c43a0d95d5bca757614af4985c09bce1.ppt

- Количество слайдов: 20

Milton Johnson SVP and Controller Mark Kimbrough VP, Investor Relations HCA 2004 Goldman Sachs

This press release contains forward-looking statements based on current management expectations. Those forward-looking statements include all statements regarding our estimated results of operations in future periods and all statements other than those made solely with respect to historical fact. Numerous risks, uncertainties and other factors may cause actual results to differ materially from those expressed in any forward-looking statements. These factors include, but are not limited to (i) increases in the amount and risk of collectability of uninsured accounts and deductibles and co-pay amounts for insured accounts, (ii) the ability to achieve operating and financial targets and achieve expected levels of patient volumes and control the costs of providing services, (iii) the highly competitive nature of the health care business, (iv) the efforts of insurers, health care providers and others to contain health care costs, (v) possible changes in the Medicare and Medicaid programs that may impact reimbursements to health care providers and insurers, (vi) the ability to attract and retain qualified management and personnel, including affiliated physicians, nurses and medical support personnel, (vii) potential liabilities and other claims that may be asserted against the Company, (viii) fluctuations in the market value of the Company’s common stock, (ix) the impact of the Company’s charity care and self-pay discounting policy changes, (x) changes in accounting practices, (xi) changes in general economic conditions, (xii) future divestitures which may result in charges, (xiii) changes in revenue mix and the ability to enter into and renew managed care provider arrangements on acceptable terms, (xiv) the availability and terms of capital to fund the expansion of the Company’s business, (xv) changes in business strategy or development plans, (xvi) delays in receiving payments for services provided, (xvii) the possible enactment of Federal or state health care reform, ( xviii) the outcome of pending and any future tax audits and litigation associated with the Company’s tax positions, ( xix) the outcome of the Company’s continuing efforts to monitor, maintain and comply with appropriate laws, regulations, policies and procedures and the Company’s corporate integrity agreement with the government, ( xx) changes in Federal, state or local regulations affecting the health care industry, (xxi) the ability to successfully integrate the operations of Health Midwest, ( xxii) the ability to develop and implement the payroll and human resources information system within the expected time and cost projections and, upon implementation, to realize the expected benefits and efficiencies, and ( xxiii) other risk factors detailed in the Company’s filings with the SEC. Many of the factors that will determine the Company’s future results are beyond the ability of the Company to control or predict. In light of the significant uncertainties inherent in the forward-looking statements contained herein, readers should not place undue reliance on forward-looking statements, which reflect management’s views only as of the date hereof. The Company undertakes no obligation to revise or update any forward-looking statements, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise. All references to “Company” and “HCA” as used throughout this document refer to HCA Inc. and its affiliates. HCA 2004 Goldman Sachs

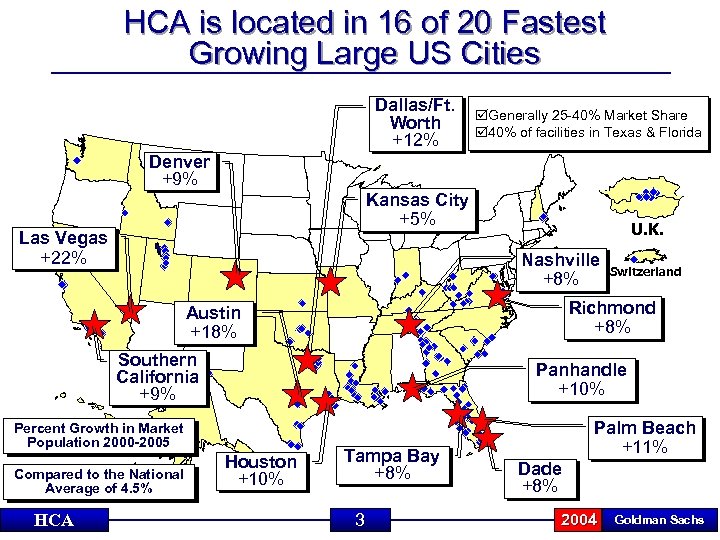

HCA is located in 16 of 20 Fastest Growing Large US Cities Dallas/Ft. Worth +12% þGenerally 25 -40% Market Share þ 40% of facilities in Texas & Florida Denver +9% Kansas City +5% Las Vegas +22% U. K. Nashville +8% Richmond +8% Austin +18% Southern California +9% Compared to the National Average of 4. 5% HCA Panhandle +10% % Percent Growth in Market Population 2000 -2005 Palm Beach +11% % Houston +10% Switzerland Tampa Bay +8% 3 Dade +8% 2004 Goldman Sachs

