dfa7f71e1625f45494ffeffa8e2b0a28.ppt

- Количество слайдов: 22

Mergers and Acquisitions in Russia and CIS Legal Risks and Mitigation Shane De. Beer, Partner (London/Moscow), Dechert LLP IC Energy Corporate Financing in Russia & CIS 24 November 2011 © 2011 Dechert LLP shane. debeer@dechert. com +44 20 7184 7871 (London) +7 499 922 1100 (Moscow) www. dechert. com

Mergers and Acquisitions in Russia and CIS Legal Risks and Mitigation Shane De. Beer, Partner (London/Moscow), Dechert LLP IC Energy Corporate Financing in Russia & CIS 24 November 2011 © 2011 Dechert LLP shane. debeer@dechert. com +44 20 7184 7871 (London) +7 499 922 1100 (Moscow) www. dechert. com

Russia and CIS Country Risk versus Legal Risk • Many investors and deal-makers consider this to be the same thing, but that’s not quite true. . . – Legal Risks: • Will a court/arbitral tribunal enforce your deal? – Does the law contemplate it (legal risk)? – Will the courts behave honestly and predictably (country risk)? • Does anything in the law constrain the terms of your deal? – Inflexible laws and regulations (legal risk) – Rent-seeking bureaucracy (country risk) 1 3934150

Russia and CIS Country Risk versus Legal Risk • Many investors and deal-makers consider this to be the same thing, but that’s not quite true. . . – Legal Risks: • Will a court/arbitral tribunal enforce your deal? – Does the law contemplate it (legal risk)? – Will the courts behave honestly and predictably (country risk)? • Does anything in the law constrain the terms of your deal? – Inflexible laws and regulations (legal risk) – Rent-seeking bureaucracy (country risk) 1 3934150

Legal and Country Risks can be Mitigated: 1. Foreign Law Risk: Russian law is inflexible, with such concepts as representations, warranties and indemnities not readily available. Solution: The typical Russian (or other CIS) M&A deal is often a Share Purchase Agreement between, for example, a Dutch seller selling shares in a Cyprus company (that holds the Russian assets) to a BVI buyer, and the bulk of the legal documents are governed by English law. 2 3934150

Legal and Country Risks can be Mitigated: 1. Foreign Law Risk: Russian law is inflexible, with such concepts as representations, warranties and indemnities not readily available. Solution: The typical Russian (or other CIS) M&A deal is often a Share Purchase Agreement between, for example, a Dutch seller selling shares in a Cyprus company (that holds the Russian assets) to a BVI buyer, and the bulk of the legal documents are governed by English law. 2 3934150

cont. . . 2. Foreign Dispute Resolution Risk: Russian courts can be unsophisticated and may be influenced. Solution: Russia, for example, is a signatory to the “New York Convention” (a treaty on the enforcement of international arbitration awards) and Russian courts have a quite commendable history of enforcing foreign arbitral awards. Any foreign entity may agree to use foreign law and foreign dispute resolution in an agreement with a Russian counterparty. 3 3934150

cont. . . 2. Foreign Dispute Resolution Risk: Russian courts can be unsophisticated and may be influenced. Solution: Russia, for example, is a signatory to the “New York Convention” (a treaty on the enforcement of international arbitration awards) and Russian courts have a quite commendable history of enforcing foreign arbitral awards. Any foreign entity may agree to use foreign law and foreign dispute resolution in an agreement with a Russian counterparty. 3 3934150

cont. . . • BUT: – an arbitral award must be enforced by a Russian court, which adds time and expense, and assets may disappear in the interim – English law or no, any deal involving certain thresholds of Russian assets, or certain kinds of assets, will necessarily be subject to Russian administrative law (regulations). The following slides review the basics of the key Russian regulatory issues affecting M&A transactions. 4 3934150

cont. . . • BUT: – an arbitral award must be enforced by a Russian court, which adds time and expense, and assets may disappear in the interim – English law or no, any deal involving certain thresholds of Russian assets, or certain kinds of assets, will necessarily be subject to Russian administrative law (regulations). The following slides review the basics of the key Russian regulatory issues affecting M&A transactions. 4 3934150

