3dc90caf229fff6899400e3d092f19f1.ppt

- Количество слайдов: 42

Minerals and Energy for Development and Prosperity Presentation to Parliamentary Portfolio Committee on Basic Fuels Price Scheduled Time: 11 H 00 – 13 h 00 Venue: Cape Town Wednesday, 31 May 2006 Department of Minerals and Energy

Minerals and Energy for Development and Prosperity Presentation to Parliamentary Portfolio Committee on Basic Fuels Price Scheduled Time: 11 H 00 – 13 h 00 Venue: Cape Town Wednesday, 31 May 2006 Department of Minerals and Energy

Our team Nhlanhla Gumede …… Chief Director – Hydrocarbons Muzi Mkhize ………… Director – Petroleum & Gas Operations Hein Baak ……………. Deputy Director – Pricing & Statistics Sylvester Malatji ……… Energy Officer 2 Department of Minerals and Energy

Our team Nhlanhla Gumede …… Chief Director – Hydrocarbons Muzi Mkhize ………… Director – Petroleum & Gas Operations Hein Baak ……………. Deputy Director – Pricing & Statistics Sylvester Malatji ……… Energy Officer 2 Department of Minerals and Energy

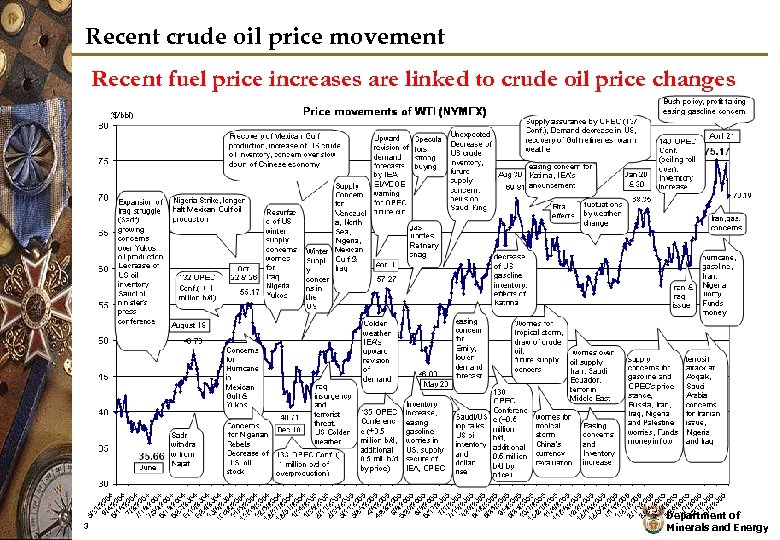

Recent crude oil price movement Recent fuel price increases are linked to crude oil price changes 3 Department of Minerals and Energy

Recent crude oil price movement Recent fuel price increases are linked to crude oil price changes 3 Department of Minerals and Energy

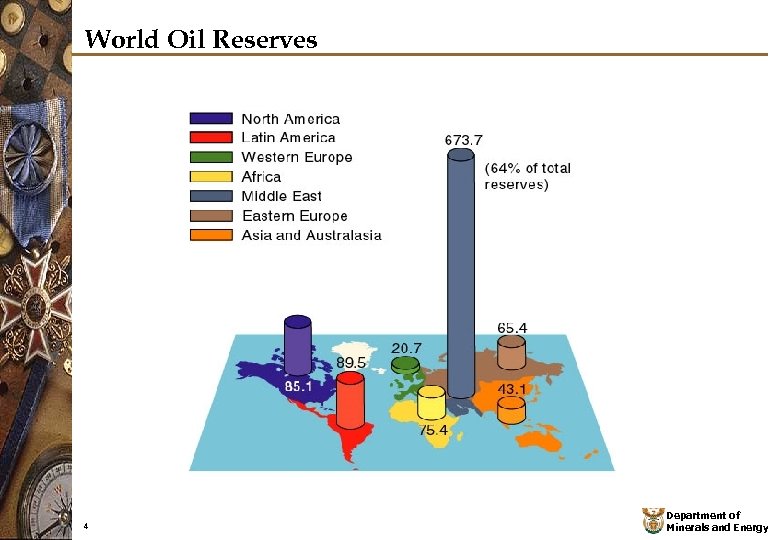

World Oil Reserves 4 Department of Minerals and Energy

World Oil Reserves 4 Department of Minerals and Energy

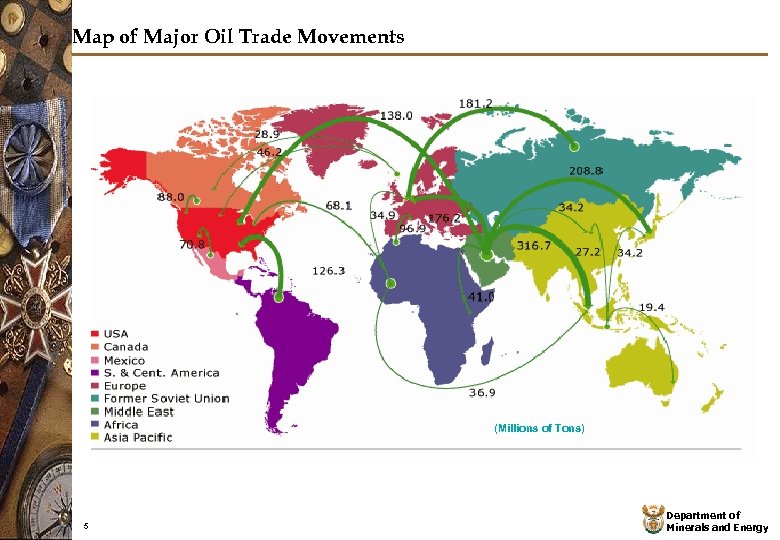

Map of Major Oil Trade Movements (Millions of Tons) 5 Department of Minerals and Energy

Map of Major Oil Trade Movements (Millions of Tons) 5 Department of Minerals and Energy

Resources vs. Production Rate Africa, South America and Asia have a problem! 6 Department of Minerals and Energy

Resources vs. Production Rate Africa, South America and Asia have a problem! 6 Department of Minerals and Energy

