096626b29cb2b47679e09067f9e14a01.ppt

- Количество слайдов: 47

Module 3. Recording Financial Transation Dr. Varadraj Bapat 1

Index Corporate Accounting Share Capital and its types Issue of share capital Debentures – issue and redemption and purchase of own debentures Dr. Varadraj Bapat 2

Index Corporate Accounting This file discusses various entries which are peculiar to companies. Dr. Varadraj Bapat 3

Corporate Accounting Share Capital § Total capital of the company is divided into a number of small indivisible units of a fixed amount and each such unit is called a share. § As the total capital of the company is divided into shares, the capital of the company is called ‘share capital’. Dr. Varadraj Bapat 4

§ The fixed value of a share, printed on the share certificate is called nominal/ par/ face value of a share. § A company can issue shares at a price different from the face value of a share; this is issue price of share. § Types of shares Shares issued by a company are divided into two categories: Dr. Varadraj Bapat 5

§ Preference Shares: The shares which are assured of preferential dividend at a fixed rate during the life of company and carry a preferential right over other shareholders to be paid first in case of winding up of company. § Equity Shares: Equity shares are those shares, which are not preference shares. It means that they do not enjoy Dr. Varadraj Bapat 6

any preferential rights in the matter of payment of dividend or repayment of capital. § Issue of share capital § The shares can be issued by company either for cash or for the consideration other than cash. § A public company issues a prospectus inviting general public to subscribe for its shares. On the basis of prospectus, application Dr. Varadraj Bapat 7

are deposited in a scheduled bank by the interested parties along with the amount payable at the time of application in cash which is called as application money. § Company reserves the right to reject or accept an application fully or partially. Successful applicants become shareholders of the company and are required to pay the second installment which is known as allotment money. Dr. Varadraj Bapat 8

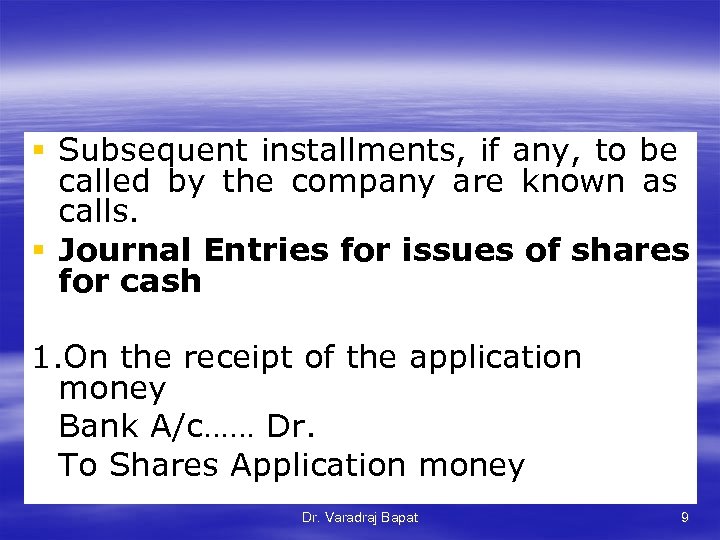

§ Subsequent installments, if any, to be called by the company are known as calls. § Journal Entries for issues of shares for cash 1. On the receipt of the application money Bank A/c…… Dr. To Shares Application money Dr. Varadraj Bapat 9

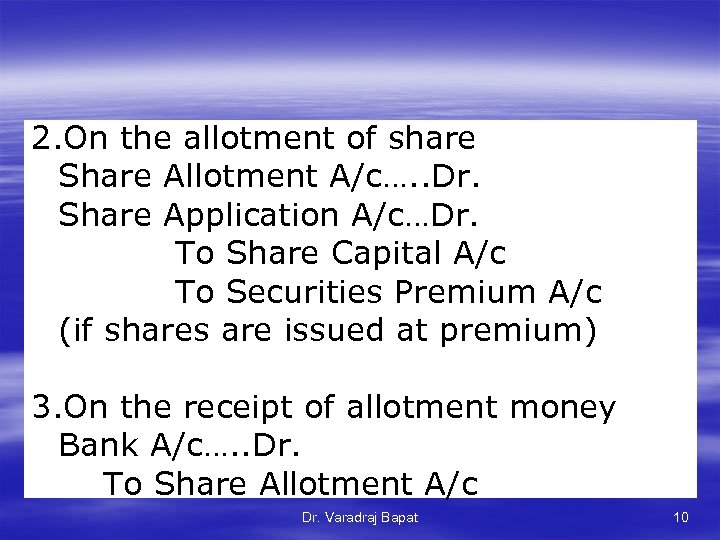

2. On the allotment of share Share Allotment A/c…. . Dr. Share Application A/c…Dr. To Share Capital A/c To Securities Premium A/c (if shares are issued at premium) 3. On the receipt of allotment money Bank A/c…. . Dr. To Share Allotment A/c Dr. Varadraj Bapat 10

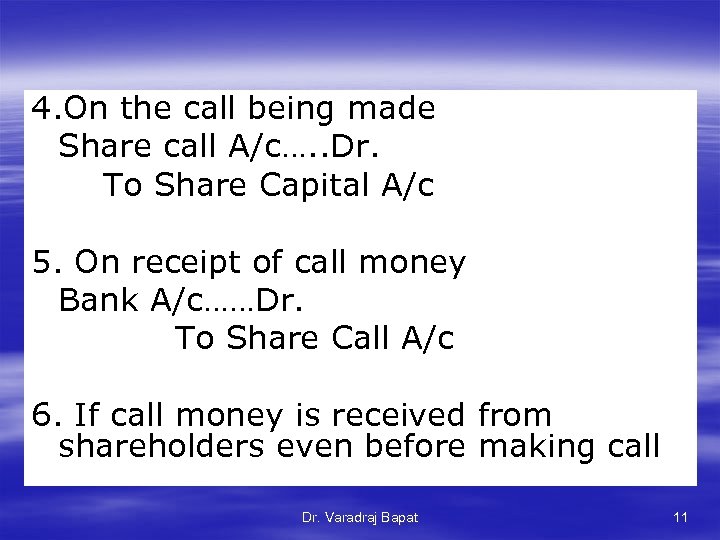

4. On the call being made Share call A/c…. . Dr. To Share Capital A/c 5. On receipt of call money Bank A/c……Dr. To Share Call A/c 6. If call money is received from shareholders even before making call Dr. Varadraj Bapat 11

