Million starts with one presentation.ppt

- Количество слайдов: 34

Million starts with one: introduction to investment

Million starts with one: introduction to investment

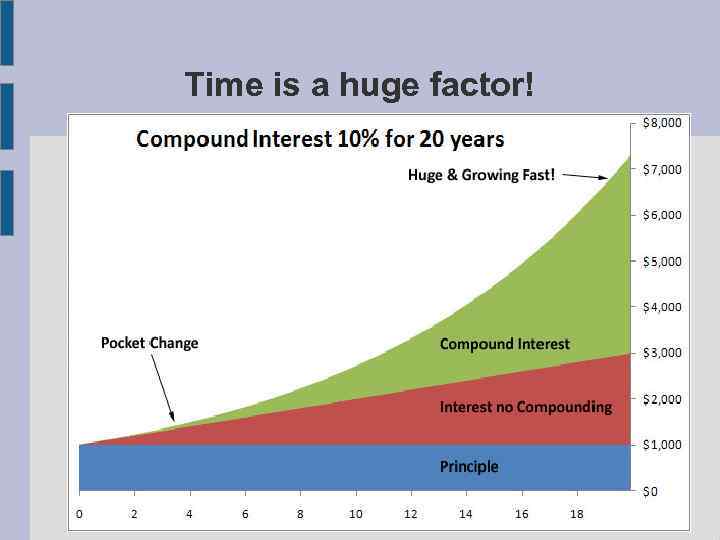

Time is a huge factor!

Time is a huge factor!

Time is a huge factor! After two years only $20 more After twenty years it is $4328 more! After thirty years the difference is $16, 837 The start investing as soon as you can. Compound interest will only help you if you invest long enough to make a difference!

Time is a huge factor! After two years only $20 more After twenty years it is $4328 more! After thirty years the difference is $16, 837 The start investing as soon as you can. Compound interest will only help you if you invest long enough to make a difference!

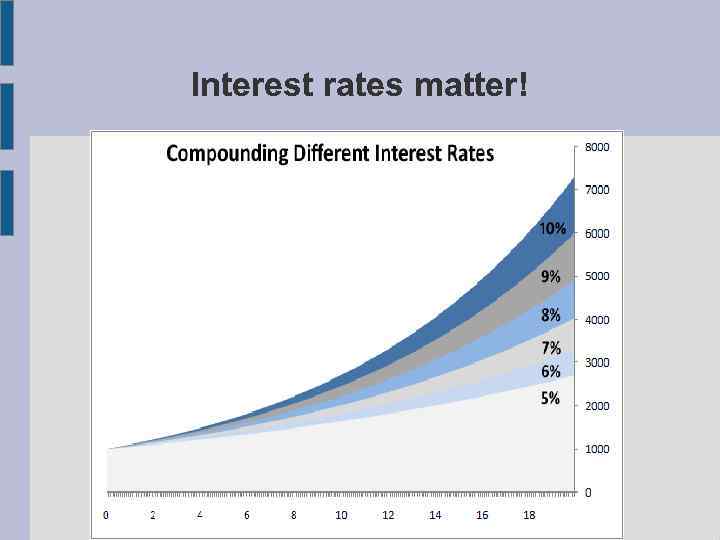

Interest rates matter!

Interest rates matter!

Interest rates matter! 1% is a big difference! 10% -> 9% is more than the original investment ($1318) 10% -> 8% is more than 2 X the original investment ($2401) 10% -> 7% is more than 3 X the original investment ($3289)

Interest rates matter! 1% is a big difference! 10% -> 9% is more than the original investment ($1318) 10% -> 8% is more than 2 X the original investment ($2401) 10% -> 7% is more than 3 X the original investment ($3289)

