8489557fa80eb90f6c446ed6a30eb7d0.ppt

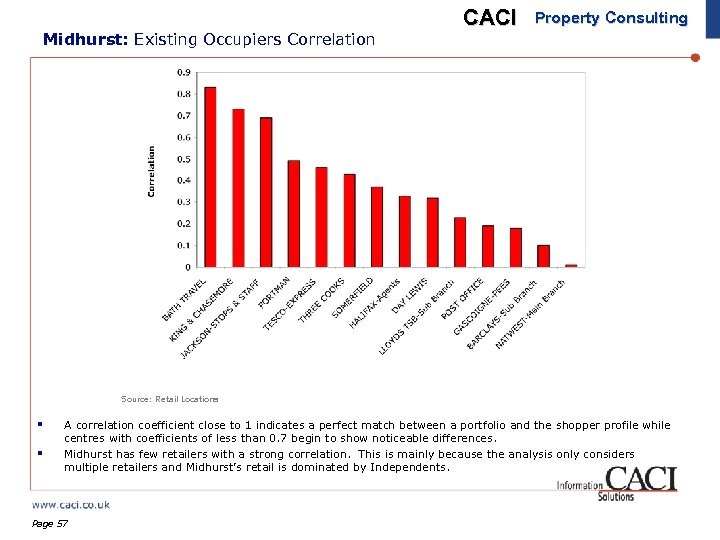

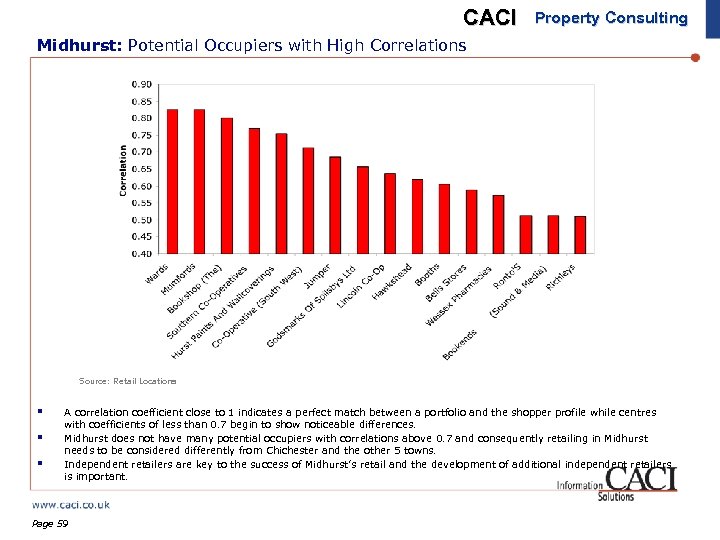

- Количество слайдов: 70

Midhurst with the 5 Town Network & Chichester: Strategy & Sustainable Opportunities Prepared for Chichester District Council Date: January 2007 Tel: 020 7602 6000 Email: property@caci. co. uk

Midhurst with the 5 Town Network & Chichester: Strategy & Sustainable Opportunities Prepared for Chichester District Council Date: January 2007 Tel: 020 7602 6000 Email: property@caci. co. uk

CACI Property Consulting Midhurst Strategy & Sustainable Opportunities 1. 2. Resident Market Potential 3. Tourist Market Potential 4. Worker Market Potential 5. Benchmarks & Retail Provision 6. Retail Development Scenarios 7. Residential Development 8. Occupier Suitability 9. Future Market Summaries 10. SWOT analysis 11. Page 2 Project Scope Strategic Conclusions

CACI Property Consulting Midhurst Strategy & Sustainable Opportunities 1. 2. Resident Market Potential 3. Tourist Market Potential 4. Worker Market Potential 5. Benchmarks & Retail Provision 6. Retail Development Scenarios 7. Residential Development 8. Occupier Suitability 9. Future Market Summaries 10. SWOT analysis 11. Page 2 Project Scope Strategic Conclusions

CACI Property Consulting Midhurst Strategy & Sustainable Opportunities 1. Page 3 Project Scope

CACI Property Consulting Midhurst Strategy & Sustainable Opportunities 1. Page 3 Project Scope

Project Scope: CACI Property Consulting § CACI have been instructed by Chichester District Council to provide an independent, strategic assessment of the retail potential of Midhurst. § Chichester District Council wish to understand who uses the town, the level of town centre retail, leisure and catering facilities, and what facilities could be added to improve the town. Comparisons have been made with the 5 towns and Chichester as reports have previously been received on these locations. § CACI have assessed in detail the current market position of Midhurst, incorporating a detailed analysis of spend derived from residents, workers and tourists. § Midhurst has also been benchmarked against similar UK centres and its current retail provision has been analysed. An initial analysis of occupier suitability has also been undertaken, based on the current market profile for the town. § Future development scenarios for both residential and retail development to 2016 have been assessed, enabling a detailed analysis of how developments in competing towns will impact upon Midhurst. § A draft local strategy for Midhurst has been recommended, based on the sector profile and occupier suitability analysis for the town. Page 4

Project Scope: CACI Property Consulting § CACI have been instructed by Chichester District Council to provide an independent, strategic assessment of the retail potential of Midhurst. § Chichester District Council wish to understand who uses the town, the level of town centre retail, leisure and catering facilities, and what facilities could be added to improve the town. Comparisons have been made with the 5 towns and Chichester as reports have previously been received on these locations. § CACI have assessed in detail the current market position of Midhurst, incorporating a detailed analysis of spend derived from residents, workers and tourists. § Midhurst has also been benchmarked against similar UK centres and its current retail provision has been analysed. An initial analysis of occupier suitability has also been undertaken, based on the current market profile for the town. § Future development scenarios for both residential and retail development to 2016 have been assessed, enabling a detailed analysis of how developments in competing towns will impact upon Midhurst. § A draft local strategy for Midhurst has been recommended, based on the sector profile and occupier suitability analysis for the town. Page 4

CACI Property Consulting Midhurst Strategy & Sustainable Opportunities 2. Page 5 Resident Market Potential

CACI Property Consulting Midhurst Strategy & Sustainable Opportunities 2. Page 5 Resident Market Potential

Retail Footprint 2006: An Overview CACI Property Consulting § In order to accurately assess the scope of Midhurst’s current retail catchment and its market share within this key area, CACI have made use of Retail Footprint. § Retail Footprint is CACI’s national comparison goods shopping model, covering circa 3, 000 shopping destinations across Great Britain. It is built using gravity modelling principles, i. e. : the flow of customers from a postal sector will be directly proportional to the size of the Centre and inversely proportional to its Distance/Drivetime. § Catchments, predicted shopper/expenditure flows and postal sector market share penetration outputs are recalibrated annually using retailer exit surveys and credit card transaction data. Retail Footprint recognises that shoppers have a choice therefore catchments overlap – Retail Footprint defines primary, secondary, tertiary and quarternary sub-catchments for each retail centre. § Retail Footprint is used by a significant and increasing number of local authorities and retailers to understand local shopping patterns, current and future retail capacity, town centre performance and as a key input into store location planning. Page 6

Retail Footprint 2006: An Overview CACI Property Consulting § In order to accurately assess the scope of Midhurst’s current retail catchment and its market share within this key area, CACI have made use of Retail Footprint. § Retail Footprint is CACI’s national comparison goods shopping model, covering circa 3, 000 shopping destinations across Great Britain. It is built using gravity modelling principles, i. e. : the flow of customers from a postal sector will be directly proportional to the size of the Centre and inversely proportional to its Distance/Drivetime. § Catchments, predicted shopper/expenditure flows and postal sector market share penetration outputs are recalibrated annually using retailer exit surveys and credit card transaction data. Retail Footprint recognises that shoppers have a choice therefore catchments overlap – Retail Footprint defines primary, secondary, tertiary and quarternary sub-catchments for each retail centre. § Retail Footprint is used by a significant and increasing number of local authorities and retailers to understand local shopping patterns, current and future retail capacity, town centre performance and as a key input into store location planning. Page 6

CACI Property Consulting Retail Footprint 2006: Gravity Modelling Methodology § Within CACI’s Retail Footprint gravity modelling system all retailers trading in every venue are scored based on average turnover (weighted based on specific quantitative & qualitative locational characteristics). § The spatial distribution of expenditure for every GB postal sector is then calculated given this competitive hierarchy and a drivetime matrix from every postal sector to every competing retail venue. § In order to define sub-catchments, all GB postal sectors are ranked according to a centre’s achieved market share penetration, with the greatest percentage at the top. § These proportions are then accumulated until at least 50% of total available catchment expenditure captured by the centre has been assigned - this defines the primary catchment. § The remaining sectors are then accumulated to define the 3 remaining catchments at 75% (secondary) 90% (tertiary) and 100% (quaternary) respectively. Page 7

CACI Property Consulting Retail Footprint 2006: Gravity Modelling Methodology § Within CACI’s Retail Footprint gravity modelling system all retailers trading in every venue are scored based on average turnover (weighted based on specific quantitative & qualitative locational characteristics). § The spatial distribution of expenditure for every GB postal sector is then calculated given this competitive hierarchy and a drivetime matrix from every postal sector to every competing retail venue. § In order to define sub-catchments, all GB postal sectors are ranked according to a centre’s achieved market share penetration, with the greatest percentage at the top. § These proportions are then accumulated until at least 50% of total available catchment expenditure captured by the centre has been assigned - this defines the primary catchment. § The remaining sectors are then accumulated to define the 3 remaining catchments at 75% (secondary) 90% (tertiary) and 100% (quaternary) respectively. Page 7

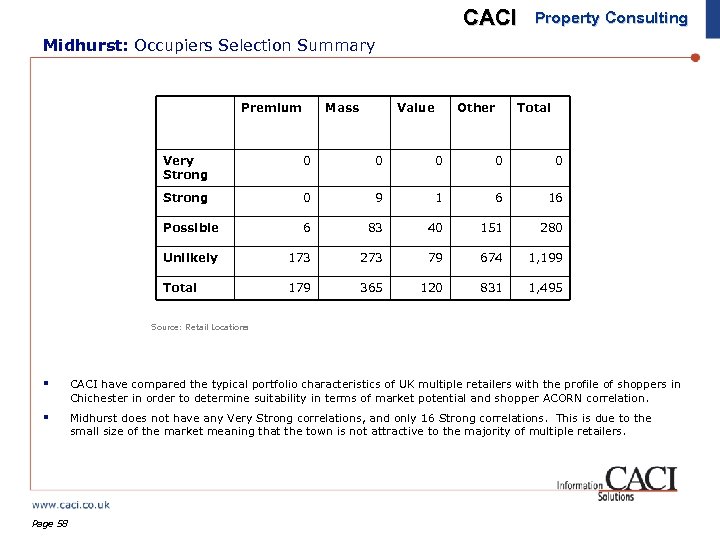

Retail Footprint 2006: Retail Footprint Class CACI Property Consulting § In Retail Footprint, centres are described by their Class, which defines the role or function of centres within the retail hierarchy and the consequent characteristics of shopping trips. § For instance, Classes such as ‘Primary Centres’ see strong shopper flows over large distances, and very strong flows from local customers. § At the other end of the hierarchy customers will only travel to ‘Small Rural Centres’ or ‘Small Local Centres’ if they live very close by. § CACI recalibrate Retail Footprint on an annual basis using new data on shopper flows received from a combination of credit and debit card transactions, client’s own in-house exit surveys and loyalty cards. Page 8

Retail Footprint 2006: Retail Footprint Class CACI Property Consulting § In Retail Footprint, centres are described by their Class, which defines the role or function of centres within the retail hierarchy and the consequent characteristics of shopping trips. § For instance, Classes such as ‘Primary Centres’ see strong shopper flows over large distances, and very strong flows from local customers. § At the other end of the hierarchy customers will only travel to ‘Small Rural Centres’ or ‘Small Local Centres’ if they live very close by. § CACI recalibrate Retail Footprint on an annual basis using new data on shopper flows received from a combination of credit and debit card transactions, client’s own in-house exit surveys and loyalty cards. Page 8

CACI Property Consulting Midhurst: Retail Footprint Class § Midhurst is currently classed as a Small Rural Centre. § Rural centres tend to be isolated centres which serve the local community effectively but do not have the mix of outlets to encourage shoppers from a greater distance. They tend to have fairly high levels of loyalty from locals due to the ‘cost’ of travelling to an alternative centre. § Small Rural Centres have a Retail Footprint score less than 25 and examples include Calne, Ilminster, Hungerford and Mildenhall. § Midhurst’s current retail score is 24. Page 9

CACI Property Consulting Midhurst: Retail Footprint Class § Midhurst is currently classed as a Small Rural Centre. § Rural centres tend to be isolated centres which serve the local community effectively but do not have the mix of outlets to encourage shoppers from a greater distance. They tend to have fairly high levels of loyalty from locals due to the ‘cost’ of travelling to an alternative centre. § Small Rural Centres have a Retail Footprint score less than 25 and examples include Calne, Ilminster, Hungerford and Mildenhall. § Midhurst’s current retail score is 24. Page 9

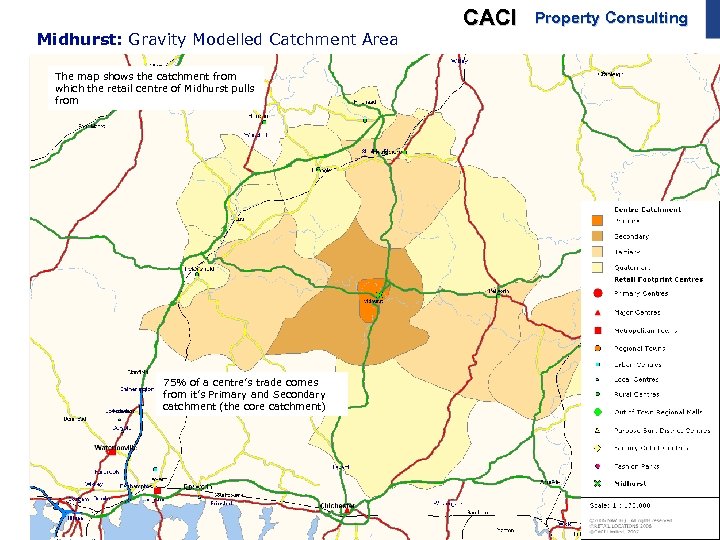

Midhurst: Gravity Modelled Catchment Area The map shows the catchment from which the retail centre of Midhurst pulls from 75% of a centre’s trade comes from it’s Primary and Secondary catchment (the core catchment) Page 10 CACI Property Consulting

Midhurst: Gravity Modelled Catchment Area The map shows the catchment from which the retail centre of Midhurst pulls from 75% of a centre’s trade comes from it’s Primary and Secondary catchment (the core catchment) Page 10 CACI Property Consulting

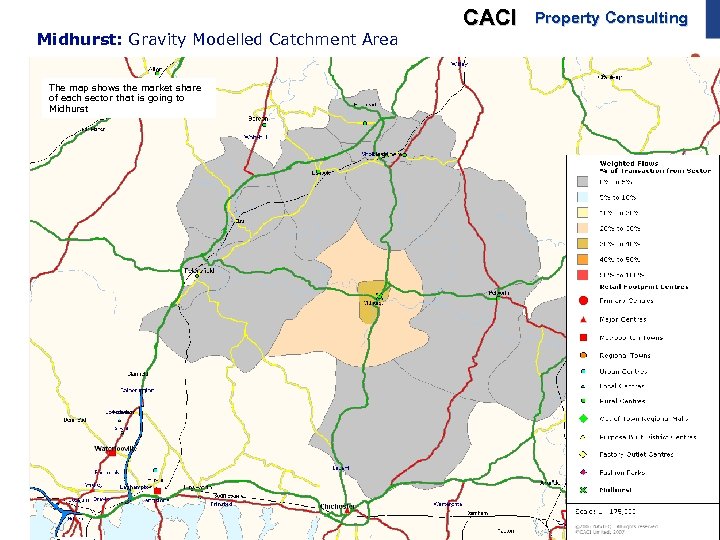

Midhurst: Gravity Modelled Catchment Area The map shows the market share of each sector that is going to Midhurst Page 11 CACI Property Consulting

Midhurst: Gravity Modelled Catchment Area The map shows the market share of each sector that is going to Midhurst Page 11 CACI Property Consulting

