Model 5 F (part 1)

Model 5 F (part 1)

Question 2: What Is Competition Like and How Strong Are Each of the Competitive Forces? • An important part of industry and competitive analysis is to delve into the industry's competitive process to discover the main sources of competitive pressure and how strong each competitive force is. This analytical step is essential because managers cannot devise a successful strategy without understanding the industry's competitive character.

Question 2: What Is Competition Like and How Strong Are Each of the Competitive Forces? • An important part of industry and competitive analysis is to delve into the industry's competitive process to discover the main sources of competitive pressure and how strong each competitive force is. This analytical step is essential because managers cannot devise a successful strategy without understanding the industry's competitive character.

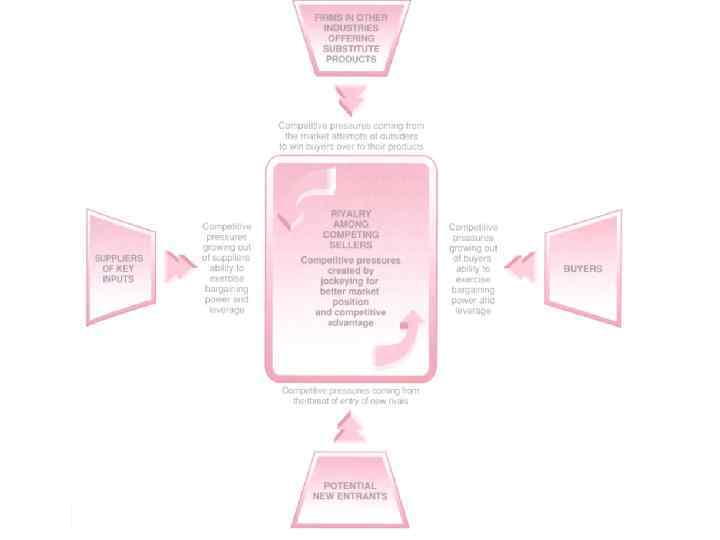

The Five-Forces Model of Competition • Even though competitive pressures in various industries are never precisely the same, the competitive process works similarly enough to use a common analytical framework in gauging the nature and intensity of competitive forces. As Professor Michael Porter of the Harvard Business School has convincingly demonstrated, the state of competition in an industry is a composite of fire competitive forces: • 1. The rivalry among competing sellers in the industry. • 2. The market attempts of companies in other industries to win customers over to their own substitute products. • 3. The potential entry of new competitors. • 4. The bargaining power and leverage suppliers of inputs can exercise. • 5. The bargaining power and leverage exercisable by buyers of the product.

The Five-Forces Model of Competition • Even though competitive pressures in various industries are never precisely the same, the competitive process works similarly enough to use a common analytical framework in gauging the nature and intensity of competitive forces. As Professor Michael Porter of the Harvard Business School has convincingly demonstrated, the state of competition in an industry is a composite of fire competitive forces: • 1. The rivalry among competing sellers in the industry. • 2. The market attempts of companies in other industries to win customers over to their own substitute products. • 3. The potential entry of new competitors. • 4. The bargaining power and leverage suppliers of inputs can exercise. • 5. The bargaining power and leverage exercisable by buyers of the product.

The Five-Forces Model of Competition • Porter's five-forces model is a powerful tool for systematically diagnosing the chief competitive pressures in a market and assessing how strong and important each one is. Not only is it the most widely used technique of competition analysis, but it is also relatively easy to understand apply.

The Five-Forces Model of Competition • Porter's five-forces model is a powerful tool for systematically diagnosing the chief competitive pressures in a market and assessing how strong and important each one is. Not only is it the most widely used technique of competition analysis, but it is also relatively easy to understand apply.

The Rivalry among Competing Sellers • The strongest of the five competitive forces is usually the jockeying for position and buyer favor that goes on among rival firms. In some industries, rivalry is centered around price competition— sometimes resulting in prices below the level of unit costs and forcing losses on most rivals. In other industries, price competition is minimal and rivalry is focused on such factors as performance features, new product innovation, quality and durability, warranties, after-the-sale service, and brand image.

