c70d6011582a429b59f16e83be1e13a4.ppt

- Количество слайдов: 56

Microeconomics Level 1

Microeconomics Level 1

0930 0940 1040 Course objectives Introduction to economics COFFEE 1100 1145 1215 1300 What markets do: supply, demand, and equilibrium Group work Review of group work LUNCH 1400 1445 Market failure, and government intervention Group work and TEA 1510 1530 1600 1610 1645 Review of group work Cost benefit analysis Lessons from Level 1 Test End

0930 0940 1040 Course objectives Introduction to economics COFFEE 1100 1145 1215 1300 What markets do: supply, demand, and equilibrium Group work Review of group work LUNCH 1400 1445 Market failure, and government intervention Group work and TEA 1510 1530 1600 1610 1645 Review of group work Cost benefit analysis Lessons from Level 1 Test End

COURSE OBJECTIVES This course has three objectives • to provide an overview of the scope and methods of economics • to offer a self-contained introduction to key themes in microeconomics • to equip participants to proceed to Level 2

COURSE OBJECTIVES This course has three objectives • to provide an overview of the scope and methods of economics • to offer a self-contained introduction to key themes in microeconomics • to equip participants to proceed to Level 2

COURSE OBJECTIVES • Economic analysis aims to be rigorous, but it need not be technical. • No prior knowledge of economics or mathematics is assumed.

COURSE OBJECTIVES • Economic analysis aims to be rigorous, but it need not be technical. • No prior knowledge of economics or mathematics is assumed.

CONCEPTS & TOOLS

CONCEPTS & TOOLS

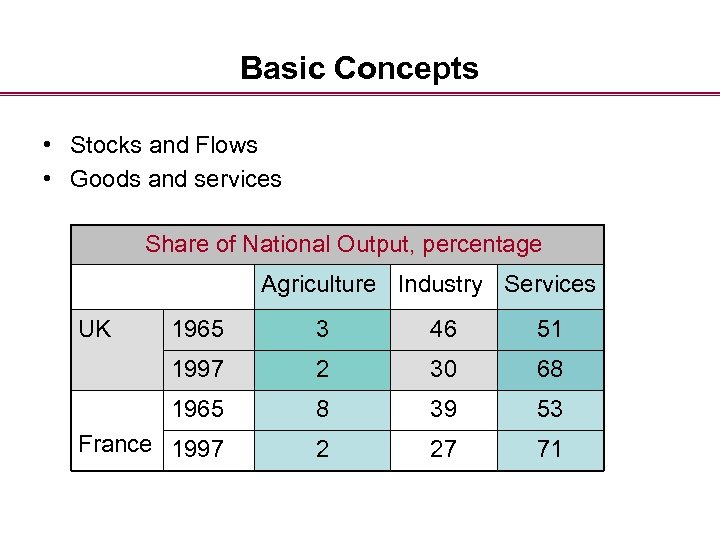

Basic Concepts • Stocks and Flows • Goods and services Share of National Output, percentage Agriculture Industry Services UK 1965 3 46 51 1997 2 30 68 1965 8 39 53 France 1997 2 27 71

Basic Concepts • Stocks and Flows • Goods and services Share of National Output, percentage Agriculture Industry Services UK 1965 3 46 51 1997 2 30 68 1965 8 39 53 France 1997 2 27 71

Basic Concepts • What, how and for whom • Markets versus ‘command economy’

Basic Concepts • What, how and for whom • Markets versus ‘command economy’

Basic Concepts • MICROECONOMICS: detailed study of decisions made by consumers, producers and their interaction in specific markets • MACROECONOMICS: big picture – emphasizes interactions in the economy as a whole.

Basic Concepts • MICROECONOMICS: detailed study of decisions made by consumers, producers and their interaction in specific markets • MACROECONOMICS: big picture – emphasizes interactions in the economy as a whole.

Basic Concepts • POSITIVE ECONOMICS tries to explain behaviour • NORMATIVE ECONOMICS prescriptions based on value judgments

Basic Concepts • POSITIVE ECONOMICS tries to explain behaviour • NORMATIVE ECONOMICS prescriptions based on value judgments