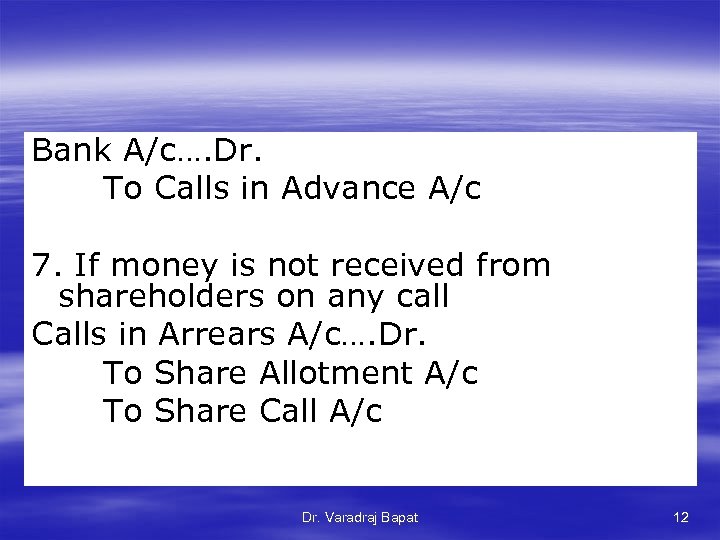

Bank A/c…. Dr. To Calls in Advance A/c 7. If money is not received from shareholders on any call Calls in Arrears A/c…. Dr. To Share Allotment A/c To Share Call A/c Dr. Varadraj Bapat 12

The Articles of Association of a company usually empower the director to charge interest at a stipulated rate on calls in arrears. According to Table A of Companies Act 1956 interest at the rate of 5% p. a. is to be charged on unpaid calls from the due date of the call up to the actual payment. Dr. Varadraj Bapat 13

JE for interest receivable on call in arrears Shareholders A/c…. Dr. To Interest on Calls in Arrears A/c For receipt of interest Interest on Calls in Arrears A/c…Dr. Shareholders A/c Dr. Varadraj Bapat 14

According to Table A of Companies Act 1956 interest at the rate of 6% p. a. is to be paid on calls in advance from the actual payment up to due date of the call. JE for Interest due Interest on Calls in Arrears A/c…Dr. To Shareholders A/c Dr. Varadraj Bapat 15

Payment of interest Shareholders A/c …Dr. Interest on Calls in Advance A/c Dr. Varadraj Bapat 16

Debentures Issuing debt instruments by offering the same for public subscription is one of the sources of financing the business activities. Debt financing does not only help in reducing the cost of the capital but also helps in designing appropriate capital structure of the company. Dr. Varadraj Bapat 17

Debenture is one of the most commonly used debt instrument issued by the company to raise funds for the business. A debenture/ bond is the a security issued by the company under its seal, acknowledging a debt and containing provisions as regards repayment of the principal and interest. Dr. Varadraj Bapat 18

Issue of debentures can be categorized into the following: 1. Debenture issued at par and redeemable at par or at a discount 2. Debenture issued at discount and redeemable at par or at a discount 3. Debenture issued at premium and redeemable at par or at a discount Dr. Varadraj Bapat 19

4. Debenture issued at par and redeemable at premium 5. Debenture issued at a discount and redeemable at premium Dr. Varadraj Bapat 20

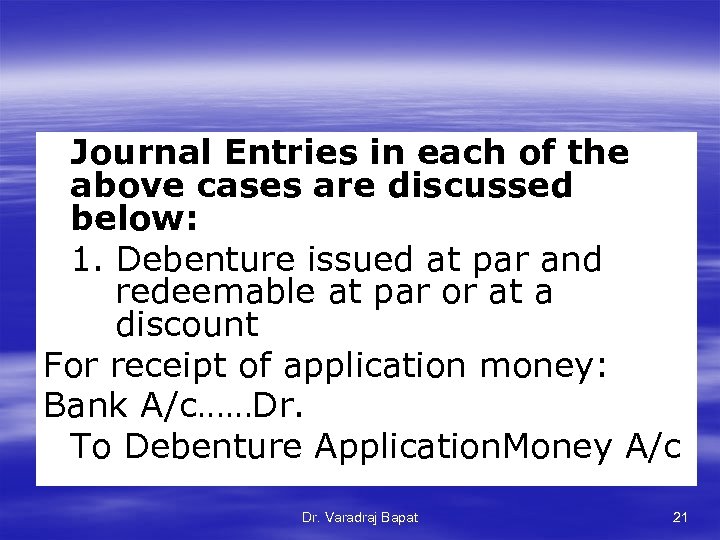

Journal Entries in each of the above cases are discussed below: 1. Debenture issued at par and redeemable at par or at a discount For receipt of application money: Bank A/c……Dr. To Debenture Application. Money A/c Dr. Varadraj Bapat 21

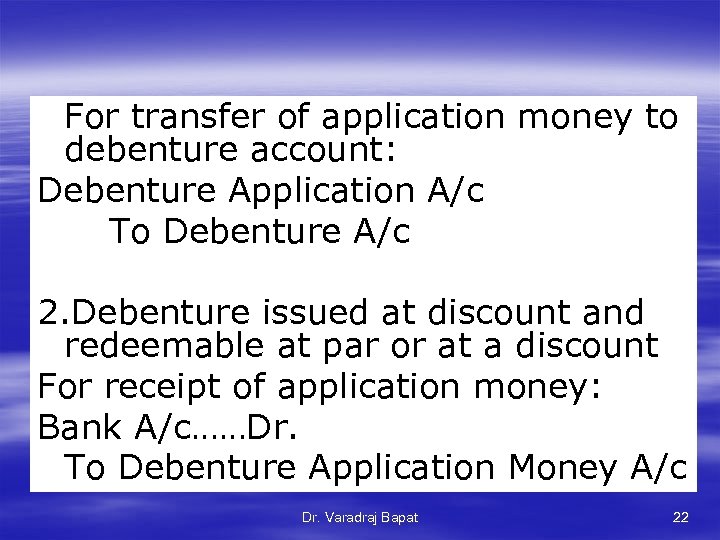

For transfer of application money to debenture account: Debenture Application A/c To Debenture A/c 2. Debenture issued at discount and redeemable at par or at a discount For receipt of application money: Bank A/c……Dr. To Debenture Application Money A/c Dr. Varadraj Bapat 22