Basics • The Foreign Investments Law (Federal Law No. 160 -FZ, dated July 9, 1999 (as amended) "On Foreign Investments in the RF" (the “FIL”) governs foreign investment in Russia. It sets out: – the main guarantees provided to foreign investors (e. g. , guarantees re: confiscation or nationalization of property of foreign investors, grandfathering clauses, etc. ) – the principal terms and conditions for making foreign investments in the RF • On May 7, 2008, Federal Law No. 57 -FZ "On the Procedures of Foreign Investment in Companies of Strategic Importance for National Security and Defense" (the "SSL") and Federal Law No. 58 -FZ, amending certain other Russian laws to give effect to the SSL (the "Amendments Law") came into effect • The SSL addresses: – – • 5 42 sectors that the Russian Government considers to be of strategic importance; definition of a "foreign investor"; types of restrictions on foreign investment; and the approval process The Russian Government and the Federal Antimonopoly Service ("FAS") have adopted numerous resolutions and orders clarifying certain provisions of the SSL and the Amendment Law 3934150

Basics • The Foreign Investments Law (Federal Law No. 160 -FZ, dated July 9, 1999 (as amended) "On Foreign Investments in the RF" (the “FIL”) governs foreign investment in Russia. It sets out: – the main guarantees provided to foreign investors (e. g. , guarantees re: confiscation or nationalization of property of foreign investors, grandfathering clauses, etc. ) – the principal terms and conditions for making foreign investments in the RF • On May 7, 2008, Federal Law No. 57 -FZ "On the Procedures of Foreign Investment in Companies of Strategic Importance for National Security and Defense" (the "SSL") and Federal Law No. 58 -FZ, amending certain other Russian laws to give effect to the SSL (the "Amendments Law") came into effect • The SSL addresses: – – • 5 42 sectors that the Russian Government considers to be of strategic importance; definition of a "foreign investor"; types of restrictions on foreign investment; and the approval process The Russian Government and the Federal Antimonopoly Service ("FAS") have adopted numerous resolutions and orders clarifying certain provisions of the SSL and the Amendment Law 3934150

Sectors Covered by the SSL Include … – activities related to aviation technology and air safety; – some industries registered as a "natural monopoly"; – entities with a dominant market position in fixed-line telecommunications; – IP, emphasizing patent litigation and IP prosecution and licensing; – geological study and exploration/extraction in subsoil areas of "federal significance"; – media-related activities such as television and radio broadcasting to more than half the population in the RF, or printing/publishing publications with a circulation greater than a million; – military technologies, ammunition or explosives; – encryption; – use of nuclear facilities, radioactive materials or waste, or the construction of nuclear facilities 6 3934150

Sectors Covered by the SSL Include … – activities related to aviation technology and air safety; – some industries registered as a "natural monopoly"; – entities with a dominant market position in fixed-line telecommunications; – IP, emphasizing patent litigation and IP prosecution and licensing; – geological study and exploration/extraction in subsoil areas of "federal significance"; – media-related activities such as television and radio broadcasting to more than half the population in the RF, or printing/publishing publications with a circulation greater than a million; – military technologies, ammunition or explosives; – encryption; – use of nuclear facilities, radioactive materials or waste, or the construction of nuclear facilities 6 3934150

A Foreign Investor Is … • any non-resident of Russia capable of investing under the laws of the jurisdiction in which it is a resident (including entities, individuals, states and/or international organizations); or • any company established in Russia operating under the control of foreign investor(s), where "control" is defined broadly to include management control 7 3934150

A Foreign Investor Is … • any non-resident of Russia capable of investing under the laws of the jurisdiction in which it is a resident (including entities, individuals, states and/or international organizations); or • any company established in Russia operating under the control of foreign investor(s), where "control" is defined broadly to include management control 7 3934150

