f3664533b7e8d8a7385711ac2f2d1f3b.ppt

- Количество слайдов: 25

Ministry of Finance of Russia FISCAL SPACE – REVIEWING, ASSESSING AND PRIORITISING GOVERNMENT EXPENDITURE 14 -15 MAY 2008 The case for fiscal space in performance budgeting and medium-term expenditure framework in Russia Karen Vartapetov Ministry of Finance Russian Federation

Ministry of Finance of Russia FISCAL SPACE – REVIEWING, ASSESSING AND PRIORITISING GOVERNMENT EXPENDITURE 14 -15 MAY 2008 The case for fiscal space in performance budgeting and medium-term expenditure framework in Russia Karen Vartapetov Ministry of Finance Russian Federation

Ministry of Finance of Russia Fiscal space of the Russian federal budget Fiscal space is substantial = Budget surplus (3 -4% GDP) + Oil-and-gas reserve funds (1012% GDP) vs. Federal budget expenditures (16 -17% GDP) • • Sustainable measures to increase fiscal space: Raising revenues (space for better tax administration) Rationalizing expenditures (a significant room for better allocation and efficiency gains, program-based budgeting) Borrowing (a valid measure, but the current strategy is to reduce the debt burden) External grants (in essence, the inflow of oil-and-gas export revenues represents an external grant of the unsustainable nature. Hence, Reserve and National Welfare Funds)

Ministry of Finance of Russia Fiscal space of the Russian federal budget Fiscal space is substantial = Budget surplus (3 -4% GDP) + Oil-and-gas reserve funds (1012% GDP) vs. Federal budget expenditures (16 -17% GDP) • • Sustainable measures to increase fiscal space: Raising revenues (space for better tax administration) Rationalizing expenditures (a significant room for better allocation and efficiency gains, program-based budgeting) Borrowing (a valid measure, but the current strategy is to reduce the debt burden) External grants (in essence, the inflow of oil-and-gas export revenues represents an external grant of the unsustainable nature. Hence, Reserve and National Welfare Funds)

Ministry of Finance of Russia Two ways of delivering better public management • ‘Imposing order’ – strengthening of external control • Optimal decentralization – providing incentives for managers to deliver agreed outcomes

Ministry of Finance of Russia Two ways of delivering better public management • ‘Imposing order’ – strengthening of external control • Optimal decentralization – providing incentives for managers to deliver agreed outcomes

Ministry of Finance of Russia Performance budgeting enables an efficient use of fiscal space Decentralization of public finance management in Russia • Fiscal decentralization - devolution of revenue and expenditure decision-making authority to subnational governments • Administrative decentralization (‘agencification’)granting financial management autonomy to accountable government agencies • Service delivery decentralization – separation of policy-making and service provision (‘steering rather

Ministry of Finance of Russia Performance budgeting enables an efficient use of fiscal space Decentralization of public finance management in Russia • Fiscal decentralization - devolution of revenue and expenditure decision-making authority to subnational governments • Administrative decentralization (‘agencification’)granting financial management autonomy to accountable government agencies • Service delivery decentralization – separation of policy-making and service provision (‘steering rather

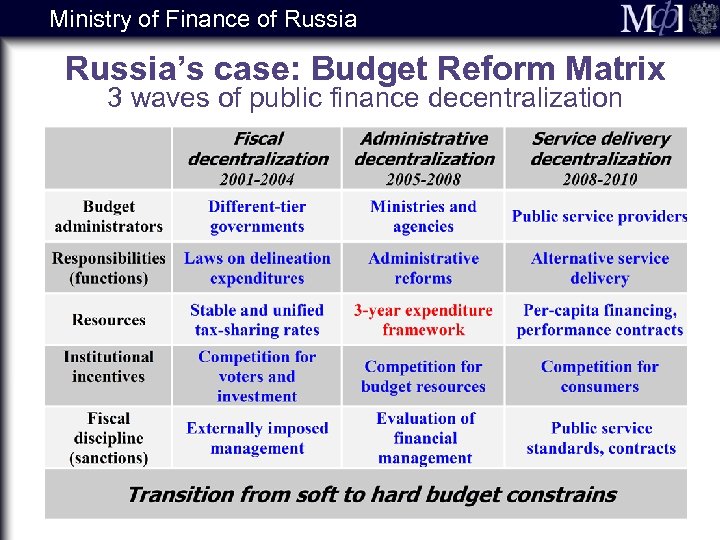

Ministry of Finance of Russia’s case: Budget Reform Matrix 3 waves of public finance decentralization

Ministry of Finance of Russia’s case: Budget Reform Matrix 3 waves of public finance decentralization

