e253c425bf649cdf330f2f1e54bc7289.ppt

- Количество слайдов: 16

Misr For Central Clearing, Depository & Registry Corporate Actions Automation to reduce risk Presentation AMEDA conference Alex. , April 27 th -29 th 2009 Dr. Tarek Abdel Bary Managing Director

Misr For Central Clearing, Depository & Registry Corporate Actions Automation to reduce risk Presentation AMEDA conference Alex. , April 27 th -29 th 2009 Dr. Tarek Abdel Bary Managing Director

Contents § § What is Corporate action means Philosophy of introducing the service Objective of Introducing the service Types of the corporate actions § § § Cash dividends Underwriting- Public offer- Private offer Capital Increase - stock dividend Capital Decrease Privatization Share swap § Managing the corporate actions risk

Contents § § What is Corporate action means Philosophy of introducing the service Objective of Introducing the service Types of the corporate actions § § § Cash dividends Underwriting- Public offer- Private offer Capital Increase - stock dividend Capital Decrease Privatization Share swap § Managing the corporate actions risk

What is Corporate action means q Any event initiated by a corporation which impacts its shareholders When a publicly-traded company issues a corporate action, it is initiating a process that will bring actual change to its stock. q Corporate actions are typically agreed upon the company's board of directors and authorized by the shareholders. q Some examples are stock splits, dividends, mergers and acquisitions, rights issues

What is Corporate action means q Any event initiated by a corporation which impacts its shareholders When a publicly-traded company issues a corporate action, it is initiating a process that will bring actual change to its stock. q Corporate actions are typically agreed upon the company's board of directors and authorized by the shareholders. q Some examples are stock splits, dividends, mergers and acquisitions, rights issues

Philosophy of introducing the service q MCDR is the sole company in the Egyptian market that provide the clearing, settlement and Depository services of the Egyptian Public traded securities as well as the consequent re-registration process for that reason MCDR has unique possibilities in delivering corporate action services, as well as assisting shareholders in the exercise of their rights. q MCDR provides a wide range of services relating to issuers' corporate actions and the exercise of shareholder rights.

Philosophy of introducing the service q MCDR is the sole company in the Egyptian market that provide the clearing, settlement and Depository services of the Egyptian Public traded securities as well as the consequent re-registration process for that reason MCDR has unique possibilities in delivering corporate action services, as well as assisting shareholders in the exercise of their rights. q MCDR provides a wide range of services relating to issuers' corporate actions and the exercise of shareholder rights.

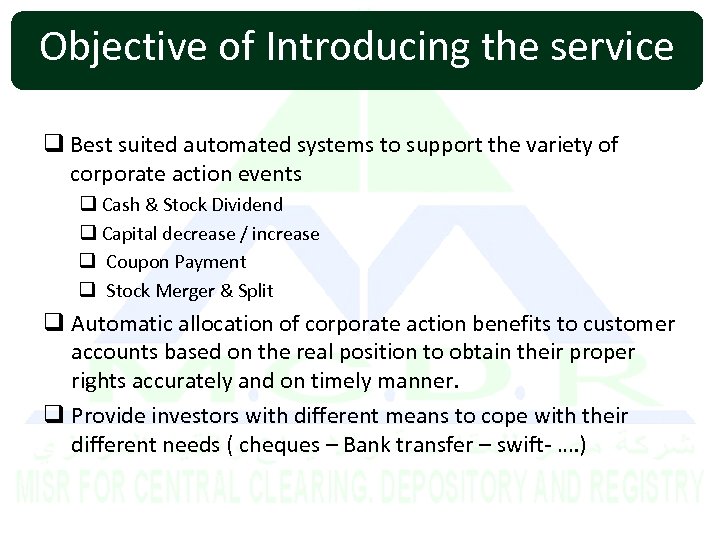

Objective of Introducing the service q Best suited automated systems to support the variety of corporate action events q Cash & Stock Dividend q Capital decrease / increase q Coupon Payment q Stock Merger & Split q Automatic allocation of corporate action benefits to customer accounts based on the real position to obtain their proper rights accurately and on timely manner. q Provide investors with different means to cope with their different needs ( cheques – Bank transfer – swift- …. )

Objective of Introducing the service q Best suited automated systems to support the variety of corporate action events q Cash & Stock Dividend q Capital decrease / increase q Coupon Payment q Stock Merger & Split q Automatic allocation of corporate action benefits to customer accounts based on the real position to obtain their proper rights accurately and on timely manner. q Provide investors with different means to cope with their different needs ( cheques – Bank transfer – swift- …. )

