112b5210d730492eef6e90749012335b.ppt

- Количество слайдов: 63

MFIN 902 - MANAGERIAL FINANCE II 2009 Sat 14: 00 – 18: 00 CASE Z-48 p p Instructor: Office: Telephone: E-mail: n p Dr. Cüneyt Demirgüreş CASE 111 212 317 2705 (emergency: 532 627 2844) cuneyt. demirgures@efgistanbulsec. com (PLEASE DO NOT SEND MAIL TO MY KOC ADDRESS AS I DO NOT REGULARLY CHECK IT) Text and Materials 1 - Textbook: Finance for Executives: Managing for Value Creation, Hawawini and Viallet, 3 rd edition, South-Western, 2006. 2 - A financial calculator is a must. HP 10 B preferred. Familiarity with excel spreadsheets, accounting, and statistics is recommended. MFIN 901 1

MFIN 902 - MANAGERIAL FINANCE II 2009 Sat 14: 00 – 18: 00 CASE Z-48 p p Instructor: Office: Telephone: E-mail: n p Dr. Cüneyt Demirgüreş CASE 111 212 317 2705 (emergency: 532 627 2844) cuneyt. demirgures@efgistanbulsec. com (PLEASE DO NOT SEND MAIL TO MY KOC ADDRESS AS I DO NOT REGULARLY CHECK IT) Text and Materials 1 - Textbook: Finance for Executives: Managing for Value Creation, Hawawini and Viallet, 3 rd edition, South-Western, 2006. 2 - A financial calculator is a must. HP 10 B preferred. Familiarity with excel spreadsheets, accounting, and statistics is recommended. MFIN 901 1

MFIN 902 - MANAGERIAL FINANCE II 2009 Course Objectives MFIN 901 2

MFIN 902 - MANAGERIAL FINANCE II 2009 Course Objectives MFIN 901 2

MFIN 902 - MANAGERIAL FINANCE II 2009 Grading: p There will be regular quizzes, homework and a final exam. Homeworks will be given after each lecture, but will not be collected. Since quizzes will take place at the beginning of the first hour, timely attendance is highly recommended. There will be no make-ups for the quizzes. p Your overall course grade will be determined as follows: Quizzes: Final Exam: MFIN 901 30% 70% 3

MFIN 902 - MANAGERIAL FINANCE II 2009 Grading: p There will be regular quizzes, homework and a final exam. Homeworks will be given after each lecture, but will not be collected. Since quizzes will take place at the beginning of the first hour, timely attendance is highly recommended. There will be no make-ups for the quizzes. p Your overall course grade will be determined as follows: Quizzes: Final Exam: MFIN 901 30% 70% 3

MFIN 902 - MANAGERIAL FINANCE II 2009 Academic Honesty p Unless otherwise specified, any work that is submitted to be evaluated in this class should belong solely to its identified author(s) and any exception to this is considered an act of academic dishonesty. p “Honesty and trust are important to all of us as individuals. Students and faculty adhere to the following principles of academic honesty at Koc University: n n Providing proper acknowledgment of original author. Copying from another student’s paper or from another text without written acknowledgement is plagiarism. n p Individual accountability for all submitted work, written or oral. Copying from others or providing answers or information, written or oral, to others is cheating. Authorized teamwork. Unauthorized help from another person or having someone else write one’s paper or assignment is collusion. Cheating, plagiarism, and collusion are serious offenses resulting in an F grade and disciplinary action. ” MFIN 901 4

MFIN 902 - MANAGERIAL FINANCE II 2009 Academic Honesty p Unless otherwise specified, any work that is submitted to be evaluated in this class should belong solely to its identified author(s) and any exception to this is considered an act of academic dishonesty. p “Honesty and trust are important to all of us as individuals. Students and faculty adhere to the following principles of academic honesty at Koc University: n n Providing proper acknowledgment of original author. Copying from another student’s paper or from another text without written acknowledgement is plagiarism. n p Individual accountability for all submitted work, written or oral. Copying from others or providing answers or information, written or oral, to others is cheating. Authorized teamwork. Unauthorized help from another person or having someone else write one’s paper or assignment is collusion. Cheating, plagiarism, and collusion are serious offenses resulting in an F grade and disciplinary action. ” MFIN 901 4

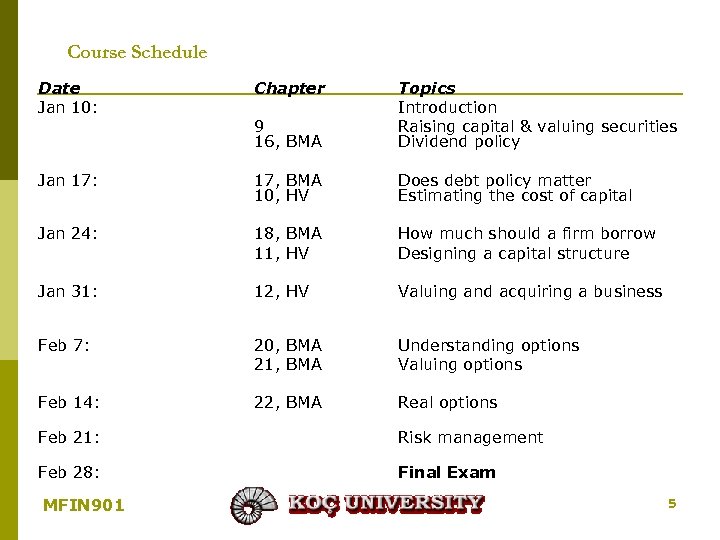

Course Schedule Date Jan 10: Chapter 9 16, BMA Topics Introduction Raising capital & valuing securities Dividend policy Jan 17: 17, BMA 10, HV Does debt policy matter Estimating the cost of capital Jan 24: 18, BMA 11, HV How much should a firm borrow Designing a capital structure Jan 31: 12, HV Valuing and acquiring a business Feb 7: 20, BMA 21, BMA Understanding options Valuing options Feb 14: 22, BMA Real options Feb 21: Risk management Feb 28: Final Exam MFIN 901 5

Course Schedule Date Jan 10: Chapter 9 16, BMA Topics Introduction Raising capital & valuing securities Dividend policy Jan 17: 17, BMA 10, HV Does debt policy matter Estimating the cost of capital Jan 24: 18, BMA 11, HV How much should a firm borrow Designing a capital structure Jan 31: 12, HV Valuing and acquiring a business Feb 7: 20, BMA 21, BMA Understanding options Valuing options Feb 14: 22, BMA Real options Feb 21: Risk management Feb 28: Final Exam MFIN 901 5

Pide A. Ş. p MFIN 901 Investments p Financing 6

Pide A. Ş. p MFIN 901 Investments p Financing 6

ASSETS LIABILITIES SHAREHOLDERS’ EQUITY Venture Capital MFIN 901 7

ASSETS LIABILITIES SHAREHOLDERS’ EQUITY Venture Capital MFIN 901 7

Venture Capital Money invested to finance a new firm MFIN 901 8

Venture Capital Money invested to finance a new firm MFIN 901 8

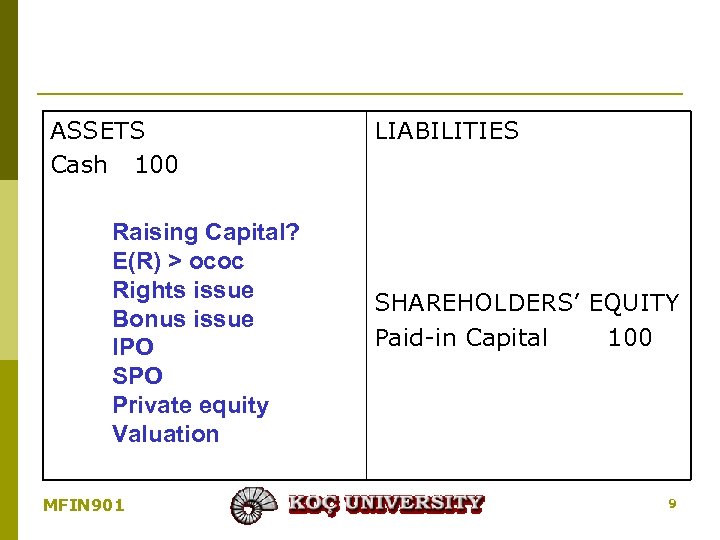

ASSETS Cash 100 Raising Capital? E(R) > ococ Rights issue Bonus issue IPO SPO Private equity Valuation MFIN 901 LIABILITIES SHAREHOLDERS’ EQUITY Paid-in Capital 100 9

ASSETS Cash 100 Raising Capital? E(R) > ococ Rights issue Bonus issue IPO SPO Private equity Valuation MFIN 901 LIABILITIES SHAREHOLDERS’ EQUITY Paid-in Capital 100 9

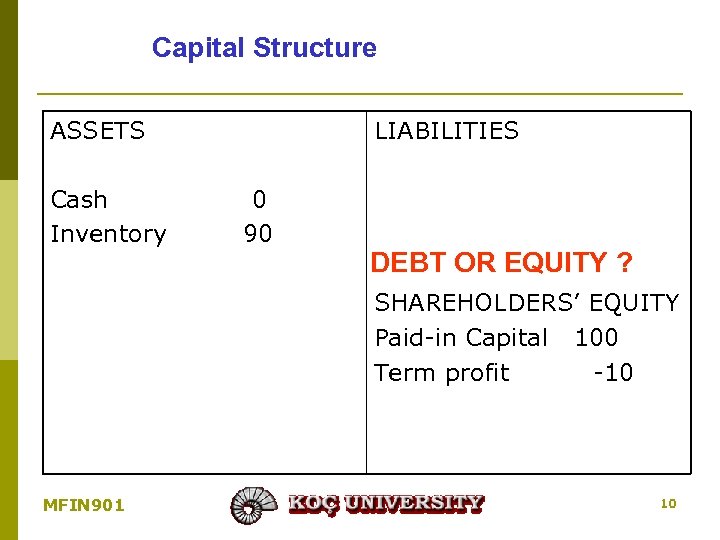

Capital Structure ASSETS Cash Inventory LIABILITIES 0 90 DEBT OR EQUITY ? SHAREHOLDERS’ EQUITY Paid-in Capital 100 Term profit -10 MFIN 901 10

Capital Structure ASSETS Cash Inventory LIABILITIES 0 90 DEBT OR EQUITY ? SHAREHOLDERS’ EQUITY Paid-in Capital 100 Term profit -10 MFIN 901 10

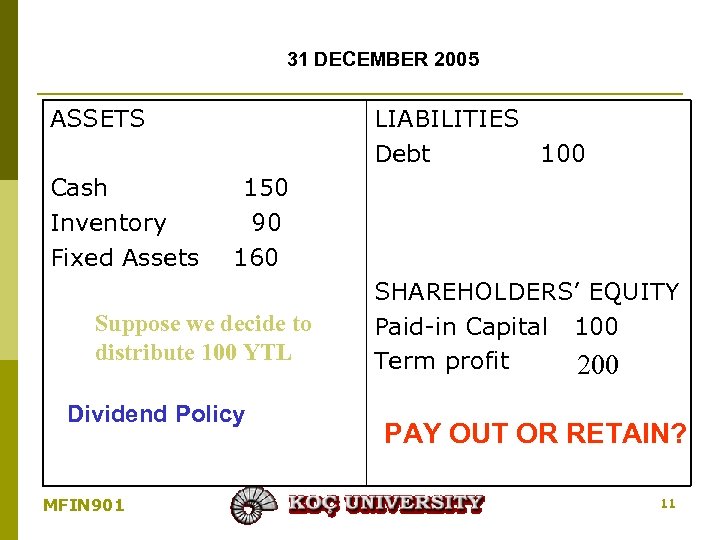

31 DECEMBER 2005 ASSETS Cash Inventory Fixed Assets LIABILITIES Debt 100 150 90 160 Suppose we decide to distribute 100 YTL Dividend Policy MFIN 901 SHAREHOLDERS’ EQUITY Paid-in Capital 100 Term profit -10 200 PAY OUT OR RETAIN? 11

31 DECEMBER 2005 ASSETS Cash Inventory Fixed Assets LIABILITIES Debt 100 150 90 160 Suppose we decide to distribute 100 YTL Dividend Policy MFIN 901 SHAREHOLDERS’ EQUITY Paid-in Capital 100 Term profit -10 200 PAY OUT OR RETAIN? 11

