ed08b3e46eff83f44a833aaf8827c46c.ppt

- Количество слайдов: 19

MODARABA COMPANIES AND MODARABAS

AL-QURAN ﺍ ٱﻳ ﺍﻭ ٱ ﻭ ٱﻠ ﻭ ﺍ ٱﻠ ﻥ ﻧﻡ ﺅﻳ Believers, fear Allah and give up what is still due to you from usury, if you are believers; [SURAH AL-BAQARAH AYAH 278]

THE MODARABA- DEFINITION Modaraba is a kind of partnership , wherein one party provides finance to other party for the purpose of carrying on business. The party who provides the finance is called the “ Rabb-ul-Mal”, whereas the other party who puts its management skills for the Modaraba is called the “ Modarib” (working partner) Modaraba is one of the prime modes of Islamic Financial System. The concept of Modaraba was given fourteen hundred years back by our Holy prophet Hazrat Muhammad (Peace be upon him). http: //www. modarabas. com. pk/

CONSTITUTION OF MODARABA COMPANIES AND MODARABA In Pakistan the process of Islamization of the economy was initiated in 1980 when the Government introduced the concept of Modaraba for Islamization of the economy in the banking and corporate sector. The Modaraba Companies & Modaraba (Floatation & Control ) Ordinance, 1980 and Modaraba Companies and Modarabas Rules 1981, were promulgated in the early 80’s by the Government of Pakistan. The Ordinance and Rules provides matters relating to the registration of Modaraba companies and the floatation, management and regulation of Modarabas Lets see the ordinance

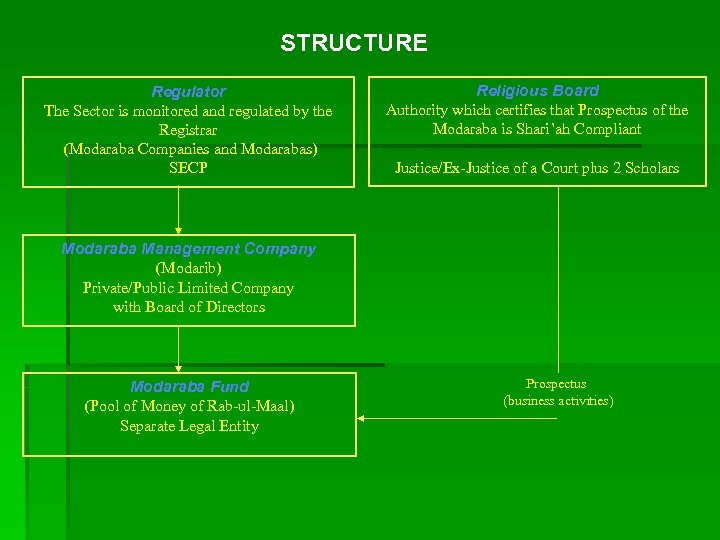

STRUCTURE Regulator The Sector is monitored and regulated by the Registrar (Modaraba Companies and Modarabas) SECP Religious Board Authority which certifies that Prospectus of the Modaraba is Shari’ah Compliant Justice/Ex-Justice of a Court plus 2 Scholars Modaraba Management Company (Modarib) Private/Public Limited Company with Board of Directors Modaraba Fund (Pool of Money of Rab-ul-Maal) Separate Legal Entity Prospectus (business activities)

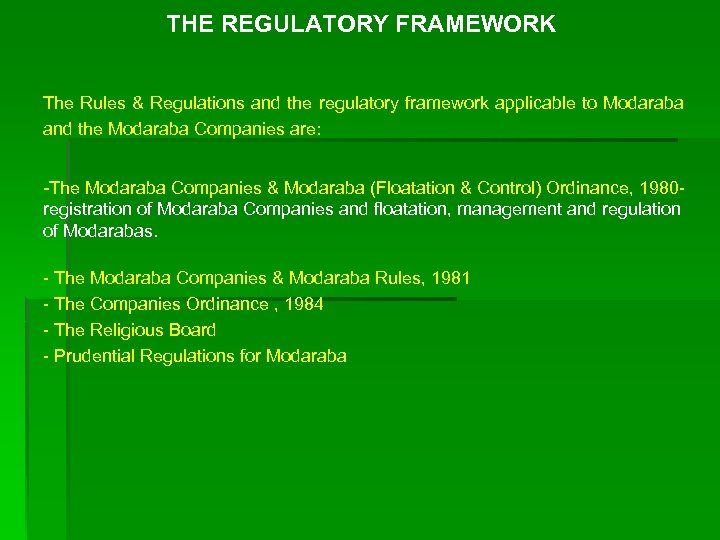

THE REGULATORY FRAMEWORK The Rules & Regulations and the regulatory framework applicable to Modaraba and the Modaraba Companies are: -The Modaraba Companies & Modaraba (Floatation & Control) Ordinance, 1980 - registration of Modaraba Companies and floatation, management and regulation of Modarabas. - The Modaraba Companies & Modaraba Rules, 1981 - The Companies Ordinance , 1984 - The Religious Board - Prudential Regulations for Modaraba

ROLE OF MODARIB IN PAKISTAN A Modaraba floated by an MMC is the manager (Modarib). He uses his entrepreneurial skills and manages the business of the Modaraba. The profit earned is distributed among the partners at a specified and defined ratio. In Pakistan the Modarib who is the MMC, manages the Modaraba Ventures. By law the Modarib can charge maximum profit of 10% of the net annual profits of the Modaraba. Besides, the Modarib also gets profit in shape of dividends on its minimum investment in the venture of Modaraba.

BENEFIT TO RABB-UL-MAL One party has the funds but does not have the expertise and another party has the expertise but does not have the funds. Modaraba gives opportunities to both the parties i. e. Modarib and Rabb-ul-Mal to join hands for the business under the Shariah. Rabb-ul-Mal can liquidate his or her investment anytime by selling his/her Modaraba Certificate through Stock markets to other Rabb-ul-Mal. In Pakistan, the income of a Modaraba is tax free if the Modarib distributes 90% of the profit to Rabb-ul-Mal earned in any single year.

MODARABA AS AN ISLAMIC FUND Modaraba can: § Invest in the stock market § Indulge in Ijara, Morabaha and Musharaka Financing activities § Indulge in trading of Halal Commodities § Undertake project financing activities § Act as an SPV/SPE § Act as a venture capital company

PERFORMANCE OF MODARABA AS AN ENTITY IN PAKISTAN § Modaraba Sector has continuously been playing an active role in the growth of Pakistan’s economy. During the last two decades, the Modaraba Sector has enrolled its place in the financial intermediaries of Pakistan and has been able to create a market niche for themselves in the corporate sector.

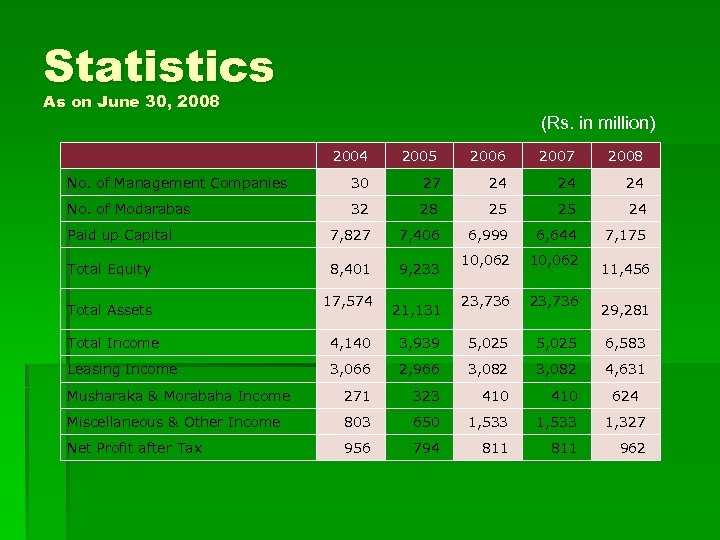

Statistics As on June 30, 2008 (Rs. in million) 2004 2005 2006 2007 2008 No. of Management Companies 30 27 24 24 24 No. of Modarabas 32 28 25 25 24 Paid up Capital 7, 827 7, 406 6, 999 6, 644 7, 175 Total Equity 8, 401 9, 233 10, 062 11, 456 Total Assets 17, 574 21, 131 23, 736 29, 281 Total Income 4, 140 3, 939 5, 025 6, 583 Leasing Income 3, 066 2, 966 3, 082 4, 631 271 323 410 624 Miscellaneous & Other Income 803 650 1, 533 1, 327 Net Profit after Tax 956 794 811 962 Musharaka & Morabaha Income

Innovation Islamic Financing Agreements § § § § Diminishing Musharaka Agreement Ijara Agreement Istisna Agreement Modaraba Agreement Musawamah Agreement Musharaka Agreement Murabaha Agreement Salam Agreement Syndicate Modaraba Agreement Syndicate Musharaka Agreement Sukkuk Agreement Commodity Murabaha Agreement CFS (Continuous Funding System) Agreement

UPDATING THE LEGAL FRAMEWORK § Proposed Amendments in the Ordinance, Rules, Regulations and Guidelines governing the Modarabas companies and Modarabas § Relaxation of Prudential Regulations § Statutory reserve requirement increased for capitalization § relaxation in current assets to current liabilities ratios from 1 : 1 to 0. 75: 1

TRENDS AND CHALLENGES n New trends Ø Concept of Islamic Funds becoming popular Ø Increasing number of entrants n Regulatory challenges Ø Minimum equity requirement to be raised Ø Stringent eligibility/fit and proper criteria and performance benchmarks to be introduced, research capabilities to be improved Ø Investor base broadened: (public sector) provident and pension funds Ø International best practices to be implemented across the sector Ø Industry Association’s role to be strengthened, in the areas of training, examinations and licensing of intermediaries

Incentives § Exemption from capital gains tax § In view of the practical difficulties faced by the industry Guidelines for issuance of Certificates of Musharaka (COM) was amended and Modarabas were allowed to issue COM after obtaining credit rating of minimum investment grade from a credit rating agency registered with the SECP. § Earlier the precondition was payment of dividend for two successive years. § Encourage mergers/acquisitions/revivals for consolidation and capitalization of the sector

Ensuring transparency and regulatory control § Placement of quarterly accounts on website § Placement of shares either with the SEC (in case of physical) or placed in an account at the Central Depository Company of Pakistan Limited. § Joint Forum of the SECP/SBP on Islamic Financial Services § Code of Corporate governance § AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions) Bharain, 1991 § International Best practices - to highlight areas that are non-permissible for investment § Membership of Islamic Financial Services Board § Industry Associations- product development § Shariah Boards on every institution § Holistic legislation, standardization and harmonization to avoid conflict and overlap.

Monitoring and Enforcement § Monitoring at two levels §Offsite §Onsite § Enforcement §Administrative actions, e. g. revocation of license §Imposition of fines §References to courts for prosecution and winding up

Exploring the developments of Islamic Capital Market Joint Initiative of the IDB (Islamic Development Bank) and IFSB (Islamic Financial Services Board) - Ten year framework for the Islamic financial industry development. General regulatory framework for Islamic financial services industry. International infrastructure institutions such as the: § § § § Islamic Financial Services Board (IFSB)- Regulator International Islamic Financial Market (IIFM)-Market (General) Council for Islamic Banks and Financial Institutions (CIBAFI)Promotion of IFIs Arbitration and Reconciliation Centre for Islamic Financial Institutions (ARCIFI)- Arbitration International Islamic Rating Agency (IIRA) – Credit rating Liquidity Management Centre (LMC)- Investment of surplus funds of IFIs. Auditing and Accounting Organization for Islamic Financial Institutions (AAOIFI)- Accounting

Promotion of Islamic Finance § Harmonization / standardization § IDB and IFSB Ten Year Framework Stands for economic and financial integration of the Muslim Ummah § -International Islamic Financial Market § -laws, regulations § -transactions / legal documents § -concepts (overcome Fiqh issues) § Obtain Membership § Become part of the IFSB Workshops § Emulate role models like Malaysia, Bahrain § Memoranda of Understanding § Networking

ed08b3e46eff83f44a833aaf8827c46c.ppt