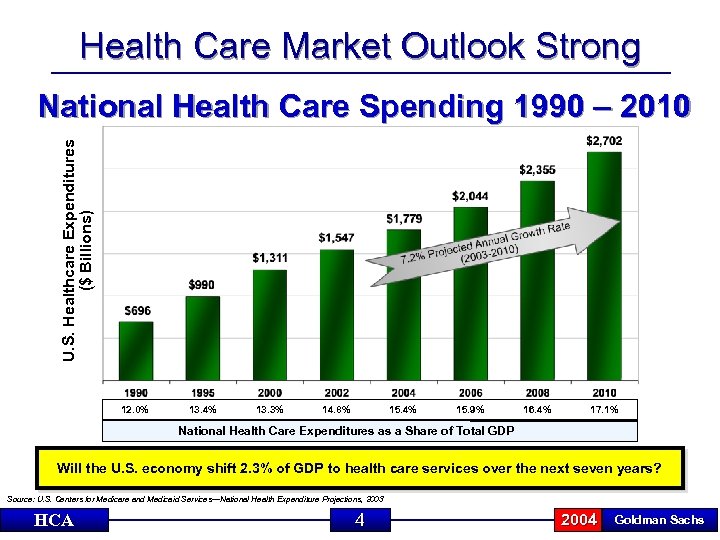

Health Care Market Outlook Strong U. S. Healthcare Expenditures ($ Billions) National Health Care Spending 1990 – 2010 12. 0% 13. 4% 13. 3% 14. 8% 15. 4% 15. 9% 16. 4% 17. 1% National Health Care Expenditures as a Share of Total GDP Will the U. S. economy shift 2. 3% of GDP to health care services over the next seven years? Source: U. S. Centers for Medicare and Medicaid Services—National Health Expenditure Projections, 2003 HCA 4 2004 Goldman Sachs

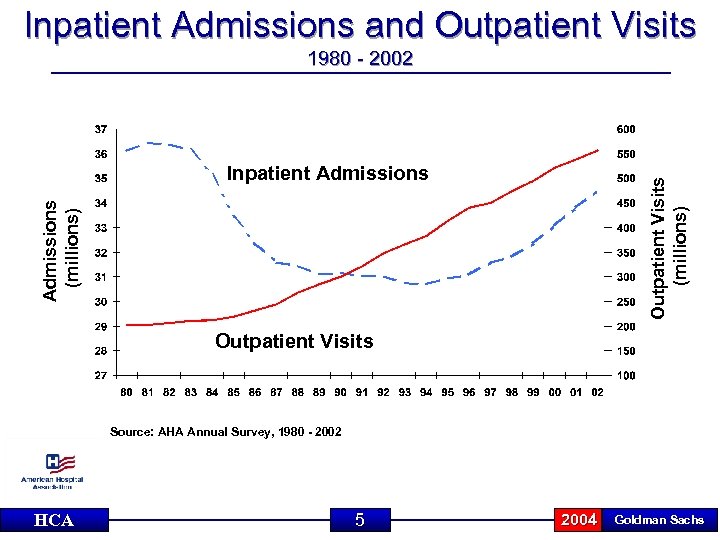

Inpatient Admissions and Outpatient Visits 1980 - 2002 Admissions (millions) Outpatient Visits (millions) Inpatient Admissions Outpatient Visits Source: AHA Annual Survey, 1980 - 2002 HCA 5 2004 Goldman Sachs

