d1866f62357d39286e63766cdda04a7f.ppt

- Количество слайдов: 28

Modern Competitive Strategy 3 rd Edition Mc. Graw-Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

Modern Competitive Strategy 3 rd Edition Mc. Graw-Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved

Chapter 7 Vertical Integration and Outsourcing 7 -2

Chapter 7 Vertical Integration and Outsourcing 7 -2

The Employment Relationship Employees’ duties as per the U. S. legal system n n n l Duty of obedience Duty of loyalty Duty of disclosure Unlike market suppliers, employers are liable for actions of their employees 7 -3

The Employment Relationship Employees’ duties as per the U. S. legal system n n n l Duty of obedience Duty of loyalty Duty of disclosure Unlike market suppliers, employers are liable for actions of their employees 7 -3

Transaction Cost Theory l l Contracts are incomplete because contingencies in a supply relationship cannot be specified in advance Two basic conditions in combination lead to vertical integration n n Supplier invests in assets specialized to the firm, increasing the supplier’s bargaining power Contract incompleteness is increased by uncertainty in the supply relationship, providing the supplier with opportunities to use its bargaining power l Uncertainty can be due to: n n n Volatility in downstream demand or volume Changes in technology Shifts in input market prices or volume 7 -4

Transaction Cost Theory l l Contracts are incomplete because contingencies in a supply relationship cannot be specified in advance Two basic conditions in combination lead to vertical integration n n Supplier invests in assets specialized to the firm, increasing the supplier’s bargaining power Contract incompleteness is increased by uncertainty in the supply relationship, providing the supplier with opportunities to use its bargaining power l Uncertainty can be due to: n n n Volatility in downstream demand or volume Changes in technology Shifts in input market prices or volume 7 -4

The Property Rights Approach l l A firm vertically integrates because it has more to gain from owning and operating the activity than the market supplier Theory is most applicable to tradable resources that are not attached to capabilities n Difficulty in separating value of asset independent of employees (with specific capabilities) attached to it 7 -5

The Property Rights Approach l l A firm vertically integrates because it has more to gain from owning and operating the activity than the market supplier Theory is most applicable to tradable resources that are not attached to capabilities n Difficulty in separating value of asset independent of employees (with specific capabilities) attached to it 7 -5

Strategy and Control l l A firm wants to control investment decisions in supplier resources and capabilities that are strategically important Strategically important activities are more likely to be specialized to the firm 7 -6

Strategy and Control l l A firm wants to control investment decisions in supplier resources and capabilities that are strategically important Strategically important activities are more likely to be specialized to the firm 7 -6

Types of Control Problems l Distribution of economic gain from the supply relationship n l Supplier investment decisions are focused on value and cost n n l Product design Labor Production processes Inputs Supplier incentives n l Negotiation over price: l What is the buyer’s surplus? l What is the supplier’s profit? Alignment with buyer strategy Supplier handling of sensitive information 7 -7

Types of Control Problems l Distribution of economic gain from the supply relationship n l Supplier investment decisions are focused on value and cost n n l Product design Labor Production processes Inputs Supplier incentives n l Negotiation over price: l What is the buyer’s surplus? l What is the supplier’s profit? Alignment with buyer strategy Supplier handling of sensitive information 7 -7

The Efficient Boundaries Model l Compares in-house and market costs as supplier specialization to the buyer increases Examines both transaction and production costs Assumes that market supply is always more attractive when the input is not customized to the buyer n The buyer incurs bureaucratic costs that are not present in the market n Production costs are much higher in-house 7 -8

The Efficient Boundaries Model l Compares in-house and market costs as supplier specialization to the buyer increases Examines both transaction and production costs Assumes that market supply is always more attractive when the input is not customized to the buyer n The buyer incurs bureaucratic costs that are not present in the market n Production costs are much higher in-house 7 -8

