BMW Mini Presentation.pptx

- Количество слайдов: 34

MINI IN RUSSIA THE CHALLENGE WHAT IS THE BUSINESS OPPORTUNITY FOR A NEW MINI CAR CONCEPT IN RUSSIA WITH WHICH TO ATTRACT A MORE MALE AUDIENCE? 8 MAY 2012 MINI IN RUSSIA 2

MINI IN RUSSIA THE CHALLENGE WHAT IS THE BUSINESS OPPORTUNITY FOR A NEW MINI CAR CONCEPT IN RUSSIA WITH WHICH TO ATTRACT A MORE MALE AUDIENCE? 8 MAY 2012 MINI IN RUSSIA 2

CONTENT START MARKET ANALYSIS SWOT CONCEPT OF PREMIUM BRAND CONCLUSION MINI 2 FINISH 8 MAY 2012 MINI IN RUSSIA 3

CONTENT START MARKET ANALYSIS SWOT CONCEPT OF PREMIUM BRAND CONCLUSION MINI 2 FINISH 8 MAY 2012 MINI IN RUSSIA 3

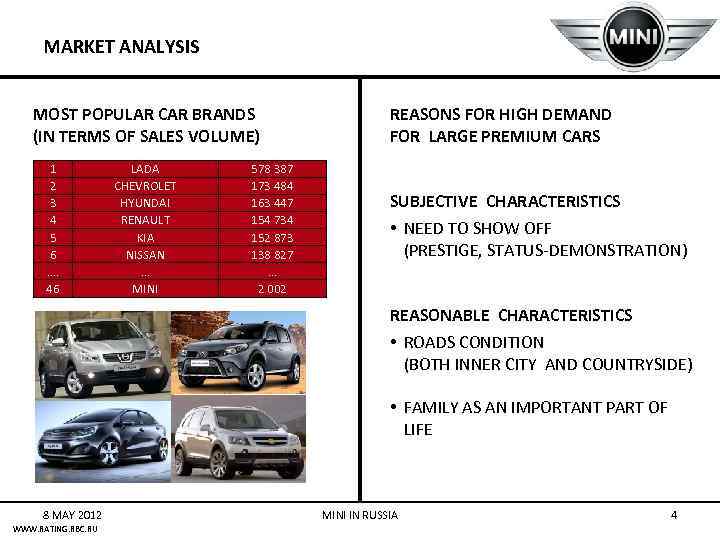

MARKET ANALYSIS MOST POPULAR CAR BRANDS (IN TERMS OF SALES VOLUME) 1 2 3 4 5 6 …. 46 LADA CHEVROLET HYUNDAI RENAULT KIA NISSAN … MINI 578 387 173 484 163 447 154 734 152 873 138 827 … 2 002 REASONS FOR HIGH DEMAND FOR LARGE PREMIUM CARS SUBJECTIVE CHARACTERISTICS • NEED TO SHOW OFF (PRESTIGE, STATUS-DEMONSTRATION) REASONABLE CHARACTERISTICS • ROADS CONDITION (BOTH INNER CITY AND COUNTRYSIDE) • FAMILY AS AN IMPORTANT PART OF LIFE 8 MAY 2012 WWW. RATING. RBC. RU MINI IN RUSSIA 4

MARKET ANALYSIS MOST POPULAR CAR BRANDS (IN TERMS OF SALES VOLUME) 1 2 3 4 5 6 …. 46 LADA CHEVROLET HYUNDAI RENAULT KIA NISSAN … MINI 578 387 173 484 163 447 154 734 152 873 138 827 … 2 002 REASONS FOR HIGH DEMAND FOR LARGE PREMIUM CARS SUBJECTIVE CHARACTERISTICS • NEED TO SHOW OFF (PRESTIGE, STATUS-DEMONSTRATION) REASONABLE CHARACTERISTICS • ROADS CONDITION (BOTH INNER CITY AND COUNTRYSIDE) • FAMILY AS AN IMPORTANT PART OF LIFE 8 MAY 2012 WWW. RATING. RBC. RU MINI IN RUSSIA 4

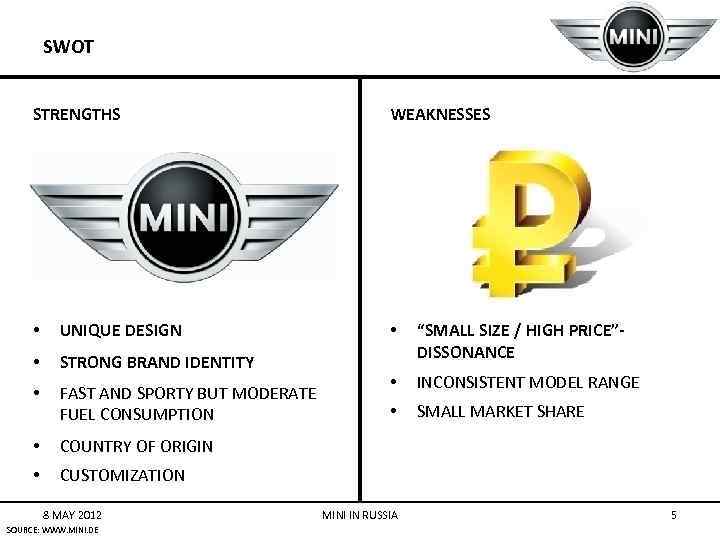

SWOT STRENGTHS • UNIQUE DESIGN • STRONG BRAND IDENTITY • FAST AND SPORTY BUT MODERATE FUEL CONSUMPTION • COUNTRY OF ORIGIN • WEAKNESSES CUSTOMIZATION 8 MAY 2012 SOURCE: WWW. MINI. DE • “SMALL SIZE / HIGH PRICE”- DISSONANCE • INCONSISTENT MODEL RANGE • SMALL MARKET SHARE MINI IN RUSSIA 5

SWOT STRENGTHS • UNIQUE DESIGN • STRONG BRAND IDENTITY • FAST AND SPORTY BUT MODERATE FUEL CONSUMPTION • COUNTRY OF ORIGIN • WEAKNESSES CUSTOMIZATION 8 MAY 2012 SOURCE: WWW. MINI. DE • “SMALL SIZE / HIGH PRICE”- DISSONANCE • INCONSISTENT MODEL RANGE • SMALL MARKET SHARE MINI IN RUSSIA 5

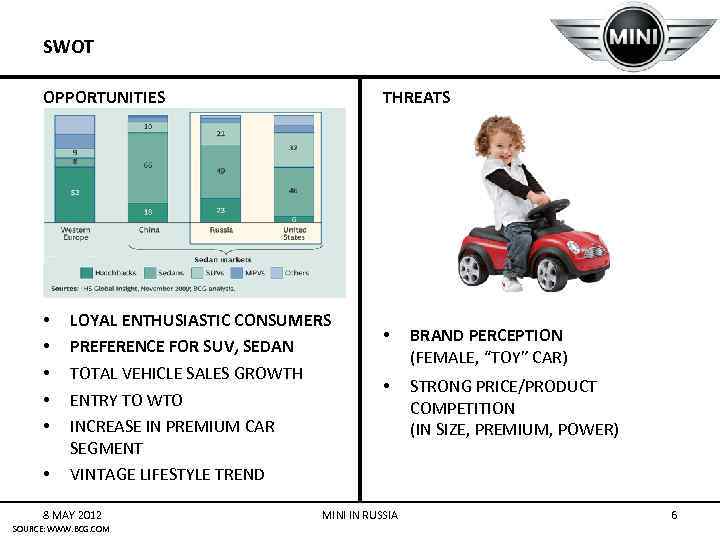

SWOT OPPORTUNITIES • • • THREATS LOYAL ENTHUSIASTIC CONSUMERS PREFERENCE FOR SUV, SEDAN TOTAL VEHICLE SALES GROWTH ENTRY TO WTO INCREASE IN PREMIUM CAR SEGMENT VINTAGE LIFESTYLE TREND 8 MAY 2012 SOURCE: WWW. BCG. COM • BRAND PERCEPTION (FEMALE, “TOY” CAR) • STRONG PRICE/PRODUCT COMPETITION (IN SIZE, PREMIUM, POWER) MINI IN RUSSIA 6