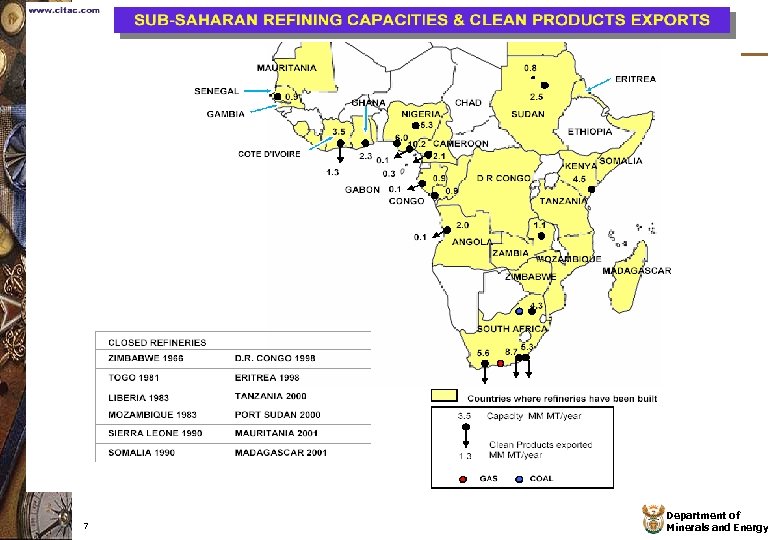

7 Department of Minerals and Energy

7 Department of Minerals and Energy

8 Department of Minerals and Energy

8 Department of Minerals and Energy

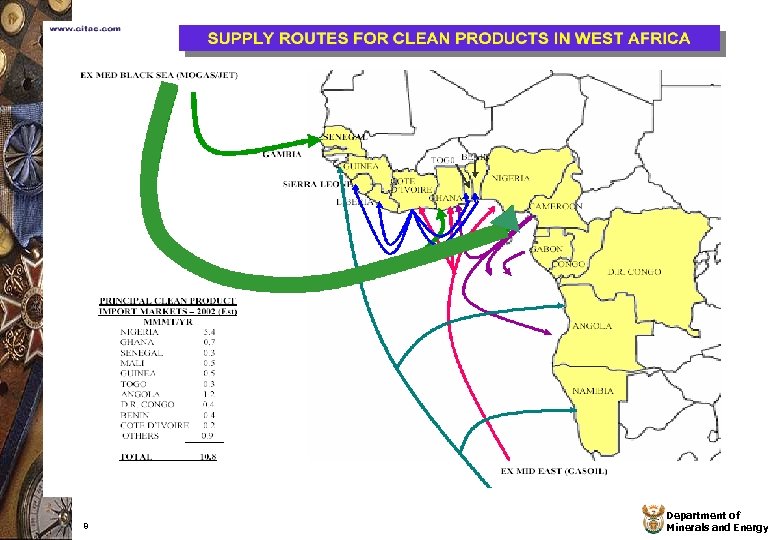

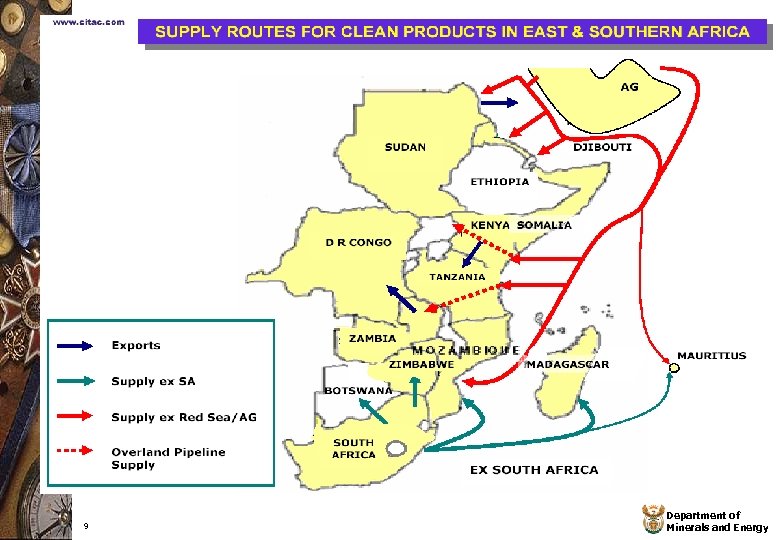

9 Department of Minerals and Energy

9 Department of Minerals and Energy

Global oil challenges • Strength of global oil demand growth • Poor or unreliable data availability • Lack of confidence in long-term oil prices • The oil industry facing challenge of adding 18 mbpd new production by 2020 • Changing petroleum product slate demand • Clean fuels refinery investments • Investment in oil supply chain Ü Tight refinery capacities Ü High refinery margins 10 Department of Minerals and Energy

Global oil challenges • Strength of global oil demand growth • Poor or unreliable data availability • Lack of confidence in long-term oil prices • The oil industry facing challenge of adding 18 mbpd new production by 2020 • Changing petroleum product slate demand • Clean fuels refinery investments • Investment in oil supply chain Ü Tight refinery capacities Ü High refinery margins 10 Department of Minerals and Energy

White Paper on Energy Policy The White Paper on Energy envisages import parity system for pricing • The refining industry was deregulated in 1991 and although the income of refineries is determined by the deemed import parity cost of fuels there is no control in respect of refining margins • “Government will not extend regulatory control over the crude oil industry ” • “The government believes that competitive market forces should determine prices … However, as long as price control is applied the import parity pricing approach will be retained, with s improvements if necessary. ” 11 Department of Minerals and Energy

White Paper on Energy Policy The White Paper on Energy envisages import parity system for pricing • The refining industry was deregulated in 1991 and although the income of refineries is determined by the deemed import parity cost of fuels there is no control in respect of refining margins • “Government will not extend regulatory control over the crude oil industry ” • “The government believes that competitive market forces should determine prices … However, as long as price control is applied the import parity pricing approach will be retained, with s improvements if necessary. ” 11 Department of Minerals and Energy

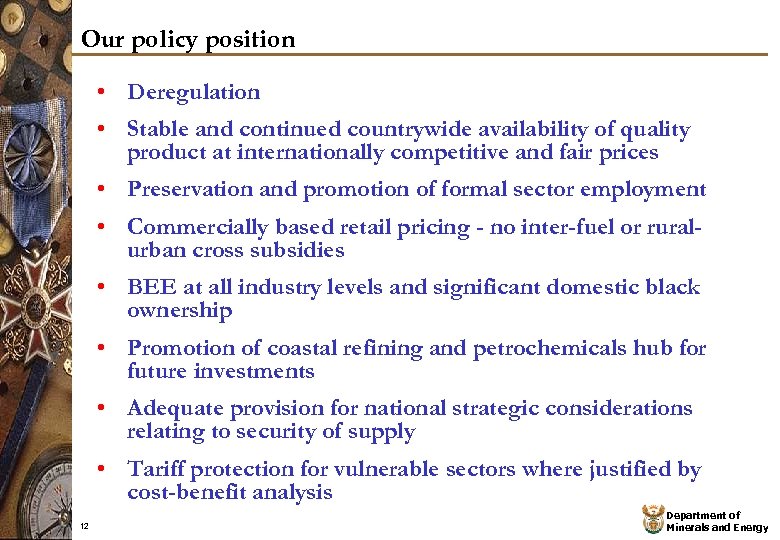

Our policy position • Deregulation • Stable and continued countrywide availability of quality product at internationally competitive and fair prices • Preservation and promotion of formal sector employment • Commercially based retail pricing - no inter-fuel or ruralurban cross subsidies • BEE at all industry levels and significant domestic black ownership • Promotion of coastal refining and petrochemicals hub for future investments • Adequate provision for national strategic considerations relating to security of supply • Tariff protection for vulnerable sectors where justified by cost-benefit analysis 12 Department of Minerals and Energy