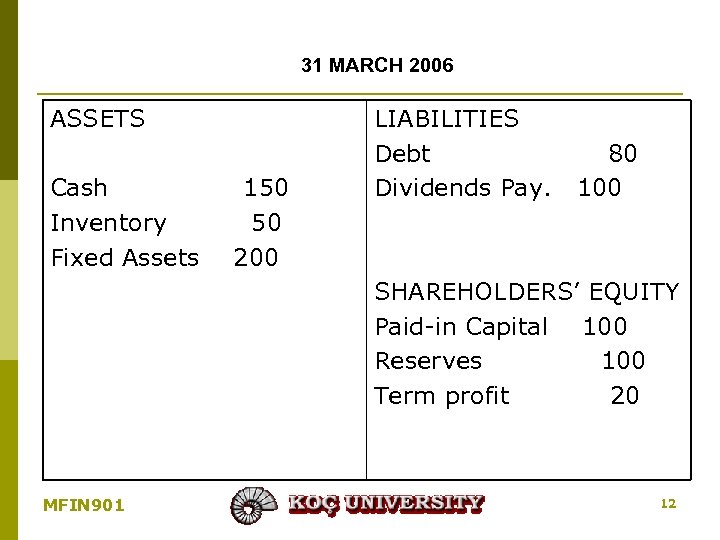

31 MARCH 2006 ASSETS Cash Inventory Fixed Assets 150 50 200 LIABILITIES Debt Dividends Pay. 80 100 SHAREHOLDERS’ EQUITY Paid-in Capital 100 Reserves 100 Term profit 20 MFIN 901 12

31 MARCH 2006 ASSETS Cash Inventory Fixed Assets 150 50 200 LIABILITIES Debt Dividends Pay. 80 100 SHAREHOLDERS’ EQUITY Paid-in Capital 100 Reserves 100 Term profit 20 MFIN 901 12

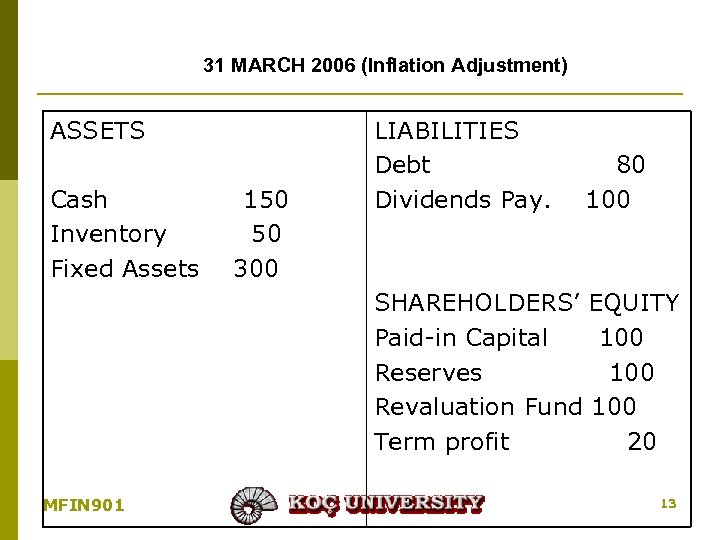

31 MARCH 2006 (Inflation Adjustment) ASSETS Cash Inventory Fixed Assets 150 50 300 LIABILITIES Debt Dividends Pay. 80 100 SHAREHOLDERS’ EQUITY Paid-in Capital 100 Reserves 100 Revaluation Fund 100 Term profit 20 MFIN 901 13

31 MARCH 2006 (Inflation Adjustment) ASSETS Cash Inventory Fixed Assets 150 50 300 LIABILITIES Debt Dividends Pay. 80 100 SHAREHOLDERS’ EQUITY Paid-in Capital 100 Reserves 100 Revaluation Fund 100 Term profit 20 MFIN 901 13

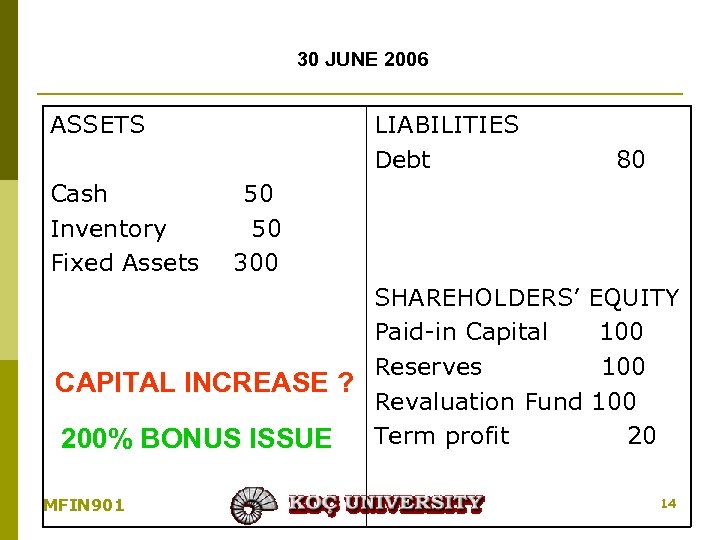

30 JUNE 2006 ASSETS Cash Inventory Fixed Assets LIABILITIES Debt 80 50 50 300 SHAREHOLDERS’ EQUITY Paid-in Capital 100 Reserves 100 CAPITAL INCREASE ? Revaluation Fund 100 20 200% BONUS ISSUE Term profit MFIN 901 14

30 JUNE 2006 ASSETS Cash Inventory Fixed Assets LIABILITIES Debt 80 50 50 300 SHAREHOLDERS’ EQUITY Paid-in Capital 100 Reserves 100 CAPITAL INCREASE ? Revaluation Fund 100 20 200% BONUS ISSUE Term profit MFIN 901 14

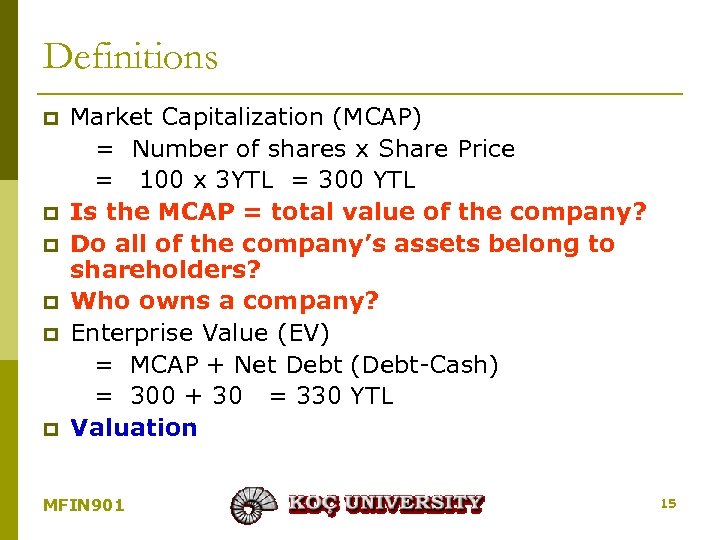

Definitions p p p Market Capitalization (MCAP) = Number of shares x Share Price = 100 x 3 YTL = 300 YTL Is the MCAP = total value of the company? Do all of the company’s assets belong to shareholders? Who owns a company? Enterprise Value (EV) = MCAP + Net Debt (Debt-Cash) = 300 + 30 = 330 YTL Valuation MFIN 901 15

Definitions p p p Market Capitalization (MCAP) = Number of shares x Share Price = 100 x 3 YTL = 300 YTL Is the MCAP = total value of the company? Do all of the company’s assets belong to shareholders? Who owns a company? Enterprise Value (EV) = MCAP + Net Debt (Debt-Cash) = 300 + 30 = 330 YTL Valuation MFIN 901 15

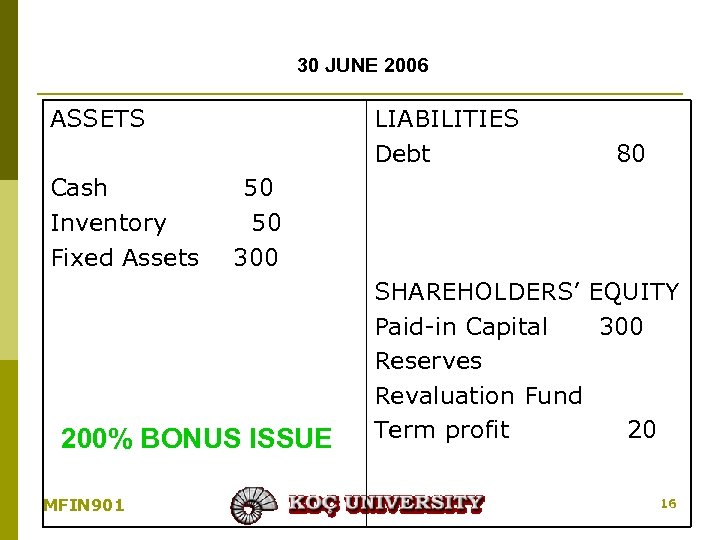

30 JUNE 2006 ASSETS Cash Inventory Fixed Assets LIABILITIES Debt 50 50 300 200% BONUS ISSUE MFIN 901 80 SHAREHOLDERS’ EQUITY Paid-in Capital 300 Reserves Revaluation Fund Term profit 20 16

30 JUNE 2006 ASSETS Cash Inventory Fixed Assets LIABILITIES Debt 50 50 300 200% BONUS ISSUE MFIN 901 80 SHAREHOLDERS’ EQUITY Paid-in Capital 300 Reserves Revaluation Fund Term profit 20 16

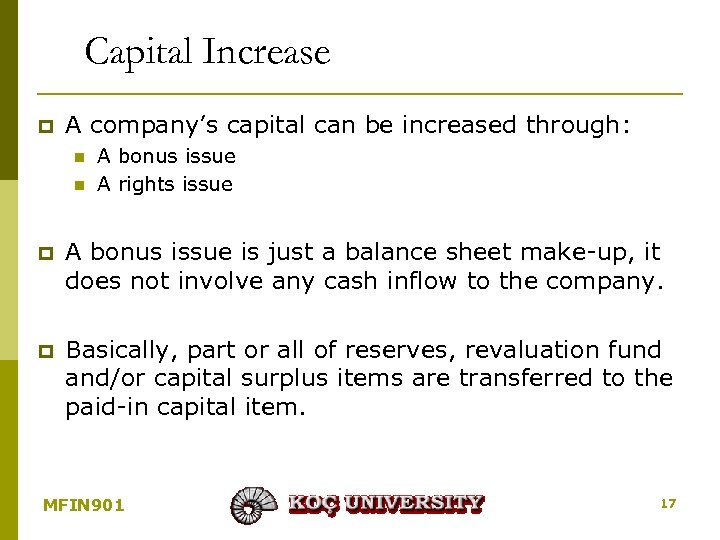

Capital Increase p A company’s capital can be increased through: n n A bonus issue A rights issue p A bonus issue is just a balance sheet make-up, it does not involve any cash inflow to the company. p Basically, part or all of reserves, revaluation fund and/or capital surplus items are transferred to the paid-in capital item. MFIN 901 17

Capital Increase p A company’s capital can be increased through: n n A bonus issue A rights issue p A bonus issue is just a balance sheet make-up, it does not involve any cash inflow to the company. p Basically, part or all of reserves, revaluation fund and/or capital surplus items are transferred to the paid-in capital item. MFIN 901 17

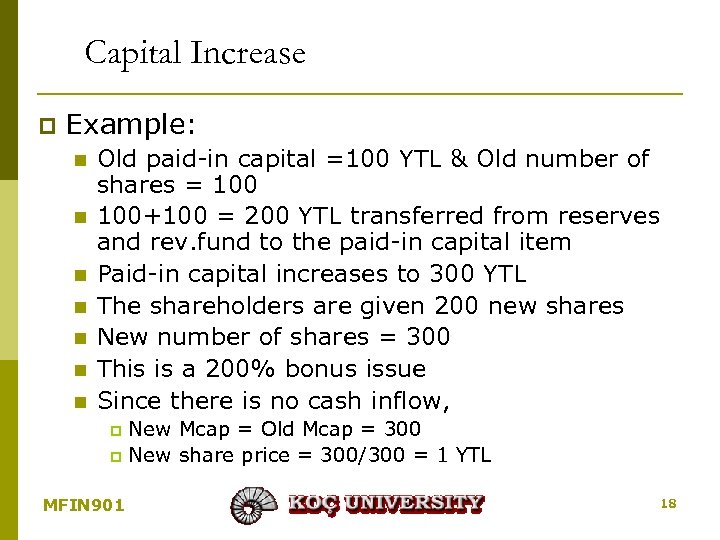

Capital Increase p Example: n n n n Old paid-in capital =100 YTL & Old number of shares = 100+100 = 200 YTL transferred from reserves and rev. fund to the paid-in capital item Paid-in capital increases to 300 YTL The shareholders are given 200 new shares New number of shares = 300 This is a 200% bonus issue Since there is no cash inflow, New Mcap = Old Mcap = 300 p New share price = 300/300 = 1 YTL p MFIN 901 18

