1255bef716a3467e997f40abec74acf1.ppt

- Количество слайдов: 20

Middle East Business Forum Sukuk and real estate finance Andrew Petry 22 November 2006

Shariah compliant investments n Islamic Finance – structured finance with ethics? n Development of a Shariah compliant market – slow in coming but are we at a tipping point? n Where is the demand for Shariah complaint investments coming from? n GCC petro-dollar surpluses; and n Muslim investors elsewhere n Opportunistic financings e. g. Saxen Anhalt’s Sukuk n Should Islamic Finance seek to replicate conventional finance techniques to compete with it? n Ability to provide funding on a stand-alone basis?

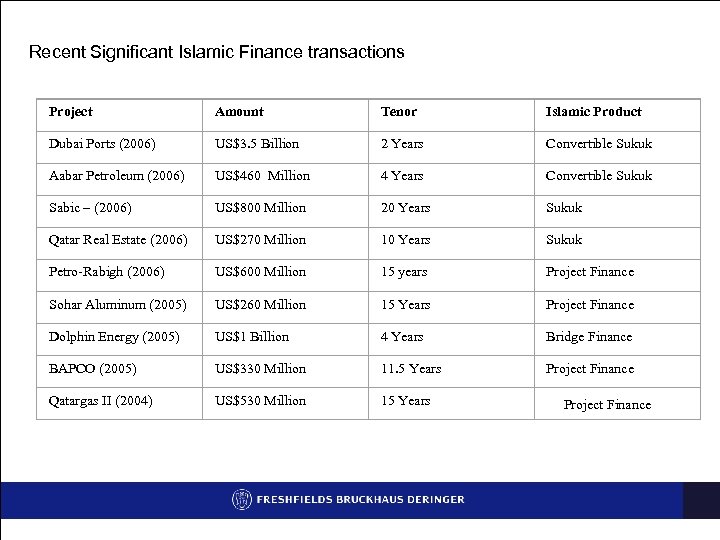

Recent Significant Islamic Finance transactions Project Amount Tenor Islamic Product Dubai Ports (2006) US$3. 5 Billion 2 Years Convertible Sukuk Aabar Petroleum (2006) US$460 Million 4 Years Convertible Sukuk Sabic – (2006) US$800 Million 20 Years Sukuk Qatar Real Estate (2006) US$270 Million 10 Years Sukuk Petro-Rabigh (2006) US$600 Million 15 years Project Finance Sohar Aluminum (2005) US$260 Million 15 Years Project Finance Dolphin Energy (2005) US$1 Billion 4 Years Bridge Finance BAPCO (2005) US$330 Million 11. 5 Years Project Finance Qatargas II (2004) US$530 Million 15 Years Project Finance

So what’s all the fuss about Sukuk? n Sukuk are often referred to as Islamic bonds n Sukuk is the plural of “Sakk” often translated as an investment participation certificate n AAOIFI definition says it is “a certificate of equal value representing undivided shares in ownership of tangible assets, usufruct and services or (in the ownership of) the assets of particular projects or investment activity” n Sukuk : n Have a link to the underlying asset / class of asset (in contrast to much conventional finance) n Carry fixed / floating payment obligations, equivalent to a coupon n And most important of all are tradable.

Size and features of the Sukuk Market n As of 3 rd quarter 2006 the size of the Sukuk market is estimated at approximately US$16 bn (excluding domestic Malaysian issuance and short term Sukuk): US$6 bn Sovereign, US$9 bn corporate. n Dubai Islamic Bank alone claims that it is about to issue up to US$10 bn of Sukuk of which 60% will be for non-Islamic investors. n Tenors tend to be from monthly up to 10 years, can be longer, but predominantly around 5 years. n Need to distinguish between private financings structured as Sukuk and listed Sukuk

The UK as a centre for Islamic Finance? n Ed Balls, the Economic Secretary to the Treasury, in a speech on 30 October, set out the government’s determination for London to be at the forefront of developments in Islamic Finance. n He summarised the Government’s initiatives as follows: n Removal of barriers to murabaha and ijara mortgages in 2003 and diminishing musharaka in 2005 enabling expansion of the UK Islamic mortgage market to over half a billion pounds (up by almost 50 per cent in the last year); n taking steps in 2005 to remove the tax barriers to retail finance enabling murabaha (cost plus) and mudaraba (profit sharing) products to be offered. n taking steps in the 2006 Finance Act to enable diminishing musharaka and ijara wa’iqtina based finance products. n He finished his speech by pledging to place domestic Sukuk on the same footing as conventional financing products by ensuring that the correct tax treatment applies for Capital Gains Tax, Capital Allowances and Corporation Tax and that he would be working with industry over the coming year to find a solution to any tax problems presented by Sukuk and ensure that London remains competitive in this market.