SWOT OPPORTUNITIES • • • THREATS LOYAL ENTHUSIASTIC CONSUMERS PREFERENCE FOR SUV, SEDAN TOTAL VEHICLE SALES GROWTH ENTRY TO WTO INCREASE IN PREMIUM CAR SEGMENT VINTAGE LIFESTYLE TREND 8 MAY 2012 SOURCE: WWW. BCG. COM • BRAND PERCEPTION (FEMALE, “TOY” CAR) • STRONG PRICE/PRODUCT COMPETITION (IN SIZE, PREMIUM, POWER) MINI IN RUSSIA 6

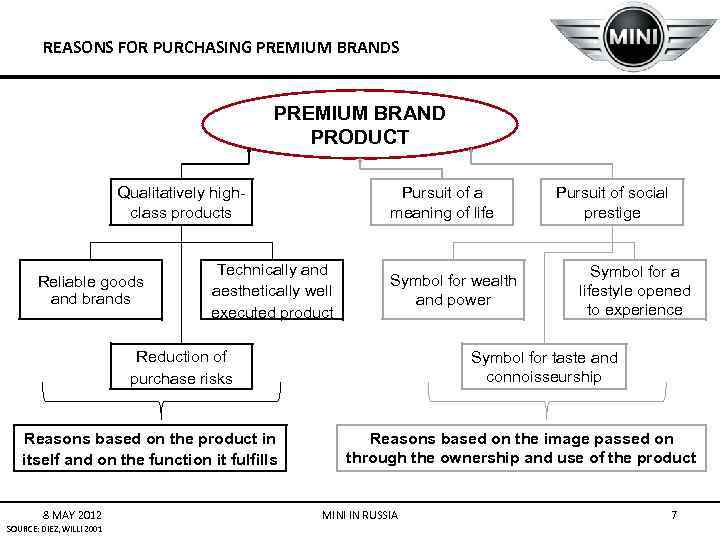

REASONS FOR PURCHASING PREMIUM BRANDS PREMIUM BRAND PRODUCT Qualitatively highclass products Reliable goods and brands Pursuit of a meaning of life Technically and aesthetically well executed product Symbol for wealth and power Reduction of purchase risks Reasons based on the product in itself and on the function it fulfills 8 MAY 2012 SOURCE: DIEZ, WILLI 2001 Pursuit of social prestige Symbol for a lifestyle opened to experience Symbol for taste and connoisseurship Reasons based on the image passed on through the ownership and use of the product MINI IN RUSSIA 7

REASONS FOR PURCHASING PREMIUM BRANDS PREMIUM BRAND PRODUCT Qualitatively highclass products Reliable goods and brands Pursuit of a meaning of life Technically and aesthetically well executed product Symbol for wealth and power Reduction of purchase risks Reasons based on the product in itself and on the function it fulfills 8 MAY 2012 SOURCE: DIEZ, WILLI 2001 Pursuit of social prestige Symbol for a lifestyle opened to experience Symbol for taste and connoisseurship Reasons based on the image passed on through the ownership and use of the product MINI IN RUSSIA 7

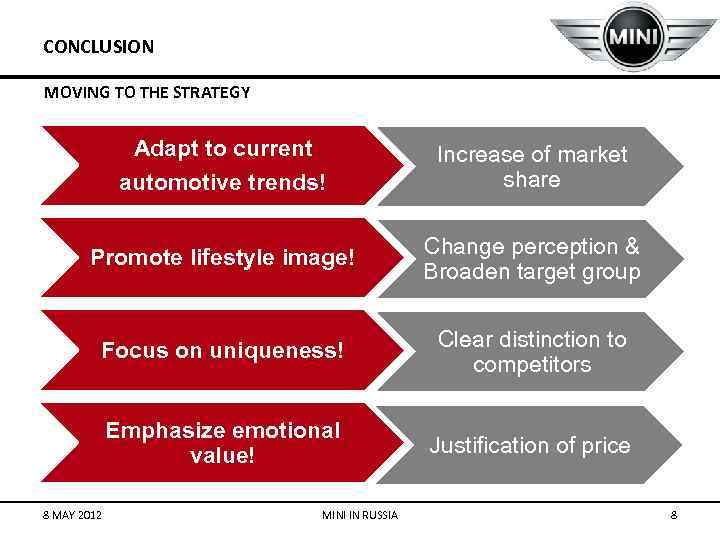

CONCLUSION MOVING TO THE STRATEGY Adapt to current automotive trends! Increase of market share Promote lifestyle image! Change perception & Broaden target group Focus on uniqueness! Clear distinction to competitors Emphasize emotional value! Justification of price 8 MAY 2012 MINI IN RUSSIA 8

CONCLUSION MOVING TO THE STRATEGY Adapt to current automotive trends! Increase of market share Promote lifestyle image! Change perception & Broaden target group Focus on uniqueness! Clear distinction to competitors Emphasize emotional value! Justification of price 8 MAY 2012 MINI IN RUSSIA 8

THE MINI SOLUTION 2 MINI 8 MAY 2012 MINI IN RUSSIA 9

THE MINI SOLUTION 2 MINI 8 MAY 2012 MINI IN RUSSIA 9

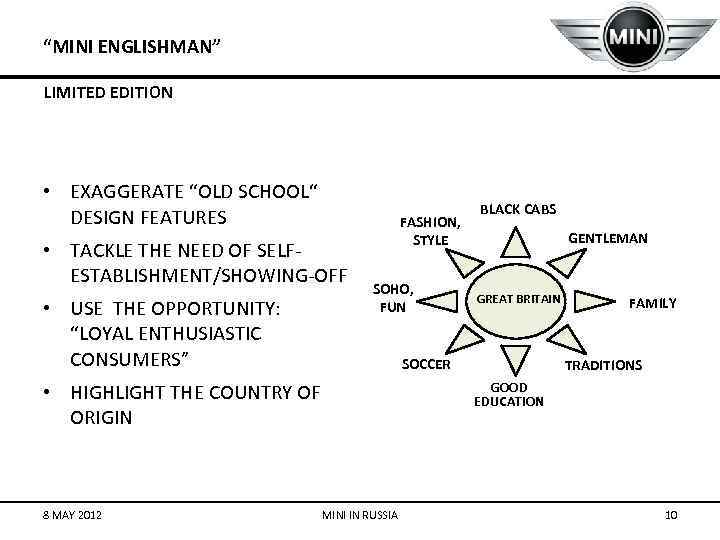

“MINI ENGLISHMAN” LIMITED EDITION • EXAGGERATE “OLD SCHOOL“ DESIGN FEATURES • TACKLE THE NEED OF SELFESTABLISHMENT/SHOWING-OFF • USE THE OPPORTUNITY: “LOYAL ENTHUSIASTIC CONSUMERS” FASHION, STYLE SOHO, FUN GENTLEMAN GREAT BRITAIN SOCCER • HIGHLIGHT THE COUNTRY OF ORIGIN 8 MAY 2012 BLACK CABS MINI IN RUSSIA FAMILY TRADITIONS GOOD EDUCATION 10

“MINI ENGLISHMAN” LIMITED EDITION • EXAGGERATE “OLD SCHOOL“ DESIGN FEATURES • TACKLE THE NEED OF SELFESTABLISHMENT/SHOWING-OFF • USE THE OPPORTUNITY: “LOYAL ENTHUSIASTIC CONSUMERS” FASHION, STYLE SOHO, FUN GENTLEMAN GREAT BRITAIN SOCCER • HIGHLIGHT THE COUNTRY OF ORIGIN 8 MAY 2012 BLACK CABS MINI IN RUSSIA FAMILY TRADITIONS GOOD EDUCATION 10

