8957c3049c5070cee1e2b06c54fd4946.ppt

- Количество слайдов: 23

Mobile Telephony in Kenya … is it “Making life better”? Luca Manica Michele Vescovi ICT 4 SD course – May 2008

Outline • • • Introduction ICT and Development Countries Mobile Telephony in Kenya M-PESA system Conclusions

Why this Topic?

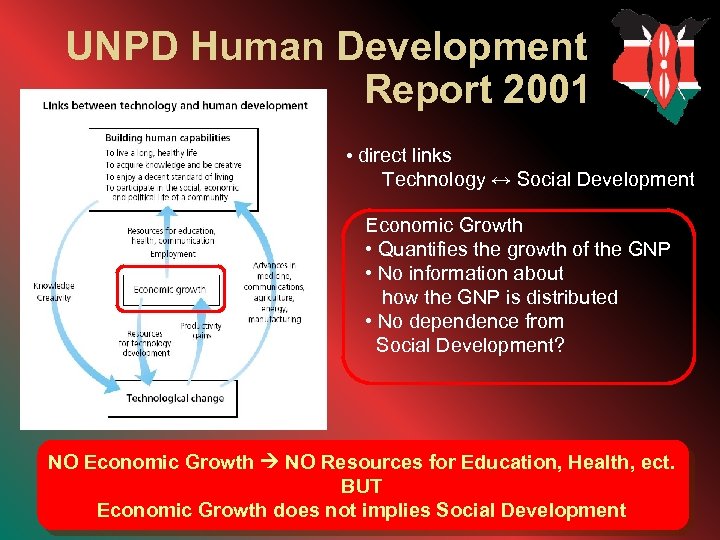

UNPD Human Development Report 2001 • direct links Technology ↔ Social Development Economic Growth • Quantifies the growth of the GNP • No information about how the GNP is distributed • No dependence from Social Development? NO Economic Growth NO Resources for Education, Health, ect. BUT Economic Growth does not implies Social Development

The ICT Role New Technologies BE OPTIMISTIC! ICT can give opportunities of Social Development: • better life conditions • new jobs • new opportunities of business • more information BUT ICT are not a magic WAND!

The Morana’s Mobile Phone Impact of the new technologies on the Kenyan culture Economic Impact Poverty • shame • look rich! Cultural Impact Be like a White ICT make Mistakes • lost of traditions • political choices

Kenya • 36 million: estimated population (Dec 2006) • 65% live in rural areas • more than 50% below the poverty line (1$/day or less) • 75% arid / semi-arid land (inhabited mainly by pastoralist communities)

Mobile Telephony • 70 - 80% population covered (March 2007) • Mobile penetration: ~ 30% = 11 milion Kenyans • 98% prepaid traffic (per second billing) • 20% geographical area covered (March 2007) • Coverage is still growing …

Mobile Operators • Safaricom (1996) – ~ 9 milion subscribers – 40% Vodafone (U. K. ) “The better option” • Celtel (2000) – ~ 2 milion subscribers – 80% Celtel Int. (Kwait) • Econet Wireless ? – South African company – In legal battles since 2003 – Will it roll out within 2008 ? – Third licenced operator “Making life better” “? ? ? ”

Third operator ?