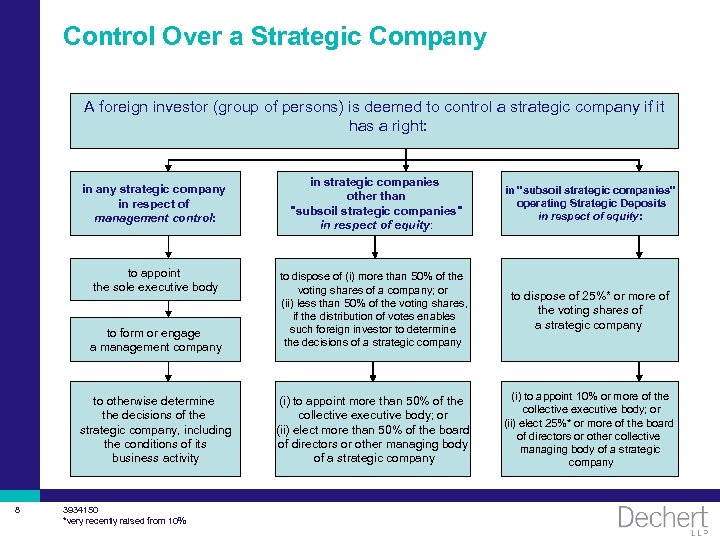

Control Over a Strategic Company A foreign investor (group of persons) is deemed to control a strategic company if it has a right: in any strategic company in respect of management control: to appoint the sole executive body in strategic companies other than "subsoil strategic companies" in respect of equity: in "subsoil strategic companies" operating Strategic Deposits in respect of equity: to form or engage a management company to dispose of 25%* or more of the voting shares of a strategic company to otherwise determine the decisions of the strategic company, including the conditions of its business activity 8 to dispose of (i) more than 50% of the voting shares of a company; or (ii) less than 50% of the voting shares, if the distribution of votes enables such foreign investor to determine the decisions of a strategic company (i) to appoint more than 50% of the collective executive body; or (ii) elect more than 50% of the board of directors or other managing body of a strategic company (i) to appoint 10% or more of the collective executive body; or (ii) elect 25%* or more of the board of directors or other collective managing body of a strategic company 3934150 *very recently raised from 10%

Control Over a Strategic Company A foreign investor (group of persons) is deemed to control a strategic company if it has a right: in any strategic company in respect of management control: to appoint the sole executive body in strategic companies other than "subsoil strategic companies" in respect of equity: in "subsoil strategic companies" operating Strategic Deposits in respect of equity: to form or engage a management company to dispose of 25%* or more of the voting shares of a strategic company to otherwise determine the decisions of the strategic company, including the conditions of its business activity 8 to dispose of (i) more than 50% of the voting shares of a company; or (ii) less than 50% of the voting shares, if the distribution of votes enables such foreign investor to determine the decisions of a strategic company (i) to appoint more than 50% of the collective executive body; or (ii) elect more than 50% of the board of directors or other managing body of a strategic company (i) to appoint 10% or more of the collective executive body; or (ii) elect 25%* or more of the board of directors or other collective managing body of a strategic company 3934150 *very recently raised from 10%

