Micro lecture05 16Sept2013-1.ppt

- Количество слайдов: 30

Microeconomics: Lecture 5 MB MC Chapter 9 Analysis of Competitive Markets, Part B

MB MC Questions We Will Answer ¡ ¡ How does a tax affect the market? What are the effects of a tax collected from consumers? by producers? How is the burden of a tax divided between buyer and seller? How does elasticity affect the amount of a tax paid by consumers? producers? How does the government support the agricultural sector: subsidies and price floors Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

MB MC Taxes ¡ What is the purpose of governmentimposed taxes? l l ¡ To raise government revenues. To restrict consumption/production of a product. What is an excise tax? l A “per-unit” tax that’s independent of the price of the product Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

MB MC Taxes ¡ ¡ ¡ Who pays the tax on a good? The buyer or the seller? How is the burden of a tax divided between buyer and seller? When the government levies a tax on a good: l ¡ the equilibrium quantity of the good falls. The size of the market for that good shrinks, shifting either the demand or supply curve. Tax incidence: The study of who bears the burden of taxation. Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

MB MC Tax Incidence ¡ The legal assignment of who pays a tax is called the statutory incidence. l The actual burden of a tax (actual incidence) may differ substantially. ¡ Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved. The actual burden does not depend who legally pays the tax (statutory incidence).

MB MC How Taxes on Buyers (and Sellers) Affect Market Outcomes Taxes discourage market activity. ¡ When a good is taxed, the quantity sold is smaller. ¡ Buyers and sellers share the tax burden. ¡ Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

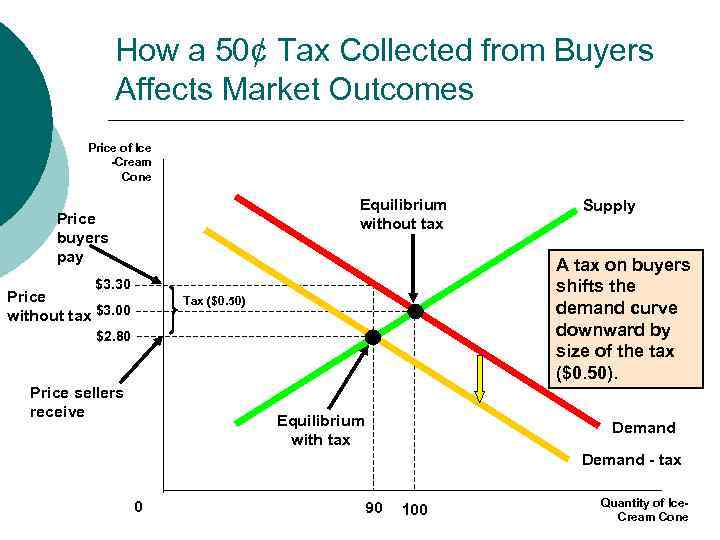

MB MC How a 50¢ Tax Collected from Buyers Affects Market Outcomes Price of Ice -Cream Cone Equilibrium without tax Price buyers pay A tax on buyers shifts the demand curve downward by size of the tax ($0. 50). $3. 30 Price without tax $3. 00 Tax ($0. 50) $2. 80 Price sellers receive Supply Equilibrium with tax Demand - tax 0 Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 90 100 Quantity of Ice. Cream Cone

MB MC How a 50¢ Tax Collected from Sellers Affects Market Outcomes The prices paid by consumers and received by producers are the same under if the tax is collected from sellers or from buyers. ¡ Sellers are burdened with 20¢ and buyers are burdened with 30¢ ¡ The burden of a tax falls on the side of the market with the smaller ownprice elasticity! ¡ Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

