ed7802a5d0427ab83dd7ec40a51d86c4.ppt

- Количество слайдов: 37

Module 5: Managing your money – budgeting

Module objectives • Provide an opportunity to look at the learner outcomes in the ‘Manage money’ element of the numeracy component of the National Literacy and Numeracy Framework (LNF), to identify where budgeting exists in the curriculum in Wales. • Highlight resources and activities that can be used in Key Stages 2, 3 and 4 to develop learners’ numeracy skills in the context of managing their money by budgeting.

Learner aims This module introduces the process of budgeting. It works across key stages and some learners will: • appreciate the decisions that need to be made relating to ‘essential and non-essential purchases’ • identify the differences between a need (something you cannot live without) and a want (something you can live without) • identify how money enters and leaves their lives • understand the differences between income and expenditure • be able to explain why a budget needs to balance.

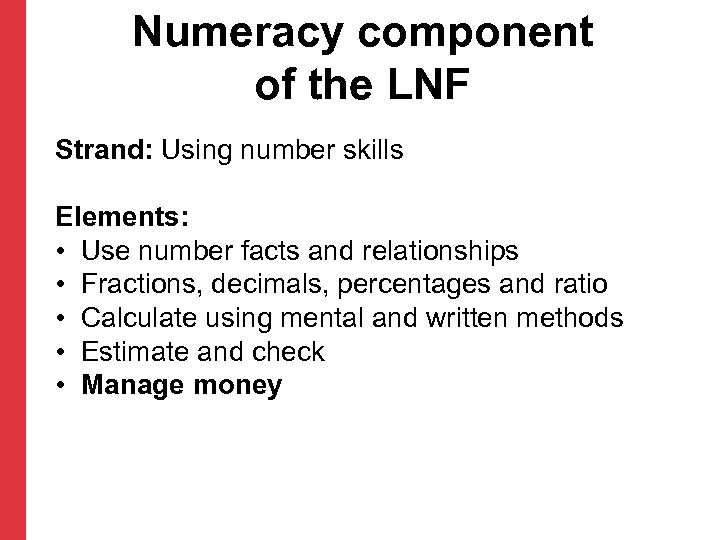

The National Literacy and Numeracy Framework (LNF) focuses on four strands of numeracy: • • Strand 1: Developing numerical reasoning Strand 2: Using number skills Strand 3: Using measuring skills Strand 4: Using data skills.

Numeracy component of the LNF Strand: Using number skills Elements: • Use number facts and relationships • Fractions, decimals, percentages and ratio • Calculate using mental and written methods • Estimate and check • Manage money

