95ff561b43a973c035b2e166a98c2a71.ppt

- Количество слайдов: 13

Ministry of Agriculture of Georgia From China to Europe: Agribusiness as emerging driver for export America-Georgia Business Council`s 19 th Annual Conference USA 2016 Levan Davitashvili Minister of Agriculture of Georgia

Ministry of Agriculture of Georgia From China to Europe: Agribusiness as emerging driver for export America-Georgia Business Council`s 19 th Annual Conference USA 2016 Levan Davitashvili Minister of Agriculture of Georgia

1 Country at Glance Fast growing § § Above 5% average growth during the last 10 years Above 5% expected growth over the next years Corruption free • Tangible improvement in Corruption Perception Index over the 10 years – up by 82 places since 2005 (Transparency International) “Globally, Georgia improved the most in the areas measured by Doing Business over the past 12 years” – DB 2016 • Western oriented • • Good Governance Association Agreement (AA), including Deep and Comprehensive Free Trade Agreement (DCFTA) with the EU since 2014 Visa Liberalization with the EU Ongoing reforms • Improved governance and rule of law •

1 Country at Glance Fast growing § § Above 5% average growth during the last 10 years Above 5% expected growth over the next years Corruption free • Tangible improvement in Corruption Perception Index over the 10 years – up by 82 places since 2005 (Transparency International) “Globally, Georgia improved the most in the areas measured by Doing Business over the past 12 years” – DB 2016 • Western oriented • • Good Governance Association Agreement (AA), including Deep and Comprehensive Free Trade Agreement (DCFTA) with the EU since 2014 Visa Liberalization with the EU Ongoing reforms • Improved governance and rule of law •

2 Sovereign Ratings – Georgia Major Rating Strengths § § Government's debt burden remains modest and fiscal performance under control; Long Term Growth potential remains strong; Banking system well capitalized and liquid; Regional competitiveness. § § § Strong support from the international community; Strong commitment to economic and structural reforms; AA with EU, DCFTA- easier access to EU market, which will boost Georgia's attractiveness as an investment location over the medium to long term; Georgia's business environment very favorable with rating peers (ease of doing business indicators); Prudent fiscal policy, sustainable debt level. Major Rating Strengths § § § Regional logistics hub and transport corridor between Europe and Asia; Very strong banking sector (Banking sector risk -Low); High institutional strength relative to peers, reflected in strong government indicators. (Georgia has progress beyond its Soviet roots, and has arguably advanced further towards Western-style, independent institutions than any other country in the post -Soviet space. ); High Worldwide Governance indicator (WGI) scores and outperforms its peers; Institutional capacity- and pro business operating environment, government's relative strong balance sheet and moderate debt burden.

2 Sovereign Ratings – Georgia Major Rating Strengths § § Government's debt burden remains modest and fiscal performance under control; Long Term Growth potential remains strong; Banking system well capitalized and liquid; Regional competitiveness. § § § Strong support from the international community; Strong commitment to economic and structural reforms; AA with EU, DCFTA- easier access to EU market, which will boost Georgia's attractiveness as an investment location over the medium to long term; Georgia's business environment very favorable with rating peers (ease of doing business indicators); Prudent fiscal policy, sustainable debt level. Major Rating Strengths § § § Regional logistics hub and transport corridor between Europe and Asia; Very strong banking sector (Banking sector risk -Low); High institutional strength relative to peers, reflected in strong government indicators. (Georgia has progress beyond its Soviet roots, and has arguably advanced further towards Western-style, independent institutions than any other country in the post -Soviet space. ); High Worldwide Governance indicator (WGI) scores and outperforms its peers; Institutional capacity- and pro business operating environment, government's relative strong balance sheet and moderate debt burden.

