5043c27a2467bd609a91b2ec248bf978.ppt

- Количество слайдов: 100

Methods of Payment Areej Aftab Siddiqui

Importance of Terms of Payment The terms of payment often decide obtaining of the order

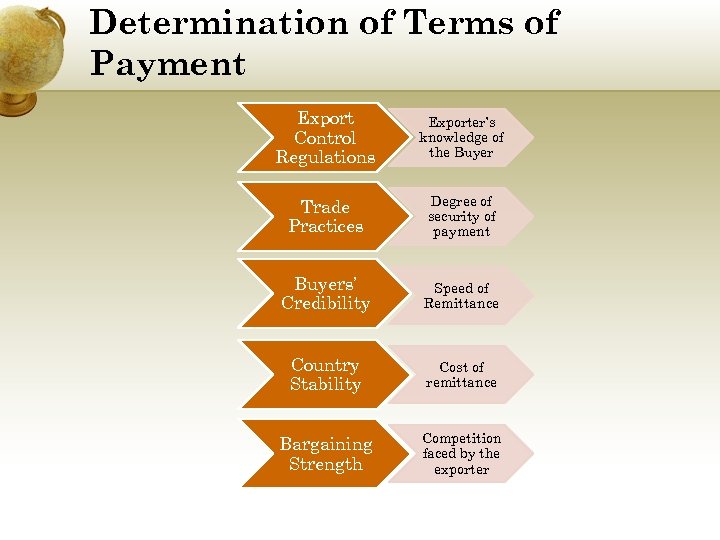

Determination of Terms of Payment Export Control Regulations Exporter’s knowledge of the Buyer Trade Practices Degree of security of payment Buyers’ Credibility Speed of Remittance Country Stability Cost of remittance Bargaining Strength Competition faced by the exporter

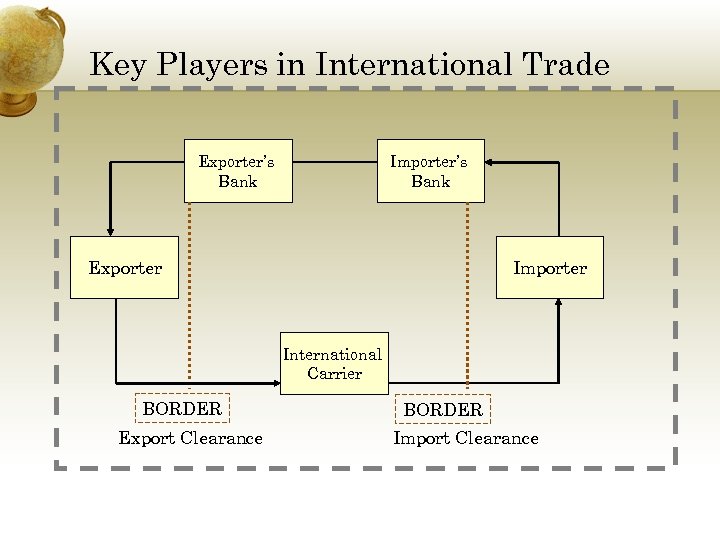

Key Players in International Trade Exporter’s Bank Importer’s Bank Exporter Importer International Carrier BORDER Export Clearance BORDER Import Clearance

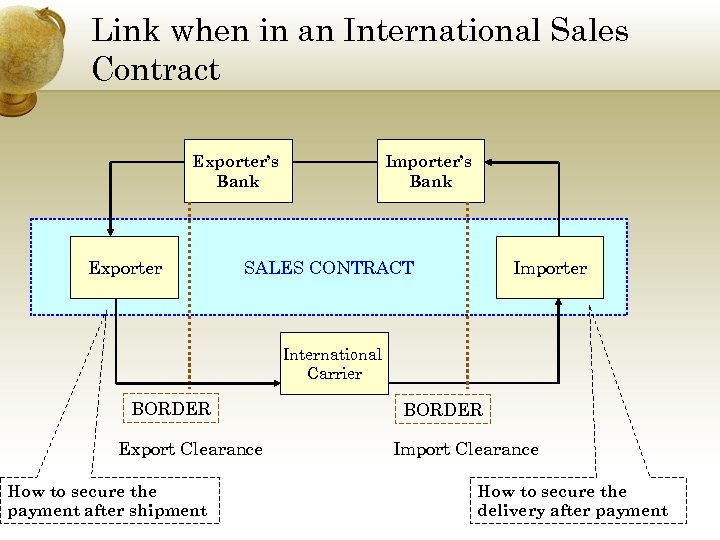

Link when in an International Sales Contract Exporter’s Bank Exporter Importer’s Bank SALES CONTRACT Importer International Carrier BORDER Export Clearance How to secure the payment after shipment BORDER Import Clearance How to secure the delivery after payment

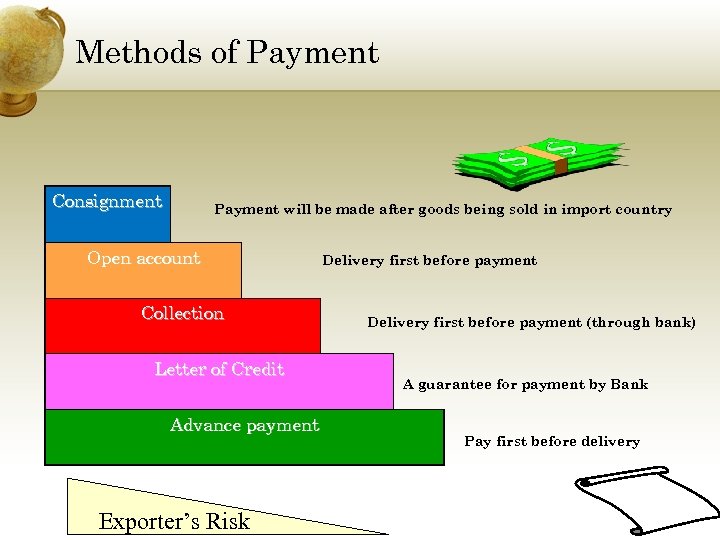

Methods of Payment Consignment Payment will be made after goods being sold in import country Open account Collection Letter of Credit Advance payment Exporter’s Risk Delivery first before payment (through bank) A guarantee for payment by Bank Pay first before delivery

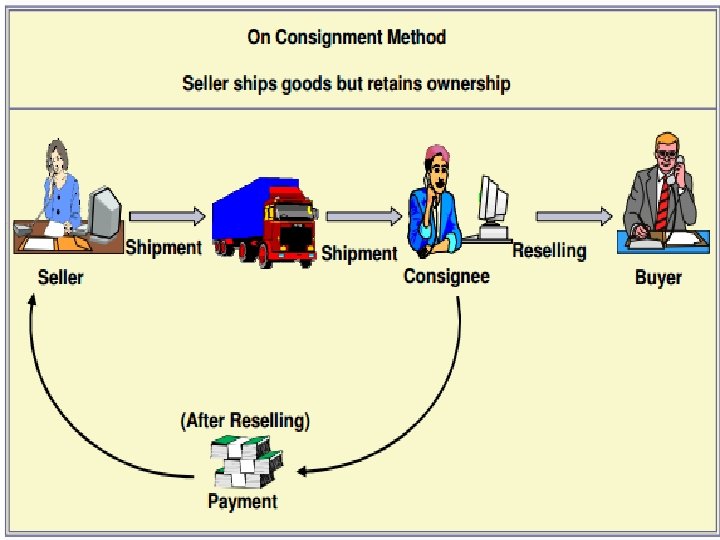

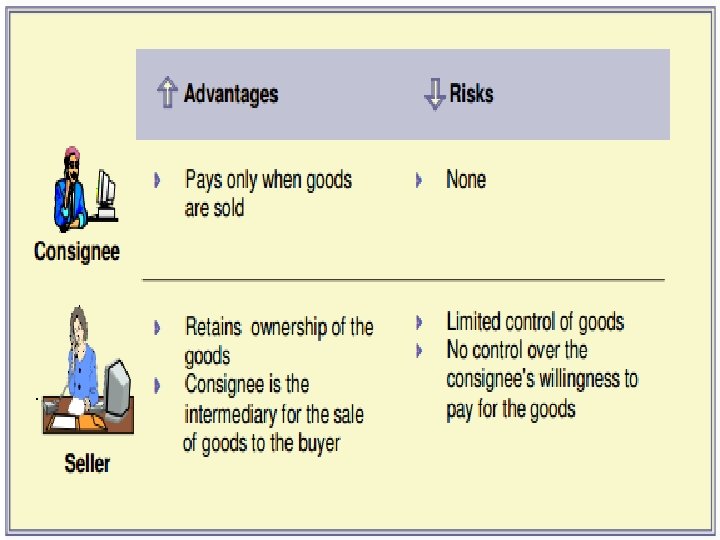

Consignment • Demand for payment is usually made by means of a clean draft( no documents attached). • Payment typically occurs after the products have been resold by the buyer.

