b614773e82e996a607f0accd68c0c52c.ppt

- Количество слайдов: 133

module 5: Strategic Decisions Project and Production Management Module 5 Strategic Decisions in Production Management Prof Arun Kanda & Prof S. G. Deshmukh, Department of Mechanical Engineering, Indian Institute of Technology, Delhi Back to main index exit continue

module 5: Strategic Decisions Project and Production Management Module 5 Strategic Decisions in Production Management Prof Arun Kanda & Prof S. G. Deshmukh, Department of Mechanical Engineering, Indian Institute of Technology, Delhi Back to main index exit continue

module 5: Strategic Decisions MODULE 5: Strategic Decisions in Production Management 1. Life Cycle of a Production System 2. Role of Models in Production Management 3. Financial Evaluation of Capital Investments 4. Project financial appraisal: An example Back to main index exit 5. Decision trees and risk evaluation 6. Illustrative Examples 7. Self Evaluation Quiz 8. Problems for Practice 9. Further exploration

module 5: Strategic Decisions MODULE 5: Strategic Decisions in Production Management 1. Life Cycle of a Production System 2. Role of Models in Production Management 3. Financial Evaluation of Capital Investments 4. Project financial appraisal: An example Back to main index exit 5. Decision trees and risk evaluation 6. Illustrative Examples 7. Self Evaluation Quiz 8. Problems for Practice 9. Further exploration

module 5: Strategic Decisions 1. LIFE CYCLE OF A PRODUCTION SYSTEM Back to main index exit back to module contents

module 5: Strategic Decisions 1. LIFE CYCLE OF A PRODUCTION SYSTEM Back to main index exit back to module contents

module 5: Strategic Decisions SUMMARY OF LAST LECTURE Notion of Projects and Production Generalized Model of a Production System Value addition Transformations, inputs and outputs Challenges in Production Service Systems Definition of Operations Management Back to main index exit back to module contents

module 5: Strategic Decisions SUMMARY OF LAST LECTURE Notion of Projects and Production Generalized Model of a Production System Value addition Transformations, inputs and outputs Challenges in Production Service Systems Definition of Operations Management Back to main index exit back to module contents

module 5: Strategic Decisions Life Cycle of a Production System Various stages in the life of a production system Characteristic problems and challenges arising at each stage Major managerial decisions to be taken at each stage Modelling and solution methodologies Back to main index exit back to module contents

module 5: Strategic Decisions Life Cycle of a Production System Various stages in the life of a production system Characteristic problems and challenges arising at each stage Major managerial decisions to be taken at each stage Modelling and solution methodologies Back to main index exit back to module contents

module 5: Strategic Decisions LIFE CYCLE APPROACH STAGE I Back to main index exit back to module contents

module 5: Strategic Decisions LIFE CYCLE APPROACH STAGE I Back to main index exit back to module contents

module 5: Strategic Decisions STAGE I : MAJOR CONSIDERATIONS Future long term trends of growth l New Products l Technologies l Consumer Preference Patterns l Industrial Climate l Govt. Policies Basic Desire, Commitment, Experience Available or Projected Resources Back to main index exit back to module contents

module 5: Strategic Decisions STAGE I : MAJOR CONSIDERATIONS Future long term trends of growth l New Products l Technologies l Consumer Preference Patterns l Industrial Climate l Govt. Policies Basic Desire, Commitment, Experience Available or Projected Resources Back to main index exit back to module contents

module 5: Strategic Decisions LIFE CYCLE APPROACH STAGE II Back to main index exit back to module contents

module 5: Strategic Decisions LIFE CYCLE APPROACH STAGE II Back to main index exit back to module contents

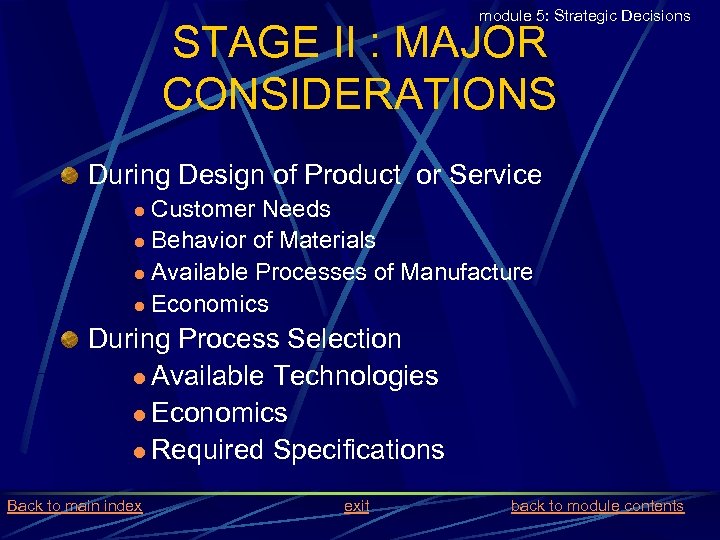

module 5: Strategic Decisions STAGE II : MAJOR CONSIDERATIONS During Design of Product or Service Customer Needs l Behavior of Materials l Available Processes of Manufacture l Economics l During Process Selection l Available Technologies l Economics l Required Specifications Back to main index exit back to module contents

module 5: Strategic Decisions STAGE II : MAJOR CONSIDERATIONS During Design of Product or Service Customer Needs l Behavior of Materials l Available Processes of Manufacture l Economics l During Process Selection l Available Technologies l Economics l Required Specifications Back to main index exit back to module contents

module 5: Strategic Decisions LIFE CYCLE APPROACH STAGE III Back to main index exit back to module contents

module 5: Strategic Decisions LIFE CYCLE APPROACH STAGE III Back to main index exit back to module contents

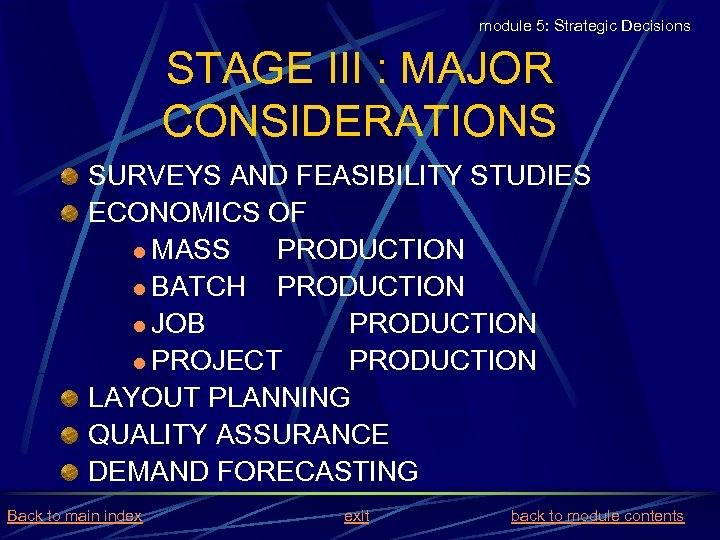

module 5: Strategic Decisions STAGE III : MAJOR CONSIDERATIONS SURVEYS AND FEASIBILITY STUDIES ECONOMICS OF l MASS PRODUCTION l BATCH PRODUCTION l JOB PRODUCTION l PROJECT PRODUCTION LAYOUT PLANNING QUALITY ASSURANCE DEMAND FORECASTING Back to main index exit back to module contents

module 5: Strategic Decisions STAGE III : MAJOR CONSIDERATIONS SURVEYS AND FEASIBILITY STUDIES ECONOMICS OF l MASS PRODUCTION l BATCH PRODUCTION l JOB PRODUCTION l PROJECT PRODUCTION LAYOUT PLANNING QUALITY ASSURANCE DEMAND FORECASTING Back to main index exit back to module contents

module 5: Strategic Decisions LIFE CYCLE APPROACH STAGE IV Back to main index exit back to module contents

module 5: Strategic Decisions LIFE CYCLE APPROACH STAGE IV Back to main index exit back to module contents

module 5: Strategic Decisions STAGE IV : MAJOR CONSIDERATIONS l WORK MEASURMENT l SETTING OF PRODUCTION STANDARDS l WAGE INCENTIVES l CAPACITY DETERMINATION l PLANNING RESOURCE ACQUISITIONS Back to main index exit back to module contents

module 5: Strategic Decisions STAGE IV : MAJOR CONSIDERATIONS l WORK MEASURMENT l SETTING OF PRODUCTION STANDARDS l WAGE INCENTIVES l CAPACITY DETERMINATION l PLANNING RESOURCE ACQUISITIONS Back to main index exit back to module contents

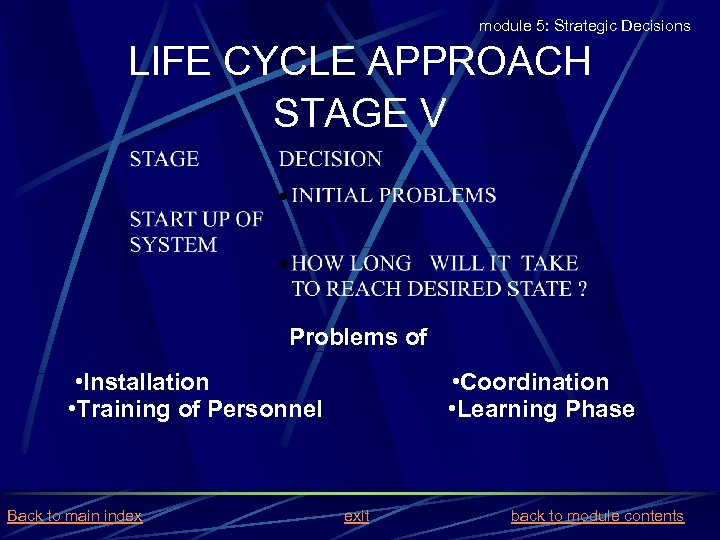

module 5: Strategic Decisions LIFE CYCLE APPROACH STAGE V Problems of • Installation • Training of Personnel Back to main index • Coordination • Learning Phase exit back to module contents

module 5: Strategic Decisions LIFE CYCLE APPROACH STAGE V Problems of • Installation • Training of Personnel Back to main index • Coordination • Learning Phase exit back to module contents

module 5: Strategic Decisions LIFE CYCLE APPROACH STAGE VI Back to main index exit back to module contents

module 5: Strategic Decisions LIFE CYCLE APPROACH STAGE VI Back to main index exit back to module contents

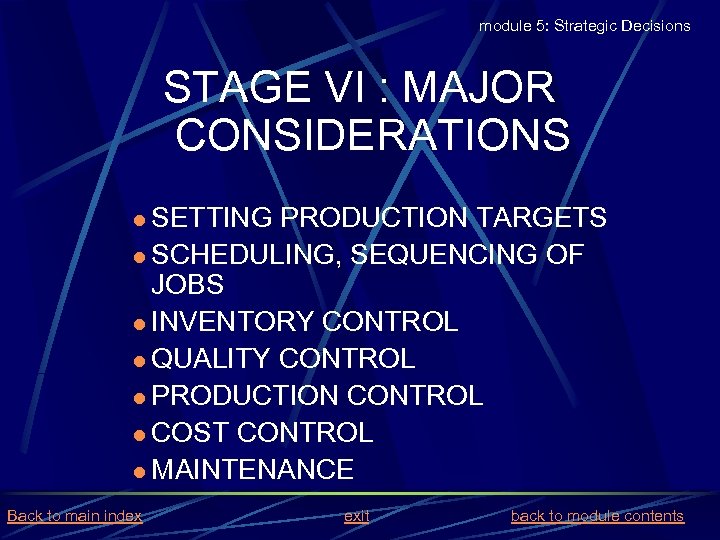

module 5: Strategic Decisions STAGE VI : MAJOR CONSIDERATIONS l SETTING PRODUCTION TARGETS l SCHEDULING, SEQUENCING OF JOBS l INVENTORY CONTROL l QUALITY CONTROL l PRODUCTION CONTROL l COST CONTROL l MAINTENANCE Back to main index exit back to module contents

module 5: Strategic Decisions STAGE VI : MAJOR CONSIDERATIONS l SETTING PRODUCTION TARGETS l SCHEDULING, SEQUENCING OF JOBS l INVENTORY CONTROL l QUALITY CONTROL l PRODUCTION CONTROL l COST CONTROL l MAINTENANCE Back to main index exit back to module contents

module 5: Strategic Decisions LIFE CYCLE APPROACH STAGE VII Back to main index exit back to module contents

module 5: Strategic Decisions LIFE CYCLE APPROACH STAGE VII Back to main index exit back to module contents

module 5: Strategic Decisions STAGE VII : MAJOR CONSIDERATIONS New technological Threats / Opportunities Revision of Market Demand Newer Products Technological Innovations Newer Methods of Manufacture Back to main index exit back to module contents

module 5: Strategic Decisions STAGE VII : MAJOR CONSIDERATIONS New technological Threats / Opportunities Revision of Market Demand Newer Products Technological Innovations Newer Methods of Manufacture Back to main index exit back to module contents

module 5: Strategic Decisions LIFE CYCLE APPROACH STAGE VIII Back to main index exit back to module contents

module 5: Strategic Decisions LIFE CYCLE APPROACH STAGE VIII Back to main index exit back to module contents

module 5: Strategic Decisions STAGE VIII : MAJOR CONSIDERATIONS l MANNER l SELLOUT l START Back to main index OF PHASE OUT / MERGER A NEW PRODUCT exit back to module contents

module 5: Strategic Decisions STAGE VIII : MAJOR CONSIDERATIONS l MANNER l SELLOUT l START Back to main index OF PHASE OUT / MERGER A NEW PRODUCT exit back to module contents

module 5: Strategic Decisions SUMMARY Various stages in the life of a production system Characteristic problems and challenges arising at each stage Major managerial decisions to be taken at each stage Modelling and solution methodologies Back to main index exit back to module contents

module 5: Strategic Decisions SUMMARY Various stages in the life of a production system Characteristic problems and challenges arising at each stage Major managerial decisions to be taken at each stage Modelling and solution methodologies Back to main index exit back to module contents

module 5: Strategic Decisions 2. ROLE OF MODELS IN PRODUCTION MANAGEMENT Back to main index exit back to module contents

module 5: Strategic Decisions 2. ROLE OF MODELS IN PRODUCTION MANAGEMENT Back to main index exit back to module contents

module 5: Strategic Decisions ROLE OF MODELS IN DECISION MAKING WHAT IS A MODEL ? WHAT ARE ITS FEATURES OF RELEVANCE TO DECISION MAKERS? DIFFERENT KINDS OF MODELS SOME EXAMPLE OF HOW MODELS HELP IN REAL LIFE DECISION MAKING Back to main index exit back to module contents

module 5: Strategic Decisions ROLE OF MODELS IN DECISION MAKING WHAT IS A MODEL ? WHAT ARE ITS FEATURES OF RELEVANCE TO DECISION MAKERS? DIFFERENT KINDS OF MODELS SOME EXAMPLE OF HOW MODELS HELP IN REAL LIFE DECISION MAKING Back to main index exit back to module contents

module 5: Strategic Decisions WHAT IS A MODEL ? A model is an abstraction to some degree of the real life thing or process for which we want to predict performance. Back to main index exit back to module contents

module 5: Strategic Decisions WHAT IS A MODEL ? A model is an abstraction to some degree of the real life thing or process for which we want to predict performance. Back to main index exit back to module contents

module 5: Strategic Decisions FEATURES OF MODELS PROVIDE a focus on relevant factors/variables opportunity for experimentation without undue cost/hazard prediction of real life phenomena Back to main index exit back to module contents

module 5: Strategic Decisions FEATURES OF MODELS PROVIDE a focus on relevant factors/variables opportunity for experimentation without undue cost/hazard prediction of real life phenomena Back to main index exit back to module contents

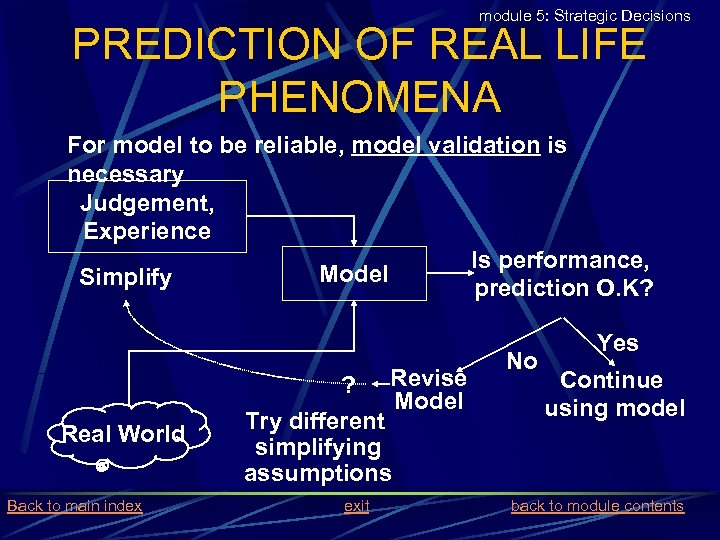

module 5: Strategic Decisions PREDICTION OF REAL LIFE PHENOMENA For model to be reliable, model validation is necessary Judgement, Experience Is performance, Model Simplify prediction O. K? ? Real World Back to main index Revise Model Try different simplifying assumptions exit No Yes Continue using model back to module contents

module 5: Strategic Decisions PREDICTION OF REAL LIFE PHENOMENA For model to be reliable, model validation is necessary Judgement, Experience Is performance, Model Simplify prediction O. K? ? Real World Back to main index Revise Model Try different simplifying assumptions exit No Yes Continue using model back to module contents

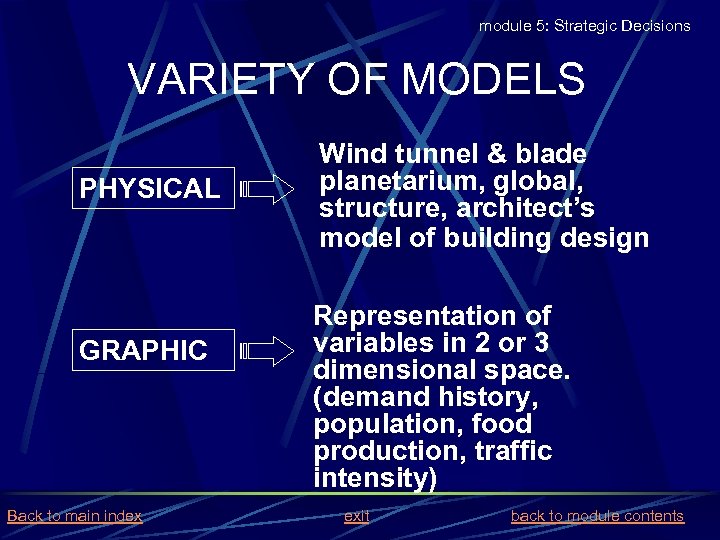

module 5: Strategic Decisions VARIETY OF MODELS PHYSICAL GRAPHIC Back to main index Wind tunnel & blade planetarium, global, structure, architect’s model of building design Representation of variables in 2 or 3 dimensional space. (demand history, population, food production, traffic intensity) exit back to module contents

module 5: Strategic Decisions VARIETY OF MODELS PHYSICAL GRAPHIC Back to main index Wind tunnel & blade planetarium, global, structure, architect’s model of building design Representation of variables in 2 or 3 dimensional space. (demand history, population, food production, traffic intensity) exit back to module contents

