cf5101d34a629649e4cbaf858fac8e6e.ppt

- Количество слайдов: 30

Mobile phone development

Overview of presentation Key drivers in the mobile industry Mobile as a business tool 3 G Concept phone (2000) Emerging mobile technologies Conclusions – personal view

Overview of presentation Key drivers in the mobile industry Mobile as a business tool Emerging mobile technologies – new business opportunities Conclusions – personal view

Key drivers in the mobile handset industry 4 Accelerating handset performance (technology) 4 Infrastructure and service delivery mechanisms (3 G, WLAN, WIMAX, IMS etc. ) 4 Ultra low cost handsets (<$30) 4 Operators and content providers looking for sustainable business models 4 Games, music, films, news etc. 4 World wide impact of the Chinese mobile industry 4 Battle to dominate the mobile screen 4 Drive to standardise handsets between vendors 4 Microsoft

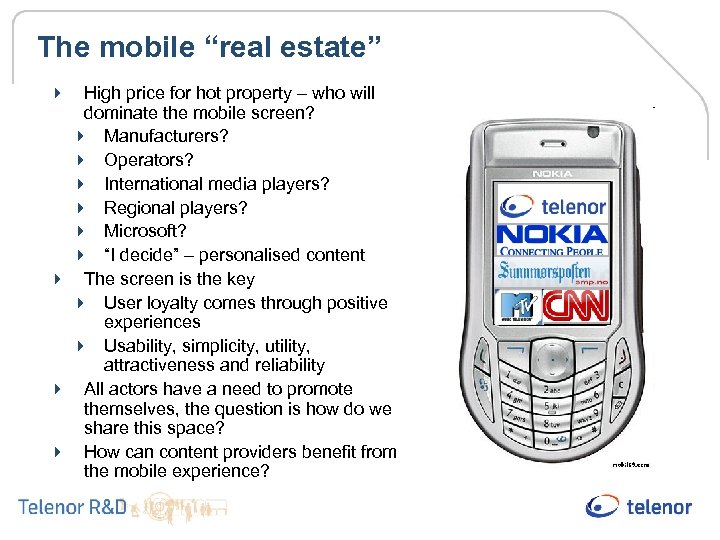

The mobile “real estate” 4 High price for hot property – who will dominate the mobile screen? 4 Manufacturers? 4 Operators? 4 International media players? 4 Regional players? 4 Microsoft? 4 “I decide” – personalised content 4 The screen is the key 4 User loyalty comes through positive experiences 4 Usability, simplicity, utility, attractiveness and reliability 4 All actors have a need to promote themselves, the question is how do we share this space? 4 How can content providers benefit from the mobile experience?

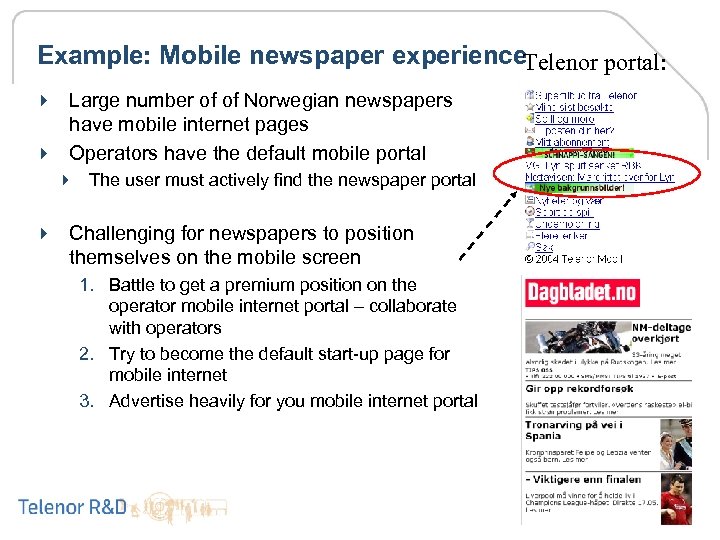

Example: Mobile newspaper experience. Telenor portal: 4 Large number of of Norwegian newspapers have mobile internet pages 4 Operators have the default mobile portal 4 The user must actively find the newspaper portal 4 Challenging for newspapers to position themselves on the mobile screen 1. Battle to get a premium position on the operator mobile internet portal – collaborate with operators 2. Try to become the default start-up page for mobile internet 3. Advertise heavily for you mobile internet portal

