e2a64c432f49919712169d8ba2c1cce0.ppt

- Количество слайдов: 14

Module 25 Banking and Money Creation KRUGMAN'S MACROECONOMICS for AP* Margaret Ray and David Anderson

What you will learn in this Module: • The role of banks in the economy • The reasons for and types of banking regulation • How banks create money Ben Bernanke: I don't really understand why there needs to be so much tension about this. The country is facing the worst economy since the Great Depression. If the financial system collapses, it will take every one of you down. (Fall 2008) From: “Too Big To Fail” – Andrew Ross Sorkin

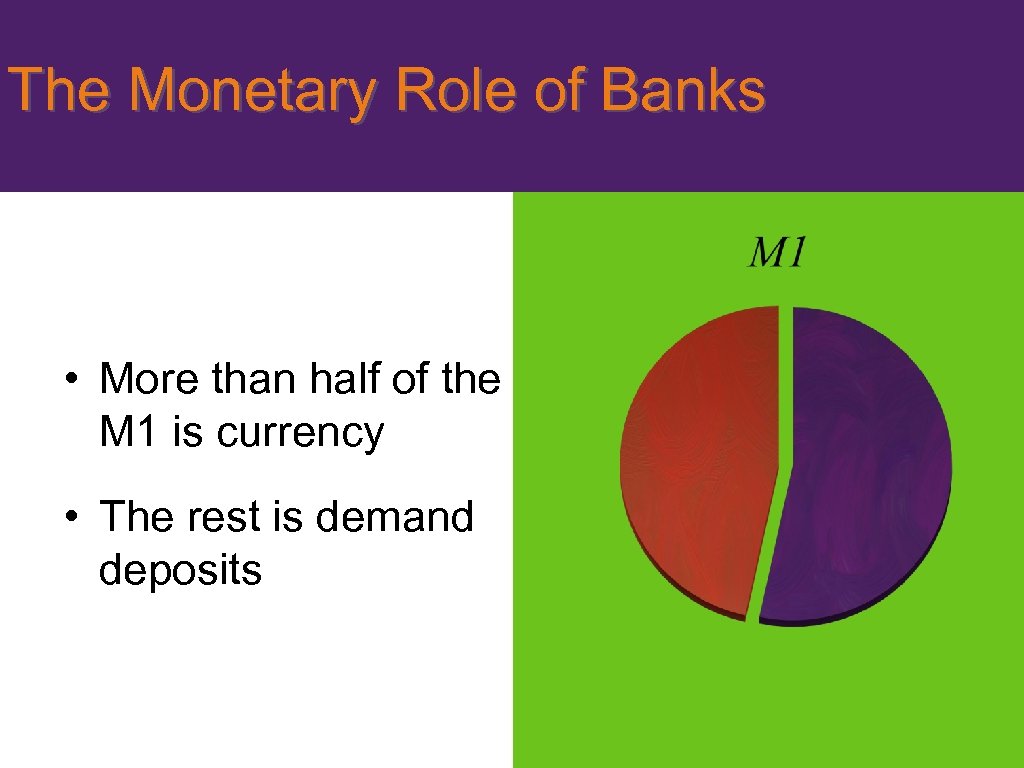

The Monetary Role of Banks • More than half of the M 1 is currency • The rest is demand deposits

