7b92abe97779d3dc554cb3257a76a2bc.ppt

- Количество слайдов: 37

Module 13. Relevant Costs in Decision Making Dr. Varadraj Bapat, IIT Mumbai 1

Module 13. Relevant Costs in Decision Making Dr. Varadraj Bapat, IIT Mumbai 1

Decision Making n Introduction n Relevant Vs. Sunk cost n Make or Buy decision making n Shutdown Cost n Joint Product Cost Allocation n Introduction of new product Dr. Varadraj Bapat, IIT Mumbai 2

Decision Making n Introduction n Relevant Vs. Sunk cost n Make or Buy decision making n Shutdown Cost n Joint Product Cost Allocation n Introduction of new product Dr. Varadraj Bapat, IIT Mumbai 2

Relevant Cost which are relevant for a particular business decision. They are not historical cost but future costs to be associated with different inputs and activities related a particular business decision. Dr. Varadraj Bapat, IIT Mumbai 3

Relevant Cost which are relevant for a particular business decision. They are not historical cost but future costs to be associated with different inputs and activities related a particular business decision. Dr. Varadraj Bapat, IIT Mumbai 3

Relevant Cost Relevant cost is expected future cost which differs for alternative course. Usually variable costs are relevant while fixed cost are non-relevant. Ex. Make or Buy, Special Pricing Dr. Varadraj Bapat, IIT Mumbai 4

Relevant Cost Relevant cost is expected future cost which differs for alternative course. Usually variable costs are relevant while fixed cost are non-relevant. Ex. Make or Buy, Special Pricing Dr. Varadraj Bapat, IIT Mumbai 4

Relevant Cost However, It is not essential that all variable cost are relevant and all fixed cost are irrelevant. Fixed or variable costs that differ for various alternatives are relevant costs. Dr. Varadraj Bapat, IIT Mumbai 5

Relevant Cost However, It is not essential that all variable cost are relevant and all fixed cost are irrelevant. Fixed or variable costs that differ for various alternatives are relevant costs. Dr. Varadraj Bapat, IIT Mumbai 5

Relevant costs draw our alternation to those elements of cost which are relevant for decision. e. g. 1) Fixed Cost for project X is Rs. 5 lakhs and for alternative project Y it is 7 lakhs. therefore fixed cost is relevant in this example. Dr. Varadraj Bapat, IIT Mumbai 6

Relevant costs draw our alternation to those elements of cost which are relevant for decision. e. g. 1) Fixed Cost for project X is Rs. 5 lakhs and for alternative project Y it is 7 lakhs. therefore fixed cost is relevant in this example. Dr. Varadraj Bapat, IIT Mumbai 6

E. g. 2) Direct material under alternative I- Rs. 150 per Kg. Direct material under alternative II- Rs. 150 per Kg. therefore variable cost is not relevant in this example. Dr. Varadraj Bapat, IIT Mumbai 7

E. g. 2) Direct material under alternative I- Rs. 150 per Kg. Direct material under alternative II- Rs. 150 per Kg. therefore variable cost is not relevant in this example. Dr. Varadraj Bapat, IIT Mumbai 7

SUNK COSTS Sunk costs are all costs incurred or committed in the past that cannot be changed by any decision made now or in the future. Sunk costs should not be considered in decisions. Dr. Varadraj Bapat, IIT Mumbai 8

SUNK COSTS Sunk costs are all costs incurred or committed in the past that cannot be changed by any decision made now or in the future. Sunk costs should not be considered in decisions. Dr. Varadraj Bapat, IIT Mumbai 8

SUNK COSTS E. g. cost incurred on research of a product will be irrelevant while making decision whether to undertake production or not. Dr. Varadraj Bapat, IIT Mumbai 9

SUNK COSTS E. g. cost incurred on research of a product will be irrelevant while making decision whether to undertake production or not. Dr. Varadraj Bapat, IIT Mumbai 9

Sunk Cost Sunk costs have been incurred and cannot be reversed. Historical costs are sunk costs. They play no role in decision making in the current period. Dr. Varadraj Bapat, IIT Mumbai 10

Sunk Cost Sunk costs have been incurred and cannot be reversed. Historical costs are sunk costs. They play no role in decision making in the current period. Dr. Varadraj Bapat, IIT Mumbai 10

Sunk Cost do not affect future costs and cannot be changed by any current or future action, hence these costs are irrelevant in decision making. Ex. Spending on advertising during product launching is sunk for taking a decision on continuance of product Dr. Varadraj Bapat, IIT Mumbai 11

