065be4593c725d7c8324ad209a6f8423.ppt

- Количество слайдов: 31

Modernising the taxation of corporate debt and derivatives Consultation open meeting 27 June 2013

Purpose • Introductions • Explanation of the consultation process • Brief review of the consultation material • To facilitate participation in the process 2

Agenda Introduction 1. 2. 3. 4. 5. Context Aims Timeline Consultation process Questions and discussion Break 6. The consultation document content 7. Questions and discussion 3

What’s the problem? Commercial practice Accountancy changes 17 years old Tax avoidance Loss of structural integrity Complexity 4

Policy drivers • Simpler rules • Appropriately aligned with commercial and accounting practice • Legislation more useable • Restoration of coherence and elimination of uncertainties • Integrated anti-avoidance provisions 5

Consultation – general points • A starting point, not an end point • Collaborative process: if you have a better idea, let’s hear it • An opportunity for all stakeholders • We are interested in fiscal impacts, cost implications and other consequences – don’t ignore Chapter 15! • Nothing in the consultation reflects on our view of existing disputes • Transition 6

How you can take part Formal Consultation Working Groups Bilateral contacts (2013 and 2014) Balancing broad representation and detailed discussion 7

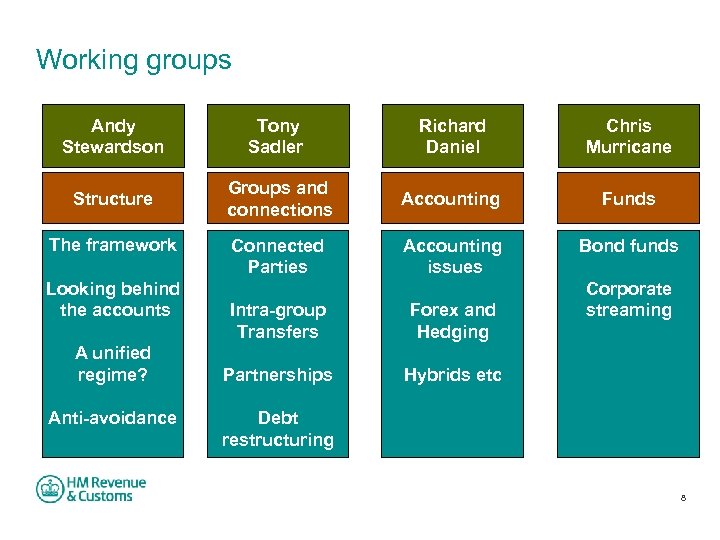

Working groups Andy Stewardson Tony Sadler Richard Daniel Chris Murricane Structure Groups and connections Accounting Funds Connected Parties Accounting issues Bond funds The framework Looking behind the accounts A unified regime? Anti-avoidance Intra-group Transfers Forex and Hedging Partnerships Corporate streaming Hybrids etc Debt restructuring 8

Working groups – what we need • Joint membership: HMRC; rep bodies; individual companies; advisers; etc • Membership by invitation, but volunteers welcome • Representative of wider constituencies • Wide practical experience – “wise heads” • Manageable numbers • Active participation - expect monthly meetings 9

Working groups – what will they do? • Consider proposals and options • Identify issues • Develop solutions • Review draft legislation • But recommendations to ministers are for officials 10