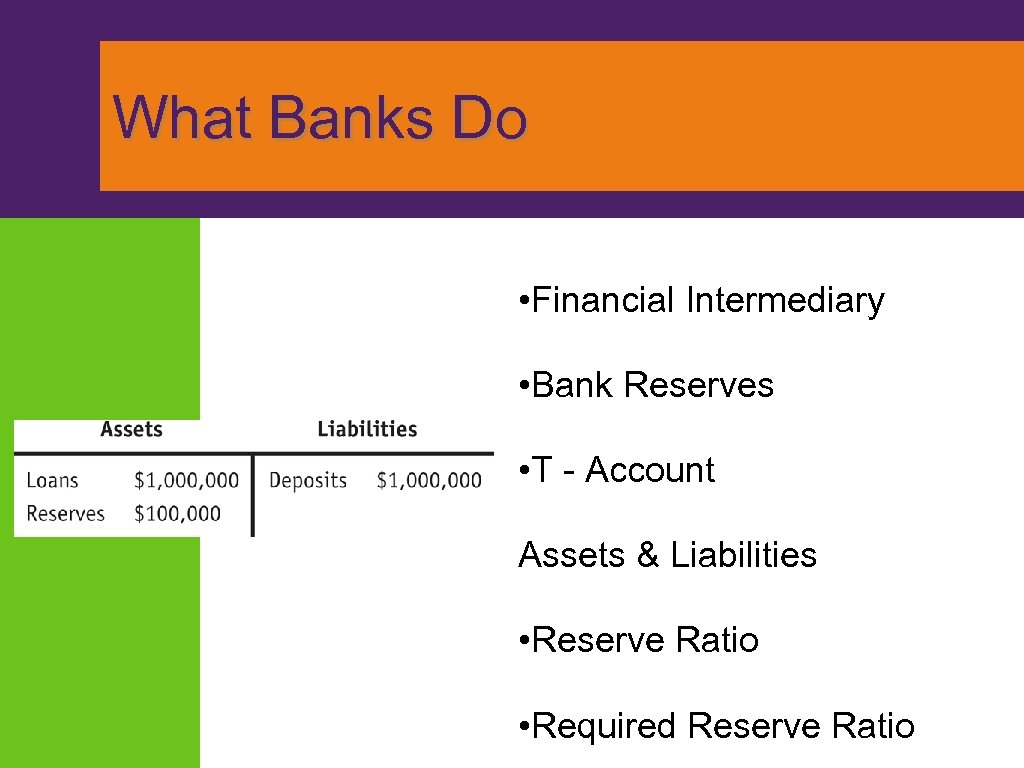

What Banks Do • Financial Intermediary • Bank Reserves • T - Account Assets & Liabilities • Reserve Ratio • Required Reserve Ratio

The Problem of Bank Runs • Customer Deposits > Bank Reserves • Why does this usually work? • Bank Run • Why? • Bank Failure

Bank Regulation • Deposit Insurance • FDIC • Capital Requirements • Reserve Requirements • The Discount Window