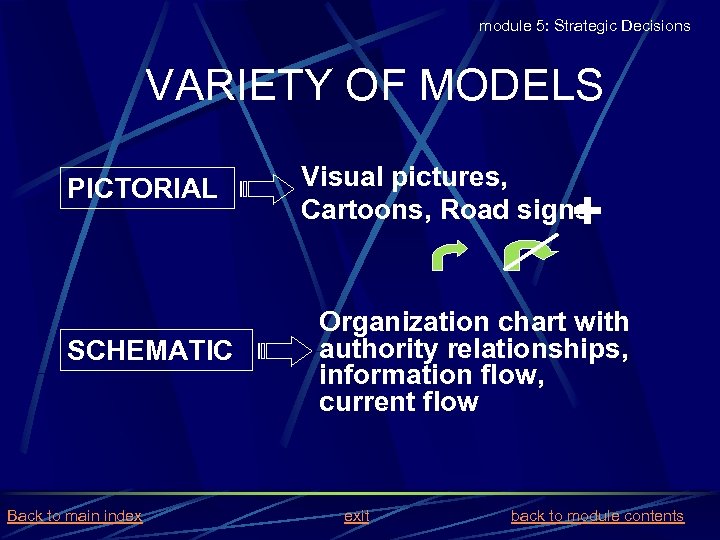

module 5: Strategic Decisions VARIETY OF MODELS PICTORIAL SCHEMATIC Back to main index Visual pictures, Cartoons, Road signs + Organization chart with authority relationships, information flow, current flow exit back to module contents

module 5: Strategic Decisions VARIETY OF MODELS PICTORIAL SCHEMATIC Back to main index Visual pictures, Cartoons, Road signs + Organization chart with authority relationships, information flow, current flow exit back to module contents

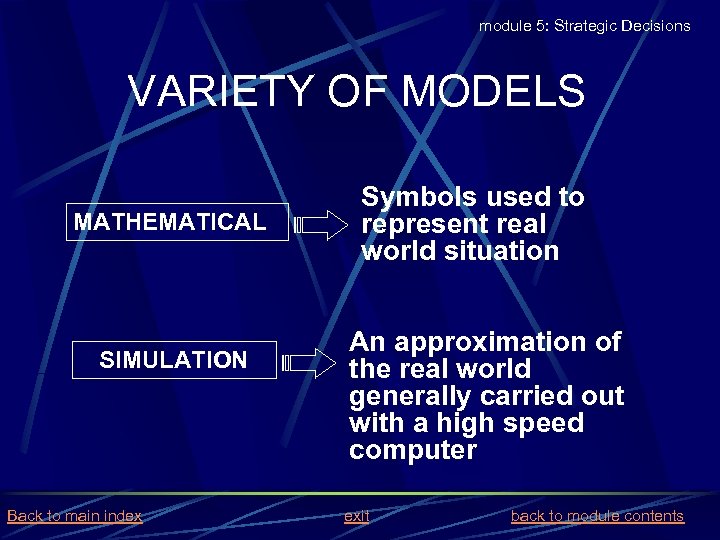

module 5: Strategic Decisions VARIETY OF MODELS MATHEMATICAL SIMULATION Back to main index Symbols used to represent real world situation An approximation of the real world generally carried out with a high speed computer exit back to module contents

module 5: Strategic Decisions VARIETY OF MODELS MATHEMATICAL SIMULATION Back to main index Symbols used to represent real world situation An approximation of the real world generally carried out with a high speed computer exit back to module contents

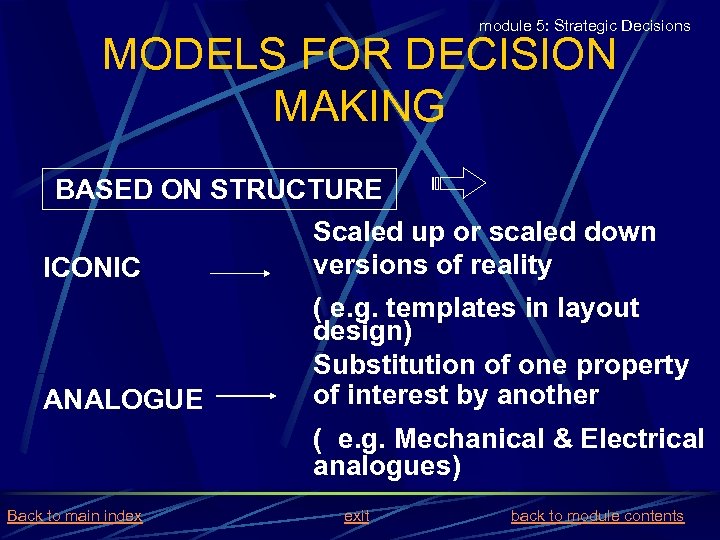

module 5: Strategic Decisions MODELS FOR DECISION MAKING BASED ON STRUCTURE Scaled up or scaled down versions of reality ICONIC ( e. g. templates in layout design) Substitution of one property of interest by another ANALOGUE ( e. g. Mechanical & Electrical analogues) Back to main index exit back to module contents

module 5: Strategic Decisions MODELS FOR DECISION MAKING BASED ON STRUCTURE Scaled up or scaled down versions of reality ICONIC ( e. g. templates in layout design) Substitution of one property of interest by another ANALOGUE ( e. g. Mechanical & Electrical analogues) Back to main index exit back to module contents

module 5: Strategic Decisions BASED ON STRUCTURE SYMBOLIC Using Mathematical symbols to establish relations e. g. LP, Queuing, Inventory Back to main index exit back to module contents

module 5: Strategic Decisions BASED ON STRUCTURE SYMBOLIC Using Mathematical symbols to establish relations e. g. LP, Queuing, Inventory Back to main index exit back to module contents

module 5: Strategic Decisions BASED ON PURPOSE DESCRIPTIVE Merely describe system PRESCRIPTIVE or NORMATIVE (Tell What to do to maximize profit, minimize cost) Hence a NORM or OBJECTIVE FUNCTION IS NEEDED Back to main index exit back to module contents

module 5: Strategic Decisions BASED ON PURPOSE DESCRIPTIVE Merely describe system PRESCRIPTIVE or NORMATIVE (Tell What to do to maximize profit, minimize cost) Hence a NORM or OBJECTIVE FUNCTION IS NEEDED Back to main index exit back to module contents

module 5: Strategic Decisions BASED ON ENVIRONMENT DETERMINISTIC CERTAINTY ASSUMED PROBABILISTIC RANDOMNESS ASSUMED Back to main index exit back to module contents

module 5: Strategic Decisions BASED ON ENVIRONMENT DETERMINISTIC CERTAINTY ASSUMED PROBABILISTIC RANDOMNESS ASSUMED Back to main index exit back to module contents

module 5: Strategic Decisions Demand EXAMPLES OF SYMBOLIC MODELS x x x x Ft = a + bt FORECASTING MODEL Regression (Descriptive) J F M A M J J Month Back to main index exit back to module contents

module 5: Strategic Decisions Demand EXAMPLES OF SYMBOLIC MODELS x x x x Ft = a + bt FORECASTING MODEL Regression (Descriptive) J F M A M J J Month Back to main index exit back to module contents

module 5: Strategic Decisions Inventory actual Approximation, d INVENTORY MODEL EOQ = 2 d Cordering/ i. C Time Back to main index exit back to module contents

module 5: Strategic Decisions Inventory actual Approximation, d INVENTORY MODEL EOQ = 2 d Cordering/ i. C Time Back to main index exit back to module contents

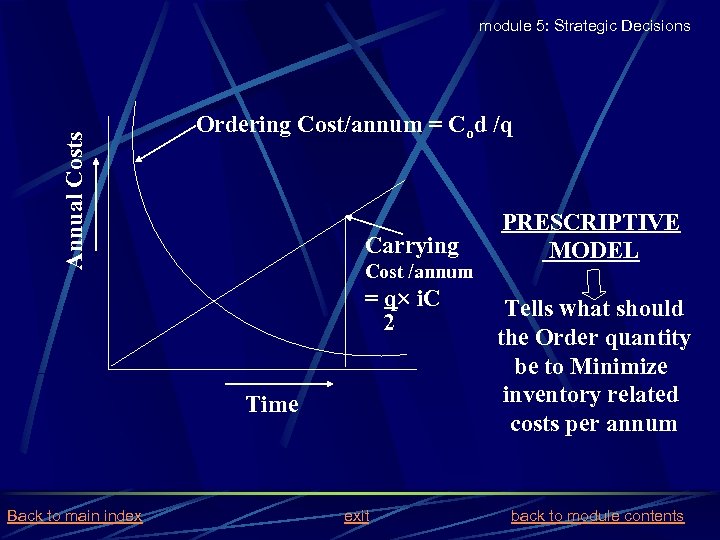

Annual Costs module 5: Strategic Decisions Ordering Cost/annum = Cod /q Carrying Cost /annum = q i. C 2 Time Back to main index exit PRESCRIPTIVE MODEL Tells what should the Order quantity be to Minimize inventory related costs per annum back to module contents

Annual Costs module 5: Strategic Decisions Ordering Cost/annum = Cod /q Carrying Cost /annum = q i. C 2 Time Back to main index exit PRESCRIPTIVE MODEL Tells what should the Order quantity be to Minimize inventory related costs per annum back to module contents

module 5: Strategic Decisions OTHER EXAMPLES LINEAR PROGRAMMING NON- LINEAR PROGRAMMING GOAL PROGRAMMING MODELS OF PRODUCTION PROCESSES etc. eg. Product mix; Scheduling Back to main index exit back to module contents

module 5: Strategic Decisions OTHER EXAMPLES LINEAR PROGRAMMING NON- LINEAR PROGRAMMING GOAL PROGRAMMING MODELS OF PRODUCTION PROCESSES etc. eg. Product mix; Scheduling Back to main index exit back to module contents

A SIMPLE MANUFACTURING PROBLEM module 5: Strategic Decisions A Company produces two kinds of products - desks & tables The manufacture of either desk or table requires 1 hour of production capacity in the plant. Maximum available production capacity =10 hours/week Limited Sales capacity : desks 6 per week tables 8 per week Gross Margin of Profit from sale of desk Rs 80; table Rs 40. Back to main index exit back to module contents

A SIMPLE MANUFACTURING PROBLEM module 5: Strategic Decisions A Company produces two kinds of products - desks & tables The manufacture of either desk or table requires 1 hour of production capacity in the plant. Maximum available production capacity =10 hours/week Limited Sales capacity : desks 6 per week tables 8 per week Gross Margin of Profit from sale of desk Rs 80; table Rs 40. Back to main index exit back to module contents

module 5: Strategic Decisions PRIORITY– WISE GOALS 1. Management wants to avoid any under utilization of production capacity. 2. Management wants to sell as many desks and tables as possible, but since the gross margin from the sale of a desk is twice that of a table, there is twice as much desire to achieve sales goal for desk as for tables. 3. Management desire to minimize overtime production of plant as much as possible. Back to main index exit back to module contents

module 5: Strategic Decisions PRIORITY– WISE GOALS 1. Management wants to avoid any under utilization of production capacity. 2. Management wants to sell as many desks and tables as possible, but since the gross margin from the sale of a desk is twice that of a table, there is twice as much desire to achieve sales goal for desk as for tables. 3. Management desire to minimize overtime production of plant as much as possible. Back to main index exit back to module contents

module 5: Strategic Decisions A B C 800 640 480 8 7 6 5 4 3 2 1 Sales Representation Profit 320 x 2 (tables) 10 9 D O Ideal Capacity E 1 2 3 4 5 6 7 8 9 10 x 1 (desk) Back to main index exit x 1 6 x 2 8 PROFIT = 80 x 1+ 40 x 2 Pt. Profit O(0, 0) = 0 A(0, 8) = 320 B(2, 8) = 480 C(6, 8) = 800 D(6, 4) = 640 E(6, 0) = 480 back to module contents

module 5: Strategic Decisions A B C 800 640 480 8 7 6 5 4 3 2 1 Sales Representation Profit 320 x 2 (tables) 10 9 D O Ideal Capacity E 1 2 3 4 5 6 7 8 9 10 x 1 (desk) Back to main index exit x 1 6 x 2 8 PROFIT = 80 x 1+ 40 x 2 Pt. Profit O(0, 0) = 0 A(0, 8) = 320 B(2, 8) = 480 C(6, 8) = 800 D(6, 4) = 640 E(6, 0) = 480 back to module contents

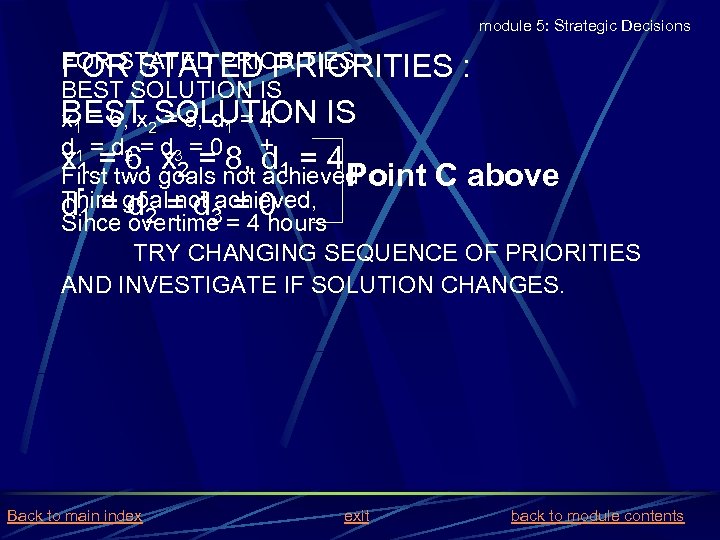

module 5: Strategic Decisions FOR STATED PRIORITIES : BEST SOLUTION IS BEST 2 SOLUTION IS x 1 = 6, x = 8, d 1 = 4 + d 1 = d 2 = d 3 = 0 x 1 =two goals not d 1 = 4 6, x 2 = 8, achieved First Point C above - not achieved, Third goal= d = 0 d 1 = d 2 3 Since overtime = 4 hours TRY CHANGING SEQUENCE OF PRIORITIES AND INVESTIGATE IF SOLUTION CHANGES. Back to main index exit back to module contents

module 5: Strategic Decisions FOR STATED PRIORITIES : BEST SOLUTION IS BEST 2 SOLUTION IS x 1 = 6, x = 8, d 1 = 4 + d 1 = d 2 = d 3 = 0 x 1 =two goals not d 1 = 4 6, x 2 = 8, achieved First Point C above - not achieved, Third goal= d = 0 d 1 = d 2 3 Since overtime = 4 hours TRY CHANGING SEQUENCE OF PRIORITIES AND INVESTIGATE IF SOLUTION CHANGES. Back to main index exit back to module contents

module 5: Strategic Decisions A GOAL PROGRAMMING FORMULATION OF PROBLEM Decision Variables x 1 = no. of desks produced /week x 2 = no. of tables produced / week Constraints ( Goal constraints & System Constraints) d 1+= overtime operation (if any) d 1 - = idle time when production does not exhaust capacity Sales capacity x 1 6 or x 1 + d 2 - = 6 Constraints x 2 8 or x 2+ d 3 - = 8 Back to main index exit back to module contents

module 5: Strategic Decisions A GOAL PROGRAMMING FORMULATION OF PROBLEM Decision Variables x 1 = no. of desks produced /week x 2 = no. of tables produced / week Constraints ( Goal constraints & System Constraints) d 1+= overtime operation (if any) d 1 - = idle time when production does not exhaust capacity Sales capacity x 1 6 or x 1 + d 2 - = 6 Constraints x 2 8 or x 2+ d 3 - = 8 Back to main index exit back to module contents

module 5: Strategic Decisions Capacity Constraint: x 1+ x 2+ d 1 - – d 2+ = 10 Objective function P 1 Minimize underutilization of production capacity (d 1 - ) P 2 Min (2 d 2 - + d 3 -) P 3 Min (d 1+) Back to main index exit back to module contents

module 5: Strategic Decisions Capacity Constraint: x 1+ x 2+ d 1 - – d 2+ = 10 Objective function P 1 Minimize underutilization of production capacity (d 1 - ) P 2 Min (2 d 2 - + d 3 -) P 3 Min (d 1+) Back to main index exit back to module contents

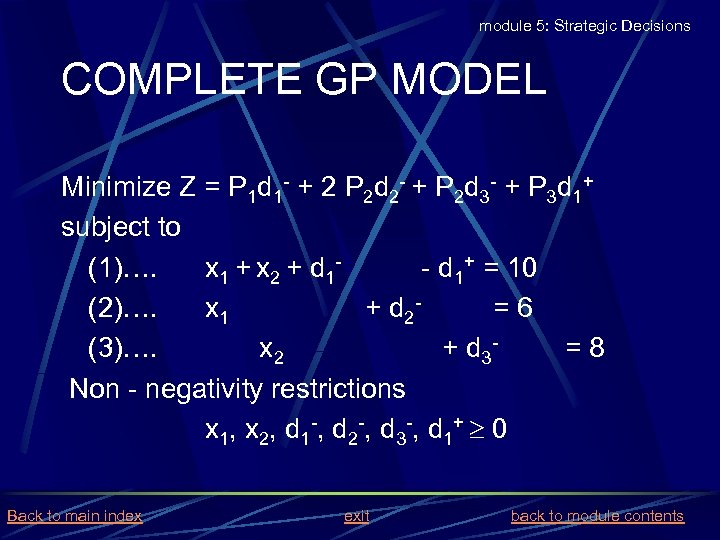

module 5: Strategic Decisions COMPLETE GP MODEL Minimize Z = P 1 d 1 - + 2 P 2 d 2 - + P 2 d 3 - + P 3 d 1+ subject to (1)…. x 1 + x 2 + d 1 - d 1+ = 10 (2)…. x 1 + d 2=6 (3)…. x 2 + d 3=8 Non - negativity restrictions x 1, x 2, d 1 -, d 2 -, d 3 -, d 1+ 0 Back to main index exit back to module contents

module 5: Strategic Decisions COMPLETE GP MODEL Minimize Z = P 1 d 1 - + 2 P 2 d 2 - + P 2 d 3 - + P 3 d 1+ subject to (1)…. x 1 + x 2 + d 1 - d 1+ = 10 (2)…. x 1 + d 2=6 (3)…. x 2 + d 3=8 Non - negativity restrictions x 1, x 2, d 1 -, d 2 -, d 3 -, d 1+ 0 Back to main index exit back to module contents

module 5: Strategic Decisions PRODUCT MIX MODEL NOTATION: n products (indexed i = 1, …, n) m resources (indexed j = 1, …, m) aij = Consumption of the jth resource per unit production of the ith product bj = Availability of the j th resource pi = Profit contribution/ unit of ith product Back to main index exit back to module contents

module 5: Strategic Decisions PRODUCT MIX MODEL NOTATION: n products (indexed i = 1, …, n) m resources (indexed j = 1, …, m) aij = Consumption of the jth resource per unit production of the ith product bj = Availability of the j th resource pi = Profit contribution/ unit of ith product Back to main index exit back to module contents

module 5: Strategic Decisions NOTATION (CONTD. ) Ui = Upper limit on sales of ith product Li = Lower limit on sales on ith product xi = Production of the ith product in the planning horizon (Decision variable) Back to main index exit back to module contents

module 5: Strategic Decisions NOTATION (CONTD. ) Ui = Upper limit on sales of ith product Li = Lower limit on sales on ith product xi = Production of the ith product in the planning horizon (Decision variable) Back to main index exit back to module contents

