49ce5b6a13b04cdaed6a58866620131b.ppt

- Количество слайдов: 30

MFLEX Overview January, 2011 MFLEX ranked #35 on Fortune’s List of 100 Fastest Growing Companies MFLEX Confidential

MFLEX Overview January, 2011 MFLEX ranked #35 on Fortune’s List of 100 Fastest Growing Companies MFLEX Confidential

Table of Contents Slide – 3 • Company Overview • MFLEX Value Proposition & Value Added Differentiation Slide – 7 • FPC Technology Slide – 13 • FPCA Technology Slide – 27 • Module Integration Slide – 40 • Conclusion Slide – 50 • Appendix Slide – 55 MFLEX Confidential 2

Table of Contents Slide – 3 • Company Overview • MFLEX Value Proposition & Value Added Differentiation Slide – 7 • FPC Technology Slide – 13 • FPCA Technology Slide – 27 • Module Integration Slide – 40 • Conclusion Slide – 50 • Appendix Slide – 55 MFLEX Confidential 2

Company Overview MFLEX Confidential 3

Company Overview MFLEX Confidential 3

Company Overview • NASDAQ symbol: MFLX Who is MFLEX ? – Flex Manufacturer with State of the Art Manufacturing Facility in Suzhou, China capable of 35 um L/S • CY 2009 Third largest FPC fabricator worldwide (Source: Japan Marketing Survey, Japan) – Global Leader in Flex Assembly • Additional New Clean Room Assembly Facility in Chengdu, China, online Q 1 2011 – Global Leader in Module Assembly & Chassis Integration • Dedicated Secure Assembly Facilities to protect Customer Intellectual Property (IP) • Where does MFLEX Operate ? – – – • Manufacturing Operations 150, 000 m 2 of manufacturing space in Suzhou & Chengdu, China R&D in USA, UK, & China for Process and Product Development Center of Excellence in USA to Incubate Ideas for New Offerings Multiple offices in USA, Europe and Asia for Local Sales and Applications Engineering Support Approximately 17, 000 employees globally How is MFLEX Performance ? – Revenue $791 Million (FY-2010), Cash & Cash Equivalents of $100 Million* – 2003 – 2010 CAGR of 30% – Ranked # 35 on FORTUNE’s 2010 list of Fastest Growing Companies * November 4, 2010 MFLEX Confidential 4

Company Overview • NASDAQ symbol: MFLX Who is MFLEX ? – Flex Manufacturer with State of the Art Manufacturing Facility in Suzhou, China capable of 35 um L/S • CY 2009 Third largest FPC fabricator worldwide (Source: Japan Marketing Survey, Japan) – Global Leader in Flex Assembly • Additional New Clean Room Assembly Facility in Chengdu, China, online Q 1 2011 – Global Leader in Module Assembly & Chassis Integration • Dedicated Secure Assembly Facilities to protect Customer Intellectual Property (IP) • Where does MFLEX Operate ? – – – • Manufacturing Operations 150, 000 m 2 of manufacturing space in Suzhou & Chengdu, China R&D in USA, UK, & China for Process and Product Development Center of Excellence in USA to Incubate Ideas for New Offerings Multiple offices in USA, Europe and Asia for Local Sales and Applications Engineering Support Approximately 17, 000 employees globally How is MFLEX Performance ? – Revenue $791 Million (FY-2010), Cash & Cash Equivalents of $100 Million* – 2003 – 2010 CAGR of 30% – Ranked # 35 on FORTUNE’s 2010 list of Fastest Growing Companies * November 4, 2010 MFLEX Confidential 4

Continued Investment in Capability & Capacity • MFLEX has a history of investing nearly 10% in capital equipment each year • Investing over $80 million in 2010, continue plant capability investments in 2011 • Equipment and facility expansion for capacity increase – Bare Flex capacity & capability addition (MFC 3) and upgrades to MFC 2 in Suzhou, China – Dedicated assembly facilities to protect customer IP • Technology, quality, and efficiency – – • Rigid Flex, fine pitch and automation including Roll to Roll Automation Initiatives for FPC and FPCA Strategic Initiative on Lean Manufacturing, Six Sigma Quality Systems Ongoing training programs for line leaders, supervisors and managers Advanced Technology Group – Anaheim New Materials and Processes – China Process Development – Cambridge HID Development MFLEX Confidential 5