Capital Increase p Example: n n n n Old paid-in capital =100 YTL & Old number of shares = 100+100 = 200 YTL transferred from reserves and rev. fund to the paid-in capital item Paid-in capital increases to 300 YTL The shareholders are given 200 new shares New number of shares = 300 This is a 200% bonus issue Since there is no cash inflow, New Mcap = Old Mcap = 300 p New share price = 300/300 = 1 YTL p MFIN 901 18

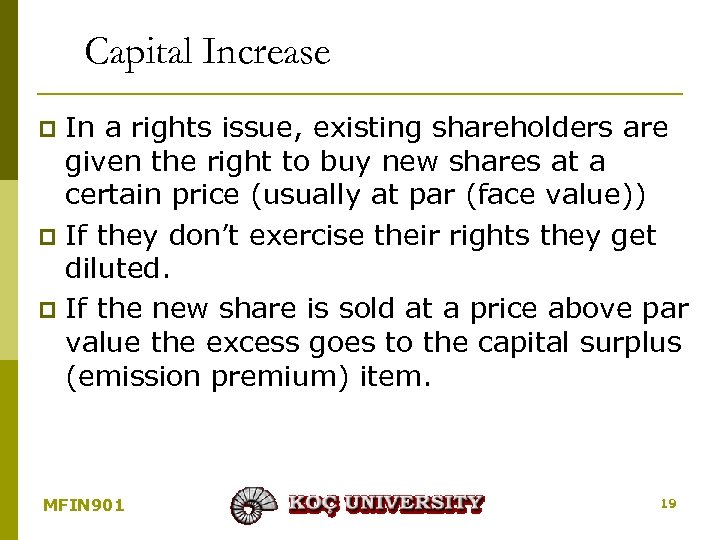

Capital Increase In a rights issue, existing shareholders are given the right to buy new shares at a certain price (usually at par (face value)) p If they don’t exercise their rights they get diluted. p If the new share is sold at a price above par value the excess goes to the capital surplus (emission premium) item. p MFIN 901 19

Capital Increase In a rights issue, existing shareholders are given the right to buy new shares at a certain price (usually at par (face value)) p If they don’t exercise their rights they get diluted. p If the new share is sold at a price above par value the excess goes to the capital surplus (emission premium) item. p MFIN 901 19

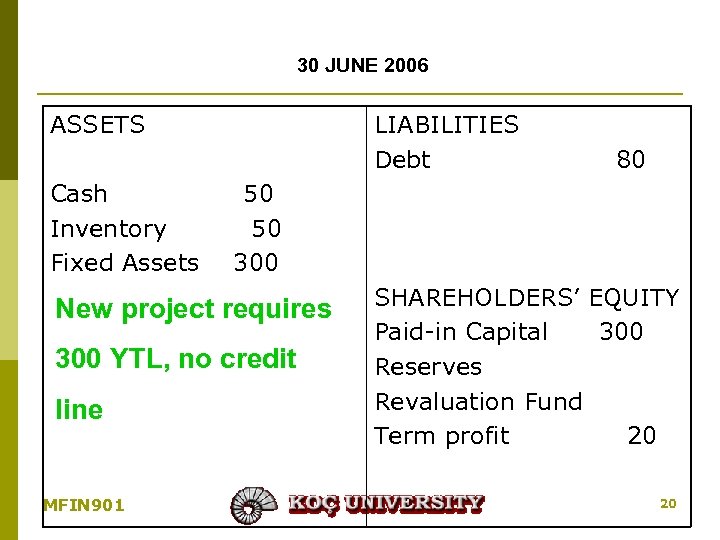

30 JUNE 2006 ASSETS Cash Inventory Fixed Assets LIABILITIES Debt 50 50 300 New project requires 300 YTL, no credit line MFIN 901 80 SHAREHOLDERS’ EQUITY Paid-in Capital 300 Reserves Revaluation Fund Term profit 20 20

30 JUNE 2006 ASSETS Cash Inventory Fixed Assets LIABILITIES Debt 50 50 300 New project requires 300 YTL, no credit line MFIN 901 80 SHAREHOLDERS’ EQUITY Paid-in Capital 300 Reserves Revaluation Fund Term profit 20 20

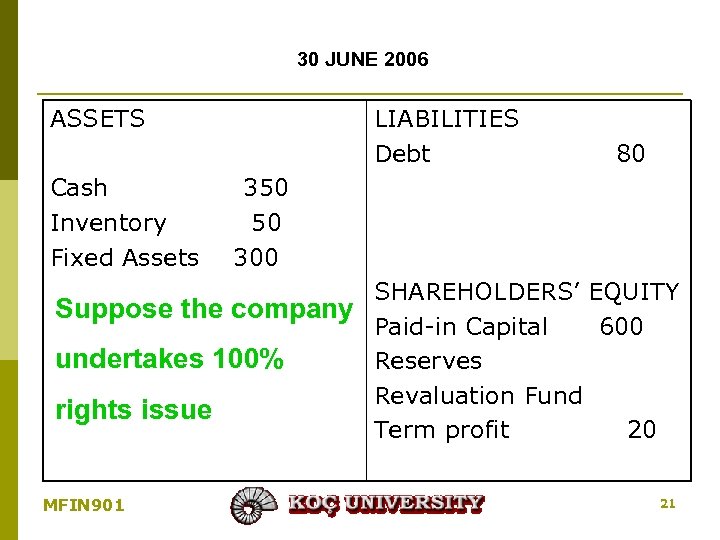

30 JUNE 2006 ASSETS Cash Inventory Fixed Assets LIABILITIES Debt 80 350 50 300 SHAREHOLDERS’ EQUITY Suppose the company Paid-in Capital 600 undertakes 100% Reserves Revaluation Fund rights issue Term profit 20 MFIN 901 21

30 JUNE 2006 ASSETS Cash Inventory Fixed Assets LIABILITIES Debt 80 350 50 300 SHAREHOLDERS’ EQUITY Suppose the company Paid-in Capital 600 undertakes 100% Reserves Revaluation Fund rights issue Term profit 20 MFIN 901 21

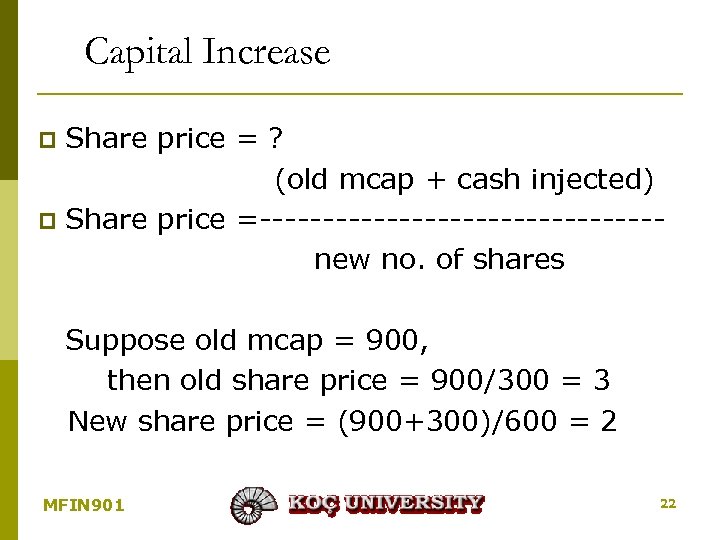

Capital Increase Share price = ? (old mcap + cash injected) p Share price =----------------new no. of shares p Suppose old mcap = 900, then old share price = 900/300 = 3 New share price = (900+300)/600 = 2 MFIN 901 22

Capital Increase Share price = ? (old mcap + cash injected) p Share price =----------------new no. of shares p Suppose old mcap = 900, then old share price = 900/300 = 3 New share price = (900+300)/600 = 2 MFIN 901 22

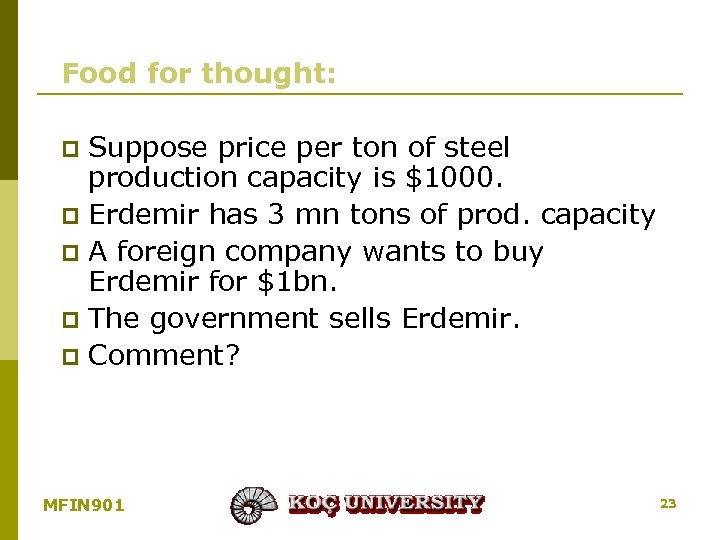

Food for thought: Suppose price per ton of steel production capacity is $1000. p Erdemir has 3 mn tons of prod. capacity p A foreign company wants to buy Erdemir for $1 bn. p The government sells Erdemir. p Comment? p MFIN 901 23

Food for thought: Suppose price per ton of steel production capacity is $1000. p Erdemir has 3 mn tons of prod. capacity p A foreign company wants to buy Erdemir for $1 bn. p The government sells Erdemir. p Comment? p MFIN 901 23

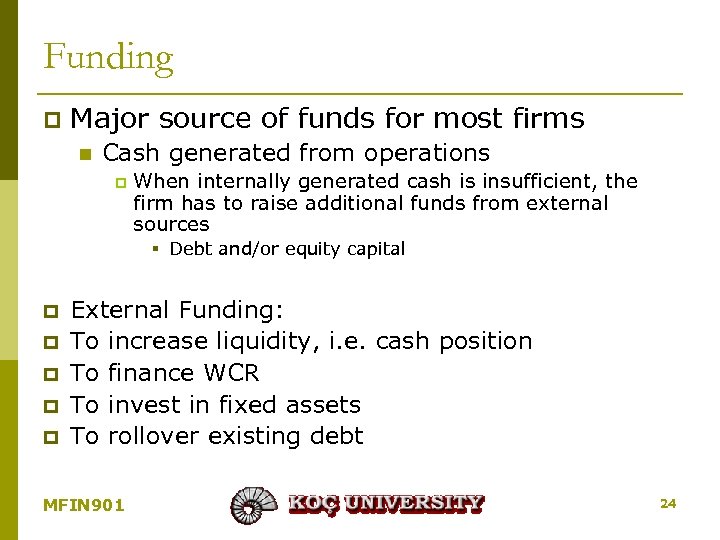

Funding p Major source of funds for most firms n Cash generated from operations p When internally generated cash is insufficient, the firm has to raise additional funds from external sources § Debt and/or equity capital p p p External Funding: To increase liquidity, i. e. cash position To finance WCR To invest in fixed assets To rollover existing debt MFIN 901 24

Funding p Major source of funds for most firms n Cash generated from operations p When internally generated cash is insufficient, the firm has to raise additional funds from external sources § Debt and/or equity capital p p p External Funding: To increase liquidity, i. e. cash position To finance WCR To invest in fixed assets To rollover existing debt MFIN 901 24

