3b8d3a7d914655d8b4f397d335bd435f.ppt

- Количество слайдов: 42

Module III: Asset-Liability Management Week 7 – February 23, 2006 J. K. Dietrich - FBE 532 – Spring, 2006

Risk Management u Measure and manage sources of variation in value or cash flows from – Interest rates – Exchange rates – Input and product prices – Unexpected casualty losses u Several approaches are available – Balance sheet management, insurance, derivatives J. K. Dietrich - FBE 532 – Spring, 2006

Micro- versus macro-risks u Micro-risks are associated with specific cash flow risks, such as commodity prices or exchange rates in specific contracts u Macro-risks are the net overall risks from all sources of cash flows, including revenues and operating and financial costs u Define and measure both macro and micro risks first J. K. Dietrich - FBE 532 – Spring, 2006

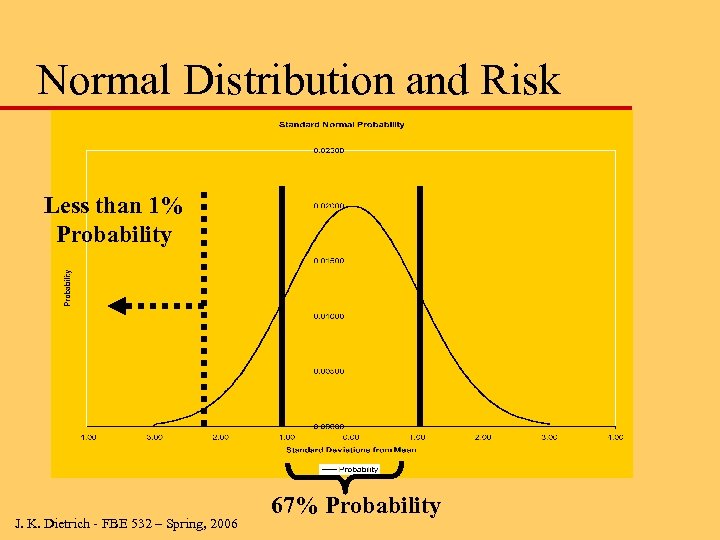

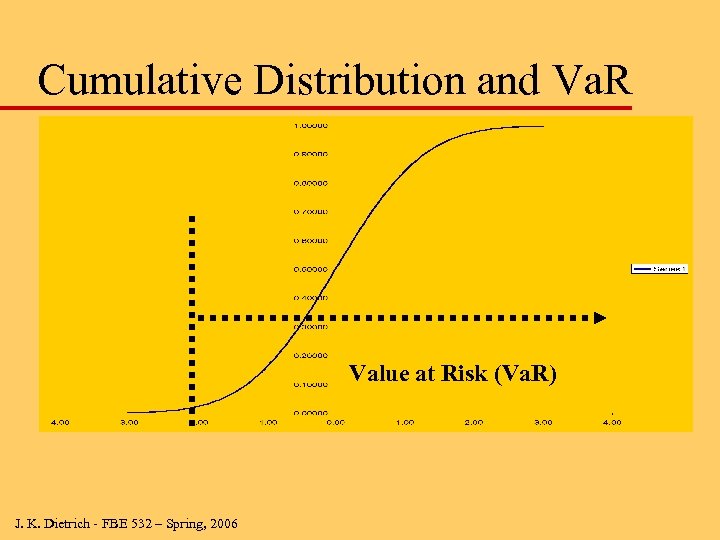

Risk Measurement: Portfolios u Standard deviation of returns ( ) is a standard risk measure – If returns are normal, 67% of the time return is within , 95% within 2 x – Risk is conceptually symmetric (not good, bad) u Cumulative probability of default or other bad income is alternative but related concept for all distributions (not just normal) u Value at Risk (VAR) looks at probability of bad outcomes, e. g. equity wiped out J. K. Dietrich - FBE 532 – Spring, 2006

Normal Distribution and Risk Less than 1% Probability J. K. Dietrich - FBE 532 – Spring, 2006 67% Probability

Cumulative Distribution and Va. R Value at Risk (Va. R) J. K. Dietrich - FBE 532 – Spring, 2006