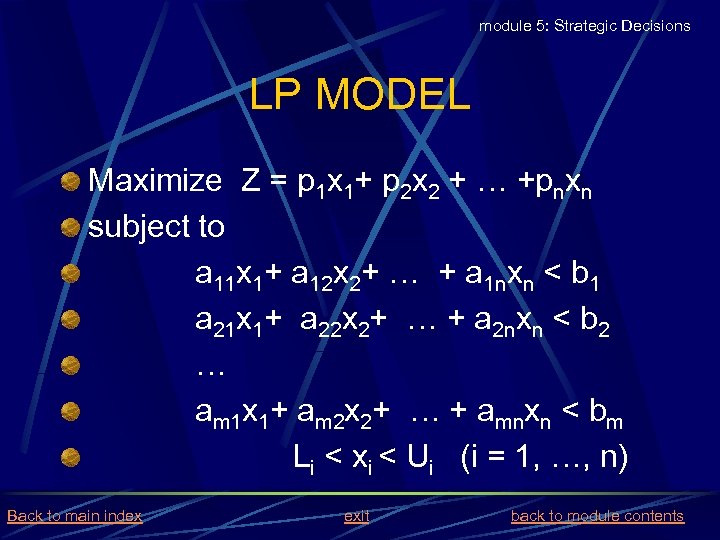

module 5: Strategic Decisions LP MODEL Maximize Z = p 1 x 1+ p 2 x 2 + … +pnxn subject to a 11 x 1+ a 12 x 2+ … + a 1 nxn < b 1 a 21 x 1+ a 22 x 2+ … + a 2 nxn < b 2 … am 1 x 1+ am 2 x 2+ … + amnxn < bm Li < xi < Ui (i = 1, …, n) Back to main index exit back to module contents

module 5: Strategic Decisions LP MODEL Maximize Z = p 1 x 1+ p 2 x 2 + … +pnxn subject to a 11 x 1+ a 12 x 2+ … + a 1 nxn < b 1 a 21 x 1+ a 22 x 2+ … + a 2 nxn < b 2 … am 1 x 1+ am 2 x 2+ … + amnxn < bm Li < xi < Ui (i = 1, …, n) Back to main index exit back to module contents

module 5: Strategic Decisions LEONTIEF’S INPUT-OUTPUT MODEL A Macro model of the National Economy Considers a number of interacting industries APPLICATIONS INCLUDE Integrated planning for the whole economy Target setting for individual industries Resource allocation to various sectors Price prediction and control in the economy Back to main index exit back to module contents

module 5: Strategic Decisions LEONTIEF’S INPUT-OUTPUT MODEL A Macro model of the National Economy Considers a number of interacting industries APPLICATIONS INCLUDE Integrated planning for the whole economy Target setting for individual industries Resource allocation to various sectors Price prediction and control in the economy Back to main index exit back to module contents

module 5: Strategic Decisions ASSUMPTIONS The economy consists of a number of interacting industries Each industry produces a single good and uses only one process of production to make this good Each industry produces to satisfy the demand in all other industries apart from an exogenous demand Back to main index exit back to module contents

module 5: Strategic Decisions ASSUMPTIONS The economy consists of a number of interacting industries Each industry produces a single good and uses only one process of production to make this good Each industry produces to satisfy the demand in all other industries apart from an exogenous demand Back to main index exit back to module contents

module 5: Strategic Decisions NOTATION Industry 1 Industry i Industry k Industry 2 yij Industry n n = Number of industries yi j= Amount of good i needed by industry j bi = Exogenous demand of good i bi Back to main index exit back to module contents

module 5: Strategic Decisions NOTATION Industry 1 Industry i Industry k Industry 2 yij Industry n n = Number of industries yi j= Amount of good i needed by industry j bi = Exogenous demand of good i bi Back to main index exit back to module contents

module 5: Strategic Decisions MASS BALANCE EQUATIONS The total amount xi which industry i must produce to exactly meet the demands is xi = yij + bi , Back to main index exit i = 1, …n back to module contents

module 5: Strategic Decisions MASS BALANCE EQUATIONS The total amount xi which industry i must produce to exactly meet the demands is xi = yij + bi , Back to main index exit i = 1, …n back to module contents

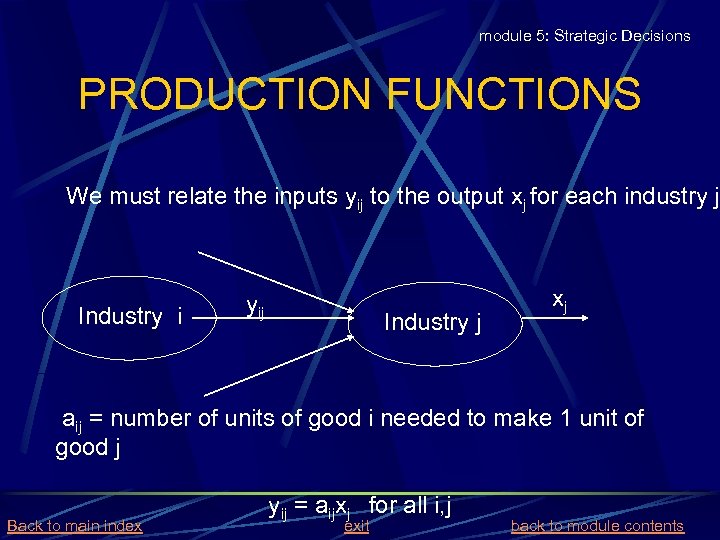

module 5: Strategic Decisions PRODUCTION FUNCTIONS We must relate the inputs yij to the output xj for each industry j Industry i yij Industry j xj aij = number of units of good i needed to make 1 unit of good j Back to main index yij = aijxj for all i, j exit back to module contents

module 5: Strategic Decisions PRODUCTION FUNCTIONS We must relate the inputs yij to the output xj for each industry j Industry i yij Industry j xj aij = number of units of good i needed to make 1 unit of good j Back to main index yij = aijxj for all i, j exit back to module contents

module 5: Strategic Decisions INPUT-OUTPUT COEFFICIENTS aij are known as Input-Output Coefficients or Technological Coefficients Input of i th industry to industry j , Slope = aij yij • Linearity assumed • No economies or diseconomies • Static (constant aij) • Dynamic (varying aij) Production of j th industry, xj Back to main index exit back to module contents

module 5: Strategic Decisions INPUT-OUTPUT COEFFICIENTS aij are known as Input-Output Coefficients or Technological Coefficients Input of i th industry to industry j , Slope = aij yij • Linearity assumed • No economies or diseconomies • Static (constant aij) • Dynamic (varying aij) Production of j th industry, xj Back to main index exit back to module contents

module 5: Strategic Decisions THE BASIC PRODUCTION MODEL Substituting the production function equations in the mass balance equations, we obtain the basic production model of LEONTIEF: x 1 = a 11 x 1+ a 12 x 2+ … +a 1 nxn + b 1 x 2 = a 21 x 1 + a 22 x 2+. . . +a 2 nxn + b 2. . xn = an 1 x 1 + an 2 x 2+ … + annxn + bn In matrix notation: X = AX + B , or X= (I-A)-1 B Back to main index exit back to module contents

module 5: Strategic Decisions THE BASIC PRODUCTION MODEL Substituting the production function equations in the mass balance equations, we obtain the basic production model of LEONTIEF: x 1 = a 11 x 1+ a 12 x 2+ … +a 1 nxn + b 1 x 2 = a 21 x 1 + a 22 x 2+. . . +a 2 nxn + b 2. . xn = an 1 x 1 + an 2 x 2+ … + annxn + bn In matrix notation: X = AX + B , or X= (I-A)-1 B Back to main index exit back to module contents

module 5: Strategic Decisions PRICES IN THE LEONTIEF SYSTEM pj = Unit price of good j aijpi = Cost of aij units of good i required to make one unit of good j. The cost of goods 1, 2, …, n needed to make one unit of good j = i=1 n aij pi If the value added by industry j is rj , pj - I=1 n aij pi = rj, j = 1, …, n Back to main index exit back to module contents

module 5: Strategic Decisions PRICES IN THE LEONTIEF SYSTEM pj = Unit price of good j aijpi = Cost of aij units of good i required to make one unit of good j. The cost of goods 1, 2, …, n needed to make one unit of good j = i=1 n aij pi If the value added by industry j is rj , pj - I=1 n aij pi = rj, j = 1, …, n Back to main index exit back to module contents

module 5: Strategic Decisions THE PRICE MODEL In Matrix notation (I-A)T P = R or P = [(I-A)-1]T R X= (I-A)-1 B Price model Production model A is the matrix of technological coefficients P is the price vector R is the of value added vector T denotes transpose & I the Identity matrix Back to main index exit back to module contents

module 5: Strategic Decisions THE PRICE MODEL In Matrix notation (I-A)T P = R or P = [(I-A)-1]T R X= (I-A)-1 B Price model Production model A is the matrix of technological coefficients P is the price vector R is the of value added vector T denotes transpose & I the Identity matrix Back to main index exit back to module contents

module 5: Strategic Decisions SUMMARY Purpose and Types of Models Aid decision making in Production Management Examples of Models Forecasting l Lot sizing l Product Mix (Graphic and LP) l Leontief’s Input Output Model l Back to main index exit back to module contents

module 5: Strategic Decisions SUMMARY Purpose and Types of Models Aid decision making in Production Management Examples of Models Forecasting l Lot sizing l Product Mix (Graphic and LP) l Leontief’s Input Output Model l Back to main index exit back to module contents

module 5: Strategic Decisions 3. Financial Evaluation Of Capital Investments Back to main index exit back to module contents

module 5: Strategic Decisions 3. Financial Evaluation Of Capital Investments Back to main index exit back to module contents

module 5: Strategic Decisions ISSUES FOR DISCUSSION A new venture as a stream of cash flows The time value of money The six rate of return formulas Notion of depreciation Computation of taxes Computation of the before/after tax l NPV l IRR l Payback period Evaluating investments on financial criteria Back to main index exit back to module contents

module 5: Strategic Decisions ISSUES FOR DISCUSSION A new venture as a stream of cash flows The time value of money The six rate of return formulas Notion of depreciation Computation of taxes Computation of the before/after tax l NPV l IRR l Payback period Evaluating investments on financial criteria Back to main index exit back to module contents

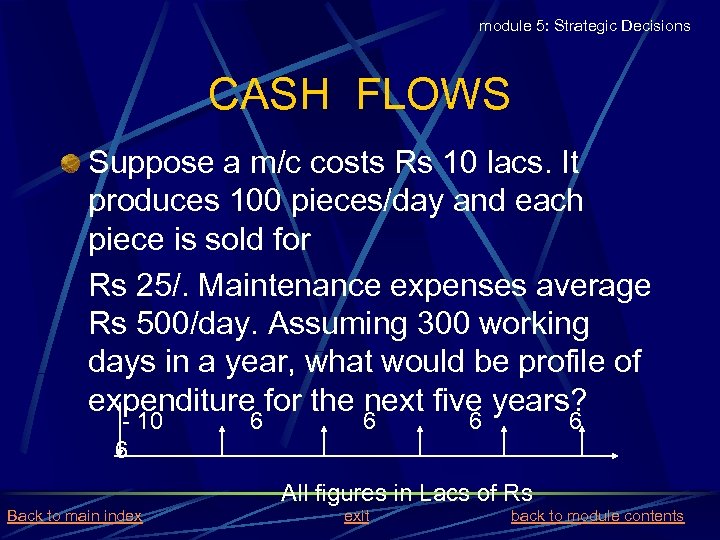

module 5: Strategic Decisions CASH FLOWS Suppose a m/c costs Rs 10 lacs. It produces 100 pieces/day and each piece is sold for Rs 25/. Maintenance expenses average Rs 500/day. Assuming 300 working days in a year, what would be profile of expenditure for the next five years? - 10 6 6 6 All figures in Lacs of Rs Back to main index exit back to module contents

module 5: Strategic Decisions CASH FLOWS Suppose a m/c costs Rs 10 lacs. It produces 100 pieces/day and each piece is sold for Rs 25/. Maintenance expenses average Rs 500/day. Assuming 300 working days in a year, what would be profile of expenditure for the next five years? - 10 6 6 6 All figures in Lacs of Rs Back to main index exit back to module contents

module 5: Strategic Decisions TIME VALUE OF MONEY A rupee today is more valuable than a rupee one year hence. Why? Current possession preferred to promises of future l Money can earn positive returns l During inflation a rupee today represents a greater real purchasing power than a future rupee l Back to main index exit back to module contents

module 5: Strategic Decisions TIME VALUE OF MONEY A rupee today is more valuable than a rupee one year hence. Why? Current possession preferred to promises of future l Money can earn positive returns l During inflation a rupee today represents a greater real purchasing power than a future rupee l Back to main index exit back to module contents

module 5: Strategic Decisions NOTION OF COMPONDING AND DISCOUNTING OF CASH FLOWS Compounding A= P(1+i)n Back to main index Discounting Present Sum, P exit Future Amount, A back to module contents

module 5: Strategic Decisions NOTION OF COMPONDING AND DISCOUNTING OF CASH FLOWS Compounding A= P(1+i)n Back to main index Discounting Present Sum, P exit Future Amount, A back to module contents

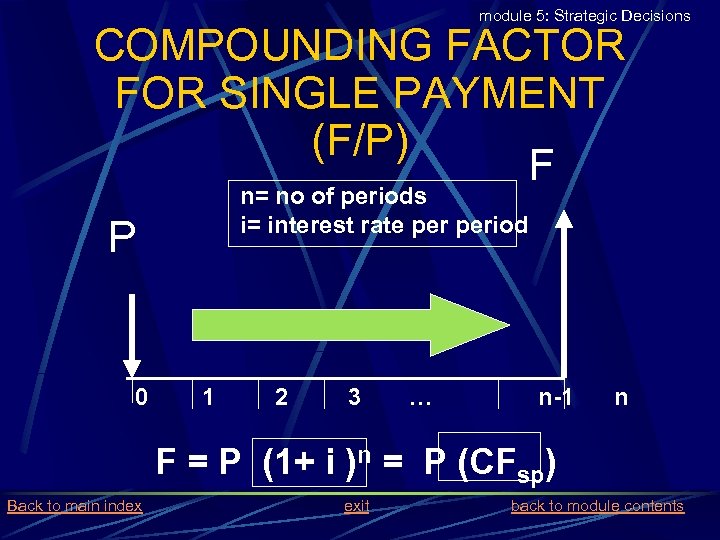

module 5: Strategic Decisions COMPOUNDING FACTOR FOR SINGLE PAYMENT (F/P) F n= no of periods i= interest rate period P 0 1 2 3 … n-1 n F = P (1+ i )n = P (CFsp) Back to main index exit back to module contents

module 5: Strategic Decisions COMPOUNDING FACTOR FOR SINGLE PAYMENT (F/P) F n= no of periods i= interest rate period P 0 1 2 3 … n-1 n F = P (1+ i )n = P (CFsp) Back to main index exit back to module contents

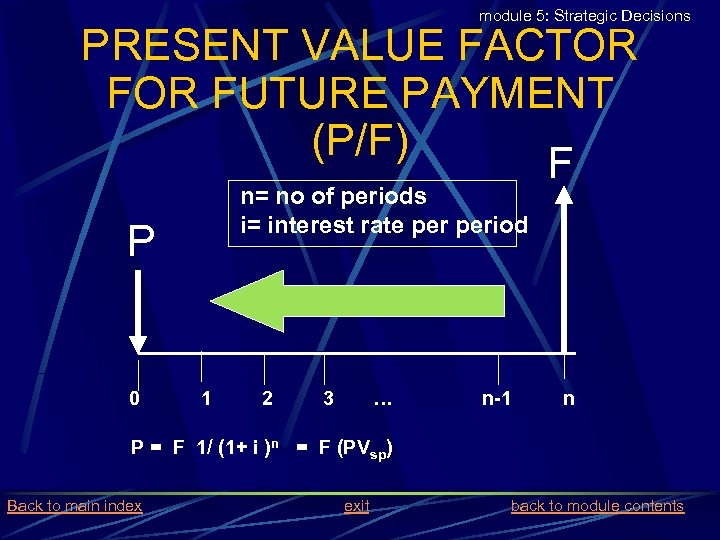

module 5: Strategic Decisions PRESENT VALUE FACTOR FUTURE PAYMENT (P/F) F n= no of periods i= interest rate period P 0 1 2 3 … n-1 n P = F 1/ (1+ i )n = F (PVsp) Back to main index exit back to module contents

module 5: Strategic Decisions PRESENT VALUE FACTOR FUTURE PAYMENT (P/F) F n= no of periods i= interest rate period P 0 1 2 3 … n-1 n P = F 1/ (1+ i )n = F (PVsp) Back to main index exit back to module contents

module 5: Strategic Decisions EQUIVALENT ANNUITY FOR A FUTURE SUM (A/F) F A 0 1 A 2 A 3 A = F. i/ [(1+i)n- 1] Back to main index A … n-1 A n = F (Sinking fund deposit factor) exit back to module contents

module 5: Strategic Decisions EQUIVALENT ANNUITY FOR A FUTURE SUM (A/F) F A 0 1 A 2 A 3 A = F. i/ [(1+i)n- 1] Back to main index A … n-1 A n = F (Sinking fund deposit factor) exit back to module contents