The UK tax reforms (1) n The first group of changes were to the Stamp Duty Land Tax (SDLT) reliefs in 2003 (supplemented by provisions in FA 2005 and FA 2006), and following that direct tax provisions were introduced in FA 2005 and extended by FA 2006. n Chapter 5 Part 2 FA 2005 (alternative finance arrangements) introduced rules to deal with finance arrangements that are structured so that they do not involve the payment or receipt of interest. n FA 2005 applies to: (a) Alternative finance returns (sections 47 and 47 A FA 2005); and (b) Profit share returns (sections 49 and 49 A FA 2005).

The UK tax reforms (2) n A requirement of all the structures described below is that at least one of the parties must be a “financial institution”. This is widely defined in section 46 FA 2005. n Section 47 FA 2005 (purchase and re-sale/Murabaha structure): under this structure a financial institution buys an asset and then sells it, for a profit, to its customer (either immediately or over time). n Section 47 A FA 2005 (diminishing shared ownership/Musharaka structure), inserted by FA 2006: under this structure, a financial institution and its customer jointly acquire an asset and the financial institution’s interest in the asset subsequently reduces. n Section 49 FA 2005 (deposit/Mudaraba structure): under this structure, a customer deposits funds with a financial institution, which invests those funds and shares the profits of the investment with the customer. n Section 49 A: FA 2005 (profit share agency/ Wakala structure), inserted by FA 2006: under this structure, a customer appoints a financial institution as its agent for the making of investments, with the customer being entitled to the profits arising from the investment only to a certain extent and the remainder of the profits belonging to the financial institution.

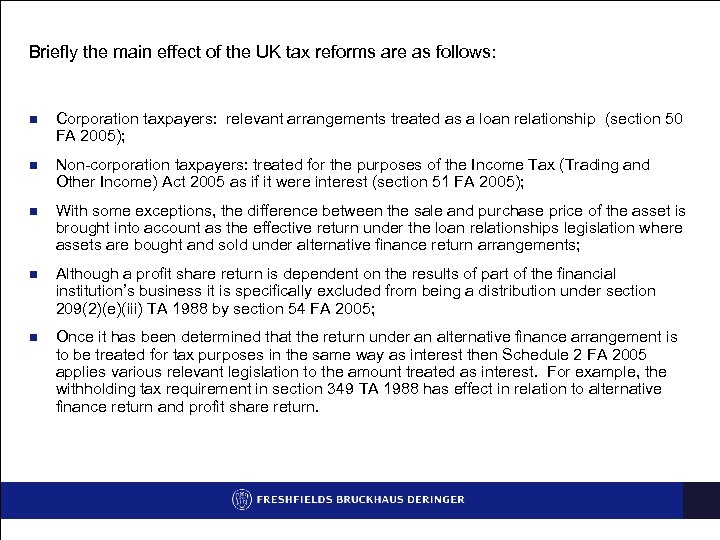

Briefly the main effect of the UK tax reforms are as follows: n Corporation taxpayers: relevant arrangements treated as a loan relationship (section 50 FA 2005); n Non-corporation taxpayers: treated for the purposes of the Income Tax (Trading and Other Income) Act 2005 as if it were interest (section 51 FA 2005); n With some exceptions, the difference between the sale and purchase price of the asset is brought into account as the effective return under the loan relationships legislation where assets are bought and sold under alternative finance return arrangements; n Although a profit share return is dependent on the results of part of the financial institution’s business it is specifically excluded from being a distribution under section 209(2)(e)(iii) TA 1988 by section 54 FA 2005; n Once it has been determined that the return under an alternative finance arrangement is to be treated for tax purposes in the same way as interest then Schedule 2 FA 2005 applies various relevant legislation to the amount treated as interest. For example, the withholding tax requirement in section 349 TA 1988 has effect in relation to alternative finance return and profit share return.