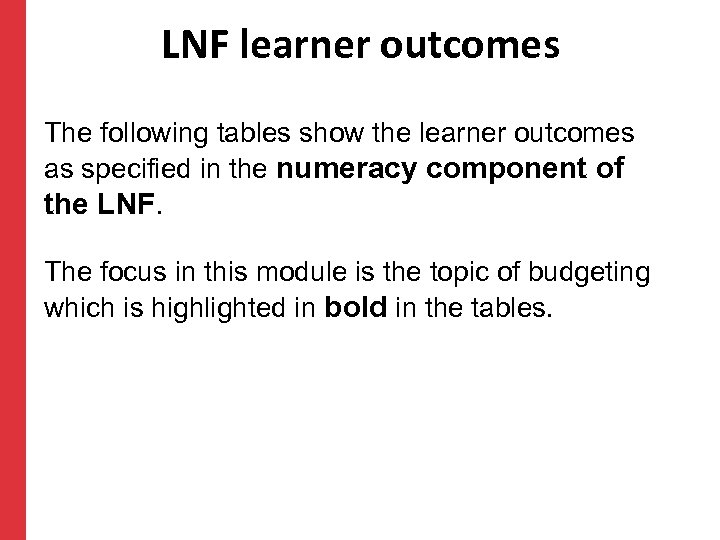

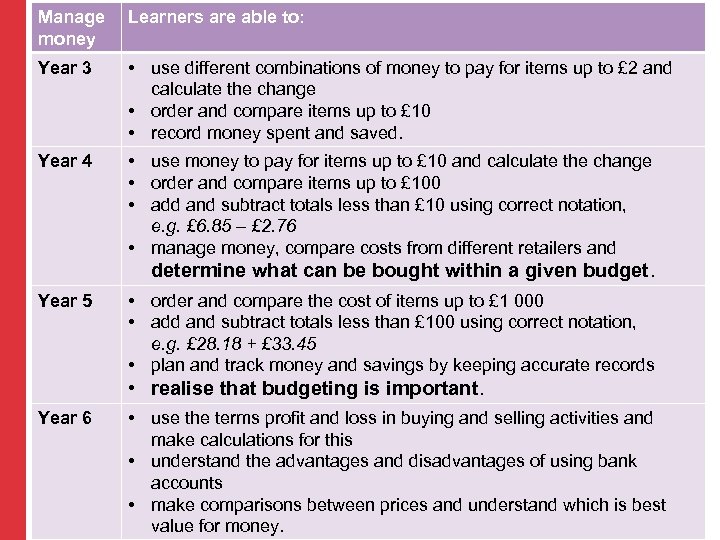

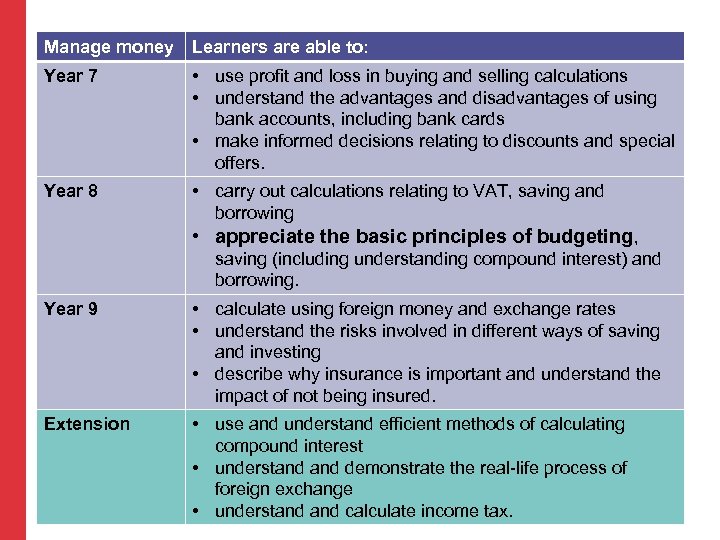

LNF learner outcomes The following tables show the learner outcomes as specified in the numeracy component of the LNF. The focus in this module is the topic of budgeting which is highlighted in bold in the tables.

Manage money Learners are able to: Year 3 • use different combinations of money to pay for items up to £ 2 and calculate the change • order and compare items up to £ 10 • record money spent and saved. Year 4 • use money to pay for items up to £ 10 and calculate the change • order and compare items up to £ 100 • add and subtract totals less than £ 10 using correct notation, e. g. £ 6. 85 – £ 2. 76 • manage money, compare costs from different retailers and determine what can be bought within a given budget. Year 5 • order and compare the cost of items up to £ 1 000 • add and subtract totals less than £ 100 using correct notation, e. g. £ 28. 18 + £ 33. 45 • plan and track money and savings by keeping accurate records • realise that budgeting is important. Year 6 • use the terms profit and loss in buying and selling activities and make calculations for this • understand the advantages and disadvantages of using bank accounts • make comparisons between prices and understand which is best value for money.

Manage money Learners are able to: Year 7 • use profit and loss in buying and selling calculations • understand the advantages and disadvantages of using bank accounts, including bank cards • make informed decisions relating to discounts and special offers. Year 8 • carry out calculations relating to VAT, saving and borrowing • appreciate the basic principles of budgeting, saving (including understanding compound interest) and borrowing. Year 9 • calculate using foreign money and exchange rates • understand the risks involved in different ways of saving and investing • describe why insurance is important and understand the impact of not being insured. Extension • use and understand efficient methods of calculating compound interest • understand demonstrate the real-life process of foreign exchange • understand calculate income tax.

