24708aa4ce0a878e539b6367502a7b85.ppt

- Количество слайдов: 20

Ministry of Finance of the Republic of Indonesia Government Securities Prospects in 2013 Directorate of Gov Debt Securities, DG of Debt Management Ministry of Finance Republic of Indonesia

Outline 1. 2. 3. Government Securities Management and Financing Strategy Government Securities Performance Government Securities Market Prospects in 2013 2

Government Securities Management and Financing Strategy 3

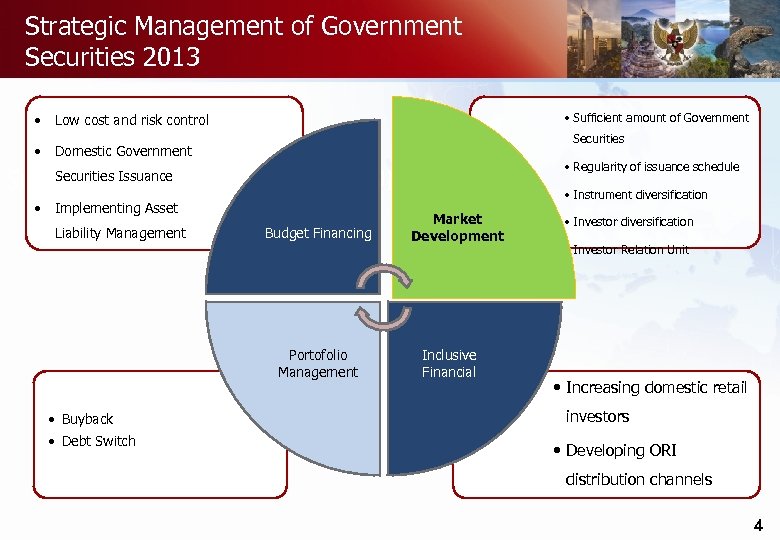

Strategic Management of Government Securities 2013 • • • Sufficient amount of Government Low cost and risk control Securities Domestic Government Strategi Umum Pengelolaan SUN 2013 Securities Issuance • Implementing Asset Liability Management Budget Financing Portofolio Management • Buyback • Debt Switch Market Development Inclusive Financial • Regularity of issuance schedule • Instrument diversification • Investor Relation Unit • Increasing domestic retail investors • Developing ORI distribution channels 4

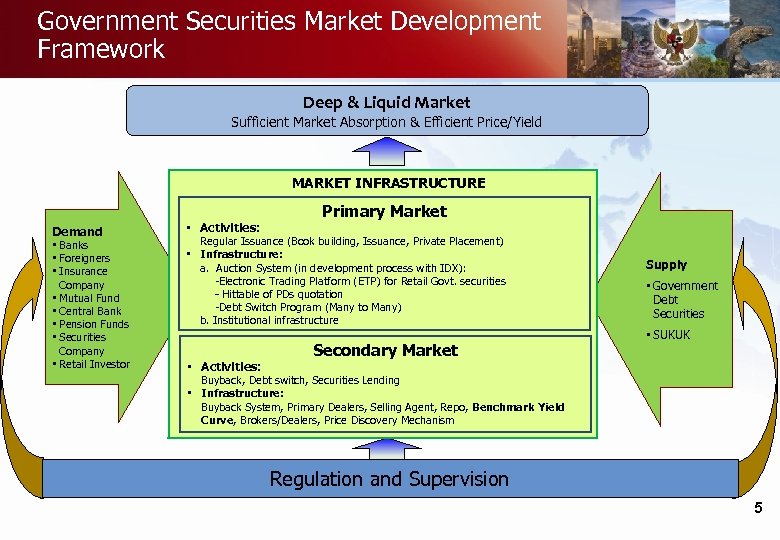

Government Securities Market Development Framework Deep & Liquid Market Sufficient Market Absorption & Efficient Price/Yield MARKET INFRASTRUCTURE Demand • Banks • Foreigners • Insurance Company • Mutual Fund • Central Bank • Pension Funds • Securities Company • Retail Investor • Activities: Primary Market Regular Issuance (Book building, Issuance, Private Placement) • Infrastructure: a. Auction System (in development process with IDX): -Electronic Trading Platform (ETP) for Retail Govt. securities - Hittable of PDs quotation -Debt Switch Program (Many to Many) b. Institutional infrastructure • Activities: Secondary Market Supply • Government Debt Securities • SUKUK Buyback, Debt switch, Securities Lending • Infrastructure: Buyback System, Primary Dealers, Selling Agent, Repo, Benchmark Yield Curve, Brokers/Dealers, Price Discovery Mechanism Regulation and Supervision 5