Continued Investment in Capability & Capacity • MFLEX has a history of investing nearly 10% in capital equipment each year • Investing over $80 million in 2010, continue plant capability investments in 2011 • Equipment and facility expansion for capacity increase – Bare Flex capacity & capability addition (MFC 3) and upgrades to MFC 2 in Suzhou, China – Dedicated assembly facilities to protect customer IP • Technology, quality, and efficiency – – • Rigid Flex, fine pitch and automation including Roll to Roll Automation Initiatives for FPC and FPCA Strategic Initiative on Lean Manufacturing, Six Sigma Quality Systems Ongoing training programs for line leaders, supervisors and managers Advanced Technology Group – Anaheim New Materials and Processes – China Process Development – Cambridge HID Development MFLEX Confidential 5

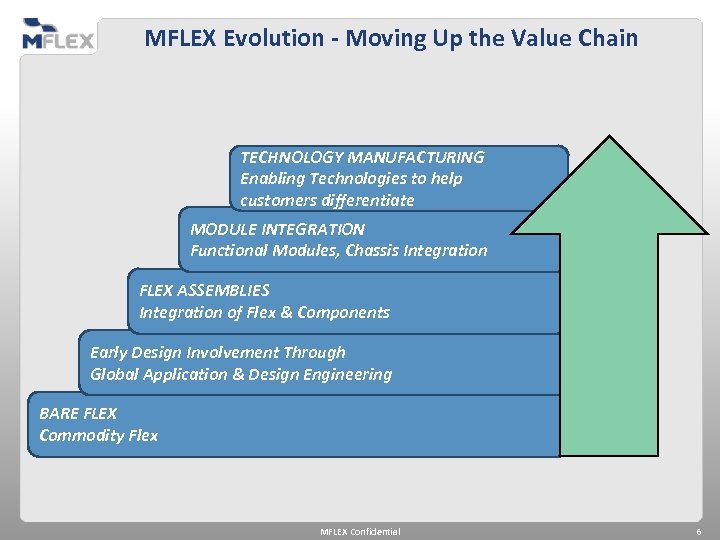

MFLEX Evolution - Moving Up the Value Chain TECHNOLOGY MANUFACTURING Enabling Technologies to help customers differentiate MODULE INTEGRATION Functional Modules, Chassis Integration FLEX ASSEMBLIES Integration of Flex & Components Early Design Involvement Through Global Application & Design Engineering BARE FLEX Commodity Flex MFLEX Confidential 6

MFLEX Evolution - Moving Up the Value Chain TECHNOLOGY MANUFACTURING Enabling Technologies to help customers differentiate MODULE INTEGRATION Functional Modules, Chassis Integration FLEX ASSEMBLIES Integration of Flex & Components Early Design Involvement Through Global Application & Design Engineering BARE FLEX Commodity Flex MFLEX Confidential 6

MFLEX Value Proposition & Value Add Differentiation to Meet Market Trends MFLEX Confidential 7

MFLEX Value Proposition & Value Add Differentiation to Meet Market Trends MFLEX Confidential 7

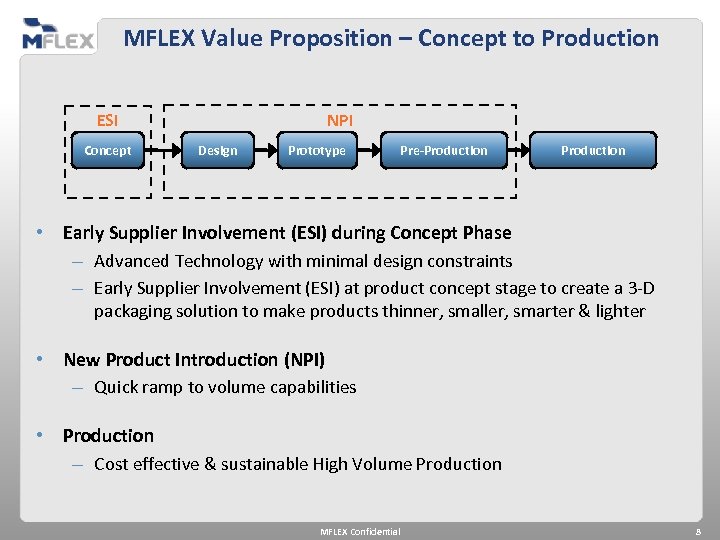

MFLEX Value Proposition – Concept to Production NPI ESI Concept Design Prototype Pre-Production • Early Supplier Involvement (ESI) during Concept Phase – Advanced Technology with minimal design constraints – Early Supplier Involvement (ESI) at product concept stage to create a 3 -D packaging solution to make products thinner, smaller, smarter & lighter • New Product Introduction (NPI) – Quick ramp to volume capabilities • Production – Cost effective & sustainable High Volume Production MFLEX Confidential 8