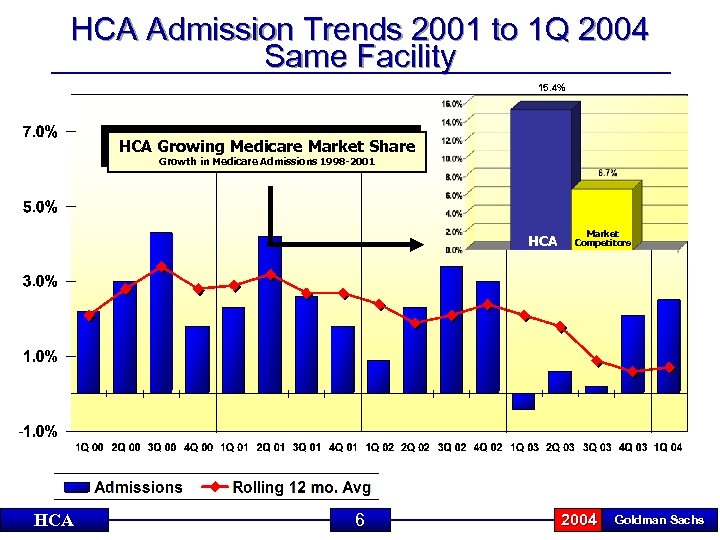

HCA Admission Trends 2001 to 1 Q 2004 Same Facility 15. 4% HCA Growing Medicare Market Share Growth in Medicare Admissions 1998 -2001 HCA 6 Market Competitors 2004 Goldman Sachs

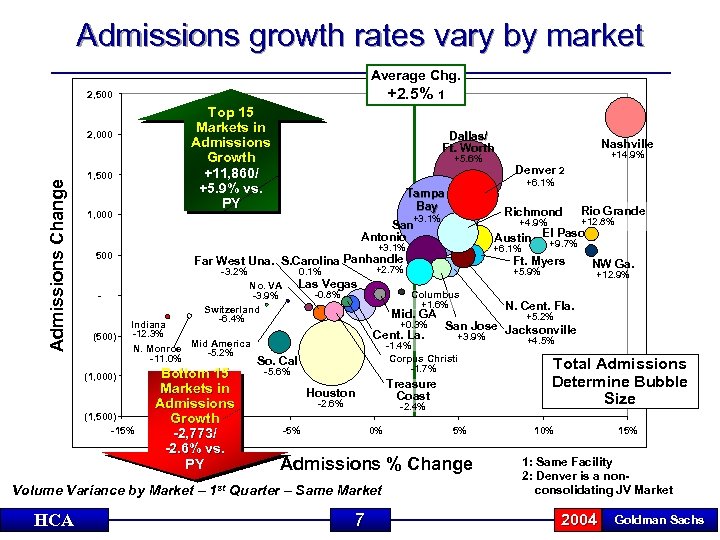

Admissions growth rates vary by market Average Chg. +2. 5% 1 2, 500 Top 15 Markets in Admissions Growth +11, 860/ +5. 9% vs. PY Admissions Change 2, 000 1, 500 1, 000 Dallas/ Ft. Worth +5. 6% Indiana -12. 3% Mid America N. Monroe -5. 2% -11. 0% (1, 000) (1, 500) -15% Bottom 15 Markets in Admissions Growth -10% -2, 773/ -2. 6% vs. PY +5. 9% Mid. GA +0. 3% Cent. La. So. Cal -5. 6% -2. 4% -5% 0% 5% Admissions % Change 7 +12. 9% N. Cent. Fla. +5. 2% Treasure Coast Houston NW Ga. San Jose Jacksonville +3. 9% -1. 4% Corpus Christi -1. 7% Volume Variance by Market – 1 st Quarter – Same Market HCA Ft. Myers Columbus +1. 6% -0. 8% +12. 8% +6. 1% +2. 7% Las Vegas No. VA -3. 9% Switzerland -6. 4% Rio Grande Austin El Paso +9. 7% +3. 1% - (500) +4. 9% Far West Una. S. Carolina Panhandle 0. 1% Denver 2 Richmond San Antonio -3. 2% +14. 9% +6. 1% Tampa Bay +3. 1% 500 Nashville +4. 5% Total Admissions Determine Bubble Size 10% 15% 1: Same Facility 2: Denver is a nonconsolidating JV Market 2004 Goldman Sachs