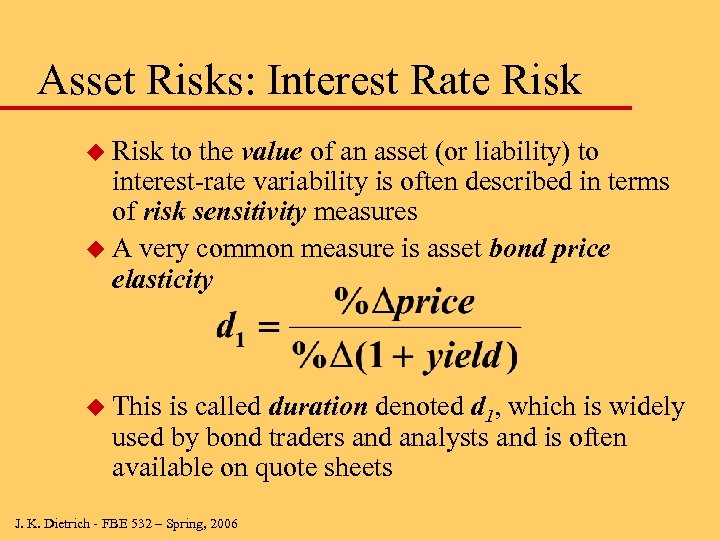

Asset Risks: Interest Rate Risk u Risk to the value of an asset (or liability) to interest-rate variability is often described in terms of risk sensitivity measures u A very common measure is asset bond price elasticity u This is called duration denoted d 1, which is widely used by bond traders and analysts and is often available on quote sheets J. K. Dietrich - FBE 532 – Spring, 2006

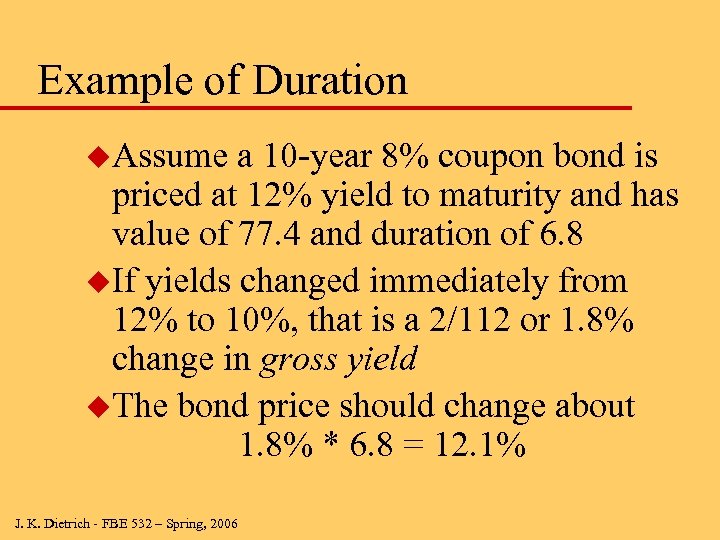

Example of Duration u. Assume a 10 -year 8% coupon bond is priced at 12% yield to maturity and has value of 77. 4 and duration of 6. 8 u. If yields changed immediately from 12% to 10%, that is a 2/112 or 1. 8% change in gross yield u. The bond price should change about 1. 8% * 6. 8 = 12. 1% J. K. Dietrich - FBE 532 – Spring, 2006

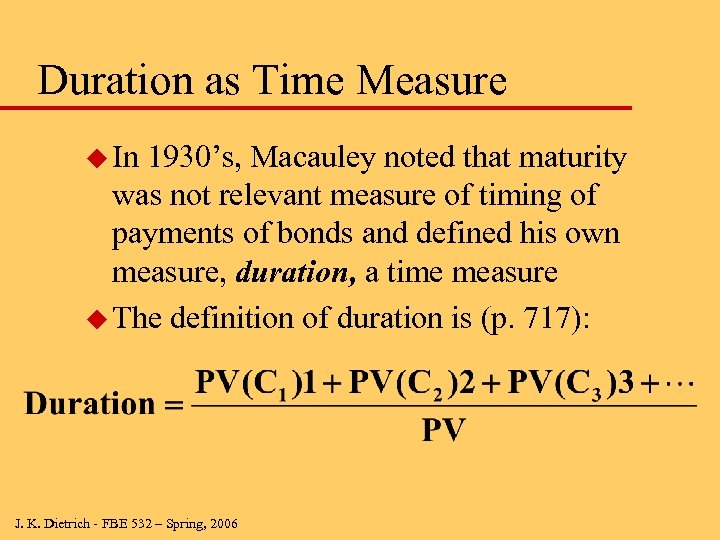

Duration as Time Measure u In 1930’s, Macauley noted that maturity was not relevant measure of timing of payments of bonds and defined his own measure, duration, a time measure u The definition of duration is (p. 717): J. K. Dietrich - FBE 532 – Spring, 2006

