8331daef794d98f0ff1a32b19260efad.ppt

- Количество слайдов: 14

MICEX-RTS FX Market: New Time, New Instruments, New Liquidity EBRD, NFEA, ISDA Conference London, 14 th March 2012

MICEX-RTS FX Market: New Time, New Instruments, New Liquidity EBRD, NFEA, ISDA Conference London, 14 th March 2012

What Is the MICEX–RTS FX Market? ! Variety of FX Instruments: USD/RUB, EUR/RUB, CHY/RUB, BKT, SWAP O/N, T/N !! !!!!! High Liquidity: USD/RUB strongest performance across international markets Benefits of On-Exchange Clearing & Settlement: CCP, PVP Technological Excellence: API (transactional FIX 4. 4 is available), high productivity, low latency Sponsored Clients’ Access (DMA replica) to FX Market 2

What Is the MICEX–RTS FX Market? ! Variety of FX Instruments: USD/RUB, EUR/RUB, CHY/RUB, BKT, SWAP O/N, T/N !! !!!!! High Liquidity: USD/RUB strongest performance across international markets Benefits of On-Exchange Clearing & Settlement: CCP, PVP Technological Excellence: API (transactional FIX 4. 4 is available), high productivity, low latency Sponsored Clients’ Access (DMA replica) to FX Market 2

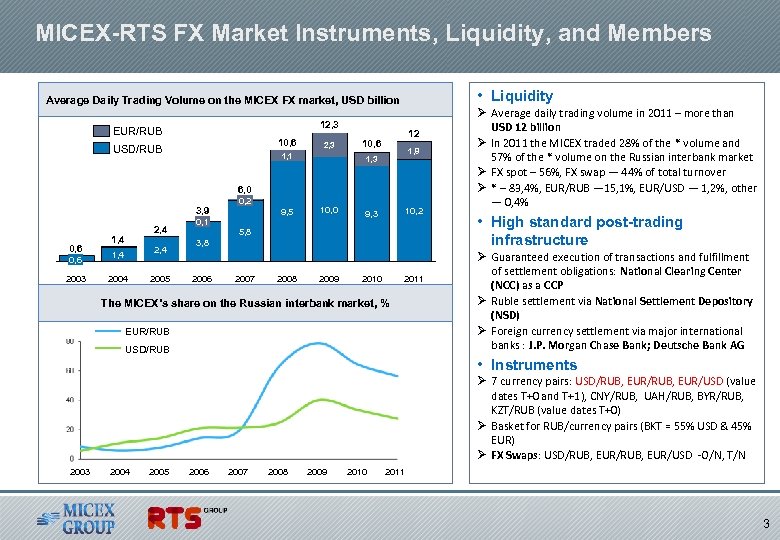

MICEX-RTS FX Market Instruments, Liquidity, and Members • Liquidity Average Daily Trading Volume on the MICEX FX market, USD billion 12, 3 EUR/RUB 10, 6 USD/RUB 2, 3 1, 1 9, 1 0, 6 1, 4 2003 2004 2, 4 2005 0, 2 9, 5 0, 1 1, 8 1, 3 6, 0 3, 9 12 10, 6 10, 0 10, 2 9, 3 5, 8 3, 8 2006 2007 2008 2009 2010 2011 The MICEX’s share on the Russian interbank market, % EUR/RUB USD/RUB Ø Average daily trading volume in 2011 – more than USD 12 billion Ø In 2011 the MICEX traded 28% of the * volume and 57% of the * volume on the Russian interbank market Ø FX spot – 56%, FX swap — 44% of total turnover Ø * – 83, 4%, EUR/RUB — 15, 1%, EUR/USD — 1, 2%, other — 0, 4% • High standard post-trading infrastructure Ø Guaranteed execution of transactions and fulfillment of settlement obligations: National Clearing Center (NCC) as a CCP Ø Ruble settlement via National Settlement Depository (NSD) Ø Foreign currency settlement via major international banks : J. P. Morgan Chase Bank; Deutsche Bank AG • Instruments Ø 7 currency pairs: USD/RUB, EUR/USD (value dates T+0 and T+1), CNY/RUB, UAH/RUB, BYR/RUB, KZT/RUB (value dates T+0) Ø Basket for RUB/currency pairs (BKT = 55% USD & 45% EUR) Ø FX Swaps: USD/RUB, EUR/USD -O/N, T/N 2003 2004 2005 2006 2007 2008 2009 2010 2011 3

