fb1b23e5683998e22dd0930844652364.ppt

- Количество слайдов: 16

MLI 28 C 060 - Corporate Finance Seminar 2

MLI 28 C 060 - Corporate Finance Seminar 2

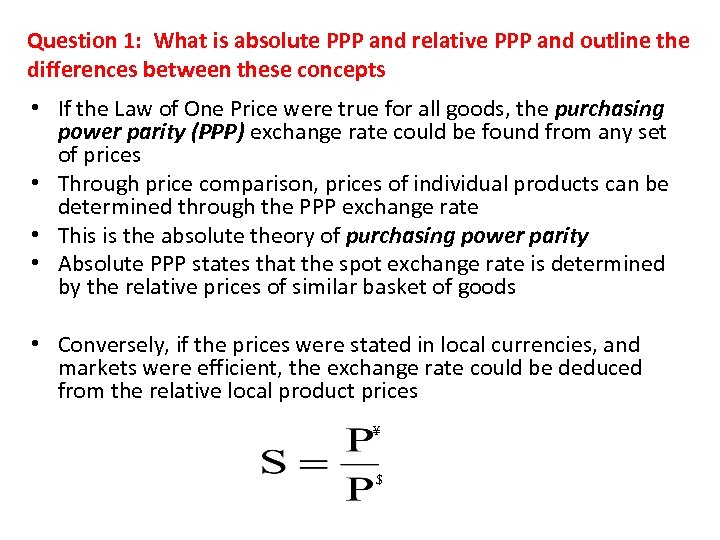

Question 1: What is absolute PPP and relative PPP and outline the differences between these concepts • If the Law of One Price were true for all goods, the purchasing power parity (PPP) exchange rate could be found from any set of prices • Through price comparison, prices of individual products can be determined through the PPP exchange rate • This is the absolute theory of purchasing power parity • Absolute PPP states that the spot exchange rate is determined by the relative prices of similar basket of goods • Conversely, if the prices were stated in local currencies, and markets were efficient, the exchange rate could be deduced from the relative local product prices ¥ $

Question 1: What is absolute PPP and relative PPP and outline the differences between these concepts • If the Law of One Price were true for all goods, the purchasing power parity (PPP) exchange rate could be found from any set of prices • Through price comparison, prices of individual products can be determined through the PPP exchange rate • This is the absolute theory of purchasing power parity • Absolute PPP states that the spot exchange rate is determined by the relative prices of similar basket of goods • Conversely, if the prices were stated in local currencies, and markets were efficient, the exchange rate could be deduced from the relative local product prices ¥ $

• If the assumptions of absolute PPP theory are relaxed, we observe relative purchasing power parity – This idea is that PPP is not particularly helpful in determining what the spot rate is today, but that the relative change in prices between countries over a period of time determines the change in exchange rates – Moreover, if the spot rate between 2 countries starts in equilibrium, any change in the differential rate of inflation between them tends to be offset over the long run by an equal but opposite change in the spot rate

• If the assumptions of absolute PPP theory are relaxed, we observe relative purchasing power parity – This idea is that PPP is not particularly helpful in determining what the spot rate is today, but that the relative change in prices between countries over a period of time determines the change in exchange rates – Moreover, if the spot rate between 2 countries starts in equilibrium, any change in the differential rate of inflation between them tends to be offset over the long run by an equal but opposite change in the spot rate