MFLEX Value Proposition – Concept to Production NPI ESI Concept Design Prototype Pre-Production • Early Supplier Involvement (ESI) during Concept Phase – Advanced Technology with minimal design constraints – Early Supplier Involvement (ESI) at product concept stage to create a 3 -D packaging solution to make products thinner, smaller, smarter & lighter • New Product Introduction (NPI) – Quick ramp to volume capabilities • Production – Cost effective & sustainable High Volume Production MFLEX Confidential 8

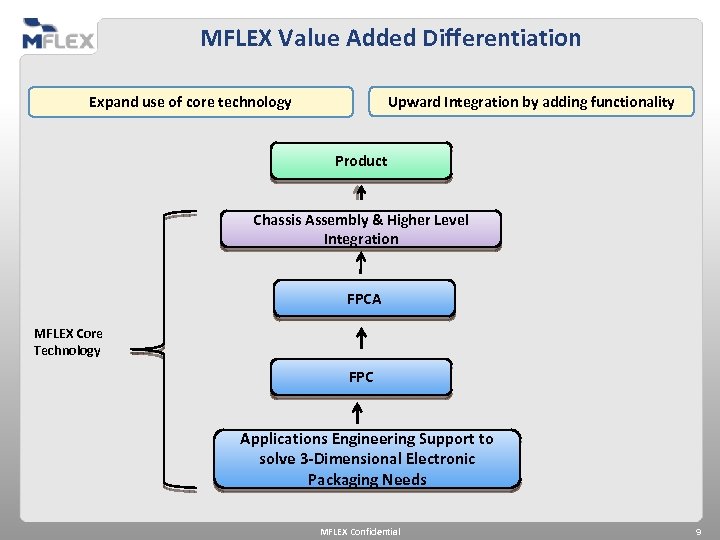

MFLEX Value Added Differentiation Upward Integration by adding functionality Expand use of core technology Product Chassis Assembly & Higher Level Integration FPCA MFLEX Core Technology FPC Applications Engineering Support to solve 3 -Dimensional Electronic Packaging Needs MFLEX Confidential 9

MFLEX Value Added Differentiation Upward Integration by adding functionality Expand use of core technology Product Chassis Assembly & Higher Level Integration FPCA MFLEX Core Technology FPC Applications Engineering Support to solve 3 -Dimensional Electronic Packaging Needs MFLEX Confidential 9

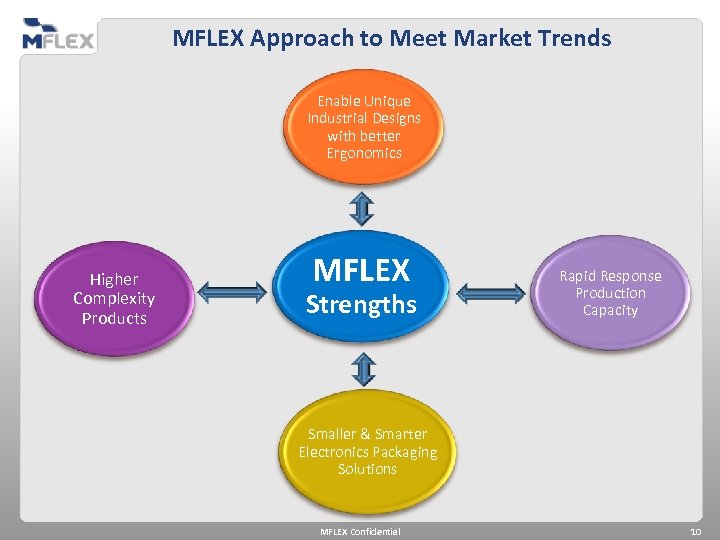

MFLEX Approach to Meet Market Trends Enable Unique Industrial Designs with better Ergonomics Higher Complexity Products MFLEX Strengths Rapid Response Production Capacity Smaller & Smarter Electronics Packaging Solutions MFLEX Confidential 10

