Metropolitan Council Environmental Services PFA Loan Negotiations Presented to the Environment Committee July 14, 2009 Jason Willett, Finance Director A Clean Water Agency

Metropolitan Council Environmental Services PFA Loan Negotiations Presented to the Environment Committee July 14, 2009 Jason Willett, Finance Director A Clean Water Agency

State Revolving Loan Program n MCES’s historical involvement — Active in program since 1989 — 18 separate prior loan agreements — $965 million of prior loans to date — Interest rates from 2. 54% (2004) to 6. 42% (1991) 2

State Revolving Loan Program n MCES’s historical involvement — Active in program since 1989 — 18 separate prior loan agreements — $965 million of prior loans to date — Interest rates from 2. 54% (2004) to 6. 42% (1991) 2

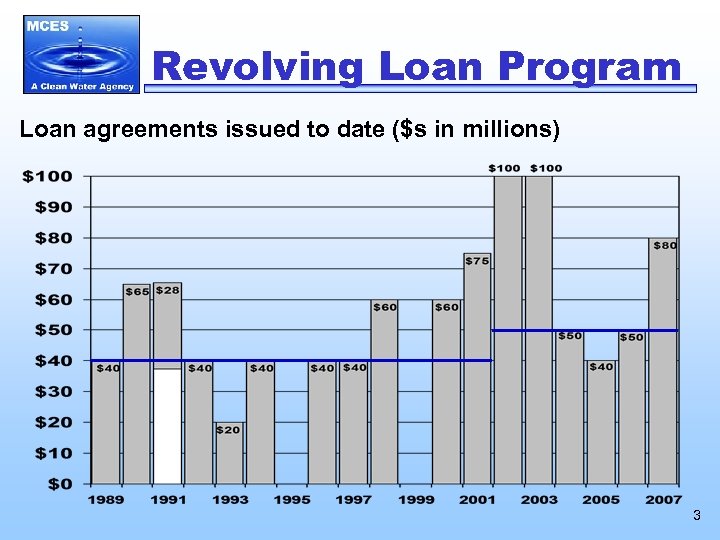

Revolving Loan Program Loan agreements issued to date ($s in millions) 3

Revolving Loan Program Loan agreements issued to date ($s in millions) 3

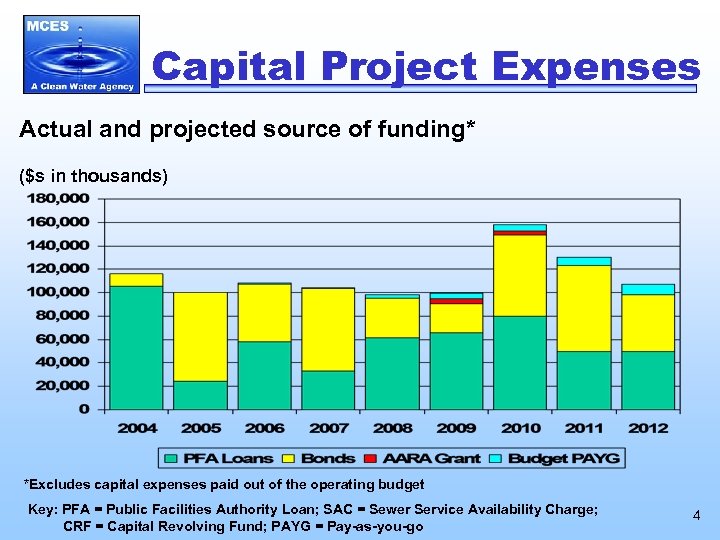

Capital Project Expenses Actual and projected source of funding* ($s in thousands) *Excludes capital expenses paid out of the operating budget Key: PFA = Public Facilities Authority Loan; SAC = Sewer Service Availability Charge; CRF = Capital Revolving Fund; PAYG = Pay-as-you-go 4

Capital Project Expenses Actual and projected source of funding* ($s in thousands) *Excludes capital expenses paid out of the operating budget Key: PFA = Public Facilities Authority Loan; SAC = Sewer Service Availability Charge; CRF = Capital Revolving Fund; PAYG = Pay-as-you-go 4

