44a95656a0b59848d61a3c588c66ef9c.ppt

- Количество слайдов: 26

Microinsurance: A Risk Management Strategy DONOR INFORMATION RESOURCE CENTRE Helping to Improve Donor Effectiveness in Microfinance www. microfinancegateway. org

Microinsurance: A Risk Management Strategy DONOR INFORMATION RESOURCE CENTRE Helping to Improve Donor Effectiveness in Microfinance www. microfinancegateway. org

PRESENTATION INSTRUCTIONS • This is a DIRECT presentation designed for microfinance donors. These slides may be used or changed without permission. Attribution to CGAP/DIRECT is appreciated. • Slides are accompanied by notes. • To view notes, select from the Power. Point menu: View/ Notes Page. Scroll to advance to next page. • To print notes, select File/ Print what: Notes Pages. • To print handouts of just slides (no notes), select File/ Print what: Handouts. Then enter the number of slides to print per page. • For optimal printing on a black-and-white printer, select from the menu: File/ Print/ Pure Black and White. April 22, 2004

PRESENTATION INSTRUCTIONS • This is a DIRECT presentation designed for microfinance donors. These slides may be used or changed without permission. Attribution to CGAP/DIRECT is appreciated. • Slides are accompanied by notes. • To view notes, select from the Power. Point menu: View/ Notes Page. Scroll to advance to next page. • To print notes, select File/ Print what: Notes Pages. • To print handouts of just slides (no notes), select File/ Print what: Handouts. Then enter the number of slides to print per page. • For optimal printing on a black-and-white printer, select from the menu: File/ Print/ Pure Black and White. April 22, 2004

Overview § What risks do poor people face and how do they protect themselves? § What is microinsurance? § What are the difficulties in providing insurance to poor people? § What are some microinsurance delivery models? § What are some dos and don’ts for donors?

Overview § What risks do poor people face and how do they protect themselves? § What is microinsurance? § What are the difficulties in providing insurance to poor people? § What are some microinsurance delivery models? § What are some dos and don’ts for donors?

What Risks Do Poor People Face? Key Risks § § § Death § Natural disaster (earthquake, drought) Illness or injury Loss of property (theft, fire) “Life is one long risk” Microfinance client in the Philippines

What Risks Do Poor People Face? Key Risks § § § Death § Natural disaster (earthquake, drought) Illness or injury Loss of property (theft, fire) “Life is one long risk” Microfinance client in the Philippines

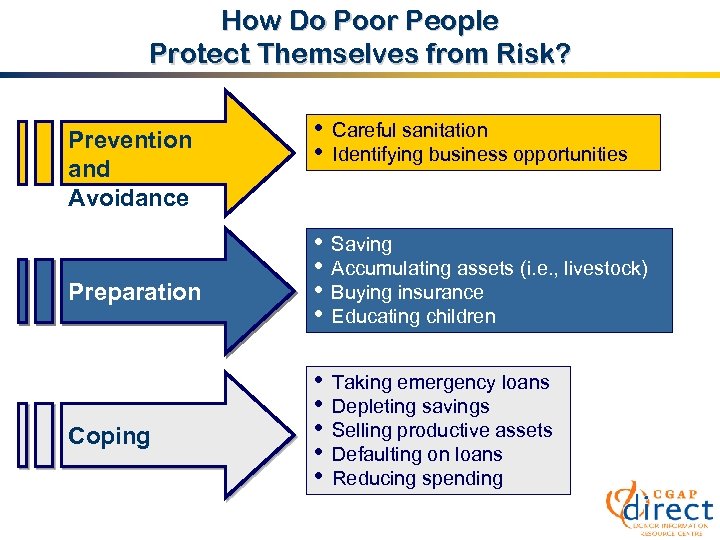

How Do Poor People Protect Themselves from Risk? Prevention and Avoidance Preparation Coping • • Careful sanitation Identifying business opportunities • Saving • Accumulating assets (i. e. , livestock) • Buying insurance • Educating children • • • Taking emergency loans Depleting savings Selling productive assets Defaulting on loans Reducing spending

How Do Poor People Protect Themselves from Risk? Prevention and Avoidance Preparation Coping • • Careful sanitation Identifying business opportunities • Saving • Accumulating assets (i. e. , livestock) • Buying insurance • Educating children • • • Taking emergency loans Depleting savings Selling productive assets Defaulting on loans Reducing spending