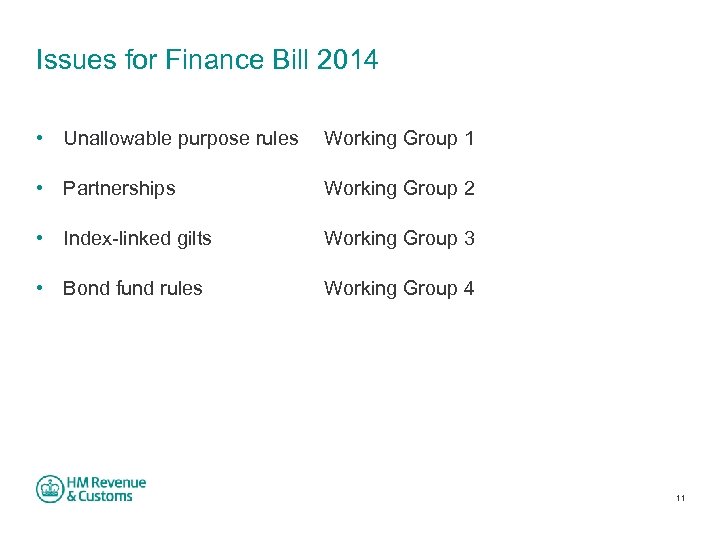

Issues for Finance Bill 2014 • Unallowable purpose rules Working Group 1 • Partnerships Working Group 2 • Index-linked gilts Working Group 3 • Bond fund rules Working Group 4 11

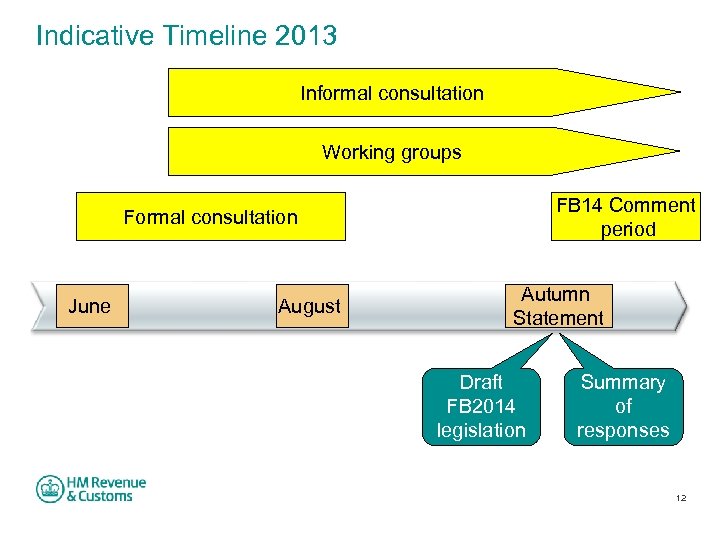

Indicative Timeline 2013 Informal consultation Working groups FB 14 Comment period Formal consultation June August Autumn Statement Draft FB 2014 legislation Summary of responses 12

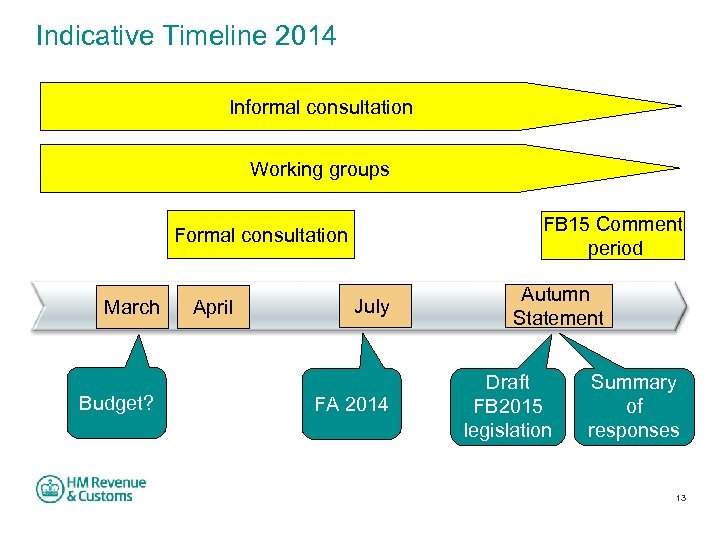

Indicative Timeline 2014 Informal consultation Working groups FB 15 Comment period Formal consultation March Budget? April July FA 2014 Autumn Statement Draft FB 2015 legislation Summary of responses 13

