720048147c37b5f81e4dfa88585af7dc.ppt

- Количество слайдов: 15

MERRILL LYNCH GLOBAL ENERGY CONFERENCE NOVEMBER 5, 2003 Presenter: Gene Isenberg Chairman & CEO

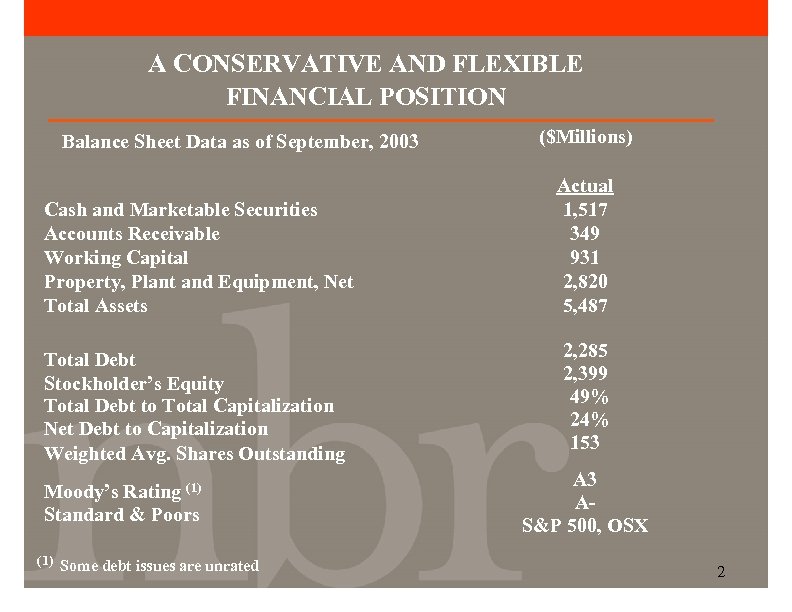

A CONSERVATIVE AND FLEXIBLE FINANCIAL POSITION Balance Sheet Data as of September, 2003 Cash and Marketable Securities Accounts Receivable Working Capital Property, Plant and Equipment, Net Total Assets Total Debt Stockholder’s Equity Total Debt to Total Capitalization Net Debt to Capitalization Weighted Avg. Shares Outstanding Moody’s Rating (1) Standard & Poors (1) Some debt issues are unrated ($Millions) Actual 1, 517 349 931 2, 820 5, 487 2, 285 2, 399 49% 24% 153 A 3 AS&P 500, OSX 2