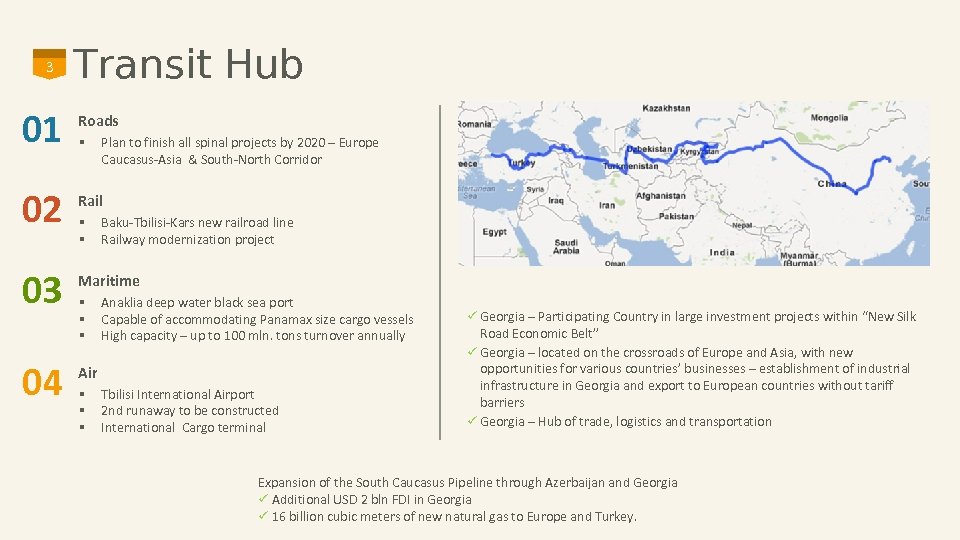

3 Transit Hub 01 Roads 02 Rail 03 Maritime 04 § § § Plan to finish all spinal projects by 2020 – Europe Caucasus-Asia & South-North Corridor Baku-Tbilisi-Kars new railroad line Railway modernization project Anaklia deep water black sea port Capable of accommodating Panamax size cargo vessels High capacity – up to 100 mln. tons turnover annually Air § § § Tbilisi International Airport 2 nd runaway to be constructed International Cargo terminal ü Georgia – Participating Country in large investment projects within “New Silk Road Economic Belt” ü Georgia – located on the crossroads of Europe and Asia, with new opportunities for various countries’ businesses – establishment of industrial infrastructure in Georgia and export to European countries without tariff barriers ü Georgia – Hub of trade, logistics and transportation Expansion of the South Caucasus Pipeline through Azerbaijan and Georgia ü Additional USD 2 bln FDI in Georgia ü 16 billion cubic meters of new natural gas to Europe and Turkey.

3 Transit Hub 01 Roads 02 Rail 03 Maritime 04 § § § Plan to finish all spinal projects by 2020 – Europe Caucasus-Asia & South-North Corridor Baku-Tbilisi-Kars new railroad line Railway modernization project Anaklia deep water black sea port Capable of accommodating Panamax size cargo vessels High capacity – up to 100 mln. tons turnover annually Air § § § Tbilisi International Airport 2 nd runaway to be constructed International Cargo terminal ü Georgia – Participating Country in large investment projects within “New Silk Road Economic Belt” ü Georgia – located on the crossroads of Europe and Asia, with new opportunities for various countries’ businesses – establishment of industrial infrastructure in Georgia and export to European countries without tariff barriers ü Georgia – Hub of trade, logistics and transportation Expansion of the South Caucasus Pipeline through Azerbaijan and Georgia ü Additional USD 2 bln FDI in Georgia ü 16 billion cubic meters of new natural gas to Europe and Turkey.

on Re c om fo i rm s Reforms Agenda Pr om Go otin ve g rn Op an en ce Ec 4 In D fra ev st el ru op ct m ure en t 4 on ti ca rm du efo E R

on Re c om fo i rm s Reforms Agenda Pr om Go otin ve g rn Op an en ce Ec 4 In D fra ev st el ru op ct m ure en t 4 on ti ca rm du efo E R

5 United Agroproject Plant The Future Preferential Agro Credit Project Co-financing of Agro Processing Enterprises and storage facilities Georgian Tea Rehabilitation Program Agro Insurance Small Farmers Support Program Seasonal Projects AMMAR

5 United Agroproject Plant The Future Preferential Agro Credit Project Co-financing of Agro Processing Enterprises and storage facilities Georgian Tea Rehabilitation Program Agro Insurance Small Farmers Support Program Seasonal Projects AMMAR

