ba032d2a5dd879c4e7dd70011a96b38e.ppt

- Количество слайдов: 29

Mike Lubrano Head, Investor & Corporate Practice Corporate Governance Department Seminario Anual FIAP Santiago, 18/19 mayo de 2006 IFC’s Corporate Governance Methodology Background, Experiences aand Applicability to Pension Funds / Institutional Investors 1

IFC Portfolio Established 1956 n Private Sector Arm of World Bank Group n US$19 billion invested for own account in Emerging Markets (Loans and Equity) n – 625 Equity Investments Approximately 250 New Commitments Per Year; 1400 Portfolio Companies n New Money in Existing Publicly-Listed / Unlisted Companies (All Industrial Sectors and Financial Sector) as well as Greenfield JVs n 2

Why Does IFC Care About CG? n Portfolio Performance – Poor Governance Increases Risk – Improving Governance is a Value Proposition (Private Equity Funds; Hikma; BCR) n Development Mission – Along with Social, Environmental, and other Elements of Sustainability n 3 Reputational Risk / Reputational Agent

Support for The Value Proposition n S&P, Moody’s and Fitch > CG Explicit Part of Credit Rating (BCR Upgrade) – Reflects Increasing Empirical Evidence n Experience of Activist Institutional Investors – Cal. PERS Governance Portfolio Performance Listing Requirements n CG Funds (Dynamo’s Puma II) n IFC is in a Unique Position to Test the Governance Thesis in Emerging Markets n 4

CG is a Natural Fit for IFC n Participation in Governance Worldwide – Access to Data – Skills, Experience to Deliver n n “Grass Roots”/PEP Projects Global Partners – – n OECD Global CG Forum / Private Sector Adv. Group Regional Partners National advocacy, b-schools, training institutes (NACD) IFC-Nominated Directors – Training Program 5

Challenge for any Institutional Investor: Developing a Workable Methodology Create a Common Definition/Vocabulary within the Institution n Be Consistent with the IFC Mission: Sustainability / Value Added n Tailored to our Unique Portfolio n Fit with Existing Operating Procedures n – Project Prep and Decision Meetings Accessible to Staff and others (website) n Avoid Compliance Mentality / Box Ticking n 6

What is a Workable Definition for Us? OECD Principles Provide an accepted/supported Framework: n n Financial Stakeholders (e. g. , Shareholders) Checks and Balances (Boards of Directors) Control Environment (Audit, Internal Controls) Transparency and Disclosure A Practical Investment-Driven Definition 7 n n n n Distinguish from: Corporate Citizenship Corporate Social Responsibility Socially Responsible Investing Other Elements of Sustainability Political Governance Business Ethics Anti-Corruption / AML (But CG does reinforce all of these!!!)

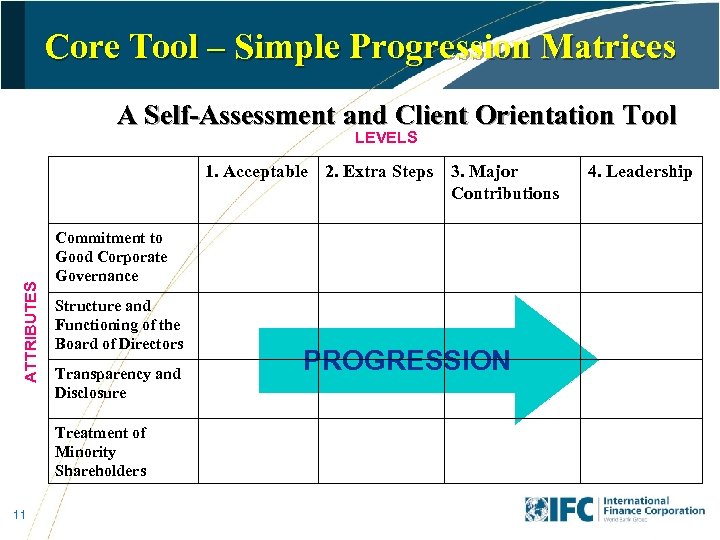

IFC’s Methodology n n Break Governance Into Digestible Bits Company archetypes, paradigms (non-exclusive): – – – n n 8 Listed companies Family- or Founder-Owned Unlisted Companies Financial Institutions Transition Economy Companies [SOE Paradigm in Progress] Five attributes of effectiveness Four levels, from “acceptable” to “leadership. ” We call this our Progression Matrix. This approach parallels the approach taken in the other areas of sustainability (social and environmental)

IFC’s Corporate Governance Toolkit CG Progression Matrices n Instruction Sheets n CG Information Request Lists n Why Corporate Governance? n Model CG Improvement Programs n Indicative Independent Director Definition n Supervision Checklist n 9