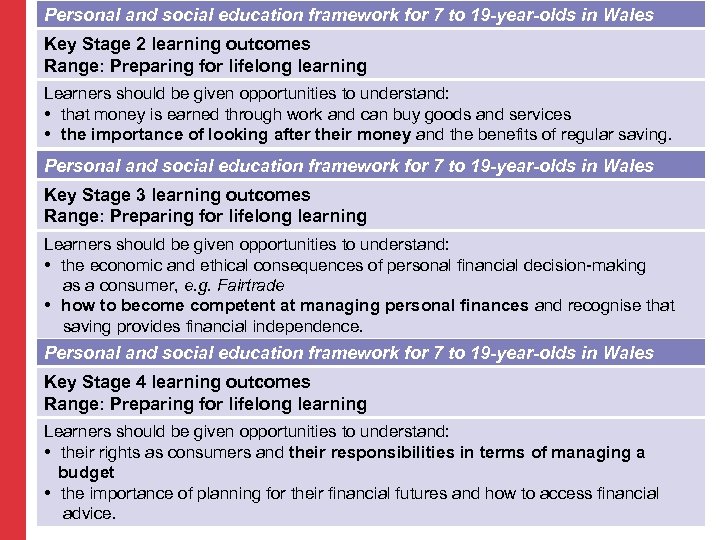

The Personal and social education framework for 7 to 19 -year-olds in Wales also highlights opportunities for learners to develop their budgeting knowledge. These are highlighted in bold on the next slide.

Personal and social education framework for 7 to 19 -year-olds in Wales Key Stage 2 learning outcomes Range: Preparing for lifelong learning Learners should be given opportunities to understand: that money is earned through work and can buy goods and services the importance of looking after their money and the benefits of regular saving. Personal and social education framework for 7 to 19 -year-olds in Wales Key Stage 3 learning outcomes Range: Preparing for lifelong learning Learners should be given opportunities to understand: the economic and ethical consequences of personal financial decision-making as a consumer, e. g. Fairtrade how to become competent at managing personal finances and recognise that saving provides financial independence. Personal and social education framework for 7 to 19 -year-olds in Wales Key Stage 4 learning outcomes Range: Preparing for lifelong learning Learners should be given opportunities to understand: their rights as consumers and their responsibilities in terms of managing a budget the importance of planning for their financial futures and how to access financial advice.

Can we afford it? Starter activity: How do we know if we can afford something?

What do these terms mean? needs wants See Manage money activity sheet: Needs and wants (Key Stage 2/3 activity). Using images and words, learners can decide which items they cannot live without (need) and those items that they simply want to have.

Need versus want Carry out the activity online by visiting https: //hwb. wales. gov. uk/cms/hwbcontent/Shared%20 Documents/vtc/200910/maths/financial-literacy/needs. Vs. Wants. swf

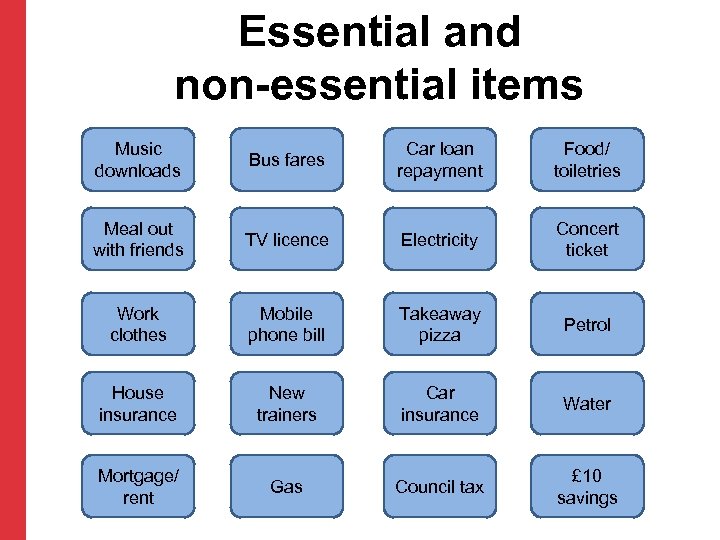

Essential and non-essential items Scenario: You have started working, have your own flat and recently had a loan to purchase a new car. Print off Resource 1: Essential and non-essential items, which is a Key Stage 3/4 activity. This activity asks learners to sort the cards into two groups – ‘essential’ and ‘non-essential’ monthly payments/purchases. Examples are shown on the next slide.