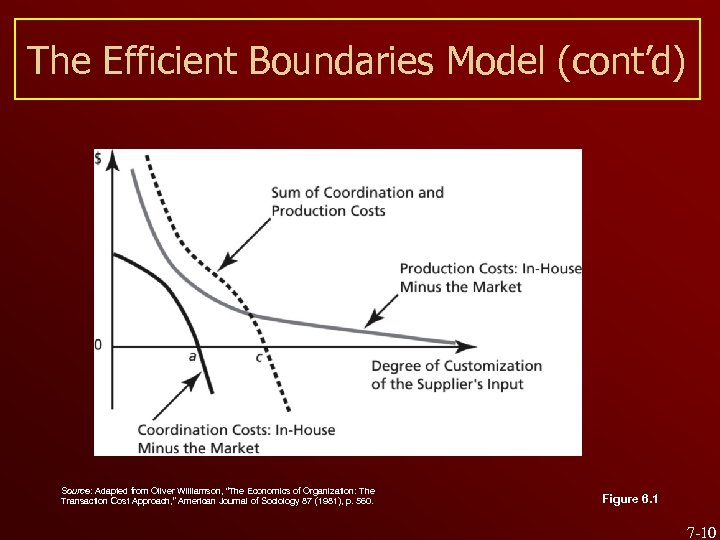

The Efficient Boundaries Model (cont’d) l In-house production becomes more attractive when: n Input customization increases and market suppliers use their bargaining power to reduce the firm’s surplus from the input n The production cost advantage of market suppliers declines with customization due to a lower volume of purchases reducing scale-based efficiencies 7 -9

The Efficient Boundaries Model (cont’d) l In-house production becomes more attractive when: n Input customization increases and market suppliers use their bargaining power to reduce the firm’s surplus from the input n The production cost advantage of market suppliers declines with customization due to a lower volume of purchases reducing scale-based efficiencies 7 -9

The Efficient Boundaries Model (cont’d) Source: Adapted from Oliver Williamson, “The Economics of Organization: The Transaction Cost Approach, ” American Journal of Sociology 87 (1981), p. 560. Figure 6. 1 7 -10

The Efficient Boundaries Model (cont’d) Source: Adapted from Oliver Williamson, “The Economics of Organization: The Transaction Cost Approach, ” American Journal of Sociology 87 (1981), p. 560. Figure 6. 1 7 -10

Strategic Sourcing Framework l Derived from the importance of both control needs and relative competence n n n Higher strategic value of an activity increases the need to control it High strategic value does not indicate a firm’s ability to perform an activity better than its suppliers Sometimes a firm can perform an non-strategic activity more competently than suppliers 7 -11

Strategic Sourcing Framework l Derived from the importance of both control needs and relative competence n n n Higher strategic value of an activity increases the need to control it High strategic value does not indicate a firm’s ability to perform an activity better than its suppliers Sometimes a firm can perform an non-strategic activity more competently than suppliers 7 -11

Strategic Sourcing Framework (cont’d) Figure 6. 2 7 -12

Strategic Sourcing Framework (cont’d) Figure 6. 2 7 -12

Patterns of Vertical Integration I l Initial market purchase of a standard input n n l Rising strategic importance of the input n n l Low buyer competence Low strategic importance Low buyer competence High strategic importance Supplier unable to give the firm the control it needs n Partnering fails 7 -13

Patterns of Vertical Integration I l Initial market purchase of a standard input n n l Rising strategic importance of the input n n l Low buyer competence Low strategic importance Low buyer competence High strategic importance Supplier unable to give the firm the control it needs n Partnering fails 7 -13

Patterns of Vertical Integration I (cont’d) l The firm vertically integrates as it invests in building capabilities to increase its competence n n l High buyer competence High strategic importance Key point: The firm has a strong incentive to continue investing in the activity since it is strategically important 7 -14

Patterns of Vertical Integration I (cont’d) l The firm vertically integrates as it invests in building capabilities to increase its competence n n l High buyer competence High strategic importance Key point: The firm has a strong incentive to continue investing in the activity since it is strategically important 7 -14

