1273b91434103636837fe4b26cadc3a2.ppt

- Количество слайдов: 29

MISONIX INCORPORATED NASDAQ: MSON

Safe Harbor Statement Except for the historical information contained herein, the matters discussed in this presentation contain forward-looking statements. The accuracy of these statements is subject to significant risks and uncertainties. Actual results could differ materially from those contained in the forward-looking statements. See the Company’s SEC filings on Forms 10 -K and 10 -Q for important information about the Company and related risks. 1 COMPANY CONFIDENTIAL

Why Misonix? Would you want to invest in a Company using unique ultrasound technology in these markets? §Prostate §Breast Cancer §Kidney/Liver Cancers §Liposuction §Neurosurgery §Lithotripsy 2 COMPANY CONFIDENTIAL

The Misonix Story Management at Misonix has embarked on a transition strategy that today has positioned the Company for years of growth. This plan includes: §Major medical device company §Leveraging §Allocating decades of ultrasound research and existing businesses assets to build intellectual property portfolio §Assembling a diversified line of medical devices with the potential for high growth and margins §Developing efficient manufacturing processes and distribution capabilities 3 COMPANY CONFIDENTIAL

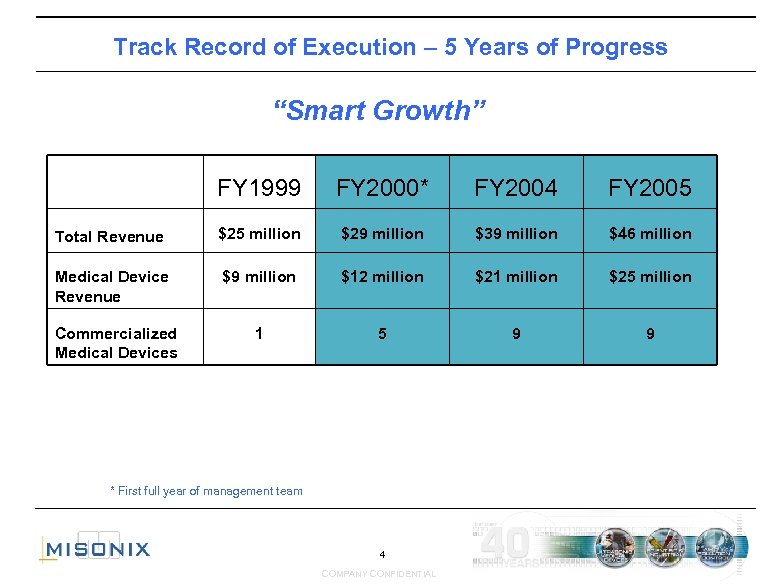

Track Record of Execution – 5 Years of Progress “Smart Growth” FY 1999 FY 2000* FY 2004 FY 2005 Total Revenue $25 million $29 million $39 million $46 million Medical Device Revenue $9 million $12 million $21 million $25 million Commercialized Medical Devices 1 5 9 9 * First full year of management team 4 COMPANY CONFIDENTIAL