Essential and non-essential items Music downloads Bus fares Car loan repayment Food/ toiletries Meal out with friends TV licence Electricity Concert ticket Work clothes Mobile phone bill Takeaway pizza Petrol House insurance New trainers Car insurance Water Mortgage/ rent Gas Council tax £ 10 savings

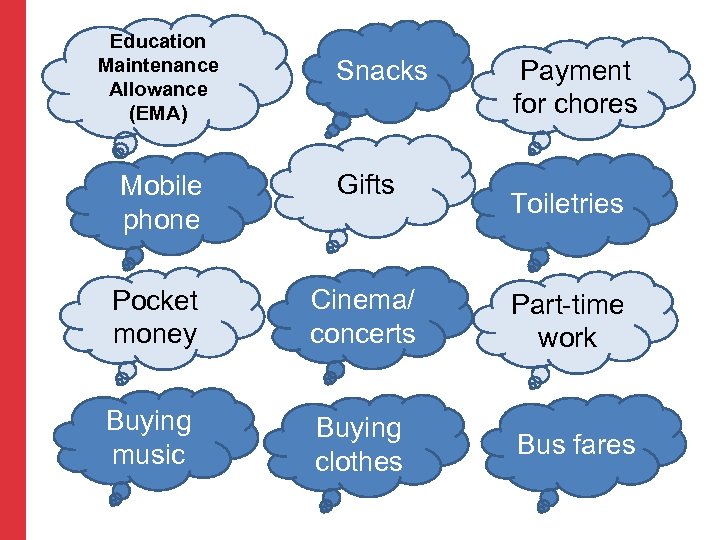

Discussion activity: How does money come in and out of your life on a daily, weekly or monthly basis?

Education Maintenance Allowance (EMA) Snacks Payment for chores Mobile phone Gifts Pocket money Cinema/ concerts Part-time work Buying music Buying clothes Bus fares Toiletries

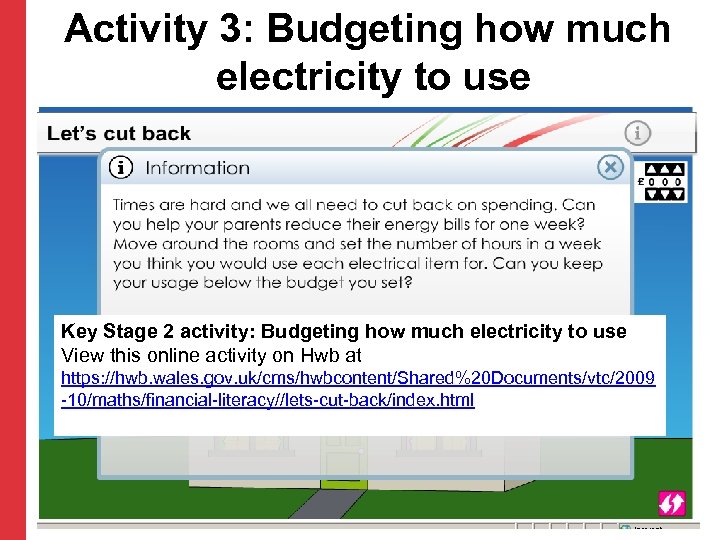

Income and expenditure Key Stage 2 activities: Activity 1: Can we afford it? (see Manage money activity sheet: Can we afford it? ) Activity 2: Money wise: a monthly budgeting card game (see Manage money activity sheet: Money wise monthly budgeting card game) Activity 3: Budgeting how much electricity to use – ‘Let’s cut back’. Visit the activity online at https: //hwb. wales. gov. uk/cms/hwbcontent/_layouts/NGFLSolution/ Material. Description. aspx? Learning. Material. Id=39431&lang=en Activities have been differentiated into key stages based on context. The key stages are for guidance only and teachers should select activities to match the ability of learners. Links/explanations for activities on the following slides.

Income and expenditure Activity 1: Can we afford it? See Manage money activity sheet: Can we afford it? Learners are given a storyboard to complete. The storyboard charts a family’s decision about whether they can afford to buy a bike as a birthday present. The storyboard raises discussion points.

Income and expenditure Activity 2: Money wise – monthly budgeting card game See Manage money activity sheet: Money wise – monthly budgeting card game. Learners cut out the cards that show ways they have earned and spent money, and turn them face down. They play in pairs, turn one card over at a time, and decide where to place it in their monthly budget table. Their challenge is to ensure they: • do not get into debt in any one month • break even at the end of the three months. This means that they may have to move their cards around, or decide on something they can’t afford to buy to ensure their spending does not exceed their earnings!