“MINI ENGLISHMAN” 11 8 MAY 2012 MINI IN RUSSIA

“MINI ENGLISHMAN” 11 8 MAY 2012 MINI IN RUSSIA

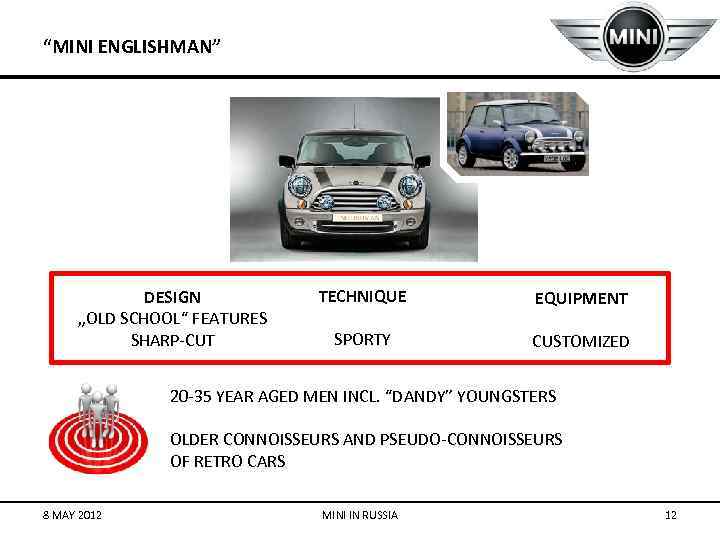

“MINI ENGLISHMAN” DESIGN „OLD SCHOOL“ FEATURES SHARP-CUT TECHNIQUE EQUIPMENT SPORTY CUSTOMIZED 20 -35 YEAR AGED MEN INCL. “DANDY” YOUNGSTERS OLDER CONNOISSEURS AND PSEUDO-CONNOISSEURS OF RETRO CARS 8 MAY 2012 MINI IN RUSSIA 12

“MINI ENGLISHMAN” DESIGN „OLD SCHOOL“ FEATURES SHARP-CUT TECHNIQUE EQUIPMENT SPORTY CUSTOMIZED 20 -35 YEAR AGED MEN INCL. “DANDY” YOUNGSTERS OLDER CONNOISSEURS AND PSEUDO-CONNOISSEURS OF RETRO CARS 8 MAY 2012 MINI IN RUSSIA 12

“MINI ENGLISHMAN” PROMOTION MINI “ENGLISHMAN” COMMUNITY (ANNUAL FEE INCLUDED INTO THE CAR PRICE): • • SPECIAL EVENTS (RACES FOR IN-GROUPS, GOLF DAYS, SOCCER OUTINGS ETC. ) AUTO CLUB (SERVICES CENTER, “A 24”) ADVANTAGES OF THE PROMOTION: • • SELL A SENSE OF BELONGING TO A CERTAIN CLUB CREATE A BUZZ (GRAPEVINE PROMOTION) VIRAL MARKETING EFFECT THROUGH INTERNET BLOGS (TIMEOUT, THE VILLAGE) EMPHASIS ON HISTORY OF MINI 8 MAY 2012 MINI IN RUSSIA 13

“MINI ENGLISHMAN” PROMOTION MINI “ENGLISHMAN” COMMUNITY (ANNUAL FEE INCLUDED INTO THE CAR PRICE): • • SPECIAL EVENTS (RACES FOR IN-GROUPS, GOLF DAYS, SOCCER OUTINGS ETC. ) AUTO CLUB (SERVICES CENTER, “A 24”) ADVANTAGES OF THE PROMOTION: • • SELL A SENSE OF BELONGING TO A CERTAIN CLUB CREATE A BUZZ (GRAPEVINE PROMOTION) VIRAL MARKETING EFFECT THROUGH INTERNET BLOGS (TIMEOUT, THE VILLAGE) EMPHASIS ON HISTORY OF MINI 8 MAY 2012 MINI IN RUSSIA 13

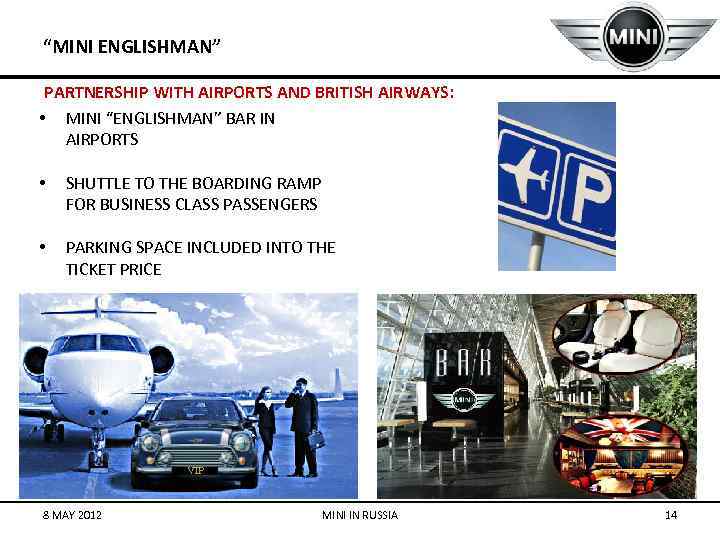

“MINI ENGLISHMAN” PARTNERSHIP WITH AIRPORTS AND BRITISH AIRWAYS: • MINI “ENGLISHMAN” BAR IN AIRPORTS • SHUTTLE TO THE BOARDING RAMP FOR BUSINESS CLASS PASSENGERS • PARKING SPACE INCLUDED INTO THE TICKET PRICE 8 MAY 2012 MINI IN RUSSIA 14

“MINI ENGLISHMAN” PARTNERSHIP WITH AIRPORTS AND BRITISH AIRWAYS: • MINI “ENGLISHMAN” BAR IN AIRPORTS • SHUTTLE TO THE BOARDING RAMP FOR BUSINESS CLASS PASSENGERS • PARKING SPACE INCLUDED INTO THE TICKET PRICE 8 MAY 2012 MINI IN RUSSIA 14

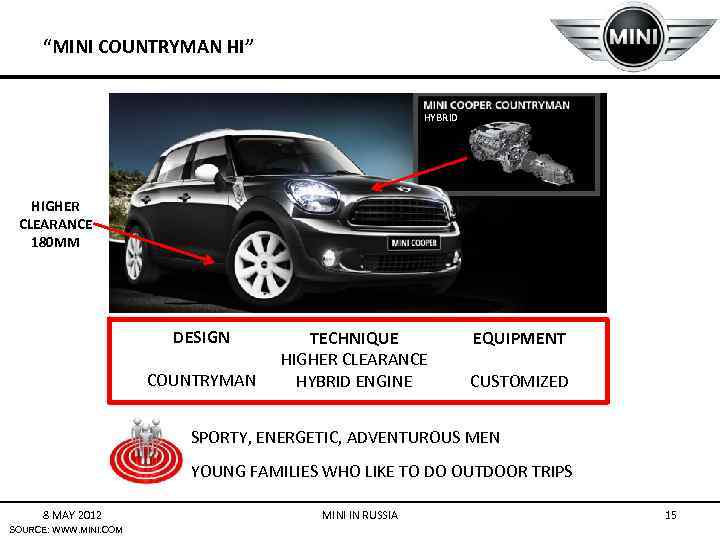

“MINI COUNTRYMAN HI” HYBRID HIGHER CLEARANCE 180 MM DESIGN COUNTRYMAN TECHNIQUE HIGHER CLEARANCE HYBRID ENGINE EQUIPMENT CUSTOMIZED SPORTY, ENERGETIC, ADVENTUROUS MEN YOUNG FAMILIES WHO LIKE TO DO OUTDOOR TRIPS 8 MAY 2012 SOURCE: WWW. MINI. COM MINI IN RUSSIA 15

“MINI COUNTRYMAN HI” HYBRID HIGHER CLEARANCE 180 MM DESIGN COUNTRYMAN TECHNIQUE HIGHER CLEARANCE HYBRID ENGINE EQUIPMENT CUSTOMIZED SPORTY, ENERGETIC, ADVENTUROUS MEN YOUNG FAMILIES WHO LIKE TO DO OUTDOOR TRIPS 8 MAY 2012 SOURCE: WWW. MINI. COM MINI IN RUSSIA 15

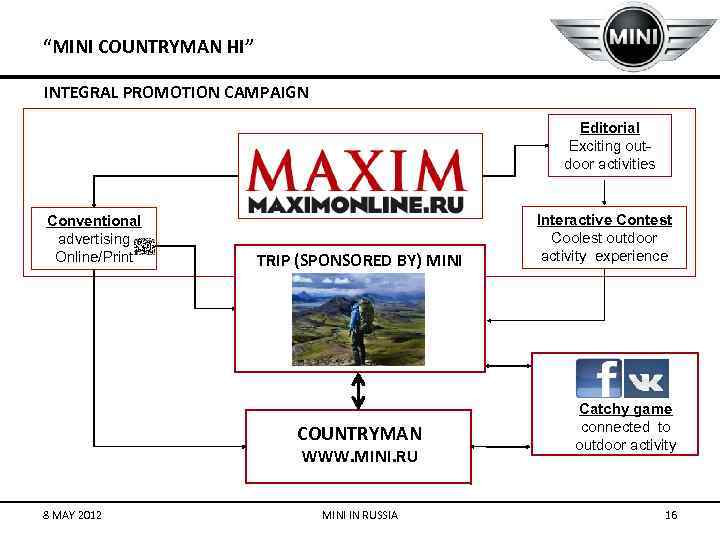

“MINI COUNTRYMAN HI” INTEGRAL PROMOTION CAMPAIGN Editorial Exciting outdoor activities Conventional advertising Online/Print TRIP (SPONSORED BY) MINI COUNTRYMAN WWW. MINI. RU 8 MAY 2012 MINI IN RUSSIA Interactive Contest Coolest outdoor activity experience Catchy game connected to outdoor activity 16

