1207f92fa674284dba4c0d21d63bf1e2.ppt

- Количество слайдов: 47

Minimizing Risk in the M&A Life Cycle April 28, 2014 Recording of this session via any media type is strictly prohibited. Page 1

Minimizing Risk in the M&A Life Cycle April 28, 2014 Recording of this session via any media type is strictly prohibited. Page 1

Agenda Overview of Market 3 M&A Life Cycle 6 Adding Value During an M&A Transaction 13 M&A Case Studies 18 Appendix 22 Due Diligence Transaction Execution, Integration and Divestiture/Spin-Off 30 Sample Scope of Activities 36 Sample Supplemental Data Request 40 Bios 2 23 45 Recording of this session via any media type is strictly prohibited. Page 2

Agenda Overview of Market 3 M&A Life Cycle 6 Adding Value During an M&A Transaction 13 M&A Case Studies 18 Appendix 22 Due Diligence Transaction Execution, Integration and Divestiture/Spin-Off 30 Sample Scope of Activities 36 Sample Supplemental Data Request 40 Bios 2 23 45 Recording of this session via any media type is strictly prohibited. Page 2

Overview of Market Recording of this session via any media type is strictly prohibited. Page 3

Overview of Market Recording of this session via any media type is strictly prohibited. Page 3

Overview of Market • The value of mergers and acquisitions around the world stands at $867. 7 billion via 9, 824 deals in 2014 so far, the highest total since 2007, according to figures from Thomson Financial. • Companies have shored up their balance sheets during the crisis, with US companies in particular boosted by the cheap loans provided under the Federal Reserve's asset purchasing program, so there is more cash to spend. • There is now more optimism about the U. S. 's economic recovery after better jobs figures and faster growth in gross domestic product (GDP). 4 Recording of this session via any media type is strictly prohibited. Page 4

Overview of Market • The value of mergers and acquisitions around the world stands at $867. 7 billion via 9, 824 deals in 2014 so far, the highest total since 2007, according to figures from Thomson Financial. • Companies have shored up their balance sheets during the crisis, with US companies in particular boosted by the cheap loans provided under the Federal Reserve's asset purchasing program, so there is more cash to spend. • There is now more optimism about the U. S. 's economic recovery after better jobs figures and faster growth in gross domestic product (GDP). 4 Recording of this session via any media type is strictly prohibited. Page 4

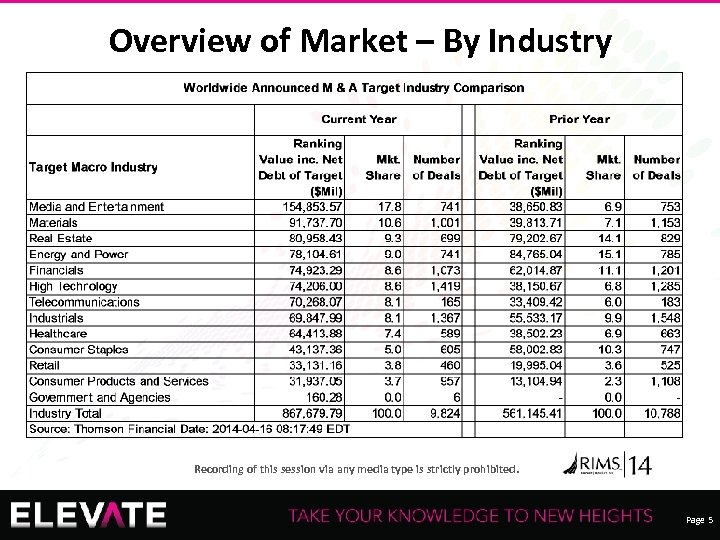

Overview of Market – By Industry 5 Recording of this session via any media type is strictly prohibited. Page 5

Overview of Market – By Industry 5 Recording of this session via any media type is strictly prohibited. Page 5

M&A Life Cycle Recording of this session via any media type is strictly prohibited. Page 6

M&A Life Cycle Recording of this session via any media type is strictly prohibited. Page 6

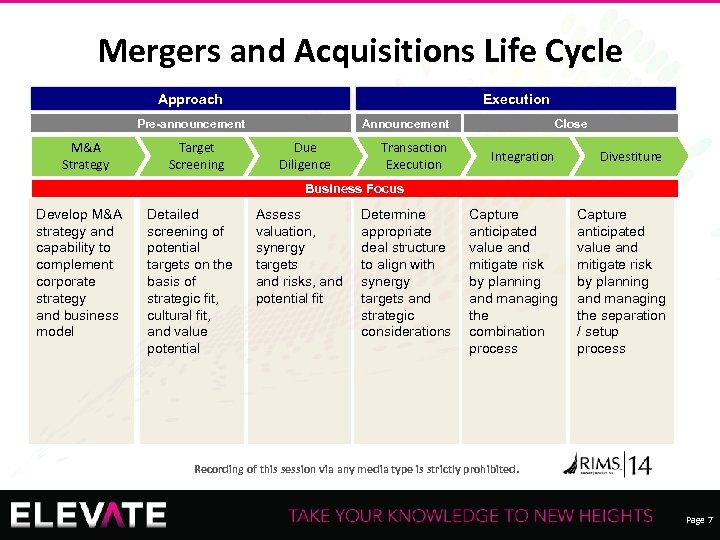

Mergers and Acquisitions Life Cycle Approach Execution Pre-announcement M&A Strategy Target Screening Announcement Due Diligence Transaction Execution Close Integration Divestiture Capture anticipated value and mitigate risk by planning and managing the combination process Capture anticipated value and mitigate risk by planning and managing the separation / setup process Business Focus Develop M&A strategy and capability to complement corporate strategy and business model 7 Detailed screening of potential targets on the basis of strategic fit, cultural fit, and value potential Assess valuation, synergy targets and risks, and potential fit Determine appropriate deal structure to align with synergy targets and strategic considerations Recording of this session via any media type is strictly prohibited. Page 7

Mergers and Acquisitions Life Cycle Approach Execution Pre-announcement M&A Strategy Target Screening Announcement Due Diligence Transaction Execution Close Integration Divestiture Capture anticipated value and mitigate risk by planning and managing the combination process Capture anticipated value and mitigate risk by planning and managing the separation / setup process Business Focus Develop M&A strategy and capability to complement corporate strategy and business model 7 Detailed screening of potential targets on the basis of strategic fit, cultural fit, and value potential Assess valuation, synergy targets and risks, and potential fit Determine appropriate deal structure to align with synergy targets and strategic considerations Recording of this session via any media type is strictly prohibited. Page 7

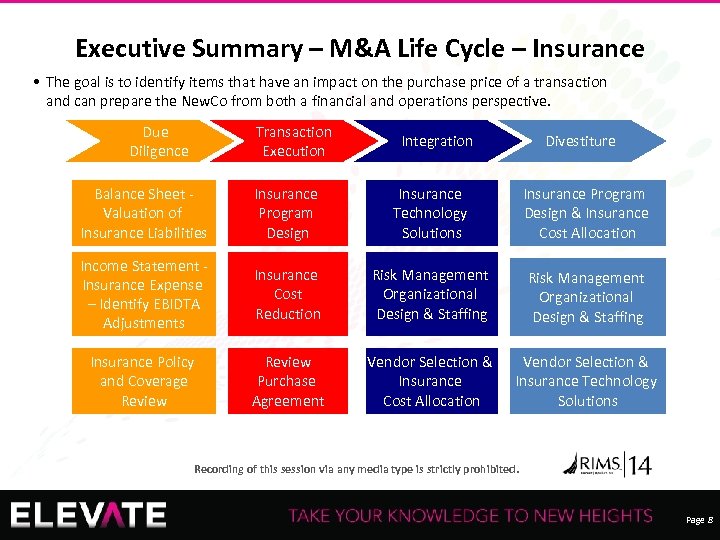

Executive Summary – M&A Life Cycle – Insurance • The goal is to identify items that have an impact on the purchase price of a transaction and can prepare the New. Co from both a financial and operations perspective. Due Diligence Integration Balance Sheet Valuation of Insurance Liabilities Insurance Program Design Insurance Technology Solutions Insurance Program Design & Insurance Cost Allocation Income Statement Insurance Expense – Identify EBIDTA Adjustments Insurance Cost Reduction Risk Management Organizational Design & Staffing Insurance Policy and Coverage Review 8 Transaction Execution Review Purchase Agreement Vendor Selection & Insurance Cost Allocation Vendor Selection & Insurance Technology Solutions Divestiture Recording of this session via any media type is strictly prohibited. Page 8

Executive Summary – M&A Life Cycle – Insurance • The goal is to identify items that have an impact on the purchase price of a transaction and can prepare the New. Co from both a financial and operations perspective. Due Diligence Integration Balance Sheet Valuation of Insurance Liabilities Insurance Program Design Insurance Technology Solutions Insurance Program Design & Insurance Cost Allocation Income Statement Insurance Expense – Identify EBIDTA Adjustments Insurance Cost Reduction Risk Management Organizational Design & Staffing Insurance Policy and Coverage Review 8 Transaction Execution Review Purchase Agreement Vendor Selection & Insurance Cost Allocation Vendor Selection & Insurance Technology Solutions Divestiture Recording of this session via any media type is strictly prohibited. Page 8

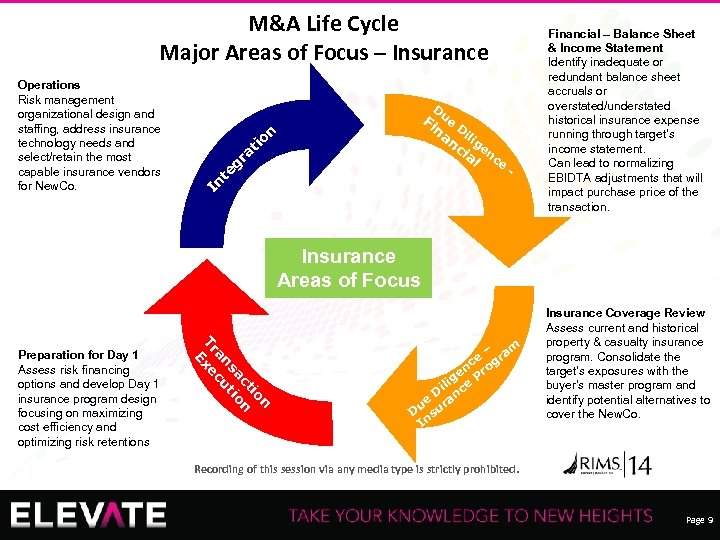

M&A Life Cycle Major Areas of Focus – Insurance Operations Risk management organizational design and staffing, address insurance technology needs and select/retain the most capable insurance vendors for New. Co. D Fi ue na Di nc lige ia nc e l on i at gr e nt - I Financial – Balance Sheet & Income Statement Identify inadequate or redundant balance sheet accruals or overstated/understated historical insurance expense running through target’s income statement. Can lead to normalizing EBIDTA adjustments that will impact purchase price of the transaction. Insurance Areas of Focus 9 n io ct n sa tio an cu Tr xe E Preparation for Day 1 Assess risk financing options and develop Day 1 insurance program design focusing on maximizing cost efficiency and optimizing risk retentions – am ce ogr en r ig e P il D nc a ue r D su In Insurance Coverage Review Assess current and historical property & casualty insurance program. Consolidate the target’s exposures with the buyer’s master program and identify potential alternatives to cover the New. Co. Recording of this session via any media type is strictly prohibited. Page 9

