b182fc1c2a1f915a88641f8479389724.ppt

- Количество слайдов: 27

Module II: Private Equity Financing, Options and Warrants Week 5 – February 9, 2006 J. K. Dietrich - FBE 532 – Spring, 2006

Module II: Private Equity Financing, Options and Warrants Week 5 – February 9, 2006 J. K. Dietrich - FBE 532 – Spring, 2006

Lecture Topics u Venture capital financing terms – Different types of venture capital financing u Options and warrants in convertible securities u Pricing options and warrants – Black-Scholes option pricing – Adjusting option prices for warrant pricing J. K. Dietrich - FBE 532 – Spring, 2006

Lecture Topics u Venture capital financing terms – Different types of venture capital financing u Options and warrants in convertible securities u Pricing options and warrants – Black-Scholes option pricing – Adjusting option prices for warrant pricing J. K. Dietrich - FBE 532 – Spring, 2006

Venture Capital Terms u Term sheets are standard means of communicating all aspects of a deal (not just venture capital) u Terms on any deal contain a number of aspects and conditions (e. g. maturity, repayment, etc. ) u Venture capital terms tend to focus on key issues important to venture capitalists J. K. Dietrich - FBE 532 – Spring, 2006

Venture Capital Terms u Term sheets are standard means of communicating all aspects of a deal (not just venture capital) u Terms on any deal contain a number of aspects and conditions (e. g. maturity, repayment, etc. ) u Venture capital terms tend to focus on key issues important to venture capitalists J. K. Dietrich - FBE 532 – Spring, 2006

Venture Capital Terms u Venture capitalists – Have high risk-adjusted expected returns – Short investment horizons (e. g. 5 years) – Option to influence or exercise control – Exit strategies u Basic terms are amounts invested, the extent of control, factors determining returns under various outcomes, exit alternatives J. K. Dietrich - FBE 532 – Spring, 2006

Venture Capital Terms u Venture capitalists – Have high risk-adjusted expected returns – Short investment horizons (e. g. 5 years) – Option to influence or exercise control – Exit strategies u Basic terms are amounts invested, the extent of control, factors determining returns under various outcomes, exit alternatives J. K. Dietrich - FBE 532 – Spring, 2006

Negotiations: Valuation u Pre-money valuation = value placed on business by venture capital firm u Post-money valuation = value of firm after venture capital financing u Valuation can have range under different circumstances, e. g. benchmark performance or milestones and effects entrepreneur’s claim on future firm value J. K. Dietrich - FBE 532 – Spring, 2006

Negotiations: Valuation u Pre-money valuation = value placed on business by venture capital firm u Post-money valuation = value of firm after venture capital financing u Valuation can have range under different circumstances, e. g. benchmark performance or milestones and effects entrepreneur’s claim on future firm value J. K. Dietrich - FBE 532 – Spring, 2006

Negotiations: Share Allocation u Share allocation affects distribution of control and future wealth gains from the firm – Founders’ pool is equity before financing – Employee option pool may be part of founders’ pool or out of capital raised u Allocation of shares to founders and employees is vesting J. K. Dietrich - FBE 532 – Spring, 2006

Negotiations: Share Allocation u Share allocation affects distribution of control and future wealth gains from the firm – Founders’ pool is equity before financing – Employee option pool may be part of founders’ pool or out of capital raised u Allocation of shares to founders and employees is vesting J. K. Dietrich - FBE 532 – Spring, 2006

Vesting Alternatives u Immediate vesting means taking ownership of some or all shares at once u Pattern of gradual investing can be different: – Cliff meaning large amount at one time – Linear investing means gradual allocation of shares u Example: 50% immediate vesting, remainder over 24 months allocates 50% of share immediately, the remainder 2. 083% per month until 100% of commitment is satisfied J. K. Dietrich - FBE 532 – Spring, 2006