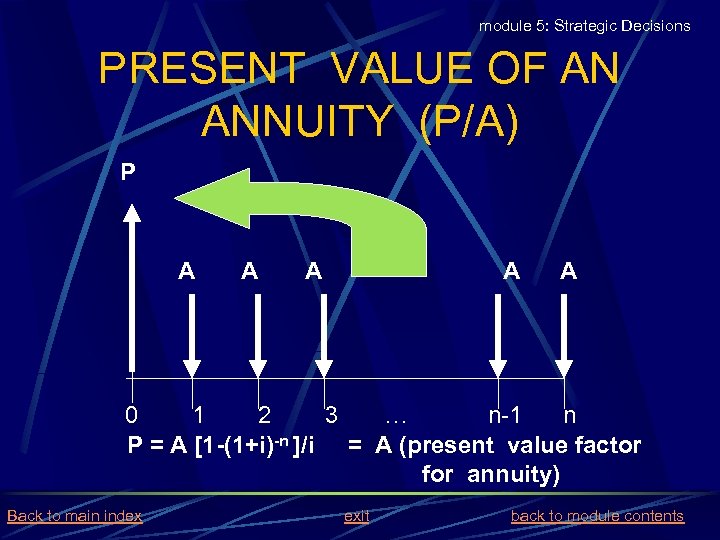

module 5: Strategic Decisions PRESENT VALUE OF AN ANNUITY (P/A) P A A A 0 1 2 3 … n-1 n P = A [1 -(1+i)-n ]/i = A (present value factor for annuity) Back to main index exit back to module contents

module 5: Strategic Decisions PRESENT VALUE OF AN ANNUITY (P/A) P A A A 0 1 2 3 … n-1 n P = A [1 -(1+i)-n ]/i = A (present value factor for annuity) Back to main index exit back to module contents

module 5: Strategic Decisions EQUIVALENT ANNUITY FOR A PRESENT SUM (A/P) P A 0 1 A A 2 A = P i/ [1 -(1+i)-n ] Back to main index A 3 … A n-1 n = P (capital recovery factor) exit back to module contents

module 5: Strategic Decisions EQUIVALENT ANNUITY FOR A PRESENT SUM (A/P) P A 0 1 A A 2 A = P i/ [1 -(1+i)-n ] Back to main index A 3 … A n-1 n = P (capital recovery factor) exit back to module contents

module 5: Strategic Decisions SAMPLE PROJECT Suppose a project has the following data: Initial investment (I) = Rs 3, 000 Annual costs of operation =Rs 20, 000 Expected annual revenues l l Rs 1, 000 per annum for the first two years Rs 200, 000 per annum for the next three years Planning horizon of 5 years Back to main index exit back to module contents

module 5: Strategic Decisions SAMPLE PROJECT Suppose a project has the following data: Initial investment (I) = Rs 3, 000 Annual costs of operation =Rs 20, 000 Expected annual revenues l l Rs 1, 000 per annum for the first two years Rs 200, 000 per annum for the next three years Planning horizon of 5 years Back to main index exit back to module contents

module 5: Strategic Decisions INVESTMENT, YEARLY COSTS & REVENUES Revenues 100 Costs 300 20 Time (yrs) 0 1 100 200 20 20 2 3 4 5 (All revenues and costs are in thousand Rupees) Back to main index exit back to module contents

module 5: Strategic Decisions INVESTMENT, YEARLY COSTS & REVENUES Revenues 100 Costs 300 20 Time (yrs) 0 1 100 200 20 20 2 3 4 5 (All revenues and costs are in thousand Rupees) Back to main index exit back to module contents

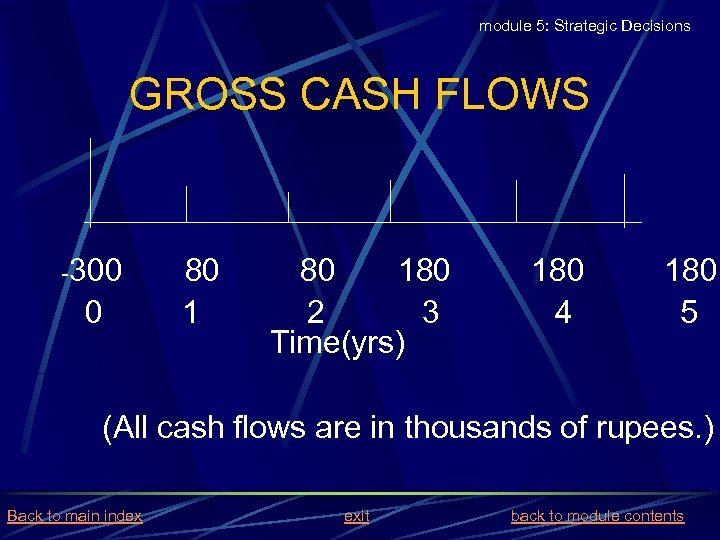

module 5: Strategic Decisions GROSS CASH FLOWS -300 0 80 180 2 3 Time(yrs) 180 4 180 5 (All cash flows are in thousands of rupees. ) Back to main index exit back to module contents

module 5: Strategic Decisions GROSS CASH FLOWS -300 0 80 180 2 3 Time(yrs) 180 4 180 5 (All cash flows are in thousands of rupees. ) Back to main index exit back to module contents

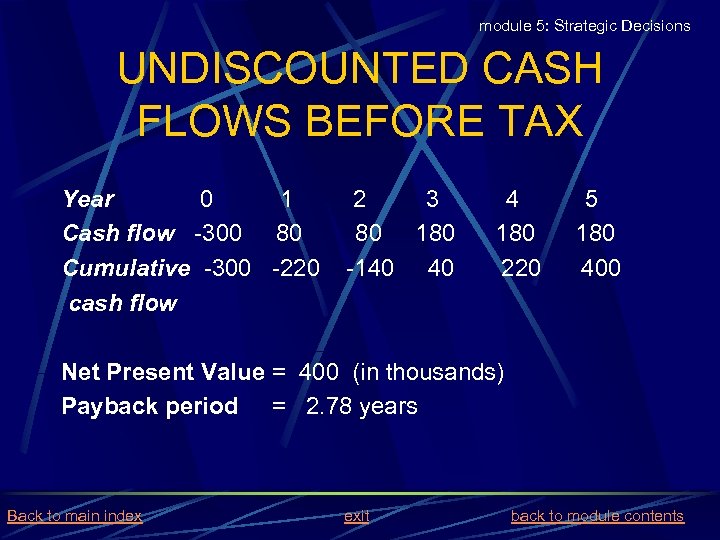

module 5: Strategic Decisions UNDISCOUNTED CASH FLOWS BEFORE TAX Year 0 1 Cash flow -300 80 Cumulative -300 -220 cash flow 2 3 80 180 -140 40 4 180 220 5 180 400 Net Present Value = 400 (in thousands) Payback period = 2. 78 years Back to main index exit back to module contents

module 5: Strategic Decisions UNDISCOUNTED CASH FLOWS BEFORE TAX Year 0 1 Cash flow -300 80 Cumulative -300 -220 cash flow 2 3 80 180 -140 40 4 180 220 5 180 400 Net Present Value = 400 (in thousands) Payback period = 2. 78 years Back to main index exit back to module contents

module 5: Strategic Decisions DISCOUNTED CASH FLOWS FOR INTEREST RATE= 10% Year 0 1 2 3 4 5 Cash flows -300 80 80 180 180 Discount 1 0. 909 0. 826 0. 751 0. 683. 621 factor DCF -300 72. 72 66. 08 135. 18 122. 94 111. 78 Cum -300 -227. 28 -161. 2 -26. 02 96. 92 208. 70 DCF Net Present Value = 208. 7 (in thousands) Payback period = 3. 21 years Back to main index exit back to module contents

module 5: Strategic Decisions DISCOUNTED CASH FLOWS FOR INTEREST RATE= 10% Year 0 1 2 3 4 5 Cash flows -300 80 80 180 180 Discount 1 0. 909 0. 826 0. 751 0. 683. 621 factor DCF -300 72. 72 66. 08 135. 18 122. 94 111. 78 Cum -300 -227. 28 -161. 2 -26. 02 96. 92 208. 70 DCF Net Present Value = 208. 7 (in thousands) Payback period = 3. 21 years Back to main index exit back to module contents

module 5: Strategic Decisions DISCOUNTED CASH FLOWS FOR INTEREST RATE= 20% Year 0 1 2 3 Cash flows -300 80 80 180 Discount 1 0. 833 0. 694 0. 579 factor DCF -300 66. 64 55. 52 104. 22 Cum -300 -233. 36 -177. 84 -73. 62 DCF 4 180 0. 482 5 180 0. 402 86. 76 72. 36 13. 14 85. 50 Net Present Value = 85. 5 (in thousands) Payback period = 3. 85 years Back to main index exit back to module contents

module 5: Strategic Decisions DISCOUNTED CASH FLOWS FOR INTEREST RATE= 20% Year 0 1 2 3 Cash flows -300 80 80 180 Discount 1 0. 833 0. 694 0. 579 factor DCF -300 66. 64 55. 52 104. 22 Cum -300 -233. 36 -177. 84 -73. 62 DCF 4 180 0. 482 5 180 0. 402 86. 76 72. 36 13. 14 85. 50 Net Present Value = 85. 5 (in thousands) Payback period = 3. 85 years Back to main index exit back to module contents

module 5: Strategic Decisions DISCOUNTED CASH FLOWS FOR INTEREST RATE= 25% Year 0 1 2 3 4 5 Cash flows -300 80 80 180 180 Discount 1 0. 800 0. 640 0. 512 0. 410 0. 328 factor DCF -300 64. 00 51. 20 92. 16 73. 80 59. 04 Cum -300 -236. 00 -184. 60 -92. 44 -18. 64 40. 40 DCF Net Present Value = 40. 4 (in thousands) Payback period = 4. 32 years Back to main index exit back to module contents

module 5: Strategic Decisions DISCOUNTED CASH FLOWS FOR INTEREST RATE= 25% Year 0 1 2 3 4 5 Cash flows -300 80 80 180 180 Discount 1 0. 800 0. 640 0. 512 0. 410 0. 328 factor DCF -300 64. 00 51. 20 92. 16 73. 80 59. 04 Cum -300 -236. 00 -184. 60 -92. 44 -18. 64 40. 40 DCF Net Present Value = 40. 4 (in thousands) Payback period = 4. 32 years Back to main index exit back to module contents

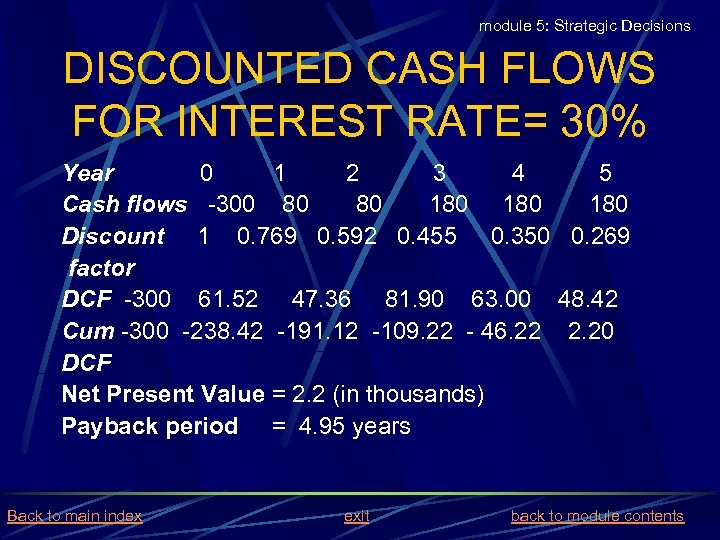

module 5: Strategic Decisions DISCOUNTED CASH FLOWS FOR INTEREST RATE= 30% Year 0 1 2 3 4 5 Cash flows -300 80 80 180 180 Discount 1 0. 769 0. 592 0. 455 0. 350 0. 269 factor DCF -300 61. 52 47. 36 81. 90 63. 00 48. 42 Cum -300 -238. 42 -191. 12 -109. 22 - 46. 22 2. 20 DCF Net Present Value = 2. 2 (in thousands) Payback period = 4. 95 years Back to main index exit back to module contents

module 5: Strategic Decisions DISCOUNTED CASH FLOWS FOR INTEREST RATE= 30% Year 0 1 2 3 4 5 Cash flows -300 80 80 180 180 Discount 1 0. 769 0. 592 0. 455 0. 350 0. 269 factor DCF -300 61. 52 47. 36 81. 90 63. 00 48. 42 Cum -300 -238. 42 -191. 12 -109. 22 - 46. 22 2. 20 DCF Net Present Value = 2. 2 (in thousands) Payback period = 4. 95 years Back to main index exit back to module contents

module 5: Strategic Decisions DISCOUNTED CASH FLOWS FOR INTEREST RATE= 35% Year 0 1 2 3 4 5 Cash flow -300 80 80 180 180 Discount 1 0. 741 0. 549 0. 406 0. 301 0. 223 factor DCF -300 59. 28 43. 92 73. 08 54. 18 40. 14 Cum -300 -240. 72 -196. 80 -123. 72 69. 54 -29. 40 DCF Net Present Value = -29. 40 (in thousands) Payback period > 5 years Back to main index exit back to module contents

module 5: Strategic Decisions DISCOUNTED CASH FLOWS FOR INTEREST RATE= 35% Year 0 1 2 3 4 5 Cash flow -300 80 80 180 180 Discount 1 0. 741 0. 549 0. 406 0. 301 0. 223 factor DCF -300 59. 28 43. 92 73. 08 54. 18 40. 14 Cum -300 -240. 72 -196. 80 -123. 72 69. 54 -29. 40 DCF Net Present Value = -29. 40 (in thousands) Payback period > 5 years Back to main index exit back to module contents

module 5: Strategic Decisions INTERNAL RATE OF RETURN NPV (GROSS CASH FLOWS) 400 300 208. 7 200 85. 5 100 0 -100 Back to main index IRR = 30. 35% 10% 40. 4 20% exit Interest i 2. 2 30% -29. 4 40% back to module contents

module 5: Strategic Decisions INTERNAL RATE OF RETURN NPV (GROSS CASH FLOWS) 400 300 208. 7 200 85. 5 100 0 -100 Back to main index IRR = 30. 35% 10% 40. 4 20% exit Interest i 2. 2 30% -29. 4 40% back to module contents

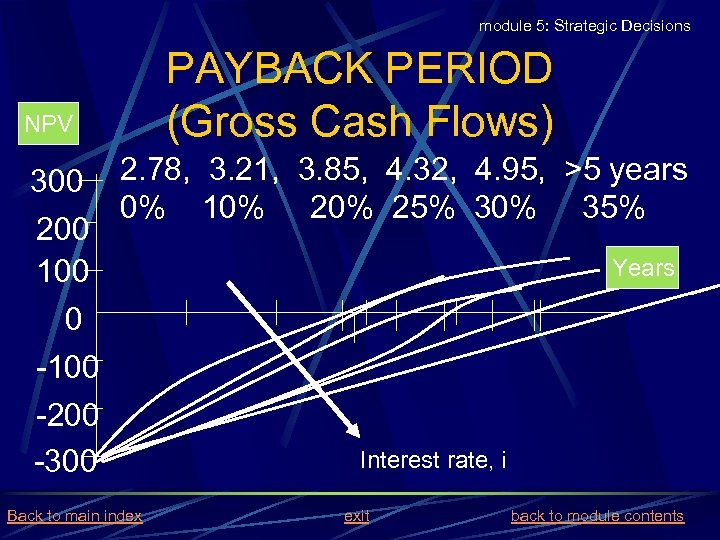

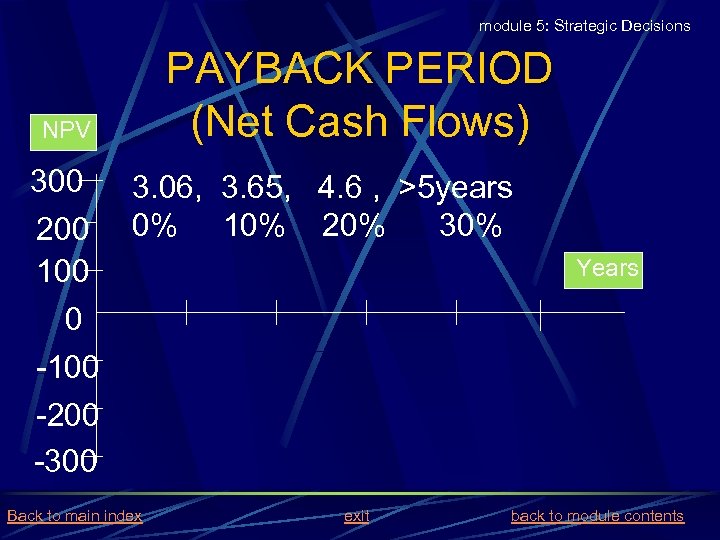

module 5: Strategic Decisions NPV PAYBACK PERIOD (Gross Cash Flows) 300 2. 78, 3. 21, 3. 85, 4. 32, 4. 95, >5 years 0% 10% 25% 30% 35% 200 Years 100 0 -100 -200 Interest rate, i -300 Back to main index exit back to module contents

module 5: Strategic Decisions NPV PAYBACK PERIOD (Gross Cash Flows) 300 2. 78, 3. 21, 3. 85, 4. 32, 4. 95, >5 years 0% 10% 25% 30% 35% 200 Years 100 0 -100 -200 Interest rate, i -300 Back to main index exit back to module contents

module 5: Strategic Decisions TAX CONSIDERATIONS Notion of Depreciation used in computing after tax cash flows. Straight line method (Here the amount to be depreciated is I/n in each period) Sum of digits (Here the depreciated amounts are I. n/S, I. (n-1)/S, . . . I. /S in the 1 st, 2 nd, . . . nth period, where S is the sum of the digits = n. (n+1)/2) Back to main index exit back to module contents

module 5: Strategic Decisions TAX CONSIDERATIONS Notion of Depreciation used in computing after tax cash flows. Straight line method (Here the amount to be depreciated is I/n in each period) Sum of digits (Here the depreciated amounts are I. n/S, I. (n-1)/S, . . . I. /S in the 1 st, 2 nd, . . . nth period, where S is the sum of the digits = n. (n+1)/2) Back to main index exit back to module contents

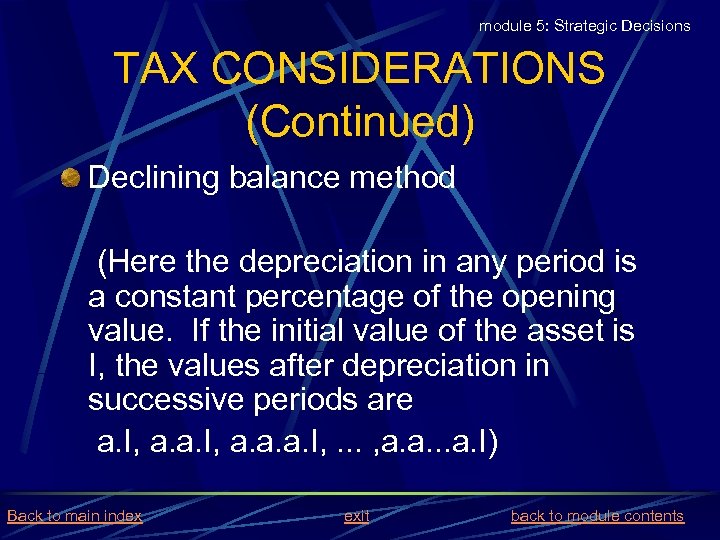

module 5: Strategic Decisions TAX CONSIDERATIONS (Continued) Declining balance method (Here the depreciation in any period is a constant percentage of the opening value. If the initial value of the asset is I, the values after depreciation in successive periods are a. I, a. a. a. I, . . . , a. a. I) Back to main index exit back to module contents

module 5: Strategic Decisions TAX CONSIDERATIONS (Continued) Declining balance method (Here the depreciation in any period is a constant percentage of the opening value. If the initial value of the asset is I, the values after depreciation in successive periods are a. I, a. a. a. I, . . . , a. a. I) Back to main index exit back to module contents