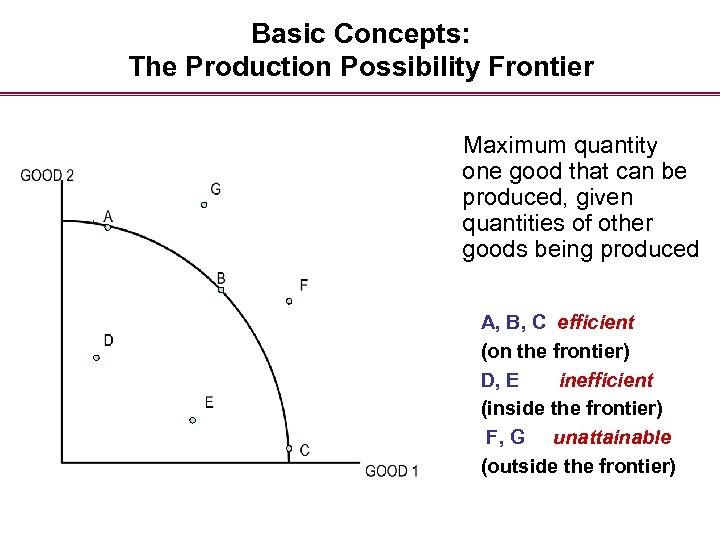

Basic Concepts: The Production Possibility Frontier Maximum quantity one good that can be produced, given quantities of other goods being produced A, B, C efficient (on the frontier) D, E inefficient (inside the frontier) F, G unattainable (outside the frontier)

Basic Concepts: The Production Possibility Frontier Maximum quantity one good that can be produced, given quantities of other goods being produced A, B, C efficient (on the frontier) D, E inefficient (inside the frontier) F, G unattainable (outside the frontier)

Basic Concepts OPPORTUNITY COST OF A GOOD What we could have had instead

Basic Concepts OPPORTUNITY COST OF A GOOD What we could have had instead

Basic Concepts COMMAND ECONOMY central planner issues orders FREE MARKET ECONOMY what, how & for whom decided by prices, incomes, wealth DEGREES OF GOVERNMENT INTERVENTION Cuba - China - Denmark - UK - USA - Hong Kong

Basic Concepts COMMAND ECONOMY central planner issues orders FREE MARKET ECONOMY what, how & for whom decided by prices, incomes, wealth DEGREES OF GOVERNMENT INTERVENTION Cuba - China - Denmark - UK - USA - Hong Kong

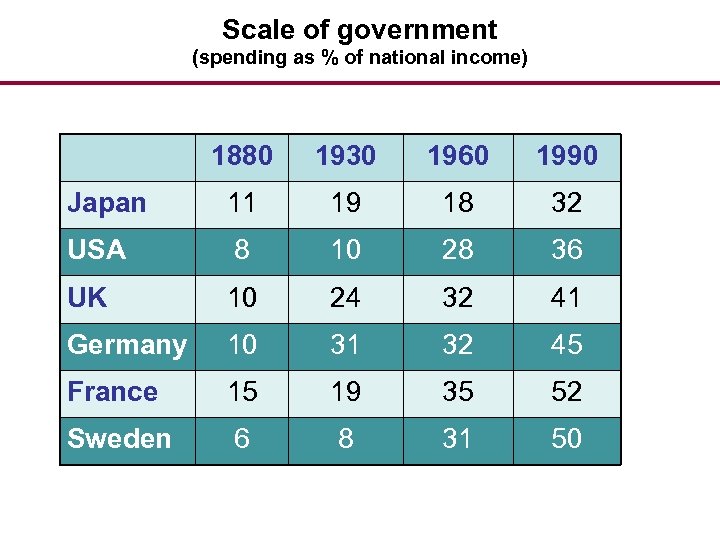

Scale of government (spending as % of national income) 1880 1930 1960 1990 Japan 11 19 18 32 USA 8 10 28 36 UK 10 24 32 41 Germany 10 31 32 45 France 15 19 35 52 Sweden 6 8 31 50

Scale of government (spending as % of national income) 1880 1930 1960 1990 Japan 11 19 18 32 USA 8 10 28 36 UK 10 24 32 41 Germany 10 31 32 45 France 15 19 35 52 Sweden 6 8 31 50

TOOLS MODEL Deliberate simplification of reality like a map DATA Time Series Cross-section

TOOLS MODEL Deliberate simplification of reality like a map DATA Time Series Cross-section