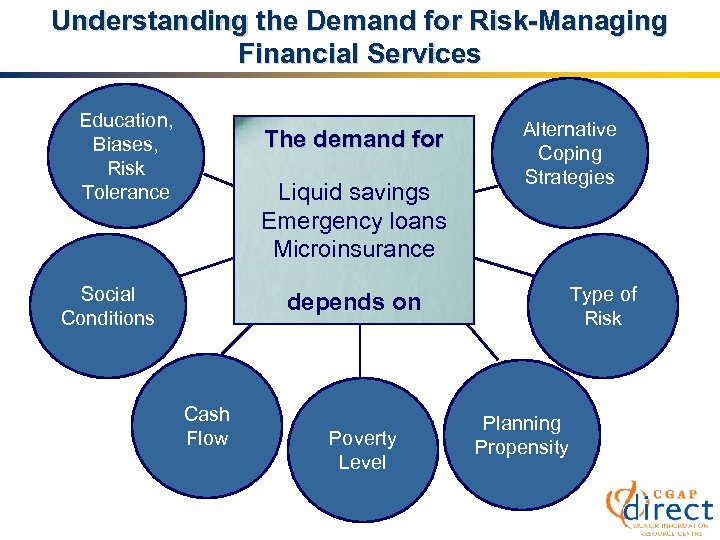

Understanding the Demand for Risk-Managing Financial Services Education, Biases, Risk Tolerance The demand for Liquid savings Emergency loans Microinsurance Social Conditions Alternative Coping Strategies Type of Risk depends on Cash Flow Poverty Level Planning Propensity

Understanding the Demand for Risk-Managing Financial Services Education, Biases, Risk Tolerance The demand for Liquid savings Emergency loans Microinsurance Social Conditions Alternative Coping Strategies Type of Risk depends on Cash Flow Poverty Level Planning Propensity

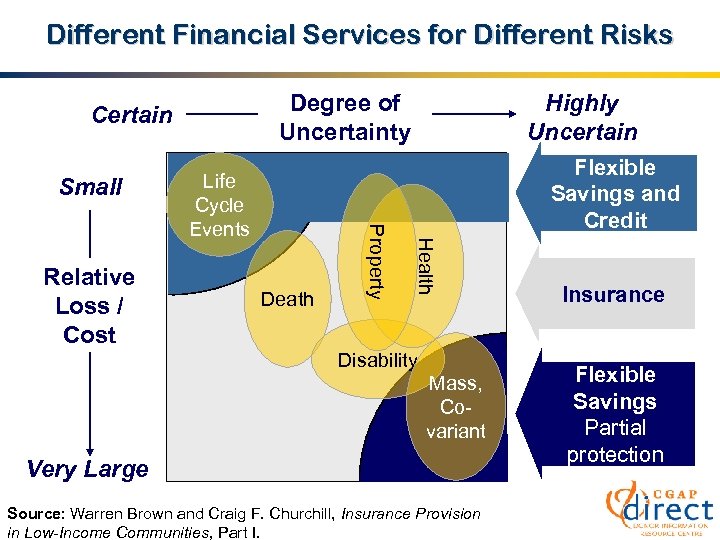

Different Financial Services for Different Risks Degree of Uncertainty Certain Small Flexible Savings and Credit Health Death Property Relative Loss / Cost Life Cycle Events Highly Uncertain Disability Mass, Covariant Very Large Source: Warren Brown and Craig F. Churchill, Insurance Provision in Low-Income Communities, Part I. Insurance Flexible Savings Partial protection

Different Financial Services for Different Risks Degree of Uncertainty Certain Small Flexible Savings and Credit Health Death Property Relative Loss / Cost Life Cycle Events Highly Uncertain Disability Mass, Covariant Very Large Source: Warren Brown and Craig F. Churchill, Insurance Provision in Low-Income Communities, Part I. Insurance Flexible Savings Partial protection

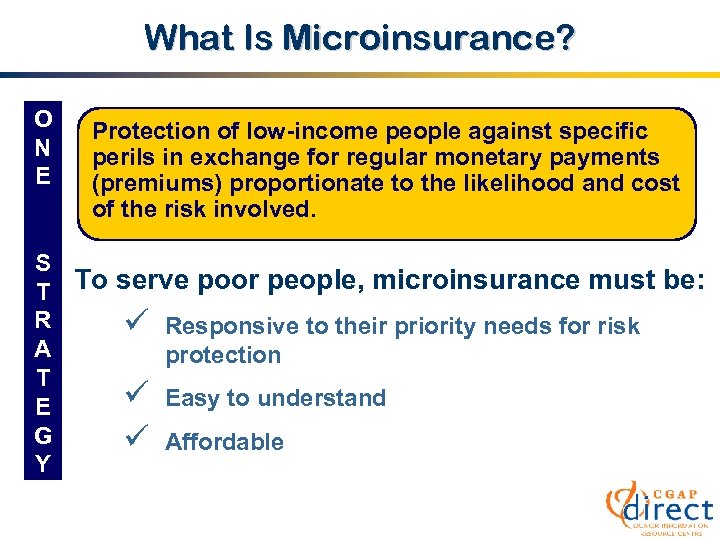

What Is Microinsurance? O N E Protection of low-income people against specific perils in exchange for regular monetary payments (premiums) proportionate to the likelihood and cost of the risk involved. S T To serve poor people, microinsurance must be: R ü Responsive to their priority needs for risk A protection T ü Easy to understand E G ü Affordable Y