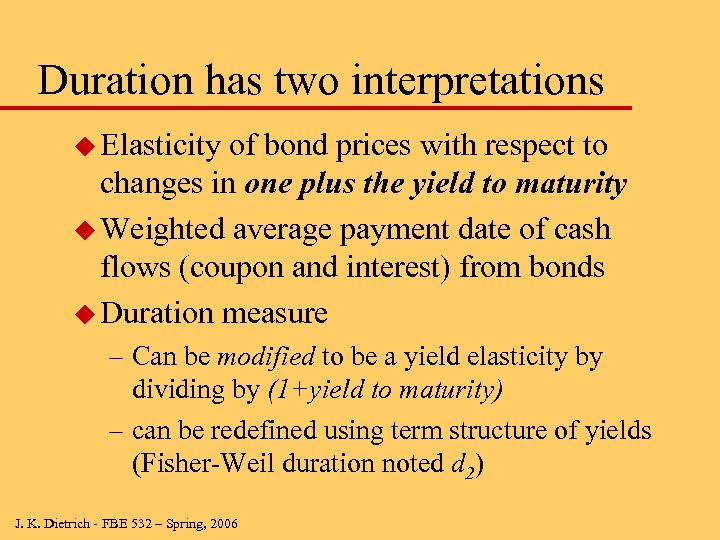

Duration has two interpretations u Elasticity of bond prices with respect to changes in one plus the yield to maturity u Weighted average payment date of cash flows (coupon and interest) from bonds u Duration measure – Can be modified to be a yield elasticity by dividing by (1+yield to maturity) – can be redefined using term structure of yields (Fisher-Weil duration noted d 2) J. K. Dietrich - FBE 532 – Spring, 2006

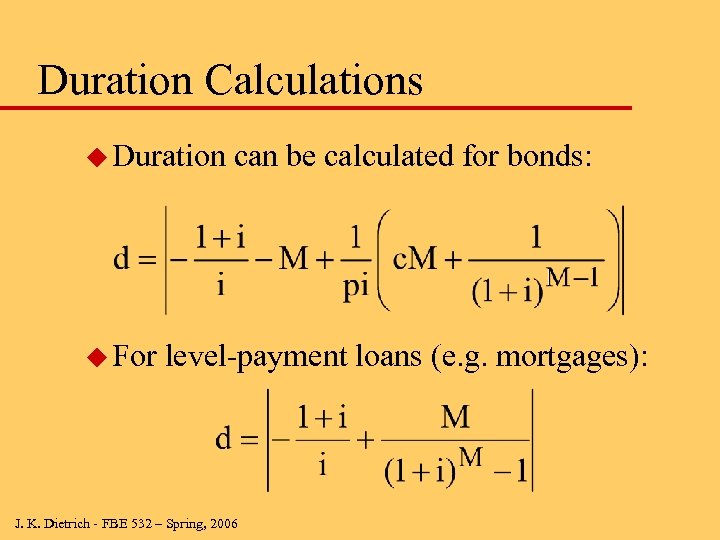

Duration Calculations u Duration u For can be calculated for bonds: level-payment loans (e. g. mortgages): J. K. Dietrich - FBE 532 – Spring, 2006

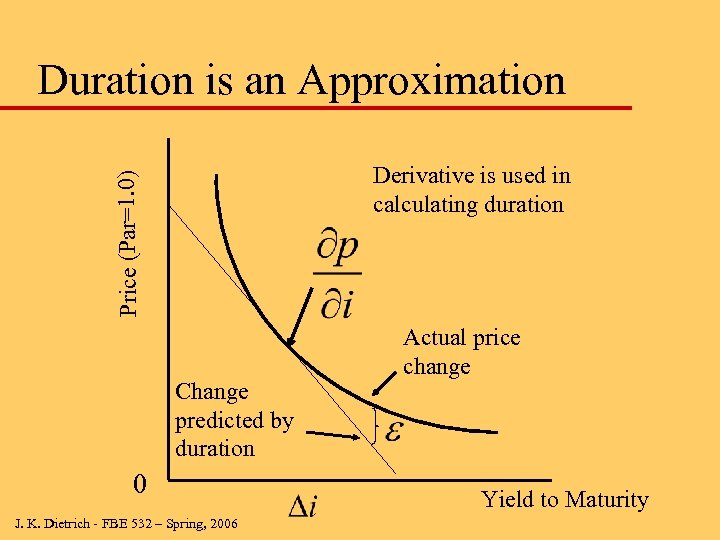

Duration is an Approximation Price (Par=1. 0) Derivative is used in calculating duration Change predicted by duration 0 J. K. Dietrich - FBE 532 – Spring, 2006 Actual price change Yield to Maturity