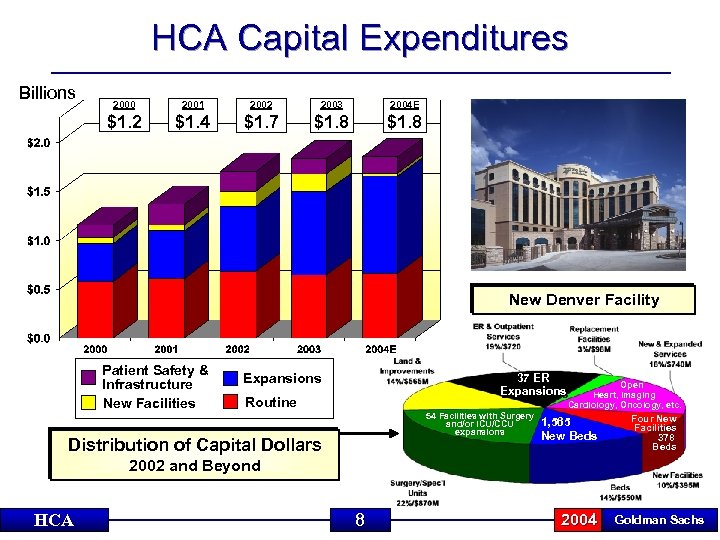

HCA Capital Expenditures Billions 2000 2001 2002 2003 2004 E $1. 2 $1. 4 $1. 7 $1. 8 Expansions New Denver Facility Patient Safety & Infrastructure New Facilities Expansions 37 ER Expansions Open Heart, Imaging Cardiology, Oncology, etc. Routine 54 Facilities with Surgery and/or ICU/CCU expansions Distribution of Capital Dollars 1, 565 New Beds Four New Facilities 378 Beds 2002 and Beyond HCA 8 2004 Goldman Sachs

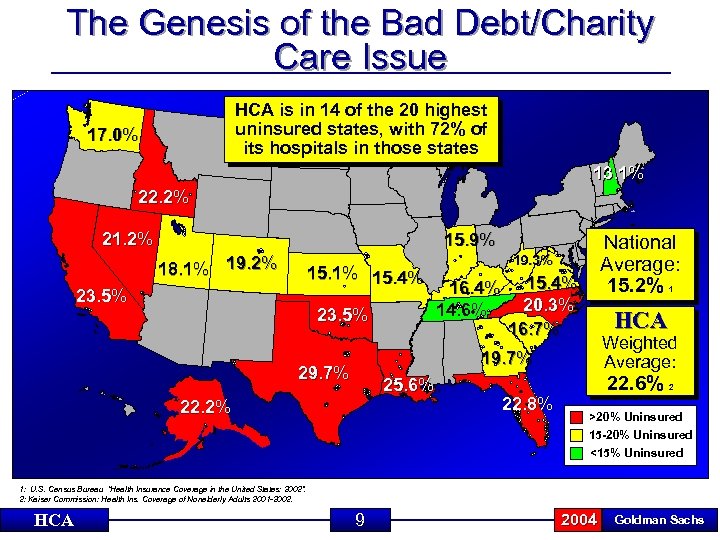

The Genesis of the Bad Debt/Charity Care Issue HCA is in 14 of the 20 highest uninsured states, with 72% of its hospitals in those states 17. 0% 13. 1% 22. 2% 21. 2% 15. 9% 18. 1% 19. 2% 23. 5% 15. 1% 15. 4% 23. 5% National Average: 15. 2% 19. 3% 16. 4% 14. 6% 15. 4% 20. 3% 16. 7% 1 HCA Weighted Average: 19. 7% 25. 6% 22. 2% 22. 8% 22. 6% 2 >20% Uninsured 15 -20% Uninsured <15% Uninsured 1: U. S. Census Bureau “Health Insurance Coverage in the United States: 2002”. 2: Kaiser Commission: Health Ins. Coverage of Nonelderly Adults 2001 -2002. HCA 9 2004 Goldman Sachs