Operator attempt for standardisation 4 Effort to overcome standardisation problems for content on mobile phones: 4 Open Mobile Terminal Platform alliance 4 Purpose is to standardise mobile handsets to 4 ease creation of services and application 4 ease terminal management 4 Make it easy to control the user interface 4 First release of OMTP compliant mobile phones scheduled for Q 1 2006 4 Desire to achieve standardisation without two players taking it all (e. g. Intel & Microsoft)

OMTP 4 To what extent will the handsets be standardised? 4 Not a desire to reduce innovation and the possibility for manufacturers to differentiate themselves 4 Introduce classes of terminals (C 0 – C 3) with a minimum set of performance criteria for each class 4 Eg. Reduce the variety of screen sizes / resolutions etc 4 Agree on codecs (picture, video, voice formats) 4 Will help ensure that services will work end-to-end and on terminals from different manufacturers 4 Will ease software development for third parties

Microsoft 4 “We are going to invest and invest to get the most popular software platform because we believe in these [kinds of mobile and wireless] scenarios” – Bill Gates, MS developers conference 2003 4 A force to be reckoned with 4 Won all battles so far (Windows, IE, MS Office, Windows Media player(? ), Exchange (? )) 4 Main strength is the link between the pc / servers and the handset (Active Sync, Exchange) 4 Nokia licensing of Active Sync 4 Potential body blow to Microsoft argues analysts 4 But it is not only about the sync protocol – more important is the consistency of data structures on both sides of the wireless / wired link.

Microsoft main assets 4 Exchange server today, Live Communication Server 2005 tomorrow 4 Real time collaboration tool 4 Presence information as an integrated part of the office tools (including MS Office) 4 Mobile handset (Smartphones) fully integrated into the corporate environment 4 Telecommunications services fully integrated into the traditional mail server 4 In the future corporate environment you will not be able to choose your own handset, you will be given a MS phone… 4 All about the software, not the hardware

Overview of presentation Key drivers in the mobile industry Mobile as a business tool Emerging mobile technologies – new business opportunities Conclusions – personal view

Mobile email to your phone 4 Mobile email: The possibility to offer a full email experience on mobile handsets. 4 Not ‘wap’ or browser based solutions 4 Not only mail, but also contacts and calendar 4 Mobile email in the SME segments expected to be a considerable driver for mobile data traffic in the short and long term 4 Potentially the killer application for 3 G toward the business segment? 4 Operator friendly commercial solutions are available from several vendors 4 Solution providers recognise the importance of the operator customer base and branding 4 Mobile email can be supported on a wide range of handsets 4 Major carriers have already launched mobile email solutions (Vodafone, O 2, TMobile, Telenor) 4 A service well suited for the entire business segment 4 From So. Ho to corporate

Mobile email solutions are complex 4 Requires installation of client software on your handset 4 Requires operator to install connection centre servers 4 Requires installation of software inside the corporate firewall But: 4 Useful tool that enables you to stay always connected and updated 4 Increases staff flexibility and efficiency 4 Reduces need for use of data cards with PCs

Mobile SAP – access to company internal systems 4 Mobile workforce management 4 Enable field staff to connect to company internal systems 4 Accept, effectuate and report status on orders 4 Flexible use of field forces 4 Connected with proximity technologies like RFID it will improve the quality control of actual field force movement (and execution) 4 Requires substantial integration effort with internal IT systems. Reported ROI (SAP numbers) – 3 to 12 months

Overview of presentation Key drivers in the mobile industry Mobile as a business tool Emerging mobile technologies – new business opportunities Conclusions – personal view