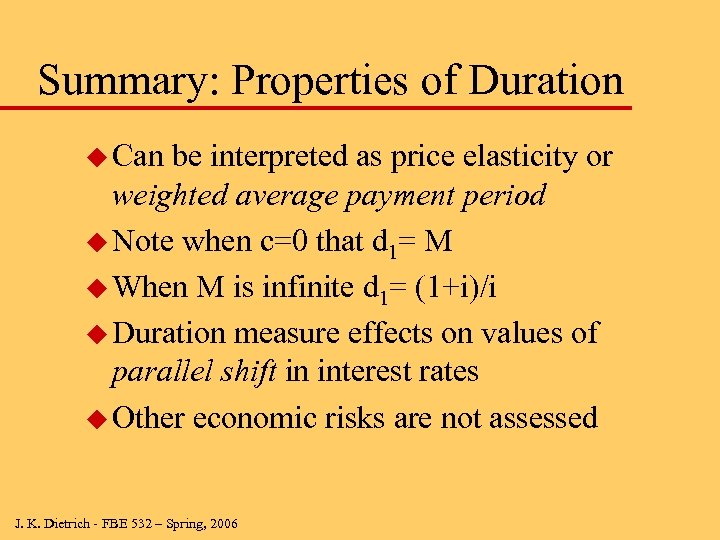

Summary: Properties of Duration u Can be interpreted as price elasticity or weighted average payment period u Note when c=0 that d 1= M u When M is infinite d 1= (1+i)/i u Duration measure effects on values of parallel shift in interest rates u Other economic risks are not assessed J. K. Dietrich - FBE 532 – Spring, 2006

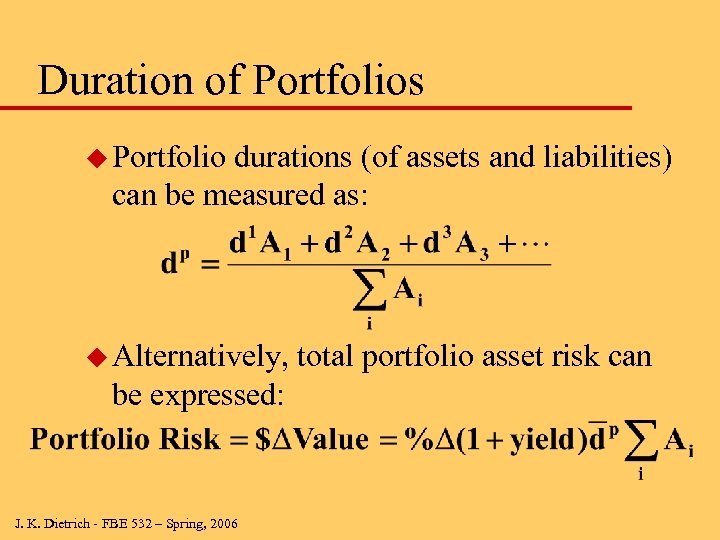

Duration of Portfolios u Portfolio durations (of assets and liabilities) can be measured as: u Alternatively, be expressed: J. K. Dietrich - FBE 532 – Spring, 2006 total portfolio asset risk can

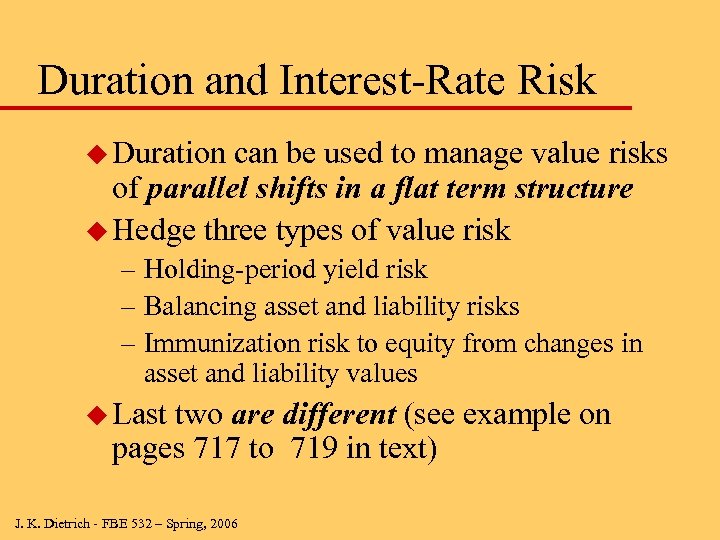

Duration and Interest-Rate Risk u Duration can be used to manage value risks of parallel shifts in a flat term structure u Hedge three types of value risk – Holding-period yield risk – Balancing asset and liability risks – Immunization risk to equity from changes in asset and liability values u Last two are different (see example on pages 717 to 719 in text) J. K. Dietrich - FBE 532 – Spring, 2006

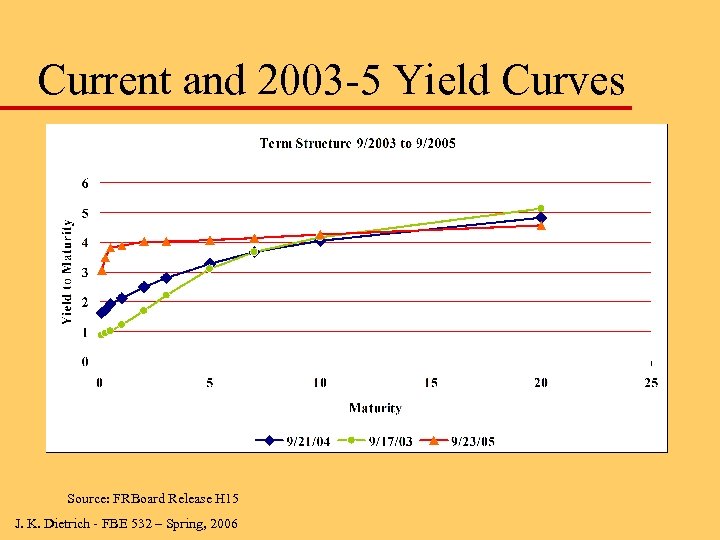

Current and 2003 -5 Yield Curves Source: FRBoard Release H 15 J. K. Dietrich - FBE 532 – Spring, 2006