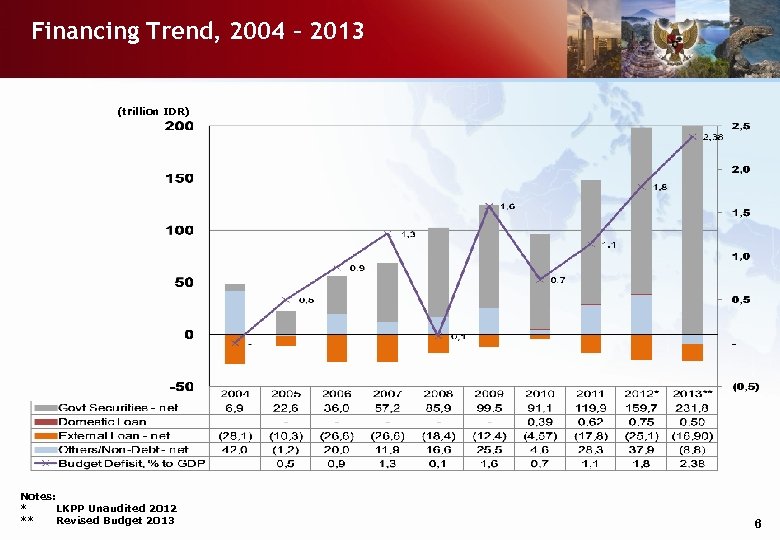

Financing Trend, 2004 – 2013 (trillion IDR) Notes: * LKPP Unaudited 2012 ** Revised Budget 2013 6