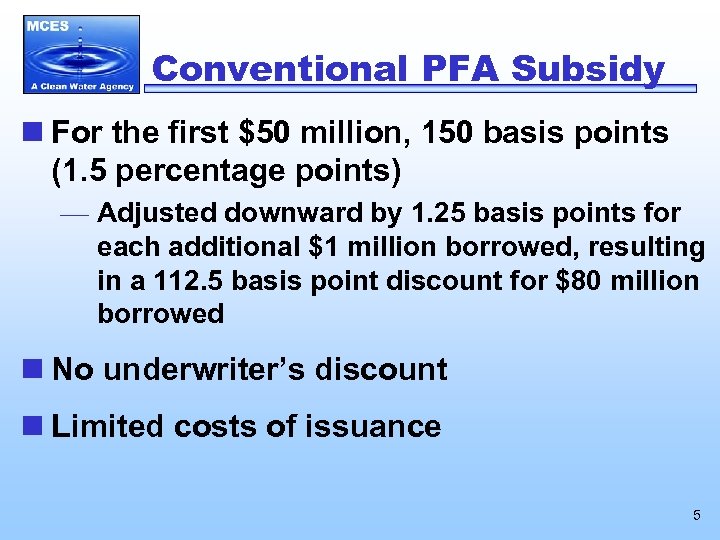

Conventional PFA Subsidy n For the first $50 million, 150 basis points (1. 5 percentage points) — Adjusted downward by 1. 25 basis points for each additional $1 million borrowed, resulting in a 112. 5 basis point discount for $80 million borrowed n No underwriter’s discount n Limited costs of issuance 5

Conventional PFA Subsidy n For the first $50 million, 150 basis points (1. 5 percentage points) — Adjusted downward by 1. 25 basis points for each additional $1 million borrowed, resulting in a 112. 5 basis point discount for $80 million borrowed n No underwriter’s discount n Limited costs of issuance 5

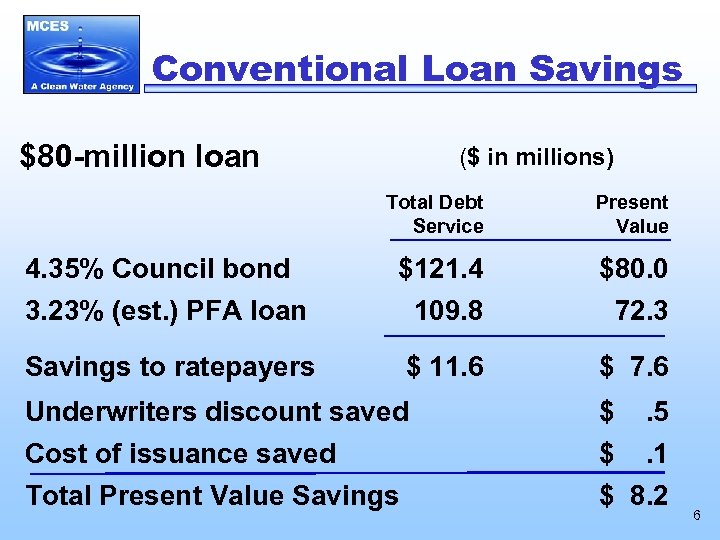

Conventional Loan Savings $80 -million loan ($ in millions) Total Debt Service Present Value 4. 35% Council bond 3. 23% (est. ) PFA loan $121. 4 109. 8 $80. 0 72. 3 Savings to ratepayers $ 11. 6 $ 7. 6 Underwriters discount saved Cost of issuance saved Total Present Value Savings $. 5 $. 1 $ 8. 2 6

Conventional Loan Savings $80 -million loan ($ in millions) Total Debt Service Present Value 4. 35% Council bond 3. 23% (est. ) PFA loan $121. 4 109. 8 $80. 0 72. 3 Savings to ratepayers $ 11. 6 $ 7. 6 Underwriters discount saved Cost of issuance saved Total Present Value Savings $. 5 $. 1 $ 8. 2 6