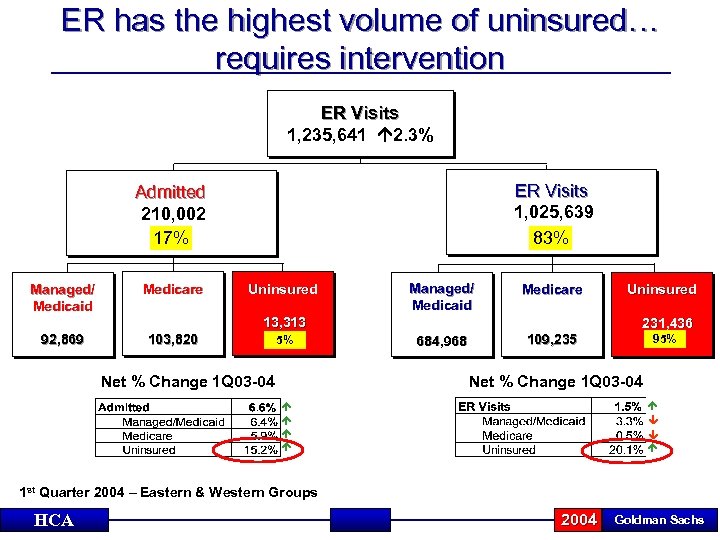

ER has the highest volume of uninsured… requires intervention ER Visits 1, 235, 641 2. 3% ER Visits 1, 025, 639 83% Admitted 210, 002 17% Managed/ Medicaid Medicare Uninsured Managed/ Medicaid Medicare 13, 313 92, 869 103, 820 5% Net % Change 1 Q 03 -04 684, 968 109, 235 Uninsured 231, 436 95% Net % Change 1 Q 03 -04 1 st Quarter 2004 – Eastern & Western Groups HCA 2004 Goldman Sachs

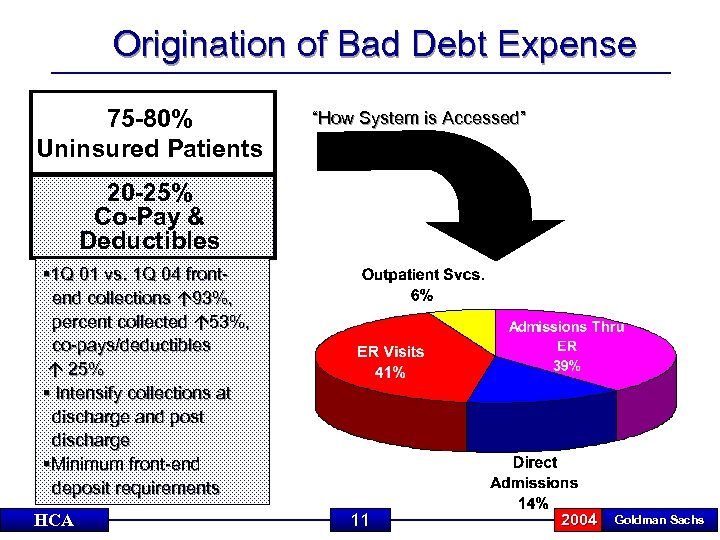

Origination of Bad Debt Expense 75 -80% Uninsured Patients “How System is Accessed” 20 -25% Co-Pay & Deductibles 1 Q 01 vs. 1 Q 04 frontend collections 93%, percent collected 53%, co-pays/deductibles 25% Intensify collections at discharge and post discharge Minimum front-end deposit requirements HCA 11 2004 Goldman Sachs