MFLEX Approach to Meet Market Trends Enable Unique Industrial Designs with better Ergonomics Higher Complexity Products MFLEX Strengths Rapid Response Production Capacity Smaller & Smarter Electronics Packaging Solutions MFLEX Confidential 10

IP Protection Benefit For optimal IP protection MFLEX uses dedicated satellite assembly sites for Module Integration • Secure facilities dedicated to a specific Customer or Program • Customer/Program Specific Dedicated Operators & Project Teams • IP is secured since only specific/related customer is allowed as an external visitor to the facility • If demand needs adjustment, impact on other projects can be made visible • Highly efficient and appreciated by current customer base MFLEX Confidential 11

IP Protection Benefit For optimal IP protection MFLEX uses dedicated satellite assembly sites for Module Integration • Secure facilities dedicated to a specific Customer or Program • Customer/Program Specific Dedicated Operators & Project Teams • IP is secured since only specific/related customer is allowed as an external visitor to the facility • If demand needs adjustment, impact on other projects can be made visible • Highly efficient and appreciated by current customer base MFLEX Confidential 11

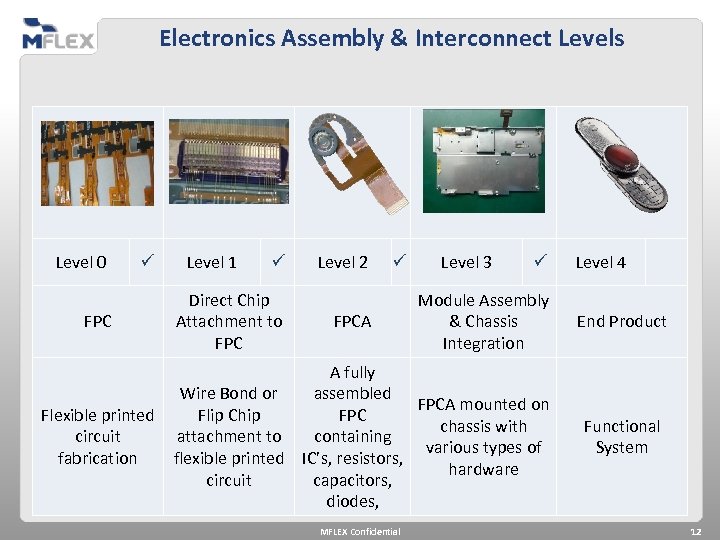

Electronics Assembly & Interconnect Levels Level 0 ü Level 1 ü ü Level 3 ü Level 4 Module Assembly & Chassis Integration End Product A fully assembled Wire Bond or FPCA mounted on FPC Flexible printed Flip Chip chassis with circuit attachment to containing various types of fabrication flexible printed IC’s, resistors, hardware circuit capacitors, diodes, Functional System FPC Direct Chip Attachment to FPC Level 2 FPCA MFLEX Confidential 12

Electronics Assembly & Interconnect Levels Level 0 ü Level 1 ü ü Level 3 ü Level 4 Module Assembly & Chassis Integration End Product A fully assembled Wire Bond or FPCA mounted on FPC Flexible printed Flip Chip chassis with circuit attachment to containing various types of fabrication flexible printed IC’s, resistors, hardware circuit capacitors, diodes, Functional System FPC Direct Chip Attachment to FPC Level 2 FPCA MFLEX Confidential 12

FPC Technology (Level 0) MFLEX Confidential 13

FPC Technology (Level 0) MFLEX Confidential 13

FPC Capabilities Overview • 3 FPC Fab Facilities in Suzhou including a state of the art new 56, 680 m² facility operational September 2010 with roll-to-roll capabilities • Current FPC monthly production capacity: 120, 000 m² • FPC monthly production capacity by April 2011: 150, 000 m² • FPC monthly production capacity by July 2011: 175, 000 m² MFLEX Confidential 14

FPC Capabilities Overview • 3 FPC Fab Facilities in Suzhou including a state of the art new 56, 680 m² facility operational September 2010 with roll-to-roll capabilities • Current FPC monthly production capacity: 120, 000 m² • FPC monthly production capacity by April 2011: 150, 000 m² • FPC monthly production capacity by July 2011: 175, 000 m² MFLEX Confidential 14

New Advanced FPC Fab Capability and Capacity 1. Panel Process – Phase 1 (Sept-2010) – 15, 000 m 2 – Phase 2 (Apr-2011) – 15, 000 m 2 – 50µm line/space – FPC and Rigid-flex 2. Roll-to-Roll Process – Phase 1 (Oct-2010) – 10, 000 m 2 – 35µm line/space – Single-sided and Double-sided FPC – Phase 2 (Feb-2011) : 25 um line/space Copper Plating MFLEX Confidential 15