Vesting Alternatives u Immediate vesting means taking ownership of some or all shares at once u Pattern of gradual investing can be different: – Cliff meaning large amount at one time – Linear investing means gradual allocation of shares u Example: 50% immediate vesting, remainder over 24 months allocates 50% of share immediately, the remainder 2. 083% per month until 100% of commitment is satisfied J. K. Dietrich - FBE 532 – Spring, 2006

Control Issues u Voting rights of shares u Board membership u Share ownership upon management or employee dismissal or quitting u Reporting and information rights u Antidilution protection u Purchase rights in case of changes u Conversion privileges J. K. Dietrich - FBE 532 – Spring, 2006

Control Issues u Voting rights of shares u Board membership u Share ownership upon management or employee dismissal or quitting u Reporting and information rights u Antidilution protection u Purchase rights in case of changes u Conversion privileges J. K. Dietrich - FBE 532 – Spring, 2006

Exit Alternatives for VC u Liquidation alternatives – Assumes cash purchase or merger – Liquidation preference of securities – Optional conversion of securities to common shares u Initial public offering (IPO) – Piggyback registration – S-3 registration J. K. Dietrich - FBE 532 – Spring, 2006

Exit Alternatives for VC u Liquidation alternatives – Assumes cash purchase or merger – Liquidation preference of securities – Optional conversion of securities to common shares u Initial public offering (IPO) – Piggyback registration – S-3 registration J. K. Dietrich - FBE 532 – Spring, 2006

Options and Warrants u. A call option or warrant is the right to buy an asset at a given price before a given date u Convertible securities can be exchanged for other securities (usually common stock) at a given ratio of face value (e. g. 50 shares per $1000 bond) or conversion price (e. g. $20 per share) u Conversion feature is similar to call option or warrant J. K. Dietrich - FBE 532 – Spring, 2006

Options and Warrants u. A call option or warrant is the right to buy an asset at a given price before a given date u Convertible securities can be exchanged for other securities (usually common stock) at a given ratio of face value (e. g. 50 shares per $1000 bond) or conversion price (e. g. $20 per share) u Conversion feature is similar to call option or warrant J. K. Dietrich - FBE 532 – Spring, 2006

Option Pricing u Major theoretical breakthrough in finance in 1973 by Fisher Black and Myron Scholes – Scholes and Robert Merton received a Nobel Prize in economics for their work in option pricing, Black died relatively young u Basic argument is that you should not be able to make money with no investment and no risk u Logic is called arbitrage pricing theory (APT) J. K. Dietrich - FBE 532 – Spring, 2006

Option Pricing u Major theoretical breakthrough in finance in 1973 by Fisher Black and Myron Scholes – Scholes and Robert Merton received a Nobel Prize in economics for their work in option pricing, Black died relatively young u Basic argument is that you should not be able to make money with no investment and no risk u Logic is called arbitrage pricing theory (APT) J. K. Dietrich - FBE 532 – Spring, 2006

Major Assumptions u European call option – Can be relaxed easily in some cases u No dividends – Easy to adjust for dividends u Returns are normally distributed – Can be extended for jump discontinuities u Constant volatility of returns – Stochastic volatility can be incorporated J. K. Dietrich - FBE 532 – Spring, 2006

Major Assumptions u European call option – Can be relaxed easily in some cases u No dividends – Easy to adjust for dividends u Returns are normally distributed – Can be extended for jump discontinuities u Constant volatility of returns – Stochastic volatility can be incorporated J. K. Dietrich - FBE 532 – Spring, 2006