Asset Liability Management: Definitions u Approach to balance sheet management including financing and balance sheet composition and use of off-balance sheet instruments u Assessment or measurement of balance sheet risk, especially to interest rate changes u Simulation of earnings performance of a portfolio or balance sheet under a variety of economic scenarios J. K. Dietrich - FBE 532 – Spring, 2006

Value versus Cash-Flow Risk u Duration measures sensitivity of value of assets and liabilities to changes in interest rates u Cash flows may change due to changes in a number of factors, including interest rates u Ultimately a firm’s value comes from cash flows, and those come from operations and depend on current and future investment needs u A Framework for Risk Management (Froot, Scharfstein, Stein, HBR Nov-Dec/1994) emphasize importance of cash-flow risks J. K. Dietrich - FBE 532 – Spring, 2006

Factor Model Risk Measures u The general factor model expresses the portfolio (or firm) returns (or cash flows) as a linear function of a number of factors u Example: the familiar CAPM market model is a single-factor model – The stock’s return is expressed as a linear function of the market factor – But many industrial firms and banks are also exposed to significant interest rate risk J. K. Dietrich - FBE 532 – Spring, 2006

Stylized Example u Suppose Citibank’s cash flows are negatively related to interest rate movements but increase with the Yen/$ rate. Define C = cash flow, millions of U. S. dollars a month Fcurr = the percentage change in the Yen/$ exchange rate, monthly Fint = the change in LIBOR, monthly J. K. Dietrich - FBE 532 – Spring, 2006

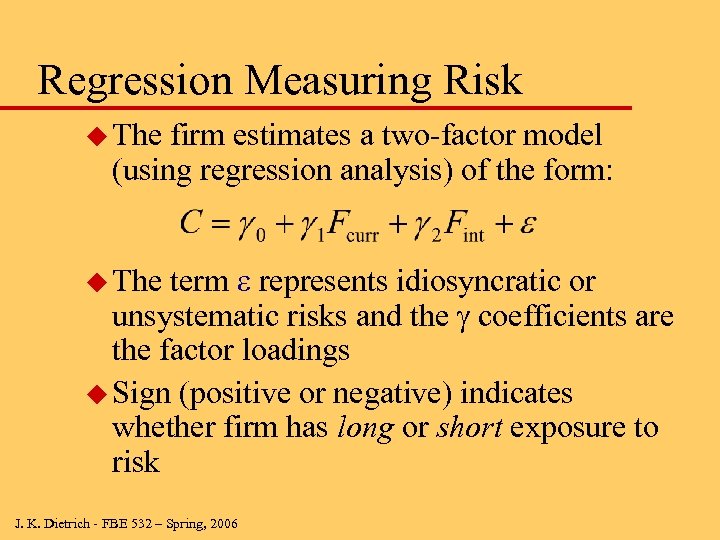

Regression Measuring Risk u The firm estimates a two-factor model (using regression analysis) of the form: term e represents idiosyncratic or unsystematic risks and the coefficients are the factor loadings u Sign (positive or negative) indicates whether firm has long or short exposure to risk u The J. K. Dietrich - FBE 532 – Spring, 2006

Hedging Balance Sheet Risk u Hedging on balance sheet – Assets and liabilities chosen to offset risks – Changing mismatches of assets and/or liabilities through swaps – Floating rate securities with short re-pricing intervals have little interest-rate risk u Hedging off balance sheet – Futures, forward contracts, and options J. K. Dietrich - FBE 532 – Spring, 2006

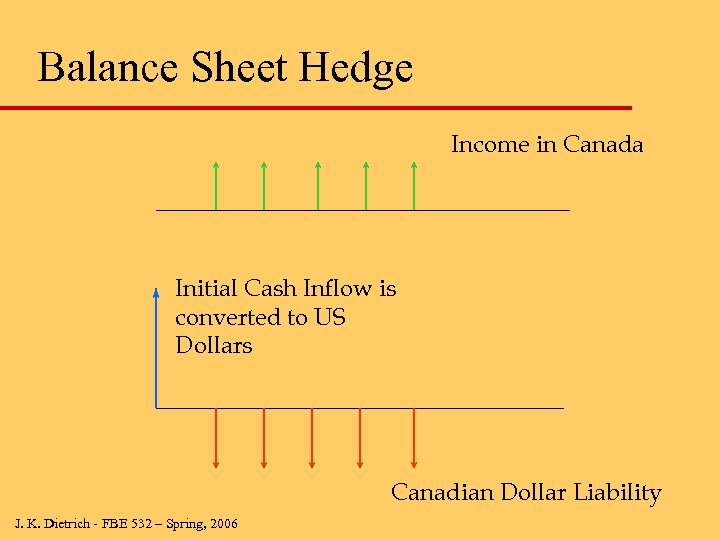

Balance Sheet Hedges u Example: United Airlines receives income in Canadian dollars from its operations in Canada u In 1997 -98, the Canadian dollar depreciated against the US Dollar. u How can United hedge its currency risk from Canadian operations? J. K. Dietrich - FBE 532 – Spring, 2006

