941b97c983629d72c140ad4104818be2.ppt

- Количество слайдов: 19

Mobile Internet Startups predicting the next big win Sanjay Jhawar Vice President, Wireless, cirlab! 1 July 2001

The Parent: CIR Group v CIR = Compagnie Industriali Riunite v one of Italy’s most significant industrial groups, founded in 1976 v publicly traded in Milan (CIRX) v FY 2000 : revenues € 2. 52 billion, capital employed € 1. 05 billion, net income € 86 million v controlled by the De Benedetti family v mission: create shareholder value through dynamic management of investment portfolio and taking an active role in management of operating companies v focus on media, utilities, telecom and automotive components v some major telecom and new media investments by CIR: v L’Espresso/Kataweb (49. 6%) v leading Italian portal with 256 million monthly page views & 6. 6 m unique users (March 2001) v H 3 G (12. 9%) v 3 G wireless license winner in Italy, currently building mobile network. JV with Hutchison Whampoa (who owns 78. 3%) v broadband access providers : e. Via and Casa. Web 2

De Benedetti Group Success Stories (Hutchison, CIR) • recently awarded 3 G-UMTS operator license in Italy • Europe’s largest wireless market with 73% penetration (now part of Vodafone Group) • established in 1994 within Olivetti • 2 nd wireless operator in Italy and Europe with 10+m customers, 43% market share • largest value creation in Italy since WW II (now owned by ENEL/Wind) • established in 1995 within Olivetti • the 2 nd fixed line operator in Italy with +5 MM customers • acquired by Vodafone in Mannesmann takeover, recently sold to Wind for $6. 5 bn Corporate Venture Capital Fund • established in 1985 to focus on emerging technologies • total investments for $200 MM • 29% IRR sinception, 35% IRR since 1992 3

Who is cirlab? v cirlab! is a seed and early-stage value-added venture investor founded in 1999 and funded to € 30 m by CIR Group, focused on v wireless Internet services, applications and software technology v digital media and broadband content v other software and services v Objectives v invest in European, US and Israeli businesses where Europe is the major market v exploit Italy’s mobile market size and our connections here and elsewhere v be active partners in building the business, spending a lot of time outside of board meetings working closely with management v Team backgrounds v seasoned entrepreneurs, technologists, marketers and finance professionals with toplevel operational experience in the US and Europe in our chosen sectors v extensive personal networks in Italy, UK, US, France, Sweden, Israel and elsewhere 4

cirlab! mobile portfolio 5

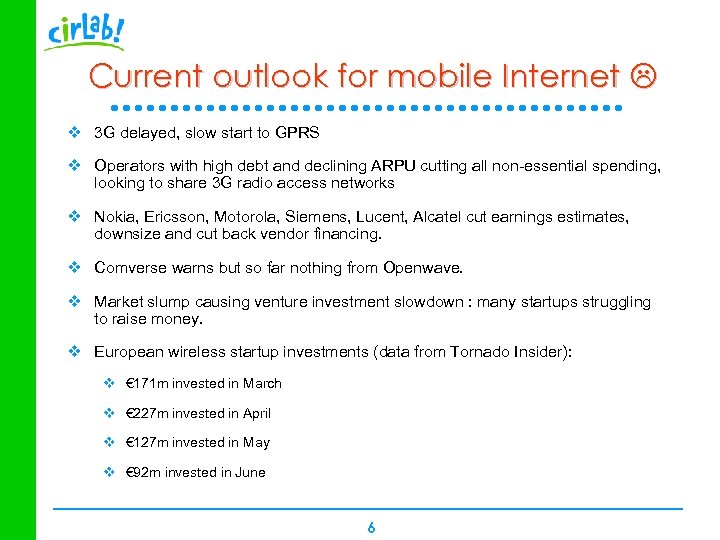

Current outlook for mobile Internet v 3 G delayed, slow start to GPRS v Operators with high debt and declining ARPU cutting all non-essential spending, looking to share 3 G radio access networks v Nokia, Ericsson, Motorola, Siemens, Lucent, Alcatel cut earnings estimates, downsize and cut back vendor financing. v Comverse warns but so far nothing from Openwave. v Market slump causing venture investment slowdown : many startups struggling to raise money. v European wireless startup investments (data from Tornado Insider): v € 171 m invested in March v € 227 m invested in April v € 127 m invested in May v € 92 m invested in June 6