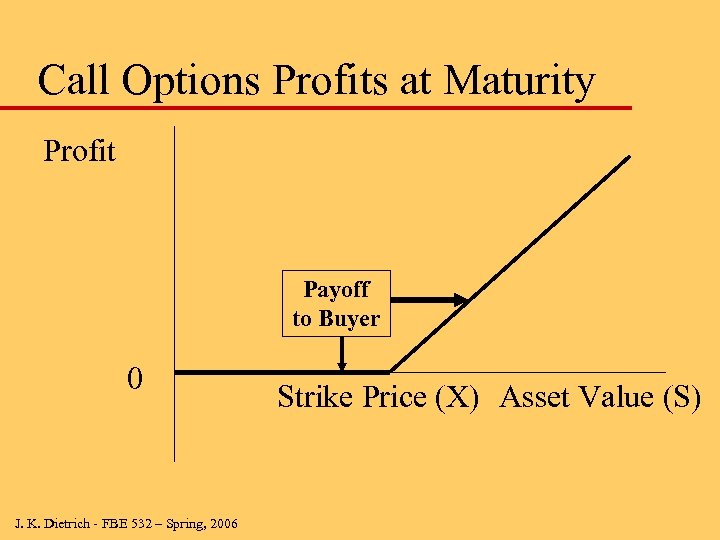

Call Options Profits at Maturity Profit Payoff to Buyer 0 J. K. Dietrich - FBE 532 – Spring, 2006 Strike Price (X) Asset Value (S)

Call Options Profits at Maturity Profit Payoff to Buyer 0 J. K. Dietrich - FBE 532 – Spring, 2006 Strike Price (X) Asset Value (S)

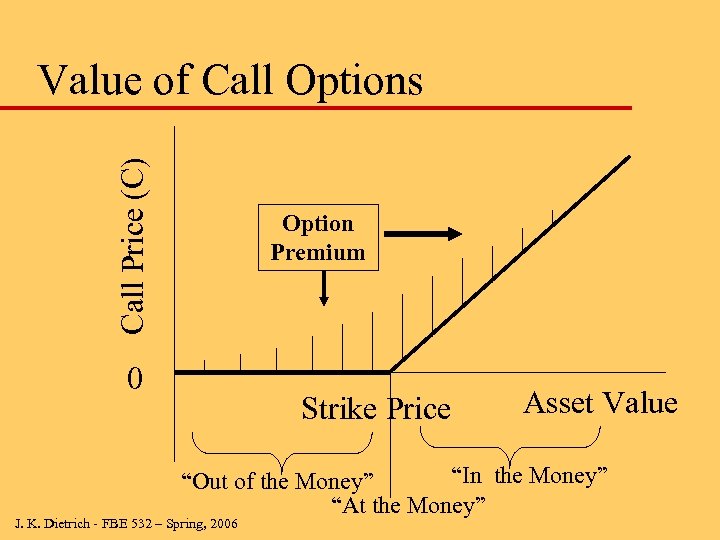

Call Price (C) Value of Call Options Option Premium 0 Strike Price Asset Value “In the Money” “Out of the Money” “At the Money” J. K. Dietrich - FBE 532 – Spring, 2006

Call Price (C) Value of Call Options Option Premium 0 Strike Price Asset Value “In the Money” “Out of the Money” “At the Money” J. K. Dietrich - FBE 532 – Spring, 2006