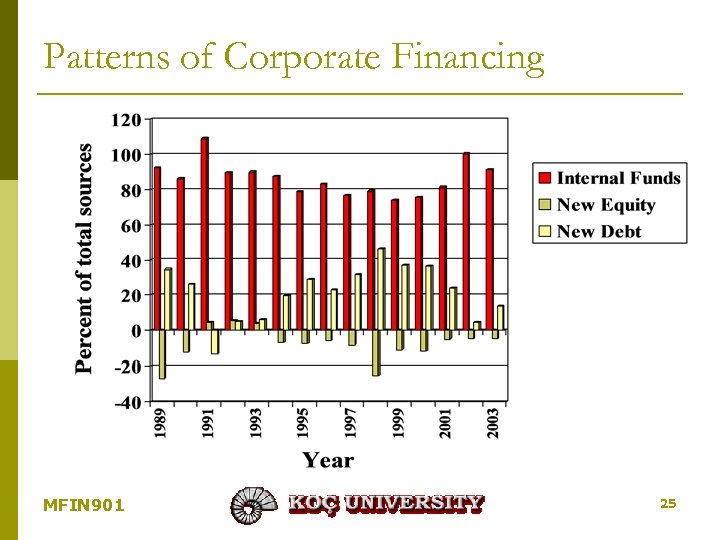

Patterns of Corporate Financing MFIN 901 25

Patterns of Corporate Financing MFIN 901 25

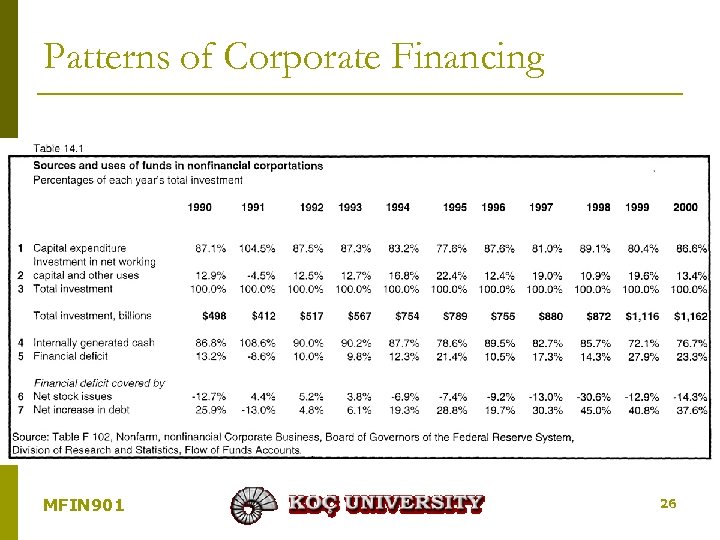

Patterns of Corporate Financing MFIN 901 26

Patterns of Corporate Financing MFIN 901 26

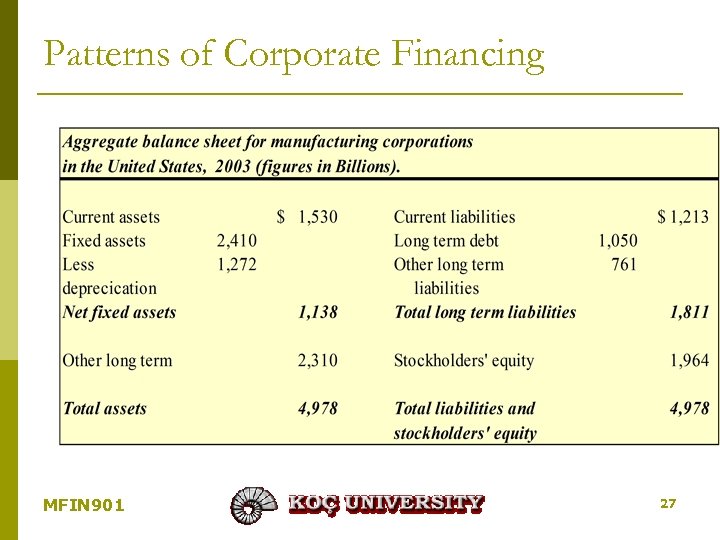

Patterns of Corporate Financing MFIN 901 27

Patterns of Corporate Financing MFIN 901 27

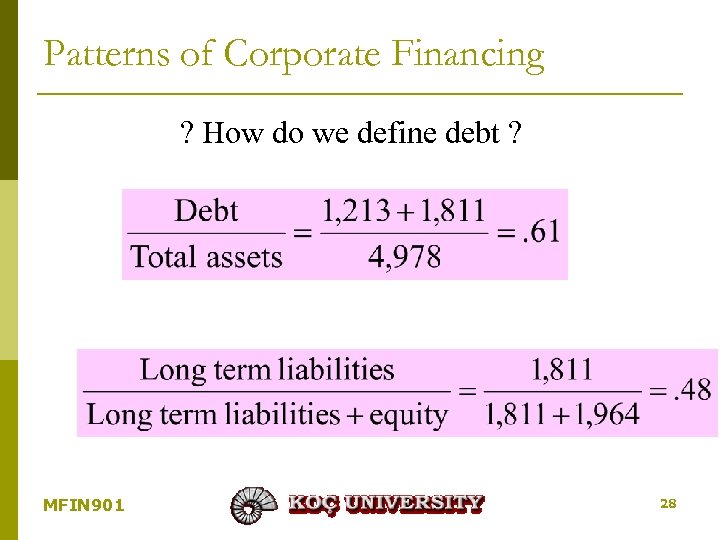

Patterns of Corporate Financing ? How do we define debt ? MFIN 901 28

Patterns of Corporate Financing ? How do we define debt ? MFIN 901 28

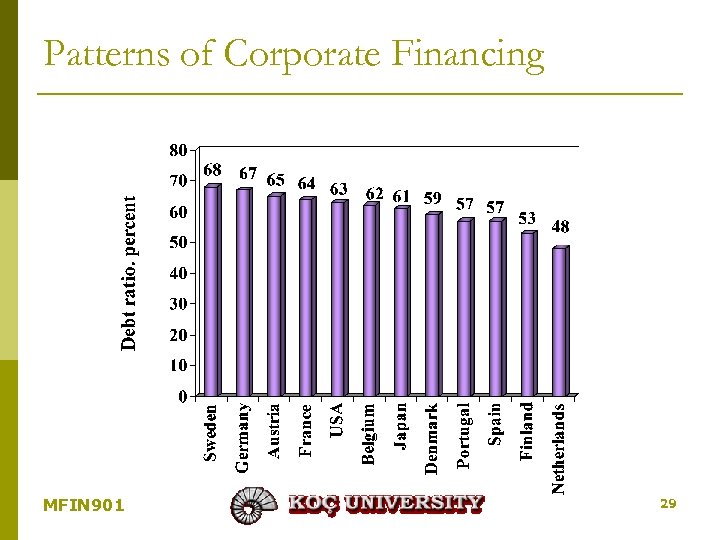

Patterns of Corporate Financing MFIN 901 29

Patterns of Corporate Financing MFIN 901 29

The Financial System: Its Structure and Functions p Financial system n The institutions and processes that facilitate the transfer of funds between the suppliers of capital and firms that need cash p MFIN 901 Most cash surplus is provided by the household sector 30

The Financial System: Its Structure and Functions p Financial system n The institutions and processes that facilitate the transfer of funds between the suppliers of capital and firms that need cash p MFIN 901 Most cash surplus is provided by the household sector 30

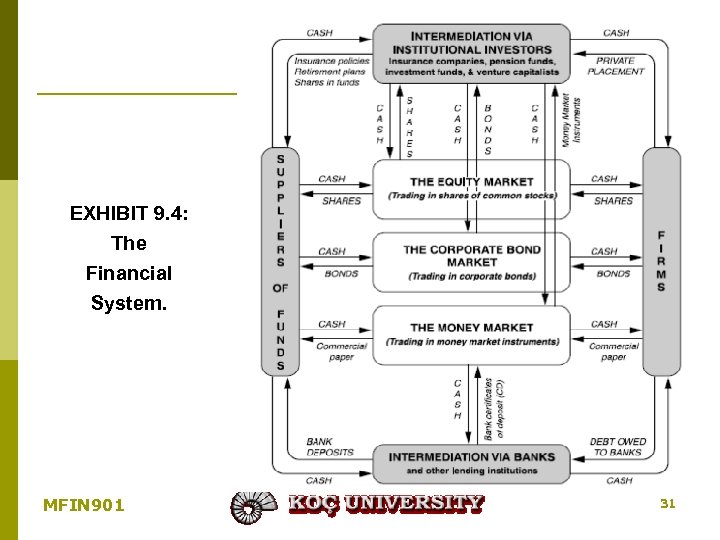

EXHIBIT 9. 4: The Financial System. MFIN 901 31

EXHIBIT 9. 4: The Financial System. MFIN 901 31

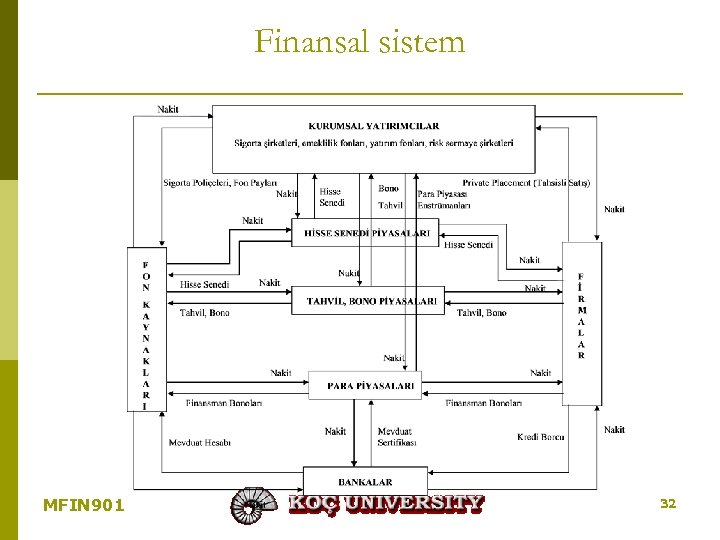

Finansal sistem MFIN 901 32

Finansal sistem MFIN 901 32

Securities Markets p Securities markets, shown in the center of Exhibit 9. 4, can be classified along several dimensions n n Primary or secondary markets Equity or debt markets Organized or over-the-counter markets Domestic or international markets MFIN 901 33

Securities Markets p Securities markets, shown in the center of Exhibit 9. 4, can be classified along several dimensions n n Primary or secondary markets Equity or debt markets Organized or over-the-counter markets Domestic or international markets MFIN 901 33

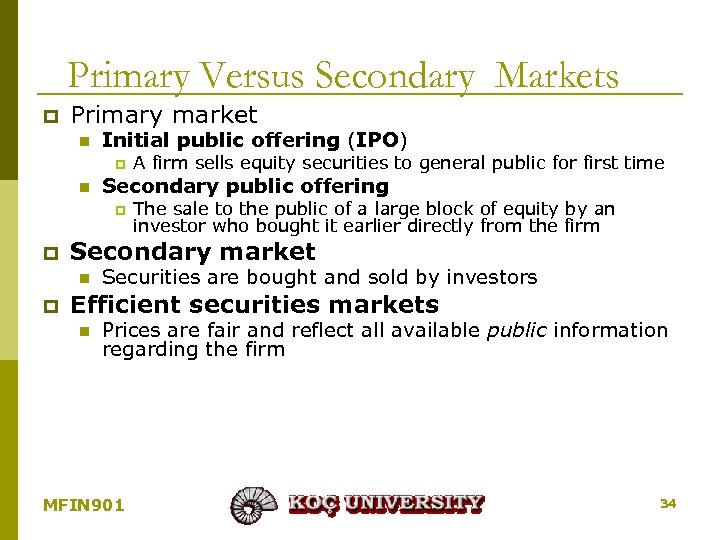

Primary Versus Secondary Markets p Primary market n Initial public offering (IPO) p n Secondary public offering p p The sale to the public of a large block of equity by an investor who bought it earlier directly from the firm Secondary market n p A firm sells equity securities to general public for first time Securities are bought and sold by investors Efficient securities markets n Prices are fair and reflect all available public information regarding the firm MFIN 901 34

Primary Versus Secondary Markets p Primary market n Initial public offering (IPO) p n Secondary public offering p p The sale to the public of a large block of equity by an investor who bought it earlier directly from the firm Secondary market n p A firm sells equity securities to general public for first time Securities are bought and sold by investors Efficient securities markets n Prices are fair and reflect all available public information regarding the firm MFIN 901 34