Sukuk Variants n AAOIFI identifies up to 14 eligible Sukuk, the main ones being: — ljara assets — Mudaraba assets — Musharaka assets — Full title assets — Variations on istisna’a and other assets — salam assets — murabaha assets — muzra’a assets — musaqa assets — mugarasa assets — ownership of usufructs or financial benefits

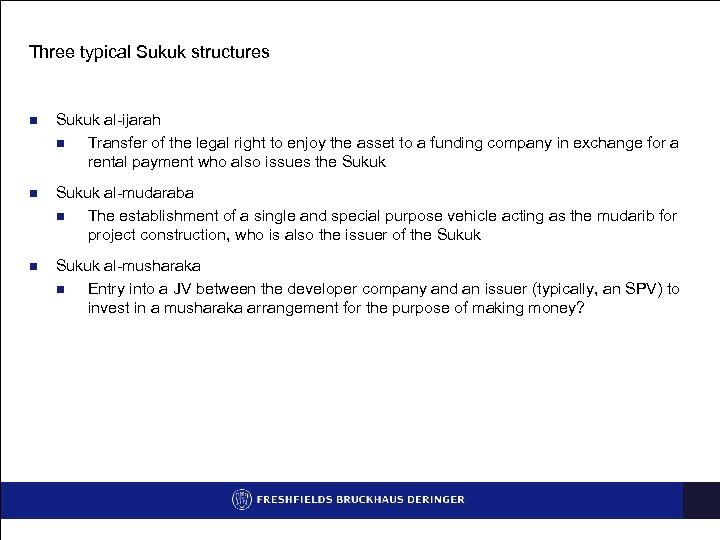

Three typical Sukuk structures n Sukuk al-ijarah n Transfer of the legal right to enjoy the asset to a funding company in exchange for a rental payment who also issues the Sukuk n Sukuk al-mudaraba n The establishment of a single and special purpose vehicle acting as the mudarib for project construction, who is also the issuer of the Sukuk n Sukuk al-musharaka n Entry into a JV between the developer company and an issuer (typically, an SPV) to invest in a musharaka arrangement for the purpose of making money?

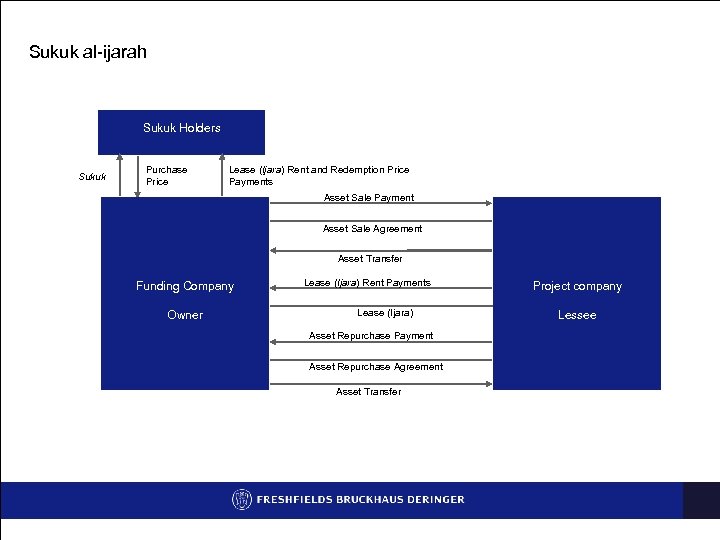

Sukuk al-ijarah Sukuk Holders Sukuk Purchase Price Lease (Ijara) Rent and Redemption Price Payments Asset Sale Payment Asset Sale Agreement Asset Transfer Funding Company Owner Lease (Ijara) Rent Payments Lease (Ijara) Asset Repurchase Payment Asset Repurchase Agreement Asset Transfer Project company Lessee

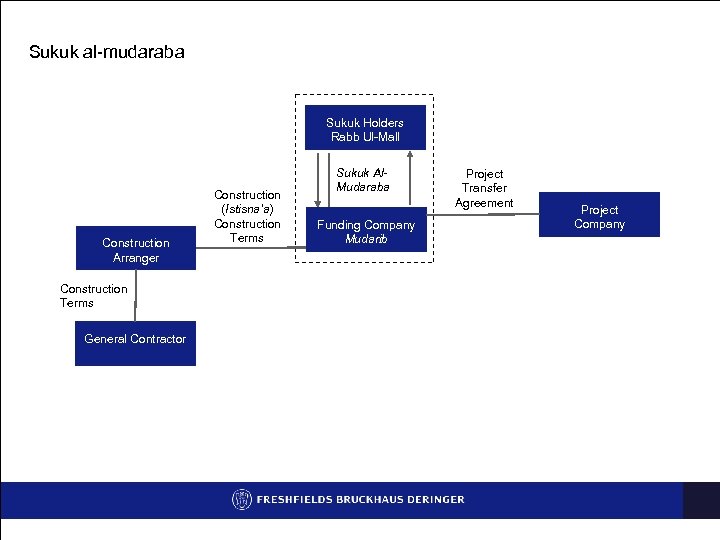

Sukuk al-mudaraba Sukuk Holders Rabb Ul-Mall Construction Arranger Construction Terms General Contractor Construction (Istisna’a) Construction Terms Sukuk Al. Mudaraba Funding Company Mudarib Project Transfer Agreement Project Company