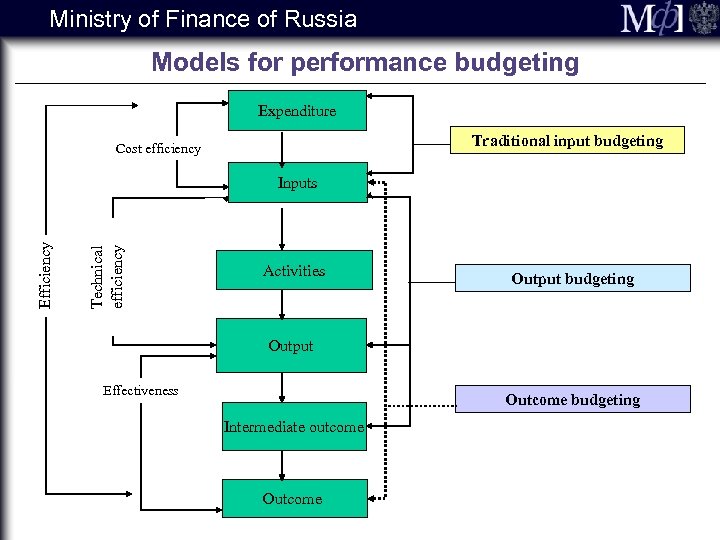

Ministry of Finance of Russia Models for performance budgeting Expenditure Traditional input budgeting Cost efficiency Technical efficiency Efficiency Inputs Activities Output budgeting Output Effectiveness Outcome budgeting Intermediate outcome Outcome

Ministry of Finance of Russia Models for performance budgeting Expenditure Traditional input budgeting Cost efficiency Technical efficiency Efficiency Inputs Activities Output budgeting Output Effectiveness Outcome budgeting Intermediate outcome Outcome

Ministry of Finance of Russia The planned trajectory of the Russian budget reform Results-based mediumterm budgeting (from 2008) Input-based short-term budgeting (1991 - 2000) ØLong-term budget stability and sustainability Øestablishment of budget procedures and regulation (Budget Code) ØRevenue and expenditure delineations between government tiers ØCash-basis budget ØFederal Treasury Øfiscal dicsipline and expenditure control ØIntergovernmental equalization transfers 2001 -2008 ØMeduim-term budget planning ØPerformance budgeting ØInternational standards in public accounting and reporting

Ministry of Finance of Russia The planned trajectory of the Russian budget reform Results-based mediumterm budgeting (from 2008) Input-based short-term budgeting (1991 - 2000) ØLong-term budget stability and sustainability Øestablishment of budget procedures and regulation (Budget Code) ØRevenue and expenditure delineations between government tiers ØCash-basis budget ØFederal Treasury Øfiscal dicsipline and expenditure control ØIntergovernmental equalization transfers 2001 -2008 ØMeduim-term budget planning ØPerformance budgeting ØInternational standards in public accounting and reporting