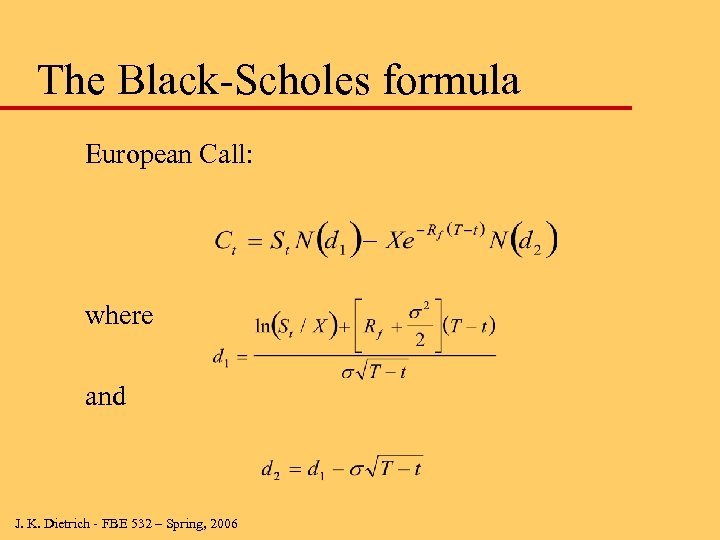

Inputs u St u. X u T-t u Rf us Stock Price at time t Exercise Price Time remaining to maturity Risk-free Rate Volatility (standard deviation of stock returns, annualized) J. K. Dietrich - FBE 532 – Spring, 2006

Inputs u St u. X u T-t u Rf us Stock Price at time t Exercise Price Time remaining to maturity Risk-free Rate Volatility (standard deviation of stock returns, annualized) J. K. Dietrich - FBE 532 – Spring, 2006

The Black-Scholes formula European Call: where and J. K. Dietrich - FBE 532 – Spring, 2006

The Black-Scholes formula European Call: where and J. K. Dietrich - FBE 532 – Spring, 2006

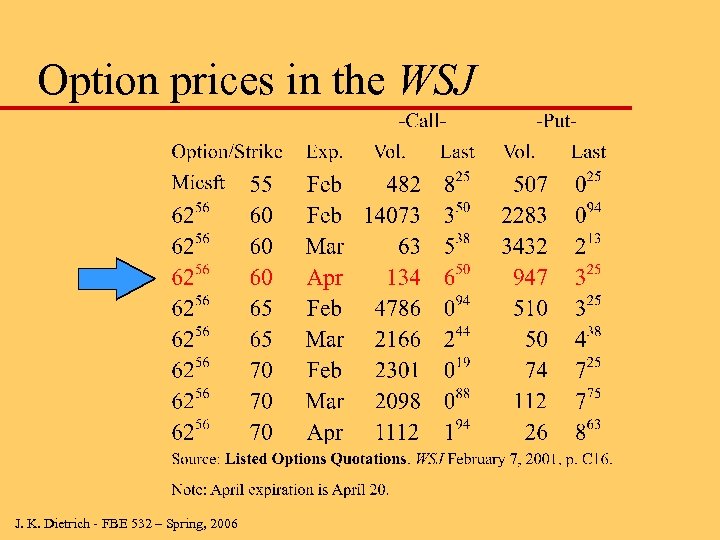

Option prices in the WSJ J. K. Dietrich - FBE 532 – Spring, 2006

Option prices in the WSJ J. K. Dietrich - FBE 532 – Spring, 2006

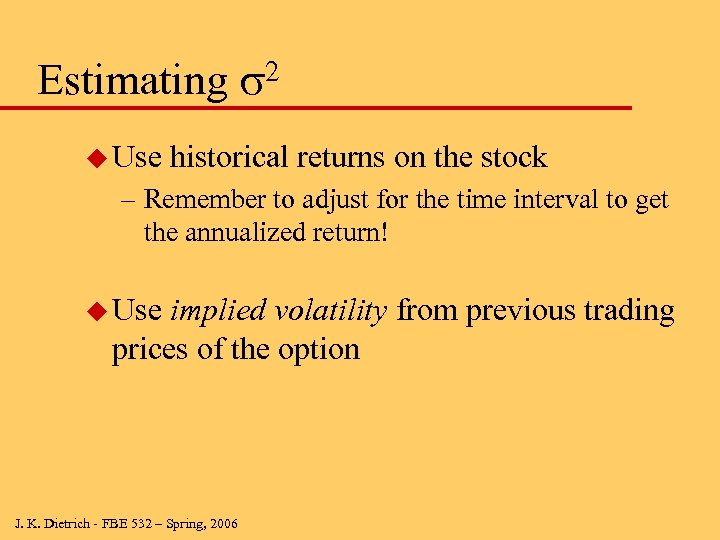

Estimating s 2 u Use historical returns on the stock – Remember to adjust for the time interval to get the annualized return! u Use implied volatility from previous trading prices of the option J. K. Dietrich - FBE 532 – Spring, 2006