Patterns of Vertical Integration II l Initial market purchase of a standard input n n l The firm’s competence rises due to unrelated investments in capabilities n n l Low buyer competence Low strategic importance High buyer competence Low strategic importance The firm vertically integrates even though the input is not strategically important 7 -15

Patterns of Vertical Integration II l Initial market purchase of a standard input n n l The firm’s competence rises due to unrelated investments in capabilities n n l Low buyer competence Low strategic importance High buyer competence Low strategic importance The firm vertically integrates even though the input is not strategically important 7 -15

Patterns of Vertical Integration II (cont’d) l Key point: The firm has no incentive to continue investing in the activity since it is not strategically important so over time the firm’s advantage disappears 7 -16

Patterns of Vertical Integration II (cont’d) l Key point: The firm has no incentive to continue investing in the activity since it is not strategically important so over time the firm’s advantage disappears 7 -16

Patterns of Outsourcing I l Initial vertical integration of a strategically important activity n n l The firm’s competence relative to competitors decreases n n l High buyer competence High strategic importance Low buyer competence High strategic importance The firm’s partnership with a market supplier gives it control over investment decisions to support the firm’s market position 7 -17

Patterns of Outsourcing I l Initial vertical integration of a strategically important activity n n l The firm’s competence relative to competitors decreases n n l High buyer competence High strategic importance Low buyer competence High strategic importance The firm’s partnership with a market supplier gives it control over investment decisions to support the firm’s market position 7 -17

Patterns of Outsourcing I (cont’d) l The partner may fail to cooperate effectively – if so: n The firm invests in new capabilities to increase its competence and vertically integrates the activity n The firm reduces the strategic importance of the activity and sources the input from a standard market supplier 7 -18

Patterns of Outsourcing I (cont’d) l The partner may fail to cooperate effectively – if so: n The firm invests in new capabilities to increase its competence and vertically integrates the activity n The firm reduces the strategic importance of the activity and sources the input from a standard market supplier 7 -18

Patterns of Outsourcing II l Initial vertical integration of a strategically important activity n n l Strategic importance of the input decreases n n l High buyer competence Low strategic importance The firm disinvests in the activity n n l High buyer competence High strategic importance Low buyer competence Low strategic importance The firm outsources to a competent supplier 7 -19

Patterns of Outsourcing II l Initial vertical integration of a strategically important activity n n l Strategic importance of the input decreases n n l High buyer competence Low strategic importance The firm disinvests in the activity n n l High buyer competence High strategic importance Low buyer competence Low strategic importance The firm outsources to a competent supplier 7 -19

Key Points l l l Control needs dominate vertical integration decisions Control and buyer competence affect outsourcing Vertical integration almost always involves a change in the way the activity is executed n Ø Otherwise there would be no benefit from increased control Vertical integration and outsourcing decisions are always made for an activity or for an asset with associated activities n Not for a product or input 7 -20

Key Points l l l Control needs dominate vertical integration decisions Control and buyer competence affect outsourcing Vertical integration almost always involves a change in the way the activity is executed n Ø Otherwise there would be no benefit from increased control Vertical integration and outsourcing decisions are always made for an activity or for an asset with associated activities n Not for a product or input 7 -20