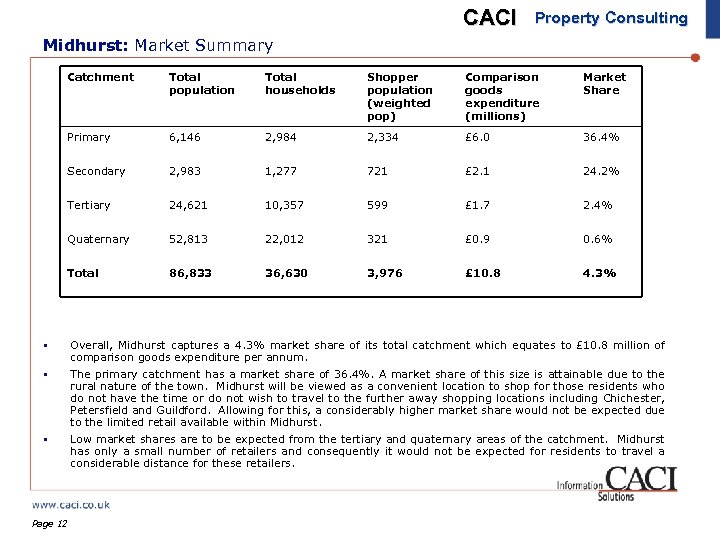

CACI Property Consulting Midhurst: Market Summary Catchment Total population Total households Shopper population (weighted pop) Comparison goods expenditure (millions) Market Share Primary 6, 146 2, 984 2, 334 £ 6. 0 36. 4% Secondary 2, 983 1, 277 721 £ 2. 1 24. 2% Tertiary 24, 621 10, 357 599 £ 1. 7 2. 4% Quaternary 52, 813 22, 012 321 £ 0. 9 0. 6% Total 86, 833 36, 630 3, 976 £ 10. 8 4. 3% § Overall, Midhurst captures a 4. 3% market share of its total catchment which equates to £ 10. 8 million of comparison goods expenditure per annum. § The primary catchment has a market share of 36. 4%. A market share of this size is attainable due to the rural nature of the town. Midhurst will be viewed as a convenient location to shop for those residents who do not have the time or do not wish to travel to the further away shopping locations including Chichester, Petersfield and Guildford. Allowing for this, a considerably higher market share would not be expected due to the limited retail available within Midhurst. § Low market shares are to be expected from the tertiary and quaternary areas of the catchment. Midhurst has only a small number of retailers and consequently it would not be expected for residents to travel a considerable distance for these retailers. Page 12

CACI Property Consulting Midhurst: Market Summary Catchment Total population Total households Shopper population (weighted pop) Comparison goods expenditure (millions) Market Share Primary 6, 146 2, 984 2, 334 £ 6. 0 36. 4% Secondary 2, 983 1, 277 721 £ 2. 1 24. 2% Tertiary 24, 621 10, 357 599 £ 1. 7 2. 4% Quaternary 52, 813 22, 012 321 £ 0. 9 0. 6% Total 86, 833 36, 630 3, 976 £ 10. 8 4. 3% § Overall, Midhurst captures a 4. 3% market share of its total catchment which equates to £ 10. 8 million of comparison goods expenditure per annum. § The primary catchment has a market share of 36. 4%. A market share of this size is attainable due to the rural nature of the town. Midhurst will be viewed as a convenient location to shop for those residents who do not have the time or do not wish to travel to the further away shopping locations including Chichester, Petersfield and Guildford. Allowing for this, a considerably higher market share would not be expected due to the limited retail available within Midhurst. § Low market shares are to be expected from the tertiary and quaternary areas of the catchment. Midhurst has only a small number of retailers and consequently it would not be expected for residents to travel a considerable distance for these retailers. Page 12

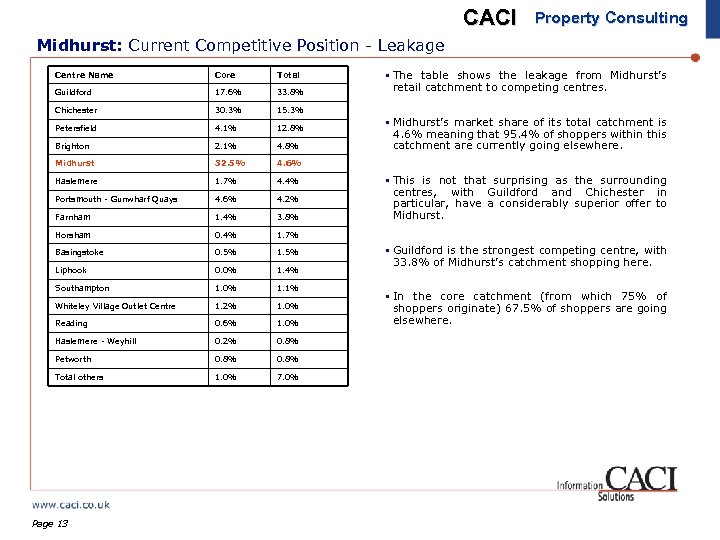

CACI Property Consulting Midhurst: Current Competitive Position - Leakage Centre Name Core Total Guildford 17. 6% 33. 8% Chichester 30. 3% 15. 3% Petersfield 4. 1% 12. 8% Brighton 2. 1% 4. 8% Midhurst 32. 5% 4. 6% Haslemere 1. 7% 4. 4% Portsmouth - Gunwharf Quays 4. 6% 4. 2% Farnham 1. 4% 3. 8% Horsham 0. 4% 1. 7% Basingstoke 0. 5% 1. 5% Liphook 0. 0% 1. 4% Southampton 1. 0% 1. 1% Whiteley Village Outlet Centre 1. 2% 1. 0% Reading 0. 6% 1. 0% Haslemere - Weyhill 0. 2% 0. 8% Petworth 0. 8% Total others 1. 0% 7. 0% § The table shows the leakage from Midhurst’s retail catchment to competing centres. Page 13 § Midhurst’s market share of its total catchment is 4. 6% meaning that 95. 4% of shoppers within this catchment are currently going elsewhere. § This is not that surprising as the surrounding centres, with Guildford and Chichester in particular, have a considerably superior offer to Midhurst. § Guildford is the strongest competing centre, with 33. 8% of Midhurst’s catchment shopping here. § In the core catchment (from which 75% of shoppers originate) 67. 5% of shoppers are going elsewhere.

CACI Property Consulting Midhurst: Current Competitive Position - Leakage Centre Name Core Total Guildford 17. 6% 33. 8% Chichester 30. 3% 15. 3% Petersfield 4. 1% 12. 8% Brighton 2. 1% 4. 8% Midhurst 32. 5% 4. 6% Haslemere 1. 7% 4. 4% Portsmouth - Gunwharf Quays 4. 6% 4. 2% Farnham 1. 4% 3. 8% Horsham 0. 4% 1. 7% Basingstoke 0. 5% 1. 5% Liphook 0. 0% 1. 4% Southampton 1. 0% 1. 1% Whiteley Village Outlet Centre 1. 2% 1. 0% Reading 0. 6% 1. 0% Haslemere - Weyhill 0. 2% 0. 8% Petworth 0. 8% Total others 1. 0% 7. 0% § The table shows the leakage from Midhurst’s retail catchment to competing centres. Page 13 § Midhurst’s market share of its total catchment is 4. 6% meaning that 95. 4% of shoppers within this catchment are currently going elsewhere. § This is not that surprising as the surrounding centres, with Guildford and Chichester in particular, have a considerably superior offer to Midhurst. § Guildford is the strongest competing centre, with 33. 8% of Midhurst’s catchment shopping here. § In the core catchment (from which 75% of shoppers originate) 67. 5% of shoppers are going elsewhere.

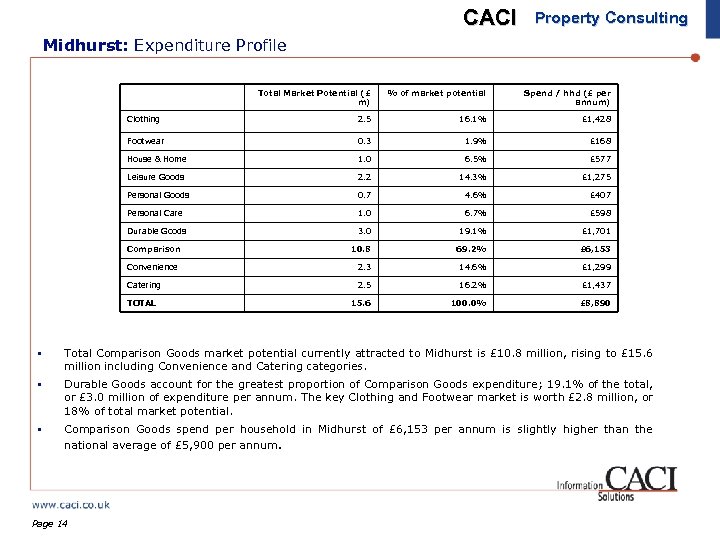

CACI Property Consulting Midhurst: Expenditure Profile Total Market Potential (£ m) % of market potential Spend / hhd (£ per annum) Clothing 2. 5 16. 1% £ 1, 428 Footwear 0. 3 1. 9% £ 168 House & Home 1. 0 6. 5% £ 577 Leisure Goods 2. 2 14. 3% £ 1, 275 Personal Goods 0. 7 4. 6% £ 407 Personal Care 1. 0 6. 7% £ 598 Durable Goods 3. 0 19. 1% £ 1, 701 Comparison 10. 8 69. 2% £ 6, 153 Convenience 2. 3 14. 6% £ 1, 299 Catering 2. 5 16. 2% £ 1, 437 15. 6 100. 0% £ 8, 890 TOTAL § Total Comparison Goods market potential currently attracted to Midhurst is £ 10. 8 million, rising to £ 15. 6 million including Convenience and Catering categories. § Durable Goods account for the greatest proportion of Comparison Goods expenditure; 19. 1% of the total, or £ 3. 0 million of expenditure per annum. The key Clothing and Footwear market is worth £ 2. 8 million, or 18% of total market potential. § Comparison Goods spend per household in Midhurst of £ 6, 153 per annum is slightly higher than the national average of £ 5, 900 per annum. Page 14

CACI Property Consulting Midhurst: Expenditure Profile Total Market Potential (£ m) % of market potential Spend / hhd (£ per annum) Clothing 2. 5 16. 1% £ 1, 428 Footwear 0. 3 1. 9% £ 168 House & Home 1. 0 6. 5% £ 577 Leisure Goods 2. 2 14. 3% £ 1, 275 Personal Goods 0. 7 4. 6% £ 407 Personal Care 1. 0 6. 7% £ 598 Durable Goods 3. 0 19. 1% £ 1, 701 Comparison 10. 8 69. 2% £ 6, 153 Convenience 2. 3 14. 6% £ 1, 299 Catering 2. 5 16. 2% £ 1, 437 15. 6 100. 0% £ 8, 890 TOTAL § Total Comparison Goods market potential currently attracted to Midhurst is £ 10. 8 million, rising to £ 15. 6 million including Convenience and Catering categories. § Durable Goods account for the greatest proportion of Comparison Goods expenditure; 19. 1% of the total, or £ 3. 0 million of expenditure per annum. The key Clothing and Footwear market is worth £ 2. 8 million, or 18% of total market potential. § Comparison Goods spend per household in Midhurst of £ 6, 153 per annum is slightly higher than the national average of £ 5, 900 per annum. Page 14

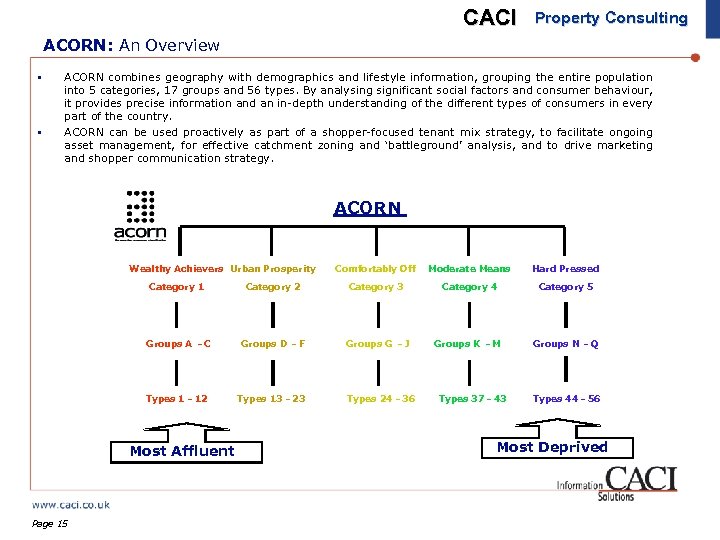

CACI Property Consulting ACORN: An Overview § § ACORN combines geography with demographics and lifestyle information, grouping the entire population into 5 categories, 17 groups and 56 types. By analysing significant social factors and consumer behaviour, it provides precise information and an in-depth understanding of the different types of consumers in every part of the country. ACORN can be used proactively as part of a shopper-focused tenant mix strategy, to facilitate ongoing asset management, for effective catchment zoning and ‘battleground’ analysis, and to drive marketing and shopper communication strategy. ACORN Wealthy Achievers Urban Prosperity Comfortably Off Moderate Means Hard Pressed Category 1 Category 2 Category 3 Category 4 Category 5 Groups A - C Groups D - F Groups G - J Groups K - M Groups N - Q Types 1 - 12 Types 13 - 23 Most Affluent Page 15 Types 24 - 36 Types 37 - 43 Types 44 - 56 Most Deprived

CACI Property Consulting ACORN: An Overview § § ACORN combines geography with demographics and lifestyle information, grouping the entire population into 5 categories, 17 groups and 56 types. By analysing significant social factors and consumer behaviour, it provides precise information and an in-depth understanding of the different types of consumers in every part of the country. ACORN can be used proactively as part of a shopper-focused tenant mix strategy, to facilitate ongoing asset management, for effective catchment zoning and ‘battleground’ analysis, and to drive marketing and shopper communication strategy. ACORN Wealthy Achievers Urban Prosperity Comfortably Off Moderate Means Hard Pressed Category 1 Category 2 Category 3 Category 4 Category 5 Groups A - C Groups D - F Groups G - J Groups K - M Groups N - Q Types 1 - 12 Types 13 - 23 Most Affluent Page 15 Types 24 - 36 Types 37 - 43 Types 44 - 56 Most Deprived

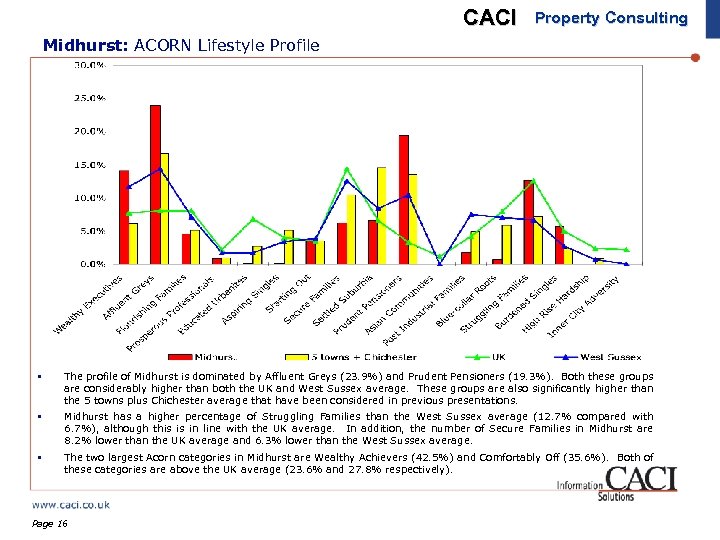

CACI Property Consulting Midhurst: ACORN Lifestyle Profile § The profile of Midhurst is dominated by Affluent Greys (23. 9%) and Prudent Pensioners (19. 3%). Both these groups are considerably higher than both the UK and West Sussex average. These groups are also significantly higher than the 5 towns plus Chichester average that have been considered in previous presentations. § Midhurst has a higher percentage of Struggling Families than the West Sussex average (12. 7% compared with 6. 7%), although this is in line with the UK average. In addition, the number of Secure Families in Midhurst are 8. 2% lower than the UK average and 6. 3% lower than the West Sussex average. § The two largest Acorn categories in Midhurst are Wealthy Achievers (42. 5%) and Comfortably Off (35. 6%). Both of these categories are above the UK average (23. 6% and 27. 8% respectively). Page 16

CACI Property Consulting Midhurst: ACORN Lifestyle Profile § The profile of Midhurst is dominated by Affluent Greys (23. 9%) and Prudent Pensioners (19. 3%). Both these groups are considerably higher than both the UK and West Sussex average. These groups are also significantly higher than the 5 towns plus Chichester average that have been considered in previous presentations. § Midhurst has a higher percentage of Struggling Families than the West Sussex average (12. 7% compared with 6. 7%), although this is in line with the UK average. In addition, the number of Secure Families in Midhurst are 8. 2% lower than the UK average and 6. 3% lower than the West Sussex average. § The two largest Acorn categories in Midhurst are Wealthy Achievers (42. 5%) and Comfortably Off (35. 6%). Both of these categories are above the UK average (23. 6% and 27. 8% respectively). Page 16

CACI Property Consulting Midhurst Strategy & Sustainable Opportunities 3. Page 17 Tourist Market Potential

CACI Property Consulting Midhurst Strategy & Sustainable Opportunities 3. Page 17 Tourist Market Potential