What Is Microinsurance? O N E Protection of low-income people against specific perils in exchange for regular monetary payments (premiums) proportionate to the likelihood and cost of the risk involved. S T To serve poor people, microinsurance must be: R ü Responsive to their priority needs for risk A protection T ü Easy to understand E G ü Affordable Y

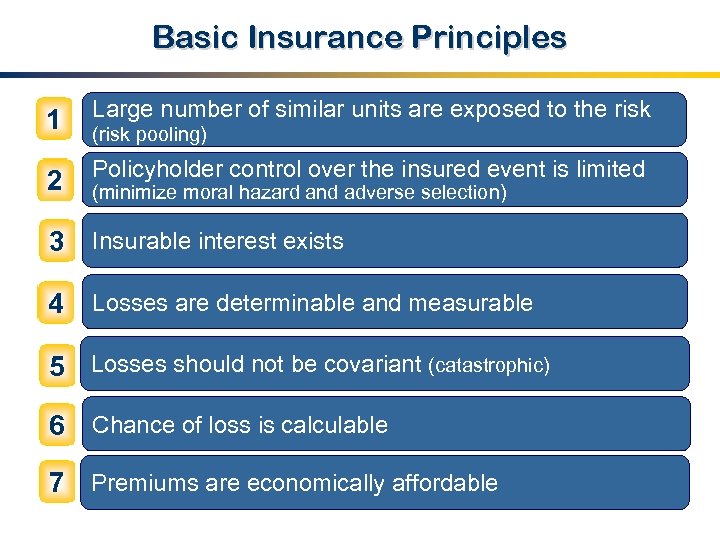

Basic Insurance Principles 1 Large number of similar units are exposed to the risk 2 Policyholder control over the insured event is limited (risk pooling) (minimize moral hazard and adverse selection) 3 Insurable interest exists 4 Losses are determinable and measurable 5 Losses should not be covariant (catastrophic) 6 Chance of loss is calculable 7 Premiums are economically affordable

Basic Insurance Principles 1 Large number of similar units are exposed to the risk 2 Policyholder control over the insured event is limited (risk pooling) (minimize moral hazard and adverse selection) 3 Insurable interest exists 4 Losses are determinable and measurable 5 Losses should not be covariant (catastrophic) 6 Chance of loss is calculable 7 Premiums are economically affordable

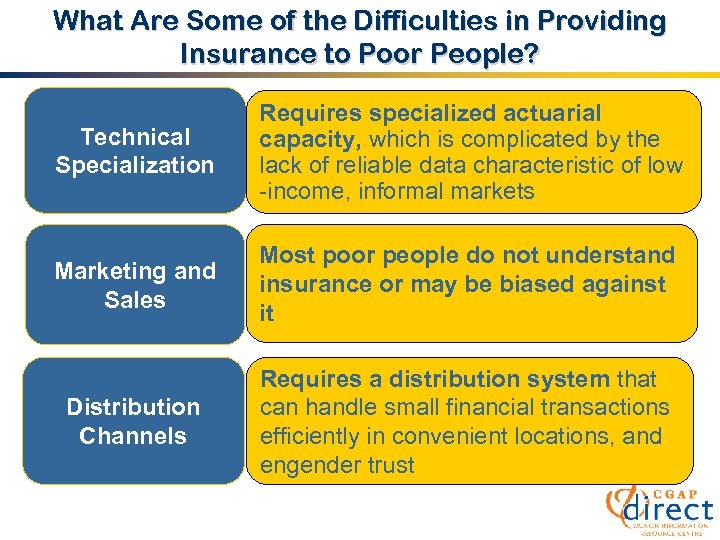

What Are Some of the Difficulties in Providing Insurance to Poor People? Technical Specialization Requires specialized actuarial capacity, which is complicated by the lack of reliable data characteristic of low -income, informal markets Marketing and Sales Most poor people do not understand insurance or may be biased against it Distribution Channels Requires a distribution system that can handle small financial transactions efficiently in convenient locations, and engender trust

What Are Some of the Difficulties in Providing Insurance to Poor People? Technical Specialization Requires specialized actuarial capacity, which is complicated by the lack of reliable data characteristic of low -income, informal markets Marketing and Sales Most poor people do not understand insurance or may be biased against it Distribution Channels Requires a distribution system that can handle small financial transactions efficiently in convenient locations, and engender trust

