Modernising HMRC Online Services – Implementing Lord Carter’s Recommendations Helen M. Smith (Carter Programme Communications & Stakeholder Engagement) CIPFA VAT Committee meeting, 14 th December 2006

Modernising HMRC Online Services – Implementing Lord Carter’s Recommendations Helen M. Smith (Carter Programme Communications & Stakeholder Engagement) CIPFA VAT Committee meeting, 14 th December 2006

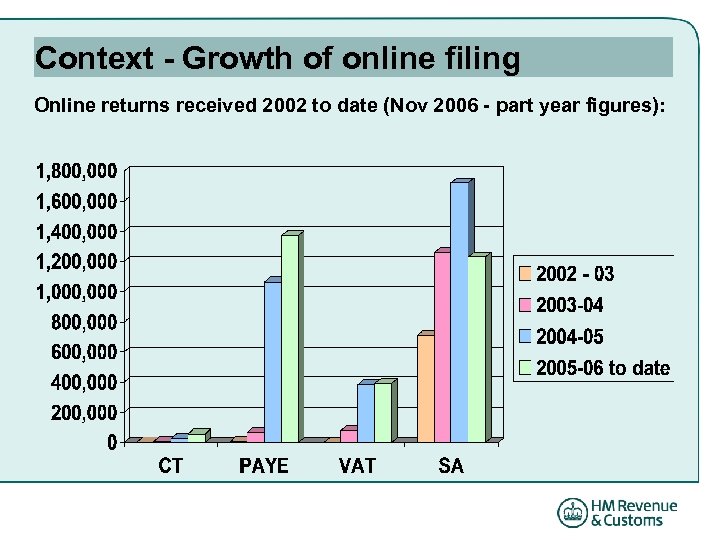

Context - Growth of online filing Online returns received 2002 to date (Nov 2006 - part year figures):

Context - Growth of online filing Online returns received 2002 to date (Nov 2006 - part year figures):

Carter Report - aspiration • HMRC to aim for universal electronic filing of tax returns by businesses and IT literate individuals by 2012

Carter Report - aspiration • HMRC to aim for universal electronic filing of tax returns by businesses and IT literate individuals by 2012

Summary of Carter’s recommendations • Businesses have to file electronically for CT, VAT and PAYE in-year forms in phases from 2008 • Businesses to pay electronically for VAT and CT in phases from 2008 • Changes to Income Tax SA, including differentiated paper and online filing dates from 2008 and withdrawing approval of SA paper substitute returns from 2007 -08 • Tying the enquiry windows for ITSA and CT returns to the date of submission • Joint filing facility with Companies House

Summary of Carter’s recommendations • Businesses have to file electronically for CT, VAT and PAYE in-year forms in phases from 2008 • Businesses to pay electronically for VAT and CT in phases from 2008 • Changes to Income Tax SA, including differentiated paper and online filing dates from 2008 and withdrawing approval of SA paper substitute returns from 2007 -08 • Tying the enquiry windows for ITSA and CT returns to the date of submission • Joint filing facility with Companies House