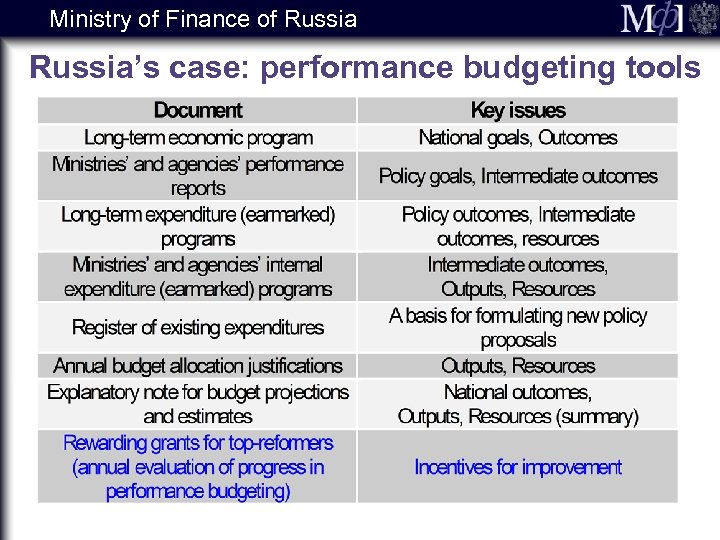

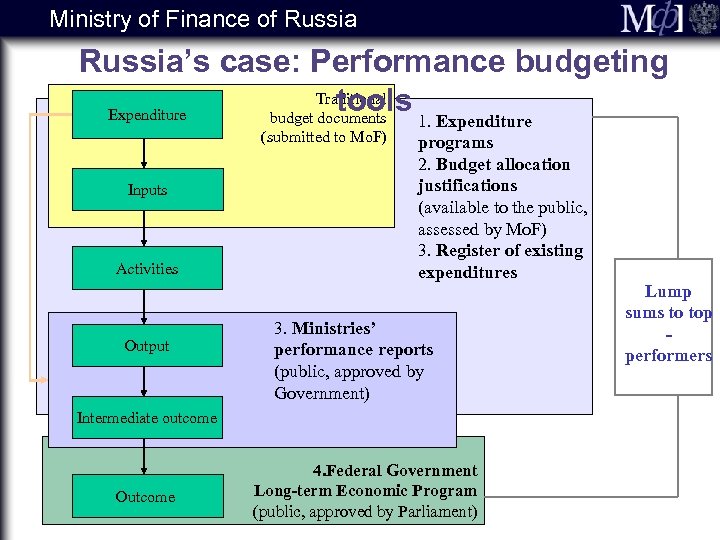

Ministry of Finance of Russia’s case: performance budgeting tools

Ministry of Finance of Russia’s case: performance budgeting tools

Ministry of Finance of Russia’s case: Performance budgeting Traditional tools 1. Expenditure budget documents (submitted to Mo. F) Inputs Activities Output programs 2. Budget allocation justifications (available to the public, assessed by Mo. F) 3. Register of existing expenditures 3. Ministries’ performance reports (public, approved by Government) Intermediate outcome Outcome 4. Federal Government Long-term Economic Program (public, approved by Parliament) Lump sums to top performers

Ministry of Finance of Russia’s case: Performance budgeting Traditional tools 1. Expenditure budget documents (submitted to Mo. F) Inputs Activities Output programs 2. Budget allocation justifications (available to the public, assessed by Mo. F) 3. Register of existing expenditures 3. Ministries’ performance reports (public, approved by Government) Intermediate outcome Outcome 4. Federal Government Long-term Economic Program (public, approved by Parliament) Lump sums to top performers

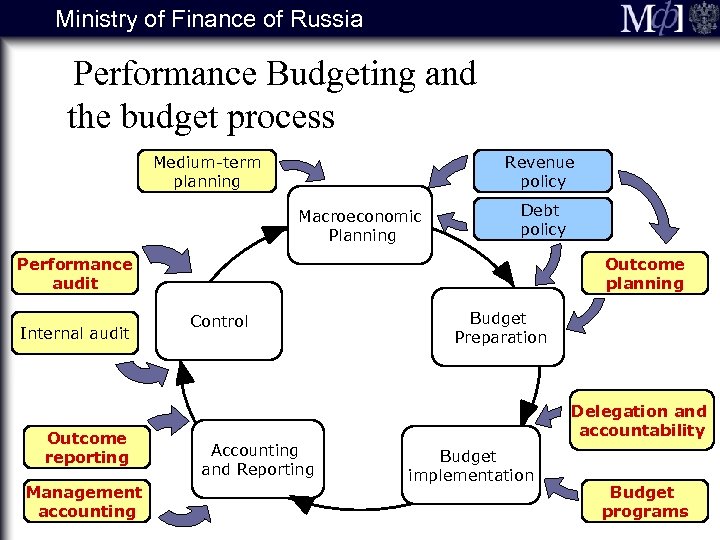

Ministry of Finance of Russia Performance Budgeting and the budget process Medium-term planning Revenue policy Macroeconomic Planning Debt policy Performance audit Internal audit Outcome reporting Management accounting Outcome planning Control Budget Preparation Delegation and accountability Accounting and Reporting Budget implementation Budget programs

Ministry of Finance of Russia Performance Budgeting and the budget process Medium-term planning Revenue policy Macroeconomic Planning Debt policy Performance audit Internal audit Outcome reporting Management accounting Outcome planning Control Budget Preparation Delegation and accountability Accounting and Reporting Budget implementation Budget programs