Activity 3: Budgeting how much electricity to use Key Stage 2 activity: Budgeting how much electricity to use View this online activity on Hwb at https: //hwb. wales. gov. uk/cms/hwbcontent/Shared%20 Documents/vtc/2009 -10/maths/financial-literacy//lets-cut-back/index. html

Income and expenditure Key Stage 3/4 activities: Activity 1: Can you help Carrie and Mo to budget? (see Spending Sense) Activity 2: ‘Managing your money’ scenarios (see Welsh Government Personal Finance Toolkit) Activity 3: Keeping a running balance for a household (see Resource 2 from this module) Activities have been differentiated into key stages based on context. The key stages are for guidance only and teachers should select activities to match the ability of learners. Links/explanations for activities are included on the following slides.

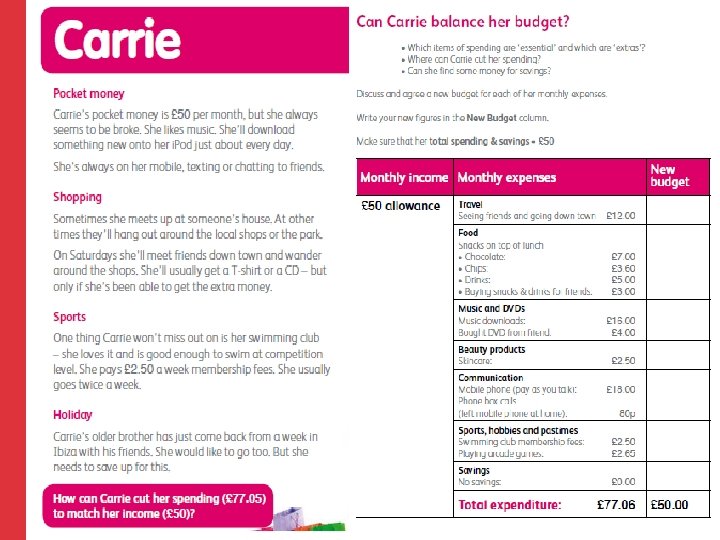

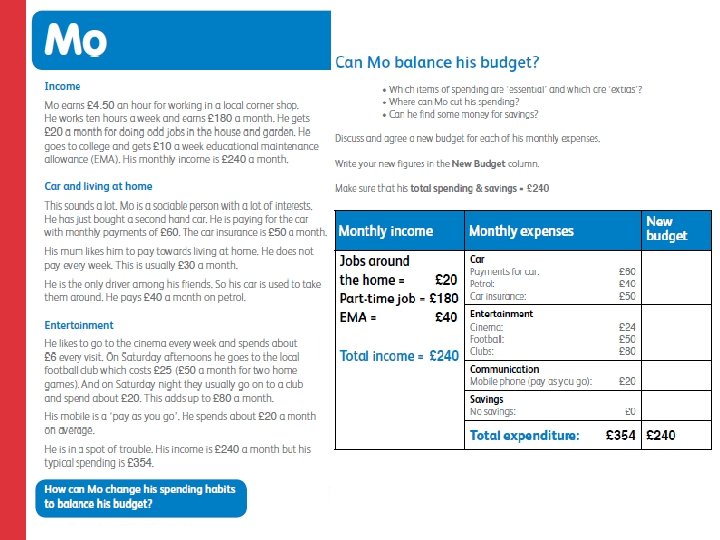

Activity 1 Can you help Carrie and Mo manage their budget? Resource: Spending Sense, Activity 5 – Carrie and Mo (pages 39– 47) Download the resource at https: //hwb. wales. gov. uk/cms/hwbcontent/_layouts/NGFLSolution/ Material. Description. aspx? Learning. Material. Id=44957&lang=en

Income and expenditure Key Stage 3/4 Activity 1: Can you help Carrie and Mo to budget? This activity raises the problem of overspending on a tight budget. The lifestyles of two young people, Carrie and Mo, are described. Each has a budget showing a typical monthly income and expenditure. The task for learners is to discuss their lifestyles and spending habits to see where they could cut down in order to balance their budget. The following slides show snapshots of this activity.