Application/Use • The consignee is reliable • The consignee has a good credit history • The consignee’s country has economic and political stability • The consignee is the branch office of the main company

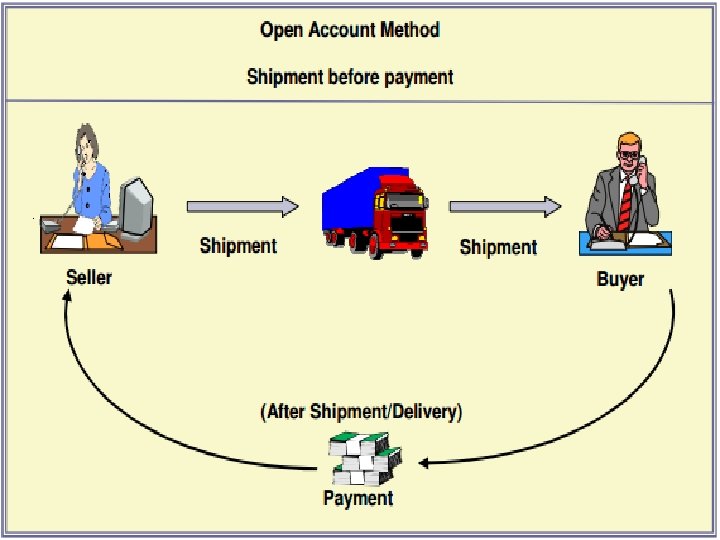

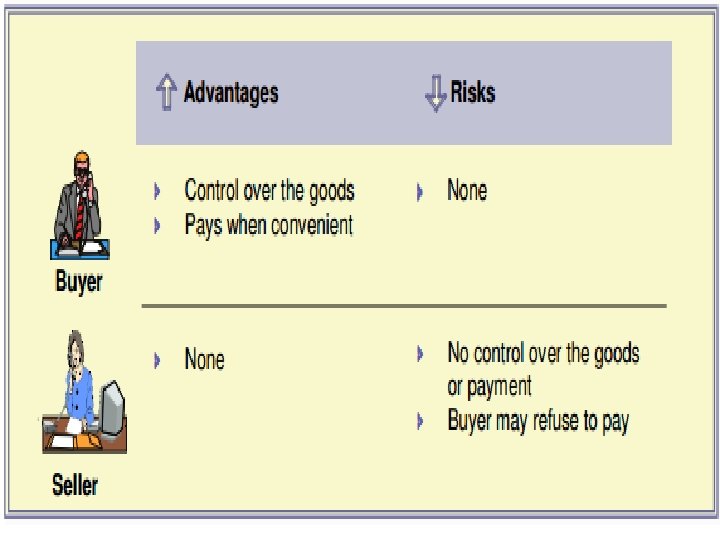

Open Account • A term of payment in which no banks are involved, only an agreement between seller and buyer that payment will be made within an agreed period of time. • The buyer opens an account in the name of the seller in the buyer’s book and show values of the goods as an amount owing to the seller • Banks become involved through wire transfers, but no negotiations. • Normally one should use this method only when he/ she has confidence in the creditworthiness of the buyer. • The seller sends the goods to the buyer BEFORE the payment

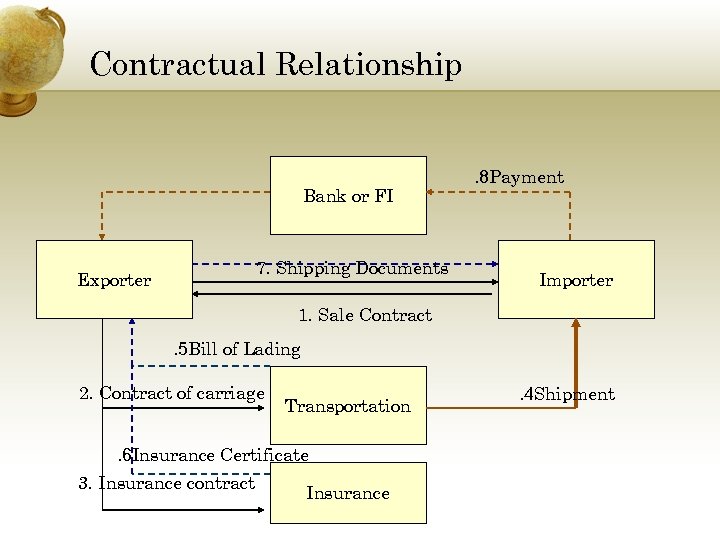

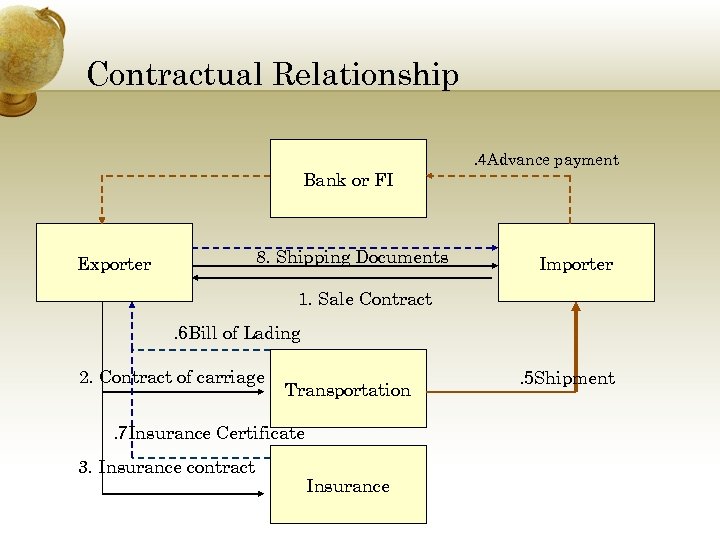

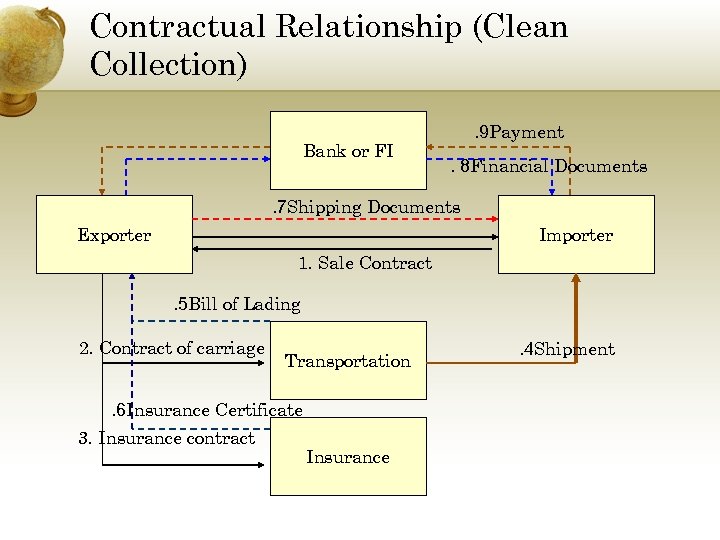

Contractual Relationship Bank or FI 7. Shipping Documents Exporter . 8 Payment Importer 1. Sale Contract. 5 Bill of Lading 2. Contract of carriage Transportation . 6 Insurance Certificate 3. Insurance contract Insurance . 4 Shipment

Application/Use • There is long-term relationship and confidence between the • buyer and the seller • The seller is under pressure to sell his goods • The buyer has a very good reputation and is wellknown in the market • The buyer is solvent

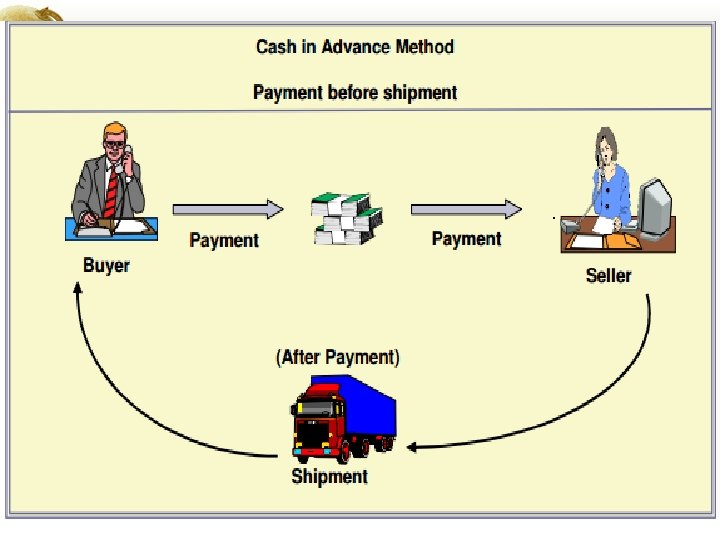

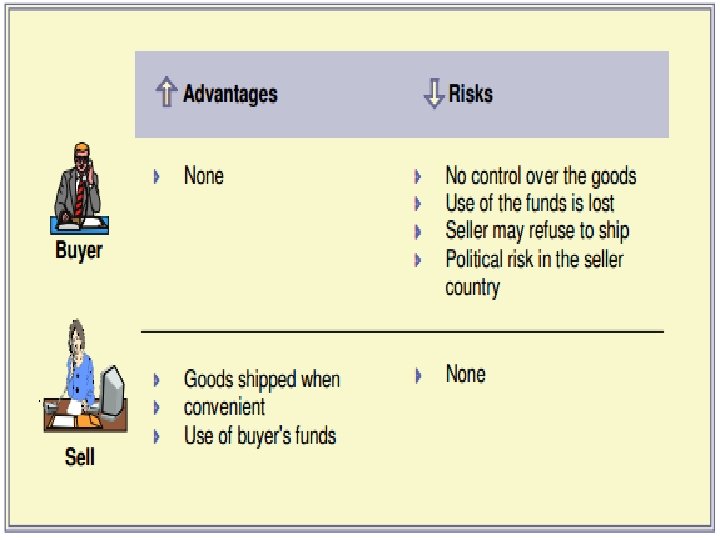

Cash in Advance (Advance Payment) v Buyer pays BEFORE shipment v Used in new relationship v Transactions are small and buyer has no choice v Maximum security to sellers v No guarantee that goods are shipped

Contractual Relationship Bank or FI 8. Shipping Documents Exporter . 4 Advance payment Importer 1. Sale Contract. 6 Bill of Lading 2. Contract of carriage Transportation . 7 Insurance Certificate 3. Insurance contract Insurance . 5 Shipment

Application/Use • The buyer lacks creditworthiness • The buyer is not able to offer sufficient security for payment • The buyer is located in a region of politic and/or economic instability • The product is so specialized that it is specifically made for the customer and cannot be easily sold to another customer