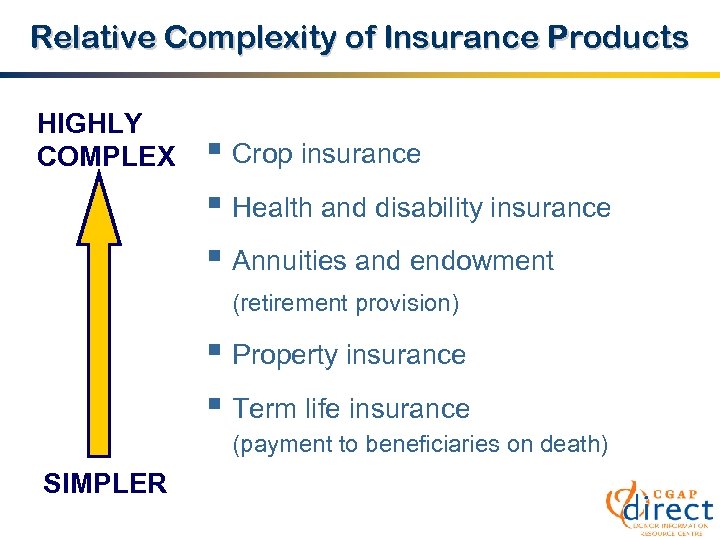

Relative Complexity of Insurance Products HIGHLY COMPLEX § Crop insurance § Health and disability insurance § Annuities and endowment (retirement provision) § Property insurance § Term life insurance (payment to beneficiaries on death) SIMPLER

Relative Complexity of Insurance Products HIGHLY COMPLEX § Crop insurance § Health and disability insurance § Annuities and endowment (retirement provision) § Property insurance § Term life insurance (payment to beneficiaries on death) SIMPLER

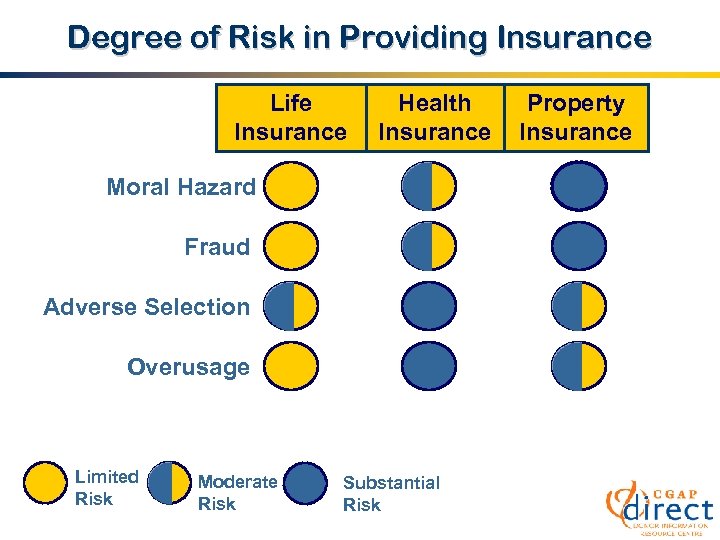

Degree of Risk in Providing Insurance Life Insurance Health Insurance Moral Hazard Fraud Adverse Selection Overusage Limited Risk Moderate Risk Substantial Risk Property Insurance

Degree of Risk in Providing Insurance Life Insurance Health Insurance Moral Hazard Fraud Adverse Selection Overusage Limited Risk Moderate Risk Substantial Risk Property Insurance

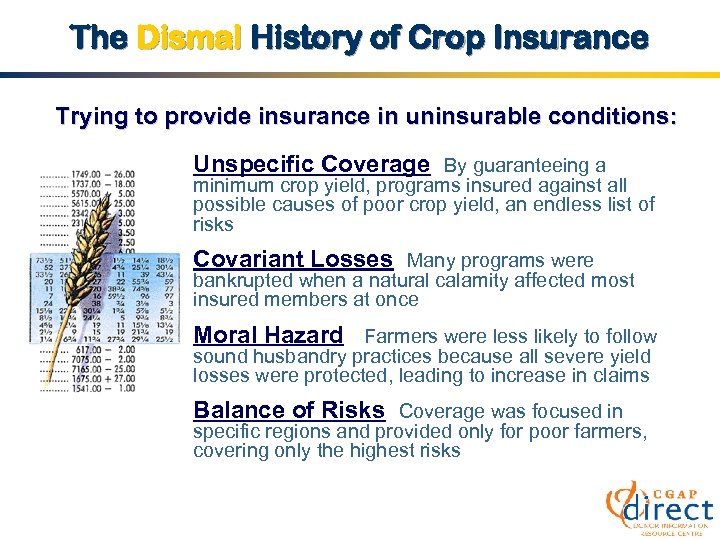

The Dismal History of Crop Insurance Trying to provide insurance in uninsurable conditions: Unspecific Coverage By guaranteeing a minimum crop yield, programs insured against all possible causes of poor crop yield, an endless list of risks Covariant Losses Many programs were bankrupted when a natural calamity affected most insured members at once Moral Hazard Farmers were less likely to follow sound husbandry practices because all severe yield losses were protected, leading to increase in claims Balance of Risks Coverage was focused in specific regions and provided only for poor farmers, covering only the highest risks