MICEX-RTS FX Market Instruments, Liquidity, and Members • Liquidity Average Daily Trading Volume on the MICEX FX market, USD billion 12, 3 EUR/RUB 10, 6 USD/RUB 2, 3 1, 1 9, 1 0, 6 1, 4 2003 2004 2, 4 2005 0, 2 9, 5 0, 1 1, 8 1, 3 6, 0 3, 9 12 10, 6 10, 0 10, 2 9, 3 5, 8 3, 8 2006 2007 2008 2009 2010 2011 The MICEX’s share on the Russian interbank market, % EUR/RUB USD/RUB Ø Average daily trading volume in 2011 – more than USD 12 billion Ø In 2011 the MICEX traded 28% of the * volume and 57% of the * volume on the Russian interbank market Ø FX spot – 56%, FX swap — 44% of total turnover Ø * – 83, 4%, EUR/RUB — 15, 1%, EUR/USD — 1, 2%, other — 0, 4% • High standard post-trading infrastructure Ø Guaranteed execution of transactions and fulfillment of settlement obligations: National Clearing Center (NCC) as a CCP Ø Ruble settlement via National Settlement Depository (NSD) Ø Foreign currency settlement via major international banks : J. P. Morgan Chase Bank; Deutsche Bank AG • Instruments Ø 7 currency pairs: USD/RUB, EUR/USD (value dates T+0 and T+1), CNY/RUB, UAH/RUB, BYR/RUB, KZT/RUB (value dates T+0) Ø Basket for RUB/currency pairs (BKT = 55% USD & 45% EUR) Ø FX Swaps: USD/RUB, EUR/USD -O/N, T/N 2003 2004 2005 2006 2007 2008 2009 2010 2011 3