Sunk Cost do not affect future costs and cannot be changed by any current or future action, hence these costs are irrelevant in decision making. Ex. Spending on advertising during product launching is sunk for taking a decision on continuance of product Dr. Varadraj Bapat, IIT Mumbai 11

Make / Buy Very often make-or-buy decision is the act of making a tactical choice between producing an item internally and buying it from an outside supplier. Dr. Varadraj Bapat, IIT Mumbai 12

Make / Buy Very often make-or-buy decision is the act of making a tactical choice between producing an item internally and buying it from an outside supplier. Dr. Varadraj Bapat, IIT Mumbai 12

Make / Buy Under such circumstances two factors are to be considered: n whether surplus capacity is available and n the marginal cost. Dr. Varadraj Bapat, IIT Mumbai 13

Make / Buy Under such circumstances two factors are to be considered: n whether surplus capacity is available and n the marginal cost. Dr. Varadraj Bapat, IIT Mumbai 13

Elements of the "make“ analysis include: Ø Incremental inventory-carrying costs Ø Direct labor costs Ø Incremental factory overhead costs Ø Delivered purchased material costs Dr. Varadraj Bapat, IIT Mumbai 14

Elements of the "make“ analysis include: Ø Incremental inventory-carrying costs Ø Direct labor costs Ø Incremental factory overhead costs Ø Delivered purchased material costs Dr. Varadraj Bapat, IIT Mumbai 14

Ø Incremental managerial costs Ø Any follow-on costs stemming from quality and related problems Ø Incremental purchasing costs Ø Incremental capital costs Ø Ms. Keshav (Case) Keshav Dr. Varadraj Bapat, IIT Mumbai 15

Ø Incremental managerial costs Ø Any follow-on costs stemming from quality and related problems Ø Incremental purchasing costs Ø Incremental capital costs Ø Ms. Keshav (Case) Keshav Dr. Varadraj Bapat, IIT Mumbai 15

Cost considerations for the "buy" analysis include: © Purchase price of the part © Transportation costs © Receiving and inspection costs © Incremental purchasing costs © Any follow-on costs related to quality or service Dr. Varadraj Bapat, IIT Mumbai 16

Cost considerations for the "buy" analysis include: © Purchase price of the part © Transportation costs © Receiving and inspection costs © Incremental purchasing costs © Any follow-on costs related to quality or service Dr. Varadraj Bapat, IIT Mumbai 16

Shutdown Cost Some times it becomes necessary for a company to temporarily close down the factory or unit because of trade downturn with view to reopening it in the future. In this situation decisions are based on the variable cost analysis. Dr. Varadraj Bapat, IIT Mumbai 17

Shutdown Cost Some times it becomes necessary for a company to temporarily close down the factory or unit because of trade downturn with view to reopening it in the future. In this situation decisions are based on the variable cost analysis. Dr. Varadraj Bapat, IIT Mumbai 17

Shutdown Cost If selling price is above the variable cost then it better to continue because the losses are minimized. By closing the manufacturing activity, some extra fixed expenses (e. g. Security) may be incurred and certain fixed expenses can be avoided (e. g. maintenance cost of plant). Such costs are also relevant. Dr. Varadraj Bapat, IIT Mumbai 18

Shutdown Cost If selling price is above the variable cost then it better to continue because the losses are minimized. By closing the manufacturing activity, some extra fixed expenses (e. g. Security) may be incurred and certain fixed expenses can be avoided (e. g. maintenance cost of plant). Such costs are also relevant. Dr. Varadraj Bapat, IIT Mumbai 18

The decision is based on as to whether the contribution is more than the difference between fixed expenses incurred in normal operation and the fixed expenses incurred when the plant is shut down. Dr. Varadraj Bapat, IIT Mumbai 19

The decision is based on as to whether the contribution is more than the difference between fixed expenses incurred in normal operation and the fixed expenses incurred when the plant is shut down. Dr. Varadraj Bapat, IIT Mumbai 19

Introducing new Product There are two reasons why a commercial enterprise should undertake the time, effort, and expense of introducing a new product or service: (1) customers have shown interest Dr. Varadraj Bapat, IIT Mumbai 20

Introducing new Product There are two reasons why a commercial enterprise should undertake the time, effort, and expense of introducing a new product or service: (1) customers have shown interest Dr. Varadraj Bapat, IIT Mumbai 20