M&A Life Cycle Major Areas of Focus – Insurance Operations Risk management organizational design and staffing, address insurance technology needs and select/retain the most capable insurance vendors for New. Co. D Fi ue na Di nc lige ia nc e l on i at gr e nt - I Financial – Balance Sheet & Income Statement Identify inadequate or redundant balance sheet accruals or overstated/understated historical insurance expense running through target’s income statement. Can lead to normalizing EBIDTA adjustments that will impact purchase price of the transaction. Insurance Areas of Focus 9 n io ct n sa tio an cu Tr xe E Preparation for Day 1 Assess risk financing options and develop Day 1 insurance program design focusing on maximizing cost efficiency and optimizing risk retentions – am ce ogr en r ig e P il D nc a ue r D su In Insurance Coverage Review Assess current and historical property & casualty insurance program. Consolidate the target’s exposures with the buyer’s master program and identify potential alternatives to cover the New. Co. Recording of this session via any media type is strictly prohibited. Page 9

M&A Lifecycle - Deal Structure • Stock Transaction The buyer buys the shares, and therefore control, of the target company being purchased. • Ownership control of the company in turn conveys effective control over the assets of the company, but since the company is acquired intact as a going business, this form of transaction carries with it all of the liabilities accrued by that business over its past and all of the risks that company faces in its commercial environment. • 10 Recording of this session via any media type is strictly prohibited. Page 10

M&A Lifecycle - Deal Structure • Stock Transaction The buyer buys the shares, and therefore control, of the target company being purchased. • Ownership control of the company in turn conveys effective control over the assets of the company, but since the company is acquired intact as a going business, this form of transaction carries with it all of the liabilities accrued by that business over its past and all of the risks that company faces in its commercial environment. • 10 Recording of this session via any media type is strictly prohibited. Page 10

M&A Life Cycle - Deal Structure • Asset Transaction The buyer buys the assets of the target company. • The cash the target receives from the sell-off is paid back to its shareholders by dividend or through liquidation. • This type of transaction leaves the target company as an empty shell, if the buyer buys out the entire assets. • A buyer often structures the transaction as an asset purchase to "cherrypick" the assets that it wants and leave out the assets and liabilities that it does not. This can be particularly important where foreseeable liabilities may include future, unquantified reserves such as those that could arise from litigation over asbestos & environmental claims. • 11 Recording of this session via any media type is strictly prohibited. Page 11

M&A Life Cycle - Deal Structure • Asset Transaction The buyer buys the assets of the target company. • The cash the target receives from the sell-off is paid back to its shareholders by dividend or through liquidation. • This type of transaction leaves the target company as an empty shell, if the buyer buys out the entire assets. • A buyer often structures the transaction as an asset purchase to "cherrypick" the assets that it wants and leave out the assets and liabilities that it does not. This can be particularly important where foreseeable liabilities may include future, unquantified reserves such as those that could arise from litigation over asbestos & environmental claims. • 11 Recording of this session via any media type is strictly prohibited. Page 11

M&A Life Cycle - Valuation • How is the purchase price determined? Accurate business valuation is one of the most important aspects of M&A as valuations like these will have a major impact on the price that a business will be sold for. • These values are determined for the most part by looking at a company's balance sheet and/or income statement and withdrawing the appropriate information. • Price-Earnings Ratio (P/E Ratio) – With the use of this ratio, an acquiring company makes an offer that is a multiple of the earnings of the target company. Looking at the P/E for all the stocks within a given industry will give the acquiring company good guidance for what the target's P/E multiple should be. • • Earnings Before Interest Taxes Depreciation and Amortization (EBITDA) • Could also use a multiple of company’s cash flow or book value 12 Recording of this session via any media type is strictly prohibited. Page 12

M&A Life Cycle - Valuation • How is the purchase price determined? Accurate business valuation is one of the most important aspects of M&A as valuations like these will have a major impact on the price that a business will be sold for. • These values are determined for the most part by looking at a company's balance sheet and/or income statement and withdrawing the appropriate information. • Price-Earnings Ratio (P/E Ratio) – With the use of this ratio, an acquiring company makes an offer that is a multiple of the earnings of the target company. Looking at the P/E for all the stocks within a given industry will give the acquiring company good guidance for what the target's P/E multiple should be. • • Earnings Before Interest Taxes Depreciation and Amortization (EBITDA) • Could also use a multiple of company’s cash flow or book value 12 Recording of this session via any media type is strictly prohibited. Page 12

Adding Value During an M&A Transaction Recording of this session via any media type is strictly prohibited. Page 13

Adding Value During an M&A Transaction Recording of this session via any media type is strictly prohibited. Page 13

Due Diligence – Adding Value • Uncover risks and liabilities in order to avoid potential surprises – Are they deal breakers or valuation issues? How are pre-acquisition occurrences treated? • Occurrence vs. Claims Made coverage • Will you have access to prior insurance policies? • How do their deductibles compare? • – Do you want to buy tail coverage? Do they have an Executive Risk policy? Cyber – liability policy? • Is the product portfolio similar? Do they have discontinued products? How will your insurance carriers respond? • – Is their claim experience materially different than yours? Any environmental exposures? Phase II’s? • Are the plants well protected? In CAT zones? Business continuity plans? • Material contracts? Insurance requirements in contracts? • Any exclusions on policies? • 14 Recording of this session via any media type is strictly prohibited. Page 14

Due Diligence – Adding Value • Uncover risks and liabilities in order to avoid potential surprises – Are they deal breakers or valuation issues? How are pre-acquisition occurrences treated? • Occurrence vs. Claims Made coverage • Will you have access to prior insurance policies? • How do their deductibles compare? • – Do you want to buy tail coverage? Do they have an Executive Risk policy? Cyber – liability policy? • Is the product portfolio similar? Do they have discontinued products? How will your insurance carriers respond? • – Is their claim experience materially different than yours? Any environmental exposures? Phase II’s? • Are the plants well protected? In CAT zones? Business continuity plans? • Material contracts? Insurance requirements in contracts? • Any exclusions on policies? • 14 Recording of this session via any media type is strictly prohibited. Page 14

Due Diligence – Adding Value • Review and provide feedback on the purchase agreement and any Transition Services Agreements • Quantify items impacting the purchase price of the transaction • • • 15 This will typically involve identifying revenue or expense items that impact EBIDTA Compare expected expense (including claims) under your program to those of the stand alone insurance program Are existing accruals sufficient? What methodologies were utilized in calculating the accrual? Do they have a captive? Any extraordinary items to account for? Loss prevention, etc. ? Recording of this session via any media type is strictly prohibited. Page 15

Due Diligence – Adding Value • Review and provide feedback on the purchase agreement and any Transition Services Agreements • Quantify items impacting the purchase price of the transaction • • • 15 This will typically involve identifying revenue or expense items that impact EBIDTA Compare expected expense (including claims) under your program to those of the stand alone insurance program Are existing accruals sufficient? What methodologies were utilized in calculating the accrual? Do they have a captive? Any extraordinary items to account for? Loss prevention, etc. ? Recording of this session via any media type is strictly prohibited. Page 15

Due Diligence – Adding Value • Seamlessly work with other third-party advisors (actuaries, broker, legal team, finance, etc. ) • Provide data for the negotiation process • Have the answers needed to launch into the carve-out / Day 1 readiness phase before the deal closes • Explore cancellation provisions & extended reporting options • Activities performed (described in the Appendix) are similar for strategic and financial buyers 16 Recording of this session via any media type is strictly prohibited. Page 16

Due Diligence – Adding Value • Seamlessly work with other third-party advisors (actuaries, broker, legal team, finance, etc. ) • Provide data for the negotiation process • Have the answers needed to launch into the carve-out / Day 1 readiness phase before the deal closes • Explore cancellation provisions & extended reporting options • Activities performed (described in the Appendix) are similar for strategic and financial buyers 16 Recording of this session via any media type is strictly prohibited. Page 16

Transaction Execution, Integration and Divestiture/Spin-off – Adding Value • Cost optimization/reduction for all items related to the property & casualty insurance program • • • Insurance program design International Vendor selection Insurance technology solutions Insurance cost allocation Risk management organizational design & staffing • Communication Plan • • • 17 Claim reporting Certs, auto id cards, posting notices Location code structures Site contacts Loss Control visits Recording of this session via any media type is strictly prohibited. Page 17

Transaction Execution, Integration and Divestiture/Spin-off – Adding Value • Cost optimization/reduction for all items related to the property & casualty insurance program • • • Insurance program design International Vendor selection Insurance technology solutions Insurance cost allocation Risk management organizational design & staffing • Communication Plan • • • 17 Claim reporting Certs, auto id cards, posting notices Location code structures Site contacts Loss Control visits Recording of this session via any media type is strictly prohibited. Page 17

M&A Case Studies 18 Recording of this session via any media type is strictly prohibited. Page 18

M&A Case Studies 18 Recording of this session via any media type is strictly prohibited. Page 18

