8e0c6d743026a9700371ef8e8326ca51.ppt

- Количество слайдов: 27

Module 6: Managing your money – borrowing

Module objectives • Provide an opportunity to look at the learner outcomes in the ‘Manage money’ element of the numeracy component of the National Literacy and Numeracy Framework (LNF) to identify where ‘the basic principles of borrowing’ exist in the curriculum in Wales. • Highlight resources and activities that can be used in Key Stages 3 and 4 to develop learners’ numeracy skills in the context of ‘borrowing money’. Note: Differentiation, extension ideas and effective questioning will often be suggested in the notes within the Power. Point for teachers/trainers to use as required.

Learner aims This module introduces the basic principles involved in the process of ‘borrowing money’. Learners will be able to: • explain the meaning of ‘borrowing’, ‘lending’, ‘credit’ and ‘debt’ • consider saving as an alternative to borrowing • describe some key questions to ask when considering taking on debt • list some different forms of lending and debt • identify advantages and disadvantages for some common forms of borrowing. This module can be used across Key Stages 3 and 4. Learners will have different aims, some of which will include the points above.

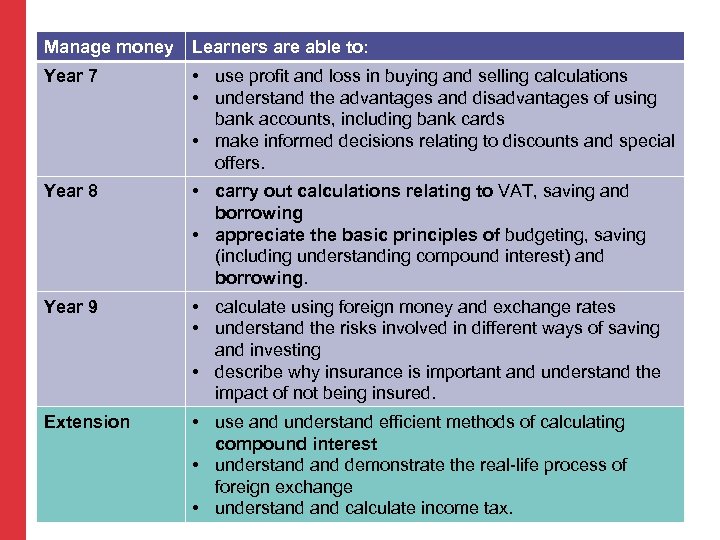

An opportunity to look at the learner outcomes in the ‘Manage money’ element of the numeracy component of the LNF to identify where ‘understanding the principles of borrowing money’ exists in the curriculum in Wales. Learner outcomes related to borrowing are marked in bold in the table.

Manage money Learners are able to: Year 7 • use profit and loss in buying and selling calculations • understand the advantages and disadvantages of using bank accounts, including bank cards • make informed decisions relating to discounts and special offers. Year 8 • carry out calculations relating to VAT, saving and borrowing • appreciate the basic principles of budgeting, saving (including understanding compound interest) and borrowing. Year 9 • calculate using foreign money and exchange rates • understand the risks involved in different ways of saving and investing • describe why insurance is important and understand the impact of not being insured. Extension • use and understand efficient methods of calculating compound interest • understand demonstrate the real-life process of foreign exchange • understand calculate income tax.