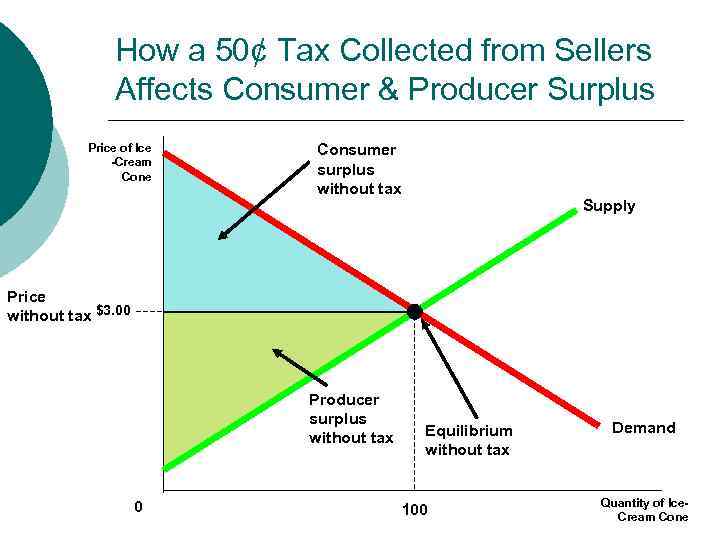

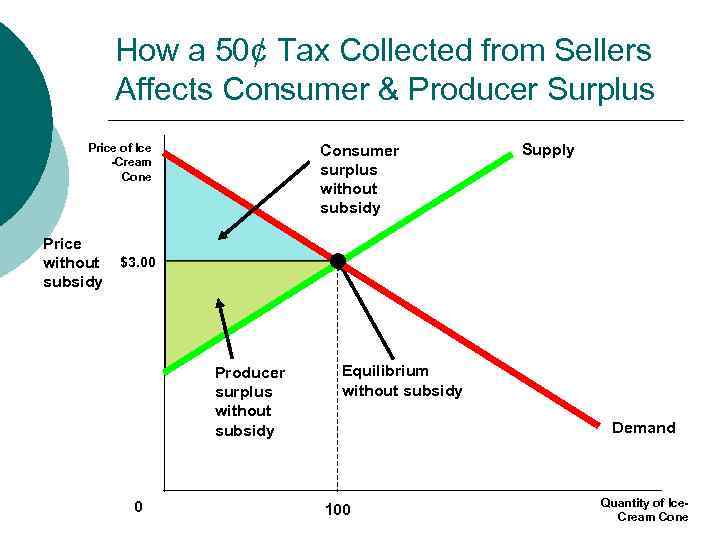

MB MC How a 50¢ Tax Collected from Sellers Affects Consumer & Producer Surplus Price of Ice -Cream Cone Consumer surplus without tax Supply Price without tax $3. 00 Producer surplus without tax 0 Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Equilibrium without tax 100 Demand Quantity of Ice. Cream Cone

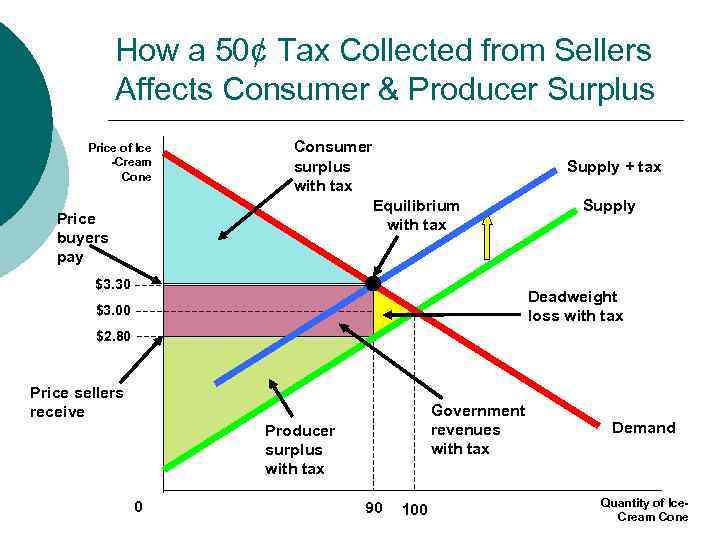

MB MC How a 50¢ Tax Collected from Sellers Affects Consumer & Producer Surplus Price of Ice -Cream Cone Price buyers pay Consumer surplus with tax Equilibrium with tax $3. 30 Supply + tax Supply Deadweight loss with tax $3. 00 $2. 80 Price sellers receive Government revenues with tax Producer surplus with tax 0 Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 90 100 Demand Quantity of Ice. Cream Cone