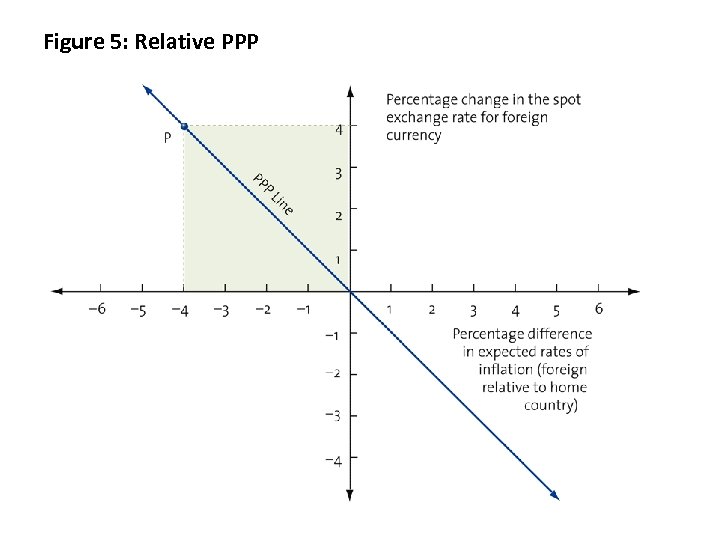

Figure 5: Relative PPP

Figure 5: Relative PPP

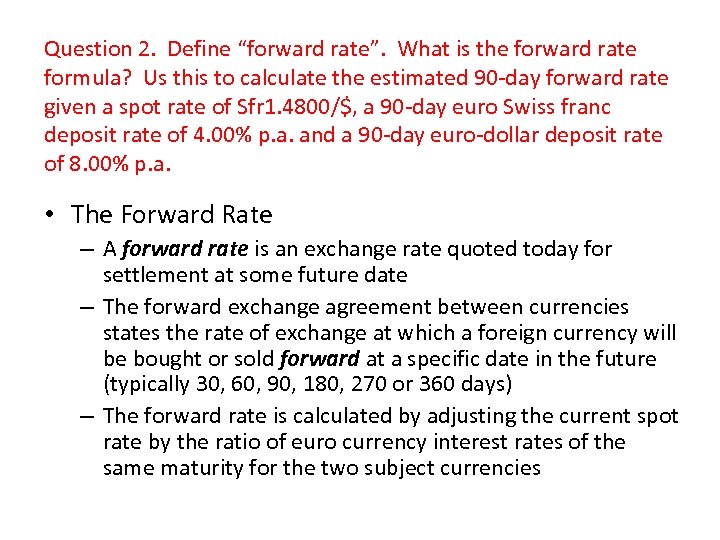

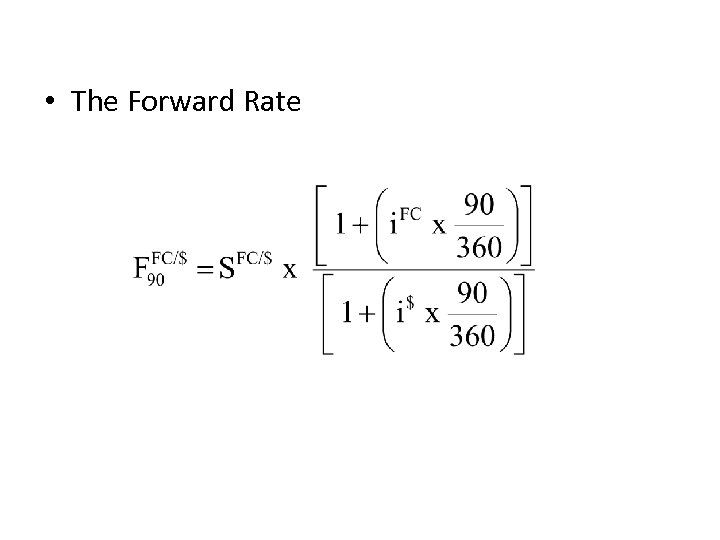

Question 2. Define “forward rate”. What is the forward rate formula? Us this to calculate the estimated 90 -day forward rate given a spot rate of Sfr 1. 4800/$, a 90 -day euro Swiss franc deposit rate of 4. 00% p. a. and a 90 -day euro-dollar deposit rate of 8. 00% p. a. • The Forward Rate – A forward rate is an exchange rate quoted today for settlement at some future date – The forward exchange agreement between currencies states the rate of exchange at which a foreign currency will be bought or sold forward at a specific date in the future (typically 30, 60, 90, 180, 270 or 360 days) – The forward rate is calculated by adjusting the current spot rate by the ratio of euro currency interest rates of the same maturity for the two subject currencies

Question 2. Define “forward rate”. What is the forward rate formula? Us this to calculate the estimated 90 -day forward rate given a spot rate of Sfr 1. 4800/$, a 90 -day euro Swiss franc deposit rate of 4. 00% p. a. and a 90 -day euro-dollar deposit rate of 8. 00% p. a. • The Forward Rate – A forward rate is an exchange rate quoted today for settlement at some future date – The forward exchange agreement between currencies states the rate of exchange at which a foreign currency will be bought or sold forward at a specific date in the future (typically 30, 60, 90, 180, 270 or 360 days) – The forward rate is calculated by adjusting the current spot rate by the ratio of euro currency interest rates of the same maturity for the two subject currencies