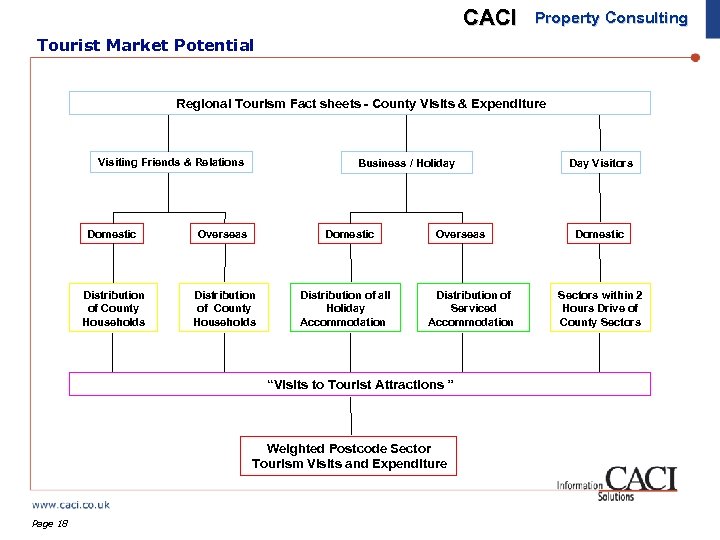

CACI Property Consulting Tourist Market Potential Regional Tourism Fact sheets - County Visits & Expenditure Visiting Friends & Relations Business / Holiday Domestic Overseas Domestic Distribution of County Households Distribution of all Holiday Accommodation Overseas Distribution of Serviced Accommodation “Visits to Tourist Attractions ” Weighted Postcode Sector Tourism Visits and Expenditure Page 18 Day Visitors Domestic Sectors within 2 Hours Drive of County Sectors

CACI Property Consulting Tourist Market Potential Regional Tourism Fact sheets - County Visits & Expenditure Visiting Friends & Relations Business / Holiday Domestic Overseas Domestic Distribution of County Households Distribution of all Holiday Accommodation Overseas Distribution of Serviced Accommodation “Visits to Tourist Attractions ” Weighted Postcode Sector Tourism Visits and Expenditure Page 18 Day Visitors Domestic Sectors within 2 Hours Drive of County Sectors

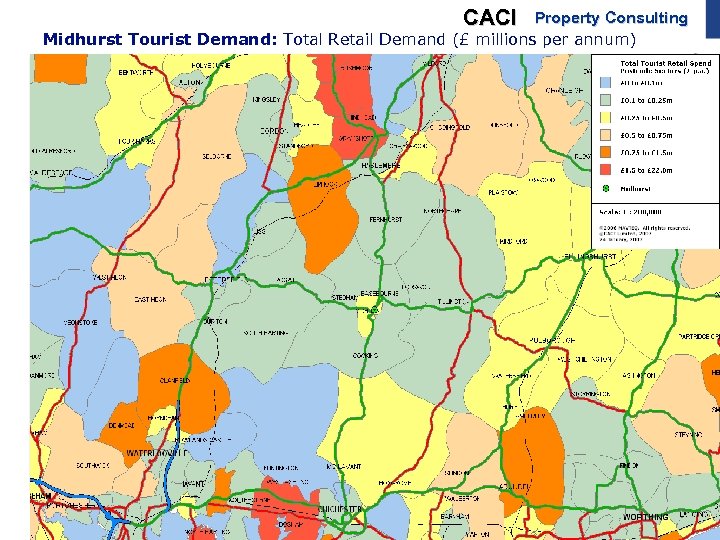

CACI Property Consulting Midhurst Tourist Demand: Total Retail Demand (£ millions per annum) Page 19

CACI Property Consulting Midhurst Tourist Demand: Total Retail Demand (£ millions per annum) Page 19

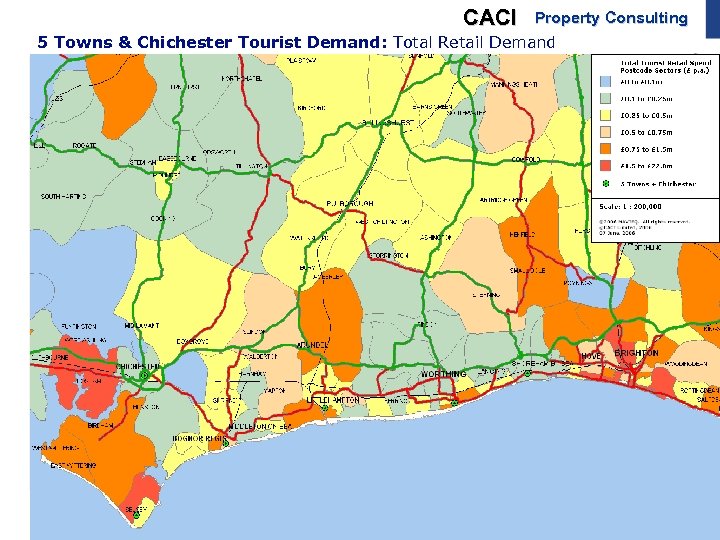

CACI Property Consulting 5 Towns & Chichester Tourist Demand: Total Retail Demand Page 20

CACI Property Consulting 5 Towns & Chichester Tourist Demand: Total Retail Demand Page 20

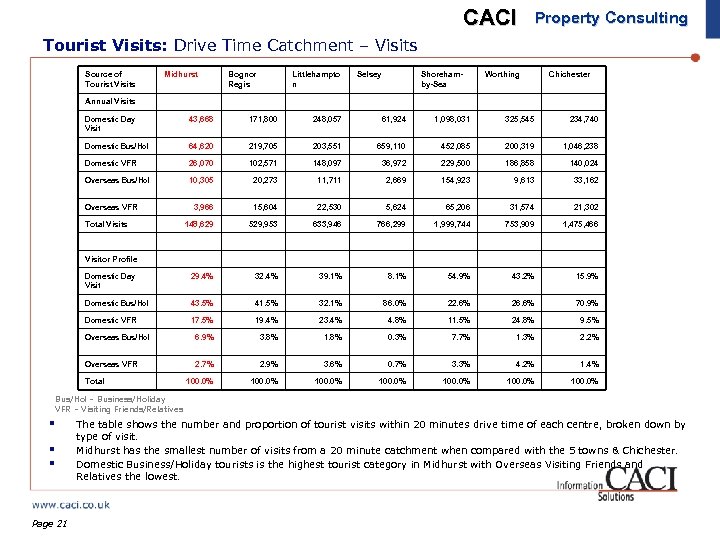

CACI Property Consulting Tourist Visits: Drive Time Catchment – Visits Source of Tourist Visits Midhurst Bognor Regis Littlehampto n Selsey Shorehamby-Sea Worthing Chichester Annual Visits Domestic Day Visit 43, 668 171, 800 248, 057 61, 924 1, 098, 031 325, 545 234, 740 Domestic Bus/Hol 64, 620 219, 705 203, 551 659, 110 452, 085 200, 319 1, 046, 238 Domestic VFR 26, 070 102, 571 148, 097 36, 972 229, 500 186, 858 140, 024 Overseas Bus/Hol 10, 305 20, 273 11, 711 2, 669 154, 923 9, 613 33, 162 3, 966 15, 604 22, 530 5, 624 65, 206 31, 574 21, 302 148, 629 529, 953 633, 946 766, 299 1, 999, 744 753, 909 1, 475, 466 Domestic Day Visit 29. 4% 32. 4% 39. 1% 8. 1% 54. 9% 43. 2% 15. 9% Domestic Bus/Hol 43. 5% 41. 5% 32. 1% 86. 0% 22. 6% 26. 6% 70. 9% Domestic VFR 17. 5% 19. 4% 23. 4% 4. 8% 11. 5% 24. 8% 9. 5% Overseas Bus/Hol 6. 9% 3. 8% 1. 8% 0. 3% 7. 7% 1. 3% 2. 2% Overseas VFR 2. 7% 2. 9% 3. 6% 0. 7% 3. 3% 4. 2% 1. 4% 100. 0% 100. 0% Overseas VFR Total Visits Visitor Profile Total Bus/Hol – Business/Holiday VFR – Visiting Friends/Relatives § § § Page 21 The table shows the number and proportion of tourist visits within 20 minutes drive time of each centre, broken down by type of visit. Midhurst has the smallest number of visits from a 20 minute catchment when compared with the 5 towns & Chichester. Domestic Business/Holiday tourists is the highest tourist category in Midhurst with Overseas Visiting Friends and Relatives the lowest.

CACI Property Consulting Tourist Visits: Drive Time Catchment – Visits Source of Tourist Visits Midhurst Bognor Regis Littlehampto n Selsey Shorehamby-Sea Worthing Chichester Annual Visits Domestic Day Visit 43, 668 171, 800 248, 057 61, 924 1, 098, 031 325, 545 234, 740 Domestic Bus/Hol 64, 620 219, 705 203, 551 659, 110 452, 085 200, 319 1, 046, 238 Domestic VFR 26, 070 102, 571 148, 097 36, 972 229, 500 186, 858 140, 024 Overseas Bus/Hol 10, 305 20, 273 11, 711 2, 669 154, 923 9, 613 33, 162 3, 966 15, 604 22, 530 5, 624 65, 206 31, 574 21, 302 148, 629 529, 953 633, 946 766, 299 1, 999, 744 753, 909 1, 475, 466 Domestic Day Visit 29. 4% 32. 4% 39. 1% 8. 1% 54. 9% 43. 2% 15. 9% Domestic Bus/Hol 43. 5% 41. 5% 32. 1% 86. 0% 22. 6% 26. 6% 70. 9% Domestic VFR 17. 5% 19. 4% 23. 4% 4. 8% 11. 5% 24. 8% 9. 5% Overseas Bus/Hol 6. 9% 3. 8% 1. 8% 0. 3% 7. 7% 1. 3% 2. 2% Overseas VFR 2. 7% 2. 9% 3. 6% 0. 7% 3. 3% 4. 2% 1. 4% 100. 0% 100. 0% Overseas VFR Total Visits Visitor Profile Total Bus/Hol – Business/Holiday VFR – Visiting Friends/Relatives § § § Page 21 The table shows the number and proportion of tourist visits within 20 minutes drive time of each centre, broken down by type of visit. Midhurst has the smallest number of visits from a 20 minute catchment when compared with the 5 towns & Chichester. Domestic Business/Holiday tourists is the highest tourist category in Midhurst with Overseas Visiting Friends and Relatives the lowest.

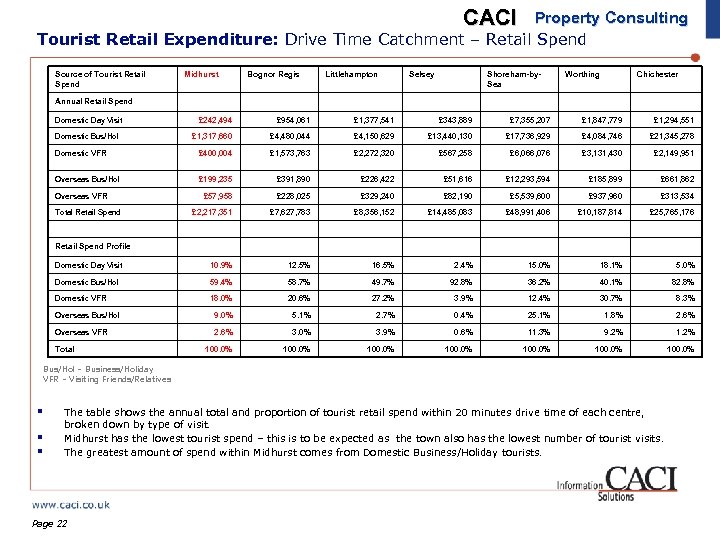

CACI Property Consulting Tourist Retail Expenditure: Drive Time Catchment – Retail Spend Source of Tourist Retail Spend Midhurst Bognor Regis Littlehampton Selsey Shoreham-by. Sea Worthing Chichester Annual Retail Spend Domestic Day Visit £ 242, 494 £ 954, 061 £ 1, 377, 541 £ 343, 889 £ 7, 355, 207 £ 1, 847, 779 £ 1, 294, 551 £ 1, 317, 660 £ 4, 480, 044 £ 4, 150, 629 £ 13, 440, 130 £ 17, 736, 929 £ 4, 084, 746 £ 21, 345, 278 Domestic VFR £ 400, 004 £ 1, 573, 763 £ 2, 272, 320 £ 567, 258 £ 6, 066, 076 £ 3, 131, 430 £ 2, 149, 951 Overseas Bus/Hol £ 199, 235 £ 391, 890 £ 226, 422 £ 51, 616 £ 12, 293, 594 £ 185, 899 £ 661, 862 £ 57, 958 £ 228, 025 £ 329, 240 £ 82, 190 £ 5, 539, 600 £ 937, 960 £ 313, 534 £ 2, 217, 351 £ 7, 627, 783 £ 8, 356, 152 £ 14, 485, 083 £ 48, 991, 406 £ 10, 187, 814 £ 25, 765, 176 Domestic Day Visit 10. 9% 12. 5% 16. 5% 2. 4% 15. 0% 18. 1% 5. 0% Domestic Bus/Hol 59. 4% 58. 7% 49. 7% 92. 8% 36. 2% 40. 1% 82. 8% Domestic VFR 18. 0% 20. 6% 27. 2% 3. 9% 12. 4% 30. 7% 8. 3% Overseas Bus/Hol 9. 0% 5. 1% 2. 7% 0. 4% 25. 1% 1. 8% 2. 6% Overseas VFR 2. 6% 3. 0% 3. 9% 0. 6% 11. 3% 9. 2% 100. 0% 100. 0% Domestic Bus/Hol Overseas VFR Total Retail Spend Profile Total Bus/Hol – Business/Holiday VFR – Visiting Friends/Relatives § § § The table shows the annual total and proportion of tourist retail spend within 20 minutes drive time of each centre, broken down by type of visit. Midhurst has the lowest tourist spend – this is to be expected as the town also has the lowest number of tourist visits. The greatest amount of spend within Midhurst comes from Domestic Business/Holiday tourists. Page 22

CACI Property Consulting Tourist Retail Expenditure: Drive Time Catchment – Retail Spend Source of Tourist Retail Spend Midhurst Bognor Regis Littlehampton Selsey Shoreham-by. Sea Worthing Chichester Annual Retail Spend Domestic Day Visit £ 242, 494 £ 954, 061 £ 1, 377, 541 £ 343, 889 £ 7, 355, 207 £ 1, 847, 779 £ 1, 294, 551 £ 1, 317, 660 £ 4, 480, 044 £ 4, 150, 629 £ 13, 440, 130 £ 17, 736, 929 £ 4, 084, 746 £ 21, 345, 278 Domestic VFR £ 400, 004 £ 1, 573, 763 £ 2, 272, 320 £ 567, 258 £ 6, 066, 076 £ 3, 131, 430 £ 2, 149, 951 Overseas Bus/Hol £ 199, 235 £ 391, 890 £ 226, 422 £ 51, 616 £ 12, 293, 594 £ 185, 899 £ 661, 862 £ 57, 958 £ 228, 025 £ 329, 240 £ 82, 190 £ 5, 539, 600 £ 937, 960 £ 313, 534 £ 2, 217, 351 £ 7, 627, 783 £ 8, 356, 152 £ 14, 485, 083 £ 48, 991, 406 £ 10, 187, 814 £ 25, 765, 176 Domestic Day Visit 10. 9% 12. 5% 16. 5% 2. 4% 15. 0% 18. 1% 5. 0% Domestic Bus/Hol 59. 4% 58. 7% 49. 7% 92. 8% 36. 2% 40. 1% 82. 8% Domestic VFR 18. 0% 20. 6% 27. 2% 3. 9% 12. 4% 30. 7% 8. 3% Overseas Bus/Hol 9. 0% 5. 1% 2. 7% 0. 4% 25. 1% 1. 8% 2. 6% Overseas VFR 2. 6% 3. 0% 3. 9% 0. 6% 11. 3% 9. 2% 100. 0% 100. 0% Domestic Bus/Hol Overseas VFR Total Retail Spend Profile Total Bus/Hol – Business/Holiday VFR – Visiting Friends/Relatives § § § The table shows the annual total and proportion of tourist retail spend within 20 minutes drive time of each centre, broken down by type of visit. Midhurst has the lowest tourist spend – this is to be expected as the town also has the lowest number of tourist visits. The greatest amount of spend within Midhurst comes from Domestic Business/Holiday tourists. Page 22