Development of FX SWAPs and Forwards at MICEX-RTS 4

Development of FX SWAPs and Forwards at MICEX-RTS 4

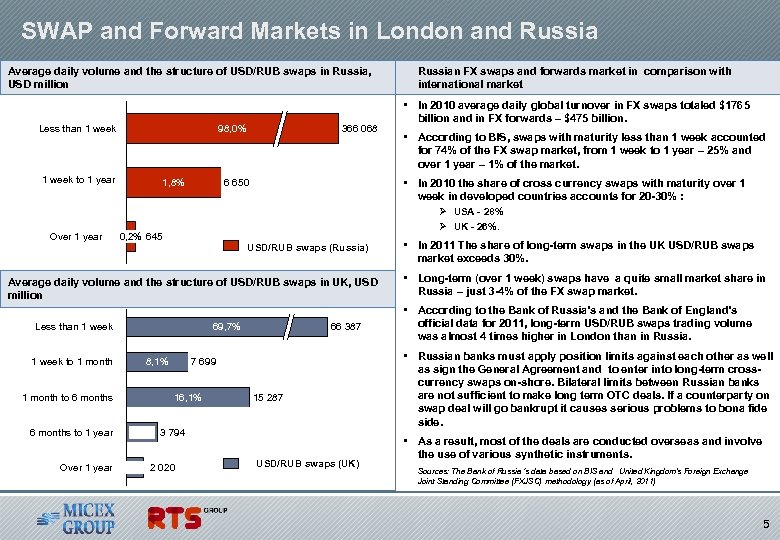

SWAP and Forward Markets in London and Russia Average daily volume and the structure of USD/RUB swaps in Russia, USD million Less than 1 week to 1 year Over 1 year 98, 0% 1, 8% 366 068 6 months to 1 year Over 1 year • According to BIS, swaps with maturity less than 1 week accounted for 74% of the FX swap market, from 1 week to 1 year – 25% and over 1 year – 1% of the market. Ø USA - 28% Ø UK - 26%. 0, 2% 645 USD/RUB swaps (Russia) Less than 1 week 1 month to 6 months • In 2010 average daily global turnover in FX swaps totaled $1765 billion and in FX forwards – $475 billion. • In 2010 the share of cross currency swaps with maturity over 1 week in developed countries accounts for 20 -30% : 6 650 Average daily volume and the structure of USD/RUB swaps in UK, USD million 1 week to 1 month Russian FX swaps and forwards market in comparison with international market 69, 7% 8, 1% 66 387 7 699 16, 1% 15 287 4, 0% 3 794 2, 1% 2 020 USD/RUB swaps (UK) • In 2011 The share of long-term swaps in the UK USD/RUB swaps market exceeds 30%. • Long-term (over 1 week) swaps have a quite small market share in Russia – just 3 -4% of the FX swap market. • According to the Bank of Russia’s and the Bank of England’s official data for 2011, long-term USD/RUB swaps trading volume was almost 4 times higher in London than in Russia. • Russian banks must apply position limits against each other as well as sign the General Agreement and to enter into long-term crosscurrency swaps on-shore. Bilateral limits between Russian banks are not sufficient to make long term OTC deals. If a counterparty on swap deal will go bankrupt it causes serious problems to bona fide side. • As a result, most of the deals are conducted overseas and involve the use of various synthetic instruments. Sources: The Bank of Russia ‘s data based on BIS and United Kingdom's Foreign Exchange Joint Standing Committee (FXJSC) methodology (as of April, 2011) 5

SWAP and Forward Markets in London and Russia Average daily volume and the structure of USD/RUB swaps in Russia, USD million Less than 1 week to 1 year Over 1 year 98, 0% 1, 8% 366 068 6 months to 1 year Over 1 year • According to BIS, swaps with maturity less than 1 week accounted for 74% of the FX swap market, from 1 week to 1 year – 25% and over 1 year – 1% of the market. Ø USA - 28% Ø UK - 26%. 0, 2% 645 USD/RUB swaps (Russia) Less than 1 week 1 month to 6 months • In 2010 average daily global turnover in FX swaps totaled $1765 billion and in FX forwards – $475 billion. • In 2010 the share of cross currency swaps with maturity over 1 week in developed countries accounts for 20 -30% : 6 650 Average daily volume and the structure of USD/RUB swaps in UK, USD million 1 week to 1 month Russian FX swaps and forwards market in comparison with international market 69, 7% 8, 1% 66 387 7 699 16, 1% 15 287 4, 0% 3 794 2, 1% 2 020 USD/RUB swaps (UK) • In 2011 The share of long-term swaps in the UK USD/RUB swaps market exceeds 30%. • Long-term (over 1 week) swaps have a quite small market share in Russia – just 3 -4% of the FX swap market. • According to the Bank of Russia’s and the Bank of England’s official data for 2011, long-term USD/RUB swaps trading volume was almost 4 times higher in London than in Russia. • Russian banks must apply position limits against each other as well as sign the General Agreement and to enter into long-term crosscurrency swaps on-shore. Bilateral limits between Russian banks are not sufficient to make long term OTC deals. If a counterparty on swap deal will go bankrupt it causes serious problems to bona fide side. • As a result, most of the deals are conducted overseas and involve the use of various synthetic instruments. Sources: The Bank of Russia ‘s data based on BIS and United Kingdom's Foreign Exchange Joint Standing Committee (FXJSC) methodology (as of April, 2011) 5