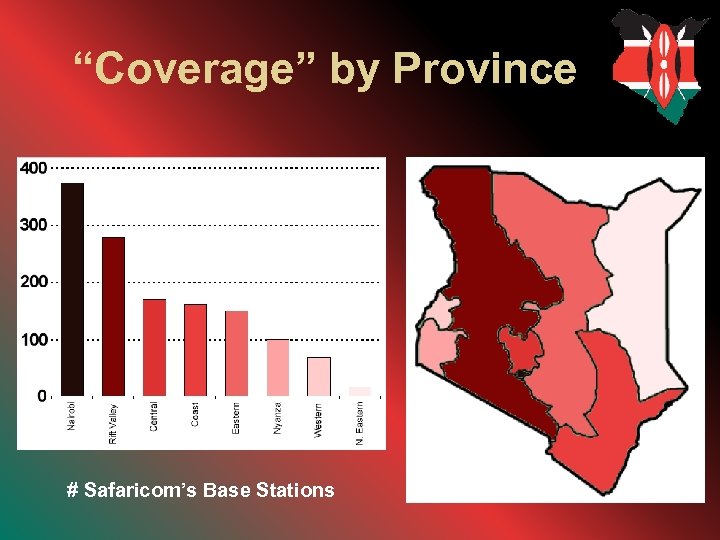

“Coverage” by Province # Safaricom’s Base Stations

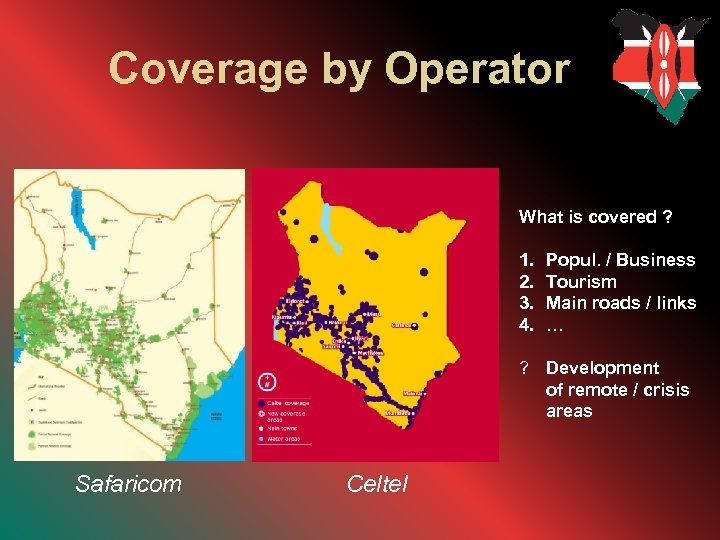

Coverage by Operator What is covered ? 1. 2. 3. 4. Popul. / Business Tourism Main roads / links … ? Development of remote / crisis areas Safaricom Celtel

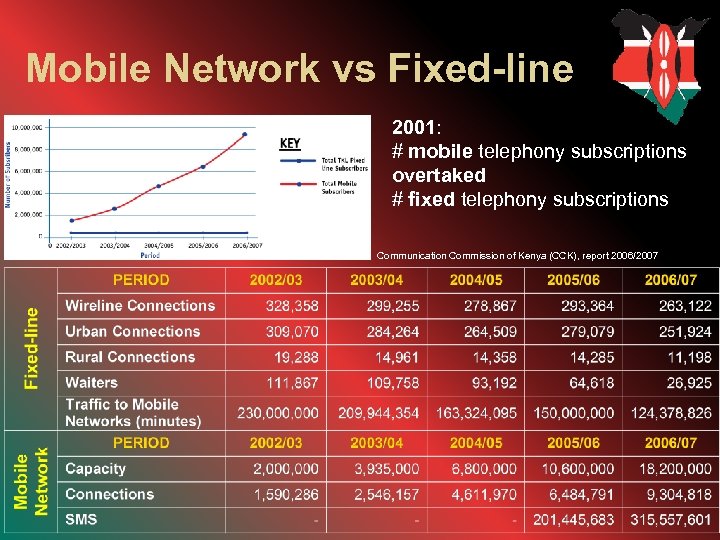

Mobile Network vs Fixed-line 2001: # mobile telephony subscriptions overtaked # fixed telephony subscriptions Communication Commission of Kenya (CCK), report 2006/2007

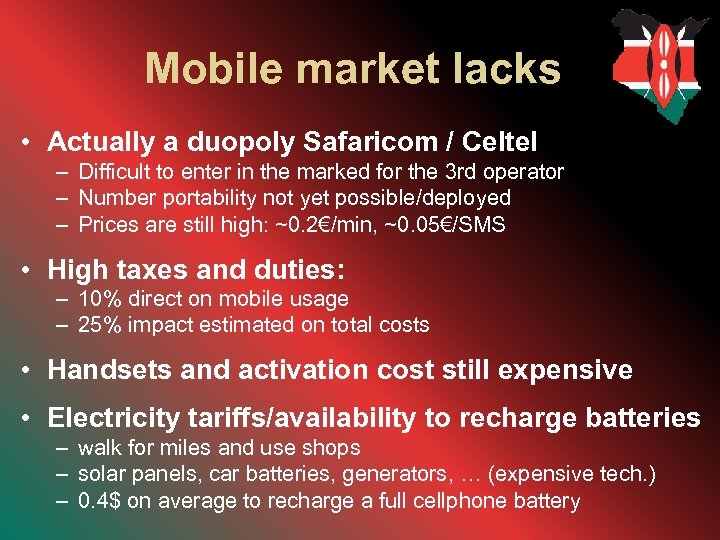

Mobile market lacks • Actually a duopoly Safaricom / Celtel – Difficult to enter in the marked for the 3 rd operator – Number portability not yet possible/deployed – Prices are still high: ~0. 2€/min, ~0. 05€/SMS • High taxes and duties: – 10% direct on mobile usage – 25% impact estimated on total costs • Handsets and activation cost still expensive • Electricity tariffs/availability to recharge batteries – walk for miles and use shops – solar panels, car batteries, generators, … (expensive tech. ) – 0. 4$ on average to recharge a full cellphone battery