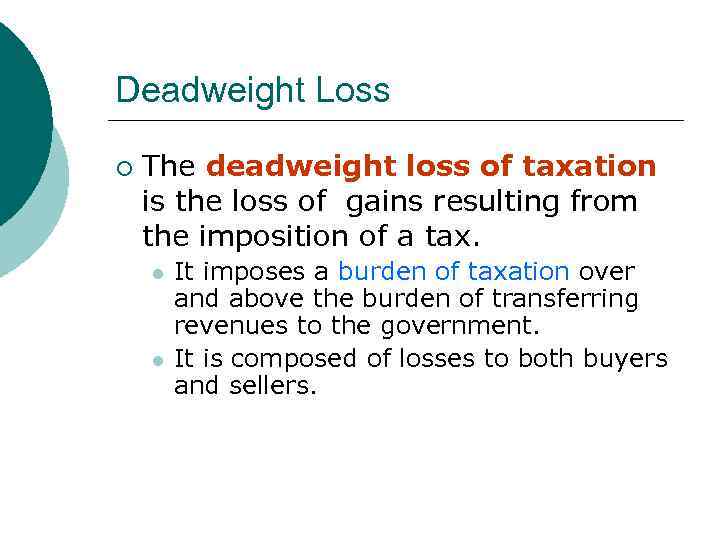

MB MC Deadweight Loss ¡ The deadweight loss of taxation is the loss of gains resulting from the imposition of a tax. l l It imposes a burden of taxation over and above the burden of transferring revenues to the government. It is composed of losses to both buyers and sellers. Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