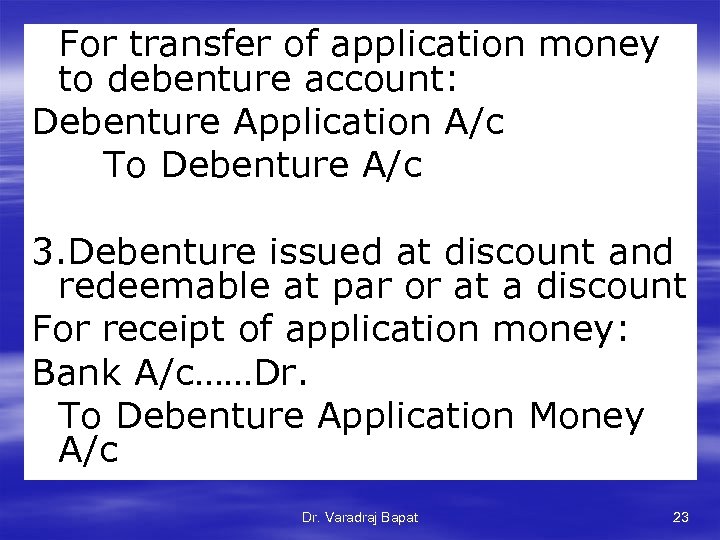

For transfer of application money to debenture account: Debenture Application A/c To Debenture A/c 3. Debenture issued at discount and redeemable at par or at a discount For receipt of application money: Bank A/c……Dr. To Debenture Application Money A/c Dr. Varadraj Bapat 23

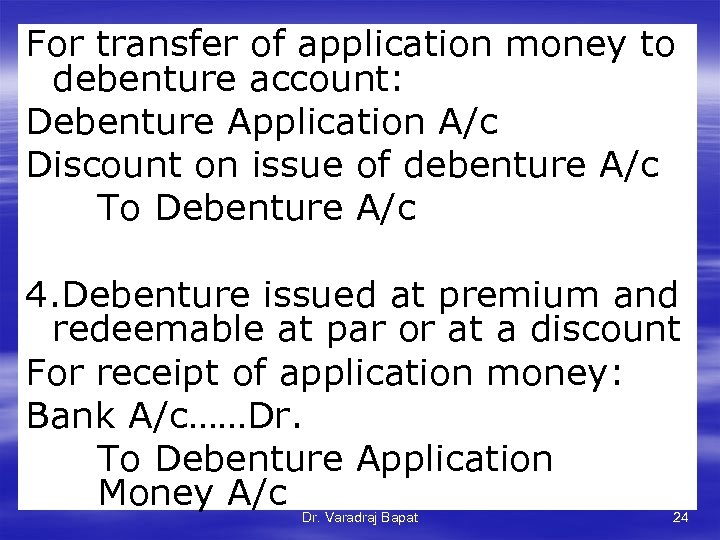

For transfer of application money to debenture account: Debenture Application A/c Discount on issue of debenture A/c To Debenture A/c 4. Debenture issued at premium and redeemable at par or at a discount For receipt of application money: Bank A/c……Dr. To Debenture Application Money A/c Dr. Varadraj Bapat 24

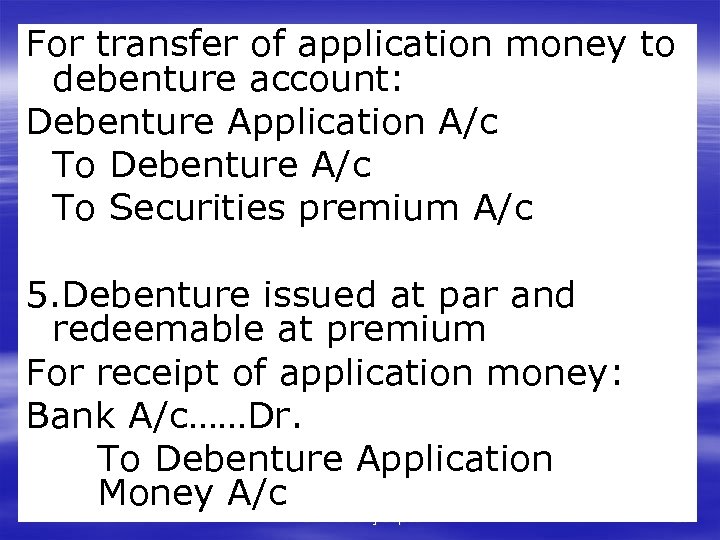

For transfer of application money to debenture account: Debenture Application A/c To Debenture A/c To Securities premium A/c 5. Debenture issued at par and redeemable at premium For receipt of application money: Bank A/c……Dr. To Debenture Application Money A/c Dr. Varadraj Bapat 25

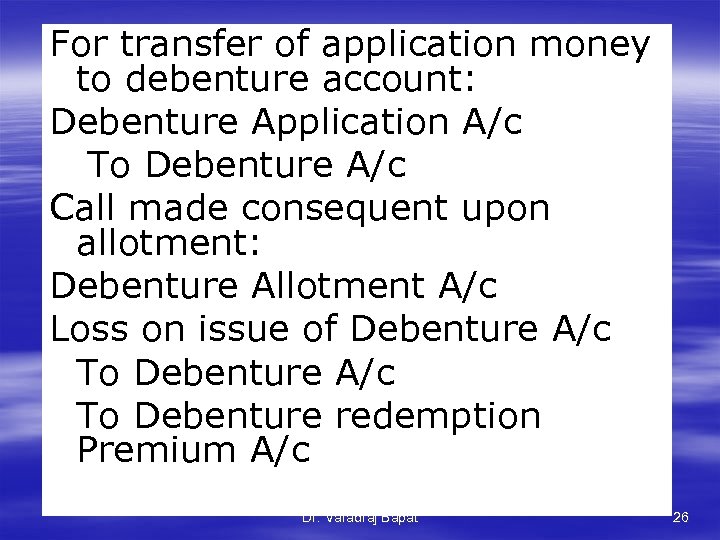

For transfer of application money to debenture account: Debenture Application A/c To Debenture A/c Call made consequent upon allotment: Debenture Allotment A/c Loss on issue of Debenture A/c To Debenture redemption Premium A/c Dr. Varadraj Bapat 26