The Dismal History of Crop Insurance Trying to provide insurance in uninsurable conditions: Unspecific Coverage By guaranteeing a minimum crop yield, programs insured against all possible causes of poor crop yield, an endless list of risks Covariant Losses Many programs were bankrupted when a natural calamity affected most insured members at once Moral Hazard Farmers were less likely to follow sound husbandry practices because all severe yield losses were protected, leading to increase in claims Balance of Risks Coverage was focused in specific regions and provided only for poor farmers, covering only the highest risks

Activities Involved in Offering Insurance Product Sales Product Manufacturing Design issues such as pricing, claims procedures, level of coverage Marketing, education, signature of policies Product Servicing Premium collection, payment of claims Policy Holders

Activities Involved in Offering Insurance Product Sales Product Manufacturing Design issues such as pricing, claims procedures, level of coverage Marketing, education, signature of policies Product Servicing Premium collection, payment of claims Policy Holders

Some Microfinance Delivery Models § Partnerships between MFIs (or other intermediaries) and insurers § Full service provision where regulated insurers provide specific products to the low-income market § Health care service providers offer a health care financing package and absorb the insurance risk § MFI-based insurance where MFIs take on the risk offering insurance to their clients § Community-based programs where communities pool funds and manage a relationship with a health care provider

Some Microfinance Delivery Models § Partnerships between MFIs (or other intermediaries) and insurers § Full service provision where regulated insurers provide specific products to the low-income market § Health care service providers offer a health care financing package and absorb the insurance risk § MFI-based insurance where MFIs take on the risk offering insurance to their clients § Community-based programs where communities pool funds and manage a relationship with a health care provider

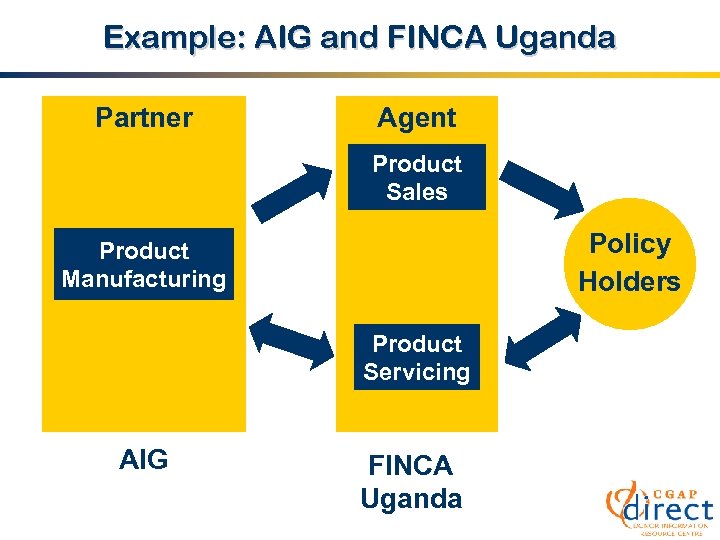

Examples of Microinsurance Delivery Partner-Agent Model Full-Service Model • Insurers utilize MFIs’ delivery • The provider is responsible for all aspects of product manufacturing, mechanism to provide sales and sales, servicing, and claims basic services to clients assessment • There is no risk and limited • The insurers are responsible for all administrative burden for MFIs insurance-related costs and losses • Example: FINCA Uganda partners and they retain all profits with American International • Example: SEWA in India Group Community-Based Model Provider Model • The policyholders own and manage • The service provider and the insurer are the same, i. e. , hospitals or the insurance program, and doctors offer policies to individuals negotiate with external health care or groups providers • Example: Gonoshatsasthya • Example: UMASIDA in Tanzania Kendra in Bangladesh

Examples of Microinsurance Delivery Partner-Agent Model Full-Service Model • Insurers utilize MFIs’ delivery • The provider is responsible for all aspects of product manufacturing, mechanism to provide sales and sales, servicing, and claims basic services to clients assessment • There is no risk and limited • The insurers are responsible for all administrative burden for MFIs insurance-related costs and losses • Example: FINCA Uganda partners and they retain all profits with American International • Example: SEWA in India Group Community-Based Model Provider Model • The policyholders own and manage • The service provider and the insurer are the same, i. e. , hospitals or the insurance program, and doctors offer policies to individuals negotiate with external health care or groups providers • Example: Gonoshatsasthya • Example: UMASIDA in Tanzania Kendra in Bangladesh

Example: AIG and FINCA Uganda Partner Agent Product Sales Policy Holders Product Manufacturing Product Servicing AIG FINCA Uganda

Example: AIG and FINCA Uganda Partner Agent Product Sales Policy Holders Product Manufacturing Product Servicing AIG FINCA Uganda