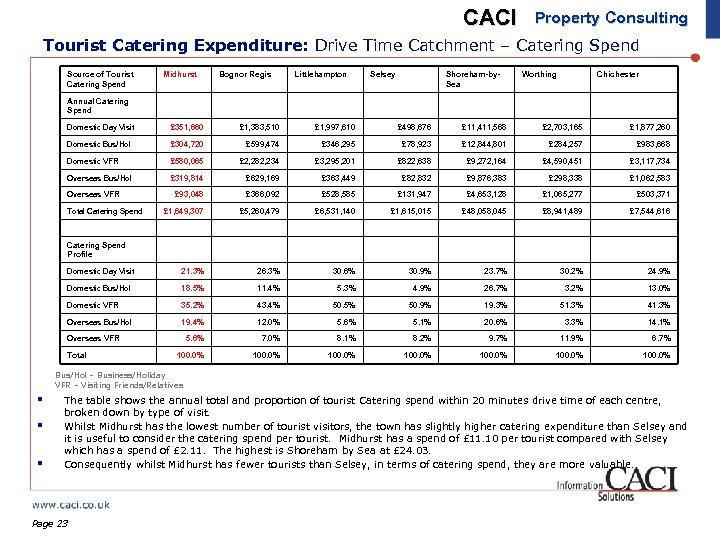

CACI Property Consulting Tourist Catering Expenditure: Drive Time Catchment – Catering Spend Source of Tourist Catering Spend Midhurst Bognor Regis Littlehampton Selsey Shoreham-by. Sea Worthing Chichester Annual Catering Spend Domestic Day Visit £ 351, 660 £ 1, 383, 510 £ 1, 997, 610 £ 498, 676 £ 11, 411, 568 £ 2, 703, 165 £ 1, 877, 260 Domestic Bus/Hol £ 304, 720 £ 599, 474 £ 346, 295 £ 78, 923 £ 12, 844, 801 £ 284, 257 £ 983, 668 Domestic VFR £ 580, 065 £ 2, 282, 234 £ 3, 295, 201 £ 822, 638 £ 9, 272, 164 £ 4, 590, 451 £ 3, 117, 734 Overseas Bus/Hol £ 319, 814 £ 629, 169 £ 363, 449 £ 82, 832 £ 9, 876, 383 £ 298, 338 £ 1, 062, 583 £ 93, 048 £ 366, 092 £ 528, 585 £ 131, 947 £ 4, 653, 128 £ 1, 065, 277 £ 503, 371 £ 1, 649, 307 £ 5, 260, 479 £ 6, 531, 140 £ 1, 615, 015 £ 48, 058, 045 £ 8, 941, 489 £ 7, 544, 616 Domestic Day Visit 21. 3% 26. 3% 30. 6% 30. 9% 23. 7% 30. 2% 24. 9% Domestic Bus/Hol 18. 5% 11. 4% 5. 3% 4. 9% 26. 7% 3. 2% 13. 0% Domestic VFR 35. 2% 43. 4% 50. 5% 50. 9% 19. 3% 51. 3% 41. 3% Overseas Bus/Hol 19. 4% 12. 0% 5. 6% 5. 1% 20. 6% 3. 3% 14. 1% 5. 6% 7. 0% 8. 1% 8. 2% 9. 7% 11. 9% 6. 7% 100. 0% 100. 0% Overseas VFR Total Catering Spend Profile Overseas VFR Total Bus/Hol – Business/Holiday VFR – Visiting Friends/Relatives § § § The table shows the annual total and proportion of tourist Catering spend within 20 minutes drive time of each centre, broken down by type of visit. Whilst Midhurst has the lowest number of tourist visitors, the town has slightly higher catering expenditure than Selsey and it is useful to consider the catering spend per tourist. Midhurst has a spend of £ 11. 10 per tourist compared with Selsey which has a spend of £ 2. 11. The highest is Shoreham by Sea at £ 24. 03. Consequently whilst Midhurst has fewer tourists than Selsey, in terms of catering spend, they are more valuable. Page 23

CACI Property Consulting Tourist Catering Expenditure: Drive Time Catchment – Catering Spend Source of Tourist Catering Spend Midhurst Bognor Regis Littlehampton Selsey Shoreham-by. Sea Worthing Chichester Annual Catering Spend Domestic Day Visit £ 351, 660 £ 1, 383, 510 £ 1, 997, 610 £ 498, 676 £ 11, 411, 568 £ 2, 703, 165 £ 1, 877, 260 Domestic Bus/Hol £ 304, 720 £ 599, 474 £ 346, 295 £ 78, 923 £ 12, 844, 801 £ 284, 257 £ 983, 668 Domestic VFR £ 580, 065 £ 2, 282, 234 £ 3, 295, 201 £ 822, 638 £ 9, 272, 164 £ 4, 590, 451 £ 3, 117, 734 Overseas Bus/Hol £ 319, 814 £ 629, 169 £ 363, 449 £ 82, 832 £ 9, 876, 383 £ 298, 338 £ 1, 062, 583 £ 93, 048 £ 366, 092 £ 528, 585 £ 131, 947 £ 4, 653, 128 £ 1, 065, 277 £ 503, 371 £ 1, 649, 307 £ 5, 260, 479 £ 6, 531, 140 £ 1, 615, 015 £ 48, 058, 045 £ 8, 941, 489 £ 7, 544, 616 Domestic Day Visit 21. 3% 26. 3% 30. 6% 30. 9% 23. 7% 30. 2% 24. 9% Domestic Bus/Hol 18. 5% 11. 4% 5. 3% 4. 9% 26. 7% 3. 2% 13. 0% Domestic VFR 35. 2% 43. 4% 50. 5% 50. 9% 19. 3% 51. 3% 41. 3% Overseas Bus/Hol 19. 4% 12. 0% 5. 6% 5. 1% 20. 6% 3. 3% 14. 1% 5. 6% 7. 0% 8. 1% 8. 2% 9. 7% 11. 9% 6. 7% 100. 0% 100. 0% Overseas VFR Total Catering Spend Profile Overseas VFR Total Bus/Hol – Business/Holiday VFR – Visiting Friends/Relatives § § § The table shows the annual total and proportion of tourist Catering spend within 20 minutes drive time of each centre, broken down by type of visit. Whilst Midhurst has the lowest number of tourist visitors, the town has slightly higher catering expenditure than Selsey and it is useful to consider the catering spend per tourist. Midhurst has a spend of £ 11. 10 per tourist compared with Selsey which has a spend of £ 2. 11. The highest is Shoreham by Sea at £ 24. 03. Consequently whilst Midhurst has fewer tourists than Selsey, in terms of catering spend, they are more valuable. Page 23

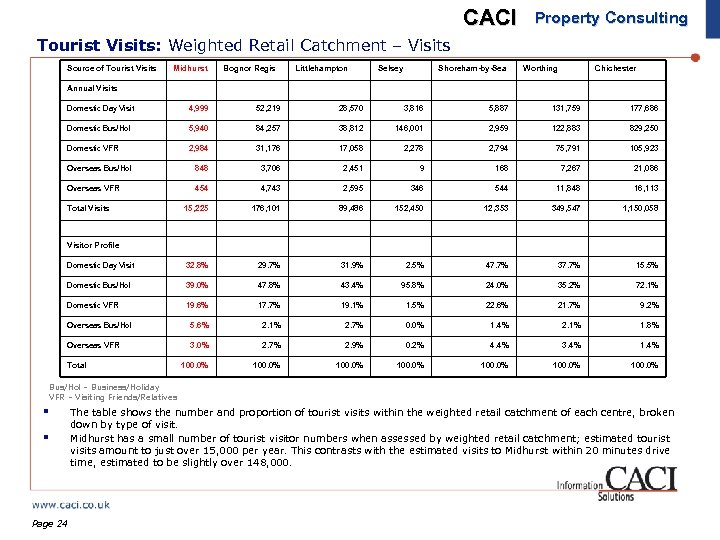

CACI Property Consulting Tourist Visits: Weighted Retail Catchment – Visits Source of Tourist Visits Midhurst Bognor Regis Littlehampton Selsey Shoreham-by-Sea Worthing Chichester Annual Visits Domestic Day Visit 4, 999 52, 219 28, 570 3, 816 5, 887 131, 759 177, 686 Domestic Bus/Hol 5, 940 84, 257 38, 812 146, 001 2, 959 122, 883 829, 250 Domestic VFR 2, 984 31, 176 17, 058 2, 278 2, 794 75, 791 105, 923 Overseas Bus/Hol 848 3, 706 2, 451 9 168 7, 267 21, 086 Overseas VFR 454 4, 743 2, 595 346 544 11, 848 16, 113 15, 225 176, 101 89, 486 152, 450 12, 353 349, 547 1, 150, 058 Domestic Day Visit 32. 8% 29. 7% 31. 9% 2. 5% 47. 7% 37. 7% 15. 5% Domestic Bus/Hol 39. 0% 47. 8% 43. 4% 95. 8% 24. 0% 35. 2% 72. 1% Domestic VFR 19. 6% 17. 7% 19. 1% 1. 5% 22. 6% 21. 7% 9. 2% Overseas Bus/Hol 5. 6% 2. 1% 2. 7% 0. 0% 1. 4% 2. 1% 1. 8% Overseas VFR 3. 0% 2. 7% 2. 9% 0. 2% 4. 4% 3. 4% 100. 0% 100. 0% Total Visits Visitor Profile Total Bus/Hol – Business/Holiday VFR – Visiting Friends/Relatives § § Page 24 The table shows the number and proportion of tourist visits within the weighted retail catchment of each centre, broken down by type of visit. Midhurst has a small number of tourist visitor numbers when assessed by weighted retail catchment; estimated tourist visits amount to just over 15, 000 per year. This contrasts with the estimated visits to Midhurst within 20 minutes drive time, estimated to be slightly over 148, 000.

CACI Property Consulting Tourist Visits: Weighted Retail Catchment – Visits Source of Tourist Visits Midhurst Bognor Regis Littlehampton Selsey Shoreham-by-Sea Worthing Chichester Annual Visits Domestic Day Visit 4, 999 52, 219 28, 570 3, 816 5, 887 131, 759 177, 686 Domestic Bus/Hol 5, 940 84, 257 38, 812 146, 001 2, 959 122, 883 829, 250 Domestic VFR 2, 984 31, 176 17, 058 2, 278 2, 794 75, 791 105, 923 Overseas Bus/Hol 848 3, 706 2, 451 9 168 7, 267 21, 086 Overseas VFR 454 4, 743 2, 595 346 544 11, 848 16, 113 15, 225 176, 101 89, 486 152, 450 12, 353 349, 547 1, 150, 058 Domestic Day Visit 32. 8% 29. 7% 31. 9% 2. 5% 47. 7% 37. 7% 15. 5% Domestic Bus/Hol 39. 0% 47. 8% 43. 4% 95. 8% 24. 0% 35. 2% 72. 1% Domestic VFR 19. 6% 17. 7% 19. 1% 1. 5% 22. 6% 21. 7% 9. 2% Overseas Bus/Hol 5. 6% 2. 1% 2. 7% 0. 0% 1. 4% 2. 1% 1. 8% Overseas VFR 3. 0% 2. 7% 2. 9% 0. 2% 4. 4% 3. 4% 100. 0% 100. 0% Total Visits Visitor Profile Total Bus/Hol – Business/Holiday VFR – Visiting Friends/Relatives § § Page 24 The table shows the number and proportion of tourist visits within the weighted retail catchment of each centre, broken down by type of visit. Midhurst has a small number of tourist visitor numbers when assessed by weighted retail catchment; estimated tourist visits amount to just over 15, 000 per year. This contrasts with the estimated visits to Midhurst within 20 minutes drive time, estimated to be slightly over 148, 000.

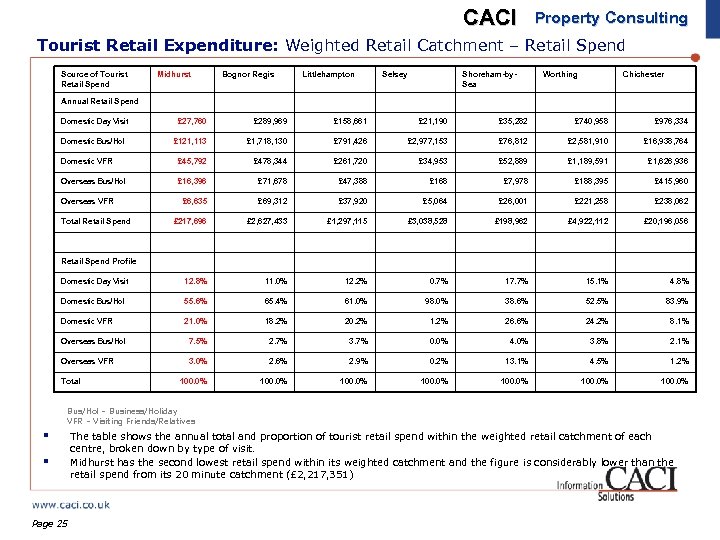

CACI Property Consulting Tourist Retail Expenditure: Weighted Retail Catchment – Retail Spend Source of Tourist Retail Spend Midhurst Bognor Regis Littlehampton Selsey Shoreham-by. Sea Worthing Chichester Annual Retail Spend Domestic Day Visit £ 27, 760 £ 289, 969 £ 158, 661 £ 21, 190 £ 35, 282 £ 740, 958 £ 976, 334 Domestic Bus/Hol £ 121, 113 £ 1, 718, 130 £ 791, 426 £ 2, 977, 153 £ 76, 812 £ 2, 581, 910 £ 16, 938, 764 Domestic VFR £ 45, 792 £ 478, 344 £ 261, 720 £ 34, 953 £ 52, 889 £ 1, 189, 591 £ 1, 626, 936 Overseas Bus/Hol £ 16, 396 £ 71, 678 £ 47, 388 £ 168 £ 7, 978 £ 188, 395 £ 415, 960 £ 6, 635 £ 69, 312 £ 37, 920 £ 5, 064 £ 26, 001 £ 221, 258 £ 238, 062 £ 217, 696 £ 2, 627, 433 £ 1, 297, 115 £ 3, 038, 528 £ 198, 962 £ 4, 922, 112 £ 20, 196, 056 Domestic Day Visit 12. 8% 11. 0% 12. 2% 0. 7% 17. 7% 15. 1% 4. 8% Domestic Bus/Hol 55. 6% 65. 4% 61. 0% 98. 0% 38. 6% 52. 5% 83. 9% Domestic VFR 21. 0% 18. 2% 20. 2% 1. 2% 26. 6% 24. 2% 8. 1% Overseas Bus/Hol 7. 5% 2. 7% 3. 7% 0. 0% 4. 0% 3. 8% 2. 1% Overseas VFR 3. 0% 2. 6% 2. 9% 0. 2% 13. 1% 4. 5% 1. 2% 100. 0% 100. 0% Overseas VFR Total Retail Spend Profile Total Bus/Hol – Business/Holiday VFR – Visiting Friends/Relatives § § Page 25 The table shows the annual total and proportion of tourist retail spend within the weighted retail catchment of each centre, broken down by type of visit. Midhurst has the second lowest retail spend within its weighted catchment and the figure is considerably lower than the retail spend from its 20 minute catchment (£ 2, 217, 351)

CACI Property Consulting Tourist Retail Expenditure: Weighted Retail Catchment – Retail Spend Source of Tourist Retail Spend Midhurst Bognor Regis Littlehampton Selsey Shoreham-by. Sea Worthing Chichester Annual Retail Spend Domestic Day Visit £ 27, 760 £ 289, 969 £ 158, 661 £ 21, 190 £ 35, 282 £ 740, 958 £ 976, 334 Domestic Bus/Hol £ 121, 113 £ 1, 718, 130 £ 791, 426 £ 2, 977, 153 £ 76, 812 £ 2, 581, 910 £ 16, 938, 764 Domestic VFR £ 45, 792 £ 478, 344 £ 261, 720 £ 34, 953 £ 52, 889 £ 1, 189, 591 £ 1, 626, 936 Overseas Bus/Hol £ 16, 396 £ 71, 678 £ 47, 388 £ 168 £ 7, 978 £ 188, 395 £ 415, 960 £ 6, 635 £ 69, 312 £ 37, 920 £ 5, 064 £ 26, 001 £ 221, 258 £ 238, 062 £ 217, 696 £ 2, 627, 433 £ 1, 297, 115 £ 3, 038, 528 £ 198, 962 £ 4, 922, 112 £ 20, 196, 056 Domestic Day Visit 12. 8% 11. 0% 12. 2% 0. 7% 17. 7% 15. 1% 4. 8% Domestic Bus/Hol 55. 6% 65. 4% 61. 0% 98. 0% 38. 6% 52. 5% 83. 9% Domestic VFR 21. 0% 18. 2% 20. 2% 1. 2% 26. 6% 24. 2% 8. 1% Overseas Bus/Hol 7. 5% 2. 7% 3. 7% 0. 0% 4. 0% 3. 8% 2. 1% Overseas VFR 3. 0% 2. 6% 2. 9% 0. 2% 13. 1% 4. 5% 1. 2% 100. 0% 100. 0% Overseas VFR Total Retail Spend Profile Total Bus/Hol – Business/Holiday VFR – Visiting Friends/Relatives § § Page 25 The table shows the annual total and proportion of tourist retail spend within the weighted retail catchment of each centre, broken down by type of visit. Midhurst has the second lowest retail spend within its weighted catchment and the figure is considerably lower than the retail spend from its 20 minute catchment (£ 2, 217, 351)

