Kozlov_SM_3_27_09_16_corporate.ppt

- Количество слайдов: 20

Modern Strategic Analysis Dr. Prof. Aleksandr Kozlov 2016/17 academic year Fall semester

Modern Strategic Analysis Dr. Prof. Aleksandr Kozlov 2016/17 academic year Fall semester

Theme 2. Strategy definition, strategy pyramid. Corporate strategy. Dr. Prof. Aleksandr Kozlov 27/09/2016

Theme 2. Strategy definition, strategy pyramid. Corporate strategy. Dr. Prof. Aleksandr Kozlov 27/09/2016

3 Strategy definition (1) • „. . the determination of the long-run goals and objectives of an enterprise and the adoption of courses of action and the allocation of resource necessary for carrying out these goals‟ Alfred Chandler • „Competitive strategy is about being different. It means deliberately choosing a different set of activities to deliver a unique mix of value‟ Michael Porter Sources: A. D. Chandler, Strategy and Structure: Chapters in the History of American Enterprise, MIT Press, 1963, p. 13 M. E. Porter, „What is strategy? ‟, Harvard Business Review, 1996, November–December, p. 60 3

3 Strategy definition (1) • „. . the determination of the long-run goals and objectives of an enterprise and the adoption of courses of action and the allocation of resource necessary for carrying out these goals‟ Alfred Chandler • „Competitive strategy is about being different. It means deliberately choosing a different set of activities to deliver a unique mix of value‟ Michael Porter Sources: A. D. Chandler, Strategy and Structure: Chapters in the History of American Enterprise, MIT Press, 1963, p. 13 M. E. Porter, „What is strategy? ‟, Harvard Business Review, 1996, November–December, p. 60 3

4 Strategy definition (2) • STRATEGY is the direction an organization takes with the objective of achieving business success in the long term. 4

4 Strategy definition (2) • STRATEGY is the direction an organization takes with the objective of achieving business success in the long term. 4

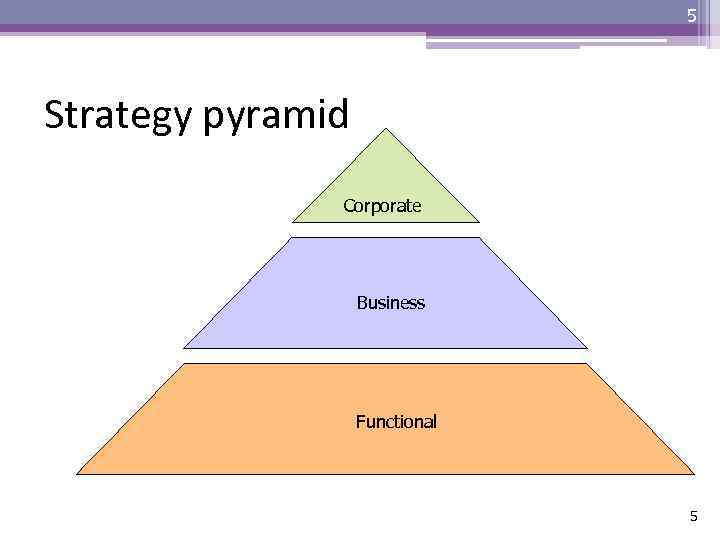

5 Strategy pyramid Corporate Business Functional 5

5 Strategy pyramid Corporate Business Functional 5

6 Corporate strategy • Corporate strategy is a proprietary set of actions that enables a company to be successful in its multimarket activities in the long term. • The process of corporate strategy formulation includes setting priorities for development of company’s business units operating in a different markets and decision making about investment, keeping the status quo or withdrawal

6 Corporate strategy • Corporate strategy is a proprietary set of actions that enables a company to be successful in its multimarket activities in the long term. • The process of corporate strategy formulation includes setting priorities for development of company’s business units operating in a different markets and decision making about investment, keeping the status quo or withdrawal

7 Corporate strategy For corporate strategy the fundamental task is to develop a balanced portfolio of businesses which will achieve the goals of the corporation and satisfy its stakeholders.

7 Corporate strategy For corporate strategy the fundamental task is to develop a balanced portfolio of businesses which will achieve the goals of the corporation and satisfy its stakeholders.