Our policy position • Deregulation • Stable and continued countrywide availability of quality product at internationally competitive and fair prices • Preservation and promotion of formal sector employment • Commercially based retail pricing - no inter-fuel or ruralurban cross subsidies • BEE at all industry levels and significant domestic black ownership • Promotion of coastal refining and petrochemicals hub for future investments • Adequate provision for national strategic considerations relating to security of supply • Tariff protection for vulnerable sectors where justified by cost-benefit analysis 12 Department of Minerals and Energy

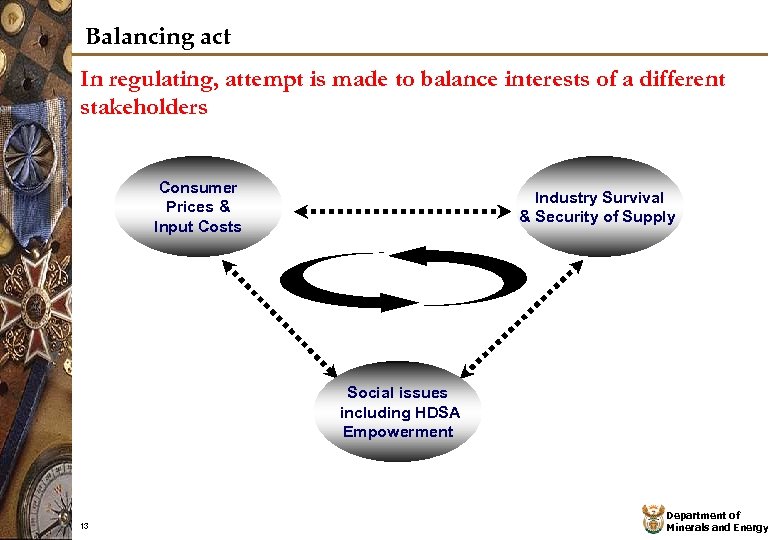

Balancing act In regulating, attempt is made to balance interests of a different stakeholders Consumer Prices & Input Costs Industry Survival & Security of Supply Social issues including HDSA Empowerment 13 Department of Minerals and Energy

Balancing act In regulating, attempt is made to balance interests of a different stakeholders Consumer Prices & Input Costs Industry Survival & Security of Supply Social issues including HDSA Empowerment 13 Department of Minerals and Energy

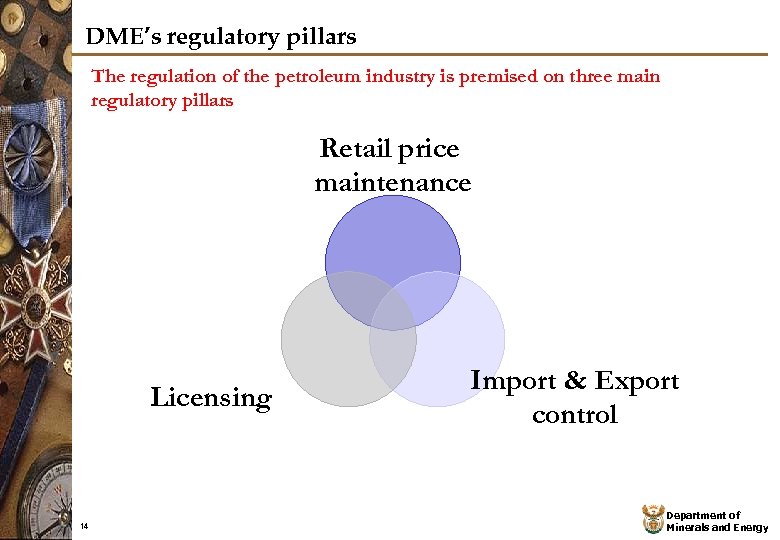

DME’s regulatory pillars The regulation of the petroleum industry is premised on three main regulatory pillars Retail price maintenance Licensing 14 Import & Export control Department of Minerals and Energy

DME’s regulatory pillars The regulation of the petroleum industry is premised on three main regulatory pillars Retail price maintenance Licensing 14 Import & Export control Department of Minerals and Energy

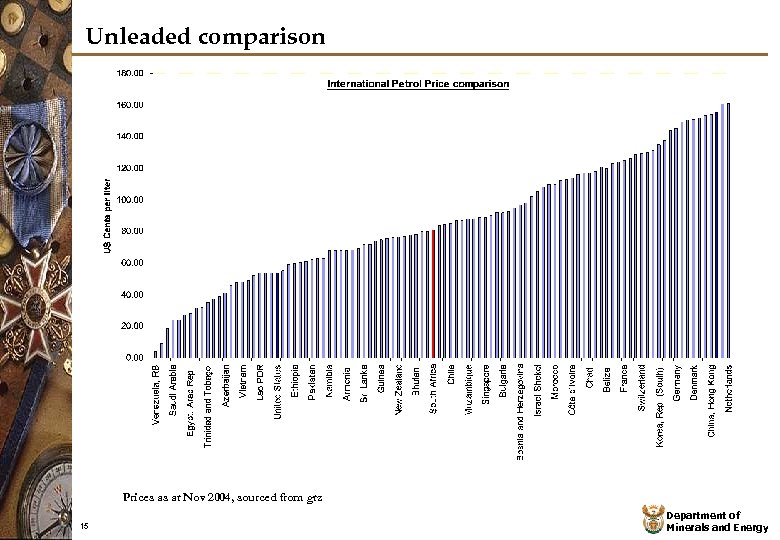

Unleaded comparison Prices as at Nov 2004, sourced from gtz 15 Department of Minerals and Energy

Unleaded comparison Prices as at Nov 2004, sourced from gtz 15 Department of Minerals and Energy

