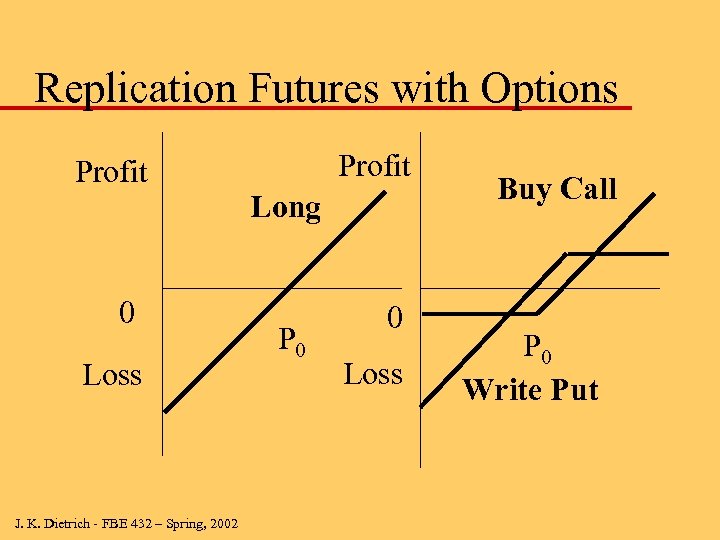

Replication Futures with Options Profit 0 Loss J. K. Dietrich - FBE 432 – Spring, 2002 Profit Long P 0 0 Loss Buy Call P 0 Write Put

Replication Futures with Options Profit 0 Loss J. K. Dietrich - FBE 432 – Spring, 2002 Profit Long P 0 0 Loss Buy Call P 0 Write Put

Next Week – October 14, 2002 u Review this week’s discussion to identify areas needing clarification u Review weekly Objectives and prepare for midterm examination on October 16, 2002 u After exam, read and prepare case Union Carbide Corporation Interest Rate Risk Management and identify issues in the case you have questions about J. K. Dietrich - FBE 432 – Spring, 2002

Next Week – October 14, 2002 u Review this week’s discussion to identify areas needing clarification u Review weekly Objectives and prepare for midterm examination on October 16, 2002 u After exam, read and prepare case Union Carbide Corporation Interest Rate Risk Management and identify issues in the case you have questions about J. K. Dietrich - FBE 432 – Spring, 2002