Mezzanine Loan Julia Koverzneva +7 (926) 337 94 50 yukoverzneva@gmail. com 23 rd of March 2015

Mezzanine Loan Julia Koverzneva +7 (926) 337 94 50 yukoverzneva@gmail. com 23 rd of March 2015

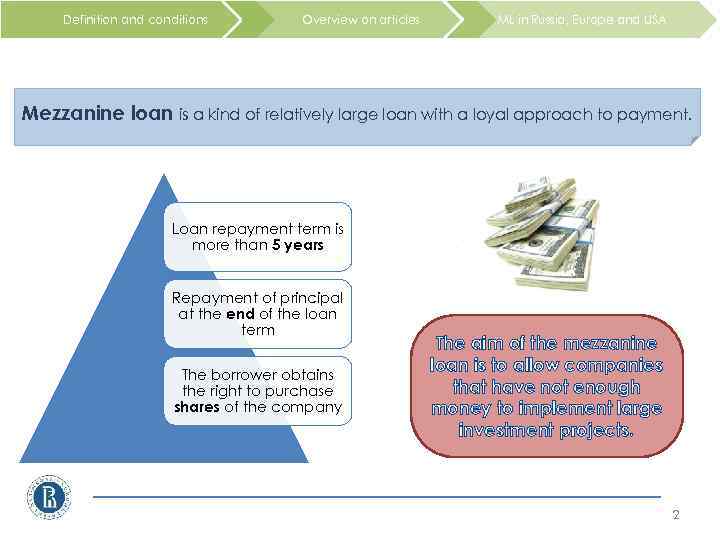

Definition and conditions Overview on articles ML in Russia, Europe and USA Mezzanine loan is a kind of relatively large loan with a loyal approach to payment. Loan repayment term is more than 5 years Repayment of principal at the end of the loan term The borrower obtains the right to purchase shares of the company The aim of the mezzanine loan is to allow companies that have not enough money to implement large investment projects. 2

Definition and conditions Overview on articles ML in Russia, Europe and USA Mezzanine loan is a kind of relatively large loan with a loyal approach to payment. Loan repayment term is more than 5 years Repayment of principal at the end of the loan term The borrower obtains the right to purchase shares of the company The aim of the mezzanine loan is to allow companies that have not enough money to implement large investment projects. 2

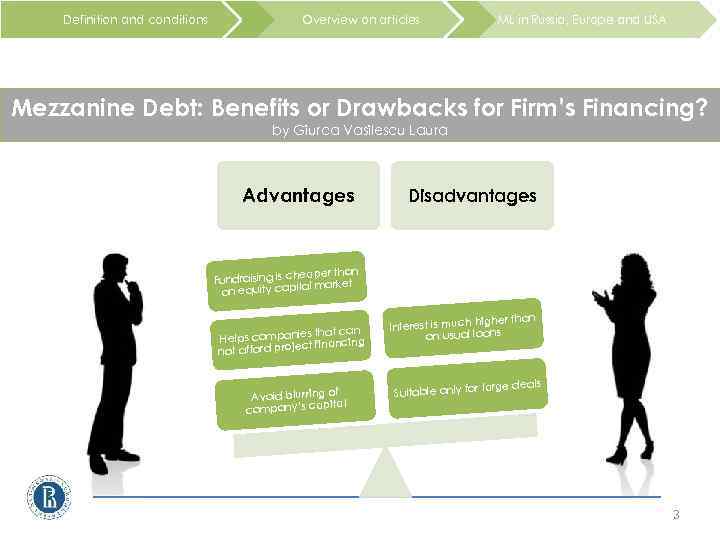

Definition and conditions Overview on articles ML in Russia, Europe and USA Mezzanine Debt: Benefits or Drawbacks for Firm’s Financing? by Giurca Vasilescu Laura Advantages Disadvantages eaper than Fundraising is ch l market on equity capita es that can Helps compani financing ct not afford proje Avoid blurring of l ita company’s cap higher than Interest is much ans on usual lo r large deals Suitable only fo 3

Definition and conditions Overview on articles ML in Russia, Europe and USA Mezzanine Debt: Benefits or Drawbacks for Firm’s Financing? by Giurca Vasilescu Laura Advantages Disadvantages eaper than Fundraising is ch l market on equity capita es that can Helps compani financing ct not afford proje Avoid blurring of l ita company’s cap higher than Interest is much ans on usual lo r large deals Suitable only fo 3