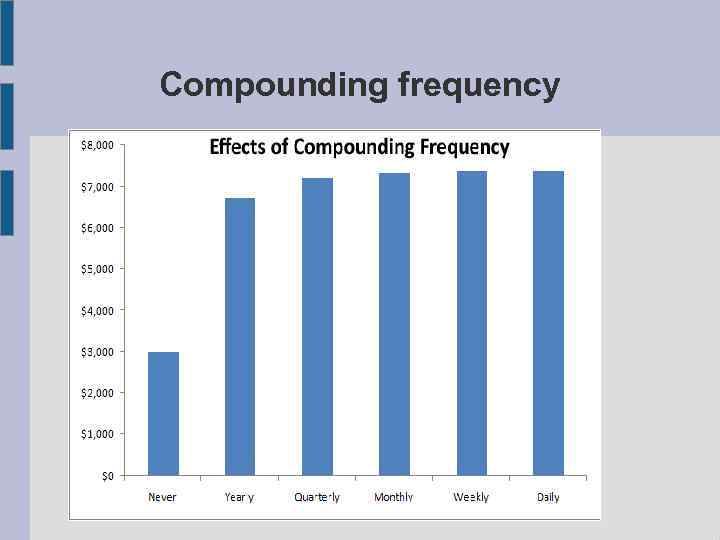

Compounding frequency

Compounding frequency

Compounding frequency More frequent is always better but the effect diminishes rapidly Not quite half the original investment ($482) Quarterly to Monthly even smaller About a tenth of the original investment ($118. 5) This is at about 99% of compounding instantly Monthly to Weekly still smaller increase May buy you a dinner ($46)

Compounding frequency More frequent is always better but the effect diminishes rapidly Not quite half the original investment ($482) Quarterly to Monthly even smaller About a tenth of the original investment ($118. 5) This is at about 99% of compounding instantly Monthly to Weekly still smaller increase May buy you a dinner ($46)

Effective interest rate Nominal Rate per Period (R) 15% Compounding per Period (m) 12 Number of Periods (t) 5 Effective Rate per Period: i = 16. 0755% Effective Rate for 5 Periods: it = 110. 7181% Rate per Compounding Intereval: p = 1. 25%

Effective interest rate Nominal Rate per Period (R) 15% Compounding per Period (m) 12 Number of Periods (t) 5 Effective Rate per Period: i = 16. 0755% Effective Rate for 5 Periods: it = 110. 7181% Rate per Compounding Intereval: p = 1. 25%

Banking: how to choose a bank? #1 40+ years of international experience #2 rating A by Moody's, Standard&Poor's, Fitch #3 IPO — transperancy — shares market value #4 Capital — the more the better #5 15+ Countries — divercification of risks

Banking: how to choose a bank? #1 40+ years of international experience #2 rating A by Moody's, Standard&Poor's, Fitch #3 IPO — transperancy — shares market value #4 Capital — the more the better #5 15+ Countries — divercification of risks

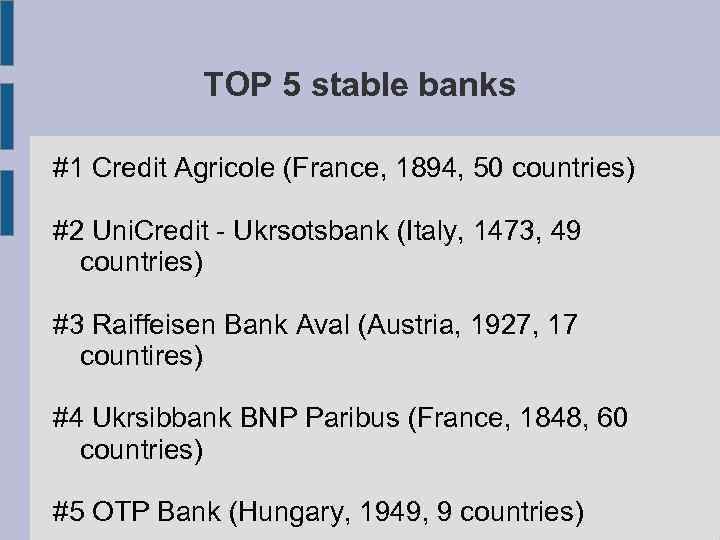

TOP 5 stable banks #1 Credit Agricole (France, 1894, 50 countries) #2 Uni. Credit - Ukrsotsbank (Italy, 1473, 49 countries) #3 Raiffeisen Bank Aval (Austria, 1927, 17 countires) #4 Ukrsibbank BNP Paribus (France, 1848, 60 countries) #5 OTP Bank (Hungary, 1949, 9 countries)

TOP 5 stable banks #1 Credit Agricole (France, 1894, 50 countries) #2 Uni. Credit - Ukrsotsbank (Italy, 1473, 49 countries) #3 Raiffeisen Bank Aval (Austria, 1927, 17 countires) #4 Ukrsibbank BNP Paribus (France, 1848, 60 countries) #5 OTP Bank (Hungary, 1949, 9 countries)