Balance Sheet Hedge u Consider taking a long-term liability in Canadian dollars to offset the (risky) income in Canadian dollars from UAL’s operations in Canada – A bank loan or bond issue (in Canada or Eurobonds denominated in Canadian dollars), generates cash which can be converted to US dollars – Interest obligations are met from Canadian income J. K. Dietrich - FBE 532 – Spring, 2006

Balance Sheet Hedge Income in Canada Initial Cash Inflow is converted to US Dollars Canadian Dollar Liability J. K. Dietrich - FBE 532 – Spring, 2006

Swaps u Exchange of future cash flows based on movement of some asset or price – Interest rates – Exchange rates – Commodity prices or other contingencies u Swaps are all over-the-counter contracts u Two contracting entities are called counter-parties u Financial institution can take both sides J. K. Dietrich - FBE 532 – Spring, 2006

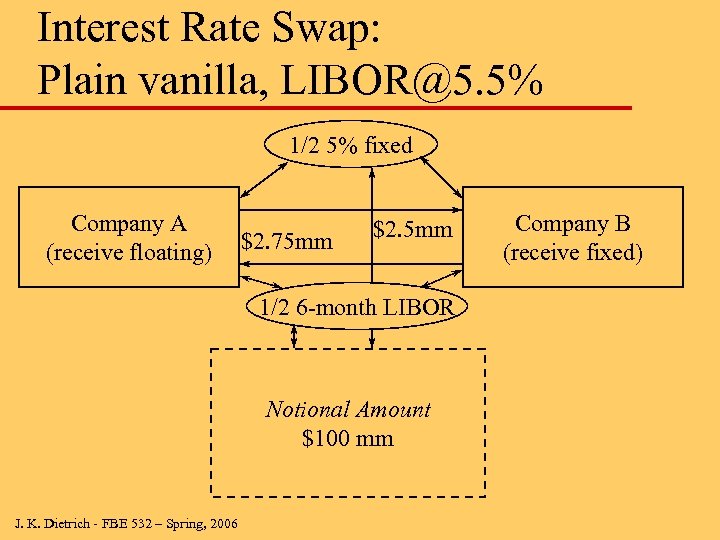

Interest Rate Swap: Plain vanilla, LIBOR@5. 5% 1/2 5% fixed Company A (receive floating) $2. 75 mm $2. 5 mm 1/2 6 -month LIBOR Notional Amount $100 mm J. K. Dietrich - FBE 532 – Spring, 2006 Company B (receive fixed)