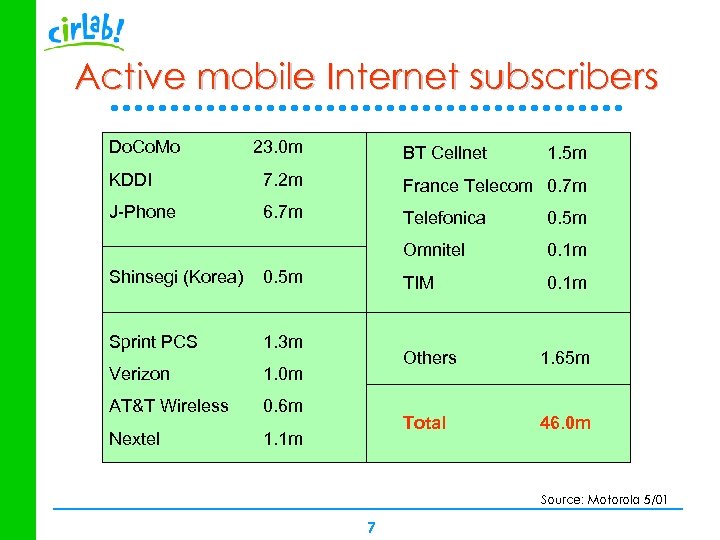

Active mobile Internet subscribers Do. Co. Mo 23. 0 m BT Cellnet 1. 5 m KDDI 7. 2 m France Telecom 0. 7 m J-Phone 6. 7 m Telefonica 0. 5 m Omnitel 0. 1 m TIM 0. 1 m Shinsegi (Korea) 0. 5 m Sprint PCS 1. 3 m Verizon 1. 0 m AT&T Wireless 0. 6 m Nextel 1. 1 m Others 1. 65 m Total 46. 0 m Source: Motorola 5/01 7

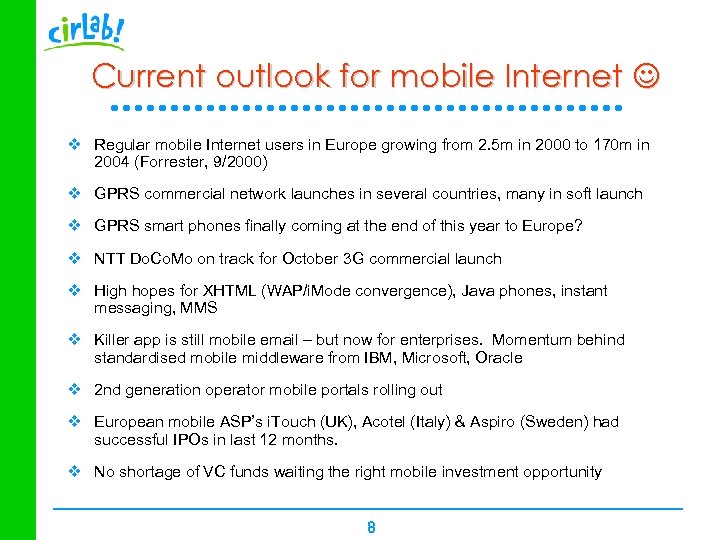

Current outlook for mobile Internet v Regular mobile Internet users in Europe growing from 2. 5 m in 2000 to 170 m in 2004 (Forrester, 9/2000) v GPRS commercial network launches in several countries, many in soft launch v GPRS smart phones finally coming at the end of this year to Europe? v NTT Do. Co. Mo on track for October 3 G commercial launch v High hopes for XHTML (WAP/i. Mode convergence), Java phones, instant messaging, MMS v Killer app is still mobile email – but now for enterprises. Momentum behind standardised mobile middleware from IBM, Microsoft, Oracle v 2 nd generation operator mobile portals rolling out v European mobile ASP’s i. Touch (UK), Acotel (Italy) & Aspiro (Sweden) had successful IPOs in last 12 months. v No shortage of VC funds waiting the right mobile investment opportunity 8