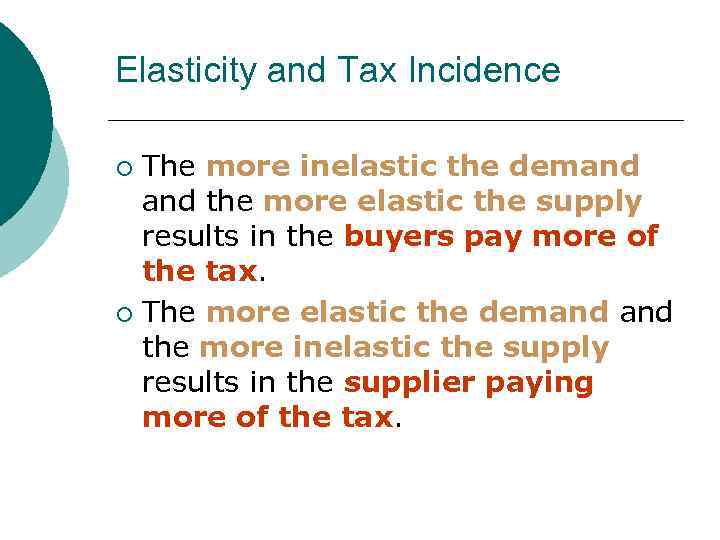

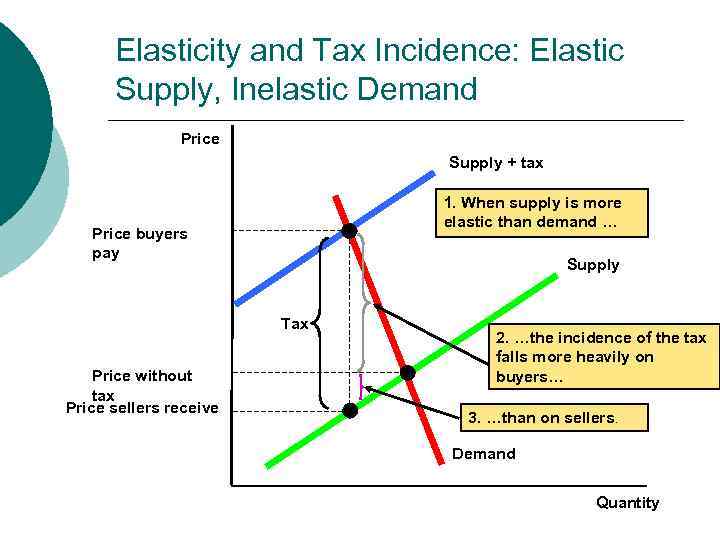

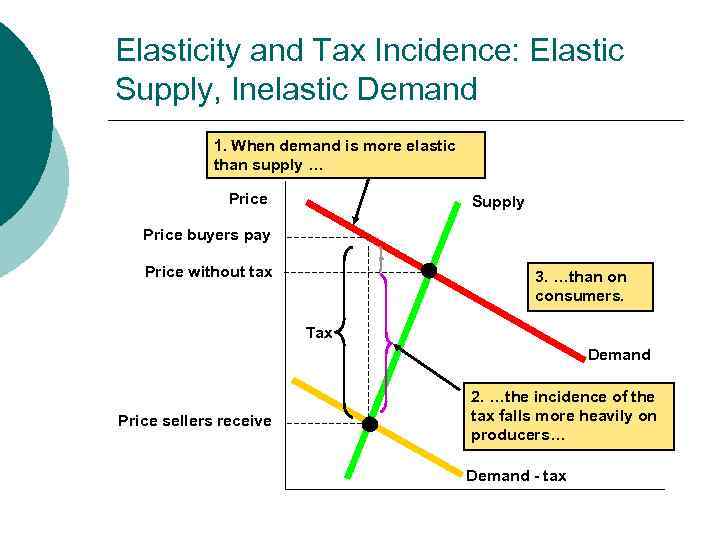

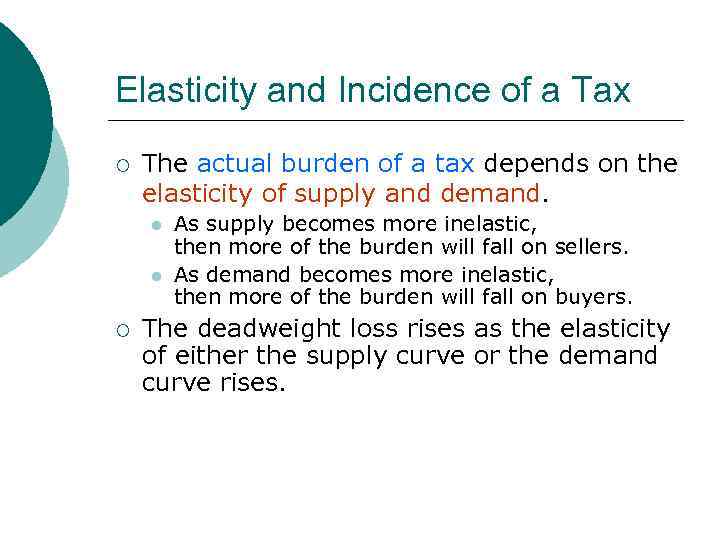

MB MC Elasticity and Tax Incidence The more inelastic the demand the more elastic the supply results in the buyers pay more of the tax. ¡ The more elastic the demand the more inelastic the supply results in the supplier paying more of the tax. ¡ Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

MB MC Elasticity and Tax Incidence: Elastic Supply, Inelastic Demand Price Supply + tax 1. When supply is more elastic than demand … Price buyers pay Supply Tax Price without tax Price sellers receive 2. …the incidence of the tax falls more heavily on buyers… 3. …than on sellers. Demand Quantity Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

MB MC Elasticity and Tax Incidence: Elastic Supply, Inelastic Demand 1. When demand is more elastic than supply … Price Supply Price buyers pay Price without tax 3. …than on consumers. Tax Demand Price sellers receive 2. …the incidence of the tax falls more heavily on producers… Demand - tax Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Quantit

MB MC Elasticity and Incidence of a Tax ¡ The actual burden of a tax depends on the elasticity of supply and demand. l l ¡ As supply becomes more inelastic, then more of the burden will fall on sellers. As demand becomes more inelastic, then more of the burden will fall on buyers. The deadweight loss rises as the elasticity of either the supply curve or the demand curve rises. Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