Determining the Money Supply

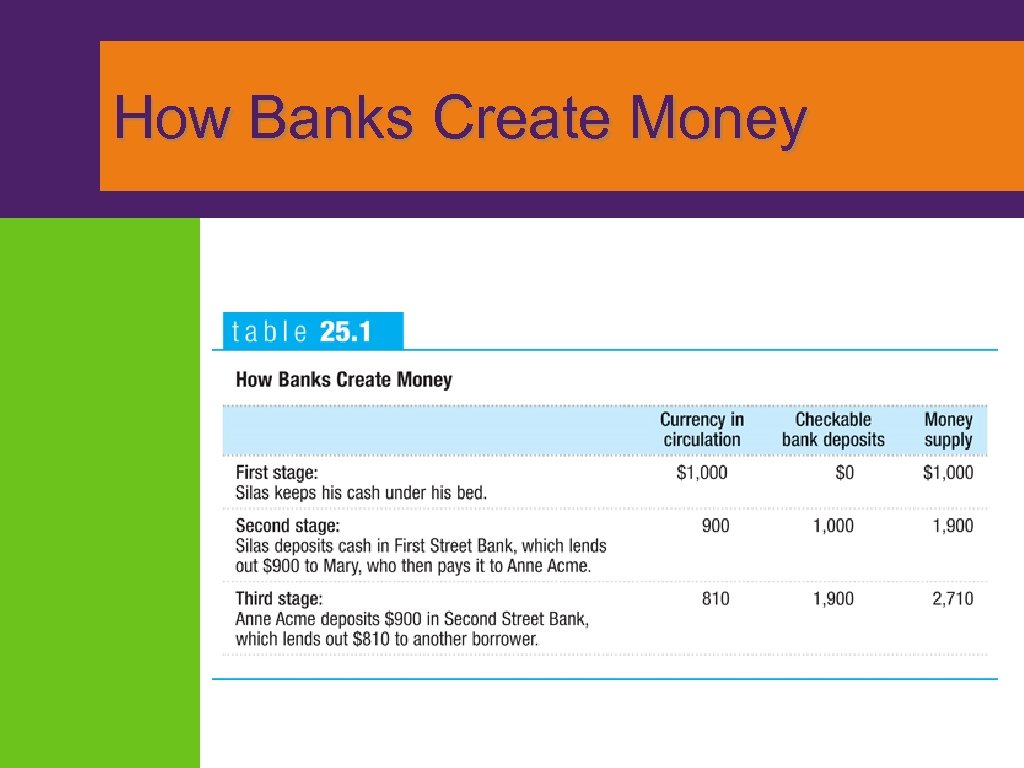

How Banks Create Money

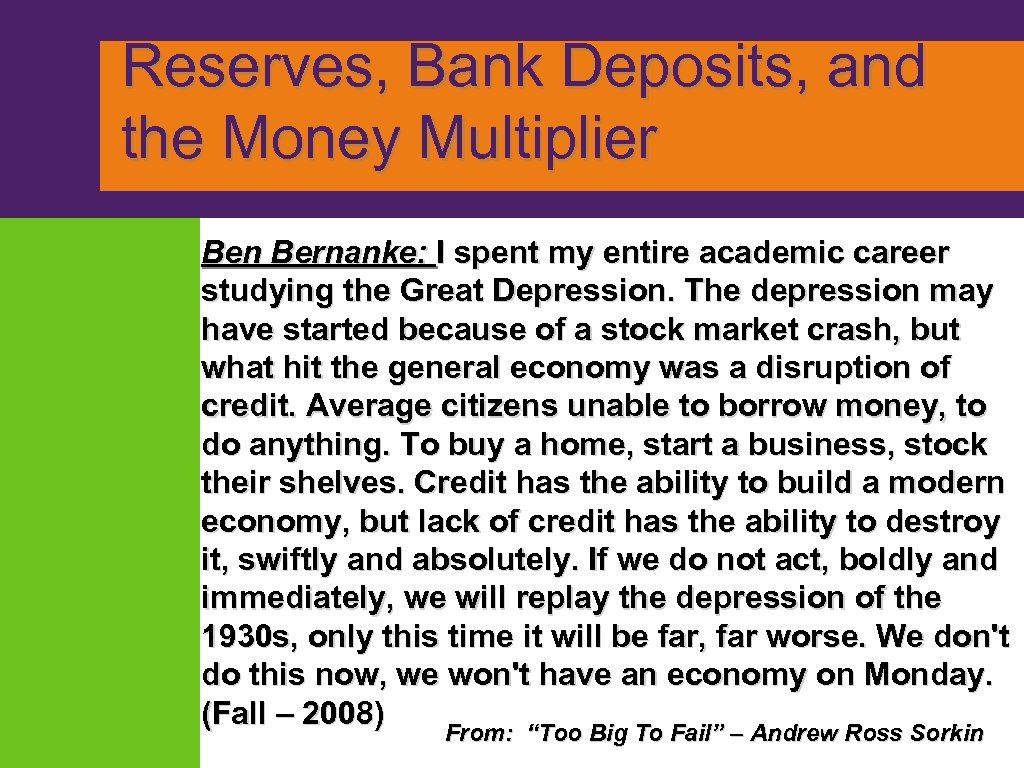

Reserves, Bank Deposits, and the Money Multiplier Ben Bernanke: I spent my entire academic career studying the Great Depression. The depression may have started because of a stock market crash, but what hit the general economy was a disruption of credit. Average citizens unable to borrow money, to do anything. To buy a home, start a business, stock their shelves. Credit has the ability to build a modern economy, but lack of credit has the ability to destroy it, swiftly and absolutely. If we do not act, boldly and immediately, we will replay the depression of the 1930 s, only this time it will be far, far worse. We don't do this now, we won't have an economy on Monday. (Fall – 2008) From: “Too Big To Fail” – Andrew Ross Sorkin