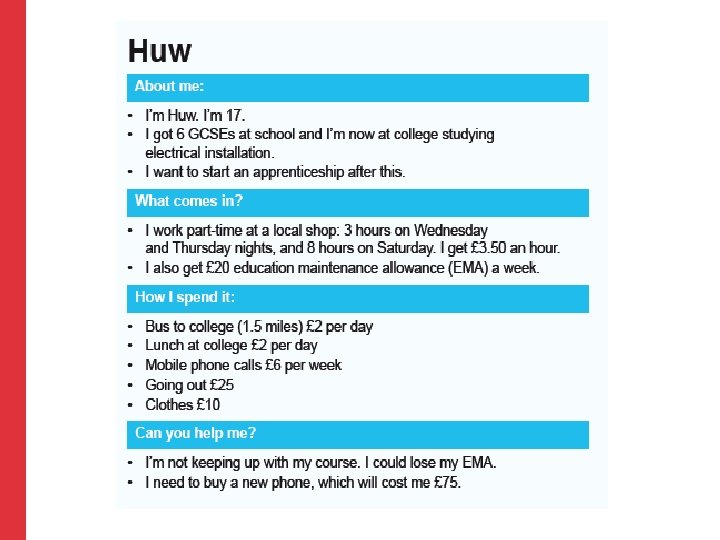

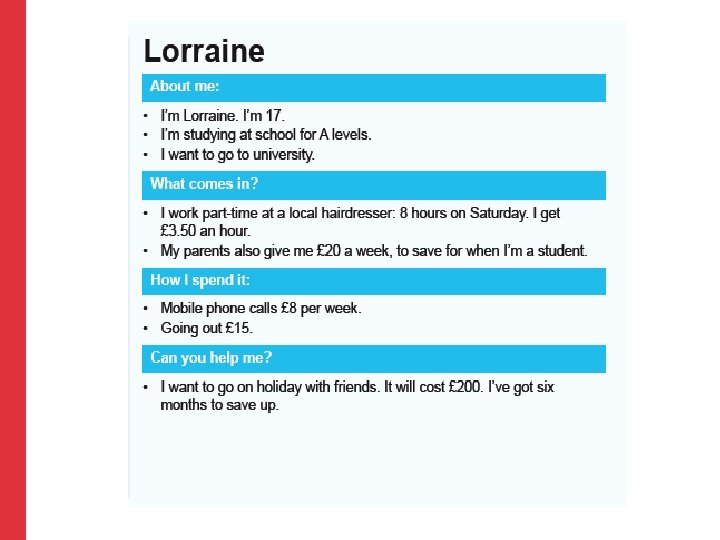

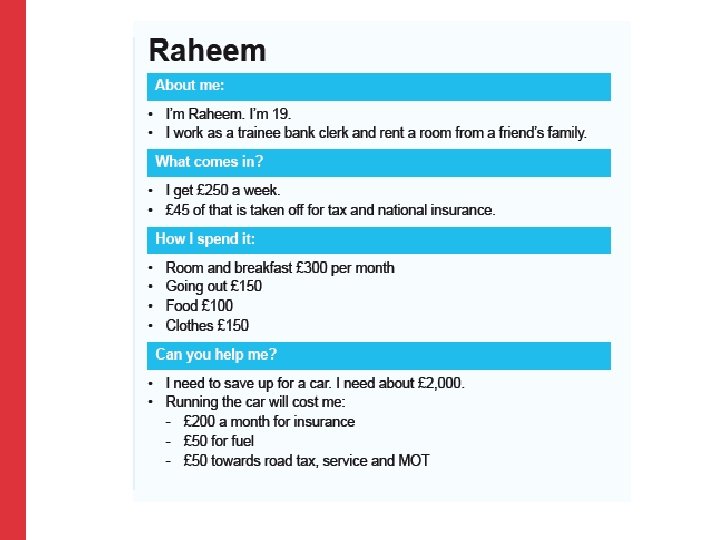

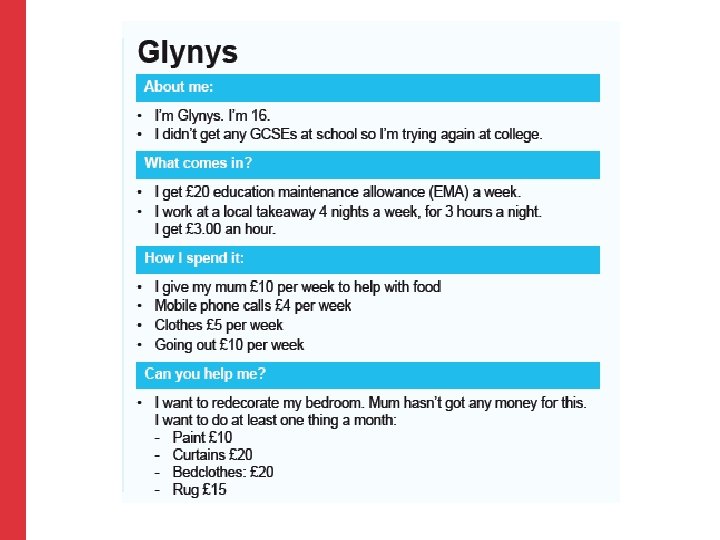

Activity 2 Managing your money scenarios Resource: Welsh Government Personal Finance Toolkit See Topic 3 ‘Managing your money’ (pages 29– 33) along with the accompanying resource sheets within Topic 3 entitled ‘Manage my cash’ (pages 31– 34). Download the resource at http: //wales. gov. uk/topics/childrenyoungpeople/publications/resource s/? skip=1&lang=en The activity (described on page 32) offers four scenarios describing young people’s financial situations. Learners suggest ways in which they could manage their money more successfully. Examples of the scenarios are given on the next slides