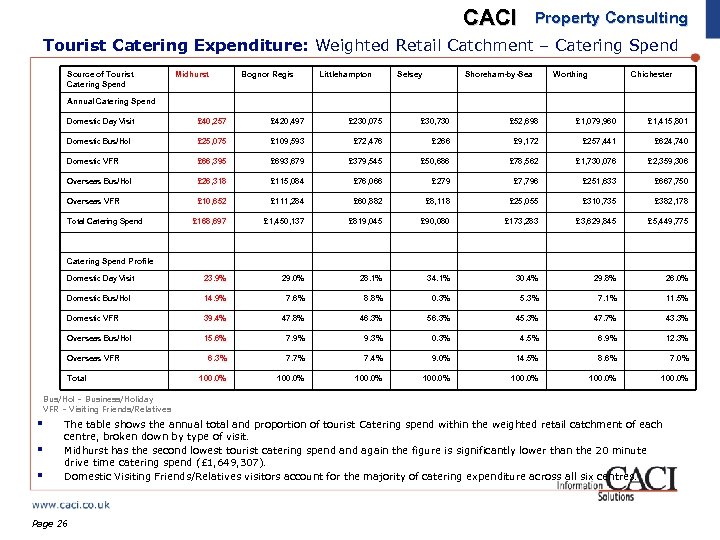

CACI Property Consulting Tourist Catering Expenditure: Weighted Retail Catchment – Catering Spend Source of Tourist Catering Spend Midhurst Bognor Regis Littlehampton Selsey Shoreham-by-Sea Worthing Chichester Annual Catering Spend Domestic Day Visit £ 40, 257 £ 420, 497 £ 230, 075 £ 30, 730 £ 52, 698 £ 1, 079, 960 £ 1, 415, 801 Domestic Bus/Hol £ 25, 075 £ 109, 593 £ 72, 476 £ 266 £ 9, 172 £ 257, 441 £ 624, 740 Domestic VFR £ 66, 395 £ 693, 679 £ 379, 545 £ 50, 686 £ 78, 562 £ 1, 730, 076 £ 2, 359, 306 Overseas Bus/Hol £ 26, 318 £ 115, 084 £ 76, 066 £ 279 £ 7, 796 £ 251, 633 £ 667, 750 Overseas VFR £ 10, 652 £ 111, 284 £ 60, 882 £ 8, 118 £ 25, 055 £ 310, 735 £ 382, 178 £ 168, 697 £ 1, 450, 137 £ 819, 045 £ 90, 080 £ 173, 283 £ 3, 629, 845 £ 5, 449, 775 Domestic Day Visit 23. 9% 29. 0% 28. 1% 34. 1% 30. 4% 29. 8% 26. 0% Domestic Bus/Hol 14. 9% 7. 6% 8. 8% 0. 3% 5. 3% 7. 1% 11. 5% Domestic VFR 39. 4% 47. 8% 46. 3% 56. 3% 45. 3% 47. 7% 43. 3% Overseas Bus/Hol 15. 6% 7. 9% 9. 3% 0. 3% 4. 5% 6. 9% 12. 3% 6. 3% 7. 7% 7. 4% 9. 0% 14. 5% 8. 6% 7. 0% 100. 0% Total Catering Spend Profile Overseas VFR Total Bus/Hol – Business/Holiday VFR – Visiting Friends/Relatives § § § The table shows the annual total and proportion of tourist Catering spend within the weighted retail catchment of each centre, broken down by type of visit. Midhurst has the second lowest tourist catering spend again the figure is significantly lower than the 20 minute drive time catering spend (£ 1, 649, 307). Domestic Visiting Friends/Relatives visitors account for the majority of catering expenditure across all six centres. Page 26

CACI Property Consulting Tourist Catering Expenditure: Weighted Retail Catchment – Catering Spend Source of Tourist Catering Spend Midhurst Bognor Regis Littlehampton Selsey Shoreham-by-Sea Worthing Chichester Annual Catering Spend Domestic Day Visit £ 40, 257 £ 420, 497 £ 230, 075 £ 30, 730 £ 52, 698 £ 1, 079, 960 £ 1, 415, 801 Domestic Bus/Hol £ 25, 075 £ 109, 593 £ 72, 476 £ 266 £ 9, 172 £ 257, 441 £ 624, 740 Domestic VFR £ 66, 395 £ 693, 679 £ 379, 545 £ 50, 686 £ 78, 562 £ 1, 730, 076 £ 2, 359, 306 Overseas Bus/Hol £ 26, 318 £ 115, 084 £ 76, 066 £ 279 £ 7, 796 £ 251, 633 £ 667, 750 Overseas VFR £ 10, 652 £ 111, 284 £ 60, 882 £ 8, 118 £ 25, 055 £ 310, 735 £ 382, 178 £ 168, 697 £ 1, 450, 137 £ 819, 045 £ 90, 080 £ 173, 283 £ 3, 629, 845 £ 5, 449, 775 Domestic Day Visit 23. 9% 29. 0% 28. 1% 34. 1% 30. 4% 29. 8% 26. 0% Domestic Bus/Hol 14. 9% 7. 6% 8. 8% 0. 3% 5. 3% 7. 1% 11. 5% Domestic VFR 39. 4% 47. 8% 46. 3% 56. 3% 45. 3% 47. 7% 43. 3% Overseas Bus/Hol 15. 6% 7. 9% 9. 3% 0. 3% 4. 5% 6. 9% 12. 3% 6. 3% 7. 7% 7. 4% 9. 0% 14. 5% 8. 6% 7. 0% 100. 0% Total Catering Spend Profile Overseas VFR Total Bus/Hol – Business/Holiday VFR – Visiting Friends/Relatives § § § The table shows the annual total and proportion of tourist Catering spend within the weighted retail catchment of each centre, broken down by type of visit. Midhurst has the second lowest tourist catering spend again the figure is significantly lower than the 20 minute drive time catering spend (£ 1, 649, 307). Domestic Visiting Friends/Relatives visitors account for the majority of catering expenditure across all six centres. Page 26

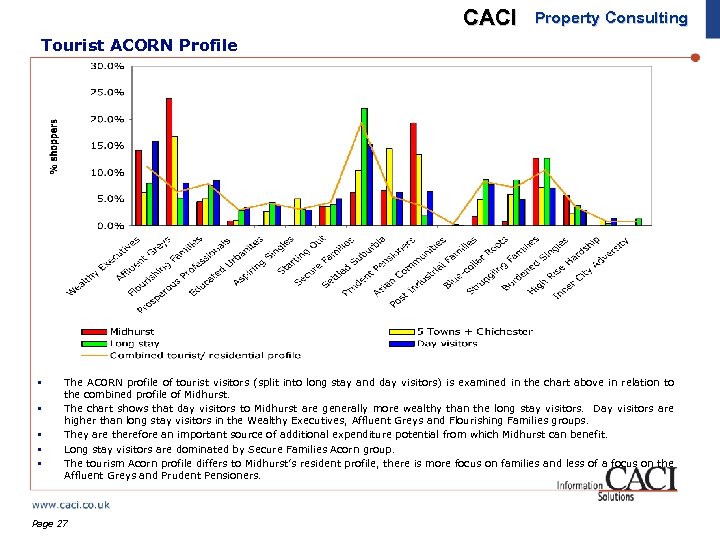

CACI Property Consulting Tourist ACORN Profile § § § The ACORN profile of tourist visitors (split into long stay and day visitors) is examined in the chart above in relation to the combined profile of Midhurst. The chart shows that day visitors to Midhurst are generally more wealthy than the long stay visitors. Day visitors are higher than long stay visitors in the Wealthy Executives, Affluent Greys and Flourishing Families groups. They are therefore an important source of additional expenditure potential from which Midhurst can benefit. Long stay visitors are dominated by Secure Families Acorn group. The tourism Acorn profile differs to Midhurst’s resident profile, there is more focus on families and less of a focus on the Affluent Greys and Prudent Pensioners. Page 27

CACI Property Consulting Tourist ACORN Profile § § § The ACORN profile of tourist visitors (split into long stay and day visitors) is examined in the chart above in relation to the combined profile of Midhurst. The chart shows that day visitors to Midhurst are generally more wealthy than the long stay visitors. Day visitors are higher than long stay visitors in the Wealthy Executives, Affluent Greys and Flourishing Families groups. They are therefore an important source of additional expenditure potential from which Midhurst can benefit. Long stay visitors are dominated by Secure Families Acorn group. The tourism Acorn profile differs to Midhurst’s resident profile, there is more focus on families and less of a focus on the Affluent Greys and Prudent Pensioners. Page 27

CACI Property Consulting Midhurst Strategy & Sustainable Opportunities 4. Page 28 Worker Market Potential

CACI Property Consulting Midhurst Strategy & Sustainable Opportunities 4. Page 28 Worker Market Potential

Worker Market Potential CACI Property Consulting § With the influx of workers, the daytime population of a town centre can change substantially from normal residential times. § CACI have quantified this change by analysing the Census 2001 Special Workplace Statistics, in order to quantify the volume of workers within Midhurst. § CACI has then applied its unique Workday Wallet expenditure estimates, to calculate the worth of these visitors in terms of comparison goods, convenience and catering spend. § The lifestyle groups that comprise the worker population have also been analysed for Midhurst, in order to understand how these visitors may differ to residents in terms of retailer preferences. Page 29

Worker Market Potential CACI Property Consulting § With the influx of workers, the daytime population of a town centre can change substantially from normal residential times. § CACI have quantified this change by analysing the Census 2001 Special Workplace Statistics, in order to quantify the volume of workers within Midhurst. § CACI has then applied its unique Workday Wallet expenditure estimates, to calculate the worth of these visitors in terms of comparison goods, convenience and catering spend. § The lifestyle groups that comprise the worker population have also been analysed for Midhurst, in order to understand how these visitors may differ to residents in terms of retailer preferences. Page 29

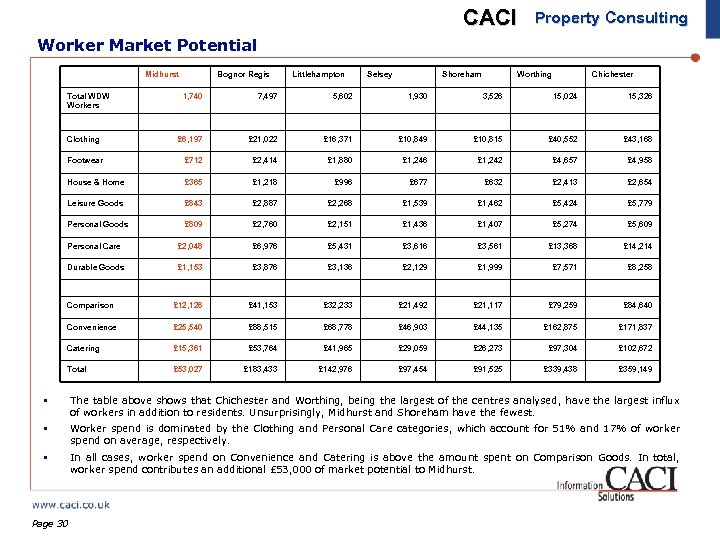

CACI Property Consulting Worker Market Potential Midhurst Total WDW Workers Bognor Regis Littlehampton Selsey Shoreham Worthing Chichester 1, 740 7, 497 5, 602 1, 930 3, 526 15, 024 15, 326 £ 6, 197 £ 21, 022 £ 16, 371 £ 10, 849 £ 10, 815 £ 40, 552 £ 43, 168 Footwear £ 712 £ 2, 414 £ 1, 880 £ 1, 246 £ 1, 242 £ 4, 657 £ 4, 958 House & Home £ 365 £ 1, 218 £ 996 £ 677 £ 632 £ 2, 413 £ 2, 654 Leisure Goods £ 843 £ 2, 887 £ 2, 268 £ 1, 539 £ 1, 462 £ 5, 424 £ 5, 779 Personal Goods £ 809 £ 2, 760 £ 2, 151 £ 1, 436 £ 1, 407 £ 5, 274 £ 5, 609 Personal Care £ 2, 048 £ 6, 976 £ 5, 431 £ 3, 616 £ 3, 561 £ 13, 368 £ 14, 214 Durable Goods £ 1, 153 £ 3, 876 £ 3, 136 £ 2, 129 £ 1, 999 £ 7, 571 £ 8, 258 Comparison £ 12, 126 £ 41, 153 £ 32, 233 £ 21, 492 £ 21, 117 £ 79, 259 £ 84, 640 Convenience £ 25, 540 £ 88, 515 £ 68, 778 £ 46, 903 £ 44, 135 £ 162, 875 £ 171, 837 Catering £ 15, 361 £ 53, 764 £ 41, 965 £ 29, 059 £ 26, 273 £ 97, 304 £ 102, 672 Total £ 53, 027 £ 183, 433 £ 142, 976 £ 97, 454 £ 91, 525 £ 339, 438 £ 359, 149 Clothing § The table above shows that Chichester and Worthing, being the largest of the centres analysed, have the largest influx of workers in addition to residents. Unsurprisingly, Midhurst and Shoreham have the fewest. § Worker spend is dominated by the Clothing and Personal Care categories, which account for 51% and 17% of worker spend on average, respectively. § In all cases, worker spend on Convenience and Catering is above the amount spent on Comparison Goods. In total, worker spend contributes an additional £ 53, 000 of market potential to Midhurst. Page 30

CACI Property Consulting Worker Market Potential Midhurst Total WDW Workers Bognor Regis Littlehampton Selsey Shoreham Worthing Chichester 1, 740 7, 497 5, 602 1, 930 3, 526 15, 024 15, 326 £ 6, 197 £ 21, 022 £ 16, 371 £ 10, 849 £ 10, 815 £ 40, 552 £ 43, 168 Footwear £ 712 £ 2, 414 £ 1, 880 £ 1, 246 £ 1, 242 £ 4, 657 £ 4, 958 House & Home £ 365 £ 1, 218 £ 996 £ 677 £ 632 £ 2, 413 £ 2, 654 Leisure Goods £ 843 £ 2, 887 £ 2, 268 £ 1, 539 £ 1, 462 £ 5, 424 £ 5, 779 Personal Goods £ 809 £ 2, 760 £ 2, 151 £ 1, 436 £ 1, 407 £ 5, 274 £ 5, 609 Personal Care £ 2, 048 £ 6, 976 £ 5, 431 £ 3, 616 £ 3, 561 £ 13, 368 £ 14, 214 Durable Goods £ 1, 153 £ 3, 876 £ 3, 136 £ 2, 129 £ 1, 999 £ 7, 571 £ 8, 258 Comparison £ 12, 126 £ 41, 153 £ 32, 233 £ 21, 492 £ 21, 117 £ 79, 259 £ 84, 640 Convenience £ 25, 540 £ 88, 515 £ 68, 778 £ 46, 903 £ 44, 135 £ 162, 875 £ 171, 837 Catering £ 15, 361 £ 53, 764 £ 41, 965 £ 29, 059 £ 26, 273 £ 97, 304 £ 102, 672 Total £ 53, 027 £ 183, 433 £ 142, 976 £ 97, 454 £ 91, 525 £ 339, 438 £ 359, 149 Clothing § The table above shows that Chichester and Worthing, being the largest of the centres analysed, have the largest influx of workers in addition to residents. Unsurprisingly, Midhurst and Shoreham have the fewest. § Worker spend is dominated by the Clothing and Personal Care categories, which account for 51% and 17% of worker spend on average, respectively. § In all cases, worker spend on Convenience and Catering is above the amount spent on Comparison Goods. In total, worker spend contributes an additional £ 53, 000 of market potential to Midhurst. Page 30

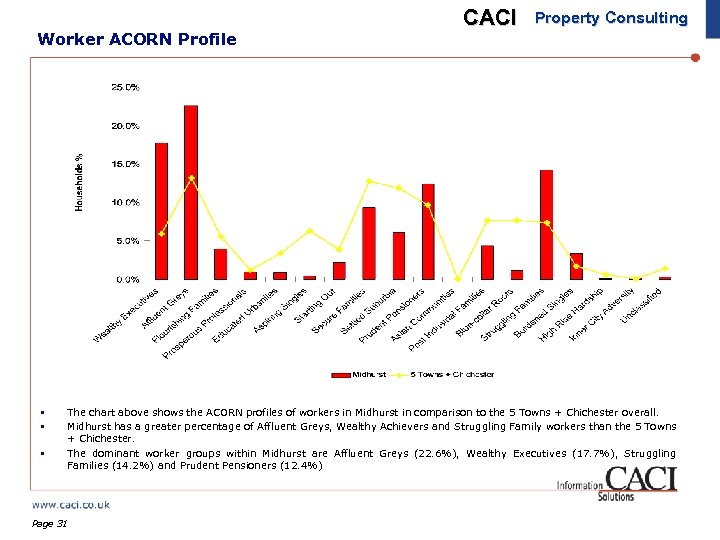

Worker ACORN Profile § § § CACI Property Consulting The chart above shows the ACORN profiles of workers in Midhurst in comparison to the 5 Towns + Chichester overall. Midhurst has a greater percentage of Affluent Greys, Wealthy Achievers and Struggling Family workers than the 5 Towns + Chichester. The dominant worker groups within Midhurst are Affluent Greys (22. 6%), Wealthy Executives (17. 7%), Struggling Families (14. 2%) and Prudent Pensioners (12. 4%) Page 31

Worker ACORN Profile § § § CACI Property Consulting The chart above shows the ACORN profiles of workers in Midhurst in comparison to the 5 Towns + Chichester overall. Midhurst has a greater percentage of Affluent Greys, Wealthy Achievers and Struggling Family workers than the 5 Towns + Chichester. The dominant worker groups within Midhurst are Affluent Greys (22. 6%), Wealthy Executives (17. 7%), Struggling Families (14. 2%) and Prudent Pensioners (12. 4%) Page 31