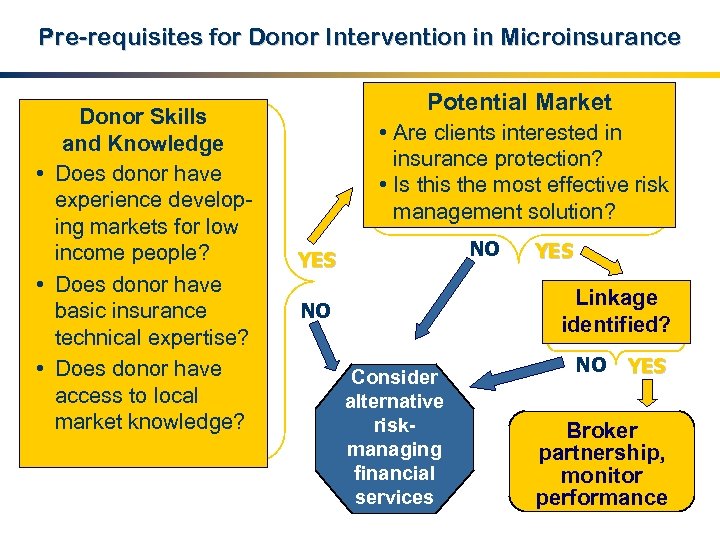

Pre-requisites for Donor Intervention in Microinsurance Donor Skills and Knowledge • Does donor have experience developing markets for low income people? • Does donor have basic insurance technical expertise? • Does donor have access to local market knowledge? Potential Market • Are clients interested in insurance protection? • Is this the most effective risk management solution? NO YES Linkage identified? NO Consider alternative riskmanaging financial services NO YES Broker partnership, monitor performance

Pre-requisites for Donor Intervention in Microinsurance Donor Skills and Knowledge • Does donor have experience developing markets for low income people? • Does donor have basic insurance technical expertise? • Does donor have access to local market knowledge? Potential Market • Are clients interested in insurance protection? • Is this the most effective risk management solution? NO YES Linkage identified? NO Consider alternative riskmanaging financial services NO YES Broker partnership, monitor performance

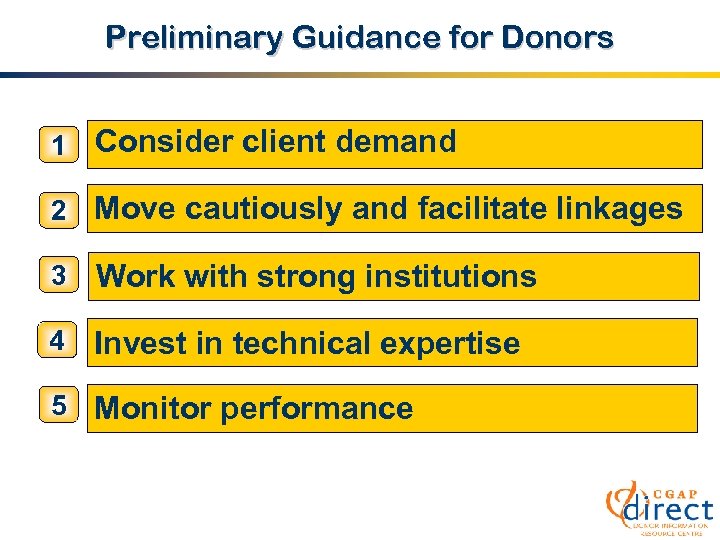

Preliminary Guidance for Donors 1 Consider client demand 2 Move cautiously and facilitate linkages 3 Work with strong institutions 4 Invest in technical expertise 5 Monitor performance

Preliminary Guidance for Donors 1 Consider client demand 2 Move cautiously and facilitate linkages 3 Work with strong institutions 4 Invest in technical expertise 5 Monitor performance

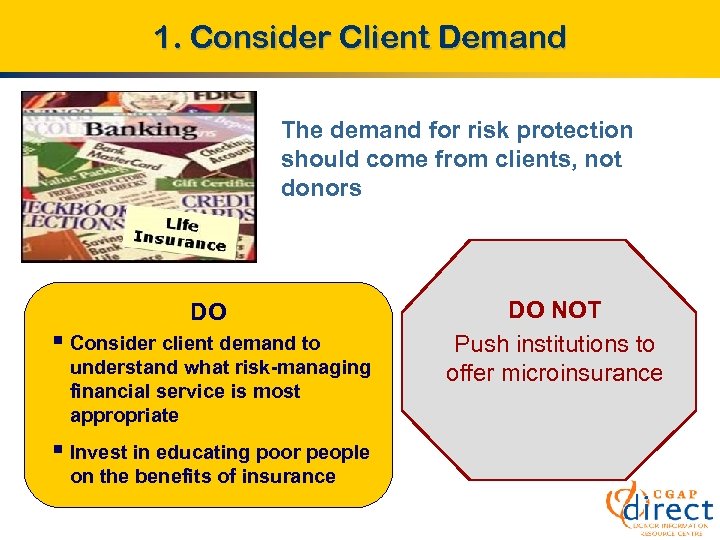

1. Consider Client Demand The demand for risk protection should come from clients, not donors DO § Consider client demand to understand what risk-managing financial service is most appropriate § Invest in educating poor people on the benefits of insurance DO NOT Push institutions to offer microinsurance