(2) demand is sufficient and sustainable enough for the proposed product to make a profit. In other words, successful enterprises sell what customers want to buy rather than what the entrepreneur wants to sell. Dr. Varadraj Bapat, IIT Mumbai 21

(2) demand is sufficient and sustainable enough for the proposed product to make a profit. In other words, successful enterprises sell what customers want to buy rather than what the entrepreneur wants to sell. Dr. Varadraj Bapat, IIT Mumbai 21

Introducing new Product All relevant costs should be recovered over a period of product life. Dr. Varadraj Bapat, IIT Mumbai 22

Introducing new Product All relevant costs should be recovered over a period of product life. Dr. Varadraj Bapat, IIT Mumbai 22

Joint Product When two or more products of equivalent importance are produced simultaneously, they are termed as joint products. Dr. Varadraj Bapat, IIT Mumbai 23

Joint Product When two or more products of equivalent importance are produced simultaneously, they are termed as joint products. Dr. Varadraj Bapat, IIT Mumbai 23

Joint Product In other words two or more products separated in course of the same processing operation, each product being in such proportion that no single product can be designated as a major product. Dr. Varadraj Bapat, IIT Mumbai 24

Joint Product In other words two or more products separated in course of the same processing operation, each product being in such proportion that no single product can be designated as a major product. Dr. Varadraj Bapat, IIT Mumbai 24

Joint Products usually require further processing. Dr. Varadraj Bapat, IIT Mumbai 25

Joint Products usually require further processing. Dr. Varadraj Bapat, IIT Mumbai 25

Joint Products. in Coke production, Coal is raw material with Coke, Sulfate of ammonia, light oil asjoint products. Dr. Varadraj Bapat, IIT Mumbai 26

Joint Products. in Coke production, Coal is raw material with Coke, Sulfate of ammonia, light oil asjoint products. Dr. Varadraj Bapat, IIT Mumbai 26

E. g. Refining Process, where crude oil is raw material gives Petrol, Diesel, Gas as Joint Products. Dr. Varadraj Bapat, IIT Mumbai 27

E. g. Refining Process, where crude oil is raw material gives Petrol, Diesel, Gas as Joint Products. Dr. Varadraj Bapat, IIT Mumbai 27

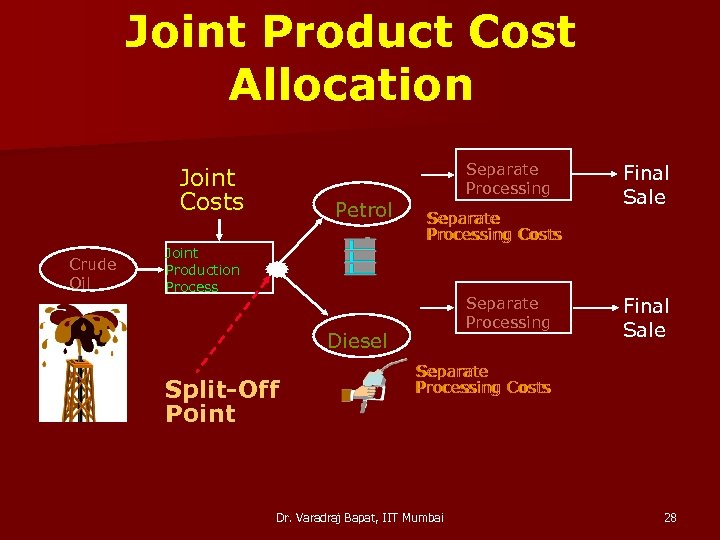

Joint Product Cost Allocation Joint Costs Crude Oil Petrol Separate Processing Costs Joint Production Process Separate Processing Diesel Split-Off Point Final Sale Separate Processing Costs Dr. Varadraj Bapat, IIT Mumbai 28

Joint Product Cost Allocation Joint Costs Crude Oil Petrol Separate Processing Costs Joint Production Process Separate Processing Diesel Split-Off Point Final Sale Separate Processing Costs Dr. Varadraj Bapat, IIT Mumbai 28

By Product is product of relatively small total value that is produced simultaneously with a product of greater total value. The product with the greater value (Main product), is usually produced in greater quantities than the By Product. Dr. Varadraj Bapat, IIT Mumbai 29

By Product is product of relatively small total value that is produced simultaneously with a product of greater total value. The product with the greater value (Main product), is usually produced in greater quantities than the By Product. Dr. Varadraj Bapat, IIT Mumbai 29