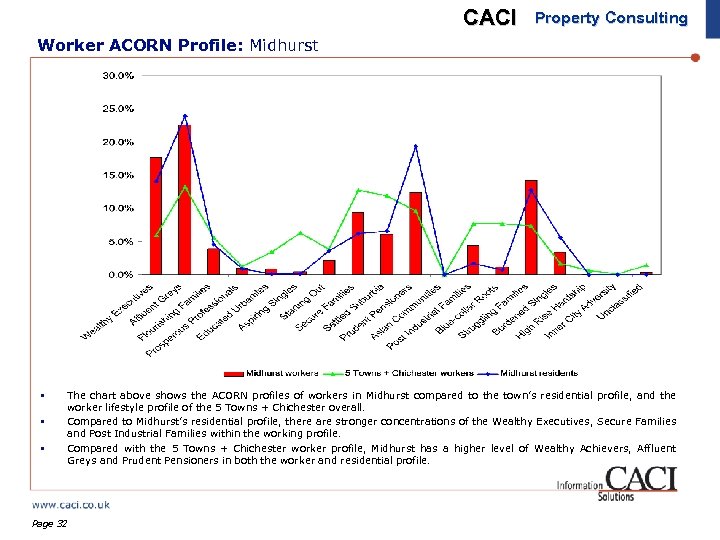

CACI Property Consulting Worker ACORN Profile: Midhurst § § § The chart above shows the ACORN profiles of workers in Midhurst compared to the town’s residential profile, and the worker lifestyle profile of the 5 Towns + Chichester overall. Compared to Midhurst’s residential profile, there are stronger concentrations of the Wealthy Executives, Secure Families and Post Industrial Families within the working profile. Compared with the 5 Towns + Chichester worker profile, Midhurst has a higher level of Wealthy Achievers, Affluent Greys and Prudent Pensioners in both the worker and residential profile. Page 32

CACI Property Consulting Worker ACORN Profile: Midhurst § § § The chart above shows the ACORN profiles of workers in Midhurst compared to the town’s residential profile, and the worker lifestyle profile of the 5 Towns + Chichester overall. Compared to Midhurst’s residential profile, there are stronger concentrations of the Wealthy Executives, Secure Families and Post Industrial Families within the working profile. Compared with the 5 Towns + Chichester worker profile, Midhurst has a higher level of Wealthy Achievers, Affluent Greys and Prudent Pensioners in both the worker and residential profile. Page 32

CACI Property Consulting Midhurst Strategy & Sustainable Opportunities 5. Page 33 Benchmarks & Retail Provision

CACI Property Consulting Midhurst Strategy & Sustainable Opportunities 5. Page 33 Benchmarks & Retail Provision

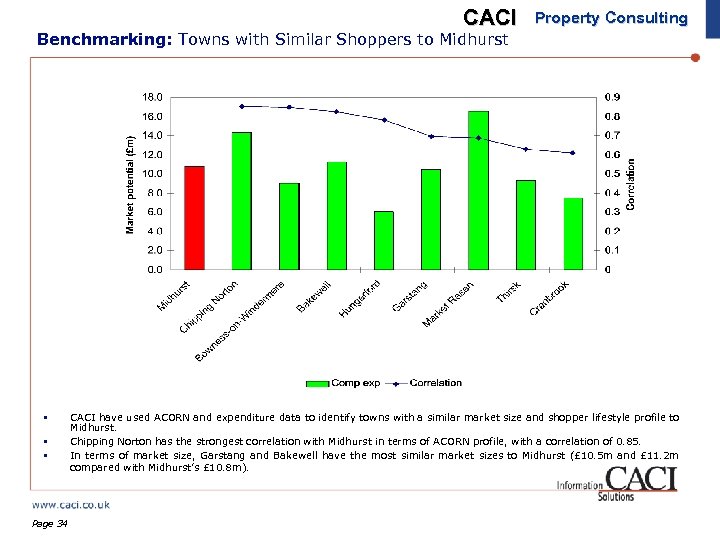

CACI Property Consulting Benchmarking: Towns with Similar Shoppers to Midhurst § § § Page 34 CACI have used ACORN and expenditure data to identify towns with a similar market size and shopper lifestyle profile to Midhurst. Chipping Norton has the strongest correlation with Midhurst in terms of ACORN profile, with a correlation of 0. 85. In terms of market size, Garstang and Bakewell have the most similar market sizes to Midhurst (£ 10. 5 m and £ 11. 2 m compared with Midhurst’s £ 10. 8 m).

CACI Property Consulting Benchmarking: Towns with Similar Shoppers to Midhurst § § § Page 34 CACI have used ACORN and expenditure data to identify towns with a similar market size and shopper lifestyle profile to Midhurst. Chipping Norton has the strongest correlation with Midhurst in terms of ACORN profile, with a correlation of 0. 85. In terms of market size, Garstang and Bakewell have the most similar market sizes to Midhurst (£ 10. 5 m and £ 11. 2 m compared with Midhurst’s £ 10. 8 m).

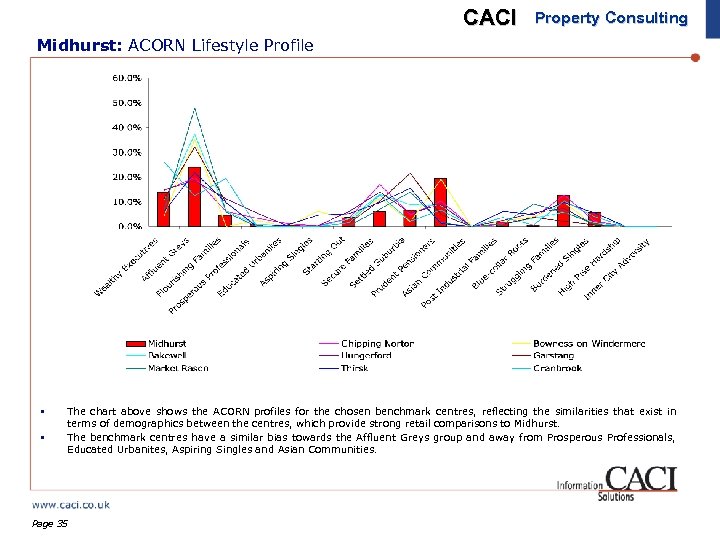

CACI Property Consulting Midhurst: ACORN Lifestyle Profile § § The chart above shows the ACORN profiles for the chosen benchmark centres, reflecting the similarities that exist in terms of demographics between the centres, which provide strong retail comparisons to Midhurst. The benchmark centres have a similar bias towards the Affluent Greys group and away from Prosperous Professionals, Educated Urbanites, Aspiring Singles and Asian Communities. Page 35

CACI Property Consulting Midhurst: ACORN Lifestyle Profile § § The chart above shows the ACORN profiles for the chosen benchmark centres, reflecting the similarities that exist in terms of demographics between the centres, which provide strong retail comparisons to Midhurst. The benchmark centres have a similar bias towards the Affluent Greys group and away from Prosperous Professionals, Educated Urbanites, Aspiring Singles and Asian Communities. Page 35

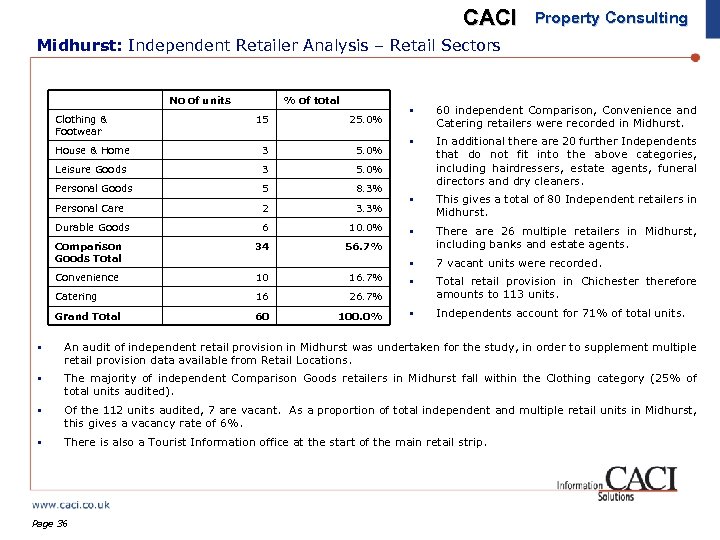

CACI Property Consulting Midhurst: Independent Retailer Analysis – Retail Sectors No of units Clothing & Footwear % of total 25. 0% House & Home 3 5. 0% Leisure Goods 3 5 8. 3% Personal Care 2 3. 3% Durable Goods 6 10. 0% Comparison Goods Total 34 10 16. 7% Catering 16 60 100. 0% In additional there are 20 further Independents that do not fit into the above categories, including hairdressers, estate agents, funeral directors and dry cleaners. § This gives a total of 80 Independent retailers in Midhurst. § There are 26 multiple retailers in Midhurst, including banks and estate agents. 7 vacant units were recorded. § Total retail provision in Chichester therefore amounts to 113 units. § Independents account for 71% of total units. 26. 7% Grand Total § 56. 7% Convenience 60 independent Comparison, Convenience and Catering retailers were recorded in Midhurst. 5. 0% Personal Goods § § 15 § An audit of independent retail provision in Midhurst was undertaken for the study, in order to supplement multiple retail provision data available from Retail Locations. § The majority of independent Comparison Goods retailers in Midhurst fall within the Clothing category (25% of total units audited). § Of the 112 units audited, 7 are vacant. As a proportion of total independent and multiple retail units in Midhurst, this gives a vacancy rate of 6%. § There is also a Tourist Information office at the start of the main retail strip. Page 36

CACI Property Consulting Midhurst: Independent Retailer Analysis – Retail Sectors No of units Clothing & Footwear % of total 25. 0% House & Home 3 5. 0% Leisure Goods 3 5 8. 3% Personal Care 2 3. 3% Durable Goods 6 10. 0% Comparison Goods Total 34 10 16. 7% Catering 16 60 100. 0% In additional there are 20 further Independents that do not fit into the above categories, including hairdressers, estate agents, funeral directors and dry cleaners. § This gives a total of 80 Independent retailers in Midhurst. § There are 26 multiple retailers in Midhurst, including banks and estate agents. 7 vacant units were recorded. § Total retail provision in Chichester therefore amounts to 113 units. § Independents account for 71% of total units. 26. 7% Grand Total § 56. 7% Convenience 60 independent Comparison, Convenience and Catering retailers were recorded in Midhurst. 5. 0% Personal Goods § § 15 § An audit of independent retail provision in Midhurst was undertaken for the study, in order to supplement multiple retail provision data available from Retail Locations. § The majority of independent Comparison Goods retailers in Midhurst fall within the Clothing category (25% of total units audited). § Of the 112 units audited, 7 are vacant. As a proportion of total independent and multiple retail units in Midhurst, this gives a vacancy rate of 6%. § There is also a Tourist Information office at the start of the main retail strip. Page 36

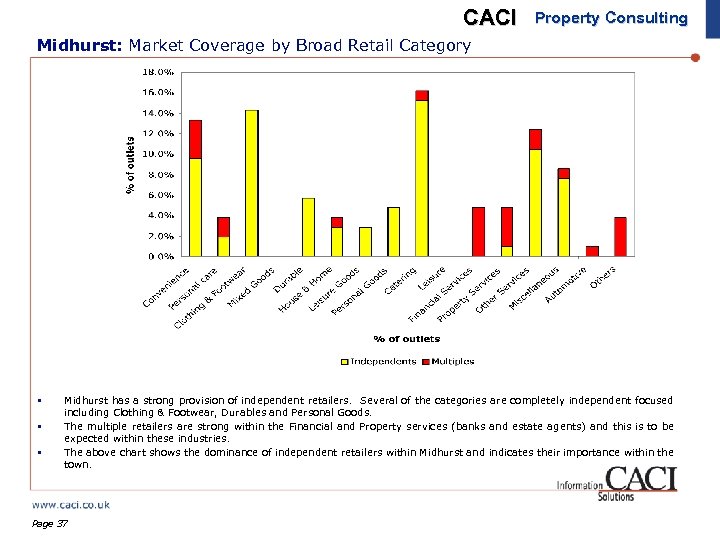

CACI Property Consulting Midhurst: Market Coverage by Broad Retail Category § § § Midhurst has a strong provision of independent retailers. Several of the categories are completely independent focused including Clothing & Footwear, Durables and Personal Goods. The multiple retailers are strong within the Financial and Property services (banks and estate agents) and this is to be expected within these industries. The above chart shows the dominance of independent retailers within Midhurst and indicates their importance within the town. Page 37

CACI Property Consulting Midhurst: Market Coverage by Broad Retail Category § § § Midhurst has a strong provision of independent retailers. Several of the categories are completely independent focused including Clothing & Footwear, Durables and Personal Goods. The multiple retailers are strong within the Financial and Property services (banks and estate agents) and this is to be expected within these industries. The above chart shows the dominance of independent retailers within Midhurst and indicates their importance within the town. Page 37

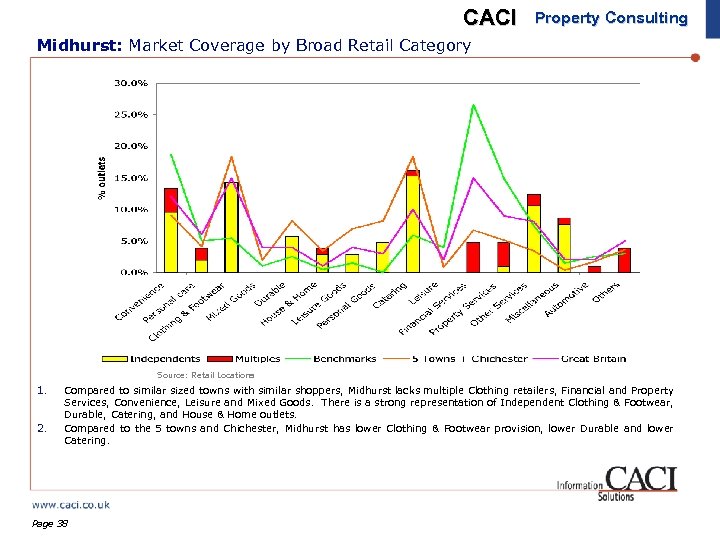

CACI Property Consulting Midhurst: Market Coverage by Broad Retail Category Source: Retail Locations 1. 2. Compared to similar sized towns with similar shoppers, Midhurst lacks multiple Clothing retailers, Financial and Property Services, Convenience, Leisure and Mixed Goods. There is a strong representation of Independent Clothing & Footwear, Durable, Catering, and House & Home outlets. Compared to the 5 towns and Chichester, Midhurst has lower Clothing & Footwear provision, lower Durable and lower Catering. Page 38

CACI Property Consulting Midhurst: Market Coverage by Broad Retail Category Source: Retail Locations 1. 2. Compared to similar sized towns with similar shoppers, Midhurst lacks multiple Clothing retailers, Financial and Property Services, Convenience, Leisure and Mixed Goods. There is a strong representation of Independent Clothing & Footwear, Durable, Catering, and House & Home outlets. Compared to the 5 towns and Chichester, Midhurst has lower Clothing & Footwear provision, lower Durable and lower Catering. Page 38

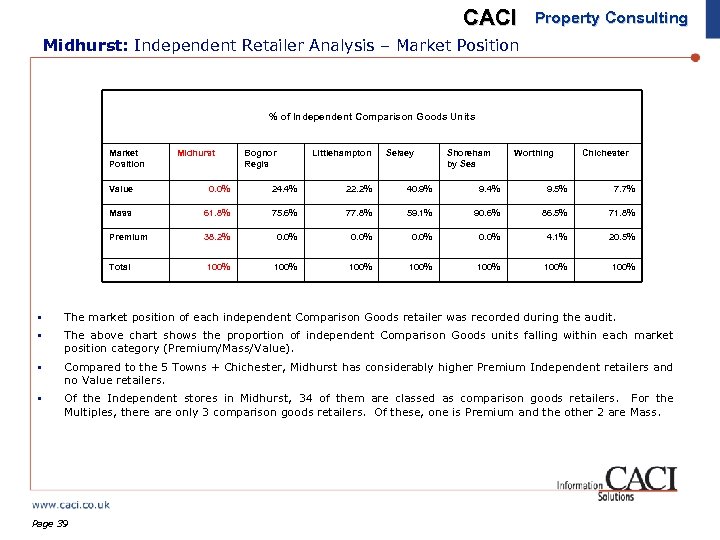

CACI Property Consulting Midhurst: Independent Retailer Analysis – Market Position % of Independent Comparison Goods Units Market Position Midhurst Bognor Regis Littlehampton Selsey Shoreham by Sea Worthing Chichester Value 0. 0% 24. 4% 22. 2% 40. 9% 9. 4% 9. 5% 7. 7% Mass 61. 8% 75. 6% 77. 8% 59. 1% 90. 6% 86. 5% 71. 8% Premium 38. 2% 0. 0% 4. 1% 20. 5% Total 100% 100% § The market position of each independent Comparison Goods retailer was recorded during the audit. § The above chart shows the proportion of independent Comparison Goods units falling within each market position category (Premium/Mass/Value). § Compared to the 5 Towns + Chichester, Midhurst has considerably higher Premium Independent retailers and no Value retailers. § Of the Independent stores in Midhurst, 34 of them are classed as comparison goods retailers. For the Multiples, there are only 3 comparison goods retailers. Of these, one is Premium and the other 2 are Mass. Page 39