Activity 3 Keeping a running balance for a household Resource: Keeping a running balance (see Resource 2 within this module) This activity presents learners with a diary style account of the transactions that take place during one month, from the view point of a working adult with three children. Learners have to read the information and keep a running a balance in the form of a table by calculating the money paid in and paid out of a bank account.

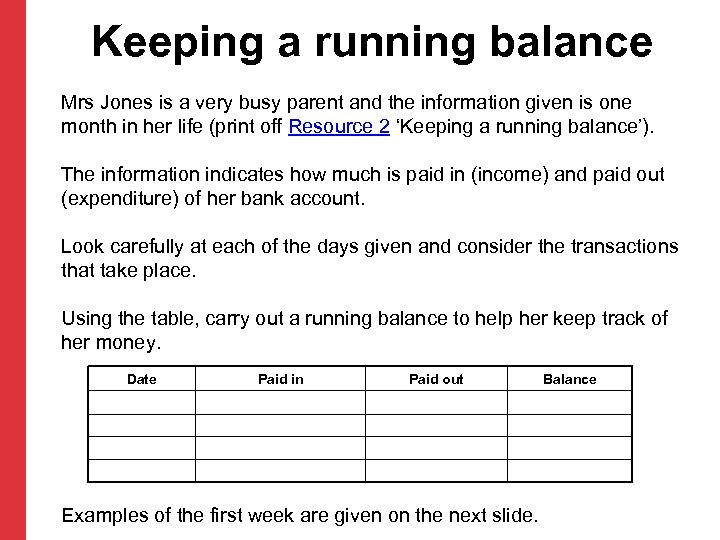

Keeping a running balance Mrs Jones is a very busy parent and the information given is one month in her life (print off Resource 2 ‘Keeping a running balance’). The information indicates how much is paid in (income) and paid out (expenditure) of her bank account. Look carefully at each of the days given and consider the transactions that take place. Using the table, carry out a running balance to help her keep track of her money. Date Paid in Paid out Examples of the first week are given on the next slide. Balance

