a247e4b7ad1d57d7a5bf0709ca08bbda.ppt

- Количество слайдов: 16

MINIs. Try OF FINa. NCe - Treasury REPUBLIC OF ALBANIA TSA DESIGN & OPERATION MIMOZA PILKATI Director Treasury Operations’ Department mimoza. peco@financa. gov. al PEMPAL_TCOP Plenary Meeting March 16 -18, 2016

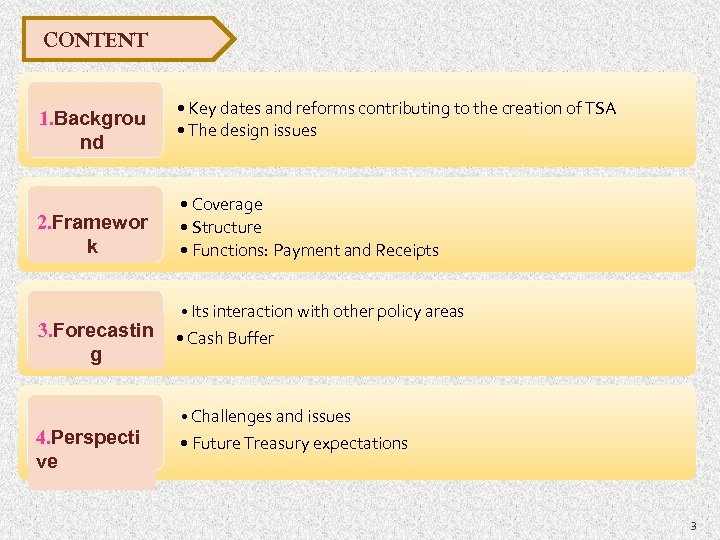

CONTENT 1. Backgrou nd 2. Framewor k 3. Forecastin g 4. Perspecti ve • Key dates and reforms contributing to the creation of TSA • The design issues • Coverage • Structure • Functions: Payment and Receipts • Its interaction with other policy areas • Cash Buffer • Challenges and issues • Future Treasury expectations 3

1. Background Key dates and reforms contributing to the creation of TSA On October 13, 1992 is undertaken the reform for unification of government cash accounts by closing of all deposit, chequing and other extra-budgetary accounts maintained by budget institutions in the commercial banks. The reform aims to consider ways and means to regulate, to account the hard currency transactions of government and to bring its expenditure within budgetary discipline by organic budget law. When budget resources are limited, sometimes the budget units accumulate idle balances in their bank accounts that increase the borrowing needs of government, instead of using the cash excess of some institutions to finance the others that need resources. TSA strengthens government control over its cash flows. The aim of cash management is to keep operating cash balances of the government to a minimum, to minimize borrowing cost and maximize its interest-bearing deposits. 4

1. Background As a result of this reform, in: Phase 1: an amount of the order of Lek 300 million, locked up in extra budgetary deposit accounts, was transferred to government revenue. Phase 2: are integrated the thousands separated budget accounts for each budget institutions into a set of six accounts on behalf of the treasury district offices (TDOs) on September 1993. The banks have been informed that the balances in the exempted categories deposit account will be reckoned as government cash balance and count towards reducing government deficit. Phase 3: is designed to unify the cash assets of government into a single current account in the Bank of Albania (Bo. A) since January 1994. The four segregated expenditure accounts was integrated into one single expenditure account (030) by banks in favour of TDOs. This did not only relieve the banks of maintaining unwanted accounts, but will also facilitate cash management, which the Treasury must soon undertake. 5

1. Background The design issues Phase 4: is designed for automation/modernizations of Treasury operations: was live implemented the AGFIS since September 2010, carrying out the budget execution transactions between budget institutions by accounting point of view (not through banking system), which is the tool to facilitate the cash management job. ü AGFIS realized the centralized electronic payments’ process between treasury and commercial banks through central bank (TSA), including RTGS/AECH systems that operate on a batch basis ü ASYCUDA (e-customs) is implemented live since May 2013. It functions as a unique system and operates through unique bank account on behalf of General Directorate of Customs (before there was one bank account on behalf of each 36 district customs branches). ü C@TS (e-tax) is partially implemented live since 1 st January 2015. It functions as a unique system and operates through unique bank account on behalf of General Directorate of Taxation (before there was one bank account on behalf of each 36 district tax branches). Phase 5: is design for integrated FMIS, which is just lunched and enable smooth communication and interoperability (e. g. , managing government payroll, revenue administration, external assistance flows, etc. ) 6