Questions? 14

Consultation document - content 15

Working Group 1 – Andy Stewardson • The framework Subject matter – role of accountancy – overriding the accounts – default approach - departures from the default • Looking behind the accounts Cases where the accounts treatment of an instrument or transaction is influenced by the existence of other • A unified regime? Is it worth it? • Anti-avoidance A “regime TAAR” Updating the unallowable purpose rules 16

Working Group 2 – Tony Sadler • Connected parties • Intra-group transfers • Partnerships • Debt restructuring 17

Working Group 2: Connected parties • Key departure from ‘following the accounts’ • Two options • Minimal change, mainly definition of Amortised Cost Basis • More extensive change, retain denial of impairment, follow accounts on releases, anti-asymmetry rule • Not hard and fast options – key issue, would the change be worth it? 18

Working Group 2: Group continuity • Three possibilities • Forward continuity • Backward continuity • No rules other than anti-asymmetry • No preferred option at this stage 19

Working Group 2: Partnerships • Better alignment of principles and mechanics • Change in partnership interests • Control • Link with separate consultation on partnership taxation • Finance Bill 2014 20

Working Group 2: Debt restructuring • Section 322(4) – debt equity swaps; explicit ‘distress’ criteria for exemption from release? • Sections 361 -362 – deemed release rules broadly retained; impact of other possible changes (e. g. connected parties, partnerships)? • Less need for clearances. 21

Working Group 3 – Richard Daniel • Accounting issues • Forex and hedging • Hybrids and “special treatment” instruments 22

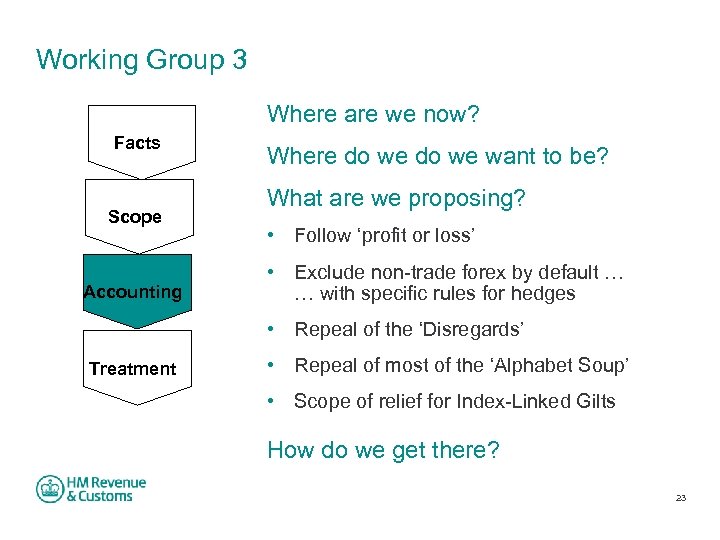

Working Group 3 Where are we now? Facts Scope Accounting Where do we want to be? What are we proposing? • Follow ‘profit or loss’ • Exclude non-trade forex by default … … with specific rules for hedges • Repeal of the ‘Disregards’ Treatment • Repeal of most of the ‘Alphabet Soup’ • Scope of relief for Index-Linked Gilts How do we get there? 23