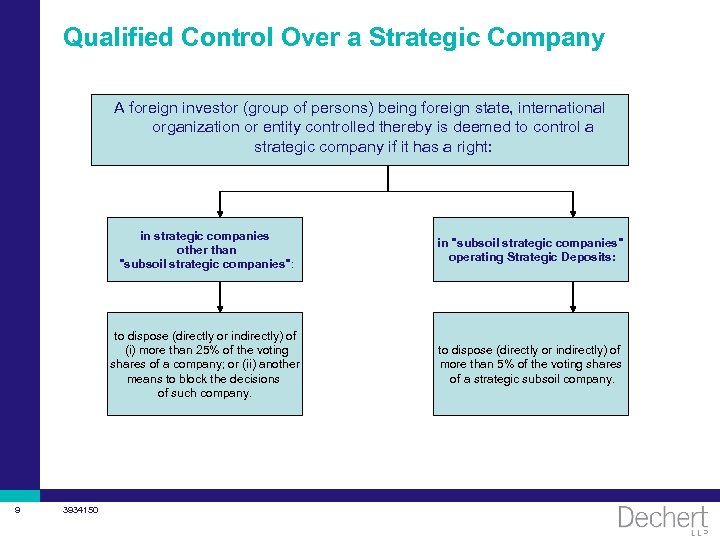

Qualified Control Over a Strategic Company A foreign investor (group of persons) being foreign state, international organization or entity controlled thereby is deemed to control a strategic company if it has a right: in strategic companies other than "subsoil strategic companies": to dispose (directly or indirectly) of (i) more than 25% of the voting shares of a company; or (ii) another means to block the decisions of such company. 9 3934150 in "subsoil strategic companies" operating Strategic Deposits: to dispose (directly or indirectly) of more than 5% of the voting shares of a strategic subsoil company.

Qualified Control Over a Strategic Company A foreign investor (group of persons) being foreign state, international organization or entity controlled thereby is deemed to control a strategic company if it has a right: in strategic companies other than "subsoil strategic companies": to dispose (directly or indirectly) of (i) more than 25% of the voting shares of a company; or (ii) another means to block the decisions of such company. 9 3934150 in "subsoil strategic companies" operating Strategic Deposits: to dispose (directly or indirectly) of more than 5% of the voting shares of a strategic subsoil company.

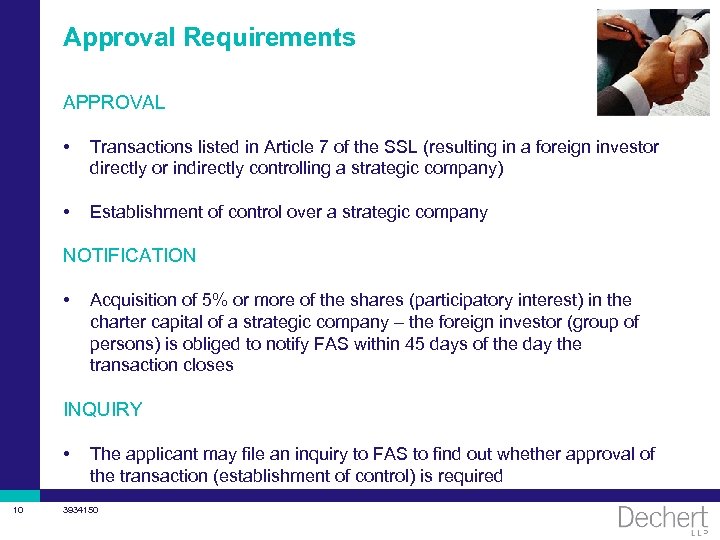

Approval Requirements APPROVAL • Transactions listed in Article 7 of the SSL (resulting in a foreign investor directly or indirectly controlling a strategic company) • Establishment of control over a strategic company NOTIFICATION • Acquisition of 5% or more of the shares (participatory interest) in the charter capital of a strategic company – the foreign investor (group of persons) is obliged to notify FAS within 45 days of the day the transaction closes INQUIRY • 10 The applicant may file an inquiry to FAS to find out whether approval of the transaction (establishment of control) is required 3934150

Approval Requirements APPROVAL • Transactions listed in Article 7 of the SSL (resulting in a foreign investor directly or indirectly controlling a strategic company) • Establishment of control over a strategic company NOTIFICATION • Acquisition of 5% or more of the shares (participatory interest) in the charter capital of a strategic company – the foreign investor (group of persons) is obliged to notify FAS within 45 days of the day the transaction closes INQUIRY • 10 The applicant may file an inquiry to FAS to find out whether approval of the transaction (establishment of control) is required 3934150