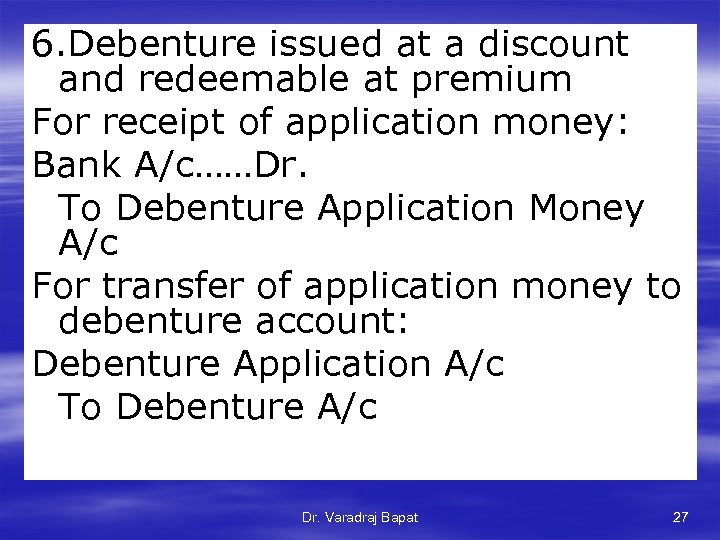

6. Debenture issued at a discount and redeemable at premium For receipt of application money: Bank A/c……Dr. To Debenture Application Money A/c For transfer of application money to debenture account: Debenture Application A/c To Debenture A/c Dr. Varadraj Bapat 27

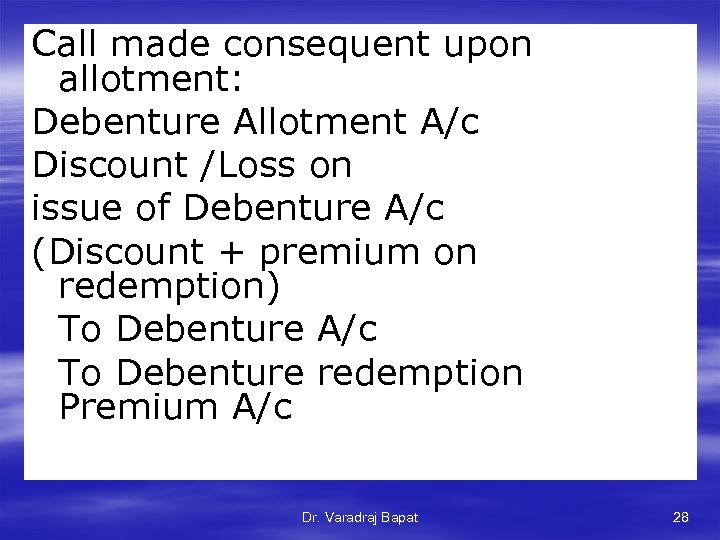

Call made consequent upon allotment: Debenture Allotment A/c Discount /Loss on issue of Debenture A/c (Discount + premium on redemption) To Debenture A/c To Debenture redemption Premium A/c Dr. Varadraj Bapat 28

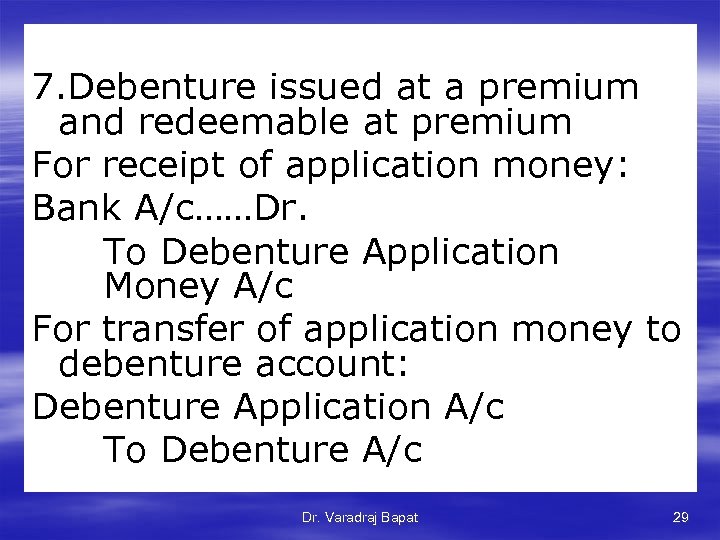

7. Debenture issued at a premium and redeemable at premium For receipt of application money: Bank A/c……Dr. To Debenture Application Money A/c For transfer of application money to debenture account: Debenture Application A/c To Debenture A/c Dr. Varadraj Bapat 29

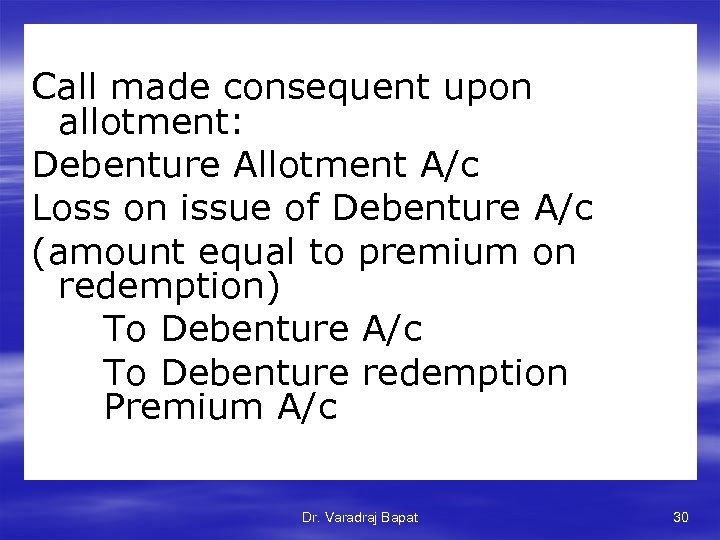

Call made consequent upon allotment: Debenture Allotment A/c Loss on issue of Debenture A/c (amount equal to premium on redemption) To Debenture A/c To Debenture redemption Premium A/c Dr. Varadraj Bapat 30