New Advanced FPC Fab Capability and Capacity 1. Panel Process – Phase 1 (Sept-2010) – 15, 000 m 2 – Phase 2 (Apr-2011) – 15, 000 m 2 – 50µm line/space – FPC and Rigid-flex 2. Roll-to-Roll Process – Phase 1 (Oct-2010) – 10, 000 m 2 – 35µm line/space – Single-sided and Double-sided FPC – Phase 2 (Feb-2011) : 25 um line/space Copper Plating MFLEX Confidential 15

Roll-to-Roll Process Copper Plating Laser Drilling Dry Film Lamination Trademarks and Logos are the property of their respective owners MFLEX Confidential Exposure 16

Roll-to-Roll Process Copper Plating Laser Drilling Dry Film Lamination Trademarks and Logos are the property of their respective owners MFLEX Confidential Exposure 16

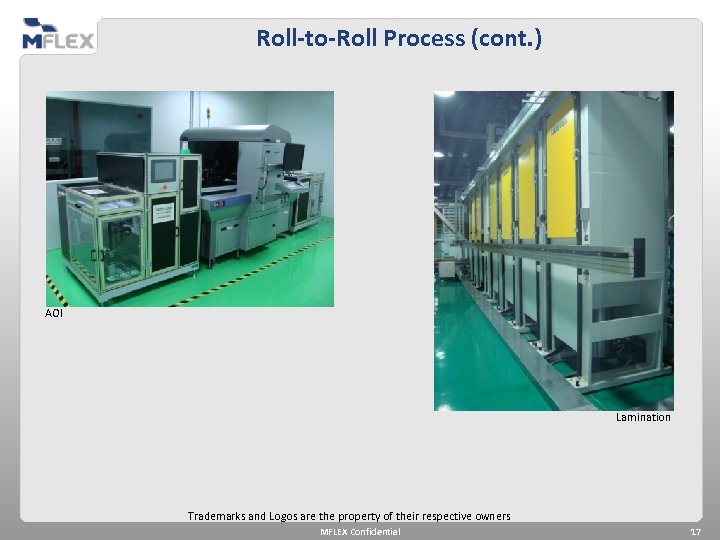

Roll-to-Roll Process (cont. ) AOI Lamination Trademarks and Logos are the property of their respective owners MFLEX Confidential 17

Roll-to-Roll Process (cont. ) AOI Lamination Trademarks and Logos are the property of their respective owners MFLEX Confidential 17

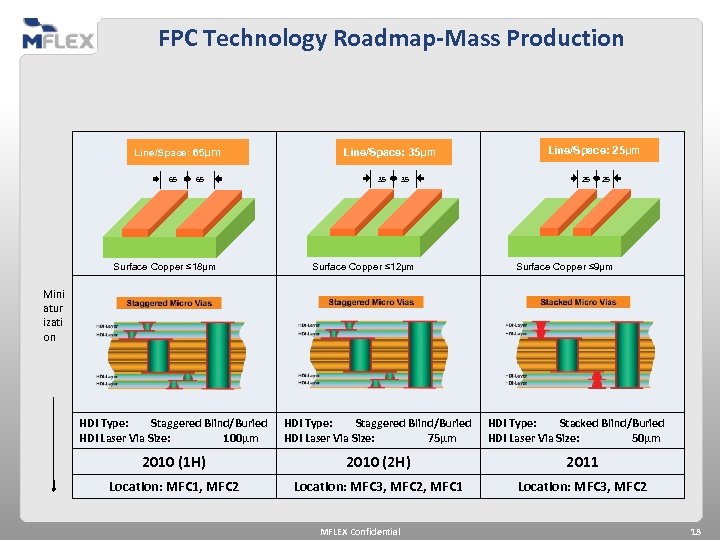

FPC Technology Roadmap-Mass Production Line/Space: 65µm 65 65 Surface Copper ≤ 18µm Line/Space: 35µm 35 35 Surface Copper ≤ 12µm Line/Space: 25µm 25 25 Surface Copper ≤ 9µm Mini atur izati on HDI Type: Staggered Blind/Buried HDI Laser Via Size: 100µm HDI Type: Staggered Blind/Buried HDI Laser Via Size: 75µm 2010 (1 H) 2010 (2 H) 2011 Location: MFC 1, MFC 2 Location: MFC 3, MFC 2, MFC 1 Location: MFC 3, MFC 2 MFLEX Confidential HDI Type: Stacked Blind/Buried HDI Laser Via Size: 50µm 18