Estimating s 2 u Use historical returns on the stock – Remember to adjust for the time interval to get the annualized return! u Use implied volatility from previous trading prices of the option J. K. Dietrich - FBE 532 – Spring, 2006

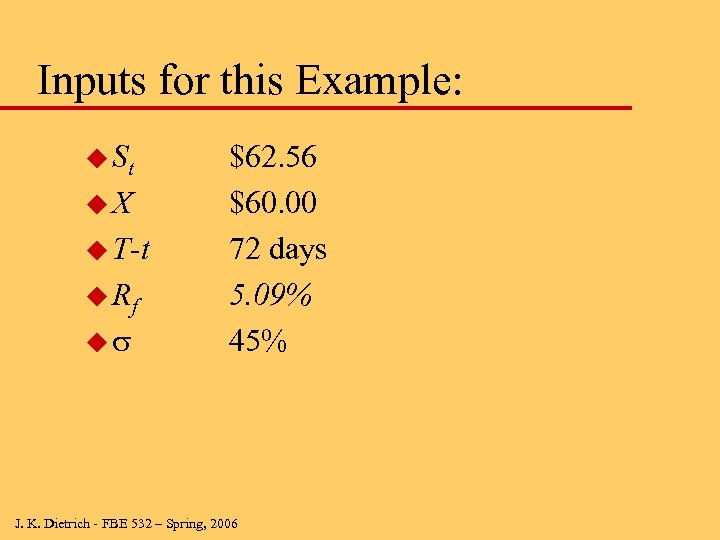

Inputs for this Example: u St u. X u T-t u Rf us $62. 56 $60. 00 72 days 5. 09% 45% J. K. Dietrich - FBE 532 – Spring, 2006

Inputs for this Example: u St u. X u T-t u Rf us $62. 56 $60. 00 72 days 5. 09% 45% J. K. Dietrich - FBE 532 – Spring, 2006