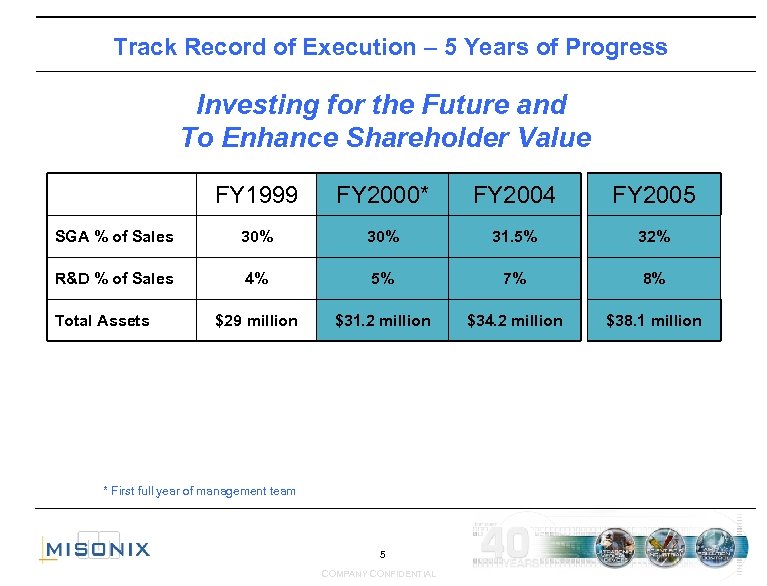

Track Record of Execution – 5 Years of Progress Investing for the Future and To Enhance Shareholder Value FY 1999 FY 2000* FY 2004 FY 2005 SGA % of Sales 30% 31. 5% 32% R&D % of Sales 4% 5% 7% 8% $29 million $31. 2 million $34. 2 million $38. 1 million Total Assets * First full year of management team 5 COMPANY CONFIDENTIAL

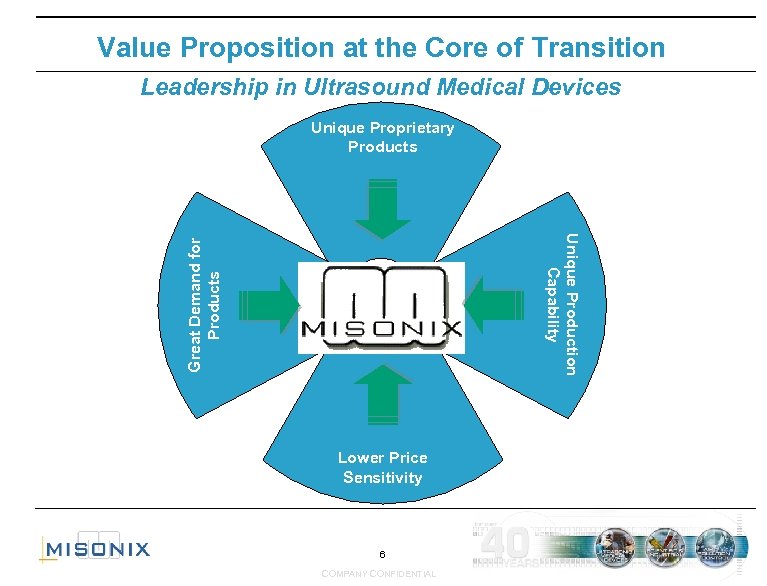

Value Proposition at the Core of Transition Leadership in Ultrasound Medical Devices Unique Proprietary Products Great Demand for Products Unique Production Capability Lower Price Sensitivity 6 COMPANY CONFIDENTIAL

Allocating Assets – Opportunistic Acquisitions* Expanding product line, manufacturing and servicing capabilities, tactical benefits and technological prowess Year Business Strategic Purpose 1999 Focus Surgery HIFU Technology/Multiple Applications 1999 Hearing Innovations New Technology/Application 2000 Sonora Medical Ultrasound Equipment Servicing 2000 Cra. Mar Technologies Ultrasound Equipment Servicing 2000 Sonic Technologies Measurement and Testing Lab 2001 Fibra Sonics Neurosurgery, Liposuction, Lithotripsy * Certain transactions were investments for less than 100% ownership 7 COMPANY CONFIDENTIAL