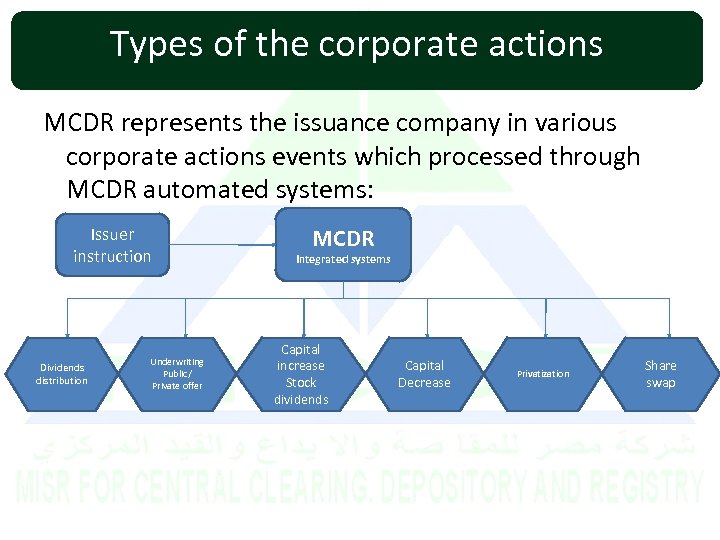

Types of the corporate actions MCDR represents the issuance company in various corporate actions events which processed through MCDR automated systems: Issuer MCDR instruction Dividends distribution Underwriting Public/ Private offer Integrated systems Capital increase Stock dividends Capital Decrease Privatization Share swap

Types of the corporate actions MCDR represents the issuance company in various corporate actions events which processed through MCDR automated systems: Issuer MCDR instruction Dividends distribution Underwriting Public/ Private offer Integrated systems Capital increase Stock dividends Capital Decrease Privatization Share swap

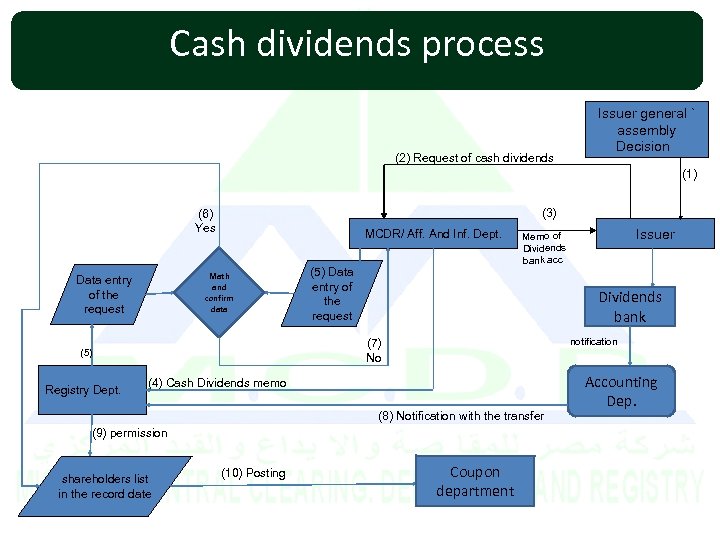

Cash dividends process (2) Request of cash dividends Issuer general ` assembly Decision (1) (3) (6) Yes MCDR/ Aff. And Inf. Dept. Math and confirm data Data entry of the request Dividends bank notification (7) No (5) Registry Dept. (5) Data entry of the request (4) Cash Dividends memo (8) Notification with the transfer (9) permission shareholders list in the record date (10) Posting Issuer Memo of Dividends bank acc Coupon department Accounting Dep.

Cash dividends process (2) Request of cash dividends Issuer general ` assembly Decision (1) (3) (6) Yes MCDR/ Aff. And Inf. Dept. Math and confirm data Data entry of the request Dividends bank notification (7) No (5) Registry Dept. (5) Data entry of the request (4) Cash Dividends memo (8) Notification with the transfer (9) permission shareholders list in the record date (10) Posting Issuer Memo of Dividends bank acc Coupon department Accounting Dep.