• The Forward Rate

• The Forward Rate

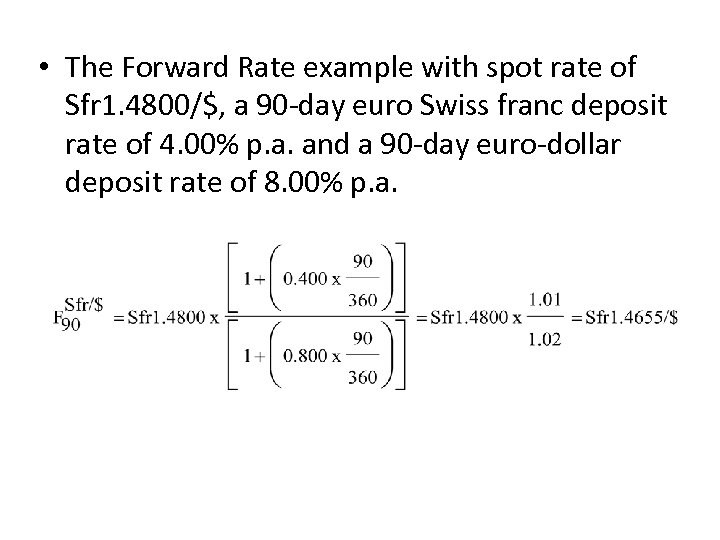

• The Forward Rate example with spot rate of Sfr 1. 4800/$, a 90 -day euro Swiss franc deposit rate of 4. 00% p. a. and a 90 -day euro-dollar deposit rate of 8. 00% p. a.

• The Forward Rate example with spot rate of Sfr 1. 4800/$, a 90 -day euro Swiss franc deposit rate of 4. 00% p. a. and a 90 -day euro-dollar deposit rate of 8. 00% p. a.

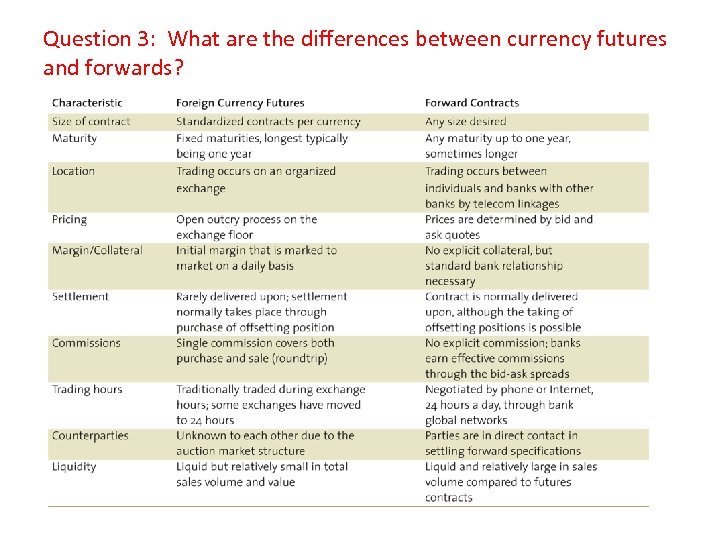

Question 3: What are the differences between currency futures and forwards?

Question 3: What are the differences between currency futures and forwards?