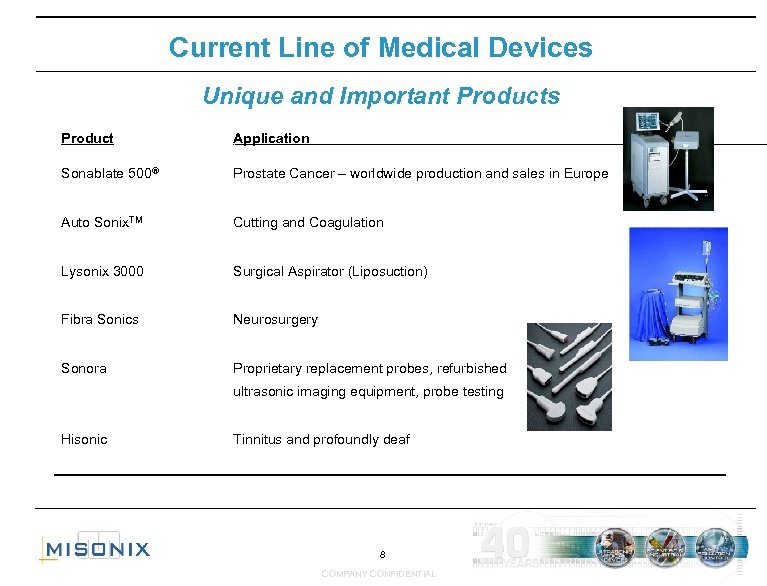

Current Line of Medical Devices Unique and Important Products Product‘ Application Sonablate 500® Prostate Cancer – worldwide production and sales in Europe Auto Sonix. TM Cutting and Coagulation Lysonix 3000 Surgical Aspirator (Liposuction) Fibra Sonics Neurosurgery Sonora Proprietary replacement probes, refurbished ‘ ultrasonic imaging equipment, probe testing Hisonic Tinnitus and profoundly deaf 8 COMPANY CONFIDENTIAL

High Intensity Focused Ultrasound (HIFU) and Focus Surgery § 1999 – MSON contractual relationship and investment § 18% fully diluted equity position in Focus Surgery, developer of HIFU technology § Right to produce their products for global distribution (manufacturing margin) § Right to sell the Sonablate 500® for prostate cancer in Europe (manufacturing and distribution margins) § 100% rights to worldwide license to market and sell HIFU treatments in Kidney, Liver and Breast (manufacturing and distribution margins) 9 COMPANY CONFIDENTIAL

The Sonablate 500® Focus Surgery Sonablate 500® - utilizing High Intensity Focused Ultrasound (HIFU) for treatment of Prostate Cancer § Non-invasive § Phase I in U. S. § Sales in Europe and Asia § Ability to treat radiated tissue Focus Surgery - Prostate Cancer § Over 1400 successful procedures Worldwide § Over 300 successful procedures in Europe § 24 patients in United States under 40 patient IDE 10 COMPANY CONFIDENTIAL

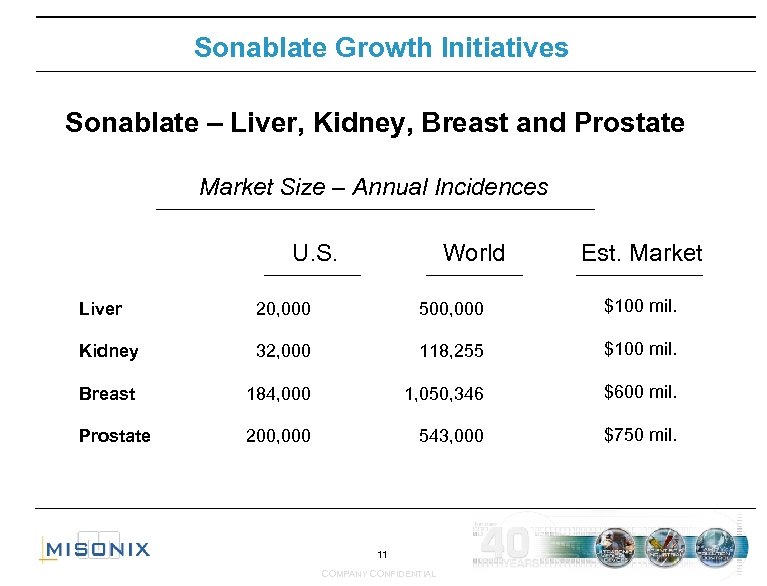

Sonablate Growth Initiatives Sonablate – Liver, Kidney, Breast and Prostate Market Size – Annual Incidences U. S. World Est. Market Liver 20, 000 500, 000 $100 mil. Kidney 32, 000 118, 255 $100 mil. Breast 184, 000 1, 050, 346 $600 mil. Prostate 200, 000 543, 000 $750 mil. 11 COMPANY CONFIDENTIAL