The Rivalry among Competing Sellers • The strongest of the five competitive forces is usually the jockeying for position and buyer favor that goes on among rival firms. In some industries, rivalry is centered around price competition— sometimes resulting in prices below the level of unit costs and forcing losses on most rivals. In other industries, price competition is minimal and rivalry is focused on such factors as performance features, new product innovation, quality and durability, warranties, after-the-sale service, and brand image.

Rivalry can range from friendly to cutthroat • Competitive jockeying among rivals heats up when one or more competitors sees an opportunity to better meet customer needs or is under pressure to improve its performance. The intensity of rivalry among competing sellers is a function of how vigorously they employ such tactics as lower prices, snazzier features, expanded customer services, longer warranties, special promotions, and new product introductions. Rivalry can range from friendly to cutthroat, depending on how frequently and how aggressively companies undertake fresh moves that threaten rivals' profitability.

Rivalry can range from friendly to cutthroat • Competitive jockeying among rivals heats up when one or more competitors sees an opportunity to better meet customer needs or is under pressure to improve its performance. The intensity of rivalry among competing sellers is a function of how vigorously they employ such tactics as lower prices, snazzier features, expanded customer services, longer warranties, special promotions, and new product introductions. Rivalry can range from friendly to cutthroat, depending on how frequently and how aggressively companies undertake fresh moves that threaten rivals' profitability.

Strategy: if we make a step our rivals will also make a step • Whether rivalry is lukewarm or heated, every company has to craft a successful strategy for competing—ideally, one that produces a competitive edge over rivals and strengthens its position with buyers. The big complication in most industries is that the success of any one firm's strategy hinges partly on what offensive and defensive maneuvers its rivals employ and the resources rivals are willing and able to put behind their strategic efforts. The "best" strategy for one firm in its maneuvering for competitive advantage depends, in other words, on the competitive capabilities and strategies of rival companies. Thus, whenever one firm makes a strategic move, its rivals often retaliate with offensive or defensive countermoves.

Strategy: if we make a step our rivals will also make a step • Whether rivalry is lukewarm or heated, every company has to craft a successful strategy for competing—ideally, one that produces a competitive edge over rivals and strengthens its position with buyers. The big complication in most industries is that the success of any one firm's strategy hinges partly on what offensive and defensive maneuvers its rivals employ and the resources rivals are willing and able to put behind their strategic efforts. The "best" strategy for one firm in its maneuvering for competitive advantage depends, in other words, on the competitive capabilities and strategies of rival companies. Thus, whenever one firm makes a strategic move, its rivals often retaliate with offensive or defensive countermoves.

Regardless of the industry, several common factors seem to influence the tempo of rivalry among competing sellers:

Regardless of the industry, several common factors seem to influence the tempo of rivalry among competing sellers:

Factor 1. Rivalry intensifies as the number of competitors increases and as competitors become more equal in size and capability. • Up to a point, the greater the number of competitors, the greater the probability of fresh, creative strategic initiatives. In addition, when rivals are more equal in size and capability, they can usually compete on a fairly even footing, making it harder for one or two firms to "win" the competitive battle and dominate the market.

Factor 1. Rivalry intensifies as the number of competitors increases and as competitors become more equal in size and capability. • Up to a point, the greater the number of competitors, the greater the probability of fresh, creative strategic initiatives. In addition, when rivals are more equal in size and capability, they can usually compete on a fairly even footing, making it harder for one or two firms to "win" the competitive battle and dominate the market.

Factor 2. Rivalry is usually stronger when demand for the product is growing slowly. • In a rapidly expanding market, there tends to be enough business for everybody to grow. Indeed, it may take all of a firm's financial and competitive resources just to keep up with buyer demand, much less steal rivals' customers. But when growth slows or when market demand drops unexpectedly, expansion-minded firms and/or firms with excess capacity often cut prices and deploy other salesincreasing tactics, thereby igniting a battle for market share that can result in a shakeout of the weak and less efficient firms. The industry then consolidates into a smaller, but individually stronger, number of sellers.