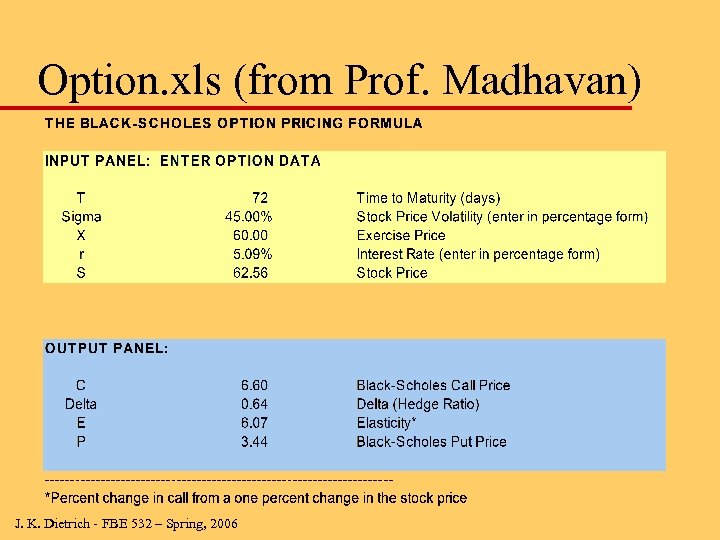

Option. xls (from Prof. Madhavan) J. K. Dietrich - FBE 532 – Spring, 2006

Option. xls (from Prof. Madhavan) J. K. Dietrich - FBE 532 – Spring, 2006

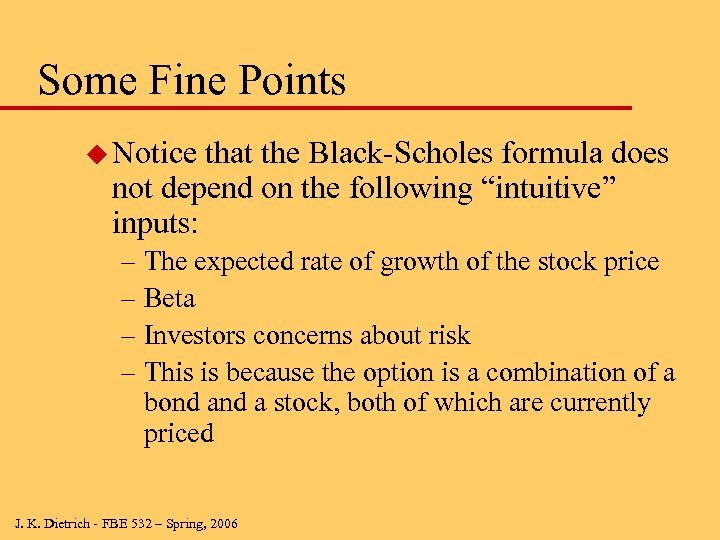

Some Fine Points u Notice that the Black-Scholes formula does not depend on the following “intuitive” inputs: – The expected rate of growth of the stock price – Beta – Investors concerns about risk – This is because the option is a combination of a bond a stock, both of which are currently priced J. K. Dietrich - FBE 532 – Spring, 2006

Some Fine Points u Notice that the Black-Scholes formula does not depend on the following “intuitive” inputs: – The expected rate of growth of the stock price – Beta – Investors concerns about risk – This is because the option is a combination of a bond a stock, both of which are currently priced J. K. Dietrich - FBE 532 – Spring, 2006

Extensions: Dividends u Pricing calls with known dividends is straightforward. The intuition is as follows: – When a stock pays a dividend, the price falls (in theory) by the amount of the dividend. – We need to adjust the stock price for the dividend. Formally, we subtract the present value of the known dividend from the stock price J. K. Dietrich - FBE 532 – Spring, 2006

Extensions: Dividends u Pricing calls with known dividends is straightforward. The intuition is as follows: – When a stock pays a dividend, the price falls (in theory) by the amount of the dividend. – We need to adjust the stock price for the dividend. Formally, we subtract the present value of the known dividend from the stock price J. K. Dietrich - FBE 532 – Spring, 2006

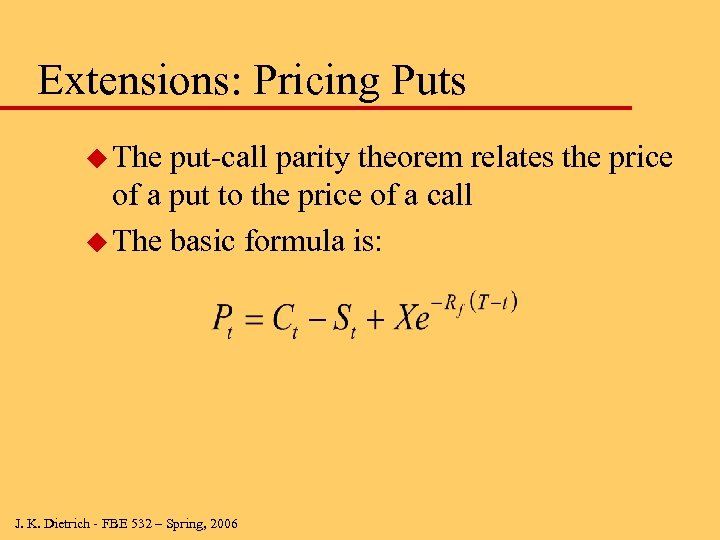

Extensions: Pricing Puts u The put-call parity theorem relates the price of a put to the price of a call u The basic formula is: J. K. Dietrich - FBE 532 – Spring, 2006