FPC Technology Roadmap-Mass Production Line/Space: 65µm 65 65 Surface Copper ≤ 18µm Line/Space: 35µm 35 35 Surface Copper ≤ 12µm Line/Space: 25µm 25 25 Surface Copper ≤ 9µm Mini atur izati on HDI Type: Staggered Blind/Buried HDI Laser Via Size: 100µm HDI Type: Staggered Blind/Buried HDI Laser Via Size: 75µm 2010 (1 H) 2010 (2 H) 2011 Location: MFC 1, MFC 2 Location: MFC 3, MFC 2, MFC 1 Location: MFC 3, MFC 2 MFLEX Confidential HDI Type: Stacked Blind/Buried HDI Laser Via Size: 50µm 18

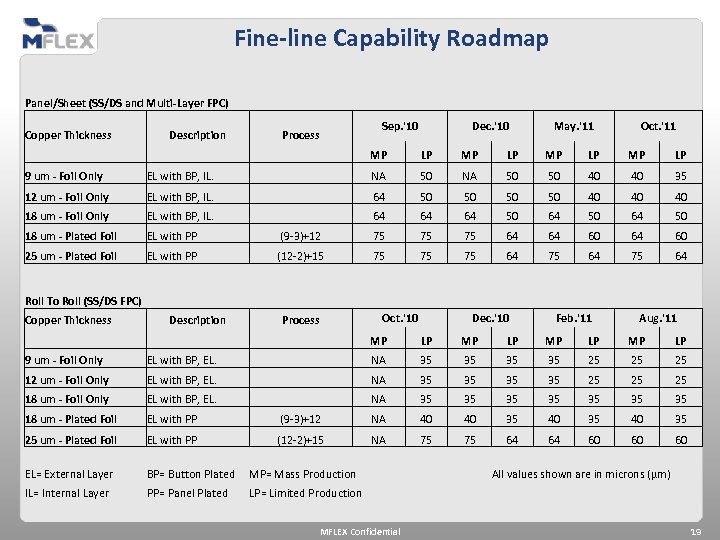

Fine-line Capability Roadmap Panel/Sheet (SS/DS and Multi-Layer FPC) Copper Thickness Description 9 um - Foil Only EL with BP, IL. 12 um - Foil Only Process Sep. '10 Dec. '10 May. '11 Oct. '11 MP LP NA 50 50 40 40 35 EL with BP, IL. 64 50 50 40 40 40 18 um - Foil Only EL with BP, IL. 64 64 64 50 18 um - Plated Foil EL with PP (9 -3)+12 75 75 75 64 64 60 25 um - Plated Foil EL with PP (12 -2)+15 75 75 75 64 Roll To Roll (SS/DS FPC) Copper Thickness Description 9 um - Foil Only EL with BP, EL. 12 um - Foil Only Process Oct. '10 Dec. '10 Feb. '11 Aug. '11 MP LP NA 35 35 25 25 25 EL with BP, EL. NA 35 35 25 25 25 18 um - Foil Only EL with BP, EL. NA 35 35 18 um - Plated Foil EL with PP (9 -3)+12 NA 40 40 35 25 um - Plated Foil EL with PP (12 -2)+15 NA 75 75 64 64 60 60 60 EL= External Layer BP= Button Plated MP= Mass Production IL= Internal Layer PP= Panel Plated LP= Limited Production MFLEX Confidential All values shown are in microns (µm) 19

Fine-line Capability Roadmap Panel/Sheet (SS/DS and Multi-Layer FPC) Copper Thickness Description 9 um - Foil Only EL with BP, IL. 12 um - Foil Only Process Sep. '10 Dec. '10 May. '11 Oct. '11 MP LP NA 50 50 40 40 35 EL with BP, IL. 64 50 50 40 40 40 18 um - Foil Only EL with BP, IL. 64 64 64 50 18 um - Plated Foil EL with PP (9 -3)+12 75 75 75 64 64 60 25 um - Plated Foil EL with PP (12 -2)+15 75 75 75 64 Roll To Roll (SS/DS FPC) Copper Thickness Description 9 um - Foil Only EL with BP, EL. 12 um - Foil Only Process Oct. '10 Dec. '10 Feb. '11 Aug. '11 MP LP NA 35 35 25 25 25 EL with BP, EL. NA 35 35 25 25 25 18 um - Foil Only EL with BP, EL. NA 35 35 18 um - Plated Foil EL with PP (9 -3)+12 NA 40 40 35 25 um - Plated Foil EL with PP (12 -2)+15 NA 75 75 64 64 60 60 60 EL= External Layer BP= Button Plated MP= Mass Production IL= Internal Layer PP= Panel Plated LP= Limited Production MFLEX Confidential All values shown are in microns (µm) 19