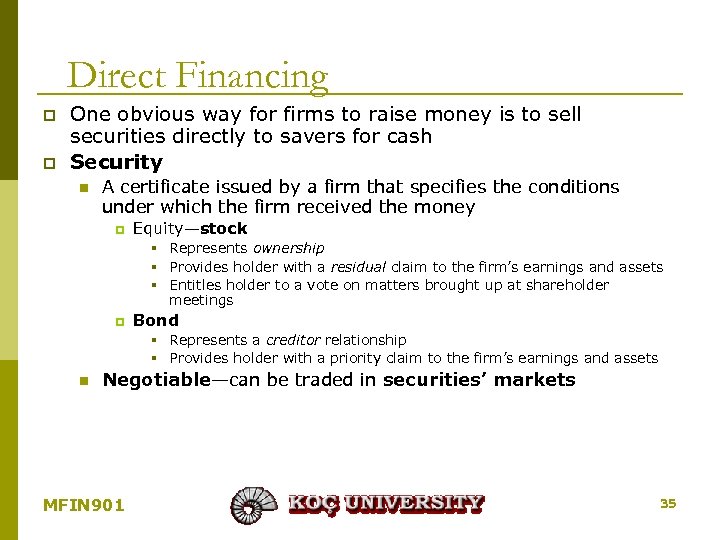

Direct Financing p p One obvious way for firms to raise money is to sell securities directly to savers for cash Security n A certificate issued by a firm that specifies the conditions under which the firm received the money p Equity—stock § Represents ownership § Provides holder with a residual claim to the firm’s earnings and assets § Entitles holder to a vote on matters brought up at shareholder meetings p Bond § Represents a creditor relationship § Provides holder with a priority claim to the firm’s earnings and assets n Negotiable—can be traded in securities’ markets MFIN 901 35

Direct Financing p p One obvious way for firms to raise money is to sell securities directly to savers for cash Security n A certificate issued by a firm that specifies the conditions under which the firm received the money p Equity—stock § Represents ownership § Provides holder with a residual claim to the firm’s earnings and assets § Entitles holder to a vote on matters brought up at shareholder meetings p Bond § Represents a creditor relationship § Provides holder with a priority claim to the firm’s earnings and assets n Negotiable—can be traded in securities’ markets MFIN 901 35

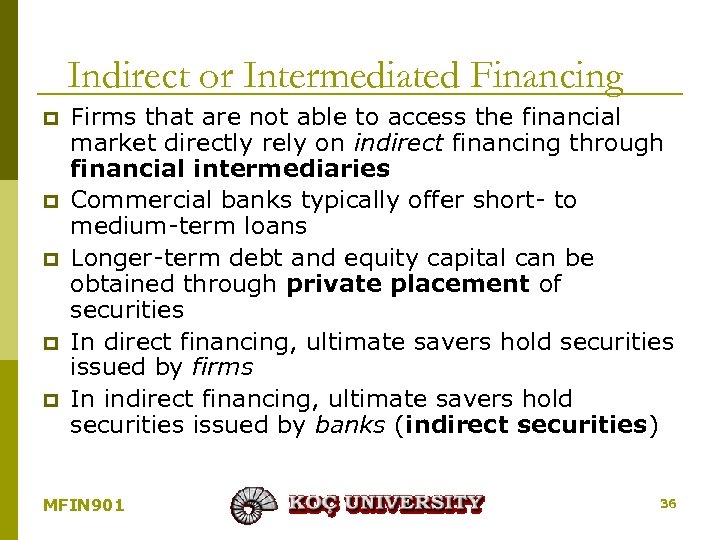

Indirect or Intermediated Financing p p p Firms that are not able to access the financial market directly rely on indirect financing through financial intermediaries Commercial banks typically offer short- to medium-term loans Longer-term debt and equity capital can be obtained through private placement of securities In direct financing, ultimate savers hold securities issued by firms In indirect financing, ultimate savers hold securities issued by banks (indirect securities) MFIN 901 36

Indirect or Intermediated Financing p p p Firms that are not able to access the financial market directly rely on indirect financing through financial intermediaries Commercial banks typically offer short- to medium-term loans Longer-term debt and equity capital can be obtained through private placement of securities In direct financing, ultimate savers hold securities issued by firms In indirect financing, ultimate savers hold securities issued by banks (indirect securities) MFIN 901 36

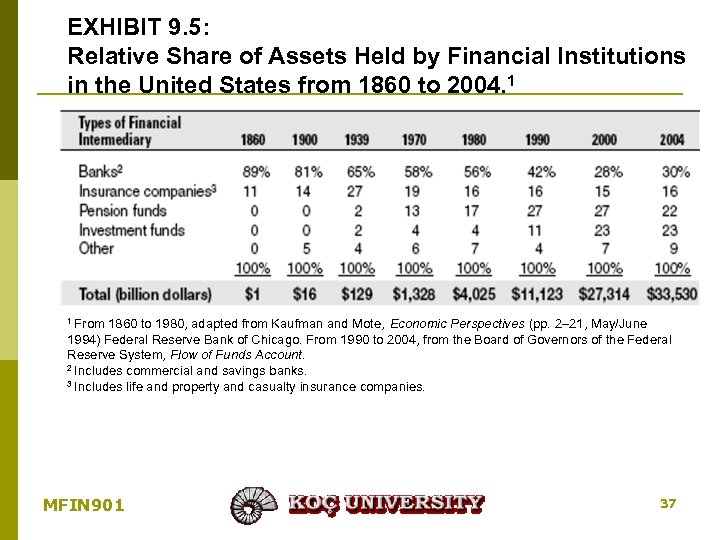

EXHIBIT 9. 5: Relative Share of Assets Held by Financial Institutions in the United States from 1860 to 2004. 1 1 From 1860 to 1980, adapted from Kaufman and Mote, Economic Perspectives (pp. 2– 21, May/June 1994) Federal Reserve Bank of Chicago. From 1990 to 2004, from the Board of Governors of the Federal Reserve System, Flow of Funds Account. 2 Includes commercial and savings banks. 3 Includes life and property and casualty insurance companies. MFIN 901 37

EXHIBIT 9. 5: Relative Share of Assets Held by Financial Institutions in the United States from 1860 to 2004. 1 1 From 1860 to 1980, adapted from Kaufman and Mote, Economic Perspectives (pp. 2– 21, May/June 1994) Federal Reserve Bank of Chicago. From 1990 to 2004, from the Board of Governors of the Federal Reserve System, Flow of Funds Account. 2 Includes commercial and savings banks. 3 Includes life and property and casualty insurance companies. MFIN 901 37

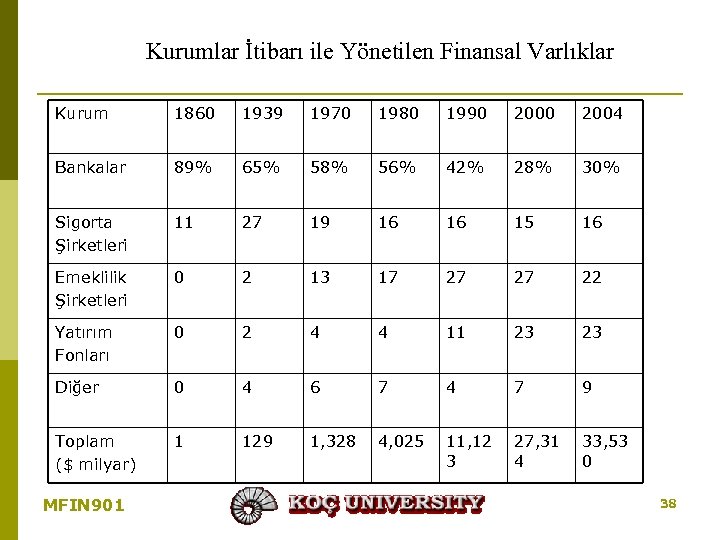

Kurumlar İtibarı ile Yönetilen Finansal Varlıklar Kurum 1860 1939 1970 1980 1990 2004 Bankalar 89% 65% 58% 56% 42% 28% 30% Sigorta Şirketleri 11 27 19 16 16 15 16 Emeklilik Şirketleri 0 2 13 17 27 27 22 Yatırım Fonları 0 2 4 4 11 23 23 Diğer 0 4 6 7 4 7 9 Toplam ($ milyar) 1 129 1, 328 4, 025 11, 12 3 27, 31 4 33, 53 0 MFIN 901 38

Kurumlar İtibarı ile Yönetilen Finansal Varlıklar Kurum 1860 1939 1970 1980 1990 2004 Bankalar 89% 65% 58% 56% 42% 28% 30% Sigorta Şirketleri 11 27 19 16 16 15 16 Emeklilik Şirketleri 0 2 13 17 27 27 22 Yatırım Fonları 0 2 4 4 11 23 23 Diğer 0 4 6 7 4 7 9 Toplam ($ milyar) 1 129 1, 328 4, 025 11, 12 3 27, 31 4 33, 53 0 MFIN 901 38

How Corporations Issue Securities p If the company owners have necessary capital then they can go for a: Rights issue Those shares unexercised, will be exercised by other shareholders in the pre-emptive rights market. (Rüçhan hakkı pazarı) p If shareholders does not have adequate capital and either does not want to go public or the company is not big enough to go public, then a: Private placement can take place. p If shareholders does not have adequate capital or they want to go public (to have a tradeable security), then an: Initial public offering (IPO) can take place. p If the company is already public then this becomes an SPO, secondary public offering. MFIN 901 39

How Corporations Issue Securities p If the company owners have necessary capital then they can go for a: Rights issue Those shares unexercised, will be exercised by other shareholders in the pre-emptive rights market. (Rüçhan hakkı pazarı) p If shareholders does not have adequate capital and either does not want to go public or the company is not big enough to go public, then a: Private placement can take place. p If shareholders does not have adequate capital or they want to go public (to have a tradeable security), then an: Initial public offering (IPO) can take place. p If the company is already public then this becomes an SPO, secondary public offering. MFIN 901 39

In an IPO either existing shareholders can sell their stake (cash offer) or increase capital of the company and sell the new shares (restricted rights issue). p A public issue has to be registered by the CMB, and involves significant costs. p Shares can be sold at a premium. (Share premium/surplus) p MFIN 901 40

In an IPO either existing shareholders can sell their stake (cash offer) or increase capital of the company and sell the new shares (restricted rights issue). p A public issue has to be registered by the CMB, and involves significant costs. p Shares can be sold at a premium. (Share premium/surplus) p MFIN 901 40

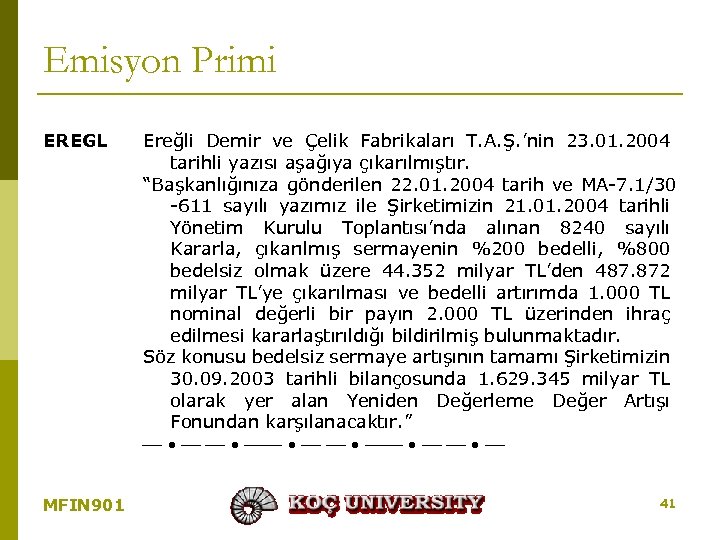

Emisyon Primi EREGL MFIN 901 Ereğli Demir ve Çelik Fabrikaları T. A. Ş. ’nin 23. 01. 2004 tarihli yazısı aşağıya çıkarılmıştır. “Başkanlığınıza gönderilen 22. 01. 2004 tarih ve MA-7. 1/30 -611 sayılı yazımız ile Şirketimizin 21. 01. 2004 tarihli Yönetim Kurulu Toplantısı’nda alınan 8240 sayılı Kararla, çıkarılmış sermayenin %200 bedelli, %800 bedelsiz olmak üzere 44. 352 milyar TL’den 487. 872 milyar TL’ye çıkarılması ve bedelli artırımda 1. 000 TL nominal değerli bir payın 2. 000 TL üzerinden ihraç edilmesi kararlaştırıldığı bildirilmiş bulunmaktadır. Söz konusu bedelsiz sermaye artışının tamamı Şirketimizin 30. 09. 2003 tarihli bilançosunda 1. 629. 345 milyar TL olarak yer alan Yeniden Değerleme Değer Artışı Fonundan karşılanacaktır. ” 41