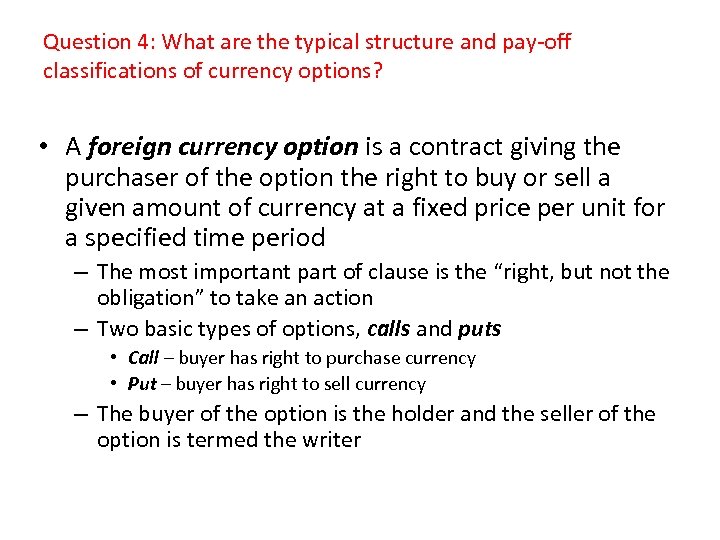

Question 4: What are the typical structure and pay-off classifications of currency options? • A foreign currency option is a contract giving the purchaser of the option the right to buy or sell a given amount of currency at a fixed price per unit for a specified time period – The most important part of clause is the “right, but not the obligation” to take an action – Two basic types of options, calls and puts • Call – buyer has right to purchase currency • Put – buyer has right to sell currency – The buyer of the option is the holder and the seller of the option is termed the writer

Question 4: What are the typical structure and pay-off classifications of currency options? • A foreign currency option is a contract giving the purchaser of the option the right to buy or sell a given amount of currency at a fixed price per unit for a specified time period – The most important part of clause is the “right, but not the obligation” to take an action – Two basic types of options, calls and puts • Call – buyer has right to purchase currency • Put – buyer has right to sell currency – The buyer of the option is the holder and the seller of the option is termed the writer

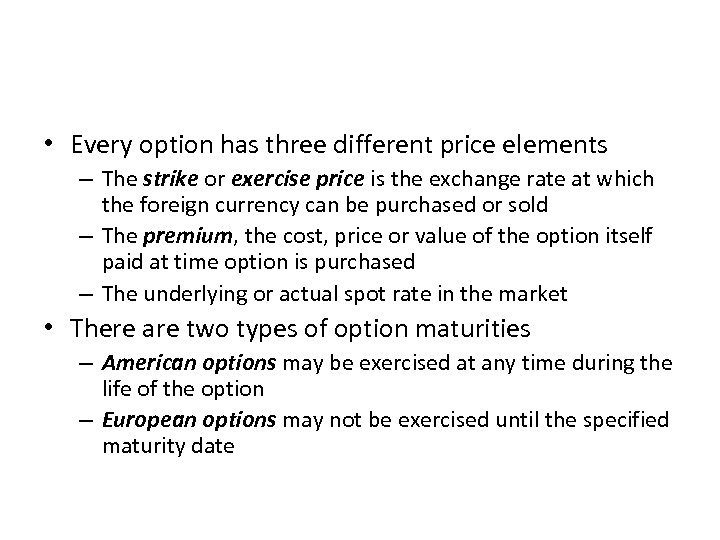

• Every option has three different price elements – The strike or exercise price is the exchange rate at which the foreign currency can be purchased or sold – The premium, the cost, price or value of the option itself paid at time option is purchased – The underlying or actual spot rate in the market • There are two types of option maturities – American options may be exercised at any time during the life of the option – European options may not be exercised until the specified maturity date

• Every option has three different price elements – The strike or exercise price is the exchange rate at which the foreign currency can be purchased or sold – The premium, the cost, price or value of the option itself paid at time option is purchased – The underlying or actual spot rate in the market • There are two types of option maturities – American options may be exercised at any time during the life of the option – European options may not be exercised until the specified maturity date