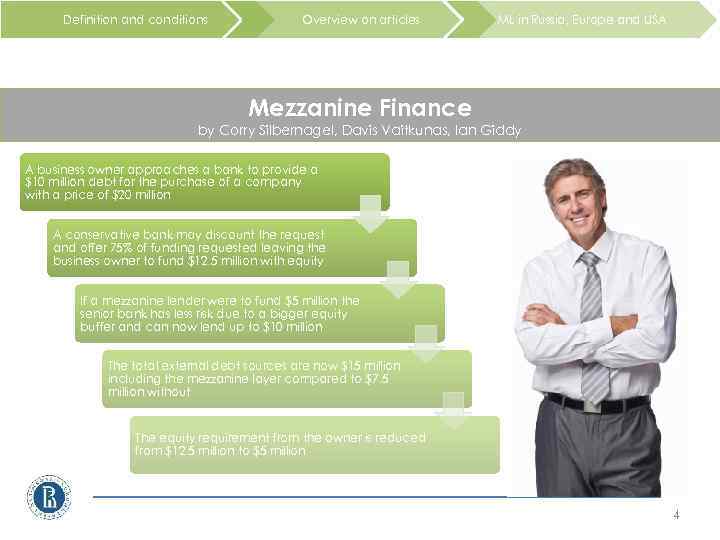

Definition and conditions Overview on articles ML in Russia, Europe and USA Mezzanine Finance by Corry Silbernagel, Davis Vaitkunas, Ian Giddy A business owner approaches a bank to provide a $10 million debt for the purchase of a company with a price of $20 million A conservative bank may discount the request and offer 75% of funding requested leaving the business owner to fund $12. 5 million with equity If a mezzanine lender were to fund $5 million the senior bank has less risk due to a bigger equity buffer and can now lend up to $10 million The total external debt sources are now $15 million including the mezzanine layer compared to $7. 5 million without The equity requirement from the owner is reduced from $12. 5 million to $5 million 4

Definition and conditions Overview on articles ML in Russia, Europe and USA Mezzanine Finance by Corry Silbernagel, Davis Vaitkunas, Ian Giddy A business owner approaches a bank to provide a $10 million debt for the purchase of a company with a price of $20 million A conservative bank may discount the request and offer 75% of funding requested leaving the business owner to fund $12. 5 million with equity If a mezzanine lender were to fund $5 million the senior bank has less risk due to a bigger equity buffer and can now lend up to $10 million The total external debt sources are now $15 million including the mezzanine layer compared to $7. 5 million without The equity requirement from the owner is reduced from $12. 5 million to $5 million 4

Definition and conditions Overview on articles ML in Russia, Europe and USA Using the UCC in real estate mezzanine financing by Marci Schmerler Mezzanine financing of real estate is an increasingly popular structure that permits a property owner to use its equity in the property as collateral even if a second mortgage on the property is not permitted Mortgage lenders believe that their position will be stronger in a bankruptcy of the property owner, since the mezzanine lender is not a creditor of the property owner and therefore does not have a "seat at the table" in the property owner's bankruptcy 5

Definition and conditions Overview on articles ML in Russia, Europe and USA Using the UCC in real estate mezzanine financing by Marci Schmerler Mezzanine financing of real estate is an increasingly popular structure that permits a property owner to use its equity in the property as collateral even if a second mortgage on the property is not permitted Mortgage lenders believe that their position will be stronger in a bankruptcy of the property owner, since the mezzanine lender is not a creditor of the property owner and therefore does not have a "seat at the table" in the property owner's bankruptcy 5

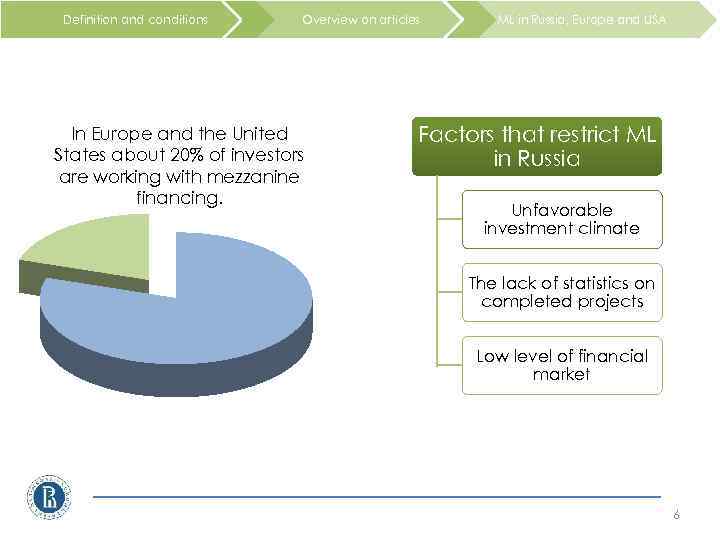

Definition and conditions Overview on articles In Europe and the United States about 20% of investors are working with mezzanine financing. ML in Russia, Europe and USA Factors that restrict ML in Russia Unfavorable investment climate The lack of statistics on completed projects Low level of financial market 6

Definition and conditions Overview on articles In Europe and the United States about 20% of investors are working with mezzanine financing. ML in Russia, Europe and USA Factors that restrict ML in Russia Unfavorable investment climate The lack of statistics on completed projects Low level of financial market 6