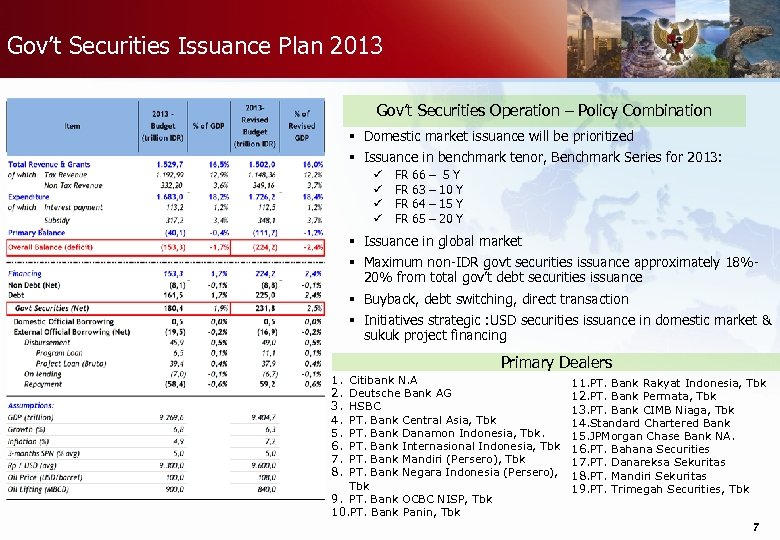

Gov’t Securities Issuance Plan 2013 Gov’t Securities Operation – Policy Combination § Domestic market issuance will be prioritized § Issuance in benchmark tenor, Benchmark Series for 2013: ü ü FR FR 66 63 64 65 – – 5 Y 10 Y 15 Y 20 Y § Issuance in global market § Maximum non-IDR govt securities issuance approximately 18%20% from total gov’t debt securities issuance § Buyback, debt switching, direct transaction § Initiatives strategic : USD securities issuance in domestic market & sukuk project financing Primary Dealers 1. 2. 3. 4. 5. 6. 7. 8. Citibank N. A Deutsche Bank AG HSBC PT. Bank Central Asia, Tbk PT. Bank Danamon Indonesia, Tbk. PT. Bank Internasional Indonesia, Tbk PT. Bank Mandiri (Persero), Tbk PT. Bank Negara Indonesia (Persero), Tbk 9. PT. Bank OCBC NISP, Tbk 10. PT. Bank Panin, Tbk 11. PT. Bank Rakyat Indonesia, Tbk 12. PT. Bank Permata, Tbk 13. PT. Bank CIMB Niaga, Tbk 14. Standard Chartered Bank 15. JPMorgan Chase Bank NA. 16. PT. Bahana Securities 17. PT. Danareksa Sekuritas 18. PT. Mandiri Sekuritas 19. PT. Trimegah Securities, Tbk 7

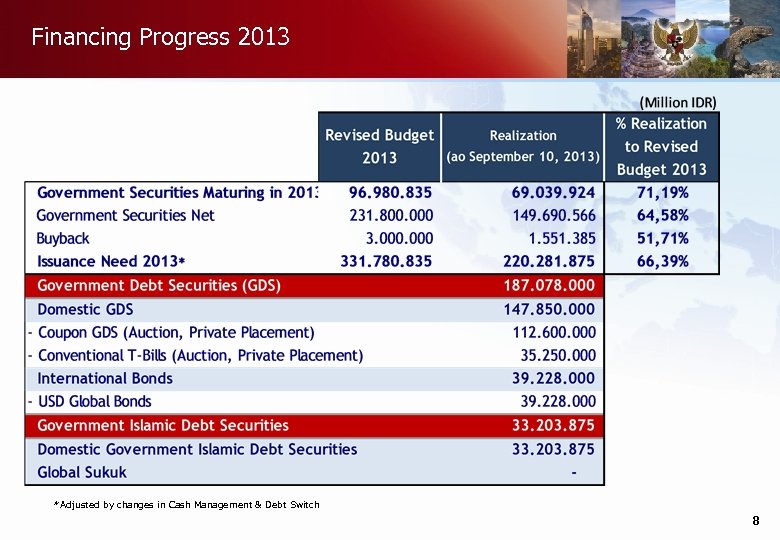

Financing Progress 2013 *Adjusted by changes in Cash Management & Debt Switch 8

Government Securities Performance

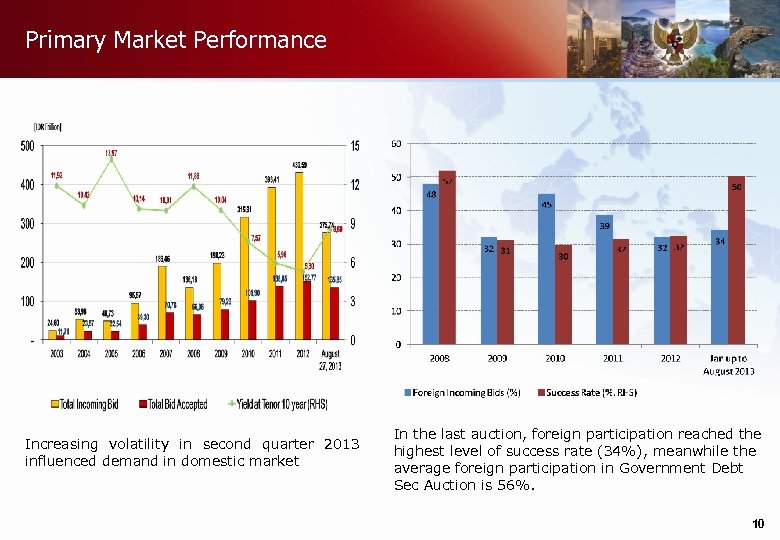

Primary Market Performance Increasing volatility in second quarter 2013 influenced demand in domestic market In the last auction, foreign participation reached the highest level of success rate (34%), meanwhile the average foreign participation in Government Debt Sec Auction is 56%. 10