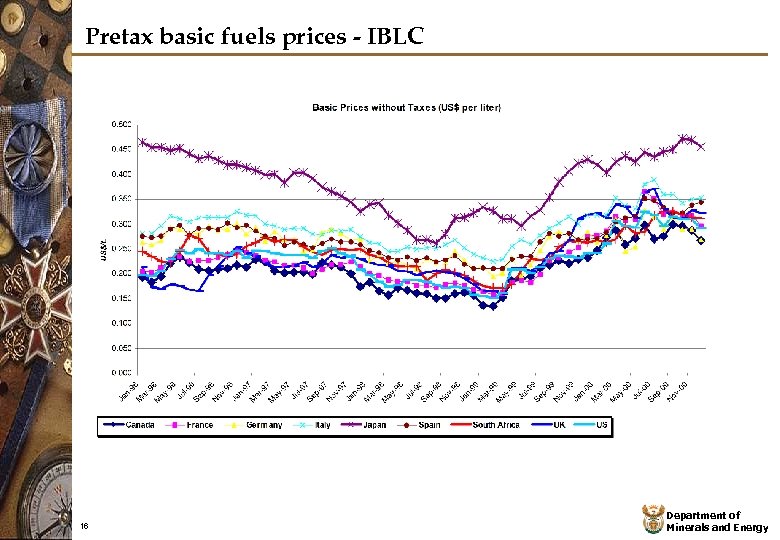

Pretax basic fuels prices - IBLC 16 Department of Minerals and Energy

Pretax basic fuels prices - IBLC 16 Department of Minerals and Energy

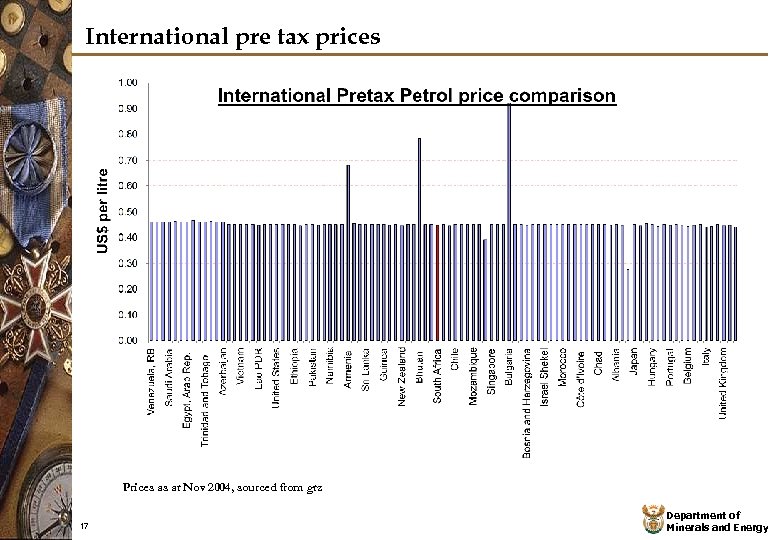

International pre tax prices Prices as at Nov 2004, sourced from gtz 17 Department of Minerals and Energy

International pre tax prices Prices as at Nov 2004, sourced from gtz 17 Department of Minerals and Energy

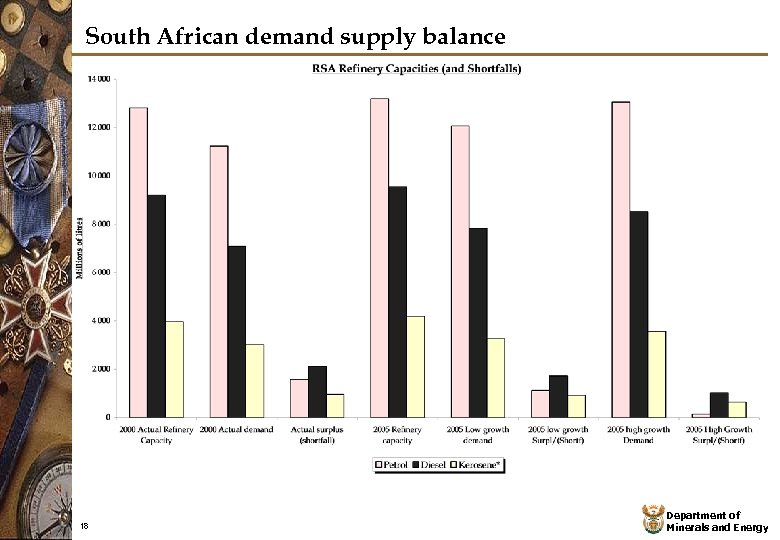

South African demand supply balance 18 Department of Minerals and Energy

South African demand supply balance 18 Department of Minerals and Energy

In bond landed price IBLC was also based on import parity pricing at the refinery gate • Originated in 1954 with the first Refinery in Durban • Protection to the local refinery industry • Outdated posted (term contract) price used • Changes in international fuels markets • Not a realistic, market-related import parity basis 19 Department of Minerals and Energy

In bond landed price IBLC was also based on import parity pricing at the refinery gate • Originated in 1954 with the first Refinery in Durban • Protection to the local refinery industry • Outdated posted (term contract) price used • Changes in international fuels markets • Not a realistic, market-related import parity basis 19 Department of Minerals and Energy

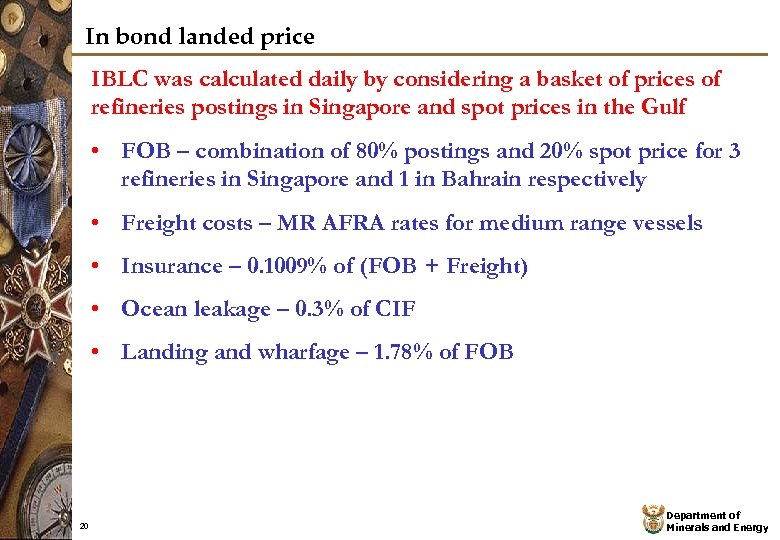

In bond landed price IBLC was calculated daily by considering a basket of prices of refineries postings in Singapore and spot prices in the Gulf • FOB – combination of 80% postings and 20% spot price for 3 refineries in Singapore and 1 in Bahrain respectively • Freight costs – MR AFRA rates for medium range vessels • Insurance – 0. 1009% of (FOB + Freight) • Ocean leakage – 0. 3% of CIF • Landing and wharfage – 1. 78% of FOB 20 Department of Minerals and Energy