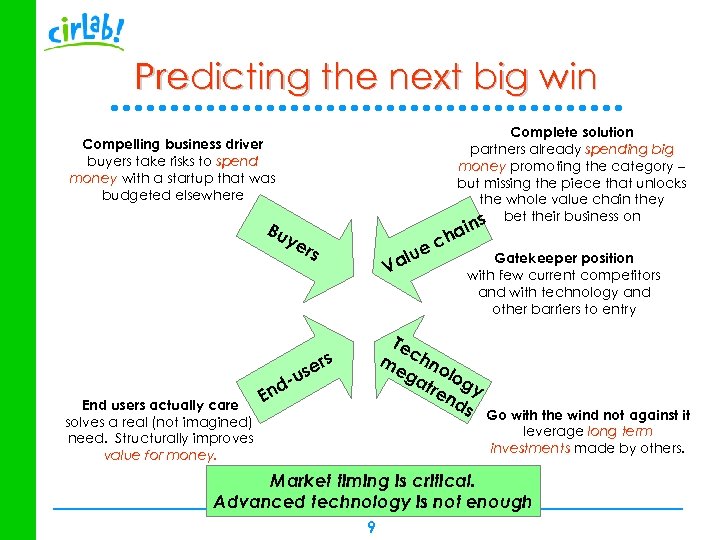

Predicting the next big win Complete solution partners already spending big money promoting the category – but missing the piece that unlocks the whole value chain they s bet their business on Compelling business driver buyers take risks to spend money with a startup that was budgeted elsewhere Bu ye - End users actually care solves a real (not imagined) need. Structurally improves value for money. d En in a ch e alu rs V Gatekeeper position with few current competitors and with technology and other barriers to entry Te me chno ga log tre y nd s rs e us Go with the wind not against it leverage long term investments made by others. Market timing is critical. Advanced technology is not enough 9

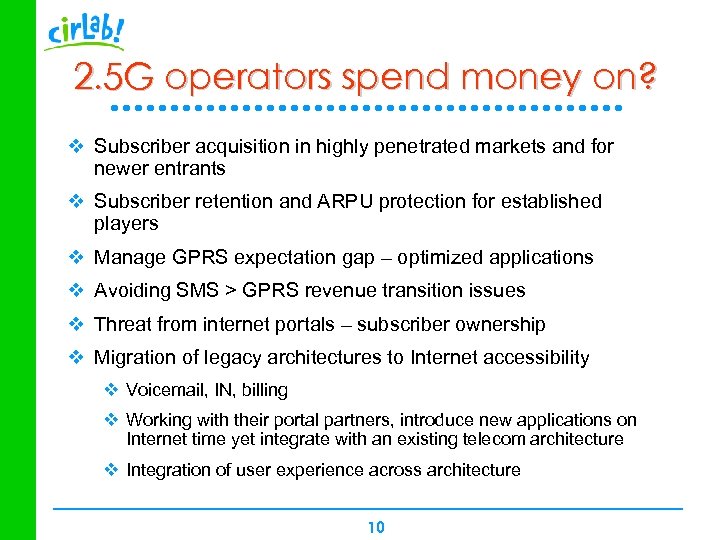

2. 5 G operators spend money on? v Subscriber acquisition in highly penetrated markets and for newer entrants v Subscriber retention and ARPU protection for established players v Manage GPRS expectation gap – optimized applications v Avoiding SMS > GPRS revenue transition issues v Threat from internet portals – subscriber ownership v Migration of legacy architectures to Internet accessibility v Voicemail, IN, billing v Working with their portal partners, introduce new applications on Internet time yet integrate with an existing telecom architecture v Integration of user experience across architecture 10

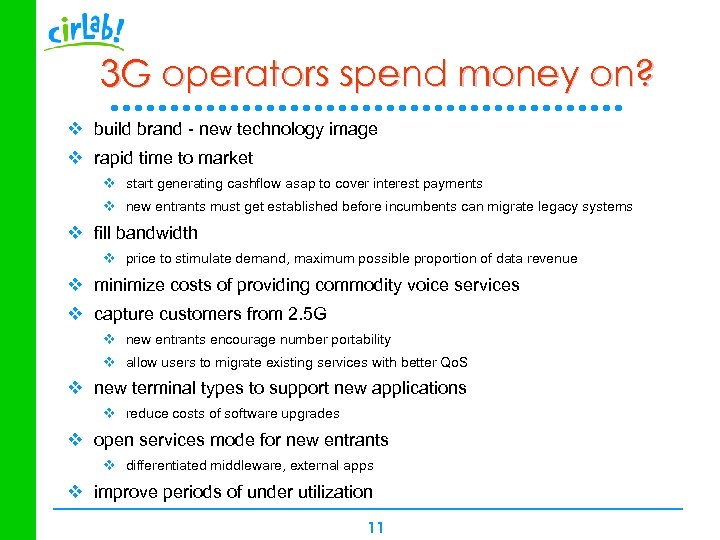

3 G operators spend money on? v build brand - new technology image v rapid time to market v start generating cashflow asap to cover interest payments v new entrants must get established before incumbents can migrate legacy systems v fill bandwidth v price to stimulate demand, maximum possible proportion of data revenue v minimize costs of providing commodity voice services v capture customers from 2. 5 G v new entrants encourage number portability v allow users to migrate existing services with better Qo. S v new terminal types to support new applications v reduce costs of software upgrades v open services mode for new entrants v differentiated middleware, external apps v improve periods of under utilization 11