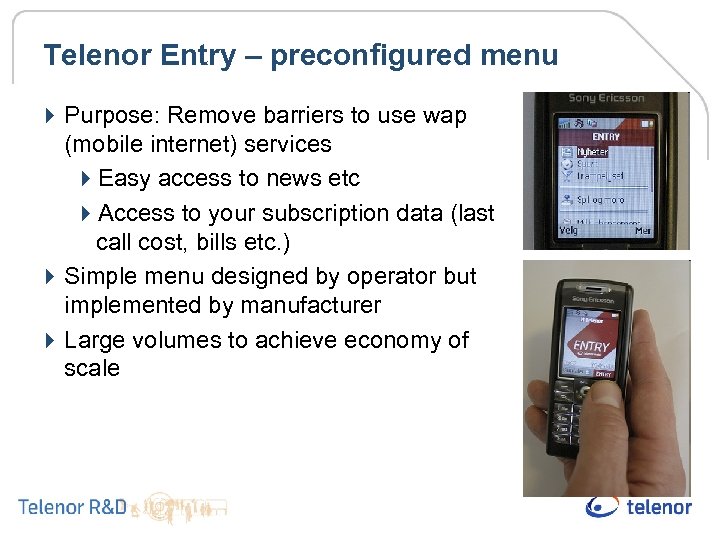

Telenor Entry – preconfigured menu 4 Purpose: Remove barriers to use wap (mobile internet) services 4 Easy access to news etc 4 Access to your subscription data (last call cost, bills etc. ) 4 Simple menu designed by operator but implemented by manufacturer 4 Large volumes to achieve economy of scale

Open OS create new opportunities 4 Plethora of more or less useful applications available for open OS phones 4 Nokia developer forum etc. 4 New types of frameworks are emerging 4 Action Engine, Freedom, Surfkitchen, Opera Platform 4 Focus on delivering services from third parties rather than applications

How to make advanced services available? 4 Barriers to use of mobile Internet services 4 What is there? 4 How to find mobile services? 4 Navigation is difficult 4 Customers believe usage implies high cost 4 Traditional portals: customer must come to you 4 Is it possible to turn this around? 4 3 months piloting of 100 users with access to active desktop 4 “Bring the portal to the customer” 4 “Push” services 4 Software that takes over the user interface 4 Co-operation with Opera

The opportunity to bring content and services closer to the customers` attention 4 An active desktop is taking over the home screen of the phone and presenting a new front-page and service menu: 4 Content teasers (news, weather and advertisement banners) on the front-page 4 News pushed to the end user every 45 minutes 4 Immediate access to pre stored and updated content through clicking on teasers 4 Upload of Photos and Contact List to web portal 4 Reversed MMS news / blogging 4 Combining useful phone applications and online content in an operator service menu 4 Restaurant guide, concerts, TV listings etc. 4 The “content provider phone” is fully possible

Users prefer active desktop and push services 4 Active desktop creates a need for daily update of news and entertainment 4 Users wish to personalise their news categories 4 The active desktop is preferred to the phone manufacturers’ frontpage 4 Active desktop is seen as a simpler and more accessible concept than WAP 4 From 12% active WAP users before pilot to 75% active WAP users after the pilot 4 Users missed active desktop after conclusion of pilot

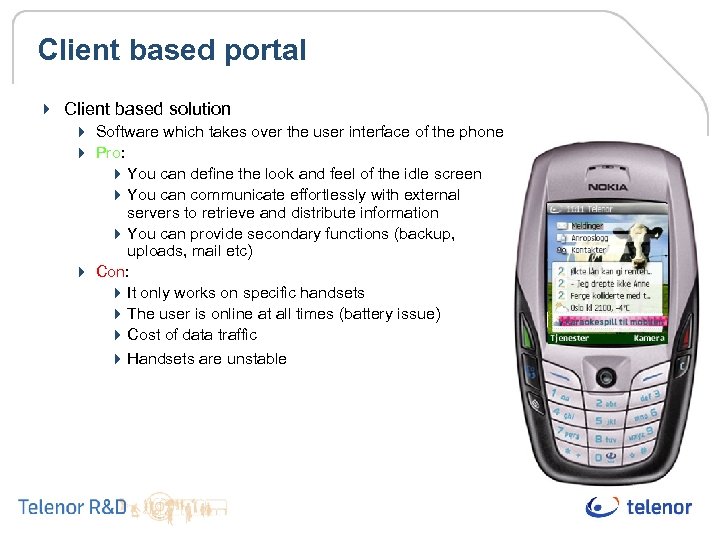

Client based portal 4 Client based solution 4 Software which takes over the user interface of the phone 4 Pro: 4 You can define the look and feel of the idle screen 4 You can communicate effortlessly with external servers to retrieve and distribute information 4 You can provide secondary functions (backup, uploads, mail etc) 4 Con: 4 It only works on specific handsets 4 The user is online at all times (battery issue) 4 Cost of data traffic 4 Handsets are unstable