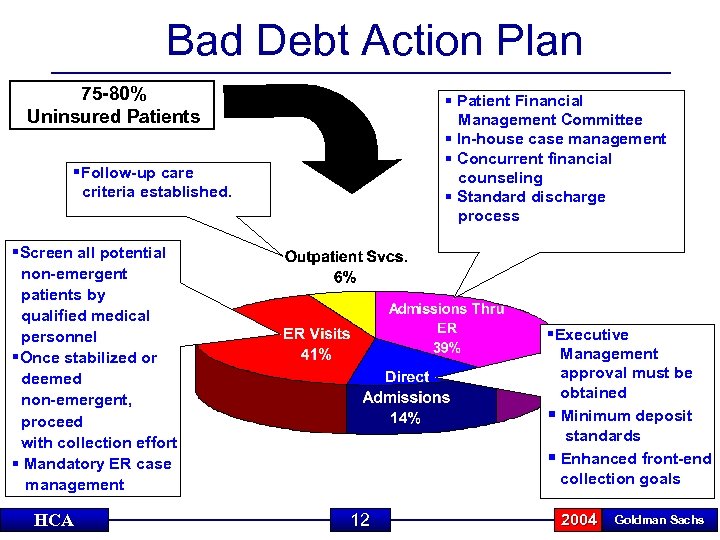

Bad Debt Action Plan 75 -80% Uninsured Patients Patient Financial Management Committee In-house case management Concurrent financial counseling Standard discharge process Follow-up care criteria established. Screen all potential non-emergent patients by qualified medical personnel Once stabilized or deemed non-emergent, proceed with collection effort Mandatory ER case management HCA Executive Management approval must be obtained Minimum deposit standards Enhanced front-end collection goals 12 2004 Goldman Sachs

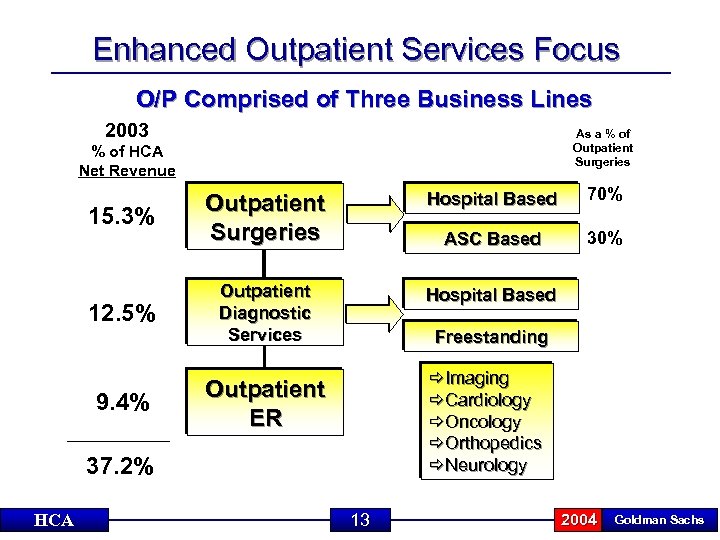

Enhanced Outpatient Services Focus O/P Comprised of Three Business Lines 2003 As a % of Outpatient Surgeries % of HCA Net Revenue 15. 3% Outpatient Surgeries Hospital Based 70% ASC Based 30% 12. 5% Outpatient Diagnostic Services Hospital Based 9. 4% Freestanding ðImaging ðCardiology ðOncology ðOrthopedics ðNeurology Outpatient ER 37. 2% HCA 13 2004 Goldman Sachs

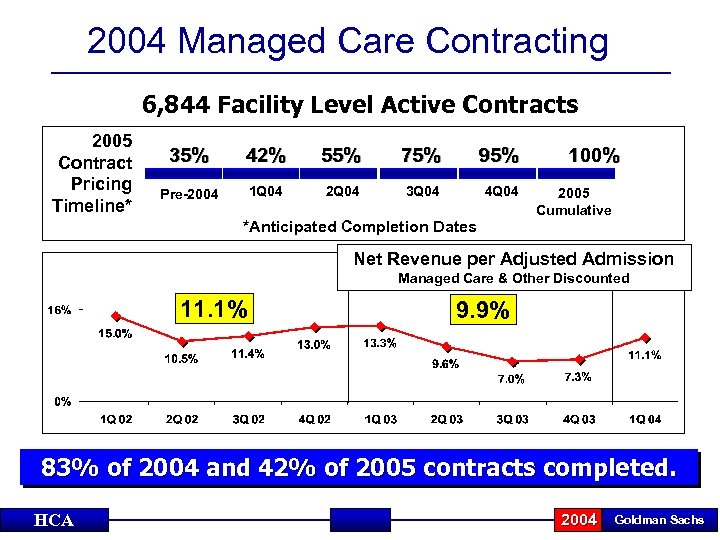

2004 Managed Care Contracting 6, 844 Facility Level Active Contracts 2005 Contract Pricing Timeline* 35% 42% 55% 75% 95% Pre-2004 1 Q 04 2 Q 04 3 Q 04 4 Q 04 *Anticipated Completion Dates 100% 2005 Cumulative Net Revenue per Adjusted Admission Managed Care & Other Discounted 11. 1% 9. 9% 83% of 2004 and 42% of 2005 contracts completed. HCA 2004 Goldman Sachs