“MINI COUNTRYMAN HI” INTEGRAL PROMOTION CAMPAIGN Editorial Exciting outdoor activities Conventional advertising Online/Print TRIP (SPONSORED BY) MINI COUNTRYMAN WWW. MINI. RU 8 MAY 2012 MINI IN RUSSIA Interactive Contest Coolest outdoor activity experience Catchy game connected to outdoor activity 16

“MINI COUNTRYMAN HI” INTEGRAL PROMOTION CAMPAIGN POSSIBLE SPECIAL EVENTS TO CONNECT PROMOTION WITH COOPERATION/ SPONSORING THEME VIP LOUNGES CAMPAIGNS CONTESTS ON-SITE PROMOTION 8 MAY 2012 MINI IN RUSSIA 17

“MINI COUNTRYMAN HI” INTEGRAL PROMOTION CAMPAIGN POSSIBLE SPECIAL EVENTS TO CONNECT PROMOTION WITH COOPERATION/ SPONSORING THEME VIP LOUNGES CAMPAIGNS CONTESTS ON-SITE PROMOTION 8 MAY 2012 MINI IN RUSSIA 17

BE MINI ENGLISHMAN MINI COUNTRYMAN HI HYBRID EXCITEMENT “LIKE A FRIEND” INVENTIVE ENERGETIC IRRESISTIBLE UNIQUENESS BACK TO “OLD SCHOOL” FAN CLUB DESIGN UNIQUE 8 MAY 2012 TECHNIQUE HIGH QUALITY MINI IN RUSSIA EQUIPMENT CUSTOMIZED 18

BE MINI ENGLISHMAN MINI COUNTRYMAN HI HYBRID EXCITEMENT “LIKE A FRIEND” INVENTIVE ENERGETIC IRRESISTIBLE UNIQUENESS BACK TO “OLD SCHOOL” FAN CLUB DESIGN UNIQUE 8 MAY 2012 TECHNIQUE HIGH QUALITY MINI IN RUSSIA EQUIPMENT CUSTOMIZED 18

THANK YOU. BE MINI. FINEC ANNA KOSALIMOVA MARIA KRASIKOVA ANGELINA MERKULOVA UNI HAMBURG LARA AHLERT JITKA BRAUNOVA CHRISTINA SANDJAJA 8 MAY 2012 MINI IN RUSSIA 19

THANK YOU. BE MINI. FINEC ANNA KOSALIMOVA MARIA KRASIKOVA ANGELINA MERKULOVA UNI HAMBURG LARA AHLERT JITKA BRAUNOVA CHRISTINA SANDJAJA 8 MAY 2012 MINI IN RUSSIA 19

SOURCES webmis. manserv. com Must af a Çamlıca, Ernst & Young Türkiye: Automotive Outlook and Trends in CEE, Russia and Turkey, 2010 www. businessmonitor. com: Russia Infrastructure Report Q 2 2012 Germany Autos Report Q 2 2012 Russia Autos Report Q 2 2012 EYGM Limited: An overview of the Russian and CIS automotive industry, 2012 Sources available at Pro. Quest Central database (April 2012): Federal Information & News Dispatch, Inc. : U. S. Automotive Parts and Components Business Development Mission to Russia : Federal Register, 2011 Information Agency F. C. Novosti: Russia's automotive industry ups production 44% in January-November y-o-y, 2011 FDCH/e. Media: Interview with Ian Robertson, Head Of Sales, BMW, 2011 Interfax-America, Inc. : COMPANIES & MARKETS; Russia could be. Europe's biggest automobile market in 5 yrs – Putin, 2011 Bursa, Mark: just-auto's Central and Eastern Europe automotive industry review: 2005 Management briefing: Russia - is the giant finally waking? , 2005 The Economist Intelligence Unit: Country Forecast Russia July 2011 Neil, Dan: OFF DUTY --- Gear & Gadgets -- Rumble Seat: What Part of 'Mini' Did You Not Grasp, BMW? 8 MAY 2012 MINI IN RUSSIA 20

SOURCES webmis. manserv. com Must af a Çamlıca, Ernst & Young Türkiye: Automotive Outlook and Trends in CEE, Russia and Turkey, 2010 www. businessmonitor. com: Russia Infrastructure Report Q 2 2012 Germany Autos Report Q 2 2012 Russia Autos Report Q 2 2012 EYGM Limited: An overview of the Russian and CIS automotive industry, 2012 Sources available at Pro. Quest Central database (April 2012): Federal Information & News Dispatch, Inc. : U. S. Automotive Parts and Components Business Development Mission to Russia : Federal Register, 2011 Information Agency F. C. Novosti: Russia's automotive industry ups production 44% in January-November y-o-y, 2011 FDCH/e. Media: Interview with Ian Robertson, Head Of Sales, BMW, 2011 Interfax-America, Inc. : COMPANIES & MARKETS; Russia could be. Europe's biggest automobile market in 5 yrs – Putin, 2011 Bursa, Mark: just-auto's Central and Eastern Europe automotive industry review: 2005 Management briefing: Russia - is the giant finally waking? , 2005 The Economist Intelligence Unit: Country Forecast Russia July 2011 Neil, Dan: OFF DUTY --- Gear & Gadgets -- Rumble Seat: What Part of 'Mini' Did You Not Grasp, BMW? 8 MAY 2012 MINI IN RUSSIA 20

SOURCES eng. autostat. ru/news/view/6350/ rating. rbc. ru/articles/2012/01/22/33539257_tbl. shtml? 2012/01/22/33539253 top. rbc. ru/economics/30/03/2011/568419. shtml www. a 24. ru/ www. abiz. ru www. autobild. de: der auto bild tüv-report 2012 www. autonews. com: without china, bric markets become brikt, 2011 www. britishairways. com/travel/home/public/en_ru www. carexpert. ru/m_search. php? mark=nissan&model=&cartype=new&page=7 www. domodedovo. ru/ru/main/way/parking/6/ www. kia. ru/models/soul/options/ www. mini. com www. mini-avangard. ru/cars/pricelist. html www. napinfo. ru: foreign car market trends, 2011 www. nissan. ru/? cid=psbrandsru_rubrdomdlocrupsg. . , purchase-guideresult? p=c 2 vszwn 0 zwrpdgvtcz 0 xjtjdmiuyqzqlmkm 2 jtjdnyuyqzklmkmxmsuyqze 1 jtjdmtcmdxjszgf 0 yt 0 lmkzsvsuyrnj 1 jtjgdmvoawnszxmlmkzjcm 9 zc 292 zxjzjtjganvrzsuyrnbyawnpbmclmkrhbmqlmkrzcgvja wzpy 2 f 0 aw 9 ucyuyrnb 1 cmnoyxnljtjez 3 vpzgulmkzyzxn 1 bhrzjtjfjtjedmlld 3 htbcuyrxhtba== www. peugeot. ru/showroom/3008/crossover/ www. press. bmwgroup. com/pressclub/p/de/startpage. htm www. pulkovoairport. ru/transportation/parking/ www. rating. rbc. ru www. volkswagen. ru/ru/models/golf_plus/features. html 8 MAY 2012 MINI IN RUSSIA 21