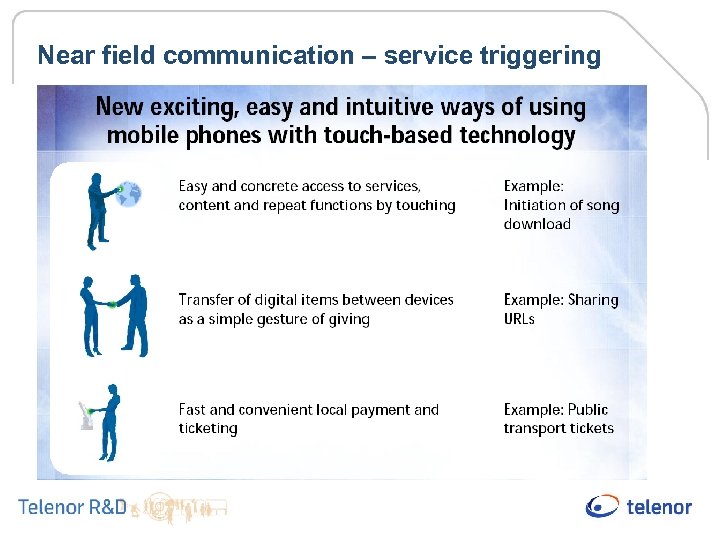

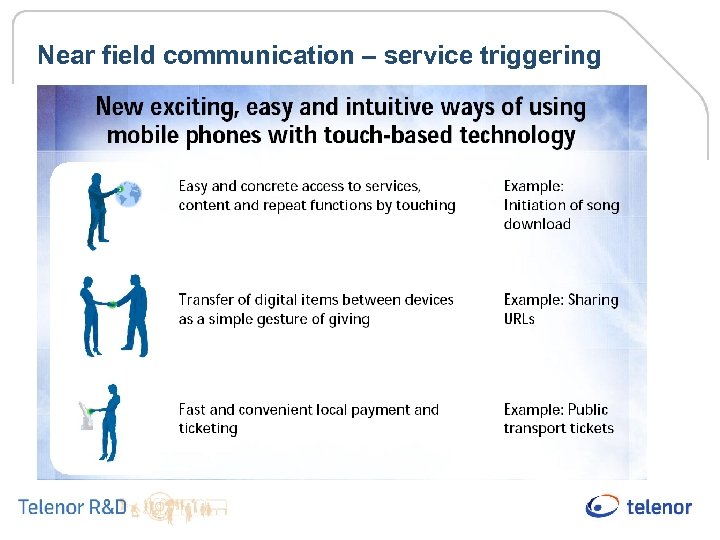

Near field communication – service triggering

Look for opportunities in new concepts.

Near field communication – service triggering

Deloppgave 1 4 Studer hva tjenestetilbydere tilbyr av mobile tjenester og konsepter til bedriftsmarkedet 4 For hvem? 4 Hva? 4 Sammenlign de forskjellige tilbyderene 4 Hver gruppe presenterer sine resultater 7 oktober

Deloppgave 2 4 Velg en tjenestetilbyder og gå i dybden på hva den leverer 4 Studer en av deres kunder 4 Velg en brukergruppe 4 Hvordan bruker de tjenestene? 4 Hvordan passer det med hvordan de jobber? 4 Hva kunne de ha tenkt seg 4 Hva vurdere som mulig å levere. 4 Ta hensyn da til hvem som skal levere, drifte etc 4 Prosjektoppgaven skal inneholde både deloppgave 1 og 2

Overview of presentation Key drivers in the mobile industry Mobile as a business tool Emerging mobile technologies – new business opportunities Conclusions – personal view

Some trends 4 Diverse portfolio of handsets 4 Made to measure and mainstream handsets 4 Hardware commodity 4 Software and connectivity the differentiating factor 4 Proximity technologies for service initiation will become important 4 Payment, identification and authorisation 4 Increased utility focus 4 Increased mobile – pc communication

Some thoughts for the future 4 Personal forecast 4 Windows will win the corporate / business segment where access to company data is essential 4 Symbian (Nokia) will be pushed down and dominate the advanced handset market (at least in Europe) 4 Significant growth in low cost handsets (< $30) production for emerging markets 4 Manufacturers will continue to distribute mass market devices based on proprietary OS for the foreseeable future due to licensing costs 4 Handsets will gradually become OMTP compliant with increased standardisation across manufacturerers

cf5101d34a629649e4cbaf858fac8e6e.ppt