By Product In other words, when two or more products are separated in course of the same processing operation, where one of the products being in such proportion/ value that it can be designated as a Main product, while others are considered as By Products. Dr. Varadraj Bapat, IIT Mumbai 30

By Product In other words, when two or more products are separated in course of the same processing operation, where one of the products being in such proportion/ value that it can be designated as a Main product, while others are considered as By Products. Dr. Varadraj Bapat, IIT Mumbai 30

By Product ex. of By-products ex. of in coke manufacture - gas and tar in lumber mills - sawdust. cotton cleaning process - cotton seed coconut oil industry - coca shells Dr. Varadraj Bapat, IIT Mumbai 31

By Product ex. of By-products ex. of in coke manufacture - gas and tar in lumber mills - sawdust. cotton cleaning process - cotton seed coconut oil industry - coca shells Dr. Varadraj Bapat, IIT Mumbai 31

Terminology Joint Product Process: A process that results in production of two or more products, which are termed as joint products. Dr. Varadraj Bapat, IIT Mumbai 32

Terminology Joint Product Process: A process that results in production of two or more products, which are termed as joint products. Dr. Varadraj Bapat, IIT Mumbai 32

Terminology Joint product cost: The cost of the raw materials/input and the joint production process. Dr. Varadraj Bapat, IIT Mumbai 33

Terminology Joint product cost: The cost of the raw materials/input and the joint production process. Dr. Varadraj Bapat, IIT Mumbai 33

Split Off Point: The point in the production process where the individual products become separately identifiable. Dr. Varadraj Bapat, IIT Mumbai 34

Split Off Point: The point in the production process where the individual products become separately identifiable. Dr. Varadraj Bapat, IIT Mumbai 34

Joint Cost Allocation: Methods • Physical units method • Relative Sales Value Method • Sale value at split off point • Net Realisable value method Dr. Varadraj Bapat, IIT Mumbai 35

Joint Cost Allocation: Methods • Physical units method • Relative Sales Value Method • Sale value at split off point • Net Realisable value method Dr. Varadraj Bapat, IIT Mumbai 35

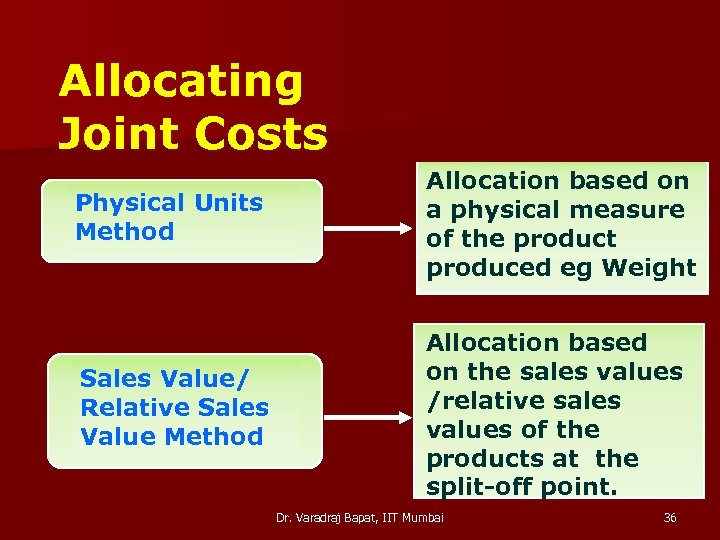

Allocating Joint Costs Physical Units Method Allocation based on a physical measure of the product produced eg Weight Sales Value/ Relative Sales Value Method Allocation based on the sales values /relative sales values of the products at the split-off point. Dr. Varadraj Bapat, IIT Mumbai 36

Allocating Joint Costs Physical Units Method Allocation based on a physical measure of the product produced eg Weight Sales Value/ Relative Sales Value Method Allocation based on the sales values /relative sales values of the products at the split-off point. Dr. Varadraj Bapat, IIT Mumbai 36

Allocation is based on estimated sales value at split off point Constant Gross Margin method Net-Realizable Value Method Allocation based on sales value less post-separation processing costs Dr. Varadraj Bapat, IIT Mumbai 37

Allocation is based on estimated sales value at split off point Constant Gross Margin method Net-Realizable Value Method Allocation based on sales value less post-separation processing costs Dr. Varadraj Bapat, IIT Mumbai 37