Factor 2. Rivalry is usually stronger when demand for the product is growing slowly. • In a rapidly expanding market, there tends to be enough business for everybody to grow. Indeed, it may take all of a firm's financial and competitive resources just to keep up with buyer demand, much less steal rivals' customers. But when growth slows or when market demand drops unexpectedly, expansion-minded firms and/or firms with excess capacity often cut prices and deploy other salesincreasing tactics, thereby igniting a battle for market share that can result in a shakeout of the weak and less efficient firms. The industry then consolidates into a smaller, but individually stronger, number of sellers.

Factor 3. Rivalry increases when strong companies outside the industry acquire weak firms in the industry and launch aggressive, well-funded moves to transform their newly acquired competitors into major market contenders. • A concerted effort to turn a weak rival into a market leader nearly always entails launching well-financed strategic initiatives to dramatically improve the competitor's product offering, excite buyer interest, and win a much bigger market share. If these actions are successful, they put pressure on rivals to counter with fresh moves of their own.

Factor 3. Rivalry increases when strong companies outside the industry acquire weak firms in the industry and launch aggressive, well-funded moves to transform their newly acquired competitors into major market contenders. • A concerted effort to turn a weak rival into a market leader nearly always entails launching well-financed strategic initiatives to dramatically improve the competitor's product offering, excite buyer interest, and win a much bigger market share. If these actions are successful, they put pressure on rivals to counter with fresh moves of their own.

Factor 4 Rivalry is stronger when customers' costs to switch brands are low. • The lower the costs of switching, the easier it is for rival sellers to raid one another's customers. High switching costs, however, give sellers a more protected customer base and work against the efforts of rivals to promote brand-switching.

Factor 4 Rivalry is stronger when customers' costs to switch brands are low. • The lower the costs of switching, the easier it is for rival sellers to raid one another's customers. High switching costs, however, give sellers a more protected customer base and work against the efforts of rivals to promote brand-switching.

Factor 5. Rivalry is stronger when one or more competitors is dissatisfied with its market position and launches moves to holster its standing at the expense of rivals. • Firms that are losing ground or in financial trouble often react aggressively by introducing new products, boosting advertising, discounting prices, acquiring smaller rivals to strengthen their capabilities, and so on. Such actions can trigger a new round of maneuvering and a more hotly contested battle for market share.

Factor 5. Rivalry is stronger when one or more competitors is dissatisfied with its market position and launches moves to holster its standing at the expense of rivals. • Firms that are losing ground or in financial trouble often react aggressively by introducing new products, boosting advertising, discounting prices, acquiring smaller rivals to strengthen their capabilities, and so on. Such actions can trigger a new round of maneuvering and a more hotly contested battle for market share.

Factor 6. Rivalry tends to be more vigorous when it costs more to get out of a business than to stay in and compete. • The higher the exit barriers, the stronger the incentive for existing rivals to remain and compete as best they can, even though they may be earning low profits or even incurring losses.

Factor 6. Rivalry tends to be more vigorous when it costs more to get out of a business than to stay in and compete. • The higher the exit barriers, the stronger the incentive for existing rivals to remain and compete as best they can, even though they may be earning low profits or even incurring losses.

Sizing up competitive pressures • In sizing up the competitive pressures created by rivalry among existing competitors, the strategist's job is to identify the current weapons and tactics of competitive rivalry, to stay on top of which tactics are most and least successful, to understand the "rules" that industry rivals play by, and to decide whether and why rivalry is likely to increase or diminish in strength.

Sizing up competitive pressures • In sizing up the competitive pressures created by rivalry among existing competitors, the strategist's job is to identify the current weapons and tactics of competitive rivalry, to stay on top of which tactics are most and least successful, to understand the "rules" that industry rivals play by, and to decide whether and why rivalry is likely to increase or diminish in strength.

The Competitive Force of Potential Entry • New entrants to a market bring new production capacity, the desire to establish a secure place in the market, and sometimes substantial resources. Just how serious the competitive threat of entry is in a particular market depends on two classes of factors: barriers to entry and the expected reaction of incumbent firms to new entry. A barrier to entry exists whenever it is hard for a newcomer to break into the market and/or economic factors put a potential entrant at a disadvantage. There are several types of entry barriers:

The Competitive Force of Potential Entry • New entrants to a market bring new production capacity, the desire to establish a secure place in the market, and sometimes substantial resources. Just how serious the competitive threat of entry is in a particular market depends on two classes of factors: barriers to entry and the expected reaction of incumbent firms to new entry. A barrier to entry exists whenever it is hard for a newcomer to break into the market and/or economic factors put a potential entrant at a disadvantage. There are several types of entry barriers:

Barrier 1. Economies of scale • Scale economies deter entry because they force potential competitors either to enter on a large-scale basis or to accept a cost disadvantage. Trying to overcome scale economies by entering on a largescale basis at the outset can result in long-term overcapacity problems for the new entrant, and it can so threaten the market shares of existing firms that they retaliate aggressively (with price cuts, increased advertising and sales promotion, and similar blocking actions). Either way, a potential entrant is discouraged by the prospect of lower profits. Entrants may encounter scale-related barriers not just in production, but in advertising, marketing and distribution, financing, after-sale customer service, raw materials purchasing, and R&D as well.

Barrier 1. Economies of scale • Scale economies deter entry because they force potential competitors either to enter on a large-scale basis or to accept a cost disadvantage. Trying to overcome scale economies by entering on a largescale basis at the outset can result in long-term overcapacity problems for the new entrant, and it can so threaten the market shares of existing firms that they retaliate aggressively (with price cuts, increased advertising and sales promotion, and similar blocking actions). Either way, a potential entrant is discouraged by the prospect of lower profits. Entrants may encounter scale-related barriers not just in production, but in advertising, marketing and distribution, financing, after-sale customer service, raw materials purchasing, and R&D as well.

Barrier 2. Inability to gain access to technology and specialized know-how • Many industries require technological capability and skills not readily available to a newcomer. Key patents can effectively bar entry as can lack of technically skilled personnel and an inability to execute complicated manufacturing techniques. Existing firms often carefully guard know-how that gives them an edge. Unless new entrants can gain access to such proprietary knowledge, they will lack the capability to compete on a level playing field.

Barrier 2. Inability to gain access to technology and specialized know-how • Many industries require technological capability and skills not readily available to a newcomer. Key patents can effectively bar entry as can lack of technically skilled personnel and an inability to execute complicated manufacturing techniques. Existing firms often carefully guard know-how that gives them an edge. Unless new entrants can gain access to such proprietary knowledge, they will lack the capability to compete on a level playing field.

Barrier 3. Brand preferences and customer loyalty • Buyers are often attached to established brands. Japanese consumers, for example, are fiercely loyal to Japanese brands of motor vehicles, electronics products, cameras, and film. European consumers have traditionally been loyal to European brands of major household appliances. High brand loyalty means that a potential entrant must build a network of distributors and dealers, then be prepared to spend enough money on advertising and sales promotion to overcome customer loyalties and build its own clientele. Establishing brand recognition and building customer loyalty can be a slow and costly process. In addition, if it is difficult or costly for a customer to switch to a new brand, a new entrant must persuade buyers that its brand is worth the costs. To overcome the switching-cost barrier, new entrants may have to offer buyers a discounted price or an extra margin of quality or service. All this can mean lower profit margins for new entrants —something that increases the risk to start-up companies dependent on sizable, early profits.

Barrier 3. Brand preferences and customer loyalty • Buyers are often attached to established brands. Japanese consumers, for example, are fiercely loyal to Japanese brands of motor vehicles, electronics products, cameras, and film. European consumers have traditionally been loyal to European brands of major household appliances. High brand loyalty means that a potential entrant must build a network of distributors and dealers, then be prepared to spend enough money on advertising and sales promotion to overcome customer loyalties and build its own clientele. Establishing brand recognition and building customer loyalty can be a slow and costly process. In addition, if it is difficult or costly for a customer to switch to a new brand, a new entrant must persuade buyers that its brand is worth the costs. To overcome the switching-cost barrier, new entrants may have to offer buyers a discounted price or an extra margin of quality or service. All this can mean lower profit margins for new entrants —something that increases the risk to start-up companies dependent on sizable, early profits.

Barrier 4. Resource requirements • The larger the total investment and other resource requirements needed to enter the market successfully, the more limited the pool of potential entrants. The most obvious capital requirements are associated with manufacturing plant and equipment, distribution facilities, working capital to finance inventories and customer credit, introductory advertising and sales promotion to establish a clientele, and cash reserves to cover start-up losses. Other resource barriers include access to technology, specialized expertise and know-how, and R&D requirements, labor force requirements, and customer service requirements.