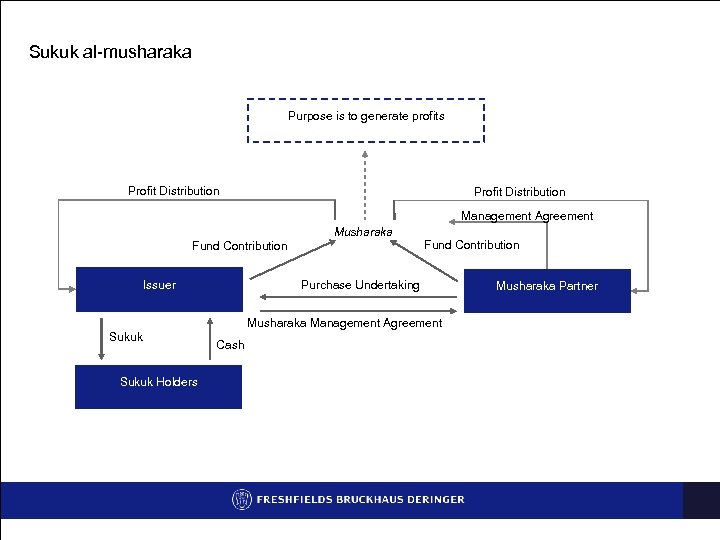

Sukuk al-musharaka Purpose is to generate profits Profit Distribution Management Agreement Musharaka Fund Contribution Issuer Sukuk Holders Fund Contribution Purchase Undertaking Musharaka Management Agreement Cash Musharaka Partner

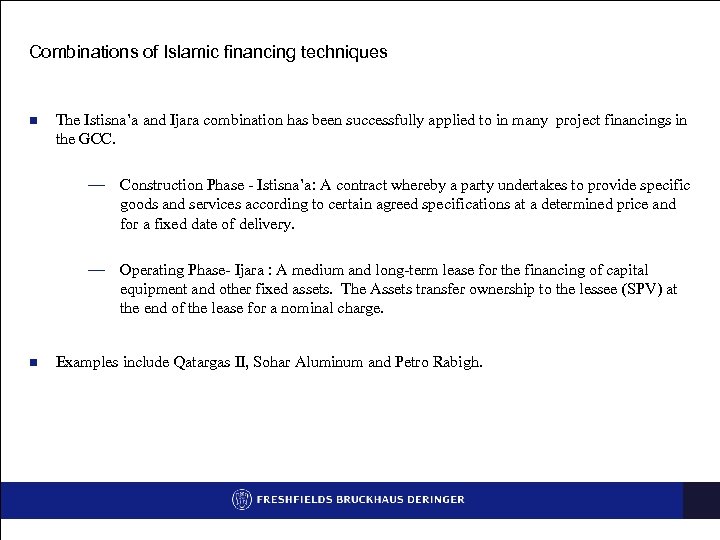

Combinations of Islamic financing techniques n The Istisna’a and Ijara combination has been successfully applied to in many project financings in the GCC. — Construction Phase - Istisna’a: A contract whereby a party undertakes to provide specific goods and services according to certain agreed specifications at a determined price and for a fixed date of delivery. — Operating Phase- Ijara : A medium and long-term lease for the financing of capital equipment and other fixed assets. The Assets transfer ownership to the lessee (SPV) at the end of the lease for a nominal charge. n Examples include Qatargas II, Sohar Aluminum and Petro Rabigh.