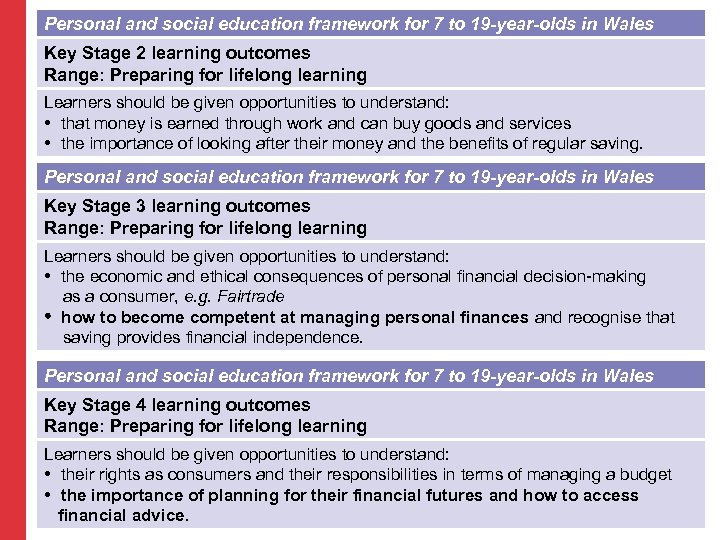

The Personal and social education framework for 7 to 19 -year-olds in Wales also highlights opportunities for learners to develop their ability to manage their finances. These are highlighted in bold on the next slide.

Personal and social education framework for 7 to 19 -year-olds in Wales Key Stage 2 learning outcomes Range: Preparing for lifelong learning Learners should be given opportunities to understand: that money is earned through work and can buy goods and services the importance of looking after their money and the benefits of regular saving. Personal and social education framework for 7 to 19 -year-olds in Wales Key Stage 3 learning outcomes Range: Preparing for lifelong learning Learners should be given opportunities to understand: the economic and ethical consequences of personal financial decision-making as a consumer, e. g. Fairtrade how to become competent at managing personal finances and recognise that saving provides financial independence. Personal and social education framework for 7 to 19 -year-olds in Wales Key Stage 4 learning outcomes Range: Preparing for lifelong learning Learners should be given opportunities to understand: their rights as consumers and their responsibilities in terms of managing a budget the importance of planning for their financial futures and how to access financial advice.

Shall I borrow? Starter activity: Discussion Why do people borrow money?

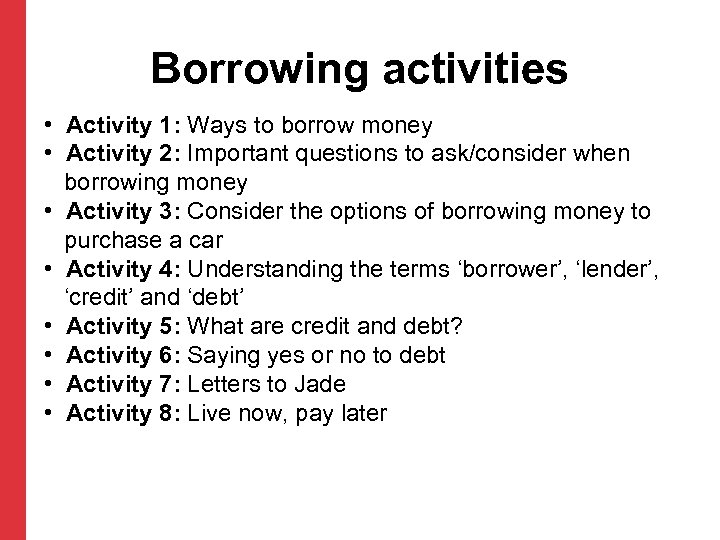

Borrowing activities • Activity 1: Ways to borrow money • Activity 2: Important questions to ask/consider when borrowing money • Activity 3: Consider the options of borrowing money to purchase a car • Activity 4: Understanding the terms ‘borrower’, ‘lender’, ‘credit’ and ‘debt’ • Activity 5: What are credit and debt? • Activity 6: Saying yes or no to debt • Activity 7: Letters to Jade • Activity 8: Live now, pay later

Activity 1: Ways to borrow money Where or who do people borrow money from?