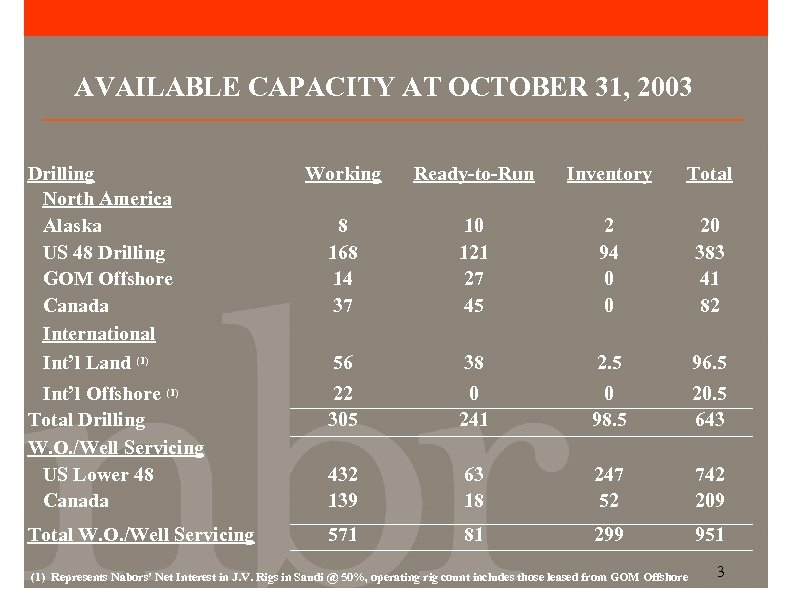

AVAILABLE CAPACITY AT OCTOBER 31, 2003 Drilling North America Alaska US 48 Drilling GOM Offshore Canada International Int’l Land (1) Working Ready-to-Run Inventory Total 8 168 14 37 10 121 27 45 2 94 0 0 20 383 41 82 56 38 2. 5 96. 5 Int’l Offshore (1) Total Drilling W. O. /Well Servicing US Lower 48 Canada 22 305 0 241 0 98. 5 20. 5 643 432 139 63 18 247 52 742 209 Total W. O. /Well Servicing 571 81 299 951 (1) Represents Nabors’ Net Interest in J. V. Rigs in Saudi @ 50%, operating rig count includes those leased from GOM Offshore 3

NATURAL GAS OUTLOOK Supply challenges point to a more orderly and sustainable cycle » North American Gas Decline Rates Imply 20+ BCFPD Production Decline Per Year » Timing of the Supply Impact of Gas From: • • Deepwater Mc. Kenzie Delta Alaska LNG » US & Canadian Basins are the only alternatives for incremental supply of natural gas over the next five to eight years. Longer term, LNG will ultimately become the marginal supply 4

GLOBAL OIL Supply Demand Balance Appears Favorable But Less Visible Than Gas Supply: » Aging and Declining Fields • North Sea, North Slope, US, Latin America, Middle East » Prospective New Supplies • Deep Water – US GOM, West Africa • Middle East – Exploration and Development • Russia – Rehabilitation and New Developments • Former Soviet Union States Demand: » Global GDP – China, India and Emerging Economics » North American Gas Alternatives 5

INCREMENTAL GAS DRILLING CHALLENGES » Existing Reserves – Higher Recovery Efficiency – Increased Technology » Incremental Reserves – Deeper Horizons – More Complex – Higher Risks – More Remote – Less Accessible 6

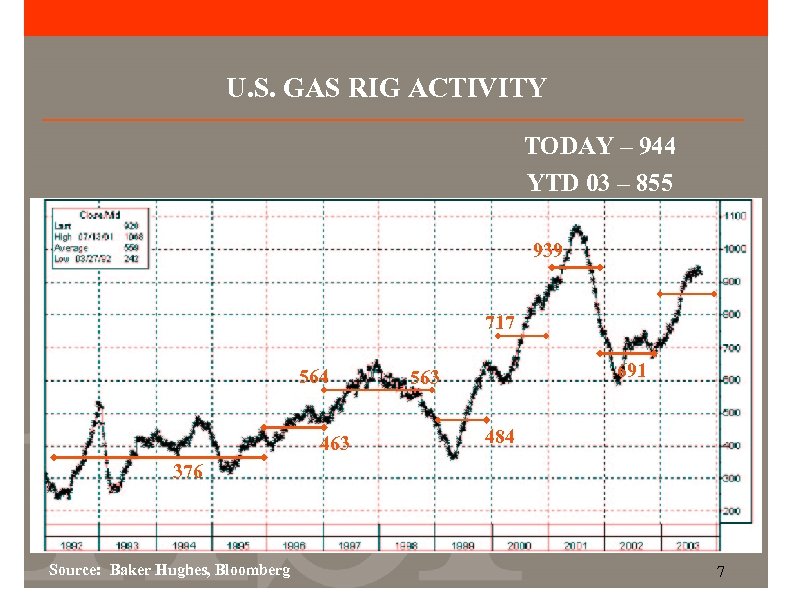

U. S. GAS RIG ACTIVITY TODAY – 944 YTD 03 – 855 939 717 564 463 691 563 484 376 Source: Baker Hughes, Bloomberg 7

U. S. NATURAL GAS PRODUCTION YEAR-OVER-YEAR % CHANGE 717 Gas Rigs 939 Gas Rigs 691 Gas Rigs 4% Est. 1, 000 at year end Today = 944 Y-T-D Avg. = 855 Quarterly YOY % Change 2% -4. 8 -5. 2 -4. 9 -6. 2 -2 E -3 E ACT ACT -2 E -1 E 0% -2% -4% Storm Related -6% -8% -10% Quarterly Bcfd: 52. 0 51. 6 52. 0 52. 1 53. 0 52. 2 51. 9 2000 Annual Change Assumes BHI Gas Rig Count 1, 000 Year End 2003 50. 5 50. 3 49. 7 48. 7 49. 4 49. 0 48. 8 2001 2002 2003 E +1. 2% -5. 3% 48. 5 -1 to -3% 8 EOG_BS 0503 -3