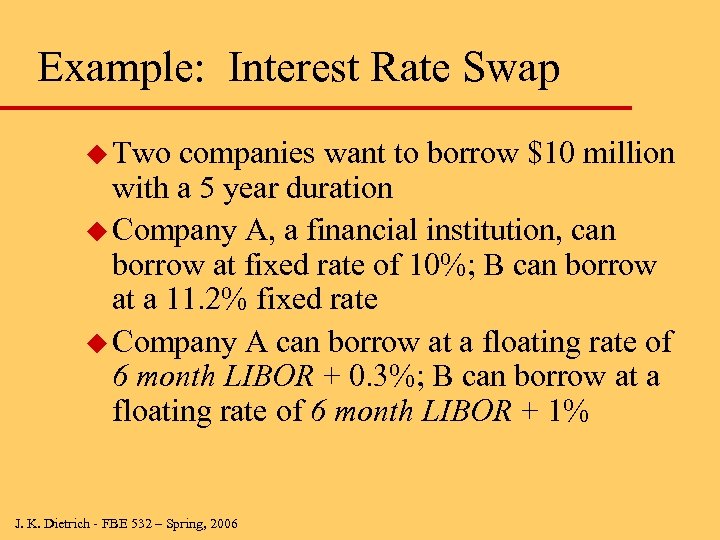

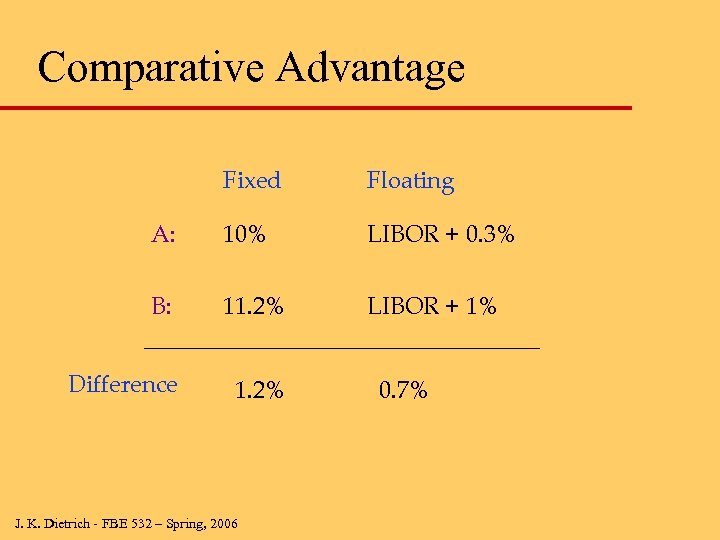

Example: Interest Rate Swap u Two companies want to borrow $10 million with a 5 year duration u Company A, a financial institution, can borrow at fixed rate of 10%; B can borrow at a 11. 2% fixed rate u Company A can borrow at a floating rate of 6 month LIBOR + 0. 3%; B can borrow at a floating rate of 6 month LIBOR + 1% J. K. Dietrich - FBE 532 – Spring, 2006

Comparative Advantage Fixed Floating A: 10% LIBOR + 0. 3% B: 11. 2% LIBOR + 1% Difference 1. 2% J. K. Dietrich - FBE 532 – Spring, 2006 0. 7%

Preferences u Company A prefers floating interest debt while B wants to lock in a fixed rate u However, A has a comparative advantage in the fixed rate market while B has a comparative advantage in the floating rate market J. K. Dietrich - FBE 532 – Spring, 2006

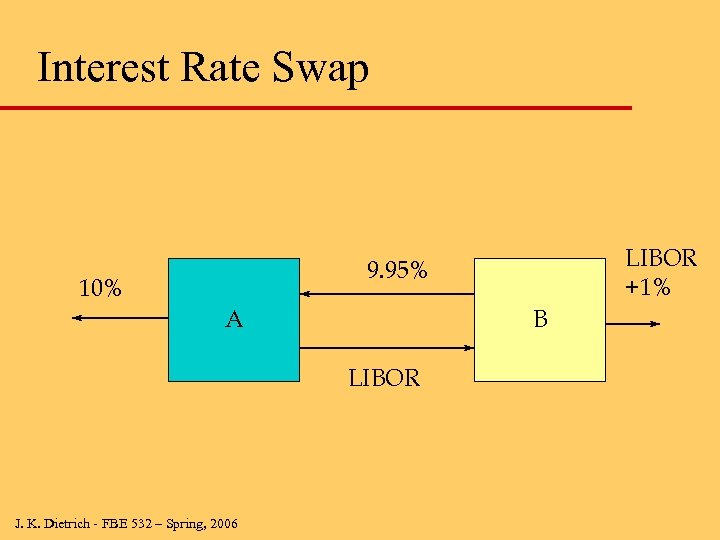

Swap Mechanics u Suppose A borrows at 10% fixed and B borrows at LIBOR + 1%, and then the two companies swap flows u Company A pays B interest at 6 -month LIBOR on $10 million u Company B pays A interest at 9. 95% per annum on $10 million J. K. Dietrich - FBE 532 – Spring, 2006

Interest Rate Swap LIBOR +1% 9. 95% 10% A B LIBOR J. K. Dietrich - FBE 532 – Spring, 2006

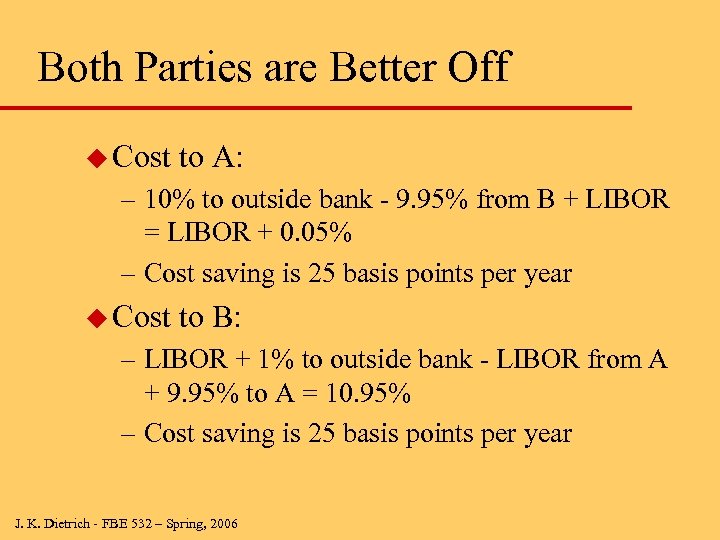

Both Parties are Better Off u Cost to A: – 10% to outside bank - 9. 95% from B + LIBOR = LIBOR + 0. 05% – Cost saving is 25 basis points per year u Cost to B: – LIBOR + 1% to outside bank - LIBOR from A + 9. 95% to A = 10. 95% – Cost saving is 25 basis points per year J. K. Dietrich - FBE 532 – Spring, 2006