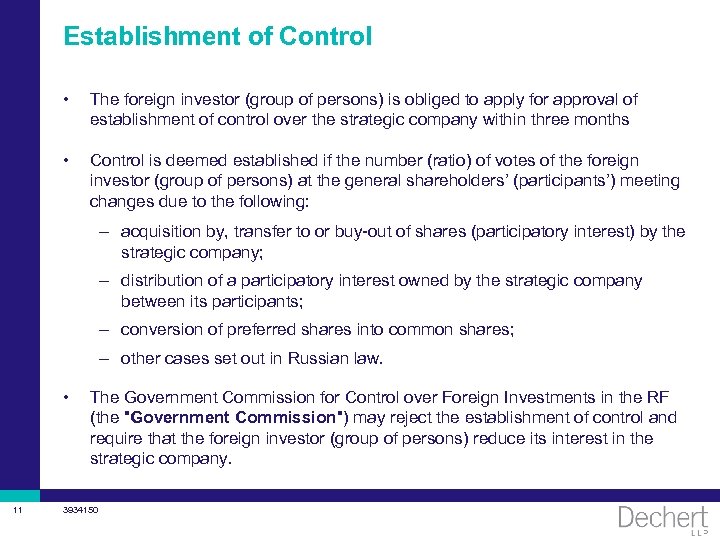

Establishment of Control • The foreign investor (group of persons) is obliged to apply for approval of establishment of control over the strategic company within three months • Control is deemed established if the number (ratio) of votes of the foreign investor (group of persons) at the general shareholders’ (participants’) meeting changes due to the following: – acquisition by, transfer to or buy-out of shares (participatory interest) by the strategic company; – distribution of a participatory interest owned by the strategic company between its participants; – conversion of preferred shares into common shares; – other cases set out in Russian law. • 11 The Government Commission for Control over Foreign Investments in the RF (the "Government Commission") may reject the establishment of control and require that the foreign investor (group of persons) reduce its interest in the strategic company. 3934150

Establishment of Control • The foreign investor (group of persons) is obliged to apply for approval of establishment of control over the strategic company within three months • Control is deemed established if the number (ratio) of votes of the foreign investor (group of persons) at the general shareholders’ (participants’) meeting changes due to the following: – acquisition by, transfer to or buy-out of shares (participatory interest) by the strategic company; – distribution of a participatory interest owned by the strategic company between its participants; – conversion of preferred shares into common shares; – other cases set out in Russian law. • 11 The Government Commission for Control over Foreign Investments in the RF (the "Government Commission") may reject the establishment of control and require that the foreign investor (group of persons) reduce its interest in the strategic company. 3934150

Approval Requirements Do Not Apply … • if the transaction closed prior to May 7, 2008; • if the foreign investor already owns more than 50% of the voting shares of the strategic company (except for subsoil strategic companies); • if the Russian Government has the right to dispose of (own), directly or indirectly, more than 50% of the voting shares of the given subsoil strategic company; • if the foreign investment is governed by other federal laws or international agreements ratified by the Russian Government; • if the investment does not concern transactions with shares (participatory interest) and/or does not result in establishment of control over the strategic company. 12 3934150

Approval Requirements Do Not Apply … • if the transaction closed prior to May 7, 2008; • if the foreign investor already owns more than 50% of the voting shares of the strategic company (except for subsoil strategic companies); • if the Russian Government has the right to dispose of (own), directly or indirectly, more than 50% of the voting shares of the given subsoil strategic company; • if the foreign investment is governed by other federal laws or international agreements ratified by the Russian Government; • if the investment does not concern transactions with shares (participatory interest) and/or does not result in establishment of control over the strategic company. 12 3934150

Mitigating Corporate Risk Besides complying with the administrative requirements, there is also the matter of co-existing with fellow Shareholders or JV Partners; this is helped by: • • Prior agreement between shareholders on the types and mechanics of extrajudicial resolution of any potential disputes • Detailed shareholders’ agreement regulating situations involving deadlock and related buyouts • 13 Steady and reliable management who constantly interact with shareholders Improvement of corporate culture in management of the company generally 3934150

Mitigating Corporate Risk Besides complying with the administrative requirements, there is also the matter of co-existing with fellow Shareholders or JV Partners; this is helped by: • • Prior agreement between shareholders on the types and mechanics of extrajudicial resolution of any potential disputes • Detailed shareholders’ agreement regulating situations involving deadlock and related buyouts • 13 Steady and reliable management who constantly interact with shareholders Improvement of corporate culture in management of the company generally 3934150