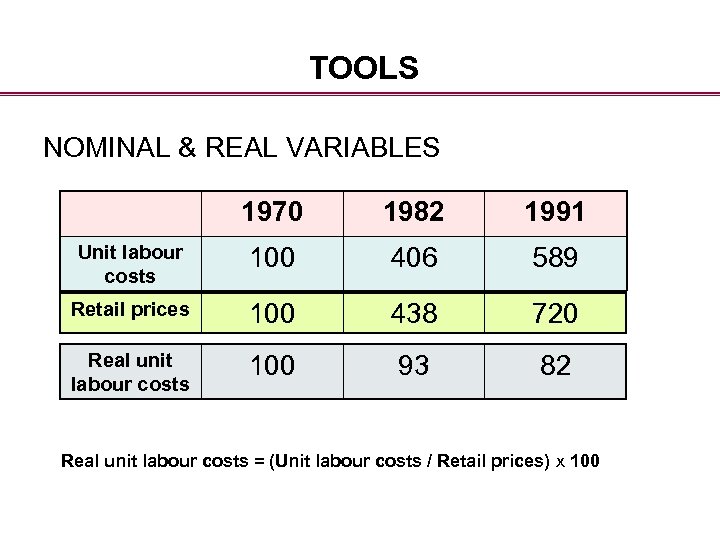

TOOLS NOMINAL & REAL VARIABLES 1970 1982 1991 Unit labour costs 100 406 589 Retail prices 100 438 720 Real unit labour costs 100 93 82 Real unit labour costs = (Unit labour costs / Retail prices) x 100

TOOLS NOMINAL & REAL VARIABLES 1970 1982 1991 Unit labour costs 100 406 589 Retail prices 100 438 720 Real unit labour costs 100 93 82 Real unit labour costs = (Unit labour costs / Retail prices) x 100

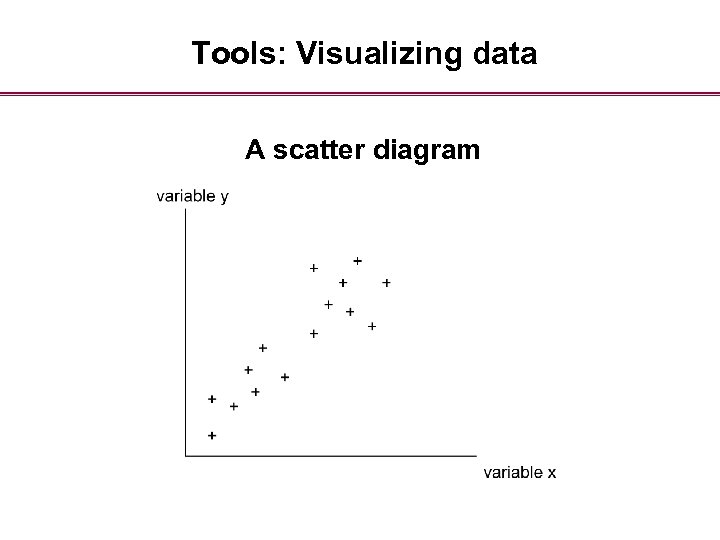

Tools: Visualizing data A scatter diagram

Tools: Visualizing data A scatter diagram

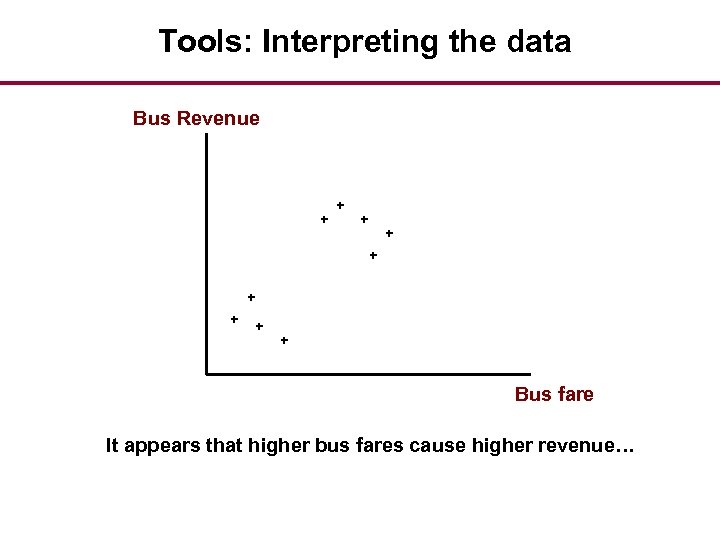

Tools: Interpreting the data Bus Revenue + + + + + Bus fare It appears that higher bus fares cause higher revenue…

Tools: Interpreting the data Bus Revenue + + + + + Bus fare It appears that higher bus fares cause higher revenue…