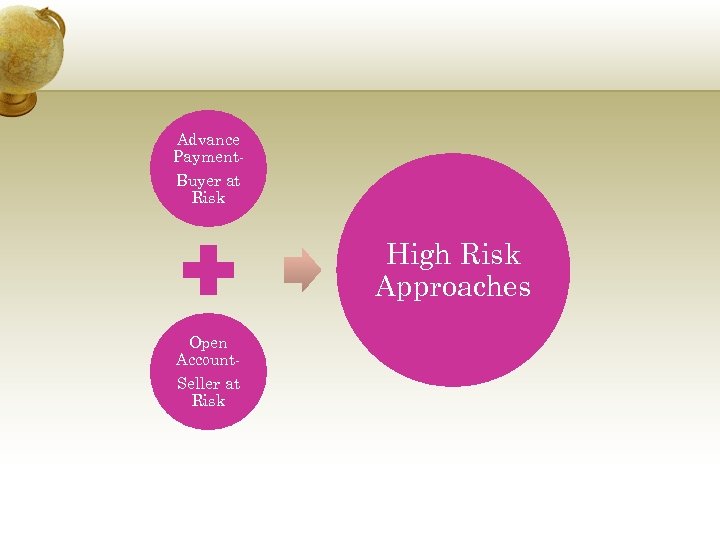

Advance Payment. Buyer at Risk High Risk Approaches Open Account. Seller at Risk

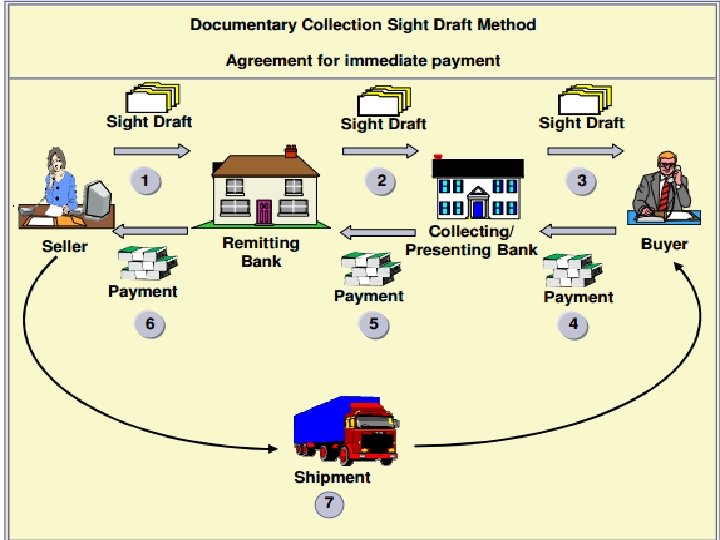

Documentary Collections • A collection, which is accompanied by commercial documents. • Means that the bank handles documents according to the instructions received. • This payment method is most often used in international trade in the exchange of merchandise for money. • With this method, the goods are shipped to the foreign country, but the documents are sent to the buyer’s bank. • Bank has the only duty to collect the payment from the buyer in exchange for delivery of the shipping & financial documents • Bank assumes no risk & responsibility associated with default payment AS LONG AS it follows the seller’s instruction

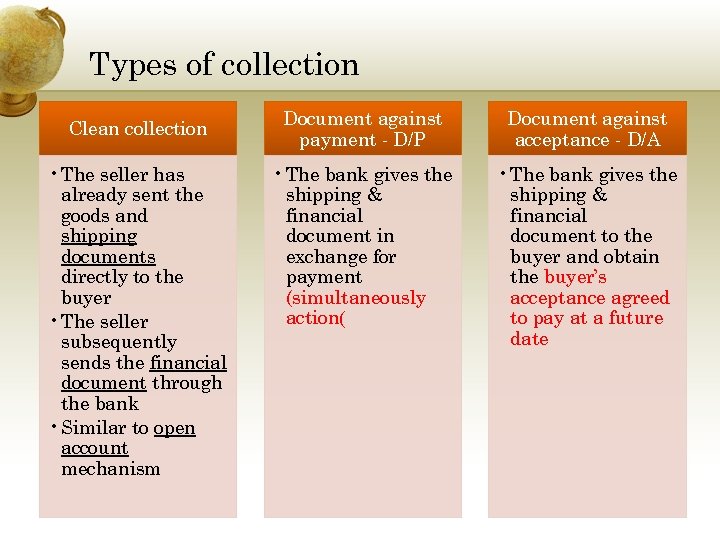

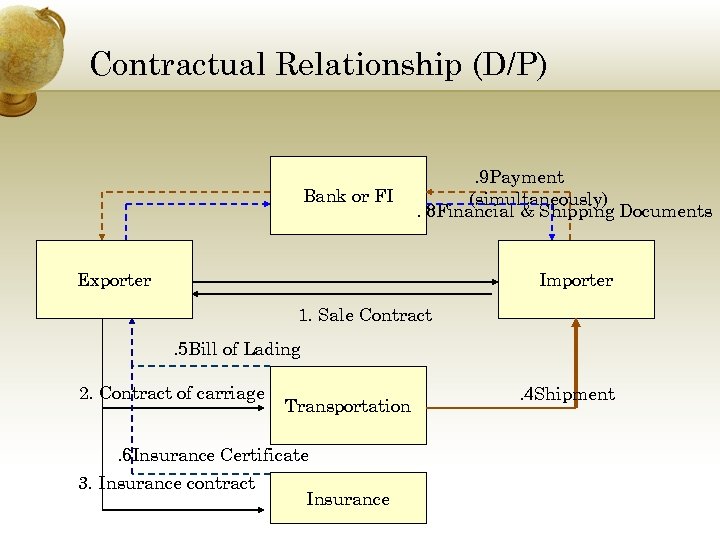

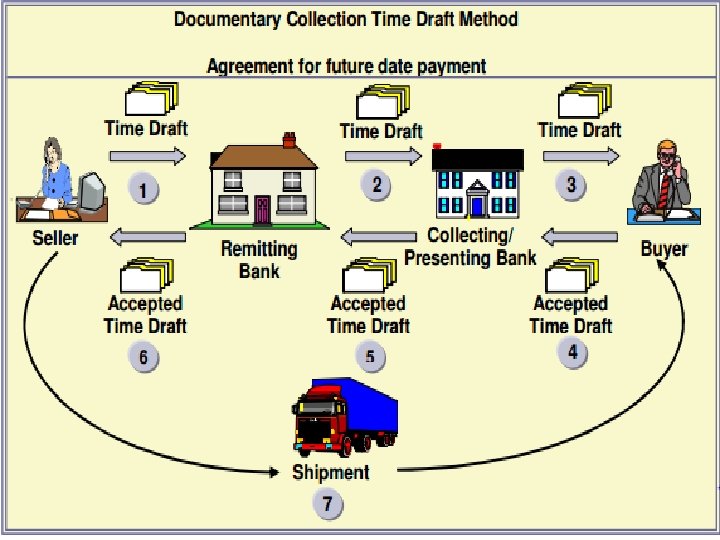

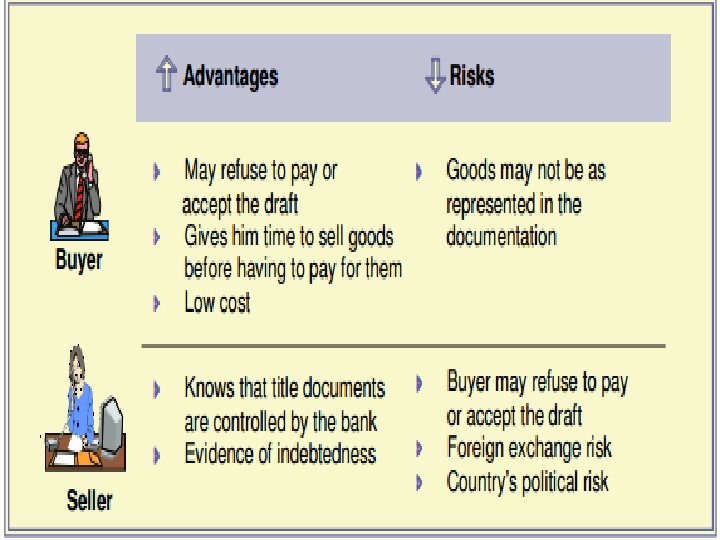

Types of collection Clean collection • The seller has already sent the goods and shipping documents directly to the buyer • The seller subsequently sends the financial document through the bank • Similar to open account mechanism Document against payment - D/P Document against acceptance - D/A • The bank gives the shipping & financial document in exchange for payment (simultaneously action( • The bank gives the shipping & financial document to the buyer and obtain the buyer’s acceptance agreed to pay at a future date

Drafts • An unconditional order in writing prepared by one (drawer) and addressed to another (drawee) • The draft is drawn by the beneficiary under the term of authorization in the letter of credit and in straight conformance with the conditions stated. • The draft has to include the name of the issuing bank. • Draft (in some countries) is said to be drawn to the account of the bank or buyer.