Mitigating Corporate Risk If soft power is not effective, there are judicial means: • • Claim to declare an interested-party transaction invalid (as discussed below) (Article 84 of the JSC law) • Claim against an executive officer or board members who by their culpable actions inflicted damages on the company (Article 71 of the JSC law) • Claim to set aside/declare invalid decisions of the board of directors/shareholders (general shareholders’ meeting) • 14 Claim to declare a major transaction (as discussed below) invalid (Article 79 of the JSC law) Others (claim on share redemptions, claim arising from violation of preemptive rights, etc. ) 3934150

Mitigating Corporate Risk If soft power is not effective, there are judicial means: • • Claim to declare an interested-party transaction invalid (as discussed below) (Article 84 of the JSC law) • Claim against an executive officer or board members who by their culpable actions inflicted damages on the company (Article 71 of the JSC law) • Claim to set aside/declare invalid decisions of the board of directors/shareholders (general shareholders’ meeting) • 14 Claim to declare a major transaction (as discussed below) invalid (Article 79 of the JSC law) Others (claim on share redemptions, claim arising from violation of preemptive rights, etc. ) 3934150

Political and Quasi-legal Risks • Legal entities in Russia face the risk of being attacked by “corporate raiders” • Such raids are usually orchestrated by individuals or entities with close ties to local governments • A corporate raider attack often includes: – Initiation of various inspections by state authorities – Criminal investigation into activities of management (which may result in arrest) – Defamatory publications in the media – In worst case scenarios, direct threats to management and theft of an entity’s physical assets 15 3934150

Political and Quasi-legal Risks • Legal entities in Russia face the risk of being attacked by “corporate raiders” • Such raids are usually orchestrated by individuals or entities with close ties to local governments • A corporate raider attack often includes: – Initiation of various inspections by state authorities – Criminal investigation into activities of management (which may result in arrest) – Defamatory publications in the media – In worst case scenarios, direct threats to management and theft of an entity’s physical assets 15 3934150

How to Deal with State Authorities • Consult with your legal counsel to determine if the state authorities have the legal right to carry out certain actions • Fully cooperate in a friendly manner with the authorities keeping in mind your rights • File a complaint with a court if the state authorities’ actions: Ø do not comply with the law, and Ø violate the company’s rights and lawful interests § general procedure for judicial review of complaints and grounds for filing of complaints is set out in Articles 197 and 198 of the RF Arbitrazh Procedural Code (the “APC”) • 16 The Statute of Limitations for filing a complaint against actions of state authorities is only three months from the moment the entity learned of the violation (Article 198(4) of the APC), which is very short and frequently missed in practice 3934150

How to Deal with State Authorities • Consult with your legal counsel to determine if the state authorities have the legal right to carry out certain actions • Fully cooperate in a friendly manner with the authorities keeping in mind your rights • File a complaint with a court if the state authorities’ actions: Ø do not comply with the law, and Ø violate the company’s rights and lawful interests § general procedure for judicial review of complaints and grounds for filing of complaints is set out in Articles 197 and 198 of the RF Arbitrazh Procedural Code (the “APC”) • 16 The Statute of Limitations for filing a complaint against actions of state authorities is only three months from the moment the entity learned of the violation (Article 198(4) of the APC), which is very short and frequently missed in practice 3934150

Russian Anti-Corruption Legislation versus, e. g. , FCPA • Sources: the Criminal Code, the Administrative Offences Code, the UN Anti-Corruption Convention (31/10/2003) • Broad language without specific carve-outs, such as “for facilitating payments meant to expedite routine governmental actions” • Not aimed at foreign corruption (limited to domestic officials), but includes payments to commercial entities (commercial bribery) 17 3934150

Russian Anti-Corruption Legislation versus, e. g. , FCPA • Sources: the Criminal Code, the Administrative Offences Code, the UN Anti-Corruption Convention (31/10/2003) • Broad language without specific carve-outs, such as “for facilitating payments meant to expedite routine governmental actions” • Not aimed at foreign corruption (limited to domestic officials), but includes payments to commercial entities (commercial bribery) 17 3934150