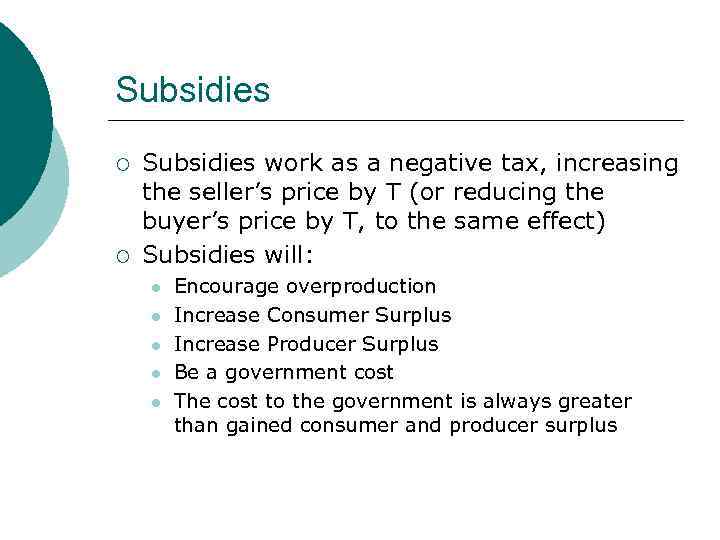

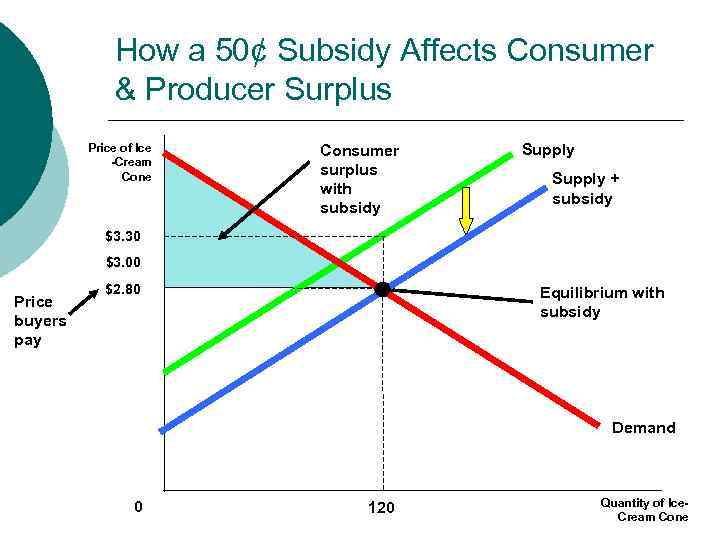

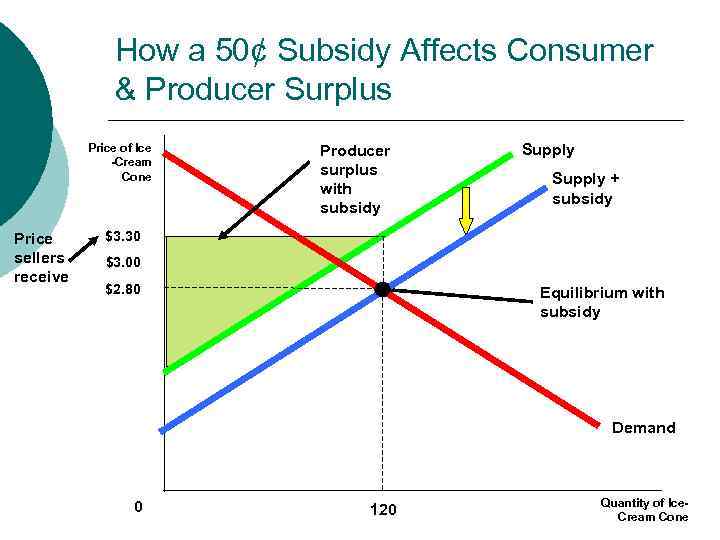

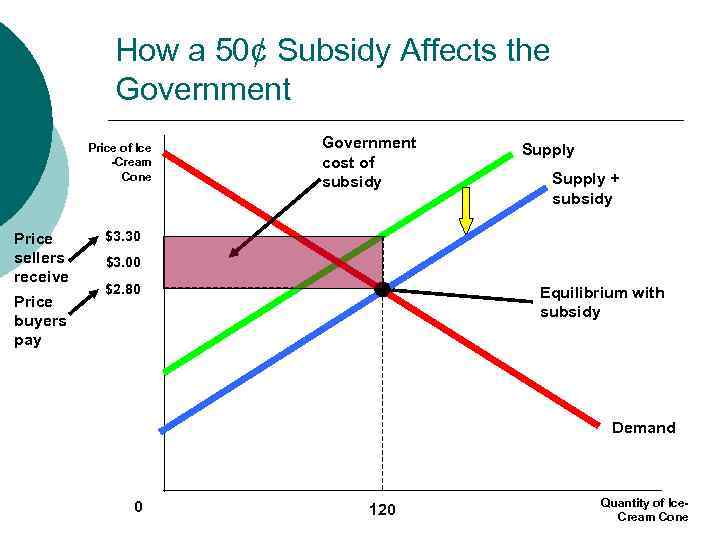

MB MC Subsidies ¡ ¡ Subsidies work as a negative tax, increasing the seller’s price by T (or reducing the buyer’s price by T, to the same effect) Subsidies will: l l l Encourage overproduction Increase Consumer Surplus Increase Producer Surplus Be a government cost The cost to the government is always greater than gained consumer and producer surplus Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

MB MC How a 50¢ Tax Collected from Sellers Affects Consumer & Producer Surplus Price of Ice -Cream Cone Price without subsidy Consumer surplus without subsidy Supply $3. 00 Producer surplus without subsidy 0 Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Equilibrium without subsidy Demand 100 Quantity of Ice. Cream Cone

MB MC How a 50¢ Subsidy Affects Consumer & Producer Surplus Price of Ice -Cream Cone Consumer surplus with subsidy Supply + subsidy $3. 30 $3. 00 Price buyers pay $2. 80 Equilibrium with subsidy Demand 0 Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 120 Quantity of Ice. Cream Cone