Using the Tools Step 1: First Impressions n Step 2: Client Self-Assessment n – Open the Dialogue n Step 3: Corporate Governance Review – Articulate the Risks / Opportunities n Step 4: Address the Risks and Opportunities – Terms and Conditions Step 5: Documentation and Implementation n Step 6: Supervision n 10

Core Tool – Simple Progression Matrices A Self-Assessment and Client Orientation Tool LEVELS ATTRIBUTES 1. Acceptable 2. Extra Steps Commitment to Good Corporate Governance Structure and Functioning of the Board of Directors Transparency and Disclosure Treatment of Minority Shareholders 11 3. Major Contributions PROGRESSION 4. Leadership

Fit with the Appraisal / Supervision Process Staff evaluate client companies and work with them to add value to their governance: n n n 12 By following a series of steps -- that fit into existing appraisal / supervision patterns The time and effort involved in each step varies in nature depending on the type of enterprise – listed companies, family/founder firms, financial institutions, etc. The intensity of project team effort depends on risk and opportunity.

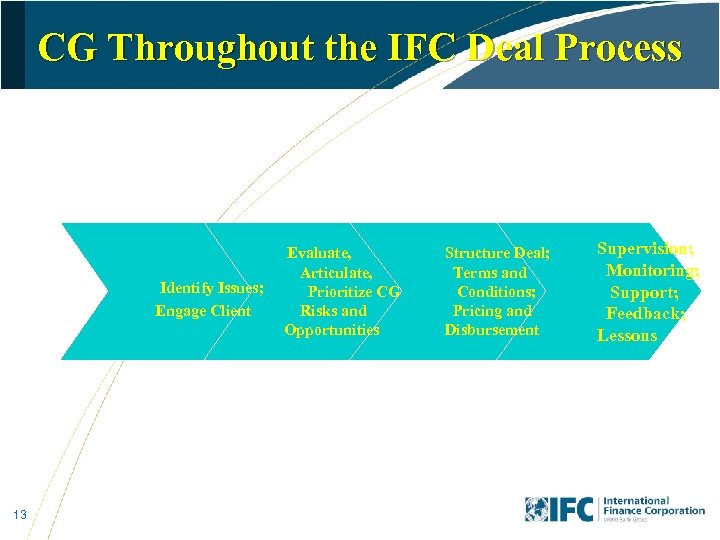

CG Throughout the IFC Deal Process Identify Issues; Engage Client 13 Evaluate, Articulate, Prioritize CG Risks and Opportunities Structure Deal; Terms and Conditions; Pricing and Disbursement Supervision; Monitoring; Support; Feedback; Lessons

When We Focus on Corporate Governance n Risks and/or Opportunities – Financial Return and Development Impact Risks may be: – – n Opportunities (to add value) may be: – – 14 attitudinal (little or no commitment to governance) financial/operational (weak controls) legal (weak compliance) reputational (negative image) attitudinal (strong commitment to governance) financial (access to capital/better valuations) legal (model codes/compliance/documentation) reputational (fulfilling IFC’s mission)

(Some) Corporate Governance Problems n n n n Developed Markets Dispersed ownership: agency problems between shareholders and managers Empire building of CEOs Excessive remuneration (stock options) Insider trading Defense mechanisms (poison pills, staggered boards) Non-disclosure of information (manipulation with SPEs) Internal control problems (independence of auditor) n n – Poor Capacity – Passive Approach – Low independence n n 15 Emerging/Transition Economies Concentrated ownership: agency problems between controlling and minority shareholders Ineffective Boards Conflicts of Interest; RPTs Minority Shareholder mistreatment, especially in change of control situations Succession / Family Business Issues Transparency / Internal Controls / Audit Function

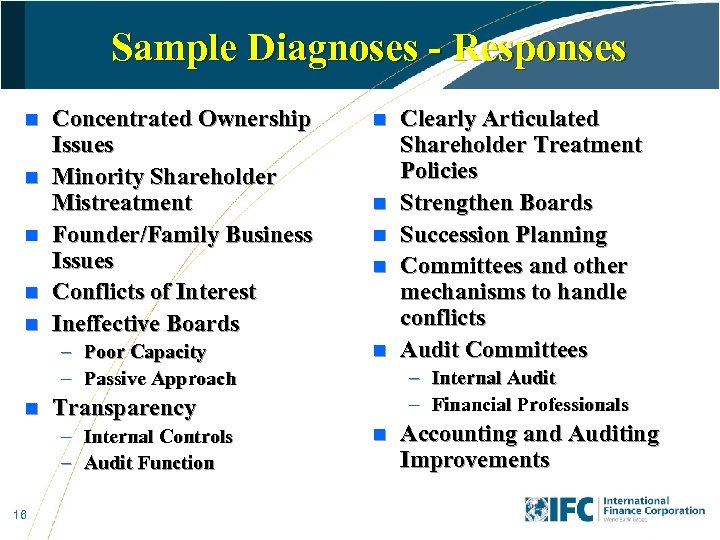

Sample Diagnoses - Responses n n n Concentrated Ownership Issues Minority Shareholder Mistreatment Founder/Family Business Issues Conflicts of Interest Ineffective Boards – Poor Capacity – Passive Approach n n n Clearly Articulated Shareholder Treatment Policies Strengthen Boards Succession Planning Committees and other mechanisms to handle conflicts Audit Committees – Internal Audit – Financial Professionals Transparency – Internal Controls – Audit Function 16 n n Accounting and Auditing Improvements