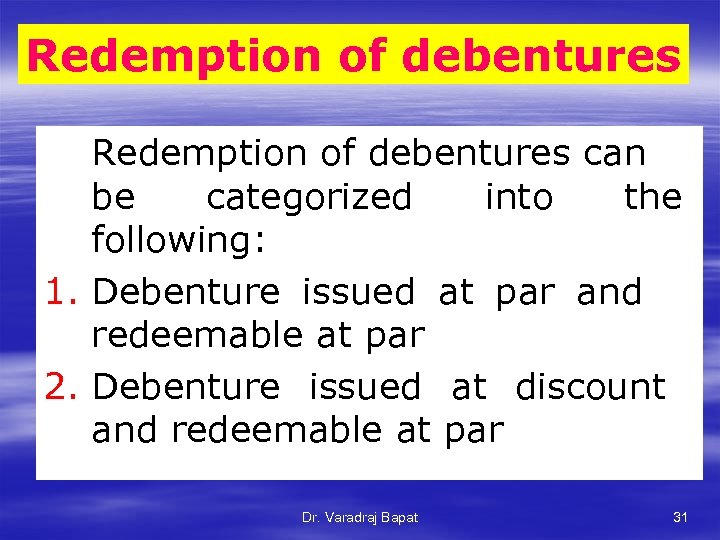

Redemption of debentures can be categorized into the following: 1. Debenture issued at par and redeemable at par 2. Debenture issued at discount and redeemable at par Dr. Varadraj Bapat 31

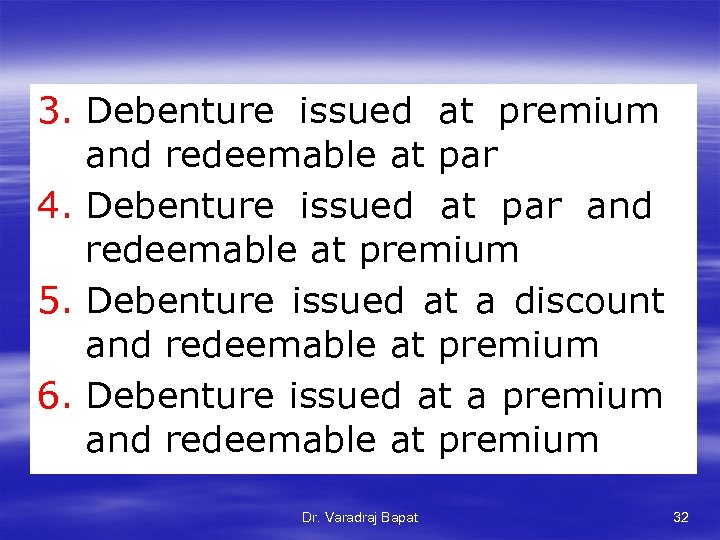

3. Debenture issued at premium and redeemable at par 4. Debenture issued at par and redeemable at premium 5. Debenture issued at a discount and redeemable at premium 6. Debenture issued at a premium and redeemable at premium Dr. Varadraj Bapat 32

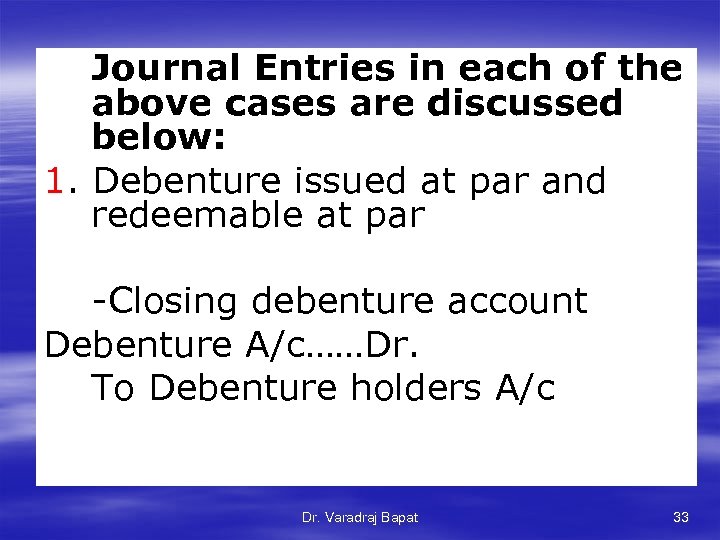

Journal Entries in each of the above cases are discussed below: 1. Debenture issued at par and redeemable at par -Closing debenture account Debenture A/c……Dr. To Debenture holders A/c Dr. Varadraj Bapat 33

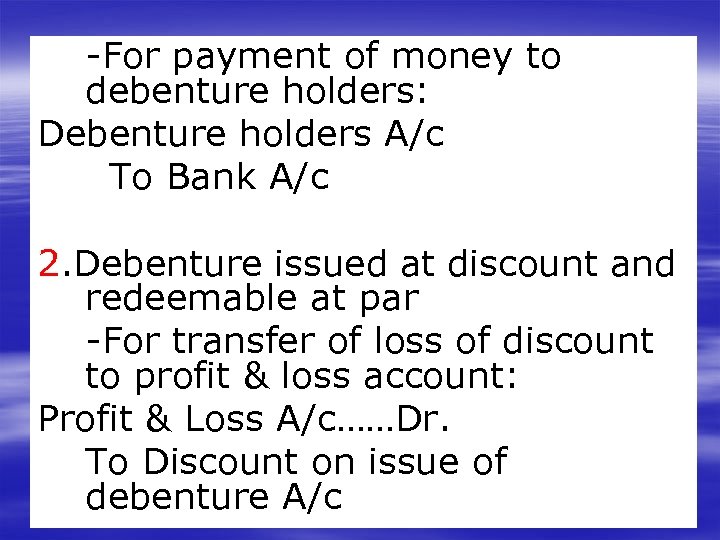

-For payment of money to debenture holders: Debenture holders A/c To Bank A/c 2. Debenture issued at discount and redeemable at par -For transfer of loss of discount to profit & loss account: Profit & Loss A/c……Dr. To Discount on issue of debenture A/c Dr. Varadraj Bapat 34

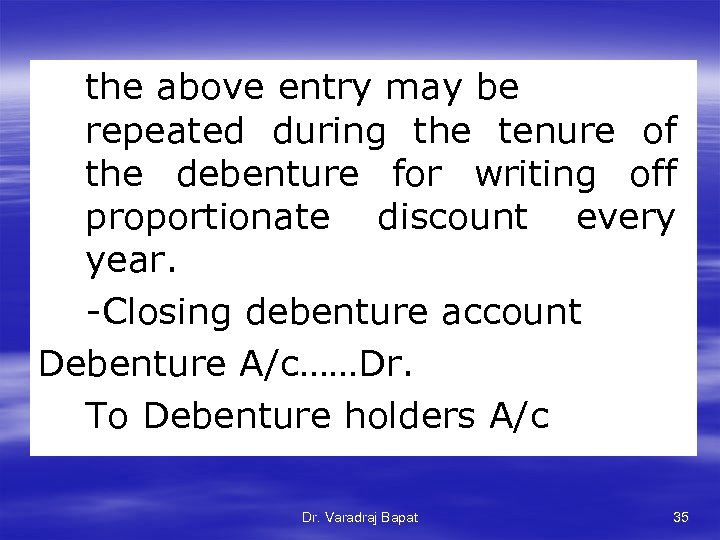

the above entry may be repeated during the tenure of the debenture for writing off proportionate discount every year. -Closing debenture account Debenture A/c……Dr. To Debenture holders A/c Dr. Varadraj Bapat 35