Mobile banking • Mobile banking… a development opportunity? • 80% people unbanked in least developed countries (also in Kenya) – Barriers to banking services are: illiteracy, lack of education, high fees, proximity to bank facilties – Be unbanked means: cash economy, vulnerability to risks, hard save or borrow money • Need of transfer money: – bread-winner far from family, run a business, avoid risky travels • Popular way to transfer money in Kenya: – send it with a relative or friend (risky, slow, …) – use postal services (expensive commissions charged in %) • Even more adults own (or have access to) a mobile phone, also in rural areas

M-PESA (intro) • World’s first (2007) mobile bancking system • Vodafone/Safaricom + U. K. gov. initial support • Cellphone based platform for simple banking services and cash-transfers • On the Safaricom’s common SIM menu • SMS-based, (personal) PIN-protected • Kenya: banking infrastructure not well developed • Kenya: large network of air-time dealers, retailers, shops, oil pumps… candidate M-PESA agents • 1600 M-PESA agents, more than 500, 000 customers

M-PESA (more details) • Customer: – – M-PESA account distinct w. r. t. personal airtime credit “Save” up to 50, 000 Ksh (~500€) Deposit and Send up to 35, 000 Ksh per time Free services: registration, deposit cash, buy airtime, withdraw cash by non M-P user – Charged service: withdraw cash by M-P. user, send to M-P. user (fixed), send to non M-P. user (variable) – Show balance, change PIN, languages: English or Swahili – Cash operations (deposit, withdraw) need an M-PESA agent • Low (directly charged) commissions w. r. t. banks (from 30 Ksh up to 400 Ksh) • All pooled balances held as a unique account (owned by Safaricom) in a Kenyan bank

M-PESA: Pros (4 SD) • Reaches many more people w. r. t. Banks • To tranfer money is secure, faster, cheaper • Extends in time the availability of banking services (some are still agent dipendent) • Opportunity of employment, new business, develop. • Possible solution to the access issue for “unbanked”. . . helps to securely store incomes • Easy to use, even by illiterate • W. r. t. micro-credit it efficiently overcomes many structural / organizative issues

M-PESA: Cons • Further addiction to mobile phones and the operator • To deposit is free , to withdraw is charged, deposited amount doesn’t accrues interests. . . : -o (Is it “save money”? ) • Cheap w. r. t. banks. . . but not so much in general (%50 population lives with less than 1$/day) • Enlarge the gap for whome cannot afford a cellphone + SIM + fees (Is M-PESA-sharing possible? ) • W. r. t. Micro-credit: – No more face-to-face realtion to m-c agent and the m-c community – M-c agent is a “skilled”-economist, often an advisor families and enterpreneurs. . . is an M-PESA agent too? – In a development perspective m-c companieas reuse the deposited cash in local projects, loans for the local community. . . It is not the case of the M-PESA accounted capitals

M-PESA: Pros (4 SV) (for Safaricom/Vodafone) • New “unmobiled” subscribers attracted by the service • Affiliation effect for M-PESA customers • Airtime credit can be easily/transparently bought • Direct incoming from services commissions • All pooled accounts accrue interests for Safaricom and can be further invested • World’ first service, actually limited to Kenya. . . a good pilot: – Vodafone plans to extend it to other countries (India, . . . ) and globally between countries – It would be the choice for the 500 million $ in remittancies sent to Kenya by migrant (earn commissions) – It would be the choice for the 268 billion $ remittancies worldwide (earn commissions)

Conclusions • • No “Right or Wrong” in ICT can give opportunities of development Systems developed in “western way” Does ICT really change the situation?

What can we do? • Recognize the role of the Information • Customize the project on the context • Measure the actions on the needs of the population • Be optimistic

Thank you! Questions?

8957c3049c5070cee1e2b06c54fd4946.ppt