In bond landed price IBLC was calculated daily by considering a basket of prices of refineries postings in Singapore and spot prices in the Gulf • FOB – combination of 80% postings and 20% spot price for 3 refineries in Singapore and 1 in Bahrain respectively • Freight costs – MR AFRA rates for medium range vessels • Insurance – 0. 1009% of (FOB + Freight) • Ocean leakage – 0. 3% of CIF • Landing and wharfage – 1. 78% of FOB 20 Department of Minerals and Energy

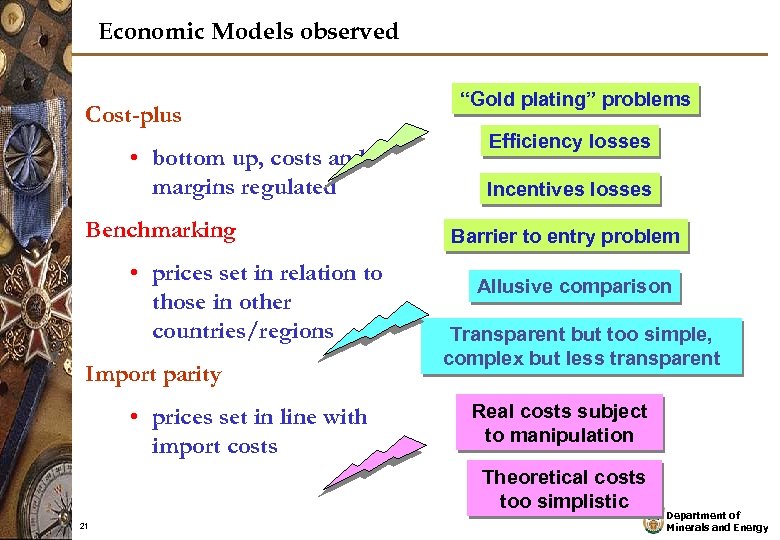

Economic Models observed Cost-plus • bottom up, costs and margins regulated Benchmarking • prices set in relation to those in other countries/regions Import parity • prices set in line with import costs “Gold plating” problems Efficiency losses Incentives losses Barrier to entry problem Allusive comparison Transparent but too simple, complex but less transparent Real costs subject to manipulation Theoretical costs too simplistic 21 Department of Minerals and Energy

Economic Models observed Cost-plus • bottom up, costs and margins regulated Benchmarking • prices set in relation to those in other countries/regions Import parity • prices set in line with import costs “Gold plating” problems Efficiency losses Incentives losses Barrier to entry problem Allusive comparison Transparent but too simple, complex but less transparent Real costs subject to manipulation Theoretical costs too simplistic 21 Department of Minerals and Energy

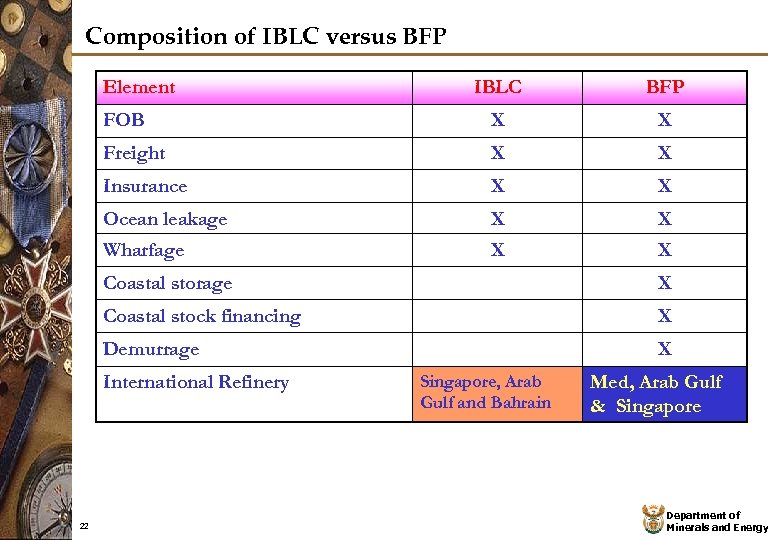

Composition of IBLC versus BFP Element IBLC BFP FOB X X Freight X X Insurance X X Ocean leakage X X Wharfage X X Coastal storage X Coastal stock financing X Demurrage X International Refinery 22 Singapore, Arab Gulf and Bahrain Med, Arab Gulf & Singapore Department of Minerals and Energy

Composition of IBLC versus BFP Element IBLC BFP FOB X X Freight X X Insurance X X Ocean leakage X X Wharfage X X Coastal storage X Coastal stock financing X Demurrage X International Refinery 22 Singapore, Arab Gulf and Bahrain Med, Arab Gulf & Singapore Department of Minerals and Energy

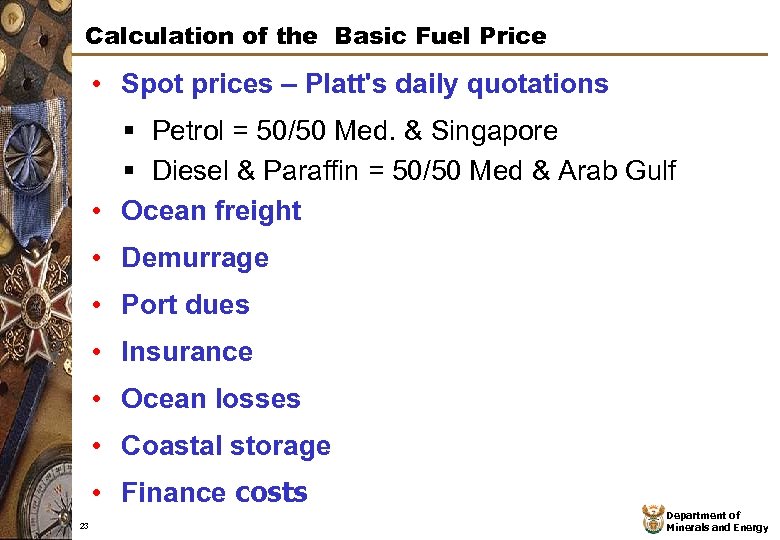

Calculation of the Basic Fuel Price • Spot prices – Platt's daily quotations § Petrol = 50/50 Med. & Singapore § Diesel & Paraffin = 50/50 Med & Arab Gulf • Ocean freight • Demurrage • Port dues • Insurance • Ocean losses • Coastal storage • Finance costs 23 Department of Minerals and Energy