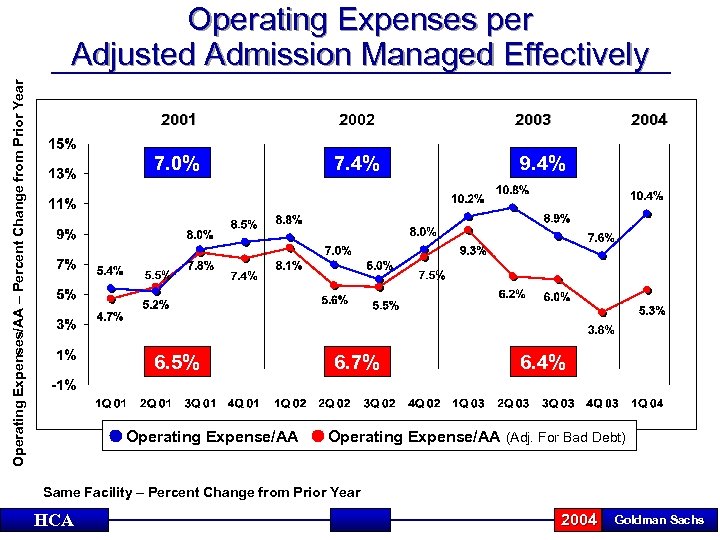

Operating Expenses/AA – Percent Change from Prior Year Operating Expenses per Adjusted Admission Managed Effectively 2001 2002 7. 0% 7. 4% 9. 4% 6. 5% 6. 7% 6. 4% Operating Expense/AA 2003 2004 Operating Expense/AA (Adj. For Bad Debt) Same Facility – Percent Change from Prior Year HCA 2004 Goldman Sachs

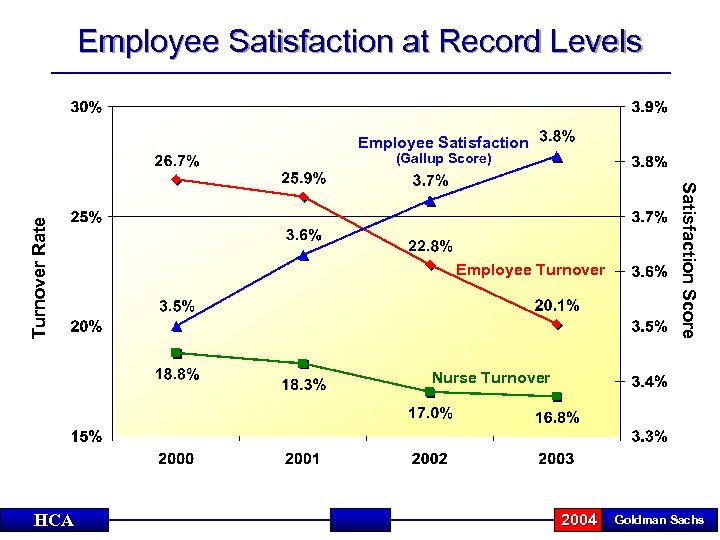

Employee Satisfaction at Record Levels Employee Satisfaction Employee Turnover Satisfaction Score Turnover Rate (Gallup Score) Nurse Turnover HCA 2004 Goldman Sachs