MB MC How a 50¢ Subsidy Affects Consumer & Producer Surplus Price of Ice -Cream Cone Price sellers receive Producer surplus with subsidy Supply + subsidy $3. 30 $3. 00 $2. 80 Equilibrium with subsidy Demand 0 Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 120 Quantity of Ice. Cream Cone

MB MC How a 50¢ Subsidy Affects the Government Price of Ice -Cream Cone Price sellers receive Price buyers pay Government cost of subsidy Supply + subsidy $3. 30 $3. 00 $2. 80 Equilibrium with subsidy Demand 0 Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 120 Quantity of Ice. Cream Cone

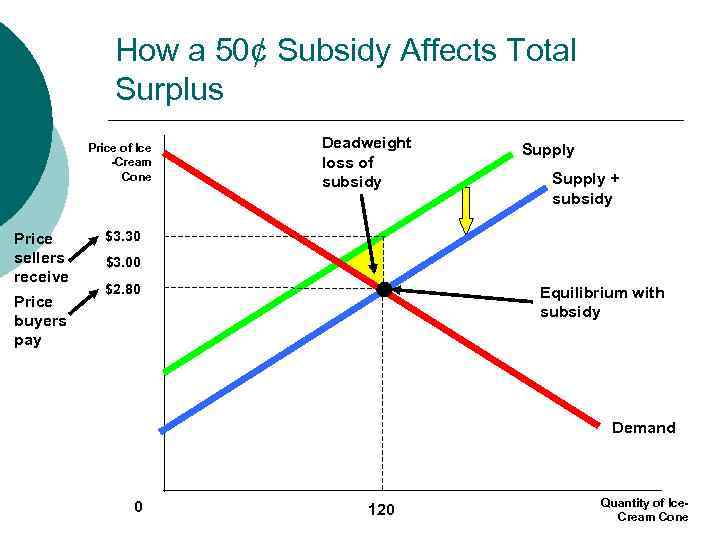

MB MC How a 50¢ Subsidy Affects Total Surplus Price of Ice -Cream Cone Price sellers receive Price buyers pay Deadweight loss of subsidy Supply + subsidy $3. 30 $3. 00 $2. 80 Equilibrium with subsidy Demand 0 Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved. 120 Quantity of Ice. Cream Cone

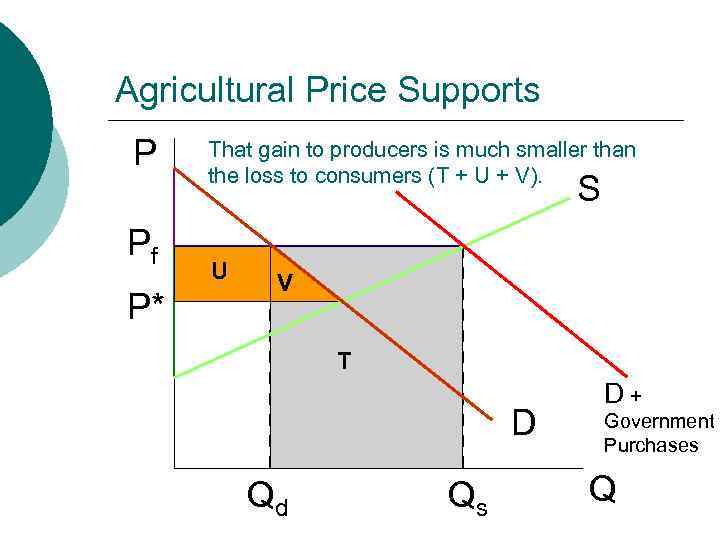

MB MC Agricultural Price Supports ¡ In the case of agricultural price supports, producers grow as much as they want and the government buys the surplus. Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