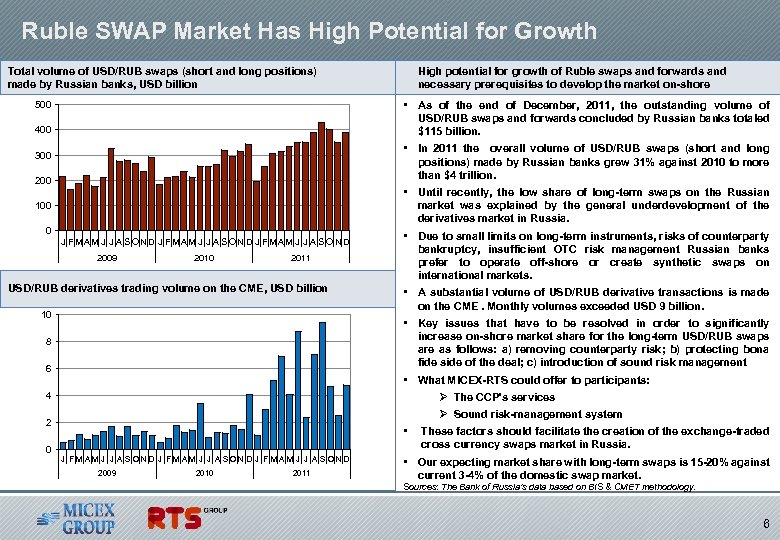

Ruble SWAP Market Has High Potential for Growth Total volume of USD/RUB swaps (short and long positions) made by Russian banks, USD billion 500 400 300 200 100 0 J F MA M J J A S O N D 2009 2010 2011 USD/RUB derivatives trading volume on the CME, USD billion 10 8 6 4 2 0 J F MAM J J A SOND 2009 2010 2011 High potential for growth of Ruble swaps and forwards and necessary prerequisites to develop the market on-shore • As of the end of December, 2011, the outstanding volume of USD/RUB swaps and forwards concluded by Russian banks totaled $115 billion. • In 2011 the overall volume of USD/RUB swaps (short and long positions) made by Russian banks grew 31% against 2010 to more than $4 trillion. • Until recently, the low share of long-term swaps on the Russian market was explained by the general underdevelopment of the derivatives market in Russia. • Due to small limits on long-term instruments, risks of counterparty bankruptcy, insufficient OTC risk management Russian banks prefer to operate off-shore or create synthetic swaps on international markets. • A substantial volume of USD/RUB derivative transactions is made on the CME. Monthly volumes exceeded USD 9 billion. • Key issues that have to be resolved in order to significantly increase on-shore market share for the long-term USD/RUB swaps are as follows: a) removing counterparty risk; b) protecting bona fide side of the deal; c) introduction of sound risk management • What MICEX-RTS could offer to participants: Ø The CCP's services Ø Sound risk-management system • These factors should facilitate the creation of the exchange-traded cross currency swaps market in Russia. • Our expecting market share with long-term swaps is 15 -20% against current 3 -4% of the domestic swap market. Sources: The Bank of Russia’s data based on BIS & СМЕT methodology. 6