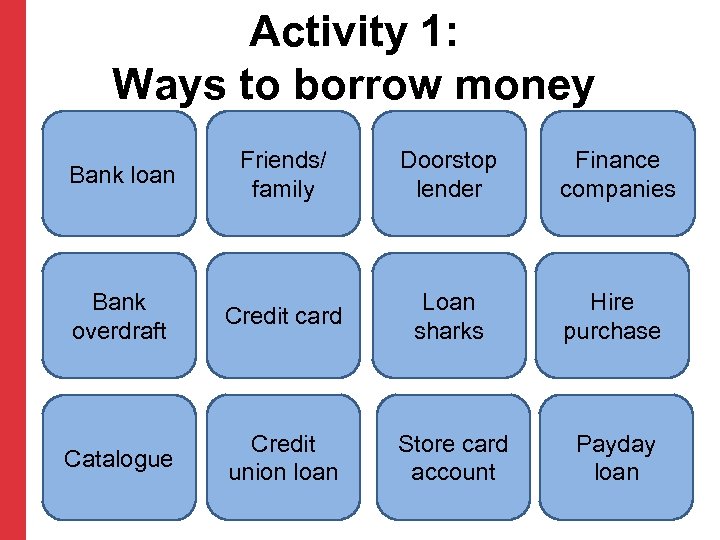

Activity 1: Ways to borrow money Friends/ family Doorstop lender Finance companies Bank overdraft Credit card Loan sharks Hire purchase Catalogue Credit union loan Store card account Payday loan Bank loan

Activity 2: Important questions to ask/consider when borrowing money Use the ‘Manage money activity sheet: Shall I borrow? ’. Learners are presented with the following scenario. Geoff has a new job in town. He wants to buy a bike and that would mean borrowing money from the bank. Learners are given a list of 10 questions Geoff should consider or ask the bank. Learners have to decide upon the importance of each one.

Activity 3: Consider the options of borrowing money to purchase a car Resource: Spending Sense, Activity 13 ‘My first car’ (pages 101– 105) Download the resource at www. hwb. wales. gov. uk/cms/hwbcontent/Shared% 20 Document/vtc/atebol/maths/eng/index. html

Activity 3: Consider the options of borrowing money to purchase a car My first car The resource provides learners with eight types of lending options to borrow £ 2, 000 over 1 year. Percentage rates are given and the total amount to pay back is also provided. This introduces learners to the concept of paying back more than you borrow. The activity prevents using APR (which is dealt with in Activity 5). Teachers may print off the resource and omit the ‘payback’ amount. The task would be for learners to calculate how much needs to be paid back using the percentage rates given.

Activity 4: Understanding the terms ‘borrower’, ‘lender’, ‘credit’ and ‘debt’ Resource: Welsh Government Personal Finance Toolkit The activity Topic 4 ‘What are credit and debt? ’ (pages 36– 37) should be used with the accompanying Resource sheet 1 (page 41). Download the resource at www. wales. gov. uk/topics/childrenyoungpeople/pu blications/resources/? lang=en

Activity 4: Understanding the terms ‘borrower’, ‘lender’, ‘credit’ and ‘debt’ Discussion activity: What do these terms mean? Borrower Lender Credit Debt See Welsh Government Personal Finance Toolkit, Topic 4 ‘What are credit and debt? ’ (pages 36– 37) and the accompanying Resource sheet 1 (page 41).

Activity 5: What are credit and debt? Resource: Welsh Government Personal Finance Toolkit The activity Topic 4 ‘What are credit and debt? ’ (pages 36– 37) should be used with the accompanying Resource sheets 2 and 3 (pages 42– 43) entitled ‘Stimulus cards’ and ‘APR table’. Download the resource at www. wales. gov. uk/topics/childrenyoungpeople/pub lications/resources/? lang=en

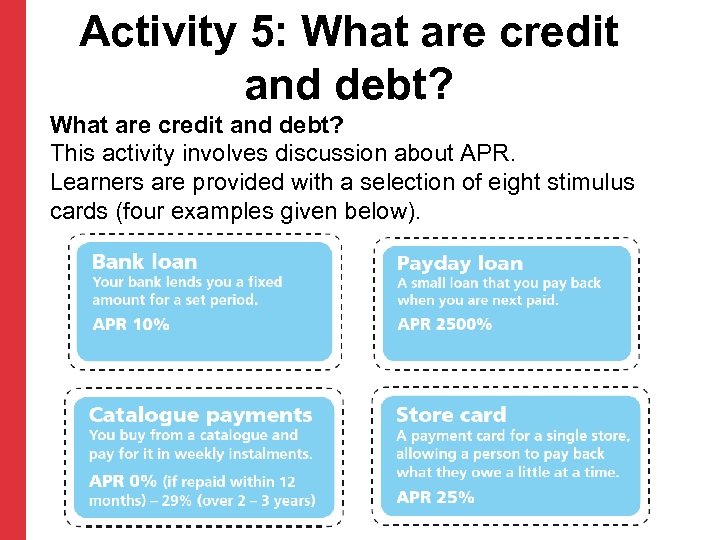

Activity 5: What are credit and debt? This activity involves discussion about APR. Learners are provided with a selection of eight stimulus cards (four examples given below).