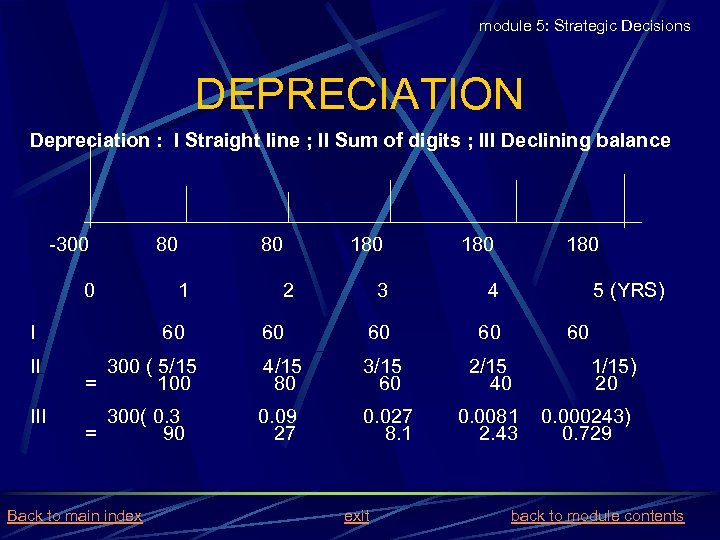

module 5: Strategic Decisions DEPRECIATION Depreciation : I Straight line ; II Sum of digits ; III Declining balance -300 0 I 80 1 60 80 180 3 4 60 60 60 2 180 5 (YRS) 60 II 300 ( 5/15 = 100 4/15 80 3/15 60 2/15 40 III 300( 0. 3 = 90 0. 09 27 0. 027 8. 1 0. 0081 2. 43 Back to main index exit 1/15) 20 0. 000243) 0. 729 back to module contents

module 5: Strategic Decisions DEPRECIATION Depreciation : I Straight line ; II Sum of digits ; III Declining balance -300 0 I 80 1 60 80 180 3 4 60 60 60 2 180 5 (YRS) 60 II 300 ( 5/15 = 100 4/15 80 3/15 60 2/15 40 III 300( 0. 3 = 90 0. 09 27 0. 027 8. 1 0. 0081 2. 43 Back to main index exit 1/15) 20 0. 000243) 0. 729 back to module contents

module 5: Strategic Decisions COMPUTATION OF NET CASH FLOWS Year Gross income Deprec. 1 2 80 60 Taxable income 20 4 5 180 60 20 120 120 Tax (30%) 6 6 36 36 36 After tax cash flows 74 74 144 144 Back to main index 3 exit back to module contents

module 5: Strategic Decisions COMPUTATION OF NET CASH FLOWS Year Gross income Deprec. 1 2 80 60 Taxable income 20 4 5 180 60 20 120 120 Tax (30%) 6 6 36 36 36 After tax cash flows 74 74 144 144 Back to main index 3 exit back to module contents

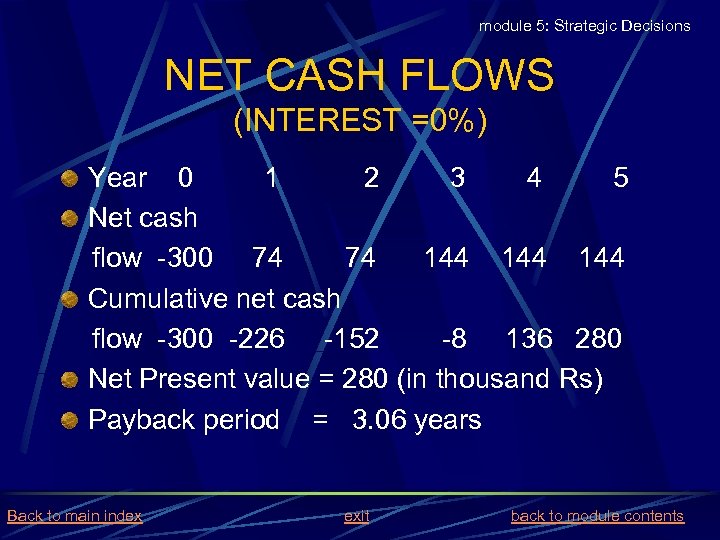

module 5: Strategic Decisions NET CASH FLOWS (INTEREST =0%) Year 0 1 2 3 4 5 Net cash flow -300 74 74 144 144 Cumulative net cash flow -300 -226 -152 -8 136 280 Net Present value = 280 (in thousand Rs) Payback period = 3. 06 years Back to main index exit back to module contents

module 5: Strategic Decisions NET CASH FLOWS (INTEREST =0%) Year 0 1 2 3 4 5 Net cash flow -300 74 74 144 144 Cumulative net cash flow -300 -226 -152 -8 136 280 Net Present value = 280 (in thousand Rs) Payback period = 3. 06 years Back to main index exit back to module contents

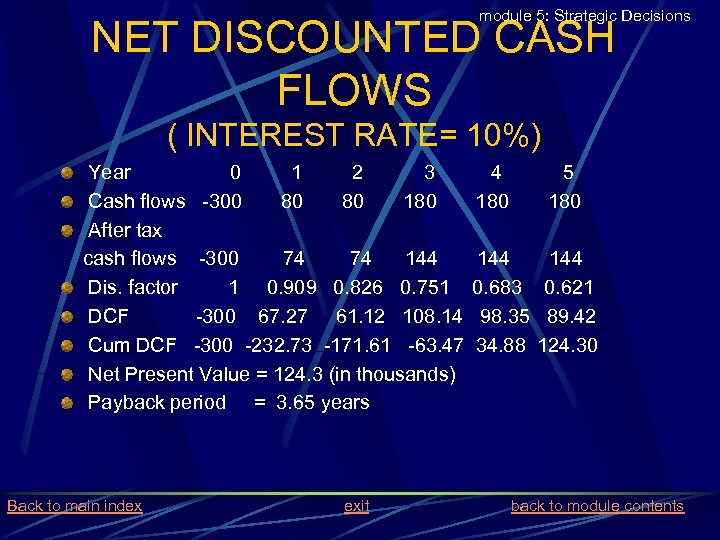

module 5: Strategic Decisions NET DISCOUNTED CASH FLOWS ( INTEREST RATE= 10%) Year 0 1 2 3 Cash flows -300 80 80 180 After tax cash flows -300 74 74 144 Dis. factor 1 0. 909 0. 826 0. 751 DCF -300 67. 27 61. 12 108. 14 Cum DCF -300 -232. 73 -171. 61 -63. 47 Net Present Value = 124. 3 (in thousands) Payback period = 3. 65 years Back to main index exit 4 180 5 180 144 0. 683 98. 35 34. 88 144 0. 621 89. 42 124. 30 back to module contents

module 5: Strategic Decisions NET DISCOUNTED CASH FLOWS ( INTEREST RATE= 10%) Year 0 1 2 3 Cash flows -300 80 80 180 After tax cash flows -300 74 74 144 Dis. factor 1 0. 909 0. 826 0. 751 DCF -300 67. 27 61. 12 108. 14 Cum DCF -300 -232. 73 -171. 61 -63. 47 Net Present Value = 124. 3 (in thousands) Payback period = 3. 65 years Back to main index exit 4 180 5 180 144 0. 683 98. 35 34. 88 144 0. 621 89. 42 124. 30 back to module contents

module 5: Strategic Decisions NET DISCOUNTED CASH FLOWS (INTEREST RATE= 20%) Year 0 1 2 3 4 5 Cash flows -300 80 80 180 180 After tax cash flows -300 74 74 144 144 Disc factor 1 0. 833 0. 694 0. 579 0. 482 0. 402 DCF -300 61. 64 51. 36 83. 38 69. 41 57. 89 Cum DCF -300 -238. 36 -187. 00 -103. 62 -34. 21 23. 68 Net Present Value = 23. 68 (in thousands) Payback period = 4. 6 years Back to main index exit back to module contents

module 5: Strategic Decisions NET DISCOUNTED CASH FLOWS (INTEREST RATE= 20%) Year 0 1 2 3 4 5 Cash flows -300 80 80 180 180 After tax cash flows -300 74 74 144 144 Disc factor 1 0. 833 0. 694 0. 579 0. 482 0. 402 DCF -300 61. 64 51. 36 83. 38 69. 41 57. 89 Cum DCF -300 -238. 36 -187. 00 -103. 62 -34. 21 23. 68 Net Present Value = 23. 68 (in thousands) Payback period = 4. 6 years Back to main index exit back to module contents

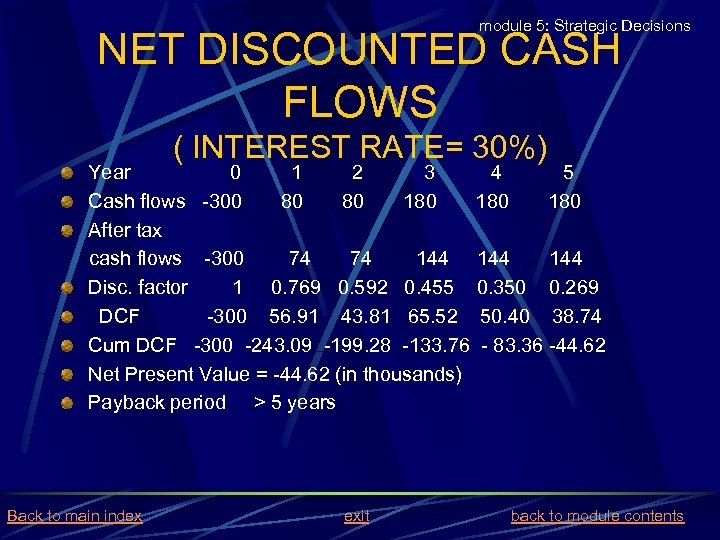

module 5: Strategic Decisions NET DISCOUNTED CASH FLOWS ( INTEREST RATE= 30%) Year 0 1 2 3 4 5 Cash flows -300 80 80 180 180 After tax cash flows -300 74 74 144 144 Disc. factor 1 0. 769 0. 592 0. 455 0. 350 0. 269 DCF -300 56. 91 43. 81 65. 52 50. 40 38. 74 Cum DCF -300 -243. 09 -199. 28 -133. 76 - 83. 36 -44. 62 Net Present Value = -44. 62 (in thousands) Payback period > 5 years Back to main index exit back to module contents

module 5: Strategic Decisions NET DISCOUNTED CASH FLOWS ( INTEREST RATE= 30%) Year 0 1 2 3 4 5 Cash flows -300 80 80 180 180 After tax cash flows -300 74 74 144 144 Disc. factor 1 0. 769 0. 592 0. 455 0. 350 0. 269 DCF -300 56. 91 43. 81 65. 52 50. 40 38. 74 Cum DCF -300 -243. 09 -199. 28 -133. 76 - 83. 36 -44. 62 Net Present Value = -44. 62 (in thousands) Payback period > 5 years Back to main index exit back to module contents

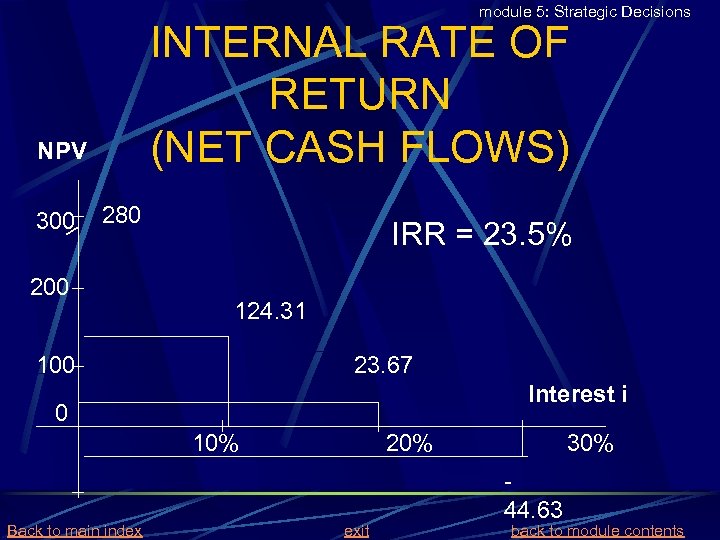

module 5: Strategic Decisions INTERNAL RATE OF RETURN (NET CASH FLOWS) NPV 300 280 200 IRR = 23. 5% 124. 31 100 23. 67 Interest i 0 10% Back to main index 20% exit 30% 44. 63 back to module contents

module 5: Strategic Decisions INTERNAL RATE OF RETURN (NET CASH FLOWS) NPV 300 280 200 IRR = 23. 5% 124. 31 100 23. 67 Interest i 0 10% Back to main index 20% exit 30% 44. 63 back to module contents

module 5: Strategic Decisions NPV PAYBACK PERIOD (Net Cash Flows) 300 3. 06, 3. 65, 4. 6 , >5 years 30% 200 0% 10% 20% 100 0 -100 -200 -300 Back to main index exit Years back to module contents

module 5: Strategic Decisions NPV PAYBACK PERIOD (Net Cash Flows) 300 3. 06, 3. 65, 4. 6 , >5 years 30% 200 0% 10% 20% 100 0 -100 -200 -300 Back to main index exit Years back to module contents

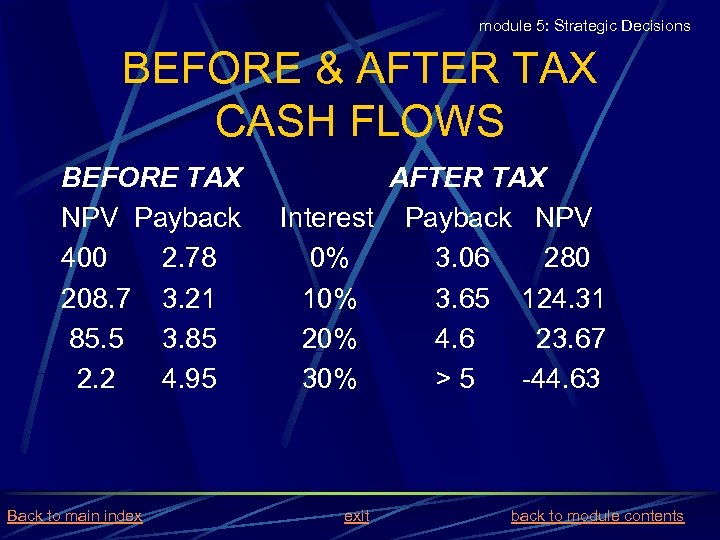

module 5: Strategic Decisions BEFORE & AFTER TAX CASH FLOWS BEFORE TAX NPV Payback 400 2. 78 208. 7 3. 21 85. 5 3. 85 2. 2 4. 95 Back to main index AFTER TAX Interest Payback NPV 0% 3. 06 280 10% 3. 65 124. 31 20% 4. 6 23. 67 30% >5 -44. 63 exit back to module contents

module 5: Strategic Decisions BEFORE & AFTER TAX CASH FLOWS BEFORE TAX NPV Payback 400 2. 78 208. 7 3. 21 85. 5 3. 85 2. 2 4. 95 Back to main index AFTER TAX Interest Payback NPV 0% 3. 06 280 10% 3. 65 124. 31 20% 4. 6 23. 67 30% >5 -44. 63 exit back to module contents

module 5: Strategic Decisions SUMMARY Vital role of financial appraisal in overall project evaluation Accounting for the time value of money Estimation of investment, yearly costs and revenues to obtain gross cash flows Depreciation and tax concepts to obtain net cash flows Computation of NPV, IRR , benefit /cost ratio and payback Back to main index exit back to module contents

module 5: Strategic Decisions SUMMARY Vital role of financial appraisal in overall project evaluation Accounting for the time value of money Estimation of investment, yearly costs and revenues to obtain gross cash flows Depreciation and tax concepts to obtain net cash flows Computation of NPV, IRR , benefit /cost ratio and payback Back to main index exit back to module contents

module 5: Strategic Decisions 4. Project Financial Appraisal: An Example Back to main index exit back to module contents

module 5: Strategic Decisions 4. Project Financial Appraisal: An Example Back to main index exit back to module contents

module 5: Strategic Decisions PROBLEM STATEMENT A project requires an initial investment of Rs 10 Lakhs and the anticipated income at the end of each of five successive years is likely to be Rs 2 lakhs, Rs 4 lakhs, Rs 6 lakhs and Rs 4 lakhs respectively. The company is planning to take a loan of Rs 5 lakhs to be returned in equal annual instalments at a rate of interest of 12% over the planning horizon of 5 years. For such cases sum of digits depreciation is allowed. The company is in the 30% tax bracket. Considering the net cash returns after taxes compute (a) Net Present Value (b) Discounted Payback period (c) Debt Service Coverage Ratio (Assume a rate of interest of 8% for discounting cash flows) What is your recommendation on going ahead with the project based on these three financial parameters? Back to main index exit back to module contents

module 5: Strategic Decisions PROBLEM STATEMENT A project requires an initial investment of Rs 10 Lakhs and the anticipated income at the end of each of five successive years is likely to be Rs 2 lakhs, Rs 4 lakhs, Rs 6 lakhs and Rs 4 lakhs respectively. The company is planning to take a loan of Rs 5 lakhs to be returned in equal annual instalments at a rate of interest of 12% over the planning horizon of 5 years. For such cases sum of digits depreciation is allowed. The company is in the 30% tax bracket. Considering the net cash returns after taxes compute (a) Net Present Value (b) Discounted Payback period (c) Debt Service Coverage Ratio (Assume a rate of interest of 8% for discounting cash flows) What is your recommendation on going ahead with the project based on these three financial parameters? Back to main index exit back to module contents

module 5: Strategic Decisions ANALYSIS OF LOAN P = A/(1+i) + A/ (1+i)2 +. . . + A/(1+i)n 0 P 1 A 2 A P = A (1+i)n – 1 i(1+i)n … n A or Years Capital A = P i(1+i)n Recovery Factor (1+i)n – 1 For i = 12% = 0. 12; n=5 years and P=Rs 5 Lakhs A = 5 * 0. 2775 = Rs 1. 3875 lakhs. Back to main index exit back to module contents

module 5: Strategic Decisions ANALYSIS OF LOAN P = A/(1+i) + A/ (1+i)2 +. . . + A/(1+i)n 0 P 1 A 2 A P = A (1+i)n – 1 i(1+i)n … n A or Years Capital A = P i(1+i)n Recovery Factor (1+i)n – 1 For i = 12% = 0. 12; n=5 years and P=Rs 5 Lakhs A = 5 * 0. 2775 = Rs 1. 3875 lakhs. Back to main index exit back to module contents

module 5: Strategic Decisions COMPUTATION OF INTEREST AND PRINCIPLE OF LOAN Year Opening principal (in Lakhs of Rs. ) Interest Paid in year (@ 12%) 1 5 0. 6 2 4. 2125 0. 5055 3 4 3. 3305 2. 3407 0. 3997 0. 2811 5 1. 2343 0. 1418 Principal paid in year 0. 7875 0. 8820 0. 9878 1. 1064 1. 2394 Total Instalment 1. 3875 Back to main index 1. 3875 exit 1. 3875 back to module contents

module 5: Strategic Decisions COMPUTATION OF INTEREST AND PRINCIPLE OF LOAN Year Opening principal (in Lakhs of Rs. ) Interest Paid in year (@ 12%) 1 5 0. 6 2 4. 2125 0. 5055 3 4 3. 3305 2. 3407 0. 3997 0. 2811 5 1. 2343 0. 1418 Principal paid in year 0. 7875 0. 8820 0. 9878 1. 1064 1. 2394 Total Instalment 1. 3875 Back to main index 1. 3875 exit 1. 3875 back to module contents