SOURCES eng. autostat. ru/news/view/6350/ rating. rbc. ru/articles/2012/01/22/33539257_tbl. shtml? 2012/01/22/33539253 top. rbc. ru/economics/30/03/2011/568419. shtml www. a 24. ru/ www. abiz. ru www. autobild. de: der auto bild tüv-report 2012 www. autonews. com: without china, bric markets become brikt, 2011 www. britishairways. com/travel/home/public/en_ru www. carexpert. ru/m_search. php? mark=nissan&model=&cartype=new&page=7 www. domodedovo. ru/ru/main/way/parking/6/ www. kia. ru/models/soul/options/ www. mini. com www. mini-avangard. ru/cars/pricelist. html www. napinfo. ru: foreign car market trends, 2011 www. nissan. ru/? cid=psbrandsru_rubrdomdlocrupsg. . , purchase-guideresult? p=c 2 vszwn 0 zwrpdgvtcz 0 xjtjdmiuyqzqlmkm 2 jtjdnyuyqzklmkmxmsuyqze 1 jtjdmtcmdxjszgf 0 yt 0 lmkzsvsuyrnj 1 jtjgdmvoawnszxmlmkzjcm 9 zc 292 zxjzjtjganvrzsuyrnbyawnpbmclmkrhbmqlmkrzcgvja wzpy 2 f 0 aw 9 ucyuyrnb 1 cmnoyxnljtjez 3 vpzgulmkzyzxn 1 bhrzjtjfjtjedmlld 3 htbcuyrxhtba== www. peugeot. ru/showroom/3008/crossover/ www. press. bmwgroup. com/pressclub/p/de/startpage. htm www. pulkovoairport. ru/transportation/parking/ www. rating. rbc. ru www. volkswagen. ru/ru/models/golf_plus/features. html 8 MAY 2012 MINI IN RUSSIA 21

BACK UP 8 MAY 2012 MINI IN RUSSIA 22

BACK UP 8 MAY 2012 MINI IN RUSSIA 22

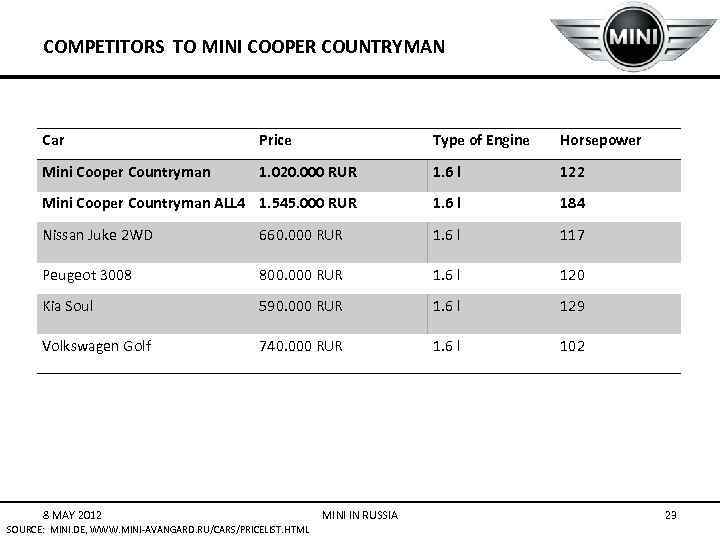

COMPETITORS TO MINI COOPER COUNTRYMAN Car Price Type of Engine Horsepower Mini Cooper Countryman 1. 020. 000 RUR 1. 6 l 122 Mini Cooper Countryman ALL 4 1. 545. 000 RUR 1. 6 l 184 Nissan Juke 2 WD 660. 000 RUR 1. 6 l 117 Peugeot 3008 800. 000 RUR 1. 6 l 120 Kia Soul 590. 000 RUR 1. 6 l 129 Volkswagen Golf 740. 000 RUR 1. 6 l 102 8 MAY 2012 SOURCE: MINI. DE, WWW. MINI-AVANGARD. RU/CARS/PRICELIST. HTML MINI IN RUSSIA 23

COMPETITORS TO MINI COOPER COUNTRYMAN Car Price Type of Engine Horsepower Mini Cooper Countryman 1. 020. 000 RUR 1. 6 l 122 Mini Cooper Countryman ALL 4 1. 545. 000 RUR 1. 6 l 184 Nissan Juke 2 WD 660. 000 RUR 1. 6 l 117 Peugeot 3008 800. 000 RUR 1. 6 l 120 Kia Soul 590. 000 RUR 1. 6 l 129 Volkswagen Golf 740. 000 RUR 1. 6 l 102 8 MAY 2012 SOURCE: MINI. DE, WWW. MINI-AVANGARD. RU/CARS/PRICELIST. HTML MINI IN RUSSIA 23

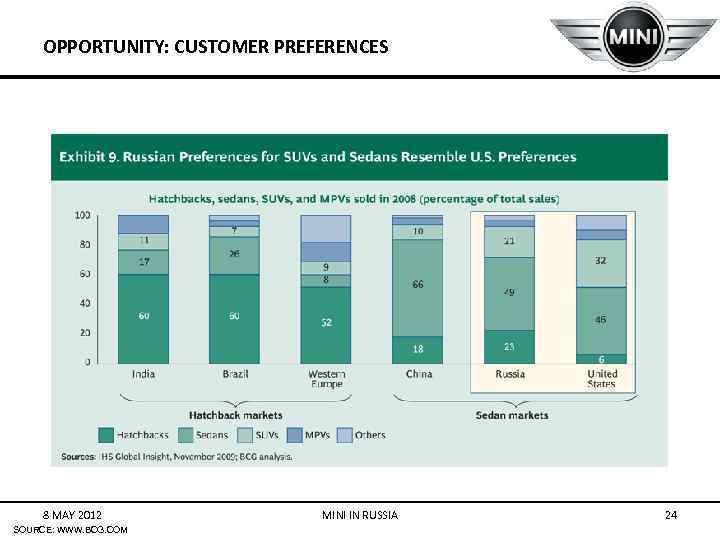

OPPORTUNITY: CUSTOMER PREFERENCES 8 MAY 2012 SOURCE: WWW. BCG. COM MINI IN RUSSIA 24

OPPORTUNITY: CUSTOMER PREFERENCES 8 MAY 2012 SOURCE: WWW. BCG. COM MINI IN RUSSIA 24

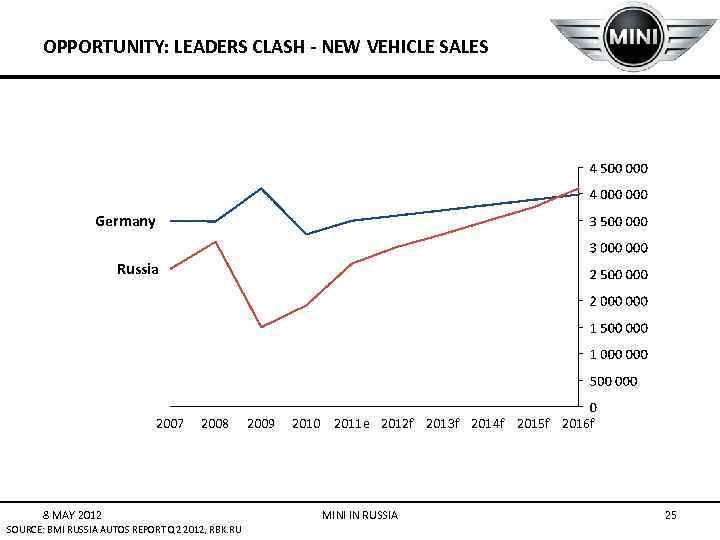

OPPORTUNITY: LEADERS CLASH - NEW VEHICLE SALES Germany Russia 2007 2008 8 MAY 2012 SOURCE: BMI RUSSIA AUTOS REPORT Q 2 2012, RBK. RU 2009 2010 2011 e 2012 f 2013 f 2014 f 2015 f 2016 f MINI IN RUSSIA 25

OPPORTUNITY: LEADERS CLASH - NEW VEHICLE SALES Germany Russia 2007 2008 8 MAY 2012 SOURCE: BMI RUSSIA AUTOS REPORT Q 2 2012, RBK. RU 2009 2010 2011 e 2012 f 2013 f 2014 f 2015 f 2016 f MINI IN RUSSIA 25