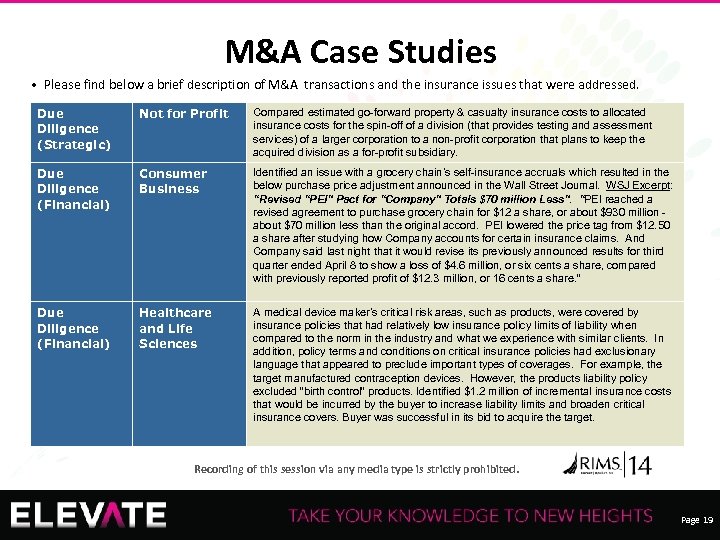

M&A Case Studies • Please find below a brief description of M&A transactions and the insurance issues that were addressed. Due Diligence (Strategic) Not for Profit Compared estimated go-forward property & casualty insurance costs to allocated insurance costs for the spin-off of a division (that provides testing and assessment services) of a larger corporation to a non-profit corporation that plans to keep the acquired division as a for-profit subsidiary. Due Diligence (Financial) Consumer Business Identified an issue with a grocery chain’s self-insurance accruals which resulted in the below purchase price adjustment announced in the Wall Street Journal. WSJ Excerpt: “Revised “PEI” Pact for “Company” Totals $70 million Less”. “PEI reached a revised agreement to purchase grocery chain for $12 a share, or about $930 million about $70 million less than the original accord. PEI lowered the price tag from $12. 50 a share after studying how Company accounts for certain insurance claims. And Company said last night that it would revise its previously announced results for third quarter ended April 8 to show a loss of $4. 6 million, or six cents a share, compared with previously reported profit of $12. 3 million, or 16 cents a share. ” Due Diligence (Financial) Healthcare and Life Sciences A medical device maker’s critical risk areas, such as products, were covered by insurance policies that had relatively low insurance policy limits of liability when compared to the norm in the industry and what we experience with similar clients. In addition, policy terms and conditions on critical insurance policies had exclusionary language that appeared to preclude important types of coverages. For example, the target manufactured contraception devices. However, the products liability policy excluded “birth control” products. Identified $1. 2 million of incremental insurance costs that would be incurred by the buyer to increase liability limits and broaden critical insurance covers. Buyer was successful in its bid to acquire the target. Independence 19 Recording of this session via any media type is strictly prohibited. Page 19

M&A Case Studies • Please find below a brief description of M&A transactions and the insurance issues that were addressed. Due Diligence (Strategic) Not for Profit Compared estimated go-forward property & casualty insurance costs to allocated insurance costs for the spin-off of a division (that provides testing and assessment services) of a larger corporation to a non-profit corporation that plans to keep the acquired division as a for-profit subsidiary. Due Diligence (Financial) Consumer Business Identified an issue with a grocery chain’s self-insurance accruals which resulted in the below purchase price adjustment announced in the Wall Street Journal. WSJ Excerpt: “Revised “PEI” Pact for “Company” Totals $70 million Less”. “PEI reached a revised agreement to purchase grocery chain for $12 a share, or about $930 million about $70 million less than the original accord. PEI lowered the price tag from $12. 50 a share after studying how Company accounts for certain insurance claims. And Company said last night that it would revise its previously announced results for third quarter ended April 8 to show a loss of $4. 6 million, or six cents a share, compared with previously reported profit of $12. 3 million, or 16 cents a share. ” Due Diligence (Financial) Healthcare and Life Sciences A medical device maker’s critical risk areas, such as products, were covered by insurance policies that had relatively low insurance policy limits of liability when compared to the norm in the industry and what we experience with similar clients. In addition, policy terms and conditions on critical insurance policies had exclusionary language that appeared to preclude important types of coverages. For example, the target manufactured contraception devices. However, the products liability policy excluded “birth control” products. Identified $1. 2 million of incremental insurance costs that would be incurred by the buyer to increase liability limits and broaden critical insurance covers. Buyer was successful in its bid to acquire the target. Independence 19 Recording of this session via any media type is strictly prohibited. Page 19

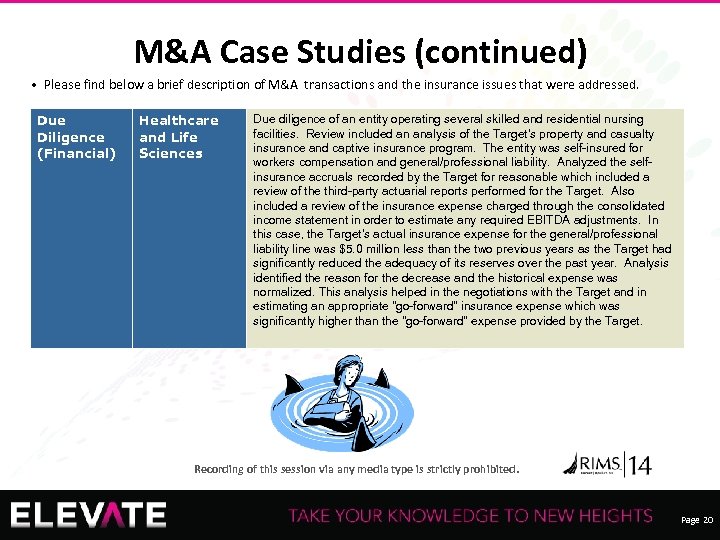

M&A Case Studies (continued) • Please find below a brief description of M&A transactions and the insurance issues that were addressed. Due Diligence (Financial) Independence 20 Healthcare and Life Sciences Due diligence of an entity operating several skilled and residential nursing facilities. Review included an analysis of the Target's property and casualty insurance and captive insurance program. The entity was self-insured for workers compensation and general/professional liability. Analyzed the selfinsurance accruals recorded by the Target for reasonable which included a review of the third-party actuarial reports performed for the Target. Also included a review of the insurance expense charged through the consolidated income statement in order to estimate any required EBITDA adjustments. In this case, the Target's actual insurance expense for the general/professional liability line was $5. 0 million less than the two previous years as the Target had significantly reduced the adequacy of its reserves over the past year. Analysis identified the reason for the decrease and the historical expense was normalized. This analysis helped in the negotiations with the Target and in estimating an appropriate "go-forward" insurance expense which was significantly higher than the "go-forward" expense provided by the Target. Recording of this session via any media type is strictly prohibited. Page 20

M&A Case Studies (continued) • Please find below a brief description of M&A transactions and the insurance issues that were addressed. Due Diligence (Financial) Independence 20 Healthcare and Life Sciences Due diligence of an entity operating several skilled and residential nursing facilities. Review included an analysis of the Target's property and casualty insurance and captive insurance program. The entity was self-insured for workers compensation and general/professional liability. Analyzed the selfinsurance accruals recorded by the Target for reasonable which included a review of the third-party actuarial reports performed for the Target. Also included a review of the insurance expense charged through the consolidated income statement in order to estimate any required EBITDA adjustments. In this case, the Target's actual insurance expense for the general/professional liability line was $5. 0 million less than the two previous years as the Target had significantly reduced the adequacy of its reserves over the past year. Analysis identified the reason for the decrease and the historical expense was normalized. This analysis helped in the negotiations with the Target and in estimating an appropriate "go-forward" insurance expense which was significantly higher than the "go-forward" expense provided by the Target. Recording of this session via any media type is strictly prohibited. Page 20

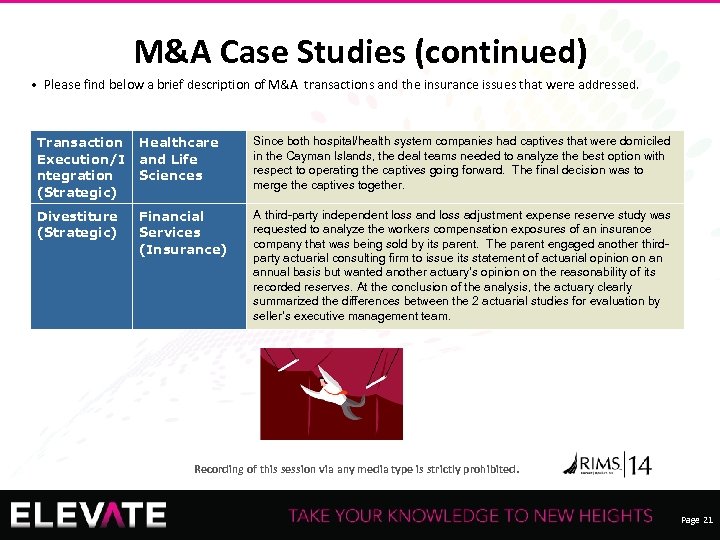

M&A Case Studies (continued) • Please find below a brief description of M&A transactions and the insurance issues that were addressed. Transaction Execution/I Independence ntegration (Strategic) Divestiture (Strategic) 21 Healthcare and Life Sciences Since both hospital/health system companies had captives that were domiciled in the Cayman Islands, the deal teams needed to analyze the best option with respect to operating the captives going forward. The final decision was to merge the captives together. Financial Services (Insurance) A third-party independent loss and loss adjustment expense reserve study was requested to analyze the workers compensation exposures of an insurance company that was being sold by its parent. The parent engaged another thirdparty actuarial consulting firm to issue its statement of actuarial opinion on an annual basis but wanted another actuary’s opinion on the reasonability of its recorded reserves. At the conclusion of the analysis, the actuary clearly summarized the differences between the 2 actuarial studies for evaluation by seller’s executive management team. Recording of this session via any media type is strictly prohibited. Page 21

M&A Case Studies (continued) • Please find below a brief description of M&A transactions and the insurance issues that were addressed. Transaction Execution/I Independence ntegration (Strategic) Divestiture (Strategic) 21 Healthcare and Life Sciences Since both hospital/health system companies had captives that were domiciled in the Cayman Islands, the deal teams needed to analyze the best option with respect to operating the captives going forward. The final decision was to merge the captives together. Financial Services (Insurance) A third-party independent loss and loss adjustment expense reserve study was requested to analyze the workers compensation exposures of an insurance company that was being sold by its parent. The parent engaged another thirdparty actuarial consulting firm to issue its statement of actuarial opinion on an annual basis but wanted another actuary’s opinion on the reasonability of its recorded reserves. At the conclusion of the analysis, the actuary clearly summarized the differences between the 2 actuarial studies for evaluation by seller’s executive management team. Recording of this session via any media type is strictly prohibited. Page 21

Appendix 22 Recording of this session via any media type is strictly prohibited. Page 22

Appendix 22 Recording of this session via any media type is strictly prohibited. Page 22

Due Diligence 23 Recording of this session via any media type is strictly prohibited. Page 23

Due Diligence 23 Recording of this session via any media type is strictly prohibited. Page 23