![Secondary Market Performance Yield of Benchmark Series trend to pick up [In Percentage] As Secondary Market Performance Yield of Benchmark Series trend to pick up [In Percentage] As](https://present5.com/presentation/24708aa4ce0a878e539b6367502a7b85/image-11.jpg)

Secondary Market Performance Yield of Benchmark Series trend to pick up [In Percentage] As of Sept 10, 2013 Activity in the domestic bond market increasing Average daily trading (IDR Trilion) Global Financial Crisis Eurozone sovereign debt crisis Bid Ask Spread 10 Y Govt Bond Turn Over 10 Y Govt Bond Up to Sept 4, 2013 11

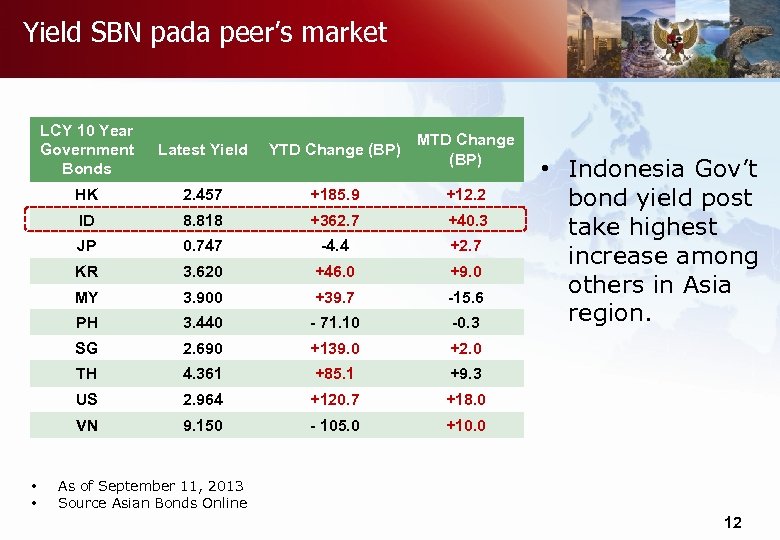

Yield SBN pada peer’s market LCY 10 Year Government Bonds YTD Change (BP) MTD Change (BP) HK 2. 457 +185. 9 +12. 2 ID 8. 818 +362. 7 +40. 3 JP 0. 747 -4. 4 +2. 7 KR 3. 620 +46. 0 +9. 0 MY 3. 900 +39. 7 -15. 6 PH 3. 440 - 71. 10 -0. 3 SG 2. 690 +139. 0 +2. 0 TH 4. 361 +85. 1 +9. 3 US 2. 964 +120. 7 +18. 0 VN • • Latest Yield 9. 150 - 105. 0 +10. 0 • Indonesia Gov’t bond yield post take highest increase among others in Asia region. As of September 11, 2013 Source Asian Bonds Online 12

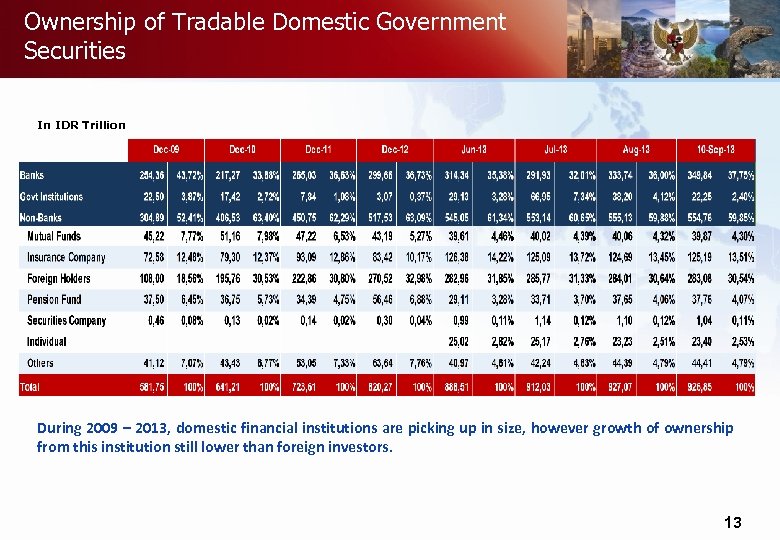

Ownership of Tradable Domestic Government Securities In IDR Trillion During 2009 – 2013, domestic financial institutions are picking up in size, however growth of ownership from this institution still lower than foreign investors. 13