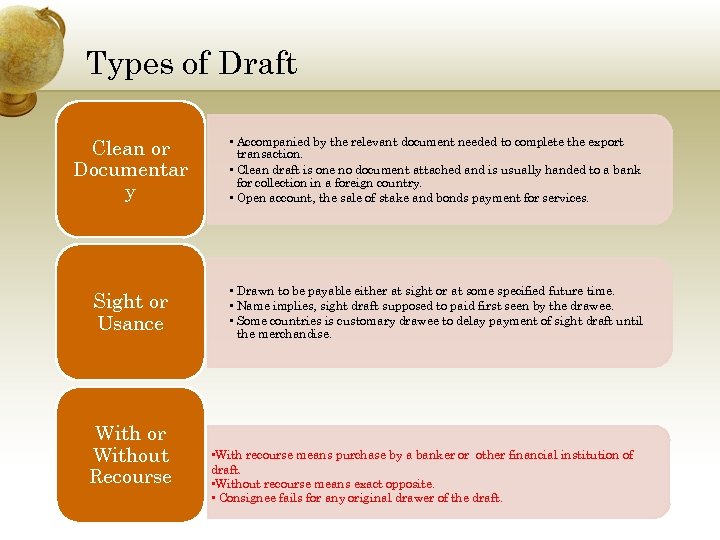

Types of Draft Clean or Documentar y • Accompanied by the relevant document needed to complete the export transaction. • Clean draft is one no document attached and is usually handed to a bank for collection in a foreign country. • Open account, the sale of stake and bonds payment for services. Sight or Usance • Drawn to be payable either at sight or at some specified future time. • Name implies, sight draft supposed to paid first seen by the drawee. • Some countries is customary drawee to delay payment of sight draft until the merchandise. With or Without Recourse • With recourse means purchase by a banker or other financial institution of draft. • Without recourse means exact opposite. • Consignee fails for any original drawer of the draft.

Contractual Relationship (Clean Collection) Bank or FI . 9 Payment. 8 Financial Documents . 7 Shipping Documents Exporter Importer 1. Sale Contract. 5 Bill of Lading 2. Contract of carriage Transportation . 6 Insurance Certificate 3. Insurance contract Insurance . 4 Shipment

Contractual Relationship (D/P) Bank or FI . 9 Payment (simultaneously). 8 Financial & Shipping Documents Exporter Importer 1. Sale Contract. 5 Bill of Lading 2. Contract of carriage Transportation . 6 Insurance Certificate 3. Insurance contract Insurance . 4 Shipment

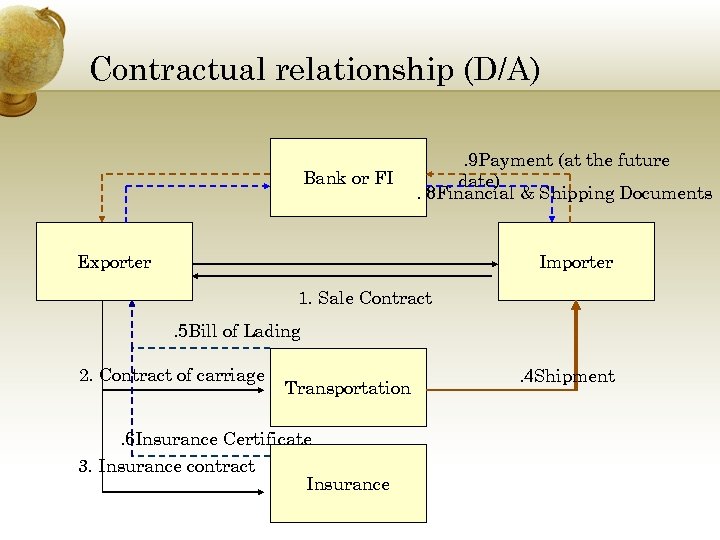

Contractual relationship (D/A) Bank or FI . 9 Payment (at the future date). 8 Financial & Shipping Documents Exporter Importer 1. Sale Contract. 5 Bill of Lading 2. Contract of carriage Transportation . 6 Insurance Certificate 3. Insurance contract Insurance . 4 Shipment

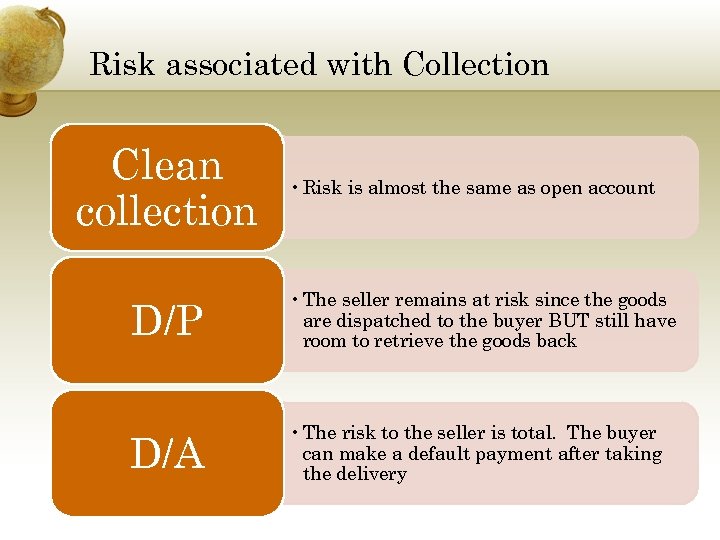

Risk associated with Collection Clean collection • Risk is almost the same as open account D/P • The seller remains at risk since the goods are dispatched to the buyer BUT still have room to retrieve the goods back D/A • The risk to the seller is total. The buyer can make a default payment after taking the delivery

What is a Letter of Credit? • • Document and undertaking issued by a bank At the request of the applicant (buyer, importer) In favor of a beneficiary (seller, exporter) Substitutes the bank’s name and credit risk for that of the applicant (buyer, importer) • Guarantees payment of a customer’s draft up to a stated amount for a specified period if certain conditions are met

Letter of Credit Summary of a contract between seller and buyer with the bank(s) as referee Governed by UCP 600

Why Have A Letter Of Credit? IF I SHIP GOODS, WILL YOU PAY? IF I PAY, WILL YOU SHIP THE GOODS? Solves Issues Of Mutual Mistrust By Using Banks As Arbiters NEGOTIATE L/C TERMS BEFORE ENTERING A CONTRACT

Trade Finance Letter Of Credit Documents Banks do not deal in the merchandise which the letter of credit covers Banks deal only in DOCUMENTS SWIFT : Society for Worldwide Interbank Financial Telecommunication

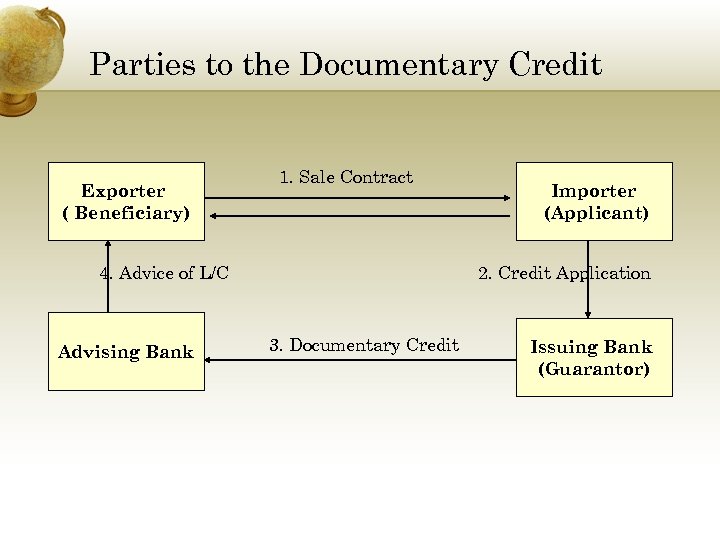

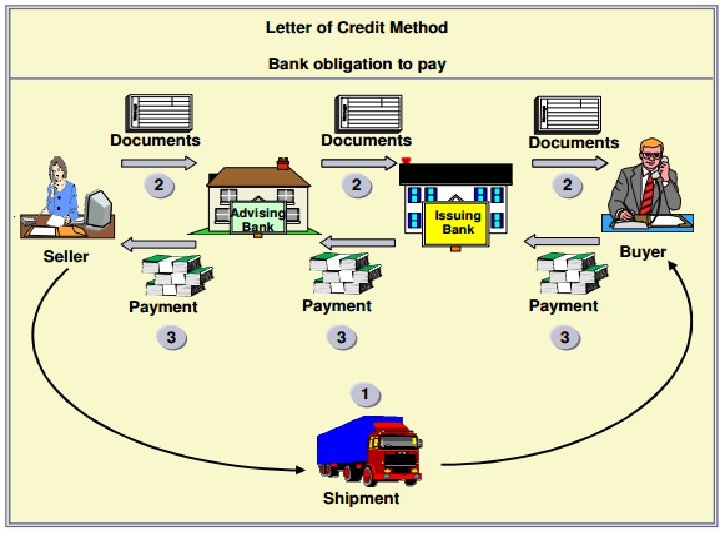

Parties to the Documentary Credit Exporter ( Beneficiary) 1. Sale Contract 4. Advice of L/C Advising Bank Importer (Applicant) 2. Credit Application 3. Documentary Credit Issuing Bank (Guarantor)

THE BANK’S COMMITMENT IN THE LETTER OF CREDIT THE L/C SAYS WHAT IT MEANS & MEANS WHAT IT SAYS KEY ELEMENTS • • AMOUNT EXPIRY LATEST SHIPMENT DATE DOCUMENTS REQUIRED PAYMENT WILL BE MADE ONLY WHEN ALL TERMS AND CONDITIONS ARE MET RESOLVE UNCLEAR ITEMS PRIOR TO SHIPMENT

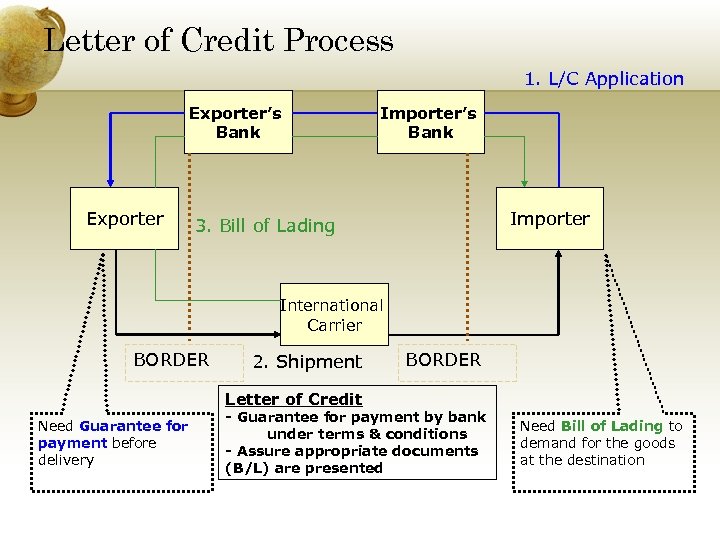

Letter of Credit Process 1. L/C Application Exporter’s Bank Exporter Importer’s Bank Importer 3. Bill of Lading International Carrier BORDER 2. Shipment BORDER Letter of Credit Need Guarantee for payment before delivery - Guarantee for payment by bank under terms & conditions - Assure appropriate documents (B/L) are presented Need Bill of Lading to demand for the goods at the destination