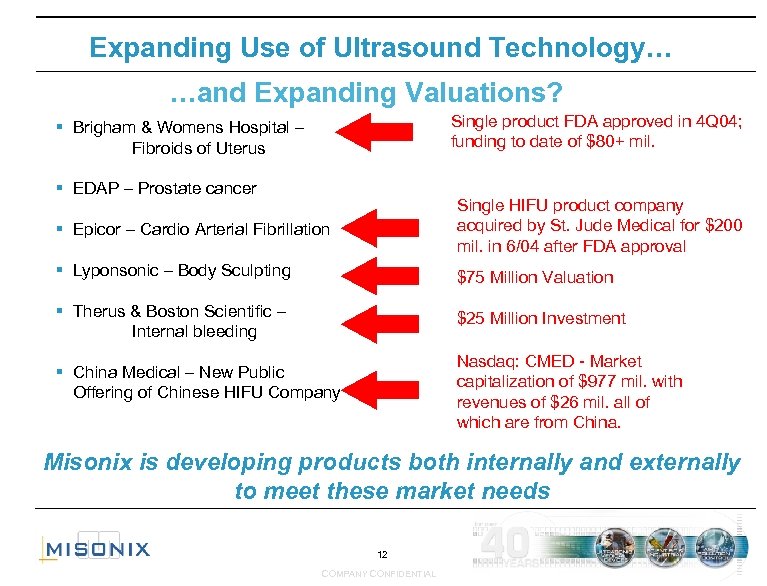

Expanding Use of Ultrasound Technology… …and Expanding Valuations? Single product FDA approved in 4 Q 04; funding to date of $80+ mil. § Brigham & Womens Hospital – Fibroids of Uterus § EDAP – Prostate cancer § Epicor – Cardio Arterial Fibrillation Single HIFU product company acquired by St. Jude Medical for $200 mil. in 6/04 after FDA approval § Lyponsonic – Body Sculpting $75 Million Valuation § Therus & Boston Scientific – Internal bleeding $25 Million Investment Nasdaq: CMED - Market capitalization of $977 mil. with revenues of $26 mil. all of which are from China. § China Medical – New Public Offering of Chinese HIFU Company Misonix is developing products both internally and externally to meet these market needs 12 COMPANY CONFIDENTIAL

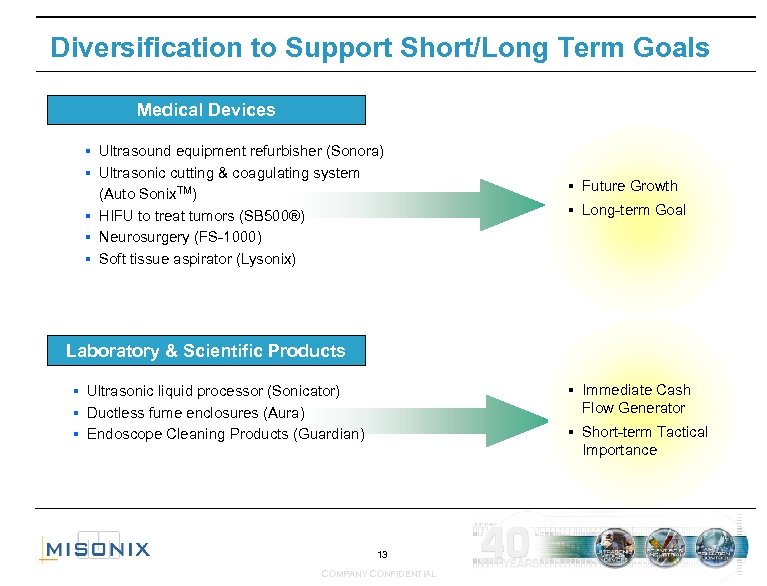

Diversification to Support Short/Long Term Goals Medical Devices § § § Ultrasound equipment refurbisher (Sonora) Ultrasonic cutting & coagulating system (Auto Sonix. TM) HIFU to treat tumors (SB 500®) Neurosurgery (FS-1000) Soft tissue aspirator (Lysonix) § Future Growth § Long-term Goal § Immediate Cash Flow Generator § Short-term Tactical Importance Laboratory & Scientific Products Ultrasonic liquid processor (Sonicator) § Ductless fume enclosures (Aura) § Endoscope Cleaning Products (Guardian) § 13 COMPANY CONFIDENTIAL