1. Consider Client Demand The demand for risk protection should come from clients, not donors DO § Consider client demand to understand what risk-managing financial service is most appropriate § Invest in educating poor people on the benefits of insurance DO NOT Push institutions to offer microinsurance

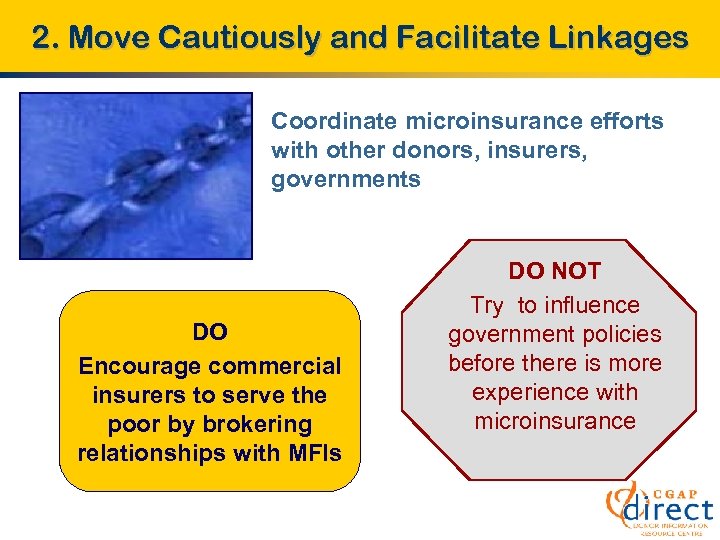

2. Move Cautiously and Facilitate Linkages Coordinate microinsurance efforts with other donors, insurers, governments DO Encourage commercial insurers to serve the poor by brokering relationships with MFIs DO NOT Try to influence government policies before there is more experience with microinsurance

2. Move Cautiously and Facilitate Linkages Coordinate microinsurance efforts with other donors, insurers, governments DO Encourage commercial insurers to serve the poor by brokering relationships with MFIs DO NOT Try to influence government policies before there is more experience with microinsurance

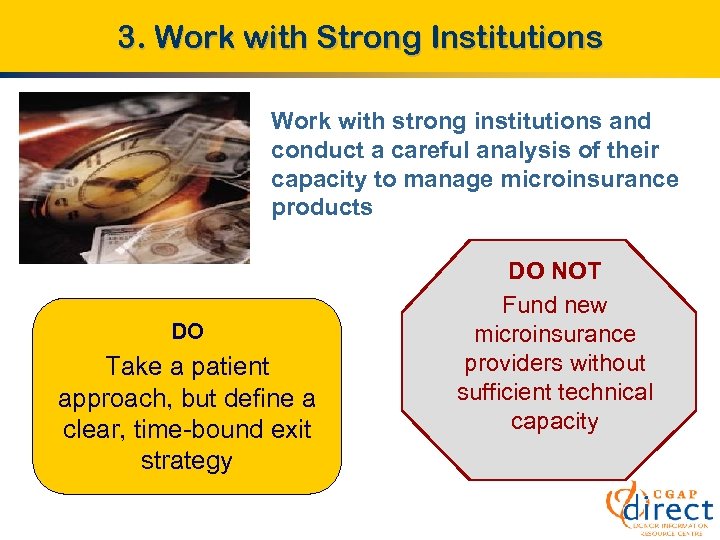

3. Work with Strong Institutions Work with strong institutions and conduct a careful analysis of their capacity to manage microinsurance products DO Take a patient approach, but define a clear, time-bound exit strategy DO NOT Fund new microinsurance providers without sufficient technical capacity

3. Work with Strong Institutions Work with strong institutions and conduct a careful analysis of their capacity to manage microinsurance products DO Take a patient approach, but define a clear, time-bound exit strategy DO NOT Fund new microinsurance providers without sufficient technical capacity

4. Invest in Technical Expertise Be careful about supporting unregulated insurance schemes that lack expertise, access to reinsurance, or consumer protection oversight DO Provide access to technical assistance for specific technical problems DO NOT Provide grant funding to cover claims costs

4. Invest in Technical Expertise Be careful about supporting unregulated insurance schemes that lack expertise, access to reinsurance, or consumer protection oversight DO Provide access to technical assistance for specific technical problems DO NOT Provide grant funding to cover claims costs