Extensions: Pricing Puts u The put-call parity theorem relates the price of a put to the price of a call u The basic formula is: J. K. Dietrich - FBE 532 – Spring, 2006

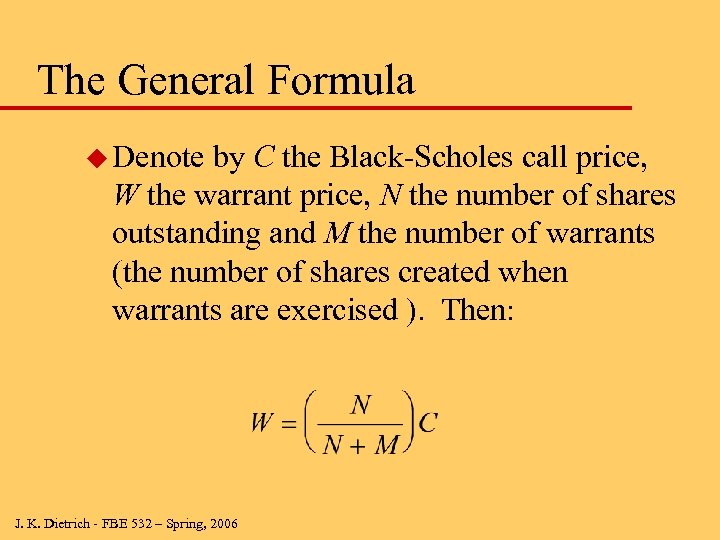

Pricing Warrants u Since warrants are issued by the firm, there is an immediate dilution effect upon the exercise of warrants u This means that the warrant is worth less than a comparable call u For most firms, the dilution effect is so small that the call value is a good approximation to true value J. K. Dietrich - FBE 532 – Spring, 2006

Pricing Warrants u Since warrants are issued by the firm, there is an immediate dilution effect upon the exercise of warrants u This means that the warrant is worth less than a comparable call u For most firms, the dilution effect is so small that the call value is a good approximation to true value J. K. Dietrich - FBE 532 – Spring, 2006

Black-Scholes for Warrants u In venture capital situations, warrant exercise may result in substantial dilution and hence you need to know how to use Black-Scholes in this situation u Suppose that a VC holds warrants for 100, 000 shares and that there are 100, 000 shares outstanding. If the B-S call value is $3, what is the warrant value? J. K. Dietrich - FBE 532 – Spring, 2006

Black-Scholes for Warrants u In venture capital situations, warrant exercise may result in substantial dilution and hence you need to know how to use Black-Scholes in this situation u Suppose that a VC holds warrants for 100, 000 shares and that there are 100, 000 shares outstanding. If the B-S call value is $3, what is the warrant value? J. K. Dietrich - FBE 532 – Spring, 2006

The General Formula u Denote by C the Black-Scholes call price, W the warrant price, N the number of shares outstanding and M the number of warrants (the number of shares created when warrants are exercised ). Then: J. K. Dietrich - FBE 532 – Spring, 2006

The General Formula u Denote by C the Black-Scholes call price, W the warrant price, N the number of shares outstanding and M the number of warrants (the number of shares created when warrants are exercised ). Then: J. K. Dietrich - FBE 532 – Spring, 2006

Next Week – February 16 u Next week we will discuss derivatives securities (options, futures, and swaps) and how they are used to hedge risk u These topics are crucial to the Union Carbide Corporation Interest Rate Risk Management case so you should read the case and review recommended chapters u Continue to review your comprehension of topics covered to date (midterm March 9) J. K. Dietrich - FBE 532 – Spring, 2006

Next Week – February 16 u Next week we will discuss derivatives securities (options, futures, and swaps) and how they are used to hedge risk u These topics are crucial to the Union Carbide Corporation Interest Rate Risk Management case so you should read the case and review recommended chapters u Continue to review your comprehension of topics covered to date (midterm March 9) J. K. Dietrich - FBE 532 – Spring, 2006