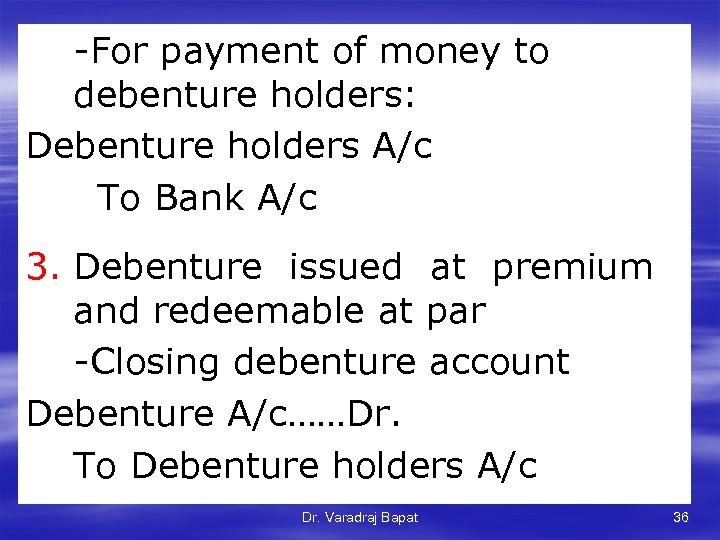

-For payment of money to debenture holders: Debenture holders A/c To Bank A/c 3. Debenture issued at premium and redeemable at par -Closing debenture account Debenture A/c……Dr. To Debenture holders A/c Dr. Varadraj Bapat 36

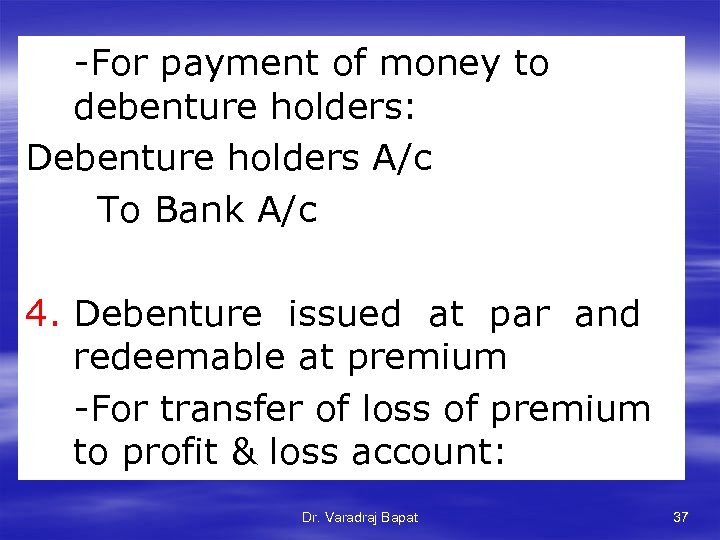

-For payment of money to debenture holders: Debenture holders A/c To Bank A/c 4. Debenture issued at par and redeemable at premium -For transfer of loss of premium to profit & loss account: Dr. Varadraj Bapat 37

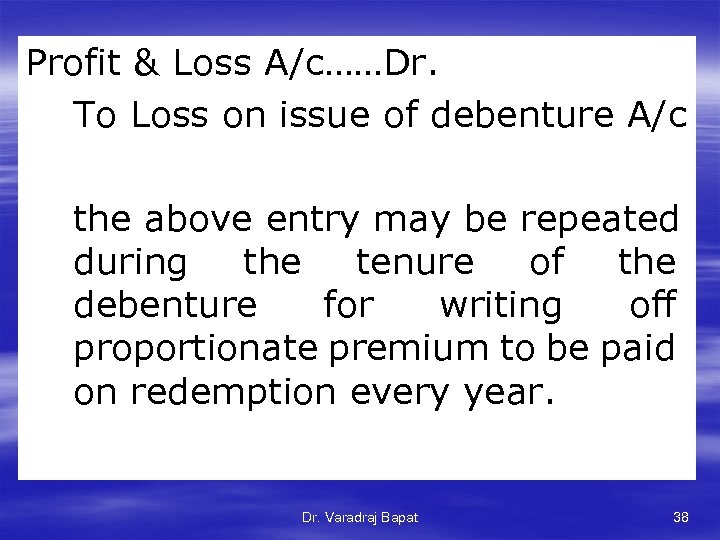

Profit & Loss A/c……Dr. To Loss on issue of debenture A/c the above entry may be repeated during the tenure of the debenture for writing off proportionate premium to be paid on redemption every year. Dr. Varadraj Bapat 38