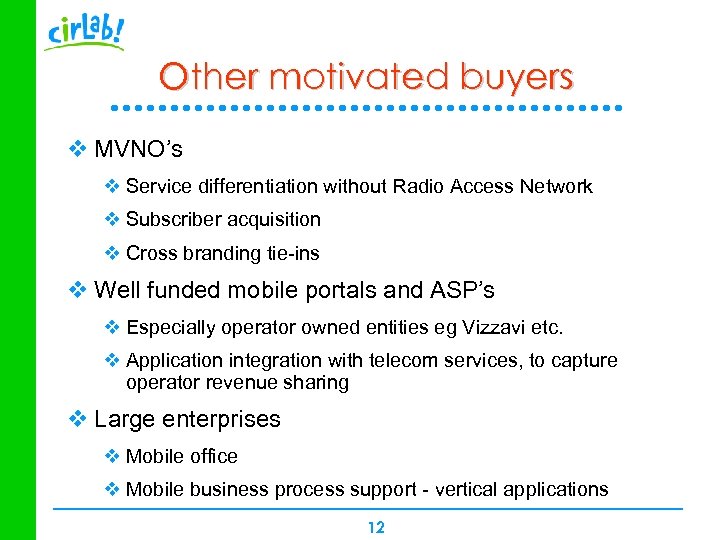

Other motivated buyers v MVNO’s v Service differentiation without Radio Access Network v Subscriber acquisition v Cross branding tie-ins v Well funded mobile portals and ASP’s v Especially operator owned entities eg Vizzavi etc. v Application integration with telecom services, to capture operator revenue sharing v Large enterprises v Mobile office v Mobile business process support - vertical applications 12

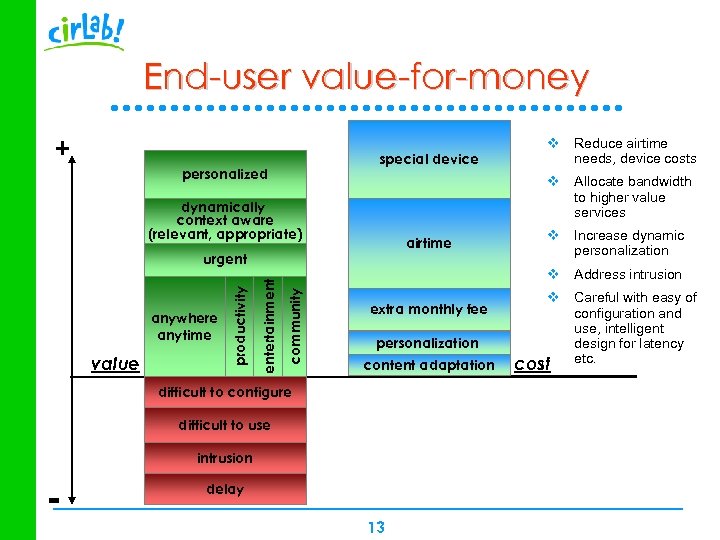

End-user value-for-money + special device personalized v Allocate bandwidth to higher value services dynamically context aware (relevant, appropriate) airtime extra monthly fee personalization content adaptation difficult to configure difficult to use intrusion - v Increase dynamic personalization v Address intrusion community entertainment value productivity urgent anywhere anytime v Reduce airtime needs, device costs delay 13 v Careful with easy of configuration and use, intelligent design for latency etc. cost