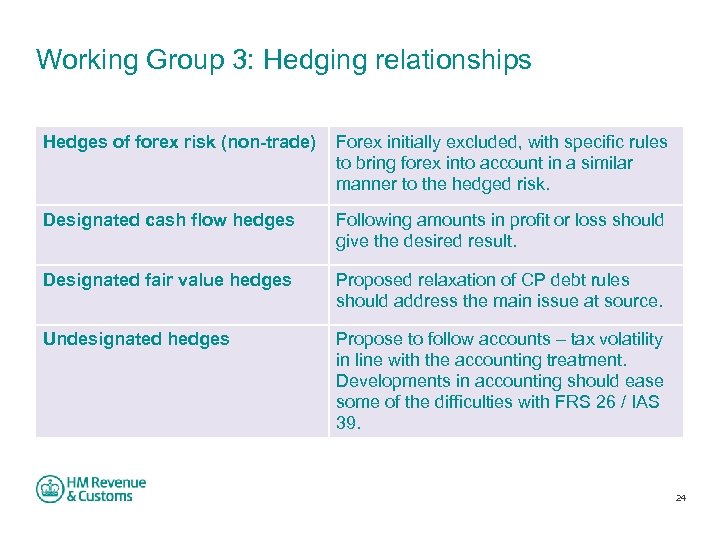

Working Group 3: Hedging relationships Hedges of forex risk (non-trade) Forex initially excluded, with specific rules to bring forex into account in a similar manner to the hedged risk. Designated cash flow hedges Following amounts in profit or loss should give the desired result. Designated fair value hedges Proposed relaxation of CP debt rules should address the main issue at source. Undesignated hedges Propose to follow accounts – tax volatility in line with the accounting treatment. Developments in accounting should ease some of the difficulties with FRS 26 / IAS 39. 24

Working Group 4 – Chris Murricane • Bond funds • Corporate streaming 25

Bond Fund Rules • Chapter 3 of Part 6 CTA 2009 • Aim to ensure that loan relationships held in funds are brought into tax • Complicated & avoidance prone • Proposal: largely repeal • But keep anti-avoidance rules in some circumstances • Finance Bill 2014 26

Bond Fund Rules • What do we need to keep? • Tightly-controlled funds. • Offshore funds. • Impacts on particular types of company (CFCs, life insurers) 27

Corporate streaming • Chapter 3 of Part 4 of the Authorised Investment Funds (Tax) Regulations 2006, referred to as the “corporate streaming” rules. • Issue: income in AIFs taxed at lower rate. • Problem solved by tax rate convergence? • In secondary legislation? • Specific industry issues. 28

Questions? 29

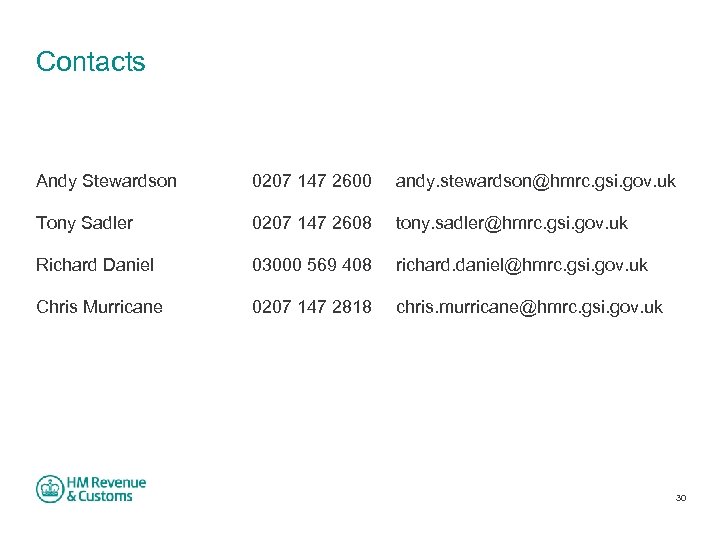

Contacts Andy Stewardson 0207 147 2600 andy. stewardson@hmrc. gsi. gov. uk Tony Sadler 0207 147 2608 tony. sadler@hmrc. gsi. gov. uk Richard Daniel 03000 569 408 richard. daniel@hmrc. gsi. gov. uk Chris Murricane 0207 147 2818 chris. murricane@hmrc. gsi. gov. uk 30

Thank you Andy Stewardson HM Revenue & Customs Room 3 C/06 100 Parliament Street London. SW 1 A 2 BQ Telephone Email 0207 147 2600 andy. stewardson@hmrc. gsi. gov. uk * | 3/16/2018 | 31

065be4593c725d7c8324ad209a6f8423.ppt