Ruble SWAP Market Has High Potential for Growth Total volume of USD/RUB swaps (short and long positions) made by Russian banks, USD billion 500 400 300 200 100 0 J F MA M J J A S O N D 2009 2010 2011 USD/RUB derivatives trading volume on the CME, USD billion 10 8 6 4 2 0 J F MAM J J A SOND 2009 2010 2011 High potential for growth of Ruble swaps and forwards and necessary prerequisites to develop the market on-shore • As of the end of December, 2011, the outstanding volume of USD/RUB swaps and forwards concluded by Russian banks totaled $115 billion. • In 2011 the overall volume of USD/RUB swaps (short and long positions) made by Russian banks grew 31% against 2010 to more than $4 trillion. • Until recently, the low share of long-term swaps on the Russian market was explained by the general underdevelopment of the derivatives market in Russia. • Due to small limits on long-term instruments, risks of counterparty bankruptcy, insufficient OTC risk management Russian banks prefer to operate off-shore or create synthetic swaps on international markets. • A substantial volume of USD/RUB derivative transactions is made on the CME. Monthly volumes exceeded USD 9 billion. • Key issues that have to be resolved in order to significantly increase on-shore market share for the long-term USD/RUB swaps are as follows: a) removing counterparty risk; b) protecting bona fide side of the deal; c) introduction of sound risk management • What MICEX-RTS could offer to participants: Ø The CCP's services Ø Sound risk-management system • These factors should facilitate the creation of the exchange-traded cross currency swaps market in Russia. • Our expecting market share with long-term swaps is 15 -20% against current 3 -4% of the domestic swap market. Sources: The Bank of Russia’s data based on BIS & СМЕT methodology. 6

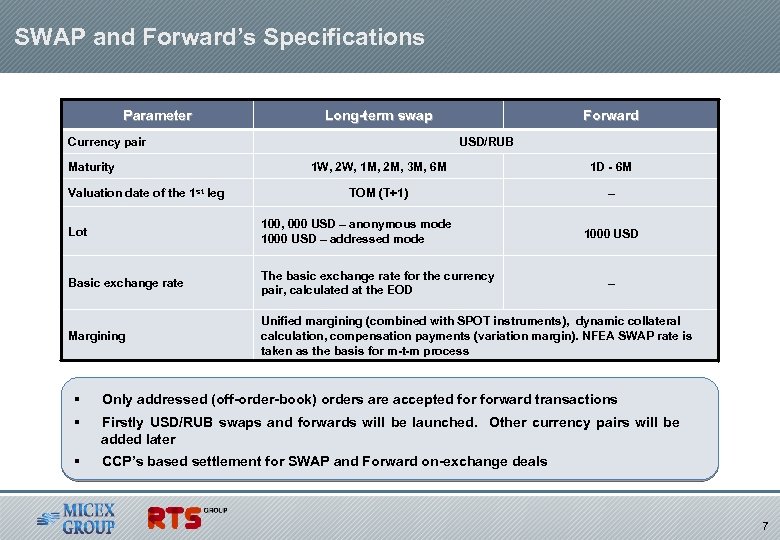

SWAP and Forward’s Specifications Parameter Long-term swap Currency pair Maturity Valuation date of the 1 st leg Forward USD/RUB 1 W, 2 W, 1 M, 2 M, 3 M, 6 M 1 D - 6 M TOM (T+1) – Lot 100, 000 USD – anonymous mode 1000 USD – addressed mode Basic exchange rate The basic exchange rate for the currency pair, calculated at the EOD Margining Unified margining (combined with SPOT instruments), dynamic collateral calculation, compensation payments (variation margin). NFEA SWAP rate is taken as the basis for m-t-m process 1000 USD – § Only addressed (off-order-book) orders are accepted forward transactions § Firstly USD/RUB swaps and forwards will be launched. Other currency pairs will be added later § CCP’s based settlement for SWAP and Forward on-exchange deals 7

SWAP and Forward’s Specifications Parameter Long-term swap Currency pair Maturity Valuation date of the 1 st leg Forward USD/RUB 1 W, 2 W, 1 M, 2 M, 3 M, 6 M 1 D - 6 M TOM (T+1) – Lot 100, 000 USD – anonymous mode 1000 USD – addressed mode Basic exchange rate The basic exchange rate for the currency pair, calculated at the EOD Margining Unified margining (combined with SPOT instruments), dynamic collateral calculation, compensation payments (variation margin). NFEA SWAP rate is taken as the basis for m-t-m process 1000 USD – § Only addressed (off-order-book) orders are accepted forward transactions § Firstly USD/RUB swaps and forwards will be launched. Other currency pairs will be added later § CCP’s based settlement for SWAP and Forward on-exchange deals 7