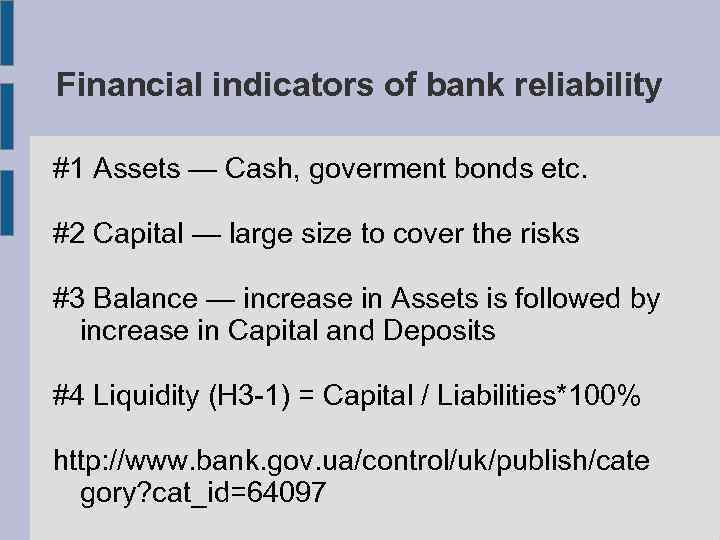

Financial indicators of bank reliability #1 Assets — Cash, goverment bonds etc. #2 Capital — large size to cover the risks #3 Balance — increase in Assets is followed by increase in Capital and Deposits #4 Liquidity (H 3 -1) = Capital / Liabilities*100% http: //www. bank. gov. ua/control/uk/publish/cate gory? cat_id=64097

Financial indicators of bank reliability #1 Assets — Cash, goverment bonds etc. #2 Capital — large size to cover the risks #3 Balance — increase in Assets is followed by increase in Capital and Deposits #4 Liquidity (H 3 -1) = Capital / Liabilities*100% http: //www. bank. gov. ua/control/uk/publish/cate gory? cat_id=64097

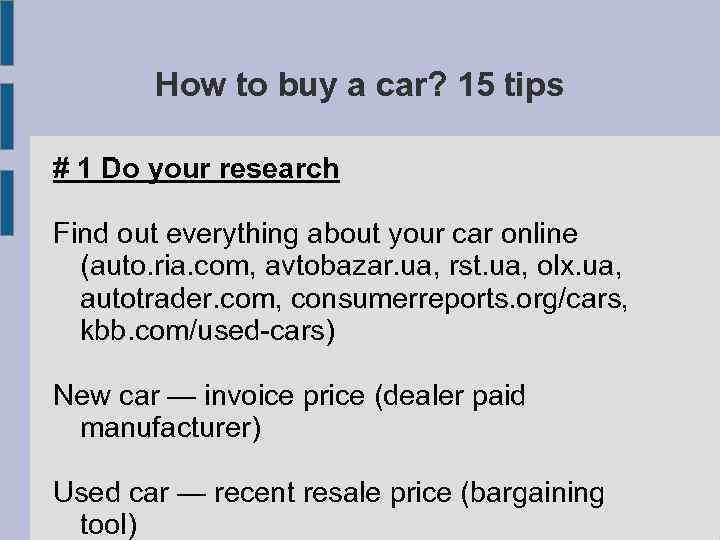

How to buy a car? 15 tips # 1 Do your research Find out everything about your car online (auto. ria. com, avtobazar. ua, rst. ua, olx. ua, autotrader. com, consumerreports. org/cars, kbb. com/used-cars) New car — invoice price (dealer paid manufacturer) Used car — recent resale price (bargaining tool)

How to buy a car? 15 tips # 1 Do your research Find out everything about your car online (auto. ria. com, avtobazar. ua, rst. ua, olx. ua, autotrader. com, consumerreports. org/cars, kbb. com/used-cars) New car — invoice price (dealer paid manufacturer) Used car — recent resale price (bargaining tool)

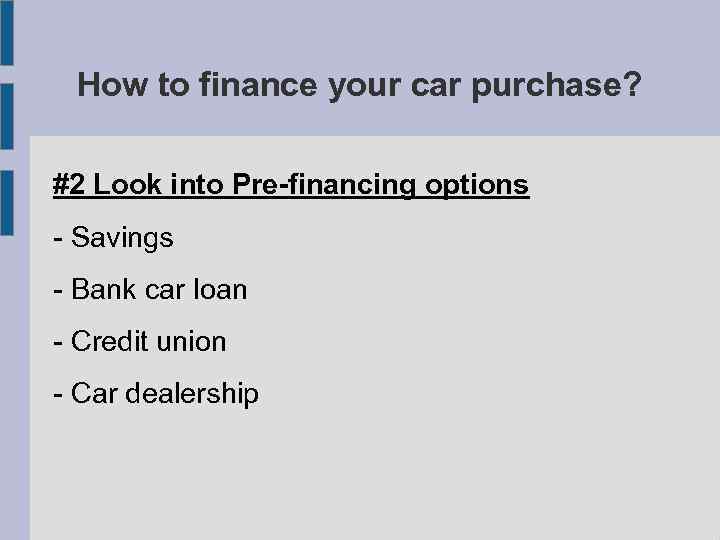

How to finance your car purchase? #2 Look into Pre-financing options - Savings - Bank car loan - Credit union - Car dealership