Calculation of the Basic Fuel Price • Spot prices – Platt's daily quotations § Petrol = 50/50 Med. & Singapore § Diesel & Paraffin = 50/50 Med & Arab Gulf • Ocean freight • Demurrage • Port dues • Insurance • Ocean losses • Coastal storage • Finance costs 23 Department of Minerals and Energy

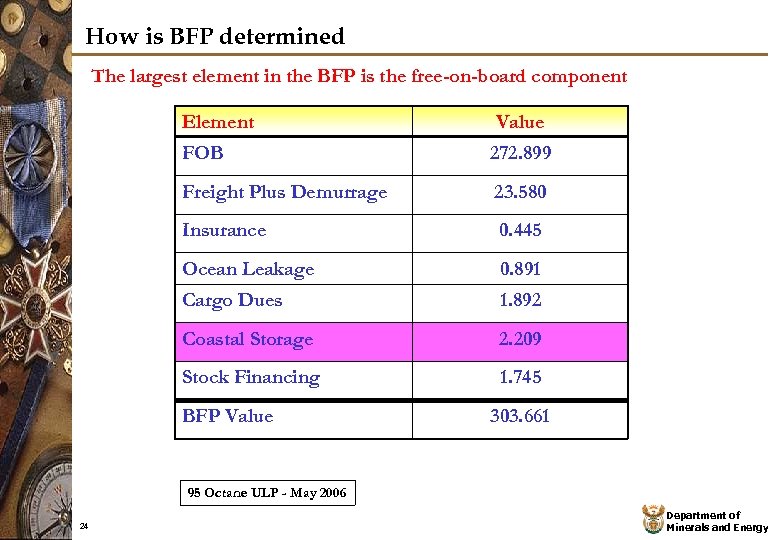

How is BFP determined The largest element in the BFP is the free-on-board component Element Value FOB 272. 899 Freight Plus Demurrage 23. 580 Insurance 0. 445 Ocean Leakage 0. 891 Cargo Dues 1. 892 Coastal Storage 2. 209 Stock Financing 1. 745 BFP Value 303. 661 95 Octane ULP - May 2006 24 Department of Minerals and Energy

How is BFP determined The largest element in the BFP is the free-on-board component Element Value FOB 272. 899 Freight Plus Demurrage 23. 580 Insurance 0. 445 Ocean Leakage 0. 891 Cargo Dues 1. 892 Coastal Storage 2. 209 Stock Financing 1. 745 BFP Value 303. 661 95 Octane ULP - May 2006 24 Department of Minerals and Energy

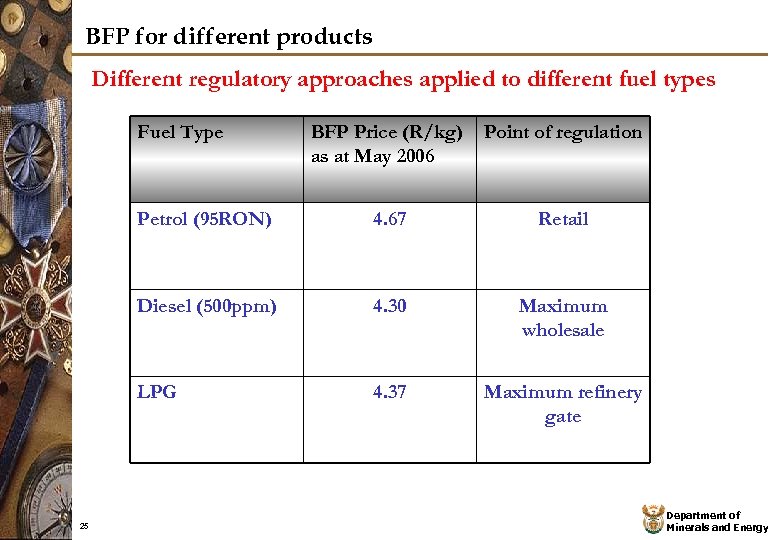

BFP for different products Different regulatory approaches applied to different fuel types Fuel Type Point of regulation Petrol (95 RON) 4. 67 Retail Diesel (500 ppm) 4. 30 Maximum wholesale LPG 25 BFP Price (R/kg) as at May 2006 4. 37 Maximum refinery gate Department of Minerals and Energy

BFP for different products Different regulatory approaches applied to different fuel types Fuel Type Point of regulation Petrol (95 RON) 4. 67 Retail Diesel (500 ppm) 4. 30 Maximum wholesale LPG 25 BFP Price (R/kg) as at May 2006 4. 37 Maximum refinery gate Department of Minerals and Energy

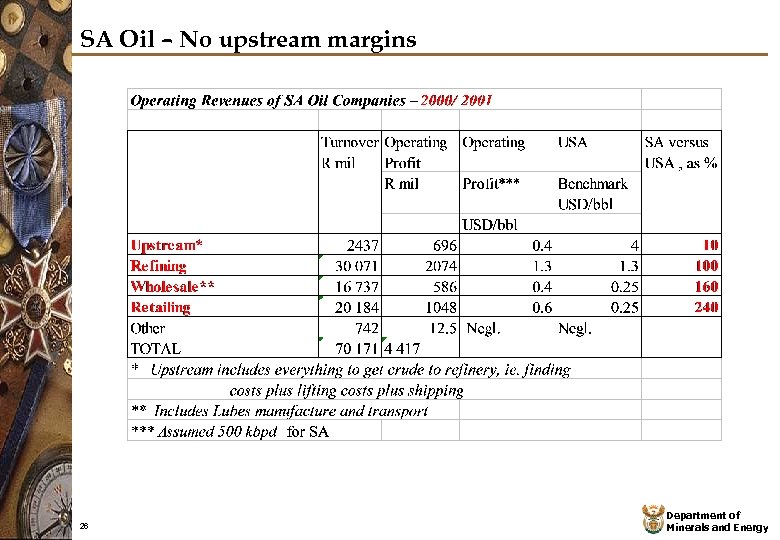

SA Oil – No upstream margins 26 Department of Minerals and Energy

SA Oil – No upstream margins 26 Department of Minerals and Energy

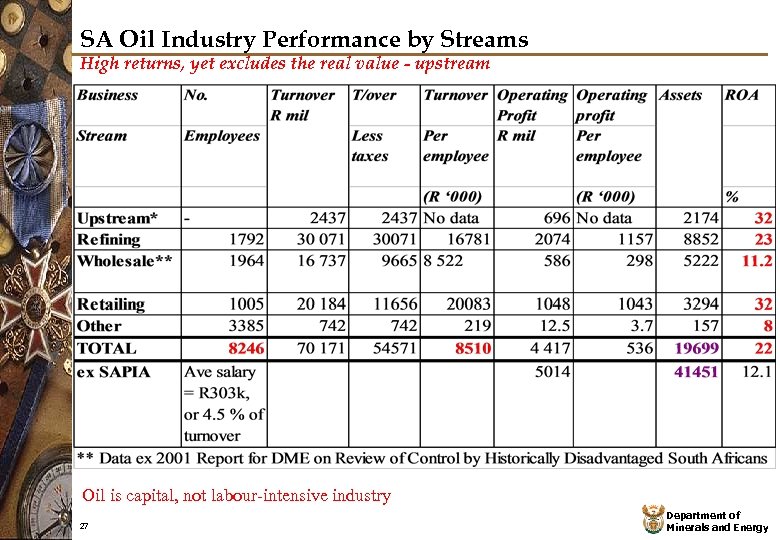

SA Oil Industry Performance by Streams High returns, yet excludes the real value - upstream Oil is capital, not labour-intensive industry 27 Department of Minerals and Energy