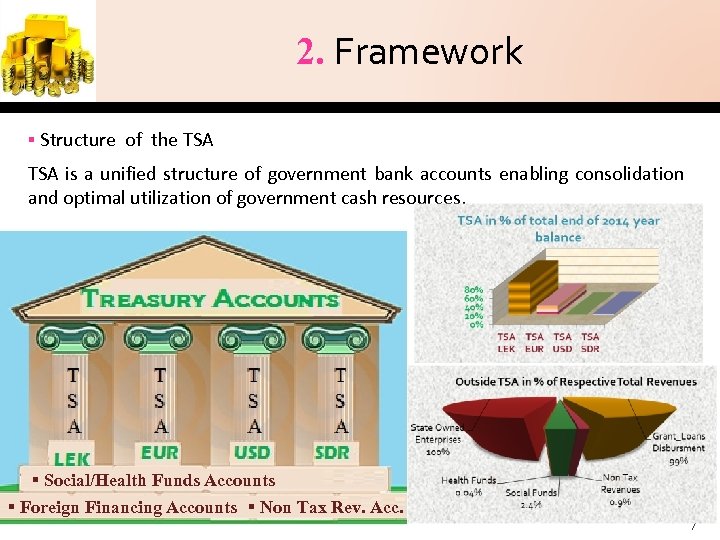

2. Framework Structure of the TSA is a unified structure of government bank accounts enabling consolidation and optimal utilization of government cash resources. Social/Health Funds Accounts Foreign Financing Accounts Non Tax Rev. Acc. 7

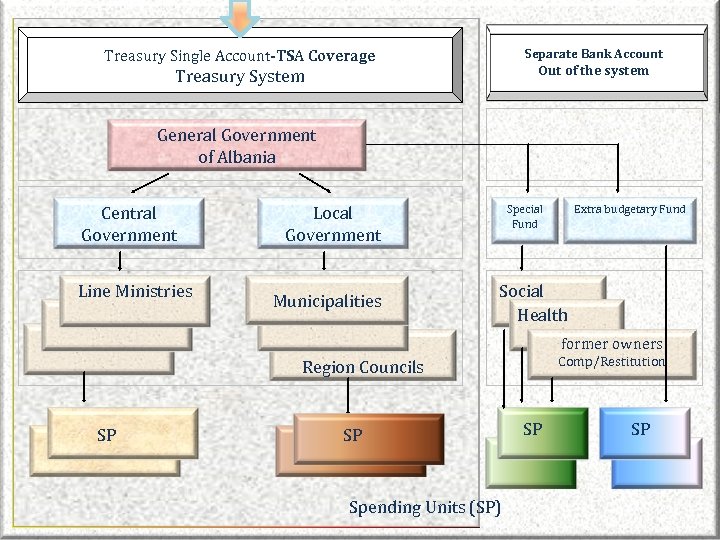

Separate Bank Account Treasury Single Account-TSA Coverage Out of the system Treasury System General Government of Albania Central Government Line Ministries Special Fund Local Government Municipalities Extra budgetary Fund Social Health former owners Comp/Restitution Region Councils SP SP Spending Units (SP) SP SP 8

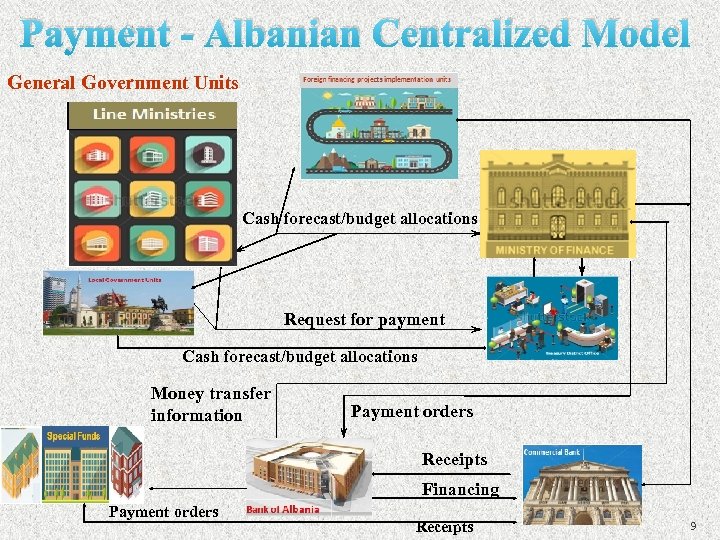

Payment - Albanian Centralized Model General Government Units Cash forecast/budget allocations Request for payment Cash forecast/budget allocations Money transfer information Payment orders Receipts Financing Payment orders Receipts 9

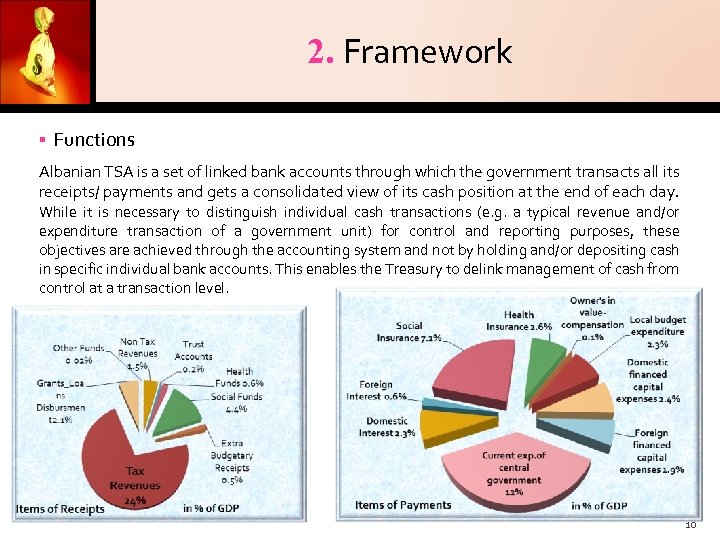

2. Framework Functions Albanian TSA is a set of linked bank accounts through which the government transacts all its receipts/ payments and gets a consolidated view of its cash position at the end of each day. While it is necessary to distinguish individual cash transactions (e. g. a typical revenue and/or expenditure transaction of a government unit) for control and reporting purposes, these objectives are achieved through the accounting system and not by holding and/or depositing cash in specific individual bank accounts. This enables the Treasury to delink management of cash from control at a transaction level. 10