Growth Strategy § Investments in high growth medical areas funded from cash flow of medical device products in addition to laboratory and scientific products § Make investments consistent with company’s core competency § § § Manufacturing exclusivity plus the rights to other products in exchange for investment Generate marketing/manufacturing efficiencies and revenue growth Apply R&D to develop products for other medical device companies and for ourselves 14 COMPANY CONFIDENTIAL

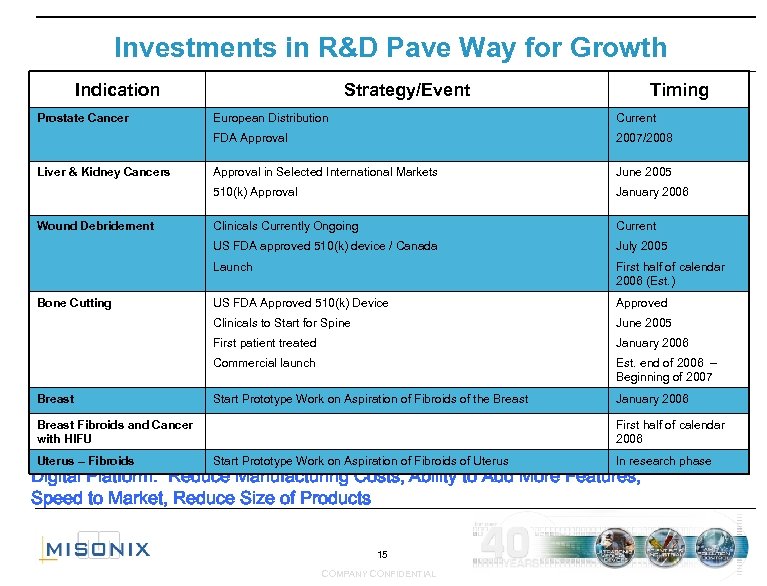

Investments in R&D Pave Way for Growth Indication Prostate Cancer Strategy/Event Timing June 2005 January 2006 Clinicals Currently Ongoing Current July 2005 Launch First half of calendar 2006 (Est. ) US FDA Approved 510(k) Device Approved Clinicals to Start for Spine June 2005 First patient treated January 2006 Commercial launch Breast Approval in Selected International Markets US FDA approved 510(k) device / Canada Bone Cutting 2007/2008 510(k) Approval Wound Debridement Current FDA Approval Liver & Kidney Cancers European Distribution Est. end of 2006 – Beginning of 2007 Start Prototype Work on Aspiration of Fibroids of the Breast January 2006 Breast Fibroids and Cancer with HIFU Uterus – Fibroids First half of calendar 2006 Start Prototype Work on Aspiration of Fibroids of Uterus In research phase Digital Platform: Reduce Manufacturing Costs, Ability to Add More Features, Speed to Market, Reduce Size of Products 15 COMPANY CONFIDENTIAL

Market Opportunity for Future Products Assuming clinical successes, regulatory approval and commercial production Indication Market Size Per Year Bone Cutter – Laminectomy $100 million Wound Debridement $3. 0 billion Hearing $100 million Prostate Cancer (US) $300 million Breast Cancer $600 million Liver & Kidney Cancer $200 million $4. 30 billion Annual Market for Existing Products $ . 65 billion Total Annual Market for Existing/Future Products $4. 95 billion 16 COMPANY CONFIDENTIAL