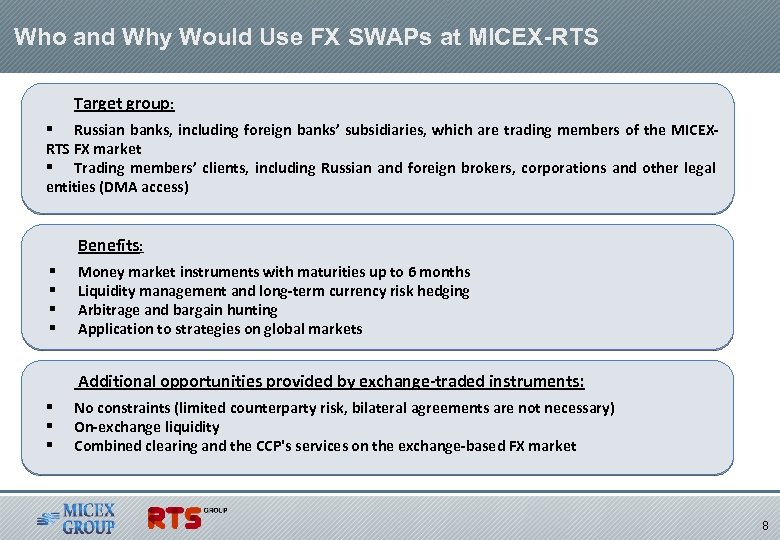

Who and Why Would Use FX SWAPs at MICEX-RTS Target group: § Russian banks, including foreign banks’ subsidiaries, which are trading members of the MICEXRTS FX market § Trading members’ clients, including Russian and foreign brokers, corporations and other legal entities (DMA access) Benefits: § § Money market instruments with maturities up to 6 months Liquidity management and long-term currency risk hedging Arbitrage and bargain hunting Application to strategies on global markets Additional opportunities provided by exchange-traded instruments: § § § No constraints (limited counterparty risk, bilateral agreements are not necessary) On-exchange liquidity Combined clearing and the CCP's services on the exchange-based FX market 8

Who and Why Would Use FX SWAPs at MICEX-RTS Target group: § Russian banks, including foreign banks’ subsidiaries, which are trading members of the MICEXRTS FX market § Trading members’ clients, including Russian and foreign brokers, corporations and other legal entities (DMA access) Benefits: § § Money market instruments with maturities up to 6 months Liquidity management and long-term currency risk hedging Arbitrage and bargain hunting Application to strategies on global markets Additional opportunities provided by exchange-traded instruments: § § § No constraints (limited counterparty risk, bilateral agreements are not necessary) On-exchange liquidity Combined clearing and the CCP's services on the exchange-based FX market 8

MICEX-RTS FX Market Access 9

MICEX-RTS FX Market Access 9

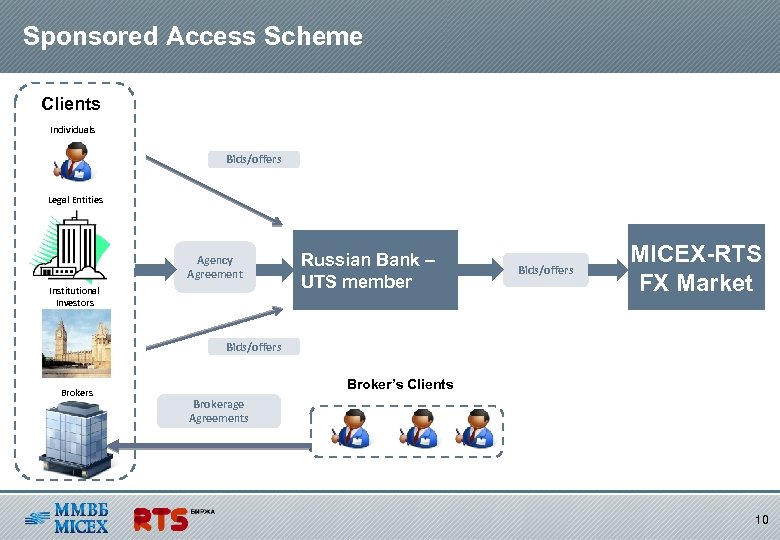

Sponsored Access Scheme Clients Individuals Bids/offers Legal Entities Agency Agreement Institutional Investors Russian Bank – UTS member Bids/offers MICEX-RTS FX Market Bids/offers Broker’s Clients Brokerage Agreements 10