8 Corporate Strategy. Tools for analysis of Strategic Business Unit (SBU) • Boston Consulting Group matrix • General Electric matrix 8

8 Corporate Strategy. Tools for analysis of Strategic Business Unit (SBU) • Boston Consulting Group matrix • General Electric matrix 8

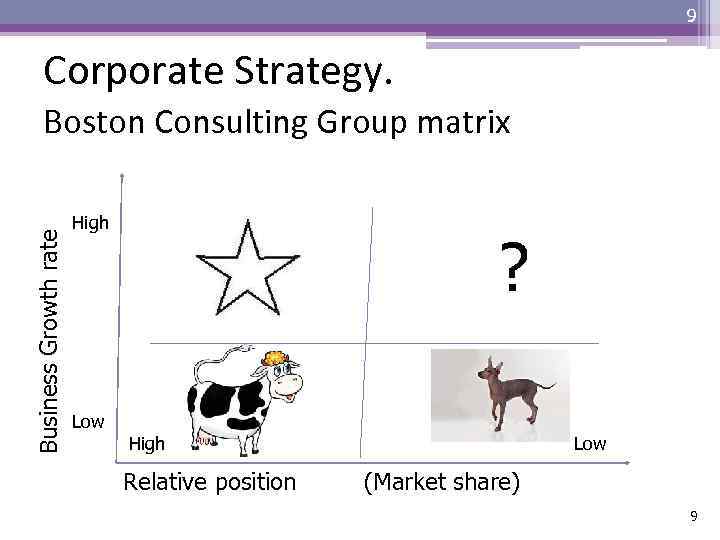

9 Corporate Strategy. Business Growth rate Boston Consulting Group matrix High ? Low High Low Relative position (Market share) 9

9 Corporate Strategy. Business Growth rate Boston Consulting Group matrix High ? Low High Low Relative position (Market share) 9

10 Cash Cows • These units generate cash in excess of the amount of cash needed to maintain the business. • Typically belonging to a "mature" market, and every corporation would be thrilled to own as many as possible. • They are to be "milked" continuously with as little investment as possible, since such investment would be wasted in an industry with low growth.

10 Cash Cows • These units generate cash in excess of the amount of cash needed to maintain the business. • Typically belonging to a "mature" market, and every corporation would be thrilled to own as many as possible. • They are to be "milked" continuously with as little investment as possible, since such investment would be wasted in an industry with low growth.

11 Dogs • Low market share in a mature, slow-growing industry. • From an accounting point of view such a unit is worthless, not generating cash for the company. • They depress a profitable company's return of assets ratio. • They should be sold off.

11 Dogs • Low market share in a mature, slow-growing industry. • From an accounting point of view such a unit is worthless, not generating cash for the company. • They depress a profitable company's return of assets ratio. • They should be sold off.

12 Question marks • They are a starting point for most businesses. Question marks have a potential to gain market share and become stars, and eventually cash cows when market growth slows. • If question marks do not succeed in becoming a market leader, they will degenerate into dogs when market growth declines. • Question marks must be analyzed carefully in order to determine whether they are worth the investment required to grow market share.

12 Question marks • They are a starting point for most businesses. Question marks have a potential to gain market share and become stars, and eventually cash cows when market growth slows. • If question marks do not succeed in becoming a market leader, they will degenerate into dogs when market growth declines. • Question marks must be analyzed carefully in order to determine whether they are worth the investment required to grow market share.

13 Stars • Stars are successful question marks and become a market leader in a high growth sector. . • Require high funding to fight competitions and maintain a growth rate. • When growth slows, if they have been able to maintain their category leadership stars become cash cows, else they become dogs due to low relative market share.

13 Stars • Stars are successful question marks and become a market leader in a high growth sector. . • Require high funding to fight competitions and maintain a growth rate. • When growth slows, if they have been able to maintain their category leadership stars become cash cows, else they become dogs due to low relative market share.