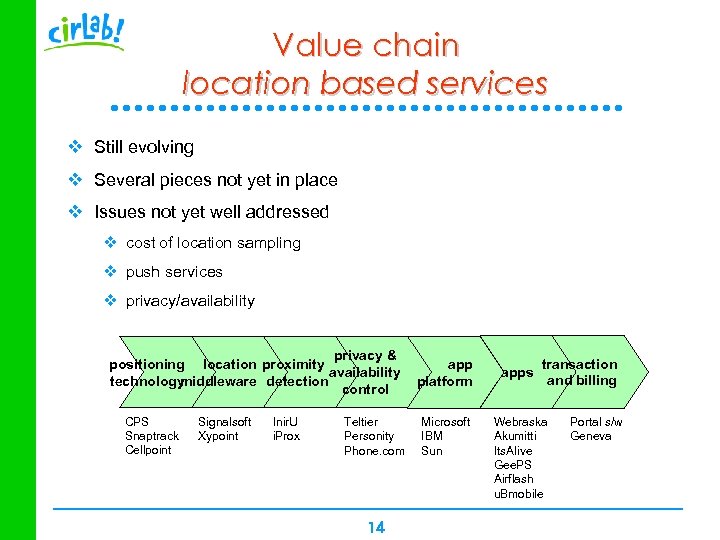

Value chain location based services v Still evolving v Several pieces not yet in place v Issues not yet well addressed v cost of location sampling v push services v privacy/availability privacy & positioning location proximity availability technology middleware detection control CPS Snaptrack Cellpoint Signalsoft Xypoint Inir. U i. Prox Teltier Personity Phone. com 14 app platform Microsoft IBM Sun apps transaction and billing Webraska Akumitti Its. Alive Gee. PS Airflash u. Bmobile Portal s/w Geneva

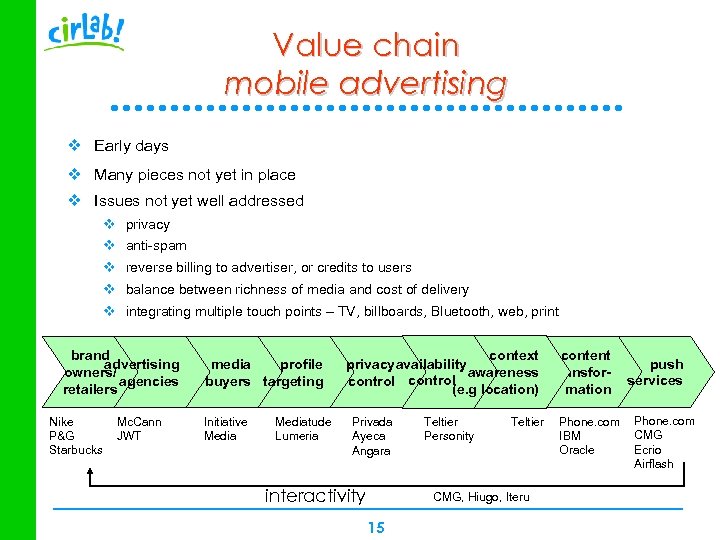

Value chain mobile advertising v Early days v Many pieces not yet in place v Issues not yet well addressed v privacy v anti-spam v reverse billing to advertiser, or credits to users v balance between richness of media and cost of delivery v integrating multiple touch points – TV, billboards, Bluetooth, web, print brand advertising owners/ agencies retailers Nike P&G Starbucks Mc. Cann JWT media profile buyers targeting Initiative Mediatude Lumeria context privacyavailability awareness control (e. g location) Privada Ayeca Angara interactivity Teltier Personity Teltier CMG, Hiugo, Iteru 15 content transformation Phone. com IBM Oracle push services Phone. com CMG Ecrio Airflash

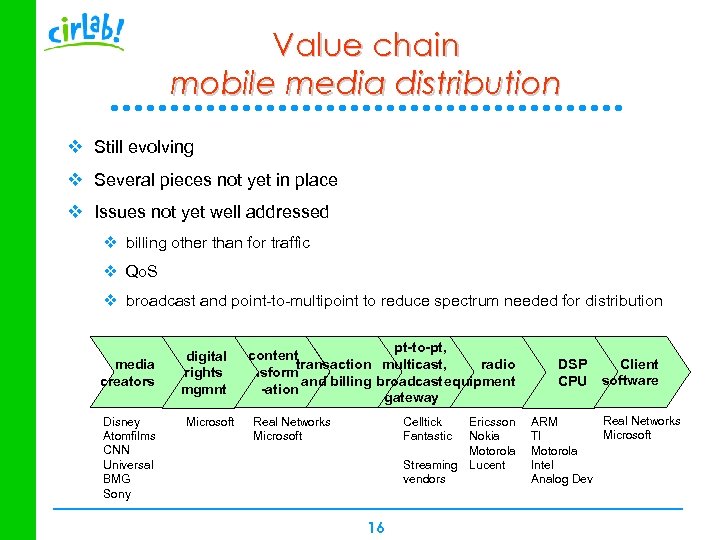

Value chain mobile media distribution v Still evolving v Several pieces not yet in place v Issues not yet well addressed v billing other than for traffic v Qo. S v broadcast and point-to-multipoint to reduce spectrum needed for distribution media creators Disney Atomfilms CNN Universal BMG Sony pt-to-pt, content digital transaction multicast, radio rights transform and billing broadcast equipment -ation mgmnt gateway Microsoft Real Networks Microsoft Celltick Fantastic Ericsson Nokia Motorola Streaming Lucent vendors 16 DSP CPU Client software Real Networks ARM Microsoft TI Motorola Intel Analog Dev