Emisyon Primi EREGL MFIN 901 Ereğli Demir ve Çelik Fabrikaları T. A. Ş. ’nin 23. 01. 2004 tarihli yazısı aşağıya çıkarılmıştır. “Başkanlığınıza gönderilen 22. 01. 2004 tarih ve MA-7. 1/30 -611 sayılı yazımız ile Şirketimizin 21. 01. 2004 tarihli Yönetim Kurulu Toplantısı’nda alınan 8240 sayılı Kararla, çıkarılmış sermayenin %200 bedelli, %800 bedelsiz olmak üzere 44. 352 milyar TL’den 487. 872 milyar TL’ye çıkarılması ve bedelli artırımda 1. 000 TL nominal değerli bir payın 2. 000 TL üzerinden ihraç edilmesi kararlaştırıldığı bildirilmiş bulunmaktadır. Söz konusu bedelsiz sermaye artışının tamamı Şirketimizin 30. 09. 2003 tarihli bilançosunda 1. 629. 345 milyar TL olarak yer alan Yeniden Değerleme Değer Artışı Fonundan karşılanacaktır. ” 41

Public offerings Underwriters: 1) Provide procedural and financial advice. 2) Buy the security from the firm at a price less than the offering price. 3) Sell it at the offering price. p The difference is called underwriters' spread, and represents compensation for the underwriters' services. p Fixed commitment : Underwriter guarantees the sale of entire issue. p Best effort: Underwriter promises to do his best. p All or nothing: If all of the issue can't be sold, the issue is cancelled. p Rights issues are much cheaper than underwritten issues. p MFIN 901 42

Public offerings Underwriters: 1) Provide procedural and financial advice. 2) Buy the security from the firm at a price less than the offering price. 3) Sell it at the offering price. p The difference is called underwriters' spread, and represents compensation for the underwriters' services. p Fixed commitment : Underwriter guarantees the sale of entire issue. p Best effort: Underwriter promises to do his best. p All or nothing: If all of the issue can't be sold, the issue is cancelled. p Rights issues are much cheaper than underwritten issues. p MFIN 901 42

Public offerings p p p Setting the offering price too low guarantees the success of the issue, but this is an additional, hidden cost to the shareholders. (Fig 15. 2, p. 393) Surely the shareholders lose. They sell claims to the firm for less than its value. The underwriter reduces its chance to get another issue. Investors who try to buy underpriced shares may or may not benefit, since only good customers may be able buy underpriced shares, and to be a good customer you may have to generate commission fees for your brokerage firm. In an IPO you will end up receiving small amount of cheap issues and large amount of unsubscribed issues. (winner’s curse) MFIN 901 43

Public offerings p p p Setting the offering price too low guarantees the success of the issue, but this is an additional, hidden cost to the shareholders. (Fig 15. 2, p. 393) Surely the shareholders lose. They sell claims to the firm for less than its value. The underwriter reduces its chance to get another issue. Investors who try to buy underpriced shares may or may not benefit, since only good customers may be able buy underpriced shares, and to be a good customer you may have to generate commission fees for your brokerage firm. In an IPO you will end up receiving small amount of cheap issues and large amount of unsubscribed issues. (winner’s curse) MFIN 901 43

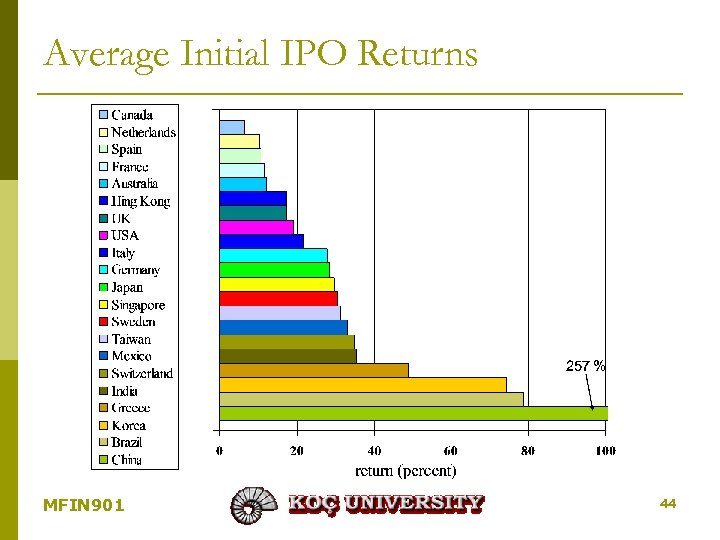

Average Initial IPO Returns MFIN 901 44

Average Initial IPO Returns MFIN 901 44

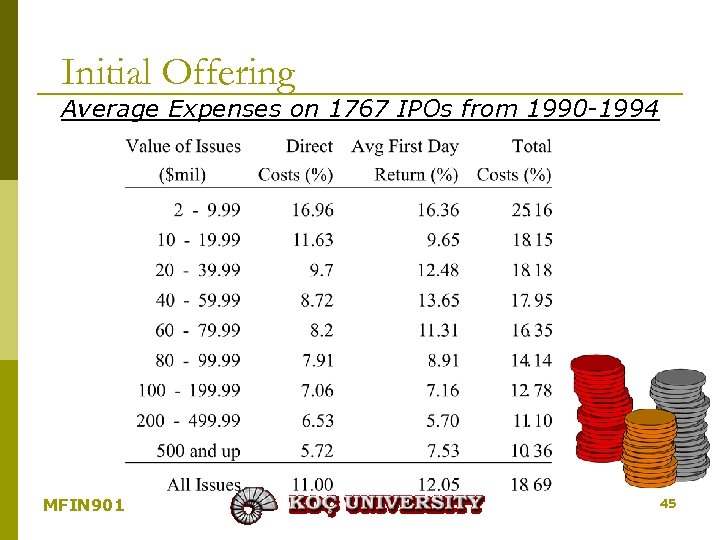

Initial Offering Average Expenses on 1767 IPOs from 1990 -1994 MFIN 901 45

Initial Offering Average Expenses on 1767 IPOs from 1990 -1994 MFIN 901 45

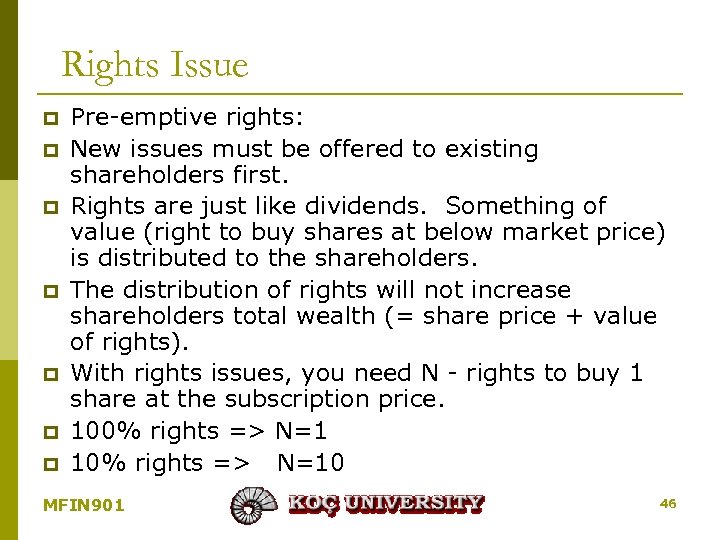

Rights Issue p p p p Pre-emptive rights: New issues must be offered to existing shareholders first. Rights are just like dividends. Something of value (right to buy shares at below market price) is distributed to the shareholders. The distribution of rights will not increase shareholders total wealth (= share price + value of rights). With rights issues, you need N - rights to buy 1 share at the subscription price. 100% rights => N=1 10% rights => N=10 MFIN 901 46

Rights Issue p p p p Pre-emptive rights: New issues must be offered to existing shareholders first. Rights are just like dividends. Something of value (right to buy shares at below market price) is distributed to the shareholders. The distribution of rights will not increase shareholders total wealth (= share price + value of rights). With rights issues, you need N - rights to buy 1 share at the subscription price. 100% rights => N=1 10% rights => N=10 MFIN 901 46

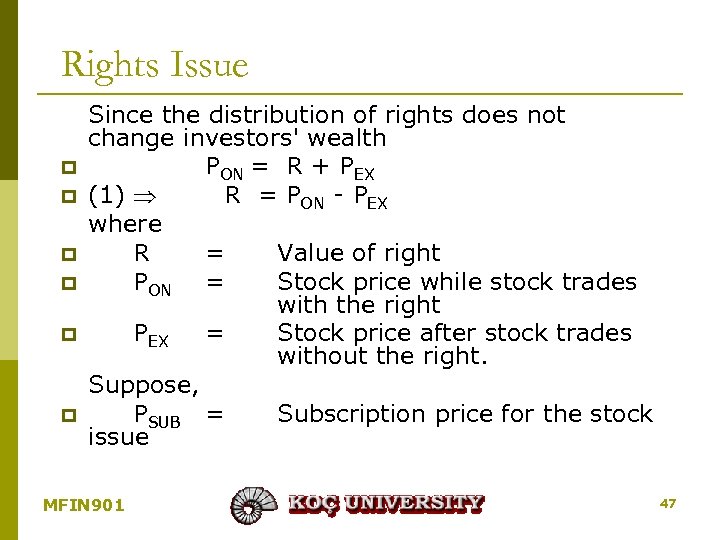

Rights Issue p p p Since the distribution of rights does not change investors' wealth PON = R + PEX (1) R = PON - PEX where R = Value of right PON = Stock price while stock trades with the right PEX = Stock price after stock trades without the right. Suppose, PSUB = Subscription price for the stock issue MFIN 901 47

Rights Issue p p p Since the distribution of rights does not change investors' wealth PON = R + PEX (1) R = PON - PEX where R = Value of right PON = Stock price while stock trades with the right PEX = Stock price after stock trades without the right. Suppose, PSUB = Subscription price for the stock issue MFIN 901 47

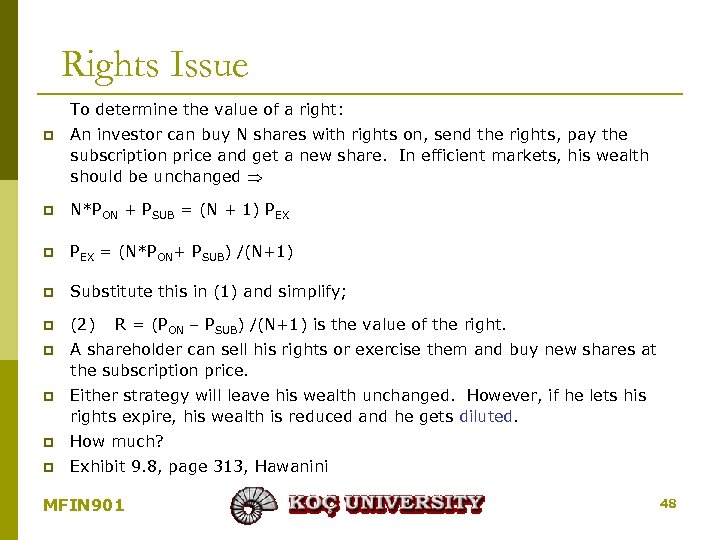

Rights Issue To determine the value of a right: p An investor can buy N shares with rights on, send the rights, pay the subscription price and get a new share. In efficient markets, his wealth should be unchanged p N*PON + PSUB = (N + 1) PEX p PEX = (N*PON+ PSUB) /(N+1) p Substitute this in (1) and simplify; p (2) p A shareholder can sell his rights or exercise them and buy new shares at the subscription price. p Either strategy will leave his wealth unchanged. However, if he lets his rights expire, his wealth is reduced and he gets diluted. p How much? p Exhibit 9. 8, page 313, Hawanini R = (PON – PSUB) /(N+1) is the value of the right. MFIN 901 48

Rights Issue To determine the value of a right: p An investor can buy N shares with rights on, send the rights, pay the subscription price and get a new share. In efficient markets, his wealth should be unchanged p N*PON + PSUB = (N + 1) PEX p PEX = (N*PON+ PSUB) /(N+1) p Substitute this in (1) and simplify; p (2) p A shareholder can sell his rights or exercise them and buy new shares at the subscription price. p Either strategy will leave his wealth unchanged. However, if he lets his rights expire, his wealth is reduced and he gets diluted. p How much? p Exhibit 9. 8, page 313, Hawanini R = (PON – PSUB) /(N+1) is the value of the right. MFIN 901 48