Swaps: Some fine points u The source of the gain is the fact that the two firms have different comparative advantages; even though A has an absolute advantage, there are still gains from trade u The total gain is 0. 25% + 0. 25% = 0. 5% = 1. 2% - 0. 7%, the difference in the relative borrowing costs J. K. Dietrich - FBE 532 – Spring, 2006

Swaps in Practice u Note that a swap does not involve the exchange of principals – All that is swapped is the cash flows u To guard against default, the deal will typically be structured with an intermediary (usually a large bank) between the two parties J. K. Dietrich - FBE 532 – Spring, 2006

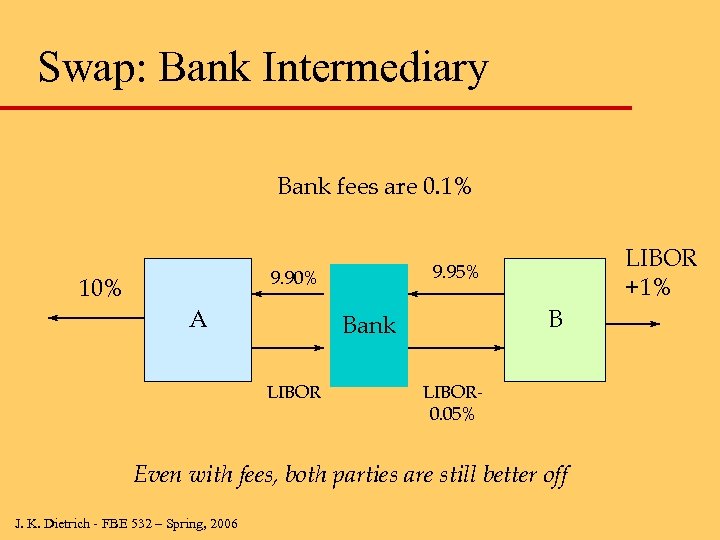

Swap: Bank Intermediary Bank fees are 0. 1% 9. 90% 10% A B Bank LIBOR +1% 9. 95% LIBOR 0. 05% Even with fees, both parties are still better off J. K. Dietrich - FBE 532 – Spring, 2006

Swaps in Practice u The intermediary will charge fees for acting as a clearing house and guaranteeing the payments u As long as these fees are below 0. 5%, all parties can be made better off u If the deal is put together by the intermediary, it is not necessary for either firm to know the trade counter-party J. K. Dietrich - FBE 532 – Spring, 2006

Swaps in Practice u Many interest rate swaps also involve currency swaps or commodity swaps u Recently, the swap market has grown so rapidly that dealers will act as counterparties J. K. Dietrich - FBE 532 – Spring, 2006

Dealer Quotations for Swaps u Example: – IBM can issue fixed rate bonds at 7. 0% per annum. IBM wants a floating rate obligation believing rates will fall. – An OTC dealer gives IBM a fixed rate quote of 60 basis points over treasuries to be exchanged for 6 -month LIBOR on a 5 year swap – If 5 -year treasuries are at 5. 53%, this quote means that you can get 6 -month LIBOR by paying 6. 13% (= 5. 53% +0. 60) fixed rate. – In IBM’s case, it would thus get 6. 13% from the counterparty (or dealer) and would have to pay 6 -month LIBOR, plus the 7. 0% on its original debt – All-in costs are approximately LIBOR+ 0. 87% J. K. Dietrich - FBE 532 – Spring, 2006

The Value of Swaps u Swaps are beneficial because they allow hedging with one contract since they typically involve cash flows over several years u There are no losers; financial engineering results in value creation u The source of this value is in overcoming segmented markets J. K. Dietrich - FBE 532 – Spring, 2006

Issues in Hedging u Micro-hedging versus macro-hedging – Accounting – Regulation u Assumptions underlying hedging – Market liquidity – Covariance structure (second moments) u Notorious examples – PNC, IG Metall, Bankers Trust, Orange Cy, Long-Term Capital Mgmt (LTCM), Banc. One J. K. Dietrich - FBE 532 – Spring, 2006

Next Week – March 2, 2006 u Review Wall Street Journal tables on interest rates, futures, swaps, options u Review this week’s discussion to identify areas needing clarification before midterm u Read and prepare case Union Carbide Corporation Interest Rate Risk Management and identify issues in the case you have questions about J. K. Dietrich - FBE 532 – Spring, 2006

3b8d3a7d914655d8b4f397d335bd435f.ppt