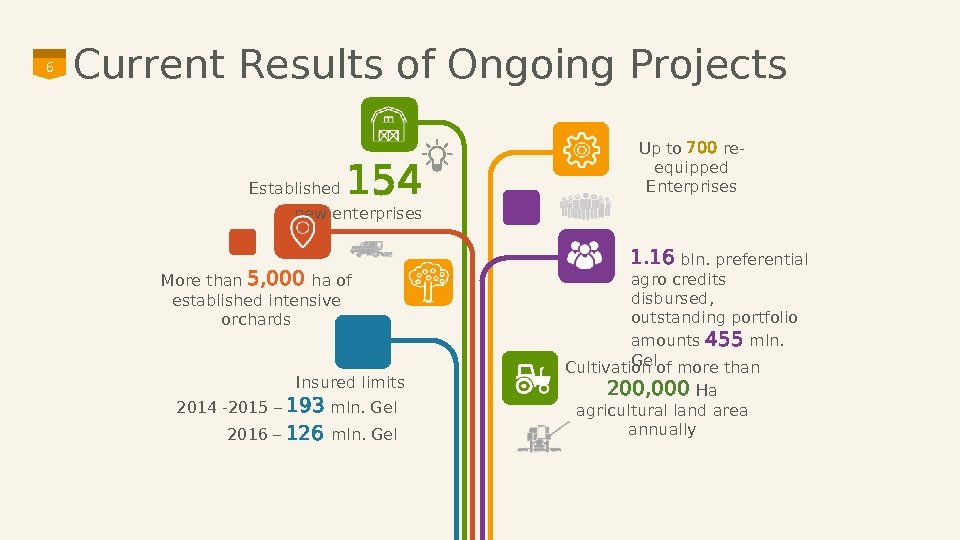

6 Current Results of Ongoing Projects Established 154 Up to 700 reequipped Enterprises new enterprises More than 5, 000 ha of established intensive orchards Insured limits 193 mln. Gel 2016 – 126 mln. Gel 2014 -2015 – 1. 16 bln. preferential agro credits disbursed, outstanding portfolio amounts 455 mln. Gel Cultivation of more than 200, 000 Ha agricultural land area annually

6 Current Results of Ongoing Projects Established 154 Up to 700 reequipped Enterprises new enterprises More than 5, 000 ha of established intensive orchards Insured limits 193 mln. Gel 2016 – 126 mln. Gel 2014 -2015 – 1. 16 bln. preferential agro credits disbursed, outstanding portfolio amounts 455 mln. Gel Cultivation of more than 200, 000 Ha agricultural land area annually

7 Trade Policy Outcomes DCFTA with EU Global Economic Integration FTA with CIS countries Economic growth FTA with Turkey, China EFTA Iceland, Liechtenstein Export Expansion Norway, GSP with - USA, Canada, Japan Switzerland, Competitiveness Foreign Investment New Jobs

7 Trade Policy Outcomes DCFTA with EU Global Economic Integration FTA with CIS countries Economic growth FTA with Turkey, China EFTA Iceland, Liechtenstein Export Expansion Norway, GSP with - USA, Canada, Japan Switzerland, Competitiveness Foreign Investment New Jobs

8 FTA with CHINA 01 Free trade negotiations with China successfully completed – Historical Deal for Georgia in terms of finalization of talks in a remarkably short time 02 Opportunities for increased business and trade turnover through the Free Trade Deal 03 Exports of Georgian products (i. e. wine, mineral and non alcoholic beverages, fruit, vegetables) to China with zero tariffs and without any transition period 04 Exports of Georgian products to the 1. 4 -billion-customers Chinese market without additional customs fees 05 Georgia – First country in the region with this type of deal with China 06 With China-Georgia Free Trade Agreement partnership of Georgian and Chinese businessmen for long term cooperation encouraged, general business environment definitely improved

8 FTA with CHINA 01 Free trade negotiations with China successfully completed – Historical Deal for Georgia in terms of finalization of talks in a remarkably short time 02 Opportunities for increased business and trade turnover through the Free Trade Deal 03 Exports of Georgian products (i. e. wine, mineral and non alcoholic beverages, fruit, vegetables) to China with zero tariffs and without any transition period 04 Exports of Georgian products to the 1. 4 -billion-customers Chinese market without additional customs fees 05 Georgia – First country in the region with this type of deal with China 06 With China-Georgia Free Trade Agreement partnership of Georgian and Chinese businessmen for long term cooperation encouraged, general business environment definitely improved