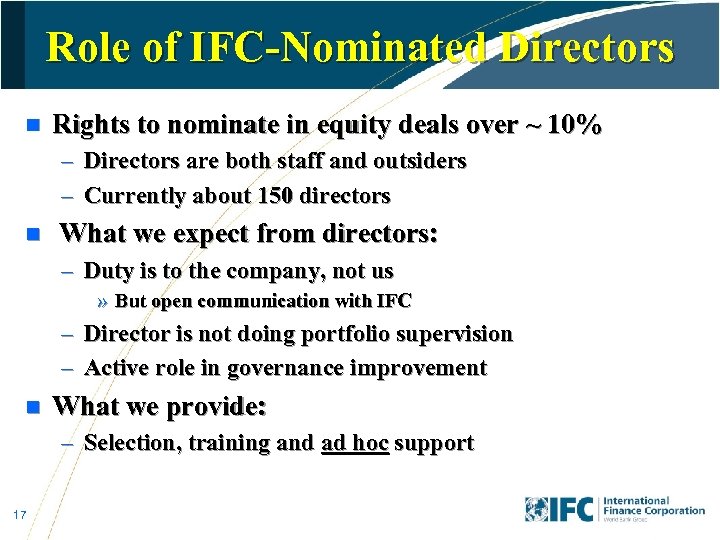

Role of IFC-Nominated Directors n Rights to nominate in equity deals over ~ 10% – Directors are both staff and outsiders – Currently about 150 directors n What we expect from directors: – Duty is to the company, not us » But open communication with IFC – Director is not doing portfolio supervision – Active role in governance improvement n What we provide: – Selection, training and ad hoc support 17

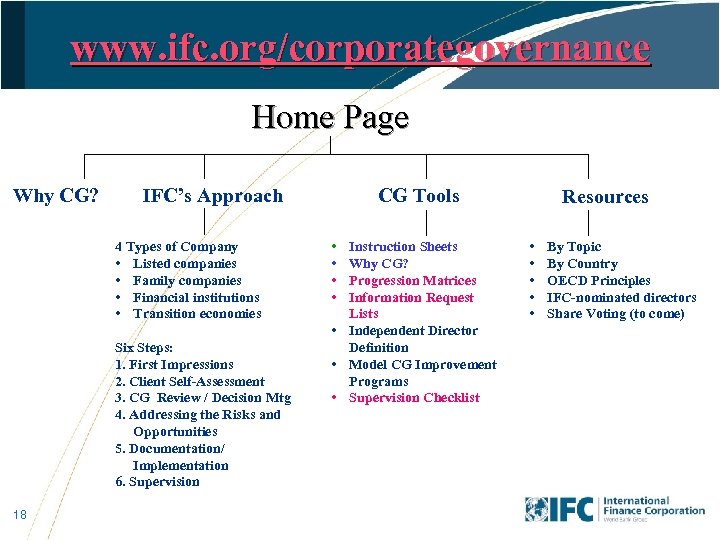

www. ifc. org/corporategovernance Home Page Why CG? IFC’s Approach 4 Types of Company • Listed companies • Family companies • Financial institutions • Transition economies Six Steps: 1. First Impressions 2. Client Self-Assessment 3. CG Review / Decision Mtg 4. Addressing the Risks and Opportunities 5. Documentation/ Implementation 6. Supervision 18 CG Tools • • Instruction Sheets Why CG? Progression Matrices Information Request Lists • Independent Director Definition • Model CG Improvement Programs • Supervision Checklist Resources • • • By Topic By Country OECD Principles IFC-nominated directors Share Voting (to come)

