Mission Statement The Southeast Kentucky Economic Development Corporation (SKED) is an SBA Certified Development Company and U. S. Department of Treasury Community Development Financial Institutions Fund whose mission is to attract new investment and create jobs in a 45 -county service area in Southeast Kentucky. • Business Recruitment • Direct Loans • Small Business Technical Assistance

Mission Statement The Southeast Kentucky Economic Development Corporation (SKED) is an SBA Certified Development Company and U. S. Department of Treasury Community Development Financial Institutions Fund whose mission is to attract new investment and create jobs in a 45 -county service area in Southeast Kentucky. • Business Recruitment • Direct Loans • Small Business Technical Assistance

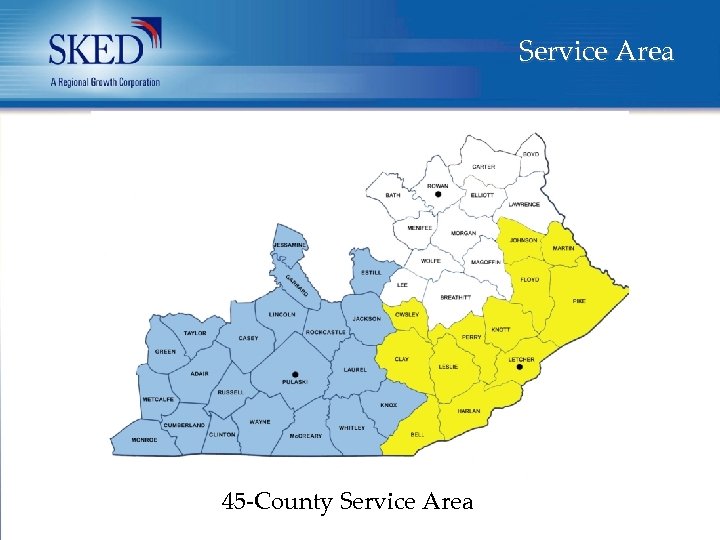

Service Area 45 -County Service Area

Service Area 45 -County Service Area

Business Recruitment • Site Selection • Marketing • Financial Packaging

Business Recruitment • Site Selection • Marketing • Financial Packaging

Marketing the Region www. southeastkentucky. com • Site Selection SKED markets its 45 -county service region through its extensive website, Marketing available building brochures, e-newsletters, annual reports and the development of regional initiatives designed to address the needs of each community. • Financial Packaging

Marketing the Region www. southeastkentucky. com • Site Selection SKED markets its 45 -county service region through its extensive website, Marketing available building brochures, e-newsletters, annual reports and the development of regional initiatives designed to address the needs of each community. • Financial Packaging

Direct Loan Programs • Micro Loan Fund (financing up to $50, 000) • Small Business Loan Fund (financing up to $500, 000) • SBA 504 Loan Program (financing up to $5, 000)

Direct Loan Programs • Micro Loan Fund (financing up to $50, 000) • Small Business Loan Fund (financing up to $500, 000) • SBA 504 Loan Program (financing up to $5, 000)

Micro Loan Fund Project Financing Ø Maximum Loan Size: $50, 000 Ø Minimum Loan Size: $500 Ø Owners’ Equity: 10% of project cost Eligible Projects Ø Machinery and Equipment Ø Permanent Working Capital Loan Term Ø Six Years Technical Assistance Ø Free pre-loan and post-loan technical assistance

Micro Loan Fund Project Financing Ø Maximum Loan Size: $50, 000 Ø Minimum Loan Size: $500 Ø Owners’ Equity: 10% of project cost Eligible Projects Ø Machinery and Equipment Ø Permanent Working Capital Loan Term Ø Six Years Technical Assistance Ø Free pre-loan and post-loan technical assistance

Small Business Loan Fund Project Financing Ø Maximum Loan Size: $500, 000 Ø Minimum Loan Size: $50, 000 Ø Owners’ Equity: 10% of project cost Eligible Projects Ø Land Building Ø Machinery and Equipment Ø Permanent Working Capital Loan Term Ø Ø Ø Real Estate: 15 Years Equipment: 10 Years Working Capital: 5 Years

Small Business Loan Fund Project Financing Ø Maximum Loan Size: $500, 000 Ø Minimum Loan Size: $50, 000 Ø Owners’ Equity: 10% of project cost Eligible Projects Ø Land Building Ø Machinery and Equipment Ø Permanent Working Capital Loan Term Ø Ø Ø Real Estate: 15 Years Equipment: 10 Years Working Capital: 5 Years

SBA 504 Loan Program What can the SBA 504 Loan be used for? Ø Purchase of Land Buildings Ø Construction of New Facility Ø Purchase of Machinery and Equipment What is the Maximum SBA 504 Loan Amount? Ø $5. 0 Million for Regular 504 Loans Ø $5. 5 Million for Manufacturing and Energy How is an SBA 504 Loan Structured? Ø Ø Ø 50% Bank 40% SBA 10% Owner’s Equity

SBA 504 Loan Program What can the SBA 504 Loan be used for? Ø Purchase of Land Buildings Ø Construction of New Facility Ø Purchase of Machinery and Equipment What is the Maximum SBA 504 Loan Amount? Ø $5. 0 Million for Regular 504 Loans Ø $5. 5 Million for Manufacturing and Energy How is an SBA 504 Loan Structured? Ø Ø Ø 50% Bank 40% SBA 10% Owner’s Equity

Small Business Technical Assistance • Business Plan/Cash Flow Analysis • Structuring Financial Incentives • Partnering With Other Lenders Entrepreneurial SMARTS Ø 12 hours training Ø Start, finance, market a new business Ø Certificate of completion

Small Business Technical Assistance • Business Plan/Cash Flow Analysis • Structuring Financial Incentives • Partnering With Other Lenders Entrepreneurial SMARTS Ø 12 hours training Ø Start, finance, market a new business Ø Certificate of completion

Southeast Kentucky Economic Development Corporation 2292 South Highway 27, Suite 340 Somerset, KY 42501 606. 677. 6100 www. southeastkentucky. com

Southeast Kentucky Economic Development Corporation 2292 South Highway 27, Suite 340 Somerset, KY 42501 606. 677. 6100 www. southeastkentucky. com