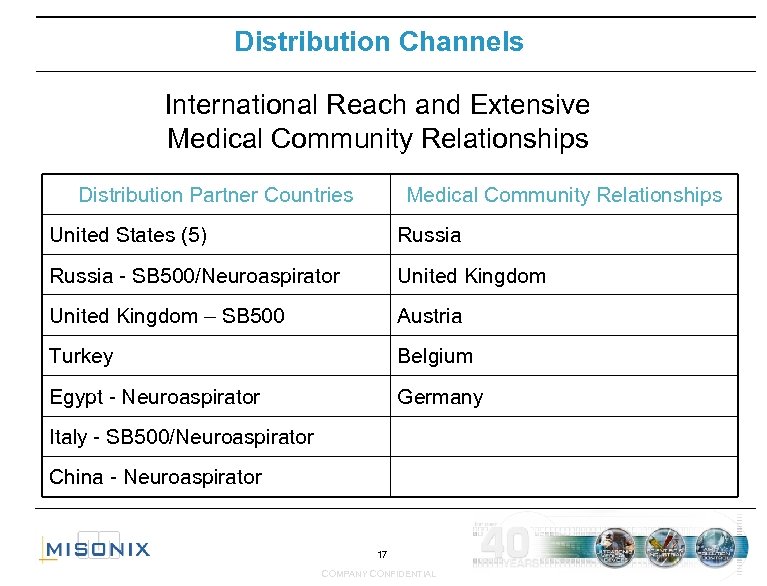

Distribution Channels International Reach and Extensive Medical Community Relationships Distribution Partner Countries Medical Community Relationships United States (5) Russia - SB 500/Neuroaspirator United Kingdom – SB 500 Austria Turkey Belgium Egypt - Neuroaspirator Germany Italy - SB 500/Neuroaspirator China - Neuroaspirator 17 COMPANY CONFIDENTIAL

We Believe We Are The Best Ultrasonic Medical Device Company Balancing economic benefits of direct sales force and partnering with market leaders With more products in the market and in anticipation of others nearing approval, management has increased spending on sales and marketing activities in FY 2005 above level of previous year. 18 COMPANY CONFIDENTIAL

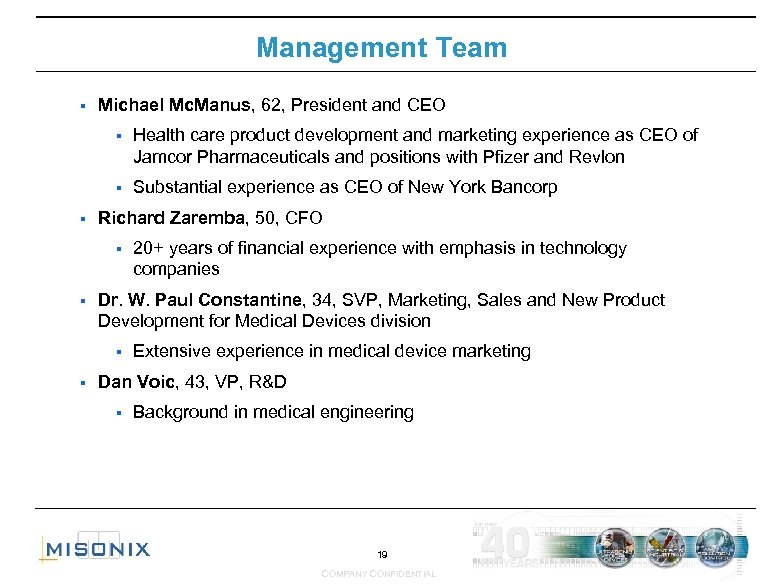

Management Team § Michael Mc. Manus, 62, President and CEO § § § Health care product development and marketing experience as CEO of Jamcor Pharmaceuticals and positions with Pfizer and Revlon Substantial experience as CEO of New York Bancorp Richard Zaremba, 50, CFO § § Dr. W. Paul Constantine, 34, SVP, Marketing, Sales and New Product Development for Medical Devices division § § 20+ years of financial experience with emphasis in technology companies Extensive experience in medical device marketing Dan Voic, 43, VP, R&D § Background in medical engineering 19 COMPANY CONFIDENTIAL