3. Forecasting TSA balance’s interaction with other policy areas TSA regime should be supplemented by proactive cash management. The treasury, as the chief financial agent of the government, should manage the government’s cash positions to ensure that sufficient funds are available to meet financial obligations, idle cash is efficiently invested, and debt is optimally issued according to the appropriate statutes. How the ministry of finance/treasury chooses to manage cash balance targeting has implications for both monetary policy and financial market development. It will be difficult for many developing and low-income countries to target cash balances in the absence of a developed domestic short-term securities market, or arrangements with commercial banks to lend cash at short notice to the treasury. 11

3. Forecasting Cash Buffer The Albanian government uses the borrowing/investment liquidity instruments in targeting the TSA balance such as treasury securities and buy back of them/term deposits in central bank and lending (energy sector). Buffer amount is defined as: Ø The average monthly expenditure planned and approved in the annual budget for items: personnel current costs and social costs for economic aid and unemployment, which constitutes the maximum limit (about nine billions) at the beginning balance of each month. The minimum limit is determined based on forecast data’s cash inflows and outflows of TSA: "Government deposits" (pessimistic version of Treasury) the extent of the average forecast of three days (about three billions) of previous month peak. 12

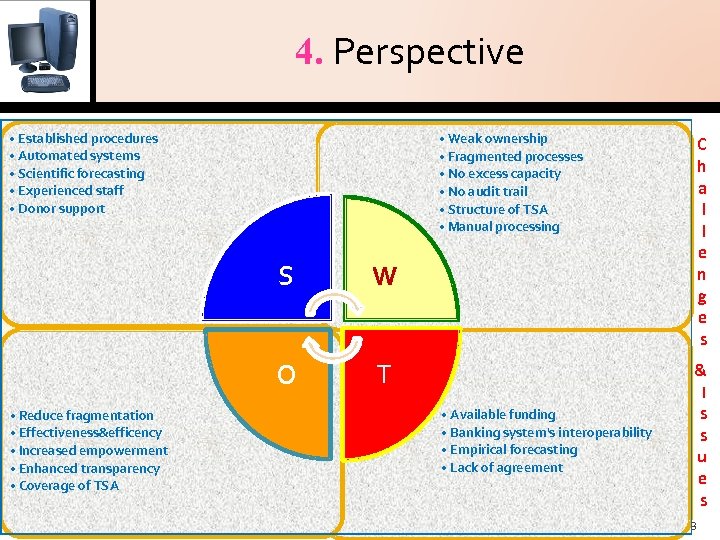

4. Perspective • Established procedures • Automated systems • Scientific forecasting • Experienced staff • Donor support • Weak ownership • Fragmented processes • No excess capacity • No audit trail • Structure of TSA • Manual processing S • Reduce fragmentation • Effectiveness&efficency • Increased empowerment • Enhanced transparency • Coverage of TSA W O T C h a l l e n g e s • Available funding • Banking system's interoperability • Empirical forecasting • Lack of agreement & I s s u e s 13

4. Perspective Strategies for overcoming the issues The introduction of electronic transaction processing (e-invoice) and payment systems facilitates of the TSA establishment. Modern payments processes rely increasingly on electronic transactions, centralizing receipts and payments through a limited number of agents, and processing government transactions with a minimum of intermediate handling steps. This avoids unnecessary use of cash, thus reducing operational risk. Further optimization of the process of revenue collection and administration by the Government of Albania. Good cash management system is of fundamental importance. Such system must recognize the time value and the opportunity cost of cash; be an enabling instrument of expenditure planning for line ministries; be forward looking – anticipating macroeconomic developments, be capable of accommodating significant macroeconomic changes and minimizing their adverse effects on budget execution. 14

4. Perspective Future Reforms of the TSA (after 2020 year) The TSA coverage should be comprehensive by including all governmentfunded entities, including the autonomous and statutory government bodies as well as extrabudgetary funds (EBFs) and special accounts. The donors should be encouraged to integrate their funds with the TSA or, as a minimum, to route final payments through the TSA. Inclusion of social security funds and other trust funds in the TSA could be considered, provided that the accounting system is well developed and adequate safeguards exist to prevent the abuse of trust fund resources. Organic budget law amendment to modified accrual accounting for revenues Centralization of revenues collection AFMIS Developing liquidity forecasting programme. Improve TSA’s interaction with other policy areas 15

a247e4b7ad1d57d7a5bf0709ca08bbda.ppt