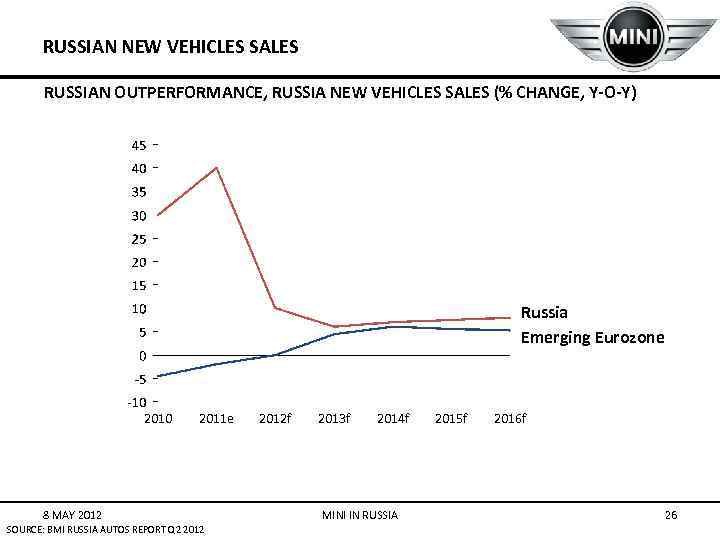

RUSSIAN NEW VEHICLES SALES RUSSIAN OUTPERFORMANCE, RUSSIA NEW VEHICLES SALES (% CHANGE, Y-O-Y) Russia Emerging Eurozone 2010 2011 e 8 MAY 2012 SOURCE: BMI RUSSIA AUTOS REPORT Q 2 2012 f 2013 f 2014 f MINI IN RUSSIA 2015 f 2016 f 26

RUSSIAN NEW VEHICLES SALES RUSSIAN OUTPERFORMANCE, RUSSIA NEW VEHICLES SALES (% CHANGE, Y-O-Y) Russia Emerging Eurozone 2010 2011 e 8 MAY 2012 SOURCE: BMI RUSSIA AUTOS REPORT Q 2 2012 f 2013 f 2014 f MINI IN RUSSIA 2015 f 2016 f 26

RUSSIA - AUTOS INDUSTRY SWOT Strengths • Low car ownership levels reflect untapped potential for growth. • Rising incomes are likely to raise demand for more expensive foreign-branded vehicles. • The autos market is among the biggest in Europe. Weaknesses • A risky business environment acts as a deterrent to would-be foreign investors. • Government aid strongly targeted at domestic manufacturers. • Scrappage scheme may be propping up sales. When program expires, sales may suffer. • Local production is fairly outdated. Opportunities • An influx of foreign manufacturers creates opportunities for JVs and technology sharing with national companies. • Increased vehicle production is likely to attract component manufacturers. • There is significant scope for demand growth from rural areas where ownership rates are much lower than in urban areas. • WTO membership and the subsequent reduction in import tariffs, making vehicles more affordable. Threats • Domestic brands may face tougher competition from foreign brands following WTO membership. • Other countries in the commonwealth of independent states (CIS) are developing their production potential as a way to gain easy access to the Russian market. This limit prospects of production growth in the country. • Protectionist measures to protect domestic industry may deter investment. 8 MAY 2012 SOURCE: BMI RUSSIA AUTOS REPORT Q 2 2012 MINI IN RUSSIA 27

RUSSIA - AUTOS INDUSTRY SWOT Strengths • Low car ownership levels reflect untapped potential for growth. • Rising incomes are likely to raise demand for more expensive foreign-branded vehicles. • The autos market is among the biggest in Europe. Weaknesses • A risky business environment acts as a deterrent to would-be foreign investors. • Government aid strongly targeted at domestic manufacturers. • Scrappage scheme may be propping up sales. When program expires, sales may suffer. • Local production is fairly outdated. Opportunities • An influx of foreign manufacturers creates opportunities for JVs and technology sharing with national companies. • Increased vehicle production is likely to attract component manufacturers. • There is significant scope for demand growth from rural areas where ownership rates are much lower than in urban areas. • WTO membership and the subsequent reduction in import tariffs, making vehicles more affordable. Threats • Domestic brands may face tougher competition from foreign brands following WTO membership. • Other countries in the commonwealth of independent states (CIS) are developing their production potential as a way to gain easy access to the Russian market. This limit prospects of production growth in the country. • Protectionist measures to protect domestic industry may deter investment. 8 MAY 2012 SOURCE: BMI RUSSIA AUTOS REPORT Q 2 2012 MINI IN RUSSIA 27

RUSSIA - POLITICAL SWOT Strengths • The Russian government maintains a strong parliamentary majority and overwhelming public support. Weaknesses • A lack of transparency in decision making, including high levels of behind-the-scenes activity by various power groups, makes for a large element of unpredictability in domestic politics over the long run. • The high degree of political authority in the executive poses a risk to further institutional development in the legislative and judicial sectors. Opportunities • President Dmitry Medvedev has expressed a more compromising tone on foreign policy matters and has suggested a new emphasis on the development of civil society. • Prospective WTO accession, though yet to be confirmed, will increase the incentive for the authorities to implement stricter regulatory standards and improve transparency. Threats • Russia's moves to increase its regional dominance in the energy sector risk a further deterioration in relations with the Western-leaning countries of the 'near abroad'. 8 MAY 2012 SOURCE: BMI RUSSIA AUTOS REPORT Q 2 2012 MINI IN RUSSIA 28

RUSSIA - POLITICAL SWOT Strengths • The Russian government maintains a strong parliamentary majority and overwhelming public support. Weaknesses • A lack of transparency in decision making, including high levels of behind-the-scenes activity by various power groups, makes for a large element of unpredictability in domestic politics over the long run. • The high degree of political authority in the executive poses a risk to further institutional development in the legislative and judicial sectors. Opportunities • President Dmitry Medvedev has expressed a more compromising tone on foreign policy matters and has suggested a new emphasis on the development of civil society. • Prospective WTO accession, though yet to be confirmed, will increase the incentive for the authorities to implement stricter regulatory standards and improve transparency. Threats • Russia's moves to increase its regional dominance in the energy sector risk a further deterioration in relations with the Western-leaning countries of the 'near abroad'. 8 MAY 2012 SOURCE: BMI RUSSIA AUTOS REPORT Q 2 2012 MINI IN RUSSIA 28

RUSSIA - ECONOMIC SWOT Strengths • Russia maintains enviable external account dynamics, with a robust current account surplus, limited foreign debt and high reserve holdings. This will continue to provide significant stability as the economy recovers from the financial crisis. • Russia's large resource base will provide a strong foundation foreign investments and export growth over the long term. Weaknesses • The economy's dependence on the oil sector makes it particularly vulnerable to a sustained decline in energy prices. • The deterioration of Soviet-era infrastructure is a constraint to private sector activity, especially outside major cities. Opportunities • A revitalization of the structural reform agenda, including support for small and medium-sized businesses, restructuring of the banking sector, administrative reform to tackle red tape and corruption, and a revamp of the 'natural monopolies', would go a long way towards developing the non-oil economy and improving long-term growth prospects. • A US$1 trn public-private investment plan over the long term will substantially modernize Russia's transport, communications, electricity and utilities infrastructure. Threats • The Russian economy is in a state of transition, with large current account and fiscal surpluses to be eroded significantly. With this will come new challenges to macroeconomic stability. 8 MAY 2012 SOURCE: BMI RUSSIA AUTOS REPORT Q 2 2012 MINI IN RUSSIA 29

RUSSIA - ECONOMIC SWOT Strengths • Russia maintains enviable external account dynamics, with a robust current account surplus, limited foreign debt and high reserve holdings. This will continue to provide significant stability as the economy recovers from the financial crisis. • Russia's large resource base will provide a strong foundation foreign investments and export growth over the long term. Weaknesses • The economy's dependence on the oil sector makes it particularly vulnerable to a sustained decline in energy prices. • The deterioration of Soviet-era infrastructure is a constraint to private sector activity, especially outside major cities. Opportunities • A revitalization of the structural reform agenda, including support for small and medium-sized businesses, restructuring of the banking sector, administrative reform to tackle red tape and corruption, and a revamp of the 'natural monopolies', would go a long way towards developing the non-oil economy and improving long-term growth prospects. • A US$1 trn public-private investment plan over the long term will substantially modernize Russia's transport, communications, electricity and utilities infrastructure. Threats • The Russian economy is in a state of transition, with large current account and fiscal surpluses to be eroded significantly. With this will come new challenges to macroeconomic stability. 8 MAY 2012 SOURCE: BMI RUSSIA AUTOS REPORT Q 2 2012 MINI IN RUSSIA 29