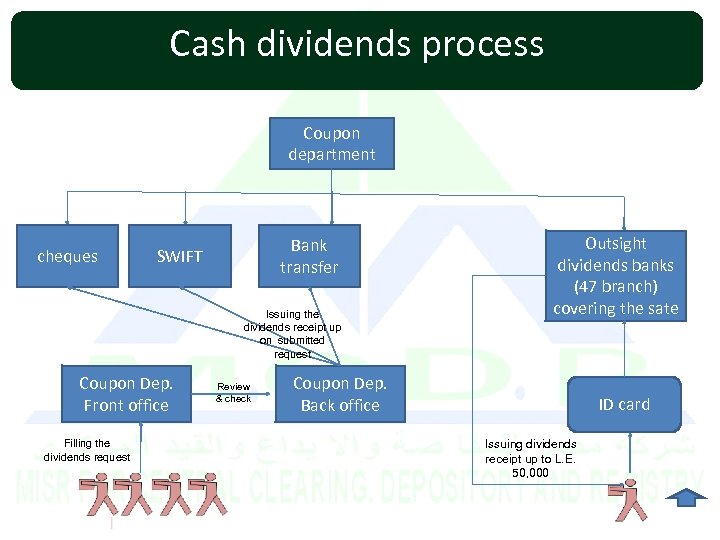

Cash dividends process Coupon department cheques Bank transfer SWIFT Issuing the dividends receipt up on submitted request Coupon Dep. Front office Filling the dividends request Review & check Outsight dividends banks (47 branch) covering the sate Coupon Dep. Back office ID card Issuing dividends receipt up to L. E. 50, 000

Cash dividends process Coupon department cheques Bank transfer SWIFT Issuing the dividends receipt up on submitted request Coupon Dep. Front office Filling the dividends request Review & check Outsight dividends banks (47 branch) covering the sate Coupon Dep. Back office ID card Issuing dividends receipt up to L. E. 50, 000

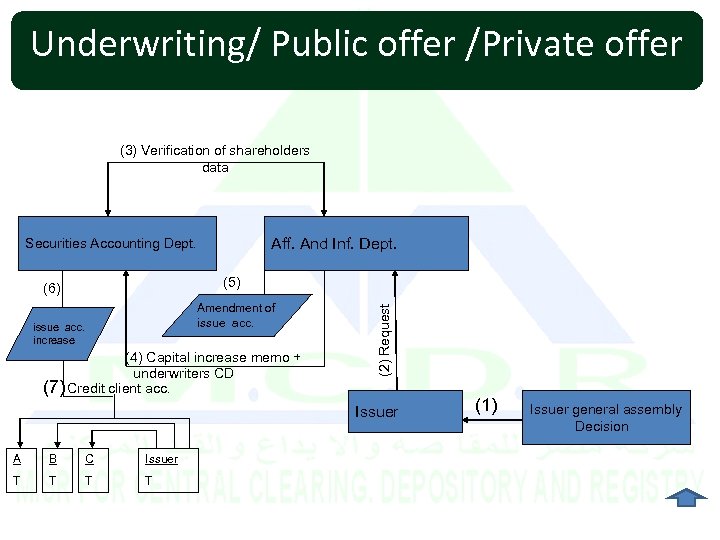

Underwriting/ Public offer /Private offer (3) Verification of shareholders data Aff. And Inf. Dept. Securities Accounting Dept. Amendment of issue acc. increase (4) Capital increase memo + underwriters CD (7) Credit client acc. (2) Request (5) (6) Issuer A B C Issuer T T (1) Issuer general assembly Decision

Underwriting/ Public offer /Private offer (3) Verification of shareholders data Aff. And Inf. Dept. Securities Accounting Dept. Amendment of issue acc. increase (4) Capital increase memo + underwriters CD (7) Credit client acc. (2) Request (5) (6) Issuer A B C Issuer T T (1) Issuer general assembly Decision