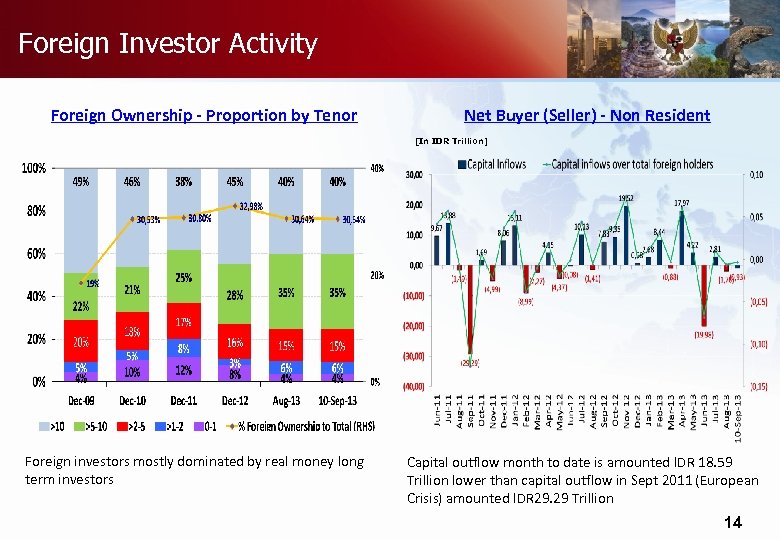

Foreign Investor Activity Foreign Ownership - Proportion by Tenor Net Buyer (Seller) - Non Resident [In IDR Trillion] Foreign investors mostly dominated by real money long term investors Capital outflow month to date is amounted IDR 18. 59 Trillion lower than capital outflow in Sept 2011 (European Crisis) amounted IDR 29. 29 Trillion 14

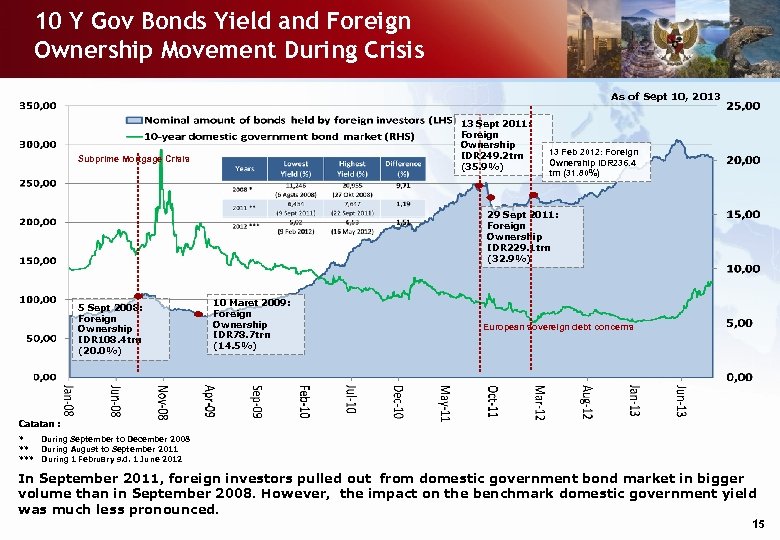

10 Y Gov Bonds Yield and Foreign Ownership Movement During Crisis As of Sept 10, 2013 13 Sept 2011: Foreign Ownership IDR 249. 2 trn (35. 9%) Subprime Mortgage Crisis 13 Feb 2012: Foreign Ownership IDR 236. 4 trn (31. 80%) 29 Sept 2011: Foreign Ownership IDR 229. 1 trn (32. 9%) 5 Sept 2008: Foreign Ownership IDR 108. 4 trn (20. 0%) 10 Maret 2009: Foreign Ownership IDR 78. 7 trn (14. 5%) European sovereign debt concerns Catatan : * During September to December 2008 ** During August to September 2011 *** During 1 February s. d. 1 June 2012 In September 2011, foreign investors pulled out from domestic government bond market in bigger volume than in September 2008. However, the impact on the benchmark domestic government yield was much less pronounced. 15