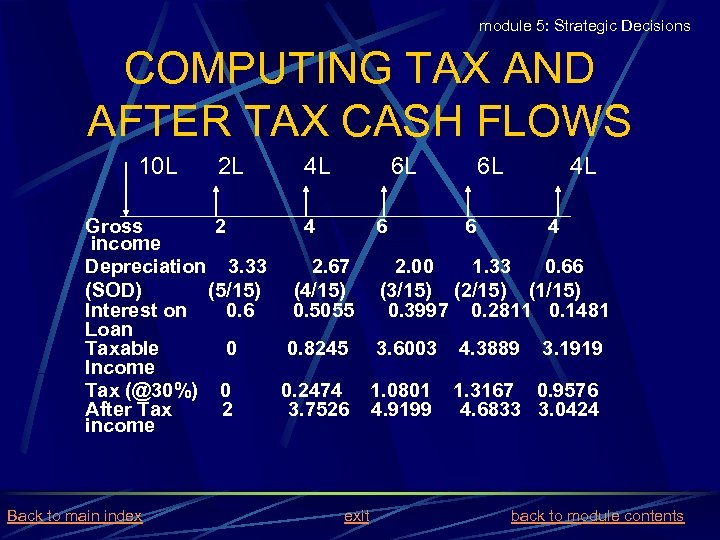

module 5: Strategic Decisions COMPUTING TAX AND AFTER TAX CASH FLOWS 10 L 2 L 4 L 6 L 6 L 4 L Gross 2 4 6 6 4 income Depreciation 3. 33 2. 67 2. 00 1. 33 0. 66 (SOD) (5/15) (4/15) (3/15) (2/15) (1/15) Interest on 0. 6 0. 5055 0. 3997 0. 2811 0. 1481 Loan Taxable 0 0. 8245 3. 6003 4. 3889 3. 1919 Income Tax (@30%) 0 0. 2474 1. 0801 1. 3167 0. 9576 After Tax 2 3. 7526 4. 9199 4. 6833 3. 0424 income Back to main index exit back to module contents

module 5: Strategic Decisions COMPUTING TAX AND AFTER TAX CASH FLOWS 10 L 2 L 4 L 6 L 6 L 4 L Gross 2 4 6 6 4 income Depreciation 3. 33 2. 67 2. 00 1. 33 0. 66 (SOD) (5/15) (4/15) (3/15) (2/15) (1/15) Interest on 0. 6 0. 5055 0. 3997 0. 2811 0. 1481 Loan Taxable 0 0. 8245 3. 6003 4. 3889 3. 1919 Income Tax (@30%) 0 0. 2474 1. 0801 1. 3167 0. 9576 After Tax 2 3. 7526 4. 9199 4. 6833 3. 0424 income Back to main index exit back to module contents

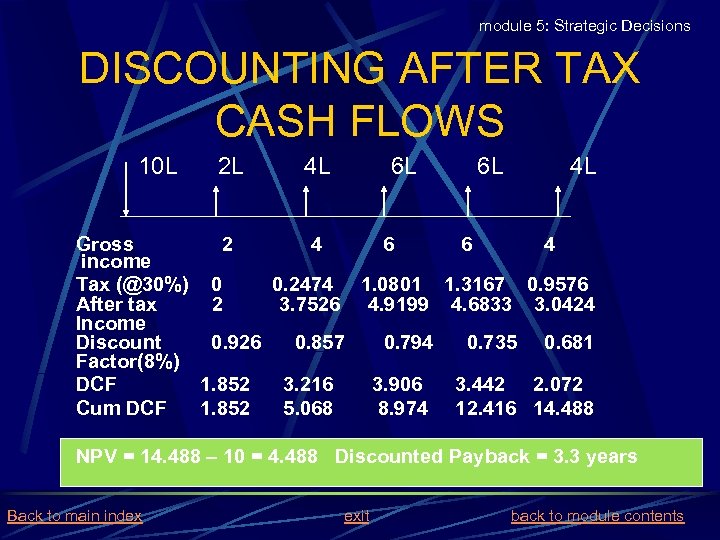

module 5: Strategic Decisions DISCOUNTING AFTER TAX CASH FLOWS 10 L 2 L 4 L 6 L 6 L 4 L Gross 2 4 6 6 income Tax (@30%) 0 0. 2474 1. 0801 1. 3167 After tax 2 3. 7526 4. 9199 4. 6833 Income Discount 0. 926 0. 857 0. 794 0. 735 Factor(8%) DCF 1. 852 3. 216 3. 906 3. 442 Cum DCF 1. 852 5. 068 8. 974 12. 416 4 0. 9576 3. 0424 0. 681 2. 072 14. 488 NPV = 14. 488 – 10 = 4. 488 Discounted Payback = 3. 3 years Back to main index exit back to module contents

module 5: Strategic Decisions DISCOUNTING AFTER TAX CASH FLOWS 10 L 2 L 4 L 6 L 6 L 4 L Gross 2 4 6 6 income Tax (@30%) 0 0. 2474 1. 0801 1. 3167 After tax 2 3. 7526 4. 9199 4. 6833 Income Discount 0. 926 0. 857 0. 794 0. 735 Factor(8%) DCF 1. 852 3. 216 3. 906 3. 442 Cum DCF 1. 852 5. 068 8. 974 12. 416 4 0. 9576 3. 0424 0. 681 2. 072 14. 488 NPV = 14. 488 – 10 = 4. 488 Discounted Payback = 3. 3 years Back to main index exit back to module contents

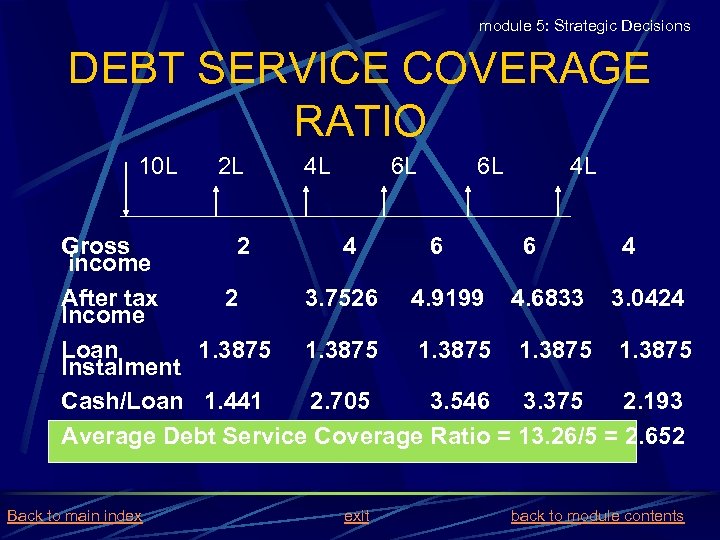

module 5: Strategic Decisions DEBT SERVICE COVERAGE RATIO 10 L 2 L 4 L 6 L 6 L 4 L Gross 2 4 6 6 4 income After tax 2 3. 7526 4. 9199 4. 6833 3. 0424 Income Loan 1. 3875 Instalment Cash/Loan 1. 441 2. 705 3. 546 3. 375 2. 193 Average Debt Service Coverage Ratio = 13. 26/5 = 2. 652 Back to main index exit back to module contents

module 5: Strategic Decisions DEBT SERVICE COVERAGE RATIO 10 L 2 L 4 L 6 L 6 L 4 L Gross 2 4 6 6 4 income After tax 2 3. 7526 4. 9199 4. 6833 3. 0424 Income Loan 1. 3875 Instalment Cash/Loan 1. 441 2. 705 3. 546 3. 375 2. 193 Average Debt Service Coverage Ratio = 13. 26/5 = 2. 652 Back to main index exit back to module contents

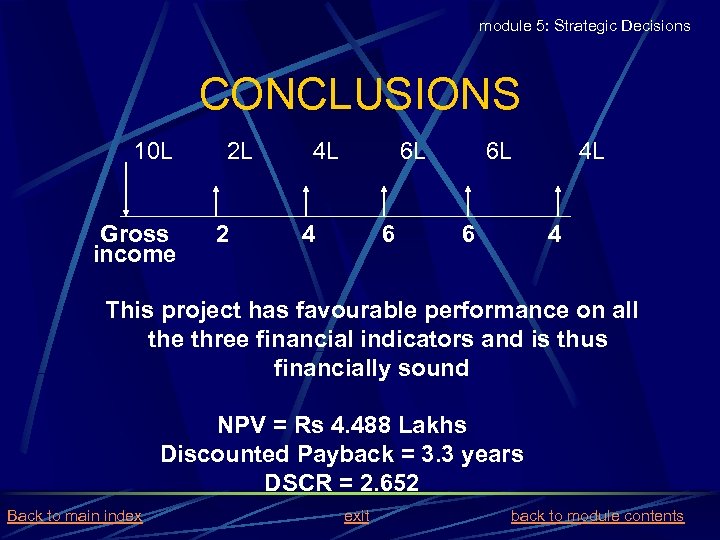

module 5: Strategic Decisions CONCLUSIONS 10 L Gross income 2 L 2 4 L 6 L 4 6 6 L 6 4 L 4 This project has favourable performance on all the three financial indicators and is thus financially sound NPV = Rs 4. 488 Lakhs Discounted Payback = 3. 3 years DSCR = 2. 652 Back to main index exit back to module contents

module 5: Strategic Decisions CONCLUSIONS 10 L Gross income 2 L 2 4 L 6 L 4 6 6 L 6 4 L 4 This project has favourable performance on all the three financial indicators and is thus financially sound NPV = Rs 4. 488 Lakhs Discounted Payback = 3. 3 years DSCR = 2. 652 Back to main index exit back to module contents

module 5: Strategic Decisions 5. Decision Trees and. Risk Evaluation Back to main index exit back to module contents

module 5: Strategic Decisions 5. Decision Trees and. Risk Evaluation Back to main index exit back to module contents

module 5: Strategic Decisions RISK EVALUATION AND DECISION TREES Business Decisions involve risk What is risk and how to measure it Use of decision trees to represent real life investment, return and risk An example of a product launch to illustrate the use of decision trees Determination of optimal strategies. Back to main index exit back to module contents

module 5: Strategic Decisions RISK EVALUATION AND DECISION TREES Business Decisions involve risk What is risk and how to measure it Use of decision trees to represent real life investment, return and risk An example of a product launch to illustrate the use of decision trees Determination of optimal strategies. Back to main index exit back to module contents

module 5: Strategic Decisions PRODUCT LAUNCH WITH Decision Trees A new consumer product has been developed by a company and preliminary marketing potential has been estimated as a chance of 0. 4 for successful launch which would result in an annual profit with the present worth of Rs. 2, 000. Failure of product would mean a loss of Rs. 300, 000. Back to main index exit back to module contents

module 5: Strategic Decisions PRODUCT LAUNCH WITH Decision Trees A new consumer product has been developed by a company and preliminary marketing potential has been estimated as a chance of 0. 4 for successful launch which would result in an annual profit with the present worth of Rs. 2, 000. Failure of product would mean a loss of Rs. 300, 000. Back to main index exit back to module contents

module 5: Strategic Decisions The company can either drop the idea , or launch the product immediately , or try in a test market ( at a cost of Rs. 40, 000) before deciding to drop or launch. The test market would classify the sample response in one of the following three categories: (a) Less than 10% of the public try the new product , Back to main index exit back to module contents

module 5: Strategic Decisions The company can either drop the idea , or launch the product immediately , or try in a test market ( at a cost of Rs. 40, 000) before deciding to drop or launch. The test market would classify the sample response in one of the following three categories: (a) Less than 10% of the public try the new product , Back to main index exit back to module contents

module 5: Strategic Decisions (b) More than 10% try the product , but less than 25% of those who try buy it on a second or subsequent occasion, (c) more 10% try the product and the repeat purchase rate is 25% or more. Based on the subjective estimates of experts the following joint probability table is available. Test Market response (a) (b) (c) Success(S) 0. 05 0. 10 0. 25 Failure(F) 0. 45 0. 15 0. 00 Back to main index exit back to module contents

module 5: Strategic Decisions (b) More than 10% try the product , but less than 25% of those who try buy it on a second or subsequent occasion, (c) more 10% try the product and the repeat purchase rate is 25% or more. Based on the subjective estimates of experts the following joint probability table is available. Test Market response (a) (b) (c) Success(S) 0. 05 0. 10 0. 25 Failure(F) 0. 45 0. 15 0. 00 Back to main index exit back to module contents

module 5: Strategic Decisions Use a decision tree to determine what is best for the company to do. Also obtain the probability distribution of outcomes for each choice , and comment on the risk in each choice. Back to main index exit back to module contents

module 5: Strategic Decisions Use a decision tree to determine what is best for the company to do. Also obtain the probability distribution of outcomes for each choice , and comment on the risk in each choice. Back to main index exit back to module contents

module 5: Strategic Decisions DECISION TREE Drop Success 1 Direct 2 Failure Drop Launch 4 Launc 7 Failur Test (a) h e market Drop Success 3 (b) 5 Launc 8 Failur (c) h Drop 6 Back to main index exit e Success Launc 9 Failur h e back to module contents

module 5: Strategic Decisions DECISION TREE Drop Success 1 Direct 2 Failure Drop Launch 4 Launc 7 Failur Test (a) h e market Drop Success 3 (b) 5 Launc 8 Failur (c) h Drop 6 Back to main index exit e Success Launc 9 Failur h e back to module contents

module 5: Strategic Decisions OPTIMAL DECISION TREE Drop(0) Success Direct 2 Failure Drop(0) Success 1 Launc h Test 7 Failur (a) 4 h e market Drop Success 3 (b) Launc 5 8 Failur (c) h e Success Drop Launc 9 Failur 6 h e Back to main index exit back to module contents

module 5: Strategic Decisions OPTIMAL DECISION TREE Drop(0) Success Direct 2 Failure Drop(0) Success 1 Launc h Test 7 Failur (a) 4 h e market Drop Success 3 (b) Launc 5 8 Failur (c) h e Success Drop Launc 9 Failur 6 h e Back to main index exit back to module contents

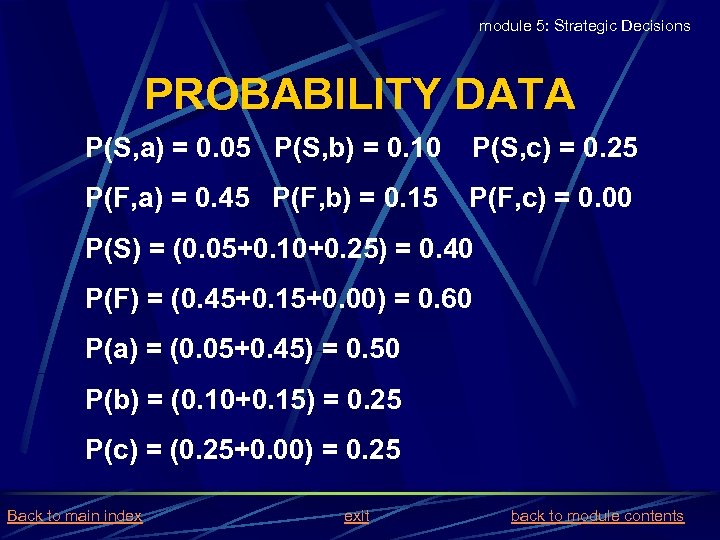

module 5: Strategic Decisions PROBABILITY DATA P(S, a) = 0. 05 P(S, b) = 0. 10 P(S, c) = 0. 25 P(F, a) = 0. 45 P(F, b) = 0. 15 P(F, c) = 0. 00 P(S) = (0. 05+0. 10+0. 25) = 0. 40 P(F) = (0. 45+0. 15+0. 00) = 0. 60 P(a) = (0. 05+0. 45) = 0. 50 P(b) = (0. 10+0. 15) = 0. 25 P(c) = (0. 25+0. 00) = 0. 25 Back to main index exit back to module contents

module 5: Strategic Decisions PROBABILITY DATA P(S, a) = 0. 05 P(S, b) = 0. 10 P(S, c) = 0. 25 P(F, a) = 0. 45 P(F, b) = 0. 15 P(F, c) = 0. 00 P(S) = (0. 05+0. 10+0. 25) = 0. 40 P(F) = (0. 45+0. 15+0. 00) = 0. 60 P(a) = (0. 05+0. 45) = 0. 50 P(b) = (0. 10+0. 15) = 0. 25 P(c) = (0. 25+0. 00) = 0. 25 Back to main index exit back to module contents

module 5: Strategic Decisions TREE EVALUATION Let annual profit be (P) = 2, 000 Let loss due to failure be (F)=300, 000 Let test market cost be (T) = 40, 000 If product is launched direct then, At node 2, value (E 2) = P(S)*P + P(F)*F = 0. 4*2, 000 + 0. 6*(-300, 000) (E 2)= 620, 000 Back to main index exit back to module contents

module 5: Strategic Decisions TREE EVALUATION Let annual profit be (P) = 2, 000 Let loss due to failure be (F)=300, 000 Let test market cost be (T) = 40, 000 If product is launched direct then, At node 2, value (E 2) = P(S)*P + P(F)*F = 0. 4*2, 000 + 0. 6*(-300, 000) (E 2)= 620, 000 Back to main index exit back to module contents