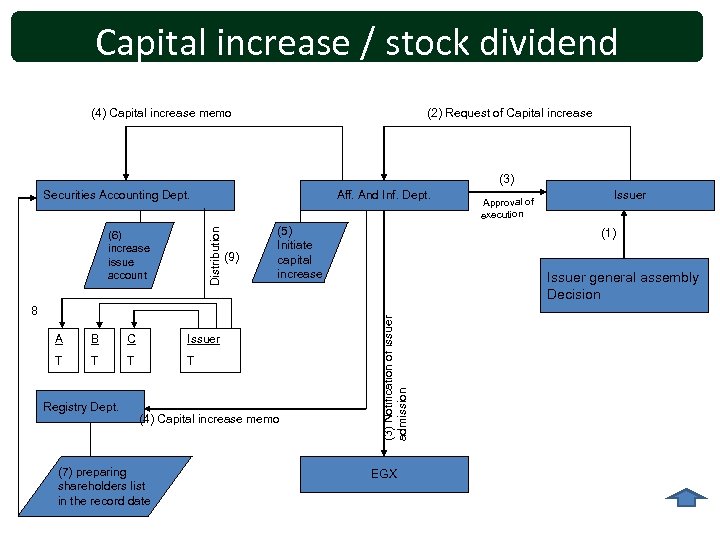

Capital increase / stock dividend (4) Capital increase memo (2) Request of Capital increase (3) Aff. And Inf. Dept. (6) increase issue account (9) (5) Initiate capital increase 8 A B C Issuer T T Registry Dept. (4) Capital increase memo (7) preparing shareholders list in the record date Approval of execution Issuer (1) Issuer general assembly Decision (3) Notification of issuer admission Distribution Securities Accounting Dept. EGX

Capital increase / stock dividend (4) Capital increase memo (2) Request of Capital increase (3) Aff. And Inf. Dept. (6) increase issue account (9) (5) Initiate capital increase 8 A B C Issuer T T Registry Dept. (4) Capital increase memo (7) preparing shareholders list in the record date Approval of execution Issuer (1) Issuer general assembly Decision (3) Notification of issuer admission Distribution Securities Accounting Dept. EGX

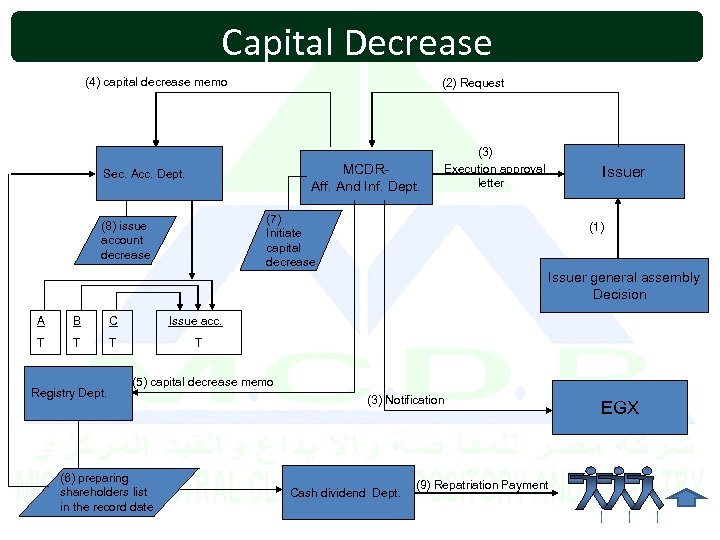

Capital Decrease (4) capital decrease memo (2) Request MCDRAff. And Inf. Dept. Sec. Acc. Dept. (3) Execution approval letter Issuer (7) Initiate capital decrease (8) issue account decrease (1) Issuer general assembly Decision A B C Issue acc. T T Registry Dept. (5) capital decrease memo (6) preparing shareholders list in the record date (3) Notification Cash dividend Dept. (9) Repatriation Payment EGX

Capital Decrease (4) capital decrease memo (2) Request MCDRAff. And Inf. Dept. Sec. Acc. Dept. (3) Execution approval letter Issuer (7) Initiate capital decrease (8) issue account decrease (1) Issuer general assembly Decision A B C Issue acc. T T Registry Dept. (5) capital decrease memo (6) preparing shareholders list in the record date (3) Notification Cash dividend Dept. (9) Repatriation Payment EGX

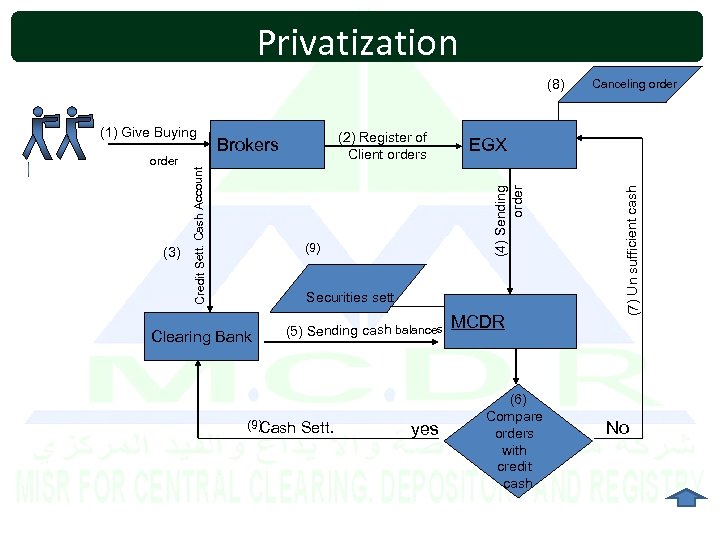

Privatization (8) (9) Securities sett. Clearing Bank (5) Sending cash balances (9) Cash Sett. yes MCDR (6) Compare orders with credit cash (7) Un sufficient cash (3) EGX (4) Sending order (2) Register of Client orders Brokers Credit Sett. Cash Account (1) Give Buying Canceling order No