Litigation in Russia • If it’s not possible to arbitrate abroad, certain issues specific to Russian litigation should be taken into account – Russian courts have exclusive jurisdiction for resolving certain types of disputes (regarding bankruptcy of Russian debtors, Russian real estate, liquidation, registration of Russian legal entities and employment disputes, etc. ) – Russian courts lack expertise in applying foreign law – Judgments of Russian courts sometimes lack predictability (there is the possibility of extrajudicial influence) – Russian courts largely adopt a formalistic approach to resolving cases – Practical difficulties exist in enforcing foreign court acts or foreign arbitral awards – However, foreign parties are frequently successful in Russian court cases 18 3934150

Litigation in Russia • If it’s not possible to arbitrate abroad, certain issues specific to Russian litigation should be taken into account – Russian courts have exclusive jurisdiction for resolving certain types of disputes (regarding bankruptcy of Russian debtors, Russian real estate, liquidation, registration of Russian legal entities and employment disputes, etc. ) – Russian courts lack expertise in applying foreign law – Judgments of Russian courts sometimes lack predictability (there is the possibility of extrajudicial influence) – Russian courts largely adopt a formalistic approach to resolving cases – Practical difficulties exist in enforcing foreign court acts or foreign arbitral awards – However, foreign parties are frequently successful in Russian court cases 18 3934150

Litigation in Russia • Jurisdiction of Russian arbitrazh courts generally advisable: – if value of contract below approx. $5, 000 • Use the arbitrazh courts in Moscow or St. Petersburg • Alternatively, submit to the jurisdiction of a court in country that has signed a treaty on mutual recognition and enforcement of judicial awards with Russian Federation, e. g. , Spain, Italy, Ukraine, Belarus • Advantages of litigating in Russian state courts – short proceedings – no need for recognition procedures in Russia – provisional measures (injunctive relief) available • Disadvantages of litigating in Russian state courts – possibility of bias in politically sensitive or high-value matters 19 3934150

Litigation in Russia • Jurisdiction of Russian arbitrazh courts generally advisable: – if value of contract below approx. $5, 000 • Use the arbitrazh courts in Moscow or St. Petersburg • Alternatively, submit to the jurisdiction of a court in country that has signed a treaty on mutual recognition and enforcement of judicial awards with Russian Federation, e. g. , Spain, Italy, Ukraine, Belarus • Advantages of litigating in Russian state courts – short proceedings – no need for recognition procedures in Russia – provisional measures (injunctive relief) available • Disadvantages of litigating in Russian state courts – possibility of bias in politically sensitive or high-value matters 19 3934150

Summary • Russia and the CIS present challenges, but they are not “unique” as so often stated; • Legal risk, as opposed to country risk, can often be effectively mitigated; • Understanding the legal obstacles to an acquisition or disposition can lead to a better assessment of the risk; • Is Russia normalising? It is worth noting that: 1. Russia is close to joining the WTO (next year); 2. Russia is very close to joining the OECD Anti-Bribery convention; and 3. Russia may soon accede to the OECD itself. 20 3934150

Summary • Russia and the CIS present challenges, but they are not “unique” as so often stated; • Legal risk, as opposed to country risk, can often be effectively mitigated; • Understanding the legal obstacles to an acquisition or disposition can lead to a better assessment of the risk; • Is Russia normalising? It is worth noting that: 1. Russia is close to joining the WTO (next year); 2. Russia is very close to joining the OECD Anti-Bribery convention; and 3. Russia may soon accede to the OECD itself. 20 3934150

Thank you! Shane De. Beer Dechert LLP shane. debeer@dechert. com +44 20 7184 7871 (London) +7 499 922 1100 (Moscow) 21 3934150

Thank you! Shane De. Beer Dechert LLP shane. debeer@dechert. com +44 20 7184 7871 (London) +7 499 922 1100 (Moscow) 21 3934150