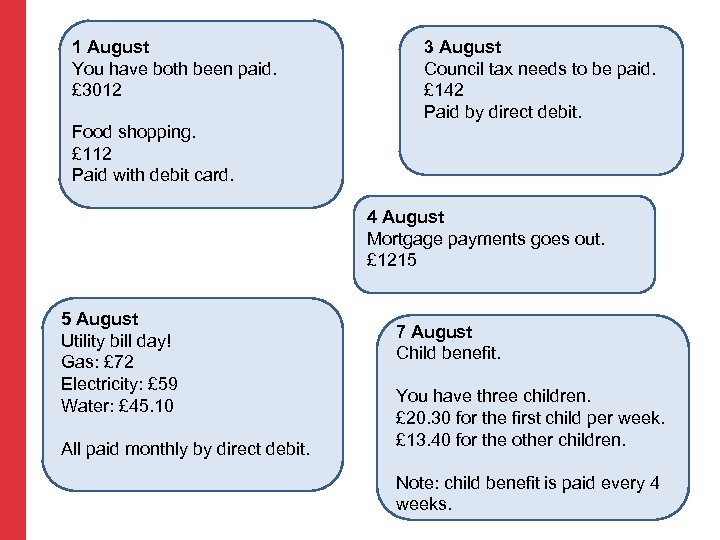

1 August You have both been paid. £ 3012 3 August Council tax needs to be paid. £ 142 Paid by direct debit. Food shopping. £ 112 Paid with debit card. 4 August Mortgage payments goes out. £ 1215 5 August Utility bill day! Gas: £ 72 Electricity: £ 59 Water: £ 45. 10 All paid monthly by direct debit. 7 August Child benefit. You have three children. £ 20. 30 for the first child per week. £ 13. 40 for the other children. Note: child benefit is paid every 4 weeks.

Adding up to a lifetime This is a free online resource which follows four characters and how they deal with financial situations. It is suitable for Key Stage 3 to Key Stage 5. The package has approximately 25 hours of learning activities which learners can complete online. It is presented as five modules: • Life as a student (aged 14 upwards) Each module has • Working life an audio tutorial which can be • Relationships listened to in English or Welsh. • New life • Active retirement. The modules offer the whole range of manage money topics including budgeting, visit www. addinguptoalifetime. org. uk

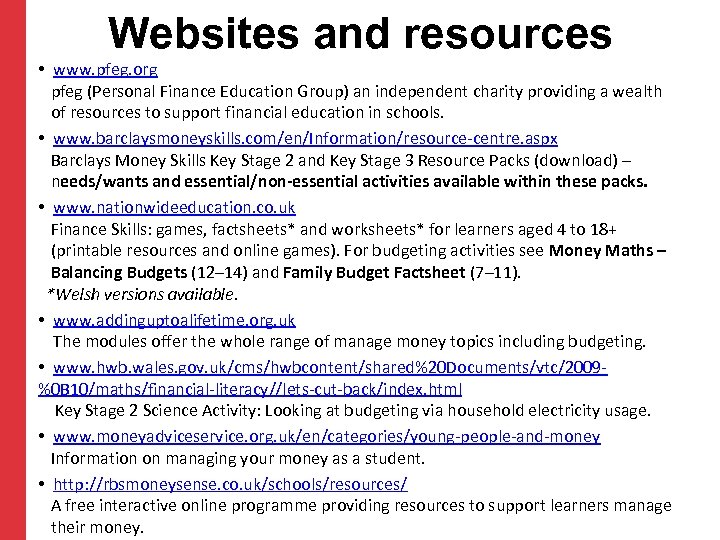

Websites and resources • www. pfeg. org pfeg (Personal Finance Education Group) an independent charity providing a wealth of resources to support financial education in schools. • www. barclaysmoneyskills. com/en/Information/resource-centre. aspx Barclays Money Skills Key Stage 2 and Key Stage 3 Resource Packs (download) – needs/wants and essential/non-essential activities available within these packs. • www. nationwideeducation. co. uk Finance Skills: games, factsheets* and worksheets* for learners aged 4 to 18+ (printable resources and online games). For budgeting activities see Money Maths – Balancing Budgets (12– 14) and Family Budget Factsheet (7– 11). *Welsh versions available. • www. addinguptoalifetime. org. uk The modules offer the whole range of manage money topics including budgeting. • www. hwb. wales. gov. uk/cms/hwbcontent/shared%20 Documents/vtc/2009%0 B 10/maths/financial-literacy//lets-cut-back/index. html Key Stage 2 Science Activity: Looking at budgeting via household electricity usage. • www. moneyadviceservice. org. uk/en/categories/young-people-and-money Information on managing your money as a student. • http: //rbsmoneysense. co. uk/schools/resources/ A free interactive online programme providing resources to support learners manage their money.

ed7802a5d0427ab83dd7ec40a51d86c4.ppt