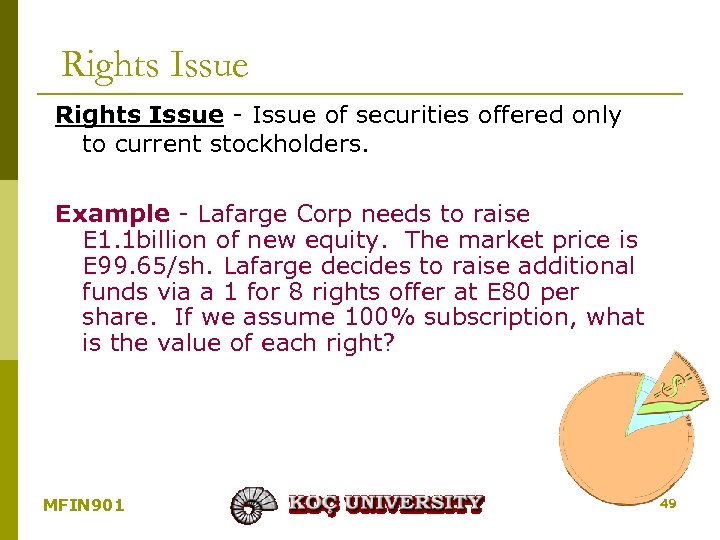

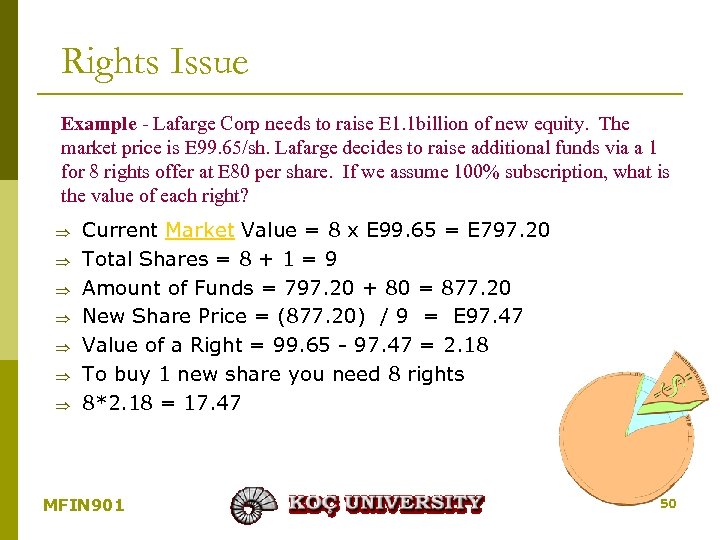

Rights Issue - Issue of securities offered only to current stockholders. Example - Lafarge Corp needs to raise E 1. 1 billion of new equity. The market price is E 99. 65/sh. Lafarge decides to raise additional funds via a 1 for 8 rights offer at E 80 per share. If we assume 100% subscription, what is the value of each right? MFIN 901 49

Rights Issue - Issue of securities offered only to current stockholders. Example - Lafarge Corp needs to raise E 1. 1 billion of new equity. The market price is E 99. 65/sh. Lafarge decides to raise additional funds via a 1 for 8 rights offer at E 80 per share. If we assume 100% subscription, what is the value of each right? MFIN 901 49

Rights Issue Example - Lafarge Corp needs to raise E 1. 1 billion of new equity. The market price is E 99. 65/sh. Lafarge decides to raise additional funds via a 1 for 8 rights offer at E 80 per share. If we assume 100% subscription, what is the value of each right? Current Market Value = 8 x E 99. 65 = E 797. 20 Total Shares = 8 + 1 = 9 Amount of Funds = 797. 20 + 80 = 877. 20 New Share Price = (877. 20) / 9 = E 97. 47 Value of a Right = 99. 65 - 97. 47 = 2. 18 To buy 1 new share you need 8 rights 8*2. 18 = 17. 47 MFIN 901 50

Rights Issue Example - Lafarge Corp needs to raise E 1. 1 billion of new equity. The market price is E 99. 65/sh. Lafarge decides to raise additional funds via a 1 for 8 rights offer at E 80 per share. If we assume 100% subscription, what is the value of each right? Current Market Value = 8 x E 99. 65 = E 797. 20 Total Shares = 8 + 1 = 9 Amount of Funds = 797. 20 + 80 = 877. 20 New Share Price = (877. 20) / 9 = E 97. 47 Value of a Right = 99. 65 - 97. 47 = 2. 18 To buy 1 new share you need 8 rights 8*2. 18 = 17. 47 MFIN 901 50

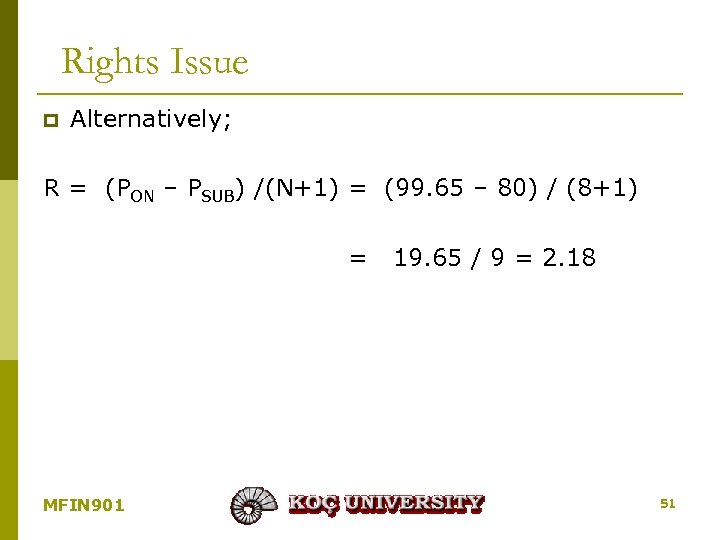

Rights Issue p Alternatively; R = (PON – PSUB) /(N+1) = (99. 65 – 80) / (8+1) = MFIN 901 19. 65 / 9 = 2. 18 51

Rights Issue p Alternatively; R = (PON – PSUB) /(N+1) = (99. 65 – 80) / (8+1) = MFIN 901 19. 65 / 9 = 2. 18 51

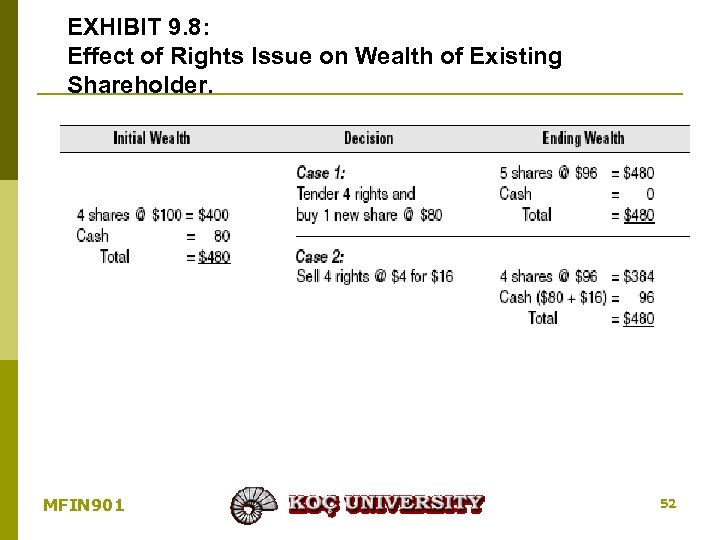

EXHIBIT 9. 8: Effect of Rights Issue on Wealth of Existing Shareholder. MFIN 901 52

EXHIBIT 9. 8: Effect of Rights Issue on Wealth of Existing Shareholder. MFIN 901 52

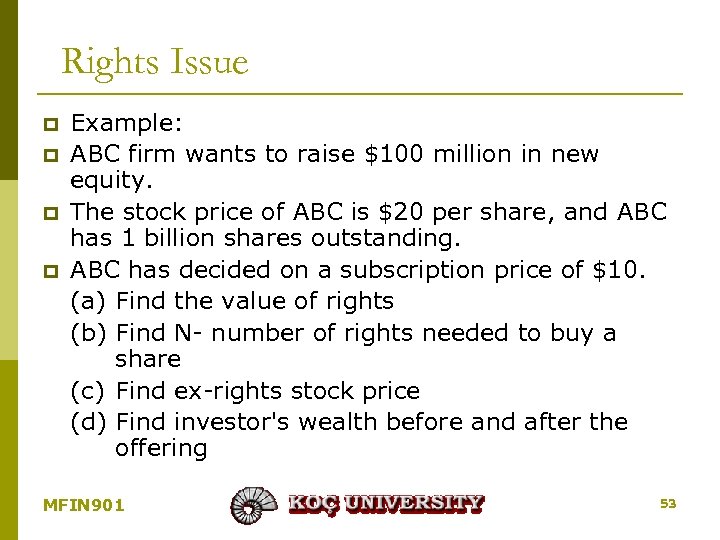

Rights Issue p p Example: ABC firm wants to raise $100 million in new equity. The stock price of ABC is $20 per share, and ABC has 1 billion shares outstanding. ABC has decided on a subscription price of $10. (a) Find the value of rights (b) Find N- number of rights needed to buy a share (c) Find ex-rights stock price (d) Find investor's wealth before and after the offering MFIN 901 53

Rights Issue p p Example: ABC firm wants to raise $100 million in new equity. The stock price of ABC is $20 per share, and ABC has 1 billion shares outstanding. ABC has decided on a subscription price of $10. (a) Find the value of rights (b) Find N- number of rights needed to buy a share (c) Find ex-rights stock price (d) Find investor's wealth before and after the offering MFIN 901 53

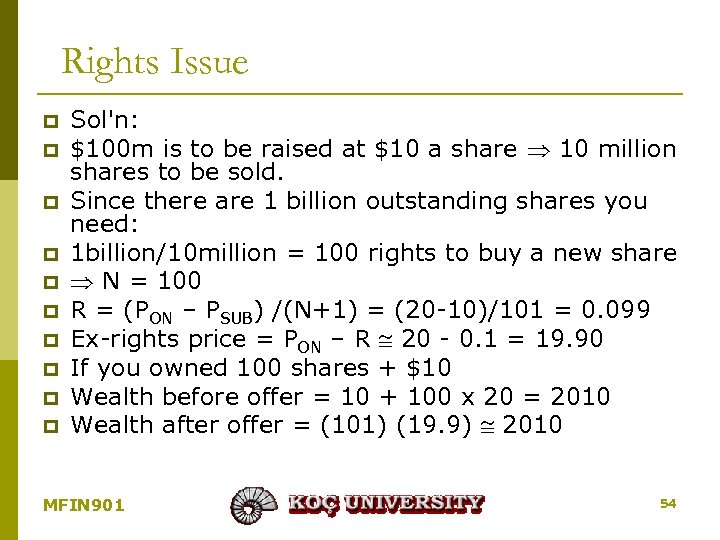

Rights Issue p p p p p Sol'n: $100 m is to be raised at $10 a share 10 million shares to be sold. Since there are 1 billion outstanding shares you need: 1 billion/10 million = 100 rights to buy a new share N = 100 R = (PON – PSUB) /(N+1) = (20 -10)/101 = 0. 099 Ex-rights price = PON – R 20 - 0. 1 = 19. 90 If you owned 100 shares + $10 Wealth before offer = 10 + 100 x 20 = 2010 Wealth after offer = (101) (19. 9) 2010 MFIN 901 54

Rights Issue p p p p p Sol'n: $100 m is to be raised at $10 a share 10 million shares to be sold. Since there are 1 billion outstanding shares you need: 1 billion/10 million = 100 rights to buy a new share N = 100 R = (PON – PSUB) /(N+1) = (20 -10)/101 = 0. 099 Ex-rights price = PON – R 20 - 0. 1 = 19. 90 If you owned 100 shares + $10 Wealth before offer = 10 + 100 x 20 = 2010 Wealth after offer = (101) (19. 9) 2010 MFIN 901 54