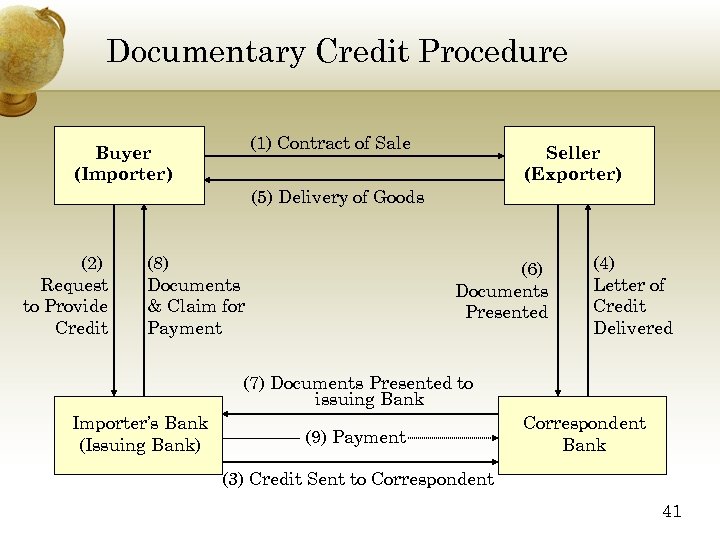

Documentary Credit Procedure (1) Contract of Sale Buyer (Importer) Seller (Exporter) (5) Delivery of Goods (2) Request to Provide Credit (8) Documents & Claim for Payment (6) Documents Presented (4) Letter of Credit Delivered (7) Documents Presented to issuing Bank Importer’s Bank (Issuing Bank) (9) Payment Correspondent Bank (3) Credit Sent to Correspondent 41

Important Highlights of UCP 600 • The UCP 600 rules apply to any credit when stated that it is subject to these rules • They are binding on all parties unless modified or excluded by the credit. – Article 1 • A credit is irrevocable unless there is an indication • A document may be signed by handwriting, facsimile signature, perforated signature, stamp, symbol or any other mechanical or electronic method of authentication

ARTICLE 2 Definitions Banking Day a day on which a bank is regularly open at the place at which an act subject to these rules is to be performed. Complying Presentation a presentation that is in accordance with the terms and conditions of the credit, the applicable provisions of these rules and international standard banking practice. 43

ARTICLE 2 Honour: a. to pay at sight if the credit is available by sight payment. b. to incur a deferred payment undertaking and pay at maturity if the credit is available by deferred payment. c. to accept a bill of exchange (“draft”) drawn by the beneficiary and pay at maturity if the credit is available by acceptance. 44

ARTICLE 2 Negotiation: the purchase by the nominated bank of drafts (drawn on a bank other than the nominated bank) and/or documents under a complying presentation, by advancing or agreeing to advance funds to the beneficiary on or before the banking day on which reimbursement is 45 due to the nominated bank.

ARTICLE 4 Credits v. Contracts • An issuing bank should discourage any attempt by the applicant to include, as an integral part of the credit, copies of the underlying contract, proforma invoice and the like. • The bank is not involved in the contract. • A credit by its nature is a separate transaction from the sale or other contract on which it may be based. 46

Article 5 • Banks deal with documents and not with goods, services or performance to which the documents may relate

Article 6 - Availability, Expiry Date and Place for Presentation • A credit must state the bank with which it is available or whether it is available with any bank. • A credit available with a nominated bank is also available with the issuing bank. • A credit must state whether it is available by sight payment, deferred payment, acceptance or negotiation. • A credit must not be issued available by a draft drawn on the applicant. • A credit must state an expiry date for presentation. • The place of the bank with which the credit is available is the place for presentation. • Except as provided in sub-article 29 (a), a presentation by or on behalf of the beneficiary must be made on or before the expiry date.

Article 7 & 8 • The Issuing Bank and Confirming Bank have to fulfill their undertakings of negotiation and honour.

Article 9 - Advising of Credits and Amendments • A credit and any amendment may be advised to a beneficiary through an advising bank. • An advising bank that is not a confirming bank advises the credit and any amendment without any undertaking to honour or negotiate. • An advising bank may utilize the services of another bank ("second advising bank") to advise the credit and any amendment to the beneficiary. • A bank utilizing the services of an advising bank or second advising bank to advise a credit must use the same bank to advise any amendment too.

Article 10 - Amendments • Except as otherwise provided by article 38, a credit can neither be amended nor cancelled without the agreement of the issuing bank, the confirming bank, if any, and the beneficiary. • The beneficiary should give notification of acceptance or rejection of an amendment. • Partial acceptance of an amendment is not allowed and will be deemed to be notification of rejection of the amendment. • A provision in an amendment to the effect that the amendment shall enter into force unless rejected by the beneficiary within a certain time shall be disregarded.

Article 11 - Teletransmitted and Pre. Advised Credits and Amendments • a. An authenticated teletransmission of a credit or amendment will be deemed to be the operative credit or amendment, and any subsequent mail confirmation shall be disregarded. • If a teletransmission states "full details to follow" (or words of similar effect), or states that the mail confirmation is to be the operative credit or amendment, then the teletransmission will not be deemed to be the operative credit or amendment. • The issuing bank must then issue the operative credit or amendment without delay in terms not inconsistent with the teletransmission. • b. A preliminary advice of the issuance of a credit or amendment ("pre-advice") shall only be sent if the issuing bank is prepared to issue the operative credit or amendment. • An issuing bank that sends a preadvice is irrevocably committed to issue the operative credit or amendment, without delay, in terms not inconsistent with the pre-advice.

Article 14 - Standard for Examination of Documents • A nominated bank acting on its nomination, a confirming bank, if any, and the issuing bank must examine a presentation to determine, on the basis of the documents alone. • A nominated bank acting on its nomination, a confirming bank, if any, and the issuing bank shall each have a maximum of five banking days following the day of presentation to determine if a presentation is complying. • A presentation including one or more original transport documents must be made by or on behalf of the beneficiary not later than 21 calendar days after the date of shipment, but in any event not later than the expiry date of the credit. • Data in a document, when read in context with the credit, the document itself and international standard banking practice, need not be identical to, but must not conflict with, data in that document, any other stipulated document or the credit.

• A document may be dated prior to the issuance date of the credit, but must not be dated later than its date of presentation. • When the addresses of the beneficiary and the applicant appear in any stipulated document, they need not be the same as those stated in the credit or in any other stipulated document, but must be within the same country as the respective addresses mentioned in the credit. • Contact details (telefax, telephone, email and the like) stated as part of the beneficiary's and the applicant's address will be disregarded. However, when the address and contact details of the applicant appear as part of the consignee or notify party details on a transport document, they must be as stated in the credit. • The shipper or consignor of the goods indicated on any document need not be the beneficiary of the credit. • A transport document may be issued by any party other than a carrier, owner, master or charterer

Article 17 - Original Documents and Copies a. At least one original of each document stipulated in the credit must be presented. b. A bank shall treat as an original any document bearing an apparently original signature, mark, stamp, or label of the issuer of the document, unless the document itself indicates that it is not an original.

Article 18 - Commercial Invoice • a. A commercial invoice: • i. must appear to have been issued by the beneficiary • ii. must be made out in the name of the applicant • iii. must be made out in the same currency as the credit; and • iv. need not be signed. • The description of the goods, services or performance in a commercial invoice must correspond with that appearing in the credit.

Article 19 - Transport Document • indicate the name of the carrier and be signed by: - the carrier or a named agent for or on behalf of the carrier, or - the master or a named agent for or on behalf of the master. • indicate that the goods have been dispatched, taken in charge or shipped on board at the place stated in the credit, by: • - pre-printed wording, or • - a stamp or notation indicating the date on which the goods have been dispatched, taken in charge or shipped on board. • The date of issuance of the transport document will be deemed to be the date of dispatch and the date of shipment. • However, if the transport document indicates, by stamp or notation, a date of dispatch, taking in charge or shipped on board, this date will be deemed to be the date of shipment. • Indicate the place of dispatch, taking in charge or shipment and the place of final destination stated in the credit.

• Be the sole original transport document or, if issued in more than one original, be the full set as indicated on the transport document. • Contain terms and conditions of carriage or make reference to another source containing the terms and conditions of carriage (short form or blank back transport document). • Contents of terms and conditions of carriage will not be examined. • Contain an indication that it is subject to a charter party or not. • A transport document may indicate that the goods will or may be transhipped provided that the entire carriage is covered by one and the same transport document. • A transport document indicating that transhipment will or may take place is acceptable, even if the credit prohibits transhipment

Article 26 -On Deck", "Shipper's Load and Count", "Said by Shipper to Contain" and Charges Additional to Freight • A transport document must not indicate that the goods are or will be loaded on deck. A clause on a transport document stating that the goods may be loaded on deck is acceptable. • A transport document bearing a clause such as "shipper's load and count" and "said by shipper to contain" is acceptable. • A transport document may bear a reference, by stamp or otherwise, to charges additional to the freight

Article 27 -Clean Transport Document • A bank will only accept a clean transport document. A clean transport document is one bearing no clause or • notation expressly declaring a defective condition of the goods or their packaging. The word "clean" need not appear on a transport document, even if a credit has a requirement for that transport document to be "clean on board".

