2d3b2a951b9c9894ce4d594ec7c63f53.ppt

- Количество слайдов: 21

“Mobilizing the Private Sector for Public Education” Private Provision of Education Services. . . myth or reality ? Presentation by Robert Taylor and Ron Perkinson International Finance Corporation at Kennedy School of Government, Harvard University 5 th & 6 th October, 2005

Global Trends n The 90 s witnessed a surge in private provision of infrastructure services (telecom, transport, power, water) in emerging markets, through privatizations/concessioning of government services and assets, BOTs, management contracts and leases n Driven by: – The need for significant capital investment to meet rising demand (vs. tight government budgets) – Public dissatisfaction with the quality and availability of public services

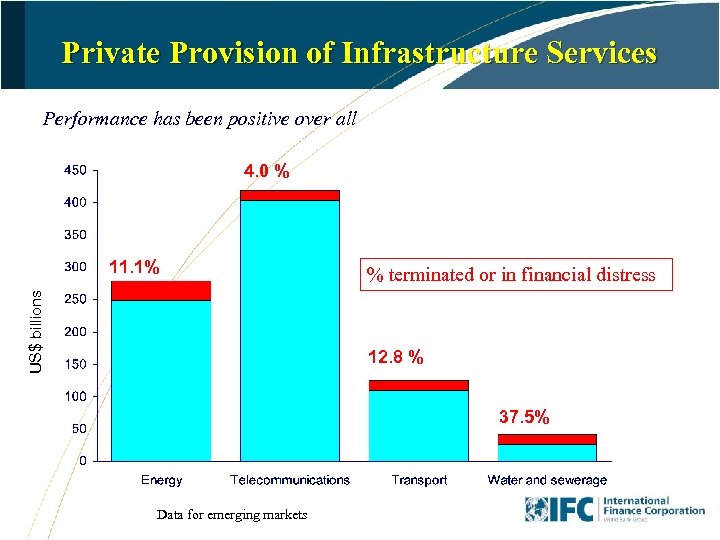

Private Provision of Infrastructure Services Performance has been positive over all 4. 0 % US$ billions 11. 1% % terminated or in financial distress 12. 8 % 37. 5% * Data for emerging markets

Lessons from Infrastructure Privatization n Public expectations are high for service improvements n Public tolerance is low for price increases, without evident service improvements n Regulation is more difficult than expected – Independence of regulator is difficult to achieve – Lack of regulatory capacity/experience in most countries n Less political will to privatize public services which are perceived as less commerical n Also more difficult to sustain the implementation – Pressures for government intervention – Pressures to stop or rollback price increases

The 3 rd Wave? n Since mid-90 s, many have forecast that privatization would progress from: – – – The 1 st wave: industry privatization in the 1980 s The 2 nd wave: infrastructure privatization in the 1990 s The 3 rd wave: social sector privatization in the 2000 s n While there have been some important initiatives (e. g. Bogota schools concessioning), private provision of public education has not taken off as predicted n Why not?

The 3 rd Wave? Possible reasons: n n Generally not facing the same capital shortages as infrastructure In many countries, consumers can choose private schools Education is more politically sensitive (and not perceived as a commercial service) Teachers’ unions resistance But, some of the underlying drivers for ‘privatization’ are still present in education, particularly n Public dissatisfaction with government-managed public schools

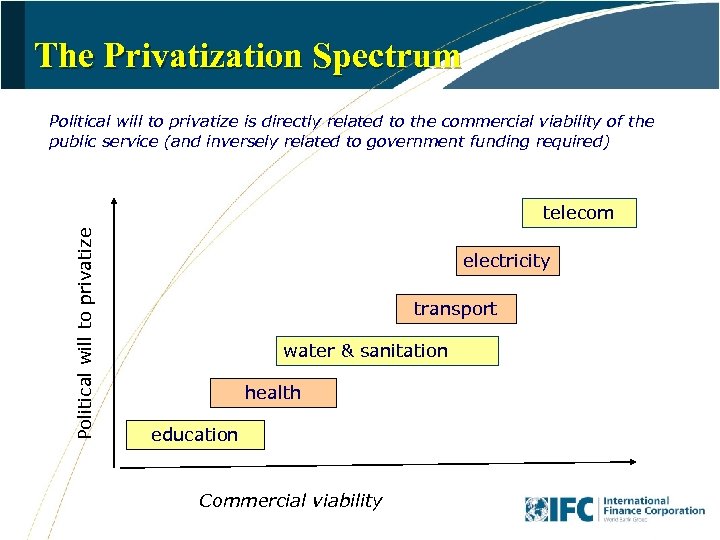

The Privatization Spectrum Political will to privatize is directly related to the commercial viability of the public service (and inversely related to government funding required) Political will to privatize telecom electricity transport water & sanitation health education Commercial viability

IFC’s Role n IFC has assisted governments in successfully implementing more than 100 privatizations, concessions and public-private partnerships (PPPs) n Most of our work is in infrastructure – transport, water/sanitation, power n IFC’s Advisory Services Group has a unit dedicated to implementing PPPs for health and education - Currently evaluating a large PPP project in Brazil for new schools n IFC’s Health & Education Department has undertaken PPP initiatives in conjunction with project investments