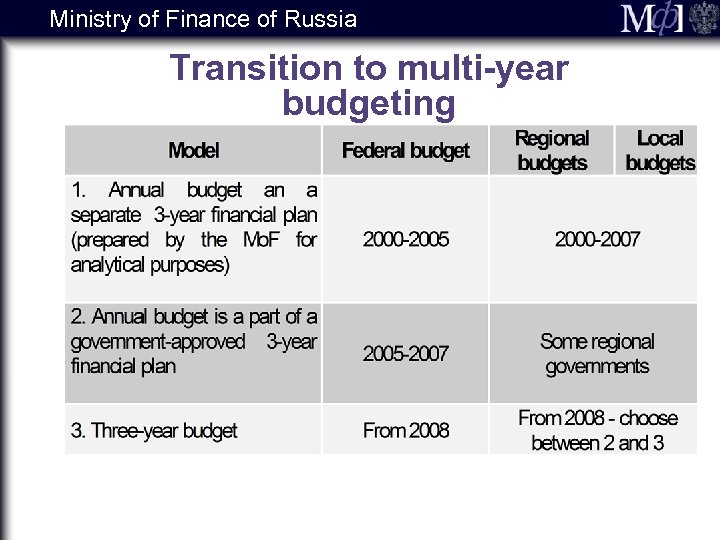

Ministry of Finance of Russia Transition to multi-year budgeting

Ministry of Finance of Russia Transition to multi-year budgeting

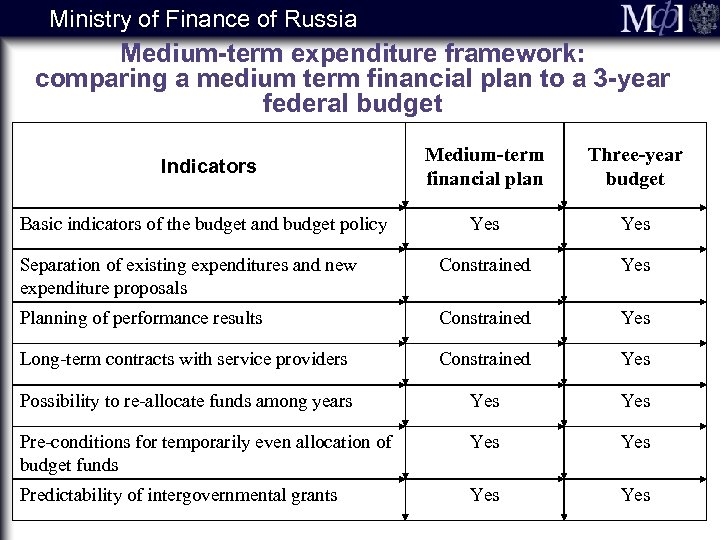

Ministry of Finance of Russia Medium-term expenditure framework: comparing a medium term financial plan to a 3 -year federal budget Indicators Medium-term financial plan Three-year budget Basic indicators of the budget and budget policy Yes Separation of existing expenditures and new expenditure proposals Constrained Yes Planning of performance results Constrained Yes Long-term contracts with service providers Constrained Yes Possibility to re-allocate funds among years Yes Pre-conditions for temporarily even allocation of budget funds Yes Predictability of intergovernmental grants Yes

Ministry of Finance of Russia Medium-term expenditure framework: comparing a medium term financial plan to a 3 -year federal budget Indicators Medium-term financial plan Three-year budget Basic indicators of the budget and budget policy Yes Separation of existing expenditures and new expenditure proposals Constrained Yes Planning of performance results Constrained Yes Long-term contracts with service providers Constrained Yes Possibility to re-allocate funds among years Yes Pre-conditions for temporarily even allocation of budget funds Yes Predictability of intergovernmental grants Yes

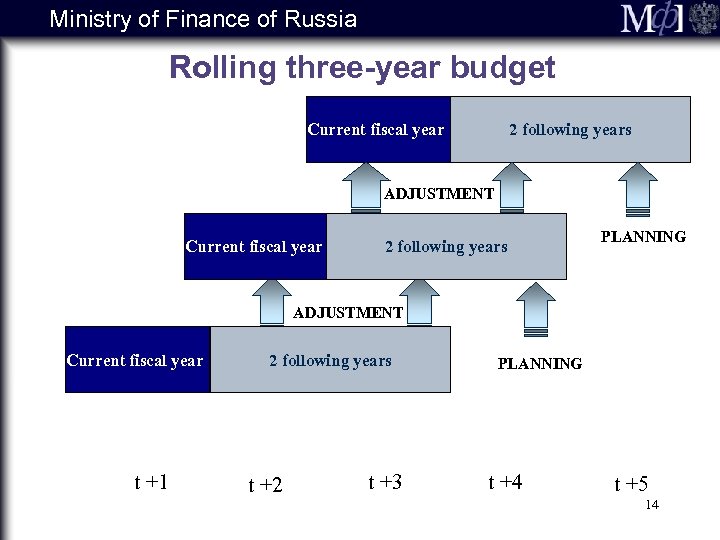

Ministry of Finance of Russia Rolling three-year budget Current fiscal year 2 following years ADJUSTMENT Current fiscal year 2 following years PLANNING ADJUSTMENT Current fiscal year t +1 2 following years t +2 t +3 PLANNING t +4 t +5 14