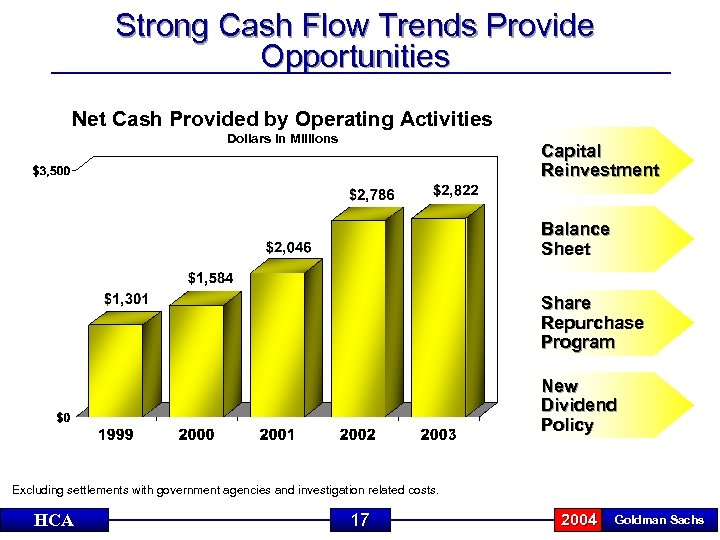

Strong Cash Flow Trends Provide Opportunities Net Cash Provided by Operating Activities Dollars in Millions Capital Reinvestment Balance Sheet Share Repurchase Program New Dividend Policy Excluding settlements with government agencies and investigation related costs. HCA 17 2004 Goldman Sachs

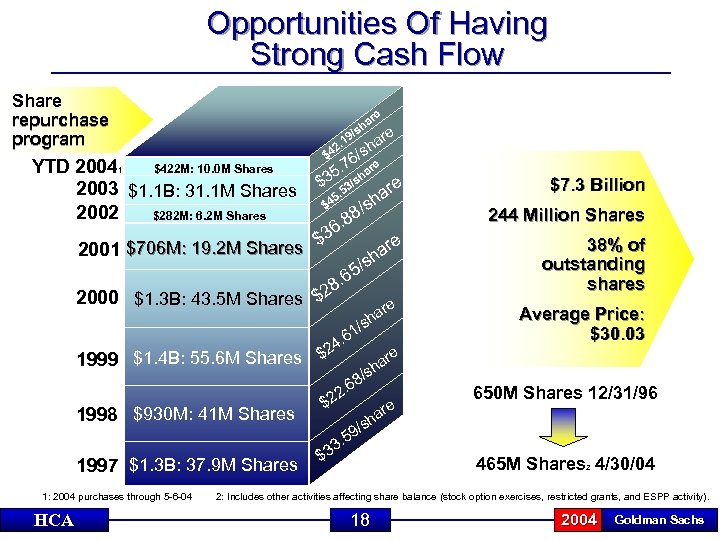

Opportunities Of Having Strong Cash Flow Share repurchase program ar sh / 19 YTD 20041 $422 M: 10. 0 M Shares 2003 $1. 1 B: 31. 1 M Shares 2002 $282 M: 6. 2 M Shares . 42 $ e e r ha /s 6 e 5. 7 shar 3 $ e ar h 3/. 5 5 8/s 6. 8 3 e $706 M: 19. 2 M Shares $ 2001 ar /sh 5 8. 6 2000 $1. 3 B: 43. 5 M Shares $2 re 1999 $1. 4 B: 55. 6 M Shares $4 a /sh 1 . 6 4 $2 1997 $1. 3 B: 37. 9 M Shares 1: 2004 purchases through 5 -6 -04 HCA 244 Million Shares 38% of outstanding shares Average Price: $30. 03 e r ha /s 8 1998 $930 M: 41 M Shares $7. 3 Billion . 6 22 $ re ha /s 650 M Shares 12/31/96 9 3. 5 $3 465 M Shares 4/30/04 2 2: Includes other activities affecting share balance (stock option exercises, restricted grants, and ESPP activity). 18 2004 Goldman Sachs

HCA is Investing Significantly in Programs for Patient Safety and Improved Patient Outcomes E MAR: Medication Error Prevention E POM: Physician Order Entry 100% Participation in CMS Quality Reporting Initiative Member of NQF and Leapfrog Cardiovascular, OB and Emergency Department Initiatives HCA 19 2004 Goldman Sachs

In Summary We Have…. Great Assets Excellent Investment Opportunities Strong Cash Flows Excellent Long-Term Earnings Growth Outlook A prudent financial strategy that provides for a strong balance sheet and return of cash to shareholders through share repurchase and/or dividends HCA 20 2004 Goldman Sachs

c43a0d95d5bca757614af4985c09bce1.ppt