Development – Additional processes • LDI – Available for dry film processing – November 2010 • Registration tolerance better than +/- 25 um • Feature to holes, layer-to-layer – Available for solder mask processing – March 2011 • Registration tolerance better than +/- 25 um • Openings for 01005 components • 0. 4 mm pitch for BGA/LGA • Electroless copper alternative to Shadow graphite chemistry – For Rigid-flex and complex ML FPC that require via fill – Development Pilot line available – December 2010 – Basis for FPC and Rigid-flex via-fill and stacked-via development; future fine line semi-additive processes • Copper filled PTH & microvia – ± 7% panel Copper uniformity, high ductility Copper MFLEX Confidential 20

Development – Additional processes • LDI – Available for dry film processing – November 2010 • Registration tolerance better than +/- 25 um • Feature to holes, layer-to-layer – Available for solder mask processing – March 2011 • Registration tolerance better than +/- 25 um • Openings for 01005 components • 0. 4 mm pitch for BGA/LGA • Electroless copper alternative to Shadow graphite chemistry – For Rigid-flex and complex ML FPC that require via fill – Development Pilot line available – December 2010 – Basis for FPC and Rigid-flex via-fill and stacked-via development; future fine line semi-additive processes • Copper filled PTH & microvia – ± 7% panel Copper uniformity, high ductility Copper MFLEX Confidential 20

Development – Surface Finish • Flexible (soft) ENIG process (mass production line) – Ready for production, pending customer approvals – Line fully configured for conversion to ENEPIG Mass Production • ENEPIG Development pilot line – 200 panels/day capacity – Ready by November 2010 – For process chemistries evaluation and prototype support MFLEX Confidential 21

Development – Surface Finish • Flexible (soft) ENIG process (mass production line) – Ready for production, pending customer approvals – Line fully configured for conversion to ENEPIG Mass Production • ENEPIG Development pilot line – 200 panels/day capacity – Ready by November 2010 – For process chemistries evaluation and prototype support MFLEX Confidential 21

Development – Rigid-Flex • Design and Process Concept – Target markets: mobile phone, automotive, medical – Typical 4 -8 layers – Static bend and dynamic applications – Assembly design and process considerations – Ready to market March 2011 – Technical considerations • Materials – for stability, dynamic applications • Design • Process • Product reliability MFLEX Confidential 22

Development – Rigid-Flex • Design and Process Concept – Target markets: mobile phone, automotive, medical – Typical 4 -8 layers – Static bend and dynamic applications – Assembly design and process considerations – Ready to market March 2011 – Technical considerations • Materials – for stability, dynamic applications • Design • Process • Product reliability MFLEX Confidential 22

Development – FPC Materials Q 4 2010 • Flexible solder mask – Pending customer approval • Black coverlay (multiple suppliers) • Flexible photoimageable coverlay Q 1 2011 • Thin copper < 9 um for fine pitch display applications • LCP for impedance control requirement – High temperature press installed by November 2010 Q 3 2011 • Sputtered copper material on PI for < 25 micron L/S by semi-additive methods MFLEX Confidential 23

Development – FPC Materials Q 4 2010 • Flexible solder mask – Pending customer approval • Black coverlay (multiple suppliers) • Flexible photoimageable coverlay Q 1 2011 • Thin copper < 9 um for fine pitch display applications • LCP for impedance control requirement – High temperature press installed by November 2010 Q 3 2011 • Sputtered copper material on PI for < 25 micron L/S by semi-additive methods MFLEX Confidential 23

Development - Automation • • Panel size Coverlay layup and pre-laminate Shielding cut, punch and apply Stiffener pick and place Automatic punch for singulation Roll to roll systems and Material handlers Multilayer Registration Systems -(2+n+2) to 12 layers Automated Plating Line Racking Systems for reduced handling damage MFLEX Confidential 24