Article 28 - Insurance Document and Coverage • An insurance document, such as an insurance policy, an insurance certificate or a declaration under an open cover, must appear to be issued and signed by an insurance company, an underwriter or their agents or their proxies. • When the insurance document indicates that it has been issued in more than one original, all originals must be presented. • Cover notes will not be accepted. • An insurance policy is acceptable in lieu of an insurance certificate or a declaration under an open cover. • The date of the insurance document must be no later than the date of shipment, unless it appears from the insurance document that the cover is effective from a date not later than the date of shipment.

• The insurance document must indicate the amount of insurance coverage and be in the same currency as the credit. • A requirement in the credit for insurance coverage to be for a percentage of the value of the goods, of the invoice value or similar is deemed to be the minimum amount of coverage required. • If there is no indication in the credit of the insurance coverage required, the amount of insurance coverage must be at least 110% of the CIF or CIP value of the goods. • When the CIF or CIP value cannot be determined from the documents, the amount of insurance coverage must be calculated on the basis of the amount for which honour or negotiation is requested or the gross value of the goods as shown on the invoice, whichever is greater. • The insurance document must indicate that risks are covered at least between the place of taking in charge or shipment and the place of discharge or final destination as stated in the credit.

• A credit should state the type of insurance required and, if any, the additional risks to be covered. An insurance document will be accepted without regard to any risks that are not covered if the credit uses imprecise terms such as "usual risks" or "customary risks". • When a credit requires insurance against "all risks" and an insurance document is presented containing any "all risks" notation or clause, whether or not bearing the heading "all risks", the insurance document will be accepted without regard to any risks stated to be excluded. • An insurance document may contain reference to any exclusion clause. • An insurance document may indicate that the cover is subject to a franchise or excess (deductible).

Article 29 a. If the expiry date of a credit or the last day for presentation falls on a day when the bank to which presentation is to be made is closed for reasons other than those referred to in article 36, the expiry date or the last day for presentation, as the case may be, will be extended to the first following banking day. b. If presentation is made on the first following banking day, a nominated bank must provide the issuing bank or confirming bank with a statement on its covering schedule that the presentation was made within the time limits extended in accordance with sub-article 29 (a). c. The latest date for shipment will not be extended as a result of sub-article 29 (a).

Article 30 -Tolerance in Credit Amount, Quantity and Unit Prices a. The words "about" or "approximately" used in connection with the amount of the credit or the quantity or the unit price stated in the credit are to be construed as allowing a tolerance not to exceed 10% more or 10% less than the amount, the quantity or the unit price to which they refer. b. A tolerance not to exceed 5% more or 5% less than the quantity of the goods is allowed, provided the credit does not state the quantity in terms of a stipulated number of packing units or individual items and the total amount of the drawings does not exceed the amount of the credit. c. Even when partial shipments are not allowed, a tolerance not to exceed 5% less than the amount of the credit is allowed, provided that the quantity of the goods, if stated in the credit, is shipped in full and a unit price, if stated in the credit, is not reduced or that sub-article 30 (b) is not applicable. This tolerance does not apply when the credit stipulates a specific tolerance or uses the expressions referred to in sub-article 30 (a).

Article 33 - Hours of Presentation • A bank has no obligation to accept a presentation outside of its banking hours.

Terms and Conditions in an L/C • Draft – • Letters of Credit usually necessitate that the Beneficiary draw a draft on the Issuing Bank. • The period of time from the date on which either the complying documents are presented or the draft is drawn, to the date on which payment is payable is the “tenor” of the draft. • If the draft is payable upon presentation, the draft will be drawn payable at ‘’sight. ” • If the draft is payable, for example, 30 days after presentation of complying documents (“ 30 days sight”) or 30 days after the date the draft is drawn (“ 30 days date”), the draft is a time draft.

Expiration Date • A Letter of Credit should contain a stated expiry date. • The Beneficiary is required to present the draft(s) and documents to the Issuing Bank or a Nominated Bank on or before that date. • Under the Uniform Customs and Practice for Documentary Credits Act (UCP), published by the International Chamber of Commerce (and incorporated by reference in most commercial • letters of credit), if the expiration date falls on a day when banks at the place of presentation are closed, the expiration date is extended to the next business day. • Letters of Credit expire at the times and locations specified in the Letter of Credit.

Latest Shipping Date • Most Commercial Letters of Credit contain a latest shipping date. • The documents confirming shipment must not be dated after that date. • When “on board” transportation documents are required, the date indicated in the “on board” notation on the transport documents is considered to be the date of shipment.

Latest Date for Presentation • Unless the credit stipulates otherwise, the UCP requires that documents be presented within 21 days of the date of shipment or at another such period stated in the Letter of Credit.

Strict Compl iance Auton omy Doctrines

Doctrine of Strict Compliance • Payment is made if and only if the details matches that of other documents • In the absence of conformity with the L/C, the Seller cannot force payment and the bank pays at its own risk. • Sellers should be careful and remember that the bank may insist upon strict compliance with all documentary requirements in the LC. • If the documents do not conform, the bank should give the seller prompt, detailed notice, specifying all discrepancies and shortfalls.

Doctrine of Autonomy • Letters of credit deal in documents, not goods. • L/Cs are purely documentary transactions, separate and independent from the underlying contract between the Buyer and the Seller. • The bank honoring the L/C is concerned only to see that the documents conform with the requirements in the L/C. • If the documents conform, the bank will pay, and obtain reimbursement from the Buyer/Applicant. • The bank need not look past the documents to examine the underlying sale of merchandise or the product itself. • The letter of credit is independent from the underlying transaction and, except in rare cases of fraud or forgery, the issuing bank must honor conforming documents. • Thus, sellers are given protections that the issuing bank must honor its demand for payment regardless of whether the goods conform with the underlying sale contract.

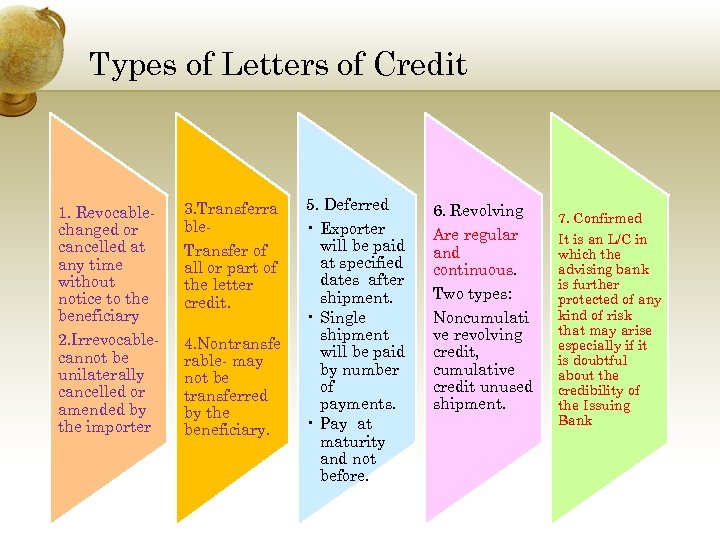

Types of Letters of Credit 1. Revocablechanged or cancelled at any time without notice to the beneficiary 2. Irrevocablecannot be unilaterally cancelled or amended by the importer 3. Transferra ble. Transfer of all or part of the letter credit. 4. Nontransfe rable- may not be transferred by the beneficiary. 5. Deferred • Exporter will be paid at specified dates after shipment. • Single shipment will be paid by number of payments. • Pay at maturity and not before. 6. Revolving Are regular and continuous. Two types: Noncumulati ve revolving credit, cumulative credit unused shipment. 7. Confirmed It is an L/C in which the advising bank is further protected of any kind of risk that may arise especially if it is doubtful about the credibility of the Issuing Bank

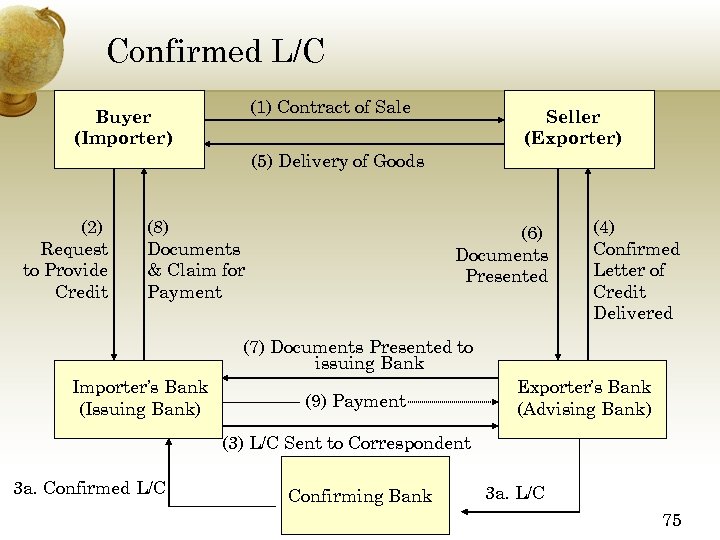

Confirmed L/C (1) Contract of Sale Buyer (Importer) Seller (Exporter) (5) Delivery of Goods (2) Request to Provide Credit (8) Documents & Claim for Payment (6) Documents Presented (4) Confirmed Letter of Credit Delivered (7) Documents Presented to issuing Bank Importer’s Bank (Issuing Bank) (9) Payment Exporter’s Bank (Advising Bank) (3) L/C Sent to Correspondent 3 a. Confirmed L/C Confirming Bank 3 a. L/C 75