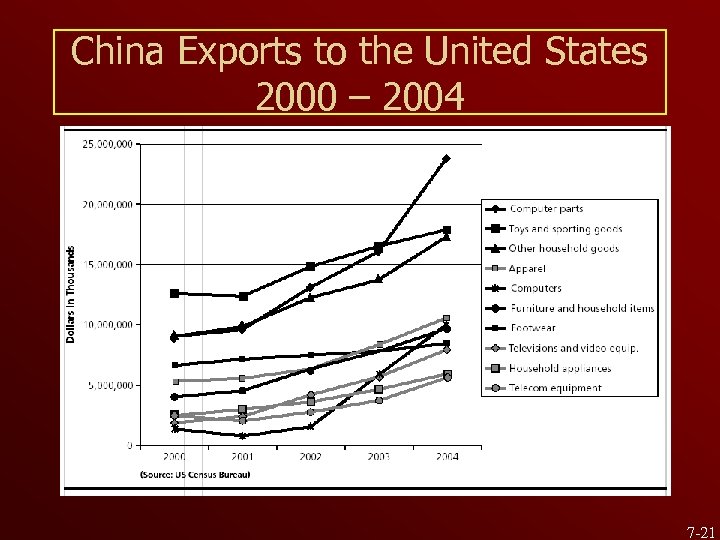

China Exports to the United States 2000 – 2004 Table 6. 1 7 -21

China Exports to the United States 2000 – 2004 Table 6. 1 7 -21

Outsourcing to China l What is driving the China export boom? n China has a country advantage in rapidly growing industries, e. g. , DVD players, computers, HDTV’s – leading to n Non-Chinese firms are replacing non-Chinese suppliers with Chinese firms l Lower cost n Non-Chinese firms are replacing their own in-house units by outsourcing to Chinese suppliers l All are true to some extent, depending on the firm and the industry 7 -22

Outsourcing to China l What is driving the China export boom? n China has a country advantage in rapidly growing industries, e. g. , DVD players, computers, HDTV’s – leading to n Non-Chinese firms are replacing non-Chinese suppliers with Chinese firms l Lower cost n Non-Chinese firms are replacing their own in-house units by outsourcing to Chinese suppliers l All are true to some extent, depending on the firm and the industry 7 -22

Hybrid Sourcing Arrangements l Vertical integration, outsourcing to a commodity supplier and partnering (a specialized supplier) are only three possible forms of supplier arrangement l Need to expand the possibilities of ownership (employment relation), control over incentives, and control over the activity l For example, what about franchising? l Also, business units in multi-business firms (e. g. , GE) sometimes supply each other n These internal supply relationships can be managed differently depending on the type of product (e. g. , creative or routine) 7 -23

Hybrid Sourcing Arrangements l Vertical integration, outsourcing to a commodity supplier and partnering (a specialized supplier) are only three possible forms of supplier arrangement l Need to expand the possibilities of ownership (employment relation), control over incentives, and control over the activity l For example, what about franchising? l Also, business units in multi-business firms (e. g. , GE) sometimes supply each other n These internal supply relationships can be managed differently depending on the type of product (e. g. , creative or routine) 7 -23