SA Oil Industry Performance by Streams High returns, yet excludes the real value - upstream Oil is capital, not labour-intensive industry 27 Department of Minerals and Energy

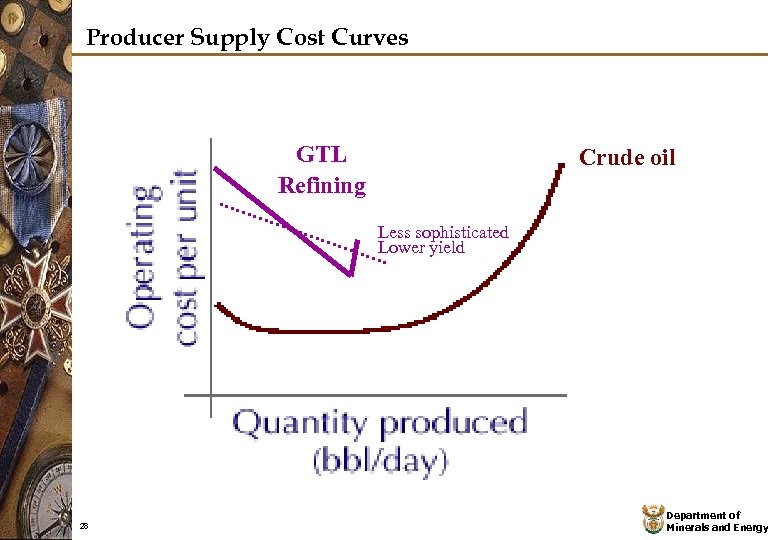

Producer Supply Cost Curves GTL Refining Crude oil Less sophisticated Lower yield 28 Department of Minerals and Energy

Producer Supply Cost Curves GTL Refining Crude oil Less sophisticated Lower yield 28 Department of Minerals and Energy

Possible future R. S. A scenario The next move could be a move from a deemed system to a true import parity approach • Based on real contract based imports into RSA • Could result in a reduction of between 10 – 20 cpl • Not expected to be different for South Africa’s end state • Similar to global best practice 29 Department of Minerals and Energy

Possible future R. S. A scenario The next move could be a move from a deemed system to a true import parity approach • Based on real contract based imports into RSA • Could result in a reduction of between 10 – 20 cpl • Not expected to be different for South Africa’s end state • Similar to global best practice 29 Department of Minerals and Energy

Thank You 30 Department of Minerals and Energy

Thank You 30 Department of Minerals and Energy

Supporting slides 31 Department of Minerals and Energy

Supporting slides 31 Department of Minerals and Energy

Basic Fuel Price components Demurrage Ø Product are charged at loading ports at overseas Refining centers and discharged at South African ports Ø Calculated using a 3 days period Ø Based on the Demurrage rates published by the world scale Association Limited expressed in USD/Tons Ø Applicable to Vessels falling within the range of 35 000 to 39 999 DWT class of Tankers. 32 Department of Minerals and Energy

Basic Fuel Price components Demurrage Ø Product are charged at loading ports at overseas Refining centers and discharged at South African ports Ø Calculated using a 3 days period Ø Based on the Demurrage rates published by the world scale Association Limited expressed in USD/Tons Ø Applicable to Vessels falling within the range of 35 000 to 39 999 DWT class of Tankers. 32 Department of Minerals and Energy

Basic Fuel Price components Storage costs Ø This is to cover the cost of providing storage and handling facilities at coastal terminals Ø The formula seeks to allow for the cost realistically incurred in a substantial import scenario Ø In such a scenario a different minimum level of stock is required than when relying on local resources of supply Ø The cost of storage was initially assessed in 2002 at 2. 5 SA c/l per Month Ø The BFP makes provision for 25 days of storage Ø Escalated annually in accordance with movement in the production price index for June each year 33 Department of Minerals and Energy

Basic Fuel Price components Storage costs Ø This is to cover the cost of providing storage and handling facilities at coastal terminals Ø The formula seeks to allow for the cost realistically incurred in a substantial import scenario Ø In such a scenario a different minimum level of stock is required than when relying on local resources of supply Ø The cost of storage was initially assessed in 2002 at 2. 5 SA c/l per Month Ø The BFP makes provision for 25 days of storage Ø Escalated annually in accordance with movement in the production price index for June each year 33 Department of Minerals and Energy

Basic Fuel Price components Stock financing Ø This is the real cost faced by importers and local Refineries Ø Stock Financing costs is based Ø On a period of 25 days Ø At an interest rate of 2 percentage points below the ruling prime interest rate of Standard Bank of S. A. 34 Department of Minerals and Energy

Basic Fuel Price components Stock financing Ø This is the real cost faced by importers and local Refineries Ø Stock Financing costs is based Ø On a period of 25 days Ø At an interest rate of 2 percentage points below the ruling prime interest rate of Standard Bank of S. A. 34 Department of Minerals and Energy

Basic Fuel Price components Example - 95 Octane Unleaded Petrol Ø Free On Board Value Ø FOB value obtained from PLATTS – an energy information provider Ø FOB 95 Octane $/BBL=( Med/Italy Premium unleaded 95 $/Ton /8. 35 x 50% + Singapore 95 unleaded $BBL X 50%) Ø FOB 95 Octane SA c/l = FOB 95 Unleaded $/BBL/42 X 100/3. 8038 X Rand/ Dollar Exchange rate 35 Department of Minerals and Energy

Basic Fuel Price components Example - 95 Octane Unleaded Petrol Ø Free On Board Value Ø FOB value obtained from PLATTS – an energy information provider Ø FOB 95 Octane $/BBL=( Med/Italy Premium unleaded 95 $/Ton /8. 35 x 50% + Singapore 95 unleaded $BBL X 50%) Ø FOB 95 Octane SA c/l = FOB 95 Unleaded $/BBL/42 X 100/3. 8038 X Rand/ Dollar Exchange rate 35 Department of Minerals and Energy