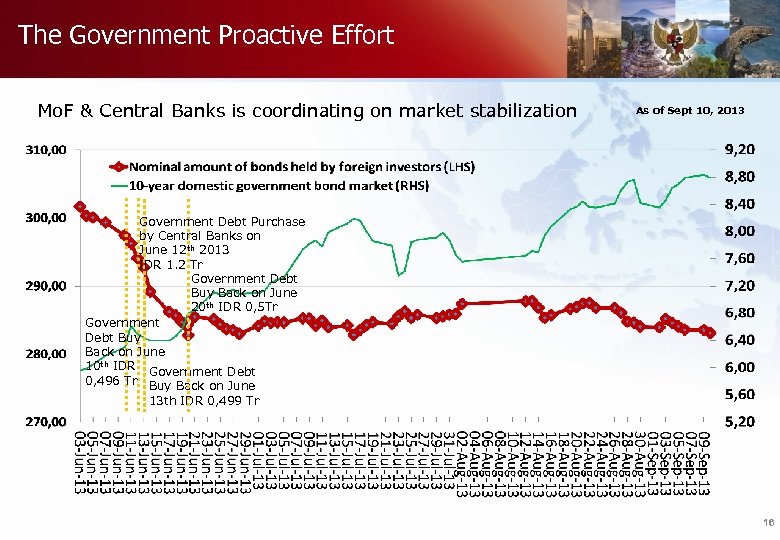

The Government Proactive Effort Mo. F & Central Banks is coordinating on market stabilization As of Sept 10, 2013 Government Debt Purchase by Central Banks on June 12 th 2013 IDR 1. 2 Tr Government Debt Buy Back on June 20 th IDR 0, 5 Tr Government Debt Buy Back on June 10 th IDR Government Debt 0, 496 Tr Buy Back on June 13 th IDR 0, 499 Tr 16