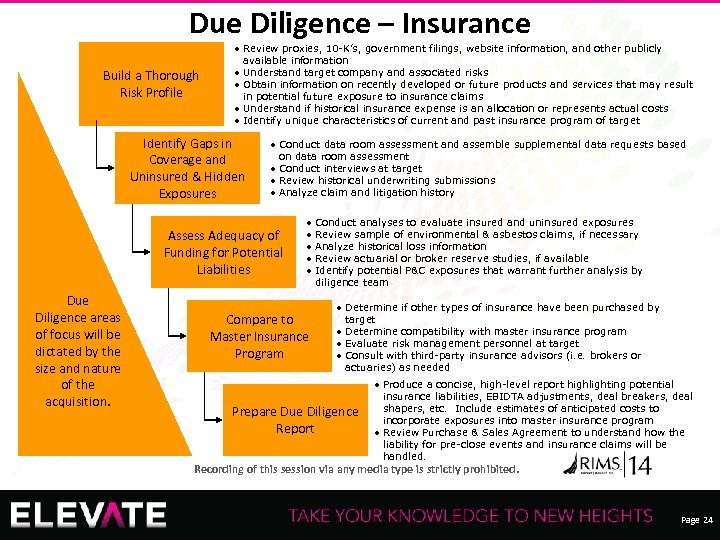

Due Diligence – Insurance Build a Thorough Risk Profile • Review proxies, 10 -K’s, government filings, website information, and other publicly available information • Understand target company and associated risks • Obtain information on recently developed or future products and services that may result in potential future exposure to insurance claims • Understand if historical insurance expense is an allocation or represents actual costs • Identify unique characteristics of current and past insurance program of target Identify Gaps in Coverage and Uninsured & Hidden Exposures • Conduct data room assessment and assemble supplemental data requests based on data room assessment • Conduct interviews at target • Review historical underwriting submissions • Analyze claim and litigation history Assess Adequacy of Funding for Potential Liabilities Due Diligence areas of focus will be dictated by the size and nature of the acquisition. 24 • • • Compare to Master Insurance Program Conduct analyses to evaluate insured and uninsured exposures Review sample of environmental & asbestos claims, if necessary Analyze historical loss information Review actuarial or broker reserve studies, if available Identify potential P&C exposures that warrant further analysis by diligence team • Determine if other types of insurance have been purchased by target • Determine compatibility with master insurance program • Evaluate risk management personnel at target • Consult with third-party insurance advisors (i. e. brokers or actuaries) as needed Prepare Due Diligence Report • Produce a concise, high-level report highlighting potential insurance liabilities, EBIDTA adjustments, deal breakers, deal shapers, etc. Include estimates of anticipated costs to incorporate exposures into master insurance program • Review Purchase & Sales Agreement to understand how the liability for pre-close events and insurance claims will be handled. Recording of this session via any media type is strictly prohibited. Page 24

Due Diligence – Insurance Build a Thorough Risk Profile • Review proxies, 10 -K’s, government filings, website information, and other publicly available information • Understand target company and associated risks • Obtain information on recently developed or future products and services that may result in potential future exposure to insurance claims • Understand if historical insurance expense is an allocation or represents actual costs • Identify unique characteristics of current and past insurance program of target Identify Gaps in Coverage and Uninsured & Hidden Exposures • Conduct data room assessment and assemble supplemental data requests based on data room assessment • Conduct interviews at target • Review historical underwriting submissions • Analyze claim and litigation history Assess Adequacy of Funding for Potential Liabilities Due Diligence areas of focus will be dictated by the size and nature of the acquisition. 24 • • • Compare to Master Insurance Program Conduct analyses to evaluate insured and uninsured exposures Review sample of environmental & asbestos claims, if necessary Analyze historical loss information Review actuarial or broker reserve studies, if available Identify potential P&C exposures that warrant further analysis by diligence team • Determine if other types of insurance have been purchased by target • Determine compatibility with master insurance program • Evaluate risk management personnel at target • Consult with third-party insurance advisors (i. e. brokers or actuaries) as needed Prepare Due Diligence Report • Produce a concise, high-level report highlighting potential insurance liabilities, EBIDTA adjustments, deal breakers, deal shapers, etc. Include estimates of anticipated costs to incorporate exposures into master insurance program • Review Purchase & Sales Agreement to understand how the liability for pre-close events and insurance claims will be handled. Recording of this session via any media type is strictly prohibited. Page 24

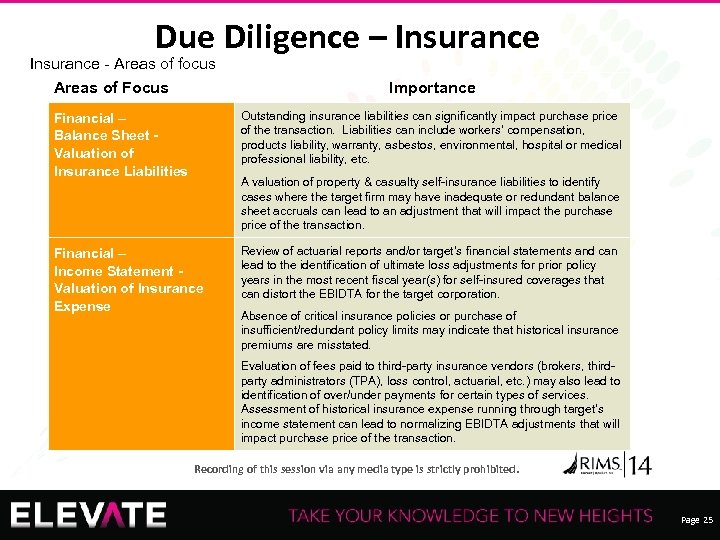

Due Diligence – Insurance - Areas of focus Areas of Focus Importance Financial – Balance Sheet Valuation of Insurance Liabilities Outstanding insurance liabilities can significantly impact purchase price of the transaction. Liabilities can include workers’ compensation, products liability, warranty, asbestos, environmental, hospital or medical professional liability, etc. Financial – Income Statement Valuation of Insurance Expense Review of actuarial reports and/or target’s financial statements and can lead to the identification of ultimate loss adjustments for prior policy years in the most recent fiscal year(s) for self-insured coverages that can distort the EBIDTA for the target corporation. A valuation of property & casualty self-insurance liabilities to identify cases where the target firm may have inadequate or redundant balance sheet accruals can lead to an adjustment that will impact the purchase price of the transaction. Absence of critical insurance policies or purchase of insufficient/redundant policy limits may indicate that historical insurance premiums are misstated. Evaluation of fees paid to third-party insurance vendors (brokers, thirdparty administrators (TPA), loss control, actuarial, etc. ) may also lead to identification of over/under payments for certain types of services. Assessment of historical insurance expense running through target’s income statement can lead to normalizing EBIDTA adjustments that will impact purchase price of the transaction. 25 Recording of this session via any media type is strictly prohibited. Page 25

Due Diligence – Insurance - Areas of focus Areas of Focus Importance Financial – Balance Sheet Valuation of Insurance Liabilities Outstanding insurance liabilities can significantly impact purchase price of the transaction. Liabilities can include workers’ compensation, products liability, warranty, asbestos, environmental, hospital or medical professional liability, etc. Financial – Income Statement Valuation of Insurance Expense Review of actuarial reports and/or target’s financial statements and can lead to the identification of ultimate loss adjustments for prior policy years in the most recent fiscal year(s) for self-insured coverages that can distort the EBIDTA for the target corporation. A valuation of property & casualty self-insurance liabilities to identify cases where the target firm may have inadequate or redundant balance sheet accruals can lead to an adjustment that will impact the purchase price of the transaction. Absence of critical insurance policies or purchase of insufficient/redundant policy limits may indicate that historical insurance premiums are misstated. Evaluation of fees paid to third-party insurance vendors (brokers, thirdparty administrators (TPA), loss control, actuarial, etc. ) may also lead to identification of over/under payments for certain types of services. Assessment of historical insurance expense running through target’s income statement can lead to normalizing EBIDTA adjustments that will impact purchase price of the transaction. 25 Recording of this session via any media type is strictly prohibited. Page 25

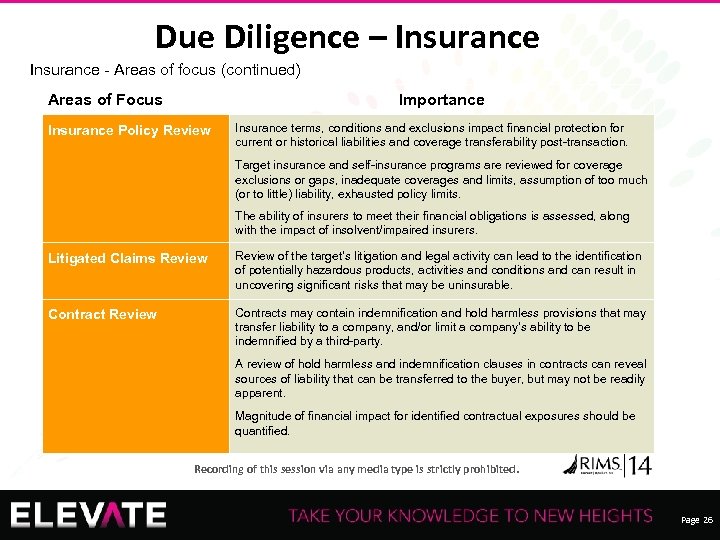

Due Diligence – Insurance - Areas of focus (continued) Areas of Focus Importance Insurance Policy Review Insurance terms, conditions and exclusions impact financial protection for current or historical liabilities and coverage transferability post-transaction. Target insurance and self-insurance programs are reviewed for coverage exclusions or gaps, inadequate coverages and limits, assumption of too much (or to little) liability, exhausted policy limits. The ability of insurers to meet their financial obligations is assessed, along with the impact of insolvent/impaired insurers. Litigated Claims Review of the target’s litigation and legal activity can lead to the identification of potentially hazardous products, activities and conditions and can result in uncovering significant risks that may be uninsurable. Contract Review Contracts may contain indemnification and hold harmless provisions that may transfer liability to a company, and/or limit a company’s ability to be indemnified by a third-party. A review of hold harmless and indemnification clauses in contracts can reveal sources of liability that can be transferred to the buyer, but may not be readily apparent. Magnitude of financial impact for identified contractual exposures should be quantified. 26 Recording of this session via any media type is strictly prohibited. Page 26

Due Diligence – Insurance - Areas of focus (continued) Areas of Focus Importance Insurance Policy Review Insurance terms, conditions and exclusions impact financial protection for current or historical liabilities and coverage transferability post-transaction. Target insurance and self-insurance programs are reviewed for coverage exclusions or gaps, inadequate coverages and limits, assumption of too much (or to little) liability, exhausted policy limits. The ability of insurers to meet their financial obligations is assessed, along with the impact of insolvent/impaired insurers. Litigated Claims Review of the target’s litigation and legal activity can lead to the identification of potentially hazardous products, activities and conditions and can result in uncovering significant risks that may be uninsurable. Contract Review Contracts may contain indemnification and hold harmless provisions that may transfer liability to a company, and/or limit a company’s ability to be indemnified by a third-party. A review of hold harmless and indemnification clauses in contracts can reveal sources of liability that can be transferred to the buyer, but may not be readily apparent. Magnitude of financial impact for identified contractual exposures should be quantified. 26 Recording of this session via any media type is strictly prohibited. Page 26