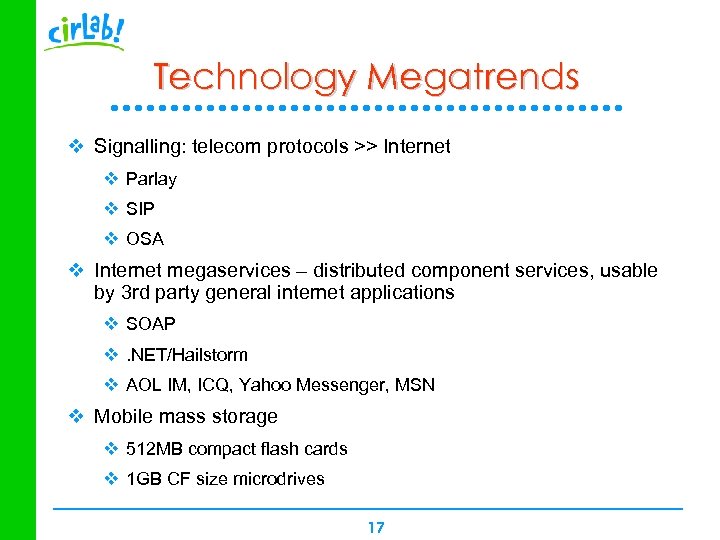

Technology Megatrends v Signalling: telecom protocols >> Internet v Parlay v SIP v OSA v Internet megaservices – distributed component services, usable by 3 rd party general internet applications v SOAP v. NET/Hailstorm v AOL IM, ICQ, Yahoo Messenger, MSN v Mobile mass storage v 512 MB compact flash cards v 1 GB CF size microdrives 17

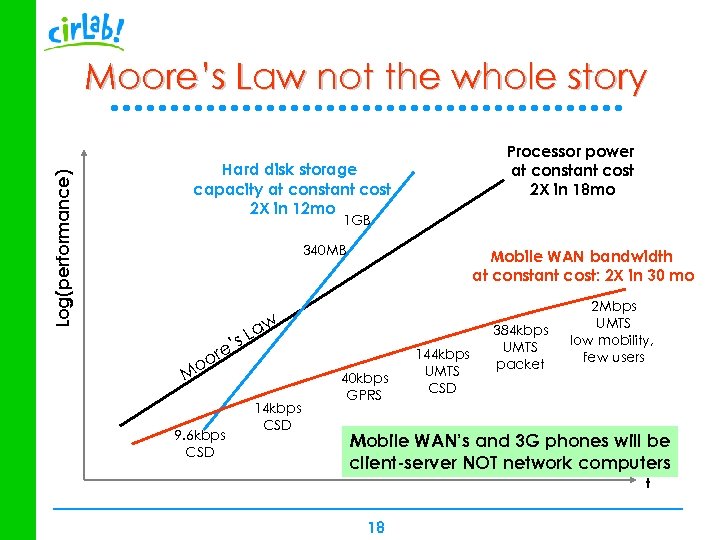

Log(performance) Moore’s Law not the whole story Processor power at constant cost 2 X in 18 mo Hard disk storage capacity at constant cost 2 X in 12 mo 1 GB 340 MB Mobile WAN bandwidth at constant cost: 2 X in 30 mo w La ’s e r oo M 9. 6 kbps CSD 14 kbps CSD 40 kbps GPRS 144 kbps UMTS CSD 384 kbps UMTS packet 2 Mbps UMTS low mobility, few users Mobile WAN’s and 3 G phones will be client-server NOT network computers t 18

Insights for potential startups Critical gaps needing solutions v Cached media, overnight delivery, digital rights management v Server management of rich clients v Internet applications accessing telecom functions v Integrated voice/visual interface; billing; network presence v Quality of Service management on 2. 5 G v IP multicast/broadcast over 3 G v Cross application megaservices v application pre-rating v proximity detection, cellular positioning and Bluetooth v mobile media distribution over multiple operators: a mobile “Akamai” v dynamic personalization bridging internet and telecom 19

941b97c983629d72c140ad4104818be2.ppt