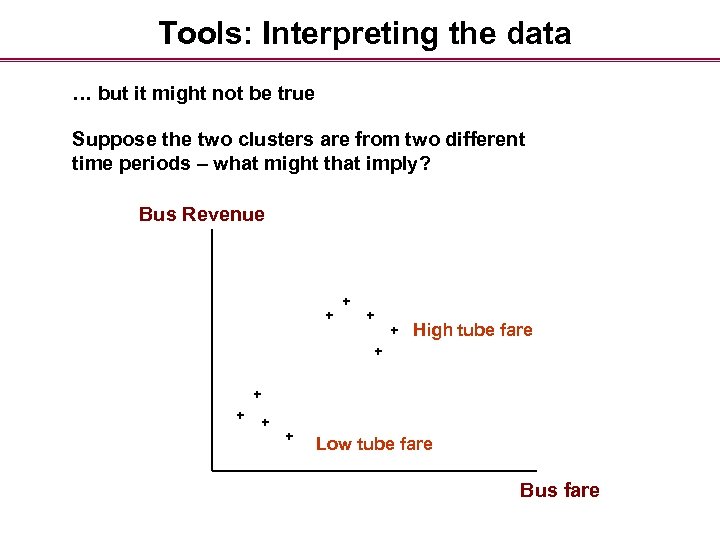

Tools: Interpreting the data … but it might not be true Suppose the two clusters are from two different time periods – what might that imply? Bus Revenue + + High tube fare + + + Low tube fare Bus fare

Tools: Interpreting the data … but it might not be true Suppose the two clusters are from two different time periods – what might that imply? Bus Revenue + + High tube fare + + + Low tube fare Bus fare

Tools: Interpreting the data Bus revenue depends on bus fares But it also depends on other things • incomes • price of other modes of travel • reliability (relative to other modes of travel) • relative comfort • relative perception of safety

Tools: Interpreting the data Bus revenue depends on bus fares But it also depends on other things • incomes • price of other modes of travel • reliability (relative to other modes of travel) • relative comfort • relative perception of safety

DEMAND, SUPPLY & PRICE ADJUSTMENT

DEMAND, SUPPLY & PRICE ADJUSTMENT

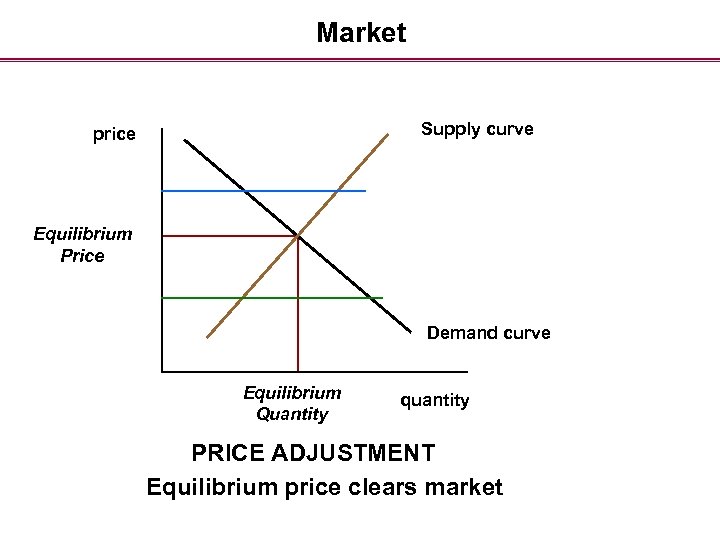

Market • DEMAND quantity buyers wish to buy at each price • SUPPLY quantity producers wish to sell at each price • MARKET arrangement to exchange goods & services • EQUILIBRIUM PRICE the price at which market clears (i. e. quantity demanded = quantity supplied)

Market • DEMAND quantity buyers wish to buy at each price • SUPPLY quantity producers wish to sell at each price • MARKET arrangement to exchange goods & services • EQUILIBRIUM PRICE the price at which market clears (i. e. quantity demanded = quantity supplied)

Market Supply curve price Equilibrium Price Demand curve Equilibrium Quantity quantity PRICE ADJUSTMENT Equilibrium price clears market

Market Supply curve price Equilibrium Price Demand curve Equilibrium Quantity quantity PRICE ADJUSTMENT Equilibrium price clears market

Market The demand curve shows the relation between price of a good and quantity demanded of that good. But how does demand change when ‘other things’ change?

Market The demand curve shows the relation between price of a good and quantity demanded of that good. But how does demand change when ‘other things’ change?

DEMAND IN MORE DETAIL elaborating on the ‘other things’ How does DEMAND for a good vary when 1 price of a related good changes? – substitutes – complements 2 consumer’s income changes? – normal goods – inferior goods 3 tastes change? – role of fashions and fads, culture

DEMAND IN MORE DETAIL elaborating on the ‘other things’ How does DEMAND for a good vary when 1 price of a related good changes? – substitutes – complements 2 consumer’s income changes? – normal goods – inferior goods 3 tastes change? – role of fashions and fads, culture

COMPARATIVE STATICS (effect of changing the ‘other things’) Suppose income rises, increasing demand

COMPARATIVE STATICS (effect of changing the ‘other things’) Suppose income rises, increasing demand

SUPPLY IN MORE DETAIL elaborating the ‘other things’ How does SUPPLY of a good vary when 1 technology improves? 2 input prices change? energy, labour, capital 3 regulation imposes extra costs?