Ministry of Finance of Russia Rolling three-year budget Current fiscal year 2 following years ADJUSTMENT Current fiscal year 2 following years PLANNING ADJUSTMENT Current fiscal year t +1 2 following years t +2 t +3 PLANNING t +4 t +5 14

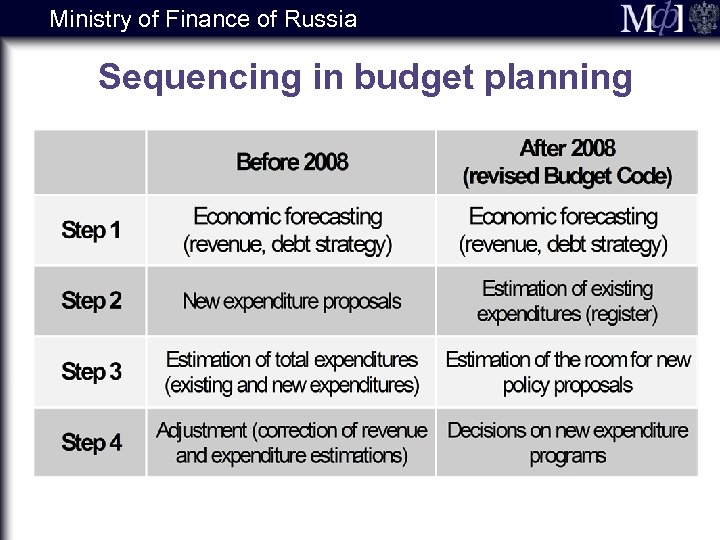

Ministry of Finance of Russia Sequencing in budget planning

Ministry of Finance of Russia Sequencing in budget planning

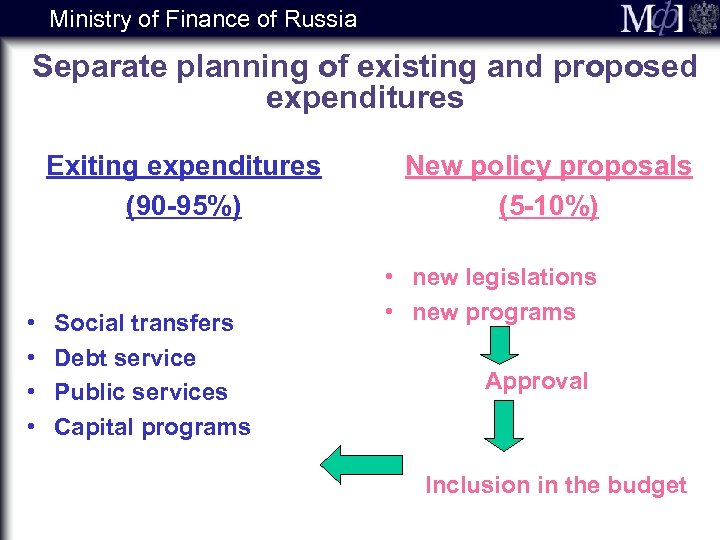

Ministry of Finance of Russia Separate planning of existing and proposed expenditures Exiting expenditures (90 -95%) • • Social transfers Debt service Public services Capital programs New policy proposals (5 -10%) • new legislations • new programs Approval Inclusion in the budget

Ministry of Finance of Russia Separate planning of existing and proposed expenditures Exiting expenditures (90 -95%) • • Social transfers Debt service Public services Capital programs New policy proposals (5 -10%) • new legislations • new programs Approval Inclusion in the budget

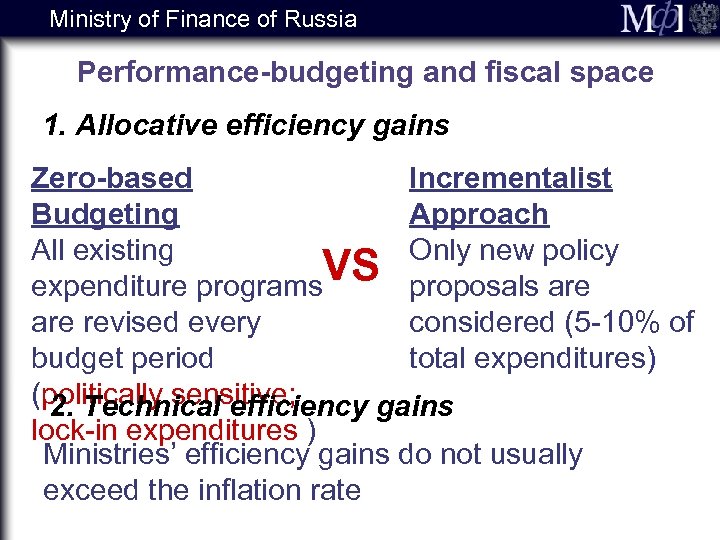

Ministry of Finance of Russia Performance-budgeting and fiscal space 1. Allocative efficiency gains Zero-based Incrementalist Budgeting Approach All existing Only new policy VS proposals are expenditure programs are revised every considered (5 -10% of budget period total expenditures) (politically sensitive; 2. Technical efficiency gains lock-in expenditures ) Ministries’ efficiency gains do not usually exceed the inflation rate