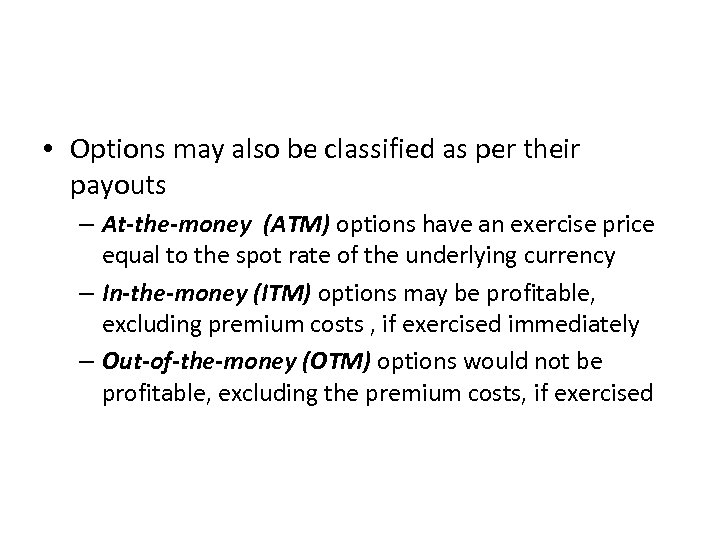

• Options may also be classified as per their payouts – At-the-money (ATM) options have an exercise price equal to the spot rate of the underlying currency – In-the-money (ITM) options may be profitable, excluding premium costs , if exercised immediately – Out-of-the-money (OTM) options would not be profitable, excluding the premium costs, if exercised

• Options may also be classified as per their payouts – At-the-money (ATM) options have an exercise price equal to the spot rate of the underlying currency – In-the-money (ITM) options may be profitable, excluding premium costs , if exercised immediately – Out-of-the-money (OTM) options would not be profitable, excluding the premium costs, if exercised

Question 5: Draw the respective pay-offs for call and put currency options [Hint: draw the charts commonly associated with pay-offs]

Question 5: Draw the respective pay-offs for call and put currency options [Hint: draw the charts commonly associated with pay-offs]

Figure 6: Buying a Call Option on Swiss Francs

Figure 6: Buying a Call Option on Swiss Francs

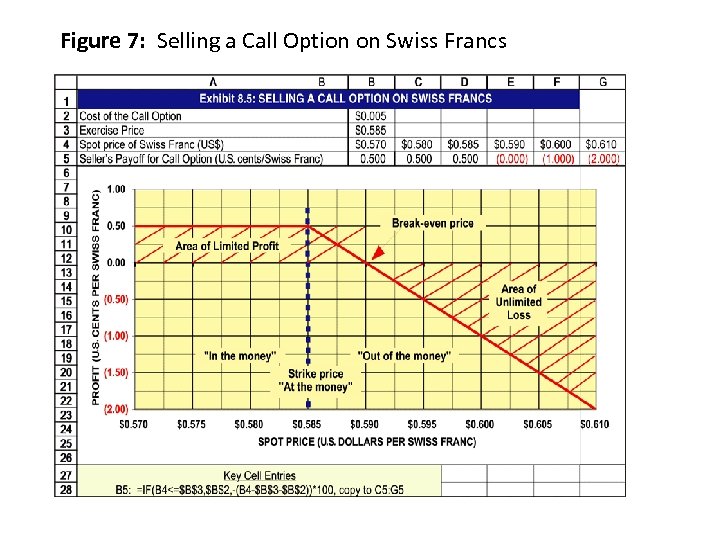

Figure 7: Selling a Call Option on Swiss Francs

Figure 7: Selling a Call Option on Swiss Francs

Figure 8: Buying a Put Option on Swiss Francs

Figure 8: Buying a Put Option on Swiss Francs

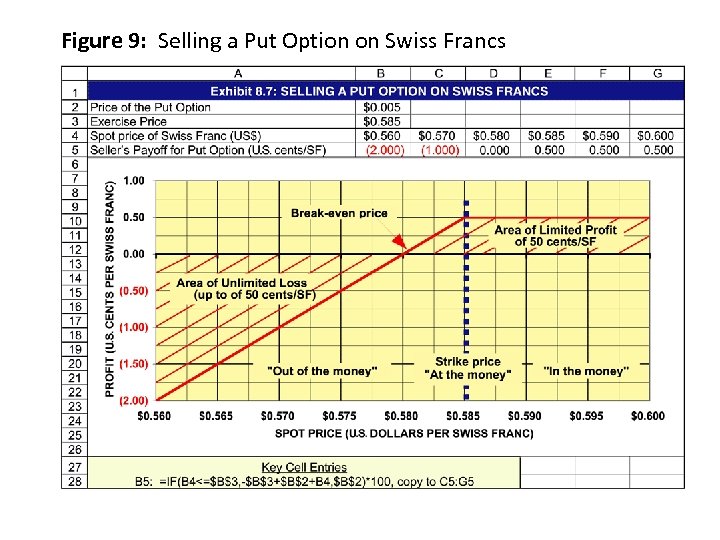

Figure 9: Selling a Put Option on Swiss Francs

Figure 9: Selling a Put Option on Swiss Francs