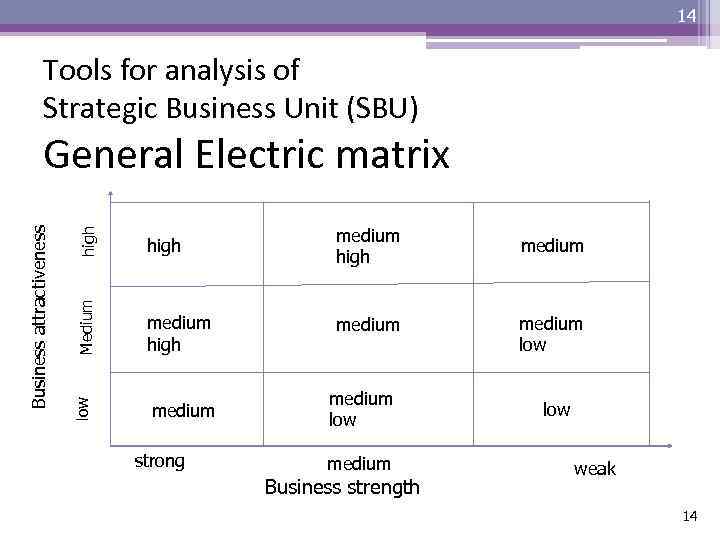

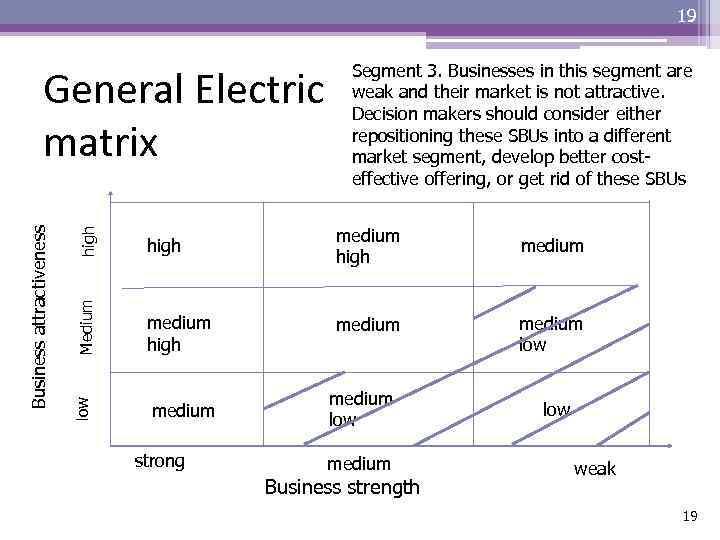

14 Tools for analysis of Strategic Business Unit (SBU) high Medium medium high low Business attractiveness General Electric matrix medium strong medium high medium low medium Business strength medium low weak 14

14 Tools for analysis of Strategic Business Unit (SBU) high Medium medium high low Business attractiveness General Electric matrix medium strong medium high medium low medium Business strength medium low weak 14