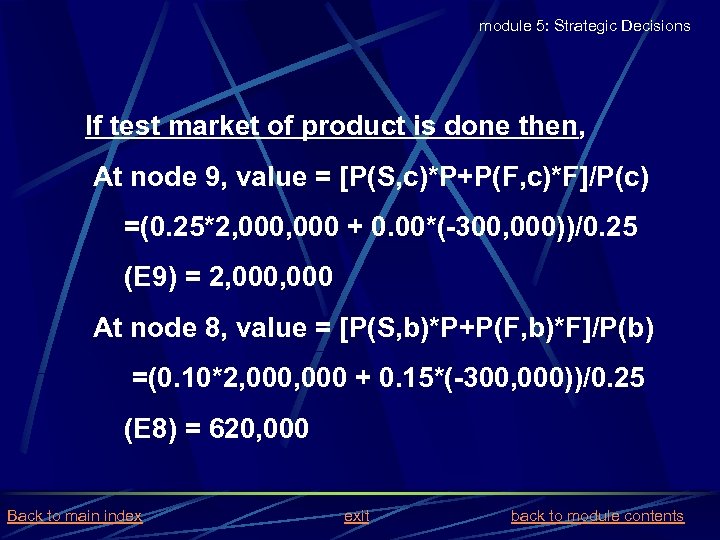

module 5: Strategic Decisions If test market of product is done then, At node 9, value = [P(S, c)*P+P(F, c)*F]/P(c) =(0. 25*2, 000 + 0. 00*(-300, 000))/0. 25 (E 9) = 2, 000 At node 8, value = [P(S, b)*P+P(F, b)*F]/P(b) =(0. 10*2, 000 + 0. 15*(-300, 000))/0. 25 (E 8) = 620, 000 Back to main index exit back to module contents

module 5: Strategic Decisions If test market of product is done then, At node 9, value = [P(S, c)*P+P(F, c)*F]/P(c) =(0. 25*2, 000 + 0. 00*(-300, 000))/0. 25 (E 9) = 2, 000 At node 8, value = [P(S, b)*P+P(F, b)*F]/P(b) =(0. 10*2, 000 + 0. 15*(-300, 000))/0. 25 (E 8) = 620, 000 Back to main index exit back to module contents

![module 5: Strategic Decisions At node 7, value = [P(S, a)*P+P(F, a)*F]/P(a) =(0. 05*2, module 5: Strategic Decisions At node 7, value = [P(S, a)*P+P(F, a)*F]/P(a) =(0. 05*2,](https://present5.com/presentation/b614773e82e996a607f0accd68c0c52c/image-110.jpg) module 5: Strategic Decisions At node 7, value = [P(S, a)*P+P(F, a)*F]/P(a) =(0. 05*2, 000 + 0. 45*(-300, 000))/0. 50 (E 7) = -70, 000 Since nodal value @ node 7 is negative indicating loss thereby it is better to drop the product @ node 4 but launch the product @ node 5 & node 6 since nodal value @ node 8 & 9 are positive indicating profit. Back to main index exit back to module contents

module 5: Strategic Decisions At node 7, value = [P(S, a)*P+P(F, a)*F]/P(a) =(0. 05*2, 000 + 0. 45*(-300, 000))/0. 50 (E 7) = -70, 000 Since nodal value @ node 7 is negative indicating loss thereby it is better to drop the product @ node 4 but launch the product @ node 5 & node 6 since nodal value @ node 8 & 9 are positive indicating profit. Back to main index exit back to module contents

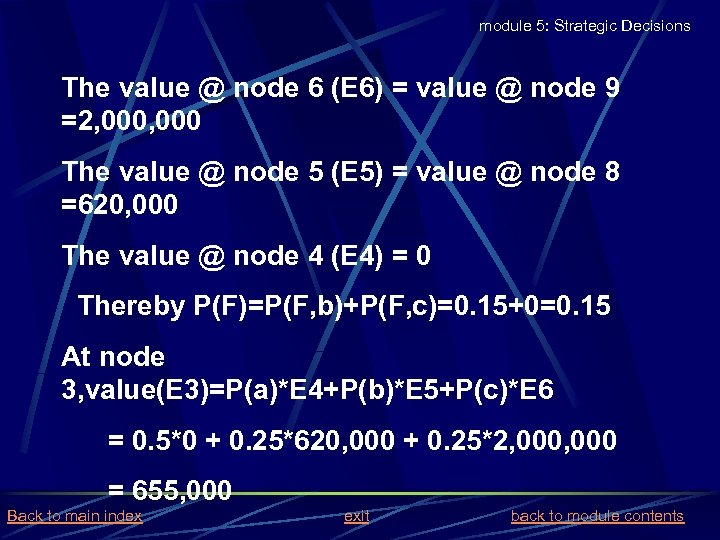

module 5: Strategic Decisions The value @ node 6 (E 6) = value @ node 9 =2, 000 The value @ node 5 (E 5) = value @ node 8 =620, 000 The value @ node 4 (E 4) = 0 Thereby P(F)=P(F, b)+P(F, c)=0. 15+0=0. 15 At node 3, value(E 3)=P(a)*E 4+P(b)*E 5+P(c)*E 6 = 0. 5*0 + 0. 25*620, 000 + 0. 25*2, 000 = 655, 000 Back to main index exit back to module contents

module 5: Strategic Decisions The value @ node 6 (E 6) = value @ node 9 =2, 000 The value @ node 5 (E 5) = value @ node 8 =620, 000 The value @ node 4 (E 4) = 0 Thereby P(F)=P(F, b)+P(F, c)=0. 15+0=0. 15 At node 3, value(E 3)=P(a)*E 4+P(b)*E 5+P(c)*E 6 = 0. 5*0 + 0. 25*620, 000 + 0. 25*2, 000 = 655, 000 Back to main index exit back to module contents

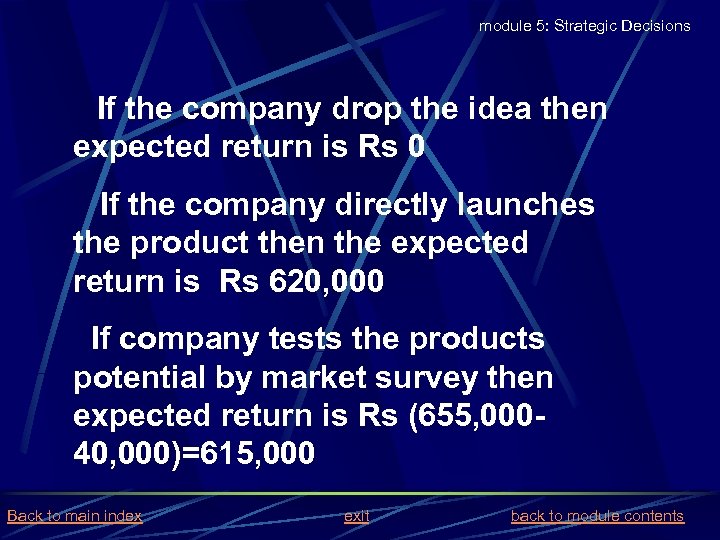

module 5: Strategic Decisions If the company drop the idea then expected return is Rs 0 If the company directly launches the product then the expected return is Rs 620, 000 If company tests the products potential by market survey then expected return is Rs (655, 00040, 000)=615, 000 Back to main index exit back to module contents

module 5: Strategic Decisions If the company drop the idea then expected return is Rs 0 If the company directly launches the product then the expected return is Rs 620, 000 If company tests the products potential by market survey then expected return is Rs (655, 00040, 000)=615, 000 Back to main index exit back to module contents

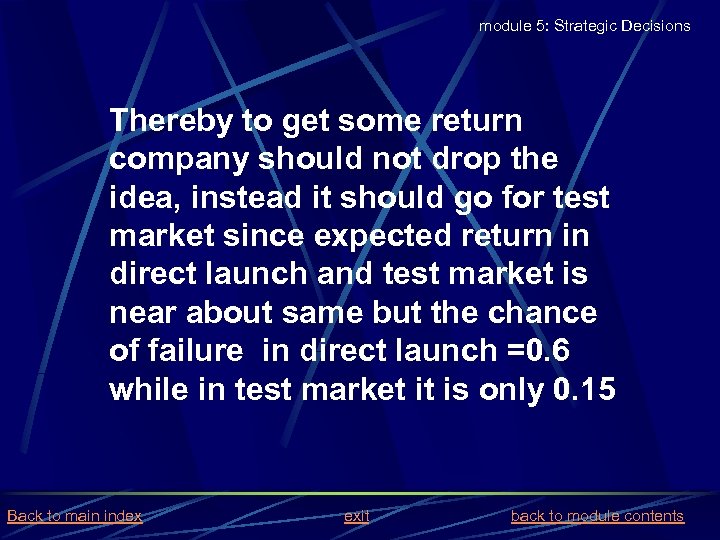

module 5: Strategic Decisions Thereby to get some return company should not drop the idea, instead it should go for test market since expected return in direct launch and test market is near about same but the chance of failure in direct launch =0. 6 while in test market it is only 0. 15 Back to main index exit back to module contents

module 5: Strategic Decisions Thereby to get some return company should not drop the idea, instead it should go for test market since expected return in direct launch and test market is near about same but the chance of failure in direct launch =0. 6 while in test market it is only 0. 15 Back to main index exit back to module contents

module 5: Strategic Decisions ENUMERATION OF ALL STRATEGIES The various possible strategies can be (1) Drop or Status quo. (2) Direct Launch (3) Test Market Back to main index exit back to module contents

module 5: Strategic Decisions ENUMERATION OF ALL STRATEGIES The various possible strategies can be (1) Drop or Status quo. (2) Direct Launch (3) Test Market Back to main index exit back to module contents

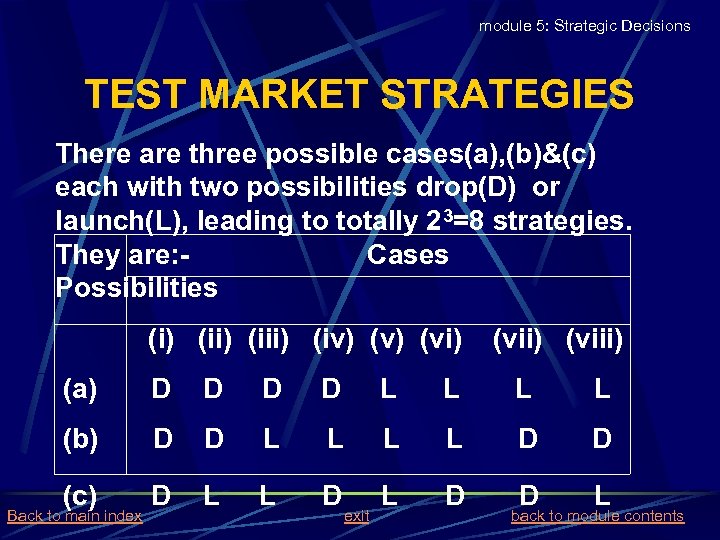

module 5: Strategic Decisions TEST MARKET STRATEGIES There are three possible cases(a), (b)&(c) each with two possibilities drop(D) or launch(L), leading to totally 23=8 strategies. They are: Cases Possibilities (i) (iii) (iv) (vi) (viii) (a) D D L L (b) D D L L D D (c) D L L D D L Back to main index exit back to module contents

module 5: Strategic Decisions TEST MARKET STRATEGIES There are three possible cases(a), (b)&(c) each with two possibilities drop(D) or launch(L), leading to totally 23=8 strategies. They are: Cases Possibilities (i) (iii) (iv) (vi) (viii) (a) D D L L (b) D D L L D D (c) D L L D D L Back to main index exit back to module contents

module 5: Strategic Decisions RISK EVALUATION STRATEGIES (1) DROP OR STATUS QUO E(return) = E(1) = 0 P(S)= 0 P(F)= 0 P(0)= 1 (2) DIRECT LAUNCH E(2) =[0. 4*2+0. 6*(-0. 3)]x 106 = Rs 0. 62 x 106 P(S)= 0. 4 Back to main index P(F)= 0. 6 exit P(0)= 0 back to module contents

module 5: Strategic Decisions RISK EVALUATION STRATEGIES (1) DROP OR STATUS QUO E(return) = E(1) = 0 P(S)= 0 P(F)= 0 P(0)= 1 (2) DIRECT LAUNCH E(2) =[0. 4*2+0. 6*(-0. 3)]x 106 = Rs 0. 62 x 106 P(S)= 0. 4 Back to main index P(F)= 0. 6 exit P(0)= 0 back to module contents

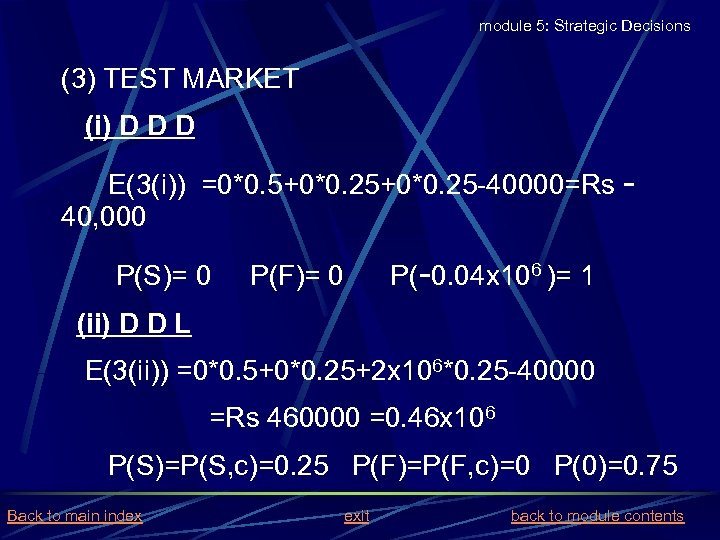

module 5: Strategic Decisions (3) TEST MARKET (i) D D D E(3(i)) =0*0. 5+0*0. 25 -40000=Rs 40, 000 P(S)= 0 P(-0. 04 x 106 )= 1 P(F)= 0 (ii) D D L E(3(ii)) =0*0. 5+0*0. 25+2 x 106*0. 25 -40000 =Rs 460000 =0. 46 x 106 P(S)=P(S, c)=0. 25 P(F)=P(F, c)=0 P(0)=0. 75 Back to main index exit back to module contents

module 5: Strategic Decisions (3) TEST MARKET (i) D D D E(3(i)) =0*0. 5+0*0. 25 -40000=Rs 40, 000 P(S)= 0 P(-0. 04 x 106 )= 1 P(F)= 0 (ii) D D L E(3(ii)) =0*0. 5+0*0. 25+2 x 106*0. 25 -40000 =Rs 460000 =0. 46 x 106 P(S)=P(S, c)=0. 25 P(F)=P(F, c)=0 P(0)=0. 75 Back to main index exit back to module contents

module 5: Strategic Decisions (iii) D L L E(3(iii))=(0*0. 5+0. 62*0. 25+2*0. 25 -0. 04)x 106 =Rs 0. 615 x 106 P(S)= P(S, b)+P(S, c)=0. 10+0. 25=0. 35 P(F)= P(F, b)+P(F, c)=0. 15+0. 00=0. 15 P(0)= 1 -0. 35+0. 15= 0. 50 (iv) D L D E(3(iv)) =(0*0. 5+. 62 X 106*0. 25+0*0. 25)-40000 =0. 115 x 106 P(S)=P(S, b)=0. 10 P(F)=P(F, b)=0. 15 P(0)=0. 75 Back to main index exit back to module contents

module 5: Strategic Decisions (iii) D L L E(3(iii))=(0*0. 5+0. 62*0. 25+2*0. 25 -0. 04)x 106 =Rs 0. 615 x 106 P(S)= P(S, b)+P(S, c)=0. 10+0. 25=0. 35 P(F)= P(F, b)+P(F, c)=0. 15+0. 00=0. 15 P(0)= 1 -0. 35+0. 15= 0. 50 (iv) D L D E(3(iv)) =(0*0. 5+. 62 X 106*0. 25+0*0. 25)-40000 =0. 115 x 106 P(S)=P(S, b)=0. 10 P(F)=P(F, b)=0. 15 P(0)=0. 75 Back to main index exit back to module contents

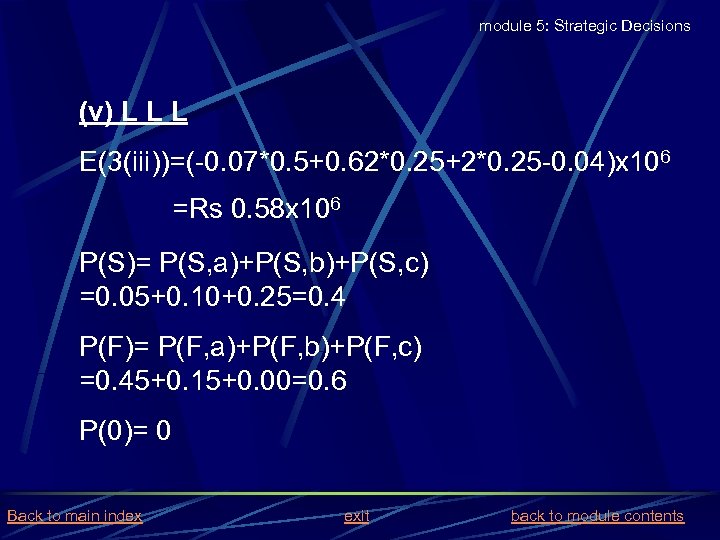

module 5: Strategic Decisions (v) L L L E(3(iii))=(-0. 07*0. 5+0. 62*0. 25+2*0. 25 -0. 04)x 106 =Rs 0. 58 x 106 P(S)= P(S, a)+P(S, b)+P(S, c) =0. 05+0. 10+0. 25=0. 4 P(F)= P(F, a)+P(F, b)+P(F, c) =0. 45+0. 15+0. 00=0. 6 P(0)= 0 Back to main index exit back to module contents

module 5: Strategic Decisions (v) L L L E(3(iii))=(-0. 07*0. 5+0. 62*0. 25+2*0. 25 -0. 04)x 106 =Rs 0. 58 x 106 P(S)= P(S, a)+P(S, b)+P(S, c) =0. 05+0. 10+0. 25=0. 4 P(F)= P(F, a)+P(F, b)+P(F, c) =0. 45+0. 15+0. 00=0. 6 P(0)= 0 Back to main index exit back to module contents

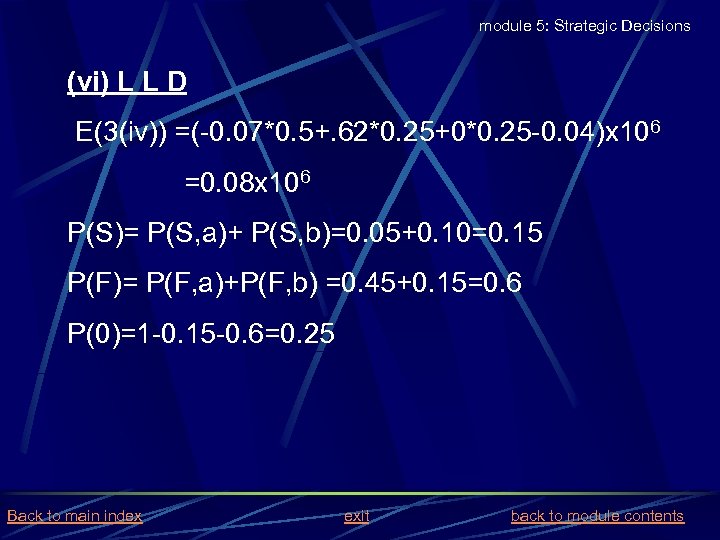

module 5: Strategic Decisions (vi) L L D E(3(iv)) =(-0. 07*0. 5+. 62*0. 25+0*0. 25 -0. 04)x 106 =0. 08 x 106 P(S)= P(S, a)+ P(S, b)=0. 05+0. 10=0. 15 P(F)= P(F, a)+P(F, b) =0. 45+0. 15=0. 6 P(0)=1 -0. 15 -0. 6=0. 25 Back to main index exit back to module contents

module 5: Strategic Decisions (vi) L L D E(3(iv)) =(-0. 07*0. 5+. 62*0. 25+0*0. 25 -0. 04)x 106 =0. 08 x 106 P(S)= P(S, a)+ P(S, b)=0. 05+0. 10=0. 15 P(F)= P(F, a)+P(F, b) =0. 45+0. 15=0. 6 P(0)=1 -0. 15 -0. 6=0. 25 Back to main index exit back to module contents