Reserves, Bank Deposits, and the Money Multiplier • “Leaks” • Excess Reserves • rr = reserve ratio • Loan Expansion = Excess Reserves / rr MM = 1/rr

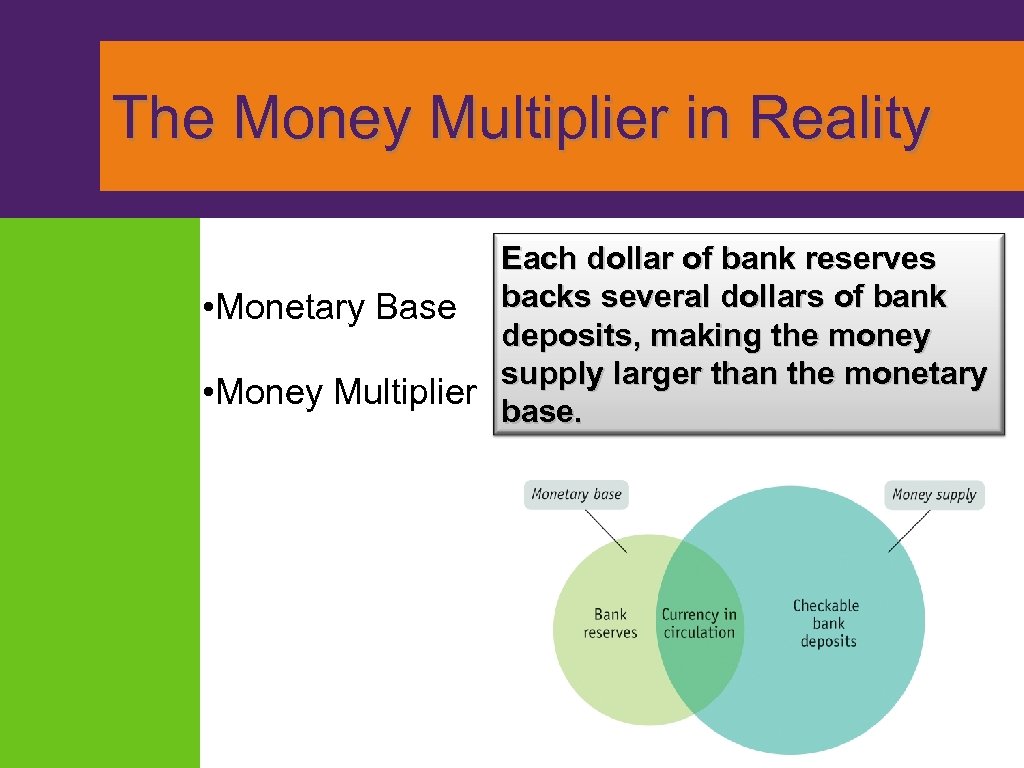

The Money Multiplier in Reality Each dollar of bank reserves • Monetary Base backs several dollars of bank deposits, making the money supply larger than the monetary • Money Multiplier base.