SUPPLY IN MORE DETAIL elaborating the ‘other things’ How does SUPPLY of a good vary when 1 technology improves? 2 input prices change? energy, labour, capital 3 regulation imposes extra costs?

COMPARATIVE STATICS Suppose technical breakthrough raises supply

COMPARATIVE STATICS Suppose technical breakthrough raises supply

COMPARATIVE STATICS An important difference • If demand shifts, equilibrium price and quantity move in the SAME DIRECTION • If supply shifts, equilibrium price and quantity move in OPPOSITE DIRECTIONS

COMPARATIVE STATICS An important difference • If demand shifts, equilibrium price and quantity move in the SAME DIRECTION • If supply shifts, equilibrium price and quantity move in OPPOSITE DIRECTIONS

SOME EXAMPLES Third world farming • What is the effect of better irrigation & fertilizer? • What happens to price? To quantity? • To revenue? Computers • The price of a personal computer has been falling. • Which is shifting, demand or supply?

SOME EXAMPLES Third world farming • What is the effect of better irrigation & fertilizer? • What happens to price? To quantity? • To revenue? Computers • The price of a personal computer has been falling. • Which is shifting, demand or supply?

Introduction to Economics GROUPWORK 1 Are the following statements positive or normative? (a) (b) (c) (d) (e) (f ) Higher tax rates cut revenue from tobacco taxes Poor countries got an unfair share of world income Smoking is antisocial & should be discouraged Airbus needs public support Airbus deserves public support Airbus is a good investment for Britain

Introduction to Economics GROUPWORK 1 Are the following statements positive or normative? (a) (b) (c) (d) (e) (f ) Higher tax rates cut revenue from tobacco taxes Poor countries got an unfair share of world income Smoking is antisocial & should be discouraged Airbus needs public support Airbus deserves public support Airbus is a good investment for Britain

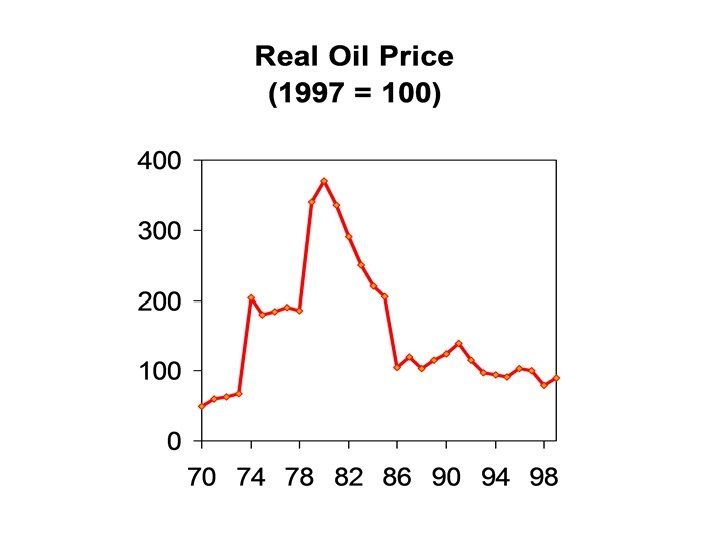

GROUPWORK 2 (a) (b) (c) (d) The price of crude oil increased from $2. 90 to $9 per barrel in 1973, in a coordinated move by OPEC members. How did the OPEC members manage to raise the price? Show using a supply-demand diagram for the oil market. What happened to the demand for coal and the price of coal? Show using a supply-demand diagram for the coal market. What happened to the demand for fuel-guzzling cars? What happened to supply and demand for oil eventually?

GROUPWORK 2 (a) (b) (c) (d) The price of crude oil increased from $2. 90 to $9 per barrel in 1973, in a coordinated move by OPEC members. How did the OPEC members manage to raise the price? Show using a supply-demand diagram for the oil market. What happened to the demand for coal and the price of coal? Show using a supply-demand diagram for the coal market. What happened to the demand for fuel-guzzling cars? What happened to supply and demand for oil eventually?