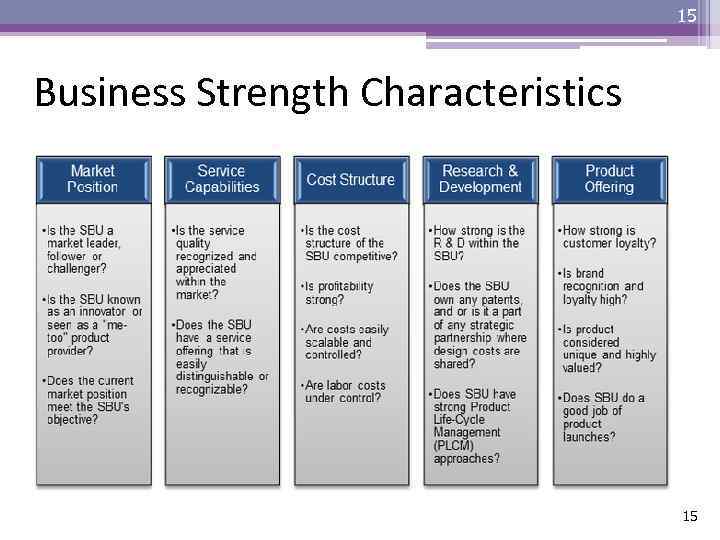

15 Business Strength Characteristics 15

15 Business Strength Characteristics 15

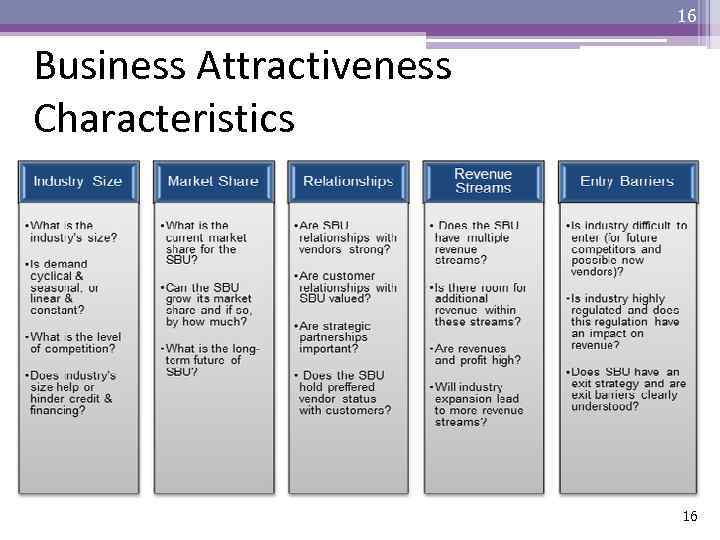

16 Business Attractiveness Characteristics 16

16 Business Attractiveness Characteristics 16

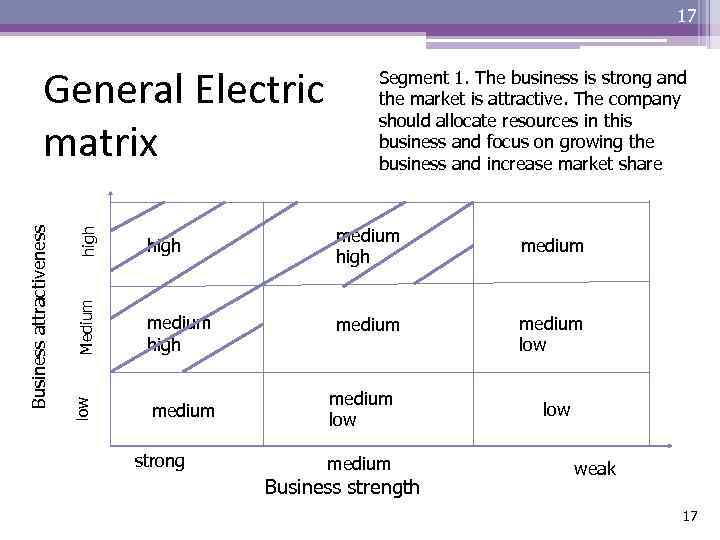

17 high Medium medium high low Business attractiveness General Electric matrix medium strong Segment 1. The business is strong and the market is attractive. The company should allocate resources in this business and focus on growing the business and increase market share medium high medium low medium Business strength medium low weak 17

17 high Medium medium high low Business attractiveness General Electric matrix medium strong Segment 1. The business is strong and the market is attractive. The company should allocate resources in this business and focus on growing the business and increase market share medium high medium low medium Business strength medium low weak 17

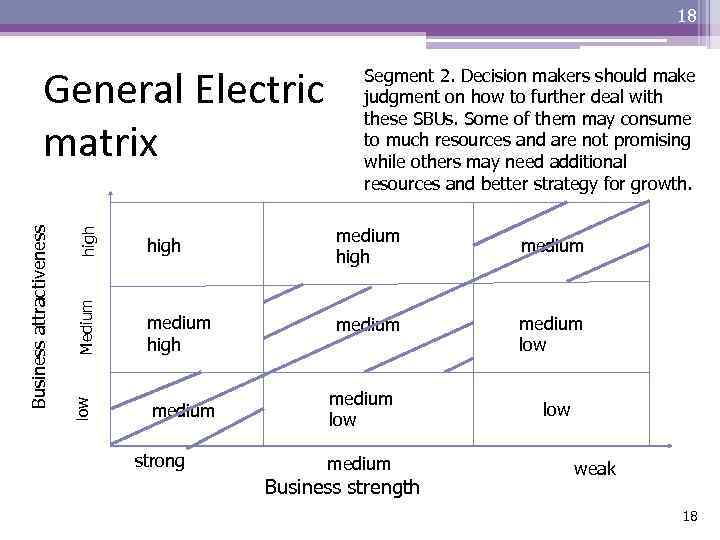

18 high Medium medium high low Business attractiveness General Electric matrix medium strong Segment 2. Decision makers should make judgment on how to further deal with these SBUs. Some of them may consume to much resources and are not promising while others may need additional resources and better strategy for growth. medium high medium low medium Business strength medium low weak 18

18 high Medium medium high low Business attractiveness General Electric matrix medium strong Segment 2. Decision makers should make judgment on how to further deal with these SBUs. Some of them may consume to much resources and are not promising while others may need additional resources and better strategy for growth. medium high medium low medium Business strength medium low weak 18

19 high Medium medium high low Business attractiveness General Electric matrix medium strong Segment 3. Businesses in this segment are weak and their market is not attractive. Decision makers should consider either repositioning these SBUs into a different market segment, develop better costeffective offering, or get rid of these SBUs medium high medium low medium Business strength medium low weak 19

19 high Medium medium high low Business attractiveness General Electric matrix medium strong Segment 3. Businesses in this segment are weak and their market is not attractive. Decision makers should consider either repositioning these SBUs into a different market segment, develop better costeffective offering, or get rid of these SBUs medium high medium low medium Business strength medium low weak 19

20 Shortcomings of the GE matrix • No generic or simplified criteria for business strength & uniqueness • Parent company can't use core competencies across multiple SBUs • Biased criteria can be used for strengths and uniqueness • Difficult to find a location for an SBU on the grid

20 Shortcomings of the GE matrix • No generic or simplified criteria for business strength & uniqueness • Parent company can't use core competencies across multiple SBUs • Biased criteria can be used for strengths and uniqueness • Difficult to find a location for an SBU on the grid