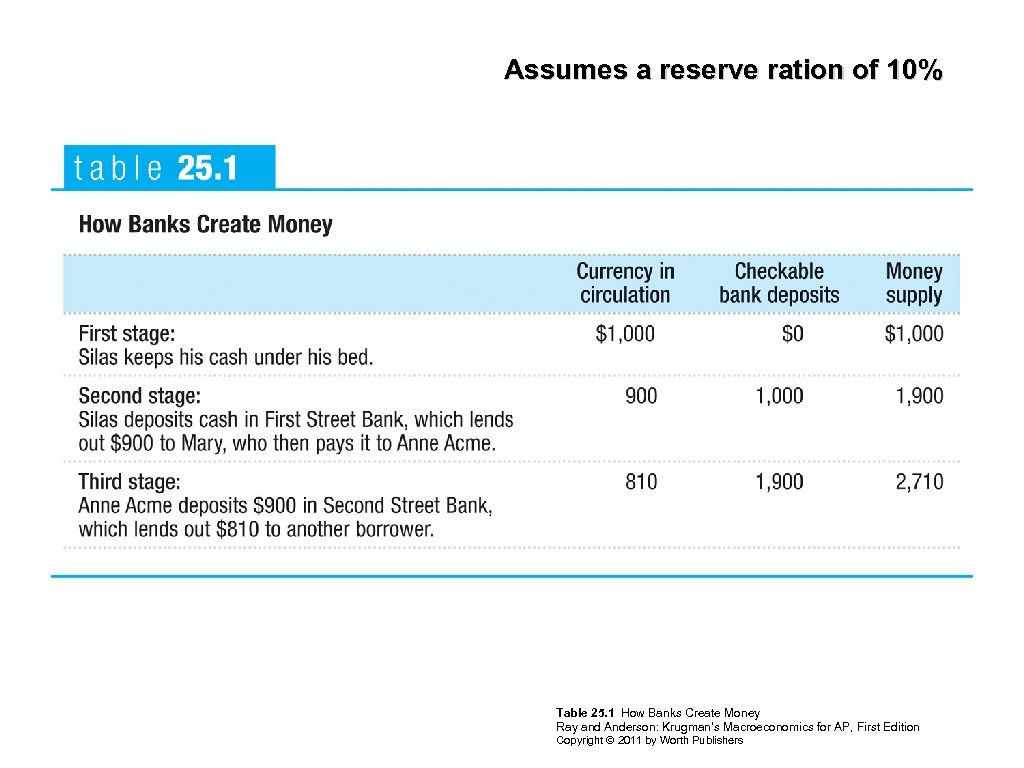

Assumes a reserve ration of 10% Table 25. 1 How Banks Create Money Ray and Anderson: Krugman’s Macroeconomics for AP, First Edition Copyright © 2011 by Worth Publishers