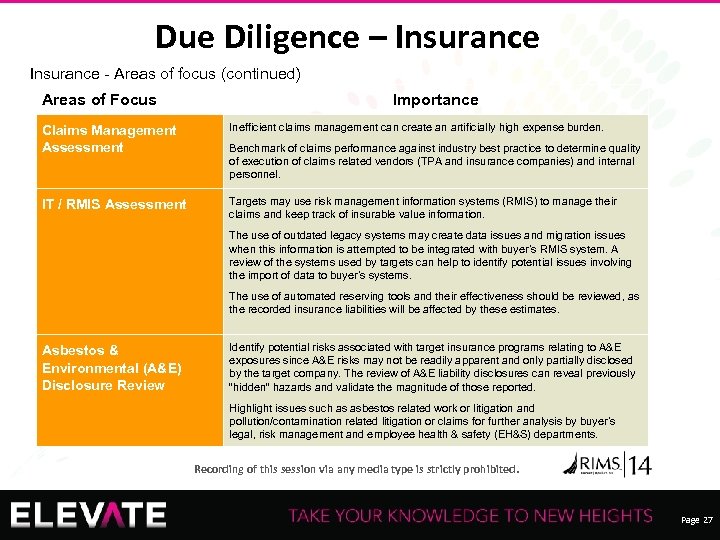

Due Diligence – Insurance - Areas of focus (continued) Areas of Focus Importance Claims Management Assessment Inefficient claims management can create an artificially high expense burden. IT / RMIS Assessment Targets may use risk management information systems (RMIS) to manage their claims and keep track of insurable value information. Benchmark of claims performance against industry best practice to determine quality of execution of claims related vendors (TPA and insurance companies) and internal personnel. The use of outdated legacy systems may create data issues and migration issues when this information is attempted to be integrated with buyer’s RMIS system. A review of the systems used by targets can help to identify potential issues involving the import of data to buyer’s systems. The use of automated reserving tools and their effectiveness should be reviewed, as the recorded insurance liabilities will be affected by these estimates. Asbestos & Environmental (A&E) Disclosure Review Identify potential risks associated with target insurance programs relating to A&E exposures since A&E risks may not be readily apparent and only partially disclosed by the target company. The review of A&E liability disclosures can reveal previously “hidden” hazards and validate the magnitude of those reported. Highlight issues such as asbestos related work or litigation and pollution/contamination related litigation or claims for further analysis by buyer’s legal, risk management and employee health & safety (EH&S) departments. 27 Recording of this session via any media type is strictly prohibited. Page 27

Due Diligence – Insurance - Areas of focus (continued) Areas of Focus Importance Claims Management Assessment Inefficient claims management can create an artificially high expense burden. IT / RMIS Assessment Targets may use risk management information systems (RMIS) to manage their claims and keep track of insurable value information. Benchmark of claims performance against industry best practice to determine quality of execution of claims related vendors (TPA and insurance companies) and internal personnel. The use of outdated legacy systems may create data issues and migration issues when this information is attempted to be integrated with buyer’s RMIS system. A review of the systems used by targets can help to identify potential issues involving the import of data to buyer’s systems. The use of automated reserving tools and their effectiveness should be reviewed, as the recorded insurance liabilities will be affected by these estimates. Asbestos & Environmental (A&E) Disclosure Review Identify potential risks associated with target insurance programs relating to A&E exposures since A&E risks may not be readily apparent and only partially disclosed by the target company. The review of A&E liability disclosures can reveal previously “hidden” hazards and validate the magnitude of those reported. Highlight issues such as asbestos related work or litigation and pollution/contamination related litigation or claims for further analysis by buyer’s legal, risk management and employee health & safety (EH&S) departments. 27 Recording of this session via any media type is strictly prohibited. Page 27

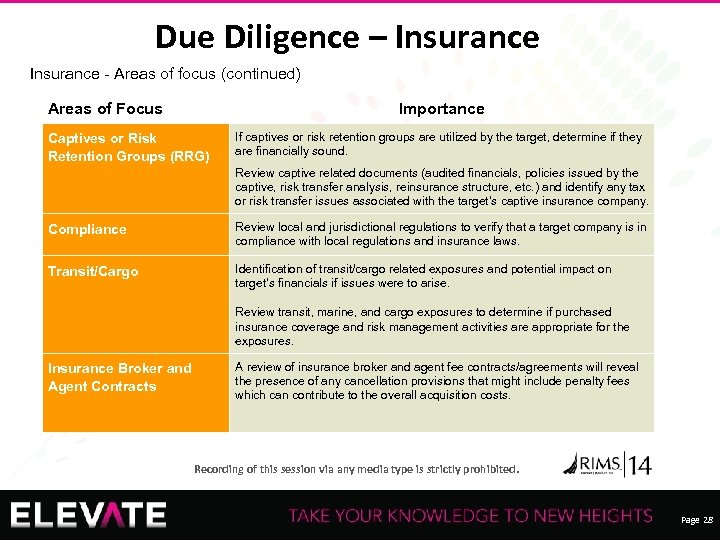

Due Diligence – Insurance - Areas of focus (continued) Areas of Focus Importance Captives or Risk Retention Groups (RRG) If captives or risk retention groups are utilized by the target, determine if they are financially sound. Review captive related documents (audited financials, policies issued by the captive, risk transfer analysis, reinsurance structure, etc. ) and identify any tax or risk transfer issues associated with the target’s captive insurance company. Compliance Review local and jurisdictional regulations to verify that a target company is in compliance with local regulations and insurance laws. Transit/Cargo Identification of transit/cargo related exposures and potential impact on target’s financials if issues were to arise. Review transit, marine, and cargo exposures to determine if purchased insurance coverage and risk management activities are appropriate for the exposures. Insurance Broker and Agent Contracts 28 A review of insurance broker and agent fee contracts/agreements will reveal the presence of any cancellation provisions that might include penalty fees which can contribute to the overall acquisition costs. Recording of this session via any media type is strictly prohibited. Page 28

Due Diligence – Insurance - Areas of focus (continued) Areas of Focus Importance Captives or Risk Retention Groups (RRG) If captives or risk retention groups are utilized by the target, determine if they are financially sound. Review captive related documents (audited financials, policies issued by the captive, risk transfer analysis, reinsurance structure, etc. ) and identify any tax or risk transfer issues associated with the target’s captive insurance company. Compliance Review local and jurisdictional regulations to verify that a target company is in compliance with local regulations and insurance laws. Transit/Cargo Identification of transit/cargo related exposures and potential impact on target’s financials if issues were to arise. Review transit, marine, and cargo exposures to determine if purchased insurance coverage and risk management activities are appropriate for the exposures. Insurance Broker and Agent Contracts 28 A review of insurance broker and agent fee contracts/agreements will reveal the presence of any cancellation provisions that might include penalty fees which can contribute to the overall acquisition costs. Recording of this session via any media type is strictly prohibited. Page 28

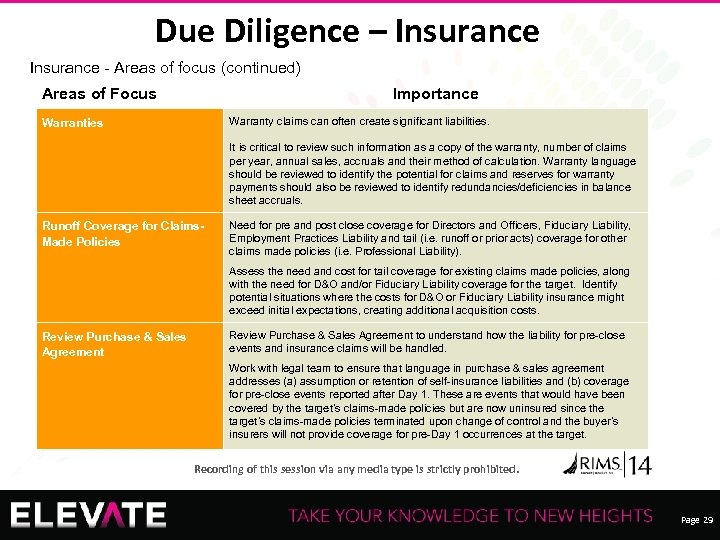

Due Diligence – Insurance - Areas of focus (continued) Areas of Focus Importance Warranty claims can often create significant liabilities. Warranties It is critical to review such information as a copy of the warranty, number of claims per year, annual sales, accruals and their method of calculation. Warranty language should be reviewed to identify the potential for claims and reserves for warranty payments should also be reviewed to identify redundancies/deficiencies in balance sheet accruals. Runoff Coverage for Claims. Made Policies Need for pre and post close coverage for Directors and Officers, Fiduciary Liability, Employment Practices Liability and tail (i. e. runoff or prior acts) coverage for other claims made policies (i. e. Professional Liability). Assess the need and cost for tail coverage for existing claims made policies, along with the need for D&O and/or Fiduciary Liability coverage for the target. Identify potential situations where the costs for D&O or Fiduciary Liability insurance might exceed initial expectations, creating additional acquisition costs. Review Purchase & Sales Agreement to understand how the liability for pre-close events and insurance claims will be handled. Work with legal team to ensure that language in purchase & sales agreement addresses (a) assumption or retention of self-insurance liabilities and (b) coverage for pre-close events reported after Day 1. These are events that would have been covered by the target’s claims-made policies but are now uninsured since the target’s claims-made policies terminated upon change of control and the buyer’s insurers will not provide coverage for pre-Day 1 occurrences at the target. 29 Recording of this session via any media type is strictly prohibited. Page 29

Due Diligence – Insurance - Areas of focus (continued) Areas of Focus Importance Warranty claims can often create significant liabilities. Warranties It is critical to review such information as a copy of the warranty, number of claims per year, annual sales, accruals and their method of calculation. Warranty language should be reviewed to identify the potential for claims and reserves for warranty payments should also be reviewed to identify redundancies/deficiencies in balance sheet accruals. Runoff Coverage for Claims. Made Policies Need for pre and post close coverage for Directors and Officers, Fiduciary Liability, Employment Practices Liability and tail (i. e. runoff or prior acts) coverage for other claims made policies (i. e. Professional Liability). Assess the need and cost for tail coverage for existing claims made policies, along with the need for D&O and/or Fiduciary Liability coverage for the target. Identify potential situations where the costs for D&O or Fiduciary Liability insurance might exceed initial expectations, creating additional acquisition costs. Review Purchase & Sales Agreement to understand how the liability for pre-close events and insurance claims will be handled. Work with legal team to ensure that language in purchase & sales agreement addresses (a) assumption or retention of self-insurance liabilities and (b) coverage for pre-close events reported after Day 1. These are events that would have been covered by the target’s claims-made policies but are now uninsured since the target’s claims-made policies terminated upon change of control and the buyer’s insurers will not provide coverage for pre-Day 1 occurrences at the target. 29 Recording of this session via any media type is strictly prohibited. Page 29

Transaction Execution, Integration and Divestiture 30 Recording of this session via any media type is strictly prohibited. Page 30

Transaction Execution, Integration and Divestiture 30 Recording of this session via any media type is strictly prohibited. Page 30