LAND RIG SUPPLY CYCLE-TO-CYLCE » August 2000 Effective 100% Utilization at 850 US Land Rigs » Today Effective 100% Utilization at 1100+ US Land Rigs » Increased Operating Costs » Increased Capital Costs » None the less, we expect significantly lower dayrates than the 2001 peak 9

FOCUSING ON RIG EFFECIENCY & INNOVATION US LOWER 48 » Reducing moving times • From 5 – 7 days to 3. 5 – 5 days • 24 hour moves, pre-planning, load unitizations, and Nabors controlled Trucking » Upgrading rig capabilities • Higher hydraulic horsepower • Iron ruffnecks » Incorporating technology innovations where cost effective • Noble Opti. Drill ™ – 8 systems expanding to 12 by end of year » Overall performance improvements in safety and efficiency • • El Paso’s Robert Guerra #1 well in South Texas set new industry record to 19, 000 feet in 38 days - 11 days and more than $1 million under AFE El Paso’s Casa de Nylon well in South Texas drilled to 17, 000 feet - 11 days and $750, 000 under AFE 10

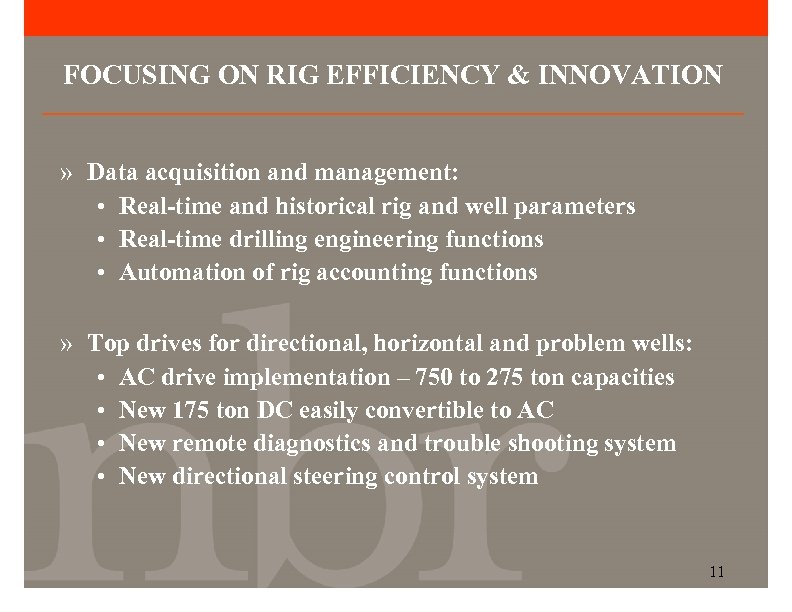

FOCUSING ON RIG EFFICIENCY & INNOVATION » Data acquisition and management: • Real-time and historical rig and well parameters • Real-time drilling engineering functions • Automation of rig accounting functions » Top drives for directional, horizontal and problem wells: • AC drive implementation – 750 to 275 ton capacities • New 175 ton DC easily convertible to AC • New remote diagnostics and trouble shooting system • New directional steering control system 11

NEW AND REMODELED RIGS CANADA: Seven rigs from September 2002 – March 2004 • AC – PLC technologies in house • 800 – 3, 000 HP highly mobile rigs • In house design and construction expertise U. S. LOWER 48: • Two modularized pad rigs for Shell Pinedale Anticline • Upgraded and refurbished rig for Shell South Texas OFFSHORE: • Three Gulf of Mexico platform rigs for deepwater development projects • Eight international platform rigs since mid 2003 12