How to finance your car purchase? #2 Look into Pre-financing options - Savings - Bank car loan - Credit union - Car dealership

#3 Shop around - visit at least one dealership and find out their rock-bottom price, often given to you just before you leave - explore out-of-town car dealership (price is sensitive towards the location)

#3 Shop around - visit at least one dealership and find out their rock-bottom price, often given to you just before you leave - explore out-of-town car dealership (price is sensitive towards the location)

#4 Negotiate terms - negotiate car loan: - keep your car loan term as short as possible. Today, banks are allowed to finance a car for up to 7 years. A car is depreciating asset andis losing a value every year. The best loan term is less than 4 years. - say no to high interest rate. Find out the average rate and do not accept any higher rate. It never worth to pay high interest just for the right to own a car

#4 Negotiate terms - negotiate car loan: - keep your car loan term as short as possible. Today, banks are allowed to finance a car for up to 7 years. A car is depreciating asset andis losing a value every year. The best loan term is less than 4 years. - say no to high interest rate. Find out the average rate and do not accept any higher rate. It never worth to pay high interest just for the right to own a car

#5 Look at both New and Used cars - Buying a gently used car is the best way to save money when purchase a vehicle. - New cars depreciate considerably the moment they are taken home from the dealership The average new car will have a residual value of around 40% of its new price after three years (assuming 10, 000 miles/year) or in other words will have lost around 60% of its value at an average of 20% per year.

#5 Look at both New and Used cars - Buying a gently used car is the best way to save money when purchase a vehicle. - New cars depreciate considerably the moment they are taken home from the dealership The average new car will have a residual value of around 40% of its new price after three years (assuming 10, 000 miles/year) or in other words will have lost around 60% of its value at an average of 20% per year.

#6 Negotiate Purchase price, not Monthly payments

#6 Negotiate Purchase price, not Monthly payments

#7 Online car purchasing - better price via internet (sales manager in the showroom tries negotiate the highest price, since his commissions are based on % of sale price) - convinient way to buy (no needs to visit multiple dealerships)

#7 Online car purchasing - better price via internet (sales manager in the showroom tries negotiate the highest price, since his commissions are based on % of sale price) - convinient way to buy (no needs to visit multiple dealerships)

#8 Don't mention your trade-in You’re looking at a $22, 000 car and the dealer’s rock-bottom price is $18, 000. If you have a trade-in worth $2, 000, the dealer might offer to give you the car for $20, 000 plus the additional $2, 000 for the trade-in, for a total purchase price of $18, 000. If you hadn’t mentioned your trade-in, you could have negotiated the price down to $18, 000 and then told the dealer about the trade-in, resulting in a final purchase price of $16, 000.

#8 Don't mention your trade-in You’re looking at a $22, 000 car and the dealer’s rock-bottom price is $18, 000. If you have a trade-in worth $2, 000, the dealer might offer to give you the car for $20, 000 plus the additional $2, 000 for the trade-in, for a total purchase price of $18, 000. If you hadn’t mentioned your trade-in, you could have negotiated the price down to $18, 000 and then told the dealer about the trade-in, resulting in a final purchase price of $16, 000.

#9 Car insurance costs - Get insurance premium quotes online based on the car’s make and model and personal information including age, marital status, and driving record. - Some cars have higher insurance rates: Honda Accord, Honda Civic, and the Toyota Camry are favorites among car thieves because of their higher resale values, and the insurance premiums for these cars can thus be more expensive.

#9 Car insurance costs - Get insurance premium quotes online based on the car’s make and model and personal information including age, marital status, and driving record. - Some cars have higher insurance rates: Honda Accord, Honda Civic, and the Toyota Camry are favorites among car thieves because of their higher resale values, and the insurance premiums for these cars can thus be more expensive.

#10 Avoid impulse buying Prevent impulse buying by conducting extensive research before you buy a vehicle. You might realize after impulse buying that you can’t afford the car, or the car performance doesn’t meet your expectations. By researching the make, model, and style of the car, and reviewing insurance rates and financing, you should be able to put yourself in a car that you will enjoy for many years to come.