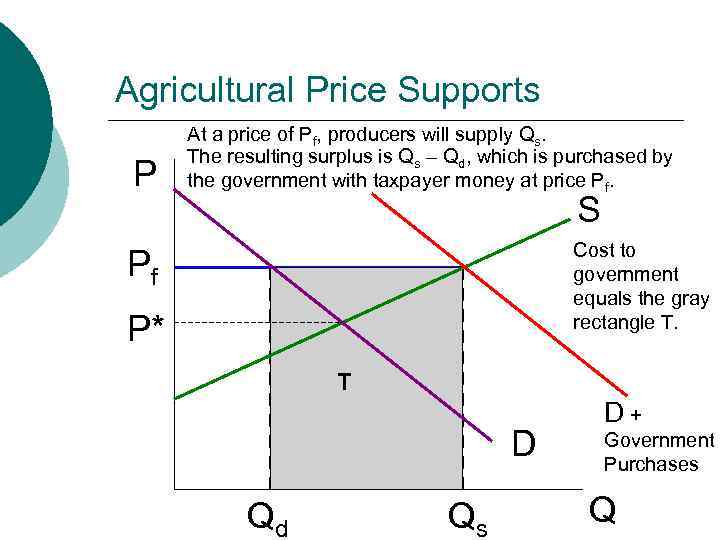

MB MC Agricultural Price Supports P At a price of Pf, producers will supply Qs. The resulting surplus is Qs – Qd, which is purchased by the government with taxpayer money at price Pf. S Cost to government equals the gray rectangle T. Pf P* T D Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Qd Qs D+ Government Purchases Q

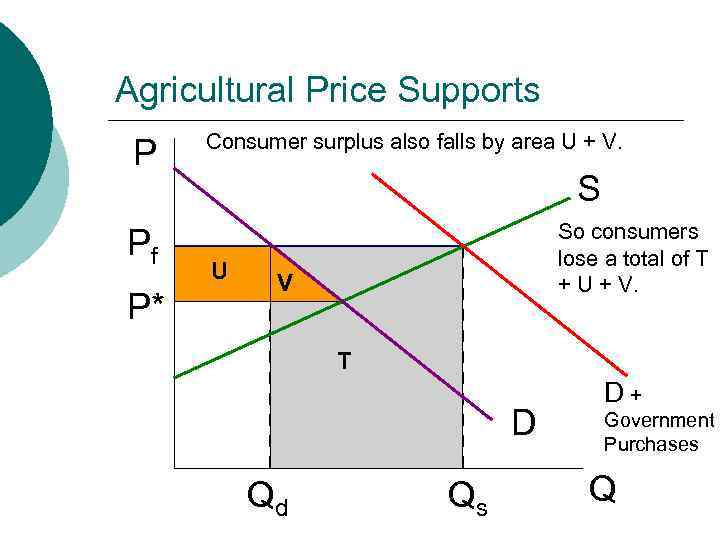

MB MC Agricultural Price Supports P Pf P* Consumer surplus also falls by area U + V. S U So consumers lose a total of T + U + V. V T D Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Qd Qs D+ Government Purchases Q

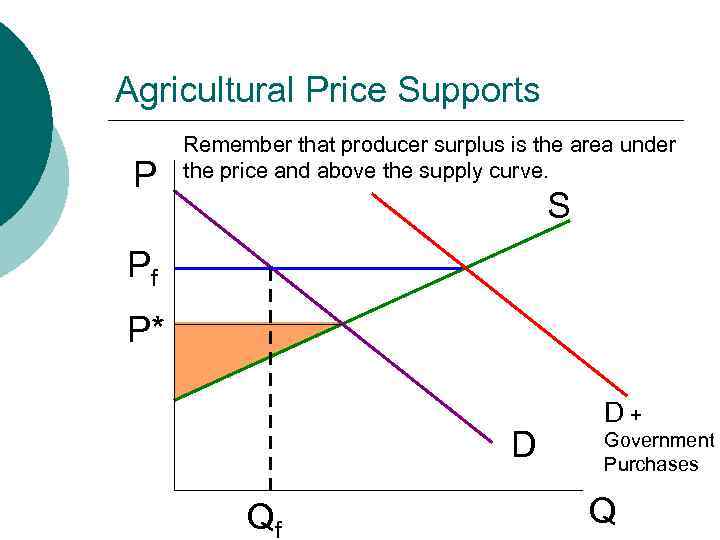

MB MC Agricultural Price Supports P Remember that producer surplus is the area under the price and above the supply curve. S Pf P* D Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Qf D+ Government Purchases Q