Financial Review 20 COMPANY CONFIDENTIAL

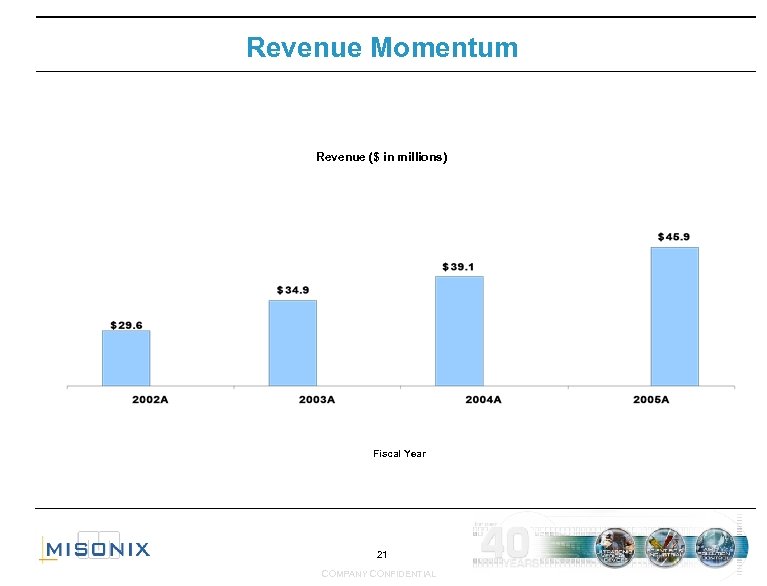

Revenue Momentum Revenue ($ in millions) Fiscal Year 21 COMPANY CONFIDENTIAL

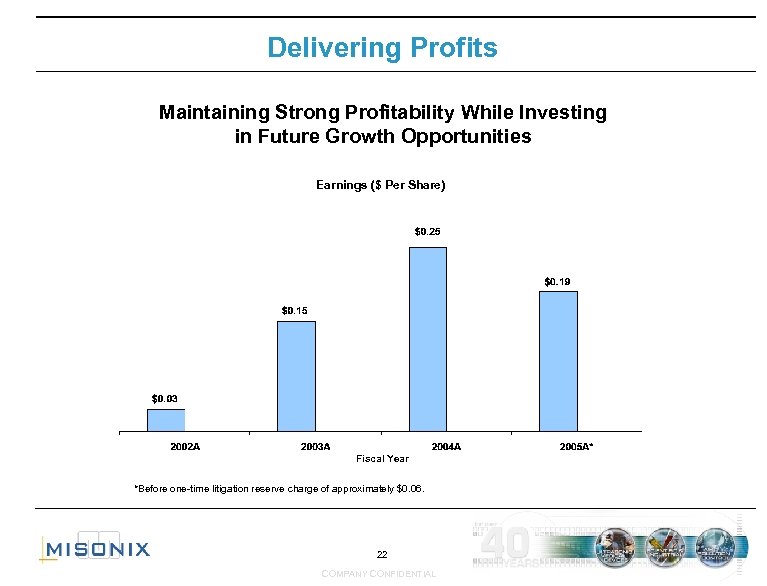

Delivering Profits Maintaining Strong Profitability While Investing in Future Growth Opportunities Earnings ($ Per Share) Fiscal Year *Before one-time litigation reserve charge of approximately $0. 06. 22 COMPANY CONFIDENTIAL