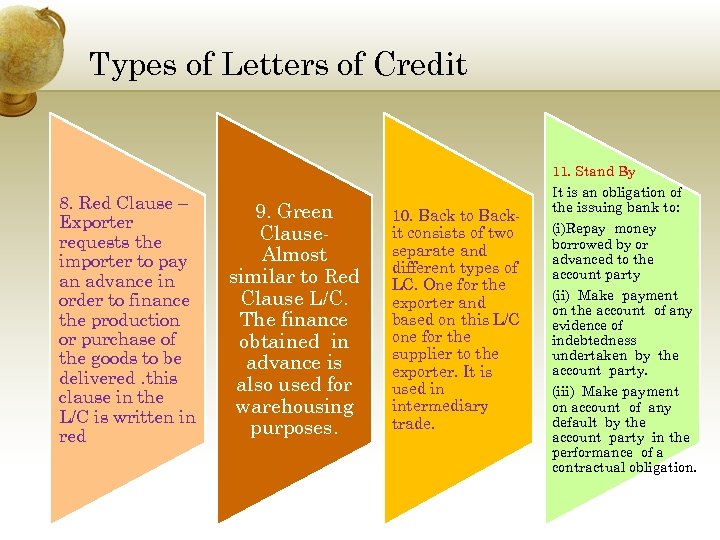

Types of Letters of Credit 8. Red Clause – Exporter requests the importer to pay an advance in order to finance the production or purchase of the goods to be delivered. this clause in the L/C is written in red 9. Green Clause. Almost similar to Red Clause L/C. The finance obtained in advance is also used for warehousing purposes. 10. Back to Backit consists of two separate and different types of LC. One for the exporter and based on this L/C one for the supplier to the exporter. It is used in intermediary trade. 11. Stand By It is an obligation of the issuing bank to: (i)Repay money borrowed by or advanced to the account party (ii) Make payment on the account of any evidence of indebtedness undertaken by the account party. (iii) Make payment on account of any default by the account party in the performance of a contractual obligation.

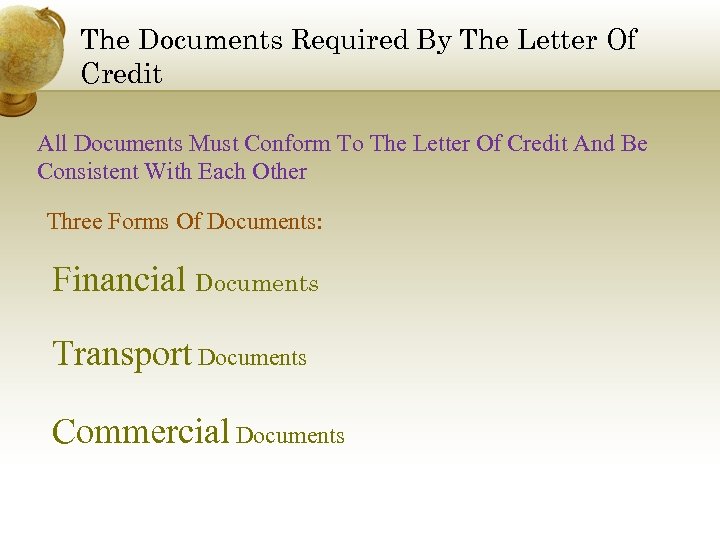

The Documents Required By The Letter Of Credit All Documents Must Conform To The Letter Of Credit And Be Consistent With Each Other Three Forms Of Documents: Financial Documents Transport Documents Commercial Documents

FINANCIAL DOCUMENTS: Bill of Exchange Promissory Note Trust Receipt Delivery Order

TRANSPORT DOCUMENTS: Bill of Lading Airway Bill Air Consignment Note Postal Parcel Receipt Truck Receipt Railway Receipt

COMMERCIAL DOCUMENTS Commercial Invoice Packing List Insurance Certificate Of Origin Inspection Certificate Weight Note Certificate Of Analysis Black List Certificate etc.

DOCUMENTARY REQUIREMENTS

Drafts should • Be drawn by the Beneficiary on behalf of the parties specificied in the Letter of Credit • Not exceed the Letter of Credit amount or its remaining balance • Not be payable or endorsed to parties other than the Beneficiary or the issuing or the nominated bank • Be in negotiable form, endorsed by the Beneficiary as necessary • Refer to the Letter of Credit

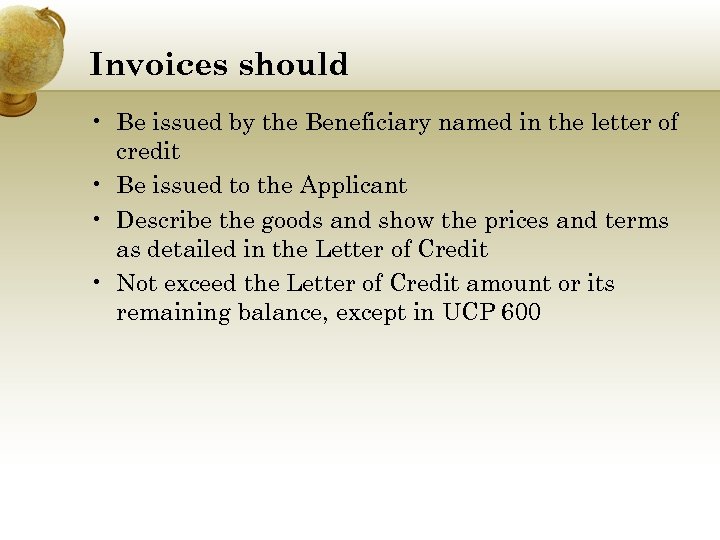

Invoices should • Be issued by the Beneficiary named in the letter of credit • Be issued to the Applicant • Describe the goods and show the prices and terms as detailed in the Letter of Credit • Not exceed the Letter of Credit amount or its remaining balance, except in UCP 600

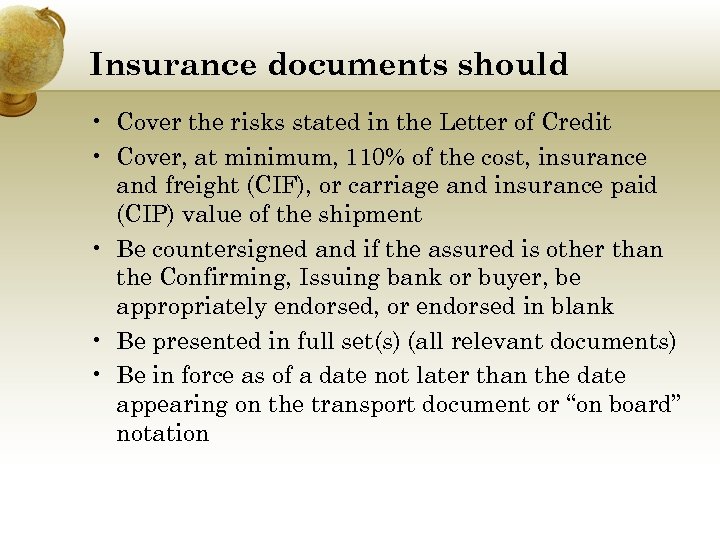

Insurance documents should • Cover the risks stated in the Letter of Credit • Cover, at minimum, 110% of the cost, insurance and freight (CIF), or carriage and insurance paid (CIP) value of the shipment • Be countersigned and if the assured is other than the Confirming, Issuing bank or buyer, be appropriately endorsed, or endorsed in blank • Be presented in full set(s) (all relevant documents) • Be in force as of a date not later than the date appearing on the transport document or “on board” notation

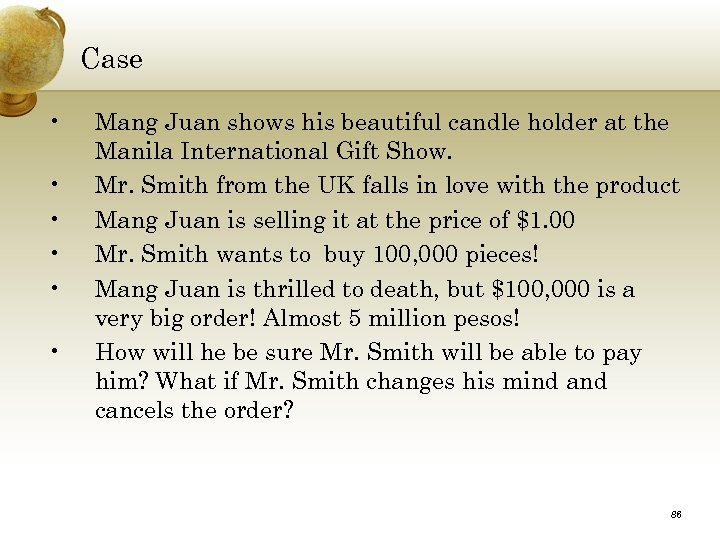

Case • • • Mang Juan shows his beautiful candle holder at the Manila International Gift Show. Mr. Smith from the UK falls in love with the product Mang Juan is selling it at the price of $1. 00 Mr. Smith wants to buy 100, 000 pieces! Mang Juan is thrilled to death, but $100, 000 is a very big order! Almost 5 million pesos! How will he be sure Mr. Smith will be able to pay him? What if Mr. Smith changes his mind and cancels the order? 86

Methods of Payment which can be adopted 1. 2. 3. 4. Can Mang Juan ask Mr. Smith to pay 50% in advance? Would Mr. Smith feel this is right? Remember, they have met for the first time. What if Mang Juan takes the money but does not ship the goods! How can Mang Juan and possibly those who will finance his production be reassured he will be paid? How about Mr. Smith? What assurance does he have that Mang Juan will deliver the 100, 000 pieces on the agreed date and the same quality as he showed? Would it be fair to Mang Juan if Mr. Smith pays him only after the goods have been shipped to him and inspected by Mr. Smith? That would be ideal for Mr. Smith. 87

How do we solve this problem of trust? Through A bank instrument called the Letter of Credit 1. 2. 3. 4. It is a bank, and not Mr. Smith, who guarantees Mang Juan that he will be paid Mr. Smith, the importer-buyer, applies to his bank for a letter of credit which if he is a good client of the bank, will be approved with a marginal deposit from Mr. Smith. With the Letter of Credit, it is the Issuing Bank and not Mr. Smith, who assures the exporter-seller, Mang Juan, that he will be paid, provided he complies with the terms of the Letter of Credit. Mr. Smith can stipulate in the Letter of Credit however the latest shipping date of the order, if partial shipments will be allowed, and that an inspection certificate approving the goods for shipment by a trusted firm specified by the buyer is 88 required.