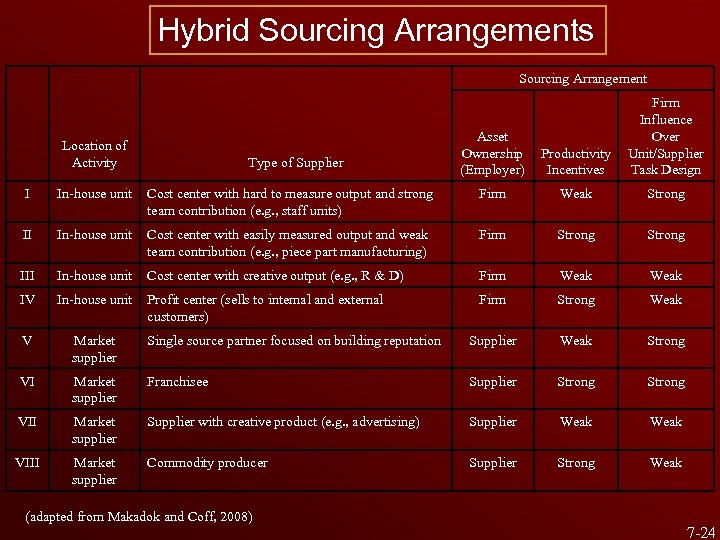

Hybrid Sourcing Arrangements Sourcing Arrangement Location of Activity Type of Supplier Asset Ownership (Employer) Productivity Incentives Firm Influence Over Unit/Supplier Task Design I In-house unit Cost center with hard to measure output and strong team contribution (e. g. , staff units) Firm Weak Strong II In-house unit Cost center with easily measured output and weak team contribution (e. g. , piece part manufacturing) Firm Strong III In-house unit Cost center with creative output (e. g. , R & D) Firm Weak IV In-house unit Profit center (sells to internal and external customers) Firm Strong Weak V Market supplier Single source partner focused on building reputation Supplier Weak Strong VI Market supplier Franchisee Supplier Strong VII Market supplier Supplier with creative product (e. g. , advertising) Supplier Weak VIII Market supplier Commodity producer Supplier Strong Weak (adapted from Makadok and Coff, 2008) 7 -24

Hybrid Sourcing Arrangements Sourcing Arrangement Location of Activity Type of Supplier Asset Ownership (Employer) Productivity Incentives Firm Influence Over Unit/Supplier Task Design I In-house unit Cost center with hard to measure output and strong team contribution (e. g. , staff units) Firm Weak Strong II In-house unit Cost center with easily measured output and weak team contribution (e. g. , piece part manufacturing) Firm Strong III In-house unit Cost center with creative output (e. g. , R & D) Firm Weak IV In-house unit Profit center (sells to internal and external customers) Firm Strong Weak V Market supplier Single source partner focused on building reputation Supplier Weak Strong VI Market supplier Franchisee Supplier Strong VII Market supplier Supplier with creative product (e. g. , advertising) Supplier Weak VIII Market supplier Commodity producer Supplier Strong Weak (adapted from Makadok and Coff, 2008) 7 -24

Key Observations Suppliers of creative input, either inside or outside the firm tend not to be controlled l Franchises and piece-work employees have similar profiles – high productivity incentives and strong firm control over the task l In-house profit centers tend to be like commodity producers – strong productivity incentives driven by market competition and weak firm control over the task l In-house cost centers with measurement problems tend to be like outside partners - weak productivity incentives (to prevent alignment problems) and strong control over the task l 7 -25

Key Observations Suppliers of creative input, either inside or outside the firm tend not to be controlled l Franchises and piece-work employees have similar profiles – high productivity incentives and strong firm control over the task l In-house profit centers tend to be like commodity producers – strong productivity incentives driven by market competition and weak firm control over the task l In-house cost centers with measurement problems tend to be like outside partners - weak productivity incentives (to prevent alignment problems) and strong control over the task l 7 -25

Competition Interacts with Uncertainty l Volume uncertainty n l Higher volume uncertainty leads to higher levels of vertical integration, especially when competition is weak Technological uncertainty n Higher levels of technological uncertainty lead to lower levels of vertical integration, especially when competition is strong 7 -26

Competition Interacts with Uncertainty l Volume uncertainty n l Higher volume uncertainty leads to higher levels of vertical integration, especially when competition is weak Technological uncertainty n Higher levels of technological uncertainty lead to lower levels of vertical integration, especially when competition is strong 7 -26

The Problem of Consistency l l Gains from consistency among activities determine in part the firm’s need for control over them System-wide benefits from coordination inhibit the outsourcing of a single activity 7 -27

The Problem of Consistency l l Gains from consistency among activities determine in part the firm’s need for control over them System-wide benefits from coordination inhibit the outsourcing of a single activity 7 -27

Strategic Boundaries Over the Industry Life Cycle l l In early stages of industry development, firms are integrated because demand for inputs is too small to attract entry of suppliers As industry grows and matures, suppliers enter and produce inputs for many firms n l Firms outsource to benefit from lower supplier costs As demand drops due to the introduction of substitutes, suppliers exit and firms in the industry re-integrate production 7 -28

Strategic Boundaries Over the Industry Life Cycle l l In early stages of industry development, firms are integrated because demand for inputs is too small to attract entry of suppliers As industry grows and matures, suppliers enter and produce inputs for many firms n l Firms outsource to benefit from lower supplier costs As demand drops due to the introduction of substitutes, suppliers exit and firms in the industry re-integrate production 7 -28