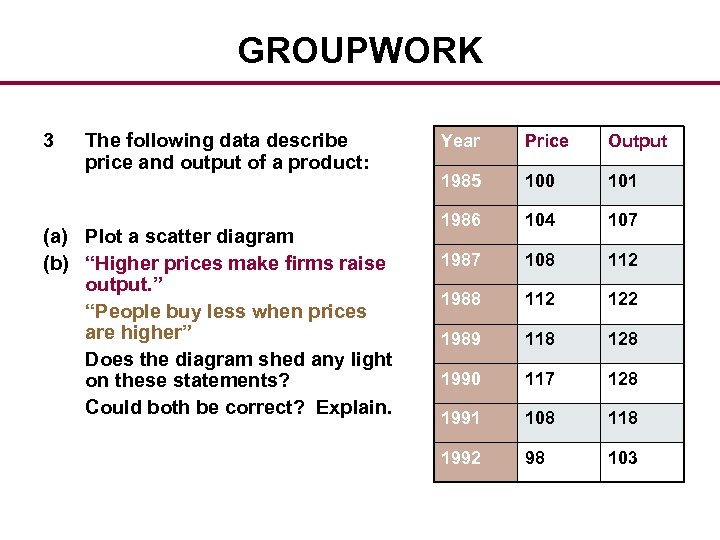

GROUPWORK 3 The following data describe price and output of a product: (a) Plot a scatter diagram (b) “Higher prices make firms raise output. ” “People buy less when prices are higher” Does the diagram shed any light on these statements? Could both be correct? Explain. Year Price Output 1985 100 101 1986 104 107 1987 108 112 1988 112 122 1989 118 128 1990 117 128 1991 108 118 1992 98 103

GROUPWORK 3 The following data describe price and output of a product: (a) Plot a scatter diagram (b) “Higher prices make firms raise output. ” “People buy less when prices are higher” Does the diagram shed any light on these statements? Could both be correct? Explain. Year Price Output 1985 100 101 1986 104 107 1987 108 112 1988 112 122 1989 118 128 1990 117 128 1991 108 118 1992 98 103

GROUPWORK 4 For each government intervention listed below, identify the possible rationale. (a) (b) (c) (d) (e) (f ) Income tax Taxation of petrol Regulating gas prices Banning the use of cannabis Running the NHS Maintaining an army

GROUPWORK 4 For each government intervention listed below, identify the possible rationale. (a) (b) (c) (d) (e) (f ) Income tax Taxation of petrol Regulating gas prices Banning the use of cannabis Running the NHS Maintaining an army

Why Intervene?

Why Intervene?

The Role of Government IF MARKETS ARE EFFICIENT (i. e. ‘invisible hand’ works), the government could confine attention to – Legislation and general regulation – Redistribution (taxation & transfer payments) – Macroeconomic management (stabilization)

The Role of Government IF MARKETS ARE EFFICIENT (i. e. ‘invisible hand’ works), the government could confine attention to – Legislation and general regulation – Redistribution (taxation & transfer payments) – Macroeconomic management (stabilization)

The Role of Government However, sometimes free markets are not efficient These instances are called MARKET FAILURES When markets fail, the government may intervene for efficiency reasons

The Role of Government However, sometimes free markets are not efficient These instances are called MARKET FAILURES When markets fail, the government may intervene for efficiency reasons

SOURCES OF MARKET FAILURE 1. EXTERNALITIES One person's decisions/choices affect others DIRECTLY If markets were free and unregulated • cannot be made to PAY for the HARM you inflict on others (e. g. pollution) • cannot RECOVER all the value of BENEFITS you confer upon others (use of green technology)

SOURCES OF MARKET FAILURE 1. EXTERNALITIES One person's decisions/choices affect others DIRECTLY If markets were free and unregulated • cannot be made to PAY for the HARM you inflict on others (e. g. pollution) • cannot RECOVER all the value of BENEFITS you confer upon others (use of green technology)

SOURCES OF MARKET FAILURE 1. EXTERNALITIES Individual’s optimal decision is not optimal for society Result: OVERPRODUCE the bad things, UNDERPRODUCE the good things. Market outcome is INEFFICIENT, Government intervenes to CORRECT INEFFICIENCY Policy Tools: tax, subsidy, quota, artificial markets

SOURCES OF MARKET FAILURE 1. EXTERNALITIES Individual’s optimal decision is not optimal for society Result: OVERPRODUCE the bad things, UNDERPRODUCE the good things. Market outcome is INEFFICIENT, Government intervenes to CORRECT INEFFICIENCY Policy Tools: tax, subsidy, quota, artificial markets

SOURCES OF MARKET FAILURE 2. PUBLIC GOODS Goods that we consume together, so that • no individual can be excluded from consuming • consumption by one does not leave less for others National defence Street lighting No one has any incentive to pay for such goods. In the absence of government intervention, too little of these will be provided. Government steps in to ensure right level is produced.

SOURCES OF MARKET FAILURE 2. PUBLIC GOODS Goods that we consume together, so that • no individual can be excluded from consuming • consumption by one does not leave less for others National defence Street lighting No one has any incentive to pay for such goods. In the absence of government intervention, too little of these will be provided. Government steps in to ensure right level is produced.