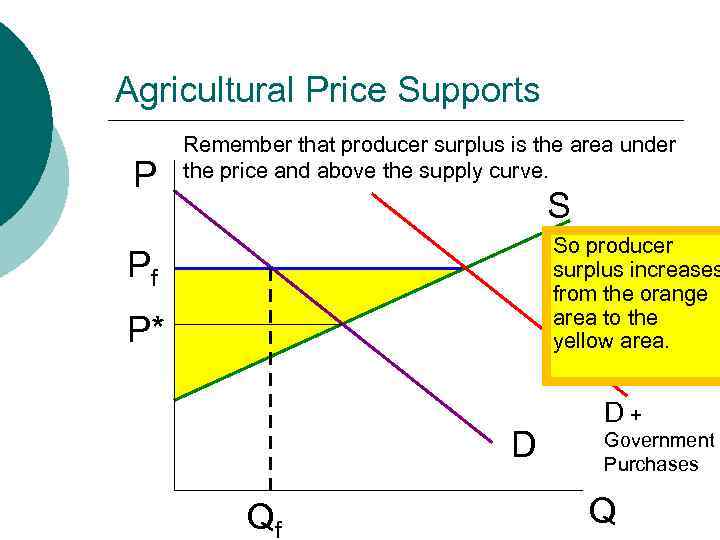

MB MC Agricultural Price Supports P Remember that producer surplus is the area under the price and above the supply curve. S So producer surplus increases from the orange area to the yellow area. Pf P* D Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Qf D+ Government Purchases Q

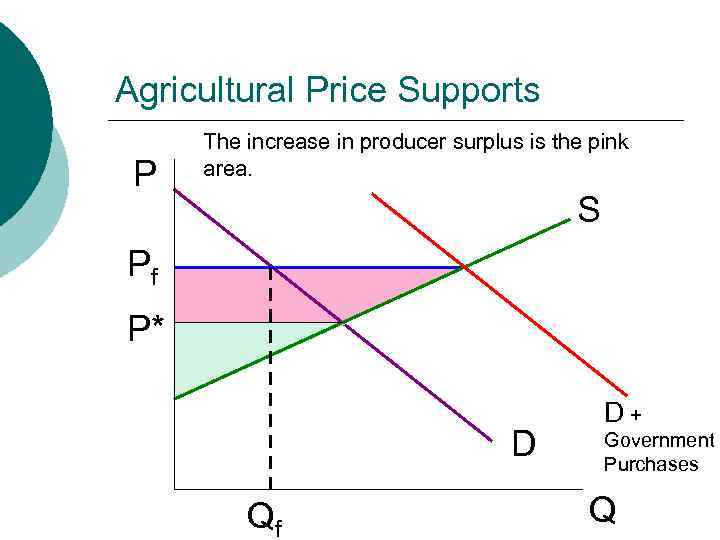

MB MC Agricultural Price Supports P The increase in producer surplus is the pink area. S Pf P* D Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Qf D+ Government Purchases Q

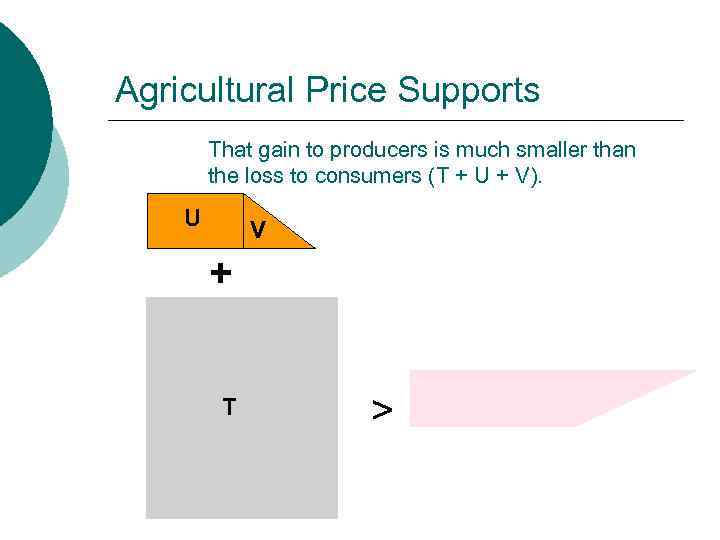

MB MC Agricultural Price Supports P Pf P* That gain to producers is much smaller than the loss to consumers (T + U + V). S U V T D Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved. Qd Qs D+ Government Purchases Q

MB MC Agricultural Price Supports That gain to producers is much smaller than the loss to consumers (T + U + V). U V + T Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved. >

MB MC Summary ¡ ¡ Price controls include price ceilings and price floors. A price ceiling is a legal maximum on the price of a good or service. An example is rent control. A price floor is a legal minimum on the price of a good or a service. An example is the minimum wage. Taxes affect consumers and producers. The burden of a tax is greater for consumers when the demand is inelastic; greater for suppliers when the supply is inelastic. Copyright c 2004 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Micro lecture05 16Sept2013-1.ppt