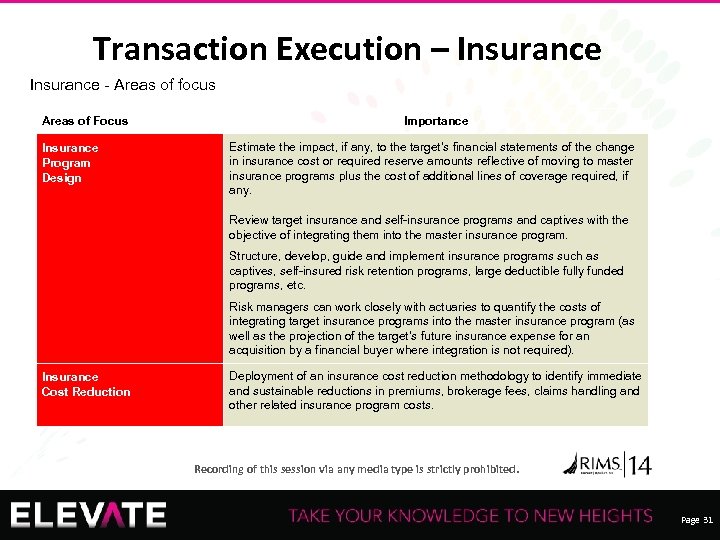

Transaction Execution – Insurance - Areas of focus Areas of Focus Insurance Program Design Importance Estimate the impact, if any, to the target’s financial statements of the change in insurance cost or required reserve amounts reflective of moving to master insurance programs plus the cost of additional lines of coverage required, if any. Review target insurance and self-insurance programs and captives with the objective of integrating them into the master insurance program. Structure, develop, guide and implement insurance programs such as captives, self-insured risk retention programs, large deductible fully funded programs, etc. Risk managers can work closely with actuaries to quantify the costs of integrating target insurance programs into the master insurance program (as well as the projection of the target’s future insurance expense for an acquisition by a financial buyer where integration is not required). Insurance Cost Reduction 31 Deployment of an insurance cost reduction methodology to identify immediate and sustainable reductions in premiums, brokerage fees, claims handling and other related insurance program costs. Recording of this session via any media type is strictly prohibited. Page 31

Transaction Execution – Insurance - Areas of focus Areas of Focus Insurance Program Design Importance Estimate the impact, if any, to the target’s financial statements of the change in insurance cost or required reserve amounts reflective of moving to master insurance programs plus the cost of additional lines of coverage required, if any. Review target insurance and self-insurance programs and captives with the objective of integrating them into the master insurance program. Structure, develop, guide and implement insurance programs such as captives, self-insured risk retention programs, large deductible fully funded programs, etc. Risk managers can work closely with actuaries to quantify the costs of integrating target insurance programs into the master insurance program (as well as the projection of the target’s future insurance expense for an acquisition by a financial buyer where integration is not required). Insurance Cost Reduction 31 Deployment of an insurance cost reduction methodology to identify immediate and sustainable reductions in premiums, brokerage fees, claims handling and other related insurance program costs. Recording of this session via any media type is strictly prohibited. Page 31

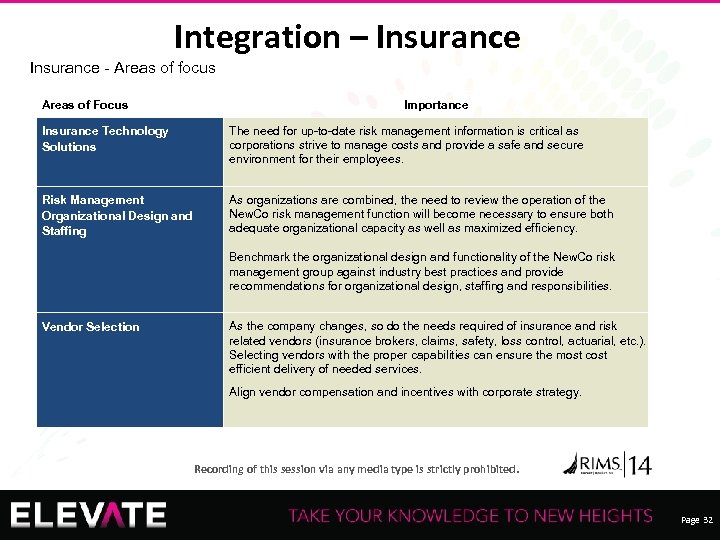

Integration – Insurance - Areas of focus Areas of Focus Importance Insurance Technology Solutions The need for up-to-date risk management information is critical as corporations strive to manage costs and provide a safe and secure environment for their employees. Risk Management Organizational Design and Staffing As organizations are combined, the need to review the operation of the New. Co risk management function will become necessary to ensure both adequate organizational capacity as well as maximized efficiency. Benchmark the organizational design and functionality of the New. Co risk management group against industry best practices and provide recommendations for organizational design, staffing and responsibilities. Vendor Selection As the company changes, so do the needs required of insurance and risk related vendors (insurance brokers, claims, safety, loss control, actuarial, etc. ). Selecting vendors with the proper capabilities can ensure the most cost efficient delivery of needed services. Align vendor compensation and incentives with corporate strategy. 32 Recording of this session via any media type is strictly prohibited. Page 32

Integration – Insurance - Areas of focus Areas of Focus Importance Insurance Technology Solutions The need for up-to-date risk management information is critical as corporations strive to manage costs and provide a safe and secure environment for their employees. Risk Management Organizational Design and Staffing As organizations are combined, the need to review the operation of the New. Co risk management function will become necessary to ensure both adequate organizational capacity as well as maximized efficiency. Benchmark the organizational design and functionality of the New. Co risk management group against industry best practices and provide recommendations for organizational design, staffing and responsibilities. Vendor Selection As the company changes, so do the needs required of insurance and risk related vendors (insurance brokers, claims, safety, loss control, actuarial, etc. ). Selecting vendors with the proper capabilities can ensure the most cost efficient delivery of needed services. Align vendor compensation and incentives with corporate strategy. 32 Recording of this session via any media type is strictly prohibited. Page 32

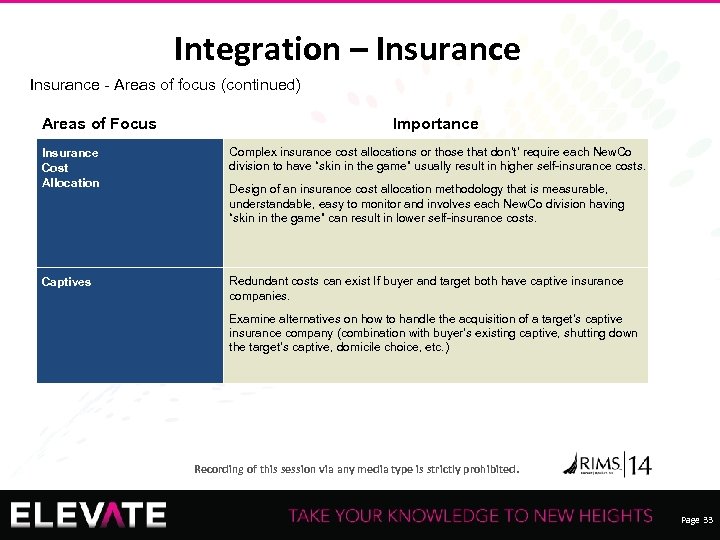

Integration – Insurance - Areas of focus (continued) Areas of Focus Importance Insurance Cost Allocation Complex insurance cost allocations or those that don’t’ require each New. Co division to have “skin in the game” usually result in higher self-insurance costs. Captives Redundant costs can exist If buyer and target both have captive insurance companies. Design of an insurance cost allocation methodology that is measurable, understandable, easy to monitor and involves each New. Co division having “skin in the game” can result in lower self-insurance costs. Examine alternatives on how to handle the acquisition of a target’s captive insurance company (combination with buyer’s existing captive, shutting down the target’s captive, domicile choice, etc. ) 33 Recording of this session via any media type is strictly prohibited. Page 33

Integration – Insurance - Areas of focus (continued) Areas of Focus Importance Insurance Cost Allocation Complex insurance cost allocations or those that don’t’ require each New. Co division to have “skin in the game” usually result in higher self-insurance costs. Captives Redundant costs can exist If buyer and target both have captive insurance companies. Design of an insurance cost allocation methodology that is measurable, understandable, easy to monitor and involves each New. Co division having “skin in the game” can result in lower self-insurance costs. Examine alternatives on how to handle the acquisition of a target’s captive insurance company (combination with buyer’s existing captive, shutting down the target’s captive, domicile choice, etc. ) 33 Recording of this session via any media type is strictly prohibited. Page 33

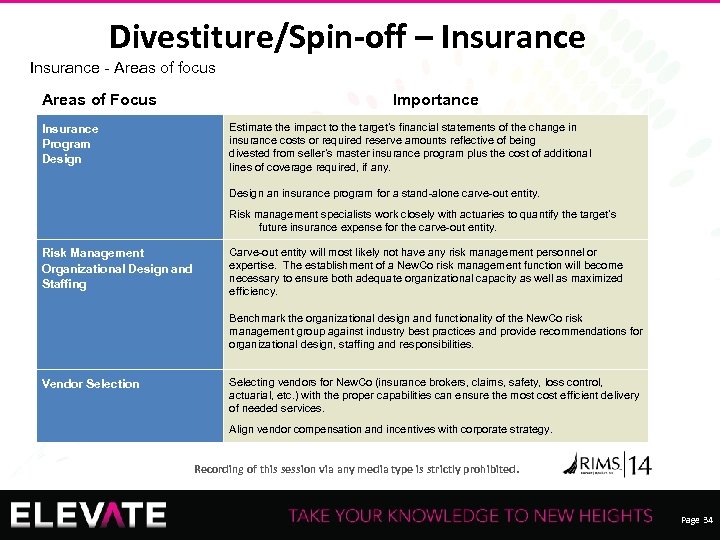

Divestiture/Spin-off – Insurance - Areas of focus Areas of Focus Insurance Program Design Importance Estimate the impact to the target’s financial statements of the change in insurance costs or required reserve amounts reflective of being divested from seller’s master insurance program plus the cost of additional lines of coverage required, if any. Design an insurance program for a stand-alone carve-out entity. Risk management specialists work closely with actuaries to quantify the target’s future insurance expense for the carve-out entity. Risk Management Organizational Design and Staffing Carve-out entity will most likely not have any risk management personnel or expertise. The establishment of a New. Co risk management function will become necessary to ensure both adequate organizational capacity as well as maximized efficiency. Benchmark the organizational design and functionality of the New. Co risk management group against industry best practices and provide recommendations for organizational design, staffing and responsibilities. Vendor Selection Selecting vendors for New. Co (insurance brokers, claims, safety, loss control, actuarial, etc. ) with the proper capabilities can ensure the most cost efficient delivery of needed services. Align vendor compensation and incentives with corporate strategy. 34 Recording of this session via any media type is strictly prohibited. Page 34