Sponsored Access Scheme Clients Individuals Bids/offers Legal Entities Agency Agreement Institutional Investors Russian Bank – UTS member Bids/offers MICEX-RTS FX Market Bids/offers Broker’s Clients Brokerage Agreements 10

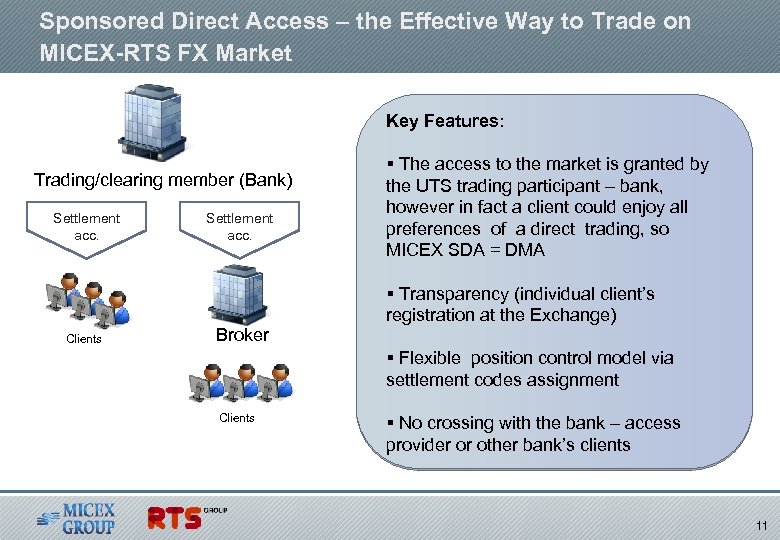

Sponsored Direct Access – the Effective Way to Trade on MICEX-RTS FX Market Key Features: Trading/clearing member (Bank) Settlement acc. Clients Settlement acc. Broker § The access to the market is granted by the UTS trading participant – bank, however in fact a client could enjoy all preferences of a direct trading, so MICEX SDA = DMA § Transparency (individual client’s registration at the Exchange) § Flexible position control model via settlement codes assignment Clients § No crossing with the bank – access provider or other bank’s clients 11

Sponsored Direct Access – the Effective Way to Trade on MICEX-RTS FX Market Key Features: Trading/clearing member (Bank) Settlement acc. Clients Settlement acc. Broker § The access to the market is granted by the UTS trading participant – bank, however in fact a client could enjoy all preferences of a direct trading, so MICEX SDA = DMA § Transparency (individual client’s registration at the Exchange) § Flexible position control model via settlement codes assignment Clients § No crossing with the bank – access provider or other bank’s clients 11