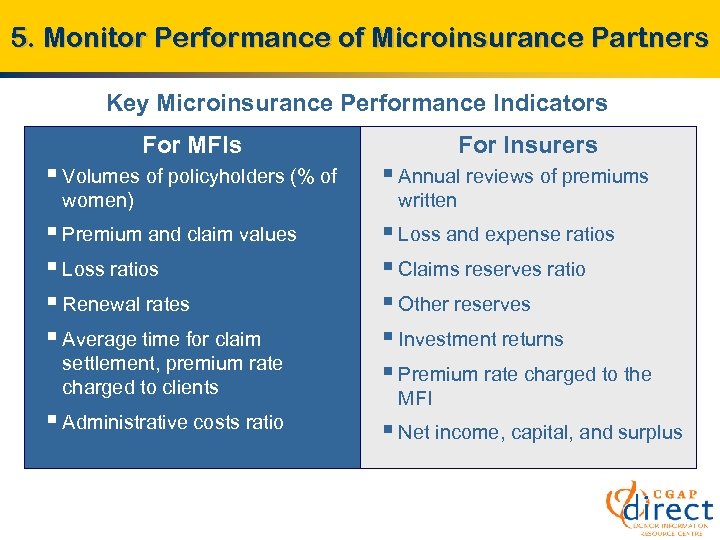

5. Monitor Performance of Microinsurance Partners Key Microinsurance Performance Indicators For MFIs For Insurers § Volumes of policyholders (% of § Annual reviews of premiums § Premium and claim values § Loss ratios § Renewal rates § Average time for claim § Loss and expense ratios § Claims reserves ratio § Other reserves § Investment returns § Premium rate charged to the women) settlement, premium rate charged to clients § Administrative costs ratio written MFI § Net income, capital, and surplus

5. Monitor Performance of Microinsurance Partners Key Microinsurance Performance Indicators For MFIs For Insurers § Volumes of policyholders (% of § Annual reviews of premiums § Premium and claim values § Loss ratios § Renewal rates § Average time for claim § Loss and expense ratios § Claims reserves ratio § Other reserves § Investment returns § Premium rate charged to the women) settlement, premium rate charged to clients § Administrative costs ratio written MFI § Net income, capital, and surplus

Summary § Microinsurance is one of many financial services that helps manage risk § To serve poor people, microinsurance must respond to their priority needs for risk protection, be easy to understand, and be affordable § Insurance is a complex matter requiring technical expertise that most MFIs and donors do not possess § At present, the ability of donors to facilitate linkages and share knowledge on microinsurance is more important than providing funds for specific programs

Summary § Microinsurance is one of many financial services that helps manage risk § To serve poor people, microinsurance must respond to their priority needs for risk protection, be easy to understand, and be affordable § Insurance is a complex matter requiring technical expertise that most MFIs and donors do not possess § At present, the ability of donors to facilitate linkages and share knowledge on microinsurance is more important than providing funds for specific programs

Where to Get More Information • CGAP Working Group on Microinsurance, “Donor Guidelines for Funding Microinsurance, ” (paper prepared for CGAP, Washington, DC, October 2003). • Microinsurance: Improving Risk Management for the Poor, Nos. 1 and 2 (Luxembourg: ADA, August and November 2003). • W. Brown, C. Green, and G. Lindquist, A Cautionary Note for Microfinance Institutions and Donors Considering Developing Microinsurance Products (Bethesda, Md. , USA: DAI, 2000). • C. Churchill, D. Liber, M. J. Mc. Cord, and J. Roth, Making Microinsurance Work for Microfinance Institutions: A Technical Guide to Developing and Delivering Microinsurance (Geneva: ILO, 2003). • W. Brown and C. Churchill, Insurance Provision to Low-Income Households: Part I (Toronto: Calmeadow, 1999), and Part 2 (Bethesda, Md. , USA: DAI, 2000). Contact: Nataša Goronja 1818 H Street, NW Washington, DC 20433 Tel: 202 -473 -9594 Fax: 202 -522 -3744 E-mail: cgap@worldbank. org Web: www. cgap. org

Where to Get More Information • CGAP Working Group on Microinsurance, “Donor Guidelines for Funding Microinsurance, ” (paper prepared for CGAP, Washington, DC, October 2003). • Microinsurance: Improving Risk Management for the Poor, Nos. 1 and 2 (Luxembourg: ADA, August and November 2003). • W. Brown, C. Green, and G. Lindquist, A Cautionary Note for Microfinance Institutions and Donors Considering Developing Microinsurance Products (Bethesda, Md. , USA: DAI, 2000). • C. Churchill, D. Liber, M. J. Mc. Cord, and J. Roth, Making Microinsurance Work for Microfinance Institutions: A Technical Guide to Developing and Delivering Microinsurance (Geneva: ILO, 2003). • W. Brown and C. Churchill, Insurance Provision to Low-Income Households: Part I (Toronto: Calmeadow, 1999), and Part 2 (Bethesda, Md. , USA: DAI, 2000). Contact: Nataša Goronja 1818 H Street, NW Washington, DC 20433 Tel: 202 -473 -9594 Fax: 202 -522 -3744 E-mail: cgap@worldbank. org Web: www. cgap. org