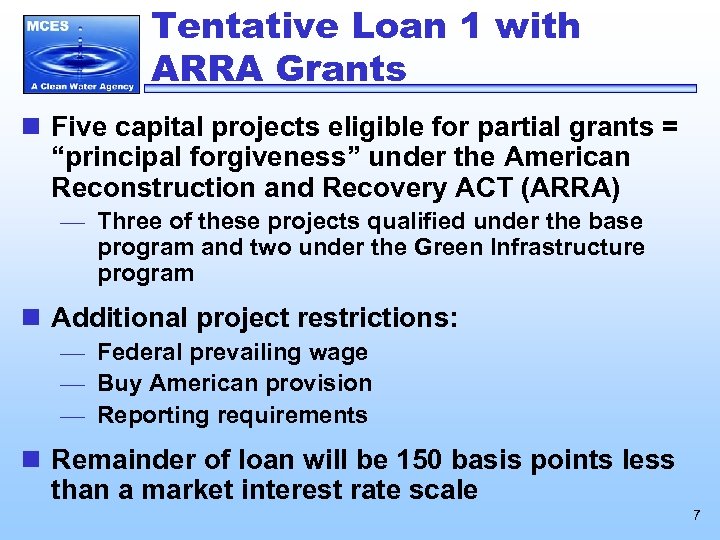

Tentative Loan 1 with ARRA Grants n Five capital projects eligible for partial grants = “principal forgiveness” under the American Reconstruction and Recovery ACT (ARRA) — Three of these projects qualified under the base program and two under the Green Infrastructure program n Additional project restrictions: — Federal prevailing wage — Buy American provision — Reporting requirements n Remainder of loan will be 150 basis points less than a market interest rate scale 7

Tentative Loan 1 with ARRA Grants n Five capital projects eligible for partial grants = “principal forgiveness” under the American Reconstruction and Recovery ACT (ARRA) — Three of these projects qualified under the base program and two under the Green Infrastructure program n Additional project restrictions: — Federal prevailing wage — Buy American provision — Reporting requirements n Remainder of loan will be 150 basis points less than a market interest rate scale 7

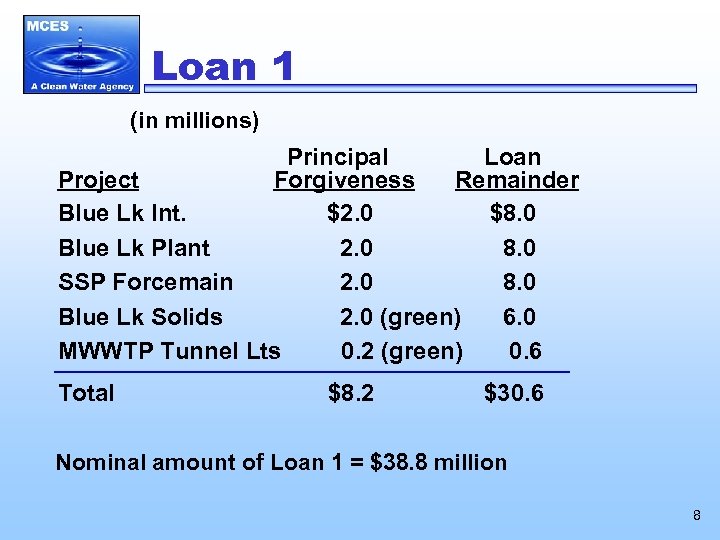

Loan 1 (in millions) Principal Loan Project Forgiveness Remainder Blue Lk Int. $2. 0 $8. 0 Blue Lk Plant 2. 0 8. 0 SSP Forcemain 2. 0 8. 0 Blue Lk Solids 2. 0 (green) 6. 0 MWWTP Tunnel Lts 0. 2 (green) 0. 6 Total $8. 2 $30. 6 Nominal amount of Loan 1 = $38. 8 million 8

Loan 1 (in millions) Principal Loan Project Forgiveness Remainder Blue Lk Int. $2. 0 $8. 0 Blue Lk Plant 2. 0 8. 0 SSP Forcemain 2. 0 8. 0 Blue Lk Solids 2. 0 (green) 6. 0 MWWTP Tunnel Lts 0. 2 (green) 0. 6 Total $8. 2 $30. 6 Nominal amount of Loan 1 = $38. 8 million 8

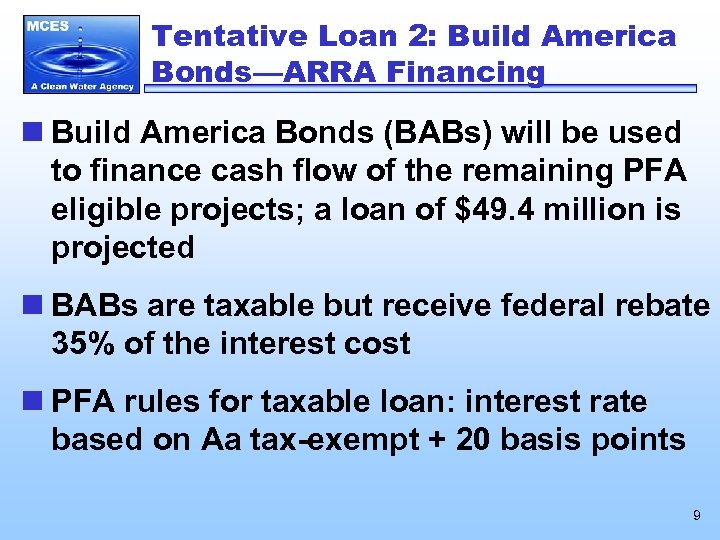

Tentative Loan 2: Build America Bonds—ARRA Financing n Build America Bonds (BABs) will be used to finance cash flow of the remaining PFA eligible projects; a loan of $49. 4 million is projected n BABs are taxable but receive federal rebate 35% of the interest cost n PFA rules for taxable loan: interest rate based on Aa tax-exempt + 20 basis points 9