Divestiture/Spin-off – Insurance - Areas of focus Areas of Focus Insurance Program Design Importance Estimate the impact to the target’s financial statements of the change in insurance costs or required reserve amounts reflective of being divested from seller’s master insurance program plus the cost of additional lines of coverage required, if any. Design an insurance program for a stand-alone carve-out entity. Risk management specialists work closely with actuaries to quantify the target’s future insurance expense for the carve-out entity. Risk Management Organizational Design and Staffing Carve-out entity will most likely not have any risk management personnel or expertise. The establishment of a New. Co risk management function will become necessary to ensure both adequate organizational capacity as well as maximized efficiency. Benchmark the organizational design and functionality of the New. Co risk management group against industry best practices and provide recommendations for organizational design, staffing and responsibilities. Vendor Selection Selecting vendors for New. Co (insurance brokers, claims, safety, loss control, actuarial, etc. ) with the proper capabilities can ensure the most cost efficient delivery of needed services. Align vendor compensation and incentives with corporate strategy. 34 Recording of this session via any media type is strictly prohibited. Page 34

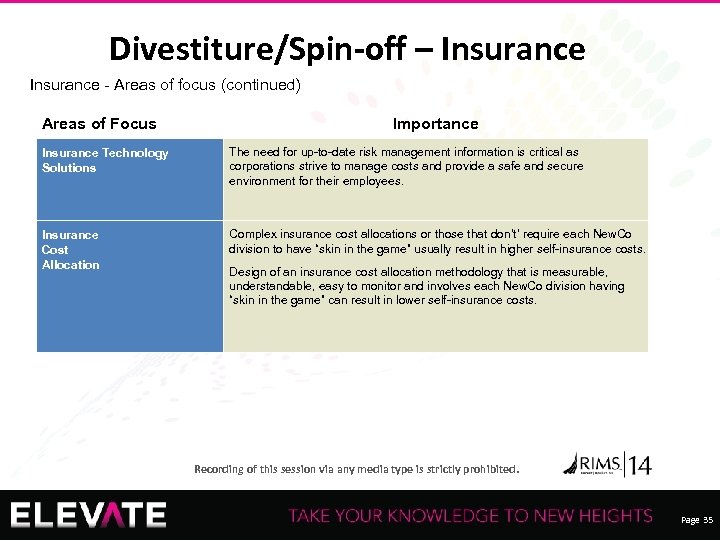

Divestiture/Spin-off – Insurance - Areas of focus (continued) Areas of Focus Importance Insurance Technology Solutions The need for up-to-date risk management information is critical as corporations strive to manage costs and provide a safe and secure environment for their employees. Insurance Cost Allocation Complex insurance cost allocations or those that don’t’ require each New. Co division to have “skin in the game” usually result in higher self-insurance costs. 35 Design of an insurance cost allocation methodology that is measurable, understandable, easy to monitor and involves each New. Co division having “skin in the game” can result in lower self-insurance costs. Recording of this session via any media type is strictly prohibited. Page 35

Divestiture/Spin-off – Insurance - Areas of focus (continued) Areas of Focus Importance Insurance Technology Solutions The need for up-to-date risk management information is critical as corporations strive to manage costs and provide a safe and secure environment for their employees. Insurance Cost Allocation Complex insurance cost allocations or those that don’t’ require each New. Co division to have “skin in the game” usually result in higher self-insurance costs. 35 Design of an insurance cost allocation methodology that is measurable, understandable, easy to monitor and involves each New. Co division having “skin in the game” can result in lower self-insurance costs. Recording of this session via any media type is strictly prohibited. Page 35

Sample Scope of Activities 36 Recording of this session via any media type is strictly prohibited. Page 36

Sample Scope of Activities 36 Recording of this session via any media type is strictly prohibited. Page 36

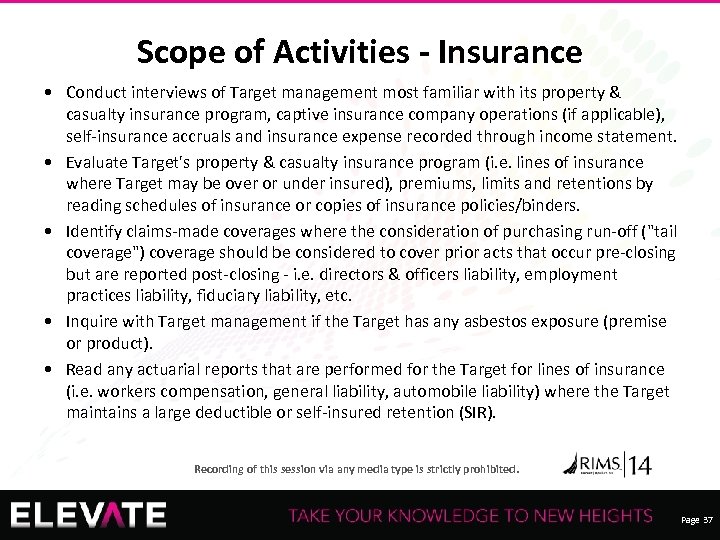

Scope of Activities - Insurance • Conduct interviews of Target management most familiar with its property & casualty insurance program, captive insurance company operations (if applicable), self-insurance accruals and insurance expense recorded through income statement. • Evaluate Target's property & casualty insurance program (i. e. lines of insurance where Target may be over or under insured), premiums, limits and retentions by reading schedules of insurance or copies of insurance policies/binders. • Identify claims-made coverages where the consideration of purchasing run-off ("tail coverage") coverage should be considered to cover prior acts that occur pre-closing but are reported post-closing - i. e. directors & officers liability, employment practices liability, fiduciary liability, etc. • Inquire with Target management if the Target has any asbestos exposure (premise or product). • Read any actuarial reports that are performed for the Target for lines of insurance (i. e. workers compensation, general liability, automobile liability) where the Target maintains a large deductible or self-insured retention (SIR). 37 Recording of this session via any media type is strictly prohibited. Page 37

Scope of Activities - Insurance • Conduct interviews of Target management most familiar with its property & casualty insurance program, captive insurance company operations (if applicable), self-insurance accruals and insurance expense recorded through income statement. • Evaluate Target's property & casualty insurance program (i. e. lines of insurance where Target may be over or under insured), premiums, limits and retentions by reading schedules of insurance or copies of insurance policies/binders. • Identify claims-made coverages where the consideration of purchasing run-off ("tail coverage") coverage should be considered to cover prior acts that occur pre-closing but are reported post-closing - i. e. directors & officers liability, employment practices liability, fiduciary liability, etc. • Inquire with Target management if the Target has any asbestos exposure (premise or product). • Read any actuarial reports that are performed for the Target for lines of insurance (i. e. workers compensation, general liability, automobile liability) where the Target maintains a large deductible or self-insured retention (SIR). 37 Recording of this session via any media type is strictly prohibited. Page 37

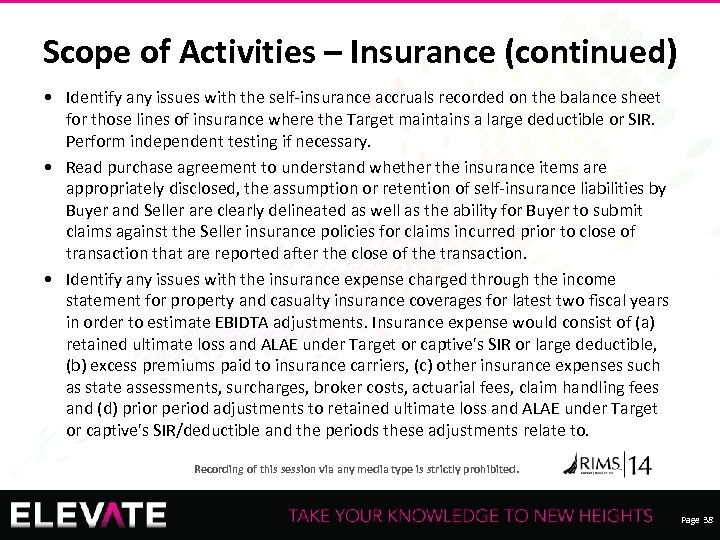

Scope of Activities – Insurance (continued) • Identify any issues with the self-insurance accruals recorded on the balance sheet for those lines of insurance where the Target maintains a large deductible or SIR. Perform independent testing if necessary. • Read purchase agreement to understand whether the insurance items are appropriately disclosed, the assumption or retention of self-insurance liabilities by Buyer and Seller are clearly delineated as well as the ability for Buyer to submit claims against the Seller insurance policies for claims incurred prior to close of transaction that are reported after the close of the transaction. • Identify any issues with the insurance expense charged through the income statement for property and casualty insurance coverages for latest two fiscal years in order to estimate EBIDTA adjustments. Insurance expense would consist of (a) retained ultimate loss and ALAE under Target or captive's SIR or large deductible, (b) excess premiums paid to insurance carriers, (c) other insurance expenses such as state assessments, surcharges, broker costs, actuarial fees, claim handling fees and (d) prior period adjustments to retained ultimate loss and ALAE under Target or captive's SIR/deductible and the periods these adjustments relate to. 38 Recording of this session via any media type is strictly prohibited. Page 38

Scope of Activities – Insurance (continued) • Identify any issues with the self-insurance accruals recorded on the balance sheet for those lines of insurance where the Target maintains a large deductible or SIR. Perform independent testing if necessary. • Read purchase agreement to understand whether the insurance items are appropriately disclosed, the assumption or retention of self-insurance liabilities by Buyer and Seller are clearly delineated as well as the ability for Buyer to submit claims against the Seller insurance policies for claims incurred prior to close of transaction that are reported after the close of the transaction. • Identify any issues with the insurance expense charged through the income statement for property and casualty insurance coverages for latest two fiscal years in order to estimate EBIDTA adjustments. Insurance expense would consist of (a) retained ultimate loss and ALAE under Target or captive's SIR or large deductible, (b) excess premiums paid to insurance carriers, (c) other insurance expenses such as state assessments, surcharges, broker costs, actuarial fees, claim handling fees and (d) prior period adjustments to retained ultimate loss and ALAE under Target or captive's SIR/deductible and the periods these adjustments relate to. 38 Recording of this session via any media type is strictly prohibited. Page 38

Scope of Activities – Insurance (continued) • If applicable, read analyze captive related documents (audited financials, policies issued by the captive, risk transfer analysis, reinsurance structure, etc. ) and identify any tax or risk transfer issues associated with the Target's captive insurance company. 39 Recording of this session via any media type is strictly prohibited. Page 39

Scope of Activities – Insurance (continued) • If applicable, read analyze captive related documents (audited financials, policies issued by the captive, risk transfer analysis, reinsurance structure, etc. ) and identify any tax or risk transfer issues associated with the Target's captive insurance company. 39 Recording of this session via any media type is strictly prohibited. Page 39

Sample Supplemental Data Request 40 Recording of this session via any media type is strictly prohibited. Page 40