IFC Examples of PPP’s YUCE Inc – Turkey n n n US$9. 6 million project Expand & modernize YUCE School in Ankara: – expand enrollments by 40% to 2, 100 students – assist the introduction of International Baccalaureate Education Software & IT Training: – expand IT Training Academy – finance further development of educational software and systems - assessment tools (testing, grading and reporting) - in use by 250 public schools and 160 private schools - supported by Ministry of Education - systems now used by CITO for PISA testing across Turkey

IFC Examples of PPP’s Shanghai Second Medical University & Shanghai Aerospace Corporation SSMU’s Role – Public university providing distance delivery by satellite – upgrading nursing vocational certificates and diplomas to bachelor degree level – lifelong learners - over 900, 000 nurses without bachelor degrees SAC’s Role – strategy formulation – design, development and establishment of platform technologies – establishing DLC and CME transmission / receiving equipment – establishing DLC and CME administration support centers – responsible for technical investments, systems and courseware development IFC will finance the SAC platform operations

Public going Private n Institute of Business – Trinidad & Tobago – private company established by University of West Indies – IFC financed construction of new facilities – leading business school in T & T n SIBFI – China – Shanghai University of Finance & Economics (public) and Bankacademie (private / Germany) – joint venture to establish a professional training school for the China finance and banking sectors – IFC participated in financing the new private JV entity (part equity / part debt)

Eduloan - South Africa private financing for students attending public institutions • Started Yr 2000 – initial IFC investment US$2. 8 million • Payroll-based lender – collections through payroll deductions • Students are working – bank/employers share the risk • Access to public University & Technikon programs – soon extends to professional training including nursing and other programs • Delinquencies – have been low (less than 2%) • EO 2003 there were 49, 000 students being financed – expected to reach US$ 40 million portfolio (est 97, 000 students) by EO 2006 • Loan amounts per student are small - est. up to US$ 500 range – repayable within 12 months

some food for thought . . . how can PPP’s leverage private sector financing in education? ?

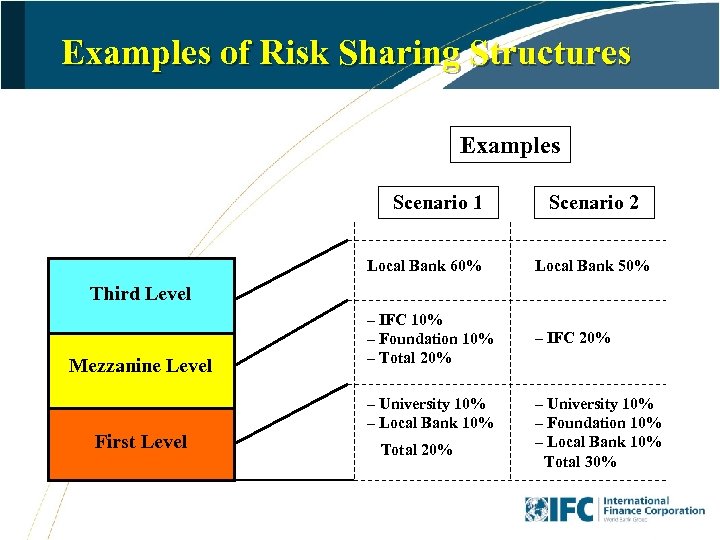

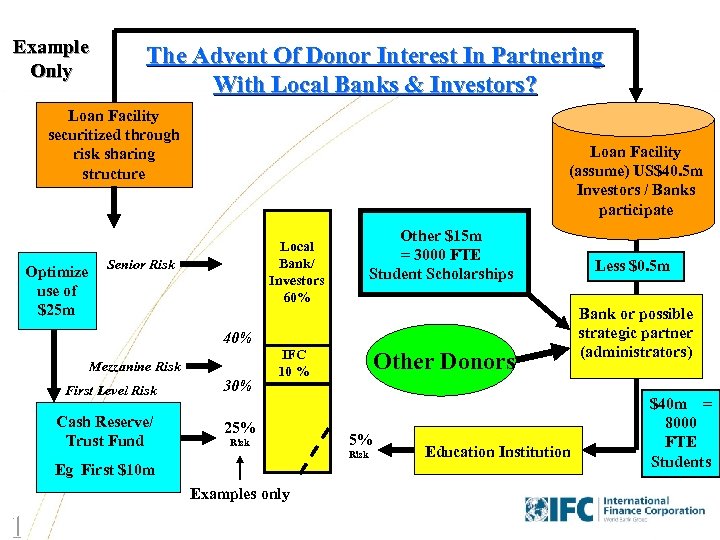

Examples of Risk Sharing Structures Examples Scenario 1 Scenario 2 Local Bank 60% Local Bank 50% – IFC 10% – Foundation 10% – Total 20% – IFC 20% Third Level Mezzanine Level First Level – University 10% – Local Bank 10% Total 20% – University 10% – Foundation 10% – Local Bank 10% Total 30%