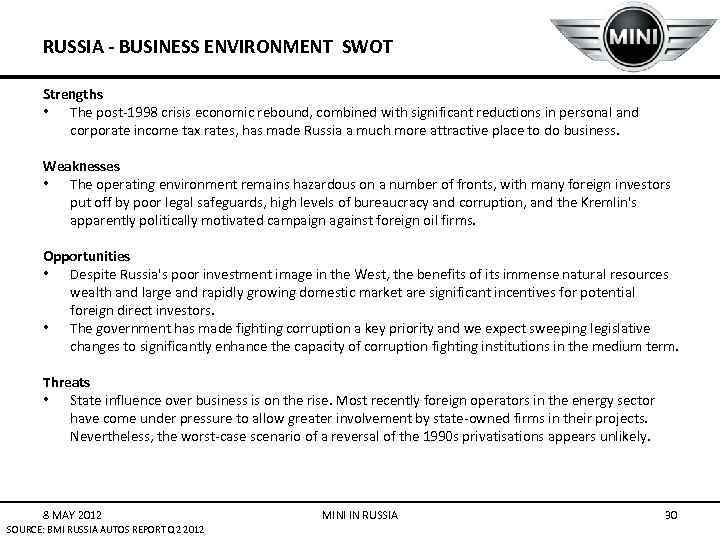

RUSSIA - BUSINESS ENVIRONMENT SWOT Strengths • The post-1998 crisis economic rebound, combined with significant reductions in personal and corporate income tax rates, has made Russia a much more attractive place to do business. Weaknesses • The operating environment remains hazardous on a number of fronts, with many foreign investors put off by poor legal safeguards, high levels of bureaucracy and corruption, and the Kremlin's apparently politically motivated campaign against foreign oil firms. Opportunities • Despite Russia's poor investment image in the West, the benefits of its immense natural resources wealth and large and rapidly growing domestic market are significant incentives for potential foreign direct investors. • The government has made fighting corruption a key priority and we expect sweeping legislative changes to significantly enhance the capacity of corruption fighting institutions in the medium term. Threats • State influence over business is on the rise. Most recently foreign operators in the energy sector have come under pressure to allow greater involvement by state-owned firms in their projects. Nevertheless, the worst-case scenario of a reversal of the 1990 s privatisations appears unlikely. 8 MAY 2012 SOURCE: BMI RUSSIA AUTOS REPORT Q 2 2012 MINI IN RUSSIA 30

RUSSIA - BUSINESS ENVIRONMENT SWOT Strengths • The post-1998 crisis economic rebound, combined with significant reductions in personal and corporate income tax rates, has made Russia a much more attractive place to do business. Weaknesses • The operating environment remains hazardous on a number of fronts, with many foreign investors put off by poor legal safeguards, high levels of bureaucracy and corruption, and the Kremlin's apparently politically motivated campaign against foreign oil firms. Opportunities • Despite Russia's poor investment image in the West, the benefits of its immense natural resources wealth and large and rapidly growing domestic market are significant incentives for potential foreign direct investors. • The government has made fighting corruption a key priority and we expect sweeping legislative changes to significantly enhance the capacity of corruption fighting institutions in the medium term. Threats • State influence over business is on the rise. Most recently foreign operators in the energy sector have come under pressure to allow greater involvement by state-owned firms in their projects. Nevertheless, the worst-case scenario of a reversal of the 1990 s privatisations appears unlikely. 8 MAY 2012 SOURCE: BMI RUSSIA AUTOS REPORT Q 2 2012 MINI IN RUSSIA 30

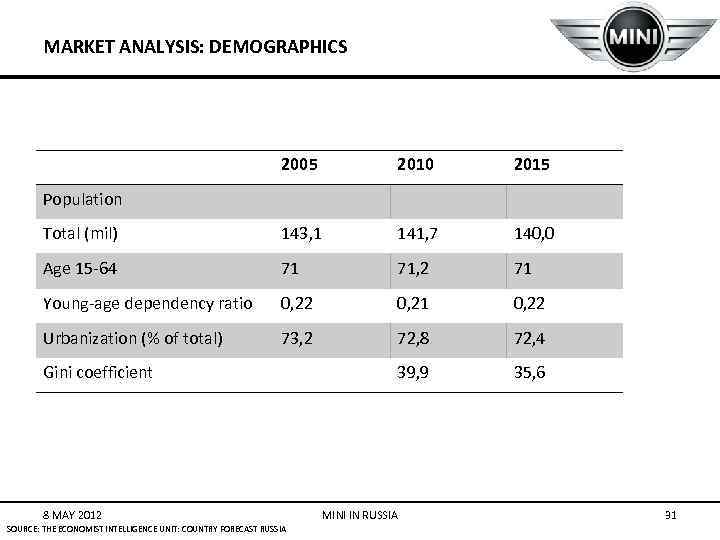

MARKET ANALYSIS: DEMOGRAPHICS 2005 2010 2015 Total (mil) 143, 1 141, 7 140, 0 Age 15 -64 71 71, 2 71 Young-age dependency ratio 0, 22 0, 21 0, 22 Urbanization (% of total) 73, 2 72, 8 72, 4 39, 9 35, 6 Population Gini coefficient 8 MAY 2012 SOURCE: THE ECONOMIST INTELLIGENCE UNIT: COUNTRY FORECAST RUSSIA MINI IN RUSSIA 31

MARKET ANALYSIS: DEMOGRAPHICS 2005 2010 2015 Total (mil) 143, 1 141, 7 140, 0 Age 15 -64 71 71, 2 71 Young-age dependency ratio 0, 22 0, 21 0, 22 Urbanization (% of total) 73, 2 72, 8 72, 4 39, 9 35, 6 Population Gini coefficient 8 MAY 2012 SOURCE: THE ECONOMIST INTELLIGENCE UNIT: COUNTRY FORECAST RUSSIA MINI IN RUSSIA 31

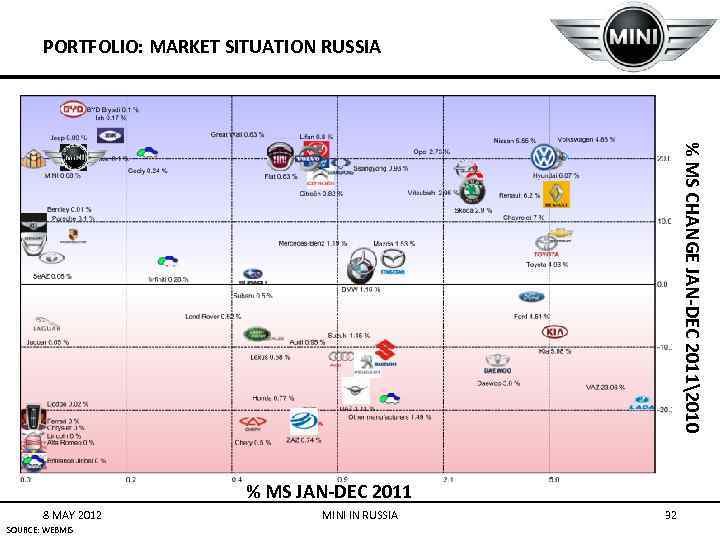

PORTFOLIO: MARKET SITUATION RUSSIA % MS CHANGE JAN-DEC 20112010 % MS JAN-DEC 2011 8 MAY 2012 SOURCE: WEBMIS MINI IN RUSSIA 32

PORTFOLIO: MARKET SITUATION RUSSIA % MS CHANGE JAN-DEC 20112010 % MS JAN-DEC 2011 8 MAY 2012 SOURCE: WEBMIS MINI IN RUSSIA 32