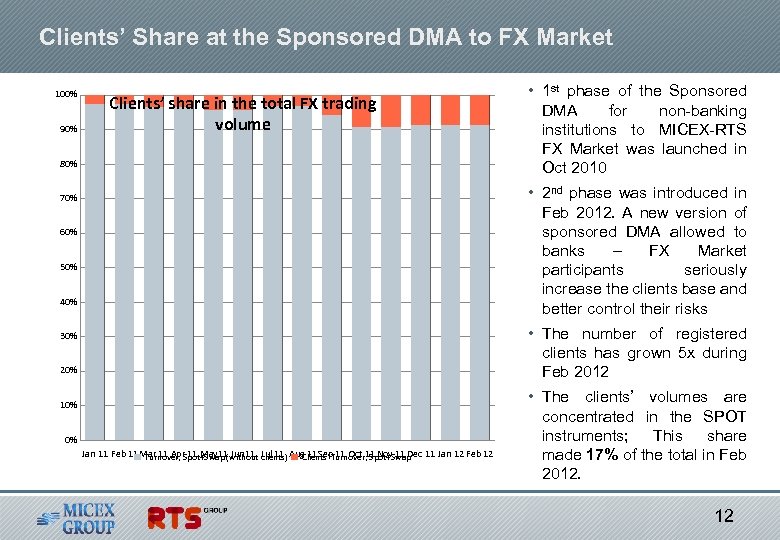

Clients’ Share at the Sponsored DMA to FX Market 100% 90% Clients’ share in the total FX trading volume 80% • 1 st phase of the Sponsored DMA for non-banking institutions to MICEX-RTS FX Market was launched in Oct 2010 • 2 nd phase was introduced in Feb 2012. A new version of sponsored DMA allowed to banks – FX Market participants seriously increase the clients base and better control their risks 70% 60% 50% 40% • The number of registered clients has grown 5 x during Feb 2012 30% 20% 10% 0% Jan 11 Feb 11 Mar 11 Apr 11 May 11(without clients) Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Turnover, Spot+Swap Jun 11 Jul 11 Clients' Turnover, Spot+Swap • The clients’ volumes are concentrated in the SPOT instruments; This share made 17% of the total in Feb 2012. 12

Clients’ Share at the Sponsored DMA to FX Market 100% 90% Clients’ share in the total FX trading volume 80% • 1 st phase of the Sponsored DMA for non-banking institutions to MICEX-RTS FX Market was launched in Oct 2010 • 2 nd phase was introduced in Feb 2012. A new version of sponsored DMA allowed to banks – FX Market participants seriously increase the clients base and better control their risks 70% 60% 50% 40% • The number of registered clients has grown 5 x during Feb 2012 30% 20% 10% 0% Jan 11 Feb 11 Mar 11 Apr 11 May 11(without clients) Aug 11 Sep 11 Oct 11 Nov 11 Dec 11 Jan 12 Feb 12 Turnover, Spot+Swap Jun 11 Jul 11 Clients' Turnover, Spot+Swap • The clients’ volumes are concentrated in the SPOT instruments; This share made 17% of the total in Feb 2012. 12

Coming soon on MICEX-RTS ü Long term FX SWAPS (1 W, 2 W, 1 M, 2 M, 3 M, 6 M) – Apr 2012 ü Deliverable FX forwards (flexible maturity up to 6 months)- negotiated deals only – Apr 2012 ü Trading time extension (till 23: 50) – Q 3–Q 4 2012 ü Introduction of more G 10 currency pairs – Q 4 ü Re-thinking a new fee structure– more benefits for liquidity providers – Q 2 13

Coming soon on MICEX-RTS ü Long term FX SWAPS (1 W, 2 W, 1 M, 2 M, 3 M, 6 M) – Apr 2012 ü Deliverable FX forwards (flexible maturity up to 6 months)- negotiated deals only – Apr 2012 ü Trading time extension (till 23: 50) – Q 3–Q 4 2012 ü Introduction of more G 10 currency pairs – Q 4 ü Re-thinking a new fee structure– more benefits for liquidity providers – Q 2 13

THANK YOU FOR YOUR ATTENTION! Contacts: Alexander Ageev, VP, Head of FX&MM Sales ageev@micex. com Tel. : +7 (495) 363 -32 -32, ext. 31 -15 Web: www. micex. ru

THANK YOU FOR YOUR ATTENTION! Contacts: Alexander Ageev, VP, Head of FX&MM Sales ageev@micex. com Tel. : +7 (495) 363 -32 -32, ext. 31 -15 Web: www. micex. ru