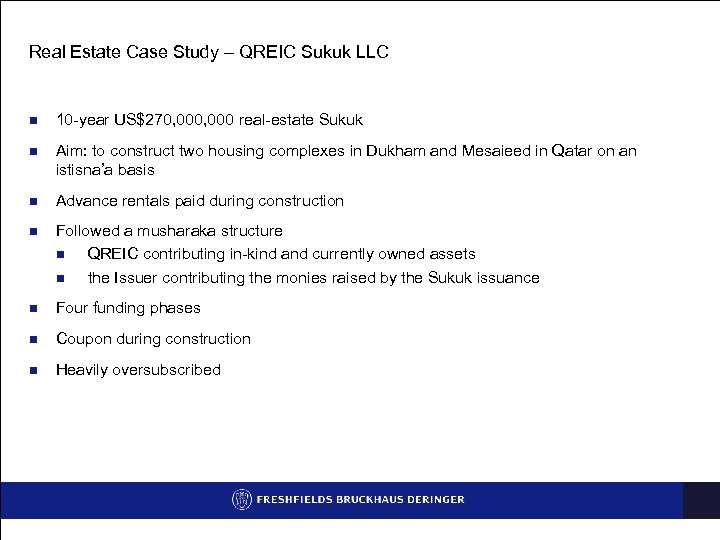

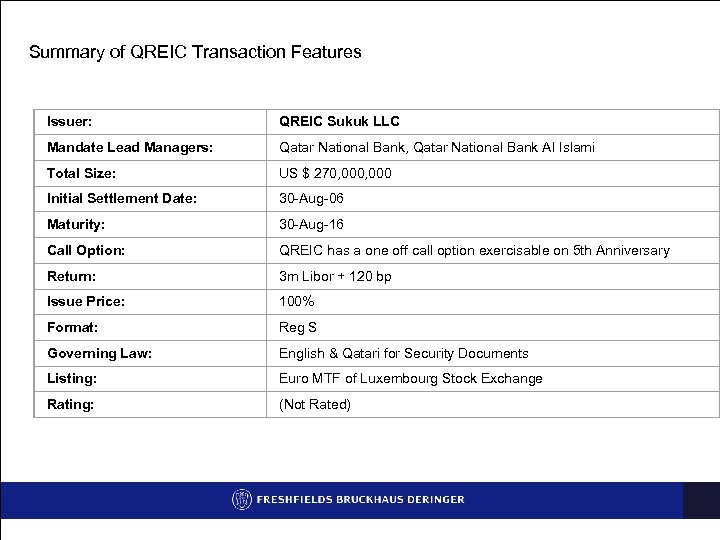

Real Estate Case Study – QREIC Sukuk LLC n 10 -year US$270, 000 real-estate Sukuk n Aim: to construct two housing complexes in Dukham and Mesaieed in Qatar on an istisna’a basis n Advance rentals paid during construction n Followed a musharaka structure n QREIC contributing in-kind and currently owned assets n the Issuer contributing the monies raised by the Sukuk issuance n Four funding phases n Coupon during construction n Heavily oversubscribed

Summary of QREIC Transaction Features Issuer: QREIC Sukuk LLC Mandate Lead Managers: Qatar National Bank, Qatar National Bank Al Islami Total Size: US $ 270, 000 Initial Settlement Date: 30 -Aug-06 Maturity: 30 -Aug-16 Call Option: QREIC has a one off call option exercisable on 5 th Anniversary Return: 3 m Libor + 120 bp Issue Price: 100% Format: Reg S Governing Law: English & Qatari for Security Documents Listing: Euro MTF of Luxembourg Stock Exchange Rating: (Not Rated)

Some possible clouds on the horizon n Excess Demand: Excess demand has lead to pricing levels in some recent Shariah compliant financings that make the transactions unattractive. n Ticket size: These have often been in the region of US$100 Million which is too big for some Islamic banks. n Tenor: Real Estate and Project Financings tend to require longer tenors and Islamic financings lend themselves less readily to these. n Shariah Interpretation: Some models are more conservative than others, causing uncertainty and reducing secondary trading.

Future of Sukuk n The UK government want Sukuk traded on equal footing to conventional bonds in London which means that the barriers to Real Estate in London being financed in a Shariah compliant and efficient way are in the process of being, or have already, been removed. n Precedent deals in the GCC show that real estate assets (whether in construction or when completed) are capable of being financed in a Shariah compliant way through combinations of Sukuk, musharaka, ijara, istisna’a and other techniques. n New regulatory regime, rules as opposed to current case-by-case decision-making process with different schools of thought depending on region etc; need for standardisation. n Launch of new Indices for trading, help liquidity. n An Islamic compliant ISDA n Growing rating agency familiarity

Andrew Petry Partner andrew. petry@freshfields. com 65 Fleet Street London EC 4 Y 1 HS Tel: +44 20 7716 4887 Fax +44 20 7108 4887 © Freshfields Bruckhaus Deringer 2006 This material is for general information only and is not intended to provide legal advice. LON 1148881

1255bef716a3467e997f40abec74acf1.ppt