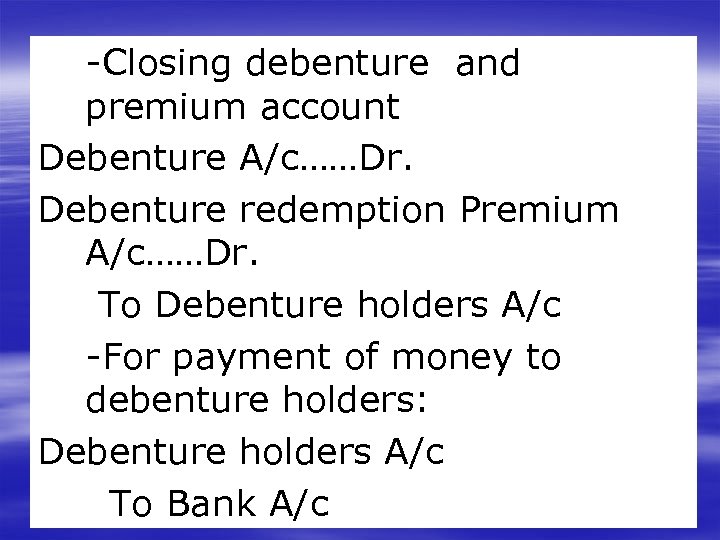

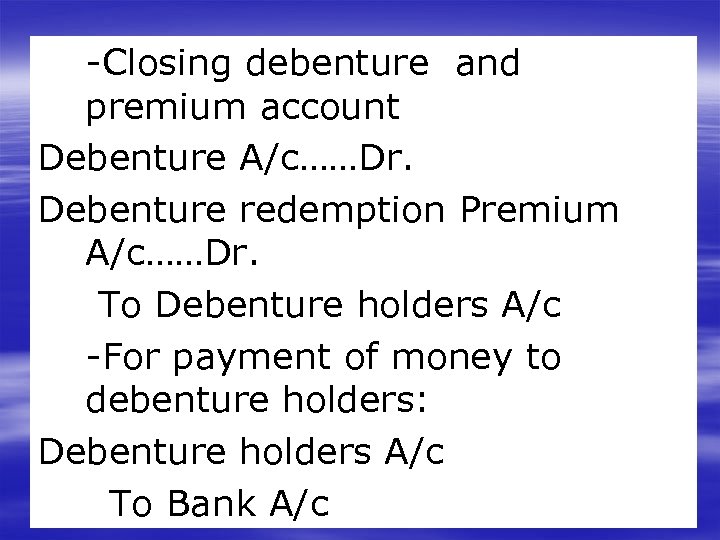

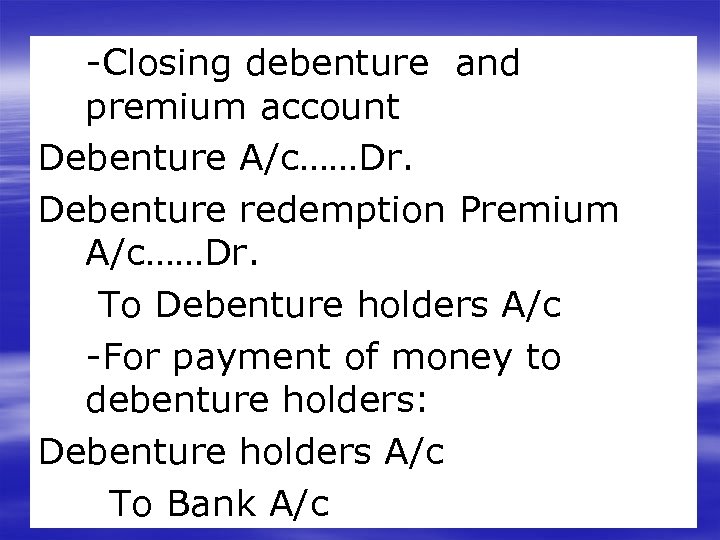

-Closing debenture and premium account Debenture A/c……Dr. Debenture redemption Premium A/c……Dr. To Debenture holders A/c -For payment of money to debenture holders: Debenture holders A/c To Bank A/c Dr. Varadraj Bapat 39

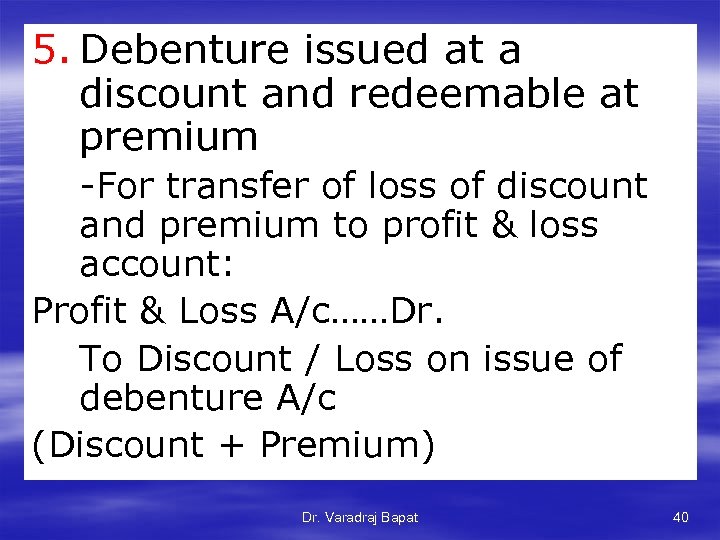

5. Debenture issued at a discount and redeemable at premium -For transfer of loss of discount and premium to profit & loss account: Profit & Loss A/c……Dr. To Discount / Loss on issue of debenture A/c (Discount + Premium) Dr. Varadraj Bapat 40

-Closing debenture and premium account Debenture A/c……Dr. Debenture redemption Premium A/c……Dr. To Debenture holders A/c -For payment of money to debenture holders: Debenture holders A/c To Bank A/c Dr. Varadraj Bapat 41

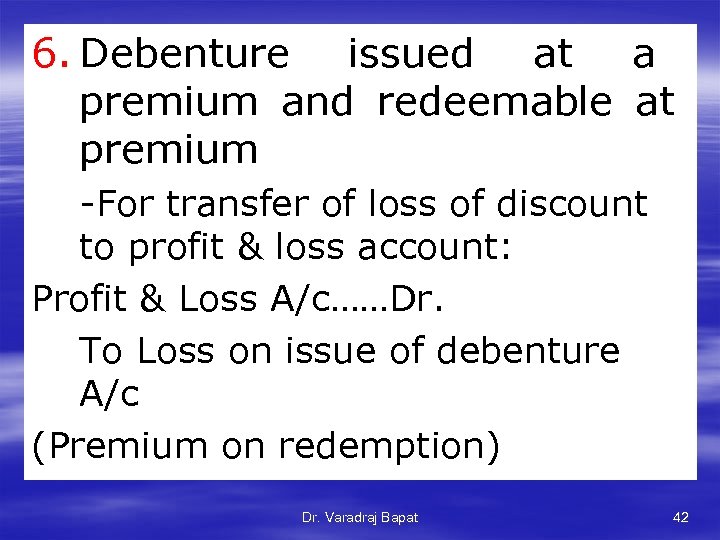

6. Debenture issued at a premium and redeemable at premium -For transfer of loss of discount to profit & loss account: Profit & Loss A/c……Dr. To Loss on issue of debenture A/c (Premium on redemption) Dr. Varadraj Bapat 42

-Closing debenture and premium account Debenture A/c……Dr. Debenture redemption Premium A/c……Dr. To Debenture holders A/c -For payment of money to debenture holders: Debenture holders A/c To Bank A/c Dr. Varadraj Bapat 43