#10 Avoid impulse buying Prevent impulse buying by conducting extensive research before you buy a vehicle. You might realize after impulse buying that you can’t afford the car, or the car performance doesn’t meet your expectations. By researching the make, model, and style of the car, and reviewing insurance rates and financing, you should be able to put yourself in a car that you will enjoy for many years to come.

#11 Don't purchase the Add-ons - If you finance the car, the overall costs for accessories will skyrocket, so keep the addons to a minimum. - You can buy a portable GPS navigation unit online for much less than expensive built-in systems.

#11 Don't purchase the Add-ons - If you finance the car, the overall costs for accessories will skyrocket, so keep the addons to a minimum. - You can buy a portable GPS navigation unit online for much less than expensive built-in systems.

#12 Don't buy the extended warranty - The extended car warranties offered by dealerships are expensive, and, even worse, the coverage is often very limited. - If you’re buying a new car, the car should come with a manufacturer’s warranty. - If you’re looking at a used car, keep in mind that many of them will still have valid manufacturer’s warranties.

#12 Don't buy the extended warranty - The extended car warranties offered by dealerships are expensive, and, even worse, the coverage is often very limited. - If you’re buying a new car, the car should come with a manufacturer’s warranty. - If you’re looking at a used car, keep in mind that many of them will still have valid manufacturer’s warranties.

#13 Always test drive the car - 90% of people who buy a new car test drive it first. There are some cars that you just won’t feel comfortable driving. If this is the case, move on. - If you have children, bring them along on the test drive. They will give you their honest assessment of the car.

#13 Always test drive the car - 90% of people who buy a new car test drive it first. There are some cars that you just won’t feel comfortable driving. If this is the case, move on. - If you have children, bring them along on the test drive. They will give you their honest assessment of the car.

#14 Visit the mechanic when buy Used - The mechanic will inspect the car and look for unusual signs of wear and tear as well as items of potential concern. - Mechanical problems or maintenance issues that the mechanic finds may determine whether or not you buy the car. - Mechanic’s report may provide you with the necessary leverage to negotiate a lower purchase price

#14 Visit the mechanic when buy Used - The mechanic will inspect the car and look for unusual signs of wear and tear as well as items of potential concern. - Mechanical problems or maintenance issues that the mechanic finds may determine whether or not you buy the car. - Mechanic’s report may provide you with the necessary leverage to negotiate a lower purchase price

#15 Buy a car you can afford - Just make sure that you’re not digging into your savings or your emergency fund to buy a top-of-the-line car. - Buy within your means. - If you are considering buying another car, a much better option is to wait until your current vehicle is paid off.

#15 Buy a car you can afford - Just make sure that you’re not digging into your savings or your emergency fund to buy a top-of-the-line car. - Buy within your means. - If you are considering buying another car, a much better option is to wait until your current vehicle is paid off.

The best way to finance buying a car #1 — personal loan — the lowest interest, if your credit rating is good #2 — hire purchase - paid in instalments over 1260 months and put down a 10% deposit. The loan is secured against the car, so you don’t own it until the last payment is made. #3 — personal contract plan - you pay the difference between car sale price and car price for resale back to the dealer (lower monthly payments) #4 — leasing — you pay the dealer a fixed monthly amount for the use of a car, with servicing and maintenance included

The best way to finance buying a car #1 — personal loan — the lowest interest, if your credit rating is good #2 — hire purchase - paid in instalments over 1260 months and put down a 10% deposit. The loan is secured against the car, so you don’t own it until the last payment is made. #3 — personal contract plan - you pay the difference between car sale price and car price for resale back to the dealer (lower monthly payments) #4 — leasing — you pay the dealer a fixed monthly amount for the use of a car, with servicing and maintenance included

Car vs. bicycle

Car vs. bicycle

Thank you! Tetyana Romanovska Mob. # +380(67)3700502 tetyana. romanovska@gmail. com https: //www. facebook. com/tetyana. romanovska https: //www. facebook. com/Toastmasters. Club. Ternopil/ https: //ua. linkedin. com/in/romanovska-tetyana-0 a 11 b 310

Thank you! Tetyana Romanovska Mob. # +380(67)3700502 tetyana. romanovska@gmail. com https: //www. facebook. com/tetyana. romanovska https: //www. facebook. com/Toastmasters. Club. Ternopil/ https: //ua. linkedin. com/in/romanovska-tetyana-0 a 11 b 310