SOURCES OF MARKET FAILURE 3. IMPERFECT COMPETITION If firms have market power (power to set prices above cost), markets are usually INEFFICIENT Once again, government can intervene (say, by regulating prices) Example: Regulation of National Grid

SOURCES OF MARKET FAILURE 3. IMPERFECT COMPETITION If firms have market power (power to set prices above cost), markets are usually INEFFICIENT Once again, government can intervene (say, by regulating prices) Example: Regulation of National Grid

GOVERNMENT FAILURE In PRINCIPLE, the government can correct market failures In PRACTICE, the government • does not always improve matters • sometimes makes things worse Why?

GOVERNMENT FAILURE In PRINCIPLE, the government can correct market failures In PRACTICE, the government • does not always improve matters • sometimes makes things worse Why?

GOVERNMENT FAILURE • INFORMATIONAL PROBLEMS • INCENTIVE PROBLEMS • RENT SEEKING & CAPTURE Hence, must check for the possibility of GOVERNMENT FAILURE before jumping to conclusions.

GOVERNMENT FAILURE • INFORMATIONAL PROBLEMS • INCENTIVE PROBLEMS • RENT SEEKING & CAPTURE Hence, must check for the possibility of GOVERNMENT FAILURE before jumping to conclusions.

MARKET FAILURE & GOVERNMENT FAILURE GROUPWORK 1 There is a tax on cars in Central London (a) Why not leave things to the market? List the different motives for intervention. (b) Which of these are to do with efficiency? (c) Are there any other motives than efficiency? (d) Is/Was there a possibility of government failure?

MARKET FAILURE & GOVERNMENT FAILURE GROUPWORK 1 There is a tax on cars in Central London (a) Why not leave things to the market? List the different motives for intervention. (b) Which of these are to do with efficiency? (c) Are there any other motives than efficiency? (d) Is/Was there a possibility of government failure?

MARKET FAILURE & GOVERNMENT FAILURE GROUPWORK 2 If people want to watch advert-free terrestrial TV, there should be a market for this. So what is the case for the compulsory TV License?

MARKET FAILURE & GOVERNMENT FAILURE GROUPWORK 2 If people want to watch advert-free terrestrial TV, there should be a market for this. So what is the case for the compulsory TV License?

COST-BENEFIT ANALYSIS Usually applied to government investment decisions – roads – channel tunnel – subsidies to start-ups, R&D The main question: How do we value SOCIAL costs and benefits of a project?

COST-BENEFIT ANALYSIS Usually applied to government investment decisions – roads – channel tunnel – subsidies to start-ups, R&D The main question: How do we value SOCIAL costs and benefits of a project?

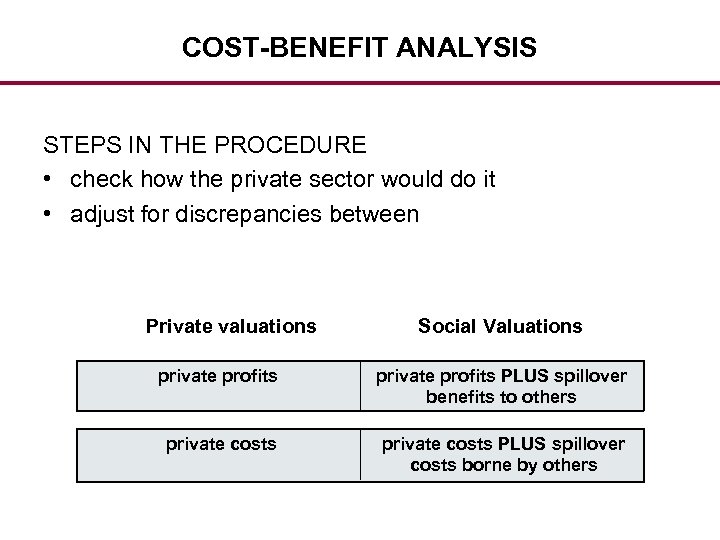

COST-BENEFIT ANALYSIS STEPS IN THE PROCEDURE • check how the private sector would do it • adjust for discrepancies between Private valuations Social Valuations private profits PLUS spillover benefits to others private costs PLUS spillover costs borne by others

COST-BENEFIT ANALYSIS STEPS IN THE PROCEDURE • check how the private sector would do it • adjust for discrepancies between Private valuations Social Valuations private profits PLUS spillover benefits to others private costs PLUS spillover costs borne by others