Privatization (8) (9) Securities sett. Clearing Bank (5) Sending cash balances (9) Cash Sett. yes MCDR (6) Compare orders with credit cash (7) Un sufficient cash (3) EGX (4) Sending order (2) Register of Client orders Brokers Credit Sett. Cash Account (1) Give Buying Canceling order No

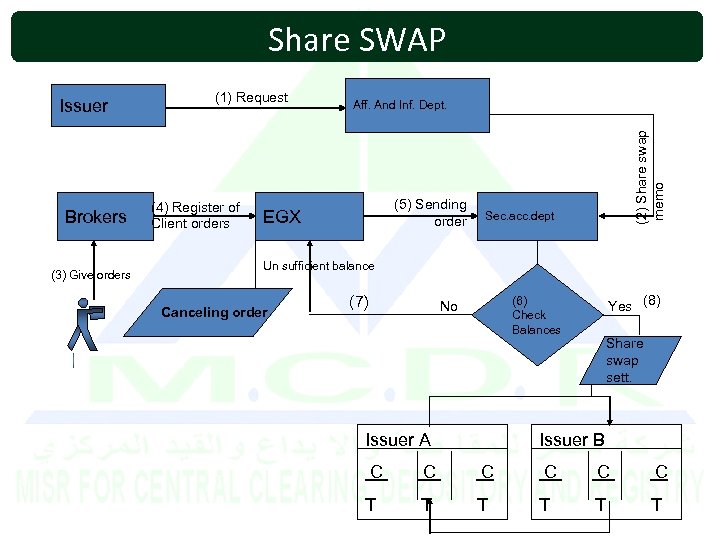

Share SWAP Brokers (3) Give orders (1) Request (4) Register of Client orders Aff. And Inf. Dept. (5) Sending order EGX (2) Share swap memo Issuer Sec. acc. dept Un sufficient balance Canceling order (7) Yes (8) (6) Check Balances No Issuer A Share swap sett. Issuer B C C C T T T

Share SWAP Brokers (3) Give orders (1) Request (4) Register of Client orders Aff. And Inf. Dept. (5) Sending order EGX (2) Share swap memo Issuer Sec. acc. dept Un sufficient balance Canceling order (7) Yes (8) (6) Check Balances No Issuer A Share swap sett. Issuer B C C C T T T

Managing the corporate actions risk Receipt of Corporate Action information. corporate action request be executed when the issuer submits the necessary authorized documents (Board of Directors or General assembly meeting decision) Distribution of Corporate Action information The issuer should notify the company with all related information accurately and on timely manner. Receipt of Corporate Action Instructions MCDR maintain a pro active client files for each Issuer MCDR has an efficient system of receiving and processing the issuer instructions information.

Managing the corporate actions risk Receipt of Corporate Action information. corporate action request be executed when the issuer submits the necessary authorized documents (Board of Directors or General assembly meeting decision) Distribution of Corporate Action information The issuer should notify the company with all related information accurately and on timely manner. Receipt of Corporate Action Instructions MCDR maintain a pro active client files for each Issuer MCDR has an efficient system of receiving and processing the issuer instructions information.

Managing the corporate actions risk Processing of Corporate Action Instructions All corporate instructions are processed on timely and accurately way to be able to managing the corporate actions effectively Clear statement of liability MCDR has the responsibly to compensate any client in the event of an error could result from wrong processing. Manual processing of the related data be limited to minimum level to reduce the likelihood of error as well as minimizing the potential losses

Managing the corporate actions risk Processing of Corporate Action Instructions All corporate instructions are processed on timely and accurately way to be able to managing the corporate actions effectively Clear statement of liability MCDR has the responsibly to compensate any client in the event of an error could result from wrong processing. Manual processing of the related data be limited to minimum level to reduce the likelihood of error as well as minimizing the potential losses

Any Question? Thank you t. Bary@mcsd. com. eg

Any Question? Thank you t. Bary@mcsd. com. eg