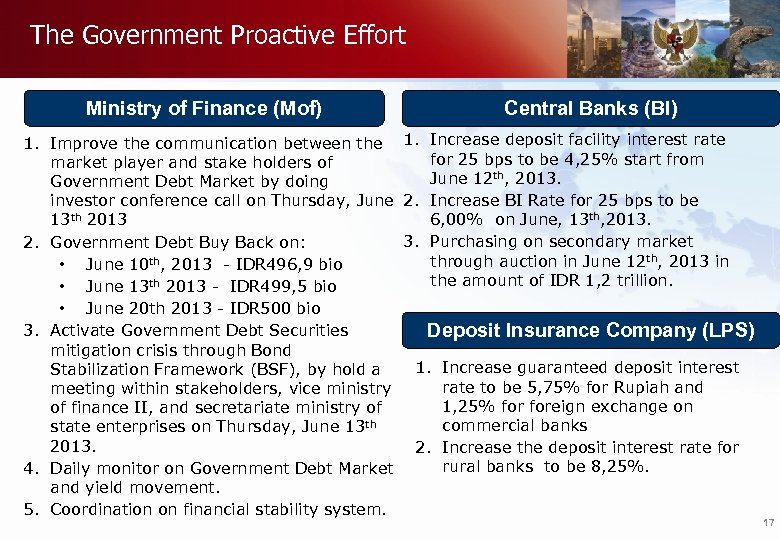

The Government Proactive Effort Ministry of Finance (Mof) Central Banks (BI) 1. Improve the communication between the 1. Increase deposit facility interest rate for 25 bps to be 4, 25% start from market player and stake holders of June 12 th, 2013. Government Debt Market by doing investor conference call on Thursday, June 2. Increase BI Rate for 25 bps to be 6, 00% on June, 13 th, 2013. 13 th 2013 3. Purchasing on secondary market 2. Government Debt Buy Back on: through auction in June 12 th, 2013 in • June 10 th, 2013 - IDR 496, 9 bio the amount of IDR 1, 2 trillion. • June 13 th 2013 - IDR 499, 5 bio • June 20 th 2013 - IDR 500 bio 3. Activate Government Debt Securities Deposit Insurance Company (LPS) mitigation crisis through Bond 1. Increase guaranteed deposit interest Stabilization Framework (BSF), by hold a rate to be 5, 75% for Rupiah and meeting within stakeholders, vice ministry 1, 25% foreign exchange on of finance II, and secretariate ministry of commercial banks state enterprises on Thursday, June 13 th 2013. 2. Increase the deposit interest rate for rural banks to be 8, 25%. 4. Daily monitor on Government Debt Market and yield movement. 5. Coordination on financial stability system. 17

Government Securities Market Prospects in 2013

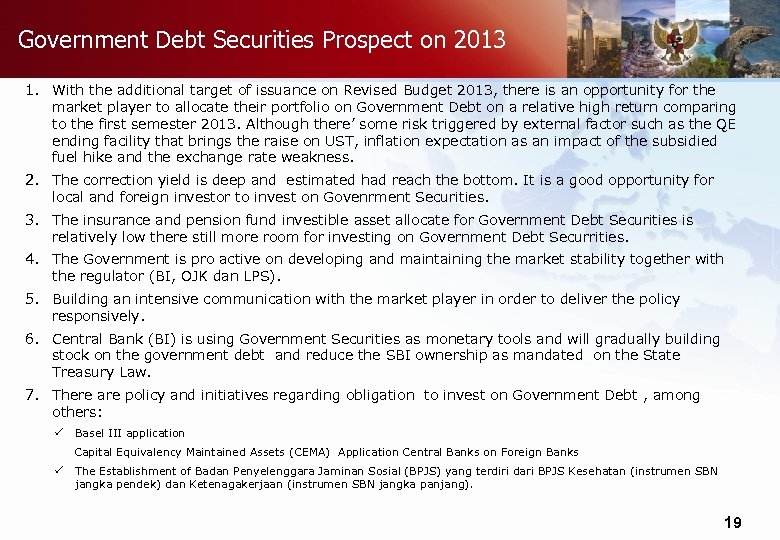

Government Debt Securities Prospect on 2013 1. With the additional target of issuance on Revised Budget 2013, there is an opportunity for the market player to allocate their portfolio on Government Debt on a relative high return comparing to the first semester 2013. Although there’ some risk triggered by external factor such as the QE ending facility that brings the raise on UST, inflation expectation as an impact of the subsidied fuel hike and the exchange rate weakness. 2. The correction yield is deep and estimated had reach the bottom. It is a good opportunity for local and foreign investor to invest on Govenrment Securities. 3. The insurance and pension fund investible asset allocate for Government Debt Securities is relatively low there still more room for investing on Government Debt Securrities. 4. The Government is pro active on developing and maintaining the market stability together with the regulator (BI, OJK dan LPS). 5. Building an intensive communication with the market player in order to deliver the policy responsively. 6. Central Bank (BI) is using Government Securities as monetary tools and will gradually building stock on the government debt and reduce the SBI ownership as mandated on the State Treasury Law. 7. There are policy and initiatives regarding obligation to invest on Government Debt , among others: ü Basel III application Capital Equivalency Maintained Assets (CEMA) Application Central Banks on Foreign Banks ü The Establishment of Badan Penyelenggara Jaminan Sosial (BPJS) yang terdiri dari BPJS Kesehatan (instrumen SBN jangka pendek) dan Ketenagakerjaan (instrumen SBN jangka panjang). 19

END OF PRESENTATION Directorate General of Debt Management Ministry of Finance of Republic of Indonesia Directorate of Government Securities Frans Seda building, 4 th floor, Jl. Wahidin Raya No. 1, Jakarta Pusat – Postal Code: 10710 Phone: +6221 3810175 Fax. : +6221 3846516 Site: www. djpu. depkeu. go. id

24708aa4ce0a878e539b6367502a7b85.ppt