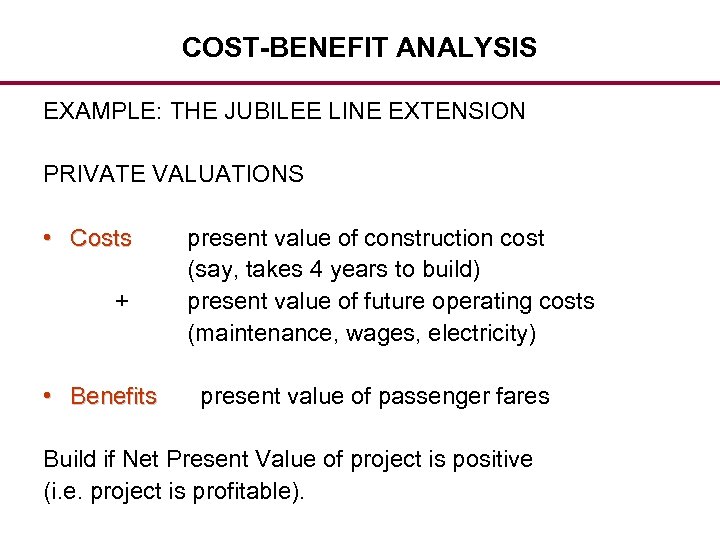

COST-BENEFIT ANALYSIS EXAMPLE: THE JUBILEE LINE EXTENSION PRIVATE VALUATIONS • Costs + • Benefits present value of construction cost (say, takes 4 years to build) present value of future operating costs (maintenance, wages, electricity) present value of passenger fares Build if Net Present Value of project is positive (i. e. project is profitable).

COST-BENEFIT ANALYSIS EXAMPLE: THE JUBILEE LINE EXTENSION PRIVATE VALUATIONS • Costs + • Benefits present value of construction cost (say, takes 4 years to build) present value of future operating costs (maintenance, wages, electricity) present value of passenger fares Build if Net Present Value of project is positive (i. e. project is profitable).

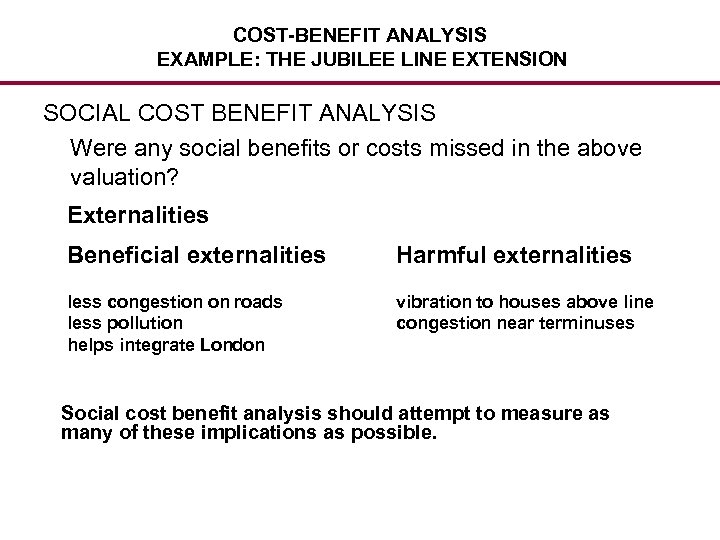

COST-BENEFIT ANALYSIS EXAMPLE: THE JUBILEE LINE EXTENSION SOCIAL COST BENEFIT ANALYSIS Were any social benefits or costs missed in the above valuation? Externalities Beneficial externalities Harmful externalities less congestion on roads less pollution helps integrate London vibration to houses above line congestion near terminuses Social cost benefit analysis should attempt to measure as many of these implications as possible.

COST-BENEFIT ANALYSIS EXAMPLE: THE JUBILEE LINE EXTENSION SOCIAL COST BENEFIT ANALYSIS Were any social benefits or costs missed in the above valuation? Externalities Beneficial externalities Harmful externalities less congestion on roads less pollution helps integrate London vibration to houses above line congestion near terminuses Social cost benefit analysis should attempt to measure as many of these implications as possible.

• • economic models are deliberate simplifications of reality ‘other things equal’ streamlines thought but its validity needs checking supply and demand explain equilibrium price and quantity markets sometimes fail to be efficient governments could intervene to correct failure but government action is itself vulnerable to failures of course, governments also care about equity social cost benefit analysis tries to measure as many inputs and outputs of a project as possible

• • economic models are deliberate simplifications of reality ‘other things equal’ streamlines thought but its validity needs checking supply and demand explain equilibrium price and quantity markets sometimes fail to be efficient governments could intervene to correct failure but government action is itself vulnerable to failures of course, governments also care about equity social cost benefit analysis tries to measure as many inputs and outputs of a project as possible

MICROECONOMICS LEVEL 1

MICROECONOMICS LEVEL 1