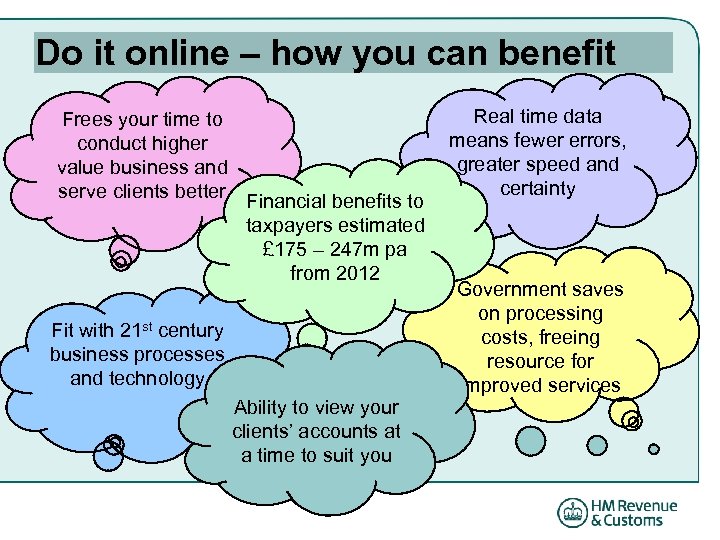

Do it online – how you can benefit Frees your time to conduct higher value business and serve clients better Financial benefits to taxpayers estimated £ 175 – 247 m pa from 2012 Fit with 21 st century business processes and technology Ability to view your clients’ accounts at a time to suit you Real time data means fewer errors, greater speed and certainty Government saves on processing costs, freeing resource for improved services

Do it online – how you can benefit Frees your time to conduct higher value business and serve clients better Financial benefits to taxpayers estimated £ 175 – 247 m pa from 2012 Fit with 21 st century business processes and technology Ability to view your clients’ accounts at a time to suit you Real time data means fewer errors, greater speed and certainty Government saves on processing costs, freeing resource for improved services

Carter prerequisites (1) Robust services: • “The most important thing that HMRC needs to do, to improve online services, is to focus on building robust services…this is a consistent message from current and potential users…the funds and resources available for online services should be focused on improving the existing services so that they better meet customers’ needs. ”

Carter prerequisites (1) Robust services: • “The most important thing that HMRC needs to do, to improve online services, is to focus on building robust services…this is a consistent message from current and potential users…the funds and resources available for online services should be focused on improving the existing services so that they better meet customers’ needs. ”

Carter prerequisites (2) Strong relationships: • Successful implementation will depend on collaborative working and partnership between HMRC and businesses, professional advisers & agents, software developers and other stakeholders.

Carter prerequisites (2) Strong relationships: • Successful implementation will depend on collaborative working and partnership between HMRC and businesses, professional advisers & agents, software developers and other stakeholders.

What this means for consultation • Collaborative working should maximise benefits for all • We need to understand your needs and to make you aware of key design phases • Not last chance – but a valuable current opportunity to raise critical IT issues • We want to ensure right input at the right time

What this means for consultation • Collaborative working should maximise benefits for all • We need to understand your needs and to make you aware of key design phases • Not last chance – but a valuable current opportunity to raise critical IT issues • We want to ensure right input at the right time

Some key dates: • Definition of requirements until end January 2007 • Finance Bill (Spring) 2007 – primary legislation • Following Finance Act (late Summer) 2007 – secondary legislation • March 2007 to March 2008 – detailed design, build and test of key IT • April 2008 – first key implementation date

Some key dates: • Definition of requirements until end January 2007 • Finance Bill (Spring) 2007 – primary legislation • Following Finance Act (late Summer) 2007 – secondary legislation • March 2007 to March 2008 – detailed design, build and test of key IT • April 2008 – first key implementation date

Working in partnership • We need to work in partnership with you: – using established channels where possible (e. g. Working Together); and – using dedicated Carter activity to get your input to priorities, and prepare you and your clients prior to implementation • What would be most useful to you and your clients? What are the priority issues and areas for investment?

Working in partnership • We need to work in partnership with you: – using established channels where possible (e. g. Working Together); and – using dedicated Carter activity to get your input to priorities, and prepare you and your clients prior to implementation • What would be most useful to you and your clients? What are the priority issues and areas for investment?

Contacts Helen Smith - helen. m. smith@hmrc. gsi. gov. uk 020 7438 4273 Julian Hatt - julian. hatt@hmrc. gsi. gov. uk 0117 907 1264

Contacts Helen Smith - helen. m. smith@hmrc. gsi. gov. uk 020 7438 4273 Julian Hatt - julian. hatt@hmrc. gsi. gov. uk 0117 907 1264