Sample Supplemental Data Request 40 Recording of this session via any media type is strictly prohibited. Page 40

Supplemental Data Request • For the following three items, please provide as of 12/31/12, 12/31/13 and 3/31/14. • Description of the Company’s methodology for establishing the accruals for each line of insurance (i. e. workers compensation, automobile liability and professional/general liability) where the Company self-insures or maintains a large deductible. • Please provide a copy of any third-party actuarial reports or internal calculations used to establish the self-insurance accruals. • Electronic (MS Excel) loss runs (5 to 10 policy years) for each line of insurance (i. e. workers compensation, automobile liability and professional/general liability) where the Company self-insures or maintains a large deductible. Please provide loss runs as of the most recent valuation date available. • Copy of in-force insurance policies 41 Recording of this session via any media type is strictly prohibited. Page 41

Supplemental Data Request • For the following three items, please provide as of 12/31/12, 12/31/13 and 3/31/14. • Description of the Company’s methodology for establishing the accruals for each line of insurance (i. e. workers compensation, automobile liability and professional/general liability) where the Company self-insures or maintains a large deductible. • Please provide a copy of any third-party actuarial reports or internal calculations used to establish the self-insurance accruals. • Electronic (MS Excel) loss runs (5 to 10 policy years) for each line of insurance (i. e. workers compensation, automobile liability and professional/general liability) where the Company self-insures or maintains a large deductible. Please provide loss runs as of the most recent valuation date available. • Copy of in-force insurance policies 41 Recording of this session via any media type is strictly prohibited. Page 41

Supplemental Data Request (continued) • Schedules or Summaries of Insurance for the last 5 years (2009/2010 through 2013/2014). The summaries should include the following information: • • • • 42 Line of Insurance Type of policy (primary, excess, etc. ) Occurrence vs. claims-made coverage Premium Limits covered Deductible/self-insured retention Treatment of allocated loss adjustment expenses (included within or excluded from a self-insured retention) Name of insurance company or captive Name of entity (insurer or third party administrator (TPA) that handles claims) Claim handling fees – Are they a % of loss or are they on a fixed fee per type of claim basis (i. e. $1, 000 for indemnity, $200 for medical only)? Please indicate if the fees are on a “cradle to grave” basis. Name of insurance broker/agent Policy effective and expiration dates Payment plan type (guaranteed cost, retrospectively rates, deductible, etc. ) Certificate holder list Recording of this session via any media type is strictly prohibited. Page 42

Supplemental Data Request (continued) • Schedules or Summaries of Insurance for the last 5 years (2009/2010 through 2013/2014). The summaries should include the following information: • • • • 42 Line of Insurance Type of policy (primary, excess, etc. ) Occurrence vs. claims-made coverage Premium Limits covered Deductible/self-insured retention Treatment of allocated loss adjustment expenses (included within or excluded from a self-insured retention) Name of insurance company or captive Name of entity (insurer or third party administrator (TPA) that handles claims) Claim handling fees – Are they a % of loss or are they on a fixed fee per type of claim basis (i. e. $1, 000 for indemnity, $200 for medical only)? Please indicate if the fees are on a “cradle to grave” basis. Name of insurance broker/agent Policy effective and expiration dates Payment plan type (guaranteed cost, retrospectively rates, deductible, etc. ) Certificate holder list Recording of this session via any media type is strictly prohibited. Page 42

Supplemental Data Request (continued) • Exposure data for workers compensation (payroll), automobile liability (vehicles) and professional liability/general liability (# of visits or sales/revenue). Please indicate whether the amounts have been audited by the insurance carrier or are estimates. Please provide a minimum of the latest 5 policy years (2010 through 2014). • What was the Company’s insurance expense for workers compensation, automobile liability, professional/general liability and all other lines of insurance combined for the calendar periods listed below? Please breakdown the expense into the following categories: (a) retained ultimate loss and allocated loss adjustment expense (ALAE), (b) excess premiums paid to third-party insurance companies, (c) other expenses such as claim handling fees, Letter of Credit (LOC) costs, assessments and surcharges, broker fees, etc. and (d) prior period adjustments (due to re-estimation of prior policy year ultimate losses) Please indicate which prior periods the adjustments relate to. • FY 2012 (1/1/12 -12/31/12) • FY 2013 (1/1/13 -12/31/13) • Last Twelve Months Ending 3/31/14 (4/1/13 -3/31/14) 43 Recording of this session via any media type is strictly prohibited. Page 43

Supplemental Data Request (continued) • Exposure data for workers compensation (payroll), automobile liability (vehicles) and professional liability/general liability (# of visits or sales/revenue). Please indicate whether the amounts have been audited by the insurance carrier or are estimates. Please provide a minimum of the latest 5 policy years (2010 through 2014). • What was the Company’s insurance expense for workers compensation, automobile liability, professional/general liability and all other lines of insurance combined for the calendar periods listed below? Please breakdown the expense into the following categories: (a) retained ultimate loss and allocated loss adjustment expense (ALAE), (b) excess premiums paid to third-party insurance companies, (c) other expenses such as claim handling fees, Letter of Credit (LOC) costs, assessments and surcharges, broker fees, etc. and (d) prior period adjustments (due to re-estimation of prior policy year ultimate losses) Please indicate which prior periods the adjustments relate to. • FY 2012 (1/1/12 -12/31/12) • FY 2013 (1/1/13 -12/31/13) • Last Twelve Months Ending 3/31/14 (4/1/13 -3/31/14) 43 Recording of this session via any media type is strictly prohibited. Page 43

Supplemental Data Request (continued) • List of claims for the past 5 years (10 years for Directors & Officers Liability) greater than $50, 000 on an incurred basis (loss & expense combined) for lines of insurance other than workers compensation, automobile liability and professional/general liability. • Copy of the broker agreement for the current year if the broker is compensated through a fee in lieu of commissions arrangement. • Copy of any third-party administrator (TPA) agreement(s) for the company/insurer that handles the Company’s claims for all lines of insurance. • Description of the Company’s internal risk management/insurance resources and capabilities. 44 Recording of this session via any media type is strictly prohibited. Page 44

Supplemental Data Request (continued) • List of claims for the past 5 years (10 years for Directors & Officers Liability) greater than $50, 000 on an incurred basis (loss & expense combined) for lines of insurance other than workers compensation, automobile liability and professional/general liability. • Copy of the broker agreement for the current year if the broker is compensated through a fee in lieu of commissions arrangement. • Copy of any third-party administrator (TPA) agreement(s) for the company/insurer that handles the Company’s claims for all lines of insurance. • Description of the Company’s internal risk management/insurance resources and capabilities. 44 Recording of this session via any media type is strictly prohibited. Page 44

Bios 45 Recording of this session via any media type is strictly prohibited. Page 45

Bios 45 Recording of this session via any media type is strictly prohibited. Page 45

Roxsann Wilson - Director – Risk Management, Care. Fusion, San Diego, CA Roxsann Wilson, Director of Global Risk Management, Care. Fusion Corporation, a $3. 6 B medical device company headquartered in Southern California. Roxsann lead Care. Fusion through a spin-off, setting up the entire Risk Management department from the ground up. Roxsann also is a member of the ERM Steering Committee, working to address the top risks facing the organization. Prior to joining Care. Fusion in 2008, she was a Risk Manager for a large home and garden company in the Mid-west responsible for claims administration, risk financing and property loss prevention. She began her career working for a large insurance broker. She has a Bachelor’s Degree in Economics and Politics from Ohio Wesleyan University and is currently pursuing her MBA from the University of Michigan. 46 Recording of this session via any media type is strictly prohibited. Page 46

Roxsann Wilson - Director – Risk Management, Care. Fusion, San Diego, CA Roxsann Wilson, Director of Global Risk Management, Care. Fusion Corporation, a $3. 6 B medical device company headquartered in Southern California. Roxsann lead Care. Fusion through a spin-off, setting up the entire Risk Management department from the ground up. Roxsann also is a member of the ERM Steering Committee, working to address the top risks facing the organization. Prior to joining Care. Fusion in 2008, she was a Risk Manager for a large home and garden company in the Mid-west responsible for claims administration, risk financing and property loss prevention. She began her career working for a large insurance broker. She has a Bachelor’s Degree in Economics and Politics from Ohio Wesleyan University and is currently pursuing her MBA from the University of Michigan. 46 Recording of this session via any media type is strictly prohibited. Page 46

Daniel Leff - Specialist Leader, Deloitte Consulting LLP, New York Daniel Leff is a Specialist Leader at Deloitte Consulting LLP. Dan has over 23 years of property & casualty actuarial experience, with over 16 years at Deloitte. His clients have included private equity investors, self-insured entities in the public and private sector, insurance departments, insurance companies, captives and reinsurers. Dan's experience includes the analysis of historical insurance expense charged through a target’s income statement and the analysis of loss reserves for all major personal and commercial lines of insurance. He has worked on due diligence engagements for corporate strategic buyers and private equity clients where the targets were insurance or reinsurance companies or self-insured entities. In addition, Dan has participated on several due diligence assignments where the target had a captive insurance company insuring significant self-insurance exposures of the parent corporation. Dan also is a member of the national Human Capital M&A Leadership team. Prior to joining Deloitte & Touche LLP in July 1997, Mr. Leff had been employed by Insurance Services Office, Inc. (ISO) since August 1990. At ISO, Mr. Leff worked in a variety of areas in the actuarial data management division: Personal Property, Personal Automobile and Commercial Automobile. He was also responsible for developing personal line data products for insurance and reinsurance companies and pricing ad-hoc requests (from various customers) for the statistical data that was reported to ISO. 47 Recording of this session via any media type is strictly prohibited. Page 47

Daniel Leff - Specialist Leader, Deloitte Consulting LLP, New York Daniel Leff is a Specialist Leader at Deloitte Consulting LLP. Dan has over 23 years of property & casualty actuarial experience, with over 16 years at Deloitte. His clients have included private equity investors, self-insured entities in the public and private sector, insurance departments, insurance companies, captives and reinsurers. Dan's experience includes the analysis of historical insurance expense charged through a target’s income statement and the analysis of loss reserves for all major personal and commercial lines of insurance. He has worked on due diligence engagements for corporate strategic buyers and private equity clients where the targets were insurance or reinsurance companies or self-insured entities. In addition, Dan has participated on several due diligence assignments where the target had a captive insurance company insuring significant self-insurance exposures of the parent corporation. Dan also is a member of the national Human Capital M&A Leadership team. Prior to joining Deloitte & Touche LLP in July 1997, Mr. Leff had been employed by Insurance Services Office, Inc. (ISO) since August 1990. At ISO, Mr. Leff worked in a variety of areas in the actuarial data management division: Personal Property, Personal Automobile and Commercial Automobile. He was also responsible for developing personal line data products for insurance and reinsurance companies and pricing ad-hoc requests (from various customers) for the statistical data that was reported to ISO. 47 Recording of this session via any media type is strictly prohibited. Page 47