CACI Property Consulting Midhurst: Independent Retailer Analysis – Market Position % of Independent Comparison Goods Units Market Position Midhurst Bognor Regis Littlehampton Selsey Shoreham by Sea Worthing Chichester Value 0. 0% 24. 4% 22. 2% 40. 9% 9. 4% 9. 5% 7. 7% Mass 61. 8% 75. 6% 77. 8% 59. 1% 90. 6% 86. 5% 71. 8% Premium 38. 2% 0. 0% 4. 1% 20. 5% Total 100% 100% § The market position of each independent Comparison Goods retailer was recorded during the audit. § The above chart shows the proportion of independent Comparison Goods units falling within each market position category (Premium/Mass/Value). § Compared to the 5 Towns + Chichester, Midhurst has considerably higher Premium Independent retailers and no Value retailers. § Of the Independent stores in Midhurst, 34 of them are classed as comparison goods retailers. For the Multiples, there are only 3 comparison goods retailers. Of these, one is Premium and the other 2 are Mass. Page 39

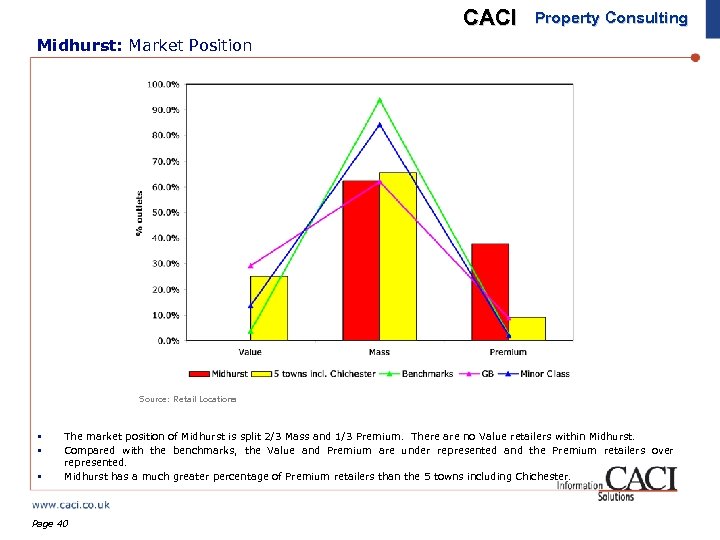

CACI Property Consulting Midhurst: Market Position Source: Retail Locations § § § The market position of Midhurst is split 2/3 Mass and 1/3 Premium. There are no Value retailers within Midhurst. Compared with the benchmarks, the Value and Premium are under represented and the Premium retailers over represented. Midhurst has a much greater percentage of Premium retailers than the 5 towns including Chichester. Page 40

CACI Property Consulting Midhurst: Market Position Source: Retail Locations § § § The market position of Midhurst is split 2/3 Mass and 1/3 Premium. There are no Value retailers within Midhurst. Compared with the benchmarks, the Value and Premium are under represented and the Premium retailers over represented. Midhurst has a much greater percentage of Premium retailers than the 5 towns including Chichester. Page 40

CACI Property Consulting Midhurst Strategy & Sustainable Opportunities 6. Page 41 Retail Development Scenarios

CACI Property Consulting Midhurst Strategy & Sustainable Opportunities 6. Page 41 Retail Development Scenarios

CACI Property Consulting Scenario Assessment § Making use of the flexibility to undertake ‘what-if’ scenarios within CACI’s Retail Footprint gravity model, CACI have modelled Midhurst’s future position in 2016. § The model assesses Midhurst’s future competitive position in 2016, utilising CACI’s extensive database of competing retail developments; ‘Centre Futures’. When incorporating these developments into the model, CACI have taken a realistic view on their future performance based on the latest information available. § In addition to data on major competing schemes from Centre Futures, CACI have supplemented this with information obtained from relevant local authorities about committed retail developments which may not yet be in the public domain, and smaller developments not picked up by Centre Futures. § The scenarios therefore reflect the competitive situation as at 2016 as far as it is currently possible to do so – i. e. based on concrete floorspace information on committed developments. They are not intended to be viewed as ‘non intervention’ scenarios – firm proposals for developments in the 5 Towns + Chichester have been included wherever possible. However, it is not possible to incorporate Masterplan-based development ‘aspirations’ into the modelling process. § The following slide summarises the potential competing developments relevant to Midhurst, based on nearby competing centres. Page 42

CACI Property Consulting Scenario Assessment § Making use of the flexibility to undertake ‘what-if’ scenarios within CACI’s Retail Footprint gravity model, CACI have modelled Midhurst’s future position in 2016. § The model assesses Midhurst’s future competitive position in 2016, utilising CACI’s extensive database of competing retail developments; ‘Centre Futures’. When incorporating these developments into the model, CACI have taken a realistic view on their future performance based on the latest information available. § In addition to data on major competing schemes from Centre Futures, CACI have supplemented this with information obtained from relevant local authorities about committed retail developments which may not yet be in the public domain, and smaller developments not picked up by Centre Futures. § The scenarios therefore reflect the competitive situation as at 2016 as far as it is currently possible to do so – i. e. based on concrete floorspace information on committed developments. They are not intended to be viewed as ‘non intervention’ scenarios – firm proposals for developments in the 5 Towns + Chichester have been included wherever possible. However, it is not possible to incorporate Masterplan-based development ‘aspirations’ into the modelling process. § The following slide summarises the potential competing developments relevant to Midhurst, based on nearby competing centres. Page 42

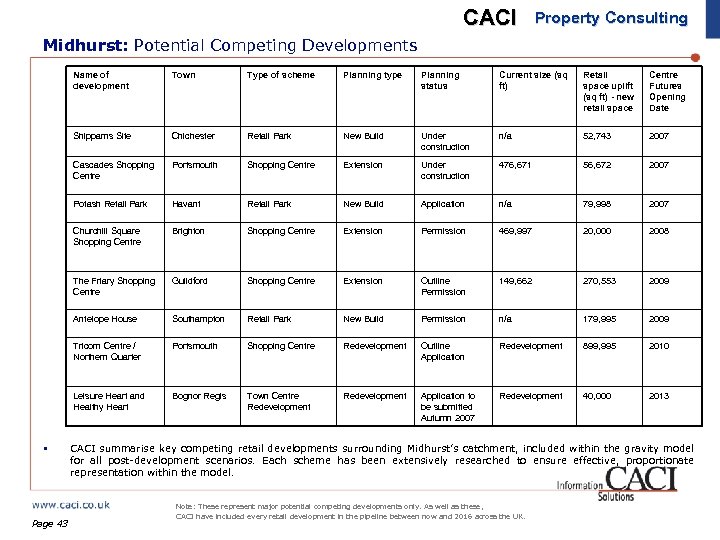

CACI Property Consulting Midhurst: Potential Competing Developments Name of development Planning type Planning status Current size (sq ft) Retail space uplift (sq ft) - new retail space Centre Futures Opening Date Chichester Retail Park New Build Under construction n/a 52, 743 2007 Cascades Shopping Centre Portsmouth Shopping Centre Extension Under construction 476, 671 56, 672 2007 Potash Retail Park Havant Retail Park New Build Application n/a 79, 998 2007 Churchill Square Shopping Centre Brighton Shopping Centre Extension Permission 469, 997 20, 000 2008 The Friary Shopping Centre Guildford Shopping Centre Extension Outline Permission 149, 662 270, 553 2009 Antelope House Southampton Retail Park New Build Permission n/a 179, 995 2009 Tricorn Centre / Northern Quarter Portsmouth Shopping Centre Redevelopment Outline Application Redevelopment 899, 995 2010 Leisure Heart and Healthy Heart Page 43 Type of scheme Shippams Site § Town Bognor Regis Town Centre Redevelopment Application to be submitted Autumn 2007 Redevelopment 40, 000 2013 CACI summarise key competing retail developments surrounding Midhurst’s catchment, included within the gravity model for all post-development scenarios. Each scheme has been extensively researched to ensure effective, proportionate representation within the model. Note: These represent major potential competing developments only. As well as these, CACI have included every retail development in the pipeline between now and 2016 across the UK.

CACI Property Consulting Midhurst: Potential Competing Developments Name of development Planning type Planning status Current size (sq ft) Retail space uplift (sq ft) - new retail space Centre Futures Opening Date Chichester Retail Park New Build Under construction n/a 52, 743 2007 Cascades Shopping Centre Portsmouth Shopping Centre Extension Under construction 476, 671 56, 672 2007 Potash Retail Park Havant Retail Park New Build Application n/a 79, 998 2007 Churchill Square Shopping Centre Brighton Shopping Centre Extension Permission 469, 997 20, 000 2008 The Friary Shopping Centre Guildford Shopping Centre Extension Outline Permission 149, 662 270, 553 2009 Antelope House Southampton Retail Park New Build Permission n/a 179, 995 2009 Tricorn Centre / Northern Quarter Portsmouth Shopping Centre Redevelopment Outline Application Redevelopment 899, 995 2010 Leisure Heart and Healthy Heart Page 43 Type of scheme Shippams Site § Town Bognor Regis Town Centre Redevelopment Application to be submitted Autumn 2007 Redevelopment 40, 000 2013 CACI summarise key competing retail developments surrounding Midhurst’s catchment, included within the gravity model for all post-development scenarios. Each scheme has been extensively researched to ensure effective, proportionate representation within the model. Note: These represent major potential competing developments only. As well as these, CACI have included every retail development in the pipeline between now and 2016 across the UK.

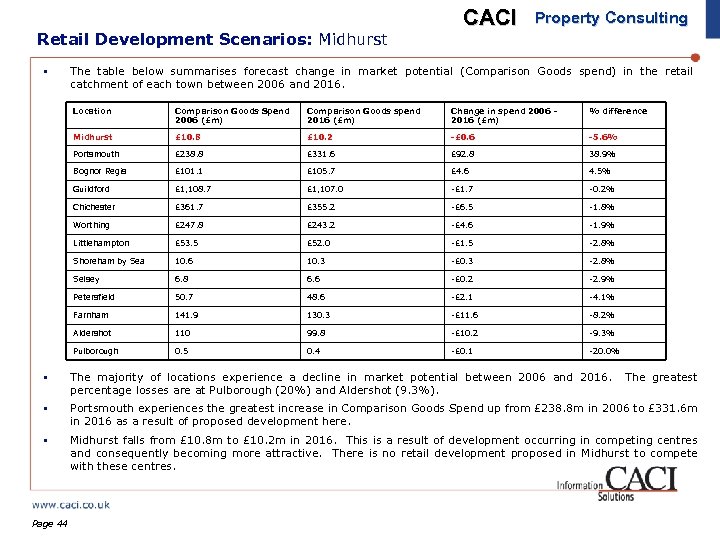

Retail Development Scenarios: Midhurst § CACI Property Consulting The table below summarises forecast change in market potential (Comparison Goods spend) in the retail catchment of each town between 2006 and 2016. Location Comparison Goods Spend 2006 (£m) Comparison Goods spend 2016 (£m) Change in spend 2006 2016 (£m) % difference Midhurst £ 10. 8 £ 10. 2 -£ 0. 6 -5. 6% Portsmouth £ 238. 8 £ 331. 6 £ 92. 8 38. 9% Bognor Regis £ 101. 1 £ 105. 7 £ 4. 6 4. 5% Guildford £ 1, 108. 7 £ 1, 107. 0 -£ 1. 7 -0. 2% Chichester £ 361. 7 £ 355. 2 -£ 6. 5 -1. 8% Worthing £ 247. 8 £ 243. 2 -£ 4. 6 -1. 9% Littlehampton £ 53. 5 £ 52. 0 -£ 1. 5 -2. 8% Shoreham by Sea 10. 6 10. 3 -£ 0. 3 -2. 8% Selsey 6. 8 6. 6 -£ 0. 2 -2. 9% Petersfield 50. 7 48. 6 -£ 2. 1 -4. 1% Farnham 141. 9 130. 3 -£ 11. 6 -8. 2% Aldershot 110 99. 8 -£ 10. 2 -9. 3% Pulborough 0. 5 0. 4 -£ 0. 1 -20. 0% § The majority of locations experience a decline in market potential between 2006 and 2016. percentage losses are at Pulborough (20%) and Aldershot (9. 3%). § Portsmouth experiences the greatest increase in Comparison Goods Spend up from £ 238. 8 m in 2006 to £ 331. 6 m in 2016 as a result of proposed development here. § Midhurst falls from £ 10. 8 m to £ 10. 2 m in 2016. This is a result of development occurring in competing centres and consequently becoming more attractive. There is no retail development proposed in Midhurst to compete with these centres. Page 44 The greatest

Retail Development Scenarios: Midhurst § CACI Property Consulting The table below summarises forecast change in market potential (Comparison Goods spend) in the retail catchment of each town between 2006 and 2016. Location Comparison Goods Spend 2006 (£m) Comparison Goods spend 2016 (£m) Change in spend 2006 2016 (£m) % difference Midhurst £ 10. 8 £ 10. 2 -£ 0. 6 -5. 6% Portsmouth £ 238. 8 £ 331. 6 £ 92. 8 38. 9% Bognor Regis £ 101. 1 £ 105. 7 £ 4. 6 4. 5% Guildford £ 1, 108. 7 £ 1, 107. 0 -£ 1. 7 -0. 2% Chichester £ 361. 7 £ 355. 2 -£ 6. 5 -1. 8% Worthing £ 247. 8 £ 243. 2 -£ 4. 6 -1. 9% Littlehampton £ 53. 5 £ 52. 0 -£ 1. 5 -2. 8% Shoreham by Sea 10. 6 10. 3 -£ 0. 3 -2. 8% Selsey 6. 8 6. 6 -£ 0. 2 -2. 9% Petersfield 50. 7 48. 6 -£ 2. 1 -4. 1% Farnham 141. 9 130. 3 -£ 11. 6 -8. 2% Aldershot 110 99. 8 -£ 10. 2 -9. 3% Pulborough 0. 5 0. 4 -£ 0. 1 -20. 0% § The majority of locations experience a decline in market potential between 2006 and 2016. percentage losses are at Pulborough (20%) and Aldershot (9. 3%). § Portsmouth experiences the greatest increase in Comparison Goods Spend up from £ 238. 8 m in 2006 to £ 331. 6 m in 2016 as a result of proposed development here. § Midhurst falls from £ 10. 8 m to £ 10. 2 m in 2016. This is a result of development occurring in competing centres and consequently becoming more attractive. There is no retail development proposed in Midhurst to compete with these centres. Page 44 The greatest

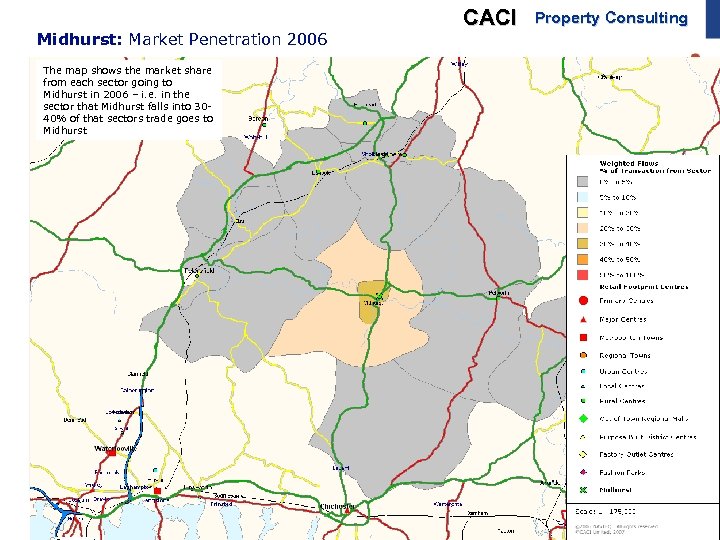

Midhurst: Market Penetration 2006 The map shows the market share from each sector going to Midhurst in 2006 – i. e. in the sector that Midhurst falls into 3040% of that sectors trade goes to Midhurst Page 45 CACI Property Consulting

Midhurst: Market Penetration 2006 The map shows the market share from each sector going to Midhurst in 2006 – i. e. in the sector that Midhurst falls into 3040% of that sectors trade goes to Midhurst Page 45 CACI Property Consulting

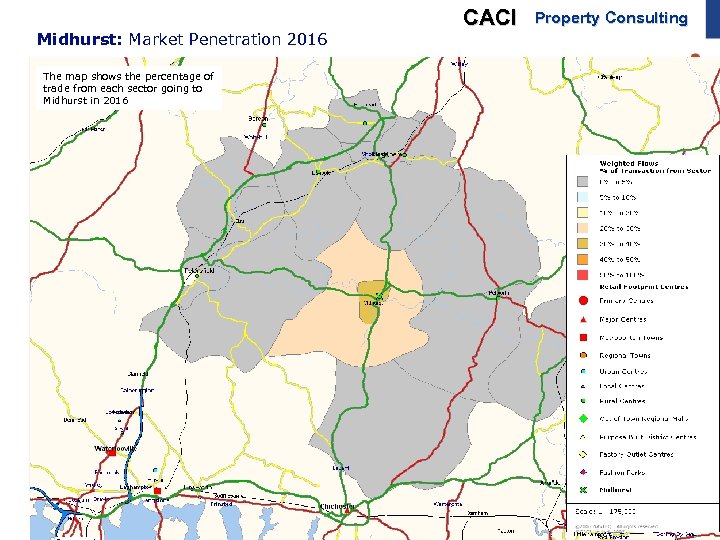

Midhurst: Market Penetration 2016 The map shows the percentage of trade from each sector going to Midhurst in 2016 Page 46 CACI Property Consulting