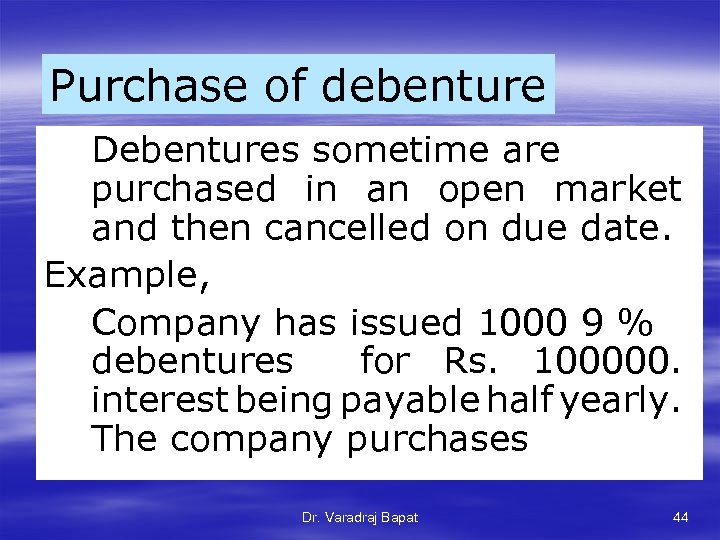

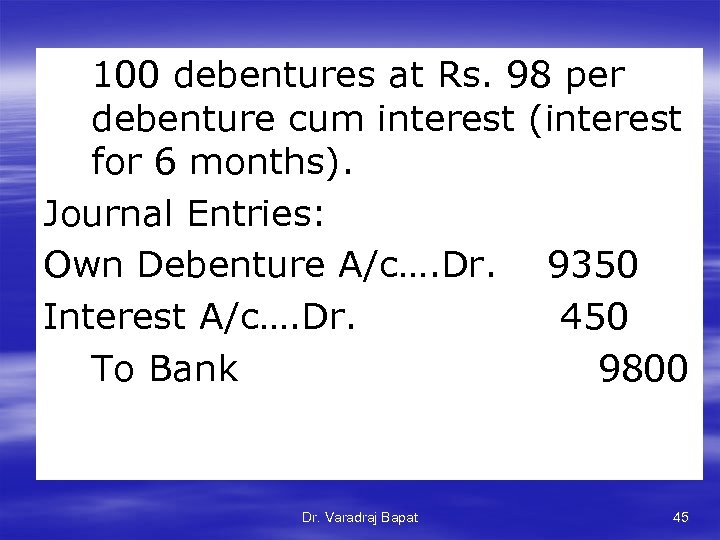

Purchase of debenture Debentures sometime are purchased in an open market and then cancelled on due date. Example, Company has issued 1000 9 % debentures for Rs. 100000. interest being payable half yearly. The company purchases Dr. Varadraj Bapat 44

100 debentures at Rs. 98 per debenture cum interest (interest for 6 months). Journal Entries: Own Debenture A/c…. Dr. 9350 Interest A/c…. Dr. 450 To Bank 9800 Dr. Varadraj Bapat 45

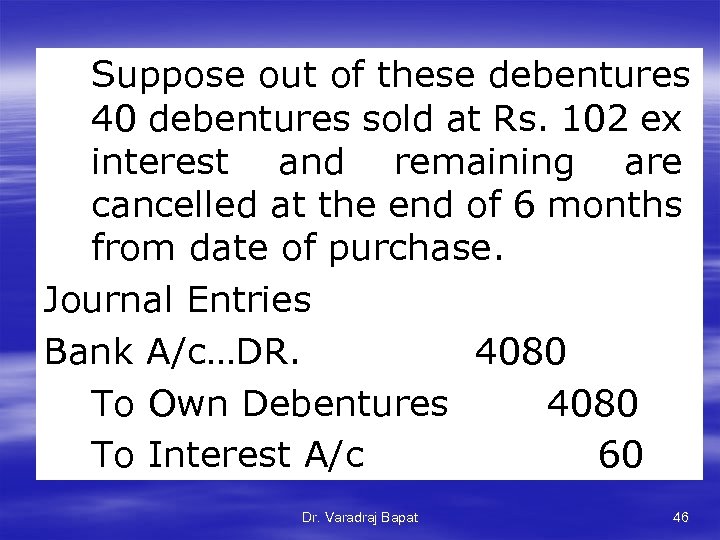

Suppose out of these debentures 40 debentures sold at Rs. 102 ex interest and remaining are cancelled at the end of 6 months from date of purchase. Journal Entries Bank A/c…DR. 4080 To Own Debentures 4080 To Interest A/c 60 Dr. Varadraj Bapat 46

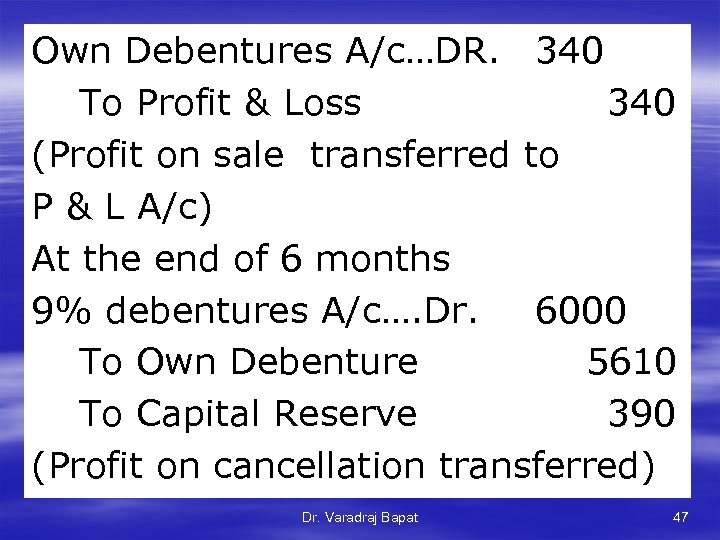

Own Debentures A/c…DR. 340 To Profit & Loss 340 (Profit on sale transferred to P & L A/c) At the end of 6 months 9% debentures A/c…. Dr. 6000 To Own Debenture 5610 To Capital Reserve 390 (Profit on cancellation transferred) Dr. Varadraj Bapat 47

096626b29cb2b47679e09067f9e14a01.ppt