IFC’s Approach in Practice Hikma Pharaceuticals 19

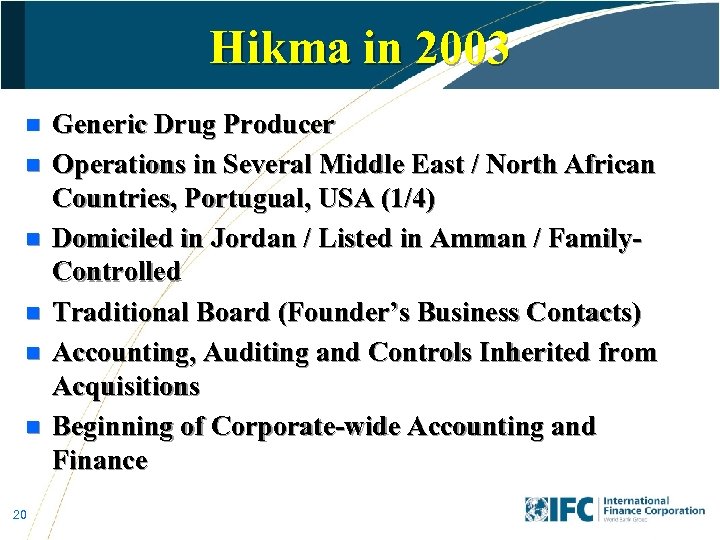

Hikma in 2003 n n n 20 Generic Drug Producer Operations in Several Middle East / North African Countries, Portugual, USA (1/4) Domiciled in Jordan / Listed in Amman / Family. Controlled Traditional Board (Founder’s Business Contacts) Accounting, Auditing and Controls Inherited from Acquisitions Beginning of Corporate-wide Accounting and Finance

Governance Challenges Objective: International IPO, Minimize National Discount Confidence and Consistency of Controls / Accounts / Auditing n International Financial Reporting n Strengthening the Board n – Composition – Committees – Practices 21

Responses; Outcomes Unified, Corporate-Wide Systems n Re-domiciled in Jersey n New Board n – Independent Directors – Audit Committee LSE/Dubai Listing – November 2005 22

IFC’s Approach in Practice Banca Comerciala Romana 23

BCR in 2003 n n n Largest Commercial Bank in Romania US$1 billion book value State-owned (70%), with minority (30%) held by Investment Funds (SIFs) Two failed privatization attempts in 2002 Management and board indistinguishable – Board composed of senior managers and SIF representatives – met more than 25 times annually n 24 Risk management and internal controls systems weak

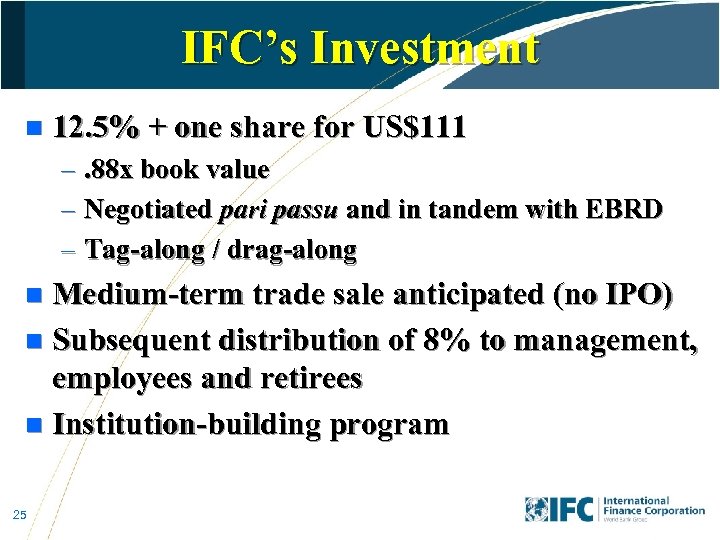

IFC’s Investment n 12. 5% + one share for US$111 –. 88 x book value – Negotiated pari passu and in tandem with EBRD – Tag-along / drag-along Medium-term trade sale anticipated (no IPO) n Subsequent distribution of 8% to management, employees and retirees n Institution-building program n 25

Corporate Governance Program n n Philosophy – “Governance for the Interim” Introduced Two-Tiered Board Structure – – n n n Management off the Supervisory Board Redrafted Charter Amendments to Banking Law Audit & Compliance and Compensation Committees IFC and EBRD-nominated directors Active engagement at Shareholders Meeting Two-Stage Training Program – IMD/IIF Seminar – In-house Program 26

Initial Results n n Rating Agency Upgrades Board effectiveness – IFC nominee attended 14 board meetings in 14 months, chaired audit committee Professionalization of Shareholders Meetings Implementation of IBP – Improvement of Risk Management and Internal Controls – IFC-sponsored Resident Advisor to Internal Controls Unit n 27 Transparency sufficient to privatize

Full Privatization 11 interested bidders initially n 7 bids submitted in mid-October n 2 finalists: Erste Bank (Austria) and BCP (Portugal) bid for Gov’t and IFC/EBRD shares n Erste wins bidding: € 3. 75 billion for 61. 88% n – ~6 x book value of € 1 billion at June 2005 – IFC’s 12. 5% stake worth € 758 million 28

Many Thanks!!! 29

ba032d2a5dd879c4e7dd70011a96b38e.ppt