Midhurst: Market Penetration 2016 The map shows the percentage of trade from each sector going to Midhurst in 2016 Page 46 CACI Property Consulting

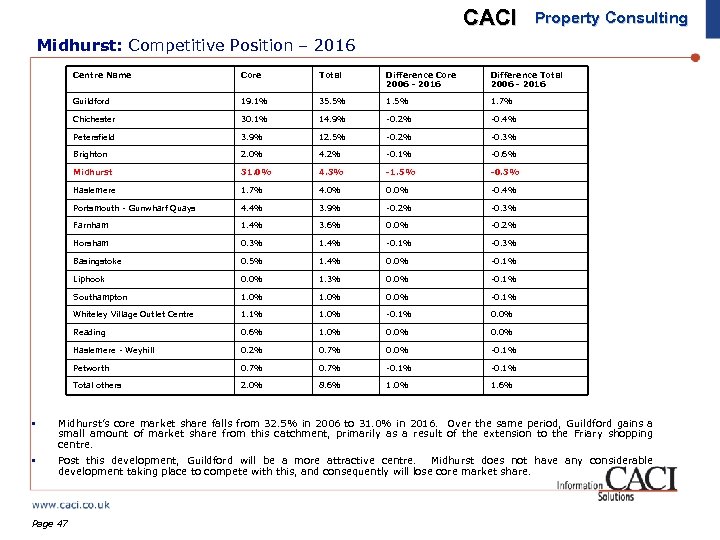

CACI Property Consulting Midhurst: Competitive Position – 2016 Centre Name Core Total Difference Core 2006 - 2016 Difference Total 2006 - 2016 Guildford 19. 1% 35. 5% 1. 7% Chichester 30. 1% 14. 9% -0. 2% -0. 4% Petersfield 3. 9% 12. 5% -0. 2% -0. 3% Brighton 2. 0% 4. 2% -0. 1% -0. 6% Midhurst 31. 0% 4. 3% -1. 5% -0. 3% Haslemere 1. 7% 4. 0% 0. 0% -0. 4% Portsmouth - Gunwharf Quays 4. 4% 3. 9% -0. 2% -0. 3% Farnham 1. 4% 3. 6% 0. 0% -0. 2% Horsham 0. 3% 1. 4% -0. 1% -0. 3% Basingstoke 0. 5% 1. 4% 0. 0% -0. 1% Liphook 0. 0% 1. 3% 0. 0% -0. 1% Southampton 1. 0% 0. 0% -0. 1% Whiteley Village Outlet Centre 1. 1% 1. 0% -0. 1% 0. 0% Reading 0. 6% 1. 0% 0. 0% Haslemere - Weyhill 0. 2% 0. 7% 0. 0% -0. 1% Petworth 0. 7% -0. 1% Total others 2. 0% 8. 6% 1. 0% 1. 6% § Midhurst’s core market share falls from 32. 5% in 2006 to 31. 0% in 2016. Over the same period, Guildford gains a small amount of market share from this catchment, primarily as a result of the extension to the Friary shopping centre. § Post this development, Guildford will be a more attractive centre. Midhurst does not have any considerable development taking place to compete with this, and consequently will lose core market share. Page 47

CACI Property Consulting Midhurst: Competitive Position – 2016 Centre Name Core Total Difference Core 2006 - 2016 Difference Total 2006 - 2016 Guildford 19. 1% 35. 5% 1. 7% Chichester 30. 1% 14. 9% -0. 2% -0. 4% Petersfield 3. 9% 12. 5% -0. 2% -0. 3% Brighton 2. 0% 4. 2% -0. 1% -0. 6% Midhurst 31. 0% 4. 3% -1. 5% -0. 3% Haslemere 1. 7% 4. 0% 0. 0% -0. 4% Portsmouth - Gunwharf Quays 4. 4% 3. 9% -0. 2% -0. 3% Farnham 1. 4% 3. 6% 0. 0% -0. 2% Horsham 0. 3% 1. 4% -0. 1% -0. 3% Basingstoke 0. 5% 1. 4% 0. 0% -0. 1% Liphook 0. 0% 1. 3% 0. 0% -0. 1% Southampton 1. 0% 0. 0% -0. 1% Whiteley Village Outlet Centre 1. 1% 1. 0% -0. 1% 0. 0% Reading 0. 6% 1. 0% 0. 0% Haslemere - Weyhill 0. 2% 0. 7% 0. 0% -0. 1% Petworth 0. 7% -0. 1% Total others 2. 0% 8. 6% 1. 0% 1. 6% § Midhurst’s core market share falls from 32. 5% in 2006 to 31. 0% in 2016. Over the same period, Guildford gains a small amount of market share from this catchment, primarily as a result of the extension to the Friary shopping centre. § Post this development, Guildford will be a more attractive centre. Midhurst does not have any considerable development taking place to compete with this, and consequently will lose core market share. Page 47

CACI Property Consulting Midhurst Strategy & Sustainable Opportunities 7. Page 48 Residential Development

CACI Property Consulting Midhurst Strategy & Sustainable Opportunities 7. Page 48 Residential Development

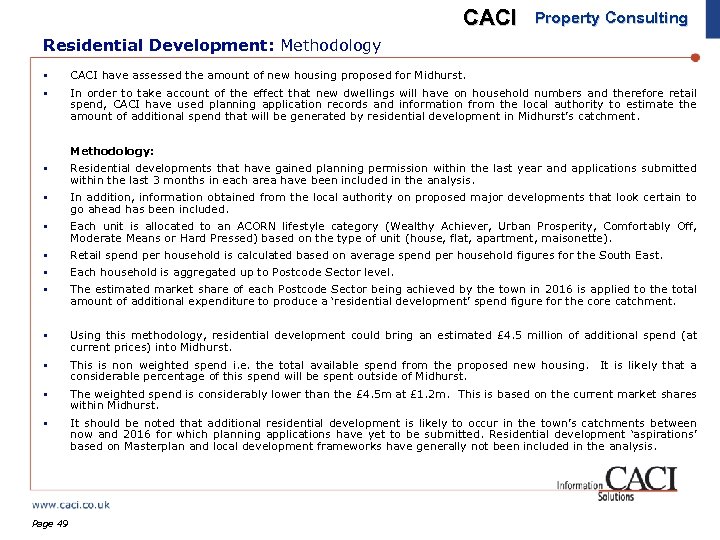

CACI Property Consulting Residential Development: Methodology § § CACI have assessed the amount of new housing proposed for Midhurst. In order to take account of the effect that new dwellings will have on household numbers and therefore retail spend, CACI have used planning application records and information from the local authority to estimate the amount of additional spend that will be generated by residential development in Midhurst’s catchment. Methodology: § Residential developments that have gained planning permission within the last year and applications submitted within the last 3 months in each area have been included in the analysis. § In addition, information obtained from the local authority on proposed major developments that look certain to go ahead has been included. § Each unit is allocated to an ACORN lifestyle category (Wealthy Achiever, Urban Prosperity, Comfortably Off, Moderate Means or Hard Pressed) based on the type of unit (house, flat, apartment, maisonette). § § § Retail spend per household is calculated based on average spend per household figures for the South East. § Using this methodology, residential development could bring an estimated £ 4. 5 million of additional spend (at current prices) into Midhurst. § This is non weighted spend i. e. the total available spend from the proposed new housing. considerable percentage of this spend will be spent outside of Midhurst. § The weighted spend is considerably lower than the £ 4. 5 m at £ 1. 2 m. This is based on the current market shares within Midhurst. § It should be noted that additional residential development is likely to occur in the town’s catchments between now and 2016 for which planning applications have yet to be submitted. Residential development ‘aspirations’ based on Masterplan and local development frameworks have generally not been included in the analysis. Page 49 Each household is aggregated up to Postcode Sector level. The estimated market share of each Postcode Sector being achieved by the town in 2016 is applied to the total amount of additional expenditure to produce a ‘residential development’ spend figure for the core catchment. It is likely that a

CACI Property Consulting Residential Development: Methodology § § CACI have assessed the amount of new housing proposed for Midhurst. In order to take account of the effect that new dwellings will have on household numbers and therefore retail spend, CACI have used planning application records and information from the local authority to estimate the amount of additional spend that will be generated by residential development in Midhurst’s catchment. Methodology: § Residential developments that have gained planning permission within the last year and applications submitted within the last 3 months in each area have been included in the analysis. § In addition, information obtained from the local authority on proposed major developments that look certain to go ahead has been included. § Each unit is allocated to an ACORN lifestyle category (Wealthy Achiever, Urban Prosperity, Comfortably Off, Moderate Means or Hard Pressed) based on the type of unit (house, flat, apartment, maisonette). § § § Retail spend per household is calculated based on average spend per household figures for the South East. § Using this methodology, residential development could bring an estimated £ 4. 5 million of additional spend (at current prices) into Midhurst. § This is non weighted spend i. e. the total available spend from the proposed new housing. considerable percentage of this spend will be spent outside of Midhurst. § The weighted spend is considerably lower than the £ 4. 5 m at £ 1. 2 m. This is based on the current market shares within Midhurst. § It should be noted that additional residential development is likely to occur in the town’s catchments between now and 2016 for which planning applications have yet to be submitted. Residential development ‘aspirations’ based on Masterplan and local development frameworks have generally not been included in the analysis. Page 49 Each household is aggregated up to Postcode Sector level. The estimated market share of each Postcode Sector being achieved by the town in 2016 is applied to the total amount of additional expenditure to produce a ‘residential development’ spend figure for the core catchment. It is likely that a

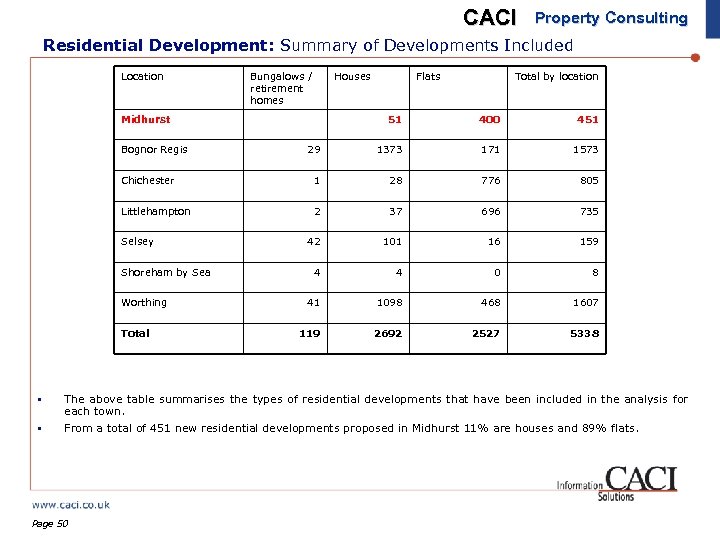

CACI Property Consulting Residential Development: Summary of Developments Included Location Bungalows / retirement homes Houses Midhurst Flats Total by location 51 400 451 29 1373 171 1573 Chichester 1 28 776 805 Littlehampton 2 37 696 735 42 101 16 159 4 4 0 8 41 1098 468 1607 119 2692 2527 5338 Bognor Regis Selsey Shoreham by Sea Worthing Total § The above table summarises the types of residential developments that have been included in the analysis for each town. § From a total of 451 new residential developments proposed in Midhurst 11% are houses and 89% flats. Page 50

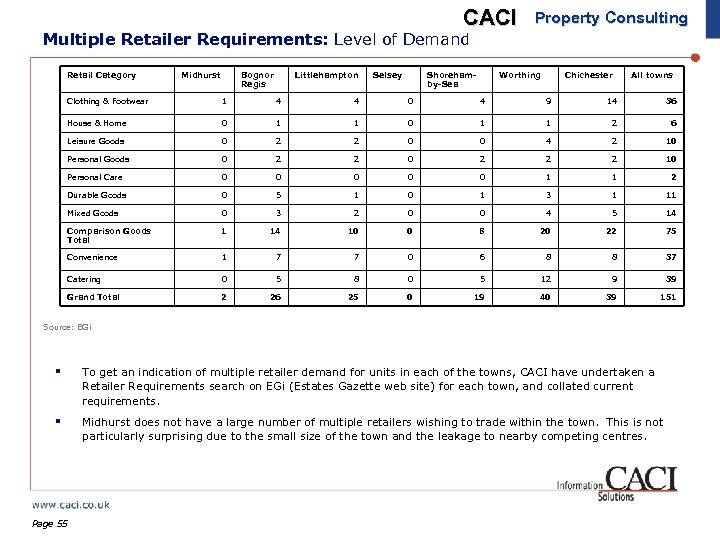

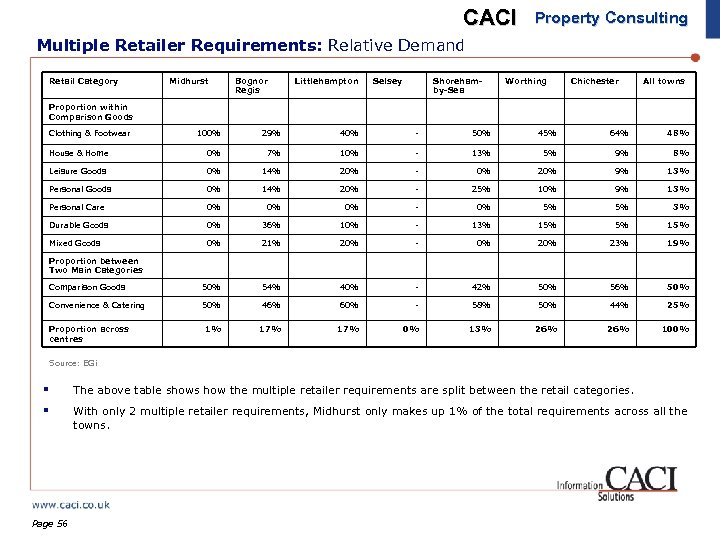

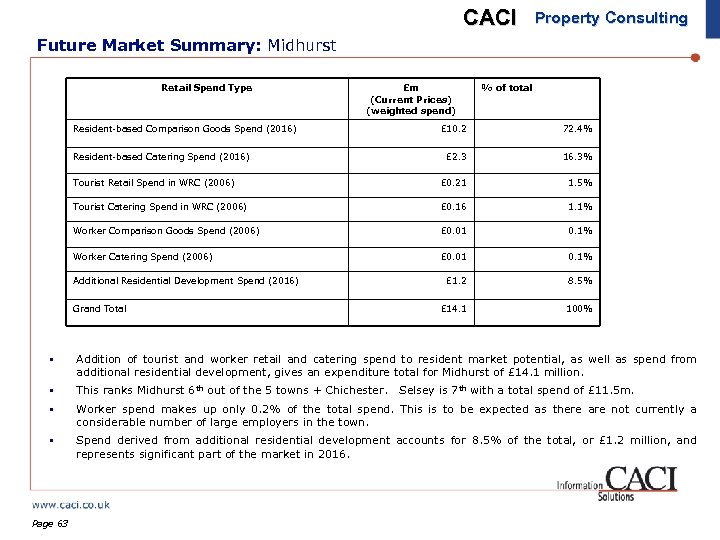

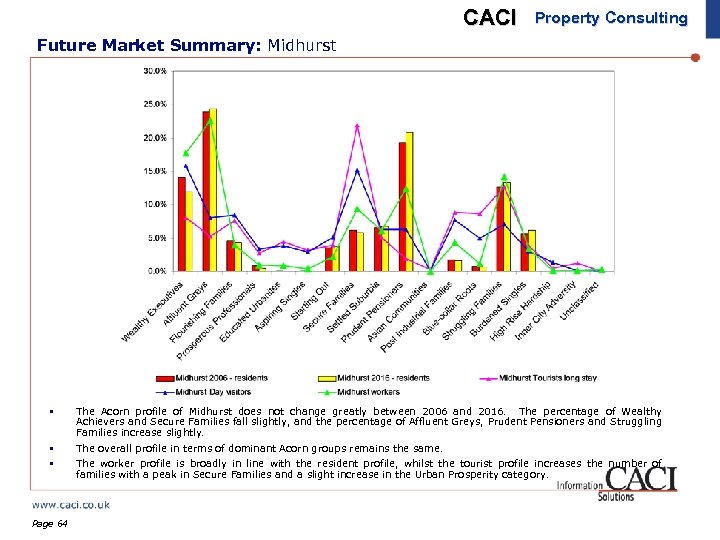

CACI Property Consulting Residential Development: Summary of Developments Included Location Bungalows / retirement homes Houses Midhurst Flats Total by location 51 400 451 29 1373 171 1573 Chichester 1 28 776 805 Littlehampton 2 37 696 735 42 101 16 159 4 4 0 8 41 1098 468 1607 119 2692 2527 5338 Bognor Regis Selsey Shoreham by Sea Worthing Total § The above table summarises the types of residential developments that have been included in the analysis for each town. § From a total of 451 new residential developments proposed in Midhurst 11% are houses and 89% flats. Page 50