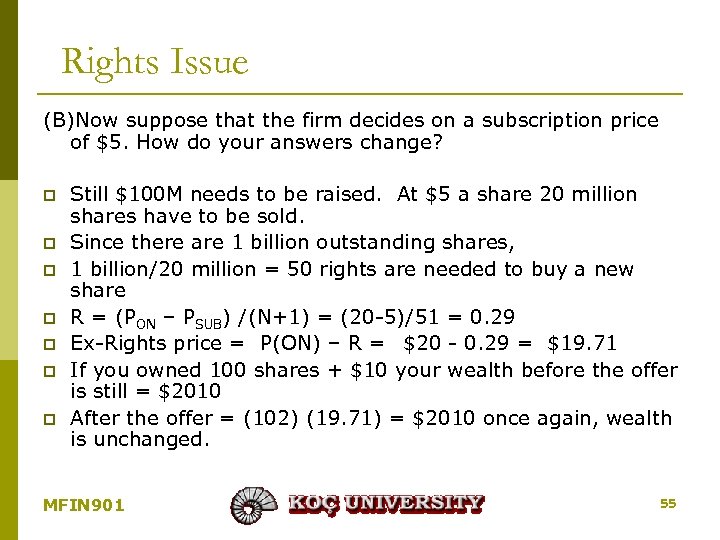

Rights Issue (B)Now suppose that the firm decides on a subscription price of $5. How do your answers change? p p p p Still $100 M needs to be raised. At $5 a share 20 million shares have to be sold. Since there are 1 billion outstanding shares, 1 billion/20 million = 50 rights are needed to buy a new share R = (PON – PSUB) /(N+1) = (20 -5)/51 = 0. 29 Ex-Rights price = P(ON) – R = $20 - 0. 29 = $19. 71 If you owned 100 shares + $10 your wealth before the offer is still = $2010 After the offer = (102) (19. 71) = $2010 once again, wealth is unchanged. MFIN 901 55

Rights Issue (B)Now suppose that the firm decides on a subscription price of $5. How do your answers change? p p p p Still $100 M needs to be raised. At $5 a share 20 million shares have to be sold. Since there are 1 billion outstanding shares, 1 billion/20 million = 50 rights are needed to buy a new share R = (PON – PSUB) /(N+1) = (20 -5)/51 = 0. 29 Ex-Rights price = P(ON) – R = $20 - 0. 29 = $19. 71 If you owned 100 shares + $10 your wealth before the offer is still = $2010 After the offer = (102) (19. 71) = $2010 once again, wealth is unchanged. MFIN 901 55

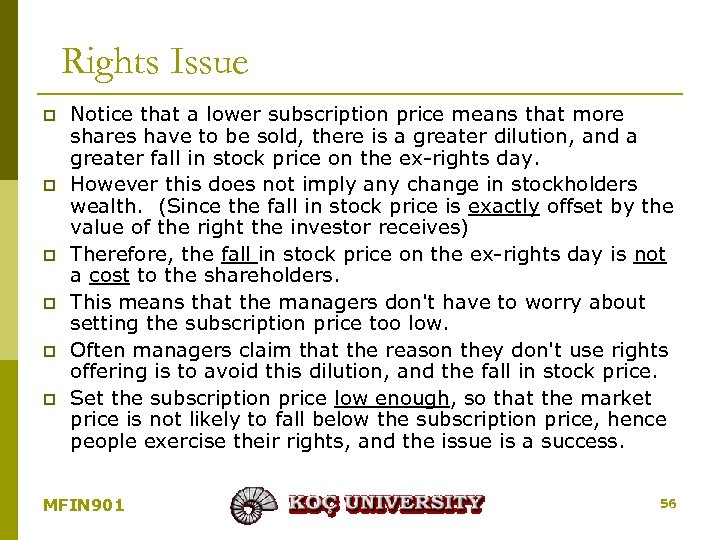

Rights Issue p p p Notice that a lower subscription price means that more shares have to be sold, there is a greater dilution, and a greater fall in stock price on the ex-rights day. However this does not imply any change in stockholders wealth. (Since the fall in stock price is exactly offset by the value of the right the investor receives) Therefore, the fall in stock price on the ex-rights day is not a cost to the shareholders. This means that the managers don't have to worry about setting the subscription price too low. Often managers claim that the reason they don't use rights offering is to avoid this dilution, and the fall in stock price. Set the subscription price low enough, so that the market price is not likely to fall below the subscription price, hence people exercise their rights, and the issue is a success. MFIN 901 56

Rights Issue p p p Notice that a lower subscription price means that more shares have to be sold, there is a greater dilution, and a greater fall in stock price on the ex-rights day. However this does not imply any change in stockholders wealth. (Since the fall in stock price is exactly offset by the value of the right the investor receives) Therefore, the fall in stock price on the ex-rights day is not a cost to the shareholders. This means that the managers don't have to worry about setting the subscription price too low. Often managers claim that the reason they don't use rights offering is to avoid this dilution, and the fall in stock price. Set the subscription price low enough, so that the market price is not likely to fall below the subscription price, hence people exercise their rights, and the issue is a success. MFIN 901 56

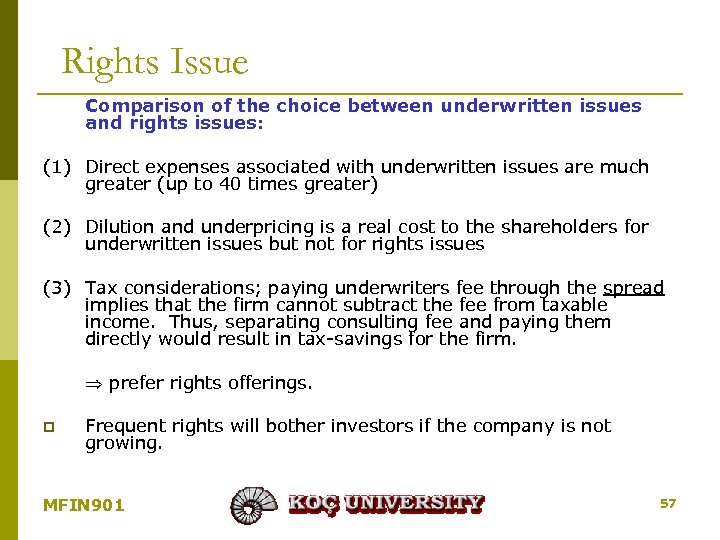

Rights Issue Comparison of the choice between underwritten issues and rights issues: (1) Direct expenses associated with underwritten issues are much greater (up to 40 times greater) (2) Dilution and underpricing is a real cost to the shareholders for underwritten issues but not for rights issues (3) Tax considerations; paying underwriters fee through the spread implies that the firm cannot subtract the fee from taxable income. Thus, separating consulting fee and paying them directly would result in tax-savings for the firm. prefer rights offerings. p Frequent rights will bother investors if the company is not growing. MFIN 901 57

Rights Issue Comparison of the choice between underwritten issues and rights issues: (1) Direct expenses associated with underwritten issues are much greater (up to 40 times greater) (2) Dilution and underpricing is a real cost to the shareholders for underwritten issues but not for rights issues (3) Tax considerations; paying underwriters fee through the spread implies that the firm cannot subtract the fee from taxable income. Thus, separating consulting fee and paying them directly would result in tax-savings for the firm. prefer rights offerings. p Frequent rights will bother investors if the company is not growing. MFIN 901 57

Private placement p p p Issue sold to no more than a dozen knowledgeable investors Investor cannot resell easily Life insurance companies are good clients Direct negotiation takes place Less expensive than a public issue, but hard to find counterparty Have to give a deeper discount to make up for the lack of liquidity MFIN 901 58

Private placement p p p Issue sold to no more than a dozen knowledgeable investors Investor cannot resell easily Life insurance companies are good clients Direct negotiation takes place Less expensive than a public issue, but hard to find counterparty Have to give a deeper discount to make up for the lack of liquidity MFIN 901 58

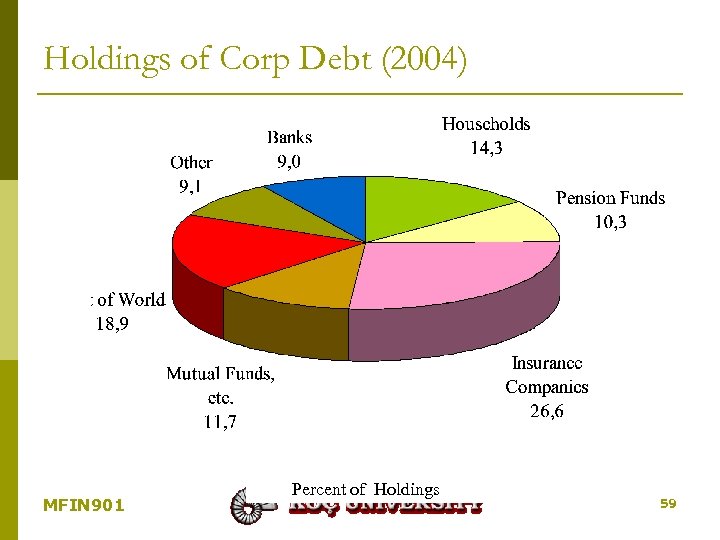

Holdings of Corp Debt (2004) MFIN 901 Percent of Holdings 59

Holdings of Corp Debt (2004) MFIN 901 Percent of Holdings 59

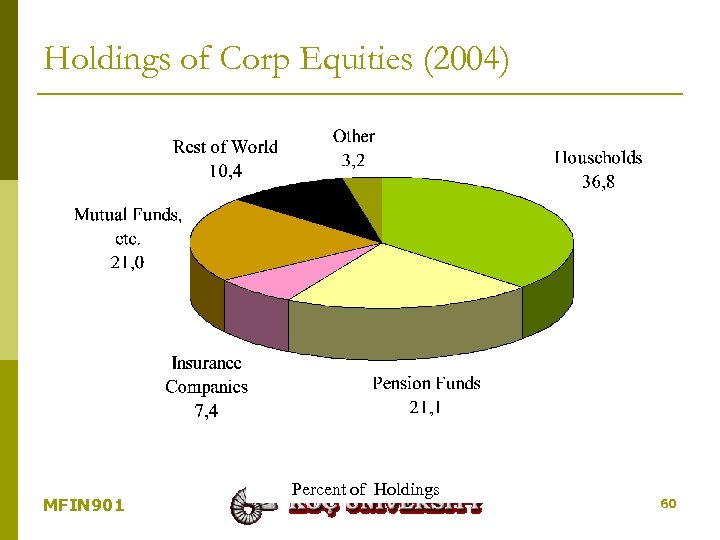

Holdings of Corp Equities (2004) MFIN 901 Percent of Holdings 60

Holdings of Corp Equities (2004) MFIN 901 Percent of Holdings 60

The big question: Valuation NAV p P/E p P/BV p P/SPS p EV/EBITDA p DCF p DDM p Replacement value p MFIN 901 61

The big question: Valuation NAV p P/E p P/BV p P/SPS p EV/EBITDA p DCF p DDM p Replacement value p MFIN 901 61

Summary p p p p Equity investment in young private companies or new establishments is venture capital. This capital may be provided by institutions or wealthy individuals (angel investors) who are prepared to back an un-tried company in return for a piece of the action. Private equity is equity that is not publicly traded. Providing venture capital, buying part/whole of unlisted distressed companies are private equity investment activities. Liquidity is the main risk. In an IPO, whereby equity is sold to the public for the first time, underpricing is an important cost to the existing shareholders. Winner’s curse may be a serious problem with IPOs. Public or private, the easiest way to increase capital is a rights issue. A bonus issue is just a balance sheet make-up, there is no cashflow. In a rights issue if the shares are sold above par (face, nominal) value, the difference is called share/emission premium (capital surplus) MFIN 901 62

Summary p p p p Equity investment in young private companies or new establishments is venture capital. This capital may be provided by institutions or wealthy individuals (angel investors) who are prepared to back an un-tried company in return for a piece of the action. Private equity is equity that is not publicly traded. Providing venture capital, buying part/whole of unlisted distressed companies are private equity investment activities. Liquidity is the main risk. In an IPO, whereby equity is sold to the public for the first time, underpricing is an important cost to the existing shareholders. Winner’s curse may be a serious problem with IPOs. Public or private, the easiest way to increase capital is a rights issue. A bonus issue is just a balance sheet make-up, there is no cashflow. In a rights issue if the shares are sold above par (face, nominal) value, the difference is called share/emission premium (capital surplus) MFIN 901 62

HW p Regarding Erdemir news, what should be the ex-split price if the current price is 50000 TL? p Ch. 15, p. 409 p Quiz 5, 7 (replace 90 with 30) p Practice question 8, p. 411 p MFIN 901 63

HW p Regarding Erdemir news, what should be the ex-split price if the current price is 50000 TL? p Ch. 15, p. 409 p Quiz 5, 7 (replace 90 with 30) p Practice question 8, p. 411 p MFIN 901 63