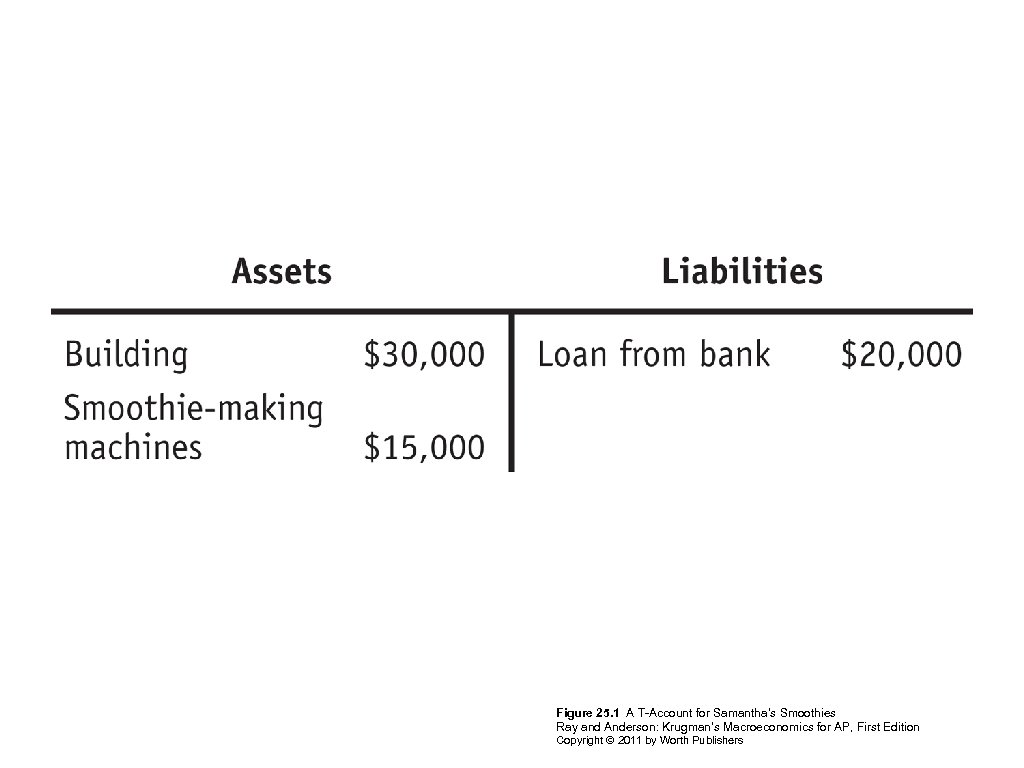

Figure 25. 1 A T-Account for Samantha’s Smoothies Ray and Anderson: Krugman’s Macroeconomics for AP, First Edition Copyright © 2011 by Worth Publishers

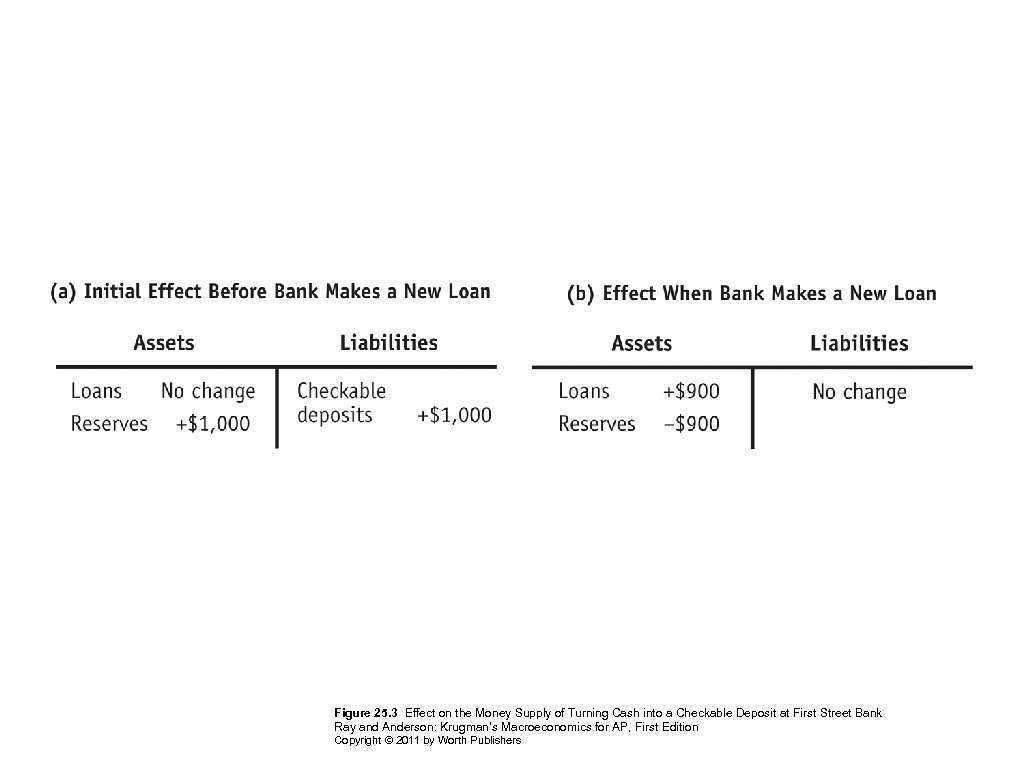

Figure 25. 3 Effect on the Money Supply of Turning Cash into a Checkable Deposit at First Street Bank Ray and Anderson: Krugman’s Macroeconomics for AP, First Edition Copyright © 2011 by Worth Publishers

e2a64c432f49919712169d8ba2c1cce0.ppt