Ministry of Finance of Russia Performance-budgeting and fiscal space 1. Allocative efficiency gains Zero-based Incrementalist Budgeting Approach All existing Only new policy VS proposals are expenditure programs are revised every considered (5 -10% of budget period total expenditures) (politically sensitive; 2. Technical efficiency gains lock-in expenditures ) Ministries’ efficiency gains do not usually exceed the inflation rate

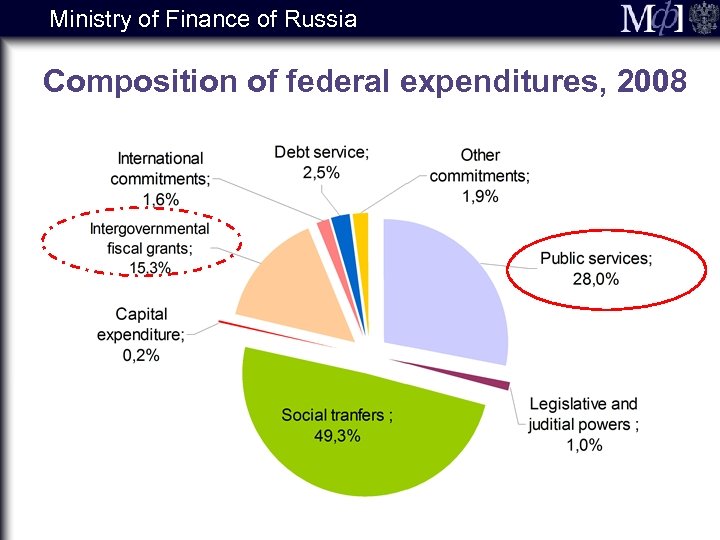

Ministry of Finance of Russia Composition of federal expenditures, 2008

Ministry of Finance of Russia Composition of federal expenditures, 2008

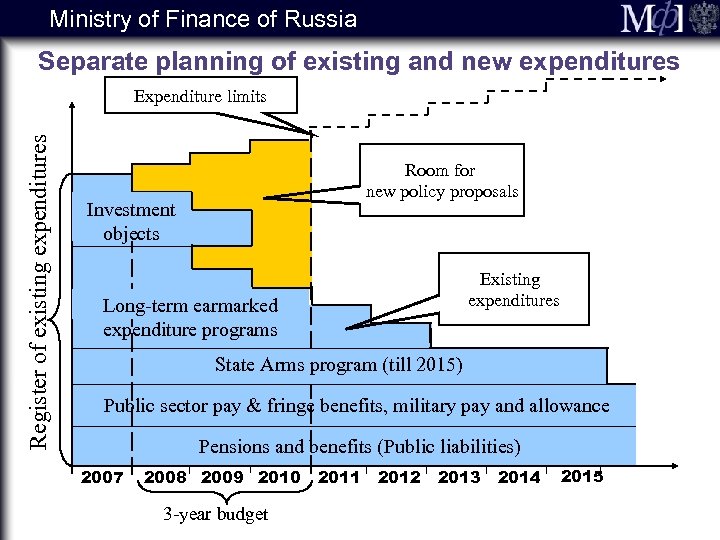

Ministry of Finance of Russia Separate planning of existing and new expenditures Register of existing expenditures Expenditure limits Room for new policy proposals Investment objects Existing expenditures Long-term earmarked expenditure programs State Arms program (till 2015) Public sector pay & fringe benefits, military pay and allowance Pensions and benefits (Public liabilities) 2007 2008 2009 2010 3 -year budget 2011 2012 2013 2014 2015

Ministry of Finance of Russia Separate planning of existing and new expenditures Register of existing expenditures Expenditure limits Room for new policy proposals Investment objects Existing expenditures Long-term earmarked expenditure programs State Arms program (till 2015) Public sector pay & fringe benefits, military pay and allowance Pensions and benefits (Public liabilities) 2007 2008 2009 2010 3 -year budget 2011 2012 2013 2014 2015