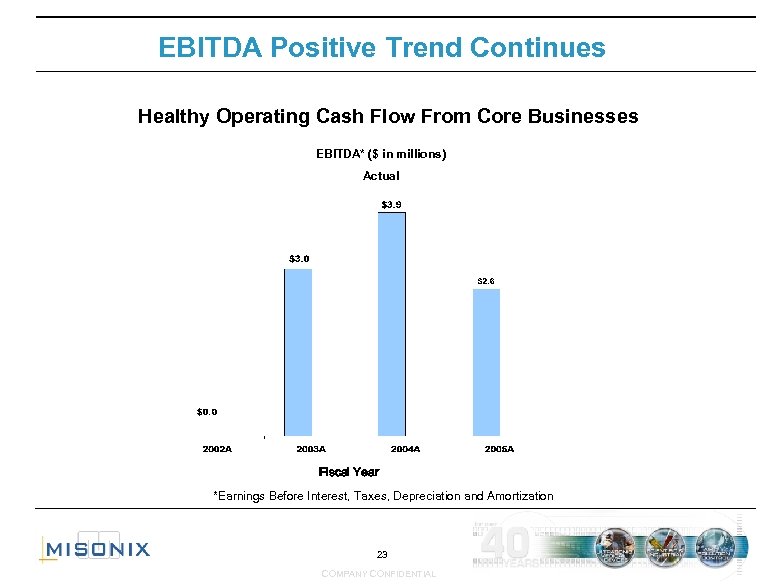

EBITDA Positive Trend Continues Healthy Operating Cash Flow From Core Businesses EBITDA* ($ in millions) Actual Fiscal Year *Earnings Before Interest, Taxes, Depreciation and Amortization 23 COMPANY CONFIDENTIAL

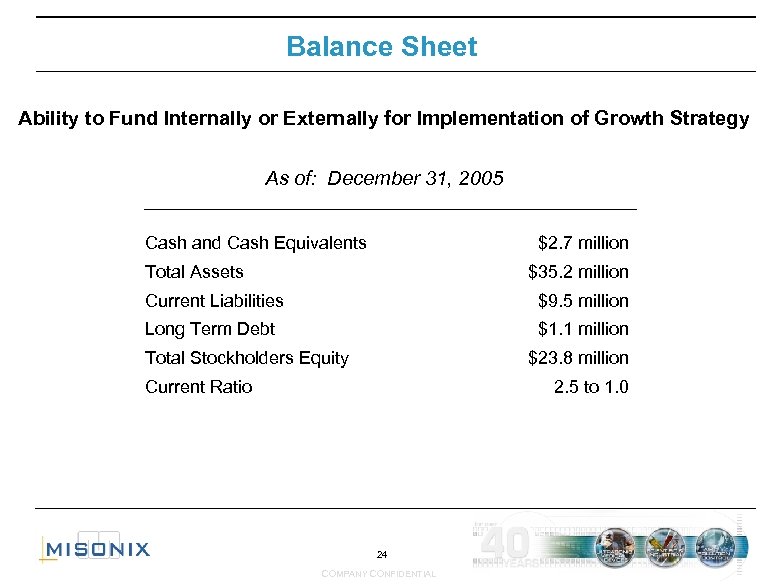

Balance Sheet Ability to Fund Internally or Externally for Implementation of Growth Strategy As of: December 31, 2005 Cash and Cash Equivalents $2. 7 million Total Assets $35. 2 million Current Liabilities $9. 5 million Long Term Debt $1. 1 million Total Stockholders Equity $23. 8 million Current Ratio 2. 5 to 1. 0 24 COMPANY CONFIDENTIAL

Results for Strategies Implemented Since 1999 § Increased Medical Devices from 1 Product to 9 Products in 2004 § Revenue up 85% since 1999 or an average annual increase of 10+%; Medical device revenue up 184% § Acquired and developed internally numerous new technologies/applications; Increased spending on R&D by 247% § Healthy profitability maintained despite increase in spending for future growth through medical device initiatives 25 COMPANY CONFIDENTIAL

Management Commitment § Focus company to be a pure medical device organization § Continue to focus on delivering sustainable results in the near term § Invest in programs intended to provide more profitable long term growth § Focus on synergistic acquisitions and other strategic alternatives to increase shareholder value 26 COMPANY CONFIDENTIAL

Investment Merits § Premiere platform of medical devices using ultrasonic technology – greatest number of unique products on the market § Internally and externally generated growth § Ability to forge alliances with strong third-party distributors and directly market to customers § Barriers to entry include years of ultrasound research and significant investment in HIFU and other technologies § Healthy balance sheet and cash flow from core businesses § Milestone-driven company focused on attaining growth and enhancing shareholder value 27 COMPANY CONFIDENTIAL

28 COMPANY CONFIDENTIAL

1273b91434103636837fe4b26cadc3a2.ppt