Tentative Loan 2: Build America Bonds—ARRA Financing n Build America Bonds (BABs) will be used to finance cash flow of the remaining PFA eligible projects; a loan of $49. 4 million is projected n BABs are taxable but receive federal rebate 35% of the interest cost n PFA rules for taxable loan: interest rate based on Aa tax-exempt + 20 basis points 9

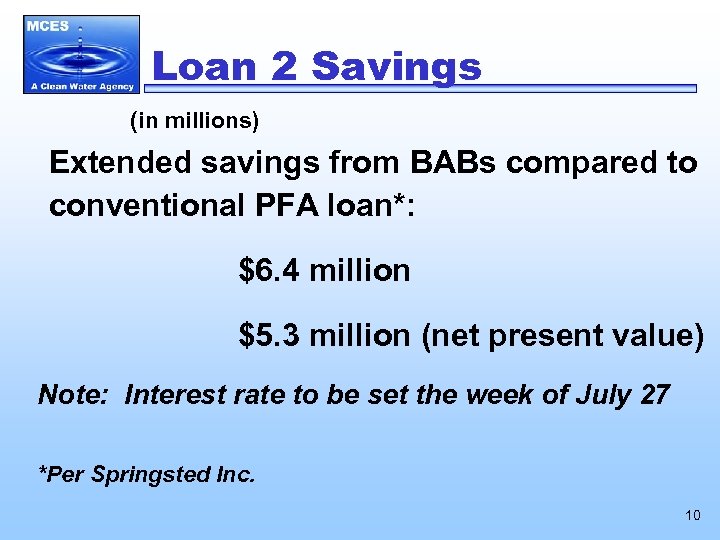

Loan 2 Savings (in millions) Extended savings from BABs compared to conventional PFA loan*: $6. 4 million $5. 3 million (net present value) Note: Interest rate to be set the week of July 27 *Per Springsted Inc. 10

Loan 2 Savings (in millions) Extended savings from BABs compared to conventional PFA loan*: $6. 4 million $5. 3 million (net present value) Note: Interest rate to be set the week of July 27 *Per Springsted Inc. 10

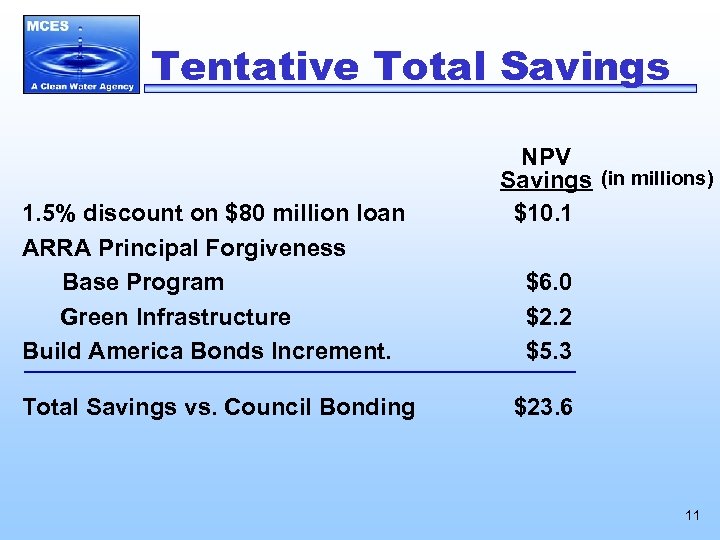

Tentative Total Savings 1. 5% discount on $80 million loan ARRA Principal Forgiveness Base Program Green Infrastructure Build America Bonds Increment. Total Savings vs. Council Bonding NPV Savings (in millions) $10. 1 $6. 0 $2. 2 $5. 3 $23. 6 11

Tentative Total Savings 1. 5% discount on $80 million loan ARRA Principal Forgiveness Base Program Green Infrastructure Build America Bonds Increment. Total Savings vs. Council Bonding NPV Savings (in millions) $10. 1 $6. 0 $2. 2 $5. 3 $23. 6 11

Questions, Concerns 12

Questions, Concerns 12