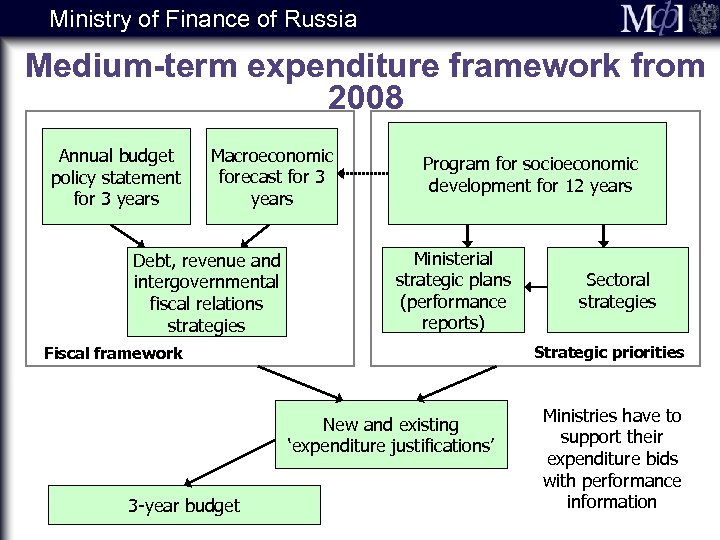

Ministry of Finance of Russia Medium-term expenditure framework from 2008 Annual budget policy statement for 3 years Macroeconomic forecast for 3 years Debt, revenue and intergovernmental fiscal relations strategies Program for socioeconomic development for 12 years Ministerial strategic plans (performance reports) Strategic priorities Fiscal framework New and existing ‘expenditure justifications’ 3 -year budget Sectoral strategies Ministries have to support their expenditure bids with performance information

Ministry of Finance of Russia Medium-term expenditure framework from 2008 Annual budget policy statement for 3 years Macroeconomic forecast for 3 years Debt, revenue and intergovernmental fiscal relations strategies Program for socioeconomic development for 12 years Ministerial strategic plans (performance reports) Strategic priorities Fiscal framework New and existing ‘expenditure justifications’ 3 -year budget Sectoral strategies Ministries have to support their expenditure bids with performance information

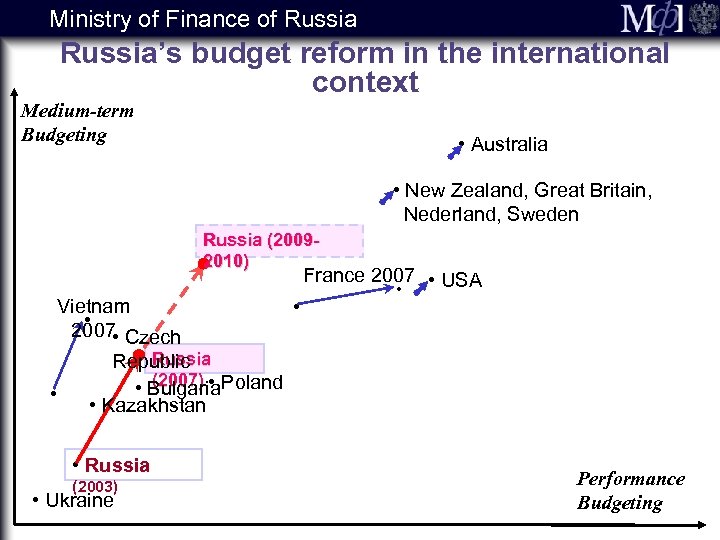

Ministry of Finance of Russia’s budget reform in the international context Medium-term Budgeting • Australia • New Zealand, Great Britain, Nederland, Sweden Russia (20092010) Vietnam • 2007 • Czech • • France 2007 • USA • Russia Republic (2007) • • Bulgaria. Poland • Kazakhstan • Russia (2003) • Ukraine Performance Budgeting

Ministry of Finance of Russia’s budget reform in the international context Medium-term Budgeting • Australia • New Zealand, Great Britain, Nederland, Sweden Russia (20092010) Vietnam • 2007 • Czech • • France 2007 • USA • Russia Republic (2007) • • Bulgaria. Poland • Kazakhstan • Russia (2003) • Ukraine Performance Budgeting

Ministry of Finance of Russia PB is instrumental in a specific institutional context In the last budget cycle Russia’s federal budget expenditures were increased by some 30% without any efficiency assessment or effectiveness consideration You can’t budget for results if you don’t manage for results. Yet the latter requires human skills and institutional arrangements (accountability, transparency, political commitment )