Barrier 4. Resource requirements • The larger the total investment and other resource requirements needed to enter the market successfully, the more limited the pool of potential entrants. The most obvious capital requirements are associated with manufacturing plant and equipment, distribution facilities, working capital to finance inventories and customer credit, introductory advertising and sales promotion to establish a clientele, and cash reserves to cover start-up losses. Other resource barriers include access to technology, specialized expertise and know-how, and R&D requirements, labor force requirements, and customer service requirements.

Barrier 5. Cost disadvantages independent of size • Existing firms may have cost advantages not available to potential entrants. These advantages can include access to the best and cheapest raw materials, patents and proprietary technology, the benefits of learning and experience curve effects, existing plants built and equipped years earlier at lower costs, favorable locations, and lower borrowing costs.

Barrier 5. Cost disadvantages independent of size • Existing firms may have cost advantages not available to potential entrants. These advantages can include access to the best and cheapest raw materials, patents and proprietary technology, the benefits of learning and experience curve effects, existing plants built and equipped years earlier at lower costs, favorable locations, and lower borrowing costs.

Barrier 6. Access to distribution channels • In the case of consumer goods, a potential entrant may face the barrier of gaining access to consumers. Wholesale distributors may be reluctant to take on a product that lacks buyer recognition. A network of retail dealers may have to be set up from scratch. Retailers have to be convinced to give a new brand display space and a trial period. The more existing producers tie up distribution channels, the tougher entry will be. To overcome this barrier, potential entrants may have to "buy" distribution access by offering better margins to dealers and distributors or by giving advertising allowances and other incentives. As a consequence, a potential entrant's profits may be squeezed unless and until its product gains enough acceptance that distributors and retailers want to carry it.

Barrier 6. Access to distribution channels • In the case of consumer goods, a potential entrant may face the barrier of gaining access to consumers. Wholesale distributors may be reluctant to take on a product that lacks buyer recognition. A network of retail dealers may have to be set up from scratch. Retailers have to be convinced to give a new brand display space and a trial period. The more existing producers tie up distribution channels, the tougher entry will be. To overcome this barrier, potential entrants may have to "buy" distribution access by offering better margins to dealers and distributors or by giving advertising allowances and other incentives. As a consequence, a potential entrant's profits may be squeezed unless and until its product gains enough acceptance that distributors and retailers want to carry it.

Barrier 7. Regulatory policies • Government agencies can limit or even bar entry by requiring licenses and permits. Regulated industries like cable TV, telecommunications, electric and gas utilities, radio and television broadcasting, liquor retailing, and railroads feature government-controlled entry.

Barrier 7. Regulatory policies • Government agencies can limit or even bar entry by requiring licenses and permits. Regulated industries like cable TV, telecommunications, electric and gas utilities, radio and television broadcasting, liquor retailing, and railroads feature government-controlled entry.

Barrier 8. Tariffs and international trade restrictions • National governments commonly use tariffs and trade restrictions (antidumping rules, local content requirements, and quotas) to raise entry barriers foreign firms. In 1996, due to tariffs imposed by the South Korean government, a Ford Taurus cost South Korean car buyers over $40, 000. The government of India requires that 90 percent of the parts and components used in Indian truck assembly plants be made in India. And to protect European chipmakers from low-cost Asian competition, European governments instituted a rigid formula for calculating floor prices for computer memory chips.

Barrier 8. Tariffs and international trade restrictions • National governments commonly use tariffs and trade restrictions (antidumping rules, local content requirements, and quotas) to raise entry barriers foreign firms. In 1996, due to tariffs imposed by the South Korean government, a Ford Taurus cost South Korean car buyers over $40, 000. The government of India requires that 90 percent of the parts and components used in Indian truck assembly plants be made in India. And to protect European chipmakers from low-cost Asian competition, European governments instituted a rigid formula for calculating floor prices for computer memory chips.