Development - Automation • • Panel size Coverlay layup and pre-laminate Shielding cut, punch and apply Stiffener pick and place Automatic punch for singulation Roll to roll systems and Material handlers Multilayer Registration Systems -(2+n+2) to 12 layers Automated Plating Line Racking Systems for reduced handling damage MFLEX Confidential 24

FPCA Technology (Level 1 and 2) (Level 1) (Level 2) MFLEX Confidential 25

FPCA Technology (Level 1 and 2) (Level 1) (Level 2) MFLEX Confidential 25

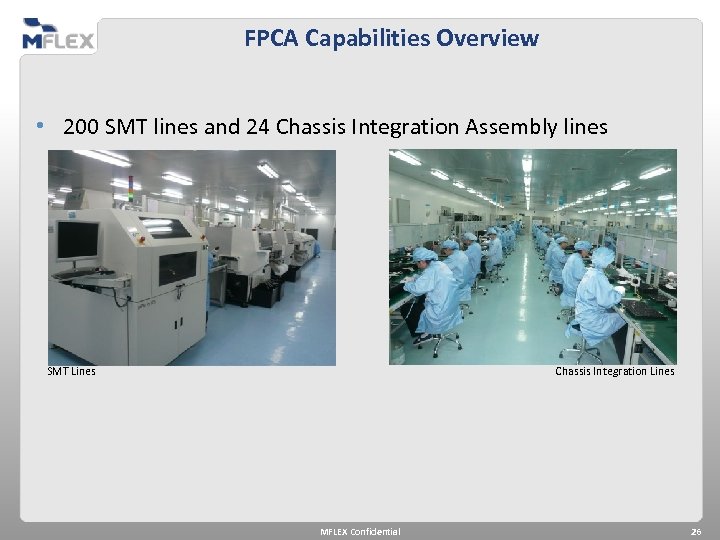

FPCA Capabilities Overview • 200 SMT lines and 24 Chassis Integration Assembly lines SMT Lines Chassis Integration Lines MFLEX Confidential 26

FPCA Capabilities Overview • 200 SMT lines and 24 Chassis Integration Assembly lines SMT Lines Chassis Integration Lines MFLEX Confidential 26

FPCA SMT Capabilities Overview • SMT Lines include: – – Solder Paste Inspection AOI 3 D X-Ray Conformal Coating and Underfill Encapsulation Solder Paste Inspection AOI Conformal Coating Trademarks and Logos are the property of their respective owners MFLEX Confidential 27

FPCA SMT Capabilities Overview • SMT Lines include: – – Solder Paste Inspection AOI 3 D X-Ray Conformal Coating and Underfill Encapsulation Solder Paste Inspection AOI Conformal Coating Trademarks and Logos are the property of their respective owners MFLEX Confidential 27

FPCA Chassis Integration Capabilities Overview • Chassis Integration Assembly Lines include: – – Heat Staking Selective Laser Soldering Laser Welding Bending FPCA for 3 D Packaging Bending Selective Laser Soldering Trademarks and Logos are the property of their respective owners MFLEX Confidential 28

FPCA Chassis Integration Capabilities Overview • Chassis Integration Assembly Lines include: – – Heat Staking Selective Laser Soldering Laser Welding Bending FPCA for 3 D Packaging Bending Selective Laser Soldering Trademarks and Logos are the property of their respective owners MFLEX Confidential 28

FPCA Chassis Integration Capabilities Overview (cont. ) • Chassis Integration Assembly Lines include: – Spot Welding – ACF Bonding and Wire Bonding Spot Welding Trademarks and Logos are the property of their respective owners MFLEX Confidential ACF Bonding 29

FPCA Chassis Integration Capabilities Overview (cont. ) • Chassis Integration Assembly Lines include: – Spot Welding – ACF Bonding and Wire Bonding Spot Welding Trademarks and Logos are the property of their respective owners MFLEX Confidential ACF Bonding 29

FPCA Capabilities Overview • New Clean Room SMT & Chassis Integration Assembly Facility in Chengdu currently under construction, operational by CY Q 1 2011 Trademarks and Logos are the property of their respective owners MFLEX Confidential 30

FPCA Capabilities Overview • New Clean Room SMT & Chassis Integration Assembly Facility in Chengdu currently under construction, operational by CY Q 1 2011 Trademarks and Logos are the property of their respective owners MFLEX Confidential 30