Common Defects in Documentation About half of all drawings contain discrepancies, like: • The L/C expires prior to presentation of documents • B/L evidences delivery prior to or after the date range stated in L/C • Changes included in invoice not authorized in L/C • Inconsistent description of goods • Insurance document errors. A document required may be missing • Invoice amount not equal to draft amount • Name of documents not exact as described in the credit. Beneficiary information not exact • Invoice/statement not signed as stipulated in L/C

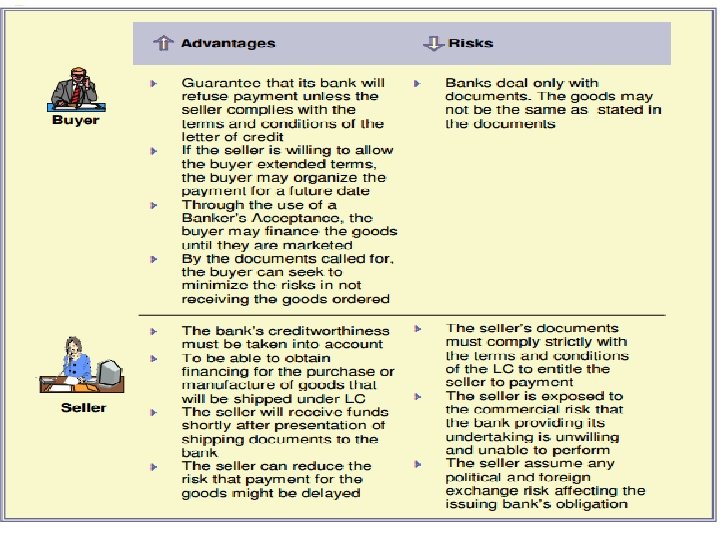

Importance of L/C for Exporter • Dependence on Credit worthiness of a bank instead of importer • If the credit is confirmed by a bank in the exporter’s country, the exporter is neither subject to commercial not to country risk • If the credit is irrevocable, it can’t be cancelled without the exporter’s consent and notice of revocation can be rejected by the exporter if received after shipment • The documents and therefore the goods will not be released until payment or commitment to payment is made (In terms of L/C) • Where credit has been allowed the accepted bill of exchange can be used to obtain the finances

Importance of L/C for Importer • The importer can negotiate better terms as the exporter is assured of payment • Importer is assured that no funds will be released unless title documents and received correct and in order • Protection is provided under UCP for documentary Credit

Risk Situations in a L/C Transaction • General- If goods being offered for sale at a price that is too good to be true, then it is a risky situation • Fraud- Payment may be obtained for non-existent or worthless goods against presentation of by the beneficiary of forged or falsified documents or credit itself may be forged • Risks to applicant – non delivery of goods, short shipment, inferior quality, early/late shipment, damages in transit, Failure of bank viz. issuing bank/collecting bank • Risks to beneficiary- failure to comply with credit conditions, failure of, or delays in payment from the issuing bank contd

Risk Situations in a L/C Transaction (contd) • Sovereign & Regulatory Risks- possibility that L/C may be prevented by the government action out side the control of parties • Risks to issuing bank- Insolvency of the applicant, fraud risk, sovereign, regulatory & legal risks • Risks to advising bank- if it is a paying bank – failure to check apparent authenticity of L/C – and advising it to beneficiary • Risks to confirming bank- Once having paid the beneficiary, it may not be able to obtain reimbursement from the issuing bank because of insolvency of issuing bank

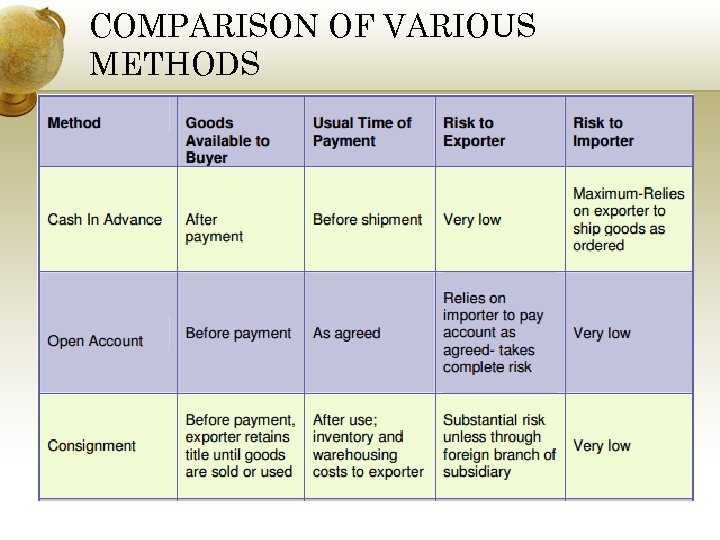

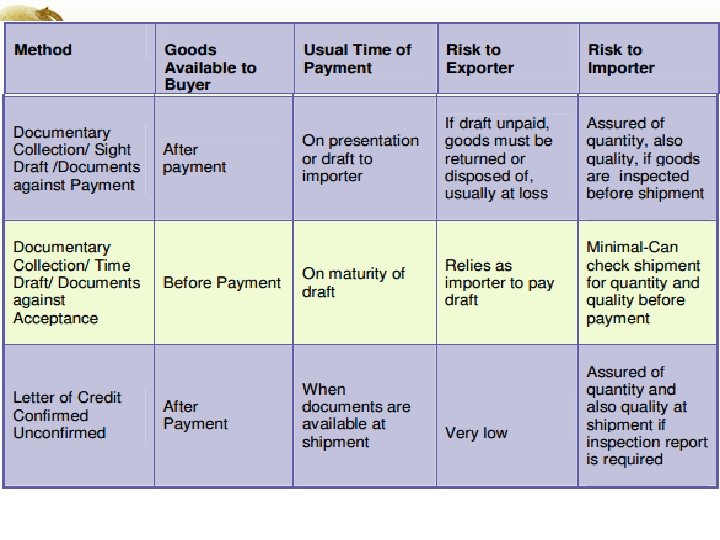

COMPARISON OF VARIOUS METHODS

Guarantees • A Guarantee is issued by a bank on behalf of its customer, the Exporter, as financial assurance to the Importer to be collected in the event that the Exporter defaults on certain specified contractual obligations. • The bank that issues a Guarantee will pay the named beneficiary the amount specified on presentation of a written demand as outlined in the Guarantee. • While there are standard Guarantee formats, Guarantees can be tailored to meet your specific contractual needs.

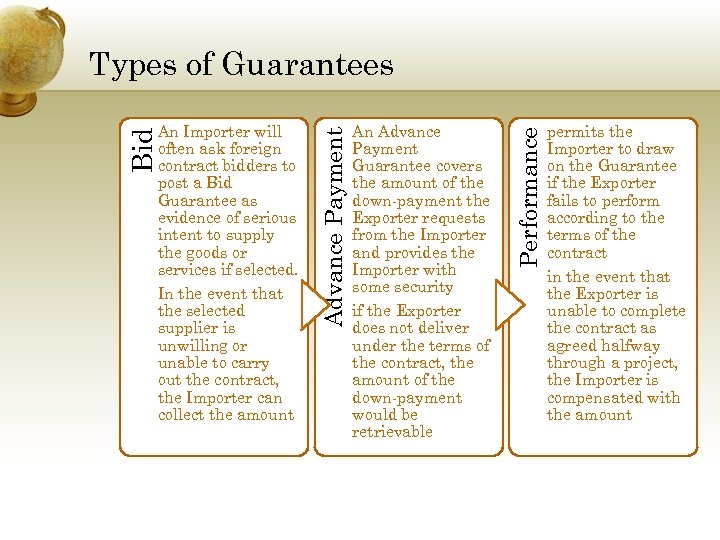

An Advance Payment Guarantee covers the amount of the down-payment the Exporter requests from the Importer and provides the Importer with some security if the Exporter does not deliver under the terms of the contract, the amount of the down-payment would be retrievable Performance Bid An Importer will often ask foreign contract bidders to post a Bid Guarantee as evidence of serious intent to supply the goods or services if selected. In the event that the selected supplier is unwilling or unable to carry out the contract, the Importer can collect the amount Advance Payment Types of Guarantees permits the Importer to draw on the Guarantee if the Exporter fails to perform according to the terms of the contract in the event that the Exporter is unable to complete the contract as agreed halfway through a project, the Importer is compensated with the amount

Class Discussion Activity • The importer applied for a credit for the full CFR value of the goods. This credit contained as term of payment: • 40% of the value payable at sight against presentation of compliant documents • 60% to be settled by draft at 90 day’s sight on credit applicant without responsibility or engagement on our part ( meaning the issuing bank) • Compliant documents were prepared by the exporter and presented to the bank and the 40% payment was effected. • The 90 days’ sight draft for the remaining 60% was duly accepted by the credit applicant. • At maturity, it remained unpaid and the issuing bank took refuge in the wording. “ without responsibility or engagement on our part”. • The beneficiary is in the opinion that a bank issuing a credit for the full value of the goods should accept responsibility for the beneficiary also to be paid in full.

Questions • What do you think about this kind of credit? • What is wrong with the terms of payment in the credit? • Do you think the beneficiary has made his objection on time?

5043c27a2467bd609a91b2ec248bf978.ppt