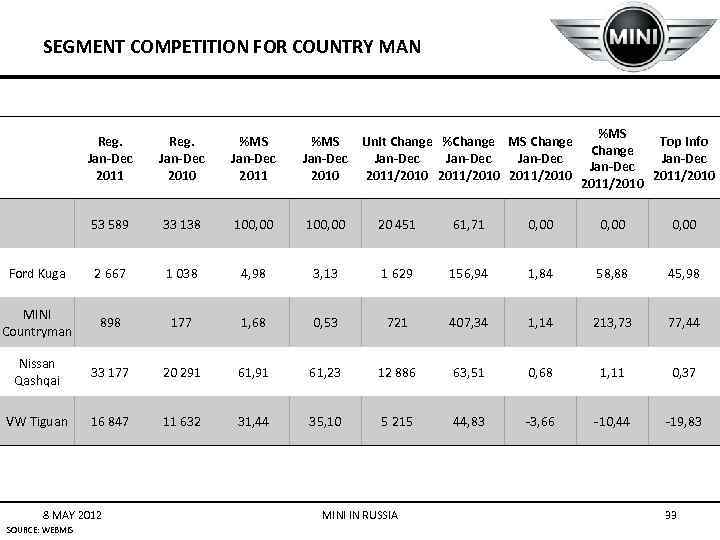

SEGMENT COMPETITION FOR COUNTRY MAN %MS Top Info Change Jan-Dec 2011/2010 Reg. Jan-Dec 2011 Reg. Jan-Dec 2010 %MS Jan-Dec 2011 %MS Unit Change %Change MS Change Jan-Dec 2010 2011/2010 53 589 33 138 100, 00 20 451 61, 71 0, 00 Ford Kuga 2 667 1 038 4, 98 3, 13 1 629 156, 94 1, 84 58, 88 45, 98 MINI Countryman 898 177 1, 68 0, 53 721 407, 34 1, 14 213, 73 77, 44 Nissan Qashqai 33 177 20 291 61, 23 12 886 63, 51 0, 68 1, 11 0, 37 VW Tiguan 16 847 11 632 31, 44 35, 10 5 215 44, 83 -3, 66 -10, 44 -19, 83 8 MAY 2012 SOURCE: WEBMIS MINI IN RUSSIA 33

SEGMENT COMPETITION FOR COUNTRY MAN %MS Top Info Change Jan-Dec 2011/2010 Reg. Jan-Dec 2011 Reg. Jan-Dec 2010 %MS Jan-Dec 2011 %MS Unit Change %Change MS Change Jan-Dec 2010 2011/2010 53 589 33 138 100, 00 20 451 61, 71 0, 00 Ford Kuga 2 667 1 038 4, 98 3, 13 1 629 156, 94 1, 84 58, 88 45, 98 MINI Countryman 898 177 1, 68 0, 53 721 407, 34 1, 14 213, 73 77, 44 Nissan Qashqai 33 177 20 291 61, 23 12 886 63, 51 0, 68 1, 11 0, 37 VW Tiguan 16 847 11 632 31, 44 35, 10 5 215 44, 83 -3, 66 -10, 44 -19, 83 8 MAY 2012 SOURCE: WEBMIS MINI IN RUSSIA 33

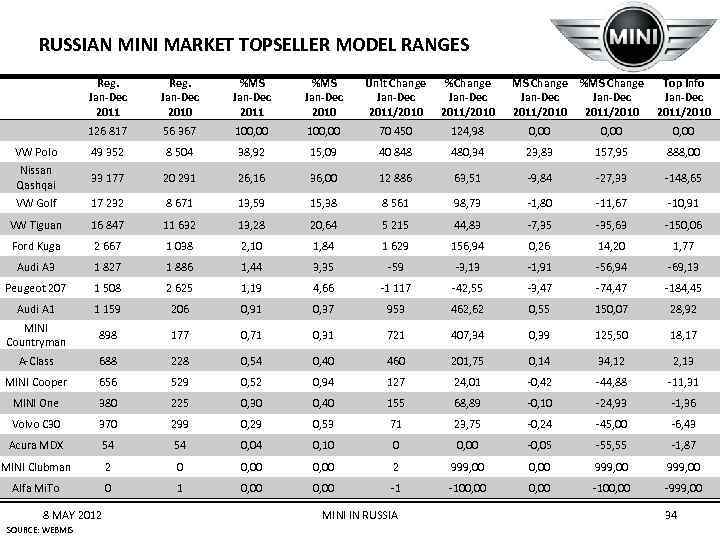

RUSSIAN MINI MARKET TOPSELLER MODEL RANGES Reg. Jan-Dec 2011 Reg. Jan-Dec 2010 %MS Jan-Dec 2011 %MS Jan-Dec 2010 Unit Change Jan-Dec 2011/2010 %Change Jan-Dec 2011/2010 126 817 56 367 100, 00 70 450 124, 98 0, 00 VW Polo 49 352 8 504 38, 92 15, 09 40 848 480, 34 23, 83 157, 95 888, 00 Nissan Qashqai 33 177 20 291 26, 16 36, 00 12 886 63, 51 -9, 84 -27, 33 -148, 65 VW Golf 17 232 8 671 13, 59 15, 38 8 561 98, 73 -1, 80 -11, 67 -10, 91 VW Tiguan 16 847 11 632 13, 28 20, 64 5 215 44, 83 -7, 35 -35, 63 -150, 06 Ford Kuga 2 667 1 038 2, 10 1, 84 1 629 156, 94 0, 26 14, 20 1, 77 Audi A 3 1 827 1 886 1, 44 3, 35 -59 -3, 13 -1, 91 -56, 94 -69, 13 Peugeot 207 1 508 2 625 1, 19 4, 66 -1 117 -42, 55 -3, 47 -74, 47 -184, 45 Audi A 1 1 159 206 0, 91 0, 37 953 462, 62 0, 55 150, 07 28, 92 MINI Countryman 898 177 0, 71 0, 31 721 407, 34 0, 39 125, 50 18, 17 A-Class 688 228 0, 54 0, 40 460 201, 75 0, 14 34, 12 2, 13 MINI Cooper 656 529 0, 52 0, 94 127 24, 01 -0, 42 -44, 88 -11, 31 MINI One 380 225 0, 30 0, 40 155 68, 89 -0, 10 -24, 93 -1, 36 Volvo C 30 370 299 0, 29 0, 53 71 23, 75 -0, 24 -45, 00 -6, 43 Acura MDX 54 54 0, 04 0, 10 0 0, 00 -0, 05 -55, 55 -1, 87 MINI Clubman 2 0 0, 00 2 999, 00 0, 00 999, 00 Alfa Mi. To 0 1 0, 00 -1 -100, 00 -999, 00 8 MAY 2012 SOURCE: WEBMIS MINI IN RUSSIA MS Change %MS Change Jan-Dec 2011/2010 Top Info Jan-Dec 2011/2010 34

RUSSIAN MINI MARKET TOPSELLER MODEL RANGES Reg. Jan-Dec 2011 Reg. Jan-Dec 2010 %MS Jan-Dec 2011 %MS Jan-Dec 2010 Unit Change Jan-Dec 2011/2010 %Change Jan-Dec 2011/2010 126 817 56 367 100, 00 70 450 124, 98 0, 00 VW Polo 49 352 8 504 38, 92 15, 09 40 848 480, 34 23, 83 157, 95 888, 00 Nissan Qashqai 33 177 20 291 26, 16 36, 00 12 886 63, 51 -9, 84 -27, 33 -148, 65 VW Golf 17 232 8 671 13, 59 15, 38 8 561 98, 73 -1, 80 -11, 67 -10, 91 VW Tiguan 16 847 11 632 13, 28 20, 64 5 215 44, 83 -7, 35 -35, 63 -150, 06 Ford Kuga 2 667 1 038 2, 10 1, 84 1 629 156, 94 0, 26 14, 20 1, 77 Audi A 3 1 827 1 886 1, 44 3, 35 -59 -3, 13 -1, 91 -56, 94 -69, 13 Peugeot 207 1 508 2 625 1, 19 4, 66 -1 117 -42, 55 -3, 47 -74, 47 -184, 45 Audi A 1 1 159 206 0, 91 0, 37 953 462, 62 0, 55 150, 07 28, 92 MINI Countryman 898 177 0, 71 0, 31 721 407, 34 0, 39 125, 50 18, 17 A-Class 688 228 0, 54 0, 40 460 201, 75 0, 14 34, 12 2, 13 MINI Cooper 656 529 0, 52 0, 94 127 24, 01 -0, 42 -44, 88 -11, 31 MINI One 380 225 0, 30 0, 40 155 68, 89 -0, 10 -24, 93 -1, 36 Volvo C 30 370 299 0, 29 0, 53 71 23, 75 -0, 24 -45, 00 -6, 43 Acura MDX 54 54 0, 04 0, 10 0 0, 00 -0, 05 -55, 55 -1, 87 MINI Clubman 2 0 0, 00 2 999, 00 0, 00 999, 00 Alfa Mi. To 0 1 0, 00 -1 -100, 00 -999, 00 8 MAY 2012 SOURCE: WEBMIS MINI IN RUSSIA MS Change %MS Change Jan-Dec 2011/2010 Top Info Jan-Dec 2011/2010 34