Basic Fuel Price components …Freight (95 Octane Petrol)… Ø Freight rates are published by London Tankers Brokers Panel Ø Freight applicable from Augusta ( Med Port in Sicily), Mina Al Ahmadi ( Arab Gulf) and Singapore to RSA ports Ø 15% Premium ( Differential between actual rates to RSA ports and world scale rates Ø AFRA: Average Freight Rates Assessment Ø Calculation of Freight Cost: Ø (AFRA + Freight Rate) * 15% Premium 36 Department of Minerals and Energy

Basic Fuel Price components …Freight (95 Octane Petrol)… Ø Freight rates are published by London Tankers Brokers Panel Ø Freight applicable from Augusta ( Med Port in Sicily), Mina Al Ahmadi ( Arab Gulf) and Singapore to RSA ports Ø 15% Premium ( Differential between actual rates to RSA ports and world scale rates Ø AFRA: Average Freight Rates Assessment Ø Calculation of Freight Cost: Ø (AFRA + Freight Rate) * 15% Premium 36 Department of Minerals and Energy

Basic Fuel Price components … Insurance (95 Octane Petrol example)… Ø Covers insurance and cost such as letter of credit, surveyors, agent fees and laboratory costs Ø Calculated as follows: Ø 0. 15 % x (FOB + Freight) Ø FOB( also referred to as cost ) + Insurance + Freight = CIF Value 37 Department of Minerals and Energy

Basic Fuel Price components … Insurance (95 Octane Petrol example)… Ø Covers insurance and cost such as letter of credit, surveyors, agent fees and laboratory costs Ø Calculated as follows: Ø 0. 15 % x (FOB + Freight) Ø FOB( also referred to as cost ) + Insurance + Freight = CIF Value 37 Department of Minerals and Energy

Basic Fuel Price components …Ocean loss (95 Octane Petrol)… Ø A loss allowance factor of 0. 3 % to be calculated on CIF value for product to provide for typical uninsurable loss during transportation Ø Calculated as follows: Ø 0. 3% x (FOB + Insurance + Freight) 38 Department of Minerals and Energy

Basic Fuel Price components …Ocean loss (95 Octane Petrol)… Ø A loss allowance factor of 0. 3 % to be calculated on CIF value for product to provide for typical uninsurable loss during transportation Ø Calculated as follows: Ø 0. 3% x (FOB + Insurance + Freight) 38 Department of Minerals and Energy

Basic Fuel Price components …Cargo dues (95 Octane Petrol)… Ø Cost to utilise the facilities at South African ports Ø Cargo Dues rates are fixed rate for a twelve month period Ø Cargo Dues are payable to the National Ports Authority of South Africa 39 Department of Minerals and Energy

Basic Fuel Price components …Cargo dues (95 Octane Petrol)… Ø Cost to utilise the facilities at South African ports Ø Cargo Dues rates are fixed rate for a twelve month period Ø Cargo Dues are payable to the National Ports Authority of South Africa 39 Department of Minerals and Energy

Basic Fuel Price components …Landed cost value (95 Octane petrol)… Ø Landed cost Value = Ø FOB + Ø Freight + Ø Demurrage + Ø Insurance + Ø Ocean Loss + Ø Cargo Dues 40 Department of Minerals and Energy

Basic Fuel Price components …Landed cost value (95 Octane petrol)… Ø Landed cost Value = Ø FOB + Ø Freight + Ø Demurrage + Ø Insurance + Ø Ocean Loss + Ø Cargo Dues 40 Department of Minerals and Energy

Basic Fuel Price components …Coastal storage (95 Octane petrol). . . Ø Typical International Storage assessed at USD 3. 00/Ton /Month or 2. 5 c/l in 2002 Ø Escalated on 1 st August annually in line with movement in the production price index 41 Department of Minerals and Energy

Basic Fuel Price components …Coastal storage (95 Octane petrol). . . Ø Typical International Storage assessed at USD 3. 00/Ton /Month or 2. 5 c/l in 2002 Ø Escalated on 1 st August annually in line with movement in the production price index 41 Department of Minerals and Energy

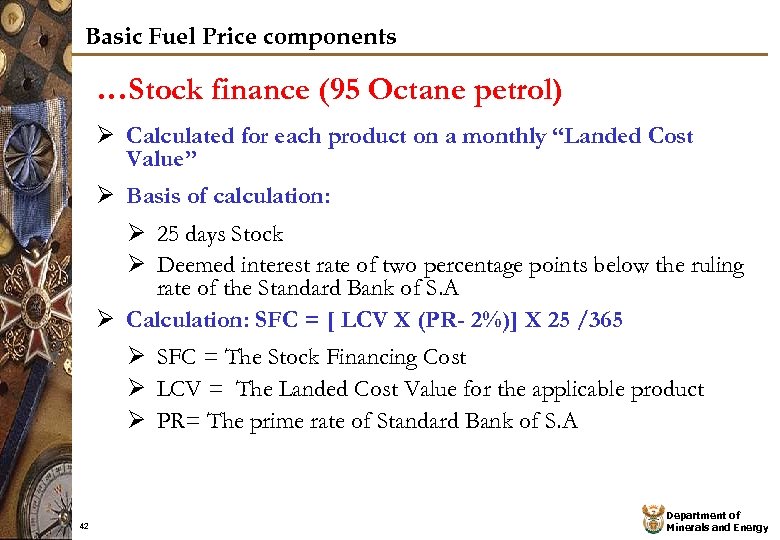

Basic Fuel Price components …Stock finance (95 Octane petrol) Ø Calculated for each product on a monthly “Landed Cost Value” Ø Basis of calculation: Ø 25 days Stock Ø Deemed interest rate of two percentage points below the ruling rate of the Standard Bank of S. A Ø Calculation: SFC = [ LCV X (PR- 2%)] X 25 /365 Ø SFC = The Stock Financing Cost Ø LCV = The Landed Cost Value for the applicable product Ø PR= The prime rate of Standard Bank of S. A 42 Department of Minerals and Energy

Basic Fuel Price components …Stock finance (95 Octane petrol) Ø Calculated for each product on a monthly “Landed Cost Value” Ø Basis of calculation: Ø 25 days Stock Ø Deemed interest rate of two percentage points below the ruling rate of the Standard Bank of S. A Ø Calculation: SFC = [ LCV X (PR- 2%)] X 25 /365 Ø SFC = The Stock Financing Cost Ø LCV = The Landed Cost Value for the applicable product Ø PR= The prime rate of Standard Bank of S. A 42 Department of Minerals and Energy