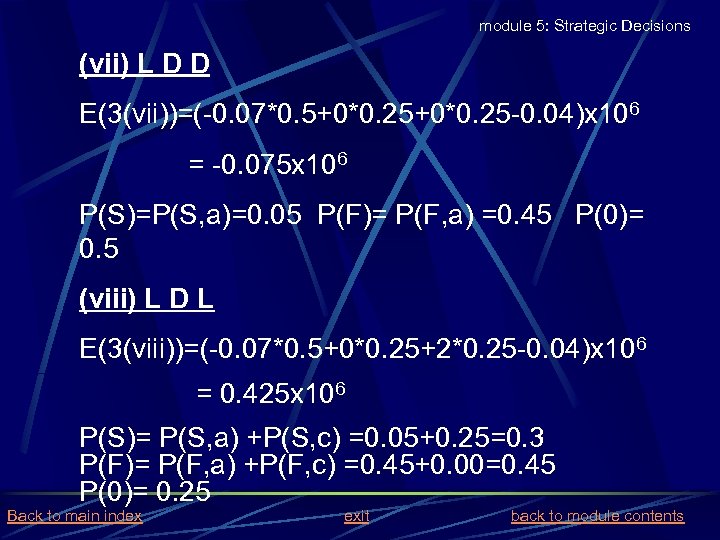

module 5: Strategic Decisions (vii) L D D E(3(vii))=(-0. 07*0. 5+0*0. 25 -0. 04)x 106 = -0. 075 x 106 P(S)=P(S, a)=0. 05 P(F)= P(F, a) =0. 45 P(0)= 0. 5 (viii) L D L E(3(viii))=(-0. 07*0. 5+0*0. 25+2*0. 25 -0. 04)x 106 = 0. 425 x 106 P(S)= P(S, a) +P(S, c) =0. 05+0. 25=0. 3 P(F)= P(F, a) +P(F, c) =0. 45+0. 00=0. 45 P(0)= 0. 25 Back to main index exit back to module contents

module 5: Strategic Decisions (vii) L D D E(3(vii))=(-0. 07*0. 5+0*0. 25 -0. 04)x 106 = -0. 075 x 106 P(S)=P(S, a)=0. 05 P(F)= P(F, a) =0. 45 P(0)= 0. 5 (viii) L D L E(3(viii))=(-0. 07*0. 5+0*0. 25+2*0. 25 -0. 04)x 106 = 0. 425 x 106 P(S)= P(S, a) +P(S, c) =0. 05+0. 25=0. 3 P(F)= P(F, a) +P(F, c) =0. 45+0. 00=0. 45 P(0)= 0. 25 Back to main index exit back to module contents

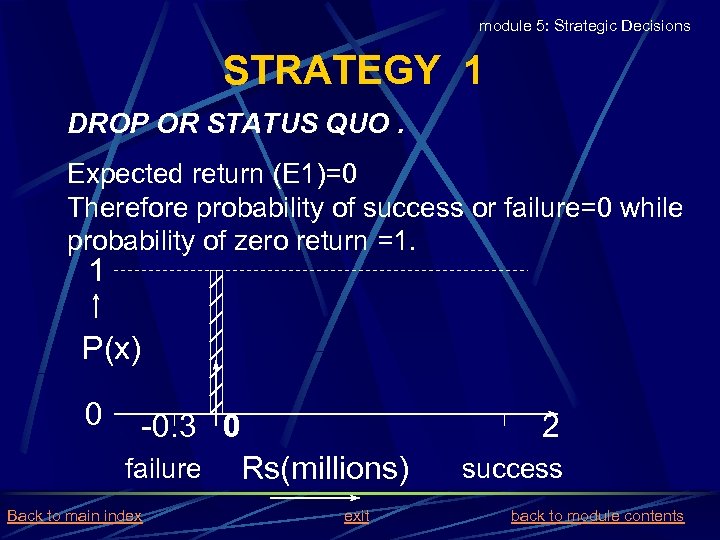

module 5: Strategic Decisions STRATEGY 1 DROP OR STATUS QUO. Expected return (E 1)=0 Therefore probability of success or failure=0 while probability of zero return =1. 1 P(x) 0 -0. 3 0 failure Back to main index 2 Rs(millions) exit success back to module contents

module 5: Strategic Decisions STRATEGY 1 DROP OR STATUS QUO. Expected return (E 1)=0 Therefore probability of success or failure=0 while probability of zero return =1. 1 P(x) 0 -0. 3 0 failure Back to main index 2 Rs(millions) exit success back to module contents

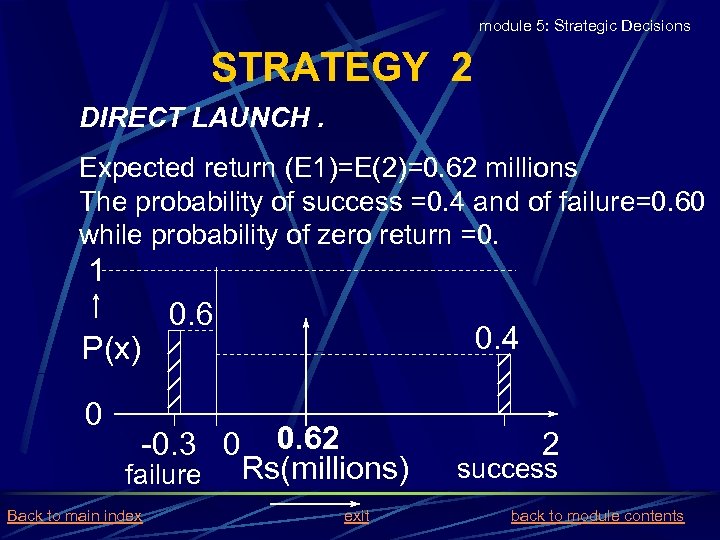

module 5: Strategic Decisions STRATEGY 2 DIRECT LAUNCH. Expected return (E 1)=E(2)=0. 62 millions The probability of success =0. 4 and of failure=0. 60 while probability of zero return =0. 1 0. 6 P(x) 0 -0. 3 0 failure Back to main index 0. 4 0. 62 Rs(millions) exit 2 success back to module contents

module 5: Strategic Decisions STRATEGY 2 DIRECT LAUNCH. Expected return (E 1)=E(2)=0. 62 millions The probability of success =0. 4 and of failure=0. 60 while probability of zero return =0. 1 0. 6 P(x) 0 -0. 3 0 failure Back to main index 0. 4 0. 62 Rs(millions) exit 2 success back to module contents

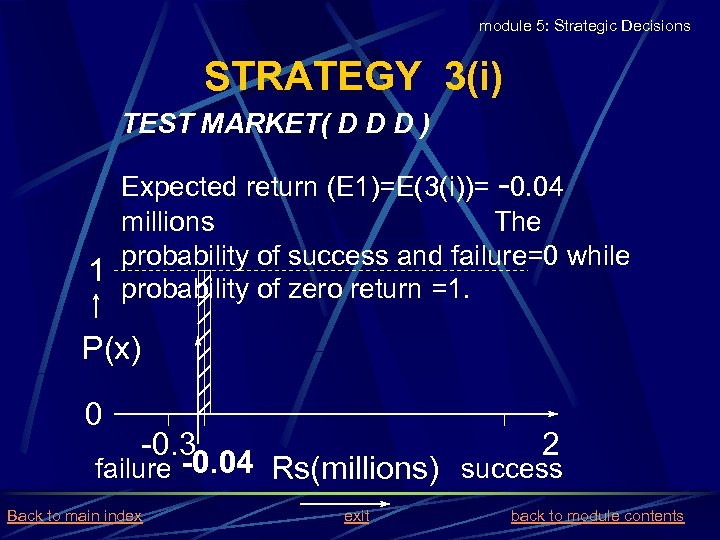

module 5: Strategic Decisions STRATEGY 3(i) TEST MARKET( D D D ) Expected return (E 1)=E(3(i))= -0. 04 millions The probability of success and failure=0 while 1 probability of zero return =1. P(x) 0 -0. 3 2 failure -0. 04 Rs(millions) success Back to main index exit back to module contents

module 5: Strategic Decisions STRATEGY 3(i) TEST MARKET( D D D ) Expected return (E 1)=E(3(i))= -0. 04 millions The probability of success and failure=0 while 1 probability of zero return =1. P(x) 0 -0. 3 2 failure -0. 04 Rs(millions) success Back to main index exit back to module contents

module 5: Strategic Decisions STRATEGY 3(ii) TEST MARKET( D D L ) Expected return E(3(ii)) = 0. 46 x 106 millions The probability of success =0. 25 and of failure=0 while probability of zero return 1 =0. 75 P(x) 0 0. 25 -0. 3 0 0. 46 failure Rs(millions) Back to main index exit 2 success back to module contents

module 5: Strategic Decisions STRATEGY 3(ii) TEST MARKET( D D L ) Expected return E(3(ii)) = 0. 46 x 106 millions The probability of success =0. 25 and of failure=0 while probability of zero return 1 =0. 75 P(x) 0 0. 25 -0. 3 0 0. 46 failure Rs(millions) Back to main index exit 2 success back to module contents

module 5: Strategic Decisions STRATEGY 3(iii) TEST MARKET( D L L ) Expected return E(3(iii)) = 0. 615 x 106 millions The probability of success =0. 35 and of failure=0. 15 while probability of zero 1 return=0. 5 P(x) 0 0. 50 0. 35 0. 15 -0. 3 0 0. 615 failure Rs(millions) Back to main index exit 2 success back to module contents

module 5: Strategic Decisions STRATEGY 3(iii) TEST MARKET( D L L ) Expected return E(3(iii)) = 0. 615 x 106 millions The probability of success =0. 35 and of failure=0. 15 while probability of zero 1 return=0. 5 P(x) 0 0. 50 0. 35 0. 15 -0. 3 0 0. 615 failure Rs(millions) Back to main index exit 2 success back to module contents

module 5: Strategic Decisions STRATEGY 3(iv) TEST MARKET( D L D ) Expected return E(3(iv)) = 0. 115 x 106 millions The probability of success=0. 1 and of failure=0. 15 while probability of zero return =0. 75 1 0. 75 P(x) 0 0. 15 0. 10 -0. 3 00. 115 failure Rs(millions) Back to main index exit 2 success back to module contents

module 5: Strategic Decisions STRATEGY 3(iv) TEST MARKET( D L D ) Expected return E(3(iv)) = 0. 115 x 106 millions The probability of success=0. 1 and of failure=0. 15 while probability of zero return =0. 75 1 0. 75 P(x) 0 0. 15 0. 10 -0. 3 00. 115 failure Rs(millions) Back to main index exit 2 success back to module contents

module 5: Strategic Decisions STRATEGY 3(v) TEST MARKET( L L L ) Expected return E(3(v)) = 0. 58 x 106 millions The probability of success=0. 4 and of failure=0. 6 while probability of zero return =0 1 0. 6 P(x) 0 -0. 3 0 failure Back to main index 0. 4 0. 58 Rs(millions) exit 2 success back to module contents

module 5: Strategic Decisions STRATEGY 3(v) TEST MARKET( L L L ) Expected return E(3(v)) = 0. 58 x 106 millions The probability of success=0. 4 and of failure=0. 6 while probability of zero return =0 1 0. 6 P(x) 0 -0. 3 0 failure Back to main index 0. 4 0. 58 Rs(millions) exit 2 success back to module contents

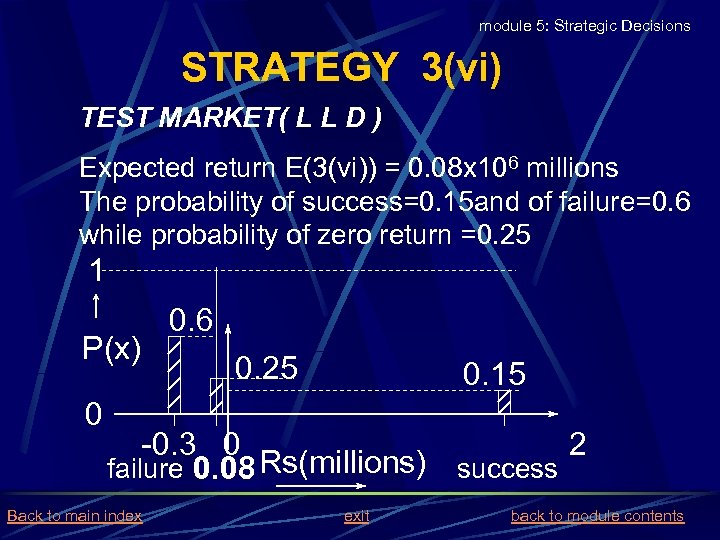

module 5: Strategic Decisions STRATEGY 3(vi) TEST MARKET( L L D ) Expected return E(3(vi)) = 0. 08 x 106 millions The probability of success=0. 15 and of failure=0. 6 while probability of zero return =0. 25 1 P(x) 0 0. 6 0. 25 0. 15 -0. 3 0 2 failure 0. 08 Rs(millions) success Back to main index exit back to module contents

module 5: Strategic Decisions STRATEGY 3(vi) TEST MARKET( L L D ) Expected return E(3(vi)) = 0. 08 x 106 millions The probability of success=0. 15 and of failure=0. 6 while probability of zero return =0. 25 1 P(x) 0 0. 6 0. 25 0. 15 -0. 3 0 2 failure 0. 08 Rs(millions) success Back to main index exit back to module contents

module 5: Strategic Decisions STRATEGY 3(vii) TEST MARKET( L D D ) Expected return E(3(vii)) =-0. 075 x 106 millions The probability of success=0. 05 and of failure=0. 45 while probability of zero return =0. 5 1 0. 45 0. 5 P(x) 0 0. 05 -0. 3 0 2 failure Rs(millions) success Back to main index 0. 075 exit back to module contents

module 5: Strategic Decisions STRATEGY 3(vii) TEST MARKET( L D D ) Expected return E(3(vii)) =-0. 075 x 106 millions The probability of success=0. 05 and of failure=0. 45 while probability of zero return =0. 5 1 0. 45 0. 5 P(x) 0 0. 05 -0. 3 0 2 failure Rs(millions) success Back to main index 0. 075 exit back to module contents

module 5: Strategic Decisions STRATEGY 3(viii) TEST MARKET( L D L ) Expected return E(3(viii)) =0. 425 x 106 millions The probability of success=0. 3 and of failure=0. 45 while probability of zero return =0. 25 1 0. 45 P(x) 0. 3 0 0. 25 0. 425 -0. 3 0 failure Rs(millions) Back to main index exit 2 success back to module contents

module 5: Strategic Decisions STRATEGY 3(viii) TEST MARKET( L D L ) Expected return E(3(viii)) =0. 425 x 106 millions The probability of success=0. 3 and of failure=0. 45 while probability of zero return =0. 25 1 0. 45 P(x) 0. 3 0 0. 25 0. 425 -0. 3 0 failure Rs(millions) Back to main index exit 2 success back to module contents

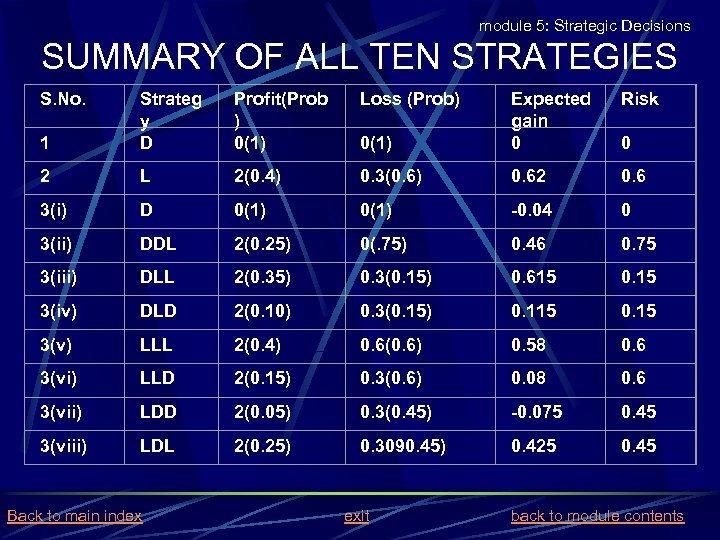

module 5: Strategic Decisions SUMMARY OF ALL TEN STRATEGIES S. No. Profit(Prob ) 0(1) Loss (Prob) 1 Strateg y D Risk 0(1) Expected gain 0 2 L 2(0. 4) 0. 3(0. 6) 0. 62 0. 6 3(i) D 0(1) -0. 04 0 3(ii) DDL 2(0. 25) 0(. 75) 0. 46 0. 75 3(iii) DLL 2(0. 35) 0. 3(0. 15) 0. 615 0. 15 3(iv) DLD 2(0. 10) 0. 3(0. 15) 0. 115 0. 15 3(v) LLL 2(0. 4) 0. 6(0. 6) 0. 58 0. 6 3(vi) LLD 2(0. 15) 0. 3(0. 6) 0. 08 0. 6 3(vii) LDD 2(0. 05) 0. 3(0. 45) -0. 075 0. 45 3(viii) LDL 2(0. 25) 0. 3090. 45) 0. 425 0. 45 Back to main index exit 0 back to module contents

module 5: Strategic Decisions SUMMARY OF ALL TEN STRATEGIES S. No. Profit(Prob ) 0(1) Loss (Prob) 1 Strateg y D Risk 0(1) Expected gain 0 2 L 2(0. 4) 0. 3(0. 6) 0. 62 0. 6 3(i) D 0(1) -0. 04 0 3(ii) DDL 2(0. 25) 0(. 75) 0. 46 0. 75 3(iii) DLL 2(0. 35) 0. 3(0. 15) 0. 615 0. 15 3(iv) DLD 2(0. 10) 0. 3(0. 15) 0. 115 0. 15 3(v) LLL 2(0. 4) 0. 6(0. 6) 0. 58 0. 6 3(vi) LLD 2(0. 15) 0. 3(0. 6) 0. 08 0. 6 3(vii) LDD 2(0. 05) 0. 3(0. 45) -0. 075 0. 45 3(viii) LDL 2(0. 25) 0. 3090. 45) 0. 425 0. 45 Back to main index exit 0 back to module contents