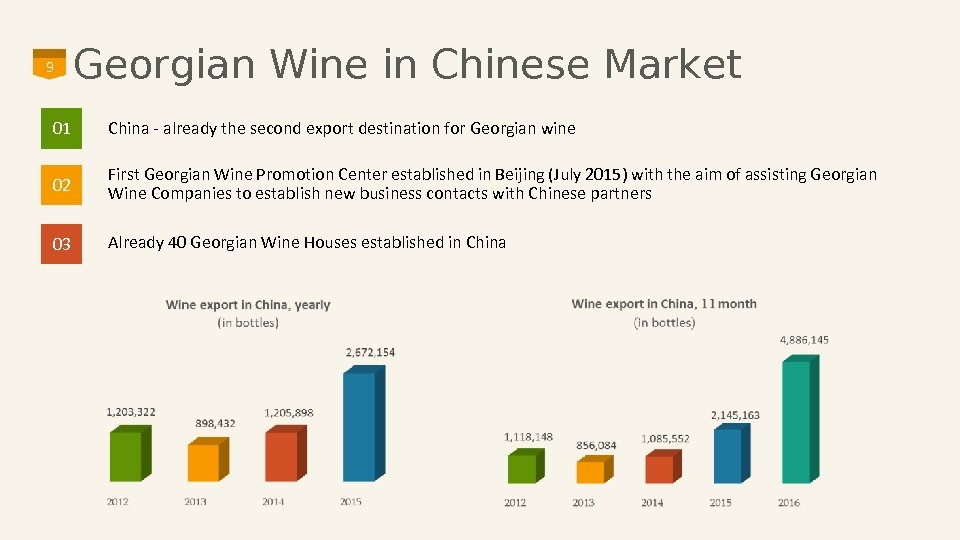

9 Georgian Wine in Chinese Market 01 China - already the second export destination for Georgian wine 02 First Georgian Wine Promotion Center established in Beijing (July 2015) with the aim of assisting Georgian Wine Companies to establish new business contacts with Chinese partners 03 Already 40 Georgian Wine Houses established in China

9 Georgian Wine in Chinese Market 01 China - already the second export destination for Georgian wine 02 First Georgian Wine Promotion Center established in Beijing (July 2015) with the aim of assisting Georgian Wine Companies to establish new business contacts with Chinese partners 03 Already 40 Georgian Wine Houses established in China

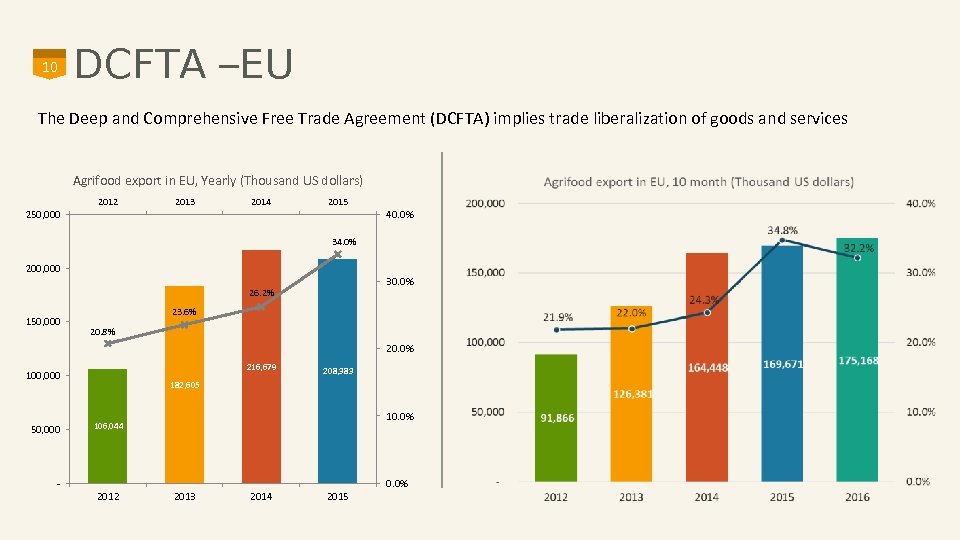

10 DCFTA –EU The Deep and Comprehensive Free Trade Agreement (DCFTA) implies trade liberalization of goods and services Agrifood export in EU, Yearly (Thousand US dollars) 250, 000 2012 2013 2014 2015 40. 0% 34. 0% 200, 000 30. 0% 26. 2% 150, 000 23. 6% 20. 8% 20. 0% 216, 679 100, 000 50, 000 208, 383 182, 605 10. 0% 106, 044 0. 0% - 2012 2013 2014 2015

10 DCFTA –EU The Deep and Comprehensive Free Trade Agreement (DCFTA) implies trade liberalization of goods and services Agrifood export in EU, Yearly (Thousand US dollars) 250, 000 2012 2013 2014 2015 40. 0% 34. 0% 200, 000 30. 0% 26. 2% 150, 000 23. 6% 20. 8% 20. 0% 216, 679 100, 000 50, 000 208, 383 182, 605 10. 0% 106, 044 0. 0% - 2012 2013 2014 2015

11 Future Objectives 01 Increase sustainable development of competitive Agribusiness 02 Increase effectiveness of export potential in Georgian Agribusiness 03 Strengthen Agriculture Extension 04 Stimulate development of efficient supply chain 05 Promote high value agricultural production 06 Identify new markets

11 Future Objectives 01 Increase sustainable development of competitive Agribusiness 02 Increase effectiveness of export potential in Georgian Agribusiness 03 Strengthen Agriculture Extension 04 Stimulate development of efficient supply chain 05 Promote high value agricultural production 06 Identify new markets

THANK YOU FOR YOUR ATTENTION! Ministry of Agriculture of Georgia Levan Davitashvili Minister of Agriculture of Georgia

THANK YOU FOR YOUR ATTENTION! Ministry of Agriculture of Georgia Levan Davitashvili Minister of Agriculture of Georgia