Enter new geographic markets • Whether an industry's entry barriers ought to be considered high or low depends on the resources and competencies possessed by the pool of potential entrants. Entry barriers are usually steeper for new start-up enterprises than for companies in other industries or for current industry participants looking to enter new geographic markets. Indeed, the most likely entrants into a geographic market are often enterprises looking to expand their market reach. A company already well established in one geographic market may have the resources, competencies, and competitive capabilities to hurdle the barriers of entering an attractive new geographic market.

Enter new geographic markets • Whether an industry's entry barriers ought to be considered high or low depends on the resources and competencies possessed by the pool of potential entrants. Entry barriers are usually steeper for new start-up enterprises than for companies in other industries or for current industry participants looking to enter new geographic markets. Indeed, the most likely entrants into a geographic market are often enterprises looking to expand their market reach. A company already well established in one geographic market may have the resources, competencies, and competitive capabilities to hurdle the barriers of entering an attractive new geographic market.

Evaluating entry barriers • In evaluating the potential threat of entry, one must look at – (1) how formidable the entry barriers are for each type of potential entrant—new start-up enterprises, candidate companies in other industries, and current industry participants aiming to enter additional geographic markets and – (2) how attractive the profit prospects are for new entrants. High profits act as a magnet to potential entrants, motivating them to commit the resources needed to hurdle entry barriers.

Evaluating entry barriers • In evaluating the potential threat of entry, one must look at – (1) how formidable the entry barriers are for each type of potential entrant—new start-up enterprises, candidate companies in other industries, and current industry participants aiming to enter additional geographic markets and – (2) how attractive the profit prospects are for new entrants. High profits act as a magnet to potential entrants, motivating them to commit the resources needed to hurdle entry barriers.

Reaction of existing firms • Even if a potential entrant has or can acquire the needed competencies and resources to attempt entry, it still faces the issue of how existing firms will react. Will they offer only passive resistance, or will they aggressively defend their market positions using price cuts, increased advertising, new product improvements, and whatever else will give a new entrant (as well as other rivals) a hard time?

Reaction of existing firms • Even if a potential entrant has or can acquire the needed competencies and resources to attempt entry, it still faces the issue of how existing firms will react. Will they offer only passive resistance, or will they aggressively defend their market positions using price cuts, increased advertising, new product improvements, and whatever else will give a new entrant (as well as other rivals) a hard time?

Evaluating force of potential entry • The best test of whether potential entry is a strong or weak competitive force is to ask if the industry's growth and profit prospects are attractive enough to induce additional entry. When the answer is no, potential entry is a weak competitive force. When the answer is yes and there are entry candidates with enough expertise and resources, then potential entry adds to competitive pressures in the marketplace. The stronger the threat of entry, the more that incumbent firms are driven to fortify their positions against newcomers.

Evaluating force of potential entry • The best test of whether potential entry is a strong or weak competitive force is to ask if the industry's growth and profit prospects are attractive enough to induce additional entry. When the answer is no, potential entry is a weak competitive force. When the answer is yes and there are entry candidates with enough expertise and resources, then potential entry adds to competitive pressures in the marketplace. The stronger the threat of entry, the more that incumbent firms are driven to fortify their positions against newcomers.

Changes of potential entry force • The threat of entry changes as the industry's prospects grow brighter or dimmer and as entry barriers rise or fall. For example, the expiration of a key patent can greatly increase threat of entry. A technological discovery can create an economy of scale advantage where none existed before. New actions by incumbent firms to increase advertising, strengthen distributor-dealer relations, step up R&D. or improve product quality can raise the roadblocks to entry. In international markets, entry barriers foreign-based firms fall as tariffs are lowered, as domestic wholesalers and dealers seek out lowercost foreign-made goods, and as domestic buyers become more willing to purchase foreign brands.

Changes of potential entry force • The threat of entry changes as the industry's prospects grow brighter or dimmer and as entry barriers rise or fall. For example, the expiration of a key patent can greatly increase threat of entry. A technological discovery can create an economy of scale advantage where none existed before. New actions by incumbent firms to increase advertising, strengthen distributor-dealer relations, step up R&D. or improve product quality can raise the roadblocks to entry. In international markets, entry barriers foreign-based firms fall as tariffs are lowered, as domestic wholesalers and dealers seek out lowercost foreign-made goods, and as domestic buyers become more willing to purchase foreign brands.