Activity 5: What are credit and debt? Below are suggested questions to encourage discussion about the eight types of lending and APR values. • What do you know and feel about each from of lending? • Which forms of lending might you think of using, and when? • Which ones might you think of avoiding and why?

Activity 6: Saying yes or no to debt Resource: Welsh Government Personal Finance Toolkit The activity Topic 4 ‘Saying yes or no to debt’ (pages 38– 39) should be used with the accompanying Resource sheets 4– 6 (pages 44– 48). Download the resource at www. wales. gov. uk/topics/childrenyoungpeople/p ublications/resources/? lang=en

Activity 6: Saying yes or no to debt This activity involves considering some situations where someone is thinking of taking on debt (getting a loan). Learners read the scenarios and decide what each person should do. Suggested questions to ask learners include the following. • Which lender represents the best option? • Could the borrower borrow less? • Do they really need the purchase? • Could they save up instead?

Activity 7: Letters to Jade Resource: Manage money activity sheet: Letters to Jade Activity: Learners read the letters to Jade and discuss her different financial circumstances over a 25 -year period.

Activity 7: Letters to Jade This activity tells the story of a fictional young woman, Jade Carpenter, through a series of letters written to her by different people and organisations. All the letters are about money and they reveal a story of Jade declining into debt. The first letter is dated 2000, when Jade is 10, and the final letter, a County Court Judgement, is dated 2025, when she is 35.

Activity 8: Live now, pay later Resource: Spending Sense Activity 14, ‘Live now, pay later’ (pages 107– 111) Download the resource at www. hwb. wales. gov. uk/cms/hwbcontent/Shared% 20 Document/vtc/atebol/maths/eng/index. html

Activity 8: Live now, pay later The first part of this activity involves a quiz. Learners respond to 10 statements which reveal their attitudes towards credit and debt. The second part of the activity is a ‘broken information’ task about a character called Joy who has got herself into debt. Learners share information presented on cards in order to build up a complete picture of what has gone wrong for Joy and how her money troubles might have been avoided. A detailed activity plan is given with the resource.

Further resources: Adding up to a lifetime This is a free online resource which follows four characters and how they deal with financial situations. It is suitable for Key Stage 3 to Key Stage 5. The package is approximately 25 hours of learning activities which learners can complete online. It is presented as five modules: • Life as a student (aged 14 upwards) Each module has an audio tutorial • Working life which can be • Relationships listened to in English or Welsh • New life • Active retirement. www. addinguptoalifetime. org. uk A whole range of managing money topics is included.

Websites and resources • www. moneyadviceservice. org Provides advice and free information booklets. See the relevant booklet for this module entitled ‘Borrowing money’. • www. barclaysmoneyskills. com/en/Information/resource-centre. aspx Barclays Money Skills Key Stage 2 Resource Pack (download). Barclays Money Skills Key Stage 3 Resource Pack (download). Barclays Money Skills Key Stage 4 Resource Pack (download). • www. pfeg. org pfeg (Personal Finance Education Group) an independent charity providing a wealth of resources to support financial education in schools. • www. nationwideeducation. co. uk Finance Skills: games, factsheets* and worksheets* for learners aged 4 to 18+ (printable resources and online games). * Welsh versions available. • www. bbc. co. uk/learningzone/clips/cashk-tz-pt-2 -3 -credit/12162. html Five-minute cartoon clip showing how a credit card purchase leads to paying more (suitable for Year 7 learners).

8e0c6d743026a9700371ef8e8326ca51.ppt