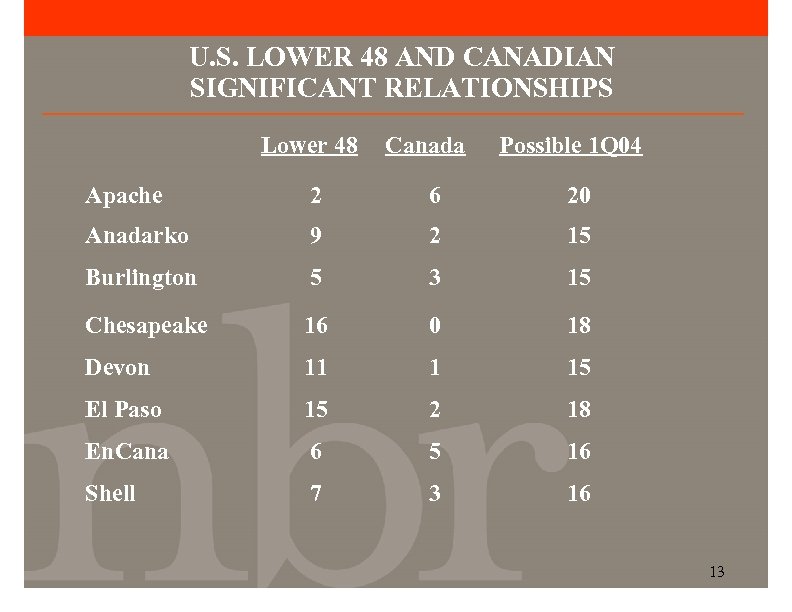

U. S. LOWER 48 AND CANADIAN SIGNIFICANT RELATIONSHIPS Lower 48 Canada Possible 1 Q 04 Apache 2 6 20 Anadarko 9 2 15 Burlington 5 3 15 Chesapeake 16 0 18 Devon 11 1 15 El Paso 15 2 18 En. Cana 6 5 16 Shell 7 3 16 13

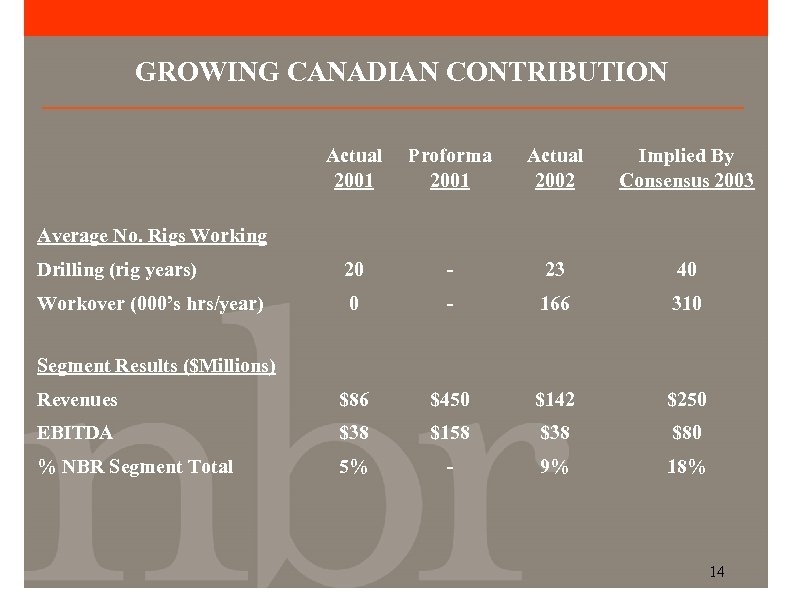

GROWING CANADIAN CONTRIBUTION Actual 2001 Proforma 2001 Actual 2002 Implied By Consensus 2003 Drilling (rig years) 20 - 23 40 Workover (000’s hrs/year) 0 - 166 310 Revenues $86 $450 $142 $250 EBITDA $38 $158 $38 $80 % NBR Segment Total 5% - 9% 18% Average No. Rigs Working Segment Results ($Millions) 14

GROWING INTERNATIONAL CONTRIBUTION Actual 2001 Actual 2002 Implied By Consensus 2003 Land 53 45 47 Offshore 1 7 15 Revenues $282 $320 $400 EBITDA $90 $114 $135 % NBR Segment Total 12% 28% 30% Average No. Rigs Working Segment Results ($Millions) 15

720048147c37b5f81e4dfa88585af7dc.ppt