Ministry of Finance of Russia PB is instrumental in a specific institutional context In the last budget cycle Russia’s federal budget expenditures were increased by some 30% without any efficiency assessment or effectiveness consideration You can’t budget for results if you don’t manage for results. Yet the latter requires human skills and institutional arrangements (accountability, transparency, political commitment )

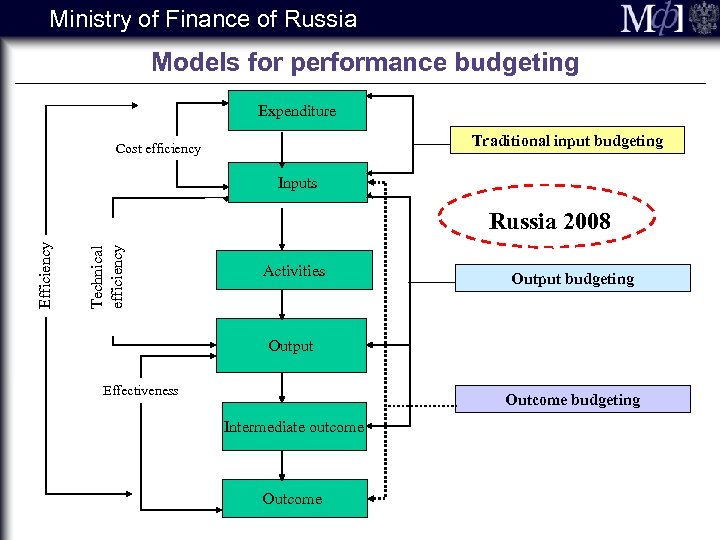

Ministry of Finance of Russia Models for performance budgeting Expenditure Traditional input budgeting Cost efficiency Inputs Technical efficiency Efficiency Russia 2008 Activities Output budgeting Output Effectiveness Outcome budgeting Intermediate outcome Outcome

Ministry of Finance of Russia Models for performance budgeting Expenditure Traditional input budgeting Cost efficiency Inputs Technical efficiency Efficiency Russia 2008 Activities Output budgeting Output Effectiveness Outcome budgeting Intermediate outcome Outcome

Ministry of Finance of Russia PB is not the easiest way to create fiscal space ALLAN SCHICK’S PRINCIPLES OF BUDGET REFORM SEQUENCING: • • • Foster an environment that supports and demands performance before introduction of performance and outcome budgeting Control inputs before seeking to control outputs Budget for work to be done before budgeting for results to be achieved Enforce formal contracts in the private sector before introducing performance contracts in the public sector Introduce effective financial auditing before moving to performance auditing Adopt and implement predictable budgets before

Ministry of Finance of Russia PB is not the easiest way to create fiscal space ALLAN SCHICK’S PRINCIPLES OF BUDGET REFORM SEQUENCING: • • • Foster an environment that supports and demands performance before introduction of performance and outcome budgeting Control inputs before seeking to control outputs Budget for work to be done before budgeting for results to be achieved Enforce formal contracts in the private sector before introducing performance contracts in the public sector Introduce effective financial auditing before moving to performance auditing Adopt and implement predictable budgets before

Ministry of Finance of Russia The question is: Whether to implement Performance Budgeting while basic institutional arrangements are not in place and fiscal space is excessive? The Russian answer: “Probably, yes” 1. Performance information contributes to better accountability and transparency. 2. The change in fiscal behavior is a long-term process. The accumulation of performance information is time-consuming. The sooner you start the better 3. Take as many steps forward as possible as there always be a few steps back 4. If you don’t sort out fiscal rules you might not be

Ministry of Finance of Russia The question is: Whether to implement Performance Budgeting while basic institutional arrangements are not in place and fiscal space is excessive? The Russian answer: “Probably, yes” 1. Performance information contributes to better accountability and transparency. 2. The change in fiscal behavior is a long-term process. The accumulation of performance information is time-consuming. The sooner you start the better 3. Take as many steps forward as possible as there always be a few steps back 4. If you don’t sort out fiscal rules you might not be

Ministry of Finance of Russia Questions for consideration 1) Does performance budgeting present an efficient tool for enhancing fiscal space? 2) In what ways is performance information used in the budget process in your economy? 3) Do the basic pre-conditions (say, control of inputs) have to delivered before introducing performance budgeting?

Ministry of Finance of Russia Questions for consideration 1) Does performance budgeting present an efficient tool for enhancing fiscal space? 2) In what ways is performance information used in the budget process in your economy? 3) Do the basic pre-conditions (say, control of inputs) have to delivered before introducing performance budgeting?