New innovations for donors. . . Donors are beginning to look for other options – how to better optimize the use of available funds Traditional method $25 million = 5000 FTE students @ $5000 tuition fees

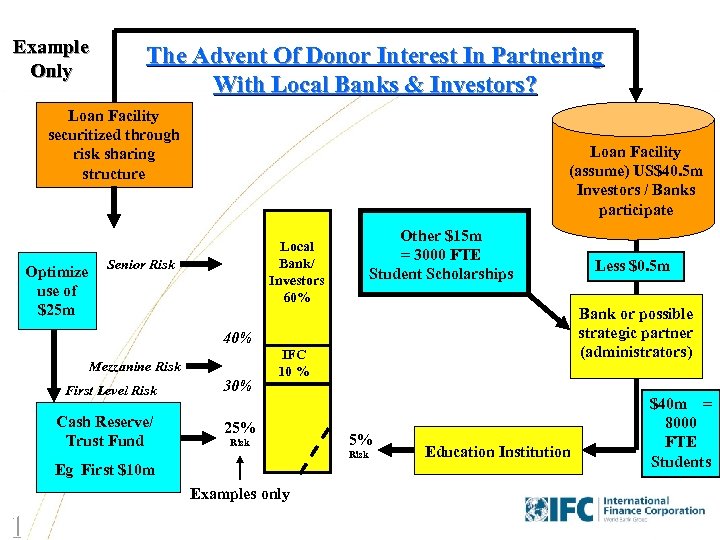

Example Only The Advent Of Donor Interest In Partnering With Local Banks & Investors? Loan Facility securitized through risk sharing structure Optimize use of $25 m Loan Facility (assume) US$40. 5 m Investors / Banks participate Other $15 m = 3000 FTE Student Scholarships Local Bank/ Investors 60% Senior Risk Bank or possible strategic partner (administrators) 40% Mezzanine Risk First Level Risk 30% Cash Reserve/ Trust Fund IFC 10 % 25% Risk Examples only 1 5% Risk Eg First $10 m Less $0. 5 m Education Institution $40 m = 8000 FTE Students

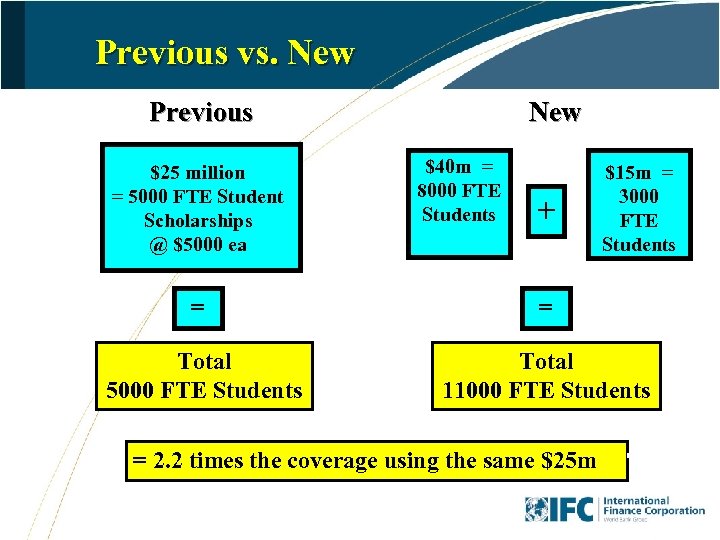

Previous vs. New Previous $25 million = 5000 FTE Student Scholarships @ $5000 ea New $40 m = 8000 FTE Students + $15 m = 3000 FTE Students = = Total 5000 FTE Students Total 11000 FTE Students = 2. 2 times the coverage using the same $25 m

Example Only The Advent Of Donor Interest In Partnering With Local Banks & Investors? Loan Facility securitized through risk sharing structure Optimize use of $25 m Loan Facility (assume) US$40. 5 m Investors / Banks participate Other $15 m = 3000 FTE Student Scholarships Local Bank/ Investors 60% Senior Risk 40% Mezzanine Risk First Level Risk 30% Cash Reserve/ Trust Fund IFC 10 % 25% Risk Eg First $10 m Examples only 1 Other Donors Education Institution Less $0. 5 m Bank or possible strategic partner (administrators) $40 m = 8000 FTE Students

The 3 rd Wave Donors are interested in risk sharing initiatives to leverage private sector financing What about governments?

Myth or reality ? ? Can governments also play a role in PPP’s – that will leverage private sector financing through more effective use of public funds?

Going Forward n IFC is ready to provide: – Technical assistance to governments in structuring and implementing PPPs for education – Financing (loans, equity and technical assistance) to the private sector partners § For additional information, please contact Robert Taylor Advisory Services Tel 001 -202 -473 -1974 rtaylor@ifc. org Ron Perkinson Education Investments Tel 001 -202 -458 